|

시장보고서

상품코드

1786131

팽창성 흑연 시장 : 플레이크 사이즈별, 용도별(난연제, 전도성 첨가제, 연질 흑연), 최종 사용자 산업별(-2030년)Expandable Graphite Market by Flake Size, Application (Flame Retardant, Conductive Additive, Flexible Graphite), End-use Industry (Electronics & Energy Storage, Automotive, Building & Construction), and Region - Global Forecast to 2030 |

||||||

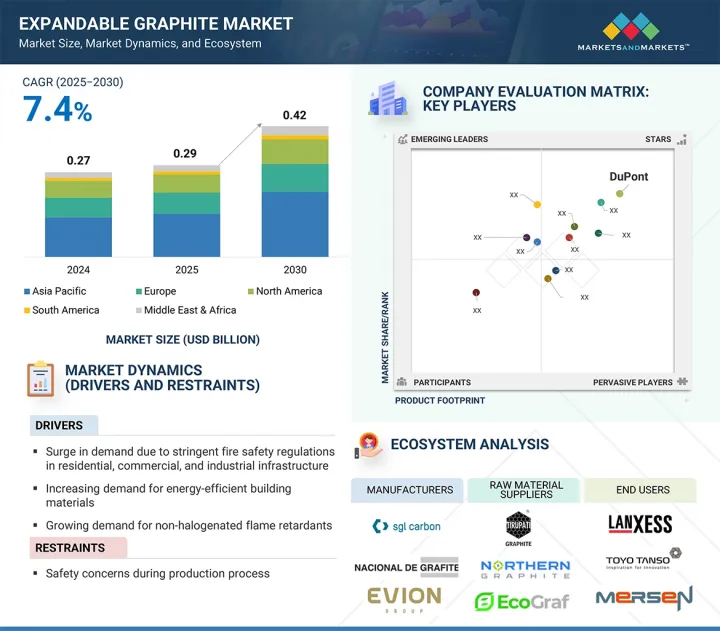

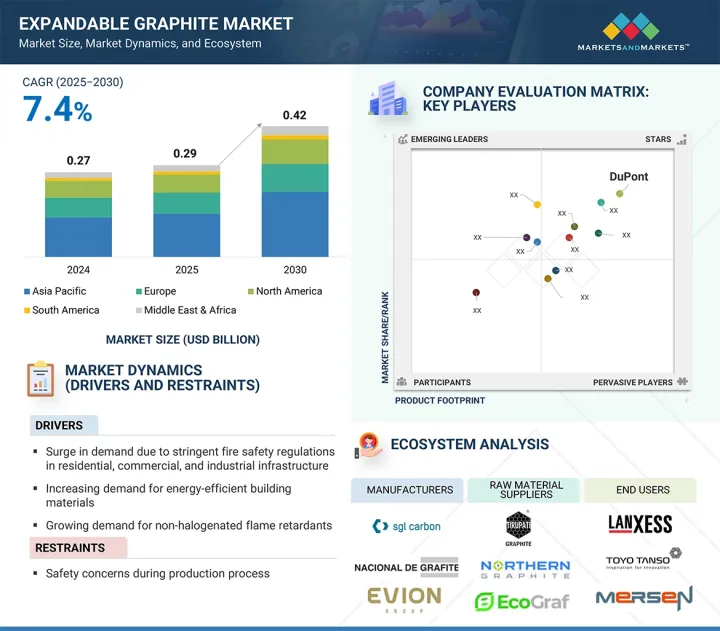

세계의 팽창성 흑연 시장 규모는 2025년 2억 9,000만 달러로 추정되고, 예측 기간 동안 CAGR 7.4%로 추이할 전망이며, 2030년에는 4억 2,000만 달러로 성장할 것으로 예측되고 있습니다.

현대의 전자기기 및 에너지 저장 시스템에서 효과적인 열 관리에 대한 수요 증가는 시장 성장의 주요 요인입니다. 디바이스 및 배터리가 점점 작고 고성능화되는 동안 여분의 열을 관리하는 것은 최적의 성능 및 안전을 보장하는 데 필수적입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 수량(톤) |

| 부문 | 플레이크 사이즈별, 용도별, 최종 사용자 산업별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

팽창성 흑연은 우수한 열전도성 및 고온 안정성을 갖추고 있으며, 리튬 이온 전지, 연료전지, 각종 열 인터페이스 재료 등의 용도에 있어서 매우 가치가 높은 전도성 첨가제가 되고 있습니다. 게다가 전기자동차나 고에너지 효율의 전자기기로의 이행이 진행됨으로써 신뢰성이 높고 환경친화적인 열관리 솔루션 수요가 한층 높아지고 있으며, 이러한 분야에서 팽창성 흑연의 중요성이 증가하고 있습니다.

'연질 흑연 부문이 예측 기간 중 2위 시장 점유율을 차지할 전망'

연질 흑연 부문은 예측 기간 동안 수량 기준으로 2위 시장 점유율을 획득할 것으로 예측됩니다. 이러한 성장은 주로 내구성, 내열성, 내식성이 뛰어난 밀봉재 및 개스킷재에 대한 다양한 산업 분야에서 수요 증가에 의해 지원되고 있습니다. 팽창성 흑연에서 생성되는 연질 흑연은 고온 및 화학적으로 가혹한 환경에서 우수한 내성으로 산업 제조, 화학 처리, 발전 분야에서 개스킷, 씰 및 라이닝에 널리 사용됩니다. 그 적응성, 신뢰성, 환경 적합성에 의해 지속 가능하고 고성능의 솔루션을 중시하는 산업계에서, 기존 실링재의 대체품으로서 선택되는 존재가 되고 있습니다.

'유럽이 예측 기간 동안 2위 시장 점유율을 차지할 전망'

이 성장은 이 지역의 방화 규제, 지속가능성 기준, 에너지 효율 향상 노력에 대한 강한 헌신에 의해 지원됩니다. 팽창성 흑연은 특히 주택과 상업 시설에서 유럽의 엄격한 방화 기준에 적합한 비독성의 난연제로서 건축자재에서 이용이 확대되고 있습니다.

또한 자동차, 항공우주, 전자기기 등 유럽의 선진 산업 분야에서는 열관리 시스템, 개스킷, 연료전지 부품에 대한 용도도 기세를 늘리고 있습니다. 신재생 에너지와 전기자동차에 대한 투자가 유럽 각국에서 진행되고 있는 가운데, 팽창성 흑연과 같은 고성능 및 환경친화적인 재료에 대한 수요는 더욱 높아지고 있습니다. 산업 수요 증가와 지속 가능한 재료 채용을 촉진하는 견고한 규제 체제로 유럽은 세계의 팽창성 흑연 시장에 중요한 공헌을 할 전망입니다.

본 보고서에서는 세계의 팽창성 흑연 시장을 조사했으며, 시장 개요, 시장 성장 영향요인 분석, 기술 및 특허 동향, 법규제 환경, 사례연구, 시장 규모 추이 및 예측, 각종 구분, 지역 및 주요 국가별 상세 분석, 경쟁 구도, 주요기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

제6장 업계 동향

- 세계의 거시경제 전망

- 밸류체인 분석

- 생태계 분석

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 가격 분석

- 규제 상황

- 주요 컨퍼런스 및 이벤트(2025년)

- 특허 분석

- 기술 분석

- 무역 분석

- 고객의 사업에 영향을 미치는 동향 및 혼란

- 생성형 AI가 팽창성 흑연 시장에 미치는 영향

- 미국 관세의 영향(2025년)

제7장 팽창성 흑연 시장 : 유형별

- 천연 팽창성 흑연

- 합성 팽창성 흑연

제8장 팽창성 흑연 시장 : 플레이크 사이즈별

- 중립 및 대립 플레이크

- 초대립 플레이크

제9장 팽창성 흑연 시장 : 용도별

- 난연제

- 전도성 첨가제

- 연질 흑연

- 기타

제10장 팽창성 흑연 시장 : 최종 사용자 산업별

- 전자 및 에너지 저장

- 자동차

- 건축 및 건설

- 공업 제조

- 항공우주 및 방위

- 기타

제11장 팽창성 흑연 시장 : 지역별

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 남미

- 브라질

- 칠레

- 아르헨티나

- 기타

제12장 경쟁 구도

- 주요 진입기업의 전략 및 강점

- 수익 분석

- 시장 점유율 분석

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 및 중소기업

- 기업평가 및 재무지표

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- SGL CARBON

- NEOGRAF

- YICHANG XINCHENG GRAPHITE CO., LTD.

- GRAPHIT KROPFMUHL GMBH

- NACIONAL DE GRAFITE

- QINGDAO XINGHE GRAPHITE CO., LTD.

- EVION GROUP

- QINGDAO YANXIN GRAPHITE PRODUCTS CO., LTD.

- QINGDAO BRAIDE GRAPHITE CO., LTD.

- SHIJIAZHUANG ADT CARBONIC MATERIAL FACTORY

- JAMES DURRANS GROUP

- NIPPON KOKUEN GROUP

- GEORG H. LUH GMBH

- CDI PRODUCTS

- GRAPHITE CENTRAL

- LKAB MINERALS

- ASBURY CARBONS

- 기타 기업

- QINGDAO MEILIKUN GRAPHITE PRODUCTS FACTORY CO., LTD.

- HEBEI JIN'AO TRADING CO., LTD.

- SEALMAX

- ZHONGPU INDUSTRIAL LTD.

- NANJING GRF CARBON MATERIAL CO., LTD.

제14장 인접 시장 및 관련 시장

제15장 부록

AJY 25.08.18The global expandable graphite market is projected to grow from USD 0.29 billion in 2025 to USD 0.42 billion by 2030, at a CAGR of 7.4% during the forecast period. The growing demand for effective thermal management in contemporary electronics and energy storage systems is a key factor driving the expansion of the expandable graphite market. As devices and batteries become increasingly compact and powerful, managing excess heat is essential for ensuring optimal performance and safety.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Tons) |

| Segments | Flake Size, Application, and End-use Industry |

| Regions covered | North America, Asia Pacific, Europe, Middle East & Africa, and South America |

Expandable graphite provides exceptional thermal conductivity and high-temperature stability, making it a highly valuable conductive additive in applications such as lithium-ion batteries, fuel cells, and various thermal interface materials. Furthermore, the ongoing transition toward electric vehicles and energy-efficient electronics amplifies the need for reliable and environmentally friendly thermal management solutions, elevating the significance of expandable graphite within these sectors.

"Flexible graphite segment to account for second-largest market share during forecast period"

The flexible graphite segment is anticipated to capture the second-largest market share, in terms of volume, within the expandable graphite sector during the forecast period. This growth is primarily fueled by the increasing demand for durable, heat-resistant, and corrosion-resistant sealing and gasketing materials across diverse industries. Flexible graphite, which is derived from expandable graphite, finds extensive application in gaskets, seals, and linings in industrial manufacturing, chemical processing, and power generation due to its exceptional resilience in high-temperature and chemically aggressive environments. Its adaptability, reliability, and environmental compatibility position it as a preferred alternative to traditional sealing materials, particularly as industries increasingly prioritize sustainable and high-performance solutions.

"Medium & large flakes segment to account for second-largest market share during forecast period"

The medium & large flake segment is anticipated to maintain the second-largest market share during the forecast period. These flake sizes are highly regarded for their balanced properties, which provide optimal expansion volume and exceptional purity, making them ideal for diverse applications. Medium and large flake expandable graphite is predominantly utilized in flame retardants, flexible graphite products, and thermal management materials, where moderate expansion and uniformity are crucial. The versatility of these flake sizes enables them to meet the stringent technical requirements of key industries, including building and construction, automotive, and electronics, all of which are experiencing steady global growth. As demand for efficient and multifunctional materials continues to rise across various end-use sectors, medium & large flake expandable graphite is positioned to secure a significant market share.

"Europe to account for second-largest market share during forecast period"

The Europe segment is projected to maintain the second-largest share of the expandable graphite market during the forecast period, driven by the region's strong commitment to fire safety regulations, sustainability standards, and energy efficiency initiatives. Expandable graphite is increasingly utilized as a non-toxic flame retardant in construction materials, aligning with Europe's stringent fire protection standards, particularly in residential and commercial sectors.

Additionally, its applications in thermal management systems, gaskets, and fuel cell components are gaining momentum within the region's advanced automotive, aerospace, and electronics industries. The ongoing investments by European countries in renewable energy and electric vehicles further amplify the demand for high-performance, environmentally friendly materials such as expandable graphite. With rising industrial demand and a robust regulatory framework promoting the adoption of sustainable materials, Europe is poised to be a significant contributor to the global expandable graphite market.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1 - 65%, Tier 2 - 20%, and Tier 3 - 15%

- By Designation: Directors- 25%, Managers- 30%, and Others - 45%

- By Region: North America - 30%, Asia Pacific - 40%, Europe - 20%, Middle East & Africa - 7%, and South America - 3%

SGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmuhl GmbH (Germany), Nacional de Grafite (Brazil), and Qingdao Xinghe Graphite Co., Ltd. (China) are some of the major players operating in the expandable graphite market. These players have adopted acquisitions, agreements, and expansion to increase their market share and business revenue.

Research Coverage:

The report defines, segments, and projects the expandable graphite market based on flake size, end-use industry, application, and region. It provides detailed information regarding the major factors influencing the market's growth, such as drivers, restraints, opportunities, and challenges. It strategically profiles expandable graphite manufacturers, comprehensively analyzing their market shares and core competencies, and tracks and analyzes competitive developments, such as partnerships, agreements, product launches, and joint ventures.

Reasons to Buy the Report:

The report is expected to help the market leaders/new entrants by providing them with the closest approximations of revenue numbers of the expandable graphite market and its segments. This report is also expected to help stakeholders understand the market's competitive landscape better, gain insights to improve the position of their businesses, and make suitable go-to-market strategies. It also enables stakeholders to understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of critical drivers (Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure; increasing demand for energy-efficient building materials; and growing demand for non-halogenated flame retardants), restraints (Safety concerns during production process), opportunities (Increasing bans on hazardous fire-resistance materials), and challenges (Supply chain disruptions and geopolitical risks) influencing the growth of the expandable graphite market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities in the expandable graphite market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the expandable graphite market across varied regions.

- Market Diversification: Exhaustive information about new products, various types, untapped geographies, recent developments, and investments in the expandable graphite market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as SGL Carbon (Germany), NeoGraf (US), Yichang Xincheng Graphite Co., Ltd. (China), Graphit Kropfmuhl GmbH (Germany), Nacional de Grafite (Brazil), Qingdao Xinghe Graphite Co., Ltd. (China), and others in the expandable graphite market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 DEMAND-SIDE ANALYSIS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.2 TOP-DOWN APPROACH

- 2.4 SUPPLY-SIDE ANALYSIS

- 2.4.1 CALCULATIONS FOR SUPPLY-SIDE ANALYSIS

- 2.5 GROWTH FORECAST

- 2.6 DATA TRIANGULATION

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH ASSUMPTIONS

- 2.9 RESEARCH LIMITATIONS

- 2.10 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EXPANDABLE GRAPHITE MARKET

- 4.2 EXPANDABLE GRAPHITE MARKET, BY REGION

- 4.3 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY

- 4.4 EXPANDABLE GRAPHITE MARKET, BY APPLICATION

- 4.5 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE

- 4.6 EXPANDABLE GRAPHITE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand due to stringent fire safety regulations in residential, commercial, and industrial infrastructure

- 5.2.1.2 Increasing demand for energy-efficient building materials

- 5.2.1.3 Growing demand for non-halogenated flame retardants

- 5.2.2 RESTRAINTS

- 5.2.2.1 Safety concerns during production process

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Increasing bans on hazardous fire-resistant materials

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain disruptions and geopolitical risks

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 GLOBAL MACROECONOMIC OUTLOOK

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PORTER'S FIVE FORCES ANALYSIS

- 6.4.1 THREAT OF NEW ENTRANTS

- 6.4.2 THREAT OF SUBSTITUTES

- 6.4.3 BARGAINING POWER OF SUPPLIERS

- 6.4.4 BARGAINING POWER OF BUYERS

- 6.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.5 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.5.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.5.2 BUYING CRITERIA

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE OF EXPANDABLE GRAPHITE, BY REGION 2022-2024

- 6.6.2 AVERAGE SELLING PRICE TREND OF EXPANDABLE GRAPHITE, BY FLAKE SIZE, 2024

- 6.7 REGULATORY LANDSCAPE

- 6.7.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8 KEY CONFERENCES AND EVENTS, 2025

- 6.9 PATENT ANALYSIS

- 6.9.1 METHODOLOGY

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGIES

- 6.10.1.1 Graphite intercalation & thermal expansion technology

- 6.10.2 COMPLEMENTARY TECHNOLOGIES

- 6.10.2.1 Spheroidization of graphite

- 6.10.1 KEY TECHNOLOGIES

- 6.11 TRADE ANALYSIS

- 6.11.1 IMPORT SCENARIO (HS CODE 250410)

- 6.11.2 EXPORT SCENARIO (HS CODE 250410)

- 6.12 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.13 IMPACT OF GENERATIVE AI ON EXPANDABLE GRAPHITE MARKET

- 6.13.1 PROCESS OPTIMIZATION & QUALITY CONTROL

- 6.13.2 DIGITAL TWINS & PREDICTIVE ANALYTICS

- 6.13.3 MATERIALS DISCOVERY & FORMULATION

- 6.13.4 SUPPLY CHAIN & SUSTAINABILITY TRACKING

- 6.13.5 EQUIPMENT MAINTENANCE & AUTOMATION

- 6.14 IMPACT OF 2025 US TARIFF - EXPANDABLE GRAPHITE MARKET

- 6.14.1 KEY TARIFF RATES

- 6.14.2 PRICE IMPACT ANALYSIS

- 6.14.3 KEY IMPACT ON COUNTRY/REGION

- 6.14.3.1 US

- 6.14.3.2 Europe

- 6.14.3.3 Asia Pacific

- 6.14.4 IMPACT ON END-USE INDUSTRIES

- 6.14.4.1 Electronics & energy storage

- 6.14.4.2 Automotive

- 6.14.4.3 Building & construction

- 6.14.4.4 Industrial manufacturing

- 6.14.4.5 Aerospace & defence

7 EXPANDABLE GRAPHITE MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 NATURAL EXPANDABLE GRAPHITE

- 7.2.1 RISING DEMAND FOR NON-HALOGENATED FLAME RETARDANTS TO DRIVE MARKET

- 7.3 SYNTHETIC EXPANDABLE GRAPHITE

- 7.3.1 RISING DEMAND FROM ELECTRONICS AND ENERGY STORAGE INDUSTRIES TO BOOST MARKET

8 EXPANDABLE GRAPHITE MARKET, BY FLAKE SIZE

- 8.1 INTRODUCTION

- 8.2 MEDIUM & LARGE FLAKES

- 8.2.1 INCREASING DEMAND FOR FLAME RETARDANTS, GASKETS, AND THERMAL INSULATION TO DRIVE MARKET

- 8.3 JUMBO FLAKES

- 8.3.1 SURGE IN DEMAND FOR ADVANCED FIRE PROTECTION AND THERMAL INSULATION SOLUTIONS CONTINUES TO DRIVE MARKET

9 EXPANDABLE GRAPHITE MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 FLAME RETARDANT

- 9.2.1 SURGE IN HIGHLY EFFECTIVE, HALOGEN-FREE FLAME-RETARDANT ADDITIVES TO DRIVE MARKET

- 9.3 CONDUCTIVE ADDITIVE

- 9.3.1 INCREASING DEMAND FOR HIGH-PERFORMANCE BATTERIES, CONDUCTIVE POLYMERS, AND THERMAL MANAGEMENT TO BOOST DEMAND

- 9.4 FLEXIBLE GRAPHITE

- 9.4.1 SUPERIOR THERMAL CONDUCTIVITY, CHEMICAL RESISTANCE, AND ADAPTABILITY FOR HIGH-PERFORMANCE SEALING TO BOOST DEMAND

- 9.5 OTHER APPLICATIONS

10 EXPANDABLE GRAPHITE MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 ELECTRONICS & ENERGY STORAGE

- 10.2.1 SURGE IN DEMAND FOR THERMAL MANAGEMENT, CONDUCTIVITY, AND EFFICIENCY TO DRIVE MARKET

- 10.3 AUTOMOTIVE

- 10.3.1 RISING EV SECTOR AND LIGHTWEIGHT MATERIALS TO DRIVE MARKET

- 10.4 BUILDING & CONSTRUCTION

- 10.4.1 FIRE SAFETY AND THERMAL INSULATION TO DRIVE MARKET

- 10.5 INDUSTRIAL MANUFACTURING

- 10.5.1 SURGE IN DEMAND FOR FLAME-RETARDANT TEXTILES, HIGH-PERFORMANCE LUBRICANTS, AND CONDUCTIVE CARBON BRUSHES TO BOOST MARKET

- 10.6 AEROSPACE & DEFENSE

- 10.6.1 LIGHTWEIGHT FLAME RESISTANCE AND STRINGENT AEROSPACE SAFETY STANDARDS TO DRIVE MARKET

- 10.7 OTHER END-USE INDUSTRIES

11 EXPANDABLE GRAPHITE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 EUROPE

- 11.2.1 GERMANY

- 11.2.1.1 Rising demand for fire safety and booming battery sector to drive market

- 11.2.2 UK

- 11.2.2.1 Expandable graphite market to gain momentum with industrial and automotive industries growth

- 11.2.3 FRANCE

- 11.2.3.1 Growing energy, construction, and aerospace sectors to drive market

- 11.2.4 ITALY

- 11.2.4.1 Fire safety and e-mobility boom to drive market

- 11.2.5 SPAIN

- 11.2.5.1 Surge in fire safety regulations and growing battery production to drive market

- 11.2.6 REST OF EUROPE

- 11.2.1 GERMANY

- 11.3 NORTH AMERICA

- 11.3.1 US

- 11.3.1.1 Surge in renewable energy integration and EV adoption to drive market

- 11.3.2 CANADA

- 11.3.2.1 Initiative for graphite independence to fuel market

- 11.3.3 MEXICO

- 11.3.3.1 Expanding end-use industries to boost market

- 11.3.1 US

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Rapid expansion of EV sector and stringent green building initiatives to drive market

- 11.4.2 JAPAN

- 11.4.2.1 Advancements in EV sector and sustainable construction initiatives to drive market

- 11.4.3 INDIA

- 11.4.3.1 Increasing investment in expandable graphite to drive market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Commitment to ecofriendly initiatives and sustainable development to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Commitment to sustainable construction to drive market

- 11.4.6 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 UAE

- 11.5.1.1.1 Significant advancements in EV and sustainable construction initiatives to propel growth

- 11.5.1.2 Saudi Arabia

- 11.5.1.2.1 Significant growth in EVs to drive growth

- 11.5.1.3 Rest of GCC Countries

- 11.5.1.1 UAE

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing automotive sector and increasing adoption of EVs to drive market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 EV surge and energy storage growth to drive market

- 11.6.2 CHILE

- 11.6.2.1 Surge amid mining boom, renewable energy push, and fire-safe construction demand to drive market

- 11.6.3 ARGENTINA

- 11.6.3.1 Surges with lithium growth and fire safety reforms to drive market

- 11.6.4 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Application footprint

- 12.6.5.4 End-use industry footprint

- 12.6.5.5 Flake size footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of key startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SGL CARBON

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths/Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses/Competitive threats

- 13.1.2 NEOGRAF

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 MnM view

- 13.1.2.3.1 Key strengths/Right to win

- 13.1.2.3.2 Strategic choices

- 13.1.2.3.3 Weaknesses/Competitive threats

- 13.1.3 YICHANG XINCHENG GRAPHITE CO., LTD.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 MnM view

- 13.1.3.3.1 Key strengths/Right to win

- 13.1.3.3.2 Strategic choices

- 13.1.3.3.3 Weaknesses/Competitive threats

- 13.1.4 GRAPHIT KROPFMUHL GMBH

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 MnM view

- 13.1.4.3.1 Key strengths/Right to win

- 13.1.4.3.2 Strategic choices

- 13.1.4.3.3 Weaknesses/Competitive threats

- 13.1.5 NACIONAL DE GRAFITE

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths/Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses/Competitive threats

- 13.1.6 QINGDAO XINGHE GRAPHITE CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 MnM view

- 13.1.6.3.1 Key strengths/Right to win

- 13.1.6.3.2 Strategic choices

- 13.1.6.3.3 Weaknesses/Competitive threats

- 13.1.7 EVION GROUP

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 QINGDAO YANXIN GRAPHITE PRODUCTS CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.9 QINGDAO BRAIDE GRAPHITE CO., LTD.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.10 SHIJIAZHUANG ADT CARBONIC MATERIAL FACTORY

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.11 JAMES DURRANS GROUP

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.12 NIPPON KOKUEN GROUP

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.13 GEORG H. LUH GMBH

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.14 CDI PRODUCTS

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 GRAPHITE CENTRAL

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.16 LKAB MINERALS

- 13.1.16.1 Business overview

- 13.1.16.2 Products/Solutions/Services offered

- 13.1.17 ASBURY CARBONS

- 13.1.17.1 Business overview

- 13.1.17.2 Products/Solutions/Services offered

- 13.1.1 SGL CARBON

- 13.2 OTHER PLAYERS

- 13.2.1 QINGDAO MEILIKUN GRAPHITE PRODUCTS FACTORY CO., LTD.

- 13.2.2 HEBEI JIN'AO TRADING CO., LTD.

- 13.2.3 SEALMAX

- 13.2.4 ZHONGPU INDUSTRIAL LTD.

- 13.2.5 NANJING GRF CARBON MATERIAL CO., LTD.

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 INTERCONNECTED MARKETS

- 14.4 GRAPHITE MARKET

- 14.4.1 MARKET DEFINITION

- 14.4.2 MARKET OVERVIEW

- 14.4.3 GRAPHITE MARKET, BY PURITY

- 14.4.4 HIGH PURITY

- 14.4.4.1 Demand for precision and performance across industries to boost market

- 14.4.5 LOW PURITY

- 14.4.5.1 Need to power cost-effective industrial solutions to drive market

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS