|

시장보고서

상품코드

1801770

AI SDR 시장 예측(-2030년) : 제공별, 사용 사례별AI SDR Market by Offering (Email Generators, Enrichment, AI Script, Template Generators, Meeting Booking), Use Case (Appointment Scheduling, Prospecting, Outreach, CRMs, Data Management, Follow up, Research, Sales Engagement) - Global Forecast to 2030 |

||||||

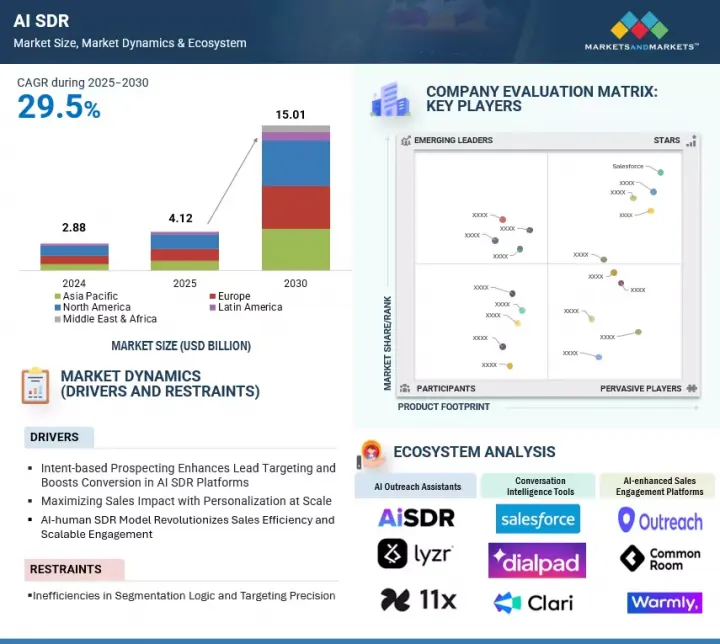

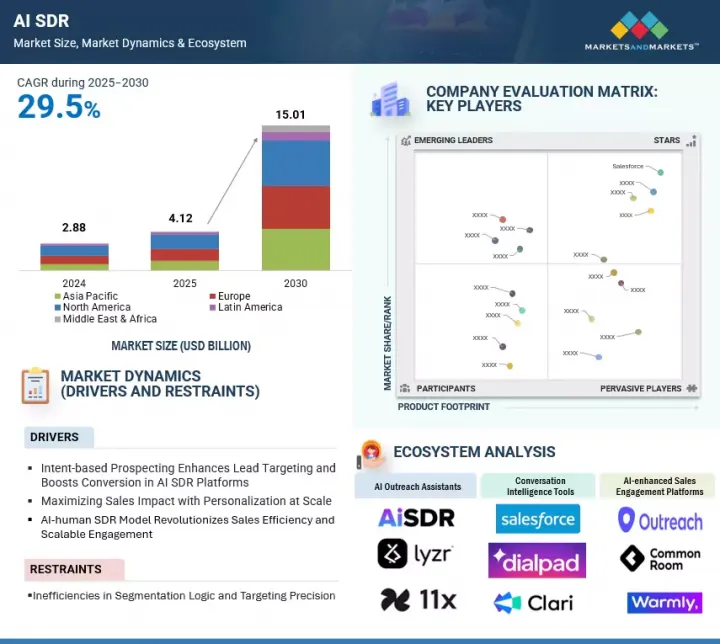

세계의 AI SDR 시장은 강력한 성장을 보이고 있으며, 시장 규모는 2025년 41억 2,000만 달러에서 2030년까지 150억 1,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 29.5%의 성장이 전망됩니다.

영업팀은 AI SDR 솔루션을 활용하여 대규모 개인화를 통한 영향력 있는 아웃리치를 실현하기 위해 AI SDR 솔루션을 활용하고 있습니다. AI를 활용하여 구매자의 신호를 분석하고, 잠재고객을 세분화하고, 실시간으로 메시징을 맞춤화함으로써 기업은 수천 명의 잠재고객에게 관련성 있고 개인화된 커뮤니케이션을 제공할 수 있습니다. 이 접근 방식은 속도와 양을 희생하지 않고도 참여의 질을 향상시킬 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제공, 배포 모델, 세일즈 채널, 사용 사례, 최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

SDR은 AI가 생성한 인사이트를 통해 리드의 우선순위를 보다 효과적으로 설정하고, 의도와 활동에 따라 후속 조치를 조정할 수 있습니다. 고객 전환에 대한 압박이 가중되는 가운데, 확장 가능한 개인화는 더 높은 응답률, 더 강력한 파이프라인 전환, 그리고 궁극적으로 더 효과적인 영업 개발 성과를 촉진하는 데 필수적인 요소로 자리 잡았습니다.

"중견 시장 영업 조직 기업 유형 부문이 예측 기간 중 가장 빠른 성장세를 보일 것입니다. "

중견 시장 영업 조직은 대규모 기업 시스템처럼 복잡하지 않으면서도 생산성을 높일 수 있는 확장 가능하고 비용 효율적인 프로스펙팅 솔루션이 필요하므로 AI SDR 시장에서 가장 높은 성장률을 주도하고 있습니다. 이러한 조직은 더 슬림한 영업팀과 한정된 리소스로 운영되는 경우가 많으며, AI를 통한 자동화가 대량 리드 생성 및 자격 검증에 필수적입니다. 클라우드 기반 AI SDR 툴은 신속한 배포, CRM과의 원활한 통합, 파이프라인 속도에 대한 측정 가능한 영향을 제공합니다. 또한 중견 시장 기업은 타겟팅 개선, 수작업 감소, 다양한 고객 부문에서 일관된 아웃바운드 성과를 지원하는 AI 강화 워크플로우의 혜택을 누릴 수 있는 하이브리드 세일즈 모델을 점점 더 많이 채택하고 있습니다.

"클라우드 네이티브 SaaS 배포 모델이 예측 기간 중 가장 큰 시장 점유율을 차지할 것입니다. "

클라우드 네이티브 SaaS 배포 모델은 확장성, 통합 용이성, 최소한의 인프라 요구 사항으로 인해 AI SDR 시장에서 가장 높은 성장률을 보이고 있습니다. SaaS는 신속한 온보딩, 원활한 업데이트, 분산된 영업팀 간의 유연한 접근을 가능하게 하며, 역동적인 프로스펙팅 환경에 필수적입니다. SaaS 플랫폼은 CRM 및 영업 지원 툴와 실시간 데이터 동기화를 지원하여 리드의 정확성과 아웃리치의 효율성을 높입니다. 영업 조직이 민첩성, 원격 지원, 가치 실현 시간 단축을 우선시하는 가운데, 클라우드 네이티브 AI SDR 솔루션은 이상적인 적합성을 제공합니다. 또한 종량제 모델로 초기 비용을 절감할 수 있으며, 중견기업과 대기업 모두에게 매우 매력적인 솔루션이 될 수 있습니다.

"북미는 기업 규모의 자동화를 통해 AI SDR을 확산하고, 아시아태평양은 급성장하는 B2B 시장에서의 채택을 가속화할 것입니다. "

북미는 성숙한 디지털 인프라, 광범위한 CRM 통합, 아웃바운드 세일즈 워크플로우에서 AI의 조기 도입으로 AI SDR 시장을 선도하고 있습니다. 다양한 부문의 기업이 AI SDR 툴을 사용하여 프로스펙팅 자동화, 리드 정량화 개선, 대량 아웃리치 간소화를 위해 AI SDR 툴을 활용하고 있습니다. AI 퍼스트 벤더의 강력한 기반과 첨단화된 세일즈 생태계의 존재는 인텐트 기반 타겟팅, 실시간 참여 제안, 동적 리드 인리치먼트 등의 분야에서 지속적인 혁신을 지원하고 있습니다.

세계의 AI SDR 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- AI SDR 시장의 기업에 매력적인 기회

- AI SDR 시장 : 상위 3개 기업 유형

- 북미의 AI SDR 시장 : 배포 모델별, 기업 유형별

- AI SDR 시장 : 지역별

제5장 시장의 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- AI SDR와 영업 담당자 : 전략의 비교

- AI SDR 시장의 진화

- 공급망 분석

- 에코시스템 분석

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 사례 연구 1 : KEATEXT, HubSpot Sales Hub와의 제휴로 리드 질과 영업 체제를 강화

- 사례 연구 2 : ARTISAN, AI에 의한 세일즈 자동화로 BIOACCESS의 수작업에 의한 아웃리치의 과제를 극복

- 사례 연구 3 : SPENDESK와 SALESLOFT, 케이던스 자동화로 아웃리치를 강화하고, 응답률을 10배로 향상

- 사례 연구 4 : ACTIONCOACH, 타겟 아웃리치에 COGNISM AI SDR 솔루션을 활용하여 질 높은 미팅을 증가

- 사례 연구 5 : 6SENSE 컨택 데이터와 인사이트를 활용한 NETSKOPE SDR의 프로스펙팅 변혁

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제 구조

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별(2016-2025년)

- 혁신과 특허 출원

- 가격결정 분석

- 평균 판매 가격 : 기능성별, 주요 기업별

- 평균 판매 가격 : 판매 프로세스별

- 주요 컨퍼런스와 이벤트(2025-2026년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 인간 SDR vs. AI SDR

제6장 AI SDR 시장 : 제공별

- 서론

- 소프트웨어

- AI 아웃리치 어시스턴트

- 대화 인텔리전스 툴

- AI 강화 세일즈 관여 플랫폼

- 리드 조사·인리치먼트 봇

- 이메일 전달 가능성 최적화

- AI 스크립트·템플릿 제너레이터

- 서비스

- 워크플로우 자동화 셋업·통합

- AI 개별화·신속한 컨설팅

- 전달 가능성·스팸 감사 서비스

제7장 AI SDR 시장 : 배포 모델별

- 서론

- 클라우드 네이티브 SaaS

- Chrome 확장 기능

- API 퍼스트 모듈러 임베드

제8장 AI SDR 시장 : 세일즈 채널별

- 서론

- 인바운드

- 아웃바운드

- 하이브리드

제9장 AI SDR 시장 : 사용 사례별

- 서론

- 리드 제너레이션·쿠오리피케이션

- 프로스펙팅·아웃리치

- CRM 통합·데이터 관리

- 회의·예약 스케줄링

- 조사·코칭·SDR 지원

- 팔로 업·육성

- 세일즈 리포트·애널리틱스

- 통합 환경

제10장 AI SDR 시장 : 최종사용자별

- 서론

- 기업 유형

- 스타트업·중소기업

- 중견 시장 영업 조직

- 기업 SDR 팀

- 업계별

- 소매·E-Commerce

- BFSI

- 통신

- 의료·생명과학

- 교육

- 미디어·엔터테인먼트

- 제조

- 여행·접객(Hoapitality)

- 부동산·건설

- 자동차·운송·물류

- 기타 업계

제11장 AI SDR 시장 : 지역별

- 서론

- 북미

- 북미의 AI SDR 시장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 AI SDR 시장 촉진요인

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 AI SDR 시장 촉진요인

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주·뉴질랜드

- ASEAN

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 AI SDR 시장 촉진요인

- 중동 및 아프리카의 거시경제 전망

- 중동

- 아프리카

- 라틴아메리카

- 라틴아메리카의 AI SDR 시장 촉진요인

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 기타 라틴아메리카

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점(2021-2025년)

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 제품의 비교

- 제품 비교 분석 : 기업 유형별(스타트업·중소기업)

- 제품 비교 분석 : 기업 유형별(중견 시장 영업 조직)

- 제품 비교 분석 : 기업 유형별(기업 SDR 팀)

- 기업의 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 서론

- 주요 기업

- HUBSPOT

- SALESFORCE

- DIALPAD

- SALESLOFT

- 6SENSE

- ZOOMINFO

- APOLLO.IO

- OPENAI

- CLARI

- COGNISM

- MICROSOFT

- GUPSHUP

- OUTREACH

- VIDYARD

- PLIVO

- QUALIFIED

- OTTER.AI

- CONVERSICA

- KLENTY

- REPLY.IO

- SEAMLESS.AI

- WAALAXY

- 기타 기업

- COMMON ROOM

- ARTISAN AI

- USERGEMS

- SCRATCHPAD

- CLAY

- UNIFY

- LYZR AI

- HUMANTIC AI

- RELEVANCE AI

- REGIE.AI

- SALESFORGE

- 11X AI

- FLOWORKS

- WARMLY

- LURU

- AISDR

- CHASELABS

- BLUEBIRDS

- SUPERREP.AI

- SUPERAGI

- INSTANTLY

- PERSANA AI

- FACTORS.AI

- SALESHANDY

제14장 인접 시장과 관련 시장

- 서론

- AI 에이전트 시장 - 세계 예측(-2030년)

- 시장의 정의

- 시장의 개요

- 세일즈·마케팅용 AI 시장 - 세계 예측(-2030년)

- 시장의 정의

- 시장의 개요

제15장 부록

KSA 25.09.05The AI SDR market is experiencing strong growth, projected to rise from USD 4.12 billion in 2025 to USD 15.01 billion by 2030, at a CAGR of 29.5% during the forecast period. Sales teams are increasingly turning to AI SDR solutions to achieve high-impact outreach through personalization at scale. By leveraging AI to analyze buyer signals, segment audiences, and adapt messaging in real time, organizations can deliver relevant, individualized communication across thousands of prospects. This approach improves engagement quality without compromising speed or volume.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Billion |

| Segments | Offering, Deployment Model, Sales Channel, Use Case, End User, And Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

AI-generated insights also enable SDRs to prioritize leads more effectively and tailor follow-ups based on intent or activity. As the pressure to convert top-of-funnel opportunities grows, scalable personalization has become essential for driving higher response rates, stronger pipeline conversions, and ultimately, more effective sales development outcomes.

"Mid-market sales organizations enterprise type segment to account for the fastest growth during the forecast period"

Mid-market sales organizations are driving the highest growth rate in the AI SDR market due to their need for scalable, cost-efficient prospecting solutions that enhance productivity without the complexity of large enterprise systems. These organizations often operate with leaner sales teams and limited resources, making AI-driven automation essential for high-volume lead generation and qualification. Cloud-based AI SDR tools offer quick deployment, seamless CRM integration, and measurable impact on pipeline velocity. Additionally, mid-market firms are increasingly adopting hybrid sales models, which benefit from AI-enhanced workflows that improve targeting, reduce manual tasks, and support consistent outbound performance across diverse customer segments.

"Cloud native SaaS deployment model to hold the largest market share during the forecast period"

The cloud-native SaaS deployment model is experiencing the highest growth rate in the AI SDR market due to its scalability, ease of integration, and minimal infrastructure requirements. It enables rapid onboarding, seamless updates, and flexible access across distributed sales teams, critical for dynamic prospecting environments. SaaS platforms support real-time data syncing with CRMs and sales engagement tools, enhancing lead accuracy and outreach efficiency. As sales organizations prioritize agility, remote enablement, and faster time-to-value, cloud-native AI SDR solutions offer an ideal fit. Their pay-as-you-go models also lower upfront costs, making them highly attractive to both mid-market firms and large enterprises.

"North America advances AI SDR deployment through enterprise-scale automation, while Asia Pacific accelerates adoption in fast-growing B2B markets."

North America leads the AI Sales Development Representative (SDR) market, driven by a mature digital infrastructure, widespread CRM integration, and the early adoption of AI in outbound sales workflows. Companies across sectors use AI SDR tools to automate prospecting, improve lead qualification, and streamline high-volume outreach. The presence of advanced sales ecosystems and a strong base of AI-first vendors supports continued innovation in areas like intent-based targeting, real-time engagement suggestions, and dynamic lead enrichment. In contrast, Asia Pacific represents the fastest-growing region for AI SDR adoption, spurred by rapid digitalization, a surge in B2B SaaS activity, and increasing demand for scalable sales automation. Markets like India, China, and Japan are actively deploying AI tools to manage lead sourcing, customize cold outreach, and accelerate qualification at scale. The region's expanding digital economy, supported by startup growth and digital infrastructure investments, is reshaping sales development across sectors. As organizations seek more efficient and intelligent ways to drive top-of-funnel engagement, Asia Pacific is becoming a key growth hub for AI SDR solutions.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI SDR market.

- By Company: Tier I - 25%, Tier II - 45%, and Tier III - 30%

- By Designation: C-Level Executives - 35%, D-Level Executives - 40%, and Others - 25%

- By Region: North America - 45%, Europe - 25%, Asia Pacific - 15%, Middle East & Africa - 10%, and Latin America - 5%

The report includes a study of key players offering AI SDR. The major market players include HubSpot (US), Salesforce (US), Dialpad (US), Salesloft (US), 6Sense (US), ZoomInfo (US), Apollo.io (US), OpenAI (US), Clari (US), Cognism (UK), Microsoft (US), GupShup (US), Outreach (US), Vidyard (Canada), Plivo (US), Qualified (US), Otter.ai (US), Conversica (US), Klenty (India), Reply.io (US), Seamless.ai (US), Waalaxy (France), Common Room (US), Artisan AI (US), UserGems (US), Scratchpad (US), Clay (US), Unify (Germany), Lyzr AI (US), Humantic AI (US), Relevance AI (Australia), Regie.ai (US), Salesforge (Estonia), 11x AI (UK), Floworks (US), Warmly (US), Luru (US), AiSDR (US), Bluebirds (US), ChaseLabs (UK), SuperRep.ai (US), SuperAGI (US), Instantly (US), Persana AI (US), Factors.ai (US), and Saleshandy (India).

Research Coverage

This research report categorizes the AI SDR market based on offering (software (AI Outreach Assistants (Personalized Email Generators, Cold Call Script Writers, Follow-Up Sequencers), Conversation Intelligence Tools (Real-Time Coaching, Sentiment & Intent Detection, Objection Handling), AI-Enhanced Sales Engagement Platforms (Multichannel Sequencing, Engagement Scoring, Meeting Booking), Lead Research & Enrichment Bots (AI-ICP Matching, Enrichment, Trigger Monitoring), Email Deliverability Optimizers (Spam Risk Tools, Inbox Rotation & Warming), AI Script & Template Generators (Agent-led Outreach Execution, Persona-based Prompting, SDR Agent Monitoring Dashboard)) and services (Workflow Automation Setup & Integration, AI Personalization & Prompt Consulting, Deliverability & Spam Audit Services), deployment model (Cloud-Native SaaS, Chrome Extensions, API-first Modular Embeds), sales channel (Inbound, Outbound, Hybrid), use case (Lead Generation & Qualification (Outbound Email Personalization, Inbound Lead Qualification, Lead Routing & Prioritization), Prospecting & Outreach (Cold Calling Assistance, Conversation Summarization), CRM Integration & Data Management (CRMs, Data Providers), Meeting & Appointment Scheduling , Research, Coaching & SDR Enablement (SDR Enablement & Onboarding, Research & Coaching), Follow-up & Nurturing, Sales Reporting & Analytics, Integration Environment (Email Tools, Sales Engagement Platforms, Marketing Platforms)), end user (enterprise type (Startups & SMBs, Mid-Market Sales Organizations, Enterprise SDR Teams), industry vertical (Retail & E-commerce, BFSI (Banking, Financial Services, Insurance), Telecommunications, Healthcare & Life Sciences, Education, Media & Entertainment (Marketing & Advertising Agencies, Music & Film Production, Gaming & Sports, Publishing & Print Media, Broadcasting & Streaming), Manufacturing, Travel & Hospitality, Real Estate & Construction, Automotive, Transportation & Logistics, and Other Industry Verticals (Law Firms, Government And Public Sector)), and region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America).

The scope of the report covers detailed information regarding drivers, restraints, challenges, and opportunities influencing the growth of the AI SDR market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the market. This report also covered the competitive analysis of upcoming startups in the market ecosystem.

Key Benefits of Buying the Report

The report will provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall AI SDR market and its subsegments. It will help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It will also help stakeholders understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (Adoption of Hybrid Human-AI Sales Engagement Models, Intent-Based Prospecting Enhances Lead Targeting and Boosts Conversion in AI SDR Platforms, Maximizing Sales Impact with Personalization at Scale), restraints (Inefficiencies in Segmentation Logic and Targeting Precision), opportunities (Emergence of Multi-Agent AI-Driven SDR Architectures, Advancing Sales Efficiency Through Predictive Lead Qualification, Transforming Process Optimization with Adaptive, Self-Improving Agentic AI Capabilities), and challenges (Deficiencies in Emotional Intelligence and Contextual Adaptability, Reliance on High-Fidelity and Contextually Accurate Data Inputs)

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the AI SDR

- Market Development: Comprehensive information about lucrative markets - analyzing the AI SDR market across varied regions

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI SDR market

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such as HubSpot (US), Salesforce (US), Dialpad (US), Salesloft (US), 6Sense (US), ZoomInfo (US), Apollo.io (US), OpenAI (US), Clari (US), Cognism (UK), Microsoft (US), GupShup (US), Outreach (US), Vidyard (Canada), Plivo (US), Qualified (US), Otter.ai (US), Conversica (US), Klenty (India), Reply.io (US), Seamless.ai (US), Waalaxy (France), Common Room (US), Artisan AI (US), UserGems (US), Scratchpad (US), Clay (US), Unify (Germany), Lyzr AI (US), Humantic AI (US), Relevance AI (Australia), Regie.ai (US), Salesforge (Estonia), 11x AI (UK), Floworks (US), Warmly (US), Luru (US), AiSDR (US), Bluebirds (US), ChaseLabs (UK), SuperRep.ai (US), SuperAGI (US), Instantly (US), Persana AI (US), Factors.ai (US), and Saleshandy (India)

The report also helps stakeholders understand the pulse of the AI SDR market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AI SDR MARKET

- 4.2 AI SDR MARKET: TOP THREE ENTERPRISE TYPES

- 4.3 NORTH AMERICA: AI SDR MARKET, BY DEPLOYMENT MODEL AND ENTERPRISE TYPE

- 4.4 AI SDR MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising implementation of hybrid human-AI sales engagement models

- 5.2.1.2 Growing adoption of intent-based prospecting and predictive analytics

- 5.2.1.3 Increasing use of AI to deliver real-time, data-driven personalization

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inefficiencies in segmentation logic and targeting precision

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of multi-agent AI-driven SDR architectures

- 5.2.3.2 Growing sales efficiency through predictive lead qualification

- 5.2.3.3 Increasing deployment of agentic AI for autonomous workflow execution

- 5.2.4 CHALLENGES

- 5.2.4.1 Deficiencies in emotional intelligence and contextual adaptability

- 5.2.4.2 Reliance on high-fidelity and contextually accurate data inputs

- 5.2.1 DRIVERS

- 5.3 AI SDRS AND SALES AGENTS: STRATEGIC COMPARISON

- 5.3.1 COMPARISON BETWEEN AI SDRS AND AI AGENTS FOR SALES

- 5.4 EVOLUTION OF AI SDR MARKET

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 SOFTWARE PROVIDERS

- 5.6.1.1 AI outreach assistants

- 5.6.1.2 Conversation intelligence tools

- 5.6.1.3 AI-enhanced sales engagement platforms

- 5.6.1.4 Lead research & enrichment bots

- 5.6.1.5 Email deliverability optimizers

- 5.6.1.6 AI script & template generators

- 5.6.1 SOFTWARE PROVIDERS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 CASE STUDY 1: KEATEXT BOOSTS LEAD QUALITY AND SALES ALIGNMENT USING HUBSPOT SALES HUB INTEGRATION

- 5.8.2 CASE STUDY 2: ARTISAN EMPOWERS BIOACCESS TO OVERCOME MANUAL OUTREACH CHALLENGES WITH AI-DRIVEN SALES AUTOMATION

- 5.8.3 CASE STUDY 3: SPENDESK AND SALESLOFT SUPERCHARGE OUTREACH WITH CADENCE AUTOMATION FOR 10X RESPONSE BOOST

- 5.8.4 CASE STUDY 4: ACTIONCOACH INCREASED QUALIFIED MEETINGS USING COGNISM'S AI SDR SOLUTION FOR TARGETED OUTREACH

- 5.8.5 CASE STUDY 5: EMPOWERING NETSKOPE SDRS TO TRANSFORM PROSPECTING WITH 6SENSE CONTACT DATA AND INSIGHTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Agentic AI

- 5.9.1.2 RPA

- 5.9.1.3 Decision intelligence

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Cloud computing

- 5.9.2.2 Causal AI

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Cybersecurity

- 5.9.3.2 Edge computing

- 5.9.1 KEY TECHNOLOGIES

- 5.10 REGULATORY LANDSCAPE

- 5.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.2 REGULATORY FRAMEWORK

- 5.10.2.1 North America

- 5.10.2.1.1 US

- 5.10.2.1.2 Canada

- 5.10.2.2 Europe

- 5.10.2.2.1 UK

- 5.10.2.2.2 Germany

- 5.10.2.2.3 France

- 5.10.2.2.4 Italy

- 5.10.2.3 Asia Pacific

- 5.10.2.3.1 India

- 5.10.2.3.2 China

- 5.10.2.3.3 Japan

- 5.10.2.3.4 South Korea

- 5.10.2.3.5 Australia

- 5.10.2.4 Middle East & Africa

- 5.10.2.4.1 Saudi Arabia

- 5.10.2.4.2 UAE

- 5.10.2.4.3 Qatar

- 5.10.2.4.4 Turkey

- 5.10.2.4.5 Africa

- 5.10.2.5 Latin America

- 5.10.2.5.1 Brazil

- 5.10.2.5.2 Mexico

- 5.10.2.5.3 Argentina

- 5.10.2.1 North America

- 5.11 PATENT ANALYSIS

- 5.11.1 METHODOLOGY

- 5.11.2 PATENTS FILED, BY DOCUMENT TYPE, 2016-2025

- 5.11.3 INNOVATION AND PATENT APPLICATIONS

- 5.12 PRICING ANALYSIS

- 5.12.1 AVERAGE SELLING PRICE OF FUNCTIONALITY, BY KEY PLAYER

- 5.12.2 AVERAGE SELLING PRICE, BY SALES PROCESS

- 5.13 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF SUPPLIERS

- 5.14.4 BARGAINING POWER OF BUYERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.17 HUMAN SDRS VS. AI SDRS

6 AI SDR MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: AI SDR MARKET DRIVERS

- 6.2 SOFTWARE

- 6.2.1 AI OUTREACH ASSISTANTS

- 6.2.1.1 Expand outbound capacity and improve response precision with AI-driven outreach

- 6.2.1.2 Personalized email generators

- 6.2.1.3 Cold call script writers

- 6.2.1.4 Follow-up sequencers

- 6.2.2 CONVERSATION INTELLIGENCE TOOLS

- 6.2.2.1 Enhance SDR performance with real-time coaching and data-backed outreach insights

- 6.2.2.2 Real-time coaching

- 6.2.2.3 Sentiment & intent detection

- 6.2.2.4 Objection handling

- 6.2.3 AI-ENHANCED SALES ENGAGEMENT PLATFORMS

- 6.2.3.1 Increase conversions through adaptive sequencing, timely engagement, and behavioral insight integration

- 6.2.3.2 Multi-channel sequencing

- 6.2.3.3 Engagement scoring

- 6.2.3.4 Meeting booking

- 6.2.4 LEAD RESEARCH & ENRICHMENT BOTS

- 6.2.4.1 Boosting AI SDR efficiency through automated, accurate, and context-rich lead data enrichment

- 6.2.4.2 AI-ICP matching

- 6.2.4.3 Enrichment

- 6.2.4.4 Trigger monitoring

- 6.2.5 EMAIL DELIVERABILITY OPTIMIZERS

- 6.2.5.1 Real-time inbox monitoring to maximize email deliverability

- 6.2.5.2 Spam risk tools

- 6.2.5.3 Inbox rotation & warming

- 6.2.6 AI SCRIPT & TEMPLATE GENERATORS

- 6.2.6.1 AI script and template generators deliver custom messaging at scale for sales teams

- 6.2.6.2 Agent-led outreach execution

- 6.2.6.3 Persona-based prompting

- 6.2.6.4 SDR agent monitoring dashboard

- 6.2.1 AI OUTREACH ASSISTANTS

- 6.3 SERVICES

- 6.3.1 WORKFLOW AUTOMATION SETUP & INTEGRATION

- 6.3.1.1 Automate SDR processes and sync sales tools for faster lead execution

- 6.3.2 AI PERSONALIZATION & PROMPT CONSULTING

- 6.3.2.1 Align AI messaging and persona relevance with integrated prompt support

- 6.3.3 DELIVERABILITY & SPAM AUDIT SERVICES

- 6.3.3.1 Detection of risk signals and calibrating AI content to maintain sender score integrity

- 6.3.1 WORKFLOW AUTOMATION SETUP & INTEGRATION

7 AI SDR MARKET, BY DEPLOYMENT MODEL

- 7.1 INTRODUCTION

- 7.1.1 DEPLOYMENT MODEL: AI SDR MARKET DRIVERS

- 7.2 CLOUD-NATIVE SAAS

- 7.2.1 ENABLING SCALABLE, CENTRALIZED AI SDR AUTOMATION ACROSS DISTRIBUTED SALES TEAMS

- 7.3 CHROME EXTENSIONS

- 7.3.1 BOOSTING REP PRODUCTIVITY WITH SEAMLESS, BROWSER-BASED AI SDR WORKFLOW ENHANCEMENTS

- 7.4 API-FIRST MODULAR EMBEDS

- 7.4.1 EMPOWERING CUSTOM AI SDR SOLUTIONS THROUGH FLEXIBLE, DEVELOPER-CENTRIC API INTEGRATIONS

8 AI SDR MARKET, BY SALES CHANNEL

- 8.1 INTRODUCTION

- 8.1.1 SALES CHANNEL: AI SDR MARKET DRIVERS

- 8.2 INBOUND

- 8.2.1 ENHANCING LEAD CONVERSION THROUGH AI-POWERED ENGAGEMENT OF INTERESTED PROSPECTS

- 8.3 OUTBOUND

- 8.3.1 DRIVING PROACTIVE OUTREACH WITH SCALABLE, AI-DRIVEN PROSPECTING AND PERSONALIZATION

- 8.4 HYBRID

- 8.4.1 INTEGRATING INBOUND AND OUTBOUND STRATEGIES FOR UNIFIED, ADAPTIVE SALES ENGAGEMENT

9 AI SDR MARKET, BY USE CASE

- 9.1 INTRODUCTION

- 9.1.1 USE CASE: AI SDR MARKET DRIVERS

- 9.2 LEAD GENERATION & QUALIFICATION

- 9.2.1 IMPROVING PIPELINE PRECISION WITH PREDICTIVE LEAD GENERATION AND SCORING

- 9.2.2 OUTBOUND EMAIL PERSONALIZATION

- 9.2.3 INBOUND LEAD QUALIFICATION

- 9.2.4 LEAD ROUTING & PRIORITIZATION

- 9.3 PROSPECTING & OUTREACH

- 9.3.1 OPTIMIZING LEAD DISCOVERY AND ENGAGEMENT TIMING WITH AI-DRIVEN PROSPECTING LOGIC

- 9.3.2 COLD CALLING ASSISTANCE

- 9.3.3 CONVERSATION SUMMARIZATION

- 9.4 CRM INTEGRATION & DATA MANAGEMENT

- 9.4.1 ENHANCING OUTREACH PRECISION AND WORKFLOW EFFICIENCY WITH UNIFIED CRM DATA INFRASTRUCTURE

- 9.4.2 CRMS

- 9.4.3 DATA PROVIDERS

- 9.5 MEETING & APPOINTMENT SCHEDULING

- 9.5.1 IMPROVING CONVERSION EFFICIENCY THROUGH AI SCHEDULING AND INTELLIGENT COORDINATION

- 9.6 RESEARCH, COACHING, & SDR ENABLEMENT

- 9.6.1 ENABLING SMARTER PROSPECTING AND SKILL DEVELOPMENT WITH AI-DRIVEN INSIGHTS AND COACHING

- 9.6.2 SDR ENABLEMENT & ONBOARDING

- 9.6.3 RESEARCH COACHING

- 9.7 FOLLOW-UP & NURTURING

- 9.7.1 BOOSTING PROSPECT CONVERSION THROUGH ADAPTIVE AND AUTOMATED AI NURTURING SEQUENCES

- 9.8 SALES REPORTING & ANALYTICS

- 9.8.1 IMPROVING SDR ACCURACY AND IMPACT THROUGH REAL-TIME AI SALES ANALYTICS

- 9.9 INTEGRATION ENVIRONMENT

- 9.9.1 UNIFYING SALES WORKFLOWS AND DATA WITH SEAMLESS AI SDR SYSTEM INTEGRATION

- 9.9.2 EMAIL TOOLS

- 9.9.3 SALES ENGAGEMENT PLATFORMS

- 9.9.4 MARKETING PLATFORMS

10 AI SDR MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.1.1 END USER: AI SDR MARKET DRIVERS

- 10.2 ENTERPRISE TYPE

- 10.2.1 STARTUPS & SMBS

- 10.2.1.1 Accelerating scalable outreach and lead conversion for startups and SMBs using AI SDRs

- 10.2.2 MID-MARKET SALES ORGANIZATIONS

- 10.2.2.1 Streamlining cross-functional alignment and accelerating scalable pipeline growth with AI SDR solutions

- 10.2.3 ENTERPRISE SDR TEAMS

- 10.2.3.1 Driving strategic account engagement and data-integrated execution across enterprise sales operations

- 10.2.1 STARTUPS & SMBS

- 10.3 INDUSTRY VERTICAL

- 10.3.1 RETAIL & E-COMMERCE

- 10.3.1.1 Driving revenue velocity through hyper-personalized outreach in retail & e-commerce

- 10.3.2 BFSI

- 10.3.2.1 Enabling compliant, data-driven outreach for financial product sales efficiency

- 10.3.2.2 Banking

- 10.3.2.3 Financial services

- 10.3.2.4 Insurance

- 10.3.3 TELECOMMUNICATIONS

- 10.3.3.1 Enhancing buyer targeting and channel engagement across telecom sales operations

- 10.3.4 HEALTHCARE & LIFE SCIENCES

- 10.3.4.1 Improving clinical outreach and product positioning through AI-enabled engagement

- 10.3.5 EDUCATION

- 10.3.5.1 Scaling enrollment pipelines and institutional sales through adaptive outreach in education

- 10.3.6 MEDIA & ENTERTAINMENT

- 10.3.6.1 Expanding content partnerships and subscriber growth through intelligent sales automation

- 10.3.6.2 Marketing & advertising agencies

- 10.3.6.3 Music & film production

- 10.3.6.4 Gaming & sports

- 10.3.6.5 Publishing & print media

- 10.3.6.6 Broadcasting & streaming

- 10.3.7 MANUFACTURING

- 10.3.7.1 Optimizing technical sales pipelines with intelligent distributor and OEM targeting

- 10.3.8 TRAVEL & HOSPITALITY

- 10.3.8.1 Boosting corporate bookings and guest conversions with adaptive sales engagement

- 10.3.9 REAL ESTATE & CONSTRUCTION

- 10.3.9.1 Accelerating investor outreach and project engagement through targeted AI prospecting

- 10.3.10 AUTOMOTIVE, TRANSPORTATION & LOGISTICS

- 10.3.10.1 Streamlining fleet sales and supply chain outreach with predictive AI workflows

- 10.3.11 OTHER INDUSTRY VERTICALS

- 10.3.1 RETAIL & E-COMMERCE

11 AI SDR MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: AI SDR MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Rapid implementation of AI SDR platforms by enterprises to enhance sales efficiency and conversion rates

- 11.2.4 CANADA

- 11.2.4.1 Advancing privacy-centric AI SDR solutions to drive responsible sales automation

- 11.3 EUROPE

- 11.3.1 EUROPE: AI SDR MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Precision outreach and seamless AI integration drive scalable sales transformation

- 11.3.4 GERMANY

- 11.3.4.1 Demand for transparent AI and secure integration accelerates enterprise sales innovation

- 11.3.5 FRANCE

- 11.3.5.1 Localized outreach and social sequencing accelerate AI SDR adoption

- 11.3.6 ITALY

- 11.3.6.1 AI SDR integration enhances sales efficiency and lead conversion across enterprises

- 11.3.7 SPAIN

- 11.3.7.1 AI SDR adoption accelerates pipeline velocity and multi-market reach for firms

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: AI SDR MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Enhancing prospecting efficiency with localized AI SDR tools and native platform integration

- 11.4.4 JAPAN

- 11.4.4.1 Precision-driven AI SDR adoption anchored in localization, workflow integration, and channel alignment

- 11.4.5 INDIA

- 11.4.5.1 Boosting SDR productivity with lead prioritization, sequencing, and scalable outreach tools

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Driving high-impact outreach through sequencing and buyer targeting

- 11.4.7 AUSTRALIA & NEW ZEALAND

- 11.4.7.1 Improving pipeline velocity and targeting precision with data-led outreach tools and insights

- 11.4.8 ASEAN

- 11.4.8.1 Accelerating market adoption amid rapid digital expansion

- 11.4.9 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: AI SDR MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 MIDDLE EAST

- 11.5.3.1 Saudi Arabia

- 11.5.3.1.1 Vision-led innovation and Arabic-centric AI propel SDR transformation

- 11.5.3.2 UAE

- 11.5.3.2.1 Accelerating AI SDR adoption due to robust data governance and multilingual demands

- 11.5.3.3 Qatar

- 11.5.3.3.1 Increasing AI SDR adoption due to broader digital transformation

- 11.5.3.4 Turkey

- 11.5.3.4.1 Driving sales efficiency through SDR personalization and intelligent outreach

- 11.5.3.5 Rest of Middle East

- 11.5.3.1 Saudi Arabia

- 11.5.4 AFRICA

- 11.5.4.1 Driving sales transformation with enterprise AI and stringent data compliance

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: AI SDR MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 AI SDR automation driving pipeline scale and response speed in tech firms

- 11.6.4 MEXICO

- 11.6.4.1 Multichannel personalization and localized engagement boosting AI SDR adoption

- 11.6.5 ARGENTINA

- 11.6.5.1 AI-powered prospecting enabling lean SDR teams to expand reach

- 11.6.6 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARISON

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY ENTERPRISE TYPE (STARTUPS & SMBS)

- 12.5.1.1 Breeze (HubSpot)

- 12.5.1.2 Apollo.io platform (Apollo.io)

- 12.5.1.3 Jazon (Lyzr AI)

- 12.5.1.4 SchedX (Klenty)

- 12.5.1.5 Agent Frank (Salesforge)

- 12.5.2 PRODUCT COMPARATIVE ANALYSIS, BY ENTERPRISE TYPE (MID-MARKET SALES ORGANIZATIONS)

- 12.5.2.1 AiSDR (AiSDR)

- 12.5.2.2 Ava (Artisan AI)

- 12.5.2.3 Gem-E (UserGems)

- 12.5.2.4 Alisha AI SDR (Floworks)

- 12.5.2.5 SuperRep (SuperRep.ai)

- 12.5.3 PRODUCT COMPARATIVE ANALYSIS, BY ENTERPRISE TYPE (ENTERPRISE SDR TEAMS)

- 12.5.3.1 Agentforce for Sales (Salesforce)

- 12.5.3.2 Piper (Qualified)

- 12.5.3.3 Luru AI SDR (Luru)

- 12.5.3.4 Alice (11x AI)

- 12.5.3.5 RoomieAI (Common Room)

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY ENTERPRISE TYPE (STARTUPS & SMBS)

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Sales channel footprint

- 12.7.5.5 Enterprise type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 HUBSPOT

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Key strengths

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 SALESFORCE

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Key strengths

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 DIALPAD

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product launches and enhancements

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Key strengths

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 SALESLOFT

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Key strengths

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 6SENSE

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches and enhancements

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Key strengths

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 ZOOMINFO

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 APOLLO.IO

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product launches and enhancements

- 13.2.8 OPENAI

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.8.3.2 Deals

- 13.2.9 CLARI

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches and enhancements

- 13.2.9.3.2 Deals

- 13.2.10 COGNISM

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches and enhancements

- 13.2.11 MICROSOFT

- 13.2.12 GUPSHUP

- 13.2.13 OUTREACH

- 13.2.14 VIDYARD

- 13.2.15 PLIVO

- 13.2.16 QUALIFIED

- 13.2.17 OTTER.AI

- 13.2.18 CONVERSICA

- 13.2.19 KLENTY

- 13.2.20 REPLY.IO

- 13.2.21 SEAMLESS.AI

- 13.2.22 WAALAXY

- 13.2.1 HUBSPOT

- 13.3 OTHER PLAYERS

- 13.3.1 COMMON ROOM

- 13.3.2 ARTISAN AI

- 13.3.3 USERGEMS

- 13.3.4 SCRATCHPAD

- 13.3.5 CLAY

- 13.3.6 UNIFY

- 13.3.7 LYZR AI

- 13.3.8 HUMANTIC AI

- 13.3.9 RELEVANCE AI

- 13.3.10 REGIE.AI

- 13.3.11 SALESFORGE

- 13.3.12 11X AI

- 13.3.13 FLOWORKS

- 13.3.14 WARMLY

- 13.3.15 LURU

- 13.3.16 AISDR

- 13.3.17 CHASELABS

- 13.3.18 BLUEBIRDS

- 13.3.19 SUPERREP.AI

- 13.3.20 SUPERAGI

- 13.3.21 INSTANTLY

- 13.3.22 PERSANA AI

- 13.3.23 FACTORS.AI

- 13.3.24 SALESHANDY

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 AI AGENTS MARKET - GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 AI agents market, by offering

- 14.2.2.2 AI agents market, by end user

- 14.2.2.3 AI agents market, by region

- 14.3 AI FOR SALES AND MARKETING MARKET - GLOBAL FORECAST TO 2030

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 AI for sales and marketing market, by offering

- 14.3.2.2 AI for sales and marketing market, by application

- 14.3.2.3 AI for sales and marketing market, by end user

- 14.3.2.4 AI for sales and marketing market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS