|

시장보고서

상품코드

1811753

주차 관리 시장(-2030년) : 솔루션(주차 예약 관리, 주차장 액세스 및 매출 관리), 주차장 사이트(노외, 노상), 최종사용자(상업, 정부, 운송 및 교통, 산업, 주택)Parking Management Market by Solutions (Parking Reservation Management, Parking Access & Revenue Control), Parking Site (Off-street, On-street), and End Use (Commercial, Government, Transport & Transit, Industrial, Residential) - Global Forecast to 2030 |

||||||

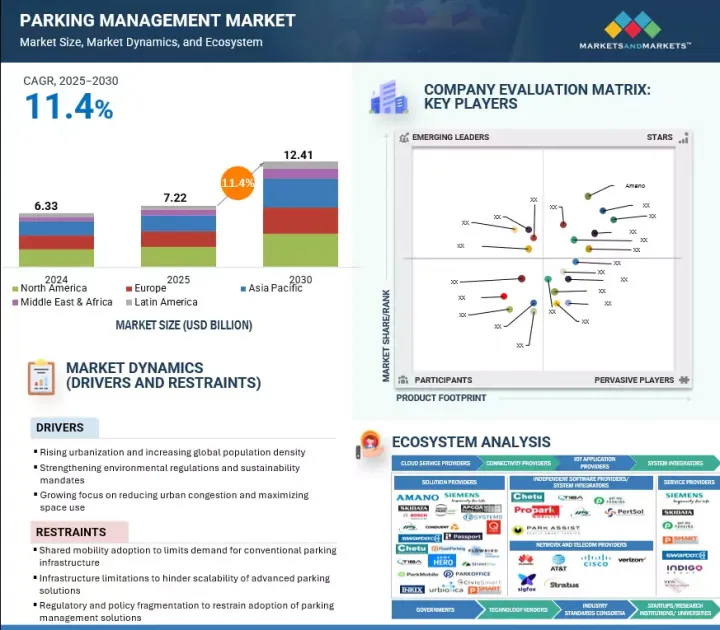

주차 관리 시장 규모는 2025년 72억 2,000만 달러에서 CAGR 11.4%로 성장을 지속하여, 2030년에는 124억 1,000만 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 제공 구분, 주차장.최종사용자, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

이는 지속가능성 목표에 의해 추진되고 있으며, 도시들은 전기차 전용 공간 설치, 주차 중 차량에서 배출되는 배기가스 저감 노력 등 친환경 주차 솔루션을 추진하고 있습니다. 경제적인 우선순위도 도입을 촉진하고 있으며, 사업자들은 동적 가격 책정 모델을 통해 수익을 최적화하고 지역 기업에 대한 접근성을 개선하고 있습니다.

라이드 헤일링, 카셰어링, 자전거 공유, 마이크로모빌리티 서비스(전기 스쿠터, 전기 자전거) 등 대체 모빌리티의 확산으로 자가용 소유에 대한 의존도가 낮아지면서 기존 주차 공간 수요가 감소하고 있습니다. 그 결과, 주차장 운영자는 이용률 감소에 직면하여 스마트 주차 시스템에 대한 투자를 정당화하기 어려워지고 있습니다. 이러한 서비스는 도시의 지속가능성을 촉진하는 한편, 주차 관리 시장을 억제하고 운영자에게 새로운 모빌리티 트렌드에 적응하도록 강요하고 있습니다.

"최종 사용자별로는 주거용 부문이 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다."

이러한 성장은 도시화와 고층 주택 증가로 인해 게이트형 커뮤니티와 공동주택에서 안전하고 효율적인 기술 기반 주차 솔루션에 대한 수요가 증가하고 있기 때문입니다. 인도에서는 DLF, Prestige Group과 같은 대형 주택 개발업체들이 자동화 주차 시스템이나 앱 기반 주민 주차 플랫폼을 도입하여 공간적 제약에 대응하고, 원활한 출입 통제를 실현하고 있습니다.

싱가포르에서는 주택개발청(HDB)의 아파트 단지에서 Parking.sg 앱과 통합된 디지털 주차 시스템을 채택하고 있습니다. 주민들은 디지털 결제, 원격 연장 조작, 종이 쿠폰이 필요 없는 편리함을 누리고 있습니다. 마찬가지로, UAE의 두바이 마리나 및 다운타운 두바이의 고급 주택에서는 RFID 기반 게이트 출입 시스템과 번호판 인식을 결합하여 주민의 자동 출입 및 방문자 관리를 실현하고 있습니다. 이러한 솔루션은 편의성을 높이고, 보안을 강화하며, 한정된 주차 공간을 최적으로 활용할 수 있게 해줍니다.

이러한 발전으로 인해 주거용 주차관리에 뚜렷한 변화가 일어나고 있으며, 자동화, 실시간 모니터링, 통합 디지털 플랫폼에 대한 수요가 급증할 것으로 예측됩니다. 도시형 주택 프로젝트가 확대되고 주민들이 스마트 모빌리티의 편리함을 추구함에 따라, 주택 부문은 예측 기간 동안 가장 빠르게 성장하는 도입 분야로 부상할 것으로 예측됩니다.

세계의 주차 관리(Parking Lot Management) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요와 업계 동향

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 주차 관리 진화

- 생태계 분석

- 사례 연구 분석

- 공급망 분석

- 가격 분석

- 기술 분석

- 특허 분석

- 고객 사업에 영향을 미치는 동향/혼란

- Porter의 Five Forces 분석

- 관세 및 규제 상황

- 주요 이해관계자와 구입 기준

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 주차 관리 시장 기술 로드맵

- 주차 관리에 대한 AI와 생성형 AI의 영향

- 2024년 투자, 자금조달 시나리오

- 현재 비즈니스 모델과 신흥 비즈니스 모델

- 주차 관리 솔루션 베스트 프랙티스

- 무역 분석

- 주차 관리 솔루션으로 사용되는 툴, 프레임워크, 테크닉

- 2025년 미국 관세의 영향 - 주차 관리 시장

제6장 주차 관리 시장 : 제공 구분별

- 솔루션

- 주차장 액세스 및 매출 관리

- 주차 위반 단속 관리

- 주차 예약 관리

- 주차장 안내

- 주차장 보안 및 감시

- 주차 허가증 관리

- 기타 솔루션

- 서비스

- 전문 서비스

- 매니지드 서비스

제7장 주차 관리 시장 : 주차장 사이트별

- 노외 주차

- 차고 주차장

- 로트 주차장

- 노상 주차

제8장 주차 관리 시장 : 최종사용자별

- 주택

- 상업

- 산업

- 정부 및 공공

- 운송 및 교통

제9장 주차 관리 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 거시경제 전망

- 아랍에미리트(UAE)

- 사우디아라비아

- 남아프리카공화국

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

제10장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드 및 제품 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- AMANO

- SKIDATA

- GROUP INDIGO

- ARRIVE

- TIBA PARKING SYSTEMS

- SWARCO

- CHETU

- INRIX

- IPS GROUP

- PRECISE PARKLINK

- VERRA MOBILITY

- INFOCOMM GROUP

- EGIS GROUP

- 기타 기업

- PASSPORT LABS

- GET MY PARKING

- STREETLINE

- CLEVERCITI

- SPOTHERO

- WAYLEADR

- URBIOTICA

- CIVICSMART

- PARKLIO

- TCS INTERNATIONAL

- PARKABLE

- PARKALOT

- PARKING TELECOM

- OMNITEC

제12장 인접 시장/관련 시장

제13장 부록

LSH 25.09.23The parking management market is estimated to be USD 7.22 billion in 2025 and is projected to reach USD 12.41 billion by 2030 at a CAGR of 11.4%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) Million/Billion |

| Segments | Offering, Parking Site, End Use, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

It is driven by sustainability goals, with cities promoting green parking solutions such as dedicated bays for electric vehicles and initiatives to reduce exhaust emissions from parked cars. Economic priorities fuel adoption as operators seek to optimize revenue through dynamic pricing models and improve accessibility for local businesses.

The rise of alternative mobility options, such as ride-hailing, car-sharing, bike-sharing, and micro-mobility services (e-scooters and e-bikes), is decreasing reliance on private vehicle ownership and lowering demand for traditional parking spaces. As a result, parking operators face declining utilization rates, making it harder to justify investments in smart parking systems. While these services promote urban sustainability, they restrain the parking management market and force operators to adapt to new mobility trends.

"Residential end-use segment is projected to register the highest CAGR during the forecast period"

The residential segment is expected to achieve the highest CAGR in the parking management market as rising urbanization and vertical housing trends push demand for secure, efficient, and technology-driven parking solutions within gated communities and apartment complexes. In India, large residential developers, such as DLF and Prestige Group, have begun deploying automated parking systems and app-based resident parking platforms to address space constraints and ensure seamless access control.

In Singapore, Housing and Development Board (HDB) estates adopted digital parking systems integrated with the Parking.sg app, enabling residents to pay digitally, extend sessions remotely, and avoid manual coupon systems. Similarly, in the United Arab Emirates, premium residential complexes in Dubai Marina and Downtown Dubai are increasingly using RFID-enabled gated entry systems combined with license plate recognition for automated resident access and visitor management. These solutions improve convenience, enhance security, and optimize the limited parking spaces available in dense residential areas.

Such developments are driving a clear shift in residential parking management, with a demand for automation, real-time monitoring, and integrated digital platforms expected to surge. As urban housing projects expand and residents seek smart mobility conveniences, the residential end-use segment is poised to emerge as the fastest-growing area of adoption during the forecast period.

"Off-street parking segment to hold the largest market share during forecast period"

The off-street parking segment is expected to contribute the largest market share in adopting parking management systems, as cities and private operators increasingly modernize garages, malls, and institutional facilities with advanced solutions. In the US, operators such as LAZ Parking and SP+ have integrated license plate recognition, digital payment systems, and real-time occupancy management in multi-level parking structures across New York, Chicago, and Los Angeles to enhance efficiency and user convenience. In Europe, major shopping centers and business districts in Paris and Berlin are deploying Skidata's automated revenue control and access systems, allowing seamless entry and exit through ticketless, contactless solutions.

Similarly, in Japan, Amano Corporation equipped large-scale commercial garages in Tokyo with automated parking guidance and integrated EV charging stations, improving space utilization and sustainability compliance. These developments highlight why off-street facilities dominate adoption. They provide controlled environments where integrated hardware and software platforms can deliver measurable efficiency gains, reduce congestion, and optimize revenue generation. With the growing demand for automation, digital payments, and sustainable infrastructure, off-street parking is set to drive the parking management market during the forecast period.

"Asia Pacific will register the highest growth rate, while North America is expected to contribute the largest market share during the forecast period"

Asia Pacific is projected to register the highest CAGR in the parking management market, mainly due to strong government initiatives and regulatory mandates across the region. Singapore is setting a benchmark through its Urban Redevelopment Authority's Parking Guidance System (PGS), which integrates real-time occupancy data, digital signage, and mobile app capabilities for public and commercial parking facilities, creating a model of operational transparency and user convenience. In China, Beijing and Shenzhen are deploying large-scale smart parking systems that incorporate IoT sensors, license plate recognition, and contactless payments as part of national smart city roadmaps, effectively addressing growing urban vehicle volumes.

Japan is fueling adoption by enforcing cashless payment requirements in parking facilities while simultaneously expanding EV-ready infrastructure, aligning its parking sector with broader sustainability goals. South Korea has made strides, particularly in Seoul, where government-led programs mandate e-payments and automated monitoring in public and private parking lots.

North America is expected to capture the largest share of the parking management market, driven by a wave of high-impact, tech-forward implementations across transit hubs and urban centers. Detroit Metropolitan Wayne County Airport is deploying Park Assist's camera-based smart sensor system across more than 18,000 parking spaces to slash search time by up to 63%, boosting convenience and throughput. EnSight Technologies is introducing an AI-powered parking guidance system at Norfolk International Airport, utilizing over 100 cameras to provide real-time occupancy data and digital signage for faster navigation of parking spaces.

At Los Angeles International Airport, ABM's ABMvantage platform has modernized the sprawling LAX Economy Parking facility with touchless entry, pre-booking, license-plate recognition, EV charging, and unified data dashboards. Additionally, the Miami Parking Authority partnered with ParkMobile to expand mobile parking payments across more than 20,000 spaces in the city, thereby enhancing customer convenience and reducing congestion with meter-based systems. These large-scale modernization efforts spanning software-enabled operations, automation, and EV integration demonstrate how strategic deployments in high-traffic venues are fueling North America's leadership in parking management innovation.

Breakdown of Primaries

The study contains insights from various industry experts, from solution vendors to Tier 1 companies. The break-up of the primaries is as follows:

- By Company Type: Tier 1 - 18%, Tier 2 - 44%, and Tier 3 - 38%

- By Designation: C-level -32%, D-level - 36%, and Managers - 32%

- By Region: North America - 38%, Europe - 26%, Asia Pacific - 18%, Middle East & Africa - 10%, and Latin America - 8%

The major players in the parking management market are Amano (Japan), SKIDATA (Austria), Group Indigo (France), Arrive (Sweden), TIBA Parking Systems (Israel), SWARCO (Austria), Chetu (US), INRIX (US), IPS Group (US), Precise ParkLink (Canada), Infocomm Group (Oman), Verra Mobility (US), Egis Group (France), Passport Labs (US), SpotHero (US), Get My Parking (India), Streetline (US), Cleverciti (Germany), Wayleadr (US), Urbiotica (Spain), CivicSmart (US), Parklio (Croatia), TCS International (US), Parkable (New Zealand), Parkalot (Poland), Parking Telecom (France), and Omnitec (Dubai). These players have adopted various growth strategies, such as partnerships, agreements & collaborations, new product launches, enhancements, and acquisitions, to expand their parking management footprint.

Research Coverage

The market study covers the parking management market size across different segments. It aims to estimate the market size and the growth potential across various segments, including offerings (solutions and services), parking sites, end use, and regions. The study includes an in-depth competitive analysis of the leading market players, their company profiles, key observations related to product and business offerings, recent developments, and market strategies.

Key Benefits of Buying the Report

The report will help market leaders and new entrants with information on the closest approximations of the global parking management market's revenue numbers and subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to position their businesses and plan suitable go-to-market strategies. Moreover, the report will provide insights for stakeholders to understand the market's pulse and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the pointers listed below.

1. Product Development/Innovation: Detailed insights on upcoming technologies, research and development activities, and new product and service launches in the parking management market

2. Market Development: Comprehensive information about lucrative markets - the report analyzes various regions' parking management market

3. Market Diversification: Exhaustive information about new products and services, untapped geographies, recent developments, and investments in the parking management market

4. Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Amano (Japan), SKIDATA (Austria), Group Indigo (France), Arrive (Sweden), TIBA Parking Systems (Israel), SWARCO (Austria), Chetu (US), INRIX (US), IPS Group (US), Precise ParkLink (Canada), Infocomm Group (Oman), Verra Mobility (US), Egis Group (France), Passport Labs (US), SpotHero (US), Get My Parking (India), Streetline (US), Cleverciti (Germany), Wayleadr (US), Urbiotica (Spain), CivicSmart (US), Parklio (Croatia), TCS International (US), Parkable (New Zealand), Parkalot (Poland), Parking Telecom (France), and Omnitec (Dubai)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews with experts

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.3 PARKING MANAGEMENT MARKET ESTIMATION: DEMAND-SIDE ANALYSIS

- 2.3 DATA TRIANGULATION

- 2.4 RISK ASSESSMENT

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN PARKING MANAGEMENT MARKET

- 4.2 NORTH AMERICA: PARKING MANAGEMENT MARKET, BY END USE AND COUNTRY

- 4.3 ASIA PACIFIC: PARKING MANAGEMENT MARKET, BY END USE AND COUNTRY

- 4.4 PARKING MANAGEMENT MARKET, BY SEGMENT

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising urbanization and increasing global population density

- 5.2.1.2 Strengthening environmental regulations and sustainability mandates

- 5.2.1.3 Growing demand for seamless traffic flow and reduction in fuel consumption

- 5.2.2 RESTRAINTS

- 5.2.2.1 Shared mobility adoption limits demand for conventional parking infrastructure

- 5.2.2.2 Infrastructure limitations hinder scalability of advanced parking solutions

- 5.2.2.3 Regulatory and policy fragmentation restrain adoption of parking management solutions

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising smart city initiatives globally

- 5.2.3.2 Emergence of autonomous cars

- 5.2.3.3 Demand for innovative parking management solutions

- 5.2.4 CHALLENGES

- 5.2.4.1 Inefficient utilization of urban parking spaces

- 5.2.4.2 Revenue management and dynamic pricing complexity

- 5.2.4.3 Scalability limitations and growth management

- 5.2.1 DRIVERS

- 5.3 EVOLUTION OF PARKING MANAGEMENT

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 CASE STUDY ANALYSIS

- 5.5.1 CASE STUDY 1: PRECISE PARKLINK ENHANCED PARKING MANAGEMENT AT VICTORIA INTERNATIONAL AIRPORT

- 5.5.2 CASE STUDY 2: FLASH'S SCAN-TO-PAY TRANSFORMED PARKWELL PORTFOLIO

- 5.5.3 CASE STUDY 3: PASSPORT LABS COVERED MORE GROUND WITH LPR IN CLAYTON, MISSOURI

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY SOLUTION AND SERVICE

- 5.7.2 INDICATIVE PRICING ANALYSIS FOR PARKING MANAGEMENT SOLUTIONS (PER MONTH)

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Mobile payment & ticketing systems

- 5.8.1.2 License plate recognition (LPR) systems

- 5.8.1.3 Sensor-based parking guidance (ultrasonic, infrared, magnetic field & micro radar, camera)

- 5.8.1.4 Parking access control hardware

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Edge computing

- 5.8.2.2 Digital twin

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 Autonomous vehicles and self-parking technology

- 5.8.3.2 Urban mobility and smart city solutions

- 5.8.3.3 Electric vehicle charging infrastructure management

- 5.8.3.4 AES (Advanced Encryption Standard)

- 5.8.3.5 Data masking

- 5.8.3.6 Encrypted databases

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 METHODOLOGY

- 5.10 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.11 PORTER'S FIVE FORCES ANALYSIS

- 5.11.1 THREAT OF NEW ENTRANTS

- 5.11.2 THREAT OF SUBSTITUTES

- 5.11.3 BARGAINING POWER OF BUYERS

- 5.11.4 BARGAINING POWER OF SUPPLIERS

- 5.11.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.12 TARIFF AND REGULATORY LANDSCAPE

- 5.12.1 TARIFF RELATED TO PARKING MANAGEMENT (853090)

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 TECHNOLOGY ROADMAP FOR PARKING MANAGEMENT MARKET

- 5.15.1 PARKING MANAGEMENT TECHNOLOGY ROADMAP TILL 2030

- 5.15.1.1 Short-term roadmap (2025-2026)

- 5.15.1.2 Mid-term roadmap (2027-2028)

- 5.15.1.3 Long-term roadmap (2029-2030)

- 5.15.1 PARKING MANAGEMENT TECHNOLOGY ROADMAP TILL 2030

- 5.16 IMPACT OF ARTIFICIAL INTELLIGENCE AND GENERATIVE AI ON PARKING MANAGEMENT

- 5.16.1 USE CASES OF GENERATIVE AI IN PARKING MANAGEMENT

- 5.16.2 FUTURE OF GENERATIVE AI IN PARKING MANAGEMENT

- 5.16.3 BEST PRACTICES TO LEVERAGE AI FOR PARKING MANAGEMENT

- 5.17 INVESTMENT AND FUNDING SCENARIO, 2024

- 5.17.1 PARKING MANAGEMENT MARKET: INVESTMENT AND FUNDING SCENARIO OF MAJOR COMPANIES

- 5.18 CURRENT AND EMERGING BUSINESS MODELS

- 5.18.1 SHARED PARKING

- 5.18.2 SMART PARKING

- 5.18.3 PARKING-AS-A-SERVICE (PAAS)

- 5.18.4 ELECTRIC VEHICLE (EV) CHARGING AND PARKING INTEGRATION

- 5.18.5 MARKETPLACE/AGGREGATION PLATFORMS

- 5.18.6 SUBSCRIPTION-BASED BUSINESS MODELS

- 5.19 PARKING MANAGEMENT SOLUTION BEST PRACTICES

- 5.20 TRADE ANALYSIS

- 5.20.1 EXPORT SCENARIO FOR HS CODE: 8530

- 5.20.2 IMPORT SCENARIO FOR HS CODE: 8530

- 5.21 TOOLS, FRAMEWORKS, AND TECHNIQUES USED IN PARKING MANAGEMENT SOLUTIONS

- 5.22 IMPACT OF 2025 US TARIFF - PARKING MANAGEMENT MARKET

- 5.22.1 INTRODUCTION

- 5.22.2 KEY TARIFF RATES

- 5.22.3 PRICE IMPACT ANALYSIS

- 5.22.4 IMPACT ON COUNTRY/REGION

- 5.22.4.1 US

- 5.22.4.2 Europe

- 5.22.4.3 Asia Pacific

- 5.22.5 IMPACT ON END USERS

- 5.22.5.1 Municipal Governments and Public Authorities

- 5.22.5.2 Commercial Property Owners and Managers

- 5.22.5.3 Transportation Hubs

- 5.22.5.4 Residential Complexes

6 PARKING MANAGEMENT MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 OFFERING: PARKING MANAGEMENT MARKET DRIVERS

- 6.2 SOLUTIONS

- 6.2.1 PARKING ACCESS AND REVENUE CONTROL

- 6.2.1.1 Need for proper organization of vehicles in parking facilities to drive market

- 6.2.2 PARKING ENFORCEMENT MANAGEMENT

- 6.2.2.1 Need for strict adherence to parking rules to drive demand for parking management solutions

- 6.2.3 PARKING RESERVATION MANAGEMENT

- 6.2.3.1 Growing demand for convenience parking spaces to drive market

- 6.2.4 PARKING GUIDANCE

- 6.2.4.1 Rising need for reduced traffic congestion and short travel time to drive market

- 6.2.5 PARKING SECURITY AND SURVEILLANCE

- 6.2.5.1 Growing need to prevent theft and ensure personal safety to drive market

- 6.2.6 PARKING PERMIT MANAGEMENT

- 6.2.6.1 Growing need to manage parking permits to drive market

- 6.2.7 OTHER SOLUTIONS

- 6.2.1 PARKING ACCESS AND REVENUE CONTROL

- 6.3 SERVICES

- 6.3.1 PROFESSIONAL SERVICES

- 6.3.1.1 System integration & deployment

- 6.3.1.1.1 Need to improve decision-making, enhance efficiency, and reduce costs to propel market

- 6.3.1.2 Support & maintenance

- 6.3.1.2.1 Need for enhanced performance of parking management solutions to boost market

- 6.3.1.3 Consulting & training

- 6.3.1.3.1 Need to develop and arrange better practices to address specific management requirements to drive market

- 6.3.1.1 System integration & deployment

- 6.3.2 MANAGED SERVICES

- 6.3.2.1 Requirement for technical skills to maintain and update parking management software to drive demand for managed services

- 6.3.1 PROFESSIONAL SERVICES

7 PARKING MANAGEMENT MARKET, BY PARKING SITE

- 7.1 INTRODUCTION

- 7.1.1 PARKING SITE: PARKING MANAGEMENT MARKET DRIVERS

- 7.2 OFF-STREET PARKING

- 7.2.1 FOCUS ON VEHICLE SECURITY, PRE-BOOKING OF PARKING SPOTS, AND PARKING FEE MANAGEMENT TO BOOST MARKET

- 7.2.2 GARAGE PARKING

- 7.2.2.1 Single-level Garage Parking

- 7.2.2.2 Multi-level/Structured Garage Parking

- 7.2.2.3 Automated Garage Parking

- 7.2.3 LOT PARKING

- 7.3 ON-STREET PARKING

- 7.3.1 AVAILABILITY OF ON-STREET PARKING NEAR COMMERCIAL AREAS TO ENCOURAGE MARKET GROWTH

8 PARKING MANAGEMENT MARKET, BY END USE

- 8.1 INTRODUCTION

- 8.1.1 END USE: PARKING MANAGEMENT MARKET DRIVERS

- 8.2 RESIDENTIAL

- 8.2.1 GROWING NUMBER OF APARTMENT COMPLEXES AND GATED COMMUNITIES TO DRIVE MARKET

- 8.2.2 RESIDENTIAL PARKING MANAGEMENT: USE CASES

- 8.3 COMMERCIAL

- 8.3.1 RISING FOCUS OF COMMERCIAL BUSINESSES ON AUTOMATING PARKING OPERATIONS, TRACKING PARKING REVENUE, AND MANAGING PARKING SPACES TO DRIVE MARKET

- 8.3.2 COMMERCIAL PARKING MANAGEMENT: USE CASES

- 8.4 INDUSTRIAL

- 8.4.1 NEED TO STREAMLINE VEHICLE FLOW AND REDUCE CONGESTION IN INDUSTRIAL ZONES TO DRIVE MARKET

- 8.4.2 INDUSTRIAL PARKING MANAGEMENT: USE CASES

- 8.5 GOVERNMENT/PUBLIC

- 8.5.1 GROWING DEMAND FOR PARKING SPACES IN METROPOLITAN AREAS TO DRIVE MARKET

- 8.5.2 GOVERNMENT/PUBLIC PARKING MANAGEMENT: USE CASES

- 8.6 TRANSPORT & TRANSIT

- 8.6.1 RISING URBAN TRANSIT INTEGRATION BOOSTS DEMAND FOR SMART, EFFICIENT PARKING MANAGEMENT SOLUTIONS

- 8.6.2 TRANSPORT & TRANSIT PARKING MANAGEMENT: USE CASES

9 PARKING MANAGEMENT MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 9.2.2 US

- 9.2.2.1 Need to decrease traffic and reduce accidents to drive market

- 9.2.3 CANADA

- 9.2.3.1 Rising number of vehicles to drive adoption of parking management solutions

- 9.3 EUROPE

- 9.3.1 EUROPE: MACROECONOMIC OUTLOOK

- 9.3.2 UK

- 9.3.2.1 Adoption of new technologies to transform parking facilities to boost market

- 9.3.3 GERMANY

- 9.3.3.1 Focus of companies on technological advancements to drive market

- 9.3.4 FRANCE

- 9.3.4.1 Rising need to upgrade parking facilities with latest technologies to drive market

- 9.3.5 ITALY

- 9.3.5.1 Use of sensors and mobile apps to monitor real-time parking availability to drive market

- 9.3.6 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 9.4.2 CHINA

- 9.4.2.1 Substantial investments in digital technologies to drive market

- 9.4.3 JAPAN

- 9.4.3.1 Increasing number of vehicles and scarcity of land to boost demand for parking management solutions

- 9.4.4 INDIA

- 9.4.4.1 Increasing adoption of technology-based transportation systems to drive market

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 9.5.2 UAE

- 9.5.2.1 Significant investment in parking management to boost market

- 9.5.3 KSA

- 9.5.3.1 Government focus on sustainable urban development to drive market

- 9.5.4 SOUTH AFRICA

- 9.5.4.1 Popularity of mobile application-based parking management solutions to drive market

- 9.5.5 REST OF MIDDLE EAST & AFRICA

- 9.6 LATIN AMERICA

- 9.6.1 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 9.6.2 BRAZIL

- 9.6.2.1 Thriving startup ecosystem to drive popularity of parking management solutions

- 9.6.3 MEXICO

- 9.6.3.1 Growing traffic congestion to fuel demand for smart parking solutions

- 9.6.4 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2023

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING, 2023

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 AMANO

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 SKIDATA

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches

- 11.1.2.3.2 Deals

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 GROUP INDIGO

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 ARRIVE

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and enhancements

- 11.1.4.3.2 Deals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 TIBA PARKING SYSTEMS

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and enhancements

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 SWARCO

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and enhancements

- 11.1.6.3.2 Deals

- 11.1.7 CHETU

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services Offered

- 11.1.8 INRIX

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 Recent developments

- 11.1.8.3.1 Product launches and enhancements

- 11.1.8.3.2 Deals

- 11.1.9 IPS GROUP

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Deals

- 11.1.10 PRECISE PARKLINK

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 VERRA MOBILITY

- 11.1.12 INFOCOMM GROUP

- 11.1.13 EGIS GROUP

- 11.1.1 AMANO

- 11.2 OTHER PLAYERS

- 11.2.1 PASSPORT LABS

- 11.2.2 GET MY PARKING

- 11.2.3 STREETLINE

- 11.2.4 CLEVERCITI

- 11.2.5 SPOTHERO

- 11.2.6 WAYLEADR

- 11.2.7 URBIOTICA

- 11.2.8 CIVICSMART

- 11.2.9 PARKLIO

- 11.2.10 TCS INTERNATIONAL

- 11.2.11 PARKABLE

- 11.2.12 PARKALOT

- 11.2.13 PARKING TELECOM

- 11.2.14 OMNITEC

12 ADJACENT/RELATED MARKETS

- 12.1 INTRODUCTION

- 12.2 TRAFFIC MANAGEMENT MARKET - GLOBAL FORECAST TO 2029

- 12.2.1 MARKET DEFINITION

- 12.2.2 MARKET OVERVIEW

- 12.2.2.1 Traffic management market, by offering

- 12.2.2.2 Traffic management market, by area of application

- 12.2.2.3 Traffic management market, by end user

- 12.2.2.4 Traffic management market, by region

- 12.3 FLEET MANAGEMENT MARKET - GLOBAL FORECAST TO 2028

- 12.3.1 MARKET DEFINITION

- 12.3.2 MARKET OVERVIEW

- 12.3.2.1 Fleet management market, by component

- 12.3.2.2 Fleet management market, by fleet type

- 12.3.2.3 Fleet management market, by vertical

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS