|

시장보고서

상품코드

1787265

수술기구 추적 시스템 시장 : 기술별, 컴포넌트별, 최종 사용자별, 지역별 예측(-2030년)Surgical Instrument Tracking Systems Market by Component (Software, Hardware, Services), Technology (Barcode, Radiofrequency Identification), End User (Hospitals, Ambulatory Surgical Centers, Other End Users), Region - Global Forecast to 2030 |

||||||

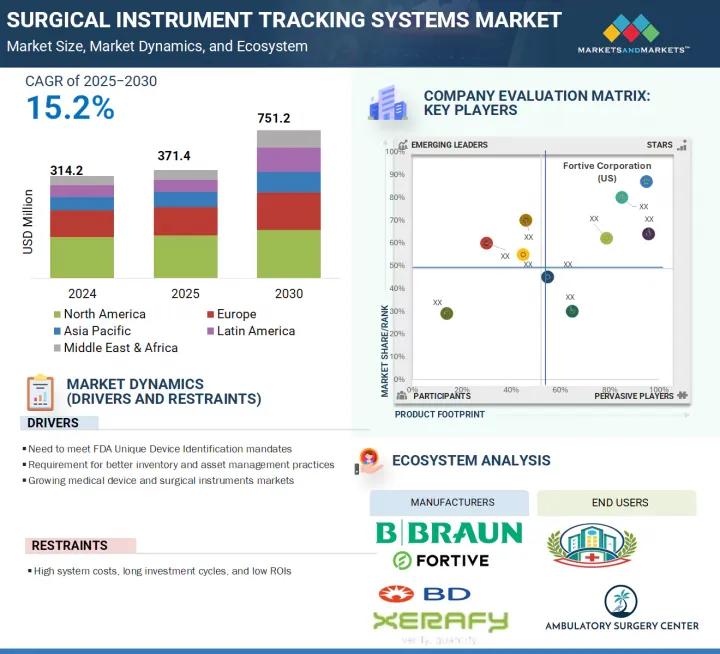

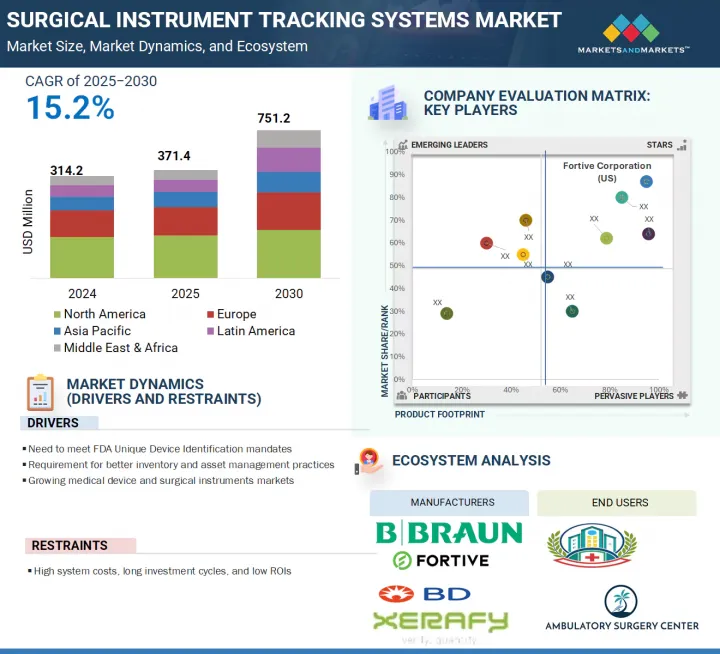

세계의 수술기구 추적 시스템 시장 규모는 2025년 3억 7,140만 달러에서 2030년까지 7억 5,120만 달러에 이를 것으로 예측되며, 예측 기간 중 CAGR은 15.2%가 될 것으로 보입니다.

수술기구 추적 시스템 시장은 다양한 요인에 의해 일관된 성장을 이루고 있습니다. 이 시장의 성장은 주로 외과적 개입이 필요한 만성 질환과 심각한 외상성 손상의 유병률 증가로 이어집니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2024-2030년 |

| 검토 단위 | 금액(100만 달러) |

| 부문 | 기술별, 구성 요소별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

이러한 질병 증가로 인해 선택적 수술의 수가 증가하고 있으며, 이는 수술기구 추적 시스템 제품 수요를 촉진하고 있습니다. 또한 효과적인 출혈 관리에 대한 수요 증가와 고급 수술기구 추적 시스템 제품의 가용성 증가가 시장을 견인할 것으로 예측됩니다. 그러나 수술기구 추적 시스템 제품의 고비용, 숙련된 전문가 부족, 엄격한 규제 프레임워크가 예측 기간 동안 이 시장의 성장을 방해할 것으로 예측됩니다.

컴포넌트별로 수술기구 추적 시스템 시장은 소프트웨어, 하드웨어, 서비스로 나뉩니다. 이 중 하드웨어 부문은 예측 기간 동안 가장 빠른 속도로 성장할 것으로 예측됩니다. 하드웨어 부문은 리더, 태그 및 기타 하드웨어 구성 요소로 구분됩니다. 그 중에서도 리더 분야는 수술기구의 효율적인 추적과 관리를 위해 병원에서 RFID와 바코드 기술의 채용이 증가하고 있기 때문에 예측 기간 동안 가장 빠른 속도로 성장할 것으로 예측되고 있습니다. RFID 리더는 핸드헬드형, 고정형, 모바일형이 있어, 전파를 통해 실시간 데이터 캡처를 제공하고, 신속하고 정확한 기구 식별을 가능하게 하고, 인적 실수를 최소화하고, 수술 워크플로우를 간소화합니다. 데이터 입력 실수를 줄이고 공급망의 효율성을 높이고 귀중한 수술기구의 분실과 잊어버림을 방지하는 수요 증가가 리더의 도입을 더욱 가속화하고 있습니다. 또한 의료기관이 디지털 변환과 자동화를 선호하는 동안 소프트웨어 플랫폼과 리더를 통합하면 가시성 향상, 자산 추적 및 규정 준수가 촉진됩니다. 비용 효율적이고 확장 가능한 추적 솔루션에 대한 요구가 증가하고 리더 기술의 지속적인 발전이 세계 의료시설에서 이 부문의 급속한 성장 궤도를 강화하고 있습니다.

수술기구 추적 시스템 시장은 기술에 따라 바코드와 RFID(Radiofrequency Identification)로 나뉩니다. RFID(Radiofrequency Identification) 부문은 예측 기간 동안 수술기구 추적 시스템 시장에서 가장 빠르게 성장하는 부문으로 예측됩니다. 이는 기존의 바코드 시스템보다 우수한 기능이 있기 때문입니다. RFID는 고속, 배치, 비직시 스캔을 가능하게 하며, 라벨을 읽을 수 없는 까다로운 환경에서도 여러 기구를 동시에 효율적으로 추적할 수 있습니다. 동적 데이터를 저장하고 업데이트하고, 더 높은 전송 속도를 제공하며, 가혹한 멸균 조건 하에서 작동하는 능력은 수술 워크플로우에 매우 적합합니다. 또한 RFID 태그는 각 기구를 고유하게 식별하므로 실시간 시각화 및 재고 관리 향상을 용이하게 합니다. 병원 및 의료기기 제조업체들에게 RFID는 UDI와 같은 규제 준수를 간소화하고 수작업으로 인한 실수를 줄이고 워크플로우의 정확성을 향상시킵니다. 신흥 시장에서는 초기 비용이 높고 도입이 진행되지 않았음에도 불구하고 외과 수술에 있어서 자동화, 안전성, 추적성의 필요성이 높아지고 있기 때문에 예측기간 중 특히 고도의 헬스케어 환경에서 RFID 기술의 도입이 가속될 것으로 예측됩니다.

세계 수술기구 추적 시스템 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카의 주요 5개 지역으로 구분됩니다. 2024년에는 북미가 수술기구 추적 시스템 시장 전체에서 가장 큰 점유율을 차지했습니다. 북미가 수술기구 추적 시스템 시장에서 가장 높은 점유율을 차지하는 것은 주로 고급 의료 인프라의 강력한 존재, 높은 수술량 및 엄격한 규제 의무 때문입니다. 이 지역은 미국과 캐나다로 나뉘어져 있으며, 미국은 혁신적인 의료 기술의 조기 도입과 FDA의 UDI(Unique Device Identification) 규제 시행에 의해 가장 큰 점유율을 차지하고 있습니다. 이러한 규제는 의료기기의 종합적인 추적을 의무화하고 있으며 추적 솔루션의 광범위한 배포를 촉진합니다. 게다가 이 지역의 병원과 수술센터는 워크플로우 효율성 개선, 수술 실수 최소화, 환자 안전성 향상에 주력하고 있으며, 이들 모두 수술기구 추적 시스템 수요 증가에 기여하고 있습니다. 주요 시장 진출기업의 존재와 건강 관리 IT에 대한 왕성한 투자는 이 시장에서 북미의 우위를 뒷받침하고 있습니다.

본 보고서에서는 세계의 수술기구 추적 시스템 시장에 대해 조사했으며, 기술별, 컴포넌트별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 업계 동향

- 기술 분석

- 밸류체인 분석

- 생태계 분석

- 공급망 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 규제 상황

- 특허 분석

- 2025-2026년의 주된 회의와 이벤트

- 인접 시장 분석

- 미충족 요구/최종사용자의 기대

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 투자 및 자금조달 시나리오

- AI/생성형 AI가 수술기구 추적 시스템 시장에 미치는 영향

- 트럼프 관세가 수술기구 추적 시스템 시장에 미치는 영향

제6장 수술기구 추적 시스템 시장(기술별)

- 소개

- 바코드

- 무선 주파수 식별(RFID)

- 기타

제7장 수술기구 추적 시스템 시장(컴포넌트별)

- 소개

- 소프트웨어

- 하드웨어

- 서비스

제8장 수술기구 추적 시스템 시장(최종사용자별)

- 소개

- 병원

- 공립병원

- 사립병원

- 기타

제9장 수술기구 추적 시스템 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업평가와 재무지표

- 브랜드/제품 비교 분석

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- FORTIVE CORPORATION

- BECTON, DICKINSON AND COMPANY(BD)

- STERIS

- SECURITAS AB

- GETINGE AB

- ASSA ABLOY AB

- B BRAUN SE

- SYRMA SGS

- MOBILE ASPECTS

- XERAFY

- 기타 기업

- SPATRACK MEDICAL LIMITED

- SCANLAN INTERNATIONAL, INC.

- CASE MEDICAL

- ASANUS MEDIZINTECHNIK GMBH

- NB AUTOMATION INC.

- TECHNOSOURCE AUSTRALIA PTY LTD.

- NUTRACE

- SCANCARE PTY. LTD.

- RFID DISCOVERY

- HEALTHTECH PIVOT LLP

- RMS OMEGA HEALTHCARE

- AVERY DENNISON CORPORATION

- RAPID SURGICAL

- CARETAG

- BIOENABLE TECHNOLOGIES PVT. LTD.

제12장 부록

JHS 25.08.14The global surgical instrument tracking systems market is projected to reach USD 751.2 million by 2030 from USD 371.4 million in 2025, at a CAGR of 15.2% during the forecast period. The surgical instrument tracking systems market is seeing consistent growth due to various factors. Growth in this market is mainly driven by the growing prevalence of chronic diseases requiring surgical interventions and severe traumatic injuries.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2024-2030 |

| Units Considered | Value (USD million) |

| Segments | Component, Technology, End User, and Region |

| Regions covered | North America, Europe, APAC, LATAM, MEA |

Owing to the increasing growth in such incidences, the volume of elective surgical procedures is increasing, which is driving the demand for surgical instrument tracking systems products. In addition, rising demand for effective blood loss management and increasing availability of advanced surgical instrument tracking systems products are expected to drive market. However, the high cost of surgical instrument tracking systems products, dearth of skilled professionals, and stringent regulatory framework are expected to hamper the growth of this market during the forecast period.

The readers segment of the surgical instrument tracking systems market, by type of hardware, led the market in 2024.

Based on the component, the surgical instrument tracking systems market is divided into software, hardware, and services. Among these, the hardware segment is expected to grow at the fastest rate during the forecast period. The hardware segment is further segmented into readers, tags, and other hardware components. Among these, the readers segment is expected to grow at the fastest rate during the forecast period, owing to the increasing adoption of RFID and barcode technologies in hospitals for efficient tracking and management of surgical instruments. RFID readers, available in handheld, fixed, and mobile forms, offer real-time data capture through radio waves, enabling fast and accurate instrument identification, minimizing human errors, and streamlining surgical workflows. The growing demand to reduce data entry errors, improve supply chain efficiency, and prevent loss or misplacement of valuable surgical tools further accelerates the deployment of readers. Additionally, as healthcare institutions prioritize digital transformation and automation, the integration of readers with software platforms facilitates enhanced visibility, asset tracking, and regulatory compliance. The rising need for cost-effective, scalable tracking solutions and continuous advancements in reader technology reinforce the segment's rapid growth trajectory across global healthcare facilities.

The RFID segment of the surgical instrument tracking systems market is expected to grow at the fastest rate during the forecast period.

The surgical instrument tracking systems market, based on technology, is divided into barcode and Radiofrequency Identification (RFID). The Radiofrequency Identification (RFID) segment is projected to be the fastest-growing segment in the surgical instrument tracking systems market over the forecast period. This is due to its superior capabilities over traditional barcode systems. RFID enables high-speed, batch, and non-line-of-sight scanning, allowing for efficient tracking of multiple instruments simultaneously, even in challenging environments where labels may be unreadable. Its ability to store and update dynamic data, offer higher transmission rates, and operate under extreme sterilization conditions makes it highly suitable for surgical workflows. Additionally, RFID tags uniquely identify each instrument, facilitating real-time visibility and better inventory management. For hospitals and medical device manufacturers, RFID simplifies compliance with regulations like UDI, reduces manual errors, and improves workflow accuracy. Despite higher upfront costs and low adoption in emerging markets, the increasing need for automation, safety, and traceability in surgical procedures is expected to drive the accelerated adoption of RFID technology during the forecast period, particularly in advanced healthcare settings.

In 2024, the North America region accounted for the highest market share in the surgical instrument tracking systems market.

The global surgical instrument tracking systems market is segmented into five major regions, namely, North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. In 2024, the North American region accounted for the largest share across the surgical instrument tracking systems market. North America accounts for the highest share in the surgical instrument tracking systems market, primarily due to the strong presence of advanced healthcare infrastructure, high surgical volumes, and stringent regulatory mandates. The region is bifurcated into the US and Canada, with the US holding the largest share owing to early adoption of innovative healthcare technologies and the enforcement of the FDA's Unique Device Identification (UDI) regulations. These regulations mandate comprehensive tracking of medical instruments, driving widespread deployment of tracking solutions. Furthermore, hospitals and surgical centers in the region are focused on improving workflow efficiency, minimizing surgical errors, and enhancing patient safety, all of which contribute to the increased demand for surgical instrument tracking systems. The presence of leading market players and robust investments in healthcare IT also support the dominance of North America in this market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1- 40%, Tier 2- 30%, and Tier 3- 30%

- By Designation: C Level- 50%, Director Level- 30%, and Others- 20%

- By Region: North America- 30%, Europe- 25%, Asia Pacific- 20%, Latin America- 15%, and Middle East & Africa- 10%.

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the surgical instrument tracking systems market include Fortive Corporation (US), Becton, Dickinson and Company (US), Getinge AB (Sweden), STERIS (US), Securitas Healthcare LLC (US), Mobile Aspects (US), Integra LifeSciences Holdings Corporation (US), Xerafy (Singapore), B. Braun Melsungen AG (Germany), SpaTrack Medical Limited (UK), Syrma SGS (India), Scanlan International, Inc. (US), Case Medical (US), ASANUS Medizintechnik GmbH (Germany), Keir Surgical Ltd. (Canada), TechnoSource Australia Pty Ltd. (Australia), NuTrace (US), ASSA ABLOY AB (Sweden), ScanCARE Pty. Ltd. (US), RFID Discovery (UK), Healthtech Pivot LLP (India), RMS Omega Healthcare (US), Avery Dennison Corporation (US), Caretag (Denmark), and RapID Surgical (US).

Research Coverage

This report studies the surgical instrument tracking systems market based on component, technology, end user, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micro markets with respect to their individual growth trends and forecasts the revenue of the market segments with respect to five major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to gain a larger market share. Firms purchasing the report could use one or a combination of the following strategies to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (Need to meet FDA Unique Device Identification mandates, requirement for better inventory and asset management practices, Growing medical device and surgical instruments market), restraints (high system costs, long investment cycles and low ROIs), opportunities (Emerging economies, development of active RFID technology for instruments), challenges (Technology limitations)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the surgical instrument tracking systems market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches within the surgical instrument tracking systems market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the surgical instrument tracking systems industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and product offerings of leading players such as Fortive Corporation (US), Becton, Dickinson and Company (US), Getinge AB (Sweden), STERIS (US), Securitas Healthcare LLC (US), Mobile Aspects (US), Xerafy (Singapore), B. Braun SE (Germany), SpaTrack Medical Limited (UK), Syrma SGS (India), Scanlan International, Inc. (US), and Case Medical (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET RANKING ANALYSIS

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.6.2 SCOPE-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET OVERVIEW

- 4.2 NORTH AMERICA: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER & COUNTRY, 2024

- 4.3 GEOGRAPHIC SNAPSHOT

- 4.4 REGIONAL MIX: SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, 2022-2030 (USD MILLION)

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Stringent FDA requirements for UDI mandates

- 5.2.1.2 Growing requirement for enhanced inventory & asset management practices

- 5.2.2 RESTRAINTS

- 5.2.2.1 High system costs, extended investment cycles, and low ROIs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of active RFID technology for instruments

- 5.2.3.2 High growth potential of emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological limitations

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCED DIGITIZATION & IMPROVED AUTOMATION IN SURGICAL INSTRUMENT TRACKING SYSTEMS

- 5.3.2 AI & ANALYTICS FOR PREDICTIVE MAINTENANCE

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Cloud-based & on-premise instrument tracking technologies

- 5.4.2 COMPLEMENTARY TECHNOLOGIES

- 5.4.2.1 Real-time location systems technologies

- 5.4.3 ADJACENT TECHNOLOGIES

- 5.4.3.1 Machine learning & predictive analytics

- 5.4.1 KEY TECHNOLOGIES

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 SUPPLY CHAIN ANALYSIS

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF BUYERS

- 5.8.4 BARGAINING POWER OF SUPPLIER

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.9.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.9.2 BUYING CRITERIA

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY ANALYSIS

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.3 Asia Pacific

- 5.10.2.4 Latin America

- 5.10.2.5 Middle East & Africa

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 INSIGHTS: JURISDICTIONS & TOP APPLICANT ANALYSIS

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 ADJACENT MARKET ANALYSIS

- 5.13.1 TRACK & TRACE SOLUTIONS MARKET

- 5.14 UNMET NEEDS/END-USER EXPECTATIONS

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI/GENERATIVE AI ON SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 5.18 TRUMP TARIFF IMPACT ON SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 END-USE INDUSTRY IMPACT

6 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 BARCODE

- 6.2.1 LOW INSTALLATION COSTS DRIVE MARKET

- 6.3 RADIO-FREQUENCY IDENTIFICATION (RFID)

- 6.3.1 HIGHER DATA STORAGE CAPACITY & FASTER DATA TRANSMISSION RATE TO PROPEL MARKET

- 6.4 OTHER TECHNOLOGIES

7 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 SOFTWARE

- 7.2.1 FREQUENT NEED FOR UPGRADES AND INTRODUCTION OF NEW SOFTWARE APPLICATIONS TO DRIVE MARKET

- 7.3 HARDWARE

- 7.3.1 READERS

- 7.3.1.1 Real-time data capture & tracking to boost demand

- 7.3.2 TAGS

- 7.3.2.1 Durability & long-read range features to fuel market uptake

- 7.3.3 OTHER HARDWARE COMPONENTS

- 7.3.1 READERS

- 7.4 SERVICES

- 7.4.1 RECURRING REQUIREMENT TO PROPEL MARKET

8 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 PUBLIC HOSPITALS

- 8.2.1.1 Need to curtail healthcare expenditure to fuel market

- 8.2.2 PRIVATE HOSPITALS

- 8.2.2.1 High investments in healthcare modernization to boost demand

- 8.2.1 PUBLIC HOSPITALS

- 8.3 OTHER END USERS

9 SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 High healthcare expenditure to drive market

- 9.2.3 CANADA

- 9.2.3.1 Increasing establishment of hospitals and surgical centers to boost demand

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Favorable regulatory framework to fuel uptake

- 9.3.3 UK

- 9.3.3.1 Expanding focus on digitization to drive talmarket

- 9.3.4 FRANCE

- 9.3.4.1 Increasing geriatric population and subsequent rise in surgical procedures to boost demand

- 9.3.5 ITALY

- 9.3.5.1 Modernization of healthcare infrastructure to drive market

- 9.3.6 SPAIN

- 9.3.6.1 Growing emphasis on patient safety for alignment of EU quality standards to drive market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Increasing incidence of age-related conditions to fuel uptake

- 9.4.3 CHINA

- 9.4.3.1 High incidence of infectious diseases to propel market

- 9.4.4 INDIA

- 9.4.4.1 Modernization of healthcare infrastructure to drive market

- 9.4.5 AUSTRALIA

- 9.4.5.1 Growing focus on asset management to support market growth

- 9.4.6 SOUTH KOREA

- 9.4.6.1 Demand for high-value surgical instruments to fuel uptake

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Increasing reliance on medical device imports to drive market

- 9.5.3 MEXICO

- 9.5.3.1 Focus on AI to support market uptake

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.6.2 GCC COUNTRIES

- 9.6.2.1 Adoption of advanced technologies to drive market

- 9.6.3 REST OF MIDDLE EAST & AFRICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN SURGICAL INSTRUMENT TRACKING SYSTEMS MARKET

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Component footprint

- 10.5.5.4 Technology footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SME players

- 10.6.5.2 Competitive benchmarking of key emerging players/startups

- 10.7 COMPANY VALUATION & FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 FORTIVE CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Services offered

- 11.1.1.3 MnM view

- 11.1.1.3.1 Key strengths

- 11.1.1.3.2 Strategic choices

- 11.1.1.3.3 Weaknesses & competitive threats

- 11.1.2 BECTON, DICKINSON AND COMPANY (BD)

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Services offered

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths

- 11.1.2.3.2 Strategic choices

- 11.1.2.3.3 Weaknesses & competitive threats

- 11.1.3 STERIS

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses & competitive threats

- 11.1.4 SECURITAS AB

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 GETINGE AB

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses & competitive threats

- 11.1.6 ASSA ABLOY AB

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Deals

- 11.1.7 B BRAUN SE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Services offered

- 11.1.8 SYRMA SGS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Services offered

- 11.1.9 MOBILE ASPECTS

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Services offered

- 11.1.10 XERAFY

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Services offered

- 11.1.1 FORTIVE CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 SPATRACK MEDICAL LIMITED

- 11.2.2 SCANLAN INTERNATIONAL, INC.

- 11.2.3 CASE MEDICAL

- 11.2.4 ASANUS MEDIZINTECHNIK GMBH

- 11.2.5 NB AUTOMATION INC.

- 11.2.6 TECHNOSOURCE AUSTRALIA PTY LTD.

- 11.2.7 NUTRACE

- 11.2.8 SCANCARE PTY. LTD.

- 11.2.9 RFID DISCOVERY

- 11.2.10 HEALTHTECH PIVOT LLP

- 11.2.11 RMS OMEGA HEALTHCARE

- 11.2.12 AVERY DENNISON CORPORATION

- 11.2.13 RAPID SURGICAL

- 11.2.14 CARETAG

- 11.2.15 BIOENABLE TECHNOLOGIES PVT. LTD.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS