|

시장보고서

상품코드

1780346

고체 냉각 시장 예측(-2030년) : 냉각 시스템, 냉장 시스템, 열전냉각, 전기 열량 냉각, 자기 열량 냉각, 칠러, 쿨러, 에어컨, 냉장고, 냉동고Solid State Cooling Market by Cooling System, Refrigeration System, Thermoelectric Cooling, Electrocaloric Cooling, Magnetocaloric Cooling, Chiller, Cooler, Air Conditioner, Refrigerator and Freezer - Global Forecast to 2030 |

||||||

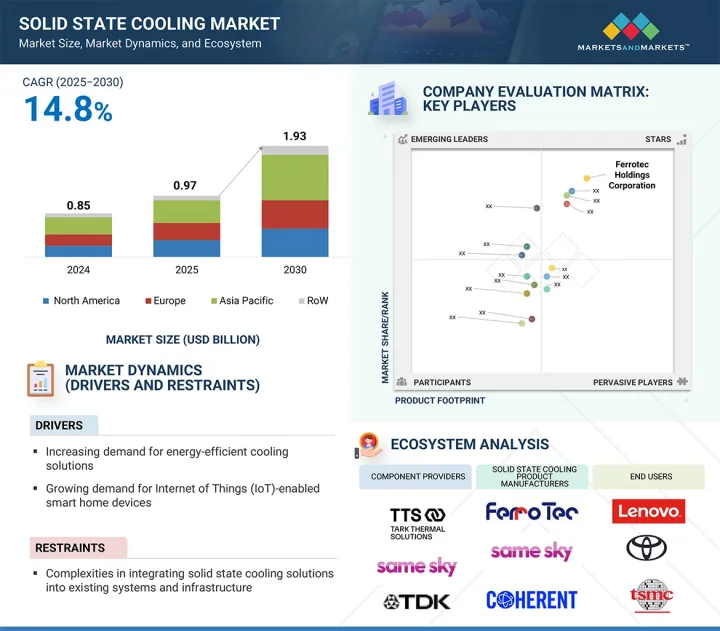

세계의 고체 냉각 시장 규모는 2025년에 9억 7,000만 달러, 2030년까지 19억 3,000만 달러에 달할 것으로 예측되며, 2025-2030년에 CAGR로 14.8%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 기술, 업계, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

민감한 의료기기 및 연구 장비의 저소음 및 무진동 냉각에 대한 수요 증가와 산업 자동화, 통신, 반도체 제조 분야에서 유지보수 비용이 낮은 열 솔루션의 채택 확대가 주요 촉진요인으로 작용하고 있습니다. 또한 배터리 및 차량내 온도 제어를 위해 국부적으로 고체 냉각을 사용하는 전기자동차의 고체 냉각 사용 증가도 고체 냉각 시스템에 대한 수요를 증가시키고 있습니다.

"냉장고 부문은 2025년 냉장 시스템 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. "

냉장고 부문은 주거용, 상업용, 의료용으로 널리 사용되므로 2025년 냉장 시스템용 고체 냉각 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 열전 냉각을 이용하는 고체냉각 냉장고는 정숙한 운전, 컴팩트한 크기, 냉매 미사용, 낮은 유지보수 비용 등 기존 시스템에 비해 여러 가지 장점이 있습니다. 이러한 특징은 미니 냉장고, 휴대용 의료용 저장 장치, 고가 가전제품의 특수 냉장 등 소규모 냉각 수요에 특히 적합합니다. 또한 에너지 효율적이고 친환경적인 냉장 옵션에 대한 수요 증가와 의료 및 개인용 휴대용 및 소형 냉장 시스템의 채택이 증가함에 따라 이 제품의 우수성이 더욱 부각되고 있습니다. 재료 효율이 향상되고 제조 비용이 감소함에 따라 고체냉각 냉장고는 선진국과 신흥 시장에서 보다 실행 가능하고 매력적인 솔루션이 되고 있습니다.

"에어컨 부문이 2025-2030년 냉각 시스템 부문 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. "

에어컨 부문은 기존 HVAC 시스템을 대체할 수 있는 컴팩트하고 에너지 효율적인 냉매를 사용하지 않는 제품에 대한 수요가 증가함에 따라 예측 기간 중 냉각 시스템 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 고체 냉각 공조 시스템, 특히 열전기 및 전기열 기술을 기반으로 한 고체 냉각 공조 시스템은 조용한 작동, 정확한 온도 제어, 지역 또는 개인 기후 구역에 통합할 수 있는 가능성을 제공합니다. 기존 에어컨에서 배출되는 온실가스를 줄이기 위한 지속가능성 및 환경 규제에 대한 관심이 높아지면서 산업계와 소비자들은 주거, 자동차, 상업용 용도를 위한 고체 냉각 솔루션을 모색하고 있습니다. 지속적인 연구개발과 재료의 발전으로 시스템의 성능과 확장성이 향상됨에 따라 고체냉각 공조는 공간 제약이 있는 환경이나 오프 그리드 환경에서 차세대 공조 솔루션으로 점점 더 매력적으로 다가오고 있습니다.

"중국이 2025-2030년 세계 고체냉각 시장에서 가장 높은 CAGR을 보일 것으로 예측됩니다. "

중국은 전자제품 제조거점의 급속한 확장, 전기자동차 채택의 강력한 추진, 의료, 산업 및 소비자 부문에서 에너지 효율적인 열 솔루션에 대한 수요 증가로 인해 예측 기간 중 전 세계 고체 냉각 시장에서 가장 높은 CAGR을 보일 것으로 예측됩니다. 기존 냉매를 사용하는 시스템에 대한 의존도를 줄이는 데 대한 관심은 유리한 정부 정책 및 연구개발 자금에 힘입어 고체 냉각 기술의 채택을 촉진하고 있습니다. 또한 주요 부품 제조업체의 존재, 국내 소비 증가, 열전 재료의 지속적인 발전으로 중국은 세계 시장의 중요한 성장 동력이 되고 있습니다.

세계의 고체 냉각 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요한 인사이트

- 고체 냉각 시장의 기업에 매력적인 기회

- 고체 냉각 시장 : 제품별

- 고체 냉각 시장 : 업계별

- 고체 냉각 시장 : 지역별

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 칠러의 평균 판매 가격 : 주요 기업별(2024년)

- 칠러의 평균 판매 가격 동향 : 지역별(2020-2024년)

- 밸류체인 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 무역 분석

- 수입 데이터

- 수출 데이터

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 사례 연구 분석

- 기준과 규제 상황

- 규제기관, 정부기관, 기타 조직

- 고체 냉각 시장에 관련된 규격과 규제

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고체 냉각 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 업계에 대한 영향

제6장 고체 냉각 시스템의 컴포넌트

- 서론

- 냉장 시스템 컴포넌트

- TEC 모듈(냉장 등급)

- 컴팩트 컨트롤 유닛

- 서멀 인터페이스 매트리얼

- 냉장 시스템의 기타 컴포넌트

- 냉각 시스템 컴포넌트

- 대용량 TEC 모듈/캐스케이드 TEC

- 스마트 컨트롤 보드

- 히트 스프레더·히트 싱크

- 서멀 인터페이스 매트리얼

- 냉각 시스템의 기타 컴포넌트

제7장 고체 냉각 시장 : 제품별

- 서론

- 냉장 시스템

- 냉장고

- 냉동고

- 냉각 시스템

- 에어컨

- 쿨러

- 칠러

제8장 고체 냉각 시장 : 기술별

- 서론

- 열전냉각

- 전기 열량 냉각

- 자기 열량 냉각

- 기타 기술

제9장 고체 냉각 시장 : 업계별

- 서론

- 자동차

- CE(Consumer Electronics)·반도체

- 의료

- 기타 업계

제10장 고체 냉각 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 한국

- 기타 아시아태평양

- 기타 지역

- 기타 지역의 거시경제 전망

- 중동

- 남미

- 아프리카

제11장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점, 2020년 1월-2025년 4월

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업의 평가와 재무 지표

- 브랜드/제품의 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- COHERENT CORP.

- DELTA ELECTRONICS, INC.

- FERROTEC HOLDINGS CORPORATION

- TARK THERMAL SOLUTIONS

- KOMATSU LTD.

- CRYSTAL LTD.

- SAME SKY

- SOLID STATE COOLING SYSTEMS, INC.

- TE TECHNOLOGY, INC.

- TEC MICROSYSTEMS GMBH

- 기타 기업

- ALIGN SOURCING LLC.

- AMS TECHNOLOGIES AG

- EVERREDTRONICS

- XIAMEN HICOOL ELECTRONICS CO., LTD.

- INHECO INDUSTRIAL HEATING & COOLING GMBH

- KRYOTHERM

- MERIT TECHNOLOGY GROUP

- PHONONIC

- SHEETAK INC.

- THERMONAMIC ELECTRONICS(JIANGXI) CORP., LTD.

- WELLEN TECHNOLOGY CO., LTD.

- EUROPEAN THERMODYNAMICS LTD.

- THERMOELECTRIC COOLING AMERICA CORPORATION

- MEERSTETTER ENGINEERING

- CUSTOM THERMOELECTRIC, LLC

제13장 부록

KSA 25.08.07The global solid state cooling market is expected to reach USD 0.97 billion in 2025 and USD 1.93 billion by 2030, registering at a CAGR of 14.8% from 2025 to 2030.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Product, Technology, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The rising demand for silent, vibration-free cooling in sensitive medical and laboratory devices and the growing adoption of low-maintenance thermal solutions in industrial automation, telecom, and semiconductor manufacturing are key drivers. Furthermore, the increasing use of solid state cooling in electric vehicles for localized battery and cabin temperature control augments the demand for solid state cooling systems.

"Refrigerators segment is expected to hold the largest share of the market for refrigeration systems in 2025."

The refrigerators segment is expected to hold the largest share of the solid state cooling market for refrigeration systems in 2025 due to their widespread use across residential, commercial, and medical applications. Solid state cooling refrigerators, which utilize thermoelectric cooling, offer several advantages over traditional systems, including silent operation, compact size, no use of refrigerants, and low maintenance. These features make them particularly suitable for small-scale cooling needs such as mini-fridges, portable medical storage units, and specialty refrigeration in premium consumer appliances. Additionally, the increasing demand for energy-efficient and environmentally friendly refrigeration options and the rising adoption of portable and compact refrigeration systems in healthcare and personal use continue to drive its dominance. As material efficiency improves and manufacturing costs decline, solid state cooling refrigerators are becoming a more viable and attractive solution for developed and emerging markets.

"Air conditioners segment is projected to witness the highest CAGR in market for cooling systems segment between 2025 and 2030."

The air conditioners segment is expected to register the highest CAGR in the market for cooling systems during the forecast period due to the growing demand for compact, energy-efficient, and refrigerant-free alternatives to traditional HVAC systems. Solid state cooling air conditioning systems, particularly those based on thermoelectric and electrocaloric technologies, offer silent operation, precise temperature control, and the potential for integration into localized or personal climate zones. With increasing focus on sustainability and environmental regulations targeting the reduction of greenhouse gas emissions from conventional air conditioners, industries and consumers are exploring solid state cooling solutions for residential, automotive, and commercial applications. Ongoing R&D and material advancements improve system performance and scalability, making solid state cooling air conditioning increasingly attractive for next-generation climate control solutions in space-constrained or off-grid environments.

"China is expected to exhibit the highest CAGR in the global solid state cooling market from 2025 to 2030."

China is likely to exhibit the highest CAGR in the global solid state cooling market during the forecast period due to its rapidly expanding electronics manufacturing base, strong push for electric vehicle adoption, and growing demand for energy-efficient thermal solutions across medical, industrial, and consumer sectors. The focus on reducing reliance on conventional refrigerant-based systems, supported by favorable government policies and R&D funding, boosts the adoption of solid state cooling technologies. Additionally, the presence of major component manufacturers, rising domestic consumption, and ongoing advancements in thermoelectric materials position China as a key growth engine in the global market.

Extensive primary interviews were conducted with key industry experts in the solid state cooling market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below:

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 10%, Tier 2 - 55%, and Tier 3 - 35%

- By Designation: C-level Executives - 45%, Managers - 25%, and Others - 30%

- By Region: North America - 15%, Europe - 20%, Asia Pacific - 55%, and RoW - 10%

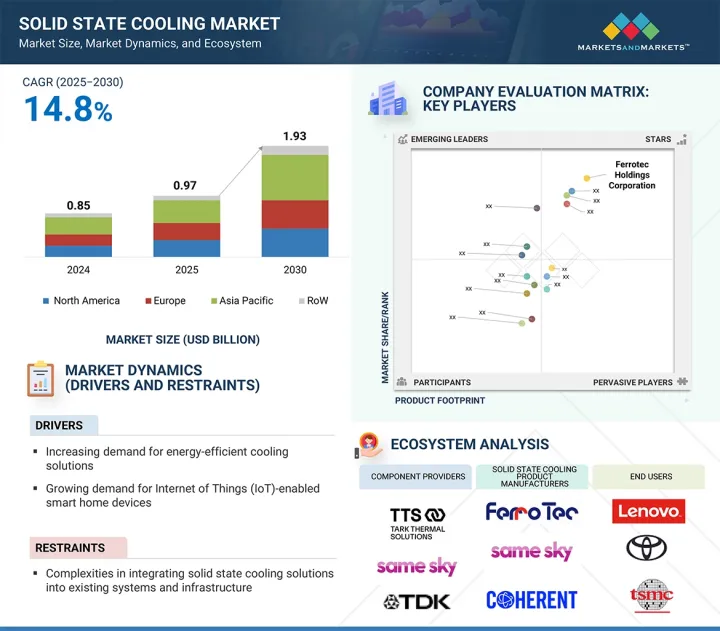

Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) are some of the key players in the solid state cooling market.

Research Coverage:

This research report categorizes the solid state cooling market based on product (cooling systems and refrigeration systems), technology (thermoelectric cooling, electrocaloric cooling, magnetocaloric cooling, and other technologies), vertical (automotive, consumer electronics & semiconductors, healthcare, and other verticals), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the solid state cooling market and forecasts the same till 2030. Apart from this, the report also consists of leadership mapping and analysis of all the companies included in the solid state cooling ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall solid state cooling market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (surging demand for energy-efficient cooling solutions; rising implementation of IoT-enabled smart home devices; growing adoption of electric and hybrid electric vehicles; booming data center industry), restraints (high initial investment and manufacturing costs associated with solid state cooling technology; complexities in integrating solid state cooling solutions into existing systems and infrastructure; regulatory barriers and standards compliance requirements in healthcare and automotive industries), opportunities (emerging applications of solid state cooling technology in aerospace, defense, and consumer sectors; growing industrialization and urbanization), and challenges (complexities in designing and engineering solid state cooling systems for diverse applications and operating conditions; shortage of qualified experts with technical know-how regarding thermoelectric cooling and thermal management) influencing the growth of the solid state cooling market

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the solid state cooling market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the solid state cooling market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the solid state cooling market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players, such as Ferrotec Holdings Corporation (Japan), Coherent Corp. (US), Delta Electronics, Inc. (Taiwan), Komatsu Ltd. (Japan), and Tark Thermal Solutions (US) in the solid state cooling market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of key participants in primary interviews

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primaries

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to estimate market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to estimate market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SOLID STATE COOLING MARKET

- 4.2 SOLID STATE COOLING MARKET, BY PRODUCT

- 4.3 SOLID STATE COOLING MARKET, BY VERTICAL

- 4.4 SOLID STATE COOLING MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for energy-efficient cooling solutions

- 5.2.1.2 Rising implementation of IoT-enabled smart home devices

- 5.2.1.3 Growing adoption of electric and hybrid electric vehicles

- 5.2.1.4 Thriving data center industry

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial investment and manufacturing costs associated with solid state cooling technology

- 5.2.2.2 Complexities associated with integrating solid state cooling solutions into existing systems and infrastructure

- 5.2.2.3 Regulatory barriers and standards compliance requirements

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing deployment in aerospace, defense, and consumer sectors

- 5.2.3.2 Expanding industrialization and urbanization

- 5.2.4 CHALLENGES

- 5.2.4.1 Complexities associated with designing and engineering solid state cooling systems

- 5.2.4.2 Shortage of qualified experts with technical knowledge

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF CHILLERS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CHILLERS, BY REGION, 2020-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Thermoelectric cooling

- 5.8.1.2 Magnetic cooling

- 5.8.1.3 Electrocaloric cooling

- 5.8.1.4 Thermoelastic cooling

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Heat exchangers

- 5.8.2.2 Thermal interface materials (TIMs)

- 5.8.2.3 Temperature sensors and control systems

- 5.8.2.4 Power electronics and drivers

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Thermal management solutions

- 5.8.3.2 Energy harvesting systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 INTEL INTEGRATED PHONONIC'S SOLID STATE COOLING TECHNOLOGY INTO ITS DATA CENTERS TO REDUCE ENERGY CONSUMPTION AND ENVIRONMENTAL IMPACT

- 5.12.2 THERMO FISHER SCIENTIFIC INCORPORATED TE TECHNOLOGY'S SOLID-STATE COOLING MODULES INTO ITS ULTRA-LOW TEMPERATURE FREEZERS TO ENSURE PRECISE TEMPERATURE CONTROL AND STABILITY

- 5.12.3 BMW GROUP IMPLEMENTED II-VI MARLOW'S THERMOELECTRIC COOLING MODULES IN ELECTRIC VEHICLES TO ENSURE EFFICIENT OPERATION AND PREVENT OVERHEATING

- 5.12.4 PHILIPS HEALTHCARE INTEGRATED LAIRD'S SOLID-STATE COOLING MODULES INTO ITS MEDICAL IMAGING EQUIPMENT TO MAINTAIN OPTIMAL OPERATING TEMPERATURE

- 5.12.5 NASA PARTNERED WITH ATG TO DEVELOP SOLID STATE COOLING SYSTEMS FOR SPACE MISSIONS

- 5.13 STANDARDS AND REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 STANDARDS AND REGULATIONS RELATED TO SOLID STATE COOLING MARKET

- 5.13.2.1 International Electrotechnical Commission (IEC) standards

- 5.13.2.2 Underwriters Laboratories (UL) Standards

- 5.13.2.3 ISO standards

- 5.13.2.4 Energy star certification

- 5.13.2.5 Safety regulations

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITION RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF 2025 US TARIFF ON SOLID STATE COOLING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON VERTICALS

6 COMPONENTS OF SOLID STATE COOLING SYSTEMS

- 6.1 INTRODUCTION

- 6.2 REFRIGERATION SYSTEM COMPONENTS

- 6.2.1 TEC MODULES (REFRIGERATION-GRADE)

- 6.2.2 COMPACT CONTROL UNITS

- 6.2.3 THERMAL INTERFACE MATERIALS

- 6.2.4 OTHER COMPONENTS IN REFRIGERATION SYSTEMS

- 6.3 COOLING SYSTEM COMPONENTS

- 6.3.1 HIGH-CAPACITY TEC MODULES/CASCADE TECS

- 6.3.2 SMART CONTROL BOARDS

- 6.3.3 HEAT SPREADERS & HEAT SINKS

- 6.3.4 THERMAL INTERFACE MATERIALS

- 6.3.5 OTHER COMPONENTS IN COOLING SYSTEMS

7 SOLID STATE COOLING MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 REFRIGERATION SYSTEMS

- 7.2.1 REFRIGERATORS

- 7.2.1.1 Advancements in materials science, semiconductor technology, and thermal management to boost segmental growth

- 7.2.2 FREEZERS

- 7.2.2.1 Increasing demand for energy-efficient and environmentally friendly cooling solutions to drive market

- 7.2.1 REFRIGERATORS

- 7.3 COOLING SYSTEMS

- 7.3.1 AIR CONDITIONERS

- 7.3.1.1 Growing demand for cooling solutions with precise control and minimal maintenance to boost demand

- 7.3.2 COOLERS

- 7.3.2.1 Surging demand for compact and high-power electronics to offer lucrative growth opportunities

- 7.3.3 CHILLERS

- 7.3.3.1 Increasing demand for precise temperature control in medical equipment to support market growth

- 7.3.1 AIR CONDITIONERS

8 SOLID STATE COOLING MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 THERMOELECTRIC COOLING

- 8.2.1 GROWING APPLICATIONS IN CONSUMER ELECTRONICS, AUTOMOTIVE, AND MEDICAL DEVICES TO FOSTER MARKET GROWTH

- 8.2.2 TYPES OF THERMOELECTRIC COOLING

- 8.2.2.1 Single-stage

- 8.2.2.2 Multi-stage

- 8.2.2.3 Thermocycler

- 8.3 ELECTROCALORIC COOLING

- 8.3.1 CLIMATE-FRIENDLY COOLING AND RAPID RESPONSE TIME TO DRIVE MARKET

- 8.4 MAGNETOCALORIC COOLING

- 8.4.1 LOW ENERGY CONSUMPTION AND REDUCED NOISE LEVELS TO FOSTER MARKET GROWTH

- 8.5 OTHER TECHNOLOGIES

9 SOLID STATE COOLING MARKET, BY VERTICAL

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE

- 9.2.1 ACCELERATED EV ADOPTION TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 9.2.2 CASE STUDY: BMW COLLABORATED WITH GENTHERM TO INTEGRATE SOLID STATE COOLING SYSTEMS IN ITS VEHICLES FOR PERSONALIZED CLIMATE CONTROL

- 9.2.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON AUTOMOTIVE VERTICAL

- 9.3 CONSUMER ELECTRONICS & SEMICONDUCTOR

- 9.3.1 RISE OF EDGE COMPUTING AND ALWAYS-ON FEATURES IN MOBILE AND IOT DEVICES TO BOOST DEMAND

- 9.3.2 CASE STUDY: INTEL COLLABORATED WITH TARK THERMAL SOLUTIONS TO INTEGRATE SOLID STATE COOLING TECHNOLOGY INTO CPUS FOR EFFICIENT HEAT DISSIPATION AND THERMAL MANAGEMENT

- 9.3.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON CONSUMER ELECTRONICS & SEMICONDUCTOR VERTICAL

- 9.4 HEALTHCARE

- 9.4.1 EMPHASIS ON ADDRESSING TEMPERATURE MANAGEMENT CHALLENGES AND IMPROVING PATIENT CARE TO FUEL MARKET GROWTH

- 9.4.2 CASE STUDY: PFIZER COLLABORATED WITH PHONONIC TO DEPLOY SOLID STATE COOLING TECHNOLOGY IN VACCINE STORAGE UNITS TO ENSURE PRECISE TEMPERATURE CONTROL

- 9.4.3 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON HEALTHCARE VERTICAL

- 9.5 OTHER VERTICALS

- 9.5.1 CASE STUDY: BOEING COLLABORATED WITH LAIRD THERMAL SYSTEMS TO IMPLEMENT SOLID STATE COOLING TECHNOLOGY IN AIRCRAFT AVIONICS SYSTEMS TO ENHANCE COMPONENT RELIABILITY AND LONGEVITY

- 9.5.2 IMPACT ANALYSIS OF SOLID STATE COOLING TECHNOLOGY TYPES ON OTHER VERTICALS

10 SOLID STATE COOLING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Increasing number of construction projects to boost demand

- 10.2.3 CANADA

- 10.2.3.1 Growing investment in data centers to fuel market growth

- 10.2.4 MEXICO

- 10.2.4.1 Rapid urbanization and infrastructure development to boost demand

- 10.3 EUROPE

- 10.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.2 UK

- 10.3.2.1 Emphasis on developing electric vehicle infrastructure to accelerate market growth

- 10.3.3 GERMANY

- 10.3.3.1 Adoption of Industry 4.0 and smart manufacturing techniques to foster market growth

- 10.3.4 FRANCE

- 10.3.4.1 Rising focus on reducing greenhouse gases to support market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising focus on developing energy-efficient buildings to offer lucrative growth opportunities

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Emphasis on energy conservation and carbon emissions reduction to fuel market growth

- 10.4.3 JAPAN

- 10.4.3.1 Increasing need for advanced cooling solutions in healthcare sector to drive market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Thriving electronics & semiconductor industries to fuel market growth

- 10.4.5 REST OF ASIA PACIFIC

- 10.5 ROW

- 10.5.1 ROW: MACROECONOMIC OUTLOOK

- 10.5.2 MIDDLE EAST

- 10.5.2.1 Rapid economic development and infrastructure expansion to foster market growth

- 10.5.3 SOUTH AMERICA

- 10.5.3.1 Rising investment in green technologies to drive market

- 10.5.4 AFRICA

- 10.5.4.1 Increasing awareness of environmental impact of traditional cooling methods to boost demand

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, JANUARY 2020-APRIL 2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 KEY PLAYERS IN SOLID STATE COOLING MARKET, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS

- 11.7.5.1 Company footprint

- 11.7.5.2 Product footprint

- 11.7.5.3 Technology footprint

- 11.7.5.4 Vertical footprint

- 11.7.5.5 Region footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING, STARTUPS/SMES, 2024

- 11.8.5.1 List of startups/SMEs

- 11.8.6 COMPANY FOOTPRINT: STARTUPS/SMES

- 11.8.6.1 Company footprint

- 11.8.6.2 Product footprint

- 11.8.6.3 Technology footprint

- 11.8.6.4 Vertical footprint

- 11.8.6.5 Region footprint

- 11.9 COMPETITIVE SCENARIOS

- 11.9.1 PRODUCT/SERVICE LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 COHERENT CORP.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 DELTA ELECTRONICS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product/Service launches

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 FERROTEC HOLDINGS CORPORATION

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 TARK THERMAL SOLUTIONS

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product/Service launches

- 12.1.4.3.2 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 KOMATSU LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths/Right to win

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses/Competitive threats

- 12.1.6 CRYSTAL LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.7 SAME SKY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product/Service launches

- 12.1.7.3.2 Deals

- 12.1.8 SOLID STATE COOLING SYSTEMS, INC.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product/Service launches

- 12.1.9 TE TECHNOLOGY, INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.10 TEC MICROSYSTEMS GMBH

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product/Service launches

- 12.1.1 COHERENT CORP.

- 12.2 OTHER PLAYERS

- 12.2.1 ALIGN SOURCING LLC.

- 12.2.2 AMS TECHNOLOGIES AG

- 12.2.3 EVERREDTRONICS

- 12.2.4 XIAMEN HICOOL ELECTRONICS CO., LTD.

- 12.2.5 INHECO INDUSTRIAL HEATING & COOLING GMBH

- 12.2.6 KRYOTHERM

- 12.2.7 MERIT TECHNOLOGY GROUP

- 12.2.8 PHONONIC

- 12.2.9 SHEETAK INC.

- 12.2.10 THERMONAMIC ELECTRONICS (JIANGXI) CORP., LTD.

- 12.2.11 WELLEN TECHNOLOGY CO., LTD.

- 12.2.12 EUROPEAN THERMODYNAMICS LTD.

- 12.2.13 THERMOELECTRIC COOLING AMERICA CORPORATION

- 12.2.14 MEERSTETTER ENGINEERING

- 12.2.15 CUSTOM THERMOELECTRIC, LLC

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS