|

시장보고서

상품코드

1808966

폴리올 시장 : 유형별, 용도별, 최종 이용 산업별, 지역별 세계 예측(-2030년)Polyols Market by Type (Polyether Polyols, Polyester Polyols), Application (Flexible Polyurethane Foam, Rigid Polyurethane Foam, CASE), End-use Industry (Building & Construction, Furnishing, Automotive, Electronics), and Region - Global Forecast to 2030 |

||||||

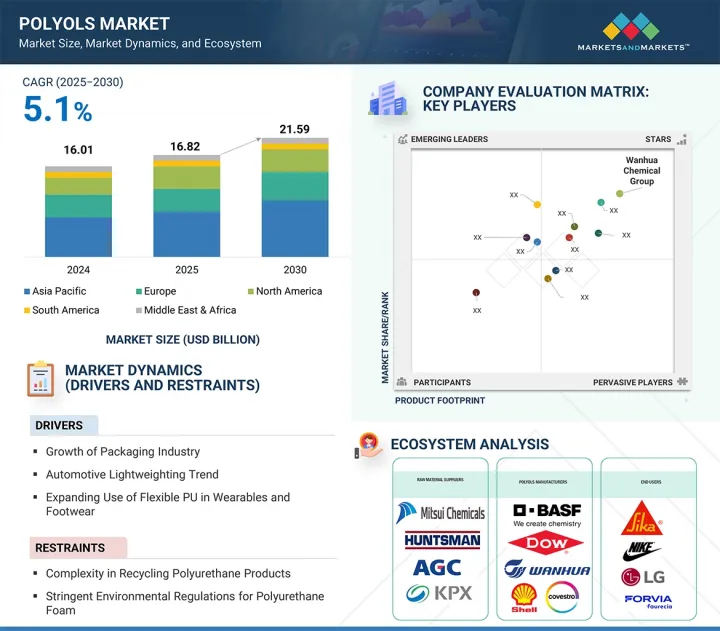

세계의 폴리올 시장 규모는 2024년 160억 1,000만 달러로 평가되었고, 2030년까지 215억 9,000만 달러에 이를 것으로 예상되며, 예측 기간에 CAGR는 5.1%를 나타낼 것으로 전망됩니다.

폴리올 수요의 성장 촉진요인은 폴리우레탄 기반 제품의 생산에 널리 사용되고 있으며, 폴리올은 많은 산업에서 필수적인 재료가 되고 있습니다. 폴리올은 에너지 효율적인 건물을 지원하는 단단한 폼 단열재를 생산하기 위해 건설에 사용됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러, 킬로톤 |

| 부문 | 유형, 용도, 최종 이용 산업, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 남미 |

자동차 부문이나 가구 부문에서는 폴리올로 만들어진 연질 폴리우레탄 폼이 제품을 경량으로 유지하면서 쾌적성과 내구성을 높이고 있습니다. 또한 완충재 및 보호재의 생산에 사용되기 때문에 포장 산업의 성장도 폴리올 수요를 밀어 올리고 있습니다. 게다가 지속가능하고 고성능 재료에 대한 관심 증가는 바이오 폴리올의 개발을 뒷받침하고 있습니다. 전반적으로 폴리올의 다용도는 제품 성능을 향상시키고 환경에 미치는 영향을 줄이고 기존 시장과 신흥 시장 모두에서 수요를 증가시킵니다.

유형별로 폴리에테르 폴리올 부문은 예측 기간에 가장 높은 CAGR을 나타낼 전망입니다.

유형별로는 폭넓은 용도로 사용됨에 따라 폴리에테르폴리올이 예측 기간에 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 폴리에테르 폴리올은 낮은 점도, 이소시아네이트와의 빠른 반응, 다양한 첨가제와의 우수한 상용성으로 알려져 있습니다. 이러한 특성 때문에 폴리에테르 폴리올은 일반적으로 연질 폼과 경질 폼에 사용됩니다. 이러한 양식은 자동차 시트, 침구, 가구, 단열재, 포장 시장 등에서 사용되며, 모두 선진국 시장과 신흥국 시장 모두에서 수요가 증가하고 있습니다.

이 부문의 강력한 성장은 특히 건설 시장과 자동차 시장에서 에너지 효율과 경량 재료에 대한 관심이 높아짐에 따라 더욱 촉진되고 있습니다. 폴리에테르 폴리올은 폴리에스테르 폴리올보다 가수분해 안정성이 높고 가공상의 이점이 있습니다. 또한 폴리에테르폴리올은 바이오 선택의 등장으로 폴리에스테르 폴리올을 뛰어넘는 시장 점유율을 획득하여 새로운 성장 기회를 창출할 것으로 예측됩니다.

폴리에테르 폴리올은 현재 안정적인 생산성, 우수한 성능, 다양한 배합 옵션을 통해 수량과 금액 모두 우위를 차지하고 있습니다. 산업계가 성능, 비용 효율성, 환경 컴플라이언스를 선호하는 경향이 강해지고 있는 가운데, 폴리에테르 폴리올 부문은 예측 기간 말까지 최전선에 지속될 전망입니다.

최종 이용 산업별로는 건축 및 건설 부문이 예측 기간에 가장 높은 CAGR을 나타냅니다.

에너지 효율이 높은 재료와 지속 가능한 건축 솔루션에 대한 수요가 급속히 높아짐에 따라 최종 이용 산업별로는 건축 및 건설 부문이 예측 기간을 통해 가장 높은 CAGR을 나타낼 것으로 예상됩니다. 폴리올은 경질 폴리우레탄 폼의 주요 재료 원료이며 벽 패널, 지붕, 바닥 단열재, 파이프 단열재 등의 단열 용도에 널리 사용됩니다. 또한 급속한 도시화, 인프라 개발, 에너지 절약을 위한 규제 요건으로 인해 특히 아시아태평양, 중동 등 신흥 경제 지역에서는 고성능 단열재에 대한 수요가 직접 및 간접적으로 증가하고 있습니다. 폴리올로 만들어진 폴리우레탄 단열재는 내열성, 방습성, 안정성을 포함한 이러한 모든 성능을 갖추고 있습니다. 또한 그린 빌딩 인증과 환경 기준에 대한 의식이 폴리 우레탄 건축자재의 지속적인 채용에 박차를 가하고 있습니다. 건설 관행이 긴 수명과 환경 성능을 중시하도록 진화하는 중, 폴리올은 이러한 최신 요건을 충족하는 신재료의 개발에 필수적입니다.

규제 당국의 지원, 건설 활동의 활성화, 지속 가능한 인프라 개발에 대한 주목의 고조가 결합되어 폴리올 시장의 건축 및 건설 부문의 성장은 예측 기간을 통해 계속 촉진될 전망입니다.

이 보고서는 세계의 폴리올 시장에 대한 조사 분석을 통해 주요 추진 요인과 억제요인, 경쟁 구도, 미래 동향 등에 대한 정보를 제공합니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요한 지견

- 폴리올 시장 기업에게 매력적인 기회

- 폴리올 시장 : 유형별

- 폴리올 시장 : 용도별

- 폴리올 시장 : 최종 이용 산업별

- 아시아태평양의 폴리올 시장 : 유형별, 국가별

- 폴리올 시장 : 주요 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

제6장 산업 동향

- 고객사업에 영향을 주는 동향/혼란

- 가격 설정 분석

- 주요 기업의 평균 판매 가격 동향 : 유형별(2024년)

- 평균 판매 가격 동향 : 지역별(2021-2024년)

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 폴리올 시장에 대한 생성형 AI의 영향

- 특허 분석

- 서론

- 접근

- 주요 출원자

- 무역 분석

- 수입 시나리오(HS 코드 390950)

- 수출 시나리오(HS 코드 390950)

- 주요 컨퍼런스 및 이벤트(2025-2026년)

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 폴리올에 관한 규제

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- COVESTRO, CO2 기반 폴리올을 사용한 해외 산업용 지속 가능한 주조 엘라스토머 솔루션 개발

- HUNTSMAN, 테롤 폴리에스테르 폴리올을 사용하여 플라스틱 폐기물을 에너지 절약 단열재로 변환

- BASF, 저배출 가스 LUPRANOL 폴리에테르 폴리올로 차내 배출을 삭감

- 거시경제 전망

- 서론

- GDP의 동향과 예측

- 세계의 건설 동향

- 자동차 생산 사이클

- 투자 및 자금조달 시나리오

- 폴리올 시장에 대한 미국 관세의 영향(2025년)

- 서론

- 주요 관세율

- 가격의 영향 분석

- 다양한 지역에 중요한 영향

- 최종 이용 산업에 미치는 영향

제7장 폴리올 시장 : 유형별

- 서론

- 폴리에테르 폴리올

- 폴리에스터 폴리올

제8장 폴리올 시장 : 용도별

- 서론

- 연질 폴리우레탄 폼

- 경질 폴리우레탄 폼

- 코팅, 접착제, 실란트 및 엘라스토머(케이스)

제9장 폴리올 시장 : 최종 이용 산업별

- 서론

- 건축 및 건설

- 자동차

- 가구

- 포장

- 전자

- 기타 최종 이용 산업

제10장 폴리올 시장 : 지역별

- 서론

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 인도네시아

- 기타 아시아태평양

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 러시아

- 튀르키예

- 기타 유럽

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타 중동 및 아프리카

- 남미

- 브라질

- 아르헨티나

- 기타 남미

제11장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석

- 기업 평가 및 재무 지표

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업의 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 기업

- DOW

- COVESTRO AG

- BASF SE

- HUNTSMAN INTERNATIONAL LLC

- SHELL

- STEPAN COMPANY

- WANHUA CHEMICAL GROUP

- REPSOL SA

- PCC SE

- LANXESS

- 기타 기업

- ZIBO DEXIN LIANBANG CHEMICAL INDUSTRY CO., LTD.

- SHANDONG LONGHUA NEW MATERIAL CO., LTD.

- ZHEJIANG HUAFON NEW MATERIALS CORP., LTD.

- SHAKUN INDUSTRIES

- INTERPUR CHEMICALS

- MANALI PETROCHEMICALS LIMITED

- POLYOLS & POLYMERS PVT LTD.

- KURARAY CO., LTD.

- SUMITOMO BAKELITE HIGH PERFORMANCE PLASTICS(SBHPP)

- ERCA ADVANCED POLYMER SOLUTIONS

- SINOCHEM HOLDINGS CORPORATION LTD.

- DAICEL CORPORATION

- EMERY OLEOCHEMICALS

- SOLVAY

- PERSTORP

- ARAMCO

- TOSOH CORPORATION

- ARKEMA

- PLUSKIM

- PURINOVA SP. Z OO

- PTT GLOBAL CHEMICAL PUBLIC COMPANY LIMITED

제13장 인접 시장과 관련 시장

- 서론

- 제한 사항

제14장 부록

KTH 25.09.17The market for polyols was valued at USD 16.01 billion in 2024 and is projected to reach USD 21.59 billion by 2030, growing at a CAGR of 5.1% during the forecast period. Demand for polyols is driven by their widespread use in producing polyurethane-based products, which are essential materials across many industries. Polyols are utilized in construction to create rigid foam insulation that supports energy-efficient buildings.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) Volume (Kiloton) |

| Segments | Type, Application, End-Use Industry, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and South America |

In the automotive and furniture sectors, flexible polyurethane foams made from polyols enhance comfort and durability while keeping products lightweight. The rising packaging industry also boosts demand for polyols, as they are used to produce cushioning and protective materials. Additionally, increasing interest in sustainable and high-performance materials is driving the development of bio-based polyols. Overall, the versatility of polyols improves product performance, reduces environmental impact, and increases demand in both established and emerging markets.

By type, polyether polyols segment to record highest CAGR during forecast period

By type, polyether polyols accounted for the highest CAGR for the forecast period due to their growing use in a wide range of applications. Polyether polyols are known for their low viscosity, quick reaction with isocyanates, and excellent compatibility with various additives. Because of these qualities, they are commonly used in both flexible and rigid foams. These foams are utilized in automotive seats, bedding, furniture, insulation materials, and packaging markets, all of which are experiencing increased demand in both developed and emerging markets.

The strong growth of this segment is further driven by increasing focus on energy efficiency and lightweight materials, especially in construction and automotive markets. Polyether polyols offer better hydrolytic stability and processing advantages over polyester polyols. Polyether polyols are also expected to gain market share over polyester polyols due to the emergence of bio-based options, creating new opportunities for growth.

Polyether polyols now dominate both in volume and value because of their ability to ensure consistent production, impressive performance, and a wide variety of formulation options. As industries increasingly prioritize performance, cost-efficiency, and environmental compliance, the polyether polyols segment is expected to remain at the forefront until the end of the forecast period.

By end-use industry, building & construction segment to exhibit highest CAGR during forecast period

The building and construction segment experienced the highest CAGR throughout the forecast period for end-use industries, driven by the rapidly growing demand for energy-efficient materials and sustainable building solutions. Polyols are a key raw material for rigid polyurethane foams, which are extensively used in insulation applications such as wall panels, roofs, floor insulation, and pipe insulation. Additionally, rapid urbanization, infrastructure development, and regulatory requirements for energy conservation have both directly and indirectly increased demand for high-performance insulation materials, especially in developing economies, notably in the Asia Pacific and Middle East regions. Polyurethane insulation made from polyols offers all these performance features, including thermal resistance, moisture barriers, and stability. Furthermore, awareness of green-building certifications and environmental standards is fueling continued adoption of polyurethane construction materials. As construction practices evolve to emphasize longer service life and environmental performance, polyols are essential in developing new materials that meet these modern requirements.

The combination of regulatory support, rising construction activity, and a growing focus on developing sustainable infrastructure will continue to drive the growth of the Building & Construction segment of the polyols market throughout the forecast period.

Asia Pacific to account for highest CAGR during forecast period

By region, Asia Pacific is projected to experience the highest CAGR over the forecast period due to rapid industrialization and urbanization, along with rapidly growing end-use industries such as construction, automotive, furniture, and packaging. Specifically, countries like China, India, South Korea, and Southeast Asian nations are growing quickly. This has led to increased infrastructure development, higher disposable incomes, and greater customers' demand for durable goods, consequently raising the demand for polyol products.

The construction industry in Asia Pacific has grown substantially due to government investments in residential, commercial, and industrial infrastructure, leading to higher consumption of polyol, a key ingredient in rigid polyurethane foams used for thermal insulation. Furthermore, the expanding automotive and furniture sectors have boosted the demand for flexible polyurethane foams used in seating, bedding, and other interior components.

Asia Pacific also has a strong manufacturing base, a dependable source of inexpensive raw materials, and greater government support for industrial development. Additionally, domestic and international companies are quickly expanding their production capacities through significantly increased R&D spending or enlarging their manufacturing capabilities to meet customer demand. All of these factors will help Asia Pacific become the largest regional market for polyols globally and the fastest growing during the forecast period.

- By Company Type: Tier 1: 45%, Tier 2: 22%, and Tier 3: 33%

- By Designation: C Level: 50%, Director Level: 25%, and Others: 25%

- By Region: North America: 45%, Europe: 20%, Asia Pacific: 20%, Middle East & Africa: 10%, and South America: 5%.

Companies Covered

DOW (US), Covestro AG (Germany), BASF SE (Germany), Huntsman International LLC (US), Shell (UK), Stepan Company (US), Wanhua Chemical Group (China), Repsol S.A. (Spain), PCC SE (Germany), and LANXESS (Germany) are some key players in polyols market.

Research Coverage

The market study examines the polyols market across various segments. It aims to estimate the market size and growth potential in different segments based on type, application, end-use industry, and region. The study also includes an in-depth competitive analysis of key market players, their company profiles, observations related to their products and business offerings, recent developments, and key growth strategies they have adopted to strengthen their position in the polyols market.

Key Benefits of Buying Report

The report is designed to help market leaders and new entrants estimate the revenue figures of the entire polyols market and its segments and sub-segments. It aims to assist stakeholders in understanding the competitive landscape, gaining insights to strengthen their business positions, and developing effective go-to-market strategies. Additionally, the report provides stakeholders with insights into the market's current trends, including key drivers, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Growth of packaging industry and automotive light-weighting trend), restraints (Complexity in recycling polyurethane products and stringent environmental regulations for polyurethane foam), opportunities (Growing adoption of bio-based polyols and high-purity polyols for medical grade applications), and challenges (Eco-friendly alternatives) influencing the growth of the polyols market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the polyols market

- Market Development: Comprehensive information about profitable markets - the report analyses the polyols market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the polyols market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like as DOW (US), Covestro AG (Germany), BASF SE (Germany), Huntsman International LLC (US), Shell (UK), Stepan Company (US), Wanhua Chemical Group (China), Repsol S.A. (Spain), PCC SE (Germany), LANXESS (Germany), and others in the polyols market. The report also helps stakeholders understand the pulse of the polyols market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.2.3 BASE NUMBER CALCULATION

- 2.2.4 SUPPLY-SIDE ANALYSIS

- 2.3 GROWTH FORECAST

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 FACTOR ANALYSIS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN POLYOLS MARKET

- 4.2 POLYOLS MARKET, BY TYPE

- 4.3 POLYOLS MARKET, BY APPLICATION

- 4.4 POLYOLS MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC POLYOLS MARKET, BY TYPE AND COUNTRY

- 4.6 POLYOLS MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expanding packaging industry

- 5.2.1.2 Increasing automobile lightweighting trend

- 5.2.1.3 Rising use of flexible PU in wearables and footwear

- 5.2.2 RESTRAINTS

- 5.2.2.1 Complexity in recycling polyurethane products

- 5.2.2.2 Stringent environmental regulations associated with polyurethane foam

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of bio-based polyols

- 5.2.3.2 Adoption of high-purity polyols for medical-grade applications

- 5.2.4 CHALLENGES

- 5.2.4.1 Shift toward eco-friendly alternatives

- 5.2.4.2 Cross-border compliance complexity related to CASE polyols

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.2 PRICING ANALYSIS

- 6.2.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE, 2024

- 6.2.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 6.3 VALUE CHAIN ANALYSIS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Poly-esterification

- 6.5.1.2 Ring-opening polymerization (ROP)

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 Blowing agent technology

- 6.5.2.2 Recycling and recovery technology

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 CO2-based polyols

- 6.5.3.2 Smart foams and composites

- 6.5.1 KEY TECHNOLOGIES

- 6.6 IMPACT OF GEN AI ON POLYOLS MARKET

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.7.2 APPROACH

- 6.7.3 TOP APPLICANTS

- 6.8 TRADE ANALYSIS

- 6.8.1 IMPORT SCENARIO (HS CODE 390950)

- 6.8.2 EXPORT SCENARIO (HS CODE 390950)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.10.2 REGULATIONS RELATED TO POLYOLS

- 6.11 PORTER'S FIVE FORCES ANALYSIS

- 6.11.1 THREAT OF NEW ENTRANTS

- 6.11.2 THREAT OF SUBSTITUTES

- 6.11.3 BARGAINING POWER OF SUPPLIERS

- 6.11.4 BARGAINING POWER OF BUYERS

- 6.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.12 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.12.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.12.2 BUYING CRITERIA

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 COVESTRO DEVELOPS SUSTAINABLE CAST ELASTOMER SOLUTION FOR OFFSHORE INDUSTRY USING CO2-BASED POLYOLS

- 6.13.2 HUNTSMAN TRANSFORMS PLASTIC WASTE INTO ENERGY-SAVING INSULATION THROUGH TEROL POLYESTER POLYOLS

- 6.13.3 BASF REDUCES INTERIOR CAR EMISSIONS WITH LOW-EMISSION LUPRANOL POLYETHER POLYOLS

- 6.14 MACROECONOMIC OUTLOOK

- 6.14.1 INTRODUCTION

- 6.14.2 GDP TRENDS AND FORECASTS

- 6.14.3 GLOBAL CONSTRUCTION TRENDS

- 6.14.4 AUTOMOBILE PRODUCTION CYCLES

- 6.15 INVESTMENT AND FUNDING SCENARIO

- 6.16 IMPACT OF 2025 US TARIFF ON POLYOLS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 KEY IMPACT ON VARIOUS REGIONS

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 END-USE INDUSTRY IMPACT

7 POLYOLS MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 POLYETHER POLYOLS

- 7.2.1 HIGH REACTIVITY, VERSATILE MOLECULAR DESIGN, AND COMPATIBILITY WITH VARIOUS ISOCYANATES TO DRIVE DEMAND

- 7.3 POLYESTER POLYOLS

- 7.3.1 USE TO ENHANCE POLYURETHANE STRENGTH IN COATINGS, ELASTOMERS, AND FOAMS TO DRIVE MARKET

8 POLYOLS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 FLEXIBLE POLYURETHANE FOAM

- 8.2.1 INCREASED USE IN CUSHIONING AND COMFORT APPLICATIONS TO DRIVE MARKET

- 8.3 RIGID POLYURETHANE FOAMS

- 8.3.1 USE IN HIGH-PERFORMANCE INSULATION SYSTEMS TO PROPEL MARKET

- 8.4 COATINGS, ADHESIVES, SEALANTS, AND ELASTOMERS (CASE)

- 8.4.1 ABILITY TO OFFER HIGH MECHANICAL PERFORMANCE, CHEMICAL RESISTANCE, AND ENVIRONMENTAL DURABILITY TO DRIVE MARKET

9 POLYOLS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 BUILDING & CONSTRUCTION

- 9.2.1 USE TO POWER HIGH-PERFORMANCE INSULATION SYSTEMS IN MODERN BUILDING AND CONSTRUCTION PROJECTS TO PROPEL MARKET

- 9.3 AUTOMOTIVE

- 9.3.1 ABILITY TO SUPPORT LIGHTWEIGHT, DURABLE, AND LOW-EMISSION SOLUTIONS IN AUTOMOBILE APPLICATIONS TO DRIVE DEMAND

- 9.4 FURNISHING

- 9.4.1 ENHANCEMENT OF COMFORT, DURABILITY, AND SUSTAINABILITY IN MODERN FURNISHING APPLICATIONS TO FUEL MARKET GROWTH

- 9.5 PACKAGING

- 9.5.1 ABILITY TO OFFER HIGH-PERFORMANCE, INSULATED, AND SUSTAINABLE SOLUTIONS IN ADVANCED PACKAGING APPLICATIONS TO DRIVE MARKET

- 9.6 ELECTRONICS

- 9.6.1 ADOPTION TO DELIVER ESSENTIAL PROTECTION AND INSULATION IN ADVANCED ELECTRONIC COMPONENTS TO BOOST MARKET

- 9.7 OTHER END-USE INDUSTRIES

10 POLYOLS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 ASIA PACIFIC

- 10.2.1 CHINA

- 10.2.1.1 New Energy Vehicle (NEV) growth, rapid urbanization, and expanding electronics industry to propel demand

- 10.2.2 INDIA

- 10.2.2.1 Rising infrastructure development investments, EV adoption, and booming furniture industry to drive demand

- 10.2.3 JAPAN

- 10.2.3.1 Growing automotive and furniture industries to fuel demand

- 10.2.4 SOUTH KOREA

- 10.2.4.1 Expanding EV industry and housing development to propel demand

- 10.2.5 THAILAND

- 10.2.5.1 Booming construction, automotive, and electronics industries to drive market

- 10.2.6 INDONESIA

- 10.2.6.1 Smart city development and industrial expansion to drive demand

- 10.2.7 REST OF ASIA PACIFIC

- 10.2.1 CHINA

- 10.3 EUROPE

- 10.3.1 GERMANY

- 10.3.1.1 Booming automotive, construction, and electronics industries to fuel demand

- 10.3.2 UK

- 10.3.2.1 Robust infrastructure development and advancements in automotive and electronics industries to drive demand

- 10.3.3 FRANCE

- 10.3.3.1 Rising urbanization and industrial resurgence to drive demand

- 10.3.4 ITALY

- 10.3.4.1 Infrastructure upgrades, industrial revival, and export growth to propel demand

- 10.3.5 RUSSIA

- 10.3.5.1 Accelerating housing targets and automotive sector rebound to fuel demand

- 10.3.6 TURKEY

- 10.3.6.1 Surging home sales, vehicle production, and furniture exports to fuel demand

- 10.3.7 REST OF EUROPE

- 10.3.1 GERMANY

- 10.4 NORTH AMERICA

- 10.4.1 US

- 10.4.1.1 Surging construction activities, EV adoption, and furniture demand to drive market

- 10.4.2 CANADA

- 10.4.2.1 Booming construction industry and EV investments to fuel demand

- 10.4.3 MEXICO

- 10.4.3.1 Increasing automobile production and electronics trade to drive demand

- 10.4.1 US

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Rising infrastructure development and automotive market to propel demand

- 10.5.1.2 UAE

- 10.5.1.2.1 Expanding real estate sector and EV infrastructure growth to drive demand

- 10.5.1.3 Rest of GCC Countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Expanding real estate sector and increasing automobile production to fuel demand

- 10.5.3 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Surging construction and EV manufacturing investments to drive demand

- 10.6.2 ARGENTINA

- 10.6.2.1 Residential expansion and EV adoption accelerating material needs to drive demand

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Application footprint

- 11.7.5.5 End-use industry footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DOW

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Expansions

- 12.1.1.3.3 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 COVESTRO AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 BASF SE

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Deals

- 12.1.3.3.3 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths/Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses/Competitive threats

- 12.1.4 HUNTSMAN INTERNATIONAL LLC

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths/Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses/Competitive threats

- 12.1.5 SHELL

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 STEPAN COMPANY

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.6.4 MnM view

- 12.1.7 WANHUA CHEMICAL GROUP

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Product launches

- 12.1.7.3.2 Deals

- 12.1.7.3.3 Expansions

- 12.1.7.4 MnM view

- 12.1.8 REPSOL S.A.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Product launches

- 12.1.8.3.2 Deals

- 12.1.8.3.3 Expansions

- 12.1.8.4 MnM view

- 12.1.9 PCC SE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Product launches

- 12.1.9.3.2 Deals

- 12.1.9.3.3 Expansions

- 12.1.9.4 MnM view

- 12.1.10 LANXESS

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Expansions

- 12.1.10.3.3 Others

- 12.1.10.4 MnM view

- 12.1.1 DOW

- 12.2 OTHER PLAYERS

- 12.2.1 ZIBO DEXIN LIANBANG CHEMICAL INDUSTRY CO., LTD.

- 12.2.2 SHANDONG LONGHUA NEW MATERIAL CO., LTD.

- 12.2.3 ZHEJIANG HUAFON NEW MATERIALS CORP., LTD.

- 12.2.4 SHAKUN INDUSTRIES

- 12.2.5 INTERPUR CHEMICALS

- 12.2.6 MANALI PETROCHEMICALS LIMITED

- 12.2.7 POLYOLS & POLYMERS PVT LTD.

- 12.2.8 KURARAY CO., LTD.

- 12.2.9 SUMITOMO BAKELITE HIGH PERFORMANCE PLASTICS (SBHPP)

- 12.2.10 ERCA ADVANCED POLYMER SOLUTIONS

- 12.2.11 SINOCHEM HOLDINGS CORPORATION LTD.

- 12.2.12 DAICEL CORPORATION

- 12.2.13 EMERY OLEOCHEMICALS

- 12.2.14 SOLVAY

- 12.2.15 PERSTORP

- 12.2.16 ARAMCO

- 12.2.17 TOSOH CORPORATION

- 12.2.18 ARKEMA

- 12.2.19 PLUSKIM

- 12.2.20 PURINOVA SP. Z O.O.

- 12.2.21 PTT GLOBAL CHEMICAL PUBLIC COMPANY LIMITED

13 ADJACENT AND RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.2.1 POLYURETHANE FOAM MARKET

- 13.2.1.1 Market definition

- 13.2.1.2 Polyurethane foam market, by type

- 13.2.1.3 Polyurethane foam market, by end-use industry

- 13.2.1.4 Polyurethane foam market, by region

- 13.2.1 POLYURETHANE FOAM MARKET

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS