|

시장보고서

상품코드

1784320

에너지 효율적 모터 시장 : 효율 레벨별, 유형별, 정격 출력별, 용도별, 최종 사용자, 지역별 - 예측(-2030년)Energy Efficient Motor Market by Efficiency Level (IE1, IE2, IE3, IE4, IE5), Type (AC, DC), Power Output Rating (<1 kW, 1-2.2 kW, 2.3-375 kW, >375 kW), Application (HVACs, Fans, Pumps, Compressors), End User, and Region - Global Forecast to 2030 |

||||||

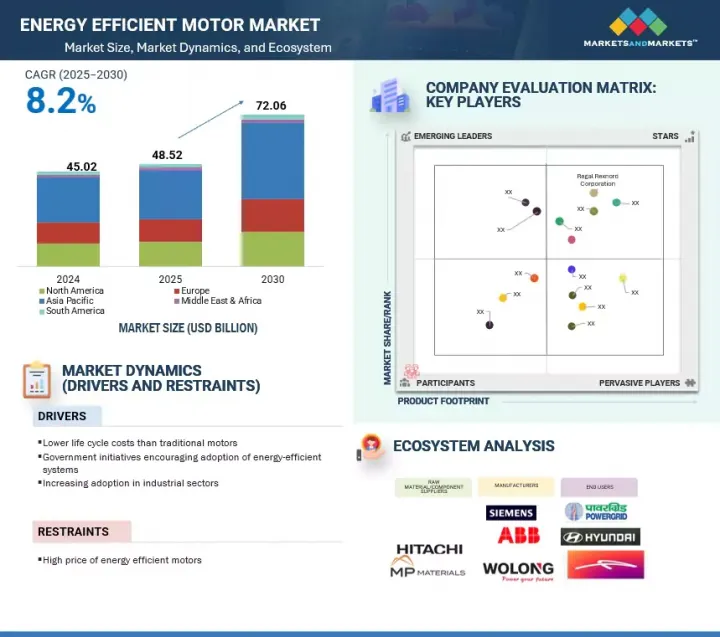

세계의 에너지 효율적 모터 시장 규모는 2025년 485억 2,000만 달러로 추정되고, 예측 기간 동안 CAGR 8.2%로 추이할 전망이며, 2030년에는 720억 6,000만 달러로 성장할 것으로 예측되고 있습니다.

전기자동차, 산업용 자동화 시스템, HVAC 시스템에서 에너지 효율이 우수한 고성능 모터에 대한 수요 증가가 시장 성장에 기여하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 수량(유닛) |

| 부문별 | 유형별, 정격 출력별, 효율 레벨별, 최종 사용자별, 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

분야별 채택도 기술 발전 및 에너지 규제 강화로 가속화되고 있습니다. 특히 모터 설계의 급속한 진보, 예지 보전을 위한 IoT 및 스마트 센서 통합, 세계적으로 점점 엄격화하는 에너지 효율 규제에 의해 분야별 도입은 더욱 기세를 늘리고 있습니다. 또한, 재생에너지와 지속 가능한 제조 관행으로의 전환은 에너지 효율적 모터 솔루션에 대한 투자를 계속 추진하고 있습니다.

'IE3 부문이 2025-2030년 크게 성장할 전망'

IE3 모터는 케이지형 로터의 도체 재료에 알루미늄이 아닌 구리를 사용하여 로터 손실을 크게 줄여 부하 시 미끄러짐을 억제합니다. 게다가, 에어 갭의 축소나, 고품질 강을 이용한 보다 얇은 적층판에 의해 기존 모터보다 높은 효율이 확보됩니다. 이러한 IE3 효율 클래스 모터의 기술적 개선이 시장 확대를 뒷받침하고 있습니다. 또한 여러 국가에서 IE3 모터의 채택을 의무화하는 유리한 규제 프레임 워크, 제조 및 수처리, 석유 및 가스와 같은 산업 수요 증가, 수명주기 비용 절감에 대한 관심이 증가함에 따라 이 부문의 성장을 더욱 촉진하고 있습니다. IE3 모터가 제공하는 성능 향상, 운영 비용 절감, 이산화탄소 배출량 감소는 에너지 효율성과 지속가능성 향상을 목표로 하는 최종 사용자에게 매력적인 선택입니다.

'북미는 2025-2030년 2위 시장이 될 가능성이 높습니다'

북미는 산업 자동화, 전기자동차, HVAC 시스템에서의 채용 확대로 시장에서 두 번째로 큰 시장이 될 것으로 예측됩니다. 이 지역에는 이미 확립된 산업 부문이 있으며, 고효율 기기에 대한 많은 투자 및 청정 에너지와 전기를 추진하는 호의적인 정부 정책이 존재합니다. 또한 미국 및 캐나다의 주요 자동차 및 제조 기업은 성능과 지속가능성 목표를 달성하기 위해 영구 자석 모터의 도입을 보다 적극적으로 추진하고 있으며, 이는 지역 수요 증가를 뒷받침하고 있습니다.

본 보고서에서는 세계의 에너지 효율적 모터 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례 연구, 시장 규모 추이 및 예측, 각종 구분, 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요 기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 사업에 영향을 미치는 동향 및 혼란

- 에코시스템 매핑

- 밸류체인 분석

- 가격 분석

- 기술 분석

- 관세, 기준 및 규제 상황

- 특허 분석

- 무역 분석

- Porter's Five Forces 분석

- 주요 회의 및 이벤트

- 주요 이해관계자 및 구매 기준

- 구입 기준

- 사례 연구 분석

- 생성형 AI 및 AI가 에너지 효율적 모터 시장에 미치는 영향

- 미국 관세가 에너지 절약 자동차 시장에 미치는 영향

제6장 에너지 효율적 모터 시장 : 효율 레벨별

- IE1

- IE2

- IE3

- IE4

- IE5

제7장 에너지 효율적 모터 시장 : 설치 유형별

- 오픈형 방적(ODP) 모터

- 전폐식 팬 냉각(TEFC) 모터

제8장 에너지 효율적 모터 시장 : 유형별

- AC 모터

- DC 모터

제9장 에너지 효율적 모터 시장 : 정격 출력별

- 1kW 미만

- 1-2.2kW

- 2.2-375kW

- 375kW초

제10장 에너지 효율적 모터 시장 : 용도별

- 에어컨

- 펌프

- 팬

- 컴프레서

- 냉동

- 자재관리

- 재료 처리

제11장 에너지 효율적 모터 시장 : 최종 사용자별

- 산업용

- 상업용

- 주택

- 자동차

- 농업

- 항공우주 및 방위

제12장 에너지 효율적 모터 시장 : 지역별

- 아시아태평양

- 중국

- 호주

- 일본

- 인도

- 한국

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타

- 중동 및 아프리카

- 사우디아라비아

- 아랍에미리트(UAE)

- 튀르키예

- 남아프리카

- 이집트

- 카타르

- 이스라엘

- 기타

- 유럽

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 폴란드

- 기타

제13장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 및 중소기업

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 기업

- ABB

- SIEMENS

- WEG

- WOLONG ELECTRIC GROUP CO., LTD

- NIDEC CORPORATION

- ROCKWELL AUTOMATION

- CG POWER & INDUSTRIAL SOLUTIONS LTD.

- REGAL REXNORD CORPORATION

- TOSHIBA CORPORATION

- BHARAT BIJLEE

- KIRLOSKAR ELECTRIC COMPANY

- HOYER MOTORS

- OME MOTORS

- EC FANS AND DRIVES

- INTEGRATED ELECTRIC CO., PVT. LTD.

- 기타 기업

- ELEKTRIM TECHTOP MOTORS PTE LTD.

- SHANGHAI ELECTRIC

- MENZEL ELEKTROMOTOREN

- ZCL ELECTRIC MOTOR TECHNOLOGY CO., LTD.

- HINDMOTORS

- AMBER ENGINEERING ENTERPRISE

- MITSUBISHI ELECTRIC CORPORATION

- HAVELLS

- TECO CORPORATION

- ELCEN

제15장 부록

AJY 25.08.14The global energy efficient motor market is estimated to grow from USD 48.52 billion in 2025 to USD 72.06 billion by 2030, at a CAGR of 8.2% during the forecast period. The escalating demand for energy-efficient and high-performance motors in electric vehicles, industrial automation systems, and HVAC systems contributes to the market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Units) |

| Segments | Distributed Control System Market by installation type, type, power output rating, eficiency level, end user, application , and region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Sector-wise adoption also gains pace due to technological improvements and tightening energy regulations. Sector-wise deployment is also gaining momentum due to rapid advancements in motor design, integration of IoT and smart sensors for predictive maintenance, and increasingly stringent global energy efficiency regulations. Moreover, the shift toward renewable energy and sustainable manufacturing practices continues to drive investments in energy-efficient motor solutions.

"The IE3 segment is projected to grow at a significant rate from 2025 to 2030."

The IE3 segment is anticipated to grow at a considerable CAGR in the energy efficient motor market during the forecast period. Rotor losses in IE3 motors are reduced considerably by using copper as the conductor material in the squirrel cage rather than aluminum, which leads to the reduction of the slip under load conditions. The reduction in air gaps and thinner laminations made of better-quality steel ensures higher efficiency than traditional motors. These technological modifications in the IE3 efficiency level motors are pushing the market. Additionally, favorable regulatory frameworks mandating the adoption of IE3 motors in several countries, rising demand from industries such as manufacturing, water treatment, and oil & gas, and increasing focus on lifecycle cost savings further boost the segmental growth. The enhanced performance, lower operational costs, and reduced carbon emissions associated with IE3 motors make them an attractive option for end users aiming to improve energy efficiency and sustainability.

"Commercial is likely to be the second-largest segment in the energy efficient motor market from 2025 to 2030. "

The end user segment is categorized as industrial, commercial, residential, automotive, agriculture, and aerospace & defense. The commercial segment is expected to be the second-largest end user in the energy-efficient motor market during the forecast period. This growth is primarily due to the increasing demand for HVAC systems, elevators, escalators, refrigeration units, and building automation solutions in commercial buildings, such as offices, shopping malls, hospitals, hotels, and educational institutions. Energy-efficient motors help reduce operational costs and support sustainability goals by minimizing energy consumption and carbon emissions. Moreover, the implementation of green building codes and energy performance standards across various countries further accelerates the adoption of high-efficiency motors in commercial applications.

"North America is likely to be the second-largest market between 2025 and 2030."

North America is projected to be the second-largest energy efficient motor market due to the high uptake in industrial automation, electric cars, and HVAC systems. The area already has an established industrial sector, heavy investment in energy-efficient equipment, and favorable government policy toward clean energy and electrification. Furthermore, the major automotive and manufacturing firms in the US and Canada are becoming more aggressive in the inclusion of permanent magnet motors to achieve performance and sustainability objectives, enhancing the demand in the region.

In-depth interviews have been conducted with various key industry participants, subject-matter experts, C-level executives of key market players, and industry consultants, among other experts, to obtain and verify critical qualitative and quantitative information and assess future market prospects. The distribution of primary interviews is as follows:

By Company Type: Tier 1 - 45%, Tier 2 - 30%, and Tier 3 - 25%

By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

By Region: North America - 27%, Europe - 20%, Asia Pacific - 33%, Middle East & Africa - 12%, and South America - 8%

Note: The tiers of the companies are defined based on their total revenues as of 2024. Tier 1: >USD 1 billion, Tier 2: USD 500 million to USD 1 billion, and Tier 3: <USD 500 million. Other designations include sales managers, engineers, and regional managers.

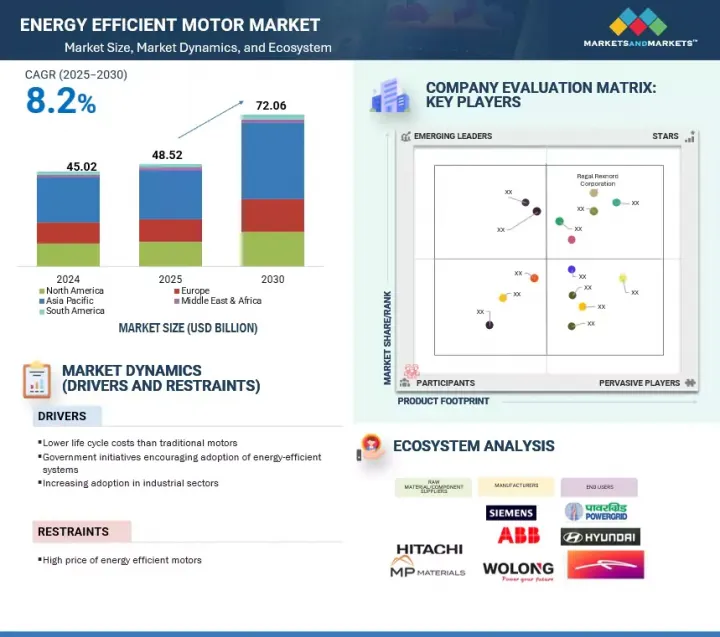

The energy efficient motor market is dominated by a few major players with a wide regional presence. The leading players in the energy efficient motor market are ABB (Switzerland), Siemens (Germany), Regal Rexnord Corporation (US), Wolong Electric Group Co., Ltd (China), and Nidec Corporation (Japan).

Research Coverage:

The report defines, describes, and forecasts the global energy efficient motor market, by Installation type, type, power output rating, application, end user, and region. It also offers a detailed qualitative and quantitative analysis of the market. The report provides a comprehensive review of the major market drivers, restraints, opportunities, and challenges. It also covers various important aspects of the market. These include an analysis of the competitive landscape, market dynamics, market estimates, in terms of value, and future trends in the energy efficient motor market.

Key Benefits of Buying the Report

- Analysis of key drivers (Lower life cycle costs than traditional motors), restraints (High price of energy-efficient motors), opportunities (Rising industrialization and decarbonization initiatives), and challenges (Limited awareness about benefits of energy-efficient motors) influences the growth of the energy efficient motor market.

- Market Development: In May 2025, ABB launched a new range of IE5 permanent magnet motors for industrial automation and HVAC systems. The motors offer higher energy efficiency and compact design, aligning with the rising demand for sustainable, high-performance motor solutions.

- Product Innovation/Development: The permanent magnet motor market saw notable product innovation, with advanced motors featuring rare-earth-efficient designs and smart control integration. These developments aim to enhance performance, reduce dependency on critical materials, and meet rising efficiency standards across various end users.

- Market Diversification: In April 2025, Nidec Corporation diversified its energy efficient motor portfolio by entering new sectors such as agriculture, renewable energy, and medical devices, aiming to expand beyond its core automotive and industrial markets.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the energy efficient motor market, such as ABB (Switzerland), Siemens (Germany), WOLONG Electric (China), Rega Rexnord Corporation (US), and NIDEC CORPORATION (Japan).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 INCLUSIONS AND EXCLUSIONS

- 1.3.1 BY EFFICIENCY LEVEL

- 1.3.2 BY POWER OUTPUT RATING

- 1.3.3 BY INSTALLATION TYPE

- 1.3.4 BY TYPE

- 1.3.5 BY END USER

- 1.3.6 BY APPLICATION

- 1.4 STUDY SCOPE

- 1.4.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.4.2 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Breakdown of primaries

- 2.2.1 SECONDARY DATA

- 2.3 STUDY SCOPE

- 2.4 MARKET SIZE ESTIMATION

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.2 TOP-DOWN APPROACH

- 2.4.3 DEMAND-SIDE ANALYSIS

- 2.4.3.1 Regional analysis

- 2.4.3.2 Country-level analysis

- 2.4.3.3 Assumptions for demand-side analysis

- 2.4.3.4 Calculations for demand-side analysis

- 2.4.4 SUPPLY-SIDE ANALYSIS

- 2.4.4.1 Calculations for supply-side analysis

- 2.4.4.2 Assumptions for supply-side analysis

- 2.4.5 FORECAST

- 2.5 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ENERGY-EFFICIENT MOTOR MARKET

- 4.2 ENERGY-EFFICIENT MOTOR MARKET IN ASIA PACIFIC, BY POWER OUTPUT RATING AND COUNTRY

- 4.3 ENERGY-EFFICIENT MOTOR MARKET, BY TYPE

- 4.4 ENERGY-EFFICIENT MOTOR MARKET, BY END USER

- 4.5 ENERGY-EFFICIENT MOTOR MARKET, BY POWER OUTPUT RATING

- 4.6 ENERGY-EFFICIENT MOTOR MARKET, BY EFFICIENCY LEVEL

- 4.7 ENERGY-EFFICIENT MOTOR MARKET, BY APPLICATION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Lower life cycle costs than traditional motors

- 5.2.1.2 Government initiatives encouraging adoption of energy-efficient motors

- 5.2.1.3 Mass urbanization and rapid industrialization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Requirement of superior materials, rigorous testing, and certifications

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising industrialization and decarbonization initiatives

- 5.2.3.2 Emergence of robotics and automation technologies

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited awareness about benefits of energy-efficient motors

- 5.2.4.2 Supply chain disruptions

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM MAPPING

- 5.5 VALUE CHAIN ANALYSIS

- 5.5.1 RAW MATERIAL/COMPONENT PROVIDERS

- 5.5.2 ENERGY-EFFICIENT MOTOR MANUFACTURERS

- 5.5.3 DISTRIBUTORS/RESELLERS

- 5.5.4 END USERS/OPERATORS

- 5.5.5 MAINTENANCE/SERVICE PROVIDERS

- 5.6 PRICING ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 IoT

- 5.7.2 ADJACENT TECHNOLOGIES

- 5.7.2.1 Permanent magnet synchronous motors (PMSMs)

- 5.7.1 KEY TECHNOLOGIES

- 5.8 TARIFFS, STANDARDS, AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF ANALYSIS

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIRS, AND OTHER ORGANIZATIONS

- 5.9 PATENT ANALYSIS, 2014-2024

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF SUBSTITUTES

- 5.11.2 BARGAINING POWER OF SUPPLIERS

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 THREAT OF NEW ENTRANTS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY CONFERENCES AND EVENTS, 2025

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14 BUYING CRITERIA

- 5.15 CASE STUDY ANALYSIS

- 5.15.1 TOYOTA REDUCES ENERGY COSTS AND CARBON FOOTPRINT THROUGH SMART MOTOR CONTROL

- 5.15.2 TOKYO METRO ENHANCES TRAIN EFFICIENCY WITH TOSHIBA'S ADVANCES IN PMSM AND BATTERY SYSTEM

- 5.15.3 ORQUIDEA IMPROVES FOOD PRODUCTION EFFICIENCY WITH BONUS MOTOR PROGRAM

- 5.16 IMPACT OF GENERATIVE AI/AI ON ENERGY-EFFICIENT MOTOR MARKET

- 5.16.1 ADOPTION OF GENERATIVE AI/AI IN ENERGY-EFFICIENT MOTOR MARKET

- 5.16.2 IMPACT OF GENERATIVE AI/AI ON KEY END USERS, BY REGION

- 5.16.3 IMPACT OF AI ON ENERGY-EFFICIENT MOTOR MARKET, BY REGION

- 5.17 IMPACT OF 2025 US TARIFF ON ENERGY-EFFICIENT MOTOR MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 IMPACT ON COUNTRY/REGION

- 5.17.3.1 North America

- 5.17.3.2 Europe

- 5.17.3.3 Asia Pacific

- 5.17.3.4 South America

- 5.17.3.5 Middle East & Africa

- 5.17.3.6 Impact on end users

6 ENERGY-EFFICIENT MOTOR MARKET, BY EFFICIENCY LEVEL

- 6.1 INTRODUCTION

- 6.2 IE1

- 6.2.1 LOW UPFRONT COSTS TO DRIVE MARKET

- 6.3 IE2

- 6.3.1 IMPLEMENTATION OF FAVORABLE REGULATIONS TO REDUCE CARBON EMISSIONS TO FUEL MARKET GROWTH

- 6.4 IE3

- 6.4.1 GROWING FOCUS ON ENERGY CONSERVATION TO BOOST DEMAND

- 6.5 IE4

- 6.5.1 LOW ENERGY CONSUMPTION AND REDUCED HEAT GENERATION TO FOSTER MARKET GROWTH

- 6.6 IE5

- 6.6.1 INCREASING APPLICATIONS IN DATA CENTERS, SEMICONDUCTOR MANUFACTURING, AND PHARMACEUTICAL PLANTS TO SPUR DEMAND

7 ENERGY-EFFICIENT MOTOR MARKET, BY INSTALLATION TYPE

- 7.1 INTRODUCTION

- 7.2 OPEN DRIP PROOF (ODP) MOTOR

- 7.2.1 REDUCED RISK OF OVERHEATING TO BOOST DEMAND

- 7.3 TOTALLY ENCLOSED FAN - COOLED (TEFC) MOTOR

- 7.3.1 ABILITY TO DISSIPATE HEAT THROUGH NATURAL AIRFLOW TO SPUR DEMAND

8 ENERGY-EFFICIENT MOTOR MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 AC MOTORS

- 8.2.1 GROWING APPLICATIONS IN INDUSTRIAL AND COMMERCIAL SECTORS TO BOOST DEMAND

- 8.3 DC MOTORS

- 8.3.1 ABILITY TO OFFER SUPERIOR PERFORMANCE AND CONTROL TO DRIVE MARKET

9 ENERGY-EFFICIENT MOTOR MARKET, BY POWER OUTPUT RATING

- 9.1 INTRODUCTION

- 9.2 <1 KW

- 9.2.1 RISING IMPLEMENTATION IN RESIDENTIAL AND LIGHT COMMERCIAL SETTINGS TO SUPPORT MARKET GROWTH

- 9.3 1-2.2 KW

- 9.3.1 APPLICATION IN INDUSTRIAL MACHINERY TO DRIVE MARKET

- 9.4 2.2-375 KW

- 9.4.1 SUITABILITY FOR POWERING FANS AND BLOWERS IN HVAC SYSTEMS TO FOSTER MARKET GROWTH

- 9.5 >375 KW

- 9.5.1 MINIMAL DOWNTIME AND MAXIMUM ENERGY EFFICIENCY TO BOOST DEMAND

10 ENERGY-EFFICIENT MOTOR MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 HVAC

- 10.2.1 GROWING FOCUS ON REDUCING POWER LOSS IN HVAC SYSTEMS TO BOOST DEMAND

- 10.3 PUMPS

- 10.3.1 RISING DEMAND FROM AGRICULTURE AND INDUSTRIAL SECTORS TO ACCELERATE MARKET GROWTH

- 10.4 FANS

- 10.4.1 INCREASING ADOPTION OF BRUSHLESS DC AND ELECTRONICALLY COMMUTATED MODELS TO BOOST DEMAND

- 10.5 COMPRESSORS

- 10.5.1 REDUCED OPERATION COSTS TO SUPPORT MARKET GROWTH

- 10.6 REFRIGERATION

- 10.6.1 DEVELOPMENT OF COLD CHAINS TO OFFER LUCRATIVE GROWTH OPPORTUNITIES

- 10.7 MATERIAL HANDLING

- 10.7.1 RISING ADOPTION OF MOBILE ROBOTS IN INDUSTRIES TO PROPEL SEGMENTAL GROWTH

- 10.8 MATERIAL PROCESSING

- 10.8.1 REPLACEMENT OF OUTDATED MOTOR SYSTEMS WITH IE3 AND IE4-RATED ENERGY-EFFICIENT MOTORS TO SPUR DEMAND

11 ENERGY-EFFICIENT MOTOR MARKET, BY END USER

- 11.1 INTRODUCTION

- 11.2 INDUSTRIAL

- 11.2.1 IMPROVED ENERGY EFFICIENCY, LOWER OPERATING COSTS, AND REDUCED DOWNTIME TO FUEL MARKET GROWTH

- 11.3 COMMERCIAL

- 11.3.1 IMPROVED DURABILITY AND SYSTEM RELIABILITY TO FOSTER MARKET GROWTH

- 11.4 RESIDENTIAL

- 11.4.1 EMPHASIS ON REDUCING ELECTRICITY CONSUMPTION TO DRIVE MARKET

- 11.5 AUTOMOTIVE

- 11.5.1 GROWING ADOPTION OF ELECTRIC VEHICLES TO BOOST DEMAND

- 11.6 AGRICULTURE

- 11.6.1 INCREASING EMPHASIS ON REDUCING OPERATIONAL COSTS IN FARMING TO BOOST DEMAND

- 11.7 AEROSPACE & DEFENSE

- 11.7.1 NEED TO IMPROVE FUEL EFFICIENCY AND INCREASE SYSTEM RELIABILITY TO SUPPORT MARKET GROWTH

12 ENERGY-EFFICIENT MOTOR MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 ASIA PACIFIC

- 12.2.1 CHINA

- 12.2.1.1 Substantial rise in energy demand across key sectors to foster market growth

- 12.2.2 AUSTRALIA

- 12.2.2.1 Government-led initiatives to advance energy efficiency to support market growth

- 12.2.3 JAPAN

- 12.2.3.1 Strong policy alignment and commitment to sustainability to offer lucrative growth opportunities

- 12.2.4 INDIA

- 12.2.4.1 Increasing investments in industrial sector to boost demand

- 12.2.5 SOUTH KOREA

- 12.2.5.1 Favorable incentives and rebate programs to support market growth

- 12.2.6 REST OF ASIA PACIFIC

- 12.2.1 CHINA

- 12.3 NORTH AMERICA

- 12.3.1 US

- 12.3.1.1 Emphasis on improving energy efficiency across industrial and government sectors to foster market growth

- 12.3.2 CANADA

- 12.3.2.1 Presence of robust framework of energy efficiency acts and regulations to drive market

- 12.3.3 MEXICO

- 12.3.3.1 Government-led programs to curb GHG emissions to foster market growth

- 12.3.1 US

- 12.4 SOUTH AMERICA

- 12.4.1 BRAZIL

- 12.4.1.1 Established aerospace manufacturing sector to boost demand

- 12.4.2 ARGENTINA

- 12.4.2.1 Expanding telecommunications sector to fuel market growth

- 12.4.3 CHILE

- 12.4.3.1 Flourishing industrial sector to accelerate market growth

- 12.4.4 REST OF SOUTH AMERICA

- 12.4.1 BRAZIL

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 SAUDI ARABIA

- 12.5.1.1 Government-led programs to reduce energy consumption to foster market growth

- 12.5.2 UAE

- 12.5.2.1 Rising emphasis on achieving net-zero targets to foster market growth

- 12.5.3 TURKEY

- 12.5.3.1 Commitment to reducing carbon footprint to boost demand

- 12.5.4 SOUTH AFRICA

- 12.5.4.1 Growing focus on boosting adoption of renewable energy sources to fuel market growth

- 12.5.5 EGYPT

- 12.5.5.1 Government initiatives to improve industrial energy efficiency to support market growth

- 12.5.6 QATAR

- 12.5.6.1 Growing emphasis on reducing GHG emissions to boost demand

- 12.5.7 ISRAEL

- 12.5.7.1 Advancements in smart home technologies and energy-efficient HVAC systems to fuel market growth

- 12.5.8 REST OF MIDDLE EAST & AFRICA

- 12.5.1 SAUDI ARABIA

- 12.6 EUROPE

- 12.6.1 UK

- 12.6.1.1 Significant developments in oil & gas and energy and power sectors to foster market growth

- 12.6.2 GERMANY

- 12.6.2.1 Need to replace aging legacy infrastructures to support market growth

- 12.6.3 FRANCE

- 12.6.3.1 Growing production and processing of metals and minerals to offer lucrative growth opportunities

- 12.6.4 ITALY

- 12.6.4.1 Rising adoption of battery storage and smart management systems to drive market

- 12.6.5 SPAIN

- 12.6.5.1 Expanding industrial sector to offer lucrative growth opportunities

- 12.6.6 POLAND

- 12.6.6.1 Emphasis on boosting sustainable practices and adoption of clean technologies to fuel market growth

- 12.6.7 REST OF EUROPE

- 12.6.1 UK

13 COMPETITIVE LANDSCAPE

- 13.1 INTRODUCTION

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.3.1 REGAL REXNORD CORPORATION

- 13.3.2 ABB

- 13.3.3 SIEMENS

- 13.3.4 NIDEC CORPORATION

- 13.3.5 WOLONG ELECTRIC GROUP

- 13.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.4.1 STARS

- 13.4.2 EMERGING LEADERS

- 13.4.3 PERVASIVE PLAYERS

- 13.4.4 PARTICIPANTS

- 13.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.4.5.1 Company footprint

- 13.4.5.2 Type footprint

- 13.4.5.3 Efficiency level footprint

- 13.4.5.4 End user footprint

- 13.4.5.5 Region footprint

- 13.5 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.5.1 PROGRESSIVE COMPANIES

- 13.5.2 RESPONSIVE COMPANIES

- 13.5.3 DYNAMIC COMPANIES

- 13.5.4 STARTING BLOCKS

- 13.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.5.5.1 List of key startups/SMEs

- 13.5.5.2 Competitive benchmarking of key startups/SMEs

- 13.6 COMPETITIVE SCENARIOS

- 13.6.1 PRODUCT LAUNCHES

- 13.6.2 DEALS

- 13.6.3 OTHER DEVELOPMENTS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 ABB

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Services/Solutions offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Other developments

- 14.1.1.4 MnM View

- 14.1.1.4.1 Key strategies/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 SIEMENS

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Services/Solutions offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.3.2 Deals

- 14.1.2.3.3 Other developments

- 14.1.2.4 MnM view

- 14.1.2.4.1 Key strengths/Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses/Competitive threats

- 14.1.3 WEG

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Services/Solutions offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.3.3 Other developments

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strategies/Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses/Competitive threats

- 14.1.4 WOLONG ELECTRIC GROUP CO., LTD

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Services/Solutions offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strategies/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 NIDEC CORPORATION

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Services/Solutions offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Key strategies/Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses/Competitive threats

- 14.1.6 ROCKWELL AUTOMATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Services/Solutions offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.7 CG POWER & INDUSTRIAL SOLUTIONS LTD.

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Services/Solutions offered

- 14.1.8 REGAL REXNORD CORPORATION

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Deals

- 14.1.9 TOSHIBA CORPORATION

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Services/Solutions offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product launches

- 14.1.10 BHARAT BIJLEE

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Services/Solutions offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Product launches

- 14.1.11 KIRLOSKAR ELECTRIC COMPANY

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Services/Solutions offered

- 14.1.12 HOYER MOTORS

- 14.1.12.1 Business overview

- 14.1.12.2 Products/Services/Solutions offered

- 14.1.13 OME MOTORS

- 14.1.13.1 Business overview

- 14.1.13.2 Products/Services/Solutions offered

- 14.1.14 EC FANS AND DRIVES

- 14.1.14.1 Business overview

- 14.1.14.2 Products/Services/Solutions offered

- 14.1.15 INTEGRATED ELECTRIC CO., PVT. LTD.

- 14.1.15.1 Business overview

- 14.1.15.2 Products/Services/Solutions offered

- 14.1.1 ABB

- 14.2 OTHER PLAYERS

- 14.2.1 ELEKTRIM TECHTOP MOTORS PTE LTD.

- 14.2.2 SHANGHAI ELECTRIC

- 14.2.3 MENZEL ELEKTROMOTOREN

- 14.2.4 ZCL ELECTRIC MOTOR TECHNOLOGY CO., LTD.

- 14.2.5 HINDMOTORS

- 14.2.6 AMBER ENGINEERING ENTERPRISE

- 14.2.7 MITSUBISHI ELECTRIC CORPORATION

- 14.2.8 HAVELLS

- 14.2.9 TECO CORPORATION

- 14.2.10 ELCEN

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS