|

시장보고서

상품코드

1781111

바이오서저리 시장 : 제품별, 용도별, 최종 사용자별 예측(-2030년)Biosurgery Market by Product (Bone Graft Substitutes, Sealants (Natural (Gelatin, Collagen)), Hemostatic Agents, Soft-tissue Attachments (Synthetic, Biological)), Application (Orthopedic, Urological), End User (Hospitals, ASCs) - Global Forecast to 2030 |

||||||

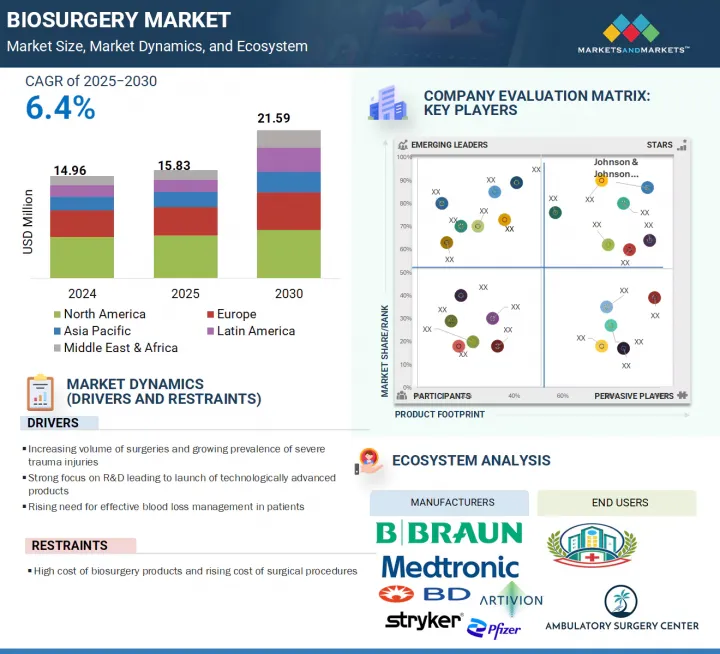

세계의 바이오서저리 시장 규모는 2025년 1,583만 달러에서 2030년까지 2,159만 달러에 이를 것으로 예측되며, 예측 기간에 CAGR은 6.4%로 성장할 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 용도, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

바이오서저리 시장은 여러 주요 촉진요인에 힘입어 강력한 성장을 기록하고 있습니다. 주요 촉진요인으로는 만성 질환의 유병률 증가로 인한 수술적 개입의 필요성 증가와 심각한 외상성 부상 사례의 증가가 있습니다. 이러한 사건이 증가함에 따라 선택적 수술 절차의 양도 증가하며, 이는 바이오서저리 제품 수요를 촉진합니다. 또한 효율적인 출혈 관리의 필요성 증가와 고급 바이오서저리 기술의 접근성 향상도 시장 확장을 지원합니다. 그러나 이 성장 추세는 바이오서저리 제품의 높은 비용, 적절히 훈련된 전문 인력 부족, 엄격한 규제 환경 등 여러 도전 과제에 직면해 있으며, 이러한 요인들은 예측 기간 동안 시장 성장에 장애물이 될 것으로 예상됩니다.

2024년 기준 뼈 이식 대체재 중 탈염 뼈 매트릭스 하위 부문이 가장 큰 시장 점유율을 차지했습니다.

제품 유형별로는 생체외 수술 시장은 뼈 이식 대체재, 연부 조직 부착재, 지혈제, 수술용 밀봉제 및 접착제, 접착 방지제, 스테이플 라인 강화제 등으로 구분됩니다. 2024년에는 골 이식 대체재 시장이 주로 탈염 뼈 매트릭스(DBM) 부문이 주도할 것으로 보입니다. DBM은 골전도성과 골유도성을 모두 갖춘 것으로 알려져 있어 효과적인 뼈 재생을 촉진합니다. 합성 이식편, 골형성 단백질(BMP) 및 기타 대체재가 포함된 광범위한 골 이식 대체재 부문에서 DBM은 바이오서저리 분야에서 가장 중요한 업체로 부상했습니다. DBM은 뼈 치유 촉진에 대한 임상적 효능이 향상되어 척추 융합 및 고관절 및 무릎 관절 치환과 같은 다양한 정형외과 수술에 광범위하게 사용되고 있습니다. 이 제품의 다목적성은 페이스트, 퍼티, 시트, 유연한 조각 등 다양한 형태로 제공되어 맞춤형 수술 용도로 사용할 수 있다는 점으로 더욱 강조됩니다. DBM을 만드는 과정에는 동종 이식 뼈에서 무기 미네랄을 제거하여 골 형성을 적극적으로 자극하는 BMP를 추출하는 단계가 포함됩니다. 이 특성으로 인해 DBM은 자가 이식편을 대체할 수 있는 신뢰할 수 있고 생물학적으로 활성적인 대체재로 자리매김했습니다. 또한 감마선 조사 및 전자빔 살균과 같은 최종 살균 기술을 구현하여 제품의 안전성과 무결성을 보장합니다. 안전하고 효과적이며 접근성이 뛰어난 이식 대체재로 외과의들이 DBM을 지속적으로 선호함에 따라 이 부문에서 DBM의 선도적 지위는 더욱 강화될 것입니다.

바이오서저리 최종 사용자 시장의 외래 수술 센터는 연구 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다.

최종 사용자를 기준으로 한 바이오서저리 시장은 외래 수술 센터(ASC), 병원, 클리닉 및 기타 최종 사용자로 나뉩니다. 외래 수술 센터(ASC) 부문은 예측 기간 동안 바이오서저리 시장의 성장을 주도할 것으로 예상됩니다. 이러한 성장은 비용 효율적이고 효율적이며 최소 침습적인 수술 옵션에 대한 수요 증가에 의해 뒷받침됩니다. ASC는 수술 안전 및 임상 결과에 대한 높은 기준을 유지하면서 기존 병원에 대한 경제적으로 실행 가능한 대안을 제시하여 환자와 의료 종사자들에게 점점 더 매력적인 선택지가 되고 있습니다. 이 센터들은 정형외과, 안과, 성형외과 및 일반 수술을 포함한 다양한 외래 환자 시술을 수행하기 위해 최적으로 갖추어져 있습니다. 이러한 환경에서 실란트, 지혈제 및 유착 방지제와 같은 바이오서저리 제품은 수술의 정확성을 높이고 환자의 회복을 촉진하는 데 매우 중요합니다. 수술 기술, 마취 및 바이오서저리 기술의 발전은 수술 건수가 입원 환자 환경에서 외래 환자 시설로 계속 전환되는 속도를 가속화하고 있습니다. 의료비 증가, 외래 환자 시술에 대한 유리한 보험 환급 정책, 환자 회복 시간 단축 등의 요인이 ASC의 성장을 더욱 촉진하고 있습니다. 환자들이 병원 감염의 위험을 최소화한 신속한 당일 시술을 점점 더 선호함에 따라 ASC에서 생체외 수술 솔루션에 대한 수요가 증가할 것으로 예상되어 이 부문의 급속한 성장이 예상됩니다.

이 보고서는 세계의 바이오서저리 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 바이오서저리 시장 개요

- 북미의 바이오서저리 시장 : 국가별, 최종 사용자별

- 바이오서저리 시장의 지리적 스냅샷

- 지역의 구성 : 바이오서저리 시장(2025-2030년)

- 바이오서저리 시장 : 신흥 시장과 선진 시장의 비교(2025년 및 2030년)

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 산업 동향

- 수술에서 젤라틴계 접착제와 하이드로겔에 대한 선호도 증가

- 차세대 접착제 개발에 있어서의 나노 기술의 활용

- 밸류체인 분석

- 생태계 분석

- 공급망 분석

- 무역 분석

- HS코드 300610의 수입 데이터(2019-2024년)

- HS코드 300610의 수출 데이터(2019-2024년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 분석

- 특허 분석

- 가격 분석

- 바이오서저리 제품의 평균 판매 가격 동향 : 주요 기업별(2022-2024년)

- 바이오서저리 제품의 평균 판매 가격의 동향 : 지역별(2022-2024년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 인접 시장 분석

- 미충족 요구 및 최종사용자의 기대

- 고객사업에 영향을 주는 동향 및 혼란

- 투자 및 자금조달 시나리오

- 바이오서저리 시장에 대한 AI/생성형 AI의 영향

- 바이오서저리 시장에 대한 미국 관세의 영향(2025년)

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 대한 영향

- 최종 이용 산업에 미치는 영향

제6장 바이오서저리 시장 : 제품별

- 소개

- 탈염 뼈 매트릭스(DBM)

- 수술용 실란트 및 접착제

- 유착 방지제

- 스테이플 라인 보강제

- 연부 조직 부착

- 지혈제

제7장 바이오서저리 시장 : 용도별

- 소개

- 정형외과 수술

- 일반 외과 수술

- 신경외과 수술

- 심혈관 수술

- 재건 수술

- 부인과 수술

- 비뇨기과 수술

- 흉부 수술

- 기타 용도

제8장 바이오서저리 시장 : 최종 사용자별

- 소개

- 병원

- 진료소

- 외래수술센터(ASC)

- 기타 최종 사용자

제9장 바이오서저리 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 기타 중동 및 아프리카

제10장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- BAXTER

- B. BRAUN SE

- BECTON, DICKINSON AND COMPANY(BD)

- JOHNSON & JOHNSON

- MEDTRONIC

- INTEGRA LIFESCIENCES CORPORATION

- COMMONWEALTH SERUM LABORATORIES LIMITED(CSL)

- HEMOSTASIS, LLC

- PFIZER INC.

- STRYKER

- ARTIVION, INC.

- ZIMMER BIOMET

- KUROS BIOSCIENCES

- ORTHOFIX MEDICAL INC.

- SMITH & NEPHEW

- 기타 기업

- TISSUE REGENIX

- BETATECH MEDICAL

- MERIL LIFE SCIENCES PVT. LTD.

- GLOBUS MEDICAL

- SAMYANG HOLDINGS CORPORATION

- AROA BIOSURGERY LIMITED

- MEYER-HAAKE GMBH

- ADVANCED MEDICAL SOLUTIONS GROUP PLC

- BIOCER ENTWICKLUNGS-GMBH

- WILTROM

제12장 부록

HBR 25.08.07The global biosurgery market is projected to reach USD 21.59 million by 2030 from USD 15.83 million in 2025, at a CAGR of 6.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The biosurgery market is experiencing robust growth, propelled by several key dynamics. A primary driver is the increasing prevalence of chronic conditions that necessitate surgical interventions, alongside a rise in severe traumatic injuries. As these incidents become more common, there is a corresponding uptick in the volume of elective surgical procedures, subsequently fueling the demand for biosurgical products. Moreover, the escalating need for efficient blood loss management and the enhanced availability of advanced biosurgical technologies further support market expansion. However, this growth trajectory faces challenges, including the high cost associated with biosurgery products, a shortage of adequately skilled professionals, and a stringent regulatory environment, all of which are anticipated to hinder the market's progress over the forecast period.

The demineralized bone matrix subsegment, by bone graft substitutes, held the largest market share in 2024.

Based on product, the biosurgery market is divided into bone-graft substitutes, soft-tissue attachments, hemostatic agents, surgical sealants and adhesives, adhesion barriers, and staple-line reinforcement agents. In 2024, the bone graft substitute market was predominantly led by the demineralized bone matrix (DBM) segment, which is recognized for its dual osteoconductive and osteoinductive properties, thereby facilitating effective bone regeneration. Within the broader category of bone graft substitutes-which includes synthetic grafts, bone morphogenetic proteins (BMPs), and other alternatives-DBM has emerged as the most significant player in the biosurgery sector. DBM is extensively employed in various orthopedic procedures, such as spinal fusion and hip & knee replacements, owing to its enhanced clinical efficacy in promoting bone healing. Its versatility is further accentuated by its availability in multiple forms, including pastes, putty, sheets, and flexible fragments, allowing for tailored surgical applications. The process of creating DBM involves the removal of inorganic minerals from allograft bones, which unveils BMPs that actively stimulate osteogenesis. This characteristic positions DBM as a reliable and biologically active substitute for autografts. Furthermore, implementing terminal sterilization techniques, such as gamma irradiation and electron-beam sterilization, ensures the safety and integrity of the product. The sustained preference of surgeons for DBM as a safe, effective, and accessible graft substitute continues to reinforce its leading status within this market segment.

The ambulatory surgical centers of the biosurgery end user market are expected to command the highest CAGR during the study period.

The biosurgery market, based on end users, is divided into ambulatory surgical centers (ASCs), hospitals, clinics, and other end users. The ambulatory surgical centers (ASCs) segment is anticipated to lead growth in the biosurgery market throughout the forecast period. This expansion is underpinned by an increasing demand for cost-effective, efficient, and minimally invasive surgical options. ASCs present an economically viable alternative to traditional hospitals while upholding high standards for surgical safety and clinical outcomes, making them increasingly appealing to patients and healthcare practitioners. These centers are optimally equipped to perform various outpatient procedures, including orthopedic, ophthalmic, cosmetic, and general surgeries. In these settings, biosurgical products such as sealants, hemostats, and adhesion barriers are critical in enhancing surgical precision and promoting patient recovery. Advancements in surgical techniques, anesthesia, and biosurgical technologies accelerate the ongoing transition of surgical volumes from inpatient environments to outpatient facilities. Factors such as rising healthcare expenditures, advantageous reimbursement policies for outpatient procedures, and reduced patient recovery times are further driving the growth of ASCs. As patient preferences increasingly lean toward expedited, same-day procedures with a minimized risk of hospital-acquired infections, the demand for biosurgical solutions in ASCs is projected to escalate, thus propelling rapid growth in this segment.

In 2024, the North America region accounted for the largest share in the biosurgery market.

The global biosurgery market is segmented into five major regions: North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North American region is projected to maintain the largest share of the global biosurgery market, attributable to its sophisticated healthcare infrastructure, elevated surgical rates, and the concentration of prominent industry players. This region has experienced notable increases in cosmetic and reconstructive surgeries and a marked rise in orthopedic procedures. According to Discovery ABA, approximately 26.2 million surgical and minimally invasive cosmetic and reconstructive procedures were performed in the United States in 2022, reflecting a 19% increase in cosmetic surgeries compared to 2019. Furthermore, the 2022 data from the American Joint Replacement Registry (AJRR) highlights over 2.8 million hip and knee procedures conducted across all 50 states and the District of Columbia, underscoring the significant demand for biosurgery products in joint replacement and orthopedic applications. Key drivers for this market expansion include a growing geriatric population, a high incidence of chronic diseases, and an increasing volume of surgical interventions necessitating advanced hemostatic agents, sealants, and materials for soft tissue repair. Coupled with favorable reimbursement frameworks, heightened patient awareness, and substantial R&D investments from leading companies such as Johnson & Johnson, Baxter, and Stryker, North America is solidifying its position as the most dominant and mature biosurgery market globally.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C-level- 50%, Director level- 30%, and Others- 20%

- By Region: North America- 30%, Europe- 25%, Asia Pacific- 20%, Latin America- 15%, and Middle East & Africa- 10%.

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the biosurgery market include Johnson & Johnson Services, Inc. (US), Baxter (US), Medtronic (Ireland), Becton, Dickinson and Company (BD) (US), B. Braun Melsungen AG (Germany), Stryker (US), Integra Lifesciences Holdings Corporation (US), CSL Ltd. (Australia), Hemostasis LLC. (US), Pfizer Inc. (US), Artivion Inc. (US), Zimmer Biomet (US), Kuros Biosciences AG (Switzerland), Orthofix Medical Inc. (US), Smiths & Nephew PLC (UK), Tissue Regenix (UK), Betatech Medical (Turkey), Meril Lifesciences Pvt. Ltd. (India), RTI Surgicals (US), Samyang Holdings Corp. (South Korea), Aroa Biosurgery Ltd. (New Zealand), Meyer-Haake GmbH (Germany), Advanced Medical Solutions Group PLC (UK), BioCer Entwicklungs-GmbH (Germany), and Hannox International Corp. (Taiwan)

Research Coverage

This report studies the biosurgery market based on product, application, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets concerning their growth trends. It forecasts the revenue of the market segments concerning five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established and entrants/smaller firms to gauge the market's pulse, which, in turn, would help them gain a larger market share. Firms purchasing the report could use one or a combination of the below-mentioned strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (increasing volume of surgeries and growing prevalence of severe trauma injuries, strong focus on R&D leading to launch of technologically advanced products, and rising need for effective blood loss management in patients), restraints (high price of biosurgery products and rising cost of surgical procedures), opportunities (increasing use of combination materials for enhancing product efficacy, rising adoption of advanced biosurgery products in emerging markets, and growing adoption of adhesive dentistry procedures), challenges (stringent regulatory framework and requirement of skilled personnel for the effective use of biosurgery products)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the biosurgery market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, R&D initiatives, and product launches within the biosurgery market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the biosurgery industry help to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Johnson & Johnson Services, Inc. (US), Baxter (US), Medtronic (Ireland), Becton Dickinson and Company (BD) (US), B. Braun SE (Germany), Stryker (US), Integra LifeSciences Holdings Corporation (US), CSL Ltd. (Australia), Hemostasis LLC. (US), Pfizer Inc. (US), Artivion Inc. (US), and others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key objectives of secondary research

- 2.1.1.2 List of key secondary sources

- 2.1.1.3 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key objectives of primary research

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 SUPPLY-SIDE ANALYSIS (REVENUE SHARE ANALYSIS)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 COMPANY PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 GROWTH FORECAST

- 2.3 DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 BIOSURGERY MARKET OVERVIEW

- 4.2 NORTH AMERICA: BIOSURGERY MARKET, BY COUNTRY AND END USER

- 4.3 GEOGRAPHIC SNAPSHOT OF BIOSURGERY MARKET

- 4.4 REGIONAL MIX: BIOSURGERY MARKET, 2025-2030 (USD MILLION)

- 4.5 BIOSURGERY MARKET: EMERGING VS. DEVELOPED MARKETS, 2025 VS. 2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing volume of surgeries and growing prevalence of severe trauma injuries

- 5.2.1.2 Rising need for effective blood loss management

- 5.2.2 RESTRAINTS

- 5.2.2.1 High price of biosurgery products and surgical procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising use of combination materials for enhancing product efficacy

- 5.2.3.2 Growing adoption of adhesive dentistry procedures

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent regulatory framework

- 5.2.4.2 Scarcity of skilled personnel for effective use of biosurgery products

- 5.2.1 DRIVERS

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Hemostatic & sealant biomaterial technology

- 5.3.1.2 Tissue engineering & regenerative medicine technology

- 5.3.2 COMPLEMENTARY TECHNOLOGIES

- 5.3.2.1 Surgical imaging & navigation technology

- 5.3.2.2 Sterilization & preservation technology

- 5.3.3 ADJACENT TECHNOLOGIES

- 5.3.3.1 3D printing technology

- 5.3.3.2 Minimally invasive technology

- 5.3.1 KEY TECHNOLOGIES

- 5.4 INDUSTRY TRENDS

- 5.4.1 GROWING PREFERENCE FOR GELATIN-BASED ADHESIVES & HYDROGELS IN SURGICAL PROCEDURES

- 5.4.2 USE OF NANOTECHNOLOGY FOR DEVELOPING NEXT-GENERATION ADHESIVES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT DATA FOR HS CODE 300610, 2019-2024

- 5.8.2 EXPORT DATA FOR HS CODE 300610, 2019-2024

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 KEY BUYING CRITERIA

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATORY ANALYSIS

- 5.11.2.1 North America

- 5.11.2.1.1 US

- 5.11.2.1.2 Canada

- 5.11.2.2 Europe

- 5.11.2.3 Asia Pacific

- 5.11.2.4 Latin America

- 5.11.2.5 Middle East & Africa

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 INSIGHTS: JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND OF BIOSURGERY PRODUCTS, BY KEY PLAYER, 2022-2024

- 5.13.2 AVERAGE SELLING PRICE TREND OF BIOSURGERY PRODUCTS, BY REGION, 2022-2024

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 ADJACENT MARKET ANALYSIS

- 5.15.1 ADHESION BARRIERS MARKET

- 5.16 UNMET NEEDS/END-USER EXPECTATIONS

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF AI/GEN AI ON BIOSURGERY MARKET

- 5.20 IMPACT OF 2025 US TARIFF ON BIOSURGERY MARKET

- 5.20.1 INTRODUCTION

- 5.20.2 KEY TARIFF RATES

- 5.20.3 PRICE IMPACT ANALYSIS

- 5.20.4 IMPACT ON COUNTRIES/REGIONS

- 5.20.4.1 North America

- 5.20.4.1.1 US

- 5.20.4.2 Europe

- 5.20.4.3 Asia Pacific

- 5.20.4.1 North America

- 5.20.5 IMPACT ON END-USE INDUSTRIES

6 BIOSURGERY MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 BONE-GRAFT SUBSTITUTES

- 6.2.1 DEMINERALIZED BONE MATRIX

- 6.2.1.1 Rising volume of spinal fusion, joint reconstruction, and replacement surgeries to drive segment

- 6.2.2 SYNTHETIC BONE GRAFTS

- 6.2.2.1 High compressive strength, osteoconductive properties, and minimal risk of disease transmission to fuel segment growth

- 6.2.3 BONE MORPHOGENETIC PROTEINS

- 6.2.3.1 Increasing prevalence of spinal deformities, disc degeneration, trauma, and sport-related injuries to propel segment growth

- 6.2.4 OTHER BONE-GRAFT SUBSTITUTES

- 6.2.1 DEMINERALIZED BONE MATRIX

- 6.3 SURGICAL SEALANTS & ADHESIVES

- 6.3.1 NATURAL/BIOLOGICAL SURGICAL SEALANTS & ADHESIVES

- 6.3.1.1 Natural/Biological surgical sealants & adhesives, by type

- 6.3.1.1.1 Fibrin-based sealants & adhesives

- 6.3.1.1.1.1 Biocompatibility, biodegradability, and effectiveness in achieving hemostasis to augment segment growth

- 6.3.1.1.2 Collagen-based sealants & adhesives

- 6.3.1.1.2.1 Low-cost and reduced risk of disease transmission to promote adoption of collagen-based sealants & adhesives

- 6.3.1.1.3 Gelatin-based sealants & adhesives

- 6.3.1.1.3.1 High elasticity, strong adhesive properties, and versatility in soft tissue applications to boost segment growth

- 6.3.1.1.4 Albumin-based sealants & adhesives

- 6.3.1.1.4.1 Increasing adoption in cardiovascular and cardiothoracic procedures to fuel market growth

- 6.3.1.1.5 Other natural/biological surgical sealants & adhesives

- 6.3.1.1.1 Fibrin-based sealants & adhesives

- 6.3.1.2 Natural/biological surgical sealants & adhesives, by origin

- 6.3.1.2.1 Animal-based sealants & adhesives

- 6.3.1.2.1.1 Ease of usage, better flexibility, and greater strength to boost adoption in medical applications

- 6.3.1.2.2 Human blood-based sealants & adhesives

- 6.3.1.2.2.1 Human blood-based sealants to be used in final stage of clotting cascade for local and diffused hemorrhages

- 6.3.1.2.1 Animal-based sealants & adhesives

- 6.3.1.1 Natural/Biological surgical sealants & adhesives, by type

- 6.3.2 SYNTHETIC & SEMI-SYNTHETIC SURGICAL SEALANTS & ADHESIVES

- 6.3.2.1 PEG hydrogel-based sealants & adhesives

- 6.3.2.1.1 Rapid sealing abilities of PEG hydrogels to drive adoption in spinal surgeries

- 6.3.2.2 Cyanoacrylate-based sealants & adhesives

- 6.3.2.2.1 Cyanoacrylate-based sealants to be preferred in dermatology and plastic surgeries

- 6.3.2.3 Urethane-based sealants & adhesives

- 6.3.2.3.1 Favorable thermostable property at body temperature without hemolytic behavior to drive segment

- 6.3.2.4 Other synthetic & semi-synthetic surgical sealants & adhesives

- 6.3.2.1 PEG hydrogel-based sealants & adhesives

- 6.3.1 NATURAL/BIOLOGICAL SURGICAL SEALANTS & ADHESIVES

- 6.4 ADHESION BARRIERS

- 6.4.1 SYNTHETIC ADHESION BARRIERS

- 6.4.1.1 Hyaluronic acid-based adhesion barriers

- 6.4.1.1.1 Rising gynecological and abdominal surgeries to fuel adoption

- 6.4.1.2 Regenerated cellulose-based adhesion barriers

- 6.4.1.2.1 Increasing number of C-section surgeries to boost adoption of regenerated cellulose-based adhesion barriers

- 6.4.1.3 PEG-based adhesion barriers

- 6.4.1.3.1 Rising number of peritoneal and abdominal surgeries to drive demand

- 6.4.1.4 Other synthetic adhesion barriers

- 6.4.1.1 Hyaluronic acid-based adhesion barriers

- 6.4.2 NATURAL ADHESION BARRIERS

- 6.4.2.1 Collagen & protein adhesion barriers

- 6.4.2.1.1 Weak antigenicity, high biocompatibility, non-toxicity, and biodegradability to propel segment growth

- 6.4.2.2 Fibrin-based adhesion barriers

- 6.4.2.2.1 Increasing applications in laparotomy procedures to spur segment growth

- 6.4.2.1 Collagen & protein adhesion barriers

- 6.4.1 SYNTHETIC ADHESION BARRIERS

- 6.5 STAPLE-LINE REINFORCEMENT AGENTS

- 6.5.1 RISING VOLUME OF COMPLEX SURGICAL PROCEDURRES TO DRIVE MARKET

- 6.6 SOFT-TISSUE ATTACHMENTS

- 6.6.1 SYNTHETIC MESHES

- 6.6.1.1 Increasing demand for safe and cost-effective soft tissue reinforcement to drive segment

- 6.6.2 BIOLOGICAL MESHES

- 6.6.2.1 Allografts

- 6.6.2.1.1 Rising cancer incidence and reconstructive surgeries to increase adoption of allografts in biosurgical procedures

- 6.6.2.2 Xenografts

- 6.6.2.2.1 High availability and size versatility to drive segmental growth

- 6.6.2.1 Allografts

- 6.6.1 SYNTHETIC MESHES

- 6.7 HEMOSTATIC AGENTS

- 6.7.1 THROMBIN-BASED HEMOSTATIC AGENTS

- 6.7.1.1 Rising demand for safer and fast-acting clotting agents to drive growth of thrombin-based hemostats

- 6.7.2 OXIDIZED REGENERATED CELLULOSE-BASED HEMOSTATIC AGENTS

- 6.7.2.1 Rising adoption of plant-based and absorbable hemostats to propel segment growth

- 6.7.3 COMBINATION HEMOSTATIC AGENTS

- 6.7.3.1 Superior efficacy in complex bleeding control to drive adoption of combination hemostatic agents globally

- 6.7.1 THROMBIN-BASED HEMOSTATIC AGENTS

7 BIOSURGERY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ORTHOPEDIC SURGERY

- 7.2.1 INCREASING INCIDENCE OF SPORTS INJURIES AND GROWING PREVALENCE OF OSTEOPOROSIS TO PROPEL MARKET GROWTH

- 7.3 GENERAL SURGERY

- 7.3.1 HIGH GERIATRIC POPULATION AND INCREASED PREVALENCE OF OBESITY TO FUEL DEMAND FOR BARIATRIC INTERVENTIONS

- 7.4 NEUROLOGICAL SURGERY

- 7.4.1 GROWING PREVALENCE OF NEUROLOGICAL DISORDERS TO AUGMENT MARKET GROWTH

- 7.5 CARDIOVASCULAR SURGERY

- 7.5.1 BIOSURGERY PRODUCTS TO REPLACE CONVENTIONAL SUTURE-BASED METHODS IN CARDIOVASCULAR PROCEDURES

- 7.6 RECONSTRUCTIVE SURGERY

- 7.6.1 INCREASING FACIAL COSMETIC SURGERIES AND BREAST RECONSTRUCTION PROCEDURES TO PROPEL MARKET GROWTH

- 7.7 GYNECOLOGICAL SURGERY

- 7.7.1 COMPLEXITY OF GYNECOLOGICAL PROCEDURES TO FUEL DEMAND FOR ADVANCED BIOSURGICAL PRODUCTS

- 7.8 UROLOGICAL SURGERY

- 7.8.1 USE OF BIOSURGERY PRODUCTS IN COMPLEX RECONSTRUCTIVE UROLOGICAL SURGERIES TO STIMULATE SEGMENT GROWTH

- 7.9 THORACIC SURGERY

- 7.9.1 RISING INCIDENCE OF PULMONARY CHRONIC DISEASES TO SPUR MARKET GROWTH

- 7.10 OTHER APPLICATIONS

8 BIOSURGERY MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RISING NUMBER OF REIMBURSED INPATIENT PROCEDURES TO DRIVE POPULARITY OF HOSPITALS FOR SURGERIES

- 8.3 CLINICS

- 8.3.1 QUICKER CONSULTATION SERVICES AND MINIMAL PATIENT STAYS TO FAVOR MARKET GROWTH

- 8.4 AMBULATORY SURGICAL CENTERS

- 8.4.1 RISING DEMAND FOR COST-EFFECTIVE SAME-DAY SURGERIES TO AUGMENT MARKET GROWTH

- 8.5 OTHER END USERS

9 BIOSURGERY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American biosurgery market during forecast period

- 9.2.3 CANADA

- 9.2.3.1 Growing prevalence of chronic diseases to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Robust healthcare investments and improved infrastructure to support adoption of advanced surgical technologies

- 9.3.3 UK

- 9.3.3.1 Rise in popularity of cosmetic and reconstructive surgeries to fuel market growth

- 9.3.4 FRANCE

- 9.3.4.1 Presence of well-established healthcare system and high geriatric population to boost market growth

- 9.3.5 ITALY

- 9.3.5.1 Increasing surgical volume to fuel market growth

- 9.3.6 SPAIN

- 9.3.6.1 Rising surgical demand to boost need for biosurgery products

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Increasing number of domestic biosurgery and medical device manufacturers to aid market growth

- 9.4.3 INDIA

- 9.4.3.1 Rising healthcare awareness and favorable government support to stimulate market growth

- 9.4.4 JAPAN

- 9.4.4.1 Advanced healthcare system and high geriatric population to spur market growth

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Rising number of cosmetic surgeries and growing adoption of innovative medical technologies to drive market

- 9.4.6 AUSTRALIA

- 9.4.6.1 Well-established healthcare system and high government medical expenditure to favor market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Rapidly aging population and high prevalence of chronic diseases to support market growth

- 9.5.3 MEXICO

- 9.5.3.1 Enhanced focus on medical tourism to drive market

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Rising prevalence of chronic diseases to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN BIOSURGERY MARKET

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES & APPROVALS

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BAXTER

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 B. BRAUN SE

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses & competitive threats

- 11.1.3 BECTON, DICKINSON AND COMPANY (BD)

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses & competitive threats

- 11.1.4 JOHNSON & JOHNSON

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses & competitive threats

- 11.1.5 MEDTRONIC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 INTEGRA LIFESCIENCES CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 COMMONWEALTH SERUM LABORATORIES LIMITED (CSL)

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.8 HEMOSTASIS, LLC

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 PFIZER INC.

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 STRYKER

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 ARTIVION, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ZIMMER BIOMET

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Deals

- 11.1.13 KUROS BIOSCIENCES

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.13.3 Recent developments

- 11.1.13.3.1 Product approvals

- 11.1.13.3.2 Deals

- 11.1.14 ORTHOFIX MEDICAL INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches

- 11.1.14.3.2 Deals

- 11.1.15 SMITH & NEPHEW

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 BAXTER

- 11.2 OTHER PLAYERS

- 11.2.1 TISSUE REGENIX

- 11.2.2 BETATECH MEDICAL

- 11.2.3 MERIL LIFE SCIENCES PVT. LTD.

- 11.2.4 GLOBUS MEDICAL

- 11.2.5 SAMYANG HOLDINGS CORPORATION

- 11.2.6 AROA BIOSURGERY LIMITED

- 11.2.7 MEYER-HAAKE GMBH

- 11.2.8 ADVANCED MEDICAL SOLUTIONS GROUP PLC

- 11.2.9 BIOCER ENTWICKLUNGS-GMBH

- 11.2.10 WILTROM

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS