|

시장보고서

상품코드

1811756

엣지 데이터센터 시장 : 구성 요소별, 용도별 예측(-2030년)Edge Data Center Market by Component (Edge Hardware (Servers, Gateways, Sensors, Devices), Edge Software (Data Management)), Edge Application (Edge AI & Inference, Real-time Processing & Control, Immersive & Interactive Experiences) - Forecast to 2030 |

||||||

엣지 데이터센터 시장은 다양한 업계에서 엣지 데이터센터 기술이 급속히 채용되고 있는 것을 배경으로 큰 성장을 이루고 있습니다.

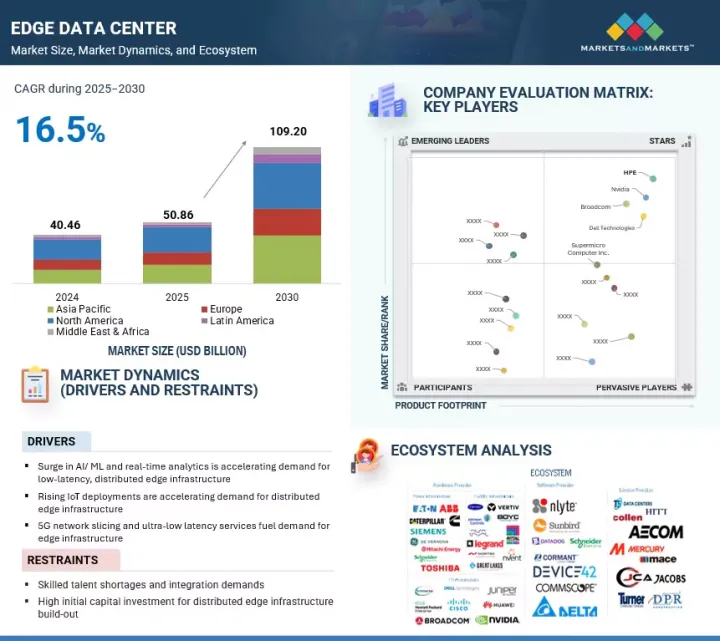

세계 시장 규모는 2025년 약 508억 6,000만 달러에서 2030년에는 1,092억 달러로 확대될 것으로 예측되고 있으며, 엣지 데이터센터는 이 확대를 지원하는 중요한 역할을 담당하고 있습니다. 이러한 시설은 보다 소스에 가까운 곳에서 실시간 데이터 처리 및 분석을 가능하게 하며, IoT, AI, 머신러닝 등의 용도에서 대기 시간을 단축하여 효율성을 향상시킵니다. 저지연 솔루션에 대한 수요 증가와 데이터 보안에 대한 엄격한 규제 요건을 준수함으로써 시장 성장이 더욱 가속화되고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 100만 달러 |

| 부문 | 구성 요소별, 용도별, 배포별, 최종 사용자별, 기업별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

또한 엣지 인프라에 AI와 자동화를 통합함으로써 조직은 보다 스마트하고 자율적인 운영을 실현할 수 있습니다. 그러나 이 시장은 분산형 인프라 구축 및 관리의 복잡성, 레거시 시스템과의 원활한 통합 보장, 고도로 분산된 환경에서 보안 문제에 대응하는 등의 과제에 직면하고 있습니다. 이러한 제약이 있음에도 불구하고 엣지 인프라에 대한 투자가 증가하고 5G와 같은 연결 기술이 발전함에 따라 도입이 촉진되고 엣지 데이터센터가 미래의 디지털 에코시스템의 핵심이 되어 제조, 헬스케어, 스마트 시티 등의 분야에서 중요한 인에이블러가 될 것으로 기대되고 있습니다.

하이퍼스케일러와 클라우드 서비스 제공업체는 저지연 서비스와 IoT, 인공지능, 고도 분석에 의해 생성되는 대량의 데이터를 처리하는 능력에 대한 수요 증가를 주요 요인으로 예측 기간 동안 엣지 데이터센터 시장에서 가장 높은 성장률을 나타낼 것으로 예측됩니다. 엔터프라이즈가 디지털 변환 전략을 강화하는 동안 하이퍼스케일러는 엣지 데이터센터를 구축하여 전략적으로 인프라를 최종 사용자에게 가까워지며 용도 성능을 최적화하고 네트워크 혼잡을 최소화합니다. 이 접근법은 자율 주행 차량, 산업 자동화, 실시간 컨텐츠 배포 등 현지화된 컴퓨팅 능력을 필요로 하는 중요한 이용 사례를 가능하게 합니다. 또한 5G 기술의 급속한 보급으로 클라우드 제공업체는 네트워크 엣지에서 초고신뢰성과 고속 연결을 제공하기 위해 엣지 장비에 대한 수요가 가속화되고 있습니다. 모듈형 및 마이크로 엣지 데이터센터에 대한 투자 증가는 확장성과 지리적 적응성이 높은 솔루션을 제공함으로써 이러한 확장을 더욱 강화하고 있습니다. 비용 효율성과 기존 인프라와의 원활한 통합과 같은 과제는 여전히 존재하고 있으며, 하이퍼스케일러와 클라우드 서비스 제공업체는 풍부한 리소스, 기술적 전문성, 클라우드에서 엣지까지 통합 솔루션을 제공하는 능력을 통해 경쟁 우위를 유지하고 있습니다. 이러한 이유로 엣지 데이터센터 인프라 개발의 다음 단계를 형성하는 중요한 추진력으로 자리매김하고 있습니다.

네트워크 엣지 데이터센터는 최종 사용자에게 보다 가까운 위치에서 고성능 연결성과 저지연 처리를 제공하는 중요한 역할을 하기 때문에 엣지 데이터센터 전망에서 가장 큰 시장 점유율을 차지할 것으로 예측됩니다. 이러한 시설은 네트워크 집약 지점 및 통신 인프라 가까이에 전략적으로 배치되어 실시간 응답성이 필요한 용도를 위해 보다 빠른 데이터 전송과 대역폭 효율성을 향상시킬 수 있습니다. 5G 네트워크의 보급과 IoT 장치의 급격한 증가는 네트워크 엣지 데이터센터 수요를 촉진하는 중요한 요소입니다. 이 센터는 스마트 시티 솔루션, 커넥티드 자동차, 비디오 스트리밍, 미션 크리티컬 산업 용도 등 대기 시간과 네트워크 신뢰성이 가장 중요한 이용 사례를 지원합니다. 또한 통신 사업자와 서비스 제공업체는 서비스 품질을 향상시키고 AR/VR 및 AI 구동형 용도 등 신기술에 의한 트래픽 증가에 대응하기 위해 분산형 네트워크 엣지 인프라스트럭처에 많은 투자를 하고 있습니다. 컴퓨팅, 스토리지 및 네트워킹 리소스를 엣지로 결합하는 능력은 현대 디지털 에코시스템의 필수 구성 요소로 자리매김하고 있습니다. 배포의 복잡성과 에너지 관리에 대한 어려움이 있지만 네트워크 엣지 데이터센터는 앞으로도 지배적 인 부문으로 계속 될 것입니다.

북미는 가장 큰 엣지 데이터센터 시장으로, 성숙한 상호 연결 캠퍼스, 고밀도 CDN 실적, 높은 기업 클라우드 도입으로 형성됩니다. 2023년 이후 다음 두 가지 변화가 두드러졌습니다. AI 추론이 메트로나 지역의 엣지 사이트에서 GPU 밀도가 높은 모듈식 확장을 추진하고 있는 것, 대기업 사업자가 5G 독립형/MEC의 커버리지를 확대해, 지연에 민감한 워크로드를 네트워크 엣지에 끌어들이고 있는 것입니다. 설계는 지속 가능한 리노베이션, 액체 냉각 테스트 도입 및 랙의 고밀도화에 중점을 둡니다. 아시아태평양은 급속한 5G 고밀도화, 모바일 퍼스트 커머스, 제조 기지의 Industry 4.0 프로그램에 밀려 가면서 가장 빠르게 성장하는 시장입니다. 클라우드와 통신 사업자의 연계를 통해 피어링, 캐싱, AI 추론과 사설 5G를 결합한 메트로 엣지 존을 구축하고 있습니다. 구축 스타일은 고온 다습한 기후에 적합한 조립식 모듈과 에너지 효율적인 냉각을 선호합니다. 2023년 이후의 주요 발전에는 여러 APAC 국가에서 전국 5G SA의 시작과 지역 처리를 강화하는 새로운 데이터 보호 규칙(예 : 인도 DPDP법)의 제정이 포함되었습니다. 이러한 움직임을 종합하면 북미에서는 꾸준히 규모가 확대되고 아시아태평양에서는 성장세가 커지고 있습니다.

본 보고서에서는 세계의 엣지 데이터센터 시장에 대해 조사했으며, 구성 요소별, 용도별, 배포 장소별, 최종 사용자 장소별, 기업별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요와 업계 동향(정량적인 의미를 가지는 전략적 성장 촉진요인)

- 서론

- 시장 역학

- 사례 연구 분석

- 생태계 분석

- 공급망 분석

- 기술 분석

- Porter's Five Forces 분석

- 가격 분석

- 특허 분석

- 무역 분석

- 규제 상황

- 고객의 비즈니스에 영향을 미치는 동향과 혼란

- 주요 이해관계자와 구매 기준

- 주요 컨퍼런스 및 행사(2025-2026년)

- 엣지 데이터센터 시장에서의 생성형 AI의 영향

- 비즈니스 모델

- 투자 상황과 자금 조달 시나리오

- 미국 관세의 영향(2025년)

제6장 엣지 데이터센터 시장(구성 요소별)(시장 규모와 예측 - 금액, -2030년)

- 서론

- 인프라

- 소프트웨어

- 서비스

제7장 엣지 데이터센터 시장 : 용도별(시장 규모와 예측 - 금액, -2030년)

- 서론

- 엣지 AI 추론 및 실시간 분석

- AR/VR 및 몰입형 체험

- 5G 서비스 및 네트워크 기능 가상화(NFV)

- 컨텐츠 전송 네트워크(CDN) 및 캐싱

- 산업용 IoT 및 자동화

- 인터랙티브 게임 및 경쟁 플레이

- 커넥티드 및 자율 주행 모빌리티

- 기타

제8장 엣지 데이터센터 시장 : 배포 장소별(시장 규모와 예측 - 금액, -2030년)

- 서론

- 메트로 엣지 데이터센터

- 네트워크 엣지 데이터센터

- 지역 엣지 데이터센터

제9장 엣지 데이터센터 시장 : 최종 사용자 장소별(시장 규모와 예측 - 금액, -2030년)

- 서론

- 하이퍼스케일러 및 클라우드 제공업체

- 코로케이션 서비스 제공업체

- 기업

제10장 엣지 데이터센터 시장 : 기업별(시장 규모와 예측 - 금액, -2030년)

- 서론

- 제조

- 소매 및 E-Commerce

- 통신

- 에너지 및 유틸리티

- 은행, 금융서비스 및 보험(BFSI)

- 의료 및 생명과학

- 기술 및 소프트웨어

- 정부 및 공공 부문

- 기타

제11장 엣지 데이터센터 시장 : 지역별(시장 규모와 예측 - 금액, -2030년)

- 서론

- 북미

- 북미 : 거시경제 전망

- 북미 : 엣지 데이터센터 시장 성장 촉진요인

- 미국

- 캐나다

- 유럽

- 유럽 : 엣지 데이터센터 시장 성장 촉진요인

- 유럽 : 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타

- 아시아태평양

- 아시아태평양 : 엣지 데이터센터 시장 성장 촉진요인

- 아시아태평양 : 거시경제 전망

- 중국

- 일본

- 인도

- 기타

- 중동 및 아프리카

- 중동 및 아프리카 : 엣지 데이터센터 시장 성장 촉진요인

- 중동 및 아프리카 : 거시경제 전망

- 걸프 협력 이사회(GCC)

- 남아프리카

- 기타

- 라틴아메리카

- 라틴아메리카 : 엣지 데이터센터 시장 성장 촉진요인

- 라틴아메리카 : 거시경제 전망

- 브라질

- 멕시코

- 기타

제12장 경쟁 구도

- 서론

- 주요 진입기업의 전략/강점

- 수익 분석

- 시장 점유율 분석(2024년)

- 브랜드/제품 비교

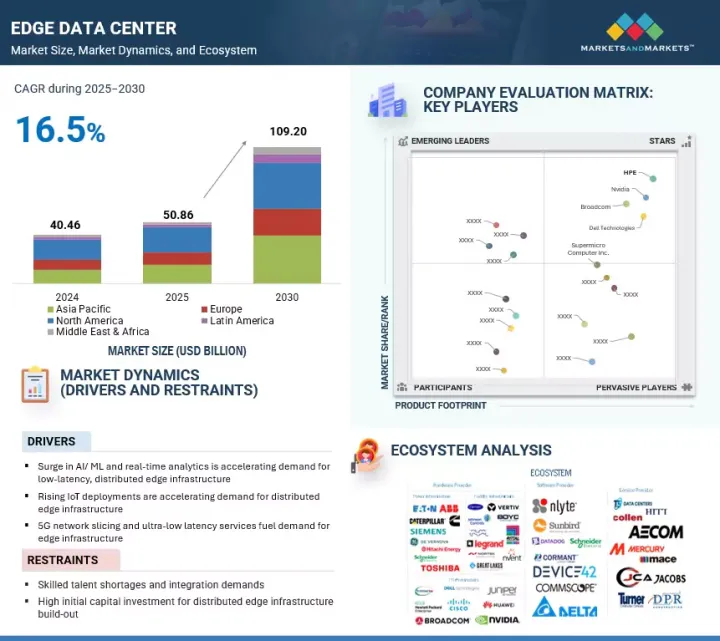

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 주요 벤더의 기업 평가 및 재무 지표

- 경쟁 시나리오와 동향

제13장 기업 프로파일

- 서론

- 주요 진출기업

- DELL TECHNOLOGIES

- BROADCOM

- HPE

- NVIDIA

- SUPERMICRO COMPUTER INC.

- IBM

- LENOVO

- SCHNEIDER ELECTRIC

- CISCO

- HUAWEI

- 기타 기업

- EATON

- CUMMINS

- SIEMENS

- GE VERNOVA

- ABB

- DELTA ELECTRONICS

- LEGRAND

- MODINE

- RITTAL

- VERTIV

- WESTERN DIGITAL

- ARISTA NETWORKS

- NUTANIX

- FUJITSU

- SUNBIRD

- PURE STORAGE

- STULZ

- COOLIT SYSTEM

- SUBMER

- RIELLO UPS

- DEVICE42

- CHATSWORTH PRODUCTS

- GREEN REVOLUTION COOLING

- ACTIVE POWER

제14장 인접 시장과 관련 시장

제15장 부록

KTH 25.09.19The edge data center market is experiencing significant growth, driven by the rapid adoption of edge data center technologies across multiple industries. With the global market projected to expand from approximately USD 50.86 billion in 2025 to USD 109.20 billion by 2030, edge data centers play a critical role in supporting this expansion. These facilities enable real-time data processing and analytics closer to the source, reducing latency and improving efficiency in applications such as IoT, AI, and machine learning. Increasing demand for low-latency solutions and compliance with stringent regulatory requirements for data security further accelerate market growth.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD Million |

| Segments | Component, Application, Deployment, End User, Enterprise |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

Additionally, the integration of AI and automation within edge infrastructures allows organizations to achieve smarter and more autonomous operations. However, the market faces challenges, including the complexity of deploying and managing distributed infrastructure, ensuring seamless integration with legacy systems, and addressing security concerns in highly decentralized environments. Despite these constraints, rising investments in edge infrastructure and advancements in connectivity technologies such as 5G are expected to enhance adoption, making edge data centers a cornerstone for future digital ecosystems and a key enabler for sectors such as manufacturing, healthcare, and smart cities.

"By end user, hyperscalers & cloud service providers to account for the fastest growth during the forecast period"

Hyperscalers and cloud service providers are projected to experience the highest growth rate in the edge data center market during the forecast period, primarily driven by the escalating demand for low-latency services and the ability to process massive volumes of data generated by IoT, artificial intelligence, and advanced analytics applications. As organizations intensify their digital transformation strategies, hyperscalers are strategically extending their infrastructure closer to end-users by deploying edge data centers to optimize application performance and minimize network congestion. This approach enables critical use cases, including autonomous vehicles, industrial automation, and real-time content delivery, which require localized computing capabilities. Furthermore, the rapid adoption of 5G technology is accelerating demand for edge facilities, as cloud providers aim to deliver ultra-reliable and high-speed connectivity at the network's edge. Increased investments in modular and micro-edge data centers further support this expansion by providing scalable and geographically adaptable solutions. While challenges such as cost efficiency and seamless integration with existing infrastructures persist, hyperscalers and cloud service providers hold a competitive advantage through their extensive resources, technological expertise, and ability to deliver integrated cloud-to-edge solutions. This positions them as key drivers in shaping the next phase of edge data center infrastructure development.

"Network edge data center to hold the largest market share during the forecast period"

Network edge data centers are expected to hold the largest market share in the edge data center landscape, driven by their critical role in delivering high-performance connectivity and low-latency processing closer to end users. These facilities are strategically deployed at network aggregation points or near telecom infrastructure, enabling faster data transmission and improved bandwidth efficiency for applications requiring real-time responsiveness. The rising adoption of 5G networks and the exponential growth of IoT devices are significant factors fueling demand for network edge data centers. These centers support essential use cases, including smart city solutions, connected vehicles, video streaming, and mission-critical industrial applications, where latency and network reliability are paramount. Additionally, telecom operators and service providers are making substantial investments in distributed network edge infrastructure to enhance the quality of service and accommodate increasing traffic from emerging technologies such as AR/VR and AI-driven applications. Their ability to combine compute, storage, and networking resources at the edge positions them as an indispensable component of modern digital ecosystems. Despite challenges related to deployment complexity and energy management, network edge data centers will remain a dominant segment, enabling businesses to achieve enhanced user experience and operational efficiency in an increasingly connected world.

"North America should focus on accelerating 5G-enabled edge data center deployments, enhancing regional interconnectivity, and implementing energy-efficient technologies to meet increasing demand for low-latency applications and comply with stringent data sovereignty regulations, while Asia Pacific should emphasize large-scale infrastructure investments, strategic telecom partnerships, and modular edge solutions to support rapid digitalization, IoT expansion, and localized computing needs across emerging economies."

North America is the largest edge data center market, shaped by mature interconnection campuses, dense CDN footprints, and high enterprise cloud adoption. Since 2023, two shifts stand out: gen AI inference is pushing GPU-dense, modular expansions in metro and regional edge sites; and major carriers are broadening 5G standalone/MEC coverage, drawing latency-sensitive workloads into the network edge. Designs emphasize sustainability retrofits, liquid-cooling pilots, and higher rack densities. Asia Pacific is the fastest-growing market, propelled by rapid 5G densification, mobile-first commerce, and Industry 4.0 programs across manufacturing hubs. Regional data-sovereignty frameworks are steering more localized processing, while cloud-telco collaborations are creating metro edge zones that pair peering, caching, and AI inference with private 5G. Build styles favor prefabricated modules and energy-efficient cooling suited to hot, high-humidity climates. Key developments since 2023 include nationwide 5G SA launches in multiple APAC countries and the enactment of new data-protection rules (e.g., India's DPDP law) that reinforce regional processing. Together, these dynamics point to steady scale in North America and outsized growth momentum in Asia Pacific.

Breakdown of Primaries

In-depth interviews were conducted with Chief Executive Officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the edge data center market.

- By Company: Tier I - 33%, Tier II - 27%, and Tier III - 40%

- By Designation: C-Level Executives - 46%, D-Level Executives -22%, and others - 32%

- By Region: North America - 40%, Europe - 28%, Asia Pacific - 27%, and Rest of the World - 5%

The report includes a study of key players offering edge data center market. It profiles major vendors in the edge data center market. The major market players include Supermicro Computer Inc. (US), Lenovo (China), Cisco Systems (US), IBM (US), Western Digital (US), Delta Electronics (Taiwan), Huawei (China), Vertiv (US), Schneider Electric (France), Eaton (Ireland), Siemens (Germany), ABB (Switzerland), General Electric (GE Vernova) (US), Fujitsu (Japan), Arista Networks (US), Nutanix (US), Pure Storage (US), Cummins (US), Rittal (Germany), Legrand (France), Sunbird Software (US), Modine (US), Riello UPS (Italy), Submer (Spain), Dell Technologies (US), Broadcom Inc. (US), NVIDIA Corporation (US), Hewlett Packard Enterprise (HPE) (US).

Research Coverage

This research report categorizes the edge data center market based on Component (IT Infrastructure (storage, server, networking), Data Center Power Infrastructure (Power Generation (Generators, Gas Turbines), Power Backup (Uninterrupted Power Supply (UPS), Battery Energy Storage System (BESS)), Power Distribution (Switchboards, Busways, Power Distribution Units (PDUs), Other Power Distribution), Switchgear (High Voltage Switchgear, Medium Voltage Switchgear, Low Voltage Switchgear), Cabling Infrastructure, Data Center Racks & Enclosure (Open Frame, Enclosed), Data Center Cooling Infrastructure ((Air Cooling (CRAH & CRAC, Air-cooled Chillers, Cooling Towers, Other Air-cooling Solutions), Liquid Cooling (Heat Exchangers, Water-cooled Chillers, Coolant Distribution Units (CDUs), Other Liquid Cooling Solutions), Software (DCIM Software, Building/Facility Management Software, Virtualization, Automation & Orchestration Software, Compliance & Security Software, Analytics & Edge AI Software), Service (Design & Consulting, Integration & Deployment, Support & Maintenance), Application (Edge AI Inference & Real-time Analytics, AR/VR & Immersive Experiences, 5G Services & Network Function Virtualization (NFV), Content Delivery Network (CDN) & Caching, Industrial IoT & Automation, Interactive Gaming & Competitive Play, Connected & Autonomous Mobility, Other Applications (Smart Facility Security & Access Management and Smart Buildings & Facility Management), Deployment Location (Metro Edge Data Center, Network Edge Data Center, Regional Edge Data Center), End User (Hyperscalers & Cloud Service Providers, Colocation Service Providers, Enterprises), Enterprise (Manufacturing, Retail and E-commerce, Telecom, Energy & Utilities, Banking, Financial Services, and Insurance (BFSI), Healthcare & Life Sciences, Technology & Software, Government & Public Sector, Other Enterprises (Transportation & Logistics and Media & Entertainment), and Region (North America, Europe, Asia Pacific, Middle East & Africa, and Latin America). The report's scope covers detailed information regarding the major factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the edge data center market. A detailed analysis of the key industry players was done to provide insights into their business overview, solutions, and services; key strategies; contracts, partnerships, agreements, product & service launches, and mergers and acquisitions; and recent developments associated with the edge data center market. This report also covers the competitive analysis of upcoming startups in the edge data center market ecosystem.

Reason to Buy This Report

The report would provide market leaders and new entrants with information on the closest approximations of the revenue numbers for the overall edge data center market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (Surge in AI/ML and Real-time Analytics Accelerating Demand for Low-latency, Distributed Edge Infrastructure, Rising IoT Deployments Are Accelerating Demand for Distributed Edge Infrastructure, 5G Network Slicing and Ultra-low Latency Services Fuel Demand for Edge Infrastructure), restraints (Skilled Talent Shortages and Integration Demands), opportunities (Rise of Liquid Cooling in AI-driven Data Center Infrastructure to Meet Next-gen Density Requirements, Emerging Edge Software Platforms - Virtualization, Orchestration, Analytics & AI), and challenges (Integration Challenges with Legacy Infrastructure and Core Data Centers, Power and Cooling Constraints in Space-restricted Edge Installations).

- Product Development/Innovation: Detailed insights into upcoming technologies, R&D activities, and product & service launches in the edge data center market.

- Market Development: Comprehensive information about lucrative markets - the report analyzes the edge data center market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the edge data center market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and service offerings of leading players such Supermicro Computer Inc. (US), Lenovo (China), Cisco Systems (US), IBM (US), Western Digital (US), Delta Electronics (Taiwan), Huawei (China), Vertiv (US), Schneider Electric (France), Eaton (Ireland), Siemens (Germany), ABB (Switzerland), General Electric (GE Vernova) (US), Fujitsu (Japan), Arista Networks (US), Nutanix (US), Pure Storage (US), Cummins (US), Rittal (Germany), Legrand (France), Sunbird Software (US), Modine (US), Riello UPS (Italy), Submer (Spain), Dell Technologies (US), Broadcom Inc. (US), NVIDIA Corporation (US), and Hewlett Packard Enterprise (HPE) (US). The report also helps stakeholders understand the edge computing market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Breakup of primary profiles

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN EDGE DATA CENTER MARKET

- 4.2 EDGE DATA CENTER MARKET, BY COMPONENT

- 4.3 EDGE DATA CENTER MARKET, BY DEPLOYMENT LOCATION

- 4.4 EDGE DATA CENTER MARKET, BY APPLICATION

- 4.5 EDGE DATA CENTER MARKET, BY END USER

- 4.6 EDGE DATA CENTER MARKET, BY ENTERPRISE

- 4.7 EDGE DATA CENTER MARKET, BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS (STRATEGIC DRIVERS WITH QUANTITATIVE IMPLICATIONS)

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Surge in AI/ML and real-time analytics accelerating demand for low-latency, distributed edge infrastructure

- 5.2.1.2 Rising IoT deployments accelerating demand for distributed edge infrastructure

- 5.2.1.3 5G network slicing and ultra-low latency services fuel demand for edge infrastructure

- 5.2.2 RESTRAINTS

- 5.2.2.1 Skilled talent shortages and integration demands

- 5.2.2.2 High initial capital investment for distributed edge infrastructure build-out

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rise of liquid cooling in AI-driven data center infrastructure to meet next-gen density requirements

- 5.2.3.2 Emerging edge software platforms - virtualization, orchestration, analytics & AI

- 5.2.4 CHALLENGES

- 5.2.4.1 Integration challenges with legacy infrastructure and core data centers

- 5.2.4.2 Power and cooling constraints in space-restricted edge installations

- 5.2.1 DRIVERS

- 5.3 CASE STUDY ANALYSIS

- 5.3.1 SK TELECOM'S DEPLOYMENT OF 5G MULTI-ACCESS EDGE COMPUTING

- 5.3.2 PROCTER & GAMBLE ACCELERATED GLOBAL MANUFACTURING WITH AZURE IOT EDGE SOLUTIONS

- 5.3.3 AFTERPAY ACCELERATED FINTECH OPERATIONS WITH DIGITAL REALTY EDGE COMPUTING

- 5.3.4 TED ENHANCED MEDIA DELIVERY AND PRODUCTIVITY WITH 365 DATA CENTERS' EDGE INFRASTRUCTURE

- 5.3.5 GEORGIA TECH ADVANCED HIGH-PERFORMANCE RESEARCH WITH DATABANK'S EDGE DATA CENTERS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 TECHNOLOGY ANALYSIS

- 5.6.1 KEY TECHNOLOGIES

- 5.6.1.1 Micro Modular Data Center Modules

- 5.6.1.2 High-density Compute & AI Accelerators

- 5.6.1.3 Software-defined Infrastructure (DCIM & Orchestration)

- 5.6.1.4 Advanced Thermal Management

- 5.6.1.5 Edge Optimized Networking (SDN/NFV)

- 5.6.2 COMPLEMENTARY TECHNOLOGIES

- 5.6.2.1 5G & MEC (Multi-access Edge Computing)

- 5.6.2.2 IoT Sensors & Industrial Gateways

- 5.6.2.3 AI/ML Frameworks and Inference Engines

- 5.6.2.4 Edge Security Appliances

- 5.6.2.5 Battery Energy Storage Systems (BESS)

- 5.6.3 ADJACENT TECHNOLOGIES

- 5.6.3.1 Content Delivery Networks

- 5.6.3.2 Distributed Cloud/Local Zones

- 5.6.3.3 Smart Factory Automation & Digital Twins

- 5.6.3.4 Autonomous Mobility & V2X Infrastructure

- 5.6.3.5 AR/VR & Immersive Experiences

- 5.6.1 KEY TECHNOLOGIES

- 5.7 PORTER'S FIVE FORCES ANALYSIS

- 5.7.1 THREAT OF NEW ENTRANTS

- 5.7.2 THREAT OF SUBSTITUTES

- 5.7.3 BARGAINING POWER OF SUPPLIERS

- 5.7.4 BARGAINING POWER OF BUYERS

- 5.7.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING OF DATA CENTER UPS, BY REGION, 2024

- 5.8.2 AVERAGE PRICING OF DATA CENTER UPS FOR EDGE DATA CENTER DEPLOYMENTS, 2024

- 5.9 PATENT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT SCENARIO

- 5.10.2 EXPORT SCENARIO

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.1.1 Federal Communications Commission (FCC)

- 5.11.1.2 European Data Protection Board (EDPB)

- 5.11.1.3 National Institute of Standards and Technology (NIST)

- 5.11.1.4 Ministry of Internal Affairs and Communications (MIC)

- 5.11.1.5 Australian Communications and Media Authority (ACMA)

- 5.11.1.6 Cybersecurity and Infrastructure Security Agency (CISA)

- 5.11.1.7 International Telecommunication Union

- 5.11.1.8 Data Centre Alliance (DCA)

- 5.11.2 REGULATIONS, BY REGION

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12 TRENDS AND DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 IMPACT OF GENERATIVE AI ON EDGE DATA CENTER MARKET

- 5.15.1 TOP USE CASES & MARKET POTENTIAL

- 5.15.2 KEY USE CASES

- 5.15.3 CASE STUDY

- 5.15.3.1 Use Case 1: Schneider Electric Partnered with Compass Datacenters to Enable AI-driven Predictive Infrastructure Colocation

- 5.15.4 VENDOR INITIATIVE

- 5.15.4.1 Vertiv

- 5.15.4.2 Dell Technologies

- 5.16 BUSINESS MODELS

- 5.16.1 COLOCATION-BASED MODEL

- 5.16.2 MICRO DATA CENTER AS A SERVICE (MDCAAS)

- 5.16.3 INTEGRATED EDGE CLOUD PLATFORM

- 5.16.4 NETWORK EDGE HOSTING FOR TELECOM OPERATORS

- 5.16.5 INDUSTRY-SPECIFIC VERTICAL SOLUTIONS

- 5.16.6 EDGE COLOCATION WITH RENEWABLE ENERGY INTEGRATION

- 5.16.7 MANAGED EDGE INFRASTRUCTURE SERVICES

- 5.17 INVESTMENT LANDSCAPE AND FUNDING SCENARIO

- 5.18 IMPACT OF 2025 US TARIFF

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.3.1 Strategic Shifts and Emerging Trends - Edge Data Center Solutions Market

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 China

- 5.18.4.3 Europe

- 5.18.4.4 Asia Pacific (excluding China)

- 5.18.5 IMPACT ON END USERS

- 5.18.5.1 Hyperscalers

- 5.18.5.2 Colocation Service Providers

- 5.18.5.3 Enterprises

6 EDGE DATA CENTER MARKET, BY COMPONENT (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 6.1 INTRODUCTION

- 6.1.1 COMPONENT: EDGE DATA CENTER MARKET DRIVERS

- 6.2 INFRASTRUCTURE

- 6.2.1 GROWTH IN EDGE INFRASTRUCTURE DRIVEN BY MODULAR, RELIABLE, EFFICIENT, AND SCALABLE SYSTEMS FOR SEAMLESS OPERATIONS

- 6.2.2 DATA CENTER IT INFRASTRUCTURE

- 6.2.2.1 Server

- 6.2.2.2 Storage

- 6.2.2.3 Networking

- 6.2.3 DATA CENTER POWER INFRASTRUCTURE

- 6.2.3.1 Power Generation

- 6.2.3.1.1 Generators

- 6.2.3.1.2 Gas Turbines

- 6.2.3.2 Power Backup

- 6.2.3.2.1 Uninterrupted power supply (UPS)

- 6.2.3.2.2 Battery energy storage system (BESS)

- 6.2.3.3 Power Distribution

- 6.2.3.3.1 Switchboards

- 6.2.3.3.2 Busways

- 6.2.3.3.3 POWER DISTRIBUTION UNITS

- 6.2.3.3.4 Other Power Distribution Units

- 6.2.3.4 Switchgear

- 6.2.3.4.1 High Voltage Switchgear

- 6.2.3.4.2 Medium Voltage Switchgear

- 6.2.3.4.3 Low Voltage Switchgear

- 6.2.3.5 Cabling Infrastructure

- 6.2.3.1 Power Generation

- 6.2.4 DATA CENTER RACKS & ENCLOSURES

- 6.2.4.1 Open Frame Racks

- 6.2.4.2 Enclosed Racks

- 6.2.4.3 Other Racks

- 6.2.5 DATA CENTER COOLING INFRASTRUCTURE

- 6.2.5.1 Air Cooling

- 6.2.5.1.1 CRAH & CRAC

- 6.2.5.1.2 Air-cooled Chillers

- 6.2.5.1.3 Cooling Towers

- 6.2.5.1.4 Other Air Cooling Solutions

- 6.2.5.2 Liquid Cooling

- 6.2.5.2.1 Heat Exchangers

- 6.2.5.2.2 Water-cooled chillers

- 6.2.5.2.3 Coolant Distribution Units (CDUs)

- 6.2.5.2.4 Other Liquid Cooling Solutions

- 6.2.5.1 Air Cooling

- 6.3 SOFTWARE

- 6.3.1 SCALABLE, SECURE, AND INTELLIGENT DATA CENTER OPERATIONS THROUGH INTEGRATED SOFTWARE

- 6.3.2 DCIM SOFTWARE

- 6.3.3 BUILDING/FACILITY MANAGEMENT SOFTWARE

- 6.3.4 VIRTUALIZATION, AUTOMATION, AND ORCHESTRATION SOFTWARE

- 6.3.5 COMPLIANCE & SECURITY SOFTWARE

- 6.3.6 ANALYTICS & EDGE AI SOFTWARE

- 6.4 SERVICES

- 6.4.1 EDGE DATA CENTER SERVICES EXPAND AS ENTERPRISES DEMAND DESIGN, SEAMLESS DEPLOYMENT, AND RELIABLE MAINTENANCE FOR DISTRIBUTED INFRASTRUCTURE

- 6.4.2 DESIGN & CONSULTING

- 6.4.3 INTEGRATION & DEPLOYMENT

- 6.4.4 SUPPORT & MAINTENANCE

7 EDGE DATA CENTER MARKET, BY APPLICATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 7.1 INTRODUCTION

- 7.1.1 APPLICATION: EDGE DATA CENTER MARKET DRIVERS

- 7.2 EDGE AI INFERENCE & REAL-TIME ANALYTICS

- 7.2.1 SCALABLE, SECURE, AND INTELLIGENT DATA CENTER OPERATIONS THROUGH INTEGRATED SOFTWARE

- 7.2.2 COMPUTER VISION & VIDEO ANALYTICS

- 7.2.3 AI-DRIVEN ANOMALY DETECTION

- 7.2.4 VOICE & NATURAL LANGUAGE PROCESSING (NLP)

- 7.3 AR/VR & IMMERSIVE EXPERIENCES

- 7.3.1 INDUSTRIAL & ENTERPRISE XR OPERATIONS

- 7.3.2 VENUE-SCALE & LIVE EVENT XR

- 7.3.3 RETAIL & HOSPITALITY IMMERSIVE COMMERCE

- 7.4 5G SERVICES & NETWORK FUNCTION VIRTUALIZATION (NFV)

- 7.4.1 NETWORK SLICING & EDGE PLATFORM SERVICES

- 7.4.2 PRIVATE 5G & CAMPUS EDGE DEPLOYMENTS

- 7.4.3 EDGE-BASED NETWORK SECURITY & QOS ENFORCEMENT

- 7.4.4 MULTI-ACCESS EDGE COMPUTING (MEC)

- 7.5 CONTENT DELIVERY NETWORK (CDN) & CACHING

- 7.5.1 VIDEO-ON-DEMAND (VOD) & LIVE STREAMING

- 7.5.2 WEB & MOBILE PERFORMANCE ACCELERATION

- 7.5.3 SECURITY & DDOS MITIGATION

- 7.6 INDUSTRIAL IOT & AUTOMATION

- 7.6.1 PREDICTIVE MAINTENANCE & CONDITION MONITORING

- 7.6.2 REAL-TIME PROCESS CONTROL & ROBOTICS AUTOMATION

- 7.6.3 QUALITY CONTROL & VISION-BASED ANALYTICS

- 7.7 INTERACTIVE GAMING & COMPETITIVE PLAY

- 7.7.1 REAL-TIME MULTIPLAYER COMPUTE & SESSION ORCHESTRATION

- 7.7.2 PLAYER PLATFORM & LIVE OPERATIONS

- 7.7.3 COMPETITIVE INFRASTRUCTURE & FAIR-PLAY SYSTEMS

- 7.8 CONNECTED & AUTONOMOUS MOBILITY

- 7.8.1 AUTONOMOUS VEHICLE PERCEPTION & DECISION SUPPORT

- 7.8.2 REAL-TIME MAPPING & HD MAP UPDATES AT EDGE

- 7.8.3 FLEET & MOBILITY-AS-A-SERVICE ORCHESTRATION

- 7.9 OTHER APPLICATIONS

8 EDGE DATA CENTER MARKET, BY DEPLOYMENT LOCATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 8.1 INTRODUCTION

- 8.1.1 DEPLOYMENT LOCATION: EDGE DATA CENTER MARKET DRIVERS

- 8.2 METRO EDGE DATA CENTERS

- 8.2.1 METRO EDGE DATA CENTERS EXPAND TO SUPPORT URBAN WORKLOADS, SMART CITY SERVICES, AND LOW-LATENCY ENTERPRISE APPLICATIONS

- 8.2.2 ENTERPRISE MICRO EDGE

- 8.2.3 TELCO ACCESS EDGE

- 8.2.4 INDUSTRIAL EDGE

- 8.3 NETWORK EDGE DATA CENTERS

- 8.3.1 NETWORK EDGE DATA CENTERS GROW AS 5G ROLLOUTS, IOT EXPANSION, AND LOW-LATENCY SERVICES DRIVE DISTRIBUTED DEPLOYMENTS

- 8.3.2 TOWER EDGE

- 8.3.3 OUTER EDGE

- 8.3.4 INNER EDGE

- 8.4 REGIONAL EDGE DATA CENTERS

- 8.4.1 REGIONAL EDGE DATA CENTERS EXPAND AS ENTERPRISES, TELCOS, AND CLOUD PROVIDERS DEMAND SCALABLE AGGREGATION AND MULTI-CLOUD INTERCONNECTION

- 8.4.2 REGIONAL INTERCONNECTION CAMPUSES (CARRIER-NEUTRAL)

- 8.4.3 REGIONAL TELCO AGGREGATION DATA CENTERS (OPERATOR-OWNED)

- 8.4.4 REGIONAL DISTRIBUTED COMPUTE REGIONS (CLOUD/CDN-RUN)

9 EDGE DATA CENTER MARKET, BY END USER LOCATION (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 9.1 INTRODUCTION

- 9.1.1 END USER: EDGE DATA CENTER MARKET DRIVERS

- 9.2 HYPERSCALERS & CLOUD SERVICE PROVIDERS

- 9.2.1 HYPERSCALERS & CLOUD PROVIDERS DRIVE GROWTH THROUGH AI, SAAS EXPANSION, AND LOW-LATENCY SERVICE DELIVERY

- 9.3 COLOCATION SERVICE PROVIDERS

- 9.3.1 COLOCATION PROVIDERS EXPAND AS DEMAND RISES FOR CARRIER-NEUTRAL, COST-EFFICIENT, AND SCALABLE EDGE INFRASTRUCTURE

- 9.4 ENTERPRISES

- 9.4.1 ENTERPRISES ACCELERATE ADOPTION OF EDGE TO POWER INDUSTRY 4.0, REAL-TIME ANALYTICS, AND DATA SOVEREIGNTY COMPLIANCE

10 EDGE DATA CENTER MARKET, BY ENTERPRISE (MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 10.1 INTRODUCTION

- 10.1.1 ENTERPRISE: EDGE DATA CENTER MARKET DRIVERS

- 10.2 MANUFACTURING

- 10.2.1 MANUFACTURING ENTERPRISES SCALE EDGE ADOPTION FOR INDUSTRY 4.0, PREDICTIVE MAINTENANCE, AND ROBOTICS AUTOMATION

- 10.2.2 MANUFACTURING: USE CASES

- 10.2.2.1 Predictive Maintenance for Industrial Machinery

- 10.2.2.2 AI-driven Quality Control in Manufacturing Lines

- 10.3 RETAIL & E-COMMERCE

- 10.3.1 RETAIL & E-COMMERCE LEVERAGE EDGE FOR PERSONALIZED CUSTOMER ENGAGEMENT, OMNICHANNEL EFFICIENCY, AND REAL-TIME FULFILLMENT

- 10.3.2 RETAIL & E-COMMERCE: USE CASES

- 10.3.2.1 Real-time Personalized In-store Experiences

- 10.3.2.2 Edge-enabled E-commerce Fulfillment Optimization

- 10.4 TELECOMMUNICATIONS

- 10.4.1 TELECOM ENTERPRISES DEPLOY EDGE FOR 5G ROLLOUTS, IOT CONNECTIVITY, AND ULTRA-LOW LATENCY DIGITAL SERVICES

- 10.4.2 TELECOMMUNICATIONS: USE CASES

- 10.4.2.1 Private 5G Networks for Enterprises

- 10.4.2.2 Edge-enabled Content Delivery for Streaming

- 10.5 ENERGY & UTILITIES

- 10.5.1 ENERGY & UTILITIES EMBRACE EDGE FOR SMART GRID OPTIMIZATION, RENEWABLE INTEGRATION, AND PREDICTIVE ASSET MANAGEMENT

- 10.5.2 ENERGY & UTILITIES: USE CASES

- 10.5.2.1 Smart Grid Optimization

- 10.5.2.2 Predictive Maintenance for Renewable Assets

- 10.6 BANKING, FINANCIAL SERVICES, AND INSURANCE (BFSI)

- 10.6.1 BFSI ENTERPRISES INVEST IN EDGE FOR REAL-TIME FRAUD DETECTION, DIGITAL BANKING, AND REGULATORY COMPLIANCE

- 10.6.2 BANKING, FINANCIAL SERVICES, AND INSURANCE: USE CASES

- 10.6.2.1 Real-time Fraud Detection

- 10.6.2.2 Edge-powered High-frequency Trading

- 10.7 HEALTHCARE & LIFE SCIENCES

- 10.7.1 HEALTHCARE SECTOR EXPANDS EDGE USE FOR AI DIAGNOSTICS, TELEMEDICINE, AND SECURE PATIENT DATA MANAGEMENT

- 10.7.2 HEALTHCARE & LIFE SCIENCES: USE CASES

- 10.7.2.1 AI-assisted Medical Imaging

- 10.7.2.2 Remote Patient Monitoring & Telehealth

- 10.8 TECHNOLOGY & SOFTWARE

- 10.8.1 TECHNOLOGY & SOFTWARE PROVIDERS ADOPT EDGE FOR SAAS OPTIMIZATION, AI INFERENCE, AND DISTRIBUTED APPLICATION DELIVERY

- 10.8.2 TECHNOLOGY & SOFTWARE: USE CASES

- 10.8.2.1 Edge-optimized SaaS Delivery

- 10.8.2.2 AI Development & Inference at the Edge

- 10.9 GOVERNMENT & PUBLIC SECTOR

- 10.9.1 GOVERNMENT VERTICALS INTEGRATE EDGE FOR SMART CITY SERVICES, EMERGENCY RESPONSE, AND SOVEREIGN DATA COMPLIANCE

- 10.9.2 GOVERNMENT& PUBLIC SECTOR: USE CASES

- 10.9.2.1 Smart City Surveillance & Traffic Management

- 10.9.2.2 Edge-powered Emergency Response Systems

- 10.10 OTHER ENTERPRISES

11 EDGE DATA CENTER MARKET, BY REGION MARKET SIZE & FORECAST TO 2030 - IN VALUE (USD MILLION))

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.2 NORTH AMERICA: EDGE DATA CENTER MARKET DRIVERS

- 11.2.3 US

- 11.2.3.1 United States Strengthens Leadership In Edge Data Centers Through Strategic Expansions

- 11.2.4 CANADA

- 11.2.4.1 Accelerating Edge Data Center Growth Through Hyperscale Expansion, Smart Cities, and Sustainable Infrastructure

- 11.3 EUROPE

- 11.3.1 EUROPE: EDGE DATA CENTER MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Driving Edge Data Center Expansion Through 5G, Sustainable Infrastructure, and Global Investment Initiatives

- 11.3.4 GERMANY

- 11.3.4.1 Advancing Sustainable Edge Data Centers Through Modular Design, Liquid Cooling, and Climate-neutral Innovation

- 11.3.5 FRANCE

- 11.3.5.1 Emergence of Startups Driving Edge Data Center Innovation

- 11.3.6 ITALY

- 11.3.6.1 AWS Investment Positions Italy as European Digital and Edge Computing Leader

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: EDGE DATA CENTER MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 5G Adoption Powers China's Rise in Edge Computing Ecosystem

- 11.4.4 JAPAN

- 11.4.4.1 Japan's Growing Edge and AI-driven Data Center Market: Strategic Investments and Infrastructure Expansion

- 11.4.5 INDIA

- 11.4.5.1 India's Edge Data Center Market Set for Threefold Growth by 2027

- 11.4.6 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: EDGE DATA CENTER MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 GULF COOPERATION COUNCIL (GCC)

- 11.5.3.1 UAE

- 11.5.3.1.1 UAE's Sustainable Edge Data Center Growth Driven by Renewable Energy and Strategic Digital Infrastructure

- 11.5.3.2 Kingdom of Saudi Arabia

- 11.5.3.2.1 Saudi Arabia's Vision 2030 Driving Edge Data Center Expansion Through 5G, Smart Cities, and Digital Innovation

- 11.5.3.3 Rest of Gulf Cooperation Council (GCC) Countries

- 11.5.3.1 UAE

- 11.5.4 SOUTH AFRICA

- 11.5.4.1 Equinix Launched Johannesburg IBX to Strengthen Regional Edge Infrastructure

- 11.5.5 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: EDGE DATA CENTER MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Brazil's Digital Transformation Accelerating Edge and Hyperscale Data Center Growth Through Strategic Investments and Connectivity

- 11.6.4 MEXICO

- 11.6.4.1 Mexico Emerges as Regional Hub for Edge Data Centers and AI Innovation

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYERS' STRATEGIES/RIGHT TO WIN

- 12.3 REVENUE ANALYSIS

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.6.1 STARS

- 12.6.2 EMERGING LEADERS

- 12.6.3 PERVASIVE PLAYERS

- 12.6.4 PARTICIPANTS

- 12.6.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.6.5.1 Company footprint

- 12.6.5.2 Region footprint

- 12.6.5.3 Infrastructure footprint

- 12.7 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.7.1 PROGRESSIVE COMPANIES

- 12.7.2 RESPONSIVE COMPANIES

- 12.7.3 DYNAMIC COMPANIES

- 12.7.4 STARTING BLOCKS

- 12.7.5 COMPETITIVE BENCHMARKING: STARTUP/SMES, 2024

- 12.7.5.1 Detailed list of key startups/SMEs

- 12.7.5.2 Competitive benchmarking of startups/SMEs

- 12.8 COMPANY VALUATION AND FINANCIAL METRICS OF KEY VENDORS

- 12.8.1 COMPANY VALUATION OF KEY VENDORS

- 12.8.2 FINANCIAL METRICS OF KEY VENDORS

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 MAJOR PLAYERS

- 13.2.1 DELL TECHNOLOGIES

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product Launches

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 BROADCOM

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product Launches

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 HPE

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Product Launches

- 13.2.3.3.2 Deals

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 NVIDIA

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product Launches

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 SUPERMICRO COMPUTER INC.

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product Launches

- 13.2.5.3.2 Deals

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 IBM

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product Launches

- 13.2.6.3.2 Deals

- 13.2.7 LENOVO

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Product Launches

- 13.2.7.3.2 Deals

- 13.2.8 SCHNEIDER ELECTRIC

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product Launches

- 13.2.8.3.2 Deals

- 13.2.9 CISCO

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product Launches

- 13.2.9.3.2 Deals

- 13.2.10 HUAWEI

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product Launches

- 13.2.10.3.2 Deals

- 13.2.1 DELL TECHNOLOGIES

- 13.3 OTHER PLAYERS

- 13.3.1 EATON

- 13.3.2 CUMMINS

- 13.3.3 SIEMENS

- 13.3.4 GE VERNOVA

- 13.3.5 ABB

- 13.3.6 DELTA ELECTRONICS

- 13.3.7 LEGRAND

- 13.3.8 MODINE

- 13.3.9 RITTAL

- 13.3.10 VERTIV

- 13.3.11 WESTERN DIGITAL

- 13.3.12 ARISTA NETWORKS

- 13.3.13 NUTANIX

- 13.3.14 FUJITSU

- 13.3.15 SUNBIRD

- 13.3.16 PURE STORAGE

- 13.3.17 STULZ

- 13.3.18 COOLIT SYSTEM

- 13.3.19 SUBMER

- 13.3.20 RIELLO UPS

- 13.3.21 DEVICE42

- 13.3.22 CHATSWORTH PRODUCTS

- 13.3.23 GREEN REVOLUTION COOLING

- 13.3.24 ACTIVE POWER

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 RELATED MARKETS

- 14.3 LIMITATIONS

- 14.4 DATA CENTER SOLUTIONS MARKET

- 14.5 EDGE COMPUTING MARKET

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS