|

시장보고서

상품코드

1787262

액체생검 시장 : 제품 및 서비스별, 순환 바이오마커별, 기술별, 용도별, 샘플 유형별, 최종 사용자별 예측(-2030년)Liquid Biopsy Market by Product & Service (Kits, Instruments), Circulating Biomarker (ctDNA, cfDNA, CTC), Technology (NGS, PCR), Application (Lung, Breast, Prostate Cancer), Sample Type (Blood, Urine, CSF), End User (Hospitals) - Global Forecast to 2030 |

||||||

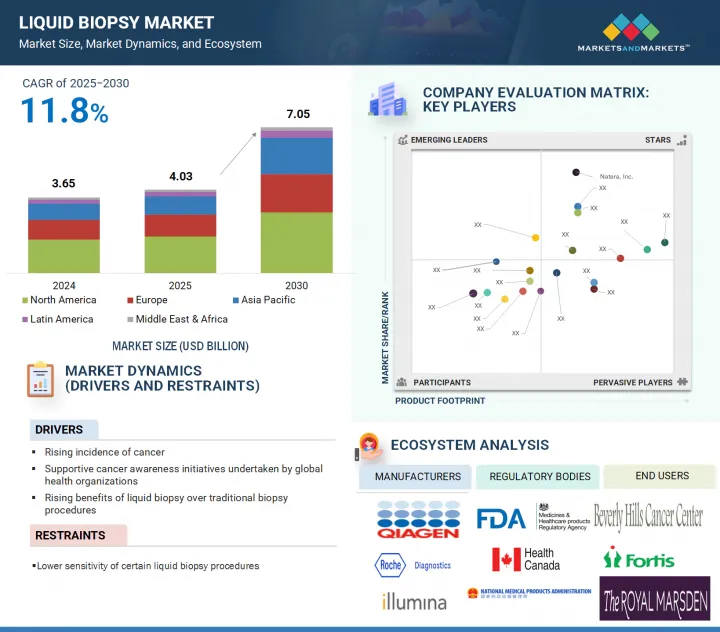

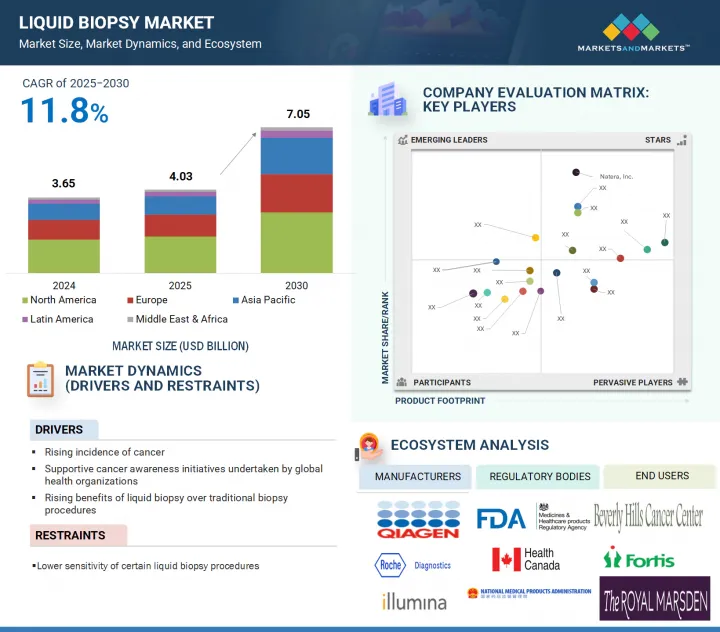

세계의 액체생검 시장 규모는 2025년 40억 3,000만 달러에서 2030년까지 70억 5,000만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR 11.8%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품 및 서비스, 순환 바이오마커 유형, 기술, 용도, 임상 용도, 샘플 유형, 최종 사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

액체생검은 기존의 생검 방법에 비해 비침습적이고, 수술 비용이 낮고, 질병의 진행을 보다 쉽게 모니터링할 수 있는 암을 조기에 발견할 수 있는 등 여러 가지 중요한 이점이 있습니다. 이러한 장점은 최종 사용자들 사이에서 수락을 진행하고 있습니다. 그 결과, 액체생검의 임상적 가치가 인식되고 채용이 증가하고 있는 것이 예측 기간 시장 성장을 가속할 전망입니다.

임상 용도별로는 조기 암 스크리닝 부문이 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다.

이 부문의 높은 성장률은 암 이환율의 상승, 조기 질환 진단의 중요성의 높아짐, 치료에 이용하는 효과적인 종양 치료법의 개발에 의해 초래됩니다. 조기 발견에 특화된 연구 활동과 연구 개발 자금 증가가 액체생검 기술의 개발을 가속화하고 있습니다.

샘플 유형별로, 혈액 샘플 부문은 2024년에 가장 큰 시장 점유율을 차지했습니다.

이 부문의 큰 점유율은 수집의 용이성, 최소 침습성, ctDNA, cfDNA, CTC와 같은 순환 바이오마커로부터 종합적인 분자적 발견을 제공하는 능력에 기인합니다. 혈액 기반 샘플링은 조직 생검보다 안전하고 빠르며 환자에게도 수용하기 쉽기 때문에 연구와 진단 모두에서 널리 채택됩니다.

지역별로는 아시아태평양이 예측기간에 가장 높은 CAGR을 나타낼 전망입니다.

이 시장의 높은 성장률은 암 이환율 증가, 의료비 증가, 첨단 진단 접근성 확대, 국제/현지 진단 기업의 존재 증가로 인한 것입니다. 게다가 암 검진 프로그램에 대한 정부의 적극적인 대처나 비침습적 진단 옵션에 대한 의식의 고조도 시장 성장에 기여할 것으로 예측됩니다.

본 보고서에서는 세계의 액체생검 시장에 대해 조사 분석하여 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 액체생검 시장 개요

- 액체생검 시장 : 제품 및 서비스별(2025년 및 2030년)

- 액체생검 시장 : 순환 바이오마커 유형별(2025년 및 2030년)

- 액체생검 시장 : 기술별(2025년 및 2030년)

- 액체생검 시장 : 용도별(2025년 및 2030년)

- 액체생검 시장 : 임상 용도별(2025년 및 2030년)

- 액체생검 시장 : 샘플 유형별(2025년 및 2030년)

- 액체생검 시장

- 액체생검 시장 : 지리적 성장 기회

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 가격 설정 분석

- 액체생검 제품의 판매 가격 동향(2023-2025년)

- 어세이 킷의 판매 가격 동향 : 주요 기업별(2023-2025년)

- 액체생검 제품의 판매 가격 동향 : 지역별(2023-2025년)

- 특허 분석

- 밸류체인 분석

- 공급망 분석

- 무역 분석

- 진단 및 검사 시약의 무역 분석

- 수입 데이터(HS 코드 3822)

- 수출 데이터(HS 코드 3822)

- 생태계 분석

- Porter's Five Forces 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 북미

- 유럽

- 아시아태평양

- 라틴아메리카

- 중동

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 고객사업에 영향을 주는 동향/혼란

- 주요 이해관계자와 구매 기준

- 투자 및 자금조달 시나리오

- 사례 연구 분석

- 사례 연구 1: 타겟 셀렉터 CTDNA 기술을 이용한 저빈도 변이의 검출

- 사례 연구 2: CTDNA 변이의 검출을 위한 혈장과 혈청의 분석적 평가

- 액체생검 시장에 대한 AI/생성형 AI의 영향

- 소개

- AI 시장의 장래성

- AI 이용 사례

- 액체생검 시장에서의 AI의 미래

- 액체생검 시장에 대한 트럼프 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 주요 영향

- 최종 이용 산업에 미치는 영향

제6장 액체생검 시장 : 제품 및 서비스별

- 소개

- 분석 키트

- 기구

- 서비스

제7장 액체생검 시장 : 순환 바이오마커 유형별

- 소개

- 순환 종양 DNA

- 유리 DNA

- 순환 종양 세포

- 세포외소포

- 기타 순환 바이오마커

제8장 액체생검 시장 : 기술별

- 소개

- NGS를 이용한 다중 유전자 병렬 분석

- PCR 마이크로어레이를 이용한 단일 유전자 분석

제9장 액체생검 시장 : 용도별

- 소개

- 암 용도

- 폐암

- 유방암

- 대장암

- 전립선암

- 흑색종

- 기타 암

- 비암 용도

- 비침습성 산전 검사

- 장기 이식

- 감염증 검사

제10장 액체생검 시장 : 임상 용도별

- 소개

- 치료법 선택

- 치료 모니터링

- 조기암 검진

- 재발 모니터링

제11장 액체생검 시장 : 샘플 유형별

- 소개

- 혈액 샘플

- 기타 샘플 유형

제12장 액체생검 시장 : 최종 사용자별

- 소개

- 레퍼런스 랩

- 병원 및 의사 검사실

- 학술연구센터

- 기타 최종 사용자

제13장 액체생검 시장 : 지역별

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

제14장 경쟁 구도

- 소개

- 주요 진입기업의 전략/강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업 기업/중소기업

- 기업 평가 및 재무 지표

- 브랜드/제품 비교 분석

- 경쟁 시나리오

제15장 기업 프로파일

- 주요 기업

- NATERA, INC.

- GUARDANT HEALTH

- MYRIAD GENETICS, INC.

- ILLUMINA, INC.

- F. HOFFMANN-LA ROCHE LTD.

- QIAGEN NV

- EXACT SCIENCES CORPORATION

- THERMO FISHER SCIENTIFIC INC.

- GRAIL, INC.

- BIO-RAD LABORATORIES, INC.

- SYSMEX CORPORATION

- MDXHEALTH

- PERSONALIS, INC.

- THE MENARINI GROUP

- 기타 기업

- NEOGENOMICS LABORATORIES

- ANGLE PLC

- LABCORP HOLDINGS INC.

- BIO-TECHNE

- MESA LABS, INC.

- MEDGENOME

- LUNGLIFE AI, INC.

- STRAND

- VORTEX BIOTECH HOLDINGS

- FREENOME HOLDINGS, INC.

- LUCENCE HEALTH INC.

- NEW DAY DIAGNOSTICS, LLC

제16장 부록

JHS 25.08.14The liquid biopsy market is projected to reach USD 7.05 billion by 2030 from USD 4.03 billion in 2025, at a CAGR of 11.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product & Service, Circulating Biomarker Type, Technology, Application, Clinical Application, Sample Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

Liquid biopsy offers several key advantages over traditional biopsy methods, including its non-invasive nature, lower procedural costs, the ability to monitor disease progression more easily, and the potential for detecting cancer at early stages. These benefits have contributed to growing acceptance among end users. As a result, the increasing adoption and recognition of liquid biopsy's clinical value are expected to fuel market growth during the forecast period.

By clinical application, the early cancer screening segment is expected to grow at the highest CAGR during the forecast period.

The liquid biopsy market is segmented by clinical application into early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring. The early cancer screening segment is projected to register the highest CAGR during the forecast period. The high growth rate of this segment is driven by the rising incidence of cancer, the increasing importance of early disease diagnosis, and the development of effective oncology therapeutics for treatment. Rising research efforts & funding dedicated to early detection are accelerating the development of liquid biopsy technologies.

By sample type, the blood sample segment accounted for the largest market share in 2024.

Based on sample type, the liquid biopsy market is segmented into blood and other sample types. In 2024, the blood sample segment accounted for the largest share of the market. The large share of this segment is attributed to the ease of collection, minimal invasiveness, and its ability to provide comprehensive molecular insights from circulating biomarkers such as ctDNA, cfDNA, and CTCs. Blood-based sampling is safer, quicker, and more acceptable to patients than tissue biopsies, which has led to its widespread adoption in both research and diagnostics.

By region, the Asia Pacific is projected to grow at the highest CAGR during the forecast period.

The market is segmented by region into North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to grow at the highest CAGR during the forecast period. The high growth rate of this market is driven by the increasing prevalence of cancer, the rising healthcare expenditure, expanding access to advanced diagnostics, and the growing presence of international & local diagnostic companies. Additionally, supportive government initiatives for cancer screening programs and rising awareness of non-invasive diagnostic options are expected to contribute to market growth.

The break-up of the profile of primary participants in the liquid biopsy market:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: C-level - 27%, D-level - 18%, and Others - 55%

- By Region: North America - 51%, Europe - 21%, Asia Pacific - 18%, Latin America - 6%, and the Middle East & Africa- 4%

The key players in this market are Natera, Inc. (US), Guardant Health (US), Myriad Genetics, Inc. (US), Illumina, Inc. (US), F. Hoffmann-La Roche Ltd. (Switzerland), QIAGEN (Netherlands), Thermo Fisher Scientific Inc. (US), Bio-Rad Laboratories, Inc. (US), Exact Sciences Corporation (US), Sysmex Corporation (Japan), maxhealth (US), Personalis, Inc. (US), GRAIL, Inc. (US), Menarini-Silicon Biosystems (Italy), NeoGenomics. Laboratories (US), ANGLE plc (UK), Vortex Biotech Holdings (US), Bio-Techne (US), MedGenome (US), Mesa Labs, Inc. (US), Labcorp, Holdings Inc (US), Freenome, Holdings, Inc. (US), Strand (India), LungLife Al, Inc. (US), Lucence Health Inc. (US), and New Day Diagnostics, LLC (US).

Research Coverage:

This research report categorizes the liquid biopsy market by product & service (assay kits, instruments, and services), circulating biomarker type (circulating tumor cells, circulating tumor DNA, cell-free DNA, extracellular vesicles, and other circulating biomarkers), technology (multi-gene parallel analysis using NGS and single-gene analysis using PCR & microarrays), application [cancer applications (lung cancer, breast cancer, colorectal cancer, prostate cancer, melanoma, and other cancers) and non-cancer applications (non-invasive prenatal testing, organ transplantation, and infectious disease testing]), clinical application (early cancer screening, therapy selection, treatment monitoring, and recurrence monitoring), sample type (blood and other sample types), end user (reference laboratories, hospitals & physician laboratories, academic & research centers, and other end users), and region (North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the liquid biopsy market. A thorough analysis of the key industry players has provided insights into their business overview, solutions, key strategies, acquisitions, and agreements. New product launches and recent developments associated with the liquid biopsy market. This report covers a competitive analysis of upcoming startups in the liquid biopsy market ecosystem.

Reasons to buy this report:

The report will help market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall liquid biopsy market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Rising incidence and prevalence of cancer, cancer awareness initiatives undertaken by global health organizations, and increased benefits of liquid biopsy over traditional biopsy procedures), opportunities (Growing significance of companion diagnostics and growth opportunities in emerging countries), restraints (Lower sensitivity of specific liquid biopsy procedures), and challenges (Unclear reimbursement scenario) influencing the growth of the liquid biopsy market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the liquid biopsy market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the liquid biopsy market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the liquid biopsy market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings of leading players like Natera, Inc. (US), Guardant Health (US), Myriad Genetics, Inc. (US), Illumina, Inc. (US), and F. Hoffmann-La Roche Ltd. (Switzerland).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 KEY STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 PARAMETRIC ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LIQUID BIOPSY MARKET OVERVIEW

- 4.2 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030 (USD MILLION)

- 4.3 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE, 2025 VS. 2030 (USD MILLION)

- 4.4 LIQUID BIOPSY MARKET, BY TECHNOLOGY, 2025 VS. 2030 (USD MILLION)

- 4.5 LIQUID BIOPSY MARKET, BY APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.6 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION, 2025 VS. 2030 (USD MILLION)

- 4.7 LIQUID BIOPSY MARKET, BY SAMPLE TYPE, 2025 VS. 2030 (USD MILLION)

- 4.8 LIQUID BIOPSY MARKET, BY END USER, 2025 VS. 2030 (USD MILLION)

- 4.9 LIQUID BIOPSY MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing burden of cancer

- 5.2.1.2 Cancer awareness initiatives undertaken by global health organizations

- 5.2.1.3 Expanding benefits of liquid biopsy over traditional biopsy procedures

- 5.2.2 RESTRAINTS

- 5.2.2.1 Lower sensitivity of specific liquid biopsy procedures

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing significance of companion diagnostics

- 5.2.3.2 Growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Unfavorable reimbursement scenario

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE SELLING PRICE TREND OF LIQUID BIOPSY PRODUCTS, 2023-2025

- 5.3.2 INDICATIVE SELLING PRICE TREND OF ASSAY KITS, BY KEY PLAYER, 2023-2025

- 5.3.3 INDICATIVE SELLING PRICE TREND OF LIQUID BIOPSY PRODUCTS, BY REGION, 2023-2025

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE ANALYSIS FOR DIAGNOSTIC & LABORATORY REAGENTS

- 5.7.2 IMPORT DATA (HS CODE 3822)

- 5.7.3 EXPORT DATA (HS CODE 3822)

- 5.8 ECOSYSTEM ANALYSIS

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 NORTH AMERICA

- 5.10.2.1 US

- 5.10.2.2 Canada

- 5.10.3 EUROPE

- 5.10.4 ASIA PACIFIC

- 5.10.4.1 China

- 5.10.4.2 Japan

- 5.10.4.3 India

- 5.10.5 LATIN AMERICA

- 5.10.5.1 Brazil

- 5.10.5.2 Mexico

- 5.10.6 MIDDLE EAST

- 5.10.6.1 Africa

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Digital Droplet PCR (ddPCR)

- 5.11.1.2 Tagged-amplicon Deep Sequencing (TAm-Seq)

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Electrochemical biosensing technology

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Microfluidic-based devices

- 5.11.1 KEY TECHNOLOGIES

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: DETECTION OF LOW-FREQUENCY MUTATIONS USING TARGET SELECTOR CTDNA TECHNOLOGY

- 5.16.2 CASE STUDY 2: ANALYTICAL ASSESSMENT OF PLASMA & SERUM FOR CTDNA MUTATION DETECTION

- 5.17 IMPACT OF AI/GENERATIVE AI ON LIQUID BIOPSY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI

- 5.17.3 AI USE CASES

- 5.17.4 FUTURE OF AI IN LIQUID BIOPSY MARKET

- 5.18 TRUMP TARIFF IMPACT ON LIQUID BIOPSY MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Reference laboratories

- 5.18.5.2 Hospitals & physicians' laboratories

- 5.18.5.3 Academic & research centers

6 LIQUID BIOPSY MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 ASSAY KITS

- 6.2.1 RECURRING PURCHASE TO PROPEL MARKET

- 6.3 INSTRUMENTS

- 6.3.1 RISING TECHNOLOGICAL ADVANCES IN DDPCR TO FUEL MARKET

- 6.4 SERVICES

- 6.4.1 ADOPTION OF CFDNA & CTC TESTING SERVICES TO SUPPORT MARKET GROWTH

7 LIQUID BIOPSY MARKET, BY CIRCULATING BIOMARKER TYPE

- 7.1 INTRODUCTION

- 7.2 CIRCULATING TUMOR DNA

- 7.2.1 HIGH SENSITIVITY & SPECIFICITY TO PROPEL MARKET

- 7.3 CELL-FREE DNA

- 7.3.1 BROADENING APPLICATIONS IN PRENATAL SCREENING TO DRIVE MARKET

- 7.4 CIRCULATING TUMOR CELLS

- 7.4.1 EASY COLLECTION AND PERSISTENT ASSESSMENT & ANALYSIS OF TUMORS TO FUEL MARKET

- 7.5 EXTRACELLULAR VESICLES

- 7.5.1 HIGH STABILITY IN BLOOD CIRCULATION TO ENSURE CONSISTENT GROWTH

- 7.6 OTHER CIRCULATING BIOMARKERS

8 LIQUID BIOPSY MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 MULTI-GENE PARALLEL ANALYSIS USING NGS

- 8.2.1 HIGHER THROUGHPUT EFFICIENCY TO PROPEL MARKET

- 8.3 SINGLE-GENE ANALYSIS USING PCR MICROARRAYS

- 8.3.1 COST-EFFICIENCY AND EASE OF USE TO FUEL UPTAKE

9 LIQUID BIOPSY MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 CANCER APPLICATIONS

- 9.2.1 LUNG CANCER

- 9.2.1.1 Growing prevalence of lung cancer to propel market

- 9.2.2 BREAST CANCER

- 9.2.2.1 Increasing funding investments for breast cancer research to drive market

- 9.2.3 COLORECTAL CANCER

- 9.2.3.1 Rising geriatric population to fuel uptake

- 9.2.4 PROSTATE CANCER

- 9.2.4.1 Adoption of tumor cell kits to boost demand

- 9.2.5 MELANOMA

- 9.2.5.1 Growing need for early diagnosis of genetically mutated tumors to drive market

- 9.2.6 OTHER CANCERS

- 9.2.1 LUNG CANCER

- 9.3 NON-CANCER APPLICATIONS

- 9.3.1 NON-INVASIVE PRENATAL TESTING

- 9.3.1.1 Growing demand for NIPT in high-risk pregnancies to drive market

- 9.3.2 ORGAN TRANSPLANTATION

- 9.3.2.1 Early disease diagnosis & detection to support market growth

- 9.3.3 INFECTIOUS DISEASE TESTING

- 9.3.3.1 Potential accuracy & efficacy for testing to fuel uptake

- 9.3.1 NON-INVASIVE PRENATAL TESTING

10 LIQUID BIOPSY MARKET, BY CLINICAL APPLICATION

- 10.1 INTRODUCTION

- 10.2 THERAPY SELECTION

- 10.2.1 GROWING PREFERENCE FOR PERSONALIZED TREATMENT TO DRIVE MARKET

- 10.3 TREATMENT MONITORING

- 10.3.1 EARLY DETECTION OF DISEASE PROGRESSION TO BOOST DEMAND

- 10.4 EARLY CANCER SCREENING

- 10.4.1 GROWING INCIDENCE OF CANCER AND RISING FUNDING INVESTMENTS TO PROPEL MARKET

- 10.5 RECURRENCE MONITORING

- 10.5.1 RISING NEED FOR POST-TREATMENT SURVEILLANCE TO FUEL UPTAKE

11 LIQUID BIOPSY MARKET, BY SAMPLE TYPE

- 11.1 INTRODUCTION

- 11.2 BLOOD SAMPLES

- 11.2.1 STANDARD SIMPLICITY AND HIGH PATIENT ACCEPTANCE TO PROPEL MARKET

- 11.3 OTHER SAMPLE TYPES

12 LIQUID BIOPSY MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 REFERENCE LABORATORIES

- 12.2.1 RISING OUTSOURCING OF TESTS AND ABILITY TO UNDERTAKE LARGE SAMPLE VOLUMES TO PROPEL MARKET

- 12.3 HOSPITALS & PHYSICIANS LABORATORIES

- 12.3.1 INCREASING ESTABLISHMENT OF HOSPITALS TO BOOST DEMAND

- 12.4 ACADEMIC & RESEARCH CENTERS

- 12.4.1 INCREASING R&D ACTIVITIES FOR INNOVATIVE TESTS TO SUPPORT MARKET GROWTH

- 12.5 OTHER END USERS

13 LIQUID BIOPSY MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 13.2.2 US

- 13.2.2.1 High healthcare expenditure to propel market

- 13.2.3 CANADA

- 13.2.3.1 Availability of various cancer screening programs to drive market

- 13.3 EUROPE

- 13.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 13.3.2 GERMANY

- 13.3.2.1 Favorable research funding investments for cancer research to fuel market

- 13.3.3 UK

- 13.3.3.1 NHS-funded lab-based disease screening facilities to boost demand

- 13.3.4 FRANCE

- 13.3.4.1 Growing focus on expanding access to advanced genomic technologies to drive market

- 13.3.5 ITALY

- 13.3.5.1 Development of novel circulating cancer biomarkers to support market growth

- 13.3.6 SPAIN

- 13.3.6.1 Focus on personalized medicine to support market uptake

- 13.3.7 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 13.4.2 CHINA

- 13.4.2.1 Increasing incidence of infectious diseases to propel market

- 13.4.3 JAPAN

- 13.4.3.1 Universal healthcare reimbursement policy to fuel market

- 13.4.4 INDIA

- 13.4.4.1 Increasing incidence of chronic diseases and growing focus on early disease diagnosis to drive market

- 13.4.5 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 13.5.2 BRAZIL

- 13.5.2.1 Improvements in laboratory infrastructure to drive market

- 13.5.3 MEXICO

- 13.5.3.1 Improving accessibility to advanced healthcare services to support market growth

- 13.5.4 REST OF LATIN AMERICA

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 INCREASING COLLABORATIONS & DEVELOPMENTS FOR ENHANCED DIAGNOSTIC ACCESS TO SUPPORT MARKET GROWTH

- 13.6.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 14.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN LIQUID BIOPSY MARKET

- 14.3 REVENUE ANALYSIS, 2022-2024

- 14.4 MARKET SHARE ANALYSIS

- 14.4.1 LIQUID BIOPSY MARKET

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Product & Service footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs, by product & service

- 14.6.5.3 Competitive benchmarking of key startups/SMEs, by region

- 14.7 COMPANY VALUATION & FINANCIAL METRICS

- 14.7.1 FINANCIAL METRICS

- 14.7.2 COMPANY VALUATION

- 14.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 14.8.1 BRAND COMPARISON OF PCR-BASED LIQUID BIOPSY ASSAYS

- 14.8.1.1 QIAGEN N.V.

- 14.8.1.2 Thermo Fisher Scientific Inc.

- 14.8.1.3 Bio-Rad Laboratories, Inc.

- 14.8.1 BRAND COMPARISON OF PCR-BASED LIQUID BIOPSY ASSAYS

- 14.9 COMPETITIVE SCENARIO

- 14.9.1 PRODUCT/SERVICE LAUNCHES & APPROVALS

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 NATERA, INC.

- 15.1.1.1 Business overview

- 15.1.1.2 Products/Services offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product/Service launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Other developments

- 15.1.1.4 MnM view

- 15.1.1.4.1 Key strengths

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses & competitive threats

- 15.1.2 GUARDANT HEALTH

- 15.1.2.1 Business overview

- 15.1.2.2 Products/Services offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product/Service launches & approvals

- 15.1.2.3.2 Deals

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses & competitive threats

- 15.1.3 MYRIAD GENETICS, INC.

- 15.1.3.1 Business overview

- 15.1.3.2 Products/Services offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product/Service launches

- 15.1.3.3.2 Deals

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses & competitive threats

- 15.1.4 ILLUMINA, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products/Services offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product/Service launches & approvals

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.3.4 Other developments

- 15.1.4.4 MnM view

- 15.1.4.4.1 Key strengths

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses & competitive threats

- 15.1.5 F. HOFFMANN-LA ROCHE LTD.

- 15.1.5.1 Business overview

- 15.1.5.2 Products/Services offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product/Service launches

- 15.1.5.3.2 Expansions

- 15.1.5.4 MnM view

- 15.1.5.4.1 Key strengths

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses & competitive threats

- 15.1.6 QIAGEN N.V.

- 15.1.6.1 Business overview

- 15.1.6.2 Products/Services offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product/Service launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Expansions

- 15.1.7 EXACT SCIENCES CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products/Services offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product/Service launches

- 15.1.7.3.2 Deals

- 15.1.8 THERMO FISHER SCIENTIFIC INC.

- 15.1.8.1 Business overview

- 15.1.8.2 Products/Services offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product/Service launches

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Expansions

- 15.1.9 GRAIL, INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products/Services offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product/Service approvals

- 15.1.9.3.2 Deals

- 15.1.10 BIO-RAD LABORATORIES, INC.

- 15.1.10.1 Business overview

- 15.1.10.2 Products/Services offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product/Service launches

- 15.1.10.3.2 Deals

- 15.1.11 SYSMEX CORPORATION

- 15.1.11.1 Business overview

- 15.1.11.2 Products/Services offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Deals

- 15.1.11.3.2 Expansions

- 15.1.12 MDXHEALTH

- 15.1.12.1 Business overview

- 15.1.12.2 Products/Services offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Deals

- 15.1.13 PERSONALIS, INC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products/Services offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product/Service launches

- 15.1.13.3.2 Deals

- 15.1.14 THE MENARINI GROUP

- 15.1.14.1 Business overview

- 15.1.14.2 Products/Services offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product/Service launches

- 15.1.14.3.2 Deals

- 15.1.1 NATERA, INC.

- 15.2 OTHER PLAYERS

- 15.2.1 NEOGENOMICS LABORATORIES

- 15.2.2 ANGLE PLC

- 15.2.3 LABCORP HOLDINGS INC.

- 15.2.4 BIO-TECHNE

- 15.2.5 MESA LABS, INC.

- 15.2.6 MEDGENOME

- 15.2.7 LUNGLIFE AI, INC.

- 15.2.8 STRAND

- 15.2.9 VORTEX BIOTECH HOLDINGS

- 15.2.10 FREENOME HOLDINGS, INC.

- 15.2.11 LUCENCE HEALTH INC.

- 15.2.12 NEW DAY DIAGNOSTICS, LLC

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS