|

시장보고서

상품코드

1777936

식품 검사기기 시장 : 제품별, 기술별, 식품 카테고리별, 업계별, 지역별 - 예측(-2030년)Food Inspection Devices Market by X-ray Inspection Devices, Metal Detectors, Checkweighers, Vision Inspection Systems, Meat, Bakery & Confectionery, Catering & Ready-to-Eat Meals, Food Packaging, Retail Chains & Hypermarkets - Global Forecast to 2030 |

||||||

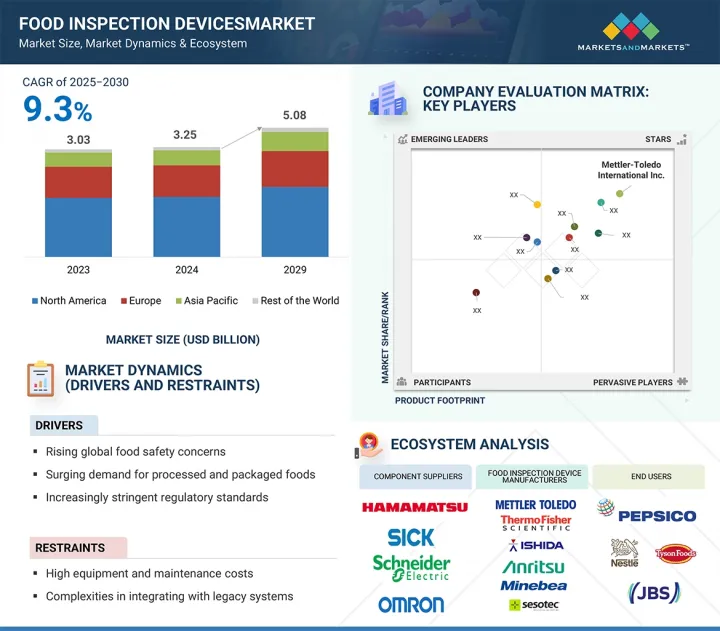

식품 검사기기 시장 규모는 예측 기간 중에 9.3%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 32억 5,000만 달러에서 2030년에는 50억 8,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 제품별, 기술별, 식품 카테고리별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

몇 가지 주요 요인이 식품 검사 장비 시장의 급격한 성장을 가속하고 있습니다. 식품 안전에 대한 우려 증가, 오염 사례 증가, 세계 규제 강화로 인해 식품 제조업체는 첨단 검사 기술을 채택할 수밖에 없습니다. 포장식품 및 가공식품에 대한 수요 증가, 클린 라벨 제품 및 알레르겐 프리 제품에 대한 소비자 선호도가 높아지면서 정밀 검사 시스템의 필요성이 더욱 높아지고 있습니다. AI, IoT, 하이퍼 스펙트럼 영상 등의 기술은 실시간 감지 및 추적 가능성을 강화하고 있습니다. 그러나 첨단 검사장비의 초기 비용과 유지보수 비용이 높아 중소기업의 도입은 제한적일 수밖에 없습니다. 또한, 일부 지역에서는 기술 전문 지식의 부족, 데이터 통합의 어려움, 규제 준수에 대한 제한된 인식이 이러한 시스템의 보급을 방해하는 요인으로 작용하고 있습니다.

자동화/전산화 시스템 분야는 식품 품질 보증의 정확성, 속도, 일관성에 대한 수요 증가로 인해 예측 기간 동안 식품 검사 장비 시장에서 더 높은 CAGR을 나타낼 것으로 예측됩니다. 이 시스템은 인공지능, 머신비전, IoT, 실시간 데이터 분석 등 첨단 기술을 통합하여 오염물질, 포장 결함, 중량 편차를 정확하게 감지할 수 있습니다. 자동 검사 시스템은 인위적 실수 감소, 처리 능력 향상, FDA, EFSA, FSSAI 등 규제 기관이 정한 엄격한 식품 안전 기준 준수율 향상 등 수작업 방식에 비해 큰 이점을 제공합니다.

전산화된 시스템 도입은 품질 관리의 간소화, 추적 가능성 향상, 제품 리콜 감소를 가능하게 하기 때문에 중대형 식품 가공 시설 전체에서 증가하고 있습니다. 또한, 식품 부문에서 인더스트리 4.0과 스마트 제조 관행으로의 전환은 이러한 추세를 더욱 가속화시키고 있습니다. 클라우드 연결, 예지보전, 원격 모니터링은 자동화 시스템의 가치 제안을 강화하고 있습니다. Thermo Fisher Scientific, Mettler-Toledo, ISHIDA 등의 기업들은 다양한 생산 환경에 맞는 지능형 모듈식 솔루션을 제공합니다. 디지털 전환이 발전함에 따라 자동 식품 검사 시스템은 특히 대량 생산에서 컴플라이언스가 중요시되는 업무에서 전 세계적으로 지속적으로 인기를 끌 것으로 예측됩니다.

예측 기간 동안 전체 식품 검사 장비 시장에서 육류 분야가 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이 큰 시장 점유율은 주로 육류 가공과 관련된 높은 오염 위험, 엄격한 위생 기준, 엄격한 규제 감독에 기인합니다. USDA, EFSA, FSSAI 등 규제기관은 식중독 확산을 방지하고 소비자의 안전을 보장하기 위해 육류 제품에 대한 종합적인 검사 프로토콜을 의무화하고 있습니다.

육류는 부패하기 쉽고 병원균의 영향을 받기 쉽기 때문에 가공업체들은 뼈 조각, 이물질, 미생물 오염을 검출하기 위해 X선 시스템, 금속 감지기, 분광학에 기반한 툴 등 첨단 검사 기술을 채택하고 있습니다. 또한, 자동 검사 시스템은 실시간 모니터링과 하이스루풋 분석이 가능하여 대규모 육류 가공 시설에서 제품 품질을 유지하고 안전 요건을 충족하는 데 필수적입니다.

세계적으로 육류 소비가 증가하고 식품 안전에 대한 관심이 높아짐에 따라 정확하고 신뢰할 수 있는 효율적인 검사 솔루션에 대한 수요는 지속적으로 증가하고 있습니다. 주요 기업들은 이 부문에 대응하기 위해 업계 특화 기술 및 컴플라이언스 대응 시스템을 제공함으로써 육류 카테고리 시장에서의 선도적 지위를 더욱 강화하고 있습니다.

아시아태평양은 식품 가공 부문의 급속한 산업화, 소비자 인식 증가, 규제 프레임워크 강화에 힘입어 예측 기간 동안 세계 식품 검사 장비 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 중국, 인도, 일본, 한국, 호주 등의 국가에서는 포장식품 및 가공식품의 소비가 크게 증가하고 있으며, 제조업체들은 안전, 품질 및 진화하는 식품 안전 기준을 준수하기 위해 첨단 검사 기술에 대한 투자를 늘리고 있습니다.

인도 식품안전표준국(FSSAI)과 중국 국가위생위원회(National Health Commission)를 비롯한 이 지역의 규제기관은 보다 엄격한 검사를 요구하고 있으며, 이에 따라 제조업체들은 X-Ray 시스템, 금속감지기, 영상 검사 솔루션을 도입하고 있습니다. 하고 있습니다. 또한, 아시아태평양의 식품 수출이 증가함에 따라 국제적인 안전 프로토콜을 준수해야 하므로 고정밀 검사 시스템에 대한 수요가 더욱 증가하고 있습니다.

비용 효율적인 제조, 식품 안전 현대화에 대한 정부의 지원, 현지 기업 및 세계 기업의 존재감 증가로 인해 검사 기술은 중소기업에 더욱 친숙해졌습니다. 도시화, 인구 증가, 식품 안전에 대한 인식이 높아짐에 따라 아시아태평양은 세계 식품 검사 장비 시장에서 가장 크고 역동적인 지역이 될 것으로 예측됩니다.

세계의 식품 검사기기 시장에 대해 조사했으며, 제품별, 기술별, 식품 카테고리별, 산업별, 지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 기술 분석

- 가격 분석

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 무역 분석

- 특허 분석

- 관세 및 규제 상황

- 2025-2026년 주요 컨퍼런스 및 이벤트

- AI/생성형 AI가 식품 검사기기 시장에 미치는 영향

- 2025년 미국 관세가 식품 검사기기 시장에 미치는 영향-개요

제6장 식품 검사기기 시장(제품별)

- 서론

- X선 검사 기기

- 금속 감지기

- 중량 선별기

- 비전 검사 시스템

- 미생물 감지 시스템

- 분광학 장치

- 기타

제7장 식품 검사기기 시장(기술별)

- 서론

- 자동화/컴퓨터화 시스템

- 수동 검사 장비

제8장 식품 검사기기 시장(식품 카테고리별)

- 서론

- 육류

- 가금육 및 어개류

- 유제품

- 베이커리 및 제과

- 케이터링 및 레디밀

- 기타

제9장 식품 검사기기 시장(업계별)

- 서론

- 식품 제조업체 및 가공업자

- 식품 포장 기업

- 소매 체인 및 하이퍼마켓

- 정부기관, 식품 안전 당국 및 기타

제10장 식품 검사기기 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 북유럽

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 인도

- 호주

- 인도네시아

- 태국

- 말레이시아

- 베트남

- 기타

- 기타 지역

- 기타 지역 거시경제 전망

- 중동

- 아프리카

- 남미

제11장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2021년-2025년

- 시장 점유율 분석, 2024년

- 매출 분석, 2020년-2024년

- 기업 평가와 재무 지표, 2025년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 개요

- 서론

- 주요 시장 진출기업

- METTLER-TOLEDO INTERNATIONAL INC.

- ANRITSU CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- ISHIDA CO., LTD.

- LOMA SYSTEMS

- FORTRESS TECHNOLOGY INC.

- SESOTEC GMBH

- MINEBEA INTEC GMBH

- BIZERBA SE & CO. KG

- MULTIVAC GROUP

- 기타 기업

- KEY TECHNOLOGY

- COGNEX CORPORATION

- WIPOTEC-OCS

- PECO INSPX

- SHANGHAI TECHIK INSTRUMENT CO., LTD.

- MARLEN INTERNATIONAL

- EAGLE PRODUCT INSPECTION

- CEIA

- CASSEL MESSTECHNIK GMBH

- HEAT AND CONTROL, INC.

- MEKITEC GROUP

- FT SYSTEMS S.R.L.

- DYLOG HITECH S.P.A.

- JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- ERIEZ MANUFACTURING CO.

제13장 부록

LSH 25.08.01The food inspection devices market is projected to reach USD 5.08 billion by 2030 from USD 3.25 billion in 2025 at a CAGR of 9.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Technology, Vertical, Food Category, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Several key factors are fueling the rapid growth of the food inspection devices market. Rising concerns over food safety, increased cases of contamination, and stricter global regulations are compelling food manufacturers to adopt advanced inspection technologies. The growing demand for packaged and processed foods, along with consumer preference for clean-label and allergen-free products, further boosts the need for precise inspection systems. Technologies such as AI, IoT, and hyperspectral imaging are enhancing real-time detection and traceability. However, high initial costs and maintenance expenses of advanced inspection devices limit adoption among small and mid-sized enterprises. Additionally, lack of technical expertise, data integration challenges, and limited awareness of regulatory compliance in some regions hinder the widespread implementation of these systems.

"By technology, the automated/computerized systems segment is expected to register the highest CAGR during the forecast period."

The automated/computerized systems segment is projected to register a higher CAGR in the food inspection devices market during the forecast period, driven by increasing demand for accuracy, speed, and consistency in food quality assurance. These systems integrate advanced technologies such as artificial intelligence, machine vision, IoT, and real-time data analytics to enable precise detection of contaminants, packaging defects, and weight deviations. Automated inspection systems offer significant advantages over manual methods, including reduced human error, higher throughput, and better compliance with stringent food safety standards set by regulatory bodies like the FDA, EFSA, and FSSAI.

The adoption of computerized systems is rising across large and mid-sized food processing facilities due to their ability to streamline quality control, improve traceability, and reduce product recalls. Additionally, the shift toward Industry 4.0 and smart manufacturing practices in the food sector is further accelerating this trend. Cloud connectivity, predictive maintenance, and remote monitoring are enhancing the value proposition of automated systems. Companies such as Thermo Fisher Scientific, Mettler-Toledo, and ISHIDA are offering intelligent, modular solutions tailored for diverse production environments. As digital transformation advances, automated food inspection systems will continue to gain traction globally, particularly in high-volume and compliance-sensitive operations.

By food category, the meat segment is projected to account for the largest market share during the forecast period."

The meat segment is expected to hold the largest market share in the overall food inspection devices market during the forecast period. This large market share is primarily attributed to the high risk of contamination, strict hygiene standards, and rigorous regulatory oversight associated with meat processing. Regulatory bodies such as the USDA, EFSA, and FSSAI mandate comprehensive inspection protocols for meat products to prevent the spread of foodborne illnesses and ensure consumer safety.

Due to the perishable nature of meat and its susceptibility to pathogens, processors are increasingly adopting advanced inspection technologies such as X-ray systems, metal detectors, and spectroscopy-based tools to detect bone fragments, foreign objects, and microbial contamination. Furthermore, automated inspection systems enable real-time monitoring and high-throughput analysis, which are essential for maintaining product quality and meeting safety requirements in large-scale meat processing facilities.

With rising global meat consumption and growing concerns over food safety, the demand for accurate, reliable, and efficient inspection solutions continues to grow. Key players are offering industry-specific technologies and compliance-ready systems to cater to this segment, further strengthening the meat category's leading position in the market.

"Asia Pacific is projected to account for the largest market share during the forecast period."

The Asia Pacific region is projected to hold the largest share of the global food inspection devices market during the forecast period, driven by rapid industrialization of the food processing sector, rising consumer awareness, and strengthening regulatory frameworks. Countries such as China, India, Japan, South Korea, and Australia are witnessing substantial growth in packaged and processed food consumption, prompting manufacturers to invest in advanced inspection technologies to ensure safety, quality, and compliance with evolving food safety standards.

Regulatory agencies across the region, including the Food Safety and Standards Authority of India (FSSAI) and China's National Health Commission, are enforcing stricter inspection mandates, compelling producers to adopt X-ray systems, metal detectors, and vision inspection solutions. Moreover, increasing food exports from Asia Pacific require adherence to international safety protocols, further boosting demand for high-precision inspection systems.

Cost-effective manufacturing, government support for food safety modernization, and the growing presence of local and global players are making inspection technologies more accessible across small and medium enterprises. As urbanization, population growth, and food safety consciousness continue to rise, Asia Pacific is expected to remain the largest and most dynamic region in the global food inspection devices market.

The break-up of the profile of primary participants in the food inspection devices market is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, Tier 3 - 25%

- By Designation Type: C Level - 40%, Director Level - 30%, Others - 30%

- By Region Type: Asia Pacific - 35%, North America - 25%, Europe - 25%, Rest of the World - 15%

Notes: Other designations include sales, marketing, and product managers.

The three tiers of the companies are based on their total revenues as of 2024; Tier 1: >USD 1 billion, Tier 2: USD 500 million-1 billion, and Tier 3: USD 500 million.

The major players in the food inspection devices market with a significant geographical presence include Mettler-Toledo International Inc. (US), Thermo Fisher Scientific Inc. (US), Ishida Co., Ltd. (Japan), Anritsu Corporation (Japan), Loma Systems (UK), and others.

Research Coverage

The report segments the food inspection devices market and forecasts its size by product, vertical, technology, food category, and region. It also provides a comprehensive review of drivers, restraints, opportunities, and challenges influencing the market growth. The report covers qualitative aspects in addition to quantitative aspects of the market.

Reasons to buy the report:

The report will help the market leaders/new entrants in this market with information on the closest approximate revenues for the overall food inspection devices market and related segments. This report will help stakeholders understand the competitive landscape and gain more insights to strengthen their position in the market and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising global food safety concerns driving mandatory inspection adoption, Surging demand for processed and packaged foods, Increasingly stringent regulatory standards), restraints (High equipment and maintenance costs, complexities in integration with legacy systems), opportunities (Technological advancements in inspection systems, Rising demand for advanced contaminant detection, Growing demand for portable and rapid testing tools in on-site applications), and challenges (Difficulty in standardizing inspection across varied diverse food products, growing cybersecurity risks associated with data-driven inspection infrastructure)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the food inspection devices market

- Market Development: Comprehensive information about lucrative markets -the report analyses the food inspection devices market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the food inspection devices market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, including include Mettler-Toledo International Inc. (US), Thermo Fisher Scientific Inc. (US), Ishida Co., Ltd. (Japan), Anritsu Corporation (Japan), Fortress Technology Inc. (Canada), Sesotec GmbH (Germany), Loma Systems (UK), Minebea Intec GmbH (Germany), Bizerba SE & Co. KG (Germany), and Multivac Group (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY AND PRIMARY RESEARCH

- 2.1.2 SECONDARY DATA

- 2.1.2.1 List of key secondary sources

- 2.1.2.2 Key data from secondary sources

- 2.1.3 PRIMARY DATA

- 2.1.3.1 List of primary interview participants

- 2.1.3.2 Breakdown of primaries

- 2.1.3.3 Key data from primary sources

- 2.1.3.4 Key industry insights

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN FOOD INSPECTION DEVICES MARKET

- 4.2 FOOD INSPECTION DEVICES MARKET, BY PRODUCT

- 4.3 FOOD INSPECTION MARKET, BY TECHNOLOGY

- 4.4 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY

- 4.5 FOOD INSPECTION DEVICES MARKET, BY VERTICAL

- 4.6 FOOD INSPECTION DEVICES MARKET, BY REGION

- 4.7 FOOD INSPECTION DEVICES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global food safety concerns

- 5.2.1.2 Surging demand for processed and packaged foods

- 5.2.1.3 Increasingly stringent regulatory standards

- 5.2.2 RESTRAINTS

- 5.2.2.1 High equipment and maintenance costs

- 5.2.2.2 Complexities in integrating with legacy systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Technological advancements in inspection systems

- 5.2.3.2 Rising demand for advanced contaminant detection

- 5.2.3.3 Growing adoption of portable and rapid testing tools in on-site applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulty in standardizing inspection across varied food products

- 5.2.4.2 Growing cybersecurity risks associated with data-driven inspection infrastructure

- 5.2.4.3 Skills shortage and low regulatory awareness

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 INVESTMENT AND FUNDING SCENARIO

- 5.6 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Ultrasound imaging

- 5.7.1.2 Machine vision

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Artificial intelligence & machine learning

- 5.7.2.2 Data analytics & cloud platforms

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Food safety testing kits

- 5.7.3.2 3D scanning

- 5.7.3.3 Digital twins

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE OF METAL DETECTORS, BY KEY PLAYER, 2021-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF METAL DETECTORS, BY REGION, 2021-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF SUPPLIERS

- 5.9.4 BARGAINING POWER OF BUYERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 FOOD INSPECTION UPGRADE AT NESTLE

- 5.11.2 QUALITY CONTROL AT TESCO WITH HYPERSPECTRAL IMAGING

- 5.11.3 AUTOMATED INSPECTION AT UNILEVER

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT SCENARIO (HS CODE 9031)

- 5.12.2 EXPORT SCENARIO (HS CODE 9031)

- 5.13 PATENT ANALYSIS

- 5.14 TARIFF AND REGULATORY LANDSCAPE

- 5.14.1 TARIFF ANALYSIS (HS CODE 9031)

- 5.14.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 IMPACT OF AI/GEN AI ON FOOD INSPECTION DEVICES MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON FOOD INSPECTION DEVICES MARKET - OVERVIEW

- 5.17.1 PRICE IMPACT ANALYSIS

- 5.17.2 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.17.3 US

- 5.17.4 EUROPE

- 5.17.5 ASIA PACIFIC

- 5.17.6 IMPACT ON VERTICALS

6 FOOD INSPECTION DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 X-RAY INSPECTION DEVICES

- 6.2.1 DEMAND FOR NON-DESTRUCTIVE, HIGH-SENSITIVITY DETECTION TO PROPEL MARKET GROWTH

- 6.3 METAL DETECTORS

- 6.3.1 NEED FOR REGULATORY COMPLIANCE AND COST-EFFECTIVENESS TO DRIVE ADOPTION

- 6.4 CHECKWEIGHERS

- 6.4.1 PRECISION AND REGULATORY MANDATES FUELING ADOPTION IN FOOD PRODUCTION

- 6.5 VISION INSPECTION SYSTEMS

- 6.5.1 AI-POWERED DEFECT DETECTION AND LABEL VERIFICATION DRIVING DEMAND

- 6.6 MICROBIAL DETECTION SYSTEMS

- 6.6.1 NEED FOR STRENGTHENING HYGIENE ASSURANCE ACROSS PACKAGING LINES TO DRIVE DEMAND

- 6.7 SPECTROSCOPY DEVICES

- 6.7.1 REAL-TIME, NON-DESTRUCTIVE MATERIAL VERIFICATION TO ACCELERATE DEMAND FOR SPECTROSCOPY DEVICES

- 6.8 OTHER DEVICES

7 FOOD INSPECTION DEVICES MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 AUTOMATED/COMPUTERIZED SYSTEMS

- 7.2.1 RISING FOOD SAFETY REGULATIONS AND LABOR SHORTAGES TO DRIVE ADOPTION OF COMPUTERIZED INSPECTION DEVICES

- 7.3 MANUAL INSPECTION DEVICES

- 7.3.1 COST-EFFECTIVENESS AND OPERATIONAL SIMPLICITY TO SUSTAIN DEMAND

8 FOOD INSPECTION DEVICES MARKET, BY FOOD CATEGORY

- 8.1 INTRODUCTION

- 8.2 MEAT

- 8.2.1 STRINGENT HYGIENE AND CONTAMINANT DETECTION NEEDS TO FUEL ADOPTION OF ADVANCED FOOD INSPECTION DEVICES

- 8.3 POULTRY & SEAFOOD

- 8.3.1 DIGITAL ADVANCES IN FOOD INSPECTION DRIVING MARKET GROWTH

- 8.4 DAIRY

- 8.4.1 RISING REGULATORY AND QUALITY ASSURANCE NEEDS IN DAIRY INDUSTRY ACCELERATING FOOD INSPECTION DEVICE ADOPTION

- 8.5 BAKERY & CONFECTIONERY

- 8.5.1 RISING GLOBAL REGULATORY ENFORCEMENT FUELING PUBLIC SECTOR DEMAND FOR FOOD INSPECTION DEVICES

- 8.6 CATERING & READY-TO-EAT MEALS

- 8.6.1 SURGE IN URBAN LIFESTYLES AND ON-THE-GO CONSUMPTION FUELING DEMAND

- 8.7 OTHERS

9 FOOD INSPECTION DEVICES MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 FOOD MANUFACTURERS & PROCESSORS

- 9.2.1 RISING FOCUS ON HACCP COMPLIANCE AND YIELD OPTIMIZATION DRIVING ADOPTION

- 9.3 FOOD PACKAGING COMPANIES

- 9.3.1 STRINGENT LABELLING AND SEAL INTEGRITY NORMS DRIVING ADOPTION

- 9.4 RETAIL CHAINS & HYPERMARKETS

- 9.4.1 RISING ON-SITE QUALITY ASSURANCE ACCELERATING ADOPTION ACROSS RETAIL CHAINS & HYPERMARKETS

- 9.5 GOVERNMENT AGENCIES, FOOD SAFETY AUTHORITIES, AND OTHER VERTICALS

- 9.5.1 DIGITAL TRACEABILITY AND INSTITUTIONAL HYGIENE STANDARDS DRIVING ADOPTION IN PUBLIC AND ALTERNATIVE FOOD VERTICALS

10 FOOD INSPECTION DEVICES MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 Regulatory rigor and technological leadership driving inspection system adoption

- 10.2.3 CANADA

- 10.2.3.1 Regulatory compliance and export-oriented food industry fueling demand for inspection technology

- 10.2.4 MEXICO

- 10.2.4.1 Export growth and food safety modernization advancing inspection device adoption

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Advanced engineering and strict regulations powering market leadership

- 10.3.3 UK

- 10.3.3.1 Post-Brexit reforms and food safety priorities driving adoption

- 10.3.4 FRANCE

- 10.3.4.1 Traceability and labeling compliance shaping inspection system demand

- 10.3.5 ITALY

- 10.3.5.1 Heritage food industry increasingly embracing automation and quality control

- 10.3.6 SPAIN

- 10.3.6.1 Export-oriented economy and increased hygiene controls bolstering demand

- 10.3.7 POLAND

- 10.3.7.1 EU compliance and industrial modernization fueling market growth

- 10.3.8 NORDICS

- 10.3.8.1 Technological sophistication and sustainability standards driving adoption

- 10.3.9 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Regulatory overhaul and smart manufacturing accelerating device adoption

- 10.4.3 JAPAN

- 10.4.3.1 Precision standards and technological maturity driving demand for high-end systems

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Export-oriented food industry and digital innovation strengthening market growth

- 10.4.5 INDIA

- 10.4.5.1 Regulatory reforms and F&B sector expansion driving market

- 10.4.6 AUSTRALIA

- 10.4.6.1 Emphasis on automation and export standards to support market growth

- 10.4.7 INDONESIA

- 10.4.7.1 Growing processed food sector and regulatory push driving adoption

- 10.4.8 THAILAND

- 10.4.8.1 Increased food export and infrastructure upgrades advancing market growth

- 10.4.9 MALAYSIA

- 10.4.9.1 Halal certification and export compliance boosting inspection demand

- 10.4.10 VIETNAM

- 10.4.10.1 Export-driven modernization accelerating adoption of inspection devices

- 10.4.11 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Increasingly stringent regulatory policies and food security initiatives driving market growth

- 10.5.2.2 Bahrain

- 10.5.2.2.1 Quality standards and import reliance supporting system adoption

- 10.5.2.3 Kuwait

- 10.5.2.3.1 Regulatory alignment and food sector expansion driving growth

- 10.5.2.4 Oman

- 10.5.2.4.1 Infrastructure development and import controls fueling demand

- 10.5.2.5 Qatar

- 10.5.2.5.1 Food safety modernization and FIFA legacy advancing inspection technologies

- 10.5.2.6 Saudi Arabia

- 10.5.2.6.1 Vision 2030 and food industry diversification supporting growth

- 10.5.2.7 UAE

- 10.5.2.7.1 High standards and global trade driving innovation in food inspection

- 10.5.2.7.2 Rest of Middle East

- 10.5.3 AFRICA

- 10.5.3.1 Strengthening food safety and export readiness to expand Africa's emerging market

- 10.5.3.2 South Africa

- 10.5.3.3 Rest of Africa

- 10.5.4 SOUTH AMERICA

- 10.5.4.1 Regulatory harmonization and export-oriented food processing supporting market growth

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.4 REVENUE ANALYSIS, 2020-2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2025

- 11.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.6.1 STARS

- 11.6.2 EMERGING LEADERS

- 11.6.3 PERVASIVE PLAYERS

- 11.6.4 PARTICIPANTS

- 11.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.6.5.1 Company footprint

- 11.6.5.2 Region footprint

- 11.6.5.3 Food category footprint

- 11.6.5.4 Technology footprint

- 11.6.5.5 Vertical footprint

- 11.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.7.1 PROGRESSIVE COMPANIES

- 11.7.2 RESPONSIVE COMPANIES

- 11.7.3 DYNAMIC COMPANIES

- 11.7.4 STARTING BLOCKS

- 11.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.7.5.1 Detailed list of key startups/SMEs

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.2.1.1 Business overview

- 12.2.1.2 Products offered

- 12.2.1.3 Recent developments

- 12.2.1.3.1 Product launches

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 ANRITSU CORPORATION

- 12.2.2.1 Business overview

- 12.2.2.2 Products offered

- 12.2.2.3 MnM view

- 12.2.2.3.1 Key strengths

- 12.2.2.3.2 Strategic choices

- 12.2.2.3.3 Weaknesses and competitive threats

- 12.2.3 THERMO FISHER SCIENTIFIC INC.

- 12.2.3.1 Business overview

- 12.2.3.2 Products offered

- 12.2.3.3 MnM view

- 12.2.3.3.1 Key strengths

- 12.2.3.3.2 Strategic choices

- 12.2.3.3.3 Weaknesses and competitive threats

- 12.2.4 ISHIDA CO., LTD.

- 12.2.4.1 Business overview

- 12.2.4.2 Products offered

- 12.2.4.3 Recent developments

- 12.2.4.3.1 Product launches

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 LOMA SYSTEMS

- 12.2.5.1 Business overview

- 12.2.5.2 Products offered

- 12.2.5.3 Recent developments

- 12.2.5.3.1 Product launches

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 FORTRESS TECHNOLOGY INC.

- 12.2.6.1 Business overview

- 12.2.6.2 Products offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Product launches

- 12.2.7 SESOTEC GMBH

- 12.2.7.1 Business overview

- 12.2.7.2 Products offered

- 12.2.7.3 Recent developments

- 12.2.7.3.1 Product launches

- 12.2.8 MINEBEA INTEC GMBH

- 12.2.8.1 Business overview

- 12.2.8.2 Products offered

- 12.2.8.3 Recent developments

- 12.2.8.3.1 Product launches

- 12.2.9 BIZERBA SE & CO. KG

- 12.2.9.1 Business overview

- 12.2.9.2 Products offered

- 12.2.10 MULTIVAC GROUP

- 12.2.10.1 Business overview

- 12.2.10.2 Products offered

- 12.2.1 METTLER-TOLEDO INTERNATIONAL INC.

- 12.3 OTHER PLAYERS

- 12.3.1 KEY TECHNOLOGY

- 12.3.2 COGNEX CORPORATION

- 12.3.3 WIPOTEC-OCS

- 12.3.4 PECO INSPX

- 12.3.5 SHANGHAI TECHIK INSTRUMENT CO., LTD.

- 12.3.6 MARLEN INTERNATIONAL

- 12.3.7 EAGLE PRODUCT INSPECTION

- 12.3.8 CEIA

- 12.3.9 CASSEL MESSTECHNIK GMBH

- 12.3.10 HEAT AND CONTROL, INC.

- 12.3.11 MEKITEC GROUP

- 12.3.12 FT SYSTEMS S.R.L.

- 12.3.13 DYLOG HITECH S.P.A.

- 12.3.14 JUZHENG ELECTRONIC TECHNOLOGY CO., LTD.

- 12.3.15 ERIEZ MANUFACTURING CO.

13 APPENDIX

- 13.1 INSIGHTS FROM INDUSTRY EXPERTS

- 13.2 DISCUSSION GUIDE

- 13.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.4 CUSTOMIZATION OPTIONS

- 13.5 RELATED REPORTS

- 13.6 AUTHOR DETAILS