|

시장보고서

상품코드

1795418

종자 처리 시장(-2030년) : 유형별, 적용 기술별(코팅, 드레싱, 펠릿 가공), 기능별(종자 보호, 종자 강화), 제제별, 작물 유형별(곡물류, 지방종자, 과일 및 채소), 지역별Seed Treatment Market by Type, Application Technique (Coating, Dressing, Pelleting), Function (Seed Protection and Seed Enhancement), Formulation, Crop Type (Cereals & Grains, Oilseeds, Fruits & Vegetables), and Region - Global Forecast to 2030 |

||||||

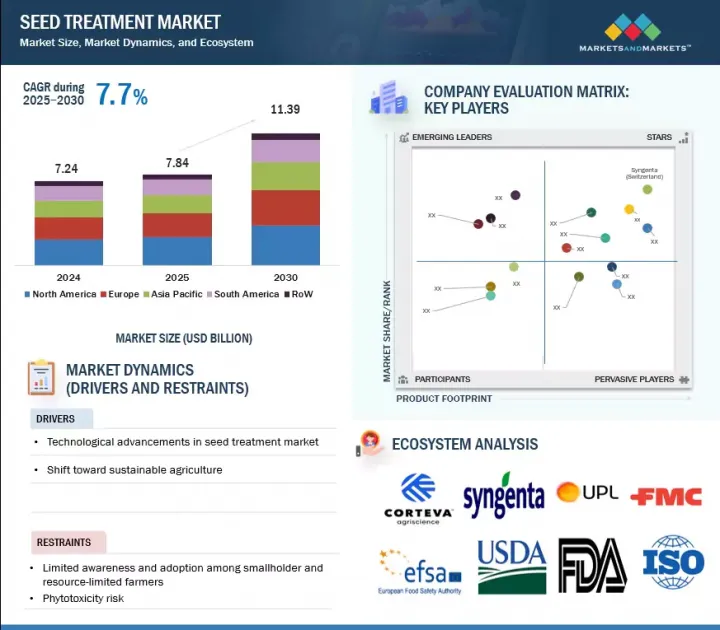

세계의 종자 처리 시장 규모는 2025년 78억 4,000만 달러에서 예측 기간 동안 CAGR 7.7%로 성장하여 2030년에는 113억 9,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2025-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) 및 킬로톤 |

| 부문별 | 유형별, 기능별, 제제별, 작물 유형별, 응용 기술별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 기타 지역 |

종자 처리 시장은 높은 작물 수확량에 대한 수요 증가, 해충 및 질병에 대한 압력 증가, 제형 및 투여 기술의 발전으로 인해 주도되고 있습니다. 고부가가치 하이브리드 종자 및 유전자 변형 종자의 채택이 증가함에 따라 방어 기능 및 성능을 향상시키는 종자 처리에 대한 수요는 더욱 확대되고 있습니다. 또한, 정부의 지원 정책과 인센티브에 힘입어 전 세계적으로 지속가능한 농업으로의 전환이 가속화되면서 생물학적 종자 처리의 활용이 가속화되고 있습니다. 상업적 농업의 확대와 디지털 농업의 도입은 정확성, 효율성, 초기 단계의 작물 보호를 개선하여 시장을 더욱 촉진하고 있습니다. 시장을 형성하는 두드러진 추세 중 하나는 생물학적 및 미생물 기반 종자 처리의 사용 확대입니다. 이는 화학제품에 대한 친환경적인 대안을 제공하며, 규제 당국과 소비자의 지속가능성에 대한 요구에 부응합니다.

"제형별로는 액상 제제 부문이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다."

이러한 장점은 적용의 용이성, 종자 표면의 균일한 피복, 화학적 및 생물학적 활성 성분을 포함한 다양한 성분과의 높은 호환성에 기인합니다. 액상 제제는 종자 부착성이 높고, 분진 발생을 억제하고 처리 효과를 높일 수 있으며, 특히 식물의 초기 발육 단계에서 안정적인 보호를 보장하는 데 중요합니다. 또한, 액상 제제는 폴리머, 착색제, 기타 첨가제를 쉽게 맞춤형으로 조합할 수 있어 파종 시 종자의 유동성과 취급성을 향상시킬 수 있습니다. 농업 종사자나 종자 가공업체들은 농장 내 처리와 상업적 시설에서 처리할 수 있는 유연성 때문에 액상 제제를 선호하는 경향이 있습니다. 또한, 액상 제제 기술의 발전으로 저장 기간 연장, 환경 부하 감소, 다양한 기후 및 토양 조건에서의 성능 향상을 실현하고 있습니다. 정밀농업의 확대와 고성능 종자 처리에 대한 수요가 증가함에 따라, 액체 제제는 앞으로도 이 주요 부문의 성장을 주도할 것으로 보입니다.

"지역별로는 북미가 가장 큰 점유율을 차지하고 아시아태평양이 예측 기간 동안 가장 큰 성장률을 기록할 것으로 예상됩니다."

북미의 우위는 선진 농법의 광범위한 도입, 주요 기업의 존재, 유전자 변형 종자 및 고부가가치 종자의 높은 이용률에 의해 뒷받침되고 있습니다. 지역 내 확립된 가공 시장도 시장 성장에 기여하고 있습니다. 옥수수, 콩, 유채와 같은 작물은 종자 보호 및 성능 향상 솔루션에 대한 강력한 수요를 주도하고 있습니다. 또한, 북미는 정밀농업과 통합적 병해충 관리 등 기술 혁신을 선도하는 지역으로 시장 지배력을 더욱 강화하고 있습니다.

한편, 아시아태평양의 성장은 식량 수요 증가, 급속한 인구 증가, 인도, 중국, 동남아시아 국가들의 농업 현대화에 의해 촉진되고 있습니다. 농가의 인식 개선, 정부의 지속가능한 농업 지원 정책, 하이브리드 종자 채택 확대 등이 종자 처리 수요를 가속화하고 있습니다. 또한, 상업적 농업의 확대, 농업 자재에 대한 접근성 개선, 세계 기업의 투자 확대도 이 지역의 시장 성장을 촉진하고 있습니다.

세계의 종자 처리 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술·특허 동향, 법·규제 환경, 사례 분석, 시장 규모 추정 및 예측, 각종 부문별·지역별·주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 거시경제 지표

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- AI/생성형 AI가 종자 처리 시장에 미치는 영향

제6장 업계 동향

- 2025년 미국 관세의 영향

- 밸류체인 분석

- 무역 분석

- 기술 분석

- 가격 분석

- 생태계 분석

- 고객의 사업에 영향을 미치는 동향/혼란

- 특허 분석

- 2025-2026년의 주요 회의와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자와 자금 조달 시나리오

- 사례 연구 분석

제7장 종자 처리 시장 : 기술별

- 정밀 종자 처리 기술

- RNA 기반 종자 처리 기술

- 나노기술

- 기타

제8장 종자 처리 시장 : 유형별

- 화학적 종자 처리

- 비화학적 종자 처리

- 물리적 종자 처리

- 생물학적 종자 처리

제9장 종자 처리 시장 : 기능별

- 종자 보호

- 화학 종자 보호

- 생물학적 종자 보호

- 종자 강화

- 생물학적 제제

- 종자 프라이밍

- 종자 소독

제10장 종자 처리 시장 : 적용 기술별

- 종자 코팅

- 필름 코팅

- 인크러스팅(피복 강화)

- 기타

- 종자 드레싱

- 건식 드레싱

- 슬러리 처리

- 미스트 스프레이

- 기타

- 종자 펠릿팅(펠릿 가공)

- 빌드업 펠릿

- 정밀 펠릿 가공

- 텀블/팬 펠릿 가공

- 기타

- 기타

- 하이드로프라이밍(수침지 처리)

- 오스모프라이밍(침투압 처리)

- 매트릭스 프라이밍

- 자외선/방사선

- 열소독

제11장 종자 처리 시장 : 제제별

- 분말(건식 종자 처리용)

- 수분산성 분말(WS : 슬러리 처리용)

- 수분산성 과립(WG)

- 수용성 분말(SS)

- 액상 제제(LS)

- 유제(ES)

- 유동성 농축액(FS)

- 캡슐 현탁액(CF)

- 겔 제제

제12장 종자 처리 시장 : 작물별

- 지방종자·두류

- 대두

- 유채

- 면화

- 해바라기

- 기타

- 곡물류

- 옥수수

- 밀

- 쌀

- 수수

- 보리

- 기타

- 과일·채소

- 인과류

- 감귤류

- 베리

- 잎 채소

- 근채류

- 기타 작물

- 알팔파

- 꽃 종자

- 잔디

- 사료

제13장 종자 처리 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 인도

- 일본

- 호주와 뉴질랜드

- 기타

- 유럽

- 프랑스

- 독일

- 스페인

- 이탈리아

- 영국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

- 기타 지역

- 아프리카

- 중동

제14장 경쟁 구도

- 개요

- 주요 기업의 전략/유력 기업

- 부문 매출 분석

- 시장 점유율 분석

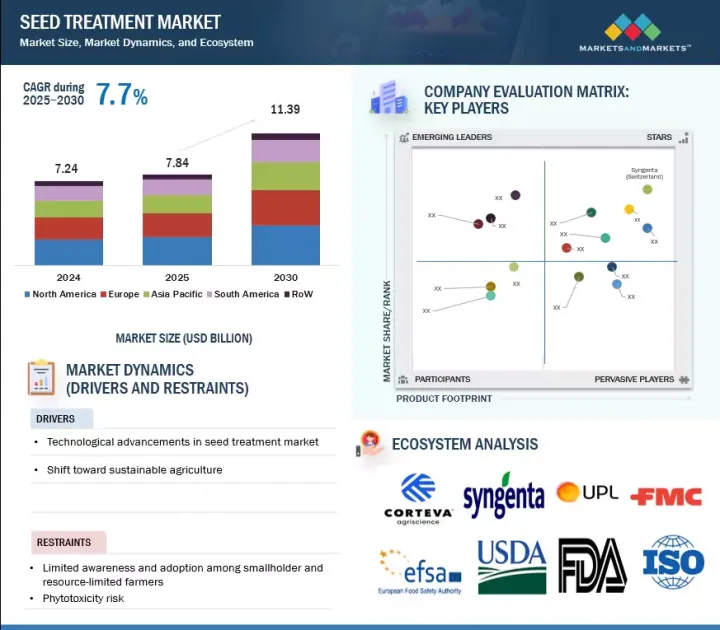

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가와 재무 지표

- 제품 분석

- 경쟁 시나리오와 동향

제15장 기업 개요

- 주요 기업

- BASF SE

- SYNGENTA

- BAYER AG

- CORTEVA

- UPL

- SYENSQO

- FMC CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- CRODA INTERNATIONAL PLC

- NUFARM

- NOVONESIS GROUP

- COVESTRO AG

- KOPPERT

- CENTOR GROUP

- GERMAINS SEED TECHNOLOGY

- 기타 기업(SME/스타트업)

- VERDESIAN LIFE SCIENCES

- ANDERMATT GROUP AG

- IPL BIOLOGICALS

- CERTIS BELCHIM

- AGRILIFE

- ROVENSA NEXT

- BIONEMA

- BIOCONSORTIA

- NORDIA MICROBES A/S

- APHEA.BIO

제16장 인접 시장과 관련 시장

제17장 부록

KSM 25.08.29The global market for seed treatment is estimated to be valued at USD 7.84 billion in 2025 and is projected to reach USD 11.39 billion by 2030, at a CAGR of 7.7% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2025-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) and Volume (KT) |

| Segments | By Type, Function, Formulation, Crop type, Application Technique, and Regions |

| Regions covered | North America, Europe, Asia Pacific, South America, and RoW |

The seed treatment market is driven by the growing need for higher crop yields, increasing pest and disease pressures, and advances in formulation and delivery technologies. The rising adoption of high-value hybrid and genetically modified seeds has amplified the demand for protective and performance-enhancing seed treatments. Additionally, a global shift toward sustainable agriculture, supported by favorable government policies and incentives, is accelerating the use of biological seed treatments. Expanding commercial farming operations and the integration of digital agriculture are further propelling the market by improving precision, efficiency, and early-stage crop protection. A notable trend shaping the market is the increasing use of biological and microbe-based seed treatments, which offer eco-friendly alternatives to chemicals and align with both regulatory and consumer demands for sustainability.

Despite these drivers, the seed treatment market is driven by the growing need for higher crop yields, increasing pest and disease pressures, and advances in formulation and delivery technologies. The rising adoption of high-value hybrid and genetically modified seeds has amplified the demand for protective and performance-enhancing seed treatments. Additionally, a global shift toward sustainable agriculture, supported by favorable government policies and incentives, is accelerating the use of biological seed treatments. Expanding commercial farming operations and the integration of digital agriculture are further propelling the market by improving precision, efficiency, and early-stage crop protection. A notable trend is the increasing use of biological and microbe-based seed treatments, offering eco-friendly alternatives to synthetic chemicals. However, a key restraint is the limited awareness and accessibility among smallholder farmers, particularly in developing regions, which slows widespread adoption despite the proven benefits of seed treatment.

"Liquid solutions will hold the largest market share during the forecast period in the formulation segment."

Liquid solutions are expected to hold the largest share in the formulation segment of the seed treatment market during the forecast period. This dominance is attributed to their ease of application, uniform seed coverage, and compatibility with a wide range of active ingredients, including chemical and biological agents. Liquid formulations offer better adhesion to seeds, reducing dust-off and enhancing treatment efficacy, which is especially important for ensuring consistent protection during early plant development. These formulations are also easier to customize and combine polymers, colorants, or other additives, improving seed flowability and handling during planting. Farmers and seed treatment providers favor liquid solutions for their flexibility in application methods, whether on-farm or through commercial seed treatment facilities. Moreover, advancements in liquid formulation technologies have led to improved shelf life, reduced environmental impact, and enhanced performance under various climatic and soil conditions. As precision agriculture expands and demand for high-performance seed treatments grows, liquid solutions will continue to drive growth in this key formulation segment.

"The seed dressing system segment will grow at the highest CAGR during the forecast period."

The seed dressing system segment is projected to grow at the highest CAGR during the forecast period in the seed treatment market. This growth is driven by its widespread adoption due to simplicity, cost-effectiveness, and ease of application. Seed dressing involves directly applying chemical or biological agents to the seed surface before planting, offering protection against seed- and soil-borne pests and diseases during early growth stages. It requires minimal equipment and can be carried out both on-farm and at commercial facilities, making it especially attractive in regions with developing agricultural infrastructure. As awareness of crop protection and sustainable practices increases, more farmers are adopting seed dressing to boost germination, reduce input costs, and ensure uniform crop emergence. Additionally, ongoing innovations in formulation and delivery systems are enhancing the efficiency and safety of seed dressing, further supporting its rapid growth across diverse crop types and geographies.

North America is expected to hold the largest share in the seed treatment market, while Asia Pacific is expected to be the fastest-growing market during the forecast period

North America is expected to hold the largest share in the global seed treatment market during the forecast period, supported by widespread adoption of advanced farming practices, the presence of key industry players, and high usage of genetically modified and high-value seeds. The region's well-established treatment market has further contributed to market growth. Crops like corn, soybeans, and canola drive strong demand for seed protection and enhancement solutions. Additionally, North America leads in technological innovation, including precision agriculture and integrated pest management, further strengthening its dominance in the market.

In contrast, the Asia Pacific region is anticipated to be the fastest-growing market for seed treatment during the forecast period, driven by increasing food demand, rapid population growth, and the modernization of agriculture in countries like India, China, and Southeast Asian nations. Rising farmer awareness, government initiatives supporting sustainable agriculture, and growing adoption of hybrid seeds are accelerating demand for seed treatment. Additionally, the expansion of commercial farming, improved access to agri-inputs, and increased investment from global seed treatment companies are expected to fuel market growth across the region.

Break-up of primaries

In-depth interviews have been conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the seed treatment market:

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: Directors- 20%, Managers - 50%, Executives- 30%

- By Region: North America - 25%, Europe - 30%, Asia Pacific - 20%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include BASF SE (Germany), Bayer AG (Germany), UPL (India), Corteva (US), Croda (UK), FMC (US), Nufarm (Australia), Syngenta (US), Germains Seed (UK), Sumitomo Chemicals (Japan), Covestro AG (Germany), Koppert (Netherlands), Novonesis Group (Denmark), Syensqo (Belgium), and Centor Group (Netherlands).

Other players include Verdesian Life Sciences (US), Andermatt Group AG (Switzerland), IPL Biologicals (India), CERTIS BELCHIM (Netherlands), Rovensa Next (Spain), Bionema (UK), BioConsortia (US), Nordic Microbes A/S (Denmark), Aphea.Bio (Belgium), and AgriLife (India).

Research Coverage

This research report categorizes the seed treatment market by type (chemical seed treatment and non-chemical seed treatment), function (seed protection and seed enhancement), crop type (cereals & grains, oilseeds, fruits & vegetables, and other crop types), application technique (seed coating, seed dressing, and seed pelleting), formulation, and region (North America, Europe, Asia Pacific, South America, and Rest of the World). The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the seed treatment market.

A detailed analysis of the key industry players was done to provide insights into their business overview, services, key strategies, contracts, partnerships, agreements, new service launches, mergers and acquisitions, and recent developments associated with the seed treatment market. This report covers a competitive analysis of upcoming startups in the seed treatment market ecosystem. Furthermore, the study covers industry-specific trends such as technology analysis, ecosystem and market mapping, and patent and regulatory landscape, among others.

Reasons to buy this report

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall seed treatment and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (technological advancement in seed treatment growing systems), restraints (limited crop variety), opportunities (integration of smart home technology), and challenges (high initial cost) influencing the growth of the seed treatment market

- Product launch/Innovation: Detailed insights on research & development activities and new product launches in the seed treatment market

- Market Development: Comprehensive information about lucrative markets - analysis of the seed treatment market across varied regions

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the seed treatment market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparisons, and product footprints of leading players such as BASF (Germany), Bayer AG (Germany), UPL (India), Corteva (US), FMC (US), and others in the seed treatment market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.5.1 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS AND RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE MARKET OPPORTUNITIES FOR PLAYERS IN SEED TREATMENT MARKET

- 4.2 NORTH AMERICA: SEED TREATMENT MARKET, BY FUNCTION AND COUNTRY

- 4.3 SHARE OF MAJOR SEED TREATMENT REGIONAL SUBMARKETS

- 4.4 SEED TREATMENT MARKET, BY TYPE AND REGION

- 4.5 SEED TREATMENT MARKET, BY FUNCTION AND REGION

- 4.6 SEED TREATMENT MARKET, BY APPLICATION TECHNIQUE AND REGION

- 4.7 SEED TREATMENT MARKET, BY CROP TYPE AND REGION

- 4.8 SEED TREATMENT MARKET, BY FORMULATION AND REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GROWTH IN MAJOR COMMERCIAL SEED PRODUCTION

- 5.2.2 RISE IN MARKET DEMAND FOR HIGH-VALUE CROPS

- 5.2.3 GROWTH IN ORGANIC AGRICULTURAL PRACTICES

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Demand for low-cost production solutions

- 5.3.1.2 Seed coating witnesses high demand for commercial operations

- 5.3.1.3 Reduced risk of exceeding MRLs

- 5.3.1.4 Expansion of precision agriculture

- 5.3.2 RESTRAINTS

- 5.3.2.1 Shorter shelf life of biological treatment

- 5.3.2.2 Limited adoption among smallholder farmers

- 5.3.2.3 Risk of seed damage

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Rise in demand for biological treatments

- 5.3.3.2 Integrated seed treatment solutions

- 5.3.4 CHALLENGES

- 5.3.4.1 Higher resistance to crop protection products

- 5.3.4.2 Regulatory barriers

- 5.3.1 DRIVERS

- 5.4 IMPACT OF AI/GEN AI ON SEED TREATMENT MARKET

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN SEED TREATMENT MARKET

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Syngenta & TraitSeq-advancing biostimulant innovation through AI

- 5.4.3.2 Croda International's seed treatment upgrading solutions through AI-powered systems

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 IMPACT OF 2025 US TARIFFS-SEED TREATMENT MARKET

- 6.2.1 INTRODUCTION

- 6.2.2 KEY TARIFF RATES

- 6.2.3 PRICE IMPACT ANALYSIS

- 6.2.4 IMPACT ON COUNTRIES/REGIONS

- 6.2.4.1 US

- 6.2.4.2 Europe

- 6.2.4.3 Asia Pacific

- 6.2.5 IMPACT ON END-USE INDUSTRIES

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO (HS CODE 3808)

- 6.4.2 IMPORT SCENARIO (HS CODE 3808)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Microencapsulation

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Film coating

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Seed infusion

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PRICING ANALYSIS

- 6.6.1 PRICING RANGE OF SEED TREATMENT FUNCTIONS

- 6.6.2 PRICING RANGE OF SEED TREATMENT PRODUCTS, BY REGION

- 6.6.3 PRICING RANGE OF SEED TREATMENT FUNCTIONS, BY KEY PLAYER

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 DEMAND SIDE

- 6.7.2 SUPPLY SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11.2 REGULATIONS

- 6.11.2.1 North America

- 6.11.2.1.1 US

- 6.11.2.1.2 Canada

- 6.11.2.2 Europe

- 6.11.2.3 Asia Pacific

- 6.11.2.3.1 India

- 6.11.2.3.2 China

- 6.11.2.3.3 Australia

- 6.11.2.4 South America

- 6.11.2.4.1 Brazil

- 6.11.2.4.2 Argentina

- 6.11.2.5 Rest of the World

- 6.11.2.5.1 South Africa

- 6.11.2.1 North America

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 BARGAINING POWER OF SUPPLIERS

- 6.12.2 BARGAINING POWER OF BUYERS

- 6.12.3 THREAT OF SUBSTITUTES

- 6.12.4 THREAT OF NEW ENTRANTS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 INVESTMENT AND FUNDING SCENARIO (2010-2024)

- 6.15 CASE STUDY ANALYSIS

- 6.15.1 BIOWEG AND BAYER PARTNERED TO DEVELOP BIODEGRADABLE SEED COATINGS FOR SUSTAINABLE AGRICULTURE

- 6.15.2 INDIGO AGRICULTURE-ENHANCING CROP YIELDS WITH MICROBIAL SEED TREATMENTS

- 6.15.3 MICROBE-BASED SEED COATING TECHNOLOGY DEVELOPED BY INDIAN COUNCIL OF AGRICULTURAL RESEARCH TO BOOST GERMINATION AND YIELD

- 6.15.4 BORREGAARD INTRODUCED CELLULOSE-BASED BIODEGRADABLE SEED COATING

7 SEED TREATMENT MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 PRECISION SEED TREATMENT TECHNOLOGY

- 7.3 RNA-BASED SEED TREATMENT TECHNOLOGY

- 7.4 NANOTECHNOLOGY

- 7.5 OTHER TECHNOLOGIES

8 SEED TREATMENT MARKET, BY TYPE

- 8.1 INTRODUCTION

- 8.2 CHEMICAL SEED TREATMENT

- 8.2.1 EFFICIENCY OF CHEMICALS IN SEED DISINFECTION AND PROTECTION TO DRIVE MARKET

- 8.3 NON-CHEMICAL SEED TREATMENT

- 8.3.1 BIOLOGICAL SEED TREATMENT TO WITNESS WIDER SCOPE OF ADOPTION WITH INCREASE IN DEMAND FOR ORGANIC PRODUCTS

- 8.3.2 PHYSICAL SEED TREATMENT

- 8.3.3 BIOLOGICAL SEED TREATMENT

9 SEED TREATMENT MARKET, BY FUNCTION

- 9.1 INTRODUCTION

- 9.2 SEED PROTECTION

- 9.2.1 PRECISION TARGETING, OPTIMIZED CHEMICAL CONCENTRATION, AND EASE OF HANDLING TO DRIVE MARKET

- 9.2.2 CHEMICAL SEED PROTECTION

- 9.2.2.1 Insecticides

- 9.2.2.1.1 Thiamethoxam

- 9.2.2.1.2 Imidacloprid

- 9.2.2.1.3 Clothianidin

- 9.2.2.1.4 Other insecticides

- 9.2.2.2 Fungicides

- 9.2.2.2.1 Thiram

- 9.2.2.2.2 Carbendazim

- 9.2.2.2.3 Tebuconazole

- 9.2.2.2.4 Other fungicides

- 9.2.2.3 Nematicides and others

- 9.2.2.1 Insecticides

- 9.2.3 BIOLOGICAL SEED PROTECTION

- 9.2.3.1 Bioinsecticides

- 9.2.3.2 Biofungicides

- 9.2.3.3 Bionematicides and others

- 9.2.3.3.1 Microbials

- 9.2.3.3.1.1 Paecilomyces lilacinus

- 9.2.3.3.1.2 Bacillus firmus

- 9.2.3.3.1.3 Other microbial nematicides

- 9.2.3.3.2 Biochemicals

- 9.2.3.3.2.1 Plant extract

- 9.2.3.3.2.2 Pheromones

- 9.2.3.3.2.3 Other biochemicals

- 9.2.3.3.1 Microbials

- 9.3 SEED ENHANCEMENT

- 9.3.1 SEED ENHANCEMENT SOLUTIONS ENHANCING UNIFORMITY OF GERMINATION TO DRIVE MARKET

- 9.3.2 BIOLOGICALS

- 9.3.2.1 Biofertilizers

- 9.3.2.2 Biostimulants

- 9.3.2.3 Plant growth regulators

- 9.3.3 SEED PRIMING

- 9.3.4 SEED DISINFECTION

10 SEED TREATMENT MARKET, BY APPLICATION TECHNIQUE

- 10.1 INTRODUCTION

- 10.2 SEED COATING

- 10.2.1 TECHNOLOGICAL ADVANCEMENTS IN AUTOMATIC SEED COATING TECHNIQUES TO DRIVE MARKET

- 10.2.2 FILM COATING

- 10.2.3 ENCRUSTING

- 10.2.4 OTHERS

- 10.3 SEED DRESSING

- 10.3.1 USE IN DEVELOPING REGIONS DUE TO LOW APPLICATION COST TO DRIVE MARKET

- 10.3.2 DRY DRESSING

- 10.3.3 SLURRY TREATMENT

- 10.3.4 MIST SPRAY

- 10.3.5 OTHERS

- 10.4 SEED PELLETING

- 10.4.1 SUITABILITY FOR HIGH-VALUE CROPS REQUIRING PLANTING ACCURACY TO DRIVE MARKET

- 10.4.2 BUILD-UP PELLETING

- 10.4.3 PRECISION PELLETING

- 10.4.4 TUMBLE/PAN PELLETING

- 10.4.5 OTHERS

- 10.5 OTHER TECHNIQUES

- 10.5.1 HYDROPRIMING

- 10.5.2 OSMOPRIMING

- 10.5.3 MATRIX PRIMING

- 10.5.4 UV/IRRADIATION

- 10.5.5 THERMAL DISINFECTION

11 SEED TREATMENT MARKET, BY FORMULATION

- 11.1 INTRODUCTION

- 11.2 POWDER FOR DRY SEED TREATMENT

- 11.2.1 AFFORDABLE SOLUTION FOR SMALLHOLDER FARMERS TO BOOST DEMAND

- 11.3 WATER-DISPERSIBLE POWDER FOR SLURRY SEED TREATMENT (WS)

- 11.3.1 EFFECTIVE DISPERSION, LOW DUST GENERATION, AND FUNGUS MANAGEMENT TO DRIVE MARKET

- 11.4 WATER-DISPERSIBLE GRANULES (WG)

- 11.4.1 SOLID, NON-DUSTY PROPERTIES, AND EASILY SOLUBILITY IN WATER TO MAKE THEM CONVENIENT FOR FOLIAR SPRAYING APPLICATIONS

- 11.5 WATER-SOLUBLE POWDER (SS)

- 11.5.1 HIGHER EASE OF HANDLING AND AFFORDABILITY FOR SMALL FARMERS TO DRIVE MARKET

- 11.6 LIQUID SOLUTION (LS)

- 11.6.1 WIDER SCOPE OF ADOPTION WITH INCREASE IN DEMAND FROM SMALLHOLDER FARMERS TO DRIVE MARKET

- 11.7 EMULSION (ES)

- 11.7.1 HIGHER DEMAND FROM ASIAN COUNTRIES TO DRIVE MARKET

- 11.8 FLOWABLE CONCENTRATE (FS)

- 11.8.1 BETTER WATER RETENTION WITH NO POWDER OR DUST ON SEED TO BOOST DEMAND

- 11.9 CAPSULE SUSPENSION (CF)

- 11.9.1 DEMAND FOR SUSTAINABLE AGRICULTURE TO EXPAND ADOPTION OF BIOLOGICAL SEED TREATMENTS

- 11.10 GELS

- 11.10.1 HIGH DEMAND FROM SUGAR BEET AND OTHER BULB FARMERS TO DRIVE MARKET

12 SEED TREATMENT MARKET, BY CROP TYPE

- 12.1 INTRODUCTION

- 12.2 OILSEED & PULSES

- 12.2.1 SOYBEANS

- 12.2.1.1 Favorable trade price-related policies to drive demand

- 12.2.2 CANOLA

- 12.2.2.1 Preference as an economically cheaper alternative to soybeans to drive market

- 12.2.3 COTTON

- 12.2.3.1 Increasing demand for cotton to drive market

- 12.2.4 SUNFLOWER

- 12.2.4.1 Higher production of sunflowers due to demand from food and feed industries to drive market

- 12.2.5 OTHER OILSEED & PULSES

- 12.2.1 SOYBEANS

- 12.3 CEREALS & GRAINS

- 12.3.1 CORN

- 12.3.1.1 Companies' focus on using hybrid corn to improve feed quality to drive market

- 12.3.2 WHEAT

- 12.3.2.1 Depleting wheat inventories to drive need for R&D activities focused on development of hybrid varieties

- 12.3.3 RICE

- 12.3.3.1 Rising popularity of genetically modified rice varieties to drive market

- 12.3.4 SORGHUM

- 12.3.4.1 High resource efficiency for arid and semi-arid regions to drive market

- 12.3.5 BARLEY

- 12.3.5.1 Wide range of applications in food & beverage industry to drive market

- 12.3.6 OTHER CEREALS & GRAINS

- 12.3.1 CORN

- 12.4 FRUITS & VEGETABLES

- 12.4.1 POME FRUITS

- 12.4.1.1 Growing emphasis on biological innovation and crop establishment efficiency to drive market

- 12.4.2 CITRUS FRUITS

- 12.4.2.1 Growing interest in biological input and management to drive market

- 12.4.3 BERRIES

- 12.4.3.1 Sustainable nursery practices and high-value exports to drive market

- 12.4.4 LEAFY VEGETABLES

- 12.4.4.1 Introduction of small varieties leading to improvement in yield to drive market

- 12.4.5 ROOT & TUBER VEGETABLES

- 12.4.5.1 High domestic demand for onions to lead to extensive cultivation and boost market

- 12.4.1 POME FRUITS

- 12.5 OTHER CROP TYPES

- 12.5.1 ALFALFA

- 12.5.2 FLOWER SEEDS

- 12.5.3 TURFGRASS

- 12.5.4 FORAGE

- 12.5.4.1 Hydroponic cultivation methods in fodder crops to provide cost-efficient and resource-efficient solutions

13 SEED TREATMENT MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 US

- 13.2.1.1 Presence of major seed companies to aid growth of market

- 13.2.2 CANADA

- 13.2.2.1 Adoption of advanced technologies in plant breeding to drive market

- 13.2.3 MEXICO

- 13.2.3.1 Import of genetically modified corn to meet rising demand from livestock sector

- 13.2.1 US

- 13.3 ASIA PACIFIC

- 13.3.1 CHINA

- 13.3.1.1 Increasing adoption of biologicals, polymer coating, and reinforcement to drive market

- 13.3.2 INDIA

- 13.3.2.1 Application of modern agricultural techniques to increase self-sustainability

- 13.3.3 JAPAN

- 13.3.3.1 Precision agriculture and crop diversification to drive growth

- 13.3.4 AUSTRALIA & NEW ZEALAND

- 13.3.4.1 Biological solution and strategic partnerships to fuel growth

- 13.3.5 REST OF ASIA PACIFIC

- 13.3.1 CHINA

- 13.4 EUROPE

- 13.4.1 FRANCE

- 13.4.1.1 Transformation from conventional chemical-based approach to advance biological seed treatment solutions

- 13.4.2 GERMANY

- 13.4.2.1 Rising demand for sustainable, certified, and precision seed treatment solutions to drive market leadership

- 13.4.3 SPAIN

- 13.4.3.1 EU compliance and rising oilseed demand to fuel market growth

- 13.4.4 ITALY

- 13.4.4.1 Corteva's key facilities to promote sustainable treatment practices

- 13.4.5 UK

- 13.4.5.1 Sustainability regulations and innovation to accelerate adoption of advanced seed treatments

- 13.4.6 REST OF EUROPE

- 13.4.1 FRANCE

- 13.5 SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.5.1.1 Integrated platforms to accelerate market growth

- 13.5.2 ARGENTINA

- 13.5.2.1 Expansion of farmlands to drive agricultural growth

- 13.5.3 REST OF SOUTH AMERICA

- 13.5.1 BRAZIL

- 13.6 ROW

- 13.6.1 AFRICA

- 13.6.1.1 Evolution through structured regulation, quality assurance, and stewardship to drive market

- 13.6.2 MIDDLE EAST

- 13.6.2.1 Increasing focus on improving agricultural productivity and climate resilience to drive market

- 13.6.1 AFRICA

14 COMPETITIVE LANDSCAPE

- 14.1 OVERVIEW

- 14.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 14.3 SEGMENTAL REVENUE ANALYSIS

- 14.4 MARKET SHARE ANALYSIS, 2024

- 14.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.5.1 STARS

- 14.5.2 EMERGING LEADERS

- 14.5.3 PERVASIVE PLAYERS

- 14.5.4 PARTICIPANTS

- 14.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 14.5.5.1 Company footprint

- 14.5.5.2 Region footprint

- 14.5.5.3 Type footprint

- 14.5.5.4 Function footprint

- 14.5.5.5 Crop type footprint

- 14.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.6.1 PROGRESSIVE COMPANIES

- 14.6.2 RESPONSIVE COMPANIES

- 14.6.3 DYNAMIC COMPANIES

- 14.6.4 STARTING BLOCKS

- 14.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 14.6.5.1 Detailed list of key startups/SMEs

- 14.6.5.2 Competitive benchmarking of key startups/SMEs

- 14.7 COMPANY VALUATION AND FINANCIAL METRICS

- 14.8 PRODUCT ANALYSIS

- 14.9 COMPETITIVE SCENARIO AND TRENDS

- 14.9.1 PRODUCT LAUNCHES

- 14.9.2 DEALS

- 14.9.3 EXPANSIONS

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 BASF SE

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 SYNGENTA

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Expansions

- 15.1.2.4 MnM view

- 15.1.2.4.1 Key strengths

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 BAYER AG

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Expansions

- 15.1.3.4 MnM view

- 15.1.3.4.1 Key strengths

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 CORTEVA

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Expansions

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 UPL

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product launches

- 15.1.5.3.2 Deals

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 SYENSQO

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Deals

- 15.1.6.4 MnM view

- 15.1.7 FMC CORPORATION

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Deals

- 15.1.7.3.2 Expansions

- 15.1.7.3.3 Other developments

- 15.1.7.4 MnM view

- 15.1.8 SUMITOMO CHEMICAL CO., LTD.

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Deals

- 15.1.8.3.2 Expansions

- 15.1.8.4 MnM view

- 15.1.9 CRODA INTERNATIONAL PLC

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Product launches

- 15.1.9.3.2 Deals

- 15.1.9.4 MnM view

- 15.1.10 NUFARM

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.10.3.2 Other developments

- 15.1.10.4 MnM view

- 15.1.11 NOVONESIS GROUP

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.11.4 MnM view

- 15.1.12 COVESTRO AG

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 MnM view

- 15.1.13 KOPPERT

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Deals

- 15.1.13.3.2 Expansions

- 15.1.13.4 MnM view

- 15.1.14 CENTOR GROUP

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 MnM view

- 15.1.15 GERMAINS SEED TECHNOLOGY

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Deals

- 15.1.15.4 MnM view

- 15.1.1 BASF SE

- 15.2 OTHER PLAYERS (SMES/STARTUPS)

- 15.2.1 VERDESIAN LIFE SCIENCES

- 15.2.1.1 Business overview

- 15.2.1.2 Products offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches

- 15.2.2 ANDERMATT GROUP AG

- 15.2.2.1 Business overview

- 15.2.2.2 Products offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Product launches

- 15.2.2.3.2 Deals

- 15.2.3 IPL BIOLOGICALS

- 15.2.3.1 Business overview

- 15.2.3.2 Products offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Product launches

- 15.2.3.3.2 Deals

- 15.2.3.3.3 Expansions

- 15.2.4 CERTIS BELCHIM

- 15.2.4.1 Business overview

- 15.2.4.2 Products offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches

- 15.2.5 AGRILIFE

- 15.2.5.1 Business overview

- 15.2.5.2 Products offered

- 15.2.5.3 Recent developments

- 15.2.5.3.1 Product launches

- 15.2.6 ROVENSA NEXT

- 15.2.7 BIONEMA

- 15.2.8 BIOCONSORTIA

- 15.2.9 NORDIA MICROBES A/S

- 15.2.10 APHEA.BIO

- 15.2.1 VERDESIAN LIFE SCIENCES

16 ADJACENT AND RELATED MARKETS

- 16.1 INTRODUCTION

- 16.2 LIMITATIONS

- 16.3 SEED COATING MARKET

- 16.3.1 MARKET DEFINITION

- 16.3.2 MARKET OVERVIEW

- 16.4 SEED MARKET

- 16.4.1 MARKET DEFINITION

- 16.4.2 MARKET OVERVIEW

17 APPENDIX

- 17.1 DISCUSSION GUIDE

- 17.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 17.3 CUSTOMIZATION OPTIONS

- 17.4 RELATED REPORTS

- 17.5 AUTHOR DETAILS