|

시장보고서

상품코드

1811734

항체 발굴 서비스 시장 : 유형별, 숙주별, 분자별, 최종 사용자별, 지역별 예측(-2030년)Antibody Discovery Services Market by Type (Target Identification, Antibody Engineering (Technology (Hybridoma, Phage Display, Single Cell)), Immunization), Host (Mouse, Rat, Rabbit, Chicken, Camelids), Molecule (Monoclonal) - Global Forecast to 2030 |

||||||

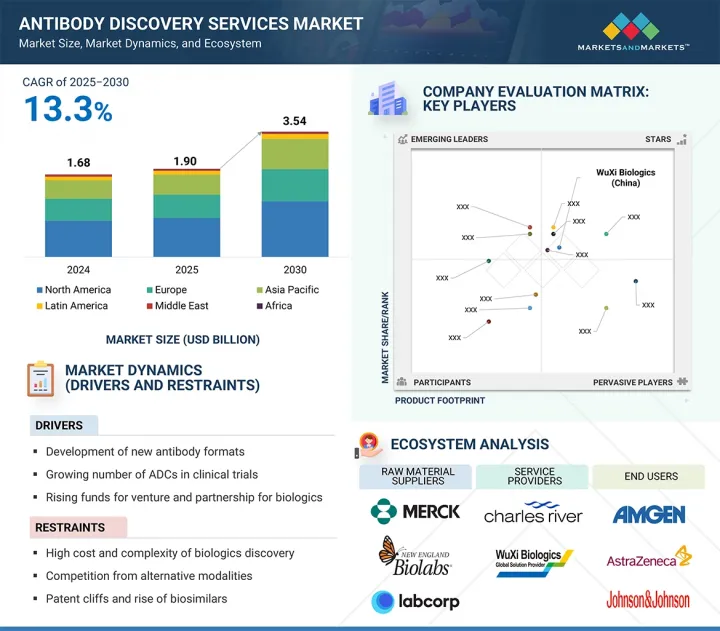

항체 발굴 서비스 시장 규모는 2024년 19억 달러에서 2030년 35억 4,000만 달러에 이를 것으로 예측되며, 예측 기간 중 연평균 성장률(CAGR)은 13.3%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 유형별, 숙주별, 분자별, 최종 사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

아프리카, GCC 국가 항체 발굴 서비스 시장을 견인하는 요인으로는 이중특이성 항체(bsAbs) 및 ADC(항체-약물 접합체)와 같은 첨단 형식의 개발과 함께 증가하는 벤처 자금 및 전략적 파트너십이 있습니다. 또한 AI 통합 및 엔드투엔드 서비스 모델 채택은 워크플로우를 간소화하고 효율성을 높이며 해당 분야의 혁신을 가속화하고 있습니다.

시장은 생쥐 및 쥐, 토끼, 닭, 낙타과 동물 및 기타 숙주로 세분화됩니다. 2024년 항체 발굴 면역 및 숙주 관리 서비스 시장에서 쥐 및 생쥐 부문이 가장 큰 비중으로 기록되었습니다. 이 종들은 인간과의 유전적 유사성, 비용 효율성, 고도로 최적화된 사육 및 실험 프로토콜로 인해 여전히 선호되는 선택지입니다. 이들의 광범위한 사용은 전임상 항체 발굴 노력에서 확립된 면역 워크플로우와 견고한 숙주 관리 인프라를 반영합니다. 또한 쥐 및 생쥐 모델의 보편성은 확장 가능하고 재현성 있는 면역 서비스를 뒷받침하여 검증된 면역학적 방법을 통한 신속한 항체 생성을 용이하게 합니다. 이러한 세분화는 서비스 제공업체가 잘 특성화된 동물 시스템에 맞춰 면역 전략과 숙주 처리 관행을 조정할 수 있게 하여 예측 가능성과 효율성을 높입니다. 종합적으로 이러한 장점들은 항체 발굴 시장 내 면역 및 숙주 관리 서비스 분야에서 쥐 및 생쥐 숙주 부문을 지배적인 부문으로 공고히 합니다.

항체 발굴 서비스 시장은 의약품 및 생명공학 기업, 학술 및 연구 기관, 기타 최종 사용자로 세분화됩니다. 2024년 항체 발굴 서비스 시장에서 제약 및 바이오기술 기업 부문이 가장 큰 비중으로 기록되었으며, 이는 치료용 항체 프로그램에 집중된 연구개발 활동의 규모에 의해 촉진되었습니다. 해당 기업들은 종양학, 면역학, 감염병 및 기타 치료 분야에서 지속적인 신규 항체 후보물질 발굴이 필요한 방대한 파이프라인을 관리합니다. 이를 뒷받침하기 위해 파지 디스플레이, 하이브리도마, 전문 서비스 제공업체의 AI 기반 스크리닝 플랫폼 등 고급 기술에 막대한 투자를 진행합니다. 아웃소싱에 대한 높은 수요는 또한 일정 간소화, 내부 비용 감축, 사내에서 확보할 수 없는 역량 확보의 필요성을 반영합니다. 또한 의약품 및 바이오기술 기업들은 발견 플랫폼 접근성이 확대되는 파트너십 및 협력을 추구하여 표적 식별에서 전임상 평가까지 효율적으로 진행할 수 있도록 합니다. 광범위한 치료 분야 집중, 대규모 투자, 외부 전문성에 대한 의존도가 결합되어 2024년 시장 수요의 주요 기여자로 이 기업들을 자리매김하게 했습니다.

2024년 항체 발굴 서비스 시장에서 가장 큰 점유율을 차지한 것은 북미였습니다. 북미 지역은 2024년 항체 발굴 서비스 시장에서 가장 큰 비중을 기록되었습니다. 이 지역은 항체 발굴에 종사하는 제약 및 바이오기술 기업, 연구 기관, 계약 서비스 제공업체가 집중되어 있어 이러한 위치를 차지했습니다. 정부 기관과 민간 투자자로부터의 광범위한 생물의학 연구 자금 지원은 발견 서비스에 대한 꾸준한 수요를 창출했습니다. 북미는 항체 기반 치료제의 발전을 뒷받침하는 성숙한 규제 체계의 혜택을 받아 발견 단계에서 임상 평가까지 효율적으로 진행할 수 있습니다. 고급 연구 인프라, 숙련된 인력, 확립된 기술 플랫폼의 존재는 항체 발굴 서비스 활용 및 확대되기를 더욱 강화했습니다. 또한 활발한 임상 시험 활동과 산업계-학계 간 강력한 협력 관계가 지속적인 수요 창출에 기여했습니다. 이러한 요인들이 종합적으로 작용하여 2024년 전 세계 항체 발굴 서비스 시장에서 북미 지역을 선도적 위치에 올려놓았습니다.

본 보고서에서는 세계의 항체 발굴 서비스 시장에 대해 조사했으며, 유형별, 숙주별, 분자별, 최종 사용자, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

제6장 업계 동향

- 고객의 비즈니스에 영향을 미치는 동향 및 혼란

- 밸류체인 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 주된 회의 및 이벤트(2025-2026년)

- 사례 연구 분석

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- AI/생성형 AI가 항체 발굴 서비스 시장에 미치는 영향

제7장 항체 발굴 서비스 시장(유형별)

- 소개

- 표적 식별 및 검증

- 항체 공학 및 최적화

- 항원 설계 및 제조

- 면역과 숙주 관리

- 기타

제8장 항체 발굴 서비스 시장(숙주별)

- 소개

- 생쥐, 쥐

- 토끼

- 닭

- 낙타과 동물

- 기타

제9장 항체 발굴 서비스 시장(분자별)

- 소개

- 단일클론항체

- 폴리클로날 항체

- 기타

제10장 항체 발굴 서비스 시장(최종사용자별)

- 소개

- 제약 및 생명공학 기업

- 학술연구기관

- 기타

제11장 항체 발굴 서비스 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 중동의 거시 경제 전망

- GCC 국가

- 기타

- 아프리카

제12장 경쟁 구도

- 소개

- 주요 진입기업의 전략 및 강점

- 수익 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업, 중소기업(2024년)

- 기업평가와 재무지표

- 브랜드, 서비스 비교

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- WUXI BIOLOGICS

- THERMO FISHER SCIENTIFIC INC.

- CHARLES RIVER LABORATORIES

- EVOTEC

- BIOCYTOGEN

- EUROFINS SCIENTIFIC

- SHANGHAI CHEMPARTNER

- AURIGENE PHARMACEUTICAL SERVICES LTD.(DR. REDDY'S LABORATORIES)

- SINO BIOLOGICAL, INC.

- SAMSUNG BIOLOGICS

- GENSCRIPT

- CURIA GLOBAL, INC.

- TWIST BIOSCIENCE

- HARBOUR BIOMED

- ARAGEN LIFE SCIENCES LTD.

- DANAHER CORPORATION

- CREATIVE BIOLABS

- VIVA BIOTECH

- IMMUNOPRECISE ANTIBODIES LTD.

- FUSION ANTIBODIES

- 기타 기업

- ABZENA

- ALLOY THERAPEUTICS, INC.

- INTEGRAL MOLECULAR

- BIODURO

- SYNBIO TECHNOLOGIES

- ABSOLUTE ANTIBODY

- ADIMAB

- ISOGENICA

- ABLEXIS

- FAIRJOURNEY

제14장 부록

HBR 25.09.22The antibody discovery services market is expected to reach 3.54 billion in 2030 from USD 1.90 billion in 2024, at a CAGR of 13.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Type, Technology, Flowrate, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa, and GCC Countries |

Factors propelling the antibody discovery services market include the development of advanced formats such as bispecific antibodies (bsAbs) and ADCs, alongside rising venture funding and strategic partnerships. Moreover, the integration of AI and adoption of end-to-end service models are streamlining workflows, enhancing efficiency, and accelerating innovation in the field.

The mice & rats segment accounted for the largest share of the antibody discovery immunization & host management services market in 2024.

The market is segmented into mice & rats, rabbits, chickens, camelids, and other hosts. In 2024, the mouse & rat segment accounted for the largest share of the antibody discovery immunization & host management services market. These species remain the preferred choice due to their genetic similarity to humans, cost-effectiveness, and highly optimized breeding and experimental protocols. Their widespread use reflects well-established immunization workflows and robust host management infrastructure in preclinical antibody discovery efforts. Furthermore, the prevalence of mouse and rat models supports scalable, reproducible immunization services, facilitating rapid antibody generation through tried-and-tested immunological methods. This segmentation also enables service providers to tailor immunization strategies and host handling practices to well-characterized animal systems, enhancing predictability and efficiency. Collectively, these advantages cement the mouse & rat host segment as the dominant segment in immunization and host management services within the antibody discovery services market.

In 2024, by end user, the pharmaceutical & biotechnology companies segment accounted for the largest share of the market.

The antibody discovery services market is segmented into pharmaceutical & biotechnology companies, academic & research institutes, and other end users. In 2024, the pharmaceutical & biotechnology companies segment accounted for the largest share of the antibody discovery services market, driven by the scale of research and development activities directed toward therapeutic antibody programs. These companies manage extensive pipelines that require continuous discovery of new antibody candidates across oncology, immunology, infectious diseases, and other therapeutic areas. They invest heavily in advanced technologies such as phage display, hybridoma, and AI-based screening platforms provided by specialized service providers to support this. The high demand for outsourcing also reflects the need to streamline timelines, reduce internal costs, and access capabilities unavailable in-house. In addition, pharmaceutical and biotechnology firms pursue partnerships and collaborations that expand access to discovery platforms, enabling them to move efficiently from target identification to preclinical evaluation. The combination of broad therapeutic focus, large-scale investments, and reliance on external expertise established these companies as the leading contributors to market demand in 2024.

In 2024, North America accounted for the largest share of the antibody discovery services market.

North America accounted for the largest share of the antibody discovery services market in 2024. The region accounted for this position due to its concentration of pharmaceutical and biotechnology companies, research institutes, and contract service providers engaged in antibody development. Extensive funding for biomedical research from government agencies and private investors created a steady demand for discovery services. North America also benefits from a mature regulatory framework that supports the advancement of antibody-based therapeutics, enabling efficient progression from discovery to clinical evaluation. The presence of advanced research infrastructure, a skilled workforce, and established technology platforms further strengthened the region's capacity to utilize and expand antibody discovery services. In addition, high clinical trial activity and strong collaborations between industry and academia contributed to sustained demand. Collectively, these factors positioned North America as the leading region in the global antibody discovery services market in 2024.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Tier 1-25%, Tier 2-35%, and Tier 3- 40%

- By Designation: C-level Executives - 55%, Directors- 20%, and Others- 25%

- By Region: North America -45%, Europe - 20%, Asia Pacific -20%, Latin America -10%, the Middle East- 3%, and Africa-2%

Charles River Laboratories (US), Thermo Fisher Scientific Inc. (US), WuXi Biologics (China), Aurigene Pharmaceutical Services Ltd. (India), EVOTEC (Germany), Sino Biological, Inc. (China), Shanghai ChemPartner (China), Biocytogen (China), Samsung Biologics (South Korea), Fusion Antibodies (UK), Twist Bioscience (US), Curia Global, Inc. (US), Danaher Corporation (US), Eurofins Scientific (Luxembourg), GenScript (US), Creative Biolabs (US), Viva Biotech (China), Harbour BioMed (China), ImmunoPrecise Antibodies Ltd. (Canada), Aragen Life Sciences Ltd. (India) are some of the key companies offering Antibody Discovery Services products.

Research Coverage

This research report categorizes the Antibody Discovery Services market by Type [Target Identification & Validation, Antibody Engineering & Optimization (Phage/Yeast Display Technology, Hybridoma Technology, Single-Cell Technologies, Other Technologies), Antigen Design & Production, Immunization & Host Management, Other Services], Immunization & Host Management By Host (Mice & Rats, Rabbits, Chickens, Camelids, Other Hosts), Molecule (Monoclonal Antibodies, Polyclonal Antibodies, Other Molecules), End User (Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Other End Users), and By Region (North America, Europe, Asia Pacific, Latin America, Middle East, and Africa). The scope of the report covers detailed information regarding the major factors, such as drivers, challenges, opportunities, and restraints influencing the growth of the Antibody Discovery Services market. A detailed analysis of the key industry players has provided insights into their business overview, service portfolio, key strategies such as collaborations, partnerships, expansions, agreements, acquisitions, and recent developments associated with the antibody discovery services market. This report covers a competitive analysis of top players and upcoming startups in the Antibody Discovery Services market ecosystem.

The scope of the report covers detailed information regarding the primary factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the Antibody Discovery Services market. A thorough analysis of the key industry players has been conducted to provide insights into their business overview, solutions, and services; key strategies; new product & service launches, acquisitions, and recent developments associated with the Antibody Discovery Services market. This report covers the competitive analysis of upcoming startups in the Antibody Discovery Services market ecosystem.

Key Benefits of Buying the Report

This report provides a detailed picture of the antibody discovery services market. It aims to estimate the size and future growth potential of the market across different segments such as the type, host, molecule, end user, and region. The report also includes an in-depth competitive analysis of the key market players along with their company profiles, recent developments, and key market strategies.

The report provides insights into the following pointers:

Analysis of key drivers (Development of new antibody formats, growing number of ADCs in clinical trials, rising funds for venture and partnership for biologics), restraints (High cost & complexity of biologics discovery, competition from alternative modalities, patent cliffs and rise of biosimilars), opportunities (end-to-end discovery-to-IND service bundles, integration of AI and automation in discovery workflow), Challenges (reagent & raw material supply chain bottlenecks, fragmented data and workflow infrastructure)

- Service Development/Innovation: Detailed insights on newly launched Services, and technological assessment of the antibody discovery services market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the antibody discovery services market across varied regions.

- Market Diversification: Exhaustive information about new, untapped geographies, recent developments, and investments in the antibody discovery services market

Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players such as Charles River Laboratories (US), Thermo Fisher Scientific Inc. (US), WuXi Biologics (China), Aurigene Pharmaceutical Services Ltd. (India), EVOTEC (Germany), among others in the antibody discovery services market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.4.1 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary data sources

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 MARKET ESTIMATION

- 2.2.1.1 Company revenue analysis (bottom-up approach)

- 2.2.1.2 MnM repository analysis & primary interviews

- 2.2.1.3 Insights from primary experts

- 2.2.1.4 Segmental market size estimation by top-down approach

- 2.2.1 MARKET ESTIMATION

- 2.3 MARKET GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS & MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR KEY STAKEHOLDERS

- 3.3 DISRUPTIVE TRENDS SHAPING ANTIBODY DISCOVERY SERVICES MARKET

- 3.4 HIGH-GROWTH SEGMENTS & EMERGING FRONTIERS

- 3.5 GLOBAL MARKET SIZE, GROWTH RATE, AND FORECAST

4 PREMIUM INSIGHTS

- 4.1 ANTIBODY DISCOVERY SERVICES MARKET OVERVIEW

- 4.2 NORTH AMERICA: ANTIBODY DISCOVERY SERVICES MARKET, BY MOLECULE AND COUNTRY (2024)

- 4.3 ANTIBODY DISCOVERY SERVICES MARKET, BY MOLECULE, 2025 VS. 2030

- 4.4 ANTIBODY DISCOVERY SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.5 ANTIBODY DISCOVERY SERVICES MARKET SHARE, BY TYPE

- 4.6 UNMET NEEDS & WHITE SPACES

- 4.7 INTERCONNECTED MARKETS & CROSS-SECTOR OPPORTUNITIES

- 4.8 EMERGING BUSINESS MODELS & ECOSYSTEM SHIFTS

- 4.9 STRATEGIC MOVES BY TIER-1/2/3 PLAYERS

- 4.10 VC/PRIVATE EQUITY INVESTMENT TRENDS

- 4.11 SUSTAINABILITY IMPACT & REGULATORY POLICY INITIATIVES

- 4.11.1 SUSTAINABILITY IMPACT

- 4.11.2 REGULATORY POLICIES & ACCESS INITIATIVES

- 4.12 IP/PATENT LANDSCAPE IN ANTIBODY DISCOVERY SERVICES MARKET

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Development of bispecific antibodies and antibody fragments

- 5.2.1.2 Rising number of antibody-drug conjugates in clinical trials

- 5.2.1.3 Increasing venture and partnership funding for biologics

- 5.2.2 RESTRAINTS

- 5.2.2.1 High costs and complexity of biologics discovery

- 5.2.2.2 Competition from alternative modalities

- 5.2.2.3 Patent cliffs for blockbuster monoclonal antibodies and rise of biosimilars

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 End-to-end discovery-to-IND service bundles/one-stop shop models in antibody discovery

- 5.2.3.2 Integration of AI and automation in discovery workflow

- 5.2.4 CHALLENGES

- 5.2.4.1 Reagents and raw material supply chain bottlenecks

- 5.2.4.2 Fragmented data and disjointed workflow infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 TRENDS/DISRUPTIONS IMPACTING CUSTOMER'S BUSINESS

- 6.2 VALUE CHAIN ANALYSIS

- 6.3 ECOSYSTEM ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 ANTIBODY DISCOVERY SERVICE PROVIDERS

- 6.3.3 END USERS

- 6.3.4 REGULATORY BODIES

- 6.4 INVESTMENT & FUNDING SCENARIO

- 6.4.1 MAJOR INVESTMENTS AND FUNDING

- 6.5 TECHNOLOGY ANALYSIS

- 6.5.1 KEY TECHNOLOGIES

- 6.5.1.1 Phage display platforms

- 6.5.1.2 Hybridoma technology

- 6.5.1.3 Single B-cell screening

- 6.5.2 COMPLEMENTARY TECHNOLOGIES

- 6.5.2.1 AI/ML-based protein structure prediction

- 6.5.2.2 Surface plasmon resonance (SPR)/Bio-layer interferometry (BLI)

- 6.5.2.3 Cryo-electron microscopy (CRYO-EM)

- 6.5.3 ADJACENT TECHNOLOGIES

- 6.5.3.1 CRISPR-based functional genomics

- 6.5.3.2 CHO cell line development

- 6.5.3.3 In-vivo modelling

- 6.5.1 KEY TECHNOLOGIES

- 6.6 PATENT ANALYSIS

- 6.6.1 METHODOLOGY

- 6.6.2 NUMBER OF PATENTS FILED, BY DOCUMENT TYPE, 2014-2024

- 6.6.3 LIST OF KEY PATENTS

- 6.7 KEY CONFERENCES & EVENTS, 2025-2026

- 6.8 CASE STUDY ANALYSIS

- 6.8.1 BISPECIFIC ANTIBODY MANUFACTURABILITY ASSESSMENT AND OPTIMIZATION

- 6.8.2 ACCELERATING ANTIBODY DISCOVERY FOR PANDEMIC PREPAREDNESS

- 6.8.3 USE OF REPAB POLYCLONAL ANTIBODY SEQUENCING PLATFORM TO TO IDENTIFY PROTECTIVE ANTIBODIES FROM HUMAN HOSTS IMMUNE TO MALARIA

- 6.9 REGULATORY ANALYSIS

- 6.9.1 REGULATORY LANDSCAPE

- 6.9.1.1 North America

- 6.9.1.2 Europe

- 6.9.1.3 Asia Pacific

- 6.9.1.4 Rest of the World

- 6.9.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.1 REGULATORY LANDSCAPE

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 BARGAINING POWER OF SUPPLIERS

- 6.10.2 BARGAINING POWER OF BUYERS

- 6.10.3 THREAT OF NEW ENTRANTS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 KEY BUYING CRITERIA

- 6.12 IMPACT OF AI/GEN AI ON ANTIBODY DISCOVERY SERVICES MARKET

- 6.12.1 INTRODUCTION

- 6.12.2 MARKET POTENTIAL OF AI

7 ANTIBODY DISCOVERY SERVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 TARGET IDENTIFICATION & VALIDATION

- 7.2.1 INTEGRATION OF OMICS-DRIVEN INSIGHTS WITH HIGH-THROUGHPUT FUNCTIONAL VALIDATION TO PROPEL MARKET GROWTH

- 7.3 ANTIBODY ENGINEERING & OPTIMIZATION

- 7.3.1 ANTIBODY ENGINEERING & OPTIMIZATION, BY TECHNOLOGY

- 7.3.1.1 Phage display technology

- 7.3.1.1.1 Adoption of AI-enhanced phage display to augment segment growth

- 7.3.1.2 Hybridoma technology

- 7.3.1.2.1 Advancements in automation and single-cell integration to support segment growth

- 7.3.1.3 Single-cell technologies

- 7.3.1.3.1 Use of high-throughput, single-cell platforms to boost segment growth

- 7.3.1.4 Other antibody engineering & optimization technologies

- 7.3.1.1 Phage display technology

- 7.3.1 ANTIBODY ENGINEERING & OPTIMIZATION, BY TECHNOLOGY

- 7.4 ANTIGEN DESIGN & PRODUCTION

- 7.4.1 HIGH-QUALITY ANTIGEN DESIGN AND PRODUCTION TO SPUR SEGMENT GROWTH

- 7.5 IMMUNIZATION & HOST MANAGEMENT

- 7.5.1 RISING ADOPTION OF ADVANCED TRANSGENIC AND HUMANIZED MODELS TO PROPEL SEGMENT GROWTH

- 7.6 OTHER ANTIBODY DISCOVERY SERVICES

8 IMMUNIZATION & HOST MANAGEMENT SERVICES MARKET, BY HOST

- 8.1 INTRODUCTION

- 8.2 MOUSE & RAT

- 8.2.1 GROWING PRECLINICAL RESEARCH DEMAND TO DRIVE GROWTH

- 8.3 RABBIT

- 8.3.1 INCREASED RESEARCH AND DIAGNOSTIC APPLICATIONS TO FAVOR MARKET GROWTH

- 8.4 CHICKEN

- 8.4.1 INCREASING FOCUS OF THERAPEUTIC AND DIAGNOSTIC APPLICATIONS TO DRIVE MARKET

- 8.5 CAMELIDS

- 8.5.1 RISING ADOPTION OF NANOBODIES IN THERAPEUTICS AND DIAGNOSTICS TO BOOST MARKET GROWTH

- 8.6 OTHER HOSTS

9 ANTIBODY DISCOVERY SERVICES MARKET, BY MOLECULE

- 9.1 INTRODUCTION

- 9.2 MONOCLONAL ANTIBODIES

- 9.2.1 GROWING ADOPTION IN TISSUE TYPING FOR ORGAN & BLOOD TRANSPLANTS AND PERSONALIZED MEDICINES TO DRIVE MARKET

- 9.3 POLYCLONAL ANTIBODIES

- 9.3.1 DIVERSE EPITOPE RECOGNITION ABILITY OF POLYCLONAL ANTIBODIES TO SUPPORT SEGMENT GROWTH

- 9.4 OTHER MOLECULES

10 ANTIBODY DISCOVERY SERVICES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL & BIOTECHNOLOGY COMPANIES

- 10.2.1 STRATEGIC COLLABORATIONS AND AI INTEGRATION TO BOLSTER GROWTH

- 10.3 ACADEMIC & RESEARCH INSTITUTES

- 10.3.1 INCREASING COLLABORATIVE RESEARCH AND RISING GRANT FUNDING TO AUGMENT MARKET GROWTH

- 10.4 OTHER END USERS

11 ANTIBODY DISCOVERY SERVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 US to dominate antibody discovery services market during forecast period

- 11.2.3 CANADA

- 11.2.3.1 Innovative biotech community and strategic platform investments to propel market growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Transformative cross-border acquisitions and platform-driven antibody innovation to expedite market growth

- 11.3.3 UK

- 11.3.3.1 Ramped ADC innovation and surging biotech investment to propel market growth

- 11.3.4 FRANCE

- 11.3.4.1 Strategic biomanufacturing investments and AI-enabled innovation to support market expansion

- 11.3.5 ITALY

- 11.3.5.1 Advanced R&D infrastructure and biotech innovation to aid market growth

- 11.3.6 SPAIN

- 11.3.6.1 High biotech investment and innovation in advanced antibody modalities to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Scalable integrated platforms, strategic global certification, and domestic innovation acceleration to augment market growth

- 11.4.3 JAPAN

- 11.4.3.1 Enhanced translational platforms and strategic cross-border R&D partnerships to expedite market growth

- 11.4.4 INDIA

- 11.4.4.1 Advanced biomanufacturing platforms and innovation-led public-private partnerships to strengthen Indian market

- 11.4.5 SOUTH KOREA

- 11.4.5.1 AI platform investments and CDMO-led modality innovation to accelerate market growth

- 11.4.6 AUSTRALIA

- 11.4.6.1 High-throughput single-cell platforms and increased academic-industry collaborations to spur market growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Local biologics infrastructure expansion and collaborative innovation ecosystems to favor market growth

- 11.5.3 MEXICO

- 11.5.3.1 Focus on local emerging startups and industry-academic collaborations to aid antibody discovery services

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 UAE

- 11.6.2.1.1 High biomanufacturing investments and focus on global pharmaceutical partnerships to fuel market growth

- 11.6.2.2 Kingdom of Saudi Arabia

- 11.6.2.2.1 Advanced biologics infrastructure and strategic life science innovation hubs to bolster market growth

- 11.6.2.3 Rest of GCC Countries

- 11.6.2.1 UAE

- 11.6.3 REST OF MIDDLE EAST

- 11.7 AFRICA

- 11.7.1 ADVANCED REGIONAL MANUFACTURING CAPABILITIES AND BIOTECH INNOVATION ECOSYSTEMS TO DRIVE MARKET

- 11.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN ANTIBODY DISCOVERY SERVICES MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Type footprint

- 12.5.5.4 Host footprint

- 12.5.5.5 Molecule footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 List of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 FINANCIAL METRICS

- 12.7.2 COMPANY VALUATION

- 12.8 BRAND/SERVICE COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 SERVICE LAUNCHES

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 WUXI BIOLOGICS

- 13.1.1.1 Business overview

- 13.1.1.2 Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.3.2 Expansions

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 THERMO FISHER SCIENTIFIC INC.

- 13.1.2.1 Business overview

- 13.1.2.2 Services offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 CHARLES RIVER LABORATORIES

- 13.1.3.1 Business overview

- 13.1.3.2 Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 EVOTEC

- 13.1.4.1 Business overview

- 13.1.4.2 Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.4.3.2 Contracts

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 BIOCYTOGEN

- 13.1.5.1 Business overview

- 13.1.5.2 Services offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Service launches

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 EUROFINS SCIENTIFIC

- 13.1.6.1 Business overview

- 13.1.6.2 Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Expansions

- 13.1.7 SHANGHAI CHEMPARTNER

- 13.1.7.1 Business overview

- 13.1.7.2 Services offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Deals

- 13.1.8 AURIGENE PHARMACEUTICAL SERVICES LTD. (DR. REDDY'S LABORATORIES)

- 13.1.8.1 Business overview

- 13.1.8.2 Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Expansions

- 13.1.9 SINO BIOLOGICAL, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.9.3.2 Expansions

- 13.1.10 SAMSUNG BIOLOGICS

- 13.1.10.1 Business overview

- 13.1.10.2 Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Service launches

- 13.1.11 GENSCRIPT

- 13.1.11.1 Business overview

- 13.1.11.2 Services offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Service launches

- 13.1.11.3.2 Deals

- 13.1.12 CURIA GLOBAL, INC.

- 13.1.12.1 Business overview

- 13.1.12.2 Services offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.12.3.2 Other developments

- 13.1.13 TWIST BIOSCIENCE

- 13.1.13.1 Business overview

- 13.1.13.2 Services offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Service launches

- 13.1.13.3.2 Deals

- 13.1.13.3.3 Expansions

- 13.1.14 HARBOUR BIOMED

- 13.1.14.1 Business overview

- 13.1.14.2 Services offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.14.3.2 Other developments

- 13.1.15 ARAGEN LIFE SCIENCES LTD.

- 13.1.15.1 Business overview

- 13.1.15.2 Services offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Expansions

- 13.1.16 DANAHER CORPORATION

- 13.1.16.1 Business overview

- 13.1.16.2 Services offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Deals

- 13.1.17 CREATIVE BIOLABS

- 13.1.17.1 Business overview

- 13.1.17.2 Services offered

- 13.1.18 VIVA BIOTECH

- 13.1.18.1 Business overview

- 13.1.18.2 Services offered

- 13.1.19 IMMUNOPRECISE ANTIBODIES LTD.

- 13.1.19.1 Business overview

- 13.1.19.2 Services offered

- 13.1.19.3 Recent developments

- 13.1.19.3.1 Deals

- 13.1.20 FUSION ANTIBODIES

- 13.1.20.1 Business overview

- 13.1.20.2 Services offered

- 13.1.1 WUXI BIOLOGICS

- 13.2 OTHER PLAYERS

- 13.2.1 ABZENA

- 13.2.2 ALLOY THERAPEUTICS, INC.

- 13.2.3 INTEGRAL MOLECULAR

- 13.2.4 BIODURO

- 13.2.5 SYNBIO TECHNOLOGIES

- 13.2.6 ABSOLUTE ANTIBODY

- 13.2.7 ADIMAB

- 13.2.8 ISOGENICA

- 13.2.9 ABLEXIS

- 13.2.10 FAIRJOURNEY

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS