|

시장보고서

상품코드

1783248

치과 이미징 시장 : 제품별, 용도별, 최종사용자별 - 예측(-2030년)Dental Imaging Market by Product (Extraoral Imaging (CBCT, Panoramic), Intraoral Imaging (X-ray, Intraoral Camera, IOL Scanner)), Application (Endodontics, Implantology), & End User (Dental Hospitals, Dental Diagnostic Centers) - Global Forecast to 2030 |

||||||

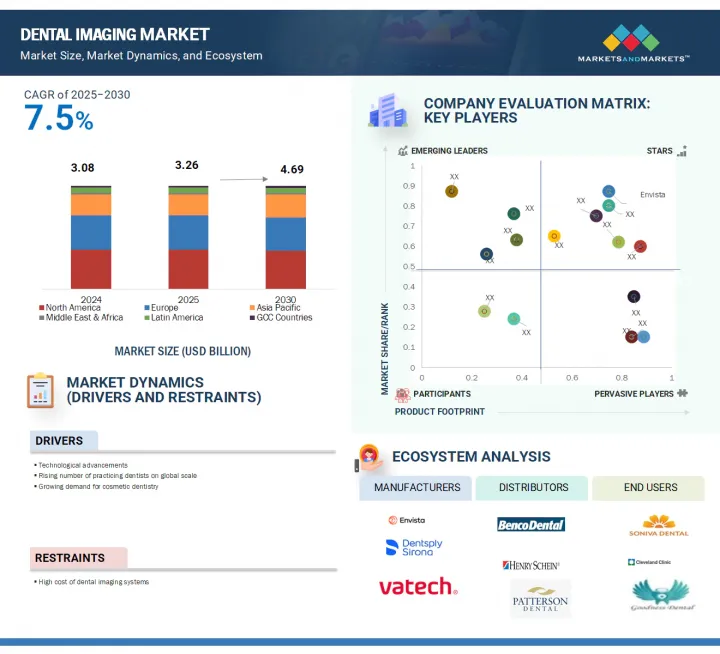

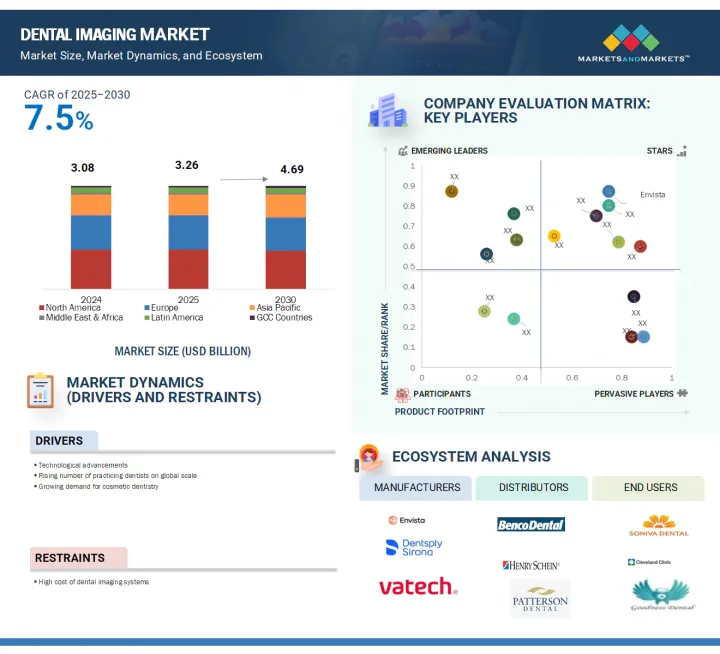

세계의 치과 이미징 시장 규모는 2025년 32억 6,000만 달러에서 2030년까지 46억 9,000만 달러에 이를 것으로 예측되며, 2025-2030년 CAGR 7.5%의 성장이 전망됩니다.

치과용 이미징 제품에 대한 수요는 기술의 발전과 해부학적 구조의 상세한 이미징을 필요로 하는 심미치과에 대한 관심 증가 등 여러 요인에 의해 증가하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 용도, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

또한, 충치 및 치주질환 증가와 치과 관광의 활황은 치과 영상 시장의 성장에 기여하는 주요 촉진요인입니다.

이 시장은 치과 질환의 유병률 증가, 3D 영상 기술의 발전, 정확한 진단 및 치료 계획에 대한 수요 증가 등 여러 요인의 영향을 받고 있습니다. 또한, 휴대용 치과 이미징의 활용도가 높아짐에 따라, 특히 원격지나 이동이 어려운 환자들의 치과 치료 접근성이 향상되어 시장이 더욱 확대되고 있습니다.

"제품별로는 구강외 이미징 시스템 부문이 치과용 이미징 시장에서 가장 큰 점유율을 차지하고 있습니다. "

구강외 영상 시스템 부문은 2024년 치과용 영상 시스템 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 구강외 영상 부문에서는 3D CBCT가 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다. 특히 임플란트, 근관치료, 구강악안면 수술, 교정 치과에서 진단, 치료 계획, 치료 후 평가에 구강외 영상 시스템이 광범위하게 사용되고 있는 것이 이 부문의 성장을 가속하고 있습니다.

"용도별로는 임플란트 분야가 2024년 치과용 이미징 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. "

이는 주로 임플란트 식립 시 정확한 측정이 가능하고, 치료의 정확성을 보장하며, 치료 후 평가를 돕는 이미징의 장점에 기인합니다.

"최종 사용자별로는 치과 진단센터 부문이 2024년 가장 큰 시장 점유율을 차지할 것으로 보입니다. "

이러한 성장의 원동력은 첨단 영상 시스템 도입 증가, 환자들의 인식 개선, 신속한 진단과 효과적인 치료 계획에 대한 수요 증가 등이 있습니다.

"북미가 2024년 치과용 이미징 시장에서 가장 큰 점유율을 차지했습니다. "

이러한 큰 시장 입지는 주요 제조업체의 R&D 활동 증가, 미용 치과에 대한 관심 증가, 첨단 기술 시스템에 대한 수요 증가, 진단센터의 콘빔 CT(CBCT) 시스템 보급 등 여러 요인에 기인합니다.

반대로 아시아태평양은 예측 기간 동안 가장 높은 CAGR을 보일 것으로 예측됩니다. 이러한 성장은 아시아 개발도상국의 신흥/기존 시장 기업, 비교적 완화된 규제 가이드라인, 의료 인프라의 개선에 기인합니다.

세계의 치과용 이미징(Dental Imaging) 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 치과 이미징 시장 개요

- 아시아태평양의 치과 이미징 시장 : 제품 유형별, 국가별

- 치과 이미징 시장 : 지역적 성장 기회

- 치과 이미징 시장 : 지역 구성

- 치과 이미징 시장 : 신흥국가와 선진국

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 규제 상황

- 미국

- 유럽연합

- 중국

- 규제기관, 정부기관 및 기타 조직

- 산업 동향

- AI 활용

- 휴대용 디바이스 및 핸드헬드 디바이스

- 상환 시나리오

- 투자 및 자금조달 시나리오

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 주요 컨퍼런스 및 이벤트

- 가격 결정 분석

- 주요 기업의 치과 이미징 평균 판매 가격 : 제품별

- 치과 이미징 평균 판매 가격 : 지역별

- 무역 분석

- 수입 시나리오

- 수출 시나리오

- 특허 분석

- 치과 이미징에 관한 특허 공보 동향

- 관할 분석 : 치과 이미징 시장 특허 출원 상위자

- 밸류체인 분석

- 에코시스템

- 공급망 분석

- 사례 연구 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 주요 이해관계자와 구입 기준

- 인접 시장 분석

- 치과 이미징 시장 미충족 요구/최종사용자 기대

- 치과 이미징 시장에 대한 AI/생성형 AI의 영향

- 2025년 미국 관세의 영향 - 개요

- 서론

- 주요 관세율

- 가격 영향 분석

- 최종 이용 산업에 대한 영향

제6장 치과 이미징 시장 : 제품별

- 서론

- 구강외 이미징 시스템

- 파노라마 시스템

- PANORAMIC & CEPHALOMETRIC SYSTEMS

- 3D CBCT 시스템

- 구강내 이미징 시스템

- 구강내 스캐너

- 구강내 X선 시스템

- 구강내 센서

- 구강내 휘진성 형광체 시스템

- 구강 카메라

- 치과 이미징 소프트웨어

제7장 치과 이미징 시장 : 용도별

- 서론

- 임플란트

- 치내 요법

- 구강 악안면 수술

- 교정 치과

- 기타 용도

제8장 치과 이미징 시장 : 최종사용자별

- 서론

- 치과의원 및 진료소

- 치과 진단센터

- 치과 학술연구기관

제9장 치과 이미징 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 이탈리아

- 프랑스

- 스페인

- 영국

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 한국

- 일본

- 인도

- 호주

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- GCC 국가

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분배 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 중소기업과 스타트업에 대한 경쟁 리더십 매핑(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- ENVISTA

- DENTSPLY SIRONA, INC.

- PLANMECA OY

- CARESTREAM DENTAL, LLC

- VATECH CO., LTD.

- GENORAY CO., LTD.

- ALIGN TECHNOLOGY, INC.

- INSTITUT STRAUMANN AG

- RAY CO. LTD

- ACTEON

- OWANDY RADIOLOGY

- J. MORITA CORP

- MIDMARK CORPORATION

- DURR DENTAL SE

- 기타 기업

- XLINE S.R.L

- 3SHAPE A/S

- RUNYES MEDICAL INSTRUMENT CO., LTD.

- ASAHI ROENTGEN IND. CO., LTD.

- CEFLA S.C.

- YOSHIDA DENTAL MFG. CO. LTD.

- PREXION, INC.

- YOFO MEDICAL TECHNOLOGY CO., LTD.

- MEDIT CORP

- SHINING 3D

- SHANGHAI HANDY MEDICAL EQUIPMENT

- SHANGHAI CAREJOY MEDICAL CO., LTD

제12장 부록

LSH 25.08.11The dental imaging market is projected to reach USD 4.69 billion by 2030 from USD 3.26 billion in 2025, at a CAGR of 7.5% from 2025 to 2030. The demand for dental imaging products is increasing due to several factors, including technological advancements and a growing interest in cosmetic dentistry, which requires detailed imaging of anatomical structures.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Additionally, the rise in caries and periodontal diseases, along with a boost in dental tourism, are key drivers contributing to the growth of the dental imaging market.

The market is influenced by several factors, including the rising prevalence of dental disorders, advancements in 3D imaging technologies, and the increasing demand for accurate diagnosis and treatment planning. Additionally, the growing availability of portable dental imaging devices is enhancing access to dental care, particularly in remote areas and for patients with mobility challenges, thereby further expanding the market.

"By product, the extraoral imaging systems segment holds the largest share of the dental imaging market."

Within the product category, the dental imaging market has been segmented into extraoral imaging and intraoral imaging systems. The extraoral imaging systems segment accounted for the largest share of the dental imaging market in 2024. Within the extraoral imaging segment, 3D CBCT is expected to grow at the highest CAGR during the forecast period. The extensive use of extraoral imaging systems for diagnosis, treatment planning, and post-treatment assessment, particularly in implantology, endodontics, oral and maxillofacial surgery, and orthodontics, is driving the growth of this segment.

"By application, the implantology segment held the largest share of the dental imaging market in 2024."

The dental imaging market is divided into several segments based on application, including implantology, endodontics, oral & maxillofacial surgery, orthodontics, and other applications. Among these, the implantology segment holds the largest market share. This is primarily due to the advantages of imaging, which enables precise measurements during implant placement, ensures treatment accuracy, and aids in post-treatment evaluation.

"By end user, the dental diagnostic centers segment held the largest market share in 2024."

The dental imaging market has been segmented based on end users into three categories: dental clinics & hospitals, dental diagnostic centers, and dental research & academic institutes. The dental diagnostic centers segment holds the largest market share in the dental imaging market. This growth is driven by the increasing adoption of advanced imaging systems, heightened awareness among patients, and a growing demand for quick diagnosis and effective treatment planning.

"North America held the largest share of the dental imaging market in 2024."

North America held the largest share of the global dental imaging market in 2024. This significant market presence can be attributed to several factors, including increased research and development efforts by key manufacturers, a growing interest in cosmetic dentistry, rising demand for advanced technological systems, and the widespread adoption of cone beam computed tomography (CBCT) systems in diagnostic centers.

Conversely, the Asia Pacific (APAC) region is expected to experience the highest CAGR during the forecast period. This growth is driven by emerging and established market players in developing Asian countries, relatively lenient regulatory guidelines, and improvements in healthcare infrastructure.

The breakdown of primary participants was as mentioned below:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (50%), Directors (30%), and Others (20%)

- By Region: North America (30%), Europe (25%), Asia Pacific (20%), Latin America (15%), and the Middle East & Africa (10%)

The major players in the global dental imaging industry are Envista Holdings Corporation (US), Planmeca Oy (Finland), ACTEON (UK), DENTSPLY SIRONA, Inc. (US), Carestream Dental LLC (US), VATECH (South Korea), Owandy Radiology, Inc. (France), DURR DENTAL AG (Germany), Midmark Corporation (US), Genoray Co., Ltd. (South Korea), Asahi Roentgen Co., Ltd. (Japan), 3Shape A/S (Denmark), PreXion, Inc. (US), Runyes Medical Instrument Co., Ltd. (China), Cefla s.c. (Italy), RAY Co. (South Korea), The Yoshida Dental Mfg. Co., Ltd. (Japan), Align Technology Inc. (US), J. MORITA CORP (Japan), and Xline S.r.l (Italy).

Research Coverage

The report examines various dental imaging products and their adoption patterns across different fields, including implantology, endodontics, oral and maxillofacial surgery, orthodontics, and more. Its purpose is to estimate the market size and future growth potential of the global dental imaging market, focusing on various segments such as products, applications, end users, and regions. Additionally, the report features a comprehensive competitive analysis of key players in the market, including their company profiles, product offerings, and recent developments.

Reasons to Buy the Report

The report will benefit both established companies and new or smaller firms by providing insights into market trends. This information will help them capture a larger market share. Companies that purchase the report can use one or more of the five strategies outlined below to strengthen their market position.

This report provides insights on the following pointers:

- Analysis of key drivers (technological advancements, increasing number of dental practices, growing demand for cosmetic dentistry, rising incidence of dental caries and periodontal diseases, and rising dental tourism in emerging market), restraints (high cost of dental imaging system), opportunities (high growth potential in emerging countries and AI in dental imaging), and challenges (managing vast amounts of imaging data).

- Market Penetration: The report includes extensive information on products offered by the major players in the global dental imaging market. It also includes various segments by product type, application, distribution, and region.

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the global dental imaging market.

- Market Development: Comprehensive information on the lucrative emerging regions by product, application, and end user.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the global dental imaging market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and products of leading players in the global dental imaging market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY UNIT CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 SCOPE-RELATED LIMITATIONS

- 2.6.2 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DENTAL IMAGING MARKET OVERVIEW

- 4.2 ASIA PACIFIC: DENTAL IMAGING MARKET, BY PRODUCT TYPE AND COUNTRY

- 4.3 DENTAL IMAGING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 DENTAL IMAGING MARKET: REGIONAL MIX

- 4.5 DENTAL IMAGING MARKET: EMERGING VS. DEVELOPED COUNTRIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Technological advancements

- 5.2.1.2 Increase in number of dental practices and rise in dental expenditure

- 5.2.1.3 Growth in demand for cosmetic dentistry

- 5.2.1.4 Rise in incidence of dental caries and other periodontal diseases

- 5.2.1.5 Growing dental tourism in emerging markets

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of dental imaging systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential in emerging countries

- 5.2.3.2 Artificial intelligence in dental imaging

- 5.2.3.3 Expansion of DSOs

- 5.2.4 CHALLENGES

- 5.2.4.1 Managing high volumes of imaging data

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.3.2 BARGAINING POWER OF SUPPLIERS

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 THREAT OF SUBSTITUTES

- 5.3.5 THREAT OF NEW ENTRANTS

- 5.4 REGULATORY LANDSCAPE

- 5.4.1 US

- 5.4.2 EUROPEAN UNION

- 5.4.3 CHINA

- 5.4.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5 INDUSTRY TRENDS

- 5.5.1 USE OF AI

- 5.5.2 PORTABLE AND HANDHELD DEVICES

- 5.6 REIMBURSEMENT SCENARIO

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 CAD/CAM technology

- 5.8.1.2 AI in intraoral scanners

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Fluorescence-based caries detection

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 3D printing

- 5.8.1 KEY TECHNOLOGIES

- 5.9 KEY CONFERENCES & EVENTS

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF DENTAL IMAGING AMONG KEY PLAYERS, BY PRODUCT

- 5.10.2 AVERAGE SELLING PRICE OF DENTAL IMAGING, BY REGION

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT SCENARIO

- 5.11.2 EXPORT SCENARIO

- 5.12 PATENT ANALYSIS

- 5.12.1 PATENT PUBLICATION TRENDS FOR DENTAL IMAGING

- 5.12.2 JURISDICTION ANALYSIS: TOP APPLICANTS FOR PATENTS IN DENTAL IMAGING MARKET

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 ECOSYSTEM

- 5.15 SUPPLY CHAIN ANALYSIS

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 DIAGNOSING HIDDEN ROOT CANAL ISSUES

- 5.16.2 ENHANCING DIAGNOSTIC ACCURACY WITH 3D IMAGING

- 5.16.3 TREATING MOLARS WITH UNUSUAL ANATOMY

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.18 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.18.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.18.2 BUYING CRITERIA

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 UNMET NEEDS/END USER EXPECTATIONS IN DENTAL IMAGING MARKET

- 5.21 IMPACT OF AI/GENERATIVE AI ON DENTAL IMAGING MARKET

- 5.22 IMPACT OF 2025 US TARIFF - OVERVIEW

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON END-USER INDUSTRIES

6 DENTAL IMAGING MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 EXTRAORAL IMAGING SYSTEMS

- 6.2.1 PANORAMIC SYSTEMS

- 6.2.1.1 Increase in prevalence of dental disorders to support growth of this market segment

- 6.2.2 PANORAMIC & CEPHALOMETRIC SYSTEMS

- 6.2.2.1 Benefits of offering single digital platform for dental treatments to drive subsegment

- 6.2.3 3D CBCT SYSTEMS

- 6.2.3.1 Increase in dental implants to drive demand for 3D CBCT systems

- 6.2.1 PANORAMIC SYSTEMS

- 6.3 INTRAORAL IMAGING SYSTEMS

- 6.3.1 INTRAORAL SCANNERS

- 6.3.1.1 Intraoral scanners to provide fast and accurate scanning

- 6.3.2 INTRAORAL X-RAY SYSTEMS

- 6.3.2.1 Efficient and faster intraoral diagnostics to offer major advantages

- 6.3.3 INTRAORAL SENSORS

- 6.3.3.1 Intraoral sensors to enable significant reduction in operating time

- 6.3.4 INTRAORAL PHOTOSTIMULABLE PHOSPHOR SYSTEMS

- 6.3.4.1 Phosphor imaging plates to offer economical option for intraoral imaging

- 6.3.5 INTRAORAL CAMERAS

- 6.3.5.1 Intraoral cameras help in early detection and accurate representation of dental conditions

- 6.3.6 DENTAL IMAGING SOFTWARE

- 6.3.6.1 Continuous development of AI-powered diagnostic aids and seamless integration with practice management systems to strengthen importance of dental imaging software

- 6.3.1 INTRAORAL SCANNERS

7 DENTAL IMAGING MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 IMPLANTOLOGY

- 7.2.1 IMPLANTOLOGY SEGMENT TO LEAD DENTAL IMAGING MARKET

- 7.3 ENDODONTICS

- 7.3.1 CBCT SYSTEMS: IMPORTANT DIAGNOSTIC TOOLS IN ENDODONTICS

- 7.4 ORAL & MAXILLOFACIAL SURGERY

- 7.4.1 CLINICAL AND RADIOLOGICAL DATA TO PLAY MAJOR ROLE IN ORAL & MAXILLOFACIAL SURGERY

- 7.5 ORTHODONTICS

- 7.5.1 GROWING PENETRATION OF 3D IMAGING TECHNIQUES TO SUPPORT MARKET GROWTH

- 7.6 OTHER APPLICATIONS

8 DENTAL IMAGING MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 DENTAL HOSPITALS & CLINICS

- 8.2.1 RISE IN ADOPTION OF ADVANCED TECHNOLOGIES TO SUPPORT GROWTH OF THIS END-USER SEGMENT

- 8.3 DENTAL DIAGNOSTIC CENTERS

- 8.3.1 INCREASE IN NUMBER OF DENTAL PROCEDURES AND DEMAND FOR COSMETIC DENTISTRY TO SUPPORT GROWTH OF THIS SEGMENT

- 8.4 DENTAL ACADEMIC & RESEARCH INSTITUTES

- 8.4.1 LOW PURCHASING POWER AND SLOW ADOPTION OF ADVANCED DENTAL TECHNOLOGIES TO HINDER GROWTH OF THIS SEGMENT

9 DENTAL IMAGING MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 US to dominate North American dental imaging market

- 9.2.3 CANADA

- 9.2.3.1 Increase in awareness of dental care to support growth of dental imaging industry in Canada

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Germany to be largest market for dental imaging in Europe

- 9.3.3 ITALY

- 9.3.3.1 Increase in spending on oral health to drive dental imaging market in Italy

- 9.3.4 FRANCE

- 9.3.4.1 Well-organized distribution network to support market growth in France

- 9.3.5 SPAIN

- 9.3.5.1 Increase in number of dentists, growing dental tourism, and rise in geriatric population to aid market growth

- 9.3.6 UK

- 9.3.6.1 Subsidies for treatment costs by NHS to provide broader access to essential dental care in UK

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 CHINA

- 9.4.2.1 Significant increase in demand for dental care services to drive market growth in China

- 9.4.3 SOUTH KOREA

- 9.4.3.1 Rise in disposable incomes to drive overall market growth in South Korea

- 9.4.4 JAPAN

- 9.4.4.1 Increase in geriatric population and dental awareness among patients to support market growth in Japan

- 9.4.5 INDIA

- 9.4.5.1 India to offer lucrative growth opportunities for market players

- 9.4.6 AUSTRALIA

- 9.4.6.1 Growth in number of registered dental practitioners to support market growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Large number of dentists and dental tourism to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Lower dental care costs compared to other countries to support market growth

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR THE MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN DENTAL IMAGING MARKET

- 10.3 REVENUE SHARE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 PERVASIVE PLAYERS

- 10.5.3 EMERGING LEADERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Product type footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 End user footprint

- 10.5.5.5 Region footprint

- 10.6 COMPETITIVE LEADERSHIP MAPPING FOR SMES & STARTUPS, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 DYNAMIC COMPANIES

- 10.6.3 STARTING BLOCKS

- 10.6.4 RESPONSIVE COMPANIES

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT & SERVICE LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

- 10.9.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ENVISTA

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 DENTSPLY SIRONA, INC.

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 PLANMECA OY

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches & approvals

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM View

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 CARESTREAM DENTAL, LLC

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches & approvals

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Right to win

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 VATECH CO., LTD.

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 GENORAY CO., LTD.

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches & approvals

- 11.1.6.3.2 Expansions

- 11.1.7 ALIGN TECHNOLOGY, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches & approvals

- 11.1.7.3.2 Deals

- 11.1.8 INSTITUT STRAUMANN AG

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Deals

- 11.1.9 RAY CO. LTD

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 ACTEON

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product launches & approvals

- 11.1.11 OWANDY RADIOLOGY

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Product launches & approvals

- 11.1.12 J. MORITA CORP

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.13 MIDMARK CORPORATION

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 DURR DENTAL SE

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.14.3 Recent developments

- 11.1.14.3.1 Product launches & approvals

- 11.1.14.3.2 Deals

- 11.1.14.3.3 Expansions

- 11.1.1 ENVISTA

- 11.2 OTHER PLAYERS

- 11.2.1 XLINE S.R.L

- 11.2.2 3SHAPE A/S

- 11.2.3 RUNYES MEDICAL INSTRUMENT CO., LTD.

- 11.2.4 ASAHI ROENTGEN IND. CO., LTD.

- 11.2.5 CEFLA S.C.

- 11.2.6 YOSHIDA DENTAL MFG. CO. LTD.

- 11.2.7 PREXION, INC.

- 11.2.8 YOFO MEDICAL TECHNOLOGY CO., LTD.

- 11.2.9 MEDIT CORP

- 11.2.10 SHINING 3D

- 11.2.11 SHANGHAI HANDY MEDICAL EQUIPMENT

- 11.2.12 SHANGHAI CAREJOY MEDICAL CO., LTD

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS