|

시장보고서

상품코드

1780344

고급 비닐 타일(LVT) 시장 예측(-2030년) : 유형별, 제품 유형별, 유통 채널별, 최종 용도 부문별, 지역별Luxury Vinyl Tiles Market by Type (Rigid, Flexible), Product Type (Click LVT, Glue-down LVT), Distribution Channel (Retail Stores, Online Retail), End-use Sector (Residential, Commercial), & Region - Global Forecast to 2030 |

||||||

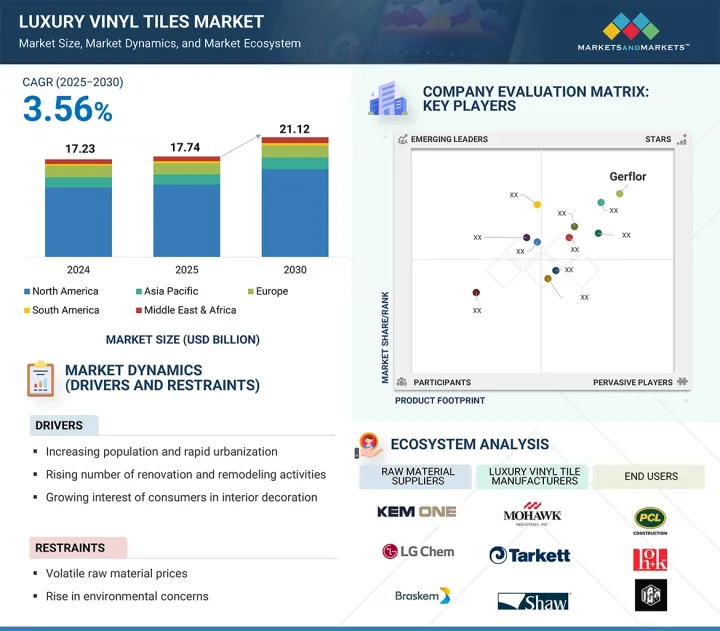

고급 비닐 타일(LVT) 시장 규모는 2025년 177억 4,000만 달러에서 2030년까지 211억 2,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 3.56%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(100만 달러/10억 달러), 수량(100만 평방미터) |

| 부문 | 제품 유형, 유통 채널, 최종 용도 부문, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

"하드 유형은 예측 기간 중 시장에서 가장 빠르게 성장하는 부문이 될 것입니다. "

경질 유형은 찌그러짐, 긁힘, 온도 변화에 대한 내구성이 뛰어나므로 유동인구가 많은 곳이나 습기가 많은 환경에 적합합니다. 리지드 코어 LVT는 콘크리트, 합판, 이전 바닥재 등 다양한 기존 바닥재 위에 간단한 클릭 잠금 또는 글루다운 공법으로 시공할 수 있습니다. 이 간단한 시공 과정은 인건비와 시간을 절약할 수 있으며, 전문가와 DIY 애호가 모두에게 인기 있는 선택이 되고 있습니다.

"글루다운 LVT 부문이 시장 점유율 2위를 차지하고 있습니다. "

글루다운 LVT가 두 번째로 큰 부문이 될 것으로 예측됩니다. 이 공법은 안정성과 내구성이 뛰어나고 유동인구가 많은 장소에 적합하다는 점에서 선호되고 있습니다. 글루다운 LVT는 감압 접착제 또는 하드셋 접착제를 사용하여 타일과 판자를 바닥 아래에 직접 접착하므로 강력하고 오래 지속됩니다. 따라서 사무실, 병원, 소매점, 학교 등 사람들의 왕래가 많은 곳에 적합합니다. 또한 글루다운 LVT는 세월의 흐름에 따른 움직임과 변형을 최소화하여 보다 부드럽고 안전한 마감을 실현하므로 넓은 공간이나 개방된 공간에서 특히 효과적입니다.

"도매업체가 시장 점유율 2위를 차지할 것으로 추정됩니다. "

LVT는 도매업체를 통해 큰 성장세를 보이고 있습니다. 그 이유는 도매업체가 다양한 제품을 제공하고, 경쟁력 있는 가격을 책정하고, 효율적인 공급망을 구축했기 때문입니다. 도매업체는 다양한 LVT를 임베디드하고 저렴한 가격에 대량으로 제공함으로써 제조업체와 소매업체, 계약업체, 대형 구매자를 연결하는 중요한 역할을 하고 있습니다. 이러한 대량 공급은 단기간에 대량의 바닥재를 필요로 하는 상업 프로젝트, 부동산 개발자, 계약자에게 특히 매력적입니다.

"상업 부문이 두 번째로 빠르게 성장하는 시장이 될 것으로 예측됩니다. "

LVT는 내구성, 디자인 유연성, 비용 효율성이라는 독특한 조합으로 인해 상업 부문에서 빠르게 인기를 얻고 있습니다. 사무실, 소매점, 호텔, 호텔, 병원, 교육기관 등 상업 공간에서는 사람들의 왕래가 잦고 잦은 청소, 장기간의 마모에 견딜 수 있는 바닥재가 필요한데, LVT는 이 모든 분야에서 탁월한 성능을 발휘합니다. 스크래치, 얼룩, 습기, 흠집에 대한 높은 내성은 이러한 열악한 환경에 이상적인 선택이 될 수 있습니다. 또한 LVT의 빠르고 간편한 시공 방법은 가동 중단 시간을 최소화할 수 있으며, 가동 유지 및 납기일을 준수해야 하는 상업용 프로젝트에서 특히 중요합니다.

"북미가 예측 기간 중 가장 큰 시장이 될 것입니다. "

북미는 주요 지역으로 수량과 금액 모두에서 가장 큰 시장 점유율을 차지하고 있습니다. 최근 미국과 캐나다에서는 주택 및 상업시설의 건설 활동이 지속적으로 증가하고 있습니다. 이러한 성장으로 인해 바닥재 및 벽재에 사용되는 재료에 대한 수요가 증가하고 있습니다. 특히 고급 비닐 타일(LVT)은 내구성, 다용도성, 가성비가 뛰어나 인기를 끌고 있습니다. 또한 북미 전역에서 리모델링 및 리노베이션 프로젝트가 증가하고 있는 것도 고급 비닐타일(LVT) 수요 증가에 기여하고 있습니다.

세계의 고급 비닐 타일(LVT) 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 고급 비닐 타일(LVT) 시장에서의 매력적인 기회

- 북미의 고급 비닐 타일(LVT) 시장 : 최종 용도 부문별, 국가별

- 고급 비닐 타일(LVT) 시장 : 유형별

- 고급 비닐 타일(LVT) 시장 : 제품 유형별

- 고급 비닐 타일(LVT) 시장 : 유통 채널별

- 고급 비닐 타일(LVT) 시장 : 최종 용도별

- 고급 비닐 타일(LVT) 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

제6장 산업 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 고급 비닐 타일(LVT)의 평균 판매 가격 : 주요 기업별

- 고급 비닐 타일(LVT)의 평균 판매 가격 : 지역별

- 밸류체인 분석

- 에코시스템 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 고급 비닐 타일(LVT) 시장에 대한 생성형 AI의 영향

- 특허 분석

- 서론

- 조사 방법

- 무역 분석

- 수출 시나리오(HS 코드 391810)

- 수입 시나리오(HS 코드 391810)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 규제 상황과 프레임워크

- 규제 상황

- 규제 구조

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 사례 연구 분석

- 거시경제 분석

- 서론

- GDP의 동향과 예측

- 투자와 자금조달 시나리오

- 고급 비닐 타일(LVT) 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제7장 고급 비닐 타일(LVT) 시장 : 유형별

- 서론

- 경질

- 연질

제8장 고급 비닐 타일(LVT) 시장 : 제품 유형별

- 서론

- 글루 다운 LVT

- 클릭 LVT

- 루즈 레이 LVT

- 자기 접착 LVT

제9장 고급 비닐 타일(LVT) 시장 : 유통 채널별

- 서론

- 소매점

- 온라인 소매

- 도매업체

제10장 고급 비닐 타일(LVT) 시장 : 최종 용도별

- 서론

- 주택

- 상업

제11장 고급 비닐 타일(LVT) 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 이탈리아

- 영국

- 프랑스

- 러시아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 시장 순위 분석

- 기업의 평가와 재무 지표

- 제품/브랜드의 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- MOHAWK INDUSTRIES INC.

- TARKETT

- SHAW INDUSTRIES GROUP, INC.

- INTERFACE, INC.

- GERFLOR

- FORBO GROUP

- ARMSTRONG FLOORING

- MANNINGTON MILLS, INC.

- RESPONSIVE INDUSTRIES LTD.

- LX HAUSYS

- 기타 기업

- AMERICAN BILTRITE

- MILLIKEN

- RASKIN

- WELLMADE PERFORMANCE FLOORS

- VINYLASA

- CONGOLEUM

- ADORE FLOORS, INC.

- EARTHWERKS

- FLOORFOLIO

- DAEJIN CO., LTD.

- JIANGSU TAIDE DECORATION MATERIALS CO., LTD

- ZHANGJIAGANG YIHUA RUNDONG NEW MATERIAL CO., LTD.

- TAIZHOU HUALI NEW MATERIALS CO., LTD.

- NOVALIS

- BEAULIEU INTERNATIONAL GROUP

제14장 인접 시장

- 서론

- 바닥재 시장

제15장 부록

KSA 25.08.07The luxury vinyl tiles market is expected to reach USD 21.12 billion by 2030 from USD 17.74 billion in 2025, at a CAGR of 3.56% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) and Volume (Million Square Meter) |

| Segments | Type, Product type, Distribution Channel, End-use Sector, and Region |

| Regions covered | Asia Pacific, North America, Europe, Middle East & Africa, and South America |

"Rigid type to be the fastest-growing segment in the market during the forecast period."

The rigid type offers excellent durability against dents, scratches, and temperature fluctuations, making it ideal for high-traffic areas and damp environments. Rigid-core LVT can be installed over various existing subfloors, including concrete, plywood, and even previous flooring, using an easy click-lock or glue-down method. This straightforward installation process reduces both labor costs and time, making it a popular choice for professionals and DIY enthusiasts alike.

"Glue-down LVT segment to account for the second-largest market share."

Glue-down LVT is anticipated to be the second-largest segment. This installation method is favored for its superior stability, durability, and suitability for high-traffic areas. Glue-down LVT involves adhering tiles or planks directly to the subfloor using either pressure-sensitive or hard-set adhesives, which creates a strong, long-lasting bond. Consequently, it is particularly well-suited for commercial environments such as offices, hospitals, retail stores, and schools, where flooring must endure heavy foot traffic. Additionally, glue-down LVT provides a smoother, more secure finish with minimal movement or shifting over time, making it especially effective in large or open spaces.

"Wholesale distributors are estimated to account for the second-largest market share."

LVT is experiencing significant growth through wholesale distributors, due to their ability to offer a wide range of products, competitive pricing, and efficient supply chains. These distributors serve as a vital link between manufacturers and retailers, contractors, or large buyers by stocking a variety of LVT options and providing them in bulk at lower prices. This bulk availability is particularly attractive to commercial projects, real estate developers, and contractors who need large quantities of flooring materials on short notice.

"The commercial sector is estimated to be the second-fastest-growing market."

LVT is rapidly gaining popularity in the commercial sector due to its unique combination of durability, design flexibility, and cost-effectiveness. Commercial spaces such as offices, retail stores, hotels, hospitals, and educational institutes require flooring that can withstand heavy foot traffic, frequent cleaning, and long-term wear, and LVT excels in all these areas. Its high resistance to scratches, stains, moisture, and dents makes it an ideal choice for such demanding environments. Additionally, the quick and easy installation method of LVT minimizes downtime, which is especially important for commercial projects that need to remain operational or meet tight deadlines.

"North America to be the largest market during the forecast period."

North America is the leading region, holding the largest market share in terms of both volume and value. In recent years, there has been continuous growth in residential and commercial construction activities in the US and Canada. This growth has resulted in a heightened demand for materials used in floor and wall coverings. Luxury vinyl tiles, in particular, have gained popularity due to their durability, versatility, and cost-effectiveness. Furthermore, the increasing number of renovation and remodeling projects across North America is also contributing to the rising demand for luxury vinyl tiles.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and the Middle East & Africa 20%

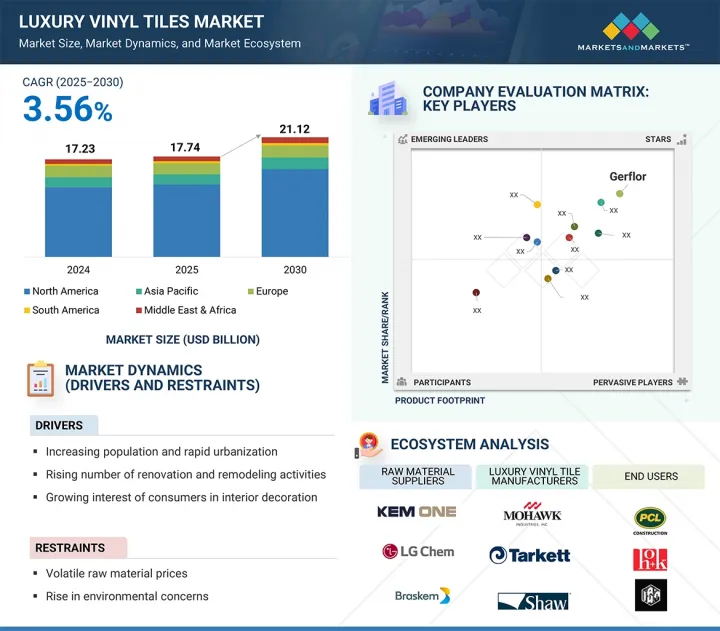

Companies Covered: Mohawk Industries, Inc. (US), Tarkett (France), Shaw Industries Group, Inc. (US), Interface, Inc. (US), Gerflor (France), Forbo Group (Switzerland), Armstrong Flooring (US), Mannington Mills, Inc. (US), Responsive Industries Ltd. (India), and LX Hausys (South Korea), among others, are covered in the report.

The study includes an in-depth competitive analysis of these key players in the luxury vinyl tiles market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the luxury vinyl tiles market based on type (rigid and flexible), product type (glue-down LVT, click LVT, loose lay LVT, and self-adhesive LVT), distribution channel (retail stores, online retail, and wholesale distributors), end-use sector (residential and commercial), and region (Asia Pacific, North America, Europe, South America, and the Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the luxury vinyl tiles market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, agreements, product launches, expansions, and acquisitions, associated with the luxury vinyl tiles market. This report covers a competitive analysis of upcoming startups in the luxury vinyl tiles market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall luxury vinyl tiles market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (increasing population and rapid urbanization, rising number of renovation and remodeling activities, and growing interest of consumers toward interior decoration), restraints (volatile raw material prices and rise in environmental concerns), opportunities (rising demand from emerging economies and growing investment in the construction industry), and challenges (disposal of waste).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the luxury vinyl tiles market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the luxury vinyl tiles market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the luxury vinyl tiles market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Mohawk Industries, Inc. (US), Tarkett (France), Shaw Industries Group, Inc. (US), Interface, Inc. (US), Gerflor (France), Forbo Group (Switzerland), Armstrong Flooring (US), Mannington Mills, Inc. (US), Responsive Industries Ltd. (India), and LX Hausys (South Korea).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/GROWTH FORECAST

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LUXURY VINYL TILES MARKET

- 4.2 NORTH AMERICA: LUXURY VINYL TILES MARKET, BY END-USE SECTOR & COUNTRY

- 4.3 LUXURY VINYL TILES MARKET, BY TYPE

- 4.4 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 4.5 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 4.6 LUXURY VINYL TILES MARKET, BY END-USE SECTOR

- 4.7 LUXURY VINYL TILES MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing population and rapid urbanization

- 5.2.1.2 Rising number of renovation and remodeling activities

- 5.2.1.3 Growing interest of consumers in interior decoration

- 5.2.2 RESTRAINTS

- 5.2.2.1 Volatile raw material prices

- 5.2.2.2 Rising environmental concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand from emerging economies

- 5.2.3.2 Growing investments in construction industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Disposal of waste

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY KEY PLAYER

- 6.2.2 AVERAGE SELLING PRICE OF LUXURY VINYL TILES, BY REGION

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Digital Printing

- 6.5.1.2 Glueless Click Systems

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Noise Reduction Technology

- 6.5.2.2 Internet of Things (IoT) Technology

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Quantum Guard Elite

- 6.5.3.2 Waterproof Core Technologies

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON LUXURY VINYL TILES MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 METHODOLOGY

- 6.8 TRADE ANALYSIS

- 6.8.1 EXPORT SCENARIO (HS CODE 391810)

- 6.8.2 IMPORT SCENARIO (HS CODE 391810)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE & FRAMEWORK

- 6.10.1 REGULATORY LANDSCAPE

- 6.10.1.1 Regulatory bodies, government agencies, and other organizations

- 6.10.2 REGULATORY FRAMEWORK

- 6.10.2.1 Floorscore Certification

- 6.10.2.2 ASTM F1700

- 6.10.2.3 EN 14041

- 6.10.1 REGULATORY LANDSCAPE

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.14 MACROECONOMIC ANALYSIS

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON LUXURY VINYL TILES MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.5 END-USE INDUSTRY IMPACT

7 LUXURY VINYL TILES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 RIGID

- 7.2.1 EXCEPTIONAL WATER RESISTANCE, DURABILITY, AND TEMPERATURE SUITABILITY TO DRIVE MARKET

- 7.3 FLEXIBLE

- 7.3.1 COST-EFFECTIVENESS AND EASE OF INSTALLATION TO AUGMENT DEMAND

8 LUXURY VINYL TILES MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 GLUE-DOWN LVT

- 8.2.1 EXCEPTIONAL ADHESION, DURABILITY, AND TEMPERATURE SUITABILITY TO DRIVE DEMAND

- 8.3 CLICK LVT

- 8.3.1 EASE OF INSTALLATION AND RESIDENTIAL REMODELING ACTIVITIES TO BOOST GROWTH

- 8.4 LOOSE LAY LVT

- 8.4.1 EASE OF INSTALLATION AND RESIDENTIAL REMODELING ACTIVITIES TO BOOST GROWTH

- 8.5 SELF-ADHESIVE LVT

- 8.5.1 IMPROVING ADHESIVE TECHNOLOGIES AND NEED FOR TEMPORARY FLOORING SOLUTIONS TO DRIVE DEMAND

9 LUXURY VINYL TILES MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 RETAIL STORES

- 9.2.1 ENHANCED CUSTOMER CONFIDENCE TO DRIVE MARKET

- 9.3 ONLINE RETAIL

- 9.3.1 COMPETITIVE PRICING AND ADVANCEMENTS IN AUGMENTED REALITY FOR VIRTUAL ROOM PREVIEWS TO DRIVE MARKET

- 9.4 WHOLESALE DISTRIBUTORS

- 9.4.1 COST-EFFECTIVE SOLUTIONS AND FLEXIBLE ORDER SIZES TO PROPEL MARKET

10 LUXURY VINYL TILES MARKET, BY END USE SECTOR

- 10.1 INTRODUCTION

- 10.2 RESIDENTIAL

- 10.2.1 POPULATION EXPANSION, EVOLVING LIVING PREFERENCES, AND ECONOMIC DEVELOPMENT TO AUGMENT DEMAND

- 10.3 COMMERCIAL

- 10.3.1 DURABILITY, LOW MAINTENANCE, AND AESTHETIC APPEAL TO DRIVE MARKET

11 LUXURY VINYL TILES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Growth in construction industry to augment demand

- 11.2.2 CANADA

- 11.2.2.1 Growth in construction sector to drive market

- 11.2.3 MEXICO

- 11.2.3.1 High application in industrial construction to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Government initiatives to fuel demand

- 11.3.2 ITALY

- 11.3.2.1 Growing government investments to propel market

- 11.3.3 UK

- 11.3.3.1 Growing construction industry and housing programs to provide growth opportunities

- 11.3.4 FRANCE

- 11.3.4.1 Government initiatives to build housing units and growing renovation activities to boost demand

- 11.3.5 RUSSIA

- 11.3.5.1 Infrastructural projects by government to support market growth

- 11.3.6 SPAIN

- 11.3.6.1 Government investments in construction projects to boost market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government investments in infrastructure to drive market growth

- 11.4.2 JAPAN

- 11.4.2.1 High urban population to boost market

- 11.4.3 INDIA

- 11.4.3.1 Greater investment in housing and infrastructure projects to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Enhanced investor and consumer confidence to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing population and stable economic conditions to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Saudi Vision 2030 to play pivotal role in driving market

- 11.5.1.2 UAE

- 11.5.1.2.1 Rapid urbanization and infrastructure projects to drive growth

- 11.5.1.3 Rest of GCC countries

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Government initiatives and urbanization trends to support market growth

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Increase in construction and housing programs to fuel market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growing investment for enhancing housing conditions to boost market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 MARKET RANKING ANALYSIS

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 PRODUCT/BRAND COMPARISON

- 12.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.8.1 STARS

- 12.8.2 EMERGING LEADERS

- 12.8.3 PERVASIVE PLAYERS

- 12.8.4 PARTICIPANTS

- 12.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.8.5.1 Company footprint

- 12.8.5.2 Region footprint

- 12.8.5.3 End-use sector footprint

- 12.8.5.4 Type footprint

- 12.8.5.5 Product type footprint

- 12.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.9.1 PROGRESSIVE COMPANIES

- 12.9.2 RESPONSIVE COMPANIES

- 12.9.3 DYNAMIC COMPANIES

- 12.9.4 STARTING BLOCKS

- 12.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.9.5.1 Detailed list of key startups/SMEs

- 12.9.5.2 Competitive benchmarking of key startups/SMEs

- 12.10 COMPETITIVE SCENARIO

- 12.10.1 PRODUCT LAUNCHES

- 12.10.2 EXPANSIONS

- 12.10.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 MOHAWK INDUSTRIES INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 TARKETT

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 SHAW INDUSTRIES GROUP, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 INTERFACE, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 GERFLOR

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 FORBO GROUP

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 MnM view

- 13.1.7 ARMSTRONG FLOORING

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.4 MnM view

- 13.1.8 MANNINGTON MILLS, INC.

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 RESPONSIVE INDUSTRIES LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 MnM view

- 13.1.10 LX HAUSYS

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 MnM view

- 13.1.1 MOHAWK INDUSTRIES INC.

- 13.2 OTHER PLAYERS

- 13.2.1 AMERICAN BILTRITE

- 13.2.2 MILLIKEN

- 13.2.3 RASKIN

- 13.2.4 WELLMADE PERFORMANCE FLOORS

- 13.2.5 VINYLASA

- 13.2.6 CONGOLEUM

- 13.2.7 ADORE FLOORS, INC.

- 13.2.8 EARTHWERKS

- 13.2.9 FLOORFOLIO

- 13.2.10 DAEJIN CO., LTD.

- 13.2.11 JIANGSU TAIDE DECORATION MATERIALS CO., LTD

- 13.2.12 ZHANGJIAGANG YIHUA RUNDONG NEW MATERIAL CO., LTD.

- 13.2.13 TAIZHOU HUALI NEW MATERIALS CO., LTD.

- 13.2.14 NOVALIS

- 13.2.15 BEAULIEU INTERNATIONAL GROUP

14 ADJACENT MARKET

- 14.1 INTRODUCTION

- 14.2 FLOORING MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS