|

시장보고서

상품코드

1811736

LEO PNT(저궤도 위성 항법) 시장 : 하드웨어별, 위성 질량별, 주파수별, 최종 이용별, 지역별 예측(-2030년)LEO PNT Market by Hardware (GNSS Module, Time Synchronization, Backhaul Module, Navigation Signal Generation, Signal Transmission Module), End Use (Government & Defense and Others), Frequency, Satellite Mass and Region - Global Forecast to 2030 |

||||||

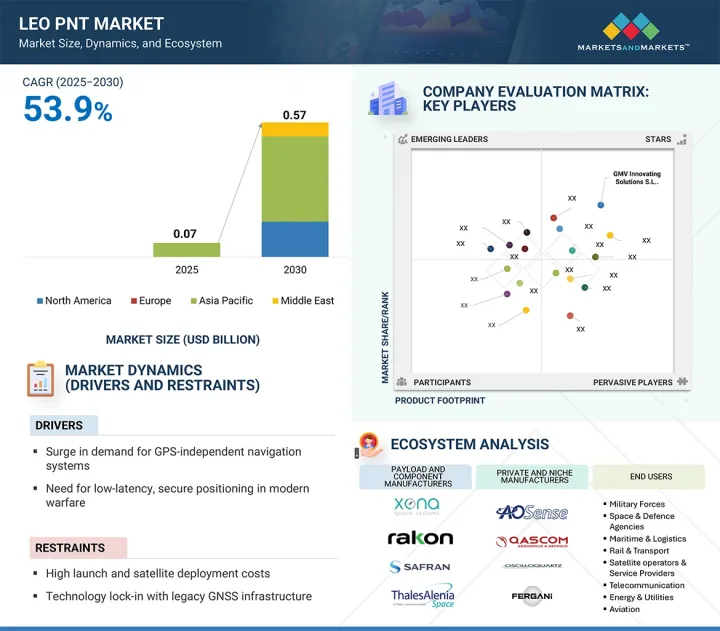

LEO PNT(저궤도 위성 항법) 시장 규모는 2025년 7,000만 달러에서 2030년 5억 7,000만 달러에 이르고, 연평균 성장률(CAGR)은 53.9%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 하드웨어별, 위성 질량별, 주파수별, 최종 이용별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양 및 기타 지역 |

이 시장은 특히 국방, 항공, 인프라 분야에서 기존 GNSS 외의 신뢰할 수 있는 항법 솔루션에 대한 수요 증가에 의해 촉진됩니다. 소형 위성 군집에 대한 투자 확대와 원자 시계, GNSS 수신기, 인증 기술의 발전도 성장을 촉진합니다. 공공-민간 파트너십과 물류 및 자율 시스템과 같은 상업 부문의 수요 증가는 시장 성장을 더욱 가속화할 것입니다.

신호 전송 모듈 부문은 정확한 항법, 시간 동기화 및 보안 통신 제공에 널리 사용되기 때문에 LEO PNT 시장에서 가장 큰 점유율을 기록합니다. 사용자와 위성 간 신호 전송 제어 역할로 인해 항공, 국방 및 전략적 인프라 시장에서 선도적 위치를 유지하고 있습니다. 고주파 및 간섭 방지 신호의 추가 용도도 시장 리더십 유지에 기여합니다.

CubeSat는 소형 위성의 소형화로 인한 발사 비용 절감, 위성 군집의 신속한 확장 가능성, 시험용 PNT 임무에 활용 가능한 추가 공간 확보 등의 요인에 의해 LEO PNT 시장에서 가장 빠르게 성장하는 부문을 촉진합니다. 이 위성들은 GNSS 수신기, 원자 시계, 신호 인증 모듈과 같은 고급 페이로드를 탑재할 수 있어 군사 및 상업적 응용 모두에 매력적입니다. 또한 소형 위성에 대한 정부 지원 사업 증가와 개인 투자 확대가 보안 및 분산형 PNT 아키텍처 내 큐브샛 용도 확대에 기여하고 있습니다.

북미는 LEO PNT 시장에서 가장 빠른 성장세를 보이고 있으며, 이는 강력한 정부 지출, 방위 체계 현대화 프로젝트, 향후 위성 항법 기술의 조기 도입에 기인합니다. 주요 시장 업체들의 존재와 GNSS 취약성으로 인한 백업 PNT 솔루션 수요 증가는 지역 성장을 더욱 촉진하고 있습니다. 항공, 물류, 자율 시스템 분야에서 PNT의 상업적 활용이 증가함에 따라 예측 기간 동안 북미는 가장 빠르게 성장하는 지역으로 자리매김할 것입니다.

본 보고서에서는 세계의 LEO PNT 시장에 대해 조사했으며, 하드웨어별, 위성 질량별, 주파수별, 최종 이용별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 밸류체인 분석

- 가격 분석

- 볼륨 데이터

- 생태계 분석

- 관세 및 규제 상황

- 무역 데이터

- 주된 회의 및 이벤트(2025-2026년)

- 주요 이해관계자와 구매 기준

- 사례 연구 분석

- 비즈니스 모델

- 총소유비용

- 부품표

- 투자 및 자금조달 시나리오

- 기술 로드맵

- 기술 분석

- 거시경제 전망

- 메가 트렌드의 영향

- 특허 분석

- AI의 영향

- 시장 시나리오 분석

- 미국의 관세(2025년)

제6장 LEO PNT 시장(하드웨어별)

- 소개

- 이용 사례

- GNSS 모듈

- 시간 동기화

- 백홀 모듈

- 네비게이션 신호 생성

- 신호 전송 모듈

제7장 LEO PNT 시장(위성 질량별)

- 소개

- 이용 사례

- CubeSat

- 소형 위성

제8장 LEO PNT 시장(주파수별)

- 소개

- 이용 사례

- VHF 및 UHF 밴드

- L 밴드

- S 밴드

- C 밴드

- KU &KA 밴드

제9장 LEO PNT 시장(최종 이용별)

- 소개

- 이용 사례

- 정부 및 방위

- 민간항공과 UAS

- 해사 및 해외

- 자동차 및 모빌리티

- 통신 및 전력

- 건설 및 정밀 농업

- 산업 및 물류

- 기타

제10장 LEO PNT 시장(지역별)

- 소개

- 북미

- PESTLE 분석

- 미국

- 유럽

- PESTLE 분석

- 프랑스

- 영국

- 아시아태평양

- PESTLE 분석

- 중국

- 일본

- 호주

- 중동

- PESTLE 분석

- GCC

- 튀르키예

제11장 경쟁 구도

- 소개

- 주요 참가 기업의 전략 및 강점(2020-2024년)

- 수익 분석(2021-2024년)

- 시장 점유율 분석(2025년)

- 브랜드, 제품 비교

- 기업평가와 재무지표

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업, 중소기업(2024년)

- 경쟁 시나리오

제12장 기업 프로파일

- 주요 진출기업

- GMV INNOVATING SOLUTIONS SL

- SAFRAN

- THALES ALENIA SPACE

- XONA SPACE SYSTEMS, INC.

- TRUSTPOINT, INC.

- HEXAGON AB

- L3HARRIS TECHNOLOGIES, INC.

- AIRBUS

- CACI INTERNATIONAL INC

- MICROCHIP TECHNOLOGY INC.

- GENERAL DYNAMICS CORPORATION

- RUAG GROUP

- NORTHROP GRUMMAN

- HONEYWELL INTERNATIONAL INC.

- FUGRO

- RAKON LIMITED

- TELEDYNE TECHNOLOGIES INCORPORATED

- SATELLES, INC.

- 기타 기업

- SKYKRAFT PTY LTD

- QASCOM

- AOSENSE, INC.

- ARKEDGE SPACE INC.

- INFLEQTION, INC.

- OSCILLOQUARTZ

- ACCUBEAT LTD.

- BLILEY TECHNOLOGIES

- FERGANI

제13장 부록

HBR 25.09.22The LEO PNT market is expected to reach USD 0.57 billion by 2030, from USD 0.07 billion in 2025, with a CAGR of 53.9%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Hardware, Satellite Mass, End Use, and Frequency |

| Regions covered | North America, Europe, APAC, RoW |

The market is driven by increasing demand for reliable navigation solutions beyond traditional GNSS, especially in defense, aviation, and infrastructure. Growth is also boosted by higher investments in small satellite constellations and advancements in atomic clocks, GNSS receivers, and authentication technologies. Public-private partnerships and elevated demand in commercial sectors such as logistics and autonomous systems will further accelerate market growth.

"By hardware, signal transmission module is expected to hold the largest share."

The signal transmission module segment holds the largest share of the LEO PNT market because it is widely used for delivering accurate navigation, time synchronization, and secure communication. Its role in controlling signal transmission among users and satellites keeps it ahead in aviation, defense, and strategic infrastructure markets. Additional applications of high-frequency and interference-resistant signals also help maintain its market leadership.

"By satellite mass, CubeSat is expected to record the highest CAGR."

CubeSat represents the fastest-growing segment of the LEO PNT market, driven by factors such as the affordability of launches due to the compactness of small satellites, the potential for rapid expansion of satellite constellations, and the availability of more space for testbed PNT missions. These satellites can carry advanced payloads such as GNSS receivers, atomic clocks, and signal authentication modules, making them attractive for both military and commercial applications. Additionally, increasing government-sponsored initiatives for small satellites and rising individual investments are contributing to the growth of CubeSat applications in secure and distributed PNT architectures.

"North America is expected to be the fastest-growing market for LEO PNT."

North America is witnessing the fastest growth in the LEO PNT market. This growth can be attributed to strong government spending, defense upgrade projects, and the early adoption of next-generation satellite navigation technology. The presence of major market players, combined with a heightened demand for backup PNT solutions due to vulnerabilities in GNSS, is also fueling local growth. The increasing commercial use of PNT in aviation, logistics, and autonomous systems further positions North America as the fastest-growing region during the forecast period.

Breakdown of Primaries

The study contains insights from various industry experts, ranging from component suppliers to Tier-1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type: Tier 1-35%, Tier 2-45%, and Tier 3-20%

- By Designation: C-level-25%, D-level-30%, and Others-45%

- By Region: North America-45%, Europe-25%, Asia Pacific-20%, Middle East-10%.

GMV Innovating Solutions S.L. (Spain), Safran (France), Thales Alenia Space (France), Xona Space Systems, Inc. (US), TrustPoint, Inc. (US), Hexagon AB (Sweden), L3Harris Technologies, Inc. (US), and Airbus (Netherlands) are some of the leading players in the LEO PNT market.

Research Coverage

The report on the LEO PNT market offers an analysis from 2025 to 2030. It covers various industry and technology trends, as well as drivers, restraints, challenges, and opportunities that influence market growth. This study also includes an in-depth competitive analysis of key players in the market, featuring company profiles, key insights related to LEO PNT and business offerings, significant developments, and the main strategies adopted by these companies.

Key Benefits of Buying this Report:

This report assists market leaders and new entrants by providing approximate revenue figures for the overall LEO PNT Market and its subsegments. It covers the entire ecosystem of the LEO PNT Market, helping stakeholders understand the competitive landscape and gain insights to better position their businesses and develop appropriate go-to-market strategies. Additionally, the report offers insights into the market's current trends and key factors such as drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers such as a surge in demand for GPS-independent navigation systems, the need for low-latency, secure positioning in modern warfare, and the integration of LEO PNT into autonomous and connected systems

- Product Development: In-depth analysis of product innovation/development by companies across various regions

- Market Development: Comprehensive information about lucrative markets - the report analyses the LEO PNT market across varied regions

- Market Diversification: Exhaustive information about new solutions, untapped geographies, recent developments, and investments in the LEO PNT market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like GMV Innovating Solutions S.L. (Spain), Safran (France), Thales Alenia Space (France), Xona Space Systems, Inc. (US), TrustPoint, Inc. (US), Hexagon AB (Sweden), L3Harris Technologies, Inc (US), and Airbus (Netherlands)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 DEMAND-SIDE INDICATORS

- 2.2.2 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (demand side)

- 2.3.1.2 Market size illustration: France's CubeSat LEO PNT market

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN LEO PNT MARKET

- 4.2 LEO PNT MARKET, BY SATELLITE MASS

- 4.3 LEO PNT MARKET, BY END USE

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in demand for GPS-independent navigation systems

- 5.2.1.2 Need for low-latency, secure positioning in modern warfare

- 5.2.1.3 Integration of LEO PNT into autonomous and connected systems

- 5.2.2 RESTRAINTS

- 5.2.2.1 High launch and satellite deployment costs

- 5.2.2.2 Technology lock-in with legacy GNSS infrastructure

- 5.2.2.3 Orbital congestion and spectrum regulation challenges

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Commercialization of LEO PNT-as-a-Service

- 5.2.3.2 Export potential to non-GNSS nations or allies

- 5.2.3.3 Expansion into denied/degraded environments

- 5.2.4 CHALLENGES

- 5.2.4.1 Long development cycles and uncertain ROI

- 5.2.4.2 Cybersecurity and signal integrity vulnerabilities

- 5.2.1 DRIVERS

- 5.3 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 VALUE CHAIN ANALYSIS

- 5.5 PRICING ANALYSIS

- 5.5.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5.2 INDICATIVE PRICING ANALYSIS, BY SATELLITE MASS

- 5.6 VOLUME DATA

- 5.7 ECOSYSTEM ANALYSIS

- 5.7.1 PROMINENT COMPANIES

- 5.7.2 PRIVATE AND SMALL ENTERPRISES

- 5.7.3 END USERS

- 5.8 TARIFF AND REGULATORY LANDSCAPE

- 5.8.1 TARIFF DATA

- 5.8.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.8.3 KEY REGULATIONS

- 5.8.3.1 North America

- 5.8.3.2 Europe

- 5.8.3.3 Asia Pacific

- 5.8.3.4 Middle East

- 5.9 TRADE DATA

- 5.9.1 IMPORT SCENARIO (HS CODE 880260)

- 5.9.2 EXPORT SCENARIO (HS CODE 880260)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.11.2 BUYING CRITERIA

- 5.12 CASE STUDY ANALYSIS

- 5.12.1 ASSURED PNT FOR DEFENSE IN GNSS-DENIED ENVIRONMENTS

- 5.12.2 TIMING SYNCHRONIZATION FOR CRITICAL INFRASTRUCTURE

- 5.12.3 PRECISION CLOCKS FOR NEXT-GEN NAVIGATION SATELLITES

- 5.12.4 SDR-BASED NAVIGATION PAYLOAD FOR REGIONAL PNT SERVICES

- 5.13 BUSINESS MODELS

- 5.13.1 SUBSYSTEM OEM SALES

- 5.13.2 PNT-AS-A-SERVICE

- 5.13.3 CUSTOM PAYLOAD INTEGRATION

- 5.14 TOTAL COST OF OWNERSHIP

- 5.15 BILL OF MATERIALS

- 5.16 INVESTMENT AND FUNDING SCENARIO

- 5.17 TECHNOLOGY ROADMAP

- 5.18 TECHNOLOGY ANALYSIS

- 5.18.1 KEY TECHNOLOGIES

- 5.18.1.1 Carrier phase-based LEO ranging

- 5.18.1.2 Chip-scale atomic clocks

- 5.18.1.3 Frequency-diverse PNT waveforms

- 5.18.1.4 Two-way time transfer protocols

- 5.18.1.5 Software-defined transponders

- 5.18.2 COMPLEMENTARY TECHNOLOGIES

- 5.18.2.1 Sensor fusion

- 5.18.2.2 Cryptographic signal authentication

- 5.18.2.3 Electronically steered antennas

- 5.18.1 KEY TECHNOLOGIES

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 NORTH AMERICA

- 5.19.2 EUROPE

- 5.19.3 ASIA PACIFIC

- 5.19.4 MIDDLE EAST

- 5.20 IMPACT OF MEGATRENDS

- 5.20.1 AI-ENABLED AUTONOMY FOR LEO SATELLITE CONSTELLATIONS

- 5.20.2 TIME-SENSITIVE NETWORKING IN 5G AND 6G

- 5.20.3 GAN-BASED RF AMPLIFIERS

- 5.20.4 MINIATURIZATION AND SPACE-QUALIFICATION OF PRECISION TIMING

- 5.20.5 OPTICAL COMMUNICATIONS AND CROSSLINK INFRASTRUCTURE

- 5.21 PATENT ANALYSIS

- 5.22 IMPACT OF AI

- 5.22.1 AI IN ATOMIC CLOCK DRIFT MODELING

- 5.22.2 AI-ENABLED SOFTWARE TRANSPONDER LOGIC

- 5.22.3 AI IN ANTENNA BEAM CONTROL

- 5.22.4 AI IN POWER AMPLIFIER MANAGEMENT

- 5.22.5 AI IN GNSS SIGNAL PROCESSING

- 5.23 MARKET SCENARIO ANALYSIS

- 5.24 US 2025 TARIFF

- 5.24.1 INTRODUCTION

- 5.24.2 KEY TARIFF RATES

- 5.24.3 PRICE IMPACT ANALYSIS

- 5.24.4 IMPACT ON COUNTRY/REGION

- 5.24.4.1 US

- 5.24.4.2 Europe

- 5.24.4.3 Asia Pacific

- 5.24.5 IMPACT ON END-USE INDUSTRIES

- 5.24.5.1 Commercial

- 5.24.5.2 Defense

- 5.24.5.3 Government

6 LEO PNT MARKET, BY HARDWARE

- 6.1 INTRODUCTION

- 6.2 USE CASE

- 6.3 GNSS MODULE

- 6.3.1 INTEGRATING ANTENNA-TO-RECEIVER PNT FUNCTIONALITY FOR COMPACT LEO PAYLOADS

- 6.3.2 GNSS ANTENNA

- 6.3.3 GNSS RECEIVER

- 6.4 TIME SYNCHRONIZATION

- 6.4.1 ESTABLISHING SUB-MICROSECOND COHERENCE ACROSS LEO-BASED PNT ARCHITECTURES

- 6.4.2 ATOMIC CLOCK

- 6.4.3 CLOCK MONITORING & CONTROL UNIT

- 6.4.4 OCXO/PLL/DISTRIBUTION NETWORK

- 6.5 BACKHAUL MODULE

- 6.5.1 ENABLING HIGH-CAPACITY DATA UPLINK FOR PNT COMMAND, CONTROL, AND SYNCHRONIZATION

- 6.5.2 BACKHAUL ANTENNA

- 6.5.3 BACKHUAL RECEIVER

- 6.6 NAVIGATION SIGNAL GENERATION

- 6.6.1 ALLOWING REAL-TIME, SOFTWARE-DEFINED PNT BROADCASTS IN DYNAMIC LEO ENVIRONMENTS

- 6.6.2 NAVIGATION SIGNAL GENERATION UNIT

- 6.6.3 FREQUENCY GENERATION & UP-CONVERSION UNIT

- 6.7 SIGNAL TRANSMISSION MODULE

- 6.7.1 PROVIDING PRECISION SIGNALS TO END USERS THROUGH ROBUST TRANSMISSION CHAINS

- 6.7.2 HIGH-POWER AMPLIFIER

- 6.7.3 RF FILTER

- 6.7.4 ANTENNA

- 6.7.5 INTER-SATELLITE LINK

7 LEO SATELLITE MARKET, BY SATELLITE MASS

- 7.1 INTRODUCTION

- 7.2 USE CASE

- 7.3 CUBESAT

- 7.3.1 ACCELERATING PNT INNOVATION THROUGH LOW-COST DEMONSTRATION PLATFORMS

- 7.4 SMALLSAT

- 7.4.1 ENABLING RESILIENT SATELLITE ARCHITECTURES FOR SECURE AND SCALABLE NAVIGATION SERVICES

- 7.4.2 MICROSAT

- 7.4.3 MINISAT

8 LEO SATELLITE MARKET, BY FREQUENCY

- 8.1 INTRODUCTION

- 8.2 USE CASE

- 8.3 VHF & UHF-BAND

- 8.3.1 ENHANCING SIGNAL PENETRATION AND RELIABILITY IN CHALLENGING ENVIRONMENTS

- 8.4 L-BAND

- 8.4.1 DELIVERING CORE PNT FUNCTIONALITY WITH BROAD TERMINAL COMPATIBILITY

- 8.5 S-BAND

- 8.5.1 ENABLING AGILE PNT SIGNAL MANAGEMENT FOR DYNAMIC ENVIRONMENTS

- 8.6 C-BAND

- 8.6.1 SUPPORTING HIGH-CAPACITY PNT SIGNAL DELIVERY FOR ENCRYPTED AND SECURE APPLICATIONS

- 8.7 KU & KA-BAND

- 8.7.1 FACILITATING HIGH-CAPACITY, LOW-LATENCY PNT THROUGH NEXT-GENERATION HIGH-FREQUENCY INNOVATION

9 LEO PNT MARKET, BY END USE

- 9.1 INTRODUCTION

- 9.2 USE CASE

- 9.3 GOVERNMENT & DEFENSE

- 9.3.1 STRENGTHENING MULTI-DOMAIN DEFENSE OPERATIONS WITH SECURE, HIGH-RESILIENCE NAVIGATION SOLUTIONS

- 9.3.2 PLATFORM NAVIGATION IN GNSS-DENIED ENVIRONMENT

- 9.3.3 DISMOUNTED FORCE POSITIONING

- 9.3.4 SECURE TIMING FOR TACTICAL NETWORK

- 9.3.5 TEST & TRAINING RANGE TIME/POSITION INSTRUMENTATION

- 9.4 CIVIL AVIATION & UAS

- 9.4.1 ENHANCING AIRSPACE SAFETY AND UAS INTEGRATION WITH HIGH-ACCURACY, LOW-LATENCY POSITIONING SYSTEMS

- 9.4.2 PBN/RNP PERFORMANCE SUPPORT

- 9.4.3 AIRPORT SURFACE OPERATIONS COORDINATION

- 9.4.4 UTM/BVLOS DRONE NAVIGATION & GEOFENCING

- 9.5 MARITIME & OFFSHORE

- 9.5.1 DRIVING RELIABLE MARITIME AND OFFSHORE OPERATIONS WITH LOW-LATENCY, INTERFERENCE-RESILIENT LEO PNT SYSTEMS

- 9.5.2 PORT NAVIGATION & PILOTAGE

- 9.5.3 VESSEL TRAFFIC SERVICES TIMING

- 9.5.4 DYNAMIC POSITIONING & STATION KEEPING

- 9.5.5 OFFSHORE PLATFORM/WIND-FARM POSITIONING & TIMING

- 9.5.6 SEARCH & RESCUE LOCALIZATION

- 9.6 AUTOMOTIVE & MOBILITY

- 9.6.1 ENABLING NEXT-GENERATION AUTONOMOUS AND CONNECTED MOBILITY WITH LOCALIZATION

- 9.6.2 LANE-LEVEL LOCALIZATION FOR ADAS/AV

- 9.6.3 FLEET TELEMATICS & ROAD-ASSET TRACKING

- 9.6.4 RAIL/METRO TIMING & LOCALIZATION FOR SIGNALING

- 9.7 TELECOM & POWER

- 9.7.1 STRENGTHENING CRITICAL INFRASTRUCTURES WITH LOW-LATENCY PNT

- 9.7.2 5G/6G NETWORK SYNCHRONIZATION & BACKHAUL TIMING

- 9.7.3 POWER-GRID SYNCHROPHASOR TIMING & PROTECTION

- 9.7.4 DATA-CENTER/ENTERPRISE GRANDMASTER HOLDOVER

- 9.8 CONSTRUCTION & PRECISION AGRICULTURE

- 9.8.1 TRANSFORMING INFRASTRUCTURE DEVELOPMENT AND FARMING THROUGH LEO PNT

- 9.8.2 SURVEY/GEOMATICS PRECISE POSITIONING

- 9.8.3 CONSTRUCTION MACHINE GUIDANCE

- 9.8.4 PRECISION AGRICULTURE GUIDANCE & OPERATIONS

- 9.9 INDUSTRIAL & LOGISTICS

- 9.9.1 ENABLING PRECISE INDUSTRIAL OPERATIONS AND GLOBAL SUPPLY CHAIN EFFICIENCY

- 9.9.2 INDUSTRIAL LOCALIZATION IN HARSH/NEAR-INDOOR SITES

- 9.9.3 YARD/WAREHOUSE/PORT LOGISTICS ASSET TRACKING

- 9.10 OTHER END USES

10 LEO PNT MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 PESTLE ANALYSIS

- 10.2.2 US

- 10.2.2.1 Federal PNT initiatives and procurement programs reinforce leadership in space-based navigation

- 10.3 EUROPE

- 10.3.1 PESTLE ANALYSIS

- 10.3.2 FRANCE

- 10.3.2.1 National space sovereignty goals and ESA-backed subsystem development support expansion

- 10.3.3 UK

- 10.3.3.1 Sovereign funding and SME-led innovation sustain momentum

- 10.4 ASIA PACIFIC

- 10.4.1 PESTLE ANALYSIS

- 10.4.2 CHINA

- 10.4.2.1 Military-led LEO navigation programs and vertically integrated hardware production propel growth

- 10.4.3 JAPAN

- 10.4.3.1 Government-backed LEO augmentation research and component-level specialization fuel expansion

- 10.4.4 AUSTRALIA

- 10.4.4.1 Defense-led space strategy and allied partnerships prompt growth

- 10.5 MIDDLE EAST

- 10.5.1 PESTLE ANALYSIS

- 10.5.2 GCC

- 10.5.2.1 UAE

- 10.5.2.1.1 Public-private partnerships and knowledge transfer agreements fuel demand

- 10.5.2.1 UAE

- 10.5.3 TURKEY

- 10.5.3.1 Defense-led satellite programs and indigenous subsystem development strengthen market

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2020-2024

- 11.3 REVENUE ANALYSIS, 2021-2024

- 11.4 MARKET SHARE ANALYSIS, 2025

- 11.5 BRAND/PRODUCT COMPARISON

- 11.6 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Satellite mass footprint

- 11.7.5.4 Frequency footprint

- 11.8 COMPANY EVALUATION MATRIX: START-UPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING

- 11.8.5.1 List of start-ups/SMEs

- 11.8.5.2 Competitive benchmarking of start-ups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 GMV INNOVATING SOLUTIONS S.L.

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.3.2 Other developments

- 12.1.1.4 MnM view

- 12.1.1.4.1 Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SAFRAN

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Deals

- 12.1.2.3.3 Other developments

- 12.1.2.4 MnM view

- 12.1.2.4.1 Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses and competitive threats

- 12.1.3 THALES ALENIA SPACE

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Deals

- 12.1.3.3.2 Other developments

- 12.1.3.4 MnM view

- 12.1.3.4.1 Right to win

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 XONA SPACE SYSTEMS, INC.

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.3.2 Other developments

- 12.1.4.4 MnM view

- 12.1.4.4.1 Right to win

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 TRUSTPOINT, INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.3.3 Other developments

- 12.1.5.4 MnM view

- 12.1.5.4.1 Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses and competitive threats

- 12.1.6 HEXAGON AB

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.7 L3HARRIS TECHNOLOGIES, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Other developments

- 12.1.8 AIRBUS

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.9 CACI INTERNATIONAL INC

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.9.3 Recent developments

- 12.1.9.3.1 Deals

- 12.1.9.3.2 Other developments

- 12.1.10 MICROCHIP TECHNOLOGY INC.

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product launches

- 12.1.10.3.2 Other developments

- 12.1.11 GENERAL DYNAMICS CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Deals

- 12.1.11.3.2 Other developments

- 12.1.12 RUAG GROUP

- 12.1.12.1 Business overview

- 12.1.12.2 Products offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product launches

- 12.1.12.3.2 Deals

- 12.1.12.3.3 Other developments

- 12.1.13 NORTHROP GRUMMAN

- 12.1.13.1 Business overview

- 12.1.13.2 Products offered

- 12.1.13.3 Recent developments

- 12.1.13.3.1 Other developments

- 12.1.14 HONEYWELL INTERNATIONAL INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Product launches

- 12.1.14.3.2 Deals

- 12.1.14.3.3 Other developments

- 12.1.15 FUGRO

- 12.1.15.1 Business overview

- 12.1.15.2 Products offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Deals

- 12.1.16 RAKON LIMITED

- 12.1.16.1 Business overview

- 12.1.16.2 Products offered

- 12.1.16.3 Recent developments

- 12.1.16.3.1 Product launches

- 12.1.16.3.2 Other developments

- 12.1.17 TELEDYNE TECHNOLOGIES INCORPORATED

- 12.1.17.1 Business overview

- 12.1.17.2 Products offered

- 12.1.18 SATELLES, INC.

- 12.1.18.1 Business overview

- 12.1.18.2 Products offered

- 12.1.1 GMV INNOVATING SOLUTIONS S.L.

- 12.2 OTHER PLAYERS

- 12.2.1 SKYKRAFT PTY LTD

- 12.2.2 QASCOM

- 12.2.3 AOSENSE, INC.

- 12.2.4 ARKEDGE SPACE INC.

- 12.2.5 INFLEQTION, INC.

- 12.2.6 OSCILLOQUARTZ

- 12.2.7 ACCUBEAT LTD.

- 12.2.8 BLILEY TECHNOLOGIES

- 12.2.9 FERGANI

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS