|

시장보고서

상품코드

1811735

의료용 고분자 시장 : 유형별, 제조 기술별, 용도별, 지역별 예측(-2030년)Medical Polymer Market by Type (Medical Plastics, Medical Elastomers), Application (Medical Disposables, Medical Instruments and Devices, Prosthetics, Diagnostics Instruments and Tools), Manufacturing Technology, and Region - Global Forecast to 2030 |

||||||

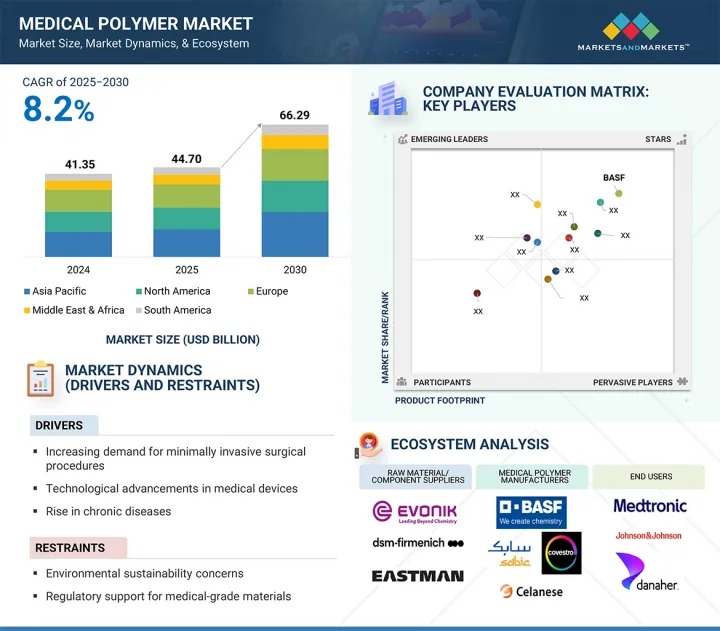

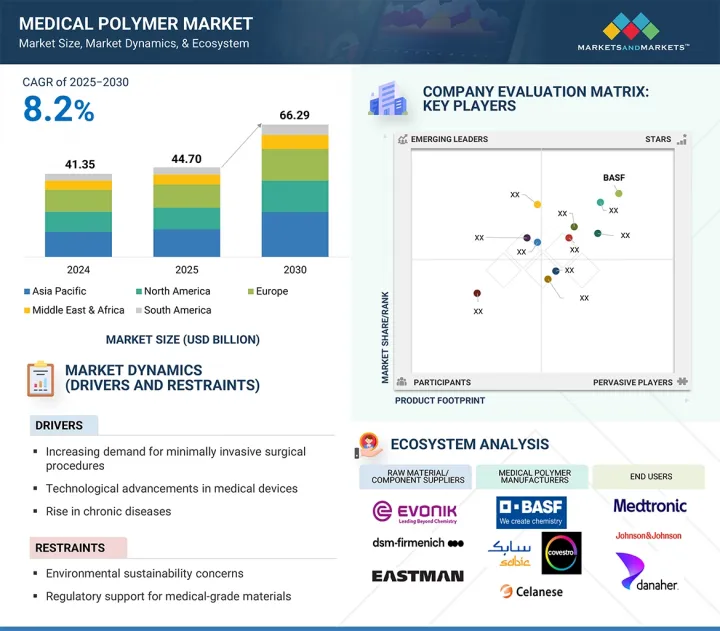

의료용 고분자 시장 규모는 예측 기간 동안 8.2%의 연평균 성장률(CAGR)로 확대되었으며(2025년) 447억 달러에서 2030년에 662억 9,000만 달러에 이를 것으로 예측됩니다.

의료용 고분자 시장은 의료 서비스, 재료 공학 및 환자 중심 혁신 분야의 지속적인 발전으로 인해 급속한 성장을 경험하고 있습니다. 주요 성장 요인으로는 경량화, 내구성, 생체 적합성 재료가 필요한 상황(예 : 임플란트, 카테터, 진단 장비, 수술 장비 등)에 적합한 소재에 대한 수요가 포함됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 킬로톤 |

| 부문 | 유형별, 제조기술별, 용도별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 남미, 중동 및 아프리카 |

만성 질환의 증가, 고령화 인구, 최소 침습적 시술에 대한 수요는 유연성, 안전성, 정확성을 제공하는 고급 폴리머에 대한 선호도를 높이고 있습니다. 위생 및 오염 물질 감소를 위해 가능한 경우 일회용 의료 제품 사용이 크게 증가하면서 폴리머로 제작된 부품의 확산에 기여했습니다. 폴리머 과학은 우수한 기계적 강도, 내구성, 항균 특성 및 능동적 살균 기술과의 호환성을 지닌 폴리머 및 소재를 창출하기 위해 발전하고 있습니다. 지식 발전과 기술 진보는 형태 기록형 또는 생체흡수성 폴리머 분야의 혁신을 가져왔으며, 이는 약물 전달 장치 및 조직 공학 분야에서 기회를 제공합니다. 의료용 3D 프린팅의 확산은 맞춤형 임플란트 및 장치를 신속하게 개발할 수 있게 하여 이 분야에 혁명을 일으켰습니다. 지속가능한 관행에 대한 관심이 증가하면서 재활용 가능 및 생분해성 폴리머에 대한 관심도 높아지고 있습니다.

의료용 탄성체는 유연성, 내구성, 생체 적합성 등 독특한 특성 조합을 바탕으로 의료용 고분자 시장에서 두 번째로 큰 유형으로 기록되며, 핵심 의료 분야에서 수백 가지 정밀한 용도로 사용됩니다. 엘라스토머 전용 용도의 상당수는 유체 저장용 제품이나 지속적인 움직임, 신축, 압축이 필요한 제품(예 : 씰, 개스킷, 튜브, 주사기, 플런저, 카테터 부품)입니다. 의료용 엘라스토머 제품은 내화학성, 온도 변화 저항성, 멸균 기술 저항성으로 가장 잘 알려져 있어 고강도 의료 응용 분야에서 신뢰할 수 있는 제품을 가능하게 합니다. 실리콘 엘라스토머, 열가소성 엘라스토머(TPE), 고무 소재는 기존 경질 폴리머 대비 향상된 착용감으로 문헌에서 자주 언급되며, 웨어러블 의료기기 및 피부 접촉 용도에 선호됩니다. 또한 소형화 추세와 함께 성능 중심 엘라스토머 소재 개발이 지속되고 있으며, 약물 전달 시스템, 자동 밀폐 시험 시스템, 생활형 진단 기기 등에 영향을 미치는 고급 설계 요소도 이를 촉진합니다. 또한 탄성체 재료는 특히 자동화 제조 및/또는 성형에 적합하며, 탄성계수와 인장 강도가 감소하여 상당한 대량 생산 시 비용 효율성을 제공합니다. 최근 의료 분야에서 혁신과 안전을 뒷받침하고 가능하게 하는 이러한 특성들은 궁극적으로 의료용 고분자 시장에서 급성장하고 매우 중요한 의료용 탄성체 부문에 기여합니다.

의료용 일회용품은 의료용 고분자 시장에서 청결성, 환자 안전, 감염 관리 측면에서 중요하기 때문에 두 번째로 큰 용도입니다. 주사기, 장갑, 정맥 주사 백, 튜브 및 연결부, 수술용 드레이프, 마스크 등의 품목은 교차 오염을 방지하고 무균 환경을 유지하기 위해 일회용으로 설계되었습니다. 감염 예방에 대한 강조와 감염 관리를 뒷받침하는 규제로 인해 일회용 의료용품 수요가 증가했습니다. 우수한 가공성, 낮은 비용, 멸균 공정과의 호환성으로 인해 의료용 일회용품에 사용되는 폴리머는 주로 폴리프로필렌, 폴리에틸렌, PVC입니다. 특히 신흥 지역에서 입원 기간 증가, 수술 절차 개선, 외래 진료 확대가 우수한 품질의 일회용품 수요를 촉진하고 있습니다. 즉시 사용 가능한 사전 멸균 제품의 편의성은 바쁜 의료 환경에서 효율성을 높일 수 있습니다. 의료 서비스가 안전성, 비용 효율적 관행 및 효율성에 계속 주력하면서 폴리머 의료용 일회용품은 향후 중요한 성장 분야가 될 것입니다.

사출 성형이 의료용 고분자 분야에서 두 번째로 큰 제조 기술인 이유는 높은 정밀도와 복잡성을 지닌 부품을 대규모로 생산할 수 있으며 신뢰성과 효율성이 우수하기 때문입니다. 사출 성형은 진단 장비 하우징, 수술 장치 핸들, 주사기, 커넥터, 이식형 장치 부품 등 다양한 의료 제품 생산에 활용됩니다. 사출 성형은 폴리카보네이트, 폴리프로필렌, ABS 등 다양한 의료용 고분자와 호환됩니다. 사출 성형을 통해 강도, 생체 적합성, 내화학성, 세척성을 갖춰야 하는 부품의 제조가 가능합니다. 사출 성형은 복잡한 형상에도 엄격한 공차로 제작할 수 있으며, 이는 모두 의료기기 산업의 안전 및 성능 요구 사항 충족과 관련이 있습니다. 사출 성형은 자동화와도 호환되며, 대량 생산에 유리하고 비용 효율적이면서 고품질의 산출물을 제공합니다. 최근 멀티샷 및 마이크로 제작 기술의 발전은 용도 범위를 더욱 확대시켰습니다. 이러한 모든 장점을 고려할 때, 사출 성형이 제품 혁신을 뒷받침하고 정교하고 신뢰할 수 있는 의료 제품에 대한 수요를 지속적으로 뒷받침하는 의료용 고분자 시장에서 핵심적인 역할을 수행하는 것은 당연합니다.

북미는 강력한 의료 동력과 혁신적인 수요로 인해 의료용 고분자 시장에서 두 번째로 빠르게 성장하는 지역입니다. 미국 내 보험 적용 범위 확대와 캐나다의 강력한 공공 및 민간 의료 투자를 계기로 1인당 의료비가 증가하고 있습니다. 의료기기, 포장재, 상처 치료 분야는 의료 기술 발전에 따라 북미 지역에서 다른 어느 지역보다 더 큰 성장을 기록될 것으로 전망됩니다. 그러나 미국은 발전된 의료 인프라, 강력한 연구개발(R&D) 생태계, 폴리머 산업과의 긴밀한 협력 관계를 바탕으로 세계에서 가장 혁신적인 의료 환경을 갖추고 있어 고성능 폴리머의 폭넓고 확대된 개발을 이끌고 있습니다. 이 중 다수는 생체 적합성 및 생분해성(수지 및 섬유) 특성을 지녀 수술용 기기, 진단 장비, 약물 전달 시스템에 활용됩니다. 의료 산업은 일회용, 최소 침습적, 재택 치료 솔루션에 대한 환자 선호도를 충족시키는 동시에 성공적인 제품 출시를 보장하기 위해 신제품 개발(예 : PEEK 및 기타 엔지니어링 플라스틱) 활용에 관한 새로운 제품 설계와 혁신적인 아이디어에 의존합니다. 아시아태평양 지역이 가장 높은 연평균 복합 성장률(연평균 성장률(CAGR))로 선두를 달리고 있는 반면, 북미는 규제 역량(및 미국 규제 혁신), 확립된 의료 시스템, 그리고 폴리머 기술 개발의 혁신을 희생하지 않으면서 환자와 의료 부문에 서비스를 제공하는 폴리머 제조업체들이 위치한 선도 지역이라는 점 덕분에 두 번째로 빠르게 성장하는 지역입니다.

본 보고서에서는 세계의 의료용 고분자 시장에 대해 조사했으며, 유형별, 제조 기술별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- Porter's Five Forces 분석

- 거시경제지표

제6장 업계 동향

- 소개

- 주요 이해관계자와 구매 기준

- 밸류체인 분석

- 생태계 분석

- 사례 연구 분석

- 규제 상황

- 기술 분석

- 고객사업에 영향을 주는 동향 및 혼란

- 무역 분석

- 주된 회의 및 이벤트(2025-2026년)

- 가격 분석

- 투자 및 자금조달 시나리오

- 특허 분석

- AI/생성형 AI가 의료용 고분자 시장에 미치는 영향

- 미국 관세가 의료용 고분자 시장에 미치는 영향(2025년)

제7장 의료용 고분자 시장(유형별)

- 소개

- 의료용 플라스틱

- 의료용 탄성체

- 기타

제8장 의료용 고분자 시장(제조 기술별)

- 소개

- 압출 튜브

- 압축 성형

- 사출 성형

- 기타

제9장 의료용 고분자 시장(용도별)

- 소개

- 의료용 일회용품

- 의료기기

- 의지

- 진단 기기 및 도구

- 기타

제10장 의료용 고분자 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 인도

- 한국

- 일본

- 호주

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카

- 기타

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제11장 경쟁 구도

- 개요

- 주요 진입기업의 전략

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업평가와 재무지표

- 브랜드, 제품 비교 분석

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업, 중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- BASF

- SABIC

- COVESTRO AG

- CELANESE CORPORATION

- EVONIK INDUSTRIES

- ARKEMA

- SOLVAY

- KURARAY CO., LTD.

- MOMENTIVE PERFORMANCE MATERIALS INC.

- DUPONT

- 기타 기업

- TRINSEO

- KRATON CORPORATION

- TOTAL PLASTICS

- SIMONA AMERICA

- DSM

- INVIBIO

- AVIENT CORPORATION

- RTP COMPANY

- TEKNIPLEX

- TEKNOR APEX

- MITSUBISHI CHEMICALS ADVANCED MATERIALS

- WACKER CHIMIE

- HARDIE POLYMERS

- ELIX POLYMERS

- INNOVATIVE POLYMER COMPOUNDS

제13장 부록

HBR 25.09.22The medical polymer market is projected to reach USD 66.29 billion by 2030 from USD 44.70 billion in 2025, at a CAGR of 8.2% during the forecast period. The medical polymer market is experiencing rapid growth as a result of continual progress in healthcare, materials engineering, and patient-focused innovation. Major factors driving include need for materials that are lightweight, durable, and suitable for use in situations involving biocompatible materials, like implants or catheters, diagnostic equipment, and even surgical instruments.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Type, Application, Manufacturing Technology, and Region |

| Regions covered | North America, Europe, Asia Pacific, South America, and Middle East & Africa |

The increased prevalence of chronic diseases, aging population, and the need for minimally invasive procedures is creating preference for advanced polymers that provide flexibility, security, and accuracy. The considerable shift in the use of disposable medical products, where possible, for sanitation and fewer contaminants has contributed to the proliferation of components made from polymers. The science of polymers is advancing to create polymers and materials with superior mechanical strength, durability, antimicrobial properties, and compatibility with active-sterilization techniques. Advances in knowledge and developments have resulted in breakthroughs in polymers that can hold shapes, or bioresorbable, that offer opportunities in the areas of drug delivery devices and tissue engineering. Proliferation of medical-grade 3D printing has revolutionized this area because custom-designed implants and devices can now be developed rapidly. There has increased attention on sustainable practices, leading to interest in recyclable and biodegradable polymers.

"Medical elastomers to account for the second-largest type in the medical polymer market during the forecast period."

Medical elastomers account for the second-largest type in the medical polymer market based on unique combinations of characteristics, such as flexibility, durability, and biocompatibility, allowing them to be used for hundreds of precise applications for critical healthcare. Many of the devoted elastomer applications are products used to contain fluids or products that need to be manipulated with constant movement, stretching, or compression, like seals, gaskets, tubing, syringes, plungers, and catheter components. Medical elastomer products are best known because of their chemical resistance, resistance to temperature swings, and resistance to sterilization techniques, which enables reliable products in high-stress medical applications. Because silicone elastomers, thermoplastic elastomers (TPE), and rubber materials are often specifically mentioned in literature due to increased comfort above conventional or hard polymers, they are favored for wearable medical devices and skin-contact applications. In addition, the influence of minimization continues to drive performance elastomeric materials, as do the advanced design aspects influencing drug delivery systems, automated enclosed testing systems, and lifestyle diagnostic devices. Furthermore, elastomeric materials are especially amenable to automated manufacturing and/or molding with E-modulus and tensile strength decreases, enabling cost-effective production in considerably large amounts. Combined with supporting and allowing innovation and safety in modern healthcare, these ultimately contribute to the fast-growing and extremely important category of medical elastomers in the medical polymer market.

"Medical disposables to account for the second-largest share of the medical polymer market during the forecast period."

Medical disposables are the second-largest application in the medical polymer market because of their importance in cleanliness, patient safety, and infection control in healthcare settings. Items such as syringes, gloves, IV bags, tubing and connections, surgical drapes, and masks are designed for single-use to prevent cross-contamination and maintain sterile environments. The emphasis on infection prevention and regulations supporting infection control have increased demand for disposable medical items. Due to their excellent processability, low cost, and compatibility with sterilizing processes, the polymers used in medical disposables are primarily polypropylene, polyethylene, and PVC. The increase in hospital stays, enhanced surgical procedures, and outpatient care, especially in emerging regions, are driving demand for good quality disposables. Convenience of ready-to-use pre-sterilized items can add efficiency in busy medical settings. As healthcare continues to focus on safety, cost-effective practices, and efficiencies, polymer medical disposables will be an important future growth area going forward.

"Injection molding is projected to be the second-largest manufacturing technology in the medical polymer market during the forecast period."

Injection molding is the second-largest manufacturing technology in the medical polymer space because it can produce highly precise and complex components at scale with good reliability and efficiency. Injection molding is used to produce a wide variety of medical products, for example, housing for diagnostic equipment, surgical instrument handles, syringes, connectors, components of implantable devices, and so forth. Injection molding is compatible with many medical-grade polymers, for example, it can be made from polycarbonate, polypropylene, and ABS. With injection molding, the manufacture of components that must have strength, biocompatibility, chemical resistance, and washability is possible. Injection molding can be made to tight tolerances with complex geometries; all of which are relevant in meeting the safety and performance requirements of the medical device industry. Injection molding is also compatible with automation and is conducive to produce items in large volumes while being cost-effective along with high quality output. Recent advancements in multi-shot and micro fabrication further enhances the application range as well. With all of these advantages it is easy to see how injection molding plays a critical role in the medical polymer market which supports product innovations and continues to aid the demand for sophisticated and reliable medical products.

"North America is projected to be the second-fastest growing region in the medical polymer market during the forecast period."

North America is the second-fastest growing region in the medical polymer market, due largely to strong healthcare dynamics, and innovated demand. Per capita healthcare expenses are rising, initiated by expanding insurance coverage in the US and strong public and private healthcare investments in Canada. The medical devices, packaging, and wound care categories are projected to account for greater growth in North America than any other region as healthcare advances. However, the US has one of the most innovative healthcare environments in the world based on a developed healthcare infrastructure, a strong Research and Development (R&D) ecosystem, and a strong partnership with the polymer industry, leading to the creation of a broad and expanding array of high-performance polymers. Many of these polymers have properties that are biocompatible and even biodegradable (resins and fibers) for surgical devices, diagnostics, and drug delivery systems. The healthcare industry relies on new product designs and innovative ideas regarding the use of new products developments (e.g., PEEK and other engineering plastics), to ensure successful product introduction that will also meet patients' preferences for disposable, minimally invasive, and home care solutions. While the Asia Pacific region is leading with the highest CAGR, North America is the second-fastest growing region, due to its regulatory strength (and US regulation innovation), established healthcare system, and leading region with polymer manufacturers serving patients and the medical sector without sacrificing innovation in the development of polymer technologies.

Extensive interviews with experts were conducted to determine and verify the market size for several segments and subsegments and the information gathered through secondary research.

The break-up of interviews with experts is given below:

- By Department: Tier 1: 40%, Tier 2: 25%, and Tier 3: 35%

- By Designation: C Level: 35%, Director Level: 30%, and Executives: 35%

- By Region: North America: 25%, Europe: 45%, Asia Pacific: 20%, South America: 5%, Middle East & Africa 5%

BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese corporation (US), Evonik Industries (Germany), Arkema (France), Solvay (Belgium), Kuraray Co., Ltd. (Japan), Momentive Performance Materials Inc. (US), and DuPont (US), among others are some of the key players in the medical polymer market.

The study includes an in-depth competitive analysis of these key players in the medical polymer market, with their company profiles, recent developments, and key market strategies.

Research Coverage

The market study covers the medical polymer market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on type, application, manufacturing technology, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to enhance their positions in the medical polymer market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall medical polymer market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the positions of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provides them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

- Analysis of key drivers (Increasing demand for biocompatible materials, Growing aging population globally, Advancements in medical technology, Regulatory support for medical-grade materials), restraints (Regulatory complexities and approvals, High competition from alternative materials, Environmental sustainability concerns), opportunities (Growth in regenerative medicine, Demand for minimally invasive devices, Advancements in biodegradable polymers), challenges (Cost constraints for novel materials, Long term durability and degradation control)

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and product & service launches in the medical polymer market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the medical polymer market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the medical polymer market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like BASF SE (Germany), SABIC (Saudi Arabia), Covestro AG (Germany), Celanese corporation (US), Evonik Industries (Germany), Arkema (France), Solvay (Belgium), Kuraray Co., Ltd. (Japan), Momentive Performance Materials Inc. (US), and DuPont (US), among others are covered in the medical polymer market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 INCLUSIONS AND EXCLUSIONS

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNITS CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants-demand and supply side

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 LIMITATIONS AND RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MEDICAL POLYMER MARKET

- 4.2 MEDICAL POLYMER MARKET, BY TYPE

- 4.3 MEDICAL POLYMER MARKET, BY APPLICATION

- 4.4 MEDICAL POLYMER MARKET, BY MANUFACTURING TECHNOLOGY

- 4.5 MEDICAL POLYMER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing demand for biocompatible materials

- 5.2.1.2 Surge in global aging population

- 5.2.1.3 Advancements in medical technology

- 5.2.1.4 Rise in chronic diseases

- 5.2.1.5 Regulatory support for medical-grade materials

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory complexities and approvals

- 5.2.2.2 High competition from alternative materials

- 5.2.2.3 Environmental sustainability concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growth in regenerative medicine

- 5.2.3.2 Demand for minimally invasive devices

- 5.2.3.3 Advancements in biodegradable polymers

- 5.2.4 CHALLENGES

- 5.2.4.1 Cost constraints for novel materials

- 5.2.4.2 Long-term durability and degradation control

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT FROM NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF BUYERS

- 5.3.4 BARGAINING POWER OF SUPPLIERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 MACROECONOMIC INDICATORS

- 5.4.1 GLOBAL GDP TRENDS

6 INDUSTRY TRENDS

- 6.1 INTRODUCTION

- 6.2 KEY STAKEHOLDERS & BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 VALUE CHAIN ANALYSIS

- 6.3.1 RAW MATERIAL SUPPLIERS

- 6.3.2 MANUFACTURERS

- 6.3.3 DISTRIBUTORS

- 6.3.4 END CONSUMERS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 CASE STUDY ANALYSIS

- 6.5.1 EVONIK INDUSTRIES PROVIDES MEDICAL POLYMERS TO JENACELL GMBH FOR WOUND DRESSINGS, IMPLANTABLE MATERIALS, AND DRUG DELIVERY SYSTEMS

- 6.5.2 ENSINGER OFFERS HIGH-PERFORMANCE, MEDICAL-GRADE POLYMERS FOR HIGH-FREQUENCY SURGERY

- 6.6 REGULATORY LANDSCAPE

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGY

- 6.7.1.1 Biocompatible polymers

- 6.7.1.2 Thermoplastic elastomers

- 6.7.2 COMPLEMENTARY TECHNOLOGY

- 6.7.2.1 Thermoplastic elastomers

- 6.7.2.2 Surface modification techniques

- 6.7.1 KEY TECHNOLOGY

- 6.8 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.9 TRADE ANALYSIS

- 6.9.1 IMPORT SCENARIO

- 6.9.2 EXPORT SCENARIO

- 6.10 KEY CONFERENCES & EVENTS, 2025-2026

- 6.11 PRICING ANALYSIS

- 6.11.1 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2024

- 6.11.2 AVERAGE SELLING PRICE TREND, BY APPLICATION, 2022-2024

- 6.11.3 AVERAGE SELLING PRICE OFFERED BY KEY PLAYERS, BY APPLICATION, 2024

- 6.12 INVESTMENT AND FUNDING SCENARIO

- 6.13 PATENT ANALYSIS

- 6.13.1 METHODOLOGY

- 6.13.2 PATENTS GRANTED WORLDWIDE, 2015-2024

- 6.13.3 PUBLICATION TRENDS

- 6.13.4 INSIGHTS

- 6.13.5 LEGAL STATUS OF PATENTS

- 6.13.6 JURISDICTION ANALYSIS

- 6.13.7 TOP APPLICANTS

- 6.14 IMPACT OF AI/GEN AI ON MEDICAL POLYMER MARKET

- 6.15 IMPACT OF 2025 US TARIFF ON MEDICAL POLYMER MARKET

- 6.15.1 INTRODUCTION

- 6.15.2 KEY TARIFF RATES

- 6.15.3 PRICE IMPACT ANALYSIS

- 6.15.4 IMPACT ON KEY COUNTRIES/REGIONS

- 6.15.4.1 North America

- 6.15.4.2 Europe

- 6.15.4.3 Asia Pacific

- 6.15.5 IMPACT ON END-USE INDUSTRIES

7 MEDICAL POLYMER MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 MEDICAL PLASTICS

- 7.2.1 ADVANCEMENTS IN MATERIAL SCIENCE AND MANUFACTURING TECHNOLOGIES TO DRIVE MARKET

- 7.2.2 POLYPROPYLENE

- 7.2.3 POLYVINYL CHLORIDE

- 7.2.4 POLYETHYLENE

- 7.2.5 POLYSTYRENE

- 7.2.6 ENGINEERING & HIGH-PERFORMANCE PLASTICS

- 7.2.6.1 Polyether ether ketone

- 7.2.6.2 Nylon/polyamide

- 7.2.6.3 Polyphenylsulfone

- 7.2.6.4 Polysulfones

- 7.2.6.5 Polymethyl methacrylate

- 7.2.6.6 Polycarbonate

- 7.2.6.7 Acrylonitrile butadiene styrene

- 7.2.6.8 Other Engineering & high-performance plastics

- 7.2.7 OTHER MEDICAL PLASTICS

- 7.3 MEDICAL ELASTOMERS

- 7.3.1 FLEXIBILITY, DURABILITY, AND BIOCOMPATIBILITY TO DRIVE MARKET

- 7.3.2 SILICONE

- 7.3.3 THERMOPLASTIC ELASTOMERS

- 7.3.3.1 Thermoplastic polyurethane

- 7.3.3.2 Thermoplastic vulcanizates

- 7.3.3.3 Thermoplastic styrenic elastomers

- 7.3.3.3.1 Poly(styrene-butadiene-styrene)

- 7.3.3.3.2 Styrene-ethylene-butylene-styrene

- 7.3.3.4 Thermoplastic copolyester elastomers

- 7.4 OTHER MEDICAL ELASTOMERS

8 MEDICAL POLYMER MARKET, BY MANUFACTURING TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 EXTRUSION TUBING

- 8.2.1 INCREASING USE IN INTRAVENOUS DELIVERY SYSTEMS, CATHETERS, AND SURGICAL INSTRUMENTS TO DRIVE MARKET

- 8.3 COMPRESSION MOLDING

- 8.3.1 INCREASING USE IN PROSTHETICS, ORTHOPEDIC IMPLANTS, AND DENTAL COMPONENTS TO DRIVE MARKET

- 8.4 INJECTION MOLDING

- 8.4.1 INCREASING USE OF SYRINGES, SURGICAL INSTRUMENTS, AND IMPLANTABLE DEVICES TO DRIVE MARKET

- 8.5 OTHER MANUFACTURING TECHNOLOGIES

9 MEDICAL POLYMER MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MEDICAL DISPOSABLES

- 9.2.1 INCREASING DEMAND FOR CATHETERS AND SYRINGES TO DRIVE MARKET

- 9.2.2 GLOVES

- 9.2.3 SYRINGES

- 9.2.4 MEDICAL BAGS

- 9.2.5 OTHER MEDICAL DISPOSABLES

- 9.3 MEDICAL INSTRUMENTS & DEVICES

- 9.3.1 INCREASING SURGICAL AND PROCEDURAL APPLICATIONS TO DRIVE MARKET

- 9.3.2 MEDICAL TUBES

- 9.3.3 CATHETERS

- 9.3.4 DRUG DELIVERY INSTRUMENTS

- 9.3.5 OTHER MEDICAL INSTRUMENTS & DEVICES

- 9.4 PROSTHETICS

- 9.4.1 RISING DEMAND FOR ADVANCED LIMB PROSTHESES AND IMPLANTS TO DRIVE MARKET

- 9.4.2 IMPLANTS

- 9.4.3 LIMB PROSTHESIS

- 9.4.4 OTHER PROSTHETICS APPLICATIONS

- 9.5 DIAGNOSTIC INSTRUMENTS & TOOLS

- 9.5.1 INCREASING DEMAND IN SURGICAL AND PROCEDURAL APPLICATIONS TO DRIVE MARKET

- 9.5.2 DENTAL TOOLS

- 9.5.3 SURGICAL INSTRUMENTS

- 9.5.4 OTHER DIAGNOSTIC INSTRUMENTS & TOOLS

- 9.6 OTHER APPLICATIONS

10 MEDICAL POLYMER MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 High R&D investments in medical sector to drive market

- 10.2.2 CANADA

- 10.2.2.1 Emerging demand for dental implants to drive market

- 10.2.3 MEXICO

- 10.2.3.1 Expansion of manufacturing facilities to drive market

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Establishment of medical device manufacturing units and investment in other healthcare-related sectors to drive market

- 10.3.2 INDIA

- 10.3.2.1 Rapid economic growth and growing population to drive market

- 10.3.3 SOUTH KOREA

- 10.3.3.1 Advanced healthcare and medical technologies to boost market

- 10.3.4 JAPAN

- 10.3.4.1 Developments in minimally invasive treatment and robotic surgery to support market growth

- 10.3.5 AUSTRALIA

- 10.3.5.1 Regulatory compliance and strategic collaborations to support market growth

- 10.3.6 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 MIDDLE EAST & AFRICA

- 10.4.1 GCC COUNTRIES

- 10.4.1.1 Saudi Arabia

- 10.4.1.1.1 Surge in aging population to drive demand for medical polymers

- 10.4.1.2 UAE

- 10.4.1.2.1 Population growth and changing epidemiology to drive market

- 10.4.1.3 Rest of GCC

- 10.4.1.1 Saudi Arabia

- 10.4.2 SOUTH AFRICA

- 10.4.2.1 Increased government spending on healthcare to drive market

- 10.4.3 REST OF MIDDLE EAST & AFRICA

- 10.4.1 GCC COUNTRIES

- 10.5 EUROPE

- 10.5.1 GERMANY

- 10.5.1.1 Rising demand in dental implant application to drive market

- 10.5.2 FRANCE

- 10.5.2.1 Aging population and sedentary lifestyle to boost demand for polymers

- 10.5.3 UK

- 10.5.3.1 Growing incidences of chronic diseases and government support for innovation to drive market

- 10.5.4 ITALY

- 10.5.4.1 Strong production facilities with presence of global players to propel market growth

- 10.5.5 SPAIN

- 10.5.5.1 Surge in government funding for healthcare sector to support market

- 10.5.6 REST OF EUROPE

- 10.5.1 GERMANY

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Growing aging population, expanding economy, and increasing health awareness to drive market

- 10.6.2 ARGENTINA

- 10.6.2.1 Availability of highly trained specialists and low cost of medical services boosting medical tourism industry

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Application footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: KEY STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 MAJOR PLAYERS

- 12.1.1 BASF

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Services/Solutions offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SABIC

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Services/Solutions offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 COVESTRO AG

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Services/Solutions offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Product launches

- 12.1.3.3.2 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 CELANESE CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Services/Solutions offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Expansions

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 EVONIK INDUSTRIES

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Services/Solutions offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Expansions

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 ARKEMA

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Services/Solutions offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product launches

- 12.1.6.3.2 Deals

- 12.1.6.3.3 Expansions

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths

- 12.1.7 SOLVAY

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Services/Solutions offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.8 KURARAY CO., LTD.

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Services/Solutions offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Expansions

- 12.1.8.4 MnM view

- 12.1.9 MOMENTIVE PERFORMANCE MATERIALS INC.

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Services/Solutions offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Expansions

- 12.1.9.4 MnM view

- 12.1.10 DUPONT

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Services/Solutions offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.3.2 Expansions

- 12.1.10.4 MnM view

- 12.1.1 BASF

- 12.2 OTHER PLAYERS

- 12.2.1 TRINSEO

- 12.2.2 KRATON CORPORATION

- 12.2.3 TOTAL PLASTICS

- 12.2.4 SIMONA AMERICA

- 12.2.5 DSM

- 12.2.6 INVIBIO

- 12.2.7 AVIENT CORPORATION

- 12.2.8 RTP COMPANY

- 12.2.9 TEKNIPLEX

- 12.2.10 TEKNOR APEX

- 12.2.11 MITSUBISHI CHEMICALS ADVANCED MATERIALS

- 12.2.12 WACKER CHIMIE

- 12.2.13 HARDIE POLYMERS

- 12.2.14 ELIX POLYMERS

- 12.2.15 INNOVATIVE POLYMER COMPOUNDS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS