|

시장보고서

상품코드

1802920

바이오뱅크 시장 예측(-2030년) : 오퍼링별, 운전 유형별, 워크플로우별, 샘플 유형별, 최종사용자별, 소유권별, 용도별, 유형별, 지역별Biobanking Market by Product (Equipment, Consumables, Software), Services (Virtual), Operation (Automated), Workflow (Storage, Collection, Transport), Sample (Blood, Cell Lines, Nucleic Acids), Application, Ownership, End User - Global Forecast to 2030 |

||||||

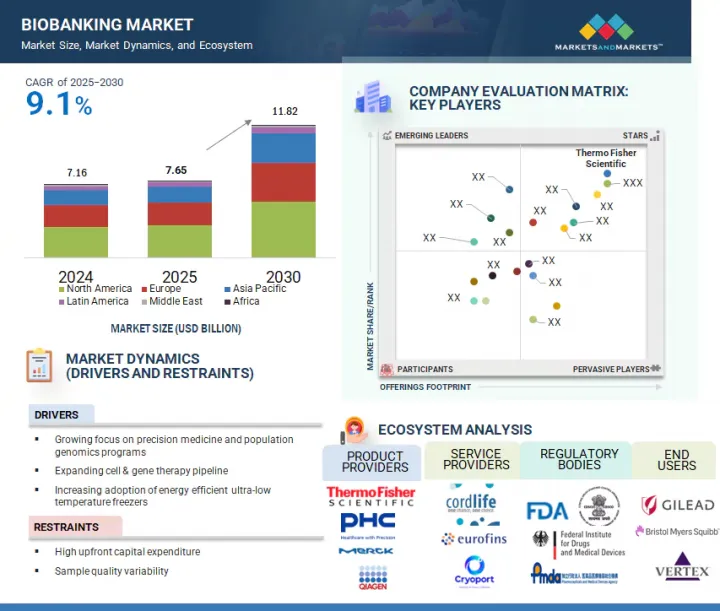

바이오뱅크 시장 규모는 예측 기간 중 9.1%의 CAGR로 확대하며, 2025년 76억 5,000만 달러에서 2030년에는 118억 2,000만 달러에 달할 것으로 예측됩니다.

정밀의료에 대한 관심 증가와 세포 및 유전자 치료 파이프라인의 확대는 바이오뱅크 시장의 성장을 크게 촉진할 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 오퍼링별, 운전 유형별, 워크플로우별, 샘플 유형별, 최종사용자별, 소유권별, 용도별, 유형별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

개인의 유전자 프로파일에 맞춘 치료를 하는 정밀의학은 개인 맞춤형 치료의 기반이 되는 만큼, 고품질의 잘 보존된 생체 샘플의 필요성이 점점 더 커지고 있습니다. 또한 세포치료제 및 유전자치료제 파이프라인 증가는 향후 수년간 바이오뱅크 시장의 주요 촉진제가 될 것으로 예측됩니다. 줄기세포, 유전자 편집, 기타 첨단 생명공학 기술에 의존하는 새로운 세포치료제 및 유전자치료제 개발을 위해서는 방대한 양의 생물학적 물질을 보관 및 관리해야 합니다. 바이오뱅크은 시료의 보관, 처리, 유통을 위한 신뢰할 수 있는 표준화된 플랫폼을 제공함으로써 이러한 치료를 지원하는 데 필수적입니다.

서비스별로 바이오뱅크 시장은 물리적 바이오뱅크, 가상 바이오뱅크, 기타 서비스로 구분됩니다. 2024년 물리적 바이오뱅크 서비스가 시장에서 큰 비중을 차지하는 것은 통제된 조건에서 시료를 수집, 보관, 보존하는 데 있으며, 물리적 바이오뱅크이 중요한 역할을 하고 있기 때문입니다. 물리적 바이오뱅크은 혈액, 조직, DNA를 포함한 광범위한 생물학적 샘플을 냉동고, 극저온 탱크, 냉장고 등의 환경에서 보관하는 데 필요한 인프라를 제공하여 샘플의 무결성을 보장하고 장기적인 사용을 가능하게 합니다. 정밀의료와 유전체학의 발전으로 고품질 생물학적 시료에 대한 수요가 증가함에 따라 물리적 바이오뱅크은 이러한 시료의 안정성과 접근성을 유지하기 위해 매우 중요합니다. 또한 신뢰할 수 있는 현장 시료 관리 및 실시간 모니터링 시스템을 제공할 수 있으므로 제약, 생명공학, 연구 부문을 지원하는 물리적 바이오뱅크의 중요성이 더욱 커지고 있습니다.

소유권 모델별로 바이오뱅크 서비스 시장은 민간/상업적 프로바이더, 학술/연구기관 바이오뱅크, 국가/지역기관, 하이브리드/PPP(민관협력) 모델, 기타 소유권 모델로 구분됩니다. 2024년에는 민간/상업적 프로바이더 부문이 세계 바이오뱅크 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 바이오뱅크 시장에서 민간/상업적 프로바이더 모델이 큰 비중을 차지하고 있는 것은 주로 고품질, 확장성, 상업적으로 실행 가능한 바이오뱅크 솔루션에 대한 수요 증가에 기인합니다. 이들 공급업체는 시료의 보관, 처리, 유통을 위한 첨단 인프라와 기술을 제공할 수 있으며, 제약, 생명공학, 임상 연구 부문의 특정 요구에 맞게 조정되는 경우가 많습니다. 또한 상업적 프로바이더들은 정밀의료, 유전체 연구, 임상시험의 진화하는 수요에 대응하기 위해 혁신 기술을 민첩하게 도입하고 서비스를 확장하고 있습니다. 종합적인 엔드투엔드 바이오뱅크 서비스를 제공하고, 효율성과 규제 준수에 중점을 둔 역량으로 신뢰할 수 있고 표준화된 생물학적 시료 관리를 원하는 조직에 필수적인 파트너로 자리매김하고 있습니다. 그 결과, 민간/상업적 소유 모델이 시장을 계속 독점하고 있으며, 민간 기업이 큰 점유율을 차지하고 있습니다.

2024년 미국은 북미 바이오뱅크 시장에서 큰 비중을 차지했습니다. 그 원동력은 첨단 헬스케어 인프라, 연구개발에 대한 막대한 투자, 정밀의료 분야에서의 선도적 역할입니다. 세계에서 유명한 학술기관, 제약회사, 연구기관을 다수 보유하고 있는 미국은 광범위한 과학적 진보를 위한 생물학적 샘플을 생성하고 활용하는 데 있으며, 최전선에 있습니다. 맞춤의료, 유전체학, 임상시험에 대한 관심이 높아지면서 이 지역에서는 고품질 바이오뱅크에 대한 수요가 증가하고 있습니다. 또한 유리한 규제 프레임워크와 공공 및 민간의 막대한 자금 지원은 바이오뱅크 서비스의 확장을 지원하고 있으며, 시장에서의 미국의 우위를 확고히 하고 있습니다.

세계의 바이오뱅크 시장에 대해 조사했으며, 오퍼링별, 운전 유형별, 워크플로우별, 샘플 유형별, 최종사용자별, 소유권별, 용도별, 유형별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 에코시스템 분석

- 특허 분석

- 주요 특허 리스트

- 기술 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 규제 분석

- 무역 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 투자와 자금조달 시나리오

- AI/생성형 AI가 바이오뱅크 시장에 미치는 영향

- 2025년 미국 관세가 바이오뱅크 시장에 미치는 영향

제6장 바이오뱅크 시장(오퍼링별)

- 서론

- 제품

- 서비스

- 소프트웨어

제7장 설비용 바이오뱅크 제품 시장(운전 유형별)

- 서론

- 수동 운전

- 자율주행

제8장 바이오뱅크 제품 시장(워크플로우별)

- 서론

- 샘플 수집과 보관

- 샘플 처리

- 샘플 분석

- 운송·물류

제9장 바이오뱅크 제품 시장(샘플 유형별)

- 서론

- 혈액제재

- 고형 조직과 장기

- 줄기세포와 세포주

- 체액

- 핵산

- 인간 배설물

제10장 바이오뱅크 제품 시장(최종사용자별)

- 서론

- 바이오뱅크

- CRO

제11장 바이오뱅크 서비스 시장(소유권별)

- 서론

- 민간/상업 바이오뱅크

- 학술연구기관 바이오뱅크

- 국가/지역 기관

- 하이브리드/PPP 모델

- 기타

제12장 바이오뱅크 시장(용도별)

- 서론

- 연구

- 치료

- 진단

- 기타

제13장 바이오뱅크 서비스 시장(유형별)

- 서론

- 물리적 바이오뱅크 서비스

- 가상 바이오뱅크

- 기타

제14장 바이오뱅크 서비스 시장(최종사용자별)

- 서론

- 제약 바이오테크놀러지 기업과 CRO

- 학술연구기관

- 병원·진단 검사실

제15장 바이오뱅크 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 중동의 거시경제 전망

- GCC 국가

- 기타 중동

- 아프리카

- 표준화 노력, 국제 인증, 능력 구축의 강화에 의해 시장의 성장을 촉진

- 아프리카의 거시경제 전망

제16장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

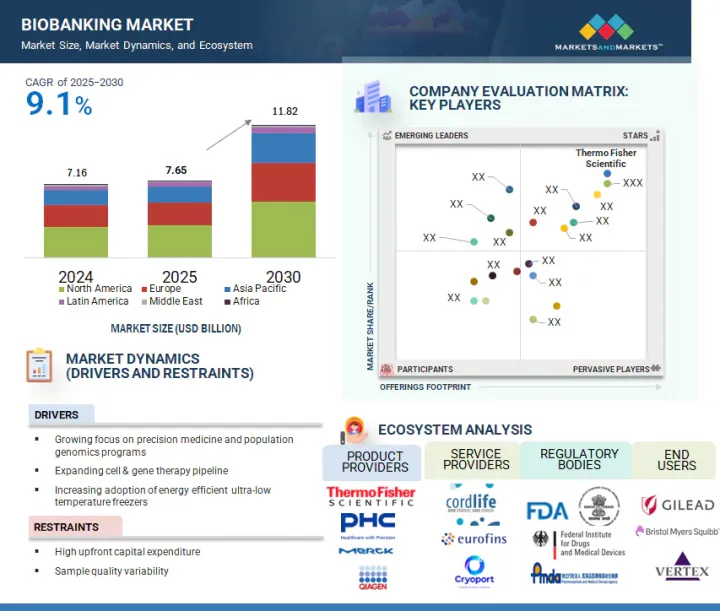

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 경쟁 시나리오

제17장 기업 개요

- 주요 참여 기업

- THERMO FISHER SCIENTIFIC INC.

- PHC HOLDINGS CORPORATION

- BECTON, DICKINSON AND COMPANY(BD)

- QIAGEN

- MERCK KGAA

- AVANTOR, INC.

- CRYOPORT

- TECAN TRADING AG

- AZENTA US INC.

- GREINER AG

- AGILENT TECHNOLOGIES, INC.

- LABCORP

- EUROFINS SCIENTIFIC

- 기타 기업

- HAIER BIOMEDICAL

- HAMILTON COMPANY

- AMSBIO

- BAY BIOSCIENCES

- BIOKRYO

- SPT LABTECH LTD.

- ASKION GMBH

- CTIBIOTECH

- CURELINE

- FIRALIS MOLECULAR PRECISION

- SOPACHEM

- FROILABO

- BIOIVT

제18장 부록

KSA 25.09.08The biobanking market is projected to reach USD 11.82 billion by 2030 from USD 7.65 billion in 2025, at a CAGR of 9.1% during the forecast period. The growing focus on precision medicine and the expanding pipeline for cell and gene therapies are set to significantly fuel the growth of the biobanking market.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Offerings, Product (Workflow, Sample Type, End User), Services (Ownership, End User), Application |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

Precision medicine, which tailors treatments to individual genetic profiles, is increasingly driving the need for high-quality, well-preserved biological samples, as these form the foundation for personalized therapies. Additionally, the growing pipeline for cell and gene therapies is expected to be a major driver for the biobanking market in the coming years. The development of new cell and gene therapies, which often rely on stem cells, gene editing, and other advanced biotechnologies, necessitates storing and managing vast amounts of biological material. Biobanks are essential in supporting these therapies by providing a reliable and standardized platform for sample storage, processing, and distribution.

The physical biobanking segment accounted for the largest share of the biobanking services market in 2024.

Based on services, the biobanking market is segmented into physical biobanking, virtual biobanking, and other services. In 2024, the large share of physical biobanking services in the market can be attributed to the essential role they play in sample collection, storage, and preservation under controlled conditions. Physical biobanks offer the infrastructure necessary to store a wide range of biological samples, including blood, tissues, and DNA, in environments such as freezers, cryogenic tanks, and refrigerators, ensuring sample integrity for long-term use. As the demand for high-quality biological specimens grows, driven by advancements in precision medicine and genomics, physical biobanks are crucial for maintaining the stability and accessibility of these samples. Additionally, the ability to provide reliable, on-site sample management and real-time monitoring systems has further cemented the importance of physical biobanks in supporting pharmaceutical, biotechnology, and research sectors.

By ownership, the private/commercial providers segment accounted for the largest share of the market in 2024.

Based on the ownership model, the biobanking services market is segmented into private/commercial providers, academic & research institutional biobanks, national/regional agencies, hybrid/PPP (public-private-partnership) models, and other ownership models. In 2024, the private/commercial providers segment accounted for the largest share of the global biobanking market. The large share of the private/commercial providers model in the biobanking market is primarily driven by the growing demand for high-quality, scalable, and commercially viable biobanking solutions. These providers can offer advanced, state-of-the-art infrastructure and technology for sample storage, processing, and distribution, often tailored to meet the specific needs of pharmaceutical, biotechnology, and clinical research sectors. Commercial providers are also more agile in adopting innovations and expanding their services to meet the evolving demands of precision medicine, genomic research, and clinical trials. Their ability to provide comprehensive, end-to-end biobanking services and focus on efficiency and regulatory compliance has made them essential partners for organizations seeking reliable and standardized biological sample management. As a result, the private/commercial ownership model continues to dominate the market, with private players capturing a significant share.

The US dominated the biobanking market in 2024.

In 2024, the US held a significant share of the North American biobanking market, driven by its advanced healthcare infrastructure, substantial investment in research and development, and leading role in precision medicine. With numerous world-renowned academic institutions, pharmaceutical companies, and research organizations, the US is at the forefront of generating and utilizing biological samples for a wide range of scientific advancements. The growing emphasis on personalized medicine, genomics, and clinical trials has increased the demand for high-quality biobanks in the region. Additionally, favorable regulatory frameworks and substantial public and private funding continue to support the expansion of biobanking services, solidifying the dominant position of the US in the market.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply-side- 70% and Demand-side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, Asia Pacific -25%, Latin America -5% and the Middle East & Africa- 5%

List of Companies Profiled in the Report:

- Thermo Fisher Scientific Inc. (US)

- Merck KGaA (Germany)

- PHC Holdings Corporation (Japan)

- Becton, Dickinson and Company (BD) (US)

- Qiagen (Germany)

- Merck KGaA (Germany)

- Labcorp (US)

- Eurofins Scientific (Luxembourg)

- Cryoport (US)

- ICON Plc (Ireland)

- Tecan Trading AG (Switzerland)

- Azenta US Inc. (US)

- Avantor, Inc. (US)

- Greiner AG (Austria)

- Amsbio (UK)

- Labcorp (US)

- Eurofins Scientific (Luxembourg)

- Hamilton Company (US)

- BioIVT LLC (US)

- BioKryo (Germany)

- ASKION GmbH (Germany)

- Sopachem (Belgium)

- Froilabo (UK)

- Cureline (US)

- SPT Labtech Ltd (UK)

Research Coverage

This research report categorizes the biobanking market by offerings [products (equipment, consumables), services (physical biobanking, virtual biobanking, other services), software]; workflow (sample collection & storage, sample processing, sample analysis, transport & logistics), operation type (manual, automated), sample type (blood products, solid tissues & organs, stem cell & cell lines, nucleic acids, biological fluids, human waste products), end user- product (biobanks, CROs), end -user services (pharma, biotech & CROs, academic & research institutes), and region (North America, Europe, the Asia Pacific, Latin America, Middle East, and Africa). The report's scope covers detailed information regarding the leading factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the biobanking market. A thorough analysis of the key industry players has provided insights into their business overview, services, products, solutions, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, and acquisitions are the recent developments associated with the biobanking market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the overall biobanking market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (growing focus on precision medicine & population-genomics programmes, cell- & gene-therapy pipeline expansion, adoption of energy-efficient Ultra Low Temperature(ULT) freezers, end-to-end automation & robotics for physical sample handling and storage), restraints (high upfront capital expenditure, sample quality variability), opportunities ( outsourcing of cryogenic storage to third-party specialists, growing focus on sustainability and green-lab solutions), and challenges (long-term funding stability for public biobanks) influencing the growth of the market.

- Product/Service Development/Innovation: Detailed insights on newly launched products, services of the biobanking market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the market across varied regions.

- Market Diversification: Exhaustive information about new products, services, untapped geographies, recent developments, and investments in the biobanking market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product & service offerings of key players including Thermo Fisher Scientific Inc. (US), Merck KGaA (Germany), PHC Holdings Corporation (Japan), Becton, Dickinson and Company (BD) (US), Qiagen (Germany), Labcorp (US), Eurofins Scientific (Luxembourg), Cryoport (US). A detailed analysis of the key industry players has been conducted to provide insights into their key strategies, product launches, acquisitions, partnerships, agreements, collaborations, expansions, other recent developments, investment and funding activities, brand/product comparative analysis, and vendor valuation and financial metrics of the biobanking product and service market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 BIOBANKING MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 MnM repository analysis

- 2.2.1.3 Primary interviews

- 2.2.1.4 Insights from primary sources

- 2.2.2 SEGMENTAL MARKET ASSESSMENT (TOP-DOWN APPROACH)

- 2.2.1 GLOBAL MARKET SIZE ESTIMATION, 2024

- 2.3 MARKET GROWTH RATE FORECAST

- 2.3.1 IMPACT ANALYSIS OF SUPPLY- AND DEMAND-SIDE FACTORS

- 2.3.2 BIOBANKING MARKET: GROWTH ANALYSIS OF MARKET DYNAMICS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS

- 3.2.1 BIOBANKING EQUIPMENT MANUFACTURERS

- 3.2.2 BIOBANKING CONSUMABLE MANUFACTURERS

- 3.2.3 BIOBANKING SERVICE PROVIDERS

4 PREMIUM INSIGHTS

- 4.1 BIOBANKING MARKET OVERVIEW

- 4.2 NORTH AMERICA: BIOBANKING MARKET, BY OFFERING AND COUNTRY, 2024

- 4.3 BIOBANKING PRODUCTS MARKET SHARE, BY END USER, 2024

- 4.4 BIOBANKING SERVICES MARKET SHARE, BY END USER, 2024

- 4.5 BIOBANKING MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing focus on precision medicine & population genomics programs

- 5.2.1.2 Expansion of cell & gene therapy pipeline

- 5.2.1.3 Adoption of energy-efficient ULT freezers

- 5.2.1.4 Integration of end-to-end automation & robotics for sample handling & storage

- 5.2.2 RESTRAINTS

- 5.2.2.1 High capital expenditure

- 5.2.2.2 Variability associated with sample quality

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Outsourcing of activities by SME biopharma companies to third-party specialists

- 5.2.3.2 Increasing focus on sustainability & green-lab solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Challenges associated with long-term funding stability for public biobanks

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.3.1 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF BIOBANKING PRODUCTS, BY KEY PLAYER, 2024

- 5.4.2 INDICATIVE PRICING OF BIOBANKING SERVICES, BY SERVICE TYPE, 2024

- 5.4.3 INDICATIVE PRICING TREND FOR BIOBANKING MARKET, BY REGION, 2022-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 ROLE IN ECOSYSTEM

- 5.6.2 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFT IN BIOBANKING MARKET

- 5.7 PATENT ANALYSIS

- 5.8 LIST OF KEY PATENTS

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Automated sample collection and processing technologies

- 5.9.1.2 Sample analysis technologies

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Data management & informatics

- 5.9.2.2 AI & ML in biobanking

- 5.9.1 KEY TECHNOLOGIES

- 5.10 KEY CONFERENCES & EVENTS, 2025-2026

- 5.11 REGULATORY ANALYSIS

- 5.11.1 REGULATORY FRAMEWORK

- 5.11.1.1 North America

- 5.11.1.2 Europe

- 5.11.1.3 Asia Pacific

- 5.11.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1 REGULATORY FRAMEWORK

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA FOR HS CODE 8418, 2020-2024

- 5.12.2 EXPORT DATA FOR HS CODE 8418, 2020-2024

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF BUYERS

- 5.13.4 BARGAINING POWER OF SUPPLIERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA FOR BIOBANKING PRODUCTS, BY END USER

- 5.14.3 KEY BUYING CRITERIA FOR BIOBANKING SERVICES, BY END USER

- 5.14.4 UNMET NEEDS & WHITE SPACES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.15.1 VC/PRIVATE EQUITY INVESTMENT TRENDS & STARTUP LANDSCAPE, 2024

- 5.16 IMPACT OF AI/GEN AI ON BIOBANKING MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 USE CASES

- 5.16.3 FUTURE OF AI IN BIOBANKING MARKET ECOSYSTEM

- 5.17 IMPACT OF 2025 US TARIFF ON BIOBANKING MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON COUNTRIES/REGIONS

- 5.17.4.1 North America

- 5.17.4.1.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.4.1 North America

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Biobanks

- 5.17.5.2 CROs

6 BIOBANKING MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 PRODUCTS

- 6.2.1 EQUIPMENT

- 6.2.1.1 Freezers & refrigerators

- 6.2.1.1.1 Storage of blood, DNA, and serum to fuel market growth

- 6.2.1.2 Cryogenic storage systems

- 6.2.1.2.1 Rising demand for cell & gene therapies to fuel market

- 6.2.1.3 Alarm & monitoring systems

- 6.2.1.3.1 Regulatory demand for continuous monitoring to support market growth

- 6.2.1.4 Thawing equipment

- 6.2.1.4.1 Growing demand for CAR-T and mRNA therapies to fuel uptake

- 6.2.1.5 Temperature & humidity control systems

- 6.2.1.5.1 Critical role in maintaining sample integrity to aid adoption

- 6.2.1.6 Other equipment & accessories

- 6.2.1.1 Freezers & refrigerators

- 6.2.2 CONSUMABLES

- 6.2.2.1 Surging sample volumes and recurring demand to drive market

- 6.2.1 EQUIPMENT

- 6.3 SERVICES

- 6.3.1 OUTSOURCING OF SERVICES TO CROS TO DRIVE MARKET

- 6.4 SOFTWARE

- 6.4.1 GROWING FOCUS ON AUTOMATION TO PROPEL MARKET

7 BIOBANKING PRODUCTS MARKET FOR EQUIPMENT, BY OPERATION TYPE

- 7.1 INTRODUCTION

- 7.2 MANUAL OPERATIONS

- 7.2.1 LARGE EXISTING INSTALLED BASE AND NO REQUIREMENT FOR SPECIALIZED LABOR TO DRIVE MARKET

- 7.3 AUTOMATED OPERATIONS

- 7.3.1 INCREASING INNOVATION AND RISING TECHNOLOGICAL ADVANCEMENTS TO PROPEL MARKET

8 BIOBANKING PRODUCTS MARKET, BY WORKFLOW

- 8.1 INTRODUCTION

- 8.2 SAMPLE COLLECTION & STORAGE

- 8.2.1 LARGE RESEARCH COHORTS AND SUSTAINABILITY MANDATES TO DRIVE MARKET

- 8.3 SAMPLE PROCESSING

- 8.3.1 AUTOMATION DEMAND AND COMPLIANCE RULES TO FUEL MARKET

- 8.4 SAMPLE ANALYSIS

- 8.4.1 HIGH DEMAND FOR ACTIONABLE DATA TO FUEL MARKET

- 8.5 TRANSPORT & LOGISTICS

- 8.5.1 TEMPERATURE-SENSITIVE REQUIREMENTS TO SUPPORT PRODUCTS UPTAKE

9 BIOBANKING PRODUCTS MARKET, BY SAMPLE TYPE

- 9.1 INTRODUCTION

- 9.2 BLOOD PRODUCTS

- 9.2.1 EASE OF COLLECTION AND ANALYTICAL VERSATILITY TO PROPEL MARKET

- 9.3 SOLID TISSUES & ORGANS

- 9.3.1 GROWTH IN SPATIAL OMICS TO FUEL MARKET

- 9.4 STEM CELLS & CELL LINES

- 9.4.1 ADOPTION OF REGENERATIVE MEDICINE TO BOOST DEMAND

- 9.5 BIOLOGICAL FLUIDS

- 9.5.1 UTILIZATION FOR DISEASE-MECHANISM STUDIES TO FUEL UPTAKE

- 9.6 NUCLEIC ACIDS

- 9.6.1 INTEGRATION OF MULTI-OMICS TO BOOST DEMAND

- 9.7 HUMAN WASTE PRODUCTS

- 9.7.1 APPLICATIONS ACROSS MICROBIOME RESEARCH TO FUEL UPTAKE

10 BIOBANKING PRODUCTS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 BIOBANKS

- 10.2.1 GROWING FOCUS ON LIFE SCIENCES & CLINICAL RESEARCH TO BOOST DEMAND

- 10.3 CROS

- 10.3.1 GROWING FOCUS ON BIOMARKER TRIALS AND OUTSOURCING OF SERVICES TO SUPPORT MARKET

11 BIOBANKING SERVICES MARKET, BY OWNERSHIP

- 11.1 INTRODUCTION

- 11.2 PRIVATE/COMMERCIAL BIOBANKS

- 11.2.1 TECHNOLOGICALLY ADVANCED INFRASTRUCTURE AND COMPLIANCE OFFERINGS TO PROPEL MARKET

- 11.3 ACADEMIC & RESEARCH INSTITUTION BIOBANKS

- 11.3.1 FAVORABLE FUNDING ACTIVITIES TO BOOST DEMAND

- 11.4 NATIONAL/REGIONAL AGENCIES

- 11.4.1 GOVERNMENT FOCUS ON ADVANCING HEALTHCARE RESEARCH INITIATIVES TO DRIVE MARKET

- 11.5 HYBRID/PPP MODELS

- 11.5.1 HIGH CREDIBILITY AND AGILITY TO SUPPORT MARKET GROWTH

- 11.6 OTHER OWNERSHIP MODELS

12 BIOBANKING MARKET, BY APPLICATION

- 12.1 INTRODUCTION

- 12.2 RESEARCH APPLICATIONS

- 12.2.1 LIFE SCIENCE RESEARCH

- 12.2.1.1 Increasing focus on genomics projects to fuel uptake

- 12.2.2 CLINICAL RESEARCH

- 12.2.2.1 Growing regulatory requirements and decentralized & hybrid trials to support market growth

- 12.2.1 LIFE SCIENCE RESEARCH

- 12.3 THERAPEUTIC APPLICATIONS

- 12.3.1 GROWING DEMAND FOR CELL & GENE THERAPIES TO PROPEL MARKET

- 12.4 DIAGNOSTIC APPLICATIONS

- 12.4.1 REQUIREMENT OF DISEASE-SPECIFIC SAMPLES TO BOOST DEMAND

- 12.5 OTHER APPLICATIONS

13 BIOBANKING SERVICES MARKET, BY TYPE

- 13.1 INTRODUCTION

- 13.2 PHYSICAL BIOBANKING SERVICES

- 13.2.1 MEGA-COHORTS IN ONCOLOGY & POPULATION GENOMICS TO PROPEL MARKET

- 13.3 VIRTUAL BIOBANKING

- 13.3.1 EASE OF SPECIMEN ACCESS FOR END USERS TO DRIVE MARKET

- 13.4 OTHER SERVICES

14 BIOBANKING SERVICES MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 PHARMA-BIOTECH COMPANIES & CROS

- 14.2.1 EXPANDING DRUG DISCOVERY & DEVELOPMENT PIPELINE TO PROPEL MARKET

- 14.3 ACADEMIC & RESEARCH INSTITUTES

- 14.3.1 ADVANCEMENTS IN RESEARCH AND FAVORABLE GRANTS TO BOOST DEMAND

- 14.4 HOSPITALS & DIAGNOSTIC LABORATORIES

- 14.4.1 USE OF SAMPLES FOR THERAPEUTIC & DIAGNOSTIC PURPOSES TO AID MARKET

15 BIOBANKING MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 NORTH AMERICA

- 15.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.2.2 US

- 15.2.2.1 US to dominate North American biobanking market during forecast period

- 15.2.3 CANADA

- 15.2.3.1 Strong public investment with national research networks and collaborations to support disease-focused biobanking

- 15.3 EUROPE

- 15.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.3.2 GERMANY

- 15.3.2.1 High government funding and focus on advanced clinical research to augment market growth

- 15.3.3 UK

- 15.3.3.1 Presence of large-scale, population-based advanced research infrastructure to propel market growth

- 15.3.4 FRANCE

- 15.3.4.1 Growing focus on quality standards, open science, and international collaboration to support market growth

- 15.3.5 ITALY

- 15.3.5.1 Improved healthcare standards to support biobanking studies in cancer, rare diseases, and personalized medicine healthcare

- 15.3.6 SPAIN

- 15.3.6.1 Adoption of international standards and advanced government-backed infrastructure to aid market growth

- 15.3.7 REST OF EUROPE

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Increased research collaborations and advancements in biobank infrastructure to drive market

- 15.4.3 JAPAN

- 15.4.3.1 Strong genomic research output and focus on AI-driven polygenic risk scoring to boost predictive healthcare innovation

- 15.4.4 INDIA

- 15.4.4.1 National and disease-specific initiatives for advanced precision medicine and healthcare innovation to aid market growth

- 15.4.5 AUSTRALIA

- 15.4.5.1 Increasing national investments in disease-specific, microbiome, and wildlife biobanks to accelerate market growth

- 15.4.6 SOUTH KOREA

- 15.4.6.1 Increased quality standards and more international collaborations to support human and environmental biobanking

- 15.4.7 REST OF ASIA PACIFIC

- 15.5 LATIN AMERICA

- 15.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 15.5.2 BRAZIL

- 15.5.2.1 Genetic diversity and large-scale stem cell & genomic initiatives to propel market growth

- 15.5.3 MEXICO

- 15.5.3.1 Favorable initiatives for improving population health research and representation in global genomic databases to drive market

- 15.5.4 REST OF LATIN AMERICA

- 15.6 MIDDLE EAST

- 15.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 15.6.2 GCC COUNTRIES

- 15.6.2.1 Kingdom of Saudi Arabia (KSA)

- 15.6.2.1.1 Investments in automated equipment biobank infrastructure, ISO accreditation, and Vision 2030 to boost market growth

- 15.6.2.2 UAE

- 15.6.2.2.1 Investments in AI-driven robotic biobanking to fuel market growth

- 15.6.2.3 Rest of GCC countries

- 15.6.2.1 Kingdom of Saudi Arabia (KSA)

- 15.6.3 REST OF MIDDLE EAST

- 15.7 AFRICA

- 15.7.1 GROWING STANDARDIZATION EFFORTS, INTERNATIONAL ACCREDITATION, AND CAPACITY-BUILDING TO PROPEL MARKET GROWTH

- 15.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 INTRODUCTION

- 16.2 KEY PLAYERS STRATEGIES/RIGHT TO WIN

- 16.3 REVENUE ANALYSIS, 2020-2024

- 16.3.1 REVENUE ANALYSIS FOR BIOBANKING PRODUCTS, 2020-2024

- 16.3.2 REVENUE ANALYSIS FOR BIOBANKING SERVICES & SOFTWARE, 2020-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.4.1 MARKET SHARE ANALYSIS FOR BIOBANKING PRODUCTS, 2024

- 16.4.2 MARKET SHARE ANALYSIS FOR BIOBANKING SERVICES & SOFTWARE, 2024

- 16.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT, KEY PLAYERS, 2024

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 Offering footprint

- 16.5.5.4 Sample type footprint

- 16.5.5.5 Workflow footprint

- 16.6 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 16.6.1 PROGRESSIVE COMPANIES

- 16.6.2 RESPONSIVE COMPANIES

- 16.6.3 DYNAMIC COMPANIES

- 16.6.4 STARTING BLOCKS

- 16.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.6.5.1 Detailed list of key startups/SMEs

- 16.6.5.2 Competitive benchmarking of startups/ SMEs

- 16.7 COMPANY VALUATION & FINANCIAL METRICS

- 16.7.1 COMPANY VALUATION & FINANCIAL METRICS FOR BIOBANKING PRODUCTS MARKET

- 16.7.1.1 Company valuation

- 16.7.1.2 Financial metrics

- 16.7.2 COMPANY VALUATION & FINANCIAL METRICS FOR BIOBANKING SERVICES & SOFTWARE MARKET

- 16.7.2.1 Company valuation

- 16.7.2.2 Financial metrics

- 16.7.1 COMPANY VALUATION & FINANCIAL METRICS FOR BIOBANKING PRODUCTS MARKET

- 16.8 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT/SERVICE/SOLUTION LAUNCHES

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 THERMO FISHER SCIENTIFIC INC.

- 17.1.1.1 Business overview

- 17.1.1.2 Products/Services/Solutions offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Product launches

- 17.1.1.3.2 Deals

- 17.1.1.3.3 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 PHC HOLDINGS CORPORATION

- 17.1.2.1 Business overview

- 17.1.2.2 Products/Services/Solutions offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Product launches

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 BECTON, DICKINSON AND COMPANY (BD)

- 17.1.3.1 Business overview

- 17.1.3.2 Products/Services/Solutions offered

- 17.1.3.3 Recent developments

- 17.1.3.3.1 Product launches

- 17.1.3.4 MnM view

- 17.1.3.4.1 Key strengths

- 17.1.3.4.2 Strategic choices

- 17.1.3.4.3 Weaknesses & competitive threats

- 17.1.4 QIAGEN

- 17.1.4.1 Business overview

- 17.1.4.2 Products/Services/Solutions offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Product launches

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 MERCK KGAA

- 17.1.5.1 Business overview

- 17.1.5.2 Products/Services/Solutions offered

- 17.1.5.3 Recent developments

- 17.1.5.3.1 Expansions

- 17.1.5.4 MnM view

- 17.1.5.4.1 Key strengths

- 17.1.5.4.2 Strategic choices

- 17.1.5.4.3 Weaknesses & competitive threats

- 17.1.6 AVANTOR, INC.

- 17.1.6.1 Business overview

- 17.1.6.2 Products/Services/Solutions offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.7 CRYOPORT

- 17.1.7.1 Business overview

- 17.1.7.2 Products/Services/Solutions offered

- 17.1.7.3 Recent developments

- 17.1.7.3.1 Product launches

- 17.1.7.3.2 Deals

- 17.1.7.3.3 Expansions

- 17.1.8 TECAN TRADING AG

- 17.1.8.1 Business overview

- 17.1.8.2 Products/Services/Solutions offered

- 17.1.8.3 Recent developments

- 17.1.8.3.1 Product launches

- 17.1.9 AZENTA US INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products/Services/Solutions offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Deals

- 17.1.9.3.3 Expansions

- 17.1.10 GREINER AG

- 17.1.10.1 Business overview

- 17.1.10.2 Products/Services/Solutions offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product launches

- 17.1.10.3.2 Expansions

- 17.1.11 AGILENT TECHNOLOGIES, INC.

- 17.1.11.1 Business overview

- 17.1.11.2 Products/Services/Solutions offered

- 17.1.12 LABCORP

- 17.1.12.1 Business overview

- 17.1.12.2 Products/Services/Solutions offered

- 17.1.12.3 Recent developments

- 17.1.12.3.1 Deals

- 17.1.13 EUROFINS SCIENTIFIC

- 17.1.13.1 Business overview

- 17.1.13.2 Products/Services/Solutions offered

- 17.1.1 THERMO FISHER SCIENTIFIC INC.

- 17.2 OTHER PLAYERS

- 17.2.1 HAIER BIOMEDICAL

- 17.2.2 HAMILTON COMPANY

- 17.2.3 AMSBIO

- 17.2.4 BAY BIOSCIENCES

- 17.2.5 BIOKRYO

- 17.2.6 SPT LABTECH LTD.

- 17.2.7 ASKION GMBH

- 17.2.8 CTIBIOTECH

- 17.2.9 CURELINE

- 17.2.10 FIRALIS MOLECULAR PRECISION

- 17.2.11 SOPACHEM

- 17.2.12 FROILABO

- 17.2.13 BIOIVT

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS