|

시장보고서

상품코드

1811731

AI 감지기 시장 : 제공 제품별, 감지 모달리티별, 용도별, 최종 사용자별, 지역별 예측(-2030년)AI Detector Market by Offering (Platform, API/SDKs), Detection Modality (AI Generated Text, Image, Video, Voice, Code), Application (Academic Integrity, Plagiarism Detection, Deepfake Detection, Content Authenticity Assessment) - Global Forecast to 2030 |

||||||

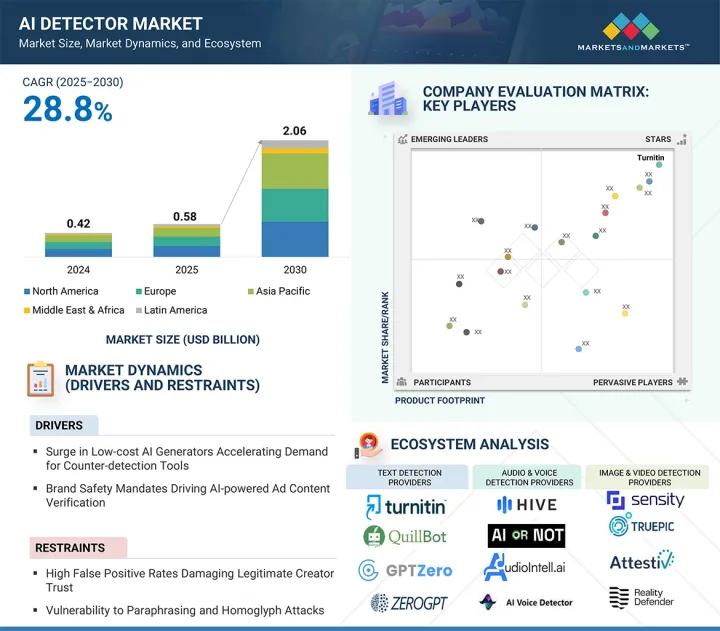

AI 감지기 시장 규모는 예측 기간 동안 28.8%의 연평균 성장률(CAGR)로 성장하고, 2025년 추정 5억 8,000만 달러에서 2030년에 20억 6,000만 달러에 이를 전망입니다.

교육, 미디어, 기업 부문 전반에 걸쳐 생성형 AI가 확산되면서 기관과 기업들이 디지털 산출물의 독창성을 보장하고 신뢰성을 유지하며 무결성을 지키기 위한 공구를 점점 더 필요로 하게 되었으며, 이는 AI 감지기 시장의 주요 촉진 요인입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 달러(100만 달러) |

| 부문 | 제공 제품별, 감지 모달리티별, 용도별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

동시에 딥페이크, 허위 정보, 합성 사기 위험이 고조되면서 커뮤니케이션 신뢰 보호, 브랜드 평판 방어, 강화되는 규정 준수를 뒷받침하는 신뢰할 수 있는 탐지 기술에 대한 긴급한 수요가 발생하고 있습니다. 그러나 이러한 강력한 성장세에도 불구하고, 탐지 업체 간 제한된 벤치마크 표준이라는 형태의 상당한 제약이 시장에 존재합니다. 보편적으로 인정받는 성능 지표와 평가 프레임워크의 부재로 인해 구매자가 솔루션을 비교하고 정확성을 평가하며 장기적 신뢰성을 측정하기 어렵게 되어, 기업 규모의 도입이 지연되고 조달 결정에 불확실성이 발생하고 있습니다.

제공 부문 내에서 플랫폼 하위 부문은 단일 인터페이스에 여러 탐지 기능을 통합하는 엔드투엔드 솔루션에 대한 선호도 증가에 촉진되어 2025년 최대 시장 점유율을 기록할 것으로 예상됩니다. 플랫폼은 기업, 교육 기관, 미디어 조직이 추가 통합 및 맞춤화가 필요한 독립형 API나 SDK에 비해 대규모 탐지 워크플로우를 보다 효율적으로 관리할 수 있도록 합니다. 다수 벤더들은 멀티모달 탐지, 출처 추적, 보고 대시보드 등의 기능으로 플랫폼을 강화하여 규정 준수 준비와 간소화된 거버넌스를 추구하는 조직에게 더 매력적인 선택지로 만들고 있습니다. 학술적 무결성부터 브랜드 안전성, 허위정보 모니터링에 이르기까지 다양한 이용 사례를 뒷받침하는 플랫폼의 역량은 대규모 전개를 위한 핵심 솔루션으로 자리매김하게 합니다. 규제 산업과 대용량 콘텐츠 생태계 전반으로 도입이 확대됨에 따라 플랫폼은 이해관계자에게 더 큰 운영 통제권, 용이한 감사 가능성, 신속한 구현을 제공하며 해당 솔루션 부문 내 리더십을 공고히 하고 있습니다.

학교, 대학, 온라인 학습 플랫폼 전반에 걸친 AI 감지기 통합 확대가 뒷받침한 결과입니다. 학생들의 생성형 AI 활용이 급증함에 따라 교육 기관들은 AI 보조 과제 식별, 평가 공정성 유지, 자격증 신뢰성 보호가 가능한 솔루션을 최우선으로 고려하고 있습니다. 학습 관리 시스템과 디지털 평가 플랫폼은 이러한 문제를 대규모로 해결하기 위해 탐지 기능을 내장하고 있으며, 대학들은 이러한 도구 사용을 의무화하는 학술 정책을 공식화하고 있습니다. 공급업체들도 표절 탐지, 글쓰기 스타일 분석, 실시간 콘텐츠 검증 기능을 제품에 적용하여 기관 요구사항에 직접 부응하고 있습니다. 원격 및 혼합형 학습의 지속적인 확장은 수요를 더욱 증폭시키고 있으며, 학술 환경은 디지털 교육 생태계에 대한 신뢰를 유지하기 위해 신뢰할 수 있는 검증 방법에 점점 더 의존하고 있습니다. 이러한 강력하고 지속적인 수요로 인해 학문적 정직성은 AI 감지기 시장의 주요 용도로서 자리매김하고 있습니다.

AI 감지기 시장은 전 세계적으로 강력한 성장세를 보이고 있으며(2025년)에는 북미가 가장 큰 시장 점유율을 기록할 것으로 예상되는 반면, 아시아태평양 지역은 2030년까지 가장 빠른 성장률을 기록할 것으로 전망됩니다. 북미의 선두는 성숙한 디지털 인프라, AI 거버넌스 프레임워크의 조기 도입, 교육 및 미디어 및 금융 서비스 등 다양한 분야에 기업용 솔루션을 제공하는 기존 벤더들의 존재가 결합되어 뒷받침됩니다. 미국과 캐나다의 대학 및 기업 사용자들은 AI 탐지 공구를 학술, 편집, 규정 준수 워크플로우에 점점 더 통합하며 지속적인 수요 기반을 형성하고 있습니다. 한편 아시아태평양 지역은 중국, 인도, 일본, 한국 등 국가들이 디지털 전환 계획을 가속화하고 AI 사용에 대한 규제 감독을 강화함에 따라 가장 빠르게 성장하는 시장으로 부상하고 있습니다. 이 지역의 에드테크 생태계 부상과 허위정보, 합성 미디어, 선거 보안에 대한 우려 증가가 기관과 기업으로 하여금 확장 가능한 탐지 플랫폼을 찾도록 촉진하고 있습니다. 또한 중국과 일본의 정부 주도 AI 생성 콘텐츠 규제 정책 및 인도 및 동남아시아 전역의 스타트업 급성장은 신규 전개를 위한 유리한 환경을 조성하고 있습니다. 이러한 역학 관계는 북미가 전 세계 시장 매출의 중심지이며 아시아태평양이 향후 확장 가능성이 가장 높은 지역임을 부각시켜, 양 지역 모두 공급업체의 경쟁 전략 수립에 핵심적 역할을 하고 있습니다.

본 보고서에서는 세계의 AI감지기 시장에 대해 조사했으며, 제공 제품별, 감지 모달리티별, 용도별, 최종 사용자별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향

- 소개

- 시장 역학

- AI 감지기 시장의 진화

- 공급망 분석

- 생태계 분석

- 투자 상황과 자금 조달 시나리오

- 사례 연구 분석

- 기술 분석

- 규제 상황

- 특허 분석

- 가격 분석

- 주요 회의 및 이벤트

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 고객의 비즈니스에 영향을 미치는 동향 및 혼란

제6장 AI 감지기 시장(제공 제품별)

- 소개

- 플랫폼

- API/SDK

제7장 AI 감지기 시장(감지 모달리티별)

- 소개

- AI 생성 텍스트

- AI 생성 이미지와 동영상

- AI 생성 오디오와 음성

- AI 생성 코드

- 멀티모달

제8장 AI 감지기 시장(용도별)

- 소개

- 학문적 진실성

- 콘텐츠 신빙성 평가

- 표절 감지

- 딥 페이크와 합성 미디어 감지

- 코드 신뢰성 체크

- 잘못된 정보와 잘못된 정보 감지

- 기타

제9장 AI 감지기 시장(최종사용자별)

- 소개

- BFSI

- 헬스케어 및 생명과학

- 미디어 및 엔터테인먼트

- 교육

- 법률

- 소프트웨어 기술 공급자

- 정부 및 방위

- 소비자

- 기타

제10장 AI 감지기 시장(지역별)

- 소개

- 북미

- 북미 : AI 감지기 시장 성장 촉진요인

- 북미 : 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽 : AI 감지기 시장 성장 촉진요인

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 기타

- 아시아태평양

- 아시아태평양 : AI 감지기 시장 성장 촉진요인

- 아시아태평양 : 거시경제 전망

- 중국

- 인도

- 일본

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : AI 감지기 시장 성장 촉진요인

- 중동 및 아프리카 : 거시경제 전망

- 사우디아라비아

- 아랍에미리트(UAE)

- 남아프리카

- 기타

- 라틴아메리카

- 라틴아메리카 : AI 감지기 시장 성장 촉진요인

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제11장 경쟁 구도

- 개요

- 주요 참가 기업의 전략 및 강점(2022-2025년)

- 시장 점유율 분석(2024년)

- 제품 비교 분석

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 기타 기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 소개

- 주요 진출기업

- TURNITIN

- GRAMMARLY

- HIVE MODERATION

- COPYLEAKS

- QUILLBOT

- REALITY DEFENDER

- ATTESTIV

- GPTZERO

- TRUEPIC

- BRANDWELL AI

- COMPILATIO

- QUETEXT

- SENSITY

- DUCKDUCKGOOSE

- PINDROP

- SCRIBBR

- RESEMBLE AI

- BLACKBIRD.AI

- 기타 기업

- ORIGINALITY.AI

- SIGHTENGINE

- WRITER.COM

- PERFIOS

- AI OR NOT

- AI DETECTOR PRO(AIDP)

- SMODIN

- SURFER

- SCALENUT

- WINSTON AI

- ILLUMINARTY

- CROSSPLAG

- ZEROGPT

- SAPLING.AI

- PANGRAM LABS

- TRACEGPT(PLAGIARISMCHECKER)

- FACIA.AI

제13장 인접 시장과 관련 시장

제14장 부록

HBR 25.09.22The AI detector market is anticipated to grow at a compound annual growth rate (CAGR) of 28.8% during the forecast period, from an estimated USD 0.58 billion in 2025 to USD 2.06 billion by 2030. The proliferation of generative AI across education, media, and enterprise sectors is a key driver of the AI detector market, as institutions and businesses increasingly require tools to ensure originality, maintain credibility, and uphold integrity in digital outputs.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Detection Modality, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, the Middle East & Africa, and Latin America |

At the same time, the escalating risk of deepfakes, disinformation, and synthetic fraud is creating urgent demand for reliable detection technologies to safeguard trust in communication, protect brand reputation, and support compliance with tightening regulations. However, despite this strong momentum, the market faces a significant restraint in the form of limited benchmark standards across detection vendors. The absence of universally accepted performance metrics and evaluation frameworks makes it difficult for buyers to compare solutions, assess accuracy, and measure long-term reliability, slowing down enterprise-scale adoption and creating uncertainty in procurement decisions.

"Platforms segment leads growth in 2025"

Within the offering segment, the platform subsegment is expected to hold the largest market share in 2025, driven by the rising preference for end-to-end solutions that consolidate multiple detection capabilities in a single interface. Platforms allow enterprises, educational institutions, and media organizations to manage large-scale detection workflows more efficiently compared to standalone APIs or SDKs, which often require additional integration and customization. Many vendors are enhancing their platforms with features such as multimodal detection, provenance tracking, and reporting dashboards, making them more attractive for organizations seeking compliance readiness and streamlined governance. The ability of platforms to support varied use cases, from academic integrity to brand safety and misinformation monitoring, positions them as the core offering for large-scale deployments. As adoption expands across regulated industries and high-volume content ecosystems, platforms provide stakeholders with greater operational control, easier auditability, and faster implementation, reinforcing their leadership within the offering segment.

"Academic integrity becomes the anchor of AI detector demand"

Within the application segment, the academic integrity subsegment is projected to hold the largest market share in 2025, supported by the growing integration of AI detection tools across schools, universities, and online learning platforms. With the rapid adoption of generative AI by students, institutions are prioritizing solutions that can identify AI-assisted assignments, maintain fairness in assessments, and protect the credibility of qualifications. Learning management systems and digital assessment platforms are embedding detection capabilities to address these concerns at scale, while universities are formalizing academic policies that mandate the use of such tools. Vendors are also tailoring their offerings with plagiarism detection, writing style analysis, and real-time content verification, which align directly with institutional requirements. The continued expansion of remote and hybrid learning further amplifies demand, as academic environments increasingly depend on reliable verification methods to uphold trust in digital education ecosystems. This strong and recurring demand positions academic integrity as the leading application area in the AI detector market.

"Asia Pacific to witness rapid AI detector growth fueled by innovation and emerging technologies, while North America leads in market size"

The AI detector market is experiencing strong global momentum, with North America expected to hold the largest market share in 2025, while Asia Pacific is projected to register the fastest growth through 2030. North America's lead is supported by a combination of mature digital infrastructure, early adoption of AI governance frameworks, and the presence of established vendors offering enterprise-grade solutions across sectors such as education, media, and financial services. Universities and corporate users across the US and Canada are increasingly embedding AI detection tools into academic, editorial, and compliance workflows, creating a sustained demand base. Meanwhile, Asia Pacific is emerging as the fastest-growing market as countries including China, India, Japan, and South Korea accelerate digital transformation initiatives and tighten regulatory oversight on AI usage. The rise of edtech ecosystems in the region, coupled with growing concerns around disinformation, synthetic media, and election security, is driving institutions and enterprises to seek scalable detection platforms. Additionally, government-backed initiatives in China and Japan to regulate AI-generated content and the rapid expansion of start-ups across India and Southeast Asia are creating fertile ground for new deployments. Together, these dynamics highlight North America as the anchor for global market revenues and Asia Pacific as the most promising region for future expansion, making both regions critical in shaping competitive strategies for vendors.

Breakdown of primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the AI detector market.

- By Company: Tier I - 30%, Tier II - 45%, and Tier III - 25%

- By Designation: C Level - 32%, Director Level - 25%, and others - 43%

- By Region: North America - 40%, Europe - 21%, Asia Pacific - 26%, Middle East & Africa - 8%, and Latin America - 5%

The report includes the study of key players offering AI detector solutions. It profiles major vendors in the AI detector market. The major players in the AI detector market include GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India).

Research coverage

This research report covers the AI detector market, which has been segmented based on Offering (Platforms, API/SDKs). The Detection Modality segment consists of AI-generated Text, AI-generated Image & video, AI-generated Audio & voice, AI-generated Code, and Multimodal. The application segment includes Academic Integrity, Content Authenticity Assessment, Plagiarism Detection, Deepfake and Synthetic Media Detection, Code Authenticity Checking, Misinformation and Disinformation Detection, and Other Applications. The End User segment consists of BFSI, Healthcare & Life Sciences, Media & Entertainment, Education, Legal, Software & Technology Providers, Government & Defense, Consumers, and Other End Users. The regional analysis of the AI detector market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall AI detector market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

Analysis of key drivers (Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption, Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools, Brand Safety Mandates Driving AI-powered Ad Content Verification, and Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment), restraints (High False Positive Rates Damaging Legitimate Creator Trust, and Vulnerability to Paraphrasing and Homoglyph Attacks), opportunities (Expansion into Real-time API Integrations for Chatbots and Collaboration Tools, Radioactive Data Tracing for Enhanced AI Output Attribution, and Integration with Blockchain-based Content Authenticity Ledgers), and challenges (Limited Explainability of Content Flagging Decisions, and Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the AI detector market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the AI detector market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the AI detector market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like GPTZero (US), Originality.AI (Canada), Copyleaks (US), Turnitin (US), Writer.com (US), Smodin (US), Hive Moderation (US), Truepic (US), BrandWell AI (US), QuillBot (US), Scribbr (Netherlands), Grammarly (US), Surfer (Poland), Winston AI (Canada), AI Detector Pro (AIDP) (US), Illuminarty (US), DuckDuckGoose (Netherlands), Crossplag (US), ZeroGPT (US), Sapling.ai (US), TraceGPT (PlagiarismCheck.org) (UK), Pangram Labs (US), Compilatio (France), Scalenut (US), Quetext (US), Sightengine (France), Sensity (Netherlands), Reality Defender (US), Attestiv (US), AI or Not (US), Facia.ai (UK), Resemble AI (US), Pindrop (US), Blackbrid.AI (US), and Perfios (India) among others in the AI detector market. The report also helps stakeholders understand the pulse of the AI detector market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN AI DETECTOR MARKET

- 4.2 AI DETECTOR MARKET: TOP THREE APPLICATIONS

- 4.3 NORTH AMERICA: AI DETECTOR MARKET, BY OFFERING AND DETECTION MODALITY

- 4.4 AI DETECTOR MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Cross-platform Content Dissemination Fueling Multi-format AI Detection Adoption

- 5.2.1.2 Surge in Low-cost AI Generators Accelerating Demand for Counter-detection Tools

- 5.2.1.3 Brand Safety Mandates Driving AI-powered Ad Content Verification

- 5.2.1.4 Advertiser-led Misinformation Control on Social Platforms Boosting Detector Deployment

- 5.2.2 RESTRAINTS

- 5.2.2.1 High False Positive Rates Damaging Legitimate Creator Trust

- 5.2.2.2 Vulnerability to Paraphrasing and Homoglyph Attacks

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion into Real-time API Integrations for Chatbots and Collaboration Tools

- 5.2.3.2 Radioactive Data Tracing for Enhanced AI Output Attribution

- 5.2.3.3 Integration with Blockchain-based Content Authenticity Ledgers

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited Explainability of Content Flagging Decisions

- 5.2.4.2 Competitive Disadvantage of Small Vendors Against Rapidly Advancing Big Tech AI Capabilities

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF AI DETECTOR MARKET

- 5.4 SUPPLY CHAIN ANALYSIS

- 5.5 ECOSYSTEM ANALYSIS

- 5.5.1 TEXT DETECTION PROVIDERS

- 5.5.2 AUDIO AND VOICE DETECTION PROVIDERS

- 5.5.3 CODE DETECTION PROVIDERS

- 5.5.4 IMAGE AND VIDEO DETECTION PROVIDERS

- 5.5.5 MULTIMODAL DETECTION PROVIDERS

- 5.6 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.7 CASE STUDY ANALYSIS

- 5.7.1 IZZ2IZZ'S CONTENT PROTECTION UPGRADED TO ENTERPRISE LEVEL THROUGH COPYLEAKS

- 5.7.2 VERIFIEDHUMAN PARTNERED WITH ORIGINALITY.AI TO EMPOWER EDUCATORS IN AUTHENTICITY VERIFICATION

- 5.7.3 HIGHRISE PARTNERED WITH HIVE MODERATION TO SAFEGUARD AND SCALE ITS VIRTUAL COMMUNITY

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Natural Language Processing (NLP)

- 5.8.1.2 Computer Vision

- 5.8.1.3 Machine Learning

- 5.8.1.4 Neural Text & Image Embeddings

- 5.8.1.5 Perplexity & Entropy Calculation Engines

- 5.8.1.6 Sequence Modeling

- 5.8.1.7 Audio Forensics

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Metadata Extraction & Forensics

- 5.8.2.2 Cloud Computing

- 5.8.2.3 Digital Watermarking

- 5.8.2.4 Data Labeling & Annotation Systems

- 5.8.2.5 Blockchain

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Generative AI

- 5.8.3.2 Synthetic Media Generation

- 5.8.3.3 Plagiarism Detection Engines

- 5.8.3.4 Digital Identity Verification

- 5.8.3.5 Content Moderation Systems

- 5.8.1 KEY TECHNOLOGIES

- 5.9 REGULATORY LANDSCAPE

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATIONS

- 5.9.2.1 North America

- 5.9.2.1.1 TAKE IT DOWN Act (2025)

- 5.9.2.1.2 Personal Information Protection and Electronic Documents Act (PIPEDA)

- 5.9.2.1.3 National Artificial Intelligence Initiative Act (NAIIA) (US)

- 5.9.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.9.2.2 Europe

- 5.9.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.9.2.2.2 General Data Protection Regulation (Europe)

- 5.9.2.2.3 Online Safety Act 2023

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 Provisions on Deep Synthesis Internet Information Services (2023)

- 5.9.2.3.2 Act on the Protection of Personal Information (APPI)

- 5.9.2.3.3 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.9.2.3.4 National AI Strategy (Singapore)

- 5.9.2.3.5 Hiroshima AI Process Comprehensive Policy Framework (Japan)

- 5.9.2.4 Middle East & Africa

- 5.9.2.4.1 Federal Decree-Law No. 45 of 2021 (UAE PDPL)

- 5.9.2.4.2 National Strategy for Artificial Intelligence (UAE)

- 5.9.2.4.3 National Artificial Intelligence Strategy (Qatar)

- 5.9.2.4.4 AI Ethics Principles and Guidelines (Dubai)

- 5.9.2.5 Latin America

- 5.9.2.5.1 Santiago Declaration (Chile)

- 5.9.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.10.1 METHODOLOGY

- 5.10.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.10.3 INNOVATIONS AND PATENT APPLICATIONS

- 5.11 PRICING ANALYSIS

- 5.11.1 AVERAGE SELLING PRICE OF OFFERING, BY KEY PLAYER, 2025

- 5.11.2 AVERAGE SELLING PRICE, BY DETECTION MODALITY, 2025

- 5.12 KEY CONFERENCES AND EVENTS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

6 AI DETECTOR MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: AI DETECTOR MARKET, BY OFFERING

- 6.2 PLATFORMS

- 6.2.1 UNIFIED HUBS FOR END-TO-END AI DETECTION

- 6.3 API/SDKS

- 6.3.1 AGILE DETECTION EMBEDDED INTO DIGITAL ECOSYSTEMS

7 AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: AI DETECTOR MARKET, BY DETECTION MODALITY

- 7.2 AI-GENERATED TEXT

- 7.2.1 SAFEGUARDING WRITTEN INTEGRITY TO PRESERVE TRUST, AUTHENTICITY, AND ACCOUNTABILITY

- 7.3 AI-GENERATED IMAGE & VIDEO

- 7.3.1 PRESERVING VISUAL TRUTH TO COMBAT MANIPULATED IMAGERY AND DEEPFAKES

- 7.4 AI-GENERATED AUDIO & VOICE

- 7.4.1 DEFENDING SONIC AUTHENTICITY AGAINST VOICE CLONING, IMPERSONATION, AND AUDIO-DRIVEN MISINFORMATION

- 7.5 AI-GENERATED CODE

- 7.5.1 SECURING SOFTWARE SUPPLY CHAIN BY DETECTING AI-GENERATED CODE RISKS

- 7.6 MULTIMODAL

- 7.6.1 TRUST ASSURANCE THROUGH MULTIMODAL DETECTION ACROSS TEXT, VISUALS, AUDIO, VIDEO, AND CODE

8 AI DETECTOR MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: AI DETECTOR MARKET, BY APPLICATION

- 8.2 ACADEMIC INTEGRITY

- 8.2.1 SAFEGUARDING ACADEMIC INTEGRITY IN AGE OF AI

- 8.3 CONTENT AUTHENTICITY ASSESSMENT

- 8.3.1 ESTABLISHING CONTENT AUTHENTICITY AS NEW TRUST CURRENCY

- 8.4 PLAGIARISM DETECTION

- 8.4.1 REDEFINING PLAGIARISM DETECTION FOR AI ERA

- 8.5 DEEPFAKE AND SYNTHETIC MEDIA DETECTION

- 8.5.1 COMBATING SYNTHETIC MEDIA WITH PRECISION DEEPFAKE DETECTION

- 8.6 CODE AUTHENTICITY CHECKING

- 8.6.1 ENSURING TRUST IN SOFTWARE THROUGH CODE AUTHENTICITY CHECKING

- 8.7 MISINFORMATION AND DISINFORMATION DETECTION

- 8.7.1 COUNTERING FALSE NARRATIVES WITH MISINFORMATION AND DISINFORMATION DETECTION

- 8.8 OTHER APPLICATIONS

9 AI DETECTOR MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: AI DETECTOR MARKET, BY END USER

- 9.2 BFSI

- 9.2.1 SAFEGUARDING TRUST IN FINANCIAL COMMUNICATION

- 9.3 HEALTHCARE & LIFE SCIENCES

- 9.3.1 PROTECTING PATIENT DATA AND CLINICAL ACCURACY

- 9.4 MEDIA & ENTERTAINMENT

- 9.4.1 MAINTAINING BRAND INTEGRITY IN DIGITAL STORYTELLING

- 9.5 EDUCATION

- 9.5.1 REINFORCING ETHICAL STANDARDS IN ACADEMIA

- 9.6 LEGAL

- 9.6.1 STRENGTHENING EVIDENCE AND DOCUMENTATION IN LEGAL PRACTICE

- 9.7 SOFTWARE & TECHNOLOGY PROVIDERS

- 9.7.1 ENHANCING PRODUCT INTEGRITY FOR SOFTWARE INNOVATORS

- 9.8 GOVERNMENT & DEFENSE

- 9.8.1 SAFEGUARDING PUBLIC TRUST IN GOVERNANCE AND DEFENSE

- 9.9 CONSUMERS

- 9.9.1 EMPOWERING INDIVIDUAL USERS WITH DIGITAL CONFIDENCE

- 9.10 OTHER END USERS

10 AI DETECTOR MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 NORTH AMERICA: AI DETECTOR MARKET DRIVERS

- 10.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 10.2.3 US

- 10.2.4 CANADA

- 10.3 EUROPE

- 10.3.1 EUROPE: AI DETECTOR MARKET DRIVERS

- 10.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 10.3.3 UK

- 10.3.4 GERMANY

- 10.3.5 FRANCE

- 10.3.6 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 ASIA PACIFIC: AI DETECTOR MARKET DRIVERS

- 10.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 10.4.3 CHINA

- 10.4.4 INDIA

- 10.4.5 JAPAN

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 MIDDLE EAST & AFRICA: AI DETECTOR MARKET DRIVERS

- 10.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 10.5.3 SAUDI ARABIA

- 10.5.4 UAE

- 10.5.5 SOUTH AFRICA

- 10.5.6 REST OF MIDDLE EAST & AFRICA

- 10.6 LATIN AMERICA

- 10.6.1 LATIN AMERICA: AI DETECTOR MARKET DRIVERS

- 10.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 10.6.3 BRAZIL

- 10.6.4 MEXICO

- 10.6.5 REST OF LATIN AMERICA

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 11.3 MARKET SHARE ANALYSIS, 2024

- 11.3.1 MARKET RANKING ANALYSIS

- 11.4 PRODUCT COMPARATIVE ANALYSIS

- 11.4.1 PRODUCT COMPARATIVE ANALYSIS, BY AI CONTENT DETECTOR PROVIDER

- 11.4.2 PRODUCT COMPARATIVE ANALYSIS, BY DEEPFAKE DETECTION PROVIDER

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company Footprint

- 11.5.5.2 Regional Footprint

- 11.5.5.3 Detection Modality Footprint

- 11.5.5.4 Application Footprint

- 11.5.5.5 End User Footprint

- 11.6 COMPANY EVALUATION MATRIX: OTHER PLAYERS, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: OTHER PLAYERS, 2024

- 11.6.5.1 Detailed List of Other Players

- 11.6.5.2 Competitive Benchmarking of Other Players

- 11.7 COMPETITIVE SCENARIO

- 11.7.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 11.7.2 DEALS

12 COMPANY PROFILES

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS

- 12.2.1 TURNITIN

- 12.2.1.1 Business overview

- 12.2.1.2 Products/Solutions/Services offered

- 12.2.1.3 Recent developments

- 12.2.1.4 MnM view

- 12.2.1.4.1 Key strengths

- 12.2.1.4.2 Strategic choices

- 12.2.1.4.3 Weaknesses and competitive threats

- 12.2.2 GRAMMARLY

- 12.2.2.1 Business overview

- 12.2.2.2 Products/Solutions/Services offered

- 12.2.2.3 Recent developments

- 12.2.2.4 MnM view

- 12.2.2.4.1 Key strengths

- 12.2.2.4.2 Strategic choices

- 12.2.2.4.3 Weaknesses and competitive threats

- 12.2.3 HIVE MODERATION

- 12.2.3.1 Business overview

- 12.2.3.2 Products/Solutions/Services offered

- 12.2.3.3 Recent developments

- 12.2.3.4 MnM view

- 12.2.3.4.1 Key strengths

- 12.2.3.4.2 Strategic choices

- 12.2.3.4.3 Weaknesses and competitive threats

- 12.2.4 COPYLEAKS

- 12.2.4.1 Business overview

- 12.2.4.2 Products/Solutions/Services offered

- 12.2.4.3 Recent developments

- 12.2.4.4 MnM view

- 12.2.4.4.1 Key strengths

- 12.2.4.4.2 Strategic choices

- 12.2.4.4.3 Weaknesses and competitive threats

- 12.2.5 QUILLBOT

- 12.2.5.1 Business overview

- 12.2.5.2 Products/Solutions/Services offered

- 12.2.5.3 Recent developments

- 12.2.5.4 MnM view

- 12.2.5.4.1 Key strengths

- 12.2.5.4.2 Strategic choices

- 12.2.5.4.3 Weaknesses and competitive threats

- 12.2.6 REALITY DEFENDER

- 12.2.6.1 Business overview

- 12.2.6.2 Products/Solutions/Services offered

- 12.2.6.3 Recent developments

- 12.2.6.3.1 Deals

- 12.2.7 ATTESTIV

- 12.2.7.1 Business overview

- 12.2.7.2 Products/Solutions/Services offered

- 12.2.7.3 Recent developments

- 12.2.8 GPTZERO

- 12.2.8.1 Business overview

- 12.2.8.2 Products/Solutions/Services offered

- 12.2.8.3 Recent developments

- 12.2.9 TRUEPIC

- 12.2.10 BRANDWELL AI

- 12.2.11 COMPILATIO

- 12.2.12 QUETEXT

- 12.2.13 SENSITY

- 12.2.14 DUCKDUCKGOOSE

- 12.2.15 PINDROP

- 12.2.16 SCRIBBR

- 12.2.17 RESEMBLE AI

- 12.2.18 BLACKBIRD.AI

- 12.2.1 TURNITIN

- 12.3 OTHER PLAYERS

- 12.3.1 ORIGINALITY.AI

- 12.3.1.1 Business overview

- 12.3.1.2 Products/Solutions/Services offered

- 12.3.1.3 Recent developments

- 12.3.2 SIGHTENGINE

- 12.3.2.1 Business overview

- 12.3.2.2 Products/Solutions/Services offered

- 12.3.2.3 Recent developments

- 12.3.3 WRITER.COM

- 12.3.4 PERFIOS

- 12.3.5 AI OR NOT

- 12.3.6 AI DETECTOR PRO (AIDP)

- 12.3.7 SMODIN

- 12.3.8 SURFER

- 12.3.9 SCALENUT

- 12.3.10 WINSTON AI

- 12.3.11 ILLUMINARTY

- 12.3.12 CROSSPLAG

- 12.3.13 ZEROGPT

- 12.3.14 SAPLING.AI

- 12.3.15 PANGRAM LABS

- 12.3.16 TRACEGPT (PLAGIARISMCHECKER)

- 12.3.17 FACIA.AI

- 12.3.1 ORIGINALITY.AI

13 ADJACENT AND RELATED MARKETS

- 13.1 INTRODUCTION

- 13.2 DEEPFAKE AI MARKET - GLOBAL FORECAST TO 2031

- 13.2.1 MARKET DEFINITION

- 13.2.2 MARKET OVERVIEW

- 13.2.2.1 Deepfake AI market, by offering

- 13.2.2.2 Deepfake AI market, by technology

- 13.2.2.3 Deepfake AI market, by vertical

- 13.2.2.4 Deepfake AI market, by region

- 13.3 ARTIFICIAL INTELLIGENCE MARKET - GLOBAL FORECAST TO 2032

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.2.1 Artificial intelligence (AI) market, by end user

- 13.3.2.2 Artificial intelligence (AI) market, by region

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS