|

시장보고서

상품코드

1794021

직장 안전 시장 예측 : 제공 제품별, 시스템별, 용도별, 전개 모드별, 조직 규모별, 업계별, 지역별(-2030년)Workplace Safety Market by Offering (Hardware (RFID Tags, Wearables), Software, Services), System (Real-time Location Monitoring; Environmental, Health, and Safety), Application (PPE Detection, Asset Tracking & Management) - Global Forecast to 2030 |

||||||

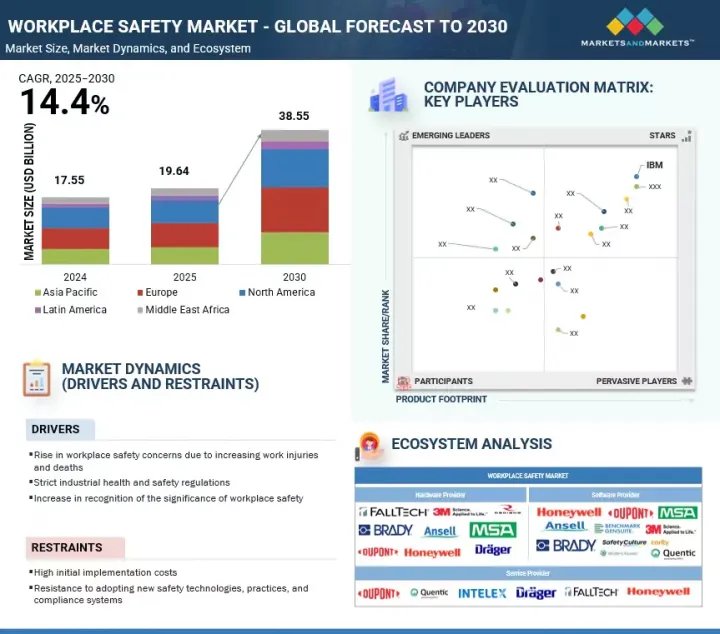

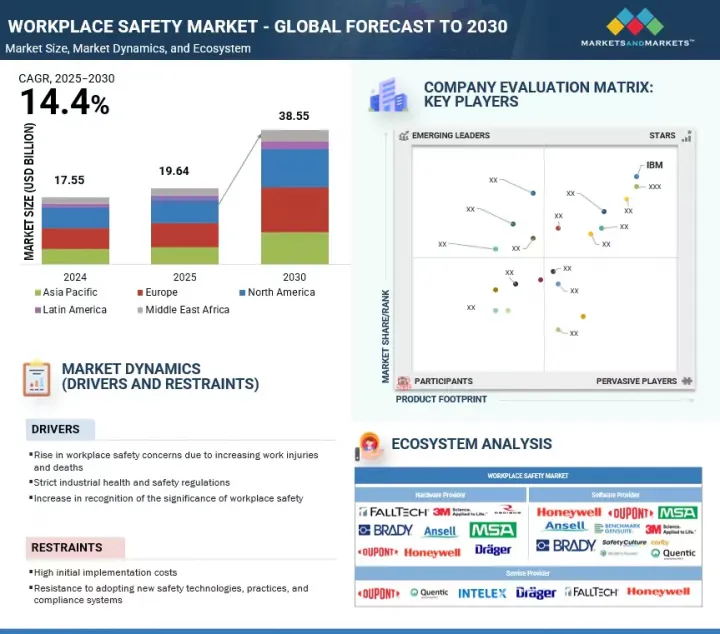

세계 직장 안전 시장 규모는 2025년 196억 4,000만 달러, 2030년에는 385억 5,000만 달러로 성장하고, 예측 기간 중 CAGR은 14.4%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 대상 연도 | 2019-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 제공 제품별, 시스템별, 용도별, 전개 모드별, 조직 규모별, 업계별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

직장 안전 시장은 정신 건강과 웰빙을 안전 전략에 통합함으로써 점점 추진되고 있으며, 조직은 스트레스, 번아웃, 정서적 건강 등의 문제에 대한 노동자의 종합 안전의 일환으로 노력하고 있습니다. 동시에 웨어러블과 센서 기반 기술의 채택이 증가하여 피로와 생체 인증의 실시간 모니터링이 가능해 사고의 미연 방지에 도움이 되고 있습니다. 이러한 진보로 안전 대책은 보다 종합적이고 예방적인 접근 방식으로 전환되고 있습니다.

On-Premise 배포는 보다 큰 제어, 커스터마이징 및 데이터 보안을 제공하는 능력으로 인해 직장 안전 시장에서 가장 큰 점유율을 차지하는 것으로 추정되며, 이는 제조, 에너지, 제약 등의 산업에서 특히 중요합니다. 이러한 분야에서는 규제 기준의 엄격한 준수가 요구되며 기업이 자사에서 관리하는 것을 선호하는 기밀 데이터를 다루는 경우가 많습니다. 또한 인터넷 연결이 제한되어 있거나 레거시 인프라와의 통합이 필요한 경우에도 On-Premise 시스템이 선호됩니다. 또한 회사 내에 IT 팀을 갖추면 기업은 타사 공급업체에 의존하지 않고 유지 관리 및 보안을 관리할 수 있습니다. 이미 안전 프로토콜이 확립된 대부분의 조직은 데이터 유출 및 다운타임 위험을 고려하여 클라우드로의 전환을 주저하고 있습니다. 이러한 이유로 On-Premise 솔루션은 비즈니스 연속성과 규제의 무결성을 유지하기 위한 안정적이고 신뢰할 수 있는 옵션이 되었습니다.

직장 안전 시장의 소프트웨어 분야는 확장 가능하고 실시간 및 지능형 안전 관리 도구에 대한 수요가 증가함에 따라 빠르게 성장하고 있습니다. 컴플라이언스 워크플로우를 자동화하고 사고 보고를 간소화하고 사전 예방적 위험 관리를 위해 예측 분석을 활용하기 위해 조직의 소프트웨어 채택이 증가하고 있습니다. 이 플랫폼은 중앙 집중식 모니터링, 직원 교육, 감사 준비 등을 지원하여 효율성과 법규의 무결성을 모두 향상시킵니다. 직장이 복잡해지고 지리적으로 분산됨에 따라 모바일 지원, 클라우드 통합 및 사용자 정의 가능한 소프트웨어 솔루션의 요구는 제조, 건설, 물류, 건강 관리 등의 분야에서 계속 확대되고 있습니다. 또한 AI, IoT, 머신러닝을 안전 소프트웨어에 통합하여 위험 예측, 피로 모니터링, 행동 기반 안전 분석 등의 고급 기능을 실현하고 있습니다. 이 기술 변화는 디지털 문서화와 스마트 안전 프로토콜을 지원하는 정부 인센티브 및 산업 규정에 의해 더욱 강화되고 있습니다.

아시아태평양은 높은 사고율, 엄격한 규제 이동 및 급속한 산업화로 직장 안전 시장에서 가장 급성장을 기록할 것으로 예측됩니다. ILO(2024년)의 보고에 따르면 이 지역에서는 연간 100만 명 이상의 업무 관련 죽음이 발생했으며, 이는 세계 최고입니다. 중국과 인도는 특히 건설업과 제조업에서 높은 부상률에 직면하고 있으며, 후생노동성에 따르면 일본은 2024년 12만건 이상의 산업재해를 기록했습니다. 인도의 OSH 코드는 디지털 보고를 추진하고 중국의 개정안전생산법은 시행을 강화하고 호주 WHS법은 조기보고와 감사를 촉진하고 있습니다. ASEAN-OSHNET은 지역 안전협력을 추진하고 있으며 한국, 싱가포르, 말레이시아 등 국가들은 스마트 PPE 및 AI 기반 모니터링에 투자하고 있습니다. 대규모 노동력, 의식 증가, 기술 도입이 지역 전체 시장 확대에 박차를 가하고 있습니다. 또한 안전 훈련 플랫폼과 실시간 모니터링 시스템에 대한 민간 부문 투자 증가가 이러한 기세에 기여하고 있습니다.

본 보고서에서는 세계의 직장안전시장에 대해 조사했으며, 제공 제품별, 시스템별, 용도별, 전개모드별, 조직규모별, 업계별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 소개

- 시장 역학

- 직장 안전 시장 : 생태계 분석

- 밸류체인 분석

- 특허 분석

- 무역 분석

- 가격 분석

- 기술 분석

- 이용 사례

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 관세 및 규제 상황

- 2025년-2026년의 주된 회의와 이벤트

- 투자와 자금 조달의 상황

- 직장 안전 시장에서의 생성형 AI의 영향

- 2025년 미국 관세의 영향 - 직장안전시장

제6장 직장 안전 시장(제공 제품별)

- 소개

- 하드웨어

- 소프트웨어

- 서비스

제7장 직장 안전 시장(시스템별)

- 소개

- 실시간 위치 감시

- 환경, 건강, 안전

- 액세스 제어 및 모니터링 시스템

- 기타

제8장 직장 안전 시장(용도별)

- 소개

- 인시던트 및 비상사태 관리

- 자산 추적 및 관리

- PPE 검출

- 인사/직원 추적

- 감사 및 컴플라이언스

- 기타 용도(차량 추적 및 화재 감지)

제9장 직장 안전 시장(전개 모드별)

- 소개

- On-Premise

- 클라우드

제10장 직장 안전 시장(조직 규모별)

- 소개

- 중소기업

- 대기업

제11장 직장 안전 시장(업계별)

- 소개

- 에너지 및 유틸리티

- 건설 및 엔지니어링

- 화학약품 및 재료

- 정부 및 방위

- 헬스케어

- 식음료

- 석유 및 가스

- 자동차

- 기타

제12장 직장 안전 시장(지역별)

- 소개

- 북미

- 북미 : 거시경제 전망

- 북미 : 직장 안전 시장 성장 촉진요인

- 미국

- 캐나다

- 유럽

- 유럽: 거시경제 전망

- 유럽: 직장 안전 시장 성장 촉진요인

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양: 거시경제 전망

- 아시아태평양 : 직장안전시장 성장 촉진요인

- 중국

- 일본

- 한국

- 인도

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 거시경제 전망

- 중동 및 아프리카 : 직장의 안전 시장 성장 촉진요인

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카 : 거시경제 전망

- 라틴아메리카 : 직장 안전 시장 성장 촉진요인

- 브라질

- 멕시코

- 기타

제13장 경쟁 구도

- 주요 참가 기업의 전략/강점, 2022년-2024년

- 수익 분석, 2020년-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업, 2024년

- 기업평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 프로파일

- 주요 진출기업

- IBM

- HONEYWELL

- 3M

- HEXAGON AB

- MICROSOFT

- APPIAN

- BOSCH

- CORITY

- WOLTERS KLUWER

- INTELEX

- HCL TECHNOLOGIES

- HSI

- VECTOR SOLUTIONS

- ARVENTA

- AMAZON WEB SERVICES(AWS)

- HITACHI SOLUTIONS

- DAMOTECH

- EHS INSIGHT

- ECOONLINE

- STRONGARM TECH

- KINETIC

- INTENSEYE

- SECURADE.AI

- BUDDYWISE

- VISIONIFY

- BENCHMARK GENSUITE

- QUARTEX SOFTWARE

- AATMUNN

제15장 인접 시장

제16장 부록

SHW 25.08.25The global workplace safety market size is projected to grow from USD 19.64 billion in 2025 to USD 38.55 billion by 2030 at a compound annual growth rate (CAGR) of 14.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2019-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million/USD Billion) |

| Segments | Offering, System, Application, Deployment Mode, Organization Size, Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The workplace safety market is increasingly driven by the integration of mental health and wellbeing into safety strategies, with organizations addressing issues such as stress, burnout, and emotional health as part of total worker safety. Simultaneously, rising adoption of wearables and sensor-based technologies enables real-time monitoring of fatigue and biometrics, helping prevent incidents before they occur. These advancements are shifting safety practices toward more comprehensive and preventive approaches.

"By deployment, the on-premises segment accounts for the larger market share during the forecast period."

On-premise deployment is estimated to account for the largest share in the workplace safety market due to its ability to offer greater control, customization, and data security, which is especially important in industries such as manufacturing, energy, and pharmaceuticals. These sectors require strict compliance with regulatory standards and often deal with sensitive data that companies prefer to manage in-house. On-premise systems are also preferred where internet connectivity is limited or where integration with legacy infrastructure is necessary. Additionally, having internal IT teams allows organizations to manage maintenance and security without relying on third-party vendors. Many organizations with established safety protocols already in place are hesitant to shift to the cloud due to perceived risks of data exposure or downtime. This makes on-premise solutions a stable and trusted option for maintaining operational continuity and regulatory alignment.

"By offering, the software segment is estimated to account for the highest market growth rate during the forecast period."

The software segment in the workplace safety market is experiencing rapid growth due to rising demand for scalable, real-time, and intelligent safety management tools. Organizations are increasingly adopting software to automate compliance workflows, streamline incident reporting, and leverage predictive analytics for proactive risk management. These platforms support centralized monitoring, employee training, and audit readiness, improving both efficiency and regulatory alignment. As workplaces become more complex and geographically dispersed, the need for mobile-enabled, cloud-integrated, and customizable software solutions continues to expand across sectors like manufacturing, construction, logistics, and healthcare. In addition, growing integration of AI, IoT, and machine learning into safety software is enabling advanced capabilities such as hazard prediction, fatigue monitoring, and behavior-based safety analysis. This technological shift is further reinforced by government incentives and industry regulations that favor digital documentation and smart safety protocols.

"By region, Asia Pacific is set to record the highest market growth."

Asia Pacific is projected to record the fastest-growing region in the workplace safety market due to high accident rates, strict regulatory shifts, and rapid industrialization. The ILO (2024) reports over 1 million work-related deaths annually in the region, the highest globally. China and India face high injury rates, especially in construction and manufacturing, while Japan recorded over 120,000 industrial accidents in 2024, according to the Ministry of Health, Labour and Welfare. Governments are stepping up as India's OSH Code pushes digital reporting, China's revised Safe Production Law tightens enforcement, and Australia's WHS Act promotes early reporting and audits. ASEAN-OSHNET is driving regional safety collaboration, and countries like South Korea, Singapore, and Malaysia are investing in smart PPE and AI-based monitoring. A large workforce, growing awareness, and tech adoption fuel market expansion across the region. Additionally, increased private sector investment in safety training platforms and real-time monitoring systems is contributing to this momentum.

Breakdown of primaries

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level - 45%, Director - 35%, and Managers - 20%

- By Region: North America - 35%, Europe - 25%, Asia Pacific - 30%, and RoW - 10%

The key players in the workplace safety market include IBM (US), Honeywell (US), 3M (US), Hexagon AB (Sweden), Appian (US), Microsoft (US), Bosch (Germany), Cority (Canada), Wolters Kluwer (Netherlands), Intelex (Canada), HCL Technologies (India), HSI (US), Vector Solutions (US), Quartex Software (Australia), Arventa (Australia), AWS (US), Hitachi Solutions (Japan), Damotech (Canada), EHS Insights (US), EcoOnline (Norway), Aatmunn (US), StrongArm Tech (US), Kinetic (US), Benchmark Gensuite (US), and Intenseye (US). The study includes an in-depth competitive analysis of the key players in the workplace safety market, their company profiles, recent developments, and key market strategies.

Research Coverage

The report segments the workplace safety market and forecasts its size, offering (hardware [safety sensors, RFID tags & reader, wearable], software, service [consulting services, integration & deployment, support & maintenance, training & education], system [real-time location monitoring, environmental health & safety, access control & surveillance systems, other systems {screening and scanning, alarm and mass notification, and connectivity systems}]), application (incident & emergency management, asset tracking & management, personnel/staff tracking, PPE detection, audit & compliance, others [vehicle tracking and fire detection]), deployment mode (on-premises and cloud), organization size (large enterprises and small and medium enterprises [SMEs]), vertical (energy & utilities, construction & engineering, chemicals & materials, government & defense, oil & gas, automotive, food & beverages, healthcare, other verticals [logistics, IT & ITeS, and retail]), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The study also includes an in-depth competitive analysis of the market's key players, their company profiles, key observations related to product and business offerings, recent developments, and key market strategies.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Workplace safety market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Rising workplace safety concerns due to increasing work injuries and deaths, Strict industrial health and safety regulations, Increasing recognition of significance of workplace safety, Proliferation of software-as-a-service deployment model), restraints (High initial implementation costs, Resistance to change), opportunities (Integration of big data and use of safety data as predictive tool for risk management, Introduction of new trends such as smart PPE, intelligent clothing, autonomous vehicles, and smart safety, ) and challenges (Lack of skilled workplace safety and health professionals, Balancing safety with employee privacy)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the workplace safety market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the workplace safety market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the workplace safety market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as IBM (US), Honeywell (US), 3M (US), Hexagon AB (Sweden), Appian (US), Microsoft (US), Bosch (Germany), Cority (Canada), Wolters Kluwer (Netherlands), Intelex (Canada), HCL Technologies (India), HSI (US), Vector Solutions (US), Quartex Software (Australia), Arventa (Australia), AWS (US), Hitachi Solutions (Japan), Damotech (Canada), EHS Insights (US), EcoOnline (Norway), Aatmunn (US), StrongArm Tech (US), Kinetic (US), Benchmark Gensuite (US), and Intenseye (US) in the workplace safety market strategies.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakup of primaries

- 2.1.2.2 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN WORKPLACE SAFETY MARKET

- 4.2 WORKPLACE SAFETY MARKET, BY OFFERING

- 4.3 WORKPLACE SAFETY MARKET, BY SYSTEM

- 4.4 WORKPLACE SAFETY MARKET, BY DEPLOYMENT MODE

- 4.5 WORKPLACE SAFETY MARKET, BY APPLICATION

- 4.6 WORKPLACE SAFETY MARKET, BY VERTICAL

- 4.7 WORKPLACE SAFETY MARKET, BY KEY VERTICAL AND REGION

- 4.8 MARKET INVESTMENT SCENARIO, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising workplace safety concerns due to increasing work injuries and deaths

- 5.2.1.2 Strict industrial health and safety regulations

- 5.2.1.3 Increasing recognition of significance of workplace safety

- 5.2.1.4 Proliferation of software-as-a-service deployment model

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial implementation costs

- 5.2.2.2 Resistance to change

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of big data and use of safety data as predictive tool for risk management

- 5.2.3.2 Introduction of new trends such as smart PPE, intelligent clothing, autonomous vehicles, and smart safety

- 5.2.4 CHALLENGES

- 5.2.4.1 Lack of skilled workplace safety and health professionals

- 5.2.4.2 Balancing safety with employee privacy

- 5.2.1 DRIVERS

- 5.3 WORKPLACE SAFETY MARKET: ECOSYSTEM ANALYSIS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PATENT ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 IMPORT DATA FOR HS CODE 8536

- 5.6.2 EXPORT DATA FOR HS CODE 8536

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF OFFERINGS, BY KEY PLAYER

- 5.7.2 INDICATIVE PRICING ANALYSIS

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Wearable Safety Devices

- 5.8.1.2 Environmental Sensors

- 5.8.1.3 Machine Safety Systems

- 5.8.1.4 Computer Vision & AI

- 5.8.1.5 Internet of Things (IoT)

- 5.8.1.6 Digital Twins

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Edge Computing

- 5.8.2.2 Cloud

- 5.8.2.3 AI & ML

- 5.8.2.4 Augmented Reality (AR)/Virtual Reality (VR)

- 5.8.2.5 Robotic Process Automation (RPA)

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Geospatial & GIS Systems

- 5.8.3.2 Drone Surveillance

- 5.8.3.3 Blockchain Technology

- 5.8.1 KEY TECHNOLOGIES

- 5.9 USE CASES

- 5.9.1 CORITY HELPED SIEMENS HEALTHINEERS GAIN GREATER UNDERSTANDING AND CONTROL OF EHS OPERATIONS

- 5.9.2 INTELEX HELPED AGNICO EAGLE MINES REDUCE ACCIDENT RATES WITH ITS EHS SOFTWARE

- 5.9.3 RAVE MOBILE SAFETY HELPED MIDDLESEX HEALTH ENHANCE WORKPLACE SAFETY FOR OFFSITE NURSES

- 5.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF SUPPLIERS

- 5.11.4 BARGAINING POWER OF BUYERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.12.2 BUYING CRITERIA

- 5.13 TARIFF & REGULATORY LANDSCAPE

- 5.13.1 TARIFFS RELATED TO WORKPLACE SAFETY SOLUTIONS

- 5.13.2 INDUSTRY STANDARDS AND REGULATORY LANDSCAPE

- 5.13.2.1 Regulatory bodies, government agencies, and other organizations

- 5.13.3 KEY REGULATIONS

- 5.13.3.1 Workplace Safety Law

- 5.13.3.2 Health and Safety at Work Act

- 5.13.3.3 Occupational Safety and Health Act (OSHA)

- 5.13.3.4 Small Business Regulatory Enforcement Fairness Act (SBREFA)

- 5.13.3.5 ISO 45001:2018

- 5.13.3.6 International Labour Organization (ILO)

- 5.13.3.7 National Institute for Occupational Safety and Health (NIOSH)

- 5.13.3.8 National Safety Council (NSC)

- 5.14 KEY CONFERENCES & EVENTS, 2025-2026

- 5.15 INVESTMENT & FUNDING LANDSCAPE

- 5.16 IMPACT OF GENERATIVE AI ON WORKPLACE SAFETY MARKET

- 5.16.1 TOP USE CASES & MARKET POTENTIAL

- 5.16.1.1 Key use cases

- 5.16.2 IMPACT OF GEN AI ON INTERCONNECTED AND ADJACENT ECOSYSTEM

- 5.16.2.1 OT (Operational Technology) Security Market

- 5.16.2.2 ICS (Industrial Control Systems) Security Market

- 5.16.2.3 Cloud Security Market

- 5.16.2.4 Critical Infrastructure Protection (CIP) Market

- 5.16.1 TOP USE CASES & MARKET POTENTIAL

- 5.17 IMPACT OF 2025 US TARIFFS-WORKPLACE SAFETY MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACTS ON COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.1.1 United States

- 5.17.4.1.2 Canada

- 5.17.4.1.3 Mexico

- 5.17.4.2 Europe

- 5.17.4.2.1 Germany

- 5.17.4.2.2 France

- 5.17.4.2.3 United Kingdom

- 5.17.4.3 Asia Pacific

- 5.17.4.3.1 China

- 5.17.4.3.2 India

- 5.17.4.3.3 Australia

- 5.17.4.1 North America

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Construction & Engineering

- 5.17.5.2 Energy & Utilities

- 5.17.5.3 Chemicals and Materials

6 WORKPLACE SAFETY MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 NEED TO INCREASE OPERATIONAL EFFICIENCY TO DRIVE ADOPTION OF WORKPLACE SAFETY HARDWARE

- 6.2.2 HARDWARE: WORKPLACE SAFETY MARKET DRIVERS

- 6.2.3 SAFETY SENSORS

- 6.2.3.1 Safety sensors: Workplace safety market drivers

- 6.2.4 RFID TAGS & READERS

- 6.2.4.1 RFID tags & readers: Workplace safety market drivers

- 6.2.5 WEARABLES

- 6.2.5.1 Wearables: Workplace safety market drivers

- 6.3 SOFTWARE

- 6.3.1 FOCUS ON IDENTIFYING AND MITIGATING SAFETY RISKS TO SPUR MARKET FOR SAFETY SOFTWARE SOLUTIONS

- 6.3.2 SOFTWARE: WORKPLACE SAFETY MARKET DRIVERS

- 6.4 SERVICES

- 6.4.1 EMPHASIS ON EFFICIENT USE OF SAFETY SOLUTIONS TO BOOST ADOPTION OF SERVICES

- 6.4.2 SERVICES: WORKPLACE SAFETY MARKET DRIVERS

- 6.4.3 CONSULTING SERVICES

- 6.4.4 INTEGRATION & DEPLOYMENT

- 6.4.5 SUPPORT & MAINTENANCE

- 6.4.6 TRAINING & EDUCATION

7 WORKPLACE SAFETY MARKET, BY SYSTEM

- 7.1 INTRODUCTION

- 7.2 REAL-TIME LOCATION MONITORING

- 7.2.1 NEED FOR DETECTING AND TRACKING LOCATION OF OBJECTS AND PEOPLE TO ENSURE SAFETY TO BOOST GROWTH

- 7.2.2 REAL-TIME LOCATION MONITORING: WORKPLACE SAFETY MARKET DRIVERS

- 7.3 ENVIRONMENT, HEALTH, AND SAFETY

- 7.3.1 DEMAND FOR MAINTAINING ENVIRONMENTAL SAFETY AND EMPLOYEE MEDICAL INFORMATION TO DRIVE MARKET

- 7.3.2 ENVIRONMENT, HEALTH, AND SAFETY: WORKPLACE SAFETY MARKET DRIVERS

- 7.4 ACCESS CONTROL & SURVEILLANCE SYSTEMS

- 7.4.1 NEED FOR ENHANCED SECURITY IN WORKPLACES TO ENCOURAGE ADOPTION OF ACCESS CONTROL & SURVEILLANCE SYSTEMS

- 7.4.2 ACCESS CONTROL & SURVEILLANCE SYSTEMS: WORKPLACE SAFETY MARKET DRIVERS

- 7.5 OTHER SYSTEMS

- 7.5.1 OTHER SYSTEMS: WORKPLACE SAFETY MARKET DRIVERS

8 WORKPLACE SAFETY MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 INCIDENT & EMERGENCY MANAGEMENT

- 8.2.1 NEED FOR ENSURING EFFICIENT HANDLING OF INCIDENTS IN ORGANIZATIONS TO SUPPORT GROWTH

- 8.2.2 INCIDENT & EMERGENCY MANAGEMENT: WORKPLACE SAFETY MARKET DRIVERS

- 8.3 ASSET TRACKING & MANAGEMENT

- 8.3.1 RISING FOCUS ON INCREASING PRODUCTIVITY AND REDUCING OPERATIONAL COSTS TO DRIVE DEMAND

- 8.3.2 ASSET TRACKING & MANAGEMENT: WORKPLACE SAFETY MARKET DRIVERS

- 8.4 PPE DETECTION

- 8.4.1 NEED TO RESTRICT EMPLOYEE EXPOSURE TO CHEMICAL, BIOLOGICAL, AND PHYSICAL HAZARDS ON WORKSITES TO FUEL GROWTH

- 8.4.2 PPE DETECTION: WORKPLACE SAFETY MARKET DRIVERS

- 8.5 PERSONNEL/STAFF TRACKING

- 8.5.1 DEMAND FOR MONITORING EMPLOYEES' ALERTNESS AND THEIR COMPLIANCE WITH WORKPLACE REGULATIONS

- 8.5.2 PERSONNEL/STAFF TRACKING: WORKPLACE SAFETY MARKET DRIVERS

- 8.6 AUDIT & COMPLIANCE

- 8.6.1 NEED TO AUTOMATE COMPLIANCE CHECKLISTS AND GENERATE AUDIT TRAILS FOR INTERNAL AND EXTERNAL ASSESSMENTS IN ORGANIZATIONS TO FUEL ADOPTION

- 8.6.2 AUDIT & COMPLIANCE: WORKPLACE SAFETY MARKET DRIVERS

- 8.7 OTHER APPLICATIONS (VEHICLE TRACKING AND FIRE DETECTION)

- 8.7.1 OTHER APPLICATIONS: WORKPLACE SAFETY MARKET DRIVERS

9 WORKPLACE SAFETY MARKET, BY DEPLOYMENT MODE

- 9.1 INTRODUCTION

- 9.2 ON-PREMISES

- 9.2.1 ON-PREMISE SAFETY MEASURES TO LIMIT THIRD-PARTY INVOLVEMENT

- 9.2.2 ON-PREMISES: WORKPLACE SAFETY MARKET DRIVERS

- 9.3 CLOUD

- 9.3.1 NEED FOR INCREASED ACCESSIBILITY AND LOW MAINTENANCE COSTS TO BOOST ADOPTION OF CLOUD PLATFORM

- 9.3.2 CLOUD: WORKPLACE SAFETY MARKET DRIVERS

10 WORKPLACE SAFETY MARKET, BY ORGANIZATION SIZE

- 10.1 INTRODUCTION

- 10.2 SMES

- 10.2.1 GROWING COMPLIANCE PRESSURE FROM CLIENTS AND REGULATORS TO PUSH SMES TO ADOPT SAFETY SOLUTIONS

- 10.2.2 SMES: WORKPLACE SAFETY MARKET DRIVERS

- 10.3 LARGE ENTERPRISES

- 10.3.1 FOCUS ON ESG GOALS TO ENCOURAGE LARGE ENTERPRISES TO ADOPT ADVANCED SAFETY TECH AND STANDARDS

- 10.3.2 LARGE ENTERPRISES: WORKPLACE SAFETY MARKET DRIVERS

11 WORKPLACE SAFETY MARKET, BY VERTICAL

- 11.1 INTRODUCTION

- 11.2 ENERGY & UTILITIES

- 11.2.1 GROWING DEPLOYMENT OF SOLUTIONS FOR OPTIMIZING PRODUCTION TO BOOST USE OF SAFETY MEASURES

- 11.2.2 ENERGY & UTILITIES: WORKPLACE SAFETY MARKET DRIVERS

- 11.3 CONSTRUCTION & ENGINEERING

- 11.3.1 INCREASE IN INCIDENTS OF WORKPLACE INJURIES AND ACCIDENTS TO PROPEL USE OF WORKPLACE SAFETY SYSTEMS

- 11.3.2 CONSTRUCTION & ENGINEERING: WORKPLACE SAFETY MARKET DRIVERS

- 11.4 CHEMICALS & MATERIALS

- 11.4.1 USE OF HAZARDOUS CHEMICAL AGENTS IN CHEMICALS & MATERIALS SECTOR TO DRIVE MARKET FOR WORKPLACE SAFETY

- 11.4.2 CHEMICALS & MATERIALS: WORKPLACE SAFETY MARKET DRIVERS

- 11.5 GOVERNMENT & DEFENSE

- 11.5.1 INCREASE IN IMPLEMENTATION OF INCIDENT MANAGEMENT POLICIES AND REGULATIONS FOR WORKER SAFETY

- 11.5.2 GOVERNMENT & DEFENSE: WORKPLACE SAFETY MARKET DRIVERS

- 11.6 HEALTHCARE

- 11.6.1 RISE IN WORKPLACE INJURIES TO SPUR NEED FOR SAFETY SYSTEMS IN HEALTHCARE INDUSTRY

- 11.6.2 HEALTHCARE: WORKPLACE SAFETY MARKET DRIVERS

- 11.7 FOOD & BEVERAGE

- 11.7.1 HIGH-RISK ENVIRONMENTS IN FOOD PROCESSING PLANTS TO DRIVE DEPLOYMENT OF SAFETY SYSTEMS IN FOOD & BEVERAGE SECTOR

- 11.7.2 FOOD & BEVERAGE: WORKPLACE SAFETY MARKET DRIVERS

- 11.8 OIL & GAS

- 11.8.1 STRICTER SAFETY REGULATIONS AND COMPLIANCE STANDARDS REQUIRED WITH HIGH RATES OF INJURIES AND FATALTIES

- 11.8.2 OIL & GAS: WORKPLACE SAFETY MARKET DRIVERS

- 11.9 AUTOMOTIVE

- 11.9.1 HIGHER ADOPTION OF AUTOMATION, AI-BASED MONITORING, AND DIGITAL TRAINING SOLUTIONS TO REDUCE WORKPLACE HAZARDS

- 11.9.2 AUTOMOTIVE: WORKPLACE SAFETY MARKET DRIVERS

- 11.10 OTHER VERTICALS

- 11.10.1 OTHER VERTICALS: WORKPLACE SAFETY MARKET DRIVERS

12 WORKPLACE SAFETY MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 12.2.2 NORTH AMERICA: WORKPLACE SAFETY MARKET DRIVERS

- 12.2.3 US

- 12.2.3.1 Increase in investments by government organizations for workplace safety

- 12.2.4 CANADA

- 12.2.4.1 Robust workplace safety framework and technology integration

- 12.3 EUROPE

- 12.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 12.3.2 EUROPE: WORKPLACE SAFETY MARKET DRIVERS

- 12.3.3 UK

- 12.3.3.1 Increase in incidents of workplace injuries and accidents

- 12.3.4 GERMANY

- 12.3.4.1 Focus on strategy designed to enhance and evolve safety and health standards through systematic policy application

- 12.3.5 FRANCE

- 12.3.5.1 Initiatives by government agencies to spread awareness and build safety frameworks

- 12.3.6 ITALY

- 12.3.6.1 Italian ministry and events such as expos focusing on safety advancements

- 12.3.7 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 12.4.2 ASIA PACIFIC: WORKPLACE SAFETY MARKET DRIVERS

- 12.4.3 CHINA

- 12.4.3.1 Growth in adoption of advanced technologies and tools by organizations

- 12.4.4 JAPAN

- 12.4.4.1 Growth in adoption of advanced technologies and tools by organizations

- 12.4.5 SOUTH KOREA

- 12.4.5.1 Regulations regarding workplace safety and huge fines levied in case of breach of law

- 12.4.6 INDIA

- 12.4.6.1 Regulations and statutes outlined by several government agencies to combat high industrial accident rate

- 12.4.7 REST OF ASIA PACIFIC

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 12.5.2 MIDDLE EAST & AFRICA: WORKPLACE SAFETY MARKET DRIVERS

- 12.5.3 MIDDLE EAST

- 12.5.3.1 GCC

- 12.5.3.1.1 UAE

- 12.5.3.1.1.1 Government collaboration with International Labour Organization to set high safety standards

- 12.5.3.1.2 KSA

- 12.5.3.1.2.1 Implementation of projects for workers' health and safety to drive growth

- 12.5.3.1.3 Rest of GCC

- 12.5.3.1.1 UAE

- 12.5.3.2 Rest of the Middle East

- 12.5.3.1 GCC

- 12.5.4 AFRICA

- 12.5.4.1 Rising workplace injuries in high-risk sectors to drive safety investments across Africa

- 12.6 LATIN AMERICA

- 12.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 12.6.2 LATIN AMERICA: WORKPLACE SAFETY MARKET DRIVERS

- 12.6.3 BRAZIL

- 12.6.3.1 Robust workplace safety regulations and awareness initiatives

- 12.6.4 MEXICO

- 12.6.4.1 Need to harmonize safety standards across sectors for high-risk workers

- 12.6.5 REST OF LATIN AMERICA

13 COMPETITIVE LANDSCAPE

- 13.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2024

- 13.2 REVENUE ANALYSIS, 2020-2024

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 BRAND/PRODUCT COMPARISON

- 13.5 COMPANY VALUATION & FINANCIAL METRICS

- 13.5.1 COMPANY VALUATION

- 13.5.2 FINANCIAL METRICS

- 13.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.6.1 STARS

- 13.6.2 EMERGING LEADERS

- 13.6.3 PERVASIVE PLAYERS

- 13.6.4 PARTICIPANTS

- 13.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.6.5.1 Company footprint

- 13.6.5.2 Region footprint

- 13.6.5.3 Offering footprint

- 13.6.5.4 Organization size footprint

- 13.6.5.5 Vertical footprint

- 13.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.7.1 PROGRESSIVE COMPANIES

- 13.7.2 RESPONSIVE COMPANIES

- 13.7.3 DYNAMIC COMPANIES

- 13.7.4 STARTING BLOCKS

- 13.7.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.7.5.1 Detailed list of key startups/SMEs

- 13.7.5.2 Competitive benchmarking of key startups/SMEs

- 13.8 COMPETITIVE SCENARIO

- 13.8.1 PRODUCT LAUNCHES/ENHANCEMENTS

- 13.8.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 IBM

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths

- 14.1.1.4.2 Strategic choices made

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 HONEYWELL

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths

- 14.1.2.3.2 Strategic choices made

- 14.1.2.3.3 Weaknesses and competitive threats

- 14.1.3 3M

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.3.2 Deals

- 14.1.3.4 MnM view

- 14.1.3.4.1 Key strengths

- 14.1.3.4.2 Strategic choices made

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 HEXAGON AB

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Deals

- 14.1.4.4 MnM view

- 14.1.4.4.1 Key strengths

- 14.1.4.4.2 Strategic choices made

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 MICROSOFT

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths

- 14.1.5.3.2 Strategic choices made

- 14.1.5.3.3 Weaknesses and competitive threats

- 14.1.6 APPIAN

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Key strengths

- 14.1.6.4.2 Strategic choices made

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 BOSCH

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.8 CORITY

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Product launches

- 14.1.8.3.2 Deals

- 14.1.9 WOLTERS KLUWER

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Product enhancements

- 14.1.9.3.2 Deals

- 14.1.10 INTELEX

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 Recent developments

- 14.1.10.3.1 Deals

- 14.1.11 HCL TECHNOLOGIES

- 14.1.11.1 Business overview

- 14.1.11.2 Products/Solutions/Services offered

- 14.1.12 HSI

- 14.1.13 VECTOR SOLUTIONS

- 14.1.14 ARVENTA

- 14.1.15 AMAZON WEB SERVICES (AWS)

- 14.1.16 HITACHI SOLUTIONS

- 14.1.17 DAMOTECH

- 14.1.18 EHS INSIGHT

- 14.1.19 ECOONLINE

- 14.1.20 STRONGARM TECH

- 14.1.21 KINETIC

- 14.1.22 INTENSEYE

- 14.1.23 SECURADE.AI

- 14.1.24 BUDDYWISE

- 14.1.25 VISIONIFY

- 14.1.26 BENCHMARK GENSUITE

- 14.1.27 QUARTEX SOFTWARE

- 14.1.28 AATMUNN

- 14.1.1 IBM

15 ADJACENT MARKETS

- 15.1 INTRODUCTION

- 15.1.1 LIMITATIONS

- 15.2 INDUSTRIAL SAFETY MARKET

- 15.3 ENVIRONMENT, HEALTH, AND SAFETY MARKET

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS