|

시장보고서

상품코드

1800742

액체 도포막 시장 : 용도별, 최종 이용 산업별, 유형별, 사용법별, 지역별 - 예측(-2030년)Liquid-applied Membrane Market by Type (Bituminous, Elastomeric, Cementitious), Application (Roofing, Walls, Roadways), Usage (New Construction, Refurbishment), End-use Industry (Commercial, Residential), And Region - Global Forecast to 2030 |

||||||

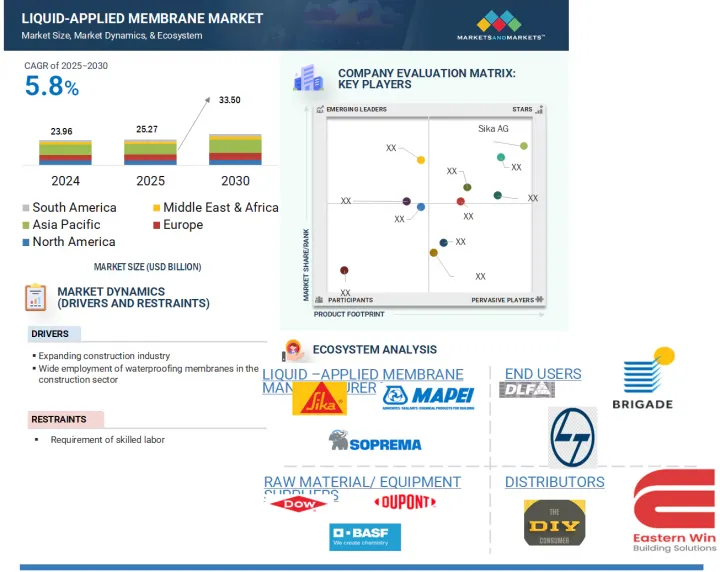

액체 도포막 시장 규모는 2025년 252억 7,000만 달러에서 2030년에는 335억 달러에 달할 것으로 예측되며, 예측 기간 동안 CAGR 5.8%가 될 것으로 보입니다.

액체 도포막은 유연하고 내구성이 뛰어난 보호 장벽을 형성하는 액체 도포형 이음매없는 방수 시스템입니다. 복잡한 표면에 적합하고 물의 침투, 자외선, 화학제품에 대한 노출로부터 장기간 보호할 수 있어 지붕, 지하실, 테라스, 터널 및 기타 구조 요소에 널리 사용되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러) 수량(100만 평방 미터) |

| 부문 | 용도별, 최종 이용 산업별, 유형별, 사용법별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

액체 코팅 필름 시장은 효율적이고 유지보수가 적은 방수 솔루션에 대한 수요 증가, 세계 건설 산업의 성장, 에너지 효율적이고 지속가능한 건축자재에 대한 관심 증가 등 여러 가지 요인에 의해 주도되고 있습니다. 또한, 액체 도포막은 시공의 용이성, 빠른 시공 시간, 기존 시트 기반 시스템보다 우수한 성능으로 인해 많은 사랑을 받고 있습니다.

지역별로는 중국, 인도와 같은 국가들의 급속한 도시화, 인프라 구축, 정부의 주택 건설 노력으로 인해 아시아태평양의 성장이 가장 두드러집니다. 북미는 리노베이션과 그린 빌딩 트렌드에 힘입어, 유럽은 엄격한 환경 규제와 지속가능한 건축에 대한 강조가 시장을 견인하고 있습니다. 중동 및 아프리카도 상업 인프라 및 운송 프로젝트에 대한 투자 증가로 인해 주요 시장으로 부상하고 있습니다. 이러한 지역적 역학은 이 소재의 성능 우위와 결합하여 액상 코팅 필름 시장의 세계 확장을 계속 지원하고 있습니다.

역청막은 건설 업계에서 가장 널리 사용되는 방수 솔루션 중 하나이며, 견고성, 내구성, 광범위한 응용 분야에서 입증된 성능으로 유명합니다. 역청막은 주로 아스팔트로 구성되어 있으며, 종종 공격적인 폴리프로필렌(APP), 스티렌-부타디엔-스티렌(SBS)과 같은 폴리머로 개질되어 있습니다. 역청막은 일반적으로 시트 또는 액체 형태로 적용되며, 인장 강도와 치수 안정성을 향상시키기 위해 유리섬유 및 폴리에스테르와 같은 재료로 보강됩니다. 이 멤브레인은 수평면과 수직면 모두에서 물의 침투로부터 장기적으로 보호하는 데 특히 효과적입니다. 지붕, 지하실, 기초, 터널, 교량, 옹벽 등에 광범위하게 사용됩니다. 콘크리트, 금속, 목재 등 다양한 기질에 대한 우수한 접착력으로 열악한 환경 조건에서도 안정적인 성능을 발휘합니다. 자외선 노출, 극한의 온도, 기계적 스트레스를 견딜 수 있는 역청막의 능력은 노출된 장소나 매립된 장소에서의 적용에 이상적입니다. 최근 환경문제를 고려하여 VOC 배출량이 적고 열성능을 향상시킨 개질 역청막이 개발되어 그린 빌딩 기준에 부합하는 등 환경문제에 대한 배려가 이루어지고 있습니다. 제조업체는 또한 접착제 층이 일체화되어 경화 시간이 단축된 조립식 롤을 도입하여 시공 효율을 향상시키는데 주력하고 있습니다. 전 세계 건설이 계속되는 가운데, 특히 인프라 및 상업 부문에서 다양한 프로젝트 규모와 환경 조건에서 신뢰할 수 있는 방수 성능을 발휘하는 역청막에 대한 수요가 계속 증가하고 있습니다.

리노베이션 부문은 건물 개보수, 인프라 업그레이드, 노후화된 구조물의 개보수가 전 세계적으로 급증하고 있는 것을 배경으로 액상 도막(액체 도막)의 급성장 부문 중 하나로 부상하고 있습니다. 도시가 성숙해짐에 따라 기존 건물을 복원하고 현대화할 필요성은 민관 이해관계자 모두에게 중요한 초점이 되고 있습니다. 노후화된 건축물은 누수, 지붕 손상, 기초 균열, 단열 성능 저하 등의 문제에 직면하는 경우가 많은데, 액체 도포막의 적용으로 효과적으로 대처할 수 있습니다. 이 멤브레인은 매끄러운 시공, 불규칙한 표면에 대한 적응력, 노후화된 콘크리트, 벽돌, 금속을 포함한 다양한 하부 구조물과의 호환성으로 인해 리노베이션 프로젝트에 특히 적합합니다.

리노베이션 공사에서 액체 도포막의 주요 장점 중 하나는 기존 시스템을 완전히 제거할 필요가 없고, 쉽게 사용할 수 있다는 점입니다. 이는 인건비 절감은 물론 주택, 학교, 병원, 상업시설 등 주거 공간의 혼란을 최소화할 수 있습니다. 공간의 제약과 건물 접근의 용이성이 문제가 되는 도시 환경에서 액체 도포막은 최소한의 설비로 수직 및 수평으로 시공할 수 있는 실용적인 솔루션을 제공합니다. 엘라스토머 특성으로 인해 구조적 움직임에 대응하고 기존 균열을 막아 건물 외벽의 수명을 연장할 수 있습니다. 또한, 유럽, 북미, 아시아의 많은 정부 프로그램에서는 기존 건물의 에너지 효율과 내수성 향상을 장려하고 있습니다. 지속가능한 건축 관행과 친환경 인증을 장려하는 규제는 개보수 공사에서 액체 도포막과 같은 고성능 방수 시스템의 사용을 더욱 촉진하고 있습니다. 액상 도포형 방수막은 또한 VOC가 적고 환경적으로 안전한 포뮬러를 제공하여 현대의 미적 감각과 환경 기준에 부합합니다.

아시아태평양은 급속한 도시화, 산업화, 인프라 투자 증가, 건설 및 시장 개발 프로젝트에 대한 정부의 강력한 지원 등 강력한 조합으로 인해 LAM(Liquid Applied Membrane) 시장에서 가장 큰 지역이 되었습니다. 이 지역의 우위는 주로 중국, 인도, 일본, 한국, 동남아시아 국가들과 같은 주요 경제국들이 주도하고 있으며, 이들은 각각 대규모 주거, 상업, 인프라 건설 활동을 통해 기여하고 있습니다. 가장 결정적인 촉진요인 중 하나는 인도와 중국에서 진행 중인 대규모 건설 붐입니다. 인도에서는 건설 부문이 경제 발전의 핵심이며, 주택, 교통, 도시 인프라 등 공공 부문과 민간 부문의 의욕적인 프로젝트가 경제 발전의 원동력이 되고 있습니다. Pradhan Mantri Awas Yojana-Urban(PMAY-U), Smart Cities Mission, 물류-창고-부동산 분야의 설비투자 증가 등의 노력으로 액체 도포막과 같은 고성능 방수재에 대한 수요가 크게 증가하고 있습니다. 지속가능성과 친환경 건축물을 지향하는 이 분야의 움직임은 환경 기준에 부합하는 첨단 액체 도포 필름 시스템의 사용을 더욱 촉진하고 있습니다.

중국 정부의 14차 5개년 계획은 교통, 에너지, 물 시스템, 녹색 도시화 등의 분야에서 새로운 인프라를 강조하고 있습니다. 또한, 중국은 대규모 건물 개보수 및 에너지 효율이 높은 넷 제로 건물의 개발을 추진하고 있으며, 이는 신축 및 개보수 모두에서 액체 도포 필름을 사용할 수 있는 큰 기회를 창출하고 있습니다. 또한, 산업 활동의 활성화, 도시 재개발, 상업 시설의 확장은 상하이, 베이징, 광저우 등 주요 도시 그룹에서 액체 도포 필름에 대한 수요를 지속적으로 증가시키고 있습니다. 또한, 이 지역에서는 에너지 효율, 물 관리, 기후 변화에 대한 인식이 높아지면서 개발업체와 정부가 첨단 방수 기술을 채택하도록 장려하고 있습니다. 도심의 경우 인건비가 상대적으로 저렴하고 토지 가용성이 계속 줄어들고 있기 때문에 특히 기존 구조물의 개보수에서는 액체 도포막과 같이 효율적이고 시공이 용이한 시스템으로 전환하는 경향이 강합니다.

세계의 액체 도포막 시장에 대해 조사했으며, 용도별, 최종 이용 산업별, 유형별, 용도별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

제6장 업계 동향

- 소개

- 밸류체인 분석

- 규제 상황

- 무역 분석

- 거시경제 지표

- 가격 분석

- 투자와 자금 조달 시나리오

- 생태계

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 기술 분석

- 원재료 분석

- Porter's Five Forces 분석

- 사례 연구 분석

- 2025-2026년의 주요 회의와 이벤트

- 특허 분석

- 주요 이해관계자와 구입 기준

제7장 액체 도포막 시장(용도별)

- 소개

- 지붕

- 벽

- 건축 구조물

- 도로

- 기타

제8장 액체 도포막시장(최종 이용 산업별)

- 소개

- 주택 건설

- 상업 건설

- 공공 인프라

제9장 액체 도포막 시장(유형별)

- 소개

- 엘라스토머 멤브레인

- 역청막

- 시멘트질 막

제10장 액체 도포막 시장(사용법별)

- 소개

- 신축

- 개선

제11장 액체 도포막 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 스페인

- 영국

- 이탈리아

- 러시아

- 기타

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 호주

- 태국

- 인도네시아

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제12장 경쟁 구도

- 개요

- 주요 진출 기업의 전략

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교

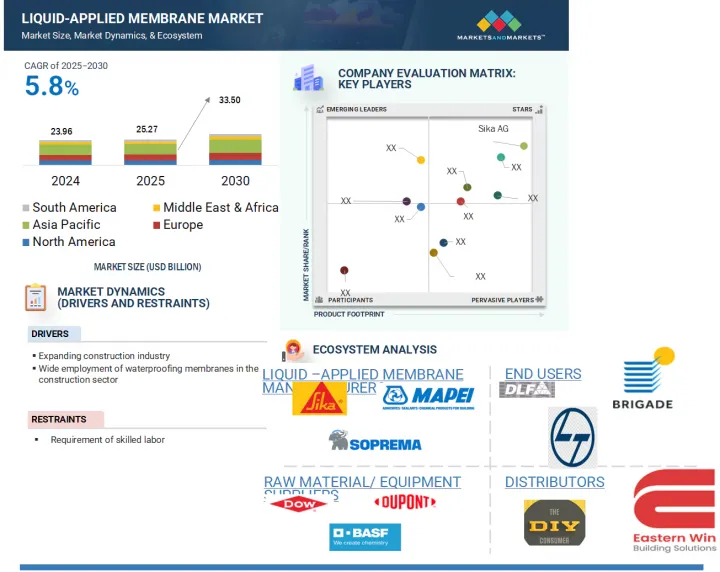

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오와 동향

제13장 기업 개요

- 주요 진출 기업

- SIKA AG

- MAPEI S.P.A.

- SOPREMA

- FOSROC, INC.

- SAINT-GOBAIN WEBER

- H.B. FULLER

- WACKER CHEMIE AG

- JOHNS MANVILLE

- BOSTIK

- GCP APPLIED TECHNOLOGIES INC.

- ARDEX

- 기타 기업

- RENOLIT SE

- PAUL BAUDER GMBH CO. KG

- GAF, INC.

- CARLISLE COMPANIES INC.

- PIDILITE

- TREMCO

- KEMPER SYSTEM

- ALCHIMICA

- AMES RESEARCH LABORATORIES, INC.

- CHASE CORPORATION

- CHEMBOND CHEMICALS

- CHEM LINK

- CONCRETE SEALANTS, INC.

- CROMMELIN WATERPROOFING & SEALING

- ESKOLA ROOFING

- EVERBUILD BUILDING PRODUCTS LIMITED

- HENRY COMPANY

- INLAND COATINGS

- KARNAK

- KEY RESIN COMPANY

- PROTECTO WRAP COMPANY

- XYPEX CHEMICAL CORPORATION

제14장 부록

KSM 25.09.04The liquid-applied membrane market is projected to reach USD 33.50 billion by 2030 from USD 25.27 billion in 2025, at a CAGR of 5.8% during the forecast period. Liquid-applied membranes (LAMs) are fluid-applied, seamless waterproofing systems that create a flexible and durable protective barrier. They are widely used in roofing, basements, terraces, tunnels, and other structural elements due to their ability to conform to complex surfaces and provide long-lasting protection against water ingress, UV radiation, and chemical exposure.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Million Square Meter) |

| Segments | Type, Application, Usage, End-Use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

The market for LAMs is being propelled by several factors, including the increasing demand for efficient and low-maintenance waterproofing solutions, the growth of the global construction industry, and a rising focus on energy-efficient and sustainable building materials. Additionally, LAMs are favored for their ease of application, rapid installation time, and superior performance over traditional sheet-based systems.

Regionally, growth is most prominent in Asia Pacific due to rapid urbanization, infrastructure development, and government housing initiatives in countries like China and India. North America is seeing strong demand driven by renovation and green building trends, while Europe's market is supported by stringent environmental regulations and emphasis on sustainable construction. The Middle East and Africa are also emerging as key markets due to increased investment in commercial infrastructure and transport projects. These regional dynamics, combined with the material's performance advantages, continue to support the global expansion of the liquid applied membrane market.

"Bituminous membranes segment is the second fastest-growing segment in the liquid-applied membrane market during the forecast period."

Bituminous membranes are one of the most widely used waterproofing solutions in the construction industry, known for their robustness, durability, and proven performance across a wide range of applications. These membranes are primarily composed of bitumen (asphalt), often modified with polymers such as Atactic Polypropylene (APP) or Styrene-Butadiene-Styrene (SBS), which enhance their elasticity, flexibility, and resistance to aging. Bituminous membranes are typically applied in sheet form or as liquid-applied coatings and are reinforced with materials like fiberglass or polyester to improve tensile strength and dimensional stability. These membranes are especially effective in providing long-lasting protection against water ingress in both horizontal and vertical surfaces. They are extensively used in roofing systems, basements, foundations, tunnels, bridges, and retaining walls. Their superior adhesion to a wide range of substrates, such as concrete, metal, and wood, ensures consistent performance even under challenging environmental conditions. The ability of bituminous membranes to withstand UV exposure, temperature extremes, and mechanical stress makes them ideal for exposed as well as buried applications. In recent years, environmental concerns have led to the development of modified bituminous membranes with lower VOC emissions and improved thermal performance, aligning with green building standards. Manufacturers are also focusing on improving installation efficiency by introducing prefabricated rolls with integrated adhesive layers and faster curing times. As construction activities continue to rise globally, especially in infrastructure and commercial sectors, the demand for bituminous membranes remains strong, supported by their ability to deliver reliable waterproofing across diverse project scales and environmental conditions.

"Refurbishment segment is the fastest-growing usage segment in the liquid-applied membrane market during the forecast period."

The refurbishment segment is emerging as one of the fastest-growing segments for liquid-applied membranes (LAMs), driven by a global surge in building renovation, infrastructure upgrades, and retrofitting of aging structures. As urban areas mature, the need to restore and modernize existing buildings has become a key focus for both public and private stakeholders. Older structures often face issues such as water leakage, roof damage, foundation cracks, and poor thermal performance-problems that can be effectively addressed through the application of LAMs. These membranes are especially well-suited for refurbishment projects due to their seamless application, ability to conform to irregular surfaces, and compatibility with various substrates, including aged concrete, brick, and metal.

One of the main advantages of LAMs in refurbishment is their ease of use without requiring the complete removal of the existing system. This not only reduces labor costs but also minimizes disruption in occupied spaces such as residential buildings, schools, hospitals, and commercial establishments. In urban environments where space constraints and building accessibility pose challenges, LAMs provide a practical solution that can be applied vertically or horizontally with minimal equipment. Their elastomeric properties allow them to accommodate structural movement and seal existing cracks, extending the lifespan of the building envelope. Additionally, many government programs in Europe, North America, and Asia are incentivizing energy efficiency and water resistance upgrades in existing buildings. Regulations encouraging sustainable building practices and green certification are further propelling the use of high-performance waterproofing systems like LAMs during renovation. Liquid-applied membranes also align with modern aesthetic and environmental standards, offering low-VOC, environmentally safe formulations.

"Asia Pacific is projected to be the largest market for liquid-applied membrane during the forecast period."

Asia Pacific stands as the largest region in the liquid-applied membrane (LAM) market, driven by a powerful combination of rapid urbanization, industrialization, rising infrastructure investments, and strong governmental support for construction and development projects. The region's dominance is primarily fueled by major economies like China, India, Japan, South Korea, and Southeast Asian countries, each contributing through large-scale residential, commercial, and infrastructure construction activities. One of the most defining growth drivers is the massive construction boom underway in India and China. In India, the construction sector is a cornerstone of economic development, propelled by ambitious public and private sector projects in housing, transportation, and urban infrastructure. Initiatives such as the Pradhan Mantri Awas Yojana-Urban (PMAY-U), Smart Cities Mission, and rising capital expenditure in logistics, warehousing, and real estate are significantly increasing the demand for high-performance waterproofing materials like liquid-applied membranes. The sector's push towards sustainability and green buildings is further encouraging the use of advanced LAM systems that align with environmental standards.

In China, the government's 14th Five-Year Plan emphasizes new infrastructure in areas like transportation, energy, water systems, and green urbanization. The country is also pushing for extensive building retrofits and the development of energy-efficient and net-zero buildings, creating robust opportunities for LAM usage in both new constructions and refurbishments. Additionally, rising industrial activity, urban redevelopment, and commercial expansions continue to add to LAM demand in key urban clusters like Shanghai, Beijing, and Guangzhou. Moreover, the region's growing awareness of energy efficiency, water management, and climate resilience is encouraging developers and governments to adopt advanced waterproofing technologies. With labor costs being comparatively lower and land availability continuing to shrink in urban cores, there is a strong shift toward efficient, easy-to-apply systems like LAMs, especially in retrofitting existing structures.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information was gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 35%, Asia Pacific: 30%, South America: 5%, Middle East & Africa 5%

Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US). among others are some of the key players in the liquid-applied membrane market.

The study includes an in-depth competitive analysis of these key players in the authentication and brand

protection market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the liquid-applied membrane market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, usage, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the liquid-applied membrane market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall liquid-applied membrane market and its segments and sub-segments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Expanding construction industry, rising renovation and refurbishment activities), restraints (Requirements of skilled labor ), opportunities (Growth in emerging markets), and challenges (Environmental & health concerns related to liquid-applied membranes)

- Market Development: Comprehensive information about lucrative markets - the report analyzes the liquid-applied membrane market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the liquid-applied membrane market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product and service offerings of leading players like Sika AG (Switzerland), Mapei S.P.A. (Italy), Soprema (France), Fosroc, Inc (UAE), Saint-Gobain Weber (France), H.B. Fuller (US), Wacker Chemie AG (Germany), Johns Manville (US), Bostik (France), GCP Applied Technologies (US), Ardex (Germany), Renolit SE (Germany), GAF, Inc. (US), Pidilite(India), and Tremco (US) among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakdown of primary interviews

- 2.1.2.3 Key industry insights

- 2.1.2.4 Key primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LIQUID-APPLIED MEMBRANE MARKET

- 4.2 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 4.3 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 4.4 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 4.5 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 4.6 LIQUID-APPLIED MEMBRANE MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding construction industry

- 5.2.1.2 Rising renovation and refurbishment activities

- 5.2.1.3 Wide deployment of waterproofing membranes in construction sector

- 5.2.1.4 Stringent building codes and standards in construction projects

- 5.2.2 RESTRAINTS

- 5.2.2.1 Increasing demand for sheet membranes as substitutes

- 5.2.2.2 High initial investment required for liquid-applied membranes

- 5.2.2.3 Requirement of skilled labor

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing demand for energy-efficient buildings and green roofs

- 5.2.3.2 Growth in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental and health concerns related to liquid-applied membranes

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 VALUE CHAIN ANALYSIS

- 6.2.1 RAW MATERIAL SOURCING

- 6.2.2 MANUFACTURING

- 6.2.3 DISTRIBUTION

- 6.2.4 END USERS

- 6.3 REGULATORY LANDSCAPE

- 6.3.1 REGULATIONS

- 6.3.1.1 North America

- 6.3.1.2 Europe

- 6.3.1.3 Asia Pacific

- 6.3.2 STANDARDS

- 6.3.2.1 ISO 15824

- 6.3.2.2 ISO 19288

- 6.3.2.3 ASTM D4068

- 6.3.2.4 ASTM D6788

- 6.3.3 REGULATORY BODIES, GOVERNMENT AGENCIES, & OTHER ORGANIZATIONS

- 6.3.1 REGULATIONS

- 6.4 TRADE ANALYSIS

- 6.4.1 IMPORT SCENARIO

- 6.4.2 EXPORT SCENARIO

- 6.5 MACROECONOMIC INDICATORS

- 6.5.1 GLOBAL GDP TRENDS

- 6.6 PRICING ANALYSIS

- 6.6.1 AVERAGE SELLING PRICE TREND, BY REGION

- 6.6.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.7 INVESTMENT AND FUNDING SCENARIO

- 6.8 ECOSYSTEM

- 6.9 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.10 TECHNOLOGY ANALYSIS

- 6.10.1 KEY TECHNOLOGY

- 6.10.1.1 New formulations

- 6.10.1.2 Self-healing & nanotechnology

- 6.10.2 COMPLEMENTARY TECHNOLOGY

- 6.10.2.1 Spray application technique

- 6.10.2.2 Moisture detection and monitoring tools

- 6.10.1 KEY TECHNOLOGY

- 6.11 RAW MATERIAL ANALYSIS

- 6.11.1 BITUMINOUS MEMBRANES

- 6.11.2 ELASTOMERIC MEMBRANES

- 6.11.2.1 Acrylic

- 6.11.2.2 Polyurethane

- 6.11.3 CEMENTITIOUS MEMBRANES

- 6.12 PORTER'S FIVE FORCES ANALYSIS

- 6.12.1 THREAT OF NEW ENTRANTS

- 6.12.2 THREAT OF SUBSTITUTES

- 6.12.3 BARGAINING POWER OF SUPPLIERS

- 6.12.4 BARGAINING POWER OF BUYERS

- 6.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 AIR GUARD VPA COATING ENHANCES ASPHALT'S FLEXIBILITY AND DURABILITY

- 6.13.2 SIKALASTIC ROOFPRO MEMBRANE SYSTEM PROVIDES FULLY REINFORCED MEMBRANE

- 6.13.3 FOSROC NITOPROOF 600PF PROVIDES EFFECTIVE WATERPROOFING

- 6.13.4 SPECTRUM HOUSE

- 6.13.5 EMPIRE STATE BUILDING

- 6.14 KEY CONFERENCES & EVENTS IN 2025-2026

- 6.15 PATENT ANALYSIS

- 6.15.1 METHODOLOGY

- 6.15.2 DOCUMENT TYPES

- 6.15.3 PUBLICATION TRENDS IN LAST 10 YEARS

- 6.15.4 INSIGHTS

- 6.15.5 JURISDICTION ANALYSIS

- 6.15.6 TOP APPLICANTS

- 6.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.16.2 BUYING CRITERIA

7 LIQUID-APPLIED MEMBRANE MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 ROOFING

- 7.2.1 RISING DEMAND FOR GREEN ROOF SYSTEMS TO DRIVE MARKET

- 7.3 WALLS

- 7.3.1 HIGH EXPOSURE TO MOISTURE, TEMPERATURE FLUCTUATIONS, UV RADIATION, AND AIR POLLUTANTS TO DRIVE DEMAND

- 7.4 BUILDING STRUCTURES

- 7.4.1 STRUCTURAL CRACKING AND BIOLOGICAL DEGRADATION TO FUEL DEMAND FOR POLYURETHANE AND BITUMINOUS MEMBRANES

- 7.5 ROADWAYS

- 7.5.1 RISING INFRASTRUCTURE PROJECTS TO FUEL MARKET

- 7.6 OTHER APPLICATIONS

8 LIQUID-APPLIED MEMBRANE MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 RESIDENTIAL CONSTRUCTION

- 8.2.1 STRONG GROWTH IN RESIDENTIAL SECTOR TO FUEL DEMAND

- 8.3 COMMERCIAL CONSTRUCTION

- 8.3.1 INCREASING DEMAND FOR COMMERCIAL INFRASTRUCTURE TO BOOST MARKET

- 8.4 PUBLIC INFRASTRUCTURE

- 8.4.1 RAPID URBANIZATION AND INDUSTRIALIZATION TO DRIVE MARKET

9 LIQUID-APPLIED MEMBRANE MARKET, BY TYPE

- 9.1 INTRODUCTION

- 9.2 ELASTOMERIC MEMBRANES

- 9.2.1 NEED FOR MEMBRANES WITH ROBUST PERFORMANCE IN SENSITIVE ENVIRONMENTS TO DRIVE MARKET

- 9.2.2 ACRYLIC MEMBRANES

- 9.2.3 POLYURETHANE WATERPROOFING MEMBRANES

- 9.2.4 PMMA MEMBRANES

- 9.3 BITUMINOUS MEMBRANES

- 9.3.1 RESISTANCE TO UV AND TEMPERATURE FLUCTUATIONS TO DRIVE DEMAND

- 9.3.2 SOLVENT-BASED

- 9.3.3 WATER-BASED

- 9.4 CEMENTITIOUS MEMBRANES

- 9.4.1 WIDE APPLICATIONS IN ROOFS AND TUNNELS TO DRIVE MARKET

- 9.4.2 ONE-COMPONENT (1K)

- 9.4.3 TWO-COMPONENT (2K)

10 LIQUID-APPLIED MEMBRANE MARKET, BY USAGE

- 10.1 INTRODUCTION

- 10.2 NEW CONSTRUCTION

- 10.2.1 STRONG GROWTH IN NEW CONSTRUCTION ACTIVITIES TO DRIVE MARKET

- 10.3 REFURBISHMENT

- 10.3.1 RISE IN INFRASTRUCTURAL DEVELOPMENTS TO BOOST MARKET

11 LIQUID-APPLIED MEMBRANE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Strong building & construction industry to drive market

- 11.2.2 CANADA

- 11.2.2.1 Increase in demand due to government measures to drive market

- 11.2.3 MEXICO

- 11.2.3.1 Increased public and private investments in infrastructure projects to drive market

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Steady economic growth and rapid urbanization to boost market

- 11.3.2 FRANCE

- 11.3.2.1 Investments in public infrastructure and digitalization to boost market

- 11.3.3 SPAIN

- 11.3.3.1 Growth of construction industry to propel market

- 11.3.4 UK

- 11.3.4.1 Various government activities to drive market

- 11.3.5 ITALY

- 11.3.5.1 Rise in renovation and refurbishment projects to boost market

- 11.3.6 RUSSIA

- 11.3.6.1 Increase in residential construction activities to fuel market

- 11.3.7 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Surge in transportation projects to drive market

- 11.4.2 INDIA

- 11.4.2.1 Government initiatives and increased infrastructure spending to drive market

- 11.4.3 JAPAN

- 11.4.3.1 Surge in redevelopment activities to boost market

- 11.4.4 SOUTH KOREA

- 11.4.4.1 Strong construction industry to fuel market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Rising need for durable waterproofing solutions to boost market

- 11.4.6 THAILAND

- 11.4.6.1 Growth of real estate and tourism industries to drive market

- 11.4.7 INDONESIA

- 11.4.7.1 Rapid urbanization and population growth to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.5.1.1 Saudi Arabia

- 11.5.1.1.1 Development of Jeddah Economic City to drive market

- 11.5.1.2 UAE

- 11.5.1.2.1 Growing emphasis on eco-friendly construction solutions to boost market

- 11.5.1.3 Rest of GCC

- 11.5.1.1 Saudi Arabia

- 11.5.2 SOUTH AFRICA

- 11.5.2.1 Growing investment in construction sector to boost market

- 11.5.3 REST OF MIDDLE EAST & AFRICA

- 11.5.1 GCC COUNTRIES

- 11.6 SOUTH AMERICA

- 11.6.1 BRAZIL

- 11.6.1.1 Upcoming international sports events to boost market

- 11.6.2 ARGENTINA

- 11.6.2.1 Growth of construction industry to drive market

- 11.6.3 REST OF SOUTH AMERICA

- 11.6.1 BRAZIL

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/PRODUCT COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Type footprint

- 12.7.5.2 Application footprint

- 12.7.5.3 Region footprint

- 12.7.5.4 Company footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 SIKA AG

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 MAPEI S.P.A.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Solutions/Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 SOPREMA

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 FOSROC, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Expansions

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 SAINT-GOBAIN WEBER

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Key strengths

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses and competitive threats

- 13.1.6 H.B. FULLER

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.4 MnM view

- 13.1.7 WACKER CHEMIE AG

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 MnM view

- 13.1.8 JOHNS MANVILLE

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product launches

- 13.1.8.4 MnM view

- 13.1.9 BOSTIK

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 MnM view

- 13.1.10 GCP APPLIED TECHNOLOGIES INC.

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.10.4 MnM view

- 13.1.10.4.1 Key strengths

- 13.1.10.4.2 Strategic choices

- 13.1.10.4.3 Weaknesses and competitive threats

- 13.1.11 ARDEX

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.4 MnM view

- 13.1.1 SIKA AG

- 13.2 OTHER PLAYERS

- 13.2.1 RENOLIT SE

- 13.2.2 PAUL BAUDER GMBH CO. KG

- 13.2.3 GAF, INC.

- 13.2.4 CARLISLE COMPANIES INC.

- 13.2.5 PIDILITE

- 13.2.6 TREMCO

- 13.2.7 KEMPER SYSTEM

- 13.2.8 ALCHIMICA

- 13.2.9 AMES RESEARCH LABORATORIES, INC.

- 13.2.10 CHASE CORPORATION

- 13.2.11 CHEMBOND CHEMICALS

- 13.2.12 CHEM LINK

- 13.2.13 CONCRETE SEALANTS, INC.

- 13.2.14 CROMMELIN WATERPROOFING & SEALING

- 13.2.15 ESKOLA ROOFING

- 13.2.16 EVERBUILD BUILDING PRODUCTS LIMITED

- 13.2.17 HENRY COMPANY

- 13.2.18 INLAND COATINGS

- 13.2.19 KARNAK

- 13.2.20 KEY RESIN COMPANY

- 13.2.21 PROTECTO WRAP COMPANY

- 13.2.22 XYPEX CHEMICAL CORPORATION

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS