|

시장보고서

상품코드

1777132

의료용 코팅 시장 : 코팅 유형별, 재료별, 기재별, 용도별, 지역별 예측(-2030년)Medical Coatings Market by Coating Type (Active, Passive), By Material (Polymers, Metals), By Application (Medical Devices, Medical Implants, Medical Equipment & Tools), By Region - Global Forecast to 2030 |

||||||

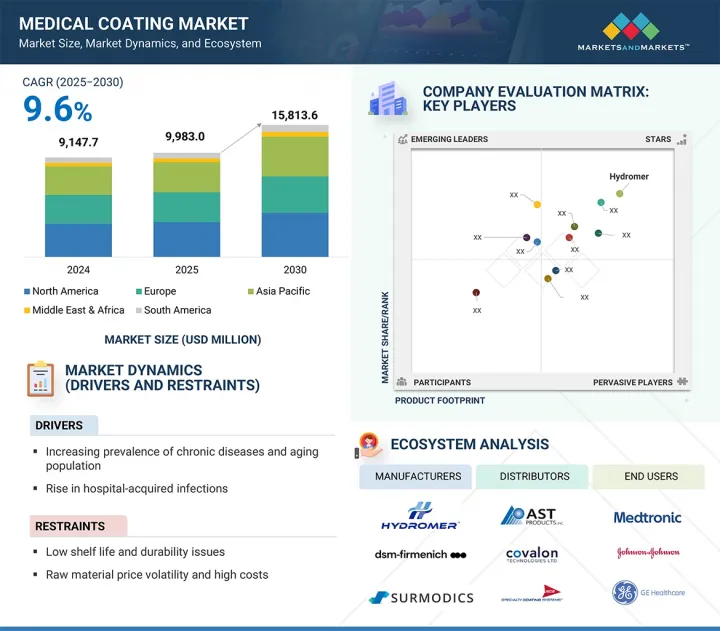

의료용 코팅 시장 규모는 2025년 99억 8,300만 달러에서 2030년에는 158억 1,360만 달러에 이르고, CAGR 9.6%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022년-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 킬로톤, 금액(100만 달러) |

| 부문 | 코팅 유형별, 재료별, 기재별, 용도별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동, 아프리카, 남미 |

의료 분야에서 의료 기기에 대한 수요가 증가함에 따라 코팅이 계속 발전하고 기기의 안전, 성능 및 내구성에 필수적인 요소가 되면서 의료용 코팅 시장의 성장이 크게 촉진되고 있습니다. 인구 고령화와 만성 질환의 유병률 증가로 인해 임플란트, 카테터, 수술 기구 등 코팅 기기의 필요성이 커지고 있으며, 이는 시장 성장을 뒷받침하고 혁신을 촉진하고 있습니다.

의료기기 분야는 모든 조직과 의료 환경에서 코팅 기기의 사용이 널리 확산되고 증가함에 따라 예측 기간 동안 의료용 코팅 시장에서 가치 면에서 가장 큰 부문을 차지할 것으로 예상됩니다. 다양한 코팅 의료 기기의 채택은 주로 만성 질환의 발병률 증가, 세계의 인구의 고령화, 최소 침습 수술의 발전에 의해 촉진되고 있으며, 이러한 모든 요인들은 성능이 향상되고 안전하며 사용하기 쉬운 의료 기기를 요구하고 있습니다. 의료용 코팅은 카테터, 스텐트, 가이드 와이어, 정형외과용 임플란트, 수술 기구 등 많은 기기에 필수적인 요소로, 우수한 윤활성, 생체 적합성 및 항균성을 제공합니다. 이러한 코팅은 마찰을 줄여 조직 손상을 최소화하고, 감염 위험을 낮추며, 기기의 성능과 유통 기한을 개선합니다. 또한, 병원 감염의 증가로 인해 항균 및 항혈전 코팅이 환자의 안전과 엄격한 규제 기준을 충족하는 데 필수적인 요소가 되었습니다. 이미징 시스템 및 정밀 기기와 같은 의료 기술의 혁신으로 인해, 보다 정확하고 외상이 적은 수술 결과를 달성하기 위해 고성능 의료용 코팅에 대한 수요가 크게 증가했습니다. 따라서 의료 기기 부문은 계속 성장할 것으로 예상됩니다.

활성 코팅은 수동 코팅에 비해 특수한 치료 기능과 환자 안전 및 임상 결과를 개선하기 위한 혁신적인 솔루션에 대한 수요가 증가함에 따라 예측 기간 동안 의료용 코팅 시장에서 가치 면에서 가장 빠르게 성장하는 코팅 유형입니다. 수동 코팅은 사용 중에 표면 보호(보호 및 윤활 등)만 제공하는 반면, 활성 코팅은 적용 부위에 의약품, 항균제 또는 생리 활성 분자를 방출하도록 설계되었습니다. 이 전달 방법은 감염, 혈전증, 염증이 환자 관리 성공을 위협하는 고위험 의료 기기(스텐트, 카테터, 정형외과 임플란트 등)에 필수적입니다. 병원 내 감염의 증가와 세계의 만성 질환 및 동반 질환의 확산은 만성 환자의 감염 위험을 높이며, 수술 후 합병증(예: PMN 매개 염증 및 감염)이 장기적인 위험과 비용을 초래합니다. 따라서 병원과 의료 서비스 제공자들은 병원 감염의 위험을 줄이고 빠른 회복을 촉진하는 보다 효과적인 코팅을 찾고 있습니다.

북미는 의료용 코팅 시장에서 가장 크고 빠르게 성장하는 지역으로, 첨단 의료 서비스 시스템, 시술 건수 증가, 의료 기기의 지속적인 개발에 대한 강력한 의지가 가치 성장을 촉진하고 있습니다. 북미, 특히 미국에는 심혈관 스텐트, 정형외과용 임플란트, 카테터, 수술 기구 등 다양한 응용 분야에 사용할 차세대 코팅을 혁신하고 있는 많은 의료 기기 제조업체와 연구 기관이 있습니다. 또한, 북미에서 의료용 코팅에 대한 수요가 증가하는 것은 만성 질환의 발병률이 증가하는 인구 증가 및 고령화와 관련이 있으며, 감염 관리 및 환자 안전에 대한 관심이 높아짐에 따라 정교하고 생체 적합성이 뛰어나며 항균성이 있는 코팅에 대한 수요가 증가하고 있기 때문입니다.

본 보고서에서는 세계의 의료용 코팅 시장에 대해 조사했으며, 코팅 유형별, 재료별, 기재별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

제6장 업계 동향

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 무역 분석

- 고객사업에 영향을 주는 동향/혼란

- 기술 분석

- 거시경제지표

- 가격 분석

- 규제 상황

- AI/생성형 AI의 영향

- 주된 회의 및 이벤트(2025-2026년)

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 특허 분석

- 미국 관세의 영향-개요(2025년)

- 주요 관세율

- 가격 영향 분석

- 국가/지역에 미치는 영향

- 최종 이용 산업에 대한 영향

제7장 의료용 코팅 시장(코팅 유형별)

- 소개

- 활성

- 수동

제8장 의료용 코팅 시장(재료별)

- 소개

- 폴리머

- 금속

- 기타

제9장 의료용 코팅 시장(기재별)

- 소개

- 금속

- 세라믹

- 폴리머

- 복합재료

- 유리

제10장 의료용 코팅 시장(용도별)

- 소개

- 의료기기

- 의료 임플란트

- 의료기기 및 도구

- 보호복

- 기타

제11장 의료용 코팅 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 기업평가와 재무지표

- 브랜드/제품 비교 분석

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- HYDROMER

- DSM-FIRMENICH

- SURMODICS, INC.

- BIOCOAT INCORPORATED

- AST PRODUCTS INC

- COVALON TECHNOLOGIES

- FREUDENBERG MEDICAL

- HARLAND MEDICAL SYSTEMS, INC.

- MERIT MEDICAL SYSTEMS

- APPLIED MEDICAL COATINGS

- PPG INDUSTRIES, INC

- THE SHERWIN-WILLIAMS COMPANY

- 기타 기업

- FORMACOAT

- TUA SYSTEMS

- APPLIED MEMBRANE TECHNOLOGIES

- A&A COATINGS

- CALICO COATINGS

- COATINGS2GO

- CURTISS-WRIGHT CORPORATION

- ENCAPSON

- ENDURA COATINGS

- MEDICOAT AG

- MILLER-STEPHENSON CHEMICAL COMPANY, INC.

- PRECISION COATING TECHNOLOGY & MANUFACTURING INC.

- SPECIALTY COATING SYSTEMS

제14장 부록

HBR 25.08.01The medical coating market is expected to reach USD 15,813.6 million by 2030, up from USD 9,983.0 million in 2025, growing at a CAGR of 9.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Kilotons; Value (USD Million) |

| Segments | Coating Type, Material, Substrate, and Application |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

The rising demand for medical devices in the healthcare sector significantly drives the growth of the medical coating market, as coatings continue to evolve and become crucial for the safety, performance, and durability of devices. An aging population and a higher prevalence of chronic diseases create a greater need for coated devices such as implants, catheters, and surgical instruments, thereby supporting market growth and fostering innovation.

"Based on application, medical devices will be the largest application in the medical coating market during the forecast period, in terms of value."

The medical devices application segment is projected to be the largest in the medical coating market by value during the forecast period due to the widespread and increasing use of coated devices across all organizations and healthcare settings. The adoption of various coated medical devices is mainly driven by the rising rates of chronic diseases, the growing aging global population, and advancements in minimally invasive surgical procedures, all of which require performance-enhanced, safer, and easier-to-use medical devices. Medical coatings are vital for many devices, including catheters, stents, guidewires, orthopedic implants, and surgical instruments, as they offer superior lubricity, biocompatibility, and antimicrobial properties. These coatings reduce friction, minimizing tissue trauma, lower infection risks, and improve device performance and shelf-life. Additionally, the rise in hospital-acquired infections has made antimicrobial and anti-thrombogenic coatings essential for patient safety and meeting strict regulatory standards. Innovations in medical technology, such as imaging systems and precision instruments, have significantly increased the demand for high-performance medical coatings to achieve more accurate and less traumatic surgical outcomes. Therefore, the medical devices segment is expected to continue its growth.

"Based on coating type, active coating will be the fastest in the medical coating market during the forecast period, in terms of value."

Active coatings are the fastest-growing type of coating by value in the medical coating market during the forecast period, due to their specialized therapeutic capabilities compared to passive coatings and the increasing demand for innovative solutions to improve patient safety and clinical outcomes. While passive coatings only provide surface protection during use (such as protection and lubrication), active coatings are engineered to release drugs, antimicrobial agents, or bioactive molecules at the application site. This delivery method is essential for high-risk medical devices (like stents, catheters, and orthopedic implants) where infection, thrombosis, and inflammation threaten successful patient management. The rise in hospital-acquired infections and the worldwide increase in chronic diseases and comorbidities expose chronic patients to higher infection risks, as post-surgical complications-such as PMN-mediated inflammation and infections-lead to extended risks and costs. Therefore, hospitals and healthcare providers are seeking more effective coatings that reduce the risk of hospital-acquired infections and promote faster recovery.

"Based on region, North America accounts for the largest share in the medical coating market, in terms of value."

North America is the largest and fastest-growing region in the medical coating market, with value growth driven by advanced healthcare delivery systems, an increase in procedures performed, and a strong commitment to the continuous development of medical devices. North America, especially the United States, hosts many top medical device manufacturers and research institutions that are innovating the next generation of coatings for applications such as cardiovascular stents, orthopedic implants, catheters, and surgical instruments. Additionally, the rising demand for medical coatings in North America is linked to a growing and aging population with increasing rates of chronic diseases, as well as a heightened focus on infection control and patient safety, which demand sophisticated, biocompatible, and antimicrobial coatings.

During the process of determining and verifying the market size for various segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors- 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, RoW - 11%

The key players in this market are Hydromer (US), DSM-Firmenich (Netherlands), Surmodics (US), Biocoat Incorporated (US), AST Products Inc (US), Covalon Technologies (Canada), Freudenberg Medical (US), Harland Medical Systems, Inc (US), Merit Medical Systems (US), Applied Medical Coatings (US), PPG Industries, Inc. (US) and The Sherwin-Williams Company (US).

Research Coverage

This report breaks down the medical coating market by coating type, material, substrate, application, and region, and provides estimates for the total market value across different regions. A thorough analysis of major industry players has been carried out to offer insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions related to the medical coating market.

Key benefits of buying this report

This research report covers different levels of analysis, including industry examination (industry trends), market ranking analysis of leading players, and company profiles. Together, these provide a comprehensive view of the competitive landscape, emerging and high-growth segments of the medical coating market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following:

- Analysis of key drivers (increasing demand for minimally invasive surgical procedures, growing geriatric population and prevalence of chronic diseases), restraints (stringent regulatory requirements, high costs and technical challenges), opportunities (development of smart and multifunctional coatings, expansion in emerging markets) and challenges (technical limitations in coating durability and adhesion, intellectual property and supply chain issues).

- Market Penetration: Comprehensive information on the medical coating market offered by top players in the global medical coating market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the medical coating market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for medical coating market across regions

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global medical coating market

- Competitive Assessment: In-depth assessment of market share, strategies, products, and manufacturing capabilities of leading players in the medical coating market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL COATING MARKET

- 4.2 MEDICAL COATING MARKET, BY COATING TYPE

- 4.3 MEDICAL COATING MARKET, BY MATERIAL

- 4.4 MEDICAL COATING MARKET, BY SUBSTRATE

- 4.5 MEDICAL COATING MARKET, BY APPLICATION

- 4.6 MEDICAL COATING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases and aging population

- 5.2.1.2 Rise in hospital-acquired infections

- 5.2.1.3 Growth in minimally invasive surgeries and medical device usage

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low shelf life and durability issues

- 5.2.2.2 Raw material price volatility and high costs

- 5.2.2.3 Strict government regulations and compliance challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise in demand for antimicrobial and drug-eluting coatings

- 5.2.3.2 Technological advancements and nanotechnology

- 5.2.4 CHALLENGES

- 5.2.4.1 Biocompatibility and durability concerns

- 5.2.4.2 Complex application and quality control

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 QUALITY

- 6.4.3 SERVICE

- 6.4.4 BUYING CRITERIA

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 9018)

- 6.5.2 IMPORT SCENARIO (HS CODE 9018)

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Plasma spraying

- 6.7.1.2 Chemical vapor deposition

- 6.7.1.3 Microblasting & laser treatments

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Nanotechnology integration

- 6.7.2.2 Advanced material formulation

- 6.7.1 KEY TECHNOLOGIES

- 6.8 MACROECONOMIC INDICATORS

- 6.8.1 GDP TRENDS AND FORECASTS

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.9.2 AVERAGE SELLING PRICE TREND, BY COATING TYPE, 2022-2024

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 NORTH AMERICA

- 6.10.2 ASIA PACIFIC

- 6.10.3 EUROPE

- 6.10.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 IMPACT OF AI/GEN AI

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 ANTIMICROBIAL COATING FOR IMPLANTABLE PACEMAKER DEVICE

- 6.13.2 INTRICOAT FOR MEDICAL ROBOTICS PROJECT

- 6.13.3 SLIPS COATING TO PREVENT BIOFILM FORMATION ON MEDICAL IMPLANTS

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 PATENT ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 LEGAL STATUS OF PATENTS

- 6.15.3 JURISDICTION ANALYSIS

- 6.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.16.1 INTRODUCTION

- 6.17 KEY TARIFF RATES

- 6.18 PRICE IMPACT ANALYSIS

- 6.19 IMPACT ON COUNTRY/REGION

- 6.19.1 US

- 6.19.2 EUROPE

- 6.19.3 ASIA PACIFIC

- 6.20 IMPACT ON END-USE INDUSTRIES

7 MEDICAL COATINGS MARKET, BY COATING TYPE

- 7.1 INTRODUCTION

- 7.2 ACTIVE

- 7.2.1 ANTIMICROBIAL

- 7.2.1.1 Used to prevent microbial infection on medical devices

- 7.2.2 OTHERS

- 7.2.1 ANTIMICROBIAL

- 7.3 PASSIVE

- 7.3.1 HYDROPHILIC/LUBRICIOUS HYDROPHILIC

- 7.3.1.1 Growing awareness of minimally invasive surgical techniques to boost demand

- 7.3.2 HYDROPHOBIC

- 7.3.2.1 High water resistance to drive market growth

- 7.3.1 HYDROPHILIC/LUBRICIOUS HYDROPHILIC

8 MEDICAL COATINGS MARKET, BY MATERIAL TYPE

- 8.1 INTRODUCTION

- 8.2 POLYMERS

- 8.2.1 FLUOROPOLYMERS

- 8.2.1.1 PTFE

- 8.2.1.1.1 Minimal friction and strong resistance to heat and chemicals to boost adoption

- 8.2.1.2 PVDF

- 8.2.1.2.1 Exceptionally robust and resistant to chemicals

- 8.2.1.3 Others

- 8.2.1.1 PTFE

- 8.2.2 PARYLENE

- 8.2.2.1 Frictional coefficient comparable to PTFE - key segment driver

- 8.2.3 SILICONES

- 8.2.3.1 Biocompatibility fuels widespread adoption in medical applications

- 8.2.4 OTHERS

- 8.2.1 FLUOROPOLYMERS

- 8.3 METALS

- 8.3.1 SILVER

- 8.3.1.1 Antimicrobial properties boost application

- 8.3.2 TITANIUM

- 8.3.2.1 Commonly employed in implant applications due to excellent biocompatibility

- 8.3.3 OTHERS

- 8.3.1 SILVER

- 8.4 OTHERS

9 MEDICAL COATINGS MARKET, BY SUBSTRATE

- 9.1 INTRODUCTION

- 9.2 METALS

- 9.2.1 METALS IN IMPLANTED MEDICAL DEVICES: DRIVING BIOCOMPATIBILITY AND MARKET GROWTH

- 9.3 CERAMICS

- 9.3.1 WIDELY USED IN DENTAL IMPLANT APPLICATIONS

- 9.4 POLYMERS

- 9.4.1 FLUOROPOLYMERS

- 9.4.1.1 PTFE's unparalleled lubricity boosts advanced medical device performance

- 9.4.2 SILICONE

- 9.4.2.1 Superior compatibility with human tissue and bodily fluids

- 9.4.3 OTHER POLYMERS

- 9.4.1 FLUOROPOLYMERS

- 9.5 COMPOSITES

- 9.5.1 LIGHT WEIGHT PROPERTY ENHANCES PROSTHETIC MOBILITY

- 9.6 GLASS

- 9.6.1 OFFERS BIOCOMPATIBILITY FOR SAFE AND DURABLE MEDICAL IMPLANTS

10 MEDICAL COATINGS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 MEDICAL DEVICES

- 10.2.1 INCREASING DEMAND FOR MINIMALLY INVASIVE SURGICAL PROCEDURES TO BOOST MARKET

- 10.3 MEDICAL IMPLANTS

- 10.3.1 ORTHOPEDIC IMPLANTS

- 10.3.1.1 Lubricity and fatigue strength in orthopedic implants

- 10.3.2 DENTAL IMPLANTS

- 10.3.2.1 Use of hydroxyapatite in dental implants to stimulate bone healing

- 10.3.3 CARDIOVASCULAR IMPLANTS

- 10.3.3.1 Nanomaterial coatings used for stents

- 10.3.1 ORTHOPEDIC IMPLANTS

- 10.4 MEDICAL EQUIPMENT & TOOLS

- 10.4.1 SURGICAL EQUIPMENT & TOOLS

- 10.4.1.1 Antimicrobial and other functional properties benefit surgical tools

- 10.4.2 INSTITUTIONAL EQUIPMENT

- 10.4.2.1 Hydrophobic coatings - widely used in institutional equipment

- 10.4.1 SURGICAL EQUIPMENT & TOOLS

- 10.5 PROTECTIVE CLOTHING

- 10.5.1 HELPS ENHANCE HEALTHCARE SAFETY

- 10.6 OTHERS

11 MEDICAL COATING MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Ongoing advancements in medical technology to propel market

- 11.2.2 CANADA

- 11.2.2.1 Rising investments to boost demand for medical coatings

- 11.2.3 MEXICO

- 11.2.3.1 Rising domestic production to drive market

- 11.2.1 US

- 11.3 ASIA PACIFIC

- 11.3.1 CHINA

- 11.3.1.1 World's third-largest market for medical device production

- 11.3.2 JAPAN

- 11.3.2.1 Rising percentage of geriatric population to drive market

- 11.3.3 INDIA

- 11.3.3.1 Government initiatives to fuel demand for medical coatings

- 11.3.4 SOUTH KOREA

- 11.3.4.1 Continuous R&D activities to fuel market

- 11.3.5 AUSTRALIA

- 11.3.5.1 Rising incidence of chronic diseases drive innovation in market

- 11.3.6 REST OF ASIA PACIFIC

- 11.3.1 CHINA

- 11.4 EUROPE

- 11.4.1 GERMANY

- 11.4.1.1 Innovations in medical technology to drive market

- 11.4.2 UK

- 11.4.2.1 Government initiatives for collaborative developments in medical technology to drive market

- 11.4.3 FRANCE

- 11.4.3.1 Well-established medical device manufacturing industry to boost market

- 11.4.4 ITALY

- 11.4.4.1 Prevalence of chronic diseases to fuel market growth

- 11.4.5 SPAIN

- 11.4.5.1 High demand for implants and catheters to boost market

- 11.4.6 RUSSIA

- 11.4.6.1 Rising demand for minimally invasive procedures to spur market

- 11.4.7 REST OF EUROPE

- 11.4.1 GERMANY

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Government initiatives for healthcare industry to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Medical tourism to drive market

- 11.5.1.3 Other GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Global investments to propel market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Market enhanced through local device production

- 11.6.2 ARGENTINA

- 11.6.2.1 Rising prevalence of non-communicable disease to boost market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Coating type footprint

- 12.7.5.4 Material footprint

- 12.7.5.5 Substrate footprint

- 12.7.5.6 Application footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 EXPANSIONS

- 12.9.3 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 HYDROMER

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 DSM-FIRMENICH

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SURMODICS, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 BIOCOAT INCORPORATED

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 Expansions

- 13.1.4.4.1 Product launches

- 13.1.4.5 MnM view

- 13.1.4.5.1 Key strengths

- 13.1.4.5.2 Strategic choices

- 13.1.4.5.3 Weaknesses and competitive threats

- 13.1.5 AST PRODUCTS INC

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 COVALON TECHNOLOGIES

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses and competitive threats

- 13.1.7 FREUDENBERG MEDICAL

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Expansions

- 13.1.7.4 MnM view

- 13.1.7.4.1 Key strengths

- 13.1.7.4.2 Strategic choices

- 13.1.7.4.3 Weaknesses and competitive threats

- 13.1.8 HARLAND MEDICAL SYSTEMS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.8.4 MnM view

- 13.1.8.4.1 Key strengths

- 13.1.8.4.2 Strategic choices

- 13.1.8.4.3 Weaknesses and competitive threats

- 13.1.9 MERIT MEDICAL SYSTEMS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 APPLIED MEDICAL COATINGS

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 MnM view

- 13.1.11 PPG INDUSTRIES, INC

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 MnM view

- 13.1.11.3.1 Key strengths

- 13.1.11.3.2 Strategic choices

- 13.1.11.3.3 Weaknesses and competitive threats

- 13.1.12 THE SHERWIN-WILLIAMS COMPANY

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 MnM view

- 13.1.12.3.1 Key strengths

- 13.1.12.3.2 Strategic choices

- 13.1.12.3.3 Weaknesses and competitive threats

- 13.1.1 HYDROMER

- 13.2 OTHER PLAYERS

- 13.2.1 FORMACOAT

- 13.2.2 TUA SYSTEMS

- 13.2.3 APPLIED MEMBRANE TECHNOLOGIES

- 13.2.4 A&A COATINGS

- 13.2.5 CALICO COATINGS

- 13.2.6 COATINGS2GO

- 13.2.7 CURTISS-WRIGHT CORPORATION

- 13.2.8 ENCAPSON

- 13.2.9 ENDURA COATINGS

- 13.2.10 MEDICOAT AG

- 13.2.11 MILLER-STEPHENSON CHEMICAL COMPANY, INC.

- 13.2.12 PRECISION COATING TECHNOLOGY & MANUFACTURING INC.

- 13.2.13 SPECIALTY COATING SYSTEMS

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS