|

시장보고서

상품코드

1793329

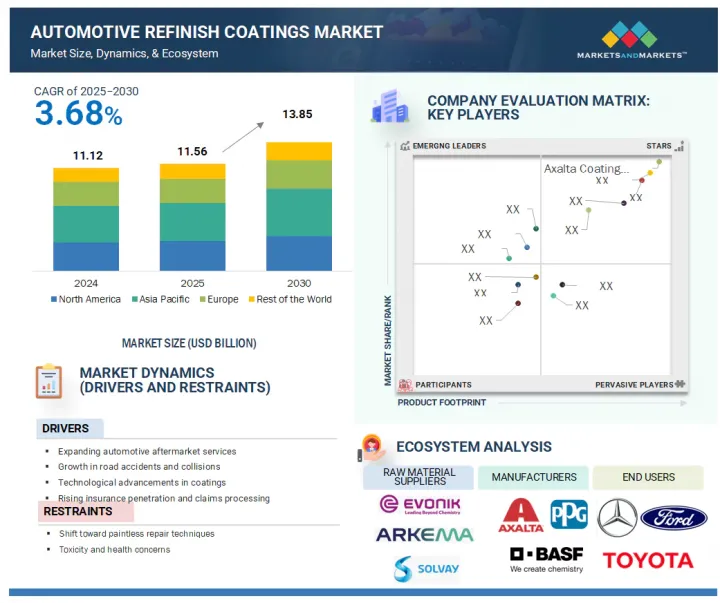

자동차 보수용 코팅 시장 : 레이어별, 수지 유형별, 차량 유형별, 지역별 예측(-2030년)Automotive Refinish Coatings Market by Layer (Clearcoat, Basecoat, Primer), Resin Type (Polyurethane, Epoxy, Acrylic, Alkyd), Vehicle Type (Passenger Cars, Commercial Vehicles), and Region - Global Forecast to 2030 |

||||||

전 세계 자동차 애프터마켓 인프라의 성숙도와 발전은 자동차 보수용 코팅 시장 확장을 위한 유리한 기반을 마련했습니다.

티어별 딜러십 서비스 센터, 인증된 충돌 수리 네트워크부터 독립형 정비소 및 프랜차이즈 수리 체인에 이르기까지, 표준화되고 품질 관리된 보수 시설의 수는 지속적으로 증가하고 있으며, 이는 제품 유통 미래의 가장 먼 지역까지 도달하고 브랜드 노출을 확대하는 데 있어 매력적인 요인으로 작용하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2023-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(100만 달러), 킬로톤(KT) |

| 부문 | 레이어 유형, 수지 유형, 차량 유형, 지역 |

| 대상 지역 | 아시아태평양, 유럽, 북미 및 기타 지역 |

더 구체적으로, 시설들은 고급 재고 관리 시스템, 디지털 구매 플랫폼, 고객 관계 관리 도구 등을 활용해 대량 구매와 일관된 코팅 소비를 지원합니다. 애프터마켓은 차량 소유주와 품질 좋은 워크숍을 연결하는 온라인 사이트 등 보수 중개업체의 등장으로 더욱 정의됩니다. 이러한 플랫폼은 서비스 패키지의 일부로 보수용 브랜드를 추천할 수 있습니다. 따라서 강력한 애프터마켓 생태계는 지역별 볼륨과 가치 성장을 지원하는 수요 안정화 역할을 합니다.

프라이머 부문은 전 세계 자동차 보수용 코팅 시장 가치 측면에서는 세 번째로 큰 부문이었습니다.

프라이머 부문은 2024년 전 세계 자동차 보수용 코팅 시장에서 세 번째로 큰 부문이었습니다. 이 강력한 위치는 프라이머가 부식 방지 수단으로서의 필수적인 역할을 수행하기 때문입니다. 보수용 과정은 금속 기판이 환경 요인에 노출된 긁히거나 찌그러지거나 녹슨 패널을 수리하는 것을 포함합니다. 표면이 적절히 실링되지 않으면 이러한 표면은 습기, 염분, 화학물질에 노출되어 부식 및 구조적 손상을 입을 위험이 있습니다. 프라이머는 산화를 방지하고 차량 차체의 전체적인 내구성을 향상시키는 방어막 역할을 합니다. 습도가 높거나 강우량이 많거나 염분이 많은 도로 조건에서는 부식 위험이 매우 높으며, 부식 방지 프라이머의 사용이 특히 중요합니다. 자동차 보수 업체는 차량의 구조적 무결성을 유지하고 OEM 보수 기준을 준수하기 위해 방청 프라이머에 중점을 두고 있습니다.

기타 수지 유형 부문은 예측 기간 동안 자동차 보수용 시장 내에서 세 번째로 빠르게 성장하는 부문으로 예상됩니다.

기타 수지 유형 부문은 자동차 보수용 시장에서 세 번째로 빠르게 성장하는 부문으로 예상됩니다. 니트로셀룰로오스와 폴리에스터를 포함한 기타 유형의 수지 확장은 자동차의 저복잡도 보수 작업에 사용되는 고속 건조형 제형에 대한 수요 증가에 의해 촉진되고 있습니다. 니트로셀룰로오스 수지는 매우 빠른 건조 능력과 빠른 보수용 과정, 소규모 보수 또는 일시적인 터치업에 적합하기 때문에 특히 사용됩니다. 이러한 경우 숙성 속도가 장기 성능보다 우선시됩니다. 도시 지역과 교통량이 많은 서비스 센터에서 차량 소유주들은 소규모 보수, 긁힘, 국소적 보수용 등에 대한 빠른 처리 시간을 요구합니다. 이러한 수지는 기술자가 짧은 시간 내에 여러 작업을 완료할 수 있도록 하여 이 요구사항을 잘 충족시킵니다. 또한, 복잡한 숙성 시설이 없지만 짧은 시간 내에 일관된 결과를 필요로 하는 소규모 작업장이나 이동식 보수 단위에서 특히 선호됩니다.

본 보고서는 세계의 자동차 수리 코팅 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 자동차 보수용 코팅 시장의 매력적인 기회

- 아시아태평양의 자동차 보수용 코팅 시장 : 국가별

- 자동차 보수용 코팅 시장 : 지역별

- 자동차 보수용 코팅 시장 매력

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제지표

제6장 산업 동향

- 공급망 분석

- 원재료 공급자

- 제조업체

- 유통 네트워크

- 최종 이용 산업

- 가격 설정 분석

- 주요 기업이 제공하는 자동차 보수용 코팅의 평균 판매 가격 : 수지 유형별

- 자동차 보수용 코팅의 평균 판매 가격 동향 : 지역별(2023-2030년)

- 고객사업에 영향을 주는 동향 및 혼란

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 사례 연구 분석

- PPG INDUSTRIES, INC.의 유럽의 수성 코팅 채용에 관한 사례 연구

- 북미의 Axalta Coating Systems LLC의 상용 플릿용 고속 경화 코팅에 관한 케이스 스터디

- 무역 분석

- 수입 시나리오(HS 코드 320820)

- 자동차 보수용 코팅의 수출 시나리오

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 틀

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 투자 및 자금조달 시나리오

- 특허 분석

- 접근

- 문서 유형

- 주요 출원자

- 관할분석

- 미국 관세의 영향(2025년) - 개요

- 소개

- 주요 관세율

- 가격 영향 분석

- 국가, 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

- 자동차 보수용 코팅 시장에 대한 AI/생성형 AI의 영향

제7장 자동차 보수용 코팅 시장 : 레이어별

- 소개

- 프라이머

- 베이스 코트

- 클리어 코트

- 기타 레이어 유형

제8장 자동차 보수용 코팅 시장 : 수지 유형별

- 소개

- 폴리우레탄

- 아크릴

- 에폭시

- 알키드

- 기타 수지 유형

제9장 자동차 보수용 코팅 시장 : 기술별

- 소개

- 수성 기술

- 용매 기반 기술

- UV 경화 기술

제10장 자동차 보수용 코팅 시장 : 차량 유형별

- 소개

- 승용차

- 상용차

제11장 자동차 보수용 코팅 시장 : 지역별

- 소개

- 아시아태평양

- 중국

- 인도

- 일본

- 인도네시아

- 유럽

- 독일

- 이탈리아

- 스페인

- 영국

- 프랑스

- 북미

- 미국

- 캐나다

- 멕시코

- 기타 지역

제12장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 시장 점유율 분석(2024년)

- 수익 분석(2023-2025년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 기업

- AXALTA COATING SYSTEMS LLC

- PPG INDUSTRIES, INC.

- BASF SE

- THE SHERWIN-WILLIAMS COMPANY

- AKZO NOBEL NV

- KANSAI PAINT CO., LTD.

- KCC CORPORATION

- NIPPON PAINT HOLDINGS CO., LTD.

- KAPCI COATINGS

- TOA PERFORMANCE COATING CORPORATION CO., LTD.

- 스타트업/중소기업

- ROCK PAINT CO., LTD.

- MAACO FRANCHISING, INC.

- XIANGJIANG PAINT TECHNOLOGY CO., LTD.

- BERGER PAINTS INDIA LTD.

- DONGLAI COATING TECHNOLOGY CO., LTD.

- NOROO PAINT & COATINGS CO., LTD.

- ALSA CORPORATION

- WEG SA

- BERNARDO ECENARRO SA

- ALPS COATING SDN. BHD.

- RUSSIAN COATINGS JSC

- NOVOL SP. Z OO

- MIPA SE

- HB BODY SA

- TERSUAVE

제14장 인접 시장과 관련 시장

- 소개

- 제한 사항

- 자동차용 코팅 시장

- 시장 정의

- 시장 개요

- 단열 제품 시장 : 지역별

제15장 부록

HBR 25.08.22The increasing maturity and development of automotive aftermarket infrastructure worldwide have set favorable platforms for the expansion of automotive refinish coatings. With everything from tiered dealership service centers and authorized collision networks to independent garages and franchised repair chains, the appeal of an ever-accelerating number of standardized, quality-controlled repair outlets is irresistible when it comes to reaching the furthest corners of the product distribution landscape and achieving more brand exposure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Kiloton) |

| Segments | Layer Type, Resin Type, Vehicle Type, and Region |

| Regions covered | Asia Pacific, Europe, North America, and the Rest of the World |

More specifically, the facilities utilize methods such as sophisticated inventory systems, digital procurement platforms, and customer relationship management tools to support volume purchasing and consistent coating consumption. The aftermarket is further defined by the rise of repair aggregators, such as online sites that link vehicle owners with quality workshops, which may recommend refinish brands as part of their service package. Therefore, the robust aftermarket ecosystem acts as a demand stabilizer, supporting both volume and value growth across geographies.

The primer segment was the third-largest segment, in terms of value, of the global automotive refinish coatings market.

The primer segment was the third-largest segment in the global market for automotive refinish coatings in 2024. This robust positioning stems from the role played by the primer as an essential means of corrosion protection. Refinish processes often entail fixing scratched, dented, or rusted panels where the metal substrate is exposed to environmental factors. In the absence of proper sealing of the surface, these surfaces are at risk of moisture, salt, and chemical exposure and consequently suffer from corrosion and structural deterioration. Primers serve as a shield, protecting against oxidation and enhancing the overall durability of the vehicle's body. In areas with high humidity, intensive rain, or salty roadways, corrosion threats are very high, and the use of anti-corrosive primers is of particular concern. Car repair shops place emphasis on anti-corrosive primers to preserve vehicle integrity and adhere to OEM repair standards.

The other resin types segment is projected to be the third-fastest-growing segment in the automotive refinish coatings market during the forecast period.

The other resin types segment is projected to be the third-fastest-growing segment in the automotive refinish coatings market. Expansion in other types of resins, including nitrocellulose and polyester, is driven by increased demand for high-speed-drying types of formulations used in low-complexity repair jobs in automobiles. Nitrocellulose resins are particularly used because they have very fast drying capabilities and are suitable for quick refinishing processes, minor repairs, or transient touch-ups where curing speed takes precedence over long-term performance. In city areas and high-traffic service centers, owners of vehicles tend to request speedy turnaround for minor repairs, scratches, or localized repaint. Such resins fulfill this requirement well by allowing technicians to finish multiple tasks within short periods. Furthermore, they are particularly favored among small-scale units and mobile repair units with no sophisticated curing facilities but a need for consistent outcomes within short periods.

The passenger cars segment led the automotive refinish coatings market, in terms of value, in 2024.

The passenger cars segment led the automotive refinish coatings market, in terms of value, in 2024. The passenger cars segment ruled the automotive refinish coatings market in 2024, a trend brought by the continued urbanization and the resulting growth in vehicle ownership. Urbanization has brought about the swift expansion of cities, increasing vehicle presence in urban areas, where daily travel and urban road congestion place vehicles at higher risk of surface damage. Passenger vehicles are especially hit given their large-scale adoption and constant exposure to congested parking lots, rough road surfaces, and heavy pedestrian traffic. As a reaction to this city migration, automotive aftermarkets for ecosystems like refinish shops and repair shops are growing in quantity and service capacity. Increased availability of such infrastructure, particularly in emerging economies, is reducing the cost and speed of refinishing services for consumers. Concurrently, urban-focused product developments by coating manufacturers include low-VOC formulations, fast-drying coatings, and miniature application systems that fit in small working areas.

"Europe accounted for the third-largest share in the automotive refinish coatings market in terms of value."

Europe accounted for the third-largest share in the automotive refinish coatings market, in terms of value, in 2024. The driving factor is the strict environmental regulations put in place by the European Union and governments of individual countries, specifically those addressing air quality, control of hazardous substances, and industrial emissions. Regulations like REACH (Registration, Evaluation, Authorisation and Restriction of Chemicals) and directives against volatile organic compound (VOC) emissions are driving a region-wide transformation toward sustainable coating formulations. This involves the widespread use of waterborne coatings, high-solid content systems, and low-VOC clearcoats. Automotive refinish coating manufacturers across Europe are investing more in sustainable innovations to meet compliance requirements while holding performance levels. Body shops and collision centers, on their part, are also upgrading their operations to include clean technologies, typically subsidized and backed by training programs from local authorities.

- By Company Type: Tier 1 - 55%, Tier 2 - 25%, and Tier 3 - 20%

- By Designation: Directors - 50%, Managers - 30%, and Others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, and the Rest of the World - 5%

The key players profiled in the report include Axalta Coating Systems LLC (US), PPG Industries, Inc. (US), BASF SE (Germany), Akzo Nobel N.V. (Netherlands), The Sherwin-Williams (US), Kansai Paint Co., Ltd. (Japan), Nippon Paint Holdings Co., Ltd. (Japan), KCC Corporation (China), and TOA Performance Coating Corporation Co., Ltd. (Thailand).

Research Coverage

This report segments the market for automotive refinish coatings based on layer type, resin type, vehicle type, and region, and provides estimations of value (USD million) for the overall market size across various regions. It has also conducted a detailed analysis of key industry players to provide insights into their business overviews, services, and key strategies associated with the market for automotive refinish coatings.

Reasons to Buy this Report

This research report is focused on various levels of analysis - industry analysis (industry trends), market share analysis of top players, and company profiles, which together provide an overall view of the competitive landscape, emerging and high-growth segments of the automotive refinish coatings market, high-growth regions, and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on automotive refinish coatings offered by top players in the global market

- Analysis of key drivers (expanding automotive aftermarket services, growth in road accidents and collisions, technological advancements in coatings, and rising insurance penetration and claims processing) restraints (shift toward paintless repair techniques and toxicity and health concerns) opportunities (adoption of eco-friendly coatings and expansion into emerging markets), and challenges (stringent environmental regulations) influencing the growth of the automotive refinish coatings market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the automotive refinish coatings market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for automotive refinish coatings across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global automotive refinish coatings market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the automotive refinish coatings market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 AUTOMOTIVE REFINISH COATINGS MARKET SEGMENTATION AND REGIONAL SPREAD

- 1.3.2 AUTOMOTIVE REFINISH COATINGS MARKET: INCLUSIONS & EXCLUSIONS

- 1.3.3 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY LAYER TYPE

- 1.3.4 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY RESIN TYPE

- 1.3.5 AUTOMOTIVE REFINISH COATINGS MARKET: MARKET DEFINITIONS AND INCLUSIONS, BY VEHICLE TYPE

- 1.3.6 YEARS CONSIDERED

- 1.3.7 CURRENCY CONSIDERED

- 1.3.8 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Interviews with experts - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH RATE ASSUMPTIONS/GROWTH FORECASTS

- 2.4.1 DEMAND SIDE

- 2.5 ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AUTOMOTIVE REFINISH COATINGS MARKET

- 4.2 ASIA PACIFIC AUTOMOTIVE REFINISH COATINGS MARKET, COUNTRY

- 4.3 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION

- 4.4 AUTOMOTIVE REFINISH COATINGS MARKET ATTRACTIVENESS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding automotive aftermarket services

- 5.2.1.2 Growth in road accidents and collisions

- 5.2.1.3 Technological advancements in coatings

- 5.2.1.4 Rising insurance penetration and claims processing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Disruption in supply chain due to geopolitical tensions

- 5.2.2.2 Toxicity and health concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of eco-friendly coatings

- 5.2.3.2 Expansion into emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST FOR MAJOR ECONOMIES

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.1.1 RAW MATERIALS SUPPLIER

- 6.1.2 MANUFACTURER

- 6.1.3 DISTRIBUTION NETWORK

- 6.1.4 END-USE INDUSTRIES

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE OF AUTOMOTIVE REFINISH COATINGS OFFERED BY KEY PLAYERS, BY RESIN TYPE

- 6.2.2 AVERAGE SELLING PRICE TREND OF AUTOMOTIVE REFINISH COATINGS, BY REGION, 2023-2030

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Waterborne coatings technology

- 6.5.1.2 UV-curable coatings technology

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Low-VOC/high-solid coatings technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 CASE STUDY ANALYSIS

- 6.6.1 CASE STUDY ON PPG INDUSTRIES, INC.'S WATERBORNE COATING ADOPTION IN EUROPE

- 6.6.2 CASE STUDY ON AXALTA COATING SYSTEMS LLC'S FAST-CURE COATINGS FOR COMMERCIAL FLEET IN NORTH AMERICA

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 320820)

- 6.7.2 EXPORT SCENARIO OF AUTOMOTIVE REFINISH COATINGS

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATORY FRAMEWORK

- 6.8.2.1 International Organization for Standardization (ISO)

- 6.9 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 DOCUMENT TYPES

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.12.1 INTRODUCTION

- 6.12.2 KEY TARIFF RATES

- 6.12.3 PRICE IMPACT ANALYSIS

- 6.12.4 IMPACT ON COUNTRY/REGION

- 6.12.4.1 US

- 6.12.4.2 Europe

- 6.12.4.3 Asia Pacific

- 6.12.5 IMPACT ON END-USE INDUSTRIES:

- 6.13 IMPACT OF AI/GEN AI ON AUTOMOTIVE REFINISH COATINGS MARKET

7 AUTOMOTIVE REFINISH COATINGS MARKET, BY LAYER TYPE

- 7.1 INTRODUCTION

- 7.2 PRIMER

- 7.2.1 PROTECTION AGAINST DEFORMATION AND CHIPPING TO BOOST MARKET

- 7.3 BASECOAT

- 7.3.1 REDUCED DOWNTIME AND MAINTENANCE OF VEHICLES TO DRIVE MARKET

- 7.4 CLEARCOAT

- 7.4.1 PROTECTION AGAINST SCRATCHES AND UV RAYS TO BOOST DEMAND

- 7.5 OTHER LAYER TYPES

8 AUTOMOTIVE REFINISH COATINGS MARKET, BY RESIN TYPE

- 8.1 INTRODUCTION

- 8.2 POLYURETHANE

- 8.2.1 GOOD ELASTICITY AT LOW TEMPERATURES TO BOOST MARKET

- 8.3 ACRYLIC

- 8.3.1 RESISTANCE TO ABRASION AND CHEMICAL ATTACK TO FUEL MARKET

- 8.4 EPOXY

- 8.4.1 HIGH ADHESION AND RUST RESISTANCE TO DRIVE MARKET

- 8.5 ALKYD

- 8.5.1 COST-EFFECTIVE SOLUTION TO SUPPORT MARKET GROWTH

- 8.6 OTHER RESIN TYPES

9 AUTOMOTIVE REFINISH COATINGS MARKET, BY TECHNOLOGY TYPE

- 9.1 INTRODUCTION

- 9.2 WATERBORNE TECHNOLOGY

- 9.3 SOLVENTBORNE TECHNOLOGY

- 9.4 UV-CURED TECHNOLOGY

10 AUTOMOTIVE REFINISH COATINGS MARKET, BY VEHICLE TYPE

- 10.1 INTRODUCTION

- 10.2 PASSENGER CARS

- 10.2.1 CONSUMER DEMAND FOR PERSONALIZED TRANSPORTATION FUEL TO DRIVE MARKET

- 10.3 COMMERCIAL VEHICLES

- 10.3.1 RISING GLOBAL TRADE AND SURGE IN E-COMMERCE TO PROPEL DEMAND FOR COMMERCIAL VEHICLES

11 AUTOMOTIVE REFINISH COATINGS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 ASIA PACIFIC

- 11.2.1 CHINA

- 11.2.1.1 Significant investments by global manufacturers to boost market

- 11.2.2 INDIA

- 11.2.2.1 Rapid economic growth and increasing disposable income to drive market

- 11.2.3 JAPAN

- 11.2.3.1 Well-established automotive industry and technological advancement to drive market

- 11.2.4 INDONESIA

- 11.2.4.1 Effective government policies and presence of global players to drive market

- 11.2.1 CHINA

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Presence of major distribution channels to increase demand

- 11.3.2 ITALY

- 11.3.2.1 New investments and sustainable approaches to drive market

- 11.3.3 SPAIN

- 11.3.3.1 Sustainable strategies and capital inflows to propel market growth

- 11.3.4 UK

- 11.3.4.1 Sustainable investment in automotive R&D to drive market

- 11.3.5 FRANCE

- 11.3.5.1 Market expansion fueled by policy initiatives and tech progress to drive market

- 11.3.1 GERMANY

- 11.4 NORTH AMERICA

- 11.4.1 US

- 11.4.1.1 Growing automotive industry to propel market

- 11.4.2 CANADA

- 11.4.2.1 Increased demand for water-borne coatings in automotive refinish to drive market

- 11.4.3 MEXICO

- 11.4.3.1 Leveraging trade pacts to boost market growth

- 11.4.1 US

- 11.5 REST OF THE WORLD

- 11.5.1 BRAZIL

- 11.5.1.1 Scaling production and distribution to drive market growth

- 11.5.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2023-2025

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Resin type footprint

- 12.5.5.4 Layer type footprint

- 12.5.5.5 Vehicle type footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: START-UPS/SMES, 2024

- 12.6.5.1 Detailed list of key start-ups/SMEs

- 12.6.5.2 Competitive benchmarking of key start-ups/SMEs

- 12.7 COMPANY VALUATION AND FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 DEALS

- 12.9.2 EXPANSIONS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 MAJOR PLAYERS

- 13.1.1 AXALTA COATING SYSTEMS LLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM View

- 13.1.1.4.1 Right to Win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 PPG INDUSTRIES, INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM View

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 BASF SE

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM View

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 THE SHERWIN-WILLIAMS COMPANY

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.4 MnM View

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 AKZO NOBEL N.V.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.3.2 Expansions

- 13.1.5.4 MnM View

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 KANSAI PAINT CO., LTD.

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 KCC CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 NIPPON PAINT HOLDINGS CO., LTD.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 KAPCI COATINGS

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 TOA PERFORMANCE COATING CORPORATION CO., LTD.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 AXALTA COATING SYSTEMS LLC

- 13.2 START-UP/SMES PLAYERS

- 13.2.1 ROCK PAINT CO., LTD.

- 13.2.2 MAACO FRANCHISING, INC.

- 13.2.3 XIANGJIANG PAINT TECHNOLOGY CO., LTD.

- 13.2.4 BERGER PAINTS INDIA LTD.

- 13.2.5 DONGLAI COATING TECHNOLOGY CO., LTD.

- 13.2.6 NOROO PAINT & COATINGS CO., LTD.

- 13.2.7 ALSA CORPORATION

- 13.2.8 WEG S.A.

- 13.2.9 BERNARDO ECENARRO S.A.

- 13.2.10 ALPS COATING SDN. BHD.

- 13.2.11 RUSSIAN COATINGS JSC

- 13.2.12 NOVOL SP. Z O.O.

- 13.2.13 MIPA SE

- 13.2.14 HB BODY S.A.

- 13.2.15 TERSUAVE

14 ADJACENT & RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 AUTOMOTIVE COATINGS MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.4 INSULATION PRODUCTS MARKET, BY REGION

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS