|

시장보고서

상품코드

1790689

파워 일렉트로닉스 시장 : 기기 유형별, 재료별, 전압 레벨별, 업계별, 지역별 예측(-2030년)Power Electronics Market by Power Discrete (Diode, Transistor, Thyristor), Power Module (FET, IGBT, Intelligent Power Module, Standard and Power Integrated Module), Power IC, Silicon, Silicon Carbide, Gallium Nitride - Global Forecast to 2030 |

||||||

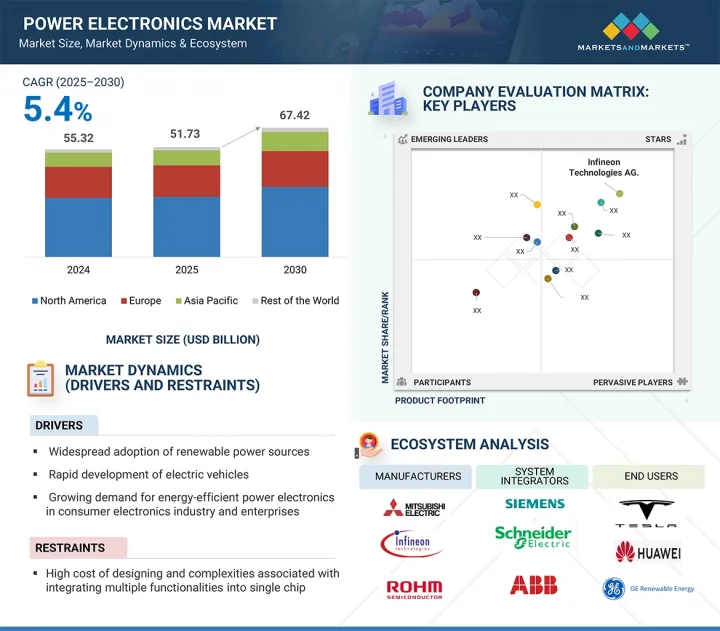

세계의 파워 일렉트로닉스 시장 규모는 2025년 517억 3,000만 달러로 추정되고, 예측 기간 중 CAGR 5.4%로 전망되고 있으며, 2030년까지 674억 2,000만 달러에 달할 것으로 예측되고 있습니다.

파워 일렉트로닉스 시스템은 에너지 효율적인 기술 채용 증가, 전기 동향, 반도체 부품의 진보에 따라 다양한 산업에서 수요가 확대되고 있습니다. 이러한 시스템은 전기자동차(EV), 신재생에너지 시스템, 산업 자동화, 가전제품 등의 용도에서 전력 제어 및 변환에 중요한 역할을 합니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 기기 유형별, 재료별, 전압 레벨별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

자동차 제조업체는 인버터, 컨버터, 배터리 관리 시스템 등의 파워 일렉트로닉스 컴포넌트를 통합하여 차량 성능의 향상과 배출 가스의 삭감을 도모하는 움직임이 가속화되고 있습니다. 동시에 태양광 발전과 풍력 발전 설비 증가로 송전망의 안정성과 에너지 최적화를 확보하기 위한 파워 일렉트로닉스 인버터와 컨트롤러의 도입이 가속화되고 있습니다. 와이드 밴드갭 반도체(SiC, GaN 등), 소형 IC, 지능형 파워 모듈의 기술 발전은 시스템 효율, 신뢰성 및 열 성능을 향상시킵니다. 또한 5G 인프라, 스마트 그리드 및 산업용 IoT에 대한 지속적인 투자는 통신 및 공장 자동화에서 파워 일렉트로닉스 제품의 채택 확대에 기여하고 있습니다.

저전압 부문은 소비자용 전자기기와 자동차용으로의 광범위한 사용, 산업용 오토메이션이나 IoT 기기에서의 급속한 채용, 소형, 에너지 효율적인 전원 관리 솔루션 수요 증가에 의해 예측 기간 동안 최대 시장 점유율을 차지할 것으로 추정·예측됩니다. 소비자용 전자기기나 차재 용도으로 널리 사용되고 있기 때문에 파워 IC나 컨버터 등의 저전압 부품에 대한 안정된 대량 수요가 견인되고 있습니다. 이러한 부품은 스마트폰, 노트북, 전기자동차 및 하이브리드 자동차 자동차 시스템과 같은 배터리 구동 장치에 필수적입니다. 이러한 장비에 대한 세계 수요가 계속 증가하고 있기 때문에 저전압 파워 일렉트로닉스의 소비도 증가하고 있습니다. 또한 산업 자동화 및 IoT 기술의 급속한 보급과 함께 스마트 센서, 컨트롤러, 액추에이터 및 연결 장치의 안전하고 효율적인 작동을 보장하는 저전압 솔루션이 필요합니다. 이러한 구성 요소는 제조 및 산업 환경 전반에 걸쳐 실시간 제어, 통신 및 에너지 최적화를 가능하게 하는 데 중요한 역할을 합니다. 또한, 컴팩트하고 에너지 효율적인 전원 관리 솔루션에 대한 수요가 증가함에 따라 공간 제약이 있는 휴대용 용도에서 저전압 파워 일렉트로닉스의 통합을 지원합니다. 에너지 절약과 지속가능성을 중시하는 경향이 강해지고 있는 가운데, 각 산업계는 저전압 시스템 수요를 견인해, 파워 일렉트로닉스 시장에서의 우위성을 확고하게 하고 있습니다.

전력모듈 분야는 전기차(EV)와 신재생에너지 시스템의 채용 증가, 컴팩트하고 고효율의 파워솔루션에 대한 수요 증가, SiC와 GaN 등의 와이드밴드 갭 반도체 재료의 진보로 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측되고 있습니다. 전기자동차와 재생에너지의 보급이 파워 모듈 수요를 크게 밀어 올리고 있습니다. 파워 모듈은 전기 드라이브 트레인, 배터리 관리 시스템, 태양광/풍력 인버터의 고출력 부하 관리에 필수적이기 때문입니다. 고효율, 열 안정성 및 신뢰성이 높기 때문에 이러한 용도에 이상적입니다. 특히 자동차, 산업 자동화, 통신 등 산업계 전체에서 컴팩트하고 효율적인 파워 솔루션에 대한 수요가 높아지고 있기 때문에 복수의 파워 컴포넌트를 단일의 합리적인 패키지에 통합한 파워 모듈의 채용이 진행되고 있습니다. 이 통합을 통해 전력 손실을 최소화하고 필요한 공간을 줄이고 전체 시스템 성능을 향상시킬 수 있습니다. 또한 실리콘 카바이드(SiC) 및 갈륨 질화물(GaN)과 같은 광대역 갭 재료의 진보는 기존 실리콘 기반 모듈에 비해 더 높은 전압 내성, 보다 빠른 스위칭 속도 및 에너지 효율 향상을 가능하게 함으로써 전력 모듈의 기능을 변화시키고 있습니다. 이러한 기술 혁신을 통해 파워 모듈은 고성능 및 고주파 용도에 점점 매력적이 되고 있으며, 그 채용이 가속화되고 예측 기간 동안 파워 일렉트로닉스 시장의 강력한 성장을 이끌고 있습니다.

북미는 전기자동차(EV)와 충전 인프라의 견조한 개발, 신재생에너지 시스템의 보급 확대, 산업 자동화 및 스마트 그리드 기술 투자 가속화로 예측 기간 동안 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. EV와 충전 인프라의 기술 개발은 인버터, 컨버터, 배터리 관리 시스템에 대한 수요를 크게 촉진하고 있으며, 이들은 차량 성능 향상, 에너지 변환 최적화, 충전 효율 달성의 주요 요인이 되고 있습니다. 동시에 신재생에너지 시스템, 특히 태양광 발전과 풍력발전의 채용이 증가하고 있기 때문에 지역의 송전망간에 효율적이고 안정적이며 원활한 에너지 전송을 지원하는 전력 변환기와 그리드 통합 기술에 대한 수요가 발생하고 있습니다. 또한 북미에서는 산업 자동화와 송전망의 근대화에 대한 투자가 활발해지고 있습니다. 이러한 추세는 실시간으로 모니터링하고 에너지 효율을 높이고 부하 균형을 맞추는 고급 전력 관리 솔루션의 채택을 촉진합니다. 스마트 그리드 기술과 자동화 산업 시스템의 설치는 고성능, 효율적인 파워 일렉트로닉스에 크게 의존하고 있으며, 이 지역 시장의 성장에 기여하고 있습니다. 전반적으로 이러한 요인은 북미를 예측 기간 동안 파워 일렉트로닉스 시장의 주요 성장 기지로 만드는 요인이 되었습니다.

본 보고서에서는 세계 파워 일렉트로닉스 시장을 조사했으며, 기기 유형별, 재료별, 전압 레벨별, 업계별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객사업에 영향을 주는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주된 회의와 이벤트

- 사례 연구

- 투자 및 자금조달 시나리오

- 관세 및 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- AI/생성형 AI가 파워 일렉트로닉스 시장에 미치는 영향

- 2025년 미국 관세가 파워 일렉트로닉스 시장에 미치는 영향

제6장 파워 일렉트로닉스의 웨이퍼 사이즈

- 소개

- 200mm 미만

- 200mm 이상

제7장 파워 일렉트로닉스의 전류

- 소개

- 25A 이하

- 26-40A

- 40A 이상

제8장 파워 일렉트로닉스 시장(기기 유형별)

- 소개

- 파워 이산

- 파워 모듈

- 파워 집적 회로

제9장 파워 일렉트로닉스 시장(재료별)

- 소개

- 실리콘

- 탄화규소(SIC)

- 질화갈륨(GAN)

제10장 파워 일렉트로닉스 시장(전압 레벨별)

- 소개

- 저전압

- 중전압

- 고전압

제11장 파워 일렉트로닉스 시장(업계별)

- 소개

- 정보통신기술

- 가전

- 공업

- 자동차 및 운송

- 항공우주 및 방위

- 기타

제12장 파워 일렉트로닉스 시장(지역별)

- 소개

- 북미

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 기타

- 기타 지역

- 기타 지역 : 거시 경제 전망

- 남미

- 중동 및 아프리카

제13장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점, 2021-2025년

- 시장 점유율 분석, 2024년

- 수익 분석, 2020-2024년

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 프로파일

- 소개

- 주요 진출기업

- INFINEON TECHNOLOGIES AG

- SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- STMICROELECTRONICS

- TEXAS INSTRUMENTS INCORPORATED

- ANALOG DEVICES, INC.

- MITSUBISHI ELECTRIC CORPORATION

- VISHAY INTERTECHNOLOGY, INC.

- FUJI ELECTRIC CO., LTD.

- TOSHIBA CORPORATION

- RENESAS ELECTRONICS CORPORATION

- 기타 기업

- ABB

- LITTELFUSE, INC.

- NXP SEMICONDUCTORS

- MICROCHIP TECHNOLOGY INC.

- ROHM CO., LTD.

- SEMIKRON

- TRANSPHORM INC.

- QORVO, INC.

- WOLFSPEED, INC.

- EUCLID TECHLABS

- NAVITAS SEMICONDUCTOR

- EFFICIENT POWER CONVERSION CORPORATION

- POWDEC

- GANPOWER

- NEXGEN POWER

제15장 부록

JHS 25.08.20The global power electronics market was valued at USD 51.73 billion in 2025 and is projected to reach USD 67.42 billion by 2030, at a CAGR of 5.4% during the forecast period. Power electronics systems are witnessing growing demand across diverse industries due to the rising adoption of energy-efficient technologies, electrification trends, and advancements in semiconductor components. These systems play a vital role in controlling and converting electrical power in applications such as electric vehicles (EVs), renewable energy systems, industrial automation, and consumer electronics.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Device Type, Material, Voltage Level, Vertical, and Region |

| Regions covered | North America, Europe, APAC, RoW |

Automotive manufacturers are increasingly integrating power electronics components like inverters, converters, and battery management systems to enhance vehicle performance and reduce emissions. Simultaneously, the rise of solar and wind energy installations is accelerating the deployment of power electronic inverters and controllers to ensure grid stability and energy optimization. Technological advancements in wide bandgap semiconductors (such as SiC and GaN), compact ICs, and intelligent power modules are boosting system efficiency, reliability, and thermal performance. Furthermore, ongoing investments in 5G infrastructure, smart grids, and industrial IoT are contributing to increased adoption of power electronics in telecommunications and factory automation.

"Low voltage segment to account for largest market share during the forecast period"

The low voltage segment is estimated to account for the largest market share during the forecast period due to its widespread use in consumer electronics and automotive applications, rapid adoption in industrial automation and IoT devices, and increasing demand for compact, energy-efficient power management solutions. Widespread use in consumer electronics and automotive applications drives consistent, high-volume demand for low-voltage components like power ICs and converters, which are essential for battery-powered devices such as smartphones, laptops, and onboard vehicle systems in electric and hybrid vehicles. As global demand for these devices continues to rise, so does the consumption of low-voltage power electronics. Additionally, the rapid adoption of industrial automation and IoT technologies requires low-voltage solutions to ensure safe and efficient operation of smart sensors, controllers, actuators, and connected devices. These components play a critical role in enabling real-time control, communication, and energy optimization across manufacturing and industrial environments. Furthermore, the rising demand for compact and energy-efficient power management solutions supports the integration of low-voltage power electronics in space-constrained and portable applications. With increasing emphasis on energy savings and sustainability, industries across the board are driving the demand for low-voltage systems, solidifying their dominant position in the power electronics market.

"Power modules segment projected to register highest CAGR during forecast period"

The power modules segment is expected to witness the highest CAGR during the forecast period due to the rising adoption of electric vehicles (EVs) and renewable energy systems, increasing demand for compact and high-efficiency power solutions, and advancements in wide bandgap semiconductor materials like SiC and GaN. Rising EV and renewable energy adoption is significantly boosting demand for power modules, as they are critical for managing high power loads in electric drivetrains, battery management systems, and solar/wind inverters. Their high efficiency, thermal stability, and reliability make them ideal for these applications. The increasing demand for compact and efficient power solutions across industries, particularly in automotive, industrial automation, and telecommunications, is driving the adoption of power modules, which integrate multiple power components into a single, streamlined package. This integration helps minimize power loss, reduce space requirements, and enhance overall system performance. Furthermore, advancements in wide bandgap materials such as silicon carbide (SiC) and gallium nitride (GaN) are transforming power module capabilities by enabling higher voltage tolerance, faster switching speeds, and improved energy efficiency compared to conventional silicon-based modules. These innovations make power modules increasingly attractive for high-performance and high-frequency applications, accelerating their adoption and driving strong growth in the power electronics market during the forecast period.

" North America to register second-highest CAGR during forecast period"

North America is anticipated to experience the second-highest CAGR during the forecast period, driven by robust developments in electric vehicle (EV) and charging infrastructure, growing uptake of renewable energy systems, and accelerating investments in industrial automation and smart grid technologies. Technological developments in EVs and charging infrastructure are driving the demand for inverters, converters, and battery management systems to a great extent, which are key to improving vehicle performance, optimizing energy conversion, and achieving charging efficiency. At the same time, increasing adoption of renewable energy systems, especially solar and wind, has generated demand for power converters and grid integration technologies that support efficient, stable, and smooth energy transmission between regional grids. In addition, North America is witnessing robust investments in industrial automation and power grid modernization. These trends are fueling broader adoption of advanced power management solutions to monitor in real-time, achieve energy efficiency, and balance loads. The installation of smart grid technologies and automated industrial systems is heavily dependent on high-performance, efficient power electronics, which contribute to the growth of the regional market. Overall, these factors contribute to making North America a key growth hub for the power electronics market during the forecast period.

Extensive primary interviews were conducted with key industry experts in the power electronics market to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation - Directors - 50%, Managers - 30%, and Others - 20%

- By Region - Asia Pacific - 45%, Europe - 30%, North America - 20%, and RoW - 5%

The power electronics market is dominated by a few globally established players, such as Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Semiconductor Components Industries, LLC (US), STMicroelectronics (Switzerland), Analog Devices, Inc. (US), NXP Semiconductors (Netherlands), ROHM Co., LTD. (Japan), Mitsubishi Electric Corporation (Japan), Wolfspeed, Inc. (US), Transphorm Inc. (US), Qorvo, Inc. (US), Renesas Electronics Corporation (Japan), TOSHIBA CORPORATION (Japan), Fuji Electric Co., Ltd. (Japan), and Vishay Intertechnology, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the power electronics market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the power electronics market and forecasts its size by device type (Power Discrete, Power Module, Power ICs), material (Silicon, Silicon Carbide, Gallium Nitride), and vertical (ICT, Consumer Electronics, Industrial, Automotive & Transportation, Aerospace & Defense, Other Verticals). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions (North America, Europe, Asia Pacific, and RoW). The report includes a value chain analysis of the key players and their competitive analysis in the power electronics ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Widespread adoption of renewable power sources, Rapid development of electric vehicles, Growing demand for energy-efficient power electronics in consumer electronics industry and enterprises), restraints (High cost of designing and complexities associated with integrating multiple functionalities into single chip), opportunities (Emergence of wide bandgap semiconductors, Growing adoption of SiC power switches), challenges (Difficulties in designing and packaging SiC power devices)

- Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product launches in the power electronics market

- Market Development: Comprehensive information about lucrative markets - the report analyses the power electronics market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the power electronics market

- Competitive Assessment: In-depth assessment of market shares and growth strategies of leading players, such as Infineon Technologies AG (Germany), Texas Instruments Incorporated (US), Semiconductor Components Industries, LLC (US), STMicroelectronics (Switzerland), Analog Devices, Inc. (US), NXP Semiconductors (Netherlands), ROHM Co., LTD. (Japan), Mitsubishi Electric Corporation (Japan), Wolfspeed, Inc. (US), Transphorm Inc. (US), Qorvo, Inc. (US), Renesas Electronics Corporation (Japan), TOSHIBA CORPORATION (Japan), Fuji Electric Co., Ltd. (Japan), and Vishay Intertechnology, Inc. (US).

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 FACTOR ANALYSIS

- 2.3.1 DEMAND-SIDE ANALYSIS

- 2.3.2 SUPPLY-SIDE ANALYSIS

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RISK ASSESSMENT

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POWER ELECTRONICS MARKET

- 4.2 POWER ELECTRONICS MARKET, BY DEVICE TYPE

- 4.3 POWER ELECTRONICS MARKET, BY MATERIAL

- 4.4 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL

- 4.5 POWER ELECTRONICS MARKET, BY VERTICAL

- 4.6 POWER ELECTRONICS MARKET, BY REGION

- 4.7 POWER ELECTRONICS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Widespread adoption of renewable power sources

- 5.2.1.2 Rapid development of electric vehicles

- 5.2.1.3 Growing demand for energy-efficient power electronics in consumer electronics industry and enterprises

- 5.2.2 RESTRAINT

- 5.2.2.1 High cost of designing and complexities associated with integrating multiple functionalities into single chip

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of wide bandgap semiconductor materials

- 5.2.3.2 Growing adoption of SiC power switches

- 5.2.4 CHALLENGES

- 5.2.4.1 Difficulties in designing and packaging SiC power devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION (2021-2024)

- 5.4.2 AVERAGE SELLING PRICE TREND OF POWER ELECTRONIC DEVICES, BY KEY PLAYERS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Wide bandgap semiconductors

- 5.7.1.2 Advanced power modules

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Digital control systems

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Battery energy storage systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8541)

- 5.9.2 EXPORT DATA (HS CODE 8541)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDIES

- 5.11.1 SEMIPOWEREX DEVELOPED OPTIMIZED SIC POWER MODULES FOR STABLE OPERATION AT HIGH FREQUENCIES WITH ASSISTANCE FROM UNITEDSIC

- 5.11.2 CORSAIR DEPLOYED GAN FETS BY TRANSPHORM TO OFFER HIGH-PERFORMANCE POWER SUPPLY UNITS

- 5.11.3 DELTA ELECTRONICS POWERED DATA CENTERS WITH GALLIUM NITRIDE FROM TEXAS INSTRUMENTS INCORPORATED

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 TARIFF AND REGULATORY LANDSCAPE

- 5.13.1 TARIFF ANALYSIS (HS CODE 8541)

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.3 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREATS OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI/GEN AI ON POWER ELECTRONICS MARKET

- 5.17 IMPACT OF 2025 US TARIFF ON POWER ELECTRONICS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

6 WAFER SIZES OF POWER ELECTRONICS

- 6.1 INTRODUCTION

- 6.2 UP TO 200 MM

- 6.3 ABOVE 200 MM

7 CURRENT LEVELS OF POWER ELECTRONICS

- 7.1 INTRODUCTION

- 7.2 UP TO 25 A

- 7.3 26 TO 40 A

- 7.4 ABOVE 40 A

8 POWER ELECTRONICS MARKET, BY DEVICE TYPE

- 8.1 INTRODUCTION

- 8.2 POWER DISCRETE

- 8.2.1 ADVANCEMENTS IN ENERGY-EFFICIENT AND HIGH-PERFORMANCE DISCRETE DEVICES DRIVING MARKET GROWTH

- 8.2.2 DIODE

- 8.2.2.1 Mounting type and diode packaging

- 8.2.2.1.1 Through-hole

- 8.2.2.1.2 Surface mount

- 8.2.2.1.3 Packaging categories

- 8.2.2.2 PIN diode

- 8.2.2.3 Zener diode

- 8.2.2.4 Schottky diode

- 8.2.2.5 Switching diode

- 8.2.2.6 Rectifier diode

- 8.2.2.1 Mounting type and diode packaging

- 8.2.3 TRANSISTOR

- 8.2.3.1 Use of smart power transistors in augmenting system reliability and effective power management to propel market growth

- 8.2.3.2 Field-effect transistor (FET)

- 8.2.3.3 Bipolar junction transistor (BJT)

- 8.2.3.4 Insulated gate bipolar transistor (IGBT)

- 8.2.3.4.1 NPT IGBT

- 8.2.3.4.2 PT IGBT

- 8.2.4 THYRISTOR

- 8.3 POWER MODULE

- 8.3.1 RISING DEMAND FOR COMPACT AND HIGH-EFFICIENCY SOLUTIONS DRIVING MARKET GROWTH

- 8.3.2 POWER MODULE, BY DEVICE TYPE

- 8.3.2.1 FET

- 8.3.2.1.1 MOSFET module

- 8.3.2.1.1.1 MOSFET module, by type

- 8.3.2.1.1.2 MOSFET module, by mode

- 8.3.2.1.1 MOSFET module

- 8.3.2.2 IGBT

- 8.3.2.3 Other power module device types

- 8.3.2.1 FET

- 8.3.3 TYPES OF POWER MODULES

- 8.3.3.1 Intelligent power module

- 8.3.3.2 Standard and power integrated module

- 8.4 POWER INTEGRATED CIRCUITS

- 8.4.1 RISING DEMAND FOR COMPACT AND ENERGY-EFFICIENT DESIGNS TO FUEL MARKET GROWTH

9 POWER ELECTRONICS MARKET, BY MATERIAL

- 9.1 INTRODUCTION

- 9.2 SILICON

- 9.3 SILICON CARBIDE (SIC)

- 9.4 GALLIUM NITRIDE (GAN)

10 POWER ELECTRONICS MARKET, BY VOLTAGE LEVEL

- 10.1 INTRODUCTION

- 10.2 LOW

- 10.3 MEDIUM

- 10.4 HIGH

11 POWER ELECTRONICS MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 ICT

- 11.2.1 RISING DATA DEMANDS AND 5G DEPLOYMENT DRIVING MARKET GROWTH

- 11.3 CONSUMER ELECTRONICS

- 11.3.1 DEMAND FOR COMPACT, ENERGY-EFFICIENT DEVICES BOOSTS MARKET GROWTH

- 11.4 INDUSTRIAL

- 11.4.1 AUTOMATION AND ENERGY EFFICIENCY INITIATIVES PROPELLING MARKET GROWTH

- 11.4.2 ENERGY & POWER

- 11.4.2.1 Photovoltaics

- 11.4.2.2 Wind turbines

- 11.5 AUTOMOTIVE & TRANSPORTATION

- 11.5.1 INCREASING ADOPTION OF FAST-CHARGING ELECTRIC VEHICLES TO CONTRIBUTE TO MARKET GROWTH

- 11.5.1.1 Powertrain

- 11.5.1.2 Body and convenience

- 11.5.1.3 Chassis and safety systems

- 11.5.1.4 Infotainment systems

- 11.5.1 INCREASING ADOPTION OF FAST-CHARGING ELECTRIC VEHICLES TO CONTRIBUTE TO MARKET GROWTH

- 11.6 AEROSPACE & DEFENSE

- 11.6.1 GROWING DEMAND FOR ELECTRIC AIRCRAFT AND HIGH-FREQUENCY WARFARE SYSTEMS TO FUEL MARKET GROWTH

- 11.7 OTHER VERTICALS

12 POWER ELECTRONICS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 US

- 12.2.2.1 Surging electrification trends and federal initiatives boost market growth

- 12.2.3 CANADA

- 12.2.3.1 Government sustainability policies and electrification goals driving market growth

- 12.2.4 MEXICO

- 12.2.4.1 Electrification initiatives and industrial modernization fueling demand

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 UK

- 12.3.2.1 Active government support to reduce carbon footprint across various verticals to drive market

- 12.3.3 GERMANY

- 12.3.3.1 Stringent environmental regulations and electrification goals to fuel market

- 12.3.4 FRANCE

- 12.3.4.1 Increasing adoption of EVs to reduce pollution to boost market growth

- 12.3.5 ITALY

- 12.3.5.1 Electricity production from renewable energy sources to support market growth

- 12.3.6 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 CHINA

- 12.4.2.1 Adoption of EVs and development of renewable energy sources to fuel market growth

- 12.4.3 JAPAN

- 12.4.3.1 Focus on renewable energy production and adoption of SiC technology to contribute to market growth

- 12.4.4 INDIA

- 12.4.4.1 Rapid urbanization and infrastructure modernization to drive market

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Government-driven electrification and semiconductor innovation to fuel demand

- 12.4.6 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 ROW: MACROECONOMIC OUTLOOK

- 12.5.2 SOUTH AMERICA

- 12.5.2.1 Rising demand from energy and industrial sectors in Brazil to contribute to market growth

- 12.5.3 MIDDLE EAST & AFRICA

- 12.5.3.1 GCC countries

- 12.5.3.2 Rest of Middle East & Africa

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND/PRODUCT COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Device type footprint

- 13.7.5.4 Vertical footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 List of startups/SMEs

- 13.8.5.2 Competitive benchmarking of startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 INTRODUCTION

- 14.2 KEY PLAYERS

- 14.2.1 INFINEON TECHNOLOGIES AG

- 14.2.1.1 Business overview

- 14.2.1.2 Products/Solutions/Services offered

- 14.2.1.3 Recent developments

- 14.2.1.3.1 Product Launches

- 14.2.1.3.2 Deals

- 14.2.1.4 MnM view

- 14.2.1.4.1 Key strengths

- 14.2.1.4.2 Strategic choices

- 14.2.1.4.3 Weaknesses and competitive threats

- 14.2.2 SEMICONDUCTOR COMPONENTS INDUSTRIES, LLC

- 14.2.2.1 Business overview

- 14.2.2.2 Products/Solutions/Services offered

- 14.2.2.3 Recent developments

- 14.2.2.3.1 Product launches

- 14.2.2.3.2 Deals

- 14.2.2.4 MnM view

- 14.2.2.4.1 Key strengths

- 14.2.2.4.2 Strategic choices

- 14.2.2.4.3 Weaknesses and competitive threats

- 14.2.3 STMICROELECTRONICS

- 14.2.3.1 Business overview

- 14.2.3.2 Products/Solutions/Services offered

- 14.2.3.3 Recent developments

- 14.2.3.3.1 Product launches

- 14.2.3.3.2 Deals

- 14.2.3.3.3 Expansions

- 14.2.3.4 MnM view

- 14.2.3.4.1 Key strengths

- 14.2.3.4.2 Strategic choices

- 14.2.3.4.3 Weaknesses and competitive threats

- 14.2.4 TEXAS INSTRUMENTS INCORPORATED

- 14.2.4.1 Business overview

- 14.2.4.2 Products/Solutions/Services offered

- 14.2.4.3 Recent developments

- 14.2.4.3.1 Product launches

- 14.2.4.3.2 Deals

- 14.2.4.4 MnM view

- 14.2.4.4.1 Key strengths

- 14.2.4.4.2 Strategic choices

- 14.2.4.4.3 Weaknesses and competitive threats

- 14.2.5 ANALOG DEVICES, INC.

- 14.2.5.1 Business overview

- 14.2.5.2 Products/Solutions/Services offered

- 14.2.5.3 Recent developments

- 14.2.5.3.1 Product launches

- 14.2.5.3.2 Deals

- 14.2.5.4 MnM view

- 14.2.5.4.1 Key strengths

- 14.2.5.4.2 Strategic choices

- 14.2.5.4.3 Weaknesses and competitive threats

- 14.2.6 MITSUBISHI ELECTRIC CORPORATION

- 14.2.6.1 Business overview

- 14.2.6.2 Products/Solutions/Services offered

- 14.2.6.3 Recent developments

- 14.2.6.3.1 Product Launches

- 14.2.6.3.2 Deals

- 14.2.7 VISHAY INTERTECHNOLOGY, INC.

- 14.2.7.1 Business overview

- 14.2.7.2 Products/Solutions/Services offered

- 14.2.7.3 Recent developments

- 14.2.7.3.1 Product Launches

- 14.2.7.3.2 Deals

- 14.2.8 FUJI ELECTRIC CO., LTD.

- 14.2.8.1 Business overview

- 14.2.8.2 Products/Solutions/Services offered

- 14.2.8.3 Recent developments

- 14.2.8.3.1 Product Launches

- 14.2.8.3.2 Deals

- 14.2.9 TOSHIBA CORPORATION

- 14.2.9.1 Business overview

- 14.2.9.2 Products/Solutions/Services offered

- 14.2.9.3 Recent developments

- 14.2.9.3.1 Product Launches

- 14.2.9.3.2 Deals

- 14.2.10 RENESAS ELECTRONICS CORPORATION

- 14.2.10.1 Business overview

- 14.2.10.2 Products/Solutions/Services offered

- 14.2.10.3 Recent developments

- 14.2.10.3.1 Product Launches

- 14.2.10.3.2 Deals

- 14.2.1 INFINEON TECHNOLOGIES AG

- 14.3 OTHER PLAYERS

- 14.3.1 ABB

- 14.3.2 LITTELFUSE, INC.

- 14.3.3 NXP SEMICONDUCTORS

- 14.3.4 MICROCHIP TECHNOLOGY INC.

- 14.3.5 ROHM CO., LTD.

- 14.3.6 SEMIKRON

- 14.3.7 TRANSPHORM INC.

- 14.3.8 QORVO, INC.

- 14.3.9 WOLFSPEED, INC.

- 14.3.10 EUCLID TECHLABS

- 14.3.11 NAVITAS SEMICONDUCTOR

- 14.3.12 EFFICIENT POWER CONVERSION CORPORATION

- 14.3.13 POWDEC

- 14.3.14 GANPOWER

- 14.3.15 NEXGEN POWER

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS