|

시장보고서

상품코드

1808093

농업 식품 손실 감소 솔루션 시장 : 작물 유형별, 기술별, 솔루션 유형별, 최종 사용자별, 지역별 - 예측(-2030년)Agricultural Food Loss Reduction Solutions Market by Crop Type (Cereals & Grains, Fruits & Vegetables, Oilseeds & Pulses, Horticultural & Specialty Crops, Root & Tuber Crops), Technology, Solution Type, End User and Region - Global Forecast to 2030 |

||||||

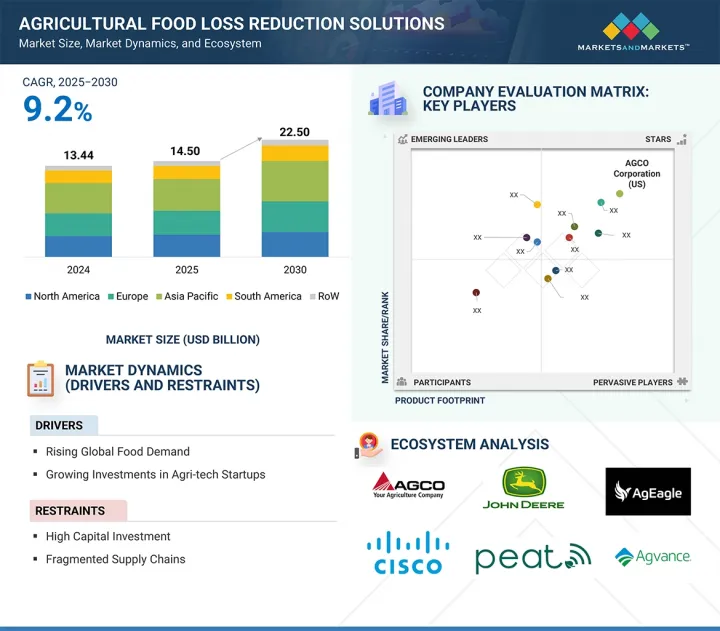

세계의 농업 식품 손실 감소 솔루션 시장 규모는 2025년에 145억 달러로 추정되고, 2030년까지 225억 달러에 이를 것으로 예측되며, CAGR 9.2%로 성장이 전망됩니다.

농업 식품 손실 감소 솔루션 시장은 식량 안보, 지속가능성, 자원 효율성을 둘러싼 우려의 고조에 힘입어, 세계 농업 기술과 공급망 산업에서 중요한 부문으로 부상하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 솔루션 유형별, 기술별, 작물 유형별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미 및 기타 지역 |

세계 식량 생산의 거의 3분의 1이 소비자에게 도달하기 전에 손실되거나 낭비되기 때문에 정부, 조직, 민간 이해관계자는 첨단 콜드체인 물류, 저장 및 포장 개선, 정밀 농업, AI 대응 재고 관리에 대한 투자를 점점 늘리고 있습니다.

식품 손실이 열악한 인프라와 관련되는 경우가 많은 개발도상 지역에서는 대규모 기술적 개입이 보이는 반면, 선진경제권에서는 식품 유통을 최적화하기 위한 자동화 및 디지털 플랫폼의 확대가 진행되고 있습니다. 강력한 성장 가능성에도 불구하고, 시장은 첨단 기술의 자본 비용이 높은 점, 크레딧 접근이 불충분하기 때문에 소규모 농가에서의 채용이 제한적인 점, 신흥 경제 지역의 인프라 격차 등 시장 성장 억제요인에 직면하고 있습니다. 게다가 공급망이 분단되고 기술 전개가 표준화되지 않기 때문에 보급이 방해되고 비용이 중시되는 시장에서의 채용이 늦어지고 있습니다.

'곡류 부문이 예측 기간에 시장을 독점할 전망입니다.'

곡류 부문은 수확, 수집, 탈곡, 세척, 건조, 포장, 운송 및 저장에 걸쳐 기록되는 높은 수준의 포스트 하베스트 손실에 의해 농업 식품 손실 감소 솔루션 시장에서 큰 점유율을 차지합니다. 2022년의 International Journal of Agriculture Sciences의 데이터에 따르면, 수수(14.60%), 겨자(14.10%), 콩(12.86%) 등의 작물은 상당한 합계 손실을 나타내고 있으며, 대부분의 곡류나 콩류의 평균 손실은 10%-15% 이상입니다. 참깨는 15.80%로 가장 높은 포스트 하베스트 손실을 기록했으며, 밀, 병아리콩, 녹두는 10% 이상의 손실이 발생했습니다.

공급망의 여러 단계에 걸친 이러한 상당한 손실은 이 부문에 맞는 효과적인 식품 손실 감소 솔루션의 심각한 필요를 부각시켜 폐기물을 최소화하고 식량 안보를 강화하기 위해, 저장 인프라 개선, 효율적인 가공 시스템, 기계화된 포스트 하베스트 기술 등, 적극적인 개입책을 개발하고 실시하는 이해관계자에게 큰 시장 기회를 제시하고 있습니다.

'센서 기반 기술 시스템 부문은 예측 기간에 큰 시장 점유율을 차지합니다.'

센서 기반 기술은 실시간 모니터링, 업무 효율화, 포스트 하베스트 손실 최소화의 필요성으로 농업 식품 손실 감소 솔루션 시장에서 큰 점유율을 차지할 것으로 보입니다. 레이더식 레벨 센서, 온도 센서, IoT 대응 시스템 등의 이러한 기술은 저장 관리 향상, 부패 상태의 조기 발견, 재고 최적화 등을 위한 채용이 진행되고 있습니다.

주목할 만한 사례는 2025년 2월 14일의 사례로 한 농장이 Jiwei의 Smart Grain Bin Level Sensor를 도입하여 곡류의 손실을 30% 삭감했습니다. 이 레이더 센서는 정확한 비접촉 측정과 재고 시스템과의 원활한 통합을 실현하여 곡류 저장 효율을 대폭 향상시켜 경영 정지 시간을 단축했습니다. 이 개발은 스마트 센서 통합의 구체적인 장점을 돋보이게 하고 데이터 중심의 농법으로의 광범위한 산업 변화를 반영합니다. 식량 안보 및 지속 가능한 농업에 대한 수요가 증가함에 따라 센서 기반 솔루션은 전체 농업 밸류체인의 손실을 줄이는 핵심 존재가 될 전망입니다.

이 보고서는 세계의 농업 식품 손실 감소 솔루션 시장에 대한 조사 분석을 통해 주요 촉진요인 및 억제요인, 경쟁 구도, 미래 동향 등에 대한 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 농업 식품 손실 감소 솔루션 시장의 기업에게 매력적인 기회

- 농업 식품 손실 감소 솔루션 시장 : 주요 지역 서브 마켓의 점유율

- 북미의 농업 식품 손실 감소 솔루션 시장 : 솔루션 유형별, 국가별

- 농업 식품 손실 감소 솔루션 시장 : 기술별, 지역별

- 농업 식품 손실 감소 솔루션 시장 : 솔루션 유형별

- 농업 식품 손실 감소 솔루션 시장 : 작물 유형별

- 농업 식품 손실 감소 솔루션 시장 : 최종 사용자별

제5장 시장 개요

- 서문

- 거시경제지표

- 세계 인구 증가 및 식량 수요

- 식품 손실 감소에 대한 정부 지출 및 개발 원조

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 농업 식품 손실 감소 솔루션에 대한 생성형 AI의 영향

- 서문

- 농업 식품 손실 감소 솔루션에서 생성형 AI 활용

- 사례 연구 분석

- 농업 식품 손실 감소 솔루션 시장에 미치는 영향

- 생성형 AI에 임하는 인접 에코시스템

제6장 산업 동향

- 서문

- 공급망 분석

- 밸류체인 분석

- 농업 생산 및 수확

- 수확 후처리

- 저장 및 창고 관리

- 가공 및 포장

- 수송 및 유통

- 소매 및 소비

- 무역 분석

- 수출 시나리오(HS 코드 8418)

- 수입 시나리오(HS 코드 8418)

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 참고 가격 분석

- 생태계 분석

- 공급사이드

- 수요측

- 고객 사업에 영향을 주는 동향 및 혼란

- 특허 분석

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 규제 상황

- 규제 틀

- 서문

- 북미

- 유럽

- 아시아태평양

- 남미

- 기타 지역

- 미국 관세의 영향-농업 식품 손실 감소 솔루션 시장(2025년)

- 서문

- 주요 관세율

- 농업 식품 손실 감소 솔루션의 파괴

- 가격의 영향 분석

- 국가 및 지역에 미치는 영향

- 최종 이용 산업에 미치는 영향

- Porter's Five Forces 분석

- 주요 이해관계자 및 구매 기준

- 사례 연구 분석

- 투자 및 자금조달 시나리오

제7장 농업 식품 손실 감소 솔루션 시장 : 솔루션 유형별

- 서문

- 프리 하베스트 손실 방지 기술

- 수확 기술

- 포스트 하베스트 손실 삭감 기술

- 서비스 및 소프트웨어 솔루션

제8장 농업 식품 손실 감소 솔루션 시장 : 기술별

- 서문

- 센서 기술

- 콜드체인 및 냉동 기술

- 데이터 분석 기술

- 로보틱스 오토메이션

제9장 농업 식품 손실 감소 솔루션 시장 : 작물 유형별

- 서문

- 곡류

- 과일 및 야채

- 지방종자 및 콩류

- 원예작물 및 특수작물

- 기타 작물

제10장 농업 식품 손실 감소 솔루션 시장 : 최종 사용자별

- 서문

- 개인 농가 및 소규모 농가

- 상업 농가 및 아그리 비즈니스

- 농업 협동 조합

- 물류 및 창고 업체

- 식품 가공업자 및 제조업체

제11장 농업 식품 손실 감소 솔루션 시장 : 지역별

- 서문

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타 유럽

- 아시아태평양

- 중국

- 인도

- 일본

- 호주 및 뉴질랜드

- 기타 아시아태평양

- 남미

- 브라질

- 아르헨티나

- 기타 남미

- 기타 지역

- 중동

- 아프리카

제12장 경쟁 구도

- 개요

- 주요 진입 기업의 전략 및 강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무 지표

- 브랜드 및 제품 비교 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업 및 중소기업(2024년)

- 경쟁 시나리오 및 동향

제13장 기업 프로파일

- 주요 기업

- DEERE & COMPANY

- CNH INDUSTRIAL NV

- AGCO

- CARRIER

- CISCO SYSTEMS, INC.

- ORBCOMM

- HEXAGON AB AND/OR ITS SUBSIDIARIES

- METOS BY PESSL INSTRUMENTS

- ECOROBOTIX

- TEEJET TECHNOLOGIES

- DJI

- AGEAGLE AERIAL SYSTEMS INC.

- MONNIT CORPORATION

- INFRATAB, INC

- SAP SE OR AN SAP AFFILIATE COMPANY

- 기타 기업

- NAIO TECHNOLOGIES INC

- ROBOTICS PLUS

- FFROBOTICS

- XAG CO., LTD.

- PHENOLITE BY HIPHEN

- TEMPCUBE

- VERIGO

- AGROBOT

- HARVESTCROO

- ONETHIRD

제14장 인접 시장 및 관련 시장

- 서문

- 제한 사항

- 콜드체인 시장

- 시장 정의

- 시장 개요

제15장 부록

AJY 25.09.16The agricultural food loss reduction solutions market is estimated at USD 14.50 billion in 2025 and is projected to reach USD 22.50 billion by 2030, at a CAGR of 9.2%. The agricultural food loss reduction solutions market is emerging as a critical segment within the global agri-tech and supply chain industries, driven by rising concerns around food security, sustainability, and resource efficiency.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (KT) |

| Segments | By Solution Type, Technology, Crop Type, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Rest of the World (RoW) |

With nearly one-third of global food production lost or wasted before reaching consumers, governments, organizations, and private stakeholders are increasingly investing in advanced cold chain logistics, improved storage and packaging, precision agriculture, and AI-enabled inventory management.

Developing regions, where food loss is often linked to poor infrastructure, are witnessing major technological interventions, while developed economies are scaling automation and digital platforms to optimize food distribution. Despite strong growth potential, the market faces restraints such as high capital costs for advanced technologies, limited adoption among smallholder farmers due to inadequate credit access, and infrastructure gaps in emerging economies. Additionally, fragmented supply chains and a lack of standardization in technology deployment hinder widespread implementation, slowing down adoption in cost-sensitive markets.

"Cereals & Grains segment is projected to dominate the market during forecast period"

The cereal & grains segment holds a significant share in the agricultural food loss reduction solutions market due to the high levels of post-harvest losses recorded across harvesting, collection, threshing, cleaning, drying, packing, transportation, and storage. According to data from the International Journal of Agriculture Sciences in 2022, crops such as sorghum (14.60%), mustard (14.10%), and pigeon pea (12.86%) demonstrate considerable total losses, with an average loss across most grains and pulses ranging from 10% to over 15%. Sesame recorded the highest post-harvest loss at 15.80%, while wheat, gram, and green gram experienced losses exceeding 10%.

These significant losses across multiple stages of the supply chain underline the critical need for effective food loss reduction solutions tailored to this segment, presenting a strong market opportunity for stakeholders to develop and implement targeted interventions, such as improved storage infrastructure, efficient processing systems, and mechanized post-harvest technologies to minimize waste and enhance food security.

"Sensor-based technology systems segment will hold a significant market share during the forecast period"

Sensor-based technologies will hold a significant share in the agricultural food loss reduction solutions market, driven by the need for real-time monitoring, operational efficiency, and minimization of post-harvest losses. These technologies, including radar level sensors, temperature sensors, and IoT-enabled systems, are increasingly being adopted to improve storage management, detect spoilage conditions early, and optimize inventory.

A notable example is the case study dated February 14, 2025, where a farm implemented Jiwei's Smart Grain Bin Level Sensors, resulting in a 30% reduction in grain loss. The radar sensors provided accurate, non-contact measurements and seamless integration with inventory systems, significantly improving grain storage efficiency and reducing operational downtime. This development highlights the tangible benefits of smart sensor integration and reflects a broader industry shift toward data-driven farming practices. As demand for food security and sustainable agriculture rises, sensor-based solutions are poised to become central to reducing losses across the agricultural value chain.

"North America leads market share, while Asia Pacific emerges as the fastest-growing region for food loss solutions"

North America, led by the United States, is projected to hold the largest share of the agricultural food loss reduction solutions market. Strong private-sector participation, government funding, and innovative technologies such as AI-enabled freshness tracking, smart packaging, waste-to-energy infrastructure, and advanced cold chains are driving adoption. Divert, Apeel Sciences, and Hazel Technologies are investing heavily in solutions that minimize post-harvest and distribution-level losses, reinforcing the region's dominance.

Meanwhile, Asia Pacific is expected to witness the fastest growth during the forecast period, supported by rising food demand, urbanization, and government-backed cold chain expansions. India and China are scaling IoT-based monitoring, modular storage hubs, and AI-powered logistics to reduce inefficiencies. Rapid investment from agri-tech startups and increasing collaboration with international players are positioning Asia Pacific as a high-growth hub for food loss reduction technologies.

Breakdown of primaries

In-depth interviews were conducted with chief executive officers (CEOs), directors, and other executives from various key organizations operating in the agricultural food loss reduction solutions market.

- By Company Type: Tier 1 - 25%, Tier 2 - 45%, and Tier 3 - 30%

- By Designation: CXOs - 20%, Managers - 50%, Executives - 30%

- By Region: North America - 25%, Europe - 20%, Asia Pacific - 30%, South America - 15%, and Rest of the World - 10%

Prominent companies in the market include Deere & Company (US), DJI (China), Lineage Inc. (US), Buhler Group (Switzerland), and Cargill (US).

Research Coverage

This research report categorizes the agricultural food loss reduction solutions market by solution type (pre-harvest loss prevention technologies, harvest technologies, post-harvest loss reduction solutions, service & software solutions), technology (sensor technology, cold chain and refrigeration technologies, packaging technologies, data & analytics technologies, robotics & automations), crop type (cereals & grains, fruits & vegetables, oilseeds & pulses, horticultural & specialty crops, root & tuber crops), end users (individual/smallholder farmers, commercial farms and agribusinesses, agricultural cooperatives, logistics and warehousing providers, food processors and manufacturers), and region (North America, Europe, Asia Pacific, South America, and Rest of the World).

The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the agricultural food loss reduction solution. A thorough analysis of the key industry players has provided insights into their business, services, key strategies, contracts, partnerships, agreements, product launches, mergers & acquisitions, and recent developments associated with the market. This report covers the competitive analysis of upcoming startups. Furthermore, industry-specific trends such as technology analysis, ecosystem & market mapping, and patent & regulatory landscape, among others, are also covered in the study.

Reasons to Buy This Report

The report will offer market leaders/new entrants' information on the closest approximate revenue numbers for the overall agricultural food loss reduction solutions and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points.

- Analysis of key drivers (Increased food losses at the farm stage & transportation drive the demand), restraints (High capital investment in reefer transport limits cold chain expansion in rural areas), opportunities (High post-harvest loss rates across crops create a clear demand for advanced loss-mitigation solutions), and challenges (Unpredictable weather patterns and extreme events can affect crop yields and increase food loss) influencing the growth of the agricultural food loss reduction solutions market

- Product Development/Innovation: Detailed insights into research & development activities and new product launches in the agricultural food loss reduction solutions market

- Market Development: Comprehensive information about the lucrative market analysis of the agricultural food loss reduction solutions across varied regions

- Market Diversification: Exhaustive information about new product sources, untapped geographies, recent developments, and investments in the agricultural food loss reduction solutions market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, brand/product comparison, and product footprints of leading players such as Lineage, Inc. (US), Americold (US), DECCO Postharvest (US), AgroFresh (Pennsylvania), JBT (US), Sealed Air (US), Amcor Plc (Switzerland), Multivac (Germany), Smurfit Westrock (Ireland), GrainPro Inc (US), and other players in the agricultural food loss reduction solutions market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 UNITS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key industry insights

- 2.1.2.2 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.3.1 SUPPLY-SIDE

- 2.3.2 DEMAND-SIDE

- 2.4 RESEARCH ASSUMPTIONS AND LIMITATIONS

- 2.4.1 ASSUMPTIONS

- 2.5 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 4.2 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET: SHARE OF MAJOR REGIONAL SUBMARKETS

- 4.3 NORTH AMERICA: AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE AND COUNTRY

- 4.4 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY AND REGION

- 4.5 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE

- 4.6 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE

- 4.7 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MACROECONOMIC INDICATORS

- 5.2.1 GLOBAL POPULATION GROWTH AND FOOD DEMAND

- 5.2.2 GOVERNMENT EXPENDITURE AND DEVELOPMENT AID IN FOOD LOSS REDUCTION

- 5.3 MARKET DYNAMICS

- 5.3.1 DRIVERS

- 5.3.1.1 Population growth and rising food demand

- 5.3.1.2 Climate and environmental pressures

- 5.3.2 RESTRAINTS

- 5.3.2.1 High initial investment costs

- 5.3.2.2 Infrastructure gaps in emerging markets

- 5.3.3 OPPORTUNITIES

- 5.3.3.1 Technological innovations

- 5.3.3.2 Circular economy models

- 5.3.4 CHALLENGES

- 5.3.4.1 Fragmented supply chains

- 5.3.4.2 Financial inclusion barriers

- 5.3.1 DRIVERS

- 5.4 IMPACT OF GEN AI ON AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 5.4.1 INTRODUCTION

- 5.4.2 USE OF GEN AI IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 5.4.3 CASE STUDY ANALYSIS

- 5.4.3.1 Super Hosokawa Co., Ltd. - AI-driven Demand Forecasting (Japan)

- 5.4.3.2 Zest AI Tool at Nestle Factory (United Kingdom)

- 5.4.4 IMPACT ON AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 5.4.5 ADJACENT ECOSYSTEM WORKING ON GEN AI

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 SUPPLY CHAIN ANALYSIS

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 FARM PRODUCTION & HARVESTING

- 6.3.2 POST-HARVEST HANDLING

- 6.3.3 STORAGE & WAREHOUSING

- 6.3.4 PROCESSING & PACKAGING

- 6.3.5 TRANSPORTATION & DISTRIBUTION

- 6.3.6 RETAIL & CONSUMPTION

- 6.4 TRADE ANALYSIS

- 6.4.1 EXPORT SCENARIO (HS CODE 8418)

- 6.4.2 IMPORT SCENARIO (HS CODE 8418)

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Cold Chain and Temperature Control Logistics Technology

- 6.5.1.2 Sensor and IoT-Based Monitoring & Control

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Modified Atmosphere Packaging

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 Precision Agriculture Technology

- 6.5.1 KEY TECHNOLOGIES

- 6.6 INDICATIVE PRICING ANALYSIS

- 6.6.1 INDICATIVE PRICING TREND: SOLUTION TYPE, BY REGION

- 6.7 ECOSYSTEM ANALYSIS

- 6.7.1 SUPPLY SIDE

- 6.7.2 DEMAND SIDE

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 PATENT ANALYSIS

- 6.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.11 REGULATORY LANDSCAPE

- 6.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.12 REGULATORY FRAMEWORK

- 6.12.1 INTRODUCTION

- 6.12.2 NORTH AMERICA

- 6.12.2.1 US

- 6.12.2.2 Canada

- 6.12.2.3 Mexico

- 6.12.3 EUROPE

- 6.12.3.1 European Union (EU)

- 6.12.3.2 France

- 6.12.3.3 Italy

- 6.12.3.4 Germany

- 6.12.4 ASIA PACIFIC

- 6.12.4.1 China

- 6.12.4.2 India

- 6.12.4.3 Japan

- 6.12.4.4 Australia/New Zealand

- 6.12.4.5 Singapore

- 6.12.5 SOUTH AMERICA

- 6.12.5.1 Brazil

- 6.12.5.2 Argentina

- 6.12.5.3 Chile

- 6.12.6 REST OF THE WORLD (ROW)

- 6.12.6.1 Gulf Cooperation Council (e.g., UAE, Saudi Arabia)

- 6.12.6.2 South Africa

- 6.12.6.3 Kenya/East Africa

- 6.12.6.4 EAEU/CIS (e.g., Kazakhstan, Russia, Belarus)

- 6.13 IMPACT OF 2025 US TARIFF - AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 DISRUPTION IN AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS

- 6.13.4 PRICE IMPACT ANALYSIS

- 6.13.5 IMPACT ON COUNTRY/REGION

- 6.13.5.1 US

- 6.13.5.2 Canada & Mexico

- 6.13.5.3 South America

- 6.13.6 IMPACT ON END-USE INDUSTRY

- 6.14 PORTER'S FIVE FORCES ANALYSIS

- 6.14.1 THREAT OF NEW ENTRANTS

- 6.14.2 THREAT OF SUBSTITUTES

- 6.14.3 BARGAINING POWER OF SUPPLIERS

- 6.14.4 BARGAINING POWER OF BUYERS

- 6.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.15.2 BUYING CRITERIA

- 6.16 CASE STUDY ANALYSIS

- 6.17 INVESTMENT AND FUNDING SCENARIO

7 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY SOLUTION TYPE

- 7.1 INTRODUCTION

- 7.2 PRE-HARVEST LOSS PREVENTION TECHNOLOGIES

- 7.2.1 PRECISION AGRICULTURE TOOLS

- 7.2.1.1 Driving smarter food loss reduction across farming systems

- 7.2.2 PEST AND DISEASE FORECASTING SYSTEMS

- 7.2.2.1 Helping farmers cut losses via timely, predictive actions

- 7.2.3 SOIL HEALTH MONITORING SENSORS

- 7.2.3.1 Safeguarding food systems and reducing agricultural loss

- 7.2.4 NUTRIENT MANAGEMENT SOLUTIONS

- 7.2.4.1 Minimizing losses and enhancing sustainable crop productivity

- 7.2.1 PRECISION AGRICULTURE TOOLS

- 7.3 HARVEST TECHNOLOGIES

- 7.3.1 MECHANIZED HARVESTERS

- 7.3.1.1 Driving efficiency and minimizing waste with mechanized harvesters

- 7.3.2 RIPENESS AND MATURITY DETECTORS

- 7.3.2.1 Driving efficiency, reducing food waste, and improving profitability

- 7.3.3 MANUAL HARVESTING TOOLS

- 7.3.3.1 Supporting smallholder farmers, reducing crop losses, and boosting productivity

- 7.3.1 MECHANIZED HARVESTERS

- 7.4 POST-HARVEST LOSS REDUCTION TECHNOLOGIES

- 7.4.1 COLD-CHAIN & LOGISTICS INFRASTRUCTURE

- 7.4.1.1 Ensuring global food security, sustainability, and loss reduction

- 7.4.2 HERMETIC STORAGE SOLUTIONS

- 7.4.2.1 Safeguarding harvests, cutting grain losses, and boosting global food security

- 7.4.3 MODIFIED ATMOSPHERE PACKAGING

- 7.4.3.1 Extending cereal shelf life, minimizing food loss

- 7.4.4 CONTROLLED ATMOSPHERE STORAGE

- 7.4.4.1 Extending grain life, reducing losses, and ensuring food security

- 7.4.5 DRYING, CURING, & EVAPORATIVE COOLING TECHNOLOGIES

- 7.4.5.1 Extending shelf life and preventing spoilage

- 7.4.6 BIO-PRESERVATION & TREATMENT TECHNOLOGIES

- 7.4.6.1 Extending freshness, reducing waste, and securing food quality

- 7.4.1 COLD-CHAIN & LOGISTICS INFRASTRUCTURE

- 7.5 SERVICE & SOFTWARE SOLUTIONS

- 7.5.1 SUPPLY CHAIN TRACEABILITY SOLUTIONS

- 7.5.1.1 Enhancing food loss reduction

- 7.5.2 REMOTE SENSING AND IOT-BASED LOSS DETECTION SYSTEMS

- 7.5.2.1 Driving agricultural food loss prevention

- 7.5.3 AI-BASED FARM ADVISORY AND DECISION SUPPORT

- 7.5.3.1 Reducing crop losses and boosting sustainability

- 7.5.4 DATA ANALYTICS AND FORECASTING TOOLS

- 7.5.4.1 Minimizing post-harvest food loss

- 7.5.1 SUPPLY CHAIN TRACEABILITY SOLUTIONS

8 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 SENSOR TECHNOLOGIES

- 8.2.1 IOT SENSORS

- 8.2.1.1 Empowering global food waste reduction across supply chains

- 8.2.2 RFID AND QR CODES SYSTEMS

- 8.2.2.1 Revolutionizing food waste reduction through smarter tracking, pricing, and freshness monitoring

- 8.2.3 SATELLITE AND DRONE IMAGING

- 8.2.3.1 Driving food waste reduction through smarter monitoring

- 8.2.1 IOT SENSORS

- 8.3 COLD CHAIN AND REFRIGERATION TECHNOLOGIES

- 8.3.1 SAFEGUARDING FOOD QUALITY AND CUTTING WASTE ACROSS GLOBAL SUPPLY CHAINS

- 8.4 DATA & ANALYTICS TECHNOLOGIES

- 8.4.1 MACHINE LEARNING AND BIG DATA ANALYTICS

- 8.4.1.1 Unlocking smarter solutions for global food loss reduction

- 8.4.2 PREDICTIVE MODELING AND YIELD FORECASTING

- 8.4.2.1 Driving smarter agriculture and reducing global food waste

- 8.4.1 MACHINE LEARNING AND BIG DATA ANALYTICS

- 8.5 ROBOTICS AND AUTOMATION

- 8.5.1 AUTOMATED HARVESTING SYSTEMS

- 8.5.1.1 Driving efficiency to reduce post-harvest agricultural food losses

- 8.5.2 SORTING AND GRADING ROBOTS

- 8.5.2.1 Transforming post-harvest food loss reduction

- 8.5.1 AUTOMATED HARVESTING SYSTEMS

9 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY CROP TYPE

- 9.1 INTRODUCTION

- 9.2 CEREALS & GRAINS

- 9.2.1 ADVANCING COLLABORATIVE TECH AND PARTNERSHIPS FOR SUSTAINABLE SOLUTIONS TO DRIVE MARKET

- 9.3 FRUITS & VEGETABLES

- 9.3.1 TRANSFORMING SUPPLY CHAINS TO CUT FRUITS & VEGETABLES WASTE

- 9.4 OILSEEDS & PULSES

- 9.4.1 DRIVING DIGITAL INNOVATIONS TO MINIMIZE OILSEED AND PULSE LOSSES FOR SUSTAINABLE FOOD SECURITY AND PROFITABILITY

- 9.5 HORTICULTURAL & SPECIALTY CROPS

- 9.5.1 HARNESSING DIGITAL TOOLS TO REDUCE LOSSES IN HORTICULTURAL AND SPECIALTY CROPS GLOBALLY

- 9.6 OTHER CROP TYPES

- 9.6.1 ADVANCING POST-HARVEST INNOVATIONS TO REDUCE LOSSES IN ROOT AND TUBER CROPS WORLDWIDE

10 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 INDIVIDUAL/SMALLHOLDER FARMERS

- 10.2.1 EMPOWERING SMALLHOLDER FARMERS TO DRIVE FOOD LOSS REDUCTION

- 10.3 COMMERCIAL FARMERS & AGRIBUSINESSES

- 10.3.1 BUILDING SMARTER, EFFICIENT SUPPLY CHAINS TO TACKLE GLOBAL FOOD WASTE

- 10.4 AGRICULTURAL CO-OPERATIVES

- 10.4.1 REDUCING FOOD WASTE, ENHANCING FARMER INCOMES, AND DRIVING SUSTAINABLE GROWTH GLOBALLY

- 10.5 LOGISTICS & WAREHOUSING PROVIDERS

- 10.5.1 ENHANCING FOOD SECURITY THROUGH SMARTER LOGISTICS, COLD CHAINS, AND DIGITAL WAREHOUSING

- 10.6 FOOD PROCESSORS & MANUFACTURERS

- 10.6.1 EMPOWERING FOOD PROCESSORS WITH INNOVATIVE TECHNOLOGIES FOR EFFECTIVE LOSS REDUCTION

11 AGRICULTURAL FOOD LOSS REDUCTION SOLUTIONS MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Federal and industry collaboration to halve food loss and waste by 2030

- 11.2.2 CANADA

- 11.2.2.1 Canada accelerates food waste reduction with innovation, upcycling, and annual loss prevention efforts

- 11.2.3 MEXICO

- 11.2.3.1 Mexico advances food loss solutions with public-private partnerships, tech innovation, and global sustainability goals

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Germany scales food waste reduction with national strategy, retail innovation, and sustainable supply chain partnerships

- 11.3.2 UK

- 11.3.2.1 UK combats food waste with agritech innovation, retail leadership, and national reduction roadmap

- 11.3.3 FRANCE

- 11.3.3.1 France accelerates food waste reduction with circular economy solutions

- 11.3.4 SPAIN

- 11.3.4.1 Spain's food waste law spurs innovation in agricultural food loss reduction and retail sustainability

- 11.3.5 ITALY

- 11.3.5.1 Italy's food waste initiatives drive market growth in agricultural loss reduction and retail sustainability

- 11.3.6 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 China advances agricultural food loss reduction with policy and innovation

- 11.4.2 INDIA

- 11.4.2.1 India accelerates cold chain innovation to cut food loss and strengthen farmer incomes

- 11.4.3 JAPAN

- 11.4.3.1 Collaborative insurance, business, and community models driving Japan's food loss reduction

- 11.4.4 AUSTRALIA & NEW ZEALAND

- 11.4.4.1 Driving food loss reduction with national strategies, innovation, and community partnerships

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.5.1.1 Brazil strengthens food loss reduction with tech innovations, policy reforms, and global partnerships

- 11.5.2 ARGENTINA

- 11.5.2.1 Argentina advances food loss reduction with AI, waste innovation, and strategic food bank partnerships

- 11.5.3 REST OF SOUTH AMERICA

- 11.5.1 BRAZIL

- 11.6 REST OF THE WORLD

- 11.6.1 MIDDLE EAST

- 11.6.1.1 Awareness campaigns, technological innovation, and sustainable waste policies driving market growth

- 11.6.2 AFRICA

- 11.6.2.1 Tackling Africa's food loss crisis through innovation, policy, and strategic partnerships

- 11.6.1 MIDDLE EAST

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.4.1 MARKET RANKING ANALYSIS

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.5.1 COMPANY VALUATION

- 12.5.2 EV/EBITDA

- 12.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Technology footprint

- 12.7.5.4 Solution type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 DEERE & COMPANY

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 CNH INDUSTRIAL N.V.

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 AGCO

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 CARRIER

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 CISCO SYSTEMS, INC.

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 ORBCOMM

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.4 MnM view

- 13.1.7 HEXAGON AB AND/OR ITS SUBSIDIARIES

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.7.4 MnM view

- 13.1.8 METOS BY PESSL INSTRUMENTS

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product Launches

- 13.1.8.4 MnM view

- 13.1.9 ECOROBOTIX

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.4 MnM view

- 13.1.10 TEEJET TECHNOLOGIES

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.4 MnM view

- 13.1.11 DJI

- 13.1.11.1 Business overview

- 13.1.11.2 Products/Solutions/Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product Launches

- 13.1.11.4 MnM view

- 13.1.12 AGEAGLE AERIAL SYSTEMS INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Products/Solutions/Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.4 MnM view

- 13.1.13 MONNIT CORPORATION

- 13.1.13.1 Business overview

- 13.1.13.2 Products/Solutions/Services offered

- 13.1.13.3 Recent developments

- 13.1.13.4 MnM view

- 13.1.14 INFRATAB, INC

- 13.1.14.1 Business overview

- 13.1.14.2 Products/Solutions/Services offered

- 13.1.14.3 Recent developments

- 13.1.14.4 MnM view

- 13.1.15 SAP SE OR AN SAP AFFILIATE COMPANY

- 13.1.15.1 Business overview

- 13.1.15.2 Products/Solutions/Services offered

- 13.1.15.3 Recent developments

- 13.1.15.4 MnM view

- 13.1.1 DEERE & COMPANY

- 13.2 OTHER PLAYERS

- 13.2.1 NAIO TECHNOLOGIES INC

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.4 MnM view

- 13.2.2 ROBOTICS PLUS

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.4 MnM view

- 13.2.3 FFROBOTICS

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 MnM view

- 13.2.4 XAG CO., LTD.

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product Launches

- 13.2.4.4 MnM view

- 13.2.5 PHENOLITE BY HIPHEN

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Deals

- 13.2.5.4 MnM view

- 13.2.6 TEMPCUBE

- 13.2.7 VERIGO

- 13.2.8 AGROBOT

- 13.2.9 HARVESTCROO

- 13.2.10 ONETHIRD

- 13.2.1 NAIO TECHNOLOGIES INC

14 ADJACENT AND RELATED MARKET

- 14.1 INTRODUCTION

- 14.2 LIMITATIONS

- 14.3 COLD CHAIN MARKET

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS