|

시장보고서

상품코드

1793324

동물 감염병 진단 시장 : 제품별, 기술별, 동물 유형별, 최종 사용자별, 지역별 예측(-2030년)Veterinary Infectious Disease Diagnostics Market by Product (Consumables, Instruments), Technology (Molecular Diagnostic, PCR, ELISA, Immunodiagnostics, Rapid Tests), Animal Type (Companion Animal, Livestock), End User & Region - Global Forecast to 2030 |

||||||

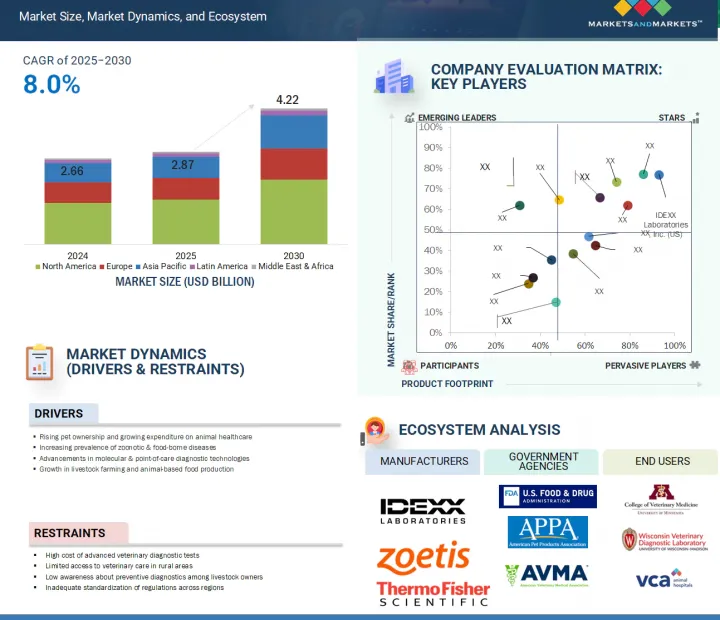

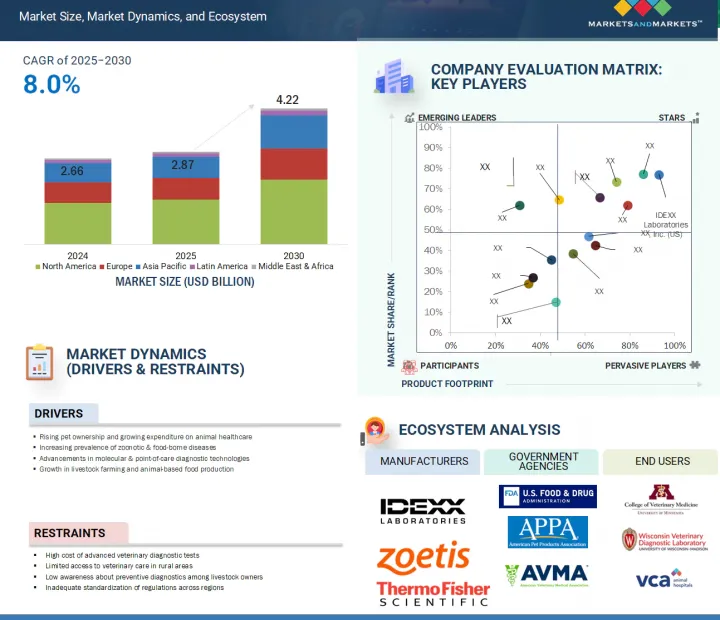

동물 감염병 진단 시장 규모는 2025년 28억 7,000만 달러에서 2030년에는 42억 2,000만 달러에 이를 것으로 예측되며, CAGR 8.0%의 성장이 전망됩니다.

이 성장은 동물 건강 및 질병 관리 분야의 변화하는 미래를 반영하는 여러 중요한 요인에 의해 촉진되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 제품별, 기술별, 동물 유형별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

주요 촉진 요인 중 하나는 반려동물과 가축 모두에서 감염병의 부담이 증가함에 따라 신속하고 신뢰할 수 있으며 현장 전개가 가능한 진단 솔루션에 대한 수요가 높아지고 있다는 점입니다. 조류 인플루엔자, 레프토스피라증, 브루셀라증 등 질병의 발생 증가로 인해 수의사 및 동물 사육자들은 위험을 완화하기 위해 조기 및 정확한 검출을 우선순위로 삼고 있습니다.

또 다른 중요한 요인은 예방적 수의학으로의 전환입니다. 반려동물 소유자와 가축 관리자의 인식이 높아지면서 감염이 악화되기 전에 감염을 조기에 발견하기 위한 정기 검진과 건강 모니터링에 대한 강조가 강화되고 있습니다. 이 동향은 인수공통 감염병의 전파와 관련된 경제적 및 퍼블릭 보건적 영향에 대한 인식이 증가함에 따라 더욱 강화되고 있습니다.

반려동물 세분화은 특히 도시 지역의 고소득 가구에서 반려동물 사육이 증가함에 따라 동물 감염병 진단 시장에서 가장 높은 성장이 예상됩니다. 반려동물의 주인은 인류 공통 감염에 대한 의식 증가와 조기 발견의 중요성으로부터 건강 진단 및 진단 서비스에 대한 투자에 적극적입니다. 게다가, 포인트 오브 케어와 재택 진단 도구의 기술 혁신은 반려동물 주인과 수의사 모두에게 접근성을 향상시킵니다. 동물 병원을 방문하는 빈도가 증가하고 반려동물의 건강 관리 지출이 증가하고 있기 때문에이 분야는 시장 급성장이 예측됩니다.

2024년 면역진단 부문은 비용 효율성과 높은 정확성으로 인해 동물 감염병 진단 시장에서 주도적인 위치를 차지했습니다. ELISA와 측면 유동 검사(lateral flow assays)와 같은 기술은 반려동물과 가축에서 다양한 감염병을 검출하는 데 널리 사용됩니다. 이러한 검사는 빠른 결과 제공, 사용 편의성, 최소한의 장비 요구사항으로 인해 수의사 클리닉과 현장 사용에 이상적입니다. 특정 항원이나 항체를 검출할 수 있는 능력은 조기 진단과 효과적인 질병 관리를 가능하게 하여 대규모 인구 검진 및 정기 감시 프로그램에 유용합니다.

아시아태평양 지역은 인구 통계적, 경제적, 의료적 요인으로 인해 동물 감염병 진단 시장 성장률이 가장 높을 것으로 예상됩니다. 해당 지역의 대규모 가축 인구는 발굽구진병과 조류 인플루엔자 등 증가하는 감염병에 대응하기 위한 정확한 진단 수요를 촉진하고 있습니다. 또한 중국과 인도 도시 지역에서 반려동물 수가 증가함에 따라 수의학 의료 지출이 확대되고 있습니다. 강화된 수의학 인프라, 인수공통 감염병 위협에 대한 인식 향상, 동물 건강에 대한 투자도 시장 성장에 기여하고 있습니다. 기업들은 고급 진단 기술에 대한 접근성을 개선하기 위해 해당 지역의 존재감을 확대하고 있습니다.

본 보고서에서는 세계의 동물 감염병 진단 시장에 대해 조사했으며, 제품별, 기술별, 동물 유형별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 시장 역학

- 업계 동향

- 기술 분석

- Porter's Five Forces 분석

- 규제 분석

- 특허 분석

- 무역 분석

- 가격 분석

- 상환 분석

- 주된 회의 및 이벤트(2025-2026년)

- 주요 이해관계자와 구매 기준

- 최종 사용자의 시점과 미충족 요구

- 동물 감염병 진단 시장에 있어서의 AI의 영향

- 생태계 분석

- 밸류체인 분석

- 공급망 분석

- 인접 시장 분석

- 투자 및 자금조달 시나리오

- 미국 관세의 영향 및 동물 감염병 진단 시장에 미치는 영향(2025년)

제6장 동물 감염병 진단 시장(제품별)

- 소개

- 소모품

- 장비

제7장 동물 감염병 진단 시장(기술별)

- 소개

- 면역 진단

- 분자 진단

- 기타

제8장 동물 감염병 진단 시장(동물 유형별)

- 소개

- 반려동물

- 가축

제9장 동물 감염병 진단 시장(최종 사용자별)

- 소개

- 수의학 참고 실험실

- 동물병원 및 클리닉

- 현장 진단/내부 검사

- 수의학 연구 기관 및 대학

제10장 동물 감염병 진단 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 네덜란드

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 뉴질랜드

- 베트남

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 기타

제11장 경쟁 구도

- 개요

- 주요 진입기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진출기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 브랜드/제품 비교

- 주요 기업의 연구 개발비

- 기업평가와 재무지표

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- IDEXX LABORATORIES, INC.

- ZOETIS SERVICES LLC

- THERMO FISHER SCIENTIFIC INC.

- VIRBAC

- BIOMERIEUX

- ANTECH DIAGNOSTICS, INC.

- INNOVATIVE DIAGNOSTICS

- NEOGEN CORPORATION

- INDICAL BIOSCIENCE GMBH

- AGROLABO SPA

- BIONOTE

- BIOGAL

- BIOCHEK

- MEGACOR DIAGNOSTIK GMBH

- BIO-RAD LABORATORIES, INC.

- 기타 기업

- FASSISI, GMBH

- BIOTANGENTS LIMITED

- SKYER, INC.

- BIOPANDA REAGENTS LTD.

- SHENZHEN BIOEASY BIOTECHNOLOGY, INC.

- GOLD STANDARD DIAGNOSTICS

- BIO-X DIAGNOSTICS SA

- DEMEDITEC DIAGNOSTICS GMBH

- EUROIMMUN MEDIZINISCHE LABORDIAGNOSTIKA AG

- BIOSTONE ANIMAL HEALTH

제13장 부록

HBR 25.08.22The veterinary infectious disease diagnostics market is expected to grow from USD 2.87 billion in 2025 to USD 4.22 billion by 2030, at a CAGR of 8.0%. This growth is driven by several important factors that reflect the changing landscape of animal health and disease management.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Product, Technology, Animal Type, End User, Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

One primary driver is the increasing burden of infectious diseases among both companion animals and livestock, which has heightened the need for rapid, reliable, and field-deployable diagnostic solutions. The rise in outbreaks of diseases such as avian influenza, leptospirosis, and brucellosis is leading veterinarians and animal producers to prioritize early and accurate detection to mitigate risks.

Another significant factor is the shift towards preventive veterinary care. As awareness grows among pet owners and livestock handlers, there is a stronger emphasis on routine screenings and health monitoring to identify infections before they escalate. This trend is also supported by a growing recognition of the economic and public health consequences associated with the transmission of zoonotic diseases.

"By animal type, the companion animals segment is projected to grow at the highest CAGR during the forecast period."

The companion animals segment is expected to see the highest growth in the veterinary infectious disease diagnostics market, driven by increasing pet ownership, especially in urban high-income households. Pet owners are more willing to invest in health check-ups and diagnostic services due to the growing awareness of zoonotic diseases and the importance of early detection. Additionally, innovations in point-of-care and home-based diagnostic tools enhance access for both pet owners and veterinarians. With more frequent visits to veterinary clinics and rising healthcare spending for pets, this segment is projected for rapid growth in the market.

"By technology, the immunodiagnostics segment accounted for the largest market share in 2024."

In 2024, the immunodiagnostics segment dominated the veterinary infectious disease diagnostics market due to its cost-effectiveness and high accuracy. Techniques like ELISA and lateral flow assays are commonly used to detect various infectious diseases in companion and livestock animals. These tests provide rapid results, are user-friendly, and require minimal equipment, making them ideal for veterinary clinics and field use. Their ability to detect specific antigens or antibodies enables early diagnosis and effective disease management, making them valuable for large population screenings and routine surveillance programs.

"The Asia Pacific region is expected to witness the highest growth rate during the forecast period."

The Asia Pacific is set to experience the highest growth in the veterinary infectious disease diagnostics market due to various demographic, economic, and healthcare factors. The region's large livestock population drives the demand for accurate diagnostics to address rising infectious diseases like foot-and-mouth disease and avian influenza. Additionally, the increasing number of companion animals, especially in urban areas of China and India, is boosting veterinary healthcare spending. Enhanced veterinary infrastructure, heightened awareness of zoonotic threats, and investments in animal health are also contributing to market growth. Companies are expanding their presence in the region to improve access to advanced diagnostic technologies.

Breakdown of supply-side primary interviews:

- By Company Type: Tier 1 (45%), Tier 2 (20%), and Tier 3 (35%)

- By Designation: C-level Executives (35%), Directors (25%), and Other Designations (40%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Breakdown of demand-side primary interviews:

- By End User: Veterinary Reference Laboratories (40%), Veterinary Hospitals & Clinics (25%), POC/In-house Testing (20%), and Veterinary Research Institutes & Universities (15%)

- By Designation: Veterinary Healthcare Professionals (35%), Department Heads (27%), Procurement Heads (22%), and Other Designations (16%)

- By Region: North America (40%), Europe (25%), Asia Pacific (20%), Latin America (10%), and the Middle East & Africa (5%)

Research Coverage

The market study covers the veterinary infectious disease diagnostics market in various segments. It aims to estimate the market size and growth potential of this market by product, technology, animal type, end user, and region. The study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their products and business offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report can assist established companies and newer or smaller firms in understanding market trends, enabling them to capture a larger market share. Firms that acquire the report can implement one or more of the five strategies outlined below.

This report provides insights into the following points:

- Analysis of key drivers (growth in companion animal population, increasing demand for animal-derived food products, growing concerns about infectious zoonotic diseases, rising demand for pet insurance and growing animal health expenditures, increasing number of veterinary practitioners and rising income levels in developed markets, and growing focus on disease control and prevention measures), restraints (rising pet care costs and high cost of veterinary diagnostic tests), opportunities (growth potential of emerging economies and integration of AI and ML), and challenges (low animal healthcare awareness in emerging countries and shortage of veterinary practitioners in emerging economies) influencing the growth of the veterinary infectious disease diagnostics market.

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the veterinary infectious disease diagnostics market.

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of veterinary infectious disease diagnostic products across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the veterinary infectious disease diagnostics market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the veterinary infectious disease diagnostics market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 MARKET STAKEHOLDERS

- 1.5 LIMITATIONS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.2 RESEARCH METHODOLOGY DESIGN

- 2.2.1 SECONDARY RESEARCH

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Key data from primary sources

- 2.2.2.2 Key industry insights

- 2.2.1 SECONDARY RESEARCH

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ESTIMATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RISK ASSESSMENT

- 2.8 RESEARCH LIMITATIONS

- 2.8.1 METHODOLOGY-RELATED LIMITATIONS

- 2.8.2 SCOPE-RELATED LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY PRODUCT & COUNTRY (2024)

- 4.3 INFECTIOUS DISEASE DIAGNOSTICS MARKET: REGIONAL MIX

- 4.4 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET: DEVELOPED VS. EMERGING ECONOMIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 DRIVERS

- 5.1.1.1 Growth in companion animal population

- 5.1.1.2 Increasing demand for animal-derived food products

- 5.1.1.3 Growing concerns about infectious zoonotic diseases

- 5.1.1.4 Rising demand for pet insurance and growing animal health expenditure

- 5.1.1.5 Increasing number of veterinary practitioners and rising income levels in developed markets

- 5.1.1.6 Growing focus on disease control & prevention measures

- 5.1.2 RESTRAINTS

- 5.1.2.1 Rising pet care costs

- 5.1.2.2 High cost of veterinary diagnostic tests

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 Growth potential of emerging economies

- 5.1.3.2 Integration of AI & ML

- 5.1.4 CHALLENGES

- 5.1.4.1 Low animal healthcare awareness in emerging countries

- 5.1.4.2 Shortage of veterinary practitioners in emerging economies

- 5.1.1 DRIVERS

- 5.2 INDUSTRY TRENDS

- 5.2.1 ADOPTION OF MULTIPLE TEST PANELS

- 5.2.2 OUTSOURCING OF VETERINARY DIAGNOSTIC TESTING SERVICES

- 5.2.3 GROWING SCALE OF VETERINARY BUSINESSES

- 5.3 TECHNOLOGY ANALYSIS

- 5.3.1 KEY TECHNOLOGIES

- 5.3.1.1 Portable instruments for POC diagnostic services

- 5.3.1.2 Biosensor-based diagnostic systems

- 5.3.2 ADJACENT TECHNOLOGIES

- 5.3.2.1 Wearable biosensors & remote monitoring devices

- 5.3.2.2 Rapid & sensitive veterinary diagnostic kits

- 5.3.2.3 Breath & saliva-based diagnostic tools

- 5.3.2.4 Microfluidics & Lab-on-a-chip devices

- 5.3.3 COMPLEMENTARY TECHNOLOGIES

- 5.3.3.1 AI-driven diagnostic platforms

- 5.3.3.2 Next-generation sequencing (NGS)

- 5.3.1 KEY TECHNOLOGIES

- 5.4 PORTER'S FIVE FORCES ANALYSIS

- 5.4.1 THREAT OF NEW ENTRANTS

- 5.4.2 THREAT OF SUBSTITUTES

- 5.4.3 BARGAINING POWER OF SUPPLIERS

- 5.4.4 BARGAINING POWER OF BUYERS

- 5.4.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5 REGULATORY ANALYSIS

- 5.5.1 REGULATORY LANDSCAPE

- 5.5.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.5.2.1 North America

- 5.5.2.2 Europe

- 5.5.2.3 Rest of the World

- 5.6 PATENT ANALYSIS

- 5.6.1 PATENT PUBLICATION TRENDS FOR VETERINARY INFECTIOUS DISEASE DIAGNOSTICS

- 5.6.2 JURISDICTION & TOP APPLICANT ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 TRADE DATA FOR HS CODE 9018

- 5.7.1.1 Import data for HS Code 9018

- 5.7.1.2 Export data for HS Code 9018

- 5.7.1 TRADE DATA FOR HS CODE 9018

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY PRODUCT, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE, BY REGION, 2022-2024

- 5.8.2.1 Average selling price of ELISA and PCR test kits, by region, 2024

- 5.8.2.2 Average selling price trend of ELISA test kits (per 96-well kit), by region, 2022-2024

- 5.8.2.3 Average selling price trend of lateral flow rapid tests (per unit), by region, 2022-2024

- 5.8.2.4 Average selling price trend of PCR test kits (veterinary panels), by region, 2022-2024

- 5.8.2.5 Average selling price trend of immunoassay analyzers (benchtop), by region, 2022-2024

- 5.8.2.6 Average selling price trend of high-end immunoassay analyzers, by region, 2022-2024

- 5.8.2.7 Average selling price trend of nucleic acid sequencers (benchtop), by region, 2022-2024

- 5.9 REIMBURSEMENT ANALYSIS

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 END-USER PERSPECTIVE & UNMET NEEDS

- 5.13 IMPACT OF AI ON VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET

- 5.13.1 INTRODUCTION

- 5.13.2 MARKET POTENTIAL IN VETERINARY INFECTIOUS DISEASE DIAGNOSTICS ECOSYSTEM

- 5.13.3 AI USE CASES

- 5.13.4 KEY COMPANIES IMPLEMENTING AI IN VETERINARY INFECTIOUS DISEASE DIAGNOSTICS

- 5.14 ECOSYSTEM ANALYSIS

- 5.15 VALUE CHAIN ANALYSIS

- 5.16 SUPPLY CHAIN ANALYSIS

- 5.17 ADJACENT MARKET ANALYSIS

- 5.18 INVESTMENT & FUNDING SCENARIO

- 5.19 IMPACT OF 2025 US TARIFF ON VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 CONSUMABLES

- 6.2.1 RECURRENT PURCHASE OF DIAGNOSTIC KITS AND REAGENTS TO BOOST MARKET GROWTH

- 6.3 INSTRUMENTS

- 6.3.1 INCREASING DEMAND FOR POC ANALYZERS TO SUPPORT MARKET GROWTH

7 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 IMMUNODIAGNOSTICS

- 7.2.1 LATERAL FLOW ASSAYS

- 7.2.1.1 Lateral flow rapid tests

- 7.2.1.1.1 Ability to provide real-time insights to drive market

- 7.2.1.2 Lateral flow strip readers

- 7.2.1.2.1 Rising need for readers to determine analyte quantity to fuel adoption

- 7.2.1.1 Lateral flow rapid tests

- 7.2.2 ELISA TESTS

- 7.2.2.1 Cost-effectiveness and ease of use to drive market

- 7.2.3 IMMUNOASSAY ANALYZERS

- 7.2.3.1 High sensitivity & specificity for biomarker detection to drive market

- 7.2.4 OTHER IMMUNODIAGNOSTIC TECHNOLOGIES

- 7.2.1 LATERAL FLOW ASSAYS

- 7.3 MOLECULAR DIAGNOSTICS

- 7.3.1 PCR TESTS

- 7.3.1.1 Increased laboratory usage in proteomics & genomics to support growth

- 7.3.2 NUCLEIC ACID SEQUENCING

- 7.3.2.1 Growing use of nucleic acid sequencing to identify pathogens to fuel market

- 7.3.3 MICROARRAYS

- 7.3.3.1 Growing applications of biochips in identifying infectious diseases to drive market

- 7.3.4 OTHER MOLECULAR DIAGNOSTIC TECHNOLOGIES

- 7.3.1 PCR TESTS

- 7.4 OTHER TECHNOLOGIES

8 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY ANIMAL TYPE

- 8.1 INTRODUCTION

- 8.2 COMPANION ANIMALS

- 8.2.1 COMPANION ANIMALS MARKET, BY ANIMAL TYPE

- 8.2.1.1 Dogs

- 8.2.1.1.1 High insurance coverage for dogs and rising disposable incomes to drive market

- 8.2.1.2 Cats

- 8.2.1.2.1 Growing pet cat population to support growth

- 8.2.1.3 Horses

- 8.2.1.3.1 Growing equine health awareness to drive market

- 8.2.1.4 Other companion animals

- 8.2.1.1 Dogs

- 8.2.2 COMPANION ANIMALS MARKET, BY TECHNOLOGY

- 8.2.2.1 Immunodiagnostics

- 8.2.2.1.1 Lateral flow assays

- 8.2.2.1.1.1 Rapid results, no requirement for multiple sample batches, and ease of visual reading to drive market growth

- 8.2.2.1.2 ELISA tests

- 8.2.2.1.2.1 High sensitivity, specificity, and precision of ELISA tests to drive market

- 8.2.2.1.3 Immunoassay analyzers

- 8.2.2.1.3.1 Ability to process multiple samples to drive adoption of immunoassay analyzers

- 8.2.2.1.4 Other immunodiagnostic technologies

- 8.2.2.1.1 Lateral flow assays

- 8.2.2.2 Molecular diagnostics

- 8.2.2.2.1 PCR tests

- 8.2.2.2.1.1 Extensive use of PCR due to its high specificity and sensitivity to boost adoption

- 8.2.2.2.2 Nucleic acid sequencing

- 8.2.2.2.2.1 Increasing use of nucleic acid sequencing for pathogen discovery and identification to support growth

- 8.2.2.2.3 Microarrays

- 8.2.2.2.3.1 Technological advancements and increasing incidence of infectious diseases to fuel demand for microarrays

- 8.2.2.2.4 Other molecular diagnostic technologies

- 8.2.2.2.1 PCR tests

- 8.2.2.3 Other technologies

- 8.2.2.1 Immunodiagnostics

- 8.2.1 COMPANION ANIMALS MARKET, BY ANIMAL TYPE

- 8.3 LIVESTOCK

- 8.3.1 LIVESTOCK MARKET, BY ANIMAL TYPE

- 8.3.1.1 Cattle

- 8.3.1.1.1 Growing consumption of meat to support market growth

- 8.3.1.2 Pigs

- 8.3.1.2.1 Growing incidence of infectious diseases to drive market

- 8.3.1.3 Poultry

- 8.3.1.3.1 Increasing demand for poultry meat to contribute to market growth

- 8.3.1.4 Other livestock

- 8.3.1.1 Cattle

- 8.3.2 LIVESTOCK MARKET, BY TECHNOLOGY

- 8.3.2.1 Immunodiagnostics

- 8.3.2.1.1 Lateral flow assays

- 8.3.2.1.1.1 Field-readiness and stakeholder accessibility of LFAs to boost demand

- 8.3.2.1.2 ELISA tests

- 8.3.2.1.2.1 Cost-effectiveness, high sensitivity, and ease of use to drive ELISA market

- 8.3.2.1.3 Immunoassay analyzers

- 8.3.2.1.3.1 High sensitivity & specificity for biomarker detection to drive market

- 8.3.2.1.4 Other immunodiagnostic technologies

- 8.3.2.1.1 Lateral flow assays

- 8.3.2.2 Molecular diagnostics

- 8.3.2.2.1 PCR tests

- 8.3.2.2.1.1 Growing use of PCR in proteomics and genomics to drive market growth

- 8.3.2.2.2 Nucleic acid sequencing

- 8.3.2.2.2.1 Identification of pathogens to fuel market

- 8.3.2.2.3 Microarrays

- 8.3.2.2.3.1 Emergence of biochips and growing applications in identifying infectious diseases to drive growth

- 8.3.2.2.4 Other molecular diagnostic technologies

- 8.3.2.2.1 PCR tests

- 8.3.2.3 Other technologies

- 8.3.2.1 Immunodiagnostics

- 8.3.1 LIVESTOCK MARKET, BY ANIMAL TYPE

9 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 VETERINARY REFERENCE LABORATORIES

- 9.2.1 LARGE VOLUME OF TESTING SAMPLES AND AVAILABILITY OF SKILLED WORKFORCE TO PROPEL MARKET

- 9.3 VETERINARY HOSPITALS & CLINICS

- 9.3.1 GROWING PET OWNERSHIP AND SPENDING ON PET CARE TO DRIVE MARKET

- 9.4 POINT-OF-CARE/IN-HOUSE TESTING

- 9.4.1 COST-EFFECTIVENESS AND RAPID RESULTS TO BOOST DEMAND

- 9.5 VETERINARY RESEARCH INSTITUTES & UNIVERSITIES

- 9.5.1 INCREASING COLLABORATIONS BETWEEN PRIVATE COMPANIES AND RESEARCH INSTITUTES TO SUPPORT GROWTH

10 VETERINARY INFECTIOUS DISEASE DIAGNOSTICS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High veterinary healthcare expenditure to drive market

- 10.2.3 CANADA

- 10.2.3.1 Growing pet adoption to drive market

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising awareness of zoonotic diseases to fuel market

- 10.3.3 UK

- 10.3.3.1 Increasing pet ownership to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Willingness of pet owners to spend on pet health to drive market

- 10.3.5 ITALY

- 10.3.5.1 Growing consumption of meat & dairy products to drive market

- 10.3.6 SPAIN

- 10.3.6.1 Growing demand for poultry products to fuel market

- 10.3.7 NETHERLANDS

- 10.3.7.1 Developments in veterinary diagnostic products to support market growth

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Increasing incidence of zoonotic diseases to propel market

- 10.4.3 JAPAN

- 10.4.3.1 Increasing pet expenditure to support market growth

- 10.4.4 INDIA

- 10.4.4.1 Increasing demand for dairy products to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Rise in pet ownership to support market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising need for specialized veterinary services to drive market

- 10.4.7 NEW ZEALAND

- 10.4.7.1 Focus on pet insurance to aid market

- 10.4.8 VIETNAM

- 10.4.8.1 Growing focus on disease surveillance to drive market

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Growth in livestock industry to boost demand

- 10.5.3 MEXICO

- 10.5.3.1 Increasing focus on poultry-associated products to support market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 GCC COUNTRIES

- 10.6.2.1 Kingdom of Saudi Arabia (KSA)

- 10.6.2.1.1 Technological advancements in veterinary diagnostics to boost demand

- 10.6.2.2 United Arab Emirates (UAE)

- 10.6.2.2.1 Favorable government support for vet diagnostics to drive market

- 10.6.2.3 Rest of GCC Countries

- 10.6.2.1 Kingdom of Saudi Arabia (KSA)

- 10.6.3 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGY/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 MARKET SHARE ANALYSIS FOR COMPANION ANIMALS

- 11.4.2 MARKET SHARE ANALYSIS FOR LIVESTOCK

- 11.4.3 RANKING OF KEY MARKET PLAYERS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Technology footprint

- 11.5.5.5 Animal type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups

- 11.7 BRAND/PRODUCT COMPARISON

- 11.8 R&D EXPENDITURE OF KEY PLAYERS

- 11.9 COMPANY VALUATION & FINANCIAL METRICS

- 11.9.1 FINANCIAL METRICS

- 11.9.2 COMPANY VALUATION

- 11.10 COMPETITIVE SCENARIO

- 11.10.1 PRODUCT LAUNCHES & ENHANCEMENTS

- 11.10.2 DEALS

- 11.10.3 EXPANSIONS

- 11.10.4 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products & services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product/Service launches & enhancements

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 ZOETIS SERVICES LLC

- 12.1.2.1 Business overview

- 12.1.2.2 Products & services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product enhancements

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 THERMO FISHER SCIENTIFIC INC.

- 12.1.3.1 Business overview

- 12.1.3.2 Products & services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 VIRBAC

- 12.1.4.1 Business overview

- 12.1.4.2 Products & services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 BIOMERIEUX

- 12.1.5.1 Business overview

- 12.1.5.2 Products & services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches & approvals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 ANTECH DIAGNOSTICS, INC.

- 12.1.6.1 Business overview

- 12.1.6.2 Products & services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Expansions

- 12.1.7 INNOVATIVE DIAGNOSTICS

- 12.1.7.1 Business overview

- 12.1.7.2 Products & services offered

- 12.1.8 NEOGEN CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products & services offered

- 12.1.8.2.1 Other developments

- 12.1.9 INDICAL BIOSCIENCE GMBH

- 12.1.9.1 Business overview

- 12.1.9.2 Products & services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product enhancements

- 12.1.10 AGROLABO S.P.A.

- 12.1.10.1 Business overview

- 12.1.10.2 Products & services offered

- 12.1.11 BIONOTE

- 12.1.11.1 Business overview

- 12.1.11.2 Products & services offered

- 12.1.11.3 Recent developments

- 12.1.11.4 Product launches

- 12.1.11.4.1 Deals

- 12.1.12 BIOGAL

- 12.1.12.1 Business overview

- 12.1.12.2 Products & services offered

- 12.1.13 BIOCHEK

- 12.1.13.1 Business overview

- 12.1.13.2 Products & services offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Product launches

- 12.1.13.3.2 Deals

- 12.1.14 MEGACOR DIAGNOSTIK GMBH

- 12.1.14.1 Business overview

- 12.1.14.2 Products & services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches & enhancements

- 12.1.15 BIO-RAD LABORATORIES, INC.

- 12.1.15.1 Business overview

- 12.1.15.2 Products & services offered

- 12.1.1 IDEXX LABORATORIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 FASSISI, GMBH

- 12.2.2 BIOTANGENTS LIMITED

- 12.2.3 SKYER, INC.

- 12.2.4 BIOPANDA REAGENTS LTD.

- 12.2.5 SHENZHEN BIOEASY BIOTECHNOLOGY, INC.

- 12.2.6 GOLD STANDARD DIAGNOSTICS

- 12.2.7 BIO-X DIAGNOSTICS S.A.

- 12.2.8 DEMEDITEC DIAGNOSTICS GMBH

- 12.2.9 EUROIMMUN MEDIZINISCHE LABORDIAGNOSTIKA AG

- 12.2.10 BIOSTONE ANIMAL HEALTH

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS