|

시장보고서

상품코드

1811754

웨어러블 헬스케어 기기 시장 : 제품별, 유형별, 치료별, 등급별, 유통 채널별, 용도별 예측(-2030년)Wearable Healthcare Devices Market by Product (Trackers, Smartwatch, Patches), Type (Diagnostic (Vital Sign, ECG, Glucose), Therapeutic (Pain, Insulin)), Grade (Consumer, Clinical), Channel (Online, Pharmacy), Application (RPM) - Global Forecast to 2030 |

||||||

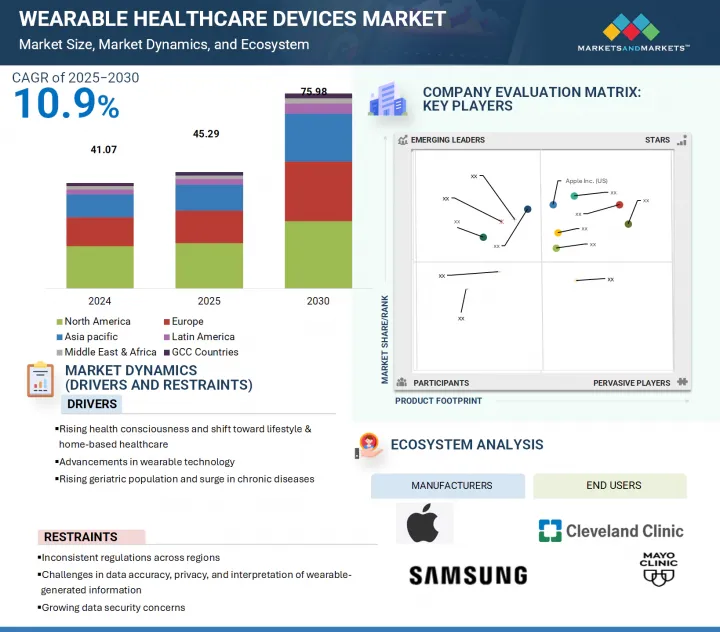

세계의 웨어러블 헬스케어 기기 시장 규모는 예측 기간 중 CAGR 10.9%를 나타내 2025년 452억 9,000만 달러에서 2030년에는 759억 8,000만 달러에 이를 것으로 예상되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 유형별, 등급별, 유통 채널별, 용도별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

최근 몇 년 동안 웨어러블 헬스케어 기기의 기술 진보는 눈부신 상황입니다. 향상된 그래픽 인터페이스와 AI 통합을 특징으로하는 컴팩트하고 사용하기 쉬운 장치가 개발되었습니다. 웨어러블 단말기가 병리의 모니터링과 관리를 지원하게 되어 환자와 일반 시민의 건강 상태 개선에 공헌하게 되었기 때문에 이러한 진보가 시장 침투를 뒷받침하고 있습니다.

응용 분야별로 웨어러블 헬스케어 기기 시장은 일반 건강 및 피트니스, 원격 환자 모니터링, 홈 건강 관리로 구분됩니다. 2024년에는 일반 건강 및 피트니스가 압도적인 용도 부문으로 부상하여 최대 시장 점유율을 차지했습니다. 이 성장은 예방건강, 웰니스 추적, 라이프스타일 관리에 대한 소비자의 관심의 고조가 원동력이 되고 있습니다. 센서와 마이크로컨트롤러가 장착된 스마트 워치, 팔찌, 피트니스 트래커는 심박수, 혈중 산소 포화도, 수면 패턴, 칼로리 소비, 신체 활동 수준 등의 생체 신호를 모니터링하는 데 널리 사용됩니다. 이러한 웨어러블은 개인이 일상적인 건강에 대한 충분한 정보를 얻은 후에 의사 결정을 내리고, 보다 건강한 행동을 촉진하는 힘을 줍니다. 생활 습관병에 대한 의식이 높아지고 일반적인 웰니스 플랫폼과 앱의 인기가 높아짐에 따라 이 분야는 광범위한 사용자층을 유치하고 있습니다. 게다가, 이러한 장비의 대부분은 규제 당국에 의해 위험이 낮은 웰빙 제품으로 분류되어 소비자들에게 더 쉽게 사용할 수 있습니다. 원격 환자 모니터링과 재택 건강 관리도 인구 고령화, 원격 의료 인프라 확대, 전통적인 임상 환경 이외의 만성 질환 관리의 필요성에 의해 꾸준히 성장하고 있습니다. 그러나 일반적인 건강과 피트니스는 대중 시장에 대한 소구력, 가전제품과의 통합, 일상적인 사용 증가로 인해 여전히 주요 응용 분야가되고 있습니다.

유통 채널별로 웨어러블 헬스케어 기기 시장은 약국, 온라인 채널, 하이퍼마켓으로 분류됩니다. 2024년에는 전자상거래의 급성장과 디지털 쇼핑에 대한 소비자의 선호도 증가로 온라인 채널이 최대 점유율을 차지했습니다. Amazon, Flipkart, BestBuy, Alibaba와 같은 플랫폼은 스마트 워치, 피트니스 트래커, 혈압계 및 수면 모니터링 장치를 포함한 웨어러블 건강 관리 제품의 광범위한 구색을 제공하여 소비자가 이러한 기술에 세계적으로 액세스할 수 있도록 합니다. 24시간 365일 이용 가능, 상세한 제품 비교, 사용자 리뷰, 유연한 결제 옵션 등 주요 이점은 이 채널의 매력을 높여줍니다. 스마트폰 이용률 증가와 인터넷 연결 향상이 온라인 판매를 더욱 뒷받침하고 있습니다. 제품의 신뢰성, 구매 전 물리적 교환 제한, 반품의 번거로움 등에 대한 우려가 남아 있는 것, 전자상거래 제공업체는 고객 지원의 충실, 반품 정책의 개선, 제품 보증 등을 통해 이들을 해결하고 있습니다. 게다가 많은 제조업체들이 공식 사이트를 통해 직접 판매함으로써 이익률을 개선하고 소비자와 보다 견고한 브랜드 관계를 구축하고 있습니다. 약국과 하이퍼마켓은 주로 즉시 구매를 위해 특정 지역에서 계속 역할을 하지만 온라인 채널은 도달 범위, 편의성 및 진화하는 디지털 경험으로 인해 여전히 선호되는 선택입니다.

세계의 웨어러블 헬스케어 기기 시장은 6개 지역 부문(북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가)로 구분됩니다. 아시아태평양은 인구 역학, 경제 및 기술적 요인의 조합으로 예측 기간 동안 웨어러블 헬스케어 기기 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 예를 들면, 일본에서는 ICT 기반의 헬스케어 시스템을 도입해, 인도에서는 원격 의료나 e헬스에의 대처를 확대하고 있습니다. 당뇨병, 심혈관 질환, 호흡기 질환 등의 만성 질환의 부담이 증가하고 있기 때문에 원격 모니터링이나 예방 의료의 필요성이 높아지고 있으며, 웨어러블 단말기는 이를 위한 충분한 기능을 갖추고 있습니다. 게다가, 이 지역에서는 고령화가 급속히 진행되고 있기 때문에 고령자가 집에서 건강 관리를 실시할 수 있도록 해, 기존 의료시설에의 부담을 경감하는 건강 추적 기술에 대한 수요가 높아지고 있습니다. 가처분 소득 증가와 소비자의 건강 의식 증가도 피트니스 밴드, 스마트 워치, 커넥티드 패치 등 소비자용 웨어러블 기기의 보급을 뒷받침하고 있습니다. 이와 병행하여, 스마트폰의 보급, 인터넷 접속의 향상, 건강 앱의 이용 증가에 의해 개인이 웨어러블을 일상생활에 도입하는 것이 용이해지고 있습니다. 아시아태평양은 대규모의 다양한 인구, 진화하는 규제 지원, 디지털 전환을 위한 강력한 기세로 세계의 웨어러블 헬스케어 기기 시장에서의 혁신과 채용의 중심 허브가 되는 좋은 위치에 있습니다.

본 보고서에서는 세계의 웨어러블 헬스케어 기기 시장에 대해 조사했으며, 제품별, 유형별, 등급별, 유통 채널별, 용도별, 지역별 동향 및 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 행사(2025-2026년)

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 웨어러블 헬스케어 기기 시장에 있어서의 AI의 영향

- 미국 관세가 웨어러블 헬스케어 기기 시장에 미치는 영향(2025년)

제6장 웨어러블 헬스케어 기기 시장(제품별)

- 서론

- 스마트 워치

- 트래커

- 패치

- 스마트 의류

제7장 웨어러블 헬스케어 기기 시장(유형별)

- 서론

- 진단 및 모니터링 장비

- 치료 기기

제8장 웨어러블 헬스케어 기기 시장(그레이드별)

- 서론

- 소비자 등급의 웨어러블 헬스케어 기기

- 의료 등급의 웨어러블 헬스케어 기기

제9장 웨어러블 헬스케어 기기 시장(유통 채널별)

- 서론

- 온라인 채널

- 약국

- 하이퍼마켓

제10장 웨어러블 헬스케어 기기 시장(용도별)

- 서론

- 일반 건강 및 피트니스

- 원격 환자 모니터링

- 홈 헬스케어

제11장 웨어러블 헬스케어 기기 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 중국

- 일본

- 인도

- 호주

- 뉴질랜드

- 기타

- 라틴아메리카

- 라틴아메리카의 거시 경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 이 지역에서의 웨어러블 헬스케어 기기 수요를 끌어올리는 파괴적 솔루션의 채용 확대

- GCC 국가

- 의료 인프라의 확대와 개선에 대한 주목이 높아져 시장을 견인

제12장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점(2024년)

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 경쟁 시나리오

제13장 기업 프로파일

- 주요 진출기업

- APPLE INC.

- SAMSUNG ELECTRONICS CO., LTD.

- ABBOTT

- DEXCOM, INC.

- FITBIT INC.(SUBSIDIARY OF ALPHABET INC.)

- KONINKLIJKE PHILIPS NV

- GARMIN LTD.

- BOSTON SCIENTIFIC CORPORATION

- OMRON CORPORATION

- MASIMO

- GE HEALTHCARE

- 기타 기업

- BIOTRICITY

- IRHYTHM TECHNOLOGIES, INC.

- CONTEC MEDICAL SYSTEMS CO., LTD.

- MEDIBIOSENSE

- VITALCONNECT

- CYRCADIA HEALTH

- EMPATICA INC.

- MINTTIHEALTH

- BIOBEAT

- IHEALTH LABS INC.

- VIVALNK, INC.

- GENTAG, INC.

- AIQ SMART CLOTHING

- NONIN

- OXITONE

제14장 부록

KTH 25.09.19The global wearable healthcare devices market is projected to reach USD 75.98 billion by 2030 from USD 45.29 billion in 2025, at a CAGR of 10.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Type, Grade, Distribution Channel, and Application |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries |

In recent years, wearable healthcare devices have seen notable technological progress. Compact, user-friendly devices featuring improved graphical interfaces and AI integration have been developed. These advancements have boosted market penetration, as wearables increasingly support monitoring and managing medical conditions, contributing to improved health outcomes for patients and the public.

"The general health & fitness segment of the wearable healthcare devices market is expected to hold the largest share during the forecast period."

By application, the wearable healthcare devices market is segmented into general health & fitness, remote patient monitoring, and home healthcare. In 2024, general health & fitness emerged as the dominant application segment, accounting for the largest market share. This growth is driven by increasing consumer focus on preventive health, wellness tracking, and lifestyle management. Smartwatches, wristbands, and fitness trackers-equipped with sensors and microcontrollers-are widely used to monitor vital signs, including heart rate, blood oxygen saturation, sleep patterns, calorie expenditure, and physical activity levels. These wearables empower individuals to make informed decisions about their daily health and promote healthier behavior. With growing awareness of lifestyle-related diseases and the rising popularity of general wellness platforms and apps, this segment continues to attract a broad user base. Moreover, many of these devices are classified by regulators as low-risk wellness products, making them more accessible to consumers. Remote patient monitoring and home healthcare are also growing steadily, supported by aging populations, the expansion of telehealth infrastructure, and the need for chronic disease management outside traditional clinical settings. However, general health & fitness remains the leading application area due to its mass-market appeal, integration with consumer electronics, and increasing daily usage.

"Online channels accounted for the largest share of the wearable healthcare devices market in 2024."

By distribution channel, the wearable healthcare devices market is categorized into pharmacies, online channels, and hypermarkets. In 2024, online channels held the largest share of the market, driven by the rapid growth of e-commerce and increasing consumer preference for digital shopping. Platforms like Amazon, Flipkart, BestBuy, and Alibaba offer a wide selection of wearable healthcare products-including smartwatches, fitness trackers, blood pressure monitors, and sleep monitoring devices-making it easier for consumers to access these technologies globally. Key advantages such as 24/7 availability, detailed product comparisons, user reviews, and flexible payment options have enhanced the appeal of this channel. Rising smartphone usage and improved internet connectivity have further boosted online sales. Although concerns remain over product authenticity, limited physical interaction before purchase, and return hassles, e-commerce providers are addressing these through enhanced customer support, better return policies, and product warranties. Furthermore, many manufacturers are now selling directly through their official websites, which improves profit margins and builds stronger brand relationships with consumers. While pharmacies and hypermarkets continue to play a role in certain regions, mainly for immediate purchases, online channels remain the preferred choice due to their reach, convenience, and evolving digital experience.

"Asia Pacific is the fastest-growing region of the wearable healthcare devices market."

The global wearable healthcare devices market is segmented into six regional segments: North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and the GCC Countries. The Asia Pacific region is projected to witness the highest CAGR in the wearable healthcare devices market during the forecast period, owing to a combination of demographic, economic, and technological factors. Governments across the region are actively promoting digital health adoption through favorable policies and infrastructure investments-for example, Japan's implementation of ICT-based healthcare systems and India's expansion of telemedicine and eHealth initiatives. The growing burden of chronic diseases such as diabetes, cardiovascular conditions, and respiratory disorders has increased the need for remote monitoring and preventive healthcare, which wearable devices are well-equipped to provide. Moreover, the region's rapidly aging population contributes to higher demand for health tracking technologies that enable elderly individuals to manage their health from home, reducing the strain on traditional healthcare facilities. Rising disposable incomes and growing health consciousness among consumers also encourage the uptake of consumer-grade wearable devices like fitness bands, smartwatches, and connected patches. In parallel, the proliferation of smartphones, better internet connectivity, and increased use of health apps are making it easier for individuals to integrate wearables into their daily routines. With a large and diverse population, evolving regulatory support, and strong momentum toward digital transformation, the Asia Pacific is well-positioned to become a central hub for innovation and adoption in the global wearable healthcare devices market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (38%), Tier 2 (29%), and Tier 3 (33%)

- By Designation: C-level Executives (27%), Directors (18%), and Others (55%)

- By Region: North America (50%), Europe (20%), Asia Pacific (20%), Latin America (7%), and the Middle East & Africa (3%)

The major players operating in the wearable healthcare devices market are Apple Inc. (US), Samsung (South Korea), Abbott (US), DexCom, Inc. (US), Fitbit Inc. (US), Koninklijke Philips N.V. (Netherlands), OMRON Corporation (Japan), Garmin Ltd. (US), GE HealthCare (US), Masimo (US), Boston Scientific Corporation (US), Biotricity (US), iRhythm Technologies, Inc. (US), and CONTEC MEDICAL SYSTEMS CO., LTD. (China).

Research Coverage

This report studies the wearable healthcare devices market based on product, type, grade, distribution channel, application, and region. The report also studies factors (such as drivers, restraints, opportunities, and challenges) affecting market growth and provides details of the competitive landscape for market leaders. Furthermore, the report analyzes micromarkets with respect to their individual growth trends. It forecasts the revenue of the market segments with respect to six major regions (and the respective countries in these regions).

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the strategies mentioned below to strengthen their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (rising health consciousness and the shift toward lifestyle & home-based healthcare, advancements in wearable technology, rising geriatric population and surge in chronic diseases, rising public and private investments accelerating wearable device innovation, increasing availability of smartphone-based applications, and rising adoption of 3G/4G networks), restraints (inconsistent regulations across regions; challenges in data accuracy, privacy, and interpretation of wearable-generated information; and growing data security concerns), opportunities (expansion of AI and 5G applications in medical devices and growing preference for wireless connectivity among healthcare providers), challenges (patent protection of wearable healthcare devices, challenges due to limited battery life, and design and integration challenges in wearable devices)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the wearable healthcare devices market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the wearable healthcare devices market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the wearable healthcare devices market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key industry insights

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Approach 3: Primary interviews

- 2.3.1.4 Growth forecast

- 2.3.1.5 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 STUDY-RELATED ASSUMPTIONS

- 2.5.2 PARAMETRIC ASSUMPTIONS

- 2.5.3 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 WEARABLE HEALTHCARE DEVICES MARKET OVERVIEW

- 4.2 ASIA PACIFIC: WEARABLE HEALTHCARE DEVICES MARKET SHARE, BY DISTRIBUTION CHANNEL AND COUNTRY

- 4.3 WEARABLE HEALTHCARE DEVICES MARKET, BY KEY COUNTRY

- 4.4 WEARABLE HEALTHCARE DEVICES MARKET, REGIONAL MIX, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising health consciousness and shift toward lifestyle & home-based healthcare

- 5.2.1.2 Advancements in wearable technology

- 5.2.1.3 Rising geriatric population and surge in chronic diseases

- 5.2.1.4 Growing public and private investments

- 5.2.1.5 Increasing availability of smartphone-based applications and rising adoption of 3G/4G networks

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inconsistent regulations across regions

- 5.2.2.2 Challenges associated with data accuracy, privacy, and interpretation of wearable-generated information

- 5.2.2.3 Growing data security concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of AI and 5G applications in medical devices

- 5.2.3.2 Growing preference for wireless connectivity among healthcare providers

- 5.2.4 CHALLENGES

- 5.2.4.1 Patent protection of wearable healthcare devices

- 5.2.4.2 Challenges due to limited battery life

- 5.2.4.3 Design and integration challenges in wearable devices

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF SMARTWATCHES, BY KEY PLAYER, 2023-2025

- 5.4.2 AVERAGE SELLING PRICE TREND OF WEARABLE HEALTHCARE DEVICES, BY REGION, 2023-2025

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Continuous glucose monitoring (CGM)

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Closed-loop drug delivery systems

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Telehealth systems

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF MAJOR PATENTS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 901890)

- 5.11.2 EXPORT DATA (HS CODE 901890)

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 REGULATORY ANALYSIS

- 5.13.1 REGULATORY LANDSCAPE

- 5.13.1.1 North America

- 5.13.1.1.1 US

- 5.13.1.1.2 Canada

- 5.13.1.2 Europe

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 China

- 5.13.1.3.2 Japan

- 5.13.1.3.3 India

- 5.13.1.1 North America

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY LANDSCAPE

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON WEARABLE HEALTHCARE DEVICES MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 POTENTIAL OF AI IN WEARABLE HEALTHCARE DEVICES MARKET

- 5.16.3 AI USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI IN WEARABLE HEALTHCARE DEVICES MARKET

- 5.17 IMPACT OF 2025 US TARIFFS ON WEARABLE HEALTHCARE DEVICES MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Remote patient monitoring

6 WEARABLE HEALTHCARE DEVICES MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SMARTWATCHES

- 6.2.1 ADVANTAGES SUCH AS SEAMLESS INTEGRATION WITH ATTRACTIVE DISPLAYS TO BOOST DEMAND

- 6.3 TRACKERS

- 6.3.1 RISING HEALTH CONCERNS AND CHRONIC DISEASE BURDEN TO FUEL DEMAND FOR FITNESS TRACKERS

- 6.4 PATCHES

- 6.4.1 HIGH ACCURACY IN DATA COLLECTION TO DRIVE DEMAND FOR WEARABLE PATCHES

- 6.5 SMART CLOTHING

- 6.5.1 ADVANCED CAPABILITIES AND FLEXIBLE DESIGN TO SUPPORT MARKET EXPANSION

7 WEARABLE HEALTHCARE DEVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 DIAGNOSTIC & MONITORING DEVICES

- 7.2.1 VITAL SIGN MONITORING DEVICES

- 7.2.1.1 Multiparameter trackers

- 7.2.1.1.1 Real-time monitoring of multiple physiological & biochemical parameters to drive demand

- 7.2.1.2 ECG/heart rate monitors

- 7.2.1.2.1 Ability to monitor critical cardiac parameters to drive adoption

- 7.2.1.3 Blood pressure monitors

- 7.2.1.3.1 Rising incidence of hypertension to propel market

- 7.2.1.4 Pulse oximeters

- 7.2.1.4.1 Rising incidence of respiratory diseases and COPD to boost market growth

- 7.2.1.1 Multiparameter trackers

- 7.2.2 GLUCOSE MONITORING DEVICES

- 7.2.2.1 Technological advancements and embedded wireless systems to drive market growth

- 7.2.3 SLEEP MONITORING DEVICES

- 7.2.3.1 Wrist actigraphs

- 7.2.3.1.1 Increasing focus on actimeter performance to drive market growth

- 7.2.3.2 Polysomnography devices

- 7.2.3.2.1 Ability to test multiple vital parameters to support market growth

- 7.2.3.1 Wrist actigraphs

- 7.2.4 FETAL MONITORING & OBSTETRIC DEVICES

- 7.2.4.1 Rising number of preterm births to fuel market growth

- 7.2.5 NEUROMONITORING DEVICES

- 7.2.5.1 Enhanced portability and ease of use to boost market growth

- 7.2.1 VITAL SIGN MONITORING DEVICES

- 7.3 THERAPEUTIC DEVICES

- 7.3.1 PAIN MANAGEMENT DEVICES

- 7.3.1.1 Rising emphasis on chronic pain relief to drive growth in wearable pain management devices market

- 7.3.2 REHABILITATION DEVICES

- 7.3.2.1 Growing demand for post-surgical home care to drive market expansion

- 7.3.3 RESPIRATORY THERAPY DEVICES

- 7.3.3.1 Increasing incidence of COPD to drive demand for respiratory wearables

- 7.3.4 INSULIN PUMPS

- 7.3.4.1 Rising awareness about self-monitoring to fuel adoption of wearable insulin delivery systems

- 7.3.1 PAIN MANAGEMENT DEVICES

8 WEARABLE HEALTHCARE DEVICES MARKET, BY GRADE

- 8.1 INTRODUCTION

- 8.2 CONSUMER-GRADE WEARABLE HEALTHCARE DEVICES

- 8.2.1 WIDESPREAD AVAILABILITY AND AFFORDABILITY TO DRIVE GROWTH OF CONSUMER-GRADE WEARABLES MARKET

- 8.3 CLINICAL-GRADE WEARABLE HEALTHCARE DEVICES

- 8.3.1 REGULATORY-APPROVED DEVICES WITH HIGH ACCURACY TO DRIVE MARKET DEMAND

9 WEARABLE HEALTHCARE DEVICES MARKET, BY DISTRIBUTION CHANNEL

- 9.1 INTRODUCTION

- 9.2 ONLINE CHANNELS

- 9.2.1 FACTORS SUCH AS EASY ACCESS AND 24/7 AVAILABILITY TO BOOST MARKET GROWTH

- 9.3 PHARMACIES

- 9.3.1 GROWING PREFERENCE FOR TRUSTED, HIGH-QUALITY PRODUCTS TO SUPPORT MARKET EXPANSION

- 9.4 HYPERMARKETS

- 9.4.1 EXPANDING RETAIL INFRASTRUCTURE IN EMERGING MARKETS TO DRIVE GROWTH

10 WEARABLE HEALTHCARE DEVICES MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 GENERAL HEALTH & FITNESS

- 10.2.1 RISING EMPHASIS ON LIFESTYLE MANAGEMENT TO DRIVE MARKET EXPANSION

- 10.3 REMOTE PATIENT MONITORING

- 10.3.1 COST EFFICIENCY AND REMOTE DATA SHARING TO DRIVE MARKET GROWTH

- 10.4 HOME HEALTHCARE

- 10.4.1 GROWING ADOPTION OF REAL-TIME MONITORING IN HOME HEALTHCARE TO DRIVE MARKET GROWTH

11 WEARABLE HEALTHCARE DEVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Presence of various federal mandates that encourage adoption of eHealth among healthcare providers to drive market growth

- 11.2.3 CANADA

- 11.2.3.1 Increasing number of investments in wearable devices to fuel market growth in Canada

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Growing preference for home monitoring to boost market growth in Germany

- 11.3.3 UK

- 11.3.3.1 Increasing incidence of chronic diseases to drive market growth in the UK

- 11.3.4 FRANCE

- 11.3.4.1 Growing geriatric population to drive demand for vital sign monitoring devices in France

- 11.3.5 ITALY

- 11.3.5.1 Growing adoption of mobile devices among healthcare professionals to support market growth in Italy

- 11.3.6 SPAIN

- 11.3.6.1 Initiatives to promote mHealth solutions to support growth of market in Spain

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Huge population base using wearable healthcare device to propel market growth

- 11.4.3 JAPAN

- 11.4.3.1 Growing geriatric population and rising focus on home monitoring to drive market in Japan

- 11.4.4 INDIA

- 11.4.4.1 Rising disposable income levels to enhance consumer access to advanced medical technologies

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing digitalization and increasing preference for home monitoring to boost market growth

- 11.4.6 NEW ZEALAND

- 11.4.6.1 Advancing remote care and equity-driven digital health to accelerate wearable device uptake

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Strengthening public digital health systems and expanding remote access to drive wearable healthcare adoption

- 11.5.3 MEXICO

- 11.5.3.1 Expanding telemedicine and digital networks to enable wearable device uptake

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GROWING ADOPTION OF DISRUPTIVE SOLUTIONS TO BOOST DEMAND FOR WEARABLE HEALTHCARE DEVICES IN THIS REGION

- 11.7 GCC COUNTRIES

- 11.7.1 RISING FOCUS ON EXPANDING AND IMPROVING HEALTH INFRASTRUCTURE TO DRIVE MARKET

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN WEARABLE HEALTHCARE DEVICES MARKET

- 12.3 REVENUE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.5.1 STARS

- 12.5.2 EMERGING LEADERS

- 12.5.3 PERVASIVE PLAYERS

- 12.5.4 PARTICIPANTS

- 12.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.5.5.1 Company footprint

- 12.5.5.2 Region footprint

- 12.5.5.3 Product footprint

- 12.5.5.4 Grade footprint

- 12.5.5.5 Distribution channel footprint

- 12.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.6.1 PROGRESSIVE COMPANIES

- 12.6.2 RESPONSIVE COMPANIES

- 12.6.3 DYNAMIC COMPANIES

- 12.6.4 STARTING BLOCKS

- 12.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.6.5.1 Detailed list of key startups/SMEs

- 12.6.5.2 Competitive benchmarking of key startups/SMEs

- 12.7 COMPANY VALUATION & FINANCIAL METRICS

- 12.7.1 COMPANY VALUATION

- 12.7.2 FINANCIAL METRICS

- 12.8 BRAND/PRODUCT COMPARISON

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES & APPROVALS

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 APPLE INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches

- 13.1.1.3.2 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 SAMSUNG ELECTRONICS CO., LTD.

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches & approvals

- 13.1.2.3.2 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 ABBOTT

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product approvals

- 13.1.3.3.2 Deals

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 DEXCOM, INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches & approvals

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 FITBIT INC. (SUBSIDIARY OF ALPHABET INC.)

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Product launches

- 13.1.5.3.2 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses & competitive threats

- 13.1.6 KONINKLIJKE PHILIPS N.V.

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 GARMIN LTD.

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product launches

- 13.1.7.3.2 Deals

- 13.1.8 BOSTON SCIENTIFIC CORPORATION

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.9 OMRON CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 MASIMO

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Product launches & approvals

- 13.1.10.3.2 Deals

- 13.1.11 GE HEALTHCARE

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Deals

- 13.1.11.3.2 Other developments

- 13.1.1 APPLE INC.

- 13.2 OTHER PLAYERS

- 13.2.1 BIOTRICITY

- 13.2.2 IRHYTHM TECHNOLOGIES, INC.

- 13.2.3 CONTEC MEDICAL SYSTEMS CO., LTD.

- 13.2.4 MEDIBIOSENSE

- 13.2.5 VITALCONNECT

- 13.2.6 CYRCADIA HEALTH

- 13.2.7 EMPATICA INC.

- 13.2.8 MINTTIHEALTH

- 13.2.9 BIOBEAT

- 13.2.10 IHEALTH LABS INC.

- 13.2.11 VIVALNK, INC.

- 13.2.12 GENTAG, INC.

- 13.2.13 AIQ SMART CLOTHING

- 13.2.14 NONIN

- 13.2.15 OXITONE

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 AVAILABLE CUSTOMIZATIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS