|

시장보고서

상품코드

1808962

산업용 질소 발생기 시장 : 사이즈별, 디자인별, 기술 유형별, 최종 이용 산업별 세계 예측(-2030년)Industrial Nitrogen Generator Market by Size, Design, Technology Type, End-use Industry, and Region - Global Forecast to 2030 |

||||||

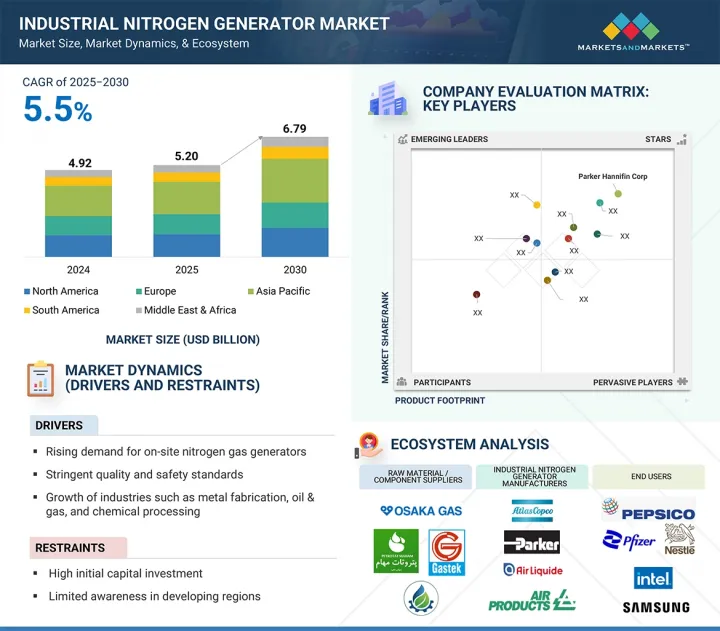

세계의 산업용 질소 발생기 시장 규모는 2025년 52억 달러에서 2030년까지 67억 9,000만 달러에 이를 것으로 예상되며, 예측 기간에 CAGR는 5.5%를 나타낼 것으로 전망됩니다.

시장은 주로 식품 및 음료, 의약품, 화학제품, 전자, 석유 및 가스 산업에 있어서 고순도 질소의 요구 증가에 의해 견인되고 있습니다. 비용 효율적이고 지속적인 현장에서 질소 공급에 대한 수요가 증가함에 따라 기존 가스 공급 방법에서 질소 발생기로의 전환이 촉진되고 있습니다. 이러한 시스템을 사용함으로써 산업은 외부 공급업체에 대한 의존성을 없앨 수 있으며, 동시에 운송 비용 절감, 안전성 향상 및 경영 제어를 더욱 향상시킬 수 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 톤 |

| 부문 | 크기, 디자인, 기술 유형, 최종 이용 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

환경 요인과 탄소 배출에 관한 엄격한 규제가 산업계를 에너지 효율이 높은 지속 가능한 가스 발생 기술로 추진하고 있습니다. 마지막으로, 기술 혁신과 최근 시스템의 자동화로 인해 질소 발생기는 보다 컴팩트하고 신뢰성이 높고 기존 시스템에 통합하기 쉬워졌습니다. 시장은 용도별로 압력 스윙 흡착(PSA), 막 분리, 극저온 분리로 구분됩니다. PSA 시스템은 고순도 질소와 작동 유연성 모두에 가장 적합한 시스템으로 현재 업계에서 우위를 차지하고 있습니다. 멤브레인 기술은 저순도 및 대유량 응용 분야에 유용하며, 극저온 시스템은 대규모 초고순도 응용 분야에 적합합니다. 전반적으로 여러 가지 촉진요인이 산업용 질소 발생기 제품의 세계적인 보급을 향해 시장을 밀어 올리고 있습니다.

"고정 산업용 질소 발생기는 예측 기간 동안 산업용 질소 발생기 시장에서 두 번째로 빠르게 성장하는 유형입니다."

고정식 산업용 질소 발생기는 안정적인 수요와 대규모의 지속적인 산업 경영을 지원하는 능력으로 시장에서 두 번째로 빠르게 성장하는 부문입니다. 이러한 시스템은 고순도 가스 출력에서 대용량 질소를 생성하므로 지속적인 가스 공급이 필수적인 화학, 제약, 전자 등 산업에 이상적입니다. 고정식 발생기와 생산 인프라는 산업용으로 특별히 설계되었기 때문에 일반적으로 이동식 장치보다 유연성이 부족하지만 큰 이점이 있습니다. 장기적인 소유비용 절감, 가스제품의 미계약 공급업체에 대한 의존도 저감, 공정제어 향상 등입니다. 고정식 질소 발생기의 주요 장점은 중앙 생산 라인에 원활하게 통합될 수 있다는 점이며, 안정적인 수요에 대응하기 위해 질소 가스를 지속적으로 공급할 수 있습니다.

"극저온 기반은 예측 기간 동안 산업용 질소 발생기 시장에서 두 번째로 빠르게 성장하는 기술 유형입니다."

극저온 기술은 산업용 질소 발생기 시장에서 두 번째로 빠르게 성장하는 기술 유형입니다. 초고순도 질소를 대량으로 생산할 수 있기 때문에 화학, 석유화학, 야금 등의 산업에서의 헤비 듀티 용도에 매우 적합합니다. 극저온 질소 발생기에서 공기는 극저온에서 분리되어 최고 수준의 순도가 요구되는 공정에 필요한 질소를 안정적으로 공급하기 위해 처리됩니다. 극저온 시스템은 일반적으로 다른 질소 발생 기술에 비해 자본 비용과 운전 비용이 높지만 대량의 질소를 공급할 수 있는 능력이 있기 때문에 대규모 질소 소비 환경에서는 이러한 비용을 정당화할 수 있습니다. 에너지 집약적인 부서가 지원하는 광범위한 산업 인프라는 신뢰할 수 있는 대용량 질소 시스템에 크게 의존하고 있습니다. 따라서, 상업용 극저온 시스템의 도입과 산업용 질소 인프라의 성장 동향은 질소 시스템의 능력을 강화함으로써 극저온 질소 발생 시스템에 대한 큰 수요를 창출할 가능성이 높습니다.

“중동 및 아프리카 시장은 예측 기간에 산업용 질소 발생기 시장에서 두 번째로 빠르게 성장하고 있는 지역입니다.”

이 성장은 특히 이집트, 사우디아라비아, 나이지리아에서 화학, 비료, 석유화학 등 에너지 집약적인 산업의 확대가 촉진요인이 되고 있습니다. 이들 국가들은 수출을 확대하고 국내 생산을 늘리고 있습니다. 중동 및 아프리카는 또한 비료 플랜트, 석유화학시설, 식품가공시설 등 제조 및 인프라 개발을 우선하고 있습니다. 이러한 주력은 경영을 지원하는 질소 가스의 현장 생산에 대한 수요를 높이고 있습니다.

본 보고서에서는 세계의 산업용 질소 발생기 시장에 대해 조사 분석하여 주요 성장 촉진요인과 억제요인, 경쟁 구도, 미래 동향 등의 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 산업용 질소 발생기 시장 기업의 기회

- 산업용 질소 발생기 시장 : 사이즈별

- 산업용 질소 발생기 시장 : 디자인별

- 산업용 질소 발생기 시장 : 기술별

- 산업용 질소 발생기 시장 : 최종 이용 산업별

- 산업용 질소 발생기 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 거시경제지표

- 밸류체인 분석

- 규제 상황

- 북미

- 아시아태평양

- 유럽

- 중동 및 아프리카

- 남미

- 규제기관, 정부기관, 기타 조직

- 무역 분석

- 수입 시나리오(HS 코드 840510)

- 수출 시나리오(HS 코드 840510)

- 생태계 분석

- 고객사업에 영향을 주는 동향/혼란

- 사례 연구 분석

- PARKER HANNIFIN, 의료 및 제약 용도용 질소 발생기를 제공

- ATLAS COPCO, 식품 및 음료 산업용 PSA 질소 발생기를 제공

- LINDE, 전자기기 제조용 첨단 질소 발생장치를 제공

- 기술 분석

- 주요 기술

- 보완 기술

- 가격 설정 분석

- 평균 판매 가격 동향 : 지역별(2022-2024년)

- 주요 기업의 평균 판매 가격 동향 : 최종 이용 산업별(2024년)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 특허 분석

- 조사 방법

- 문서 유형

- 공보의 동향

- 인사이트

- 특허의 법적 지위

- 관할분석

- 주요 출원자

- 산업용 질소 발생기 시장에 대한 AI/발생 AI의 영향

- 투자 및 자금조달 시나리오

- 산업용 질소 발생기 시장에 대한 미국 관세의 영향(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 주요 국가/지역에 대한 영향

- 최종 이용 산업에 미치는 영향

제6장 산업용 질소 발생기 시장 : 디자인별

- 서론

- 플러그 앤 플레이

- 실린더 기반

제7장 산업용 질소 발생기 시장 : 사이즈별

- 서론

- 고정식 산업용 질소 발생기

- 휴대용 산업용 질소 발생기

제8장 산업용 질소 발생기 시장 : 기술별

- 서론

- 압력 변동 흡착(PSA)

- 멤브레인 기반

- 극저온 기반

제9장 산업용 질소 발생기 시장 : 최종 이용 산업별

- 서론

- 식음료

- 의료 및 제약

- 운송

- 전기 및 전자공학

- 화학 및 석유화학

- 제조

- 포장

- 기타 최종 이용 산업

제10장 산업용 질소 발생기 시장 : 지역별

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타 아시아태평양

- 중동 및 아프리카

- GCC 국가

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략(2023-2025년)

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 및 재무지표(2024년)

- 브랜드/제품 비교 분석

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- PARKER HANNIFIN CORP

- AIR PRODUCTS AND CHEMICALS, INC.

- ATLAS COPCO GROUP

- INGERSOLL RAND

- AIR LIQUIDE

- LINDE PLC

- HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- INMATEC

- NOVAIR

- OXYMAT

- 기타 기업

- AIRPACK

- CLAIND

- COMPRESSED GAS TECHNOLOGIES, INC.

- ERRE DUE SPA

- FOXOLUTION

- GENERON

- GAZTRON

- ISOLCELL SPA.

- NOBLEGEN

- OXYWISE SRO

- OMEGA AIR

- OXAIR

- ON SITE GAS

- PEAKGAS

- WERTHER INTERNATIONAL

제13장 부록

KTH 25.09.17The industrial nitrogen generator market is projected to reach USD 6.79 billion by 2030 from USD 5.20 billion in 2025, at a CAGR of 5.5% during the forecast period. The industrial nitrogen generator market is mainly driven by an increasing need for high-purity nitrogen in the food and beverage, pharmaceuticals, chemicals, electronics, and oil & gas industries. Growing demand for cost-efficient, continuous, on-site supply of nitrogen is encouraging industries to transition away from conventional methods of gas delivery to nitrogen generators. Using these systems allows industries to eliminate the dependency on external suppliers while providing lower transport costs, added safety, and much better control of the operations.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million)/ Volume (Tons) |

| Segments | Size, Design, Technology Type, End-use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and the Middle East & Africa |

Environmental factors and stringent regulations pertaining to carbon emissions are driving industries toward energy-efficient and sustainable gas generation technologies. Lastly, due to innovations and the recent automation of systems, nitrogen generators are much more compact, reliable, and easy to incorporate into any existing system. The market is segmented by application into pressure swing adsorption (PSA), membrane separation, and cryogenic separation. PSA systems currently dominate the industry as the most suitable system for both high-purity nitrogen and operational flexibility. Membrane technology is useful in applications with lower purity and higher flow, while cryogenic systems are suited for ultra-high purity applications on a larger scale. Overall, there are several drivers that are pushing the market toward more industrial nitrogen generator products geared toward global adoption.

"Stationary industrial nitrogen generator is the second-fastest-growing type in the industrial nitrogen generators market during the forecast period."

Stationary industrial nitrogen generators are the second-fastest-growing segment in the market due to their consistent demand and ability to support large-scale, continuous industrial operations. These systems produce high-capacity nitrogen with high-purity gas output, making them ideal for industries such as chemicals, pharmaceuticals, and electronics, where a continuous gas supply is essential. While stationary generators and production infrastructures are generally less flexible than portable units since they are specifically designed for industrial use, they offer significant advantages. These include lower long-term ownership costs, reduced reliance on uncontracted suppliers for gas products, and improved process control. A key benefit of stationary nitrogen generators is their seamless integration into centralized production lines, where they can supply nitrogen gas continuously to meet stable demand.

"Cryogenic-based is the second-fastest growing technology type in the industrial nitrogen generator market during the forecast period."

Cryogenic technology is the second-fastest-growing type in the industrial nitrogen generator market. It can produce ultra-high-purity nitrogen at high volumes, making it highly relevant for heavy-duty applications in industries such as chemicals, petrochemicals, and metallurgy. In cryogenic nitrogen generators, air is separated at cryogenic temperatures and processed to provide a consistent supply of nitrogen required for processes demanding the highest levels of purity. Although cryogenic systems typically involve higher capital and operational costs compared to other nitrogen generation technologies, their ability to deliver high volumes justifies these costs in environments with large-scale nitrogen consumption. The extensive industrial infrastructure supported by energy-intensive sectors relies heavily on reliable, high-capacity nitrogen systems. Therefore, the introduction of commercial cryogenic systems, along with the growing trends in industrial nitrogen infrastructure, is likely to create significant demand for cryogenic nitrogen generation systems by enhancing nitrogen system capacity.

"The Middle East & African market is the second-fastest growing region in the industrial nitrogen generator market during the forecast period."

The Middle East and Africa (MEA) is the second fastest-growing region in the industrial nitrogen generator market. This growth is driven by the expansion of energy-intensive industries, such as chemicals, fertilizers, and petrochemicals, particularly in Egypt, Saudi Arabia, and Nigeria. These countries are boosting their exports and increasing domestic production. MEA has also prioritized the development of manufacturing and infrastructure, including fertilizer plants, petrochemical facilities, and food processing units. This focus enhances the demand for on-site production of nitrogen gas to support operations. Additionally, global instability and rising price volatility for ammonia and urea supplies have led to a greater reliance on on-site solutions to provide nitrogen, helping to mitigate the risks associated with supply chain disruptions. Governments in many larger MEA markets are reinvesting in modernizing their industries and providing incentives for the development of sustainable or decarbonized gas infrastructures. The combination of increased industrialization, diversification away from oil and gas-dependent economies, and a push for environmentally sustainable initiatives positions the Middle East and Africa as the second-fastest-growing region for industrial nitrogen generator assets.

Extensive primary interviews were conducted to determine and verify the market size for several segments and sub-segments, and the information gathered through secondary research.

The breakdown of primary interviews is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C-level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, and the Middle East & Africa: 5%

Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany) are some of the key players in the industrial nitrogen generator market.

The study includes an in-depth competitive analysis of these key players in the market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the industrial nitrogen generator market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on design, size, technology type, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the industrial nitrogen generator market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall industrial nitrogen generator market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (rising demand for on-site nitrogen gas generators, stringent quality and safety standards, and growth of industries such as metal fabrication, oil & gas, and chemical processing), restraints (high initial capital investment and limited awareness in developing regions), opportunities (expansion of emerging markets and customization and scalability of industrial nitrogen generator), challenges (technological complexity and lack of a skilled workforce).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the industrial nitrogen generator market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the industrial nitrogen generator market across varied regions.

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the industrial nitrogen generator market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Parker Hannifin Corp (US), Air Products and Chemicals, Inc. (US), Atlas Copco Group (Sweden), Ingersoll Rand (US), Air Liquide (France), Linde PLC (UK), Hitachi Industrial Equipment Systems Co., Ltd. (Japan), Inmatec (Germany), Novair SAS (France), and OXYMAT A/S (Germany), among others, are the top manufacturers covered in the industrial nitrogen generators market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 OPPORTUNITIES FOR PLAYERS IN INDUSTRIAL NITROGEN GENERATOR MARKET

- 4.2 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 4.3 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 4.4 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 4.5 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 4.6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for on-site nitrogen gas generators

- 5.2.1.2 Stringent quality and safety standards

- 5.2.1.3 Growth of metal fabrication, oil & gas, and chemical processing industries

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial capital investments

- 5.2.2.2 Limited awareness in emerging regions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of emerging markets

- 5.2.3.2 Customization and scalability of industrial nitrogen generators

- 5.2.4 CHALLENGES

- 5.2.4.1 Technological complexities

- 5.2.4.2 Lack of skilled workforce

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GLOBAL GDP TRENDS

- 5.6 VALUE CHAIN ANALYSIS

- 5.7 REGULATORY LANDSCAPE

- 5.7.1 NORTH AMERICA

- 5.7.1.1 US

- 5.7.1.2 Canada

- 5.7.2 ASIA PACIFIC

- 5.7.3 EUROPE

- 5.7.4 MIDDLE EAST & AFRICA

- 5.7.5 SOUTH AMERICA

- 5.7.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.7.1 NORTH AMERICA

- 5.8 TRADE ANALYSIS

- 5.8.1 IMPORT SCENARIO (HS CODE 840510)

- 5.8.2 EXPORT SCENARIO (HS CODE 840510)

- 5.9 ECOSYSTEM ANALYSIS

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 PARKER HANNIFIN OFFERS NITROGEN GENERATORS FOR MEDICAL AND PHARMACEUTICAL APPLICATIONS

- 5.11.2 ATLAS COPCO PROVIDES PSA NITROGEN GENERATOR FOR FOOD & BEVERAGE INDUSTRY

- 5.11.3 LINDE OFFERS ADVANCED NITROGEN GENERATORS FOR ELECTRONIC MANUFACTURING

- 5.12 TECHNOLOGY ANALYSIS

- 5.12.1 KEY TECHNOLOGIES

- 5.12.1.1 Pressure Swing Adsorption (PSA)

- 5.12.1.2 Membrane Separation

- 5.12.1.3 Cryogenic Nitrogen Generation

- 5.12.2 COMPLEMENTARY TECHNOLOGIES

- 5.12.2.1 IoT and Smart Monitoring Systems

- 5.12.2.2 Energy Recovery Systems

- 5.12.1 KEY TECHNOLOGIES

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 5.13.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PATENT ANALYSIS

- 5.15.1 METHODOLOGY

- 5.15.2 DOCUMENT TYPES

- 5.15.3 PUBLICATION TRENDS

- 5.15.4 INSIGHTS

- 5.15.5 LEGAL STATUS OF PATENTS

- 5.15.6 JURISDICTION ANALYSIS

- 5.15.7 TOP APPLICANTS

- 5.16 IMPACT OF AI/GEN AI ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.17 INVESTMENT AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF ON INDUSTRIAL NITROGEN GENERATOR MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON KEY COUNTRIES/REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 INDUSTRIAL NITROGEN GENERATOR MARKET, BY DESIGN

- 6.1 INTRODUCTION

- 6.2 PLUG & PLAY

- 6.2.1 COMPACT DESIGN, EASY ACCESSIBILITY, AND AUTONOMOUS FUNCTION TO BOOST GROWTH

- 6.3 CYLINDER-BASED

- 6.3.1 SPECIALIZED SYSTEM ARCHITECTURE PROVIDING SUPPLY CHAIN AUTONOMY TO DRIVE MARKET

7 INDUSTRIAL NITROGEN GENERATOR MARKET, BY SIZE

- 7.1 INTRODUCTION

- 7.2 STATIONARY INDUSTRIAL NITROGEN GENERATOR

- 7.2.1 DEMAND FOR COST-EFFECTIVE SOLUTION FOR PRODUCTION OF LARGE NITROGEN VOLUMES TO BOOST GROWTH

- 7.3 PORTABLE INDUSTRIAL NITROGEN GENERATOR

- 7.3.1 NEED FOR NITROGEN IN TEMPORARY, REMOTE, OR EMERGENCY SITUATIONS TO DRIVE GROWTH

- 7.3.2 CONTAINERIZED SYSTEMS

- 7.3.3 TRAILER-MOUNTED SYSTEMS

- 7.3.4 MOBILE PUMPING SERVICES

8 INDUSTRIAL NITROGEN GENERATOR MARKET, BY TECHNOLOGY TYPE

- 8.1 INTRODUCTION

- 8.2 PRESSURE SWING ADSORPTION (PSA)

- 8.2.1 DEMAND FOR HIGH TO ULTRA HIGH PURITY TO DRIVE MARKET

- 8.3 MEMBRANE-BASED

- 8.3.1 SIMPLE DESIGN AND COST-EFFECTIVENESS TO FUEL MARKET

- 8.4 CRYOGENIC-BASED

- 8.4.1 RISING DEMAND FOR ADVANCED SEMICONDUCTOR MANUFACTURING PROCESSES TO BOOST MARKET

9 INDUSTRIAL NITROGEN GENERATOR MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 FOOD & BEVERAGE

- 9.2.1 DEMAND FOR PRODUCTION, HANDLING, AND PACKING PRODUCTS TO DRIVE MARKET

- 9.3 MEDICAL & PHARMACEUTICAL

- 9.3.1 PROTECTION OF SENSITIVE, EXPENSIVE ACTIVE PHARMACEUTICAL INGREDIENTS, AND FINISHED DRUGS FROM DEGRADATION TO BOOST GROWTH

- 9.4 TRANSPORTATION

- 9.4.1 IMPROVED SAFETY, FUEL EFFICIENCY, AND TIRE LIFE TO FUEL MARKET

- 9.5 ELECTRICAL & ELECTRONICS

- 9.5.1 RISING DEMAND FOR CLEAN, STRONG, AND RELIABLE SOLDER JOINTS TO PROPEL GROWTH

- 9.6 CHEMICAL & PETROCHEMICAL

- 9.6.1 CREATION OF INERT ATMOSPHERES IN STORAGE TANKS, REACTORS, AND PIPELINES TO SUPPORT GROWTH

- 9.7 MANUFACTURING

- 9.7.1 DEMAND FOR PURGING, CARBONIZING, SHIELDING, AND COOLING APPLICATIONS TO BOOST MARKET

- 9.8 PACKAGING

- 9.8.1 RISING DEMAND FOR BOTTLING & CANNING, INERTING, AND BLANKETING APPLICATIONS TO FUEL GROWTH

- 9.9 OTHER END-USE INDUSTRIES

10 INDUSTRIAL NITROGEN GENERATOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Changing lifestyles, growing demand for convenience foods, and recovering industrial activities to boost market

- 10.2.2 CANADA

- 10.2.2.1 Massive investments in battery manufacturing and clean hydrogen production to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Surge in foreign direct investments and industrial real estate to drive market

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Robust industrial base and leadership in high-precision manufacturing to fuel market

- 10.3.2 FRANCE

- 10.3.2.1 Growing food & beverage, electric vehicle, and pharmaceutical industries to propel market

- 10.3.3 UK

- 10.3.3.1 Industrial strategy focused on life sciences sector to drive market

- 10.3.4 ITALY

- 10.3.4.1 Pharmaceutical industry to drive demand

- 10.3.5 SPAIN

- 10.3.5.1 Electrification and renewable energy sector to boost market

- 10.3.6 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 Government policies and development of EV industry to drive market

- 10.4.2 JAPAN

- 10.4.2.1 Revitalization of semiconductor industry to boost market

- 10.4.3 INDIA

- 10.4.3.1 Growing food & beverage, pharmaceutical, and electronics industries to propel market

- 10.4.4 SOUTH KOREA

- 10.4.4.1 Massive investments in semiconductor industry to fuel market

- 10.4.5 REST OF ASIA PACIFIC

- 10.4.1 CHINA

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Vision 2030 and NEOM megaproject to support market growth

- 10.5.1.2 UAE

- 10.5.1.2.1 Government initiatives to drive market

- 10.5.1.3 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Policy supporting healthcare segment to propel market

- 10.6.2 ARGENTINA

- 10.6.2.1 Demand for downstream shale production to fuel market

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES, 2023-2025

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS, 2024

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Size footprint

- 11.7.5.4 Design footprint

- 11.7.5.5 Technology type footprint

- 11.7.5.6 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 PARKER HANNIFIN CORP

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 MnM view

- 12.1.1.3.1 Right to win

- 12.1.1.3.2 Strategic choices

- 12.1.1.3.3 Weaknesses and competitive threats

- 12.1.2 AIR PRODUCTS AND CHEMICALS, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 ATLAS COPCO GROUP

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 INGERSOLL RAND

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 AIR LIQUIDE

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 LINDE PLC

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Expansions

- 12.1.6.4 MnM view

- 12.1.7 HITACHI INDUSTRIAL EQUIPMENT SYSTEMS CO., LTD.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.8 INMATEC

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.9 NOVAIR

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.10 OXYMAT

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.1 PARKER HANNIFIN CORP

- 12.2 OTHER PLAYERS

- 12.2.1 AIRPACK

- 12.2.2 CLAIND

- 12.2.3 COMPRESSED GAS TECHNOLOGIES, INC.

- 12.2.4 ERRE DUE S.P.A.

- 12.2.5 FOXOLUTION

- 12.2.6 GENERON

- 12.2.7 GAZTRON

- 12.2.8 ISOLCELL SPA.

- 12.2.9 NOBLEGEN

- 12.2.10 OXYWISE S.R.O.

- 12.2.11 OMEGA AIR

- 12.2.12 OXAIR

- 12.2.13 ON SITE GAS

- 12.2.14 PEAKGAS

- 12.2.15 WERTHER INTERNATIONAL

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS