|

시장보고서

상품코드

1795416

AI 플랫폼 시장 : 제공별, 기능성별 예측(-2030년)AI Platform Market by Offering (Conversational AI, Generative AI, AI Agent, Deep Learning, Edge AI, AI API, MLOps, Data Mesh, Data Science Platforms), Functionality (Data Management, Model Development, Deployment, Training) - Global Forecast to 2030 |

||||||

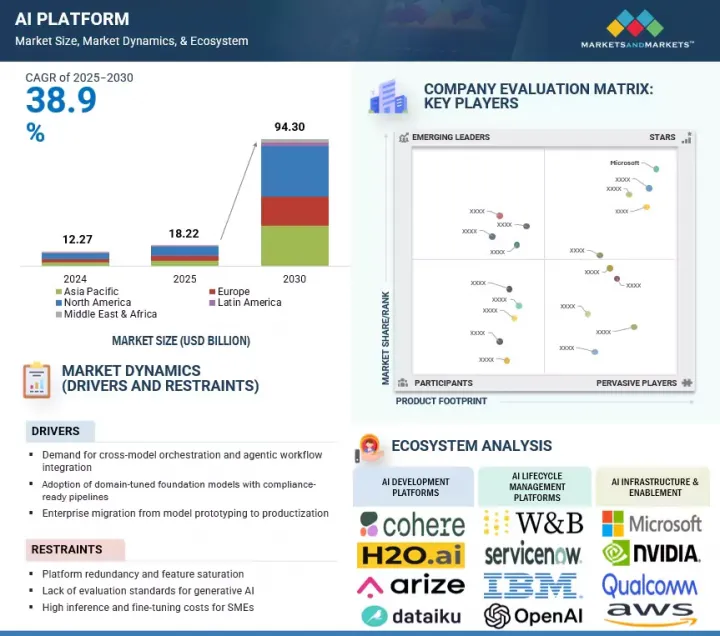

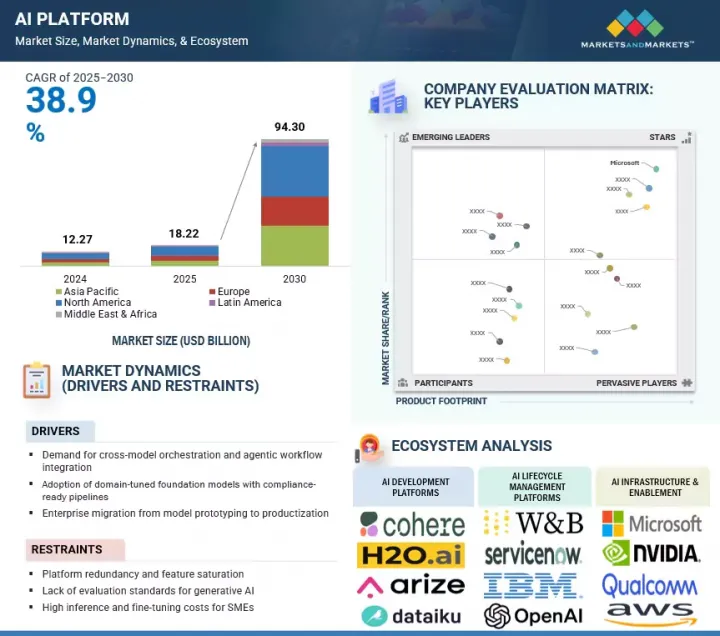

세계의 AI 플랫폼 시장은 급속히 확대되고 있으며 시장 규모는 2025년 182억 2,000만 달러에서 2030년까지 943억 달러에 이를 것으로 예측되며, 예측 기간에 CAGR 38.9%의 성장이 예상됩니다. 시장은 자동화 수요 증가, 산업(의료, 금융, 소매) 전반의 인공지능 채택 확대, 머신러닝 및 클라우드 컴퓨팅의 발전으로 인한 것입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 제공, 기능성, 사용자 유형, 최종 사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

기업은 효율성과 데이터 주도의 의사결정을 요구하고 수요를 더욱 촉진하고 있습니다. 그러나, 높은 도입 비용이나 규제상의 과제 등이 더해져, 채용이나 확장성이 늦어질 가능성이 있습니다.

"플랫폼 유형별로는 AI 인프라 인에이블먼트가 예측 기간에 두 번째로 높은 성장률이 될 전망입니다."

이러한 성장은 복잡한 AI 워크로드를 지원하는 데 필요한 HPC 리소스, 데이터 스토리지 및 확장 가능한 클라우드 인프라에 대한 수요 증가로 이어집니다. 조직은 AI 모델을 효율적으로 훈련, 배포 및 관리하는 견고한 인프라를 점점 더 필요로 합니다. 주요 구성 요소로는 GPU, 데이터 레이크, ML 프레임워크, 오케스트레이션 도구 등이 있습니다. 다양한 산업에서 AI 채용이 증가하고 있기 때문에 지원 기술에 대한 투자가 확대되고 있습니다.

"엔터프라이즈 최종 사용자별로 소프트웨어 기술 부문은 예측 기간에 가장 큰 시장 점유율을 차지합니다."

기업 최종 사용자별로는 소프트웨어 기술 부문이 예측 기간에 AI 플랫폼 시장에서 가장 큰 시장 점유율을 차지할 전망입니다. 이는 주로 이 부문이 소프트웨어 개발, 사이버 보안, 데이터 애널리틱스, IT 운영에 신속하게 AI를 채택하고 통합하고 있기 때문입니다. 하이테크 기업은 기술 혁신의 최전선에 있으며, 제품 강화, 고객 경험 향상, 경쟁 우위 확보를 위해 AI에 많은 투자를 하고 있습니다. 이 인프라는 강력한 클라우드 환경과 데이터 처리 능력 등을 포함한 AI 플랫폼 지원에도 적합합니다.

또한 이 부서에는 숙련된 전문가가 갖추어져 있어 AI 솔루션의 신속한 배포와 확장이 가능합니다. 그 결과, 소프트웨어 기술 산업은 기업 최종 사용자들 사이에서 AI 채택을 계속 이끌고 있습니다.

"북미가 시장 점유율로 선도하는 한편, 아시아태평양이 AI 플랫폼 시장에서 가장 급성장하고 있는 지역으로 대두하고 있습니다."

북미의 이점은 강력한 기술 생태계, 산업 전반의 AI 조기 채용, Google, Microsoft, IBM 등 주요 AI 플랫폼 제공업체의 존재로 인해 발생합니다. 이 지역은 고액의 R&D 투자, 고급 인프라, 숙련된 전문가의 대규모 수영장에서 이익을 얻고 있습니다.

한편, 아시아태평양은 디지털 전환의 진행, 정부 주도의 AI 전략, 중국, 인도, 일본에서의 채용 확대에 따라 가장 빠르게 성장하고 있습니다. 급속한 산업화, 테크스타트업 확대, 제조, 의료, 금융 등의 부문에서의 자동화 수요 증가가 이 성장을 뒷받침하고 있습니다. 북미가 성숙한 속도를 유지하면서 아시아태평양은 적극적인 투자와 혁신을 통해 빠르게 그 차이를 줄이고 있습니다.

이 보고서는 세계 AI 플랫폼 시장에 대한 조사 분석을 통해 주요 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- AI 플랫폼 시장에서의 매력적인 기회

- AI 플랫폼 시장 : 상위 3개의 기능성

- 북미의 AI 플랫폼 시장 : 제공별, 기능성별

- AI 플랫폼 시장 : 지역별

제5장 시장 개요와 산업 동향

- 소개

- 시장 역학

- 성장 촉진요인

- 억제요인

- 기회

- 과제

- AI 플랫폼 시장의 진화

- 공급망 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 사례 연구 분석

- 사례 연구 1: IMERYS, 생산성과 데이터 액세스를 향상시키는 엔터프라이즈 AI 채팅을 전개

- 사례 연구 2 : BASISAI, ML 전개를 자동화하여 AI 개발 라이프 사이클을 가속

- 사례 연구 3: AT&T, AI 플랫폼을 활용하여 부정 행위를 방지하고 네트워크 효율을 향상

- 사례 연구 4: BMW, 보다 스마트한 조달 분석을 위해 생성형 AI를 전개

- 사례 연구 5: MOVEWORKS, 직원 지원을 대규모로 자동화하는 AI 플랫폼을 전개

- Porter's Five Forces 분석

- 고객사업에 영향을 주는 동향/혼란

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규정 : AI

- 특허 분석

- 조사 방법

- 특허출원건수 : 서류종별

- 혁신과 특허출원

- 투자 및 자금조달 시나리오

- 가격 설정 분석

- 평균 판매 가격 : 주요 기업별(2025년)

- 참고 가격 분석 : 기능성별(2025년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 주요 이해관계자와 구매 기준

- 고객의 세분화과 바이어의 페르소나

- 주요 바이어의 아키유형

- 주요 특정 업계의 바이어의 세분화

- 바이어 저니 매핑

- 기술 로드맵과 혁신의 방향성

- 기술 로드맵과 능력 분야

- AI 플랫폼 능력 성숙도 프레임워크

- 파트너십과 생태계 전략

- 구매자에게 중요한 성공 요인

제6장 AI 플랫폼 시장 : 제공별

- 소개

- AI 개발 플랫폼

- AI 라이프사이클 매니지먼트 플랫폼

- AI 인에이블먼트 서비스

제7장 AI 플랫폼 시장 : 기능성별

- 소개

- 데이터 관리 및 준비

- 모델 개발 및 트레이닝

- 모델 전개 및 서비스 제공

- 모니터링 및 유지보수

- 모델 거버넌스 컴플라이언스

- 모델의 파인 튜닝 및 개인화

- 설명 가능성 및 바이어스 툴

- 보안 및 프라이버시

제8장 AI 플랫폼 시장 : 유저 유형별

- 소개

- 데이터 사이언티스트 및 ML 엔지니어

- MLOPS 및 AI 엔지니어

- 비즈니스 애널리스트 및 민간 개발자

- AI 제품 매니저

- IT 클라우드 아키텍트

제9장 AI 플랫폼 시장 : 최종 사용자별

- 소개

- 기업

- 의료 및 생명과학

- BFSI

- 소매 및 E-Commerce

- 운송 및 물류

- 자동차 및 모빌리티

- 통신

- 정부 및 방위

- 에너지 및 유틸리티

- 제조

- 소프트웨어 및 기술

- 미디어 및 엔터테인먼트

- 기타 기업 최종 사용자

- 개인 사용자

제10장 AI 플랫폼 시장 : 지역별

- 소개

- 북미

- 북미의 AI 플랫폼 시장 성장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 AI 플랫폼 시장 성장 촉진요인

- 유럽의 거시 경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 AI 플랫폼 시장 성장 촉진요인

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주 및 뉴질랜드

- ASEAN

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 AI 플랫폼 시장 성장 촉진요인

- 중동 및 아프리카의 거시 경제 전망

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 튀르키예

- 카타르

- 이집트

- 쿠웨이트

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 AI 플랫폼 시장 성장 촉진요인

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 칠레

- 기타 라틴아메리카

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략/강점(2022-2025년)

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 제품의 비교 분석

- 기업 평가 및 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가 매트릭스 : AI 인에이블먼트 서비스(2024년)

- 경쟁 시나리오와 동향

제12장 기업 프로파일

- 소개

- 주요 기업

- MICROSOFT

- IBM

- ORACLE

- AWS

- INTEL

- SALESFORCE

- SAP

- SERVICENOW

- NVIDIA

- OPENAI

- ALIBABA CLOUD

- HPE

- DATABRICKS

- INSIGHT

- PALANTIR

- ALTAIR

- DATAIKU

- STARTUP/SME PROFILES

- H2O.AI

- ANTHROPIC

- COHERE

- ANYSCALE

- DATAROBOT

- VITAL AI

- RAINBIRD TECHNOLOGIES

- ARIZE AI

- CALYPSOAI

- CLARIFAI

- WEIGHTS & BIASES

- ELVEX

- IGUAZIO

- MISTRAL AI

- BASETEN

- LIGHTNING AI

- PROWESS CONSULTING

- DEVTECH

- ZYXWARE TECHNOLOGIES

- FLUIDONE

- AHELIOTECH

- ORIL

- CONVERSANT SOLUTIONS

제13장 인접 시장과 관련 시장

- 소개

- AI 툴킷 시장 - 세계 예측(-2028년)

- 시장의 정의

- 시장 개요

- 노코드 AI 플랫폼 시장 - 세계 예측(-2029년)

- 시장의 정의

- 시장 개요

제14장 부록

JHS 25.08.28The AI platform market is expanding rapidly, with a projected market size rising from USD 18.22 billion in 2025 to USD 94.30 billion by 2030, at a CAGR of 38.9% during the forecast period. The market is driven by the increasing demand for automation, growing adoption of AI across industries (healthcare, finance, and retail), and advancements in machine learning and cloud computing.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Functionality, User Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

Businesses seek efficiency and data-driven decision-making, further fuelling demand. However, restraints include high implementation costs and regulatory challenges, which can slow down adoption and scalability.

"By platform type, AI infrastructure & enablement is expected to account for the second fastest growth rate during the forecast period"

By platform type, the AI infrastructure & enablement segment is expected to account for the second fastest growth rate during the forecast period in the AI platform market. This growth is driven by the rising demand for high-performance computing resources, data storage, and scalable cloud infrastructure needed to support complex AI workloads. Organizations increasingly require robust infrastructure to train, deploy, and manage AI models efficiently. Key components include GPUs, data lakes, ML frameworks, and orchestration tools. The increase in AI adoption across various industries is driving greater investment in supporting technologies.

"By enterprise end user, software & technology segment will hold the largest market share during the forecast period"

By enterprise end user, the software & technology segment is expected to hold the largest market share in the AI platform market during the forecast period. This is primarily due to the sector's early adoption and integration of AI for software development, cybersecurity, data analytics, and IT operations. Tech companies are at the forefront of innovation, investing heavily in AI to enhance product offerings, improve customer experience, and gain a competitive advantage. Their infrastructure is also well-suited to support AI platforms, including robust cloud environments and data processing capabilities.

Additionally, the availability of skilled professionals in this sector enables faster deployment and scaling of AI solutions. As a result, the software & technology industry continues to lead AI adoption among enterprise end users.

"North America leads in market share while Asia Pacific emerges as the fastest-growing region in the AI platform market"

North America leads in market share, while Asia Pacific emerges as the fastest-growing region in the AI platform market. North America's dominance is attributed to its strong technological ecosystem, early adoption of AI across industries, and presence of major AI platform providers such as Google, Microsoft, and IBM. The region benefits from high R&D investment, advanced infrastructure, and a large pool of skilled professionals.

In contrast, Asia Pacific is experiencing the fastest growth due to increasing digital transformation, government-led AI initiatives, and growing adoption in China, India, and Japan. Rapid industrialization, expanding tech startups, and rising demand for automation in sectors such as manufacturing, healthcare, and finance are driving this growth. While North America sets the pace in maturity, Asia Pacific is quickly narrowing the gap with aggressive investments and innovation.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI platform market.

- By Company: Tier I - 15%, Tier II - 42%, and Tier III - 43%

- By Designation: C-Level Executives - 65%, D-Level Executives -23%, and Others - 12%

- By Region: North America - 40%, Europe - 30%, Asia Pacific - 20%, Middle East & Africa - 5%, and Latin America - 5%

The report includes a study of key players in the AI platform market. It profiles major market vendors, including Google (US), Microsoft (US), IBM (US), Intel (US), Infosys (India), Wipro (India), Salesforce (US), HPE (US), Insight (US), NVIDIA (US), Alibaba Cloud (China), AWS (US), SAP (Germany), Palantir (US), Oracle (US), ServiceNow (US), Databricks (US), OpenAI (US), Altair (US), Dataiku (US), Cohere (Canada), H2O.ai (US), Vital AI (US), Rainbird Technologies (UK), Arize AI (US), CalypsoAI (US), Clarifai (US), Anyscale (US), Weights & Biases (US), Iguazio (Israel), Mistral AI (France), Baseten (US), Lightning AI (US), and Anthropic (US).

Research Coverage

This research report categorizes the AI platform market based on offering (platform type (AI development platforms, AI lifecycle management platforms, and AI infrastructure & enablement), and deployment mode (cloud & on-premises)), functionality (data management & preparation, model development & training, model deployment & serving, monitoring & maintenance, model governance & compliance, model fine-tuning & personalization, explainability & bias tools, and security & privacy), user type (data scientists & ML engineers, MLOps/AI engineers, business analysts & citizen developers, AI product managers, and IT & cloud architects), end user (individual and enterprises (healthcare & life sciences, BFSI, retail & e-commerce, transportation & logistics, automotive & mobility, telecommunications, government & defence, energy & utilities, manufacturing, software & technology, media and entertainment, and others), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the AI platform market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, new product & service launches, and mergers and acquisitions; and recent developments associated with the AI platform market. Competitive analysis of upcoming startups in the AI platform market ecosystem was also covered in this report.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI platform market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better their business and plan suitable go-to-market strategies. It also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Demand for cross-model orchestration and agentic workflow integration, Adoption of domain-tuned foundation models with compliance-ready pipelines, Enterprise migration from model prototyping to productization), restraints (Platform redundancy and feature saturation, Lack of evaluation standards for generative AI, High inference and fine-tuning costs for SMEs), opportunities (Fusion of AI platforms with business automation stacks, Middleware abstraction for model interoperability, Accelerating AI development with privacy-first synthetic data), and challenges (Regulatory burden on model deployment and platform fatigue from toolchain fragmentation)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the AI platform market

- Market Development: Comprehensive information about lucrative markets - analyzing the AI Platform market across varied regions

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the AI platform market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as Google (US), Microsoft (US), IBM (US), Intel (US), Infosys (India), Wipro (India), Salesforce (US), HPE (US), Insight (US), NVIDIA (US), Alibaba Cloud (China), AWS (US), SAP (Germany), Palantir (US), Oracle (US), ServiceNow (US), Databricks (US), OpenAI (US), Altair (US), Dataiku (US), Cohere (Canada), H2O.ai (US), Vital AI (US), Rainbird Technologies (UK), Arize AI (US), CalypsoAI (US), Clarifai (US), Anyscale (US), Weights & Biases (US), Iguazio (Israel), Mistral AI (France), Baseten (US), Lightning AI (US), and Anthropic (US).

The report also helps stakeholders understand the pulse of the AI platform market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI PLATFORM MARKET

- 4.2 AI PLATFORM MARKET: TOP THREE FUNCTIONALITIES

- 4.3 NORTH AMERICA: AI PLATFORM MARKET, BY OFFERING AND FUNCTIONALITY

- 4.4 AI PLATFORM MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Demand for cross-model orchestration and agentic workflow integration

- 5.2.1.2 Adoption of domain-tuned foundation models with compliance-ready pipelines

- 5.2.1.3 Enterprise migration from model prototyping to productization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Platform redundancy and feature saturation

- 5.2.2.2 Lack of evaluation standards for generative AI

- 5.2.2.3 High inference and fine-tuning costs for SMEs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Fusion of AI platforms with business automation stacks

- 5.2.3.2 Middleware abstraction for model interoperability

- 5.2.3.3 Accelerating AI development with privacy-first synthetic data

- 5.2.4 CHALLENGES

- 5.2.4.1 Regulatory burden on model deployment

- 5.2.4.2 Platform fatigue from toolchain fragmentation

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI PLATFORM MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 AI PLATFORM MARKET, BY OFFERING

- 5.5.1.1 AI Development Platforms

- 5.5.1.2 AI Lifecycle Management Platforms

- 5.5.1.3 AI Infrastructure & Enablement

- 5.5.1 AI PLATFORM MARKET, BY OFFERING

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Generative AI

- 5.6.1.2 Autonomous AI & Autonomous Agents

- 5.6.1.3 AutoML

- 5.6.1.4 Causal AI

- 5.6.1.5 MLOps

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 Blockchain

- 5.6.2.2 Edge Computing

- 5.6.2.3 Cybersecurity

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Predictive Analytics

- 5.6.3.2 IoT

- 5.6.3.3 Big Data

- 5.6.3.4 Augmented Reality/Virtual Reality

- 5.6.1 KEY TECHNOLOGIES

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 CASE STUDY 1: IMERYS DEPLOYED ENTERPRISE AI CHAT TO BOOST PRODUCTIVITY AND DATA ACCESS

- 5.7.2 CASE STUDY 2: BASISAI AUTOMATED ML DEPLOYMENT TO SPEED UP AI DEVELOPMENT LIFECYCLE

- 5.7.3 CASE STUDY 3: AT&T LEVERAGED AI PLATFORM TO COMBAT FRAUD AND IMPROVE NETWORK EFFICIENCY

- 5.7.4 CASE STUDY 4: BMW DEPLOYED GEN AI FOR SMARTER PROCUREMENT ANALYSIS

- 5.7.5 CASE STUDY 5: MOVEWORKS DEPLOYED AI PLATFORM TO AUTOMATE EMPLOYEE SUPPORT AT SCALE

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATIONS: ARTIFICIAL INTELLIGENCE

- 5.10.2.1 North America

- 5.10.2.1.1 SCR 17: Artificial Intelligence Bill (California)

- 5.10.2.1.2 S1103: Artificial Intelligence Automated Decision Bill (Connecticut)

- 5.10.2.1.3 National Artificial Intelligence Initiative Act (NAIIA)

- 5.10.2.1.4 The Artificial Intelligence and Data Act (AIDA) - Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 The European Union (EU) - Artificial Intelligence Act (AIA)

- 5.10.2.2.2 General Data Protection Regulation (Europe)

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.10.2.3.2 The National AI Strategy (Singapore)

- 5.10.2.3.3 The Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 The National Strategy for Artificial Intelligence (UAE)

- 5.10.2.4.2 Impact on AI Platform Market

- 5.10.2.4.3 The National Artificial Intelligence Strategy (Qatar)

- 5.10.2.4.4 Impact on AI Platform Market

- 5.10.2.4.5 The AI Ethics Principles and Guidelines (Dubai)

- 5.10.2.4.6 Impact on AI Platform Market

- 5.10.2.5 Latin America

- 5.10.2.5.1 The Santiago Declaration (Chile)

- 5.10.2.5.2 The Brazilian Artificial Intelligence Strategy (EBIA)

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.13.2 INDICATIVE PRICING ANALYSIS, BY FUNCTIONALITY, 2025

- 5.14 KEY CONFERENCES AND EVENTS (2025-2026)

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 CUSTOMER SEGMENTATION & BUYER PERSONAS

- 5.16.1 KEY BUYER ARCHETYPES

- 5.16.2 KEY INDUSTRY-SPECIFIC BUYER SEGMENTATION

- 5.16.3 BUYER JOURNEY MAPPING

- 5.17 TECHNOLOGY ROADMAP & INNOVATION DIRECTIONS

- 5.17.1 TECHNOLOGY ROADMAP & CAPABILITY AREA

- 5.17.2 AI PLATFORM CAPABILITY MATURITY FRAMEWORK

- 5.18 PARTNERSHIPS & ECOSYSTEM STRATEGIES

- 5.18.1 PARTNERSHIPS & ECOSYSTEM STRATEGIES

- 5.19 KEY SUCCESS FACTORS FOR BUYERS

- 5.19.1 CHECKLIST FOR SUSTAINABLE AND STRATEGIC AI PLATFORM INVESTMENTS

6 AI PLATFORM MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERINGS: AI PLATFORM MARKET DRIVERS

- 6.2 AI DEVELOPMENT PLATFORMS

- 6.2.1 AI DEVELOPMENT PLATFORMS EMPOWER FASTER, SCALABLE AI APPLICATION DEVELOPMENT, DRIVING INNOVATION AND OPERATIONAL EFFICIENCY ACROSS INDUSTRIES

- 6.2.2 DEEP LEARNING PLATFORMS

- 6.2.3 GENERATIVE AI PLATFORMS

- 6.2.4 CONVERSATIONAL AI PLATFORMS

- 6.2.5 EDGE AI PLATFORMS

- 6.2.6 AI AGENT PLATFORMS

- 6.2.7 ANNOTATION & DATA LABELING PLATFORMS

- 6.2.8 OPEN-SOURCE MODEL PLATFORMS

- 6.3 AI LIFECYCLE MANAGEMENT PLATFORMS

- 6.3.1 AI LIFECYCLE MANAGEMENT PLATFORMS ENSURE SCALABLE, COMPLIANT, AND RELIABLE AI DEPLOYMENTS, DRIVING ENTERPRISE READINESS FOR PRODUCTION-GRADE AI

- 6.3.2 MLOPS PLATFORMS

- 6.3.3 LLMOPS PLATFORMS

- 6.3.4 MODEL EVALUATION & GOVERNANCE PLATFORMS

- 6.3.5 DRIFT DETECTION & MONITORING PLATFORMS

- 6.3.6 EXPLAINABILITY & RESPONSIBLE AI TOOLS

- 6.4 AI ENABLEMENT SERVICES

- 6.4.1 AI ENABLEMENT SERVICES GUIDE ENTERPRISES THROUGH STRATEGY, DEPLOYMENT, AND MANAGEMENT OF AI, ACCELERATING ADOPTION WHILE REDUCING RISKS AND COMPLEXITIES

- 6.4.2 STRATEGIC AI PLANNING

- 6.4.3 MODEL DEVELOPMENT & DEPLOYMENT

- 6.4.4 MODEL IMPLEMENTATION & MAINTENANCE

- 6.4.5 DISCOVERY AND EVALUATION

7 AI PLATFORM MARKET, BY FUNCTIONALITY

- 7.1 INTRODUCTION

- 7.1.1 FUNCTIONALITIES: AI PLATFORM MARKET DRIVERS

- 7.2 DATA MANAGEMENT & PREPARATION

- 7.2.1 ENABLE ACCURATE, COMPLIANT, AND SCALABLE AI PROJECTS WITH STRONG DATA MANAGEMENT AND PREPARATION TOOLS

- 7.3 MODEL DEVELOPMENT & TRAINING

- 7.3.1 ACCELERATE AI INNOVATION WITH EFFICIENT, SCALABLE, AND COLLABORATIVE MODEL DEVELOPMENT AND TRAINING CAPABILITIES

- 7.4 MODEL DEPLOYMENT & SERVING

- 7.4.1 ENSURE RELIABLE, FLEXIBLE, AND REAL-TIME AI DELIVERY WITH ADVANCED MODEL DEPLOYMENT AND SERVING FUNCTIONALITIES

- 7.5 MONITORING & MAINTENANCE

- 7.5.1 MAINTAIN HIGH-PERFORMING, RISK-RESILIENT AI SYSTEMS WITH PROACTIVE MONITORING AND MAINTENANCE TOOLS

- 7.6 MODEL GOVERNANCE & COMPLIANCE

- 7.6.1 ENSURE RESPONSIBLE, AUDITABLE, AND COMPLIANT AI OPERATIONS WITH EMBEDDED GOVERNANCE FUNCTIONALITIES

- 7.7 MODEL FINE-TUNING & PERSONALIZATION

- 7.7.1 ACHIEVE HIGHER ACCURACY AND PERSONALIZATION WITH EFFICIENT FINE-TUNING AND CUSTOMIZATION FUNCTIONALITIES

- 7.8 EXPLAINABILITY & BIAS TOOLS

- 7.8.1 ENHANCE AI TRUSTWORTHINESS AND FAIRNESS WITH ADVANCED EXPLAINABILITY AND BIAS MITIGATION TOOLS

- 7.9 SECURITY & PRIVACY

- 7.9.1 SECURE AI DEPLOYMENTS WITH PRIVACY-PRESERVING TECHNOLOGIES AND ROBUST CYBERSECURITY PROTECTIONS

8 AI PLATFORM MARKET, BY USER TYPE

- 8.1 INTRODUCTION

- 8.1.1 USER TYPES: AI PLATFORM MARKET DRIVERS

- 8.1.2 DATA SCIENTISTS & ML ENGINEERS

- 8.1.2.1 Building differentiated models using open frameworks and proprietary data

- 8.1.3 MLOPS/AI ENGINEERS

- 8.1.3.1 Automating lifecycle management for scalable model operations

- 8.1.4 BUSINESS ANALYSTS & CITIZEN DEVELOPERS

- 8.1.4.1 Unlocking business value through no-code AI enablement

- 8.1.5 AI PRODUCT MANAGERS

- 8.1.5.1 Connecting model performance to product and customer impact

- 8.1.6 IT & CLOUD ARCHITECTS

- 8.1.6.1 Deploying secure, compliant infrastructure for enterprise-scale AI

9 AI PLATFORM MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 END USERS: AI PLATFORM MARKET DRIVERS

- 9.2 ENTERPRISES

- 9.2.1 HEALTHCARE & LIFE SCIENCES

- 9.2.1.1 AI platforms transforming healthcare and life sciences by enhancing diagnostics, accelerating drug development, and enabling personalized, data-driven care delivery

- 9.2.1.2 Healthcare providers

- 9.2.1.3 Pharmaceuticals & biotech sector

- 9.2.1.4 Medtech

- 9.2.2 BFSI

- 9.2.2.1 BFSI organizations leveraging AI platforms to drive intelligent automation, enhance fraud prevention, and offer personalized financial services at scale

- 9.2.2.2 Banking

- 9.2.2.3 Financial services

- 9.2.2.4 Insurance

- 9.2.3 RETAIL & E-COMMERCE

- 9.2.3.1 Retail & e-commerce firms use AI platforms to personalize customer journeys, streamline operations, and drive smarter inventory and pricing decisions.

- 9.2.4 TRANSPORTATION & LOGISTICS

- 9.2.4.1 AI enhances fleet efficiency and real-time supply chain visibility

- 9.2.5 AUTOMOTIVE & MOBILITY

- 9.2.5.1 AI platforms transforming automotive industry by enabling autonomous features, predictive maintenance, and real-time vehicle intelligence

- 9.2.6 TELECOMMUNICATIONS

- 9.2.6.1 Telecom companies use AI platforms to automate network management, enable predictive maintenance, and deploy intelligent customer services

- 9.2.7 GOVERNMENT & DEFENSE

- 9.2.7.1 AI platforms enabling governments and defense agencies to build secure, scalable AI solutions for intelligence, public safety, and operational planning

- 9.2.8 ENERGY & UTILITIES

- 9.2.8.1 AI platforms help energy and utility providers optimize grid operations, forecast demand, and manage assets through centralized, scalable model deployment

- 9.2.8.2 Oil and gas

- 9.2.8.3 Power generation

- 9.2.8.4 Utilities

- 9.2.9 MANUFACTURING

- 9.2.9.1 AI platforms enable manufacturers to automate production, predict equipment failures, and improve quality control

- 9.2.9.2 Discrete manufacturing

- 9.2.9.3 Process manufacturing

- 9.2.10 SOFTWARE & TECHNOLOGY

- 9.2.10.1 AI platforms accelerating model development, testing, and deployment for tech firms building intelligent applications

- 9.2.11 MEDIA & ENTERTAINMENT

- 9.2.11.1 AI platforms help media companies personalize content, automate editing, and optimize distribution

- 9.2.12 OTHER ENTERPRISE END USERS

- 9.2.1 HEALTHCARE & LIFE SCIENCES

- 9.3 INDIVIDUAL USERS

- 9.3.1 AI PLATFORMS EMPOWER INDIVIDUAL USERS WITH TOOLS FOR LOW-CODE MODEL BUILDING, DATA EXPLORATION, AND PERSONAL AUTOMATION

10 AI PLATFORM MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI PLATFORM MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.3.1 Federal mandates and hyperscaler innovation drive enterprise-grade AI platform adoption

- 10.2.4 CANADA

- 10.2.4.1 Ethical AI leadership and public-sector investments fuel Canada's pragmatic platform growth

- 10.3 EUROPE

- 10.3.1 EUROPE: AI PLATFORM MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.3.1 UK blends AI safety leadership with targeted platform deployment in health and finance

- 10.3.4 GERMANY

- 10.3.4.1 Germany integrates AI platforms into smart manufacturing via deep industrial digitalization

- 10.3.5 FRANCE

- 10.3.5.1 France prioritizes sovereign AI platforms with open-source momentum and industrial backing

- 10.3.6 ITALY

- 10.3.6.1 Driving integration of climate and environmental risks into financial governance in Italy

- 10.3.7 SPAIN

- 10.3.7.1 Spain champions inclusive AI platforms through public-sector innovation and smart logistics

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI PLATFORM MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.3.1 China scales sovereign AI platforms across industries under national compute and LLM push

- 10.4.4 JAPAN

- 10.4.4.1 Japan focuses on trusted, explainable AI platforms for aging society and industrial resilience

- 10.4.5 INDIA

- 10.4.5.1 India advances inclusive, mobile-first AI platforms for public health, agriculture, and education

- 10.4.6 AUSTRALIA & NEW ZEALAND

- 10.4.6.1 Australia and New Zealand embed ethics and sustainability into government-led AI platforms

- 10.4.7 ASEAN

- 10.4.7.1 ASEAN scales modular AI platforms via SME enablement and regional policy coordination

- 10.4.8 SOUTH KOREA

- 10.4.8.1 South Korea drives enterprise-grade AI platforms with edge inferencing and HyperCLOVA integration

- 10.4.9 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI PLATFORM MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.3.1 Sovereign AI investments and Arabic LLMs drive platform adoption across sectors

- 10.5.4 UNITED ARAB EMIRATES (UAE)

- 10.5.4.1 Innovation hubs and sovereign cloud investments accelerate AI platform commercialization

- 10.5.5 SOUTH AFRICA

- 10.5.5.1 Telecom-driven edge AI and enterprise digitalization expand platform opportunities

- 10.5.6 TURKEY

- 10.5.6.1 Public AI initiatives and academic R&D spur demand for ML platforms and edge AI

- 10.5.7 QATAR

- 10.5.7.1 State-driven AI adoption focuses on Arabic NLP and smart city platforms

- 10.5.8 EGYPT

- 10.5.8.1 AI platform adoption tied to public sector digitalization and telecom-led edge deployments

- 10.5.9 KUWAIT

- 10.5.9.1 Digital government initiatives drive demand for conversational AI and LLM platforms

- 10.5.10 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI PLATFORM MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.3.1 Digital government initiatives and enterprise AI investments drive platform commercialization

- 10.6.4 MEXICO

- 10.6.4.1 Financial services and public digitalization initiatives accelerate AI platform deployment

- 10.6.5 ARGENTINA

- 10.6.5.1 Public sector AI adoption and academic partnerships foster platform experimentation

- 10.6.6 CHILE

- 10.6.6.1 Public innovation programs and cloud expansion stimulate AI platform adoption

- 10.6.7 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 REVENUE ANALYSIS, 2020-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.4.1 MARKET RANKING ANALYSIS

- 11.5 PRODUCT COMPARATIVE ANALYSIS

- 11.5.1 PRODUCT COMPARATIVE ANALYSIS OF AI PLATFORMS

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company Footprint

- 11.7.5.2 Regional Footprint

- 11.7.5.3 Offering Footprint

- 11.7.5.4 Functionality Footprint

- 11.7.5.5 End User Footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPANY EVALUATION MATRIX: AI ENABLEMENT SERVICES, 2024

- 11.9.1 PROGRESSIVE COMPANIES

- 11.9.2 RESPONSIVE COMPANIES

- 11.9.3 DYNAMIC COMPANIES

- 11.9.4 STARTING BLOCKS

- 11.9.5 COMPETITIVE BENCHMARKING: AI ENABLEMENT SERVICES, 2024

- 11.9.5.1 Detailed list of key AI enablement services

- 11.9.5.2 Competitive benchmarking of AI enablement services

- 11.10 COMPETITIVE SCENARIO AND TRENDS

- 11.10.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.10.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 MAJOR PLAYERS

- 12.2.1 GOOGLE

- 12.2.1.1 Business overview

- 12.2.1.2 Products offered

- 12.2.1.3 Recent developments

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths/Right to win

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 MICROSOFT

- 12.2.2.1 Business overview

- 12.2.2.2 Products offered

- 12.2.2.3 Recent developments

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths/Right to win

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 IBM

- 12.2.3.1 Business overview

- 12.2.3.2 Products offered

- 12.2.3.3 Recent developments

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths/Right to win

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 ORACLE

- 12.2.4.1 Business overview

- 12.2.4.2 Products offered

- 12.2.4.3 Recent developments

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths/Right to win

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 AWS

- 12.2.5.1 Business overview

- 12.2.5.2 Products offered

- 12.2.5.3 Recent developments

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths/Right to win

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 INTEL

- 12.2.6.1 Business overview

- 12.2.6.2 Products offered

- 12.2.6.3 Recent developments

- 12.2.7 SALESFORCE

- 12.2.7.1 Business overview

- 12.2.7.2 Products offered

- 12.2.7.3 Recent developments

- 12.2.8 SAP

- 12.2.8.1 Business overview

- 12.2.8.2 Products offered

- 12.2.8.3 Recent developments

- 12.2.9 SERVICENOW

- 12.2.9.1 Business overview

- 12.2.9.2 Products offered

- 12.2.9.3 Recent developments

- 12.2.10 NVIDIA

- 12.2.10.1 Business overview

- 12.2.10.2 Products offered

- 12.2.10.3 Recent developments

- 12.2.11 OPENAI

- 12.2.12 ALIBABA CLOUD

- 12.2.13 HPE

- 12.2.14 DATABRICKS

- 12.2.15 INSIGHT

- 12.2.16 PALANTIR

- 12.2.17 ALTAIR

- 12.2.18 DATAIKU

- 12.2.1 GOOGLE

- 12.3 STARTUP/SME PROFILES

- 12.3.1 H2O.AI

- 12.3.2 ANTHROPIC

- 12.3.3 COHERE

- 12.3.4 ANYSCALE

- 12.3.5 DATAROBOT

- 12.3.6 VITAL AI

- 12.3.7 RAINBIRD TECHNOLOGIES

- 12.3.8 ARIZE AI

- 12.3.9 CALYPSOAI

- 12.3.10 CLARIFAI

- 12.3.11 WEIGHTS & BIASES

- 12.3.12 ELVEX

- 12.3.13 IGUAZIO

- 12.3.14 MISTRAL AI

- 12.3.15 BASETEN

- 12.3.16 LIGHTNING AI

- 12.3.17 PROWESS CONSULTING

- 12.3.18 DEVTECH

- 12.3.19 ZYXWARE TECHNOLOGIES

- 12.3.20 FLUIDONE

- 12.3.21 AHELIOTECH

- 12.3.22 ORIL

- 12.3.23 CONVERSANT SOLUTIONS

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 AI TOOLKIT MARKET - GLOBAL FORECAST TO 2028

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 AI toolkit market, by offering

- 13.2.2.2 AI toolkit market, by technology

- 13.2.2.3 AI toolkit market, by vertical

- 13.2.2.4 AI toolkit market, by region

- 13.3 NO-CODE AI PLATFORMS MARKET - GLOBAL FORECAST TO 2029

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 No-code AI platforms market, by offering

- 13.3.2.2 No-code AI platforms market, by technology

- 13.3.2.3 No-code AI platforms market, by data modality

- 13.3.2.4 No-code AI platforms market, by application

- 13.3.2.5 No-code AI platforms market, by vertical

- 13.3.2.6 No-code AI platforms market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS