|

시장보고서

상품코드

1784321

SD-WAN 시장 : 솔루션별, 서비스별, 조직 규모별, 최종 사용자별 예측(-2030년)Software-defined Wide Area Network (SD-WAN) Market by Offering (Solutions (Software and Appliances) and Services (Professional Services and Managed Services)), Organization Size, End Users (Service Providers and Enterprises) - Global Forecast to 2030 |

||||||

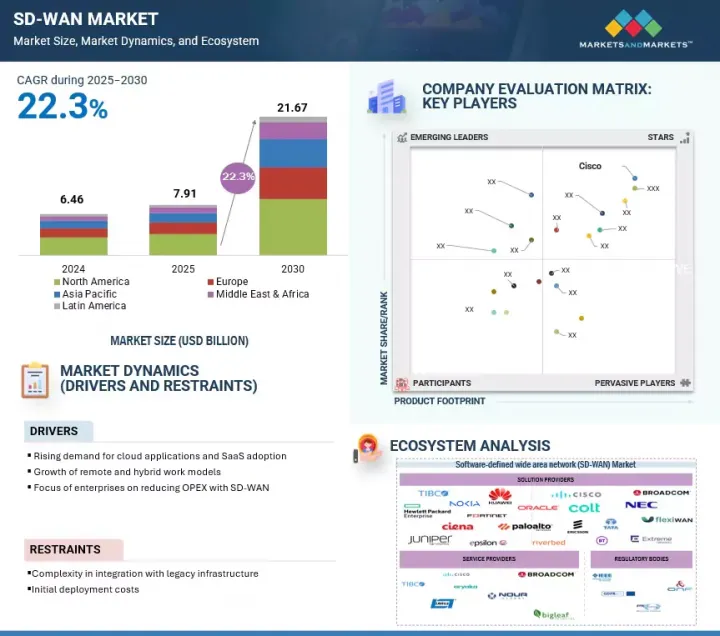

세계의 SD-WAN 시장 규모는 2025년에 79억 1,000만 달러로 평가되었고, 2030년에 216억 7,000만 달러에 이를 것으로 추정되며, 2025-2030년에 CAGR로 22.3%의 성장이 전망됩니다.

네트워크의 분산화 및 기존 경계의 붕괴로 인해 SD-WAN은 최근 기업의 연결에 필수적인 중추적인 역할을 하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 제품, 조직 규모, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

현재 기업 워크로드의 70% 이상이 SaaS, IaaS 및 엣지 환경의 데이터 센터 외부에 존재하기 때문에, 조직은 더 이상 비용이나 속도만을 위해 네트워크를 최적화하지 않고, 가시성, 제어 및 보안을 위해 네트워크를 최적화하고 있습니다.

이러한 변화는 특히 전 세계에 진출한 대기업을 중심으로 SD-WAN과 클라우드 네이티브 보안 프레임워크의 통합을 가속화하고 있습니다. 2025년 6월, AT&T는 관리형 SD-WAN 제품에 AI 기반의 이상 탐지 기능을 통합하는 전략을 발표하며, 애플리케이션 성능 저하를 사전에 방지하는 자율 네트워킹의 역할이 커지고 있음을 강조했습니다. 비슷한 동향이 의료 및 소매 부문에서도 나타나고 있습니다. 이 부문에서 기업들은 지능형 SD-WAN을 활용하여 지연 시간 임계값 및 위험 민감도에 따라 환자 모니터링 데이터나 실시간 결제 시스템과 같은 미션 크리티컬 트래픽의 우선 순위를 동적으로 지정하고 있습니다.

그러나 기술의 성숙도가 높아지는 반면 운영의 분산은 여전히 제약 요인으로 남아 있습니다. 기업들은 특히 클라우드, 지사, 원격 엔드포인트에 걸쳐 통합된 보안 정책을 시행할 때, 레거시 MPLS 기반 시스템과 동적인 SD-WAN 아키텍처를 통합하는 데 어려움을 겪고 있습니다.

이러한 통합의 어려움은 에너지 및 공공 부문과 같은 규제 산업에서 숙련된 인력이 부족하기 때문에 더욱 심화되고 있으며, 이러한 산업에서는 전개에 실수가 있으면 규정 준수 위험이나 서비스 중단이 발생할 수 있습니다. 이에 대응하여 공급업체들은 어플라이언스, 클라우드 소프트웨어, 모든 서비스, 컨설팅, 구현, 교육 및 지원, 지속적인 관리 서비스를 포함하는 번들형 제공 모델을 강조하기 위해 SD-WAN 제품을 재포지셔닝하고 있습니다. SD-WAN의 미래는 기술 자체뿐만 아니라 복잡한 환경, 규정 준수가 중요한 산업, 동적인 트래픽 환경에서 얼마나 효과적으로 운영될 수 있는지에 의해 결정될 것입니다.

기업 최종 사용자 부문이 예측 기간 동안 가장 큰 시장 규모를 차지했습니다.

BFSI, 제조, 의료 및 생명 과학, 소매 및 전자상거래, 교육, 에너지 및 유틸리티, 정부 및 공공 부문 및 기타 산업을 포함한 기업 최종 사용자 부문이 SD-WAN을 가장 많이 채택한 부문으로 부상했습니다. 이러한 리더십은 기업의 운영 규모, 다중 사이트의 복잡성, 고성능의 안전한 중앙 관리형 네트워크에 대한 중요한 의존성에 의해 촉진되고 있습니다.

그들의 요구는 핵심 SD-WAN 소프트웨어 또는 어플라이언스를 넘어, 컨설팅, 구현, 교육 및 지원, 관리형 서비스와 함께 제공되는 멀티 클라우드 연결, 정책 조정 및 제로 트러스트 아키텍처를 결합한 통합 제품으로 확대되고 있습니다. 예를 들어, Pfizer는 HPE Aruba 어플라이언스를 사용하여 전 세계 R&D 및 제조 현장에 SD-WAN 솔루션을 구현하고, 구현 및 관리 서비스를 지원함으로써 99.9%의 용도 가용성을 달성하고 지점 온보딩 시간을 절반으로 단축했습니다.

마찬가지로 Walmart는 Cisco의 SD-WAN 어플라이언스를 수많은 소매점에 전개하고 컨설팅 및 관리 지원과 통합하여 트래픽이 많은 시간대에도 원활한 결제 프로세스와 실시간 재고 관리를 실현했습니다. 이러한 사례는 기업이 SD-WAN 솔루션의 최대 소비자이며, 수직 산업별 성능, 규정 준수 및 보안 요구 사항에 맞춤화된 전체적이고 서비스 집약적인 전개를 요구하는 가장 까다로운 고객이라는 것을 보여줍니다.

이 보고서는 세계의 SD-WAN 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- SD-WAN 시장의 기업에게 매력적인 기회

- SD-WAN 시장 : 제공별

- SD-WAN 시장 : 조직 규모별

- SD-WAN 시장 : 전문 서비스별

- SD-WAN 시장 : 최종 사용자별

- SD-WAN 시장 : 기업별

- 북미의 SD-WAN 시장 : 최종 사용자별, 제공별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 공급망 분석

- 생태계 분석

- SD-WAN의 응용 분야

- 통합 커뮤니케이션

- 클라우드 접근

- 리모트 접속성

- 용도 성능

- 네트워크 최적화

- 복수 지점 접속성

- 보안

- 오프넷 VPN

- 사례 연구 분석

- 사례 연구 1 : LOTTE, CISCO SD-WAN으로 기존 WAN을 재구성

- 사례 연구 2 : TAFT STETTINIUS & HOLLISTER LLP, ORACLE SD-WAN으로 네트워크 신뢰성 향상

- 사례 연구 3 : STOLT-NIELSEN, MPLS WAN을 재구성하여 네트워크 가시성을 높이고 관리 복잡성을 제거

- 사례 연구 4 : 데이터 센터에 의존하지 않고 전 세계 지사를 쉽게 확장

- 사례 연구 5 : WINDSTREAM, 관리형 SD-WAN 서비스에 자동화를 도입하여 프로비저닝 시간 단축

- 사례 연구 6 : TSCAB의 413개 지점에 걸친 신뢰성 있는 네트워크

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 기술 분석

- 주요 기술

- 관련 기술

- 보완 기술

- 가격 설정 분석

- 주요 기업의 평균 판매 가격 : 하드웨어 기기별(2024년)

- 참고 가격 분석 : 솔루션별(2024년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향 및 혼란

- 관세 및 규제 상황

- 음성, 이미지 또는 기타 데이터의 수신, 변환, 전송 또는 재생에 사용되는 기계에 대한 관세

- 규제 기관, 정부 기관 및 기타 조직

- 주요 규제

- 특허 분석

- SD-WAN 시장 기술 로드맵

- 단기 로드맵(2025-2026년)

- 중기 로드맵(2027년-2029년)

- 장기 로드맵(2030년-2032년)

- SD-WAN 구현을 위한 최선의 실천 방법

- 현재 및 신흥 비즈니스 모델

- 도구, 프레임워크 및 기술

- 무역 분석

- 수출 시나리오(HS 코드 8517)

- 수입 시나리오(HS 코드 8517)

- SD-WAN 시장에 대한 AI/생성형 AI의 영향

- 미국 관세의 영향(2025년) - SD-WAN 시장

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

- 투자 및 자금조달 시나리오

제6장 SD-WAN 시장 : 제공별

- 소개

- 솔루션

- 소프트웨어

- 소비자 가전

- 서비스

- 전문 서비스

- 관리 서비스

제7장 SD-WAN 시장 : 조직 규모별

- 소개

- 중소기업

- 대기업

제8장 SD-WAN 시장 : 최종 사용자별

- 소개

- 서비스 제공업체

- 기업

제9장 SD-WAN 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 북유럽 국가

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 동남아시아

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 거시 경제 전망

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제10장 경쟁 구도

- 소개

- 주요 참가 기업의 전략 및 강점(2022-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

- CISCO SD-WAN

- FORTINET SECURE SD-WAN

- PRISMA SD-WAN

- VMWARE VELOCLOUD SD-WAN

- ARUBA EDGECONNECT

- 기업 평가 및 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 기업

- CISCO SYSTEMS

- BROADCOM

- PALO ALTO NETWORKS

- FORTINET

- HEWLETT PACKARD ENTERPRISE(HPE)

- HUAWEI

- JUNIPER NETWORKS

- ORACLE

- NOKIA

- EXTREME NETWORKS, INC.

- ERICSSON

- BT GROUP

- RIVERBED TECHNOLOGY

- COLT TECHNOLOGY SERVICES

- NEC CORPORATION

- TATA COMMUNICATIONS

- TIBCO SOFTWARE

- CIENA CORPORATION

- EPSILON TELECOMMUNICATIONS

- 스타트업/중소기업

- MARTELLO TECHNOLOGIES

- ARELION

- ARYAKA NETWORKS

- CATO NETWORKS

- FLEXIWAN

- NOUR GLOBAL

- FATPIPE NETWORKS

- LAVELLE NETWORKS

- SENCINET

- MCM TELECOM

- INTERNEXA

- BIGLEAF NETWORKS

제12장 인접 시장과 관련 시장

- 소개

- 기업 네트워킹 시장

- 시장의 정의

- 시장 개요

- 기업 네트워킹 시장 : 네트워크별

- 기업 네트워킹 시장 : 전개 방식별

- 기업 네트워킹 시장 : 최종 사용자별

- 기업 네트워킹 시장 : 지역별

- NaaS(Network as a Service) 시장

- 시장의 정의

- NaaS(Network as a Service) 시장 : 유형별

- NaaS(Network as a Service) 시장 : 조직 규모별

- NaaS(Network as a Service) 시장 : 최종 사용자별

- NaaS(Network as a Service) 시장 : 지역별

제13장 부록

HBR 25.08.13The SD-WAN market is estimated to be USD 7.91 billion in 2025 and reach USD 21.67 billion in 2030 at a CAGR of 22.3%, from 2025 to 2030. Rising network decentralization and the collapse of the traditional perimeter have made SD-WAN a mission-critical backbone for modern enterprise connectivity.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | By offering, organization size, end user, and region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

With over 70% of enterprise workloads now residing outside the data center across SaaS, IaaS, and edge environments, organizations are no longer optimizing networks solely for cost or speed, but for visibility, control, and security.

This shift is accelerating the integration of SD-WAN with cloud-native security frameworks, particularly among large enterprises with global footprints. In June 2025, AT&T's move to embed AI-based anomaly detection in its managed SD-WAN offering marked a strategic pivot in the market, emphasizing the growing role of autonomous networking in preempting application performance degradation. Similar trends are visible in healthcare and retail sectors, where businesses are leveraging intelligent SD-WAN to dynamically prioritize mission-critical traffic such as patient monitoring data or real-time payment systems based on latency thresholds and risk sensitivity.

However, while technological maturity is advancing, operational fragmentation remains a constraint. Enterprises still face friction in aligning legacy MPLS-based systems with dynamic SD-WAN architectures, particularly when trying to enforce unified security policies across cloud, branch, and remote endpoints.

This integration challenge is compounded by the shortage of skilled personnel in regulated industries such as the energy and public sectors, where deployment missteps can trigger compliance risks or service disruption. In response, vendors are repositioning their SD-WAN offerings to emphasize bundled delivery models that include appliances, cloud software, and a full spectrum of services, consulting, implementation, training & support, and ongoing managed services. The future of SD-WAN is being shaped by the technology itself, but by how effectively it is operationalized across complex environments, compliance-heavy verticals, and dynamic traffic landscapes.

"Enterprise end user segment contributed to the largest market size during the forecast period"

The enterprise end user segment, including BFSI, manufacturing, healthcare & life sciences, retail & e-commerce, education, energy & utilities, government & public sector, and other industries, has emerged as the most dominant adopter of SD-WAN. This leadership is driven by enterprises' operational scale, multi-site complexity, and critical dependence on high-performance, secure, and centrally managed networks.

Their needs extend beyond core SD-WAN software or appliances to integrated offerings that combine multicloud connectivity, policy orchestration, and zero-trust architecture, delivered alongside consulting, implementation, training and support, and managed services. For instance, Pfizer implemented an SD-WAN solution using HPE Aruba appliances across its global R&D and manufacturing sites, supported by implementation and managed services, which led to 99.9 percent application availability and reduced branch onboarding time by half.

Similarly, Walmart deployed Cisco's SD-WAN appliances across numerous retail outlets, integrated with consulting and managed support, enabling seamless checkout processes and real-time inventory control during high-traffic periods. These examples illustrate that enterprises are the largest consumers of SD-WAN solutions and the most demanding, requiring holistic, service-intensive deployments tailored to vertical-specific performance, compliance, and security requirements.

"Large enterprise segment is projected to register the largest market share during the forecast period"

Large enterprises are poised to contribute the largest share in SD-WAN adoption due to their complex infrastructure, global footprint, and stringent requirements for reliability, security, and performance optimization. These organizations typically manage hundreds or thousands of locations, each demanding standardized policy enforcement, real-time visibility, and robust disaster recovery capabilities. To address this, large enterprises are increasingly adopting SD-WAN offerings that bundle software and appliances with deep professional engagement consulting, implementation, training, and support, and full-scale managed services.

For instance, Toyota Motor Corporation deployed Aruba EdgeConnect across its global operations, spanning over 30 countries, utilizing managed services to maintain policy consistency and reporting a 70 percent reduction in manual configuration tasks. Similarly, Shell integrated Fortinet's SD-WAN into its energy infrastructure with end-to-end support services, achieving a 45 percent decrease in meantime to repair and enhanced control over remote asset communication. These deployments illustrate how large enterprises emphasize not only the technology itself but also the ecosystem of services that guarantees secure, scalable, and reliable implementation across their distributed environments.

"North America leads in market share, whereas Asia Pacific emerges as the fastest-growing region during the forecast period"

North America remains the leading region in SD-WAN deployment, supported by advanced enterprise cloud maturity, security regulations, and a high concentration of managed service providers. Enterprises in this region demand comprehensive offerings that integrate SD-WAN software and appliances with professional and managed services to ensure SLA compliance, cloud optimization, and centralized security enforcement. For instance, JPMorgan Chase implemented Cisco Catalyst SD-WAN across more than 5,000 branch locations, supported by consulting, implementation, and ongoing support services. This initiative enabled a 30 percent reduction in site onboarding time and reinforced zero-trust access across multicloud workloads.

Meanwhile, Asia Pacific is emerging as the fastest-growing region, driven by accelerating digitalization and telco-led service integration. For instance, Malaysia-based electronics manufacturer Inari Amertron adopted HPE Aruba SD-WAN along with consulting services across its production plants, reducing downtime by 40 percent and improving inter-site coordination. In India, public sector agencies such as the National Informatics Centre are deploying Fortinet SD-WAN with professional services to strengthen secure connectivity across government facilities. These regional trends reflect a maturing North American landscape shaped by performance-driven scale, while Asia Pacific's growth is propelled by infrastructure expansion and digitally enabled sectoral transformation.

Breakdown of Primary Interviews

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The breakdown of the primary interviews is as follows:

- By Company Type: Tier 1 - 35%, Tier 2 - 40%, and Tier 3 - 25%

- By Designation: C-level - 20%, Directors - 30%, and Others - 50%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, Rest of the World - 5%

The major players in the SD-WAN market are Cisco (US), HPE (US), Nokia (Finland), Broadcom (US), Fortinet (US), Oracle (US), Huawei (China), Juniper Networks (US), Extreme Networks (US), Tibco Software (US), Ciena (US), Epsilon Telecommunications (US), Palto Alto Networks (US), Riverbed Technology (US), and Ericsson (Sweden). These players have adopted various growth strategies, such as partnerships, agreements and collaborations, product launches, product enhancements, and acquisitions to expand their footprint in the SD-WAN market.

Research Coverage

The market study covers the SD-WAN market size and the growth potential across different segments, including offering (solution [software, appliances], services [professional services (consulting, deployment & integration, support & maintenance), managed services]), organization size (small and medium-sized enterprises, large enterprises), end user (service providers, enterprises [banking, financial services, and insurance, manufacturing, healthcare & life sciences, retail & e-commerce, education, IT & ITes, government & public sector, other enterprises]), and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global SD-WAN market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (cloud adoption, hybrid work shift, application performance needs, zero-trust security demand, cost optimization), restraints (integration with legacy systems, skill shortages, security complexity, multi-vendor fragmentation), opportunities (SME adoption surge, 5G and edge expansion, vertical-specific solutions, AI-driven orchestration), and challenges (policy consistency, compliance enforcement, limited in-house expertise, real-time visibility gaps)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the SD-WAN market

- Market Development: Comprehensive information about lucrative markets - analyzing the SD-WAN market across various regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the SD-WAN market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as Cisco (US), HPE (US), Nokia (Finland), Broadcom (US), Fortinet (US), Oracle (US), Huawei (China), Juniper Networks (US), Extreme Networks (US), Tibco Software (US), Ciena (US), Epsilon Telecommunications (US), Palto Alto Networks (US), Riverbed Technology (US), and Ericsson (Sweden)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 SD-WAN MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SD-WAN MARKET

- 4.2 SD-WAN MARKET, BY OFFERING

- 4.3 SD-WAN MARKET, BY ORGANIZATION SIZE

- 4.4 SD-WAN MARKET, BY PROFESSIONAL SERVICE

- 4.5 SD-WAN MARKET, BY END USER

- 4.6 SD-WAN MARKET, BY ENTERPRISE

- 4.7 NORTH AMERICA: SD-WAN MARKET, BY END USER AND OFFERING

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for cloud applications and SaaS adoption

- 5.2.1.2 Growth of remote and hybrid work models

- 5.2.1.3 Focus of enterprises on reducing OPEX with SD-WAN

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity in integration with legacy infrastructure

- 5.2.2.2 Initial deployment costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Digital transformation across organizations

- 5.2.3.2 5G integration for next-gen SD-WAN solutions

- 5.2.3.3 Rising adoption by SMEs

- 5.2.4 CHALLENGES

- 5.2.4.1 Concerns over SD-WAN security

- 5.2.4.2 Vendor lock-in risks

- 5.2.1 DRIVERS

- 5.3 SUPPLY CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SD-WAN APPLICATION AREAS

- 5.5.1 UNIFIED COMMUNICATION

- 5.5.2 CLOUD APPROACH

- 5.5.3 REMOTE CONNECTIVITY

- 5.5.4 APPLICATION PERFORMANCE

- 5.5.5 NETWORK OPTIMIZATION

- 5.5.6 MULTIBRANCH CONNECTIVITY

- 5.5.7 SECURITY

- 5.5.8 OFFNET VPN

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 CASE STUDY 1: LOTTE RESTRUCTURED EXISTING WAN WITH CISCO SD-WAN

- 5.6.2 CASE STUDY 2: TAFT STETTINIUS & HOLLISTER LLP IMPROVED NETWORK RELIABILITY WITH ORACLE SD-WAN

- 5.6.3 CASE STUDY 3: STOLT-NIELSEN RESTRUCTURED ITS MPLS WAN TO GAIN NETWORK VISIBILITY AND ELIMINATE MANAGEMENT COMPLEXITY

- 5.6.4 CASE STUDY 4: EASY SCALE-UP OF GLOBAL OFFICES WITHOUT DATA CENTER DEPENDENCY

- 5.6.5 CASE STUDY 5: WINDSTREAM BRINGS AUTOMATION TO MANAGED SD-WAN SERVICES TO CUT PROVISIONING TIME

- 5.6.6 CASE STUDY 6: RELIABLE NETWORK ACROSS 413 BRANCHES OF TSCAB

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF BUYERS

- 5.7.4 BARGAINING POWER OF SUPPLIERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.8.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.8.2 BUYING CRITERIA

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Software-defined Networking (SDN)

- 5.9.1.2 Network Functions Virtualization (NFV)

- 5.9.2 ADJACENT TECHNOLOGIES

- 5.9.2.1 Artificial Intelligence (AI)/Machine Learning (ML)

- 5.9.2.2 Cloud computing

- 5.9.2.3 Internet of Things (IoT)

- 5.9.2.4 Edge computing

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 Network orchestration & automation

- 5.9.3.2 Data analytics

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PRICING ANALYSIS

- 5.10.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY HARDWARE APPLIANCE, 2024

- 5.10.2 INDICATIVE PRICING ANALYSIS, BY SOLUTION, 2024

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF RELATED TO MACHINES FOR RECEPTION, CONVERSION, AND TRANSMISSION OR REGENERATION OF VOICE, IMAGES, OR OTHER DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.13.3.1 North America

- 5.13.3.1.1 US

- 5.13.3.1.2 Canada

- 5.13.3.2 Europe

- 5.13.3.3 Asia Pacific

- 5.13.3.3.1 South Korea

- 5.13.3.3.2 China

- 5.13.3.3.3 India

- 5.13.3.4 Middle East & Africa

- 5.13.3.4.1 UAE

- 5.13.3.4.2 KSA

- 5.13.3.5 Latin America

- 5.13.3.5.1 Brazil

- 5.13.3.5.2 Mexico

- 5.13.3.1 North America

- 5.14 PATENT ANALYSIS

- 5.14.1 METHODOLOGY

- 5.15 TECHNOLOGY ROADMAP FOR SD-WAN MARKET

- 5.15.1 SHORT-TERM ROADMAP (2025-2026)

- 5.15.2 MID-TERM ROADMAP (2027-2029)

- 5.15.3 LONG-TERM ROADMAP (2030-2032)

- 5.16 BEST PRACTICES TO IMPLEMENT SD-WAN

- 5.17 CURRENT AND EMERGING BUSINESS MODELS

- 5.18 TOOLS, FRAMEWORKS, AND TECHNIQUES

- 5.19 TRADE ANALYSIS

- 5.19.1 EXPORT SCENARIO (HS CODE 8517)

- 5.19.2 IMPORT SCENARIO (HS CODE 8517)

- 5.20 IMPACT OF AI/GEN AI ON SD-WAN MARKET

- 5.21 IMPACT OF 2025 US TARIFF - SD-WAN MARKET

- 5.21.1 INTRODUCTION

- 5.21.2 KEY TARIFF RATES

- 5.21.3 PRICE IMPACT ANALYSIS

- 5.21.4 IMPACT ON COUNTRY/REGION

- 5.21.4.1 US

- 5.21.4.2 Europe

- 5.21.4.3 Asia Pacific

- 5.21.5 IMPACT ON END-USE INDUSTRIES

- 5.22 INVESTMENT AND FUNDING SCENARIO

6 SD-WAN MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: SD-WAN MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 SOFTWARE

- 6.2.1.1 Increasing demand for virtual applications to drive market

- 6.2.2 APPLIANCES

- 6.2.2.1 Edge routers to manage data flow by queuing

- 6.2.1 SOFTWARE

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 Enable enterprises assess their network needs

- 6.3.1.2 Consulting

- 6.3.1.3 Deployment & integration

- 6.3.1.4 Support & maintenance

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Reduce the complexity of managing in-house networks

- 6.3.1 PROFESSIONAL SERVICES

7 SD-WAN MARKET, BY ORGANIZATION SIZE

- 7.1 INTRODUCTION

- 7.1.1 ORGANIZATION SIZE: SD-WAN MARKET DRIVERS

- 7.2 SMALL AND MEDIUM-SIZED ENTERPRISES

- 7.2.1 WIDE ADOPTION OF CLOUD TECHNOLOGY FOR CENTRALIZED CONTROL

- 7.3 LARGE ENTERPRISES

- 7.3.1 INCREASE OPERATIONAL EFFICIENCY OF SD-WAN SOLUTIONS

8 SD-WAN MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.1.1 END USER: SD-WAN MARKET DRIVERS

- 8.2 SERVICE PROVIDERS

- 8.2.1 DELIVER COMPREHENSIVE, COST-EFFECTIVE MANAGED SD-WAN SERVICES

- 8.3 ENTERPRISES

- 8.3.1 INCREASINGLY DEPLOY SD-WAN TO SUPPORT GLOBAL REMOTE WORK CULTURE

- 8.3.2 BANKING, FINANCIAL SERVICES, AND INSURANCE

- 8.3.2.1 Extend financial services to remote areas

- 8.3.3 GOVERNMENT & PUBLIC SECTOR

- 8.3.3.1 Enhance cloud agility and user experience

- 8.3.4 RETAIL & E-COMMERCE

- 8.3.4.1 Deploy SD-WAN solutions to enhance customer experience

- 8.3.5 IT & ITES

- 8.3.5.1 Rising demand for cloud services, SaaS platforms, and virtualized environments

- 8.3.6 HEALTHCARE & LIFE SCIENCES

- 8.3.6.1 Enhance reliability and security of data transmission

- 8.3.7 EDUCATION

- 8.3.7.1 Shift toward e-learning, virtual classrooms, and digital content delivery

- 8.3.8 MANUFACTURING

- 8.3.8.1 Adopt SD-WAN solutions to lower network complexities

- 8.3.9 OTHER ENTERPRISES

9 SD-WAN MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Rising initiatives by government toward infrastructure development to drive market

- 9.2.3 CANADA

- 9.2.3.1 Need to monitor increasing traffic to boost demand for software-defined technologies

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Government initiatives for telecommunication to promote regulatory compliance for vendors

- 9.3.3 GERMANY

- 9.3.3.1 Strong presence of automobile and manufacturing companies to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Strong IT and telecommunications sector to drive market

- 9.3.5 ITALY

- 9.3.5.1 CPEs to improve network performance and optimize application experience

- 9.3.6 SPAIN

- 9.3.6.1 Government to focus on digitization in Digital Spain Plan 2025

- 9.3.7 NORDIC COUNTRIES

- 9.3.7.1 Increase in adoption of software-defined networking technology by enterprises to enable remote working

- 9.3.8 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Shift toward IoT, cloud, and AI technologies

- 9.4.3 INDIA

- 9.4.3.1 SD-WAN regulatory and policy trends to drive market

- 9.4.4 JAPAN

- 9.4.4.1 Stringent laws and regulations to drive market

- 9.4.5 AUSTRALIA AND NEW ZEALAND

- 9.4.5.1 Rising inflation, chip shortages, and trade restrictions to boost demand for secure networking

- 9.4.6 SOUTHEAST ASIA

- 9.4.6.1 Adoption of Bluetooth communication technology to drive market

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 GCC COUNTRIES

- 9.5.2.1 Upgradation of traditional network technologies to drive SD-WAN market

- 9.5.2.2 UAE

- 9.5.2.3 KSA

- 9.5.2.4 Rest of GCC Countries

- 9.5.3 SOUTH AFRICA

- 9.5.3.1 SD-WAN deployment to boost efficiency by managing bandwidth availability and usage

- 9.5.4 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Growth in various verticals and increasing demand for security

- 9.6.3 MEXICO

- 9.6.3.1 Government policies and rising internet usage to drive market

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2020-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 BRAND/PRODUCT COMPARISON

- 10.5.1 CISCO SD-WAN

- 10.5.2 FORTINET SECURE SD-WAN

- 10.5.3 PRISMA SD-WAN

- 10.5.4 VMWARE VELOCLOUD SD-WAN

- 10.5.5 ARUBA EDGECONNECT

- 10.6 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Offering footprint

- 10.7.5.4 Enterprise footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 CISCO SYSTEMS

- 11.1.1.1 Business overview

- 11.1.1.2 Solutions offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 BROADCOM

- 11.1.2.1 Business overview

- 11.1.2.2 Solutions offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 PALO ALTO NETWORKS

- 11.1.3.1 Business overview

- 11.1.3.2 Solutions offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product enhancements

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 FORTINET

- 11.1.4.1 Business overview

- 11.1.4.2 Solutions offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.4 Deals

- 11.1.4.5 MnM view

- 11.1.4.5.1 Right to win

- 11.1.4.5.2 Strategic choices

- 11.1.4.5.3 Weaknesses and competitive threats

- 11.1.5 HEWLETT PACKARD ENTERPRISE (HPE)

- 11.1.5.1 Business overview

- 11.1.5.2 Solutions offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 HUAWEI

- 11.1.6.1 Business overview

- 11.1.6.2 Solutions offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 JUNIPER NETWORKS

- 11.1.7.1 Business overview

- 11.1.7.2 Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.8 ORACLE

- 11.1.8.1 Business overview

- 11.1.8.2 Solutions offered

- 11.1.9 NOKIA

- 11.1.9.1 Business overview

- 11.1.9.2 Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 EXTREME NETWORKS, INC.

- 11.1.10.1 Business overview

- 11.1.10.2 Solutions offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Product enhancements

- 11.1.10.3.2 Deals

- 11.1.11 ERICSSON

- 11.1.12 BT GROUP

- 11.1.13 RIVERBED TECHNOLOGY

- 11.1.14 COLT TECHNOLOGY SERVICES

- 11.1.15 NEC CORPORATION

- 11.1.16 TATA COMMUNICATIONS

- 11.1.17 TIBCO SOFTWARE

- 11.1.18 CIENA CORPORATION

- 11.1.19 EPSILON TELECOMMUNICATIONS

- 11.1.1 CISCO SYSTEMS

- 11.2 STARTUPS/SMES

- 11.2.1 MARTELLO TECHNOLOGIES

- 11.2.2 ARELION

- 11.2.3 ARYAKA NETWORKS

- 11.2.4 CATO NETWORKS

- 11.2.5 FLEXIWAN

- 11.2.6 NOUR GLOBAL

- 11.2.7 FATPIPE NETWORKS

- 11.2.8 LAVELLE NETWORKS

- 11.2.9 SENCINET

- 11.2.10 MCM TELECOM

- 11.2.11 INTERNEXA

- 11.2.12 BIGLEAF NETWORKS

12 ADJACENT AND RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 ENTERPRISE NETWORKING MARKET

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.3 ENTERPRISE NETWORKING MARKET, BY NETWORK

- 12.2.4 ENTERPRISE NETWORKING MARKET, BY DEPLOYMENT MODE

- 12.2.5 ENTERPRISE NETWORKING MARKET, BY END-USER

- 12.2.6 ENTERPRISE NETWORKING MARKET, BY REGION

- 12.3 NETWORK AS A SERVICE MARKET

- 12.3.1 MARKET DEFINITION

- 12.3.2 NETWORK AS A SERVICE MARKET, BY TYPE

- 12.3.3 NETWORK AS A SERVICE MARKET, BY ORGANIZATION SIZE

- 12.3.4 NETWORK AS A SERVICE MARKET, BY END-USER

- 12.3.5 NETWORK AS A SERVICE MARKET, BY REGION

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS