|

시장보고서

상품코드

1788520

자동차 텔레매틱스 시장 : 서비스별, 접속성별, 차량 유형별, 형식별, 제공별, EV 유형별, 애프터마켓별, 지역별 예측(-2032년)Automotive Telematics Market by Service (E-call, Remote Diagnostics, IRA, SVA), Connectivity (Cellular, Satellite), Vehicle Type (PC, LCV, Bus, Truck), Form Type, Offering, EV Type, Aftermarket, and Region - Global Forecast to 2032 |

||||||

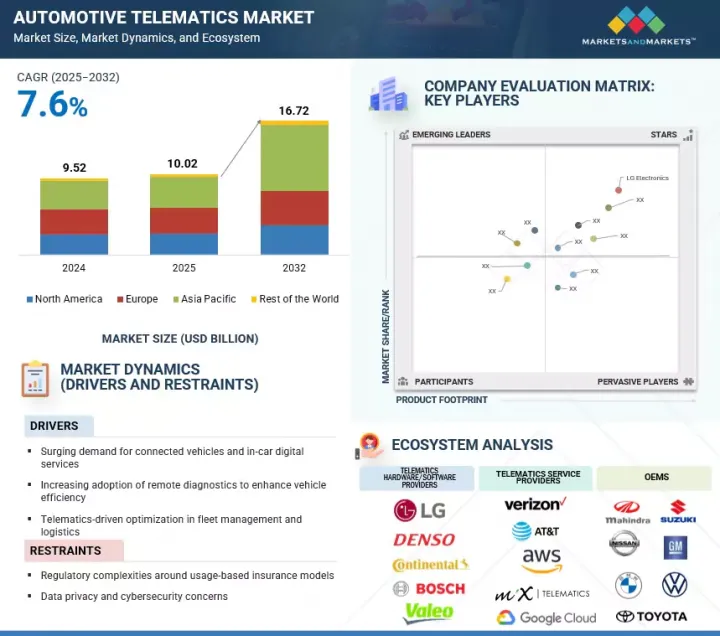

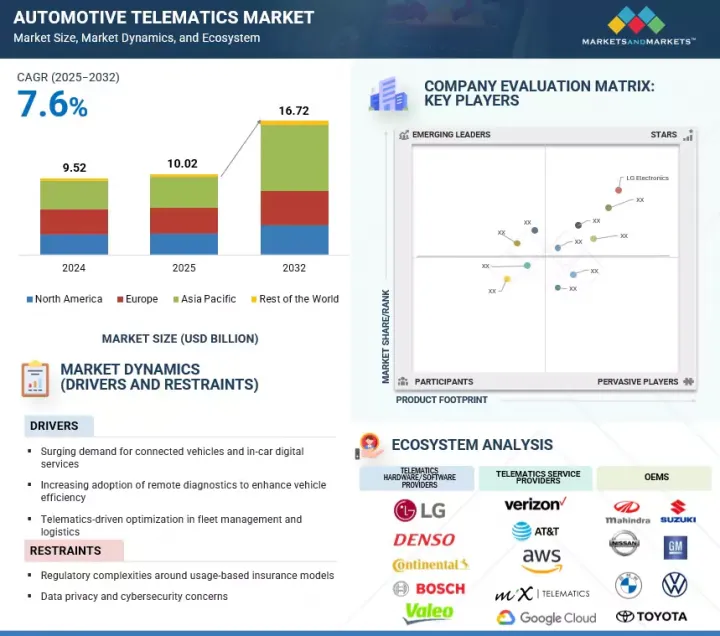

세계의 자동차 텔레매틱스 시장 규모는 2025년 100억 2,000만 달러에서 2032년까지 167억 2,000만 달러에 이를 것으로 예측되며 CAGR 7.6%의 성장이 예상됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2032년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 단위 | 100만 달러/10억 달러 |

| 부문 | 서비스, 차량 유형, 형식, 플릿 관리 서비스, 제공, 차량 유형(애프터마켓), EV 서비스, EV 유형, 접속성, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽 및 기타 지역 |

5G 네트워크의 배치는 자율주행과 지능형 교통 시스템에 필수적인 요소인 V2X 통신에 필수적인 보다 빠르고 지연이 느린 연결을 가능하게 함으로써 자동차 시스템을 크게 진화시키고 있습니다. 이러한 향상된 연결성을 통해 텔레매틱스 플랫폼은 위험 경고, 협력 운전, 스마트 교통 조정 등의 기능에 활용되는 실시간 데이터 교환을 지원할 수 있습니다. 텔레매틱스 시스템에 엣지 컴퓨팅을 채택하면 보다 중요한 차량 데이터를 온보드에서 직접 실시간 처리할 수 있어 안전성과 내비게이션 기능의 응답성이 향상됩니다. AI와 머신러닝은 텔레매틱스 플랫폼에 점점 더 통합되어 루트 최적화, 운전자 행동 분석, 사고 조기 발견 등의 예측 고려사항을 가능하게 합니다. 또한 센서의 통합과 CAN 버스 등의 통신 프로토콜의 개량에 의해 보다 정확한 데이터 수집이 가능하게 되는 한편, 사이버 보안에 대한 주목이 높아짐으로써, 커넥티드화가 진행되는 차량에 있어서의 위협으로부터의 보다 강력한 보호가 확보되고 있습니다.

임베디드 텔레매틱스가 예측 기간에 자동차 텔레매틱스 시장에서 압도적인 점유율을 차지할 전망입니다.

임베디드 텔레매틱스는 자동차 시스템에 직접 통합되며 OEM은 공장 자체에 연결된 기능을 제공할 수 있으므로 자동차 텔레매틱스 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 유럽과 중국의 규제는 또한 에너지 사용과 차량 안전을 모니터링하기 위해 공장에 설치된 텔레매틱스를 요구하고 있습니다. 중국에서는 NEV-NMP(New Energy Vehicle National Monitoring Platform)를 통해 모든 전기자동차 및 하이브리드 차량에 대해 배터리 상태, 차량의 위치 정보, 경고 등의 데이터를 정부의 집중 플랫폼에 실시간으로 전송할 의무가 있기 때문에 임베디드 텔레매틱스는 컴플라이언스에 필수적입니다. 또한 임베디드 텔레매틱스는 자동차 제조업체가 구독 기반 서비스를 제공하고 차량 데이터를 새로운 수익 기회에 활용하는 폐쇄형 생태계를 구축하는 데 도움이 됩니다. EV와 ADAS(첨단 운전 지원 시스템)가 장착된 차량에 대한 수요가 증가함에 따라 통합 소프트웨어 기반 텔레매틱스에 대한 요구가 증가하고 있습니다. OEM은 또한 임베디드 텔레매틱스를 클라우드 및 엣지 컴퓨팅과 결합하여 실시간 데이터 처리 및 더 나은 서비스 제공을 지원하는 하이브리드 시스템으로 전환하고 있습니다. GM의 OnStar, Hyundai의 BlueLink, Toyota의 i-Connect는 모두 실시간 네비게이션, 원격 진단, OTA 업데이트 등의 기능을 제공합니다. 예를 들어, Volkswagen Group(독일)은 2024년 11월 CARIAD와 공동으로 함대 인터페이스 데이터 솔루션을 구축하여 Volkswagen, Audi, Skoda, Cupra와 같은 브랜드의 함대 고객에게 임베디드 텔레매틱스를 제공합니다. 이 플랫폼은 텔레매틱스 하드웨어를 추가하지 않고도 주행 거리, 잔여 주행 거리, 경고 신호, 향후 서비스의 필요성 등을 거의 실시간으로 파악할 수 있습니다. 이러한 요인들은 임베디드 텔레매틱스 시스템의 성장을 크게 뒷받침할 것으로 예측됩니다.

하드웨어 부문이 예측 기간에 자동차 텔레매틱스 시장을 주도할 전망입니다.

하드웨어가 자동차 텔레매틱스 시장에서 압도적인 점유율을 차지할 것으로 예측됩니다. 텔레매틱스 컨트롤 유닛(TCU), 센서, 안테나, CAN 버스, 통신 모듈, 일렉트로닉 컨트롤 유닛(ECU) 등의 주요 구성요소는 차량 연결성과 데이터 교환을 가능하게 하는 데 필수적입니다. 차량의 소프트웨어 정의가 진행됨에 따라 OTA 업데이트, 임베디드 사이버 보안 및 고속 데이터 처리에 대응할 수 있는 강력하고 유연한 하드웨어에 대한 요구가 커지고 있습니다.

이 보고서는 세계 자동차 텔레매틱스 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 자동차 텔레매틱스 시장의 기업에게 매력적인 기회

- 자동차 텔레매틱스 시장 : 서비스별

- 자동차 텔레매틱스 시장 : 형식별

- 자동차 텔레매틱스 시장 : 제공별

- 전기자동차 및 하이브리드 자동차 텔레매틱스 시장 : 차량 유형별

- 전기자동차 및 하이브리드차 텔레매틱스 시장 : 서비스별

- 자동차 텔레매틱스 시장 : 차량 유형별

- 자동차 텔레매틱스 시장 : 접속성별

- 자동차 텔레매틱스 애프터마켓 : 차량 유형별

- 자동차 텔레매틱스 시장 : 플릿 관리 서비스별

- 자동차 텔레매틱스 시장 : 지역별

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- 시장 역학의 영향 분석

- 가격 설정 분석

- 텔레매틱스 컨트롤 유닛의 참고 가격 : 주요 기업별(2024년)

- 텔레매틱스 컨트롤 유닛의 평균 판매 가격 : 지역별(2022-2024년)

- 생태계 분석

- OEM

- 텔레매틱스 하드웨어 및 소프트웨어 공급업체

- 클라우드 서비스 제공업체

- 위성 내비게이션 제공업체

- 통신 서비스 제공업체

- VAS 기업

- 공급망 분석

- 사례 연구 분석

- UFFIZIO, 폐기물 수집부터 물류에 이르기까지 각 클라이언트 유형에 맞추어 대시보드, 사용자 롤, 워크플로우를 구성하는 플릿 추적 플랫폼을 제공

- ITRIANGLE의 VFOTA 탑재 텔레매틱스 솔루션에 의한 차량의 유지관리와 성능의 혁신

- ITRIANGLE, 심리스 인텔리전트 진단 솔루션으로 OBD II 디바이스 도입

- ITRIANGLE, OEM 트럭 플랫폼에의 통합을 위해서 커스터마이즈 된 견고한 TCU를 전개

- ITRIANGLE, IOCL의 요구 사항에 맞는 견고하고 확장 가능한 텔레매틱스 솔루션 구현

- VODAFONE, 실시간 엔진 진단, 운전 시간, 연료 데이터, 위치 정보를 취득하는 디바이스를 탑재해, 플릿 애널리틱스 솔루션을 전개

- Vodafone, 자사의 플릿 애널리틱스 플랫폼을 Progetti del cuore의 플릿 전체에 전개

- ATWELL, GEOTAB의 플릿 관리 플랫폼을 채용해, 플릿의 안전성을 높이고, 차량 이용률을 향상

- 투자 및 자금조달 시나리오

- 특허 분석

- 기술 분석

- 소개

- 주요 기술

- 보완 기술

- 인접 기술

- 공급자 분석

- 각 OEM의 텔레매틱스 데이터 플랜 : 지역별

- 북미

- 유럽

- HS코드

- 수입 시나리오

- 수출 시나리오

- 관세 및 규제 상황

- 관세 데이터

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 주요 이해관계자와 구매 기준

- 고객사업에 영향을 주는 동향/혼란

- 생성형 AI의 영향

- 플릿 관리 텔레매틱스의 AI

- 보험 텔레매틱스의 AI

- 커넥티드카 서비스의 AI

- 인도의 자동차 텔레매틱스 시장 동향에 관한 MNM의 지견

- IoT 통합

- AI와 머신러닝

- 5G 접속

- 클라우드 컴퓨팅 및 데이터 플랫폼

- 차량 간 통신(V2X)

- 텔레매틱스 데이터용 블록체인

- 비디오 스트리밍과 텔레매틱스 카메라

- 첨단운전지원(ADAS)

- 자동도로지원(ARAS)

- 사이버 보안

- 자동차 텔레매틱스 아키텍처에 관한 MNM의 지견

- 이륜차

- 사륜차

제6장 자동차 텔레매틱스 시장 : 차량 유형별

- 소개

- 승용차

- 소형 상용차

- 버스

- 트럭

- 중요한 지견

제7장 자동차 텔레매틱스 시장 : 형식별

- 소개

- 내장

- 통합

- 중요한 지견

제8장 자동차 텔레매틱스 시장 : 제공별

- 소개

- 하드웨어

- 소프트웨어

- 중요한 지견

제9장 자동차 텔레매틱스 시장 : 접속성별

- 소개

- 위성

- 셀룰러

- 5G

- 4G

- 2G 및 3G

- 중요한 지견

제10장 자동차 텔레매틱스 시장 : 플릿 관리 서비스별

- 소개

- 운용관리

- 차량의 유지보수, 진단

- 플릿 애널리틱스, 보고

- 기타

- 중요한 지견

제11장 자동차 텔레매틱스 시장 : 서비스별

- 소개

- 긴급신고

- 거리 지원

- 원격 진단

- 보험 리스크 평가

- 도난 차량 지원

- 기타

- 중요한 지견

제12장 전기자동차·하이브리드차 텔레매틱스 시장 : 차량 유형별

- 소개

- 배터리 전기자동차(BEV)

- 연료전지 전기자동차(FCEV)

- 플러그인 하이브리드 전기자동차(PHEV)

- 중요한 지견

제13장 전기자동차·하이브리드차 텔레매틱스 시장 : 서비스별

- 소개

- 긴급신고

- 거리 지원

- 원격 진단

- 보험 리스크 평가

- 도난 차량 지원

- 기타

- 중요한 지견

제14장 자동차 텔레매틱스 애프터마켓 : 차량 유형별

- 소개

- 승용차

- 소형 상용차

- 대형 상용차

- 중요한 지견

제15장 자동차 텔레매틱스 시장 : 지역별

- 소개

- 아시아태평양

- 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 태국

- 기타 아시아태평양

- 유럽

- 마이크로 경제 전망

- 독일

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 영국

- 기타 유럽

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 기타 지역

- 거시경제 전망

- 브라질

- 남아프리카

- 이란

제16장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 세계의 텔레매틱스 컨트롤 유닛 프로바이더 시장 점유율 분석(2024년)

- 인도의 텔레매틱스 컨트롤 유닛 프로바이더 시장 점유율 분석(2024년)

- 상장기업/상장기업의 수익 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제17장 기업 프로파일

- 주요 기업

- LG ELECTRONICS

- HARMAN INTERNATIONAL

- DENSO CORPORATION

- CONTINENTAL AG

- ROBERT BOSCH GMBH

- APTIV

- VISTEON CORPORATION

- MARELLI HOLDINGS CO., LTD.

- VALEO

- INFINEON TECHNOLOGIES AG

- FICOSA INTERNACIONAL SA

- AT&T INTELLECTUAL PROPERTY

- VERIZON

- BRIDGESTONE MOBILITY SOLUTIONS BV

- 인도의 주요 기업

- ITRIANGLE INFOTECH PVT LTD

- CE INFO SYSTEMS LTD

- ATLANTA SYSTEMS PVT. LTD.

- BLACKBOX GPS TECHNOLOGY

- ROSMERTA

- 기타 기업

- ADDSECURE

- PANASONIC CORPORATION

- GARMIN LTD.

- POWERFLEET

- TRIMBLE INC.

- CALAMP

- THE DESCARTES SYSTEMS GROUP INC.

- QUALCOMM TECHNOLOGIES, INC.

- AIRIQ INC.

- ACTSOFT, INC.

- TELETRAC NAVMAN US LTD.

- MICHELIN

- OCTO GROUP SPA

제18장 MARKETSANDMARKETS의 권고

- 공장에서 탑재되는 임베디드 솔루션을 통한 세계의 텔레매틱스 채용의 가속

- 통합 애널리틱스에 의한 운전 행동 기반 보험료

- 인텔리전트 텔레매틱스의 통합에 의한 전기자동차 운용의 최적화

- 결론

제19장 부록

JHS 25.08.20The automotive telematics market is projected to grow from USD 10.02 billion in 2025 to USD 16.72 billion by 2032 at a CAGR of 7.6%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Value (USD Million/Billion) |

| Segments | By service, vehicle type, form type, fleet management service, offering, aftermarket based on vehicle type, EV service, EV type, connectivity, and region |

| Regions covered | Asia Pacific, North America, Europe, and the Rest of the World |

The rollout of 5G networks is significantly advancing the automotive systems by enabling faster, low-latency connectivity crucial for V2X communication, an essential component for autonomous driving and intelligent transportation systems. This enhanced connectivity allows telematics platforms to support real-time data exchange for functions like hazard alerts, cooperative driving, and smart traffic coordination. The adoption of edge computing within telematics systems further enables real-time processing of critical vehicle data directly onboard, improving responsiveness for safety and navigation functions. AI and machine learning are increasingly integrated into telematics platforms to enable predictive insights such as route optimization, driver behavior analysis, and early incident detection. In addition, improved sensor integration and communication protocols such as CAN bus are enabling more precise data collection, while growing attention to cybersecurity is ensuring stronger protection against threats in increasingly connected vehicles.

Embedded telematics is expected to hold the dominant share of the automotive telematics market during the forecast period.

Embedded telematics is expected to hold the largest share of the automotive telematics market, as it is built directly into the vehicle's system, allowing OEMs to offer features connected to the factory itself. Regulations in Europe and China also require factory-installed telematics to monitor energy use and vehicle safety. In China, the New Energy Vehicle National Monitoring Platform (NEV-NMP) mandates that all electric and hybrid vehicles transmit real-time data, such as battery status, vehicle location, and alerts to a centralized government platform, making embedded telematics essential for compliance. Additionally, embedded telematics helps automakers create a closed ecosystem for offering subscription-based services and using vehicle data for new revenue opportunities. The growing demand for EVs and vehicles with advanced driver assistance systems (ADAS) is increasing the need for integrated, software-based telematics. OEMs are also moving toward hybrid systems that combine embedded telematics with cloud and edge computing to support real-time data processing and better service delivery. GM's OnStar, Hyundai's BlueLink, and Toyota's i-Connect all offer features such as real-time navigation, remote diagnostics, and OTA updates. For instance, in November 2024, Volkswagen Group (Germany) rolled out its Fleet Interface Data solution in collaboration with CARIAD, offering embedded telematics to fleet customers across brands such as Volkswagen, Audi, Skoda, and Cupra. This platform provides near real-time insights into mileage, remaining range, warning signals, and upcoming service needs, all without additional telematics hardware. These factors are expected to support the growth of embedded telematics systems significantly.

The hardware segment is projected to lead the automotive telematics market during the forecast period.

Hardware is expected to hold the dominant share of the automotive telematics market. Key components such as telematics control units (TCUs), sensors, antennas, CAN Bus, communication modules, and electronic control units (ECUs) are essential for enabling vehicle connectivity and data exchange. With vehicles becoming more software-defined, there is a growing need for powerful and flexible hardware that can support OTA updates, built-in cybersecurity, and fast data processing. OEMs are increasingly favoring embedded, factory-fitted hardware to ensure consistent deployment across vehicle models. Hardware manufacturers are integrating 4G/5G connectivity, edge computing, and satellite communication into TCUs to improve performance and service reliability. Modern TCUs also include hardware security modules (HSMs), secure boot, encryption, and intrusion detection to protect against cyber threats and ensure safe software updates. Additionally, there is growing interest in modular hardware designs that can support future upgrades and V2X features. Companies such as LG Electronics (South Korea), Denso Corporation (Japan), and HARMAN International offer advanced TCUs with 4G/5G, GNSS, and cybersecurity capabilities, which are widely used by leading OEMs such as Toyota and Volkswagen. For instance, Visteon Corporation provided a TCU to Ford for its 2025 Mustang and Mustang Mach-E vehicle models.

Europe is expected to have the second-largest share of the automotive telematics market during the forecast period.

Europe is expected to hold the second-largest share of the automotive telematics market during the forecast period. The European automotive telematics market is led by advanced OEM-integrated systems, shaped by strict regulations and varying regional needs. Unlike regions where third-party providers dominate, European automakers offer built-in telematics platforms such as Volkswagen's We Connect, BMW's ConnectedDrive, Mercedes-Benz Me Connect, Renault's EASY CONNECT, and Stellantis's Uconnect. These systems commonly include OTA updates, remote diagnostics, digital services like parking and charging, and links to insurance products. The E-Call mandate is the key regulatory driver for the automotive telematics market in the European region. It requires all new cars and light vans sold in the EU since April 2018 to be equipped with an emergency call (eCall) system. This system automatically contacts emergency services in the event of a serious accident, transmitting the vehicle's location and other key data to speed up rescue response. Other regulations, such as the General Safety Regulation and EU Data Act, are pushing manufacturers to improve data privacy, user data ownership, and system compatibility. Usage-based insurance is also growing, supported by GDPR-compliant platforms, with insurers such as AXA, Allianz, Admiral, and UNIQA partnering with automakers and tech providers to offer customized premiums based on driving behavior. The continued expansion of advanced 5G networks is further enabling real-time features such as predictive maintenance, vehicle-to-grid connectivity, and in-car digital services, positioning Europe as a highly regulated and innovation-driven telematics market.

In-depth interviews were conducted with CEOs, marketing directors, other innovation and technology directors, and executives from various key organizations operating in this market.

- By Company Type: Tier I - 8%, Tier II - 56%, and Tier III - 36%

- By Designation: CXOs - 36%, Managers - 51%, and Executives - 13%

- By Region: North America - 24%, Europe - 38%, Asia Pacific - 30%, and RoW - 8%

The automotive telematics market is dominated by major players, including LG Electronics (South Korea), Harman International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany). These companies offer comprehensive telematics solutions encompassing telematics control units (TCUs), cloud-based connectivity platforms, cybersecurity features, OTA update systems, and integrated infotainment services. They also provide customized hardware-software integration, enabling OEMs to deliver connected services across vehicle segments and global markets.

Leading telematics service providers, such as AT&T Intellectual Property (US), Geotab (Canada), Samsara (US), Verizon Connect (US), and Powerfleet (US), offer bundled and innovative telematics services tailored for fleets, OEMs, and mobility operators. These companies provide comprehensive service platforms that integrate real-time vehicle tracking, driver behavior monitoring, AI-enabled video telematics, maintenance diagnostics, EV analytics, and workflow automation.

Research Coverage:

The report covers the automotive telematics market in terms of service, form type, offering, vehicle type, connectivity, EV type, aftermarket, EV by service, and region. It covers the competitive landscape and company profiles of the major automotive telematics market ecosystem players.

The study also includes an in-depth competitive analysis of the key market players, along with their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report:

- The report will help market leaders/new entrants with information on the closest approximations of revenue numbers for the overall automotive telematics market and its subsegments.

- This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies.

- This report also provides insights into automotive telematics architecture in two-wheelers and four-wheelers, as well as automotive telematics market trends in India.

- The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

- The report also helps stakeholders understand the current and future pricing trends of the automotive telematics market.

The report provides insights into the following pointers:

- Analysis of key drivers (surging demand for connected vehicles and in-car digital services, increasing adoption of remote diagnostics to enhance vehicle efficiency, telematics-driven optimization in fleet management and logistics), restraints (regulatory complexities around usage-based insurance models, data privacy and cybersecurity concerns), opportunities (expansion of IoT and next-gen connectivity technologies, convergence of advanced analytics, generative AI, and smart city integration, heightened emphasis on vehicle safety and security through mandates), and challenges (limited user acceptance and behavioral resistance, absence of industry-wide standardization).

- Product Development/Innovation: Detailed insights on upcoming technologies and research & development activities in the automotive telematics market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the automotive telematics market across varied regions)

- Market Diversification: Exhaustive information about untapped geographies, recent developments, and investments in the automotive telematics market

- Competitive Assessment: In-depth assessment of market share, growth strategies, and product offerings of leading players such as LG Electronics (South Korea), HARMAN International (US), Denso Corporation (Japan), Continental AG (Germany), and Robert Bosch GmbH (Germany) in the automotive telematics market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews-demand and supply sides

- 2.1.2.2 Key industry insights and breakdown of primary interviews

- 2.1.2.3 Primary interview participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.4.1 DEMAND AND SUPPLY-SIDE FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AUTOMOTIVE TELEMATICS MARKET

- 4.2 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE

- 4.3 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE

- 4.4 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING

- 4.5 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE

- 4.6 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE

- 4.7 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE

- 4.8 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY

- 4.9 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE

- 4.10 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE

- 4.11 AUTOMOTIVE TELEMATICS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surging demand for connected vehicles and in-car digital services

- 5.2.1.2 Increasing adoption of remote diagnostics to enhance vehicle efficiency

- 5.2.1.3 Telematics-driven optimization in fleet management and logistics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory complexities around usage-based insurance models

- 5.2.2.2 Data privacy and cybersecurity concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of IoT and next-gen connectivity technologies

- 5.2.3.2 Convergence of advanced analytics, GenAI, and smart city integration

- 5.2.3.3 Emphasis on vehicle safety and security through mandates

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited user acceptance and behavioral resistance

- 5.2.4.2 Absence of industry-wide standardization

- 5.2.5 IMPACT ANALYSIS OF MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 INDICATIVE PRICING OF TELEMATICS CONTROL UNITS BY KEY PLAYERS, 2024

- 5.3.2 AVERAGE SELLING PRICE OF TELEMATICS CONTROL UNITS, BY REGION, 2022-2024

- 5.4 ECOSYSTEM ANALYSIS

- 5.4.1 OEMS

- 5.4.2 TELEMATICS HARDWARE/SOFTWARE SUPPLIERS

- 5.4.3 CLOUD SERVICE PROVIDERS

- 5.4.4 SATELLITE NAVIGATION PROVIDERS

- 5.4.5 TELECOM SERVICE PROVIDERS

- 5.4.6 VAS PLAYERS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 CASE STUDY ANALYSIS

- 5.6.1 UFFIZIO OFFERED FLEET TRACKING PLATFORM TO CONFIGURE DASHBOARDS, USER ROLES, AND WORKFLOWS FOR EACH CLIENT TYPE, FROM WASTE COLLECTION TO LOGISTICS

- 5.6.2 REVOLUTIONIZING FLEET MAINTENANCE AND PERFORMANCE WITH ITRIANGLE'S VFOTA-POWERED TELEMATICS SOLUTION

- 5.6.3 ITRIANGLE INTRODUCED OBD II DEVICE AS SEAMLESS AND INTELLIGENT DIAGNOSTIC SOLUTION

- 5.6.4 ITRIANGLE DEPLOYED ROBUST TCU, TAILORED FOR INTEGRATION INTO OEM TRUCK PLATFORMS

- 5.6.5 ITRIANGLE IMPLEMENTED ROBUST AND SCALABLE TELEMATICS SOLUTION TAILORED TO IOCL'S REQUIREMENTS

- 5.6.6 VODAFONE DEPLOYED ITS FLEET ANALYTICS SOLUTION, INSTALLING DEVICES THAT CAPTURE REAL-TIME ENGINE DIAGNOSTICS, DRIVER HOURS, FUEL DATA, AND LOCATION INFORMATION

- 5.6.7 VODAFONE IMPLEMENTED ITS FLEET ANALYTICS PLATFORM ACROSS PROGETTI DEL CUORE'S FLEET

- 5.6.8 ATWELL ADOPTED GEOTAB'S FLEET MANAGEMENT PLATFORM TO ENHANCE FLEET SAFETY AND IMPROVE VEHICLE UTILIZATION

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 PATENT ANALYSIS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 INTRODUCTION

- 5.9.2 KEY TECHNOLOGIES

- 5.9.2.1 Next generation eCall (NGeCall)

- 5.9.2.2 Satellite-enabled telematics

- 5.9.3 COMPLEMENTARY TECHNOLOGIES

- 5.9.3.1 5G connectivity

- 5.9.3.2 Cloud telematics platforms

- 5.9.4 ADJACENT TECHNOLOGIES

- 5.9.4.1 Vehicle-to-cloud

- 5.9.4.2 Vehicle-to-pedestrian

- 5.9.4.3 Vehicle-to-infrastructure

- 5.9.4.4 Vehicle-to-vehicle

- 5.9.4.5 Cellular V2X

- 5.9.4.5.1 LTE-V2X

- 5.9.4.5.2 5G-V2X

- 5.10 SUPPLIER ANALYSIS

- 5.11 OEM-WISE TELEMATICS DATA PLANS, BY REGION

- 5.11.1 NORTH AMERICA

- 5.11.2 EUROPE

- 5.12 HS CODES

- 5.12.1 IMPORT SCENARIO

- 5.12.2 EXPORT SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF DATA

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 IMPACT OF GENERATIVE AI

- 5.17.1 AI IN FLEET MANAGEMENT TELEMATICS

- 5.17.2 AI IN INSURANCE TELEMATICS

- 5.17.3 AI IN CONNECTED VEHICLE SERVICES

- 5.18 MNM INSIGHTS INTO INDIAN AUTOMOTIVE TELEMATICS MARKET TRENDS

- 5.18.1 IOT INTEGRATION

- 5.18.2 ARTIFICIAL INTELLIGENCE AND MACHINE LEARNING

- 5.18.3 5G CONNECTIVITY

- 5.18.4 CLOUD COMPUTING AND DATA PLATFORMS

- 5.18.5 VEHICLE-TO-EVERYTHING (V2X) COMMUNICATION

- 5.18.6 BLOCKCHAIN FOR TELEMATICS DATA

- 5.18.7 VIDEO STREAMING AND TELEMATICS CAMERAS

- 5.18.8 ADVANCED DRIVER ASSISTANCE (ADAS)

- 5.18.9 AUTOMATED ROAD ASSISTANCE (ARAS)

- 5.18.10 CYBERSECURITY

- 5.19 MNM INSIGHTS INTO AUTOMOTIVE TELEMATICS ARCHITECTURE

- 5.19.1 TWO-WHEELERS

- 5.19.2 FOUR-WHEELERS

6 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE

- 6.1 INTRODUCTION

- 6.2 PASSENGER CAR

- 6.2.1 GROWING TELEMATICS PENETRATION IN MID-PRICED VEHICLE SEGMENTS TO DRIVE MARKET

- 6.3 LIGHT COMMERCIAL VEHICLE

- 6.3.1 NEED FOR ROUTE OPTIMIZATION TO MEET TIGHT DELIVERY WINDOWS TO DRIVE MARKET

- 6.4 BUS

- 6.4.1 GROWING SAFETY AWARENESS IN PUBLIC TRANSPORT TO DRIVE MARKET

- 6.5 TRUCK

- 6.5.1 RISING DEMAND FOR SAFER AND OPTIMIZED LOGISTICS TO DRIVE MARKET

- 6.6 KEY PRIMARY INSIGHTS

7 AUTOMOTIVE TELEMATICS MARKET, BY FORM TYPE

- 7.1 INTRODUCTION

- 7.2 EMBEDDED

- 7.2.1 EXPANDING CONNECTED CAR ECOSYSTEM TO DRIVE MARKET

- 7.3 INTEGRATED

- 7.3.1 INCREASING TELEMATICS DEPLOYMENT IN FLEET MANAGEMENT TO DRIVE MARKET

- 7.4 KEY PRIMARY INSIGHTS

8 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING

- 8.1 INTRODUCTION

- 8.2 HARDWARE

- 8.2.1 GROWING DEMAND FOR EMBEDDED TELEMATICS BOXES TO DRIVE MARKET

- 8.2.2 TELEMATICS CONTROL UNIT

- 8.2.3 COMMUNICATION DEVICES

- 8.2.4 CONTROLLER AREA NETWORK (CAN) BUS

- 8.2.5 AUDIO/VIDEO INTERFACE

- 8.3 SOFTWARE

- 8.3.1 SHIFT TOWARD SOFTWARE-DEFINED VEHICLES TO TRANSFORM TELEMATICS LANDSCAPE

- 8.3.2 REAL-TIME NAVIGATION

- 8.3.3 REMOTE DIAGNOSTICS

- 8.3.4 OVER-THE-AIR (OTA) UPDATES

- 8.4 KEY PRIMARY INSIGHTS

9 AUTOMOTIVE TELEMATICS MARKET, BY CONNECTIVITY

- 9.1 INTRODUCTION

- 9.2 SATELLITE

- 9.2.1 DEMAND FOR GLOBAL VEHICLE VISIBILITY AND RELIABILITY ACROSS GEOGRAPHIES TO DRIVE MARKET

- 9.3 CELLULAR

- 9.4 5G

- 9.4.1 HIGH DATA TRANSFER SPEED, AND ABILITY TO SUPPORT MASSIVE IOT AND REAL-TIME APPLICATIONS TO DRIVE MARKET

- 9.5 4G

- 9.5.1 INCREASING 4G INTEGRATION IN MASS-MARKET VEHICLES TO DRIVE MARKET

- 9.6 2G/3G

- 9.6.1 SUSTAINED 2G/3G CONNECTIVITY DEMAND IN EMERGING ECONOMIES TO DRIVE MARKET

- 9.7 KEY PRIMARY INSIGHTS

10 AUTOMOTIVE TELEMATICS MARKET, BY FLEET MANAGEMENT SERVICE

- 10.1 INTRODUCTION

- 10.2 OPERATIONS MANAGEMENT

- 10.2.1 OPERATIONAL EFFICIENCY IMPERATIVES TO ACCELERATE TELEMATICS ADOPTION

- 10.3 VEHICLE MAINTENANCE AND DIAGNOSTICS

- 10.3.1 GROWING FOCUS ON PREVENTIVE MAINTENANCE TO ENHANCE FLEET PERFORMANCE TO DRIVE MARKET

- 10.4 FLEET ANALYTICS AND REPORTING

- 10.4.1 RISING NEED FOR FLEET PERFORMANCE TRANSPARENCY TO DRIVE MARKET

- 10.5 OTHERS

- 10.6 KEY PRIMARY INSIGHTS

11 AUTOMOTIVE TELEMATICS MARKET, BY SERVICE

- 11.1 INTRODUCTION

- 11.2 EMERGENCY CALLING

- 11.2.1 GOVERNMENT MANDATES FOR E-CALL SYSTEMS TO ENHANCE OCCUPANT SAFETY TO DRIVE MARKET

- 11.3 ON-ROAD ASSISTANCE

- 11.3.1 GROWING NEED FOR REAL-TIME BREAKDOWN ASSISTANCE TO DRIVE MARKET

- 11.4 REMOTE DIAGNOSTICS

- 11.4.1 GROWING NEED FOR VEHICLE HEALTH MONITORING AND PREDICTIVE MAINTENANCE TO DRIVE MARKET

- 11.5 INSURANCE RISK ASSESSMENT

- 11.5.1 GROWING DEMAND FOR PERSONALIZED, DATA-DRIVEN POLICIES TO DRIVE MARKET

- 11.6 STOLEN VEHICLE ASSISTANCE

- 11.6.1 RISING VEHICLE THEFT INCIDENTS TO DRIVE MARKET

- 11.7 OTHERS

- 11.8 KEY PRIMARY INSIGHTS

12 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY VEHICLE TYPE

- 12.1 INTRODUCTION

- 12.2 BATTERY ELECTRIC VEHICLE (BEV)

- 12.2.1 OEMS PRIORITIZING CONNECTED SERVICES TO ENHANCE USER EXPERIENCE TO DRIVE MARKET

- 12.3 FUEL CELL ELECTRIC VEHICLE (FCEV)

- 12.3.1 GOVERNMENT INVESTMENTS IN HYDROGEN INFRASTRUCTURE TO ACCELERATE TELEMATICS ADOPTION

- 12.4 PLUG-IN HYBRID ELECTRIC VEHICLE (PHEV)

- 12.4.1 OEMS' EMPHASIS ON INTEGRATING CONNECTED FEATURES IN PHEVS TO DRIVE MARKET

- 12.5 PRIMARY INSIGHTS

13 ELECTRIC & HYBRID VEHICLE TELEMATICS MARKET, BY SERVICE

- 13.1 INTRODUCTION

- 13.2 EMERGENCY CALLING

- 13.2.1 REGULATORY PUSH FOR MANDATORY ECALL SYSTEMS TO ACCELERATE TELEMATICS ADOPTION

- 13.3 ON-ROAD ASSISTANCE

- 13.3.1 GROWING DEMAND FOR REAL-TIME SUPPORT DURING BREAKDOWNS TO DRIVE MARKET

- 13.4 REMOTE DIAGNOSTICS

- 13.4.1 PROACTIVE DIAGNOSTICS AND MAINTENANCE OPTIMIZATION TO PROPEL TELEMATICS ADOPTION

- 13.5 INSURANCE RISK ASSESSMENT

- 13.5.1 GOVERNMENT SUPPORT FOR USAGE-BASED INSURANCE POLICIES TO DRIVE MARKET

- 13.6 STOLEN VEHICLE ASSISTANCE

- 13.6.1 RISING ADOPTION OF STOLEN VEHICLE ASSISTANCE AS STANDARD FEATURE IN ELECTRIC VEHICLES TO DRIVE MARKET

- 13.7 OTHERS

- 13.8 KEY PRIMARY INSIGHTS

14 AUTOMOTIVE TELEMATICS AFTERMARKET, BY VEHICLE TYPE

- 14.1 INTRODUCTION

- 14.2 PASSENGER CAR

- 14.2.1 GROWTH OF RIDE-HAILING AND SHARED MOBILITY SERVICES TO FUEL TELEMATICS ADOPTION

- 14.3 LIGHT COMMERCIAL VEHICLE

- 14.3.1 RISING LAST-MILE DELIVERY DEMAND TO ACCELERATE AFTERMARKET TELEMATICS ADOPTION

- 14.4 HEAVY COMMERCIAL VEHICLE

- 14.4.1 OPERATIONAL EFFICIENCY AND DOWNTIME REDUCTION TO ACCELERATE TELEMATICS ADOPTION

- 14.5 KEY PRIMARY INSIGHTS

15 AUTOMOTIVE TELEMATICS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 ASIA PACIFIC

- 15.2.1 MACROECONOMIC OUTLOOK

- 15.2.2 CHINA

- 15.2.2.1 Government's focus on vehicle data standardization and intelligent transportation systems to drive market

- 15.2.3 INDIA

- 15.2.3.1 Mandatory inclusion of GPS tracking and emergency response features in public service vehicles to drive market

- 15.2.3.2 Indian automotive telematics market, by offering

- 15.2.3.2.1 Hardware

- 15.2.3.2.1.1 Telematics control unit (TCU)

- 15.2.3.2.1.2 Audio/Video interface

- 15.2.3.2.1.3 CAN Bus

- 15.2.3.2.1.4 Communications modules

- 15.2.3.2.2 Software

- 15.2.3.2.2.1 Real-time navigation

- 15.2.3.2.2.2 Remote diagnostics

- 15.2.3.2.2.3 Over-the-air (OTA) updates

- 15.2.3.2.1 Hardware

- 15.2.4 JAPAN

- 15.2.4.1 Strong integration of safety, infrastructure, and mobility innovations to drive market

- 15.2.5 SOUTH KOREA

- 15.2.5.1 Strong convergence of automotive, telecom, and electronics sectors to drive market

- 15.2.6 THAILAND

- 15.2.6.1 Government mandates to include telematics features in commercial vehicles to drive market

- 15.2.7 REST OF ASIA PACIFIC

- 15.3 EUROPE

- 15.3.1 MICROECONOMIC OUTLOOK

- 15.3.2 GERMANY

- 15.3.2.1 Increasing sales of connected vehicles equipped with advanced telematics features to drive market

- 15.3.3 FRANCE

- 15.3.3.1 Mandating safety requirements to drive market

- 15.3.4 ITALY

- 15.3.4.1 Innovation in automobile industry to drive market

- 15.3.5 SPAIN

- 15.3.5.1 Legislative support for autonomous vehicle development and trials to drive market

- 15.3.6 RUSSIA

- 15.3.6.1 Increasing integration of advanced safety features in new vehicle models to drive market

- 15.3.7 UK

- 15.3.7.1 Rising inclusion of telematics features in mid-tier automobiles to drive market

- 15.3.8 REST OF EUROPE

- 15.4 NORTH AMERICA

- 15.4.1 MACROECONOMIC OUTLOOK

- 15.4.2 US

- 15.4.2.1 Substantial investments by OEMs in connected services and autonomous driving to drive market

- 15.4.3 CANADA

- 15.4.3.1 Growth of fleet telematics and rise of UBI programs to drive market

- 15.4.4 MEXICO

- 15.4.4.1 Rising adoption of telematics in commercial fleets to drive market

- 15.5 REST OF THE WORLD

- 15.5.1 MACROECONOMIC OUTLOOK

- 15.5.2 BRAZIL

- 15.5.2.1 Growing demand for vehicle tracking and safety features to drive market

- 15.5.3 SOUTH AFRICA

- 15.5.3.1 Rising telematics adoption in commercial vehicles to drive market

- 15.5.4 IRAN

- 15.5.4.1 Escalating telematics demand in fleets and commercial vehicles to drive market

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.3 MARKET SHARE ANALYSIS FOR GLOBAL TELEMATICS CONTROL UNIT PROVIDERS, 2024

- 16.4 MARKET SHARE ANALYSIS FOR INDIAN TELEMATICS CONTROL UNIT PROVIDERS, 2024

- 16.5 REVENUE ANALYSIS OF TOP LISTED/PUBLIC PLAYERS, 2024

- 16.6 COMPANY VALUATION AND FINANCIAL METRICS

- 16.6.1 COMPANY VALUATION

- 16.6.2 FINANCIAL METRICS

- 16.7 BRAND/ PRODUCT COMPARISON

- 16.8 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.8.1 STARS

- 16.8.2 EMERGING LEADERS

- 16.8.3 PERVASIVE PLAYERS

- 16.8.4 PARTICIPANTS

- 16.8.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.8.5.1 Company footprint

- 16.8.5.2 Region footprint

- 16.8.5.3 Form type footprint

- 16.8.5.4 Offering footprint

- 16.8.5.5 Vehicle type footprint

- 16.9 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 16.9.1 PROGRESSIVE COMPANIES

- 16.9.2 RESPONSIVE COMPANIES

- 16.9.3 DYNAMIC COMPANIES

- 16.9.4 STARTING BLOCKS

- 16.9.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.9.5.1 List of startups/SMEs

- 16.9.5.2 Competitive benchmarking of startups/SMEs

- 16.10 COMPETITIVE SCENARIO

- 16.10.1 PRODUCT LAUNCHES/DEVELOPMENTS

- 16.10.2 DEALS

- 16.10.3 EXPANSIONS

- 16.10.4 OTHER DEVELOPMENTS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 LG ELECTRONICS

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Solutions/Services offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches/developments

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.3.4 Other developments

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses and competitive threats

- 17.1.2 HARMAN INTERNATIONAL

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Solutions/Services offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches/developments

- 17.1.2.3.2 Deals

- 17.1.2.3.3 Other developments

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses and competitive threats

- 17.1.3 DENSO CORPORATION

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Solutions/Services offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses and competitive threats

- 17.1.4 CONTINENTAL AG

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Solutions/Services offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Deals

- 17.1.4.3.2 Expansions

- 17.1.4.3.3 Other developments

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses and competitive threats

- 17.1.5 ROBERT BOSCH GMBH

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Solutions/Services offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Product launches/developments

- 17.1.5.3.2 Deals

- 17.1.5.3.3 Other developments

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses and competitive threats

- 17.1.6 APTIV

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Solutions/Services offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Other developments

- 17.1.7 VISTEON CORPORATION

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Solutions/Services offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Deals

- 17.1.7.3.2 Expansions

- 17.1.8 MARELLI HOLDINGS CO., LTD.

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Solutions/Services offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches/developments

- 17.1.8.3.2 Deals

- 17.1.9 VALEO

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Solutions/Services offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches/developments

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Other developments

- 17.1.10 INFINEON TECHNOLOGIES AG

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Solutions/Services offered

- 17.1.11 FICOSA INTERNACIONAL SA

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Solutions/Services offered

- 17.1.12 AT&T INTELLECTUAL PROPERTY

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Solutions/Services offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Deals

- 17.1.13 VERIZON

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Solutions/Services offered

- 17.1.13.3 Recent developments

- 17.1.13.3.1 Deals

- 17.1.14 BRIDGESTONE MOBILITY SOLUTIONS B.V.

- 17.1.14.1 Business overview

- 17.1.14.2 Products/Solutions/Services offered

- 17.1.14.3 Recent developments

- 17.1.14.3.1 Product launches/developments

- 17.1.14.3.2 Deals

- 17.1.1 LG ELECTRONICS

- 17.2 INDIAN KEY PLAYERS

- 17.2.1 ITRIANGLE INFOTECH PVT LTD

- 17.2.1.1 Business overview

- 17.2.1.2 Products/Solutions/Services offered

- 17.2.1.3 Recent developments

- 17.2.1.3.1 Deals

- 17.2.1.3.2 Expansions

- 17.2.1.3.3 Other developments

- 17.2.1.4 MnM view

- 17.2.1.4.1 Key strengths

- 17.2.1.4.2 Strategic choices

- 17.2.1.4.3 Weaknesses and competitive threats

- 17.2.2 CE INFO SYSTEMS LTD

- 17.2.2.1 Business overview

- 17.2.2.2 Products/Solutions/Services offered

- 17.2.2.3 Recent developments

- 17.2.2.3.1 Deals

- 17.2.2.3.2 Other developments

- 17.2.2.4 MnM view

- 17.2.2.4.1 Key strengths

- 17.2.2.4.2 Strategic choices

- 17.2.2.4.3 Weaknesses and competitive threats

- 17.2.3 ATLANTA SYSTEMS PVT. LTD.

- 17.2.3.1 Business overview

- 17.2.3.2 Products/Solutions/Services offered

- 17.2.3.3 MnM view

- 17.2.3.3.1 Key strengths

- 17.2.3.3.2 Strategic choices

- 17.2.3.3.3 Weaknesses and competitive threats

- 17.2.4 BLACKBOX GPS TECHNOLOGY

- 17.2.4.1 Business overview

- 17.2.4.2 Products/Solutions/Services offered

- 17.2.4.3 MnM view

- 17.2.4.3.1 Key strengths

- 17.2.4.3.2 Strategic choices

- 17.2.4.3.3 Weaknesses and competitive threats

- 17.2.5 ROSMERTA

- 17.2.5.1 Business overview

- 17.2.5.2 Products/Solutions/Services offered

- 17.2.5.3 MnM view

- 17.2.5.3.1 Key strengths

- 17.2.5.3.2 Strategic choices

- 17.2.5.3.3 Weaknesses and competitive threats

- 17.2.1 ITRIANGLE INFOTECH PVT LTD

- 17.3 OTHER PLAYERS

- 17.3.1 ADDSECURE

- 17.3.2 PANASONIC CORPORATION

- 17.3.3 GARMIN LTD.

- 17.3.4 POWERFLEET

- 17.3.5 TRIMBLE INC.

- 17.3.6 CALAMP

- 17.3.7 THE DESCARTES SYSTEMS GROUP INC.

- 17.3.8 QUALCOMM TECHNOLOGIES, INC.

- 17.3.9 AIRIQ INC.

- 17.3.10 ACTSOFT, INC.

- 17.3.11 TELETRAC NAVMAN US LTD.

- 17.3.12 MICHELIN

- 17.3.13 OCTO GROUP S.P.A.

18 RECOMMENDATIONS BY MARKETSANDMARKETS

- 18.1 ACCELERATING GLOBAL TELEMATICS ADOPTION THROUGH FACTORY-FITTED EMBEDDED SOLUTIONS

- 18.2 DRIVING BEHAVIOR-BASED INSURANCE PREMIUMS WITH INTEGRATED ANALYTICS

- 18.3 OPTIMIZING ELECTRIC VEHICLE OPERATIONS WITH INTELLIGENT TELEMATICS INTEGRATION

- 18.4 CONCLUSION

19 APPENDIX

- 19.1 KEY INSIGHTS FROM INDUSTRY EXPERTS

- 19.2 DISCUSSION GUIDE

- 19.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 19.4 CUSTOMIZATION OPTIONS

- 19.4.1 AUTOMOTIVE TELEMATICS MARKET, BY OFFERING, AT COUNTRY LEVEL

- 19.4.2 AUTOMOTIVE TELEMATICS MARKET, BY VEHICLE TYPE, AT COUNTRY LEVEL

- 19.4.3 COMPANY INFORMATION

- 19.4.3.1 Profiling of additional market players (up to five)

- 19.5 RELATED REPORTS

- 19.6 AUTHOR DETAILS