|

시장보고서

상품코드

1811758

재택 헬스케어 시장 : 제품별, 서비스별, 적응증별, 지역별 예측(-2030년)Home Healthcare Market by Product (Therapeutic, Testing, Screening, Monitoring, Mobility Care), Service (Nursing, Infusion Therapy, Rehabilitation, Palliative Care), Indication (Cancer, Diabetes, CVD, Respiratory, Wound Care) - Global Forecast to 2030 |

||||||

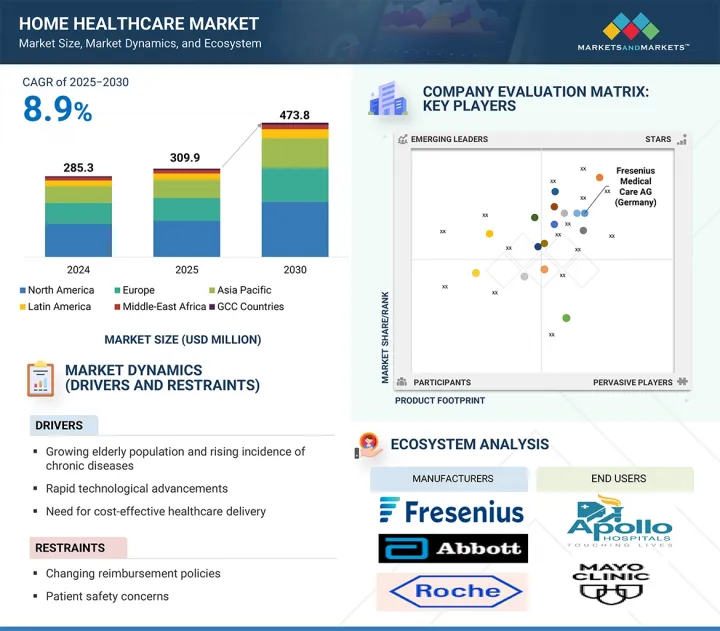

세계의 재택 헬스케어 시장 규모는 2025년 3,099억 달러에서 2030년에는 4,738억 달러에 이를 것으로 예상되며, 에측 기간 중 CAGR은 8.9%를 나타낼 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 서비스별, 적응증별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동, 아프리카, 라틴아메리카 |

고혈압, 비만, 심장질환 등 생활습관병이 증가하고 재택 헬스케어 제품에 대한 수요가 높아지면서 시장이 확대되고 있습니다. 또한 주요 세계 기업의 지속적인 혁신과 신제품 라인의 도입이 시장 성장에 기여하고 있습니다. 이 회사들은 재택 헬스케어를 위해 특별히 설계된 고급 기술을 광범위하게 제공합니다.

재택 헬스케어 시장은 제품 유형별로 치료용 제품, 검사·스크리닝·모니터링용 기기, 이동 간병용 기기로 분류됩니다. 치료 제품은 가장 큰 점유율을 차지합니다. 치료 제품 분야의 강력한 성장은 당뇨병, 심장병, 호흡기 질환 등 만성 건강 상태에 있는 사람들 증가로 인한 것이 큽니다. 이러한 장기적인 질병이 보편화됨에 따라 집에서 사용할 수있는 효과적인 치료 솔루션에 대한 수요가 증가하고 있습니다. 이러한 편리하고 사용하기 쉬운 케어에 대한 요구 증가는 재택 헬스케어 시장에서 치료 제품 부문의 확대에 박차를 가하고 있습니다.

재택 헬스케어 시장은 서비스별로 숙련 간호 서비스, 재활 치료 서비스, 호스피스 완화 케어 서비스, 비숙련 케어 서비스, 호흡 치료 서비스, 주입 치료 서비스, 임신 케어 서비스로 구분됩니다. 숙련 간호 서비스가 큰 시장 점유율을 차지하는 이유는 주로 만성 질환과 수술 후 회복, 노화와 관련된 증상 등으로 가정에서 전문 의료 치료가 필요한 환자가 증가하고 있기 때문입니다. 이러한 서비스는 면허를 가진 간호사가 제공하며, 투약 관리, 상처 케어, 생체 징후 모니터링 등의 작업을 포함합니다. 고령화가 진행되고 의료 제도가 재택 케어로 이동함에 따라, 숙련 간호사 서비스 수요는 증가의 길을 따라가고 있어, 재택 헬스케어 서비스 시장 성장 촉진요인이 되고 있습니다.

세계의 재택 헬스케어 시장은 6개 주요 지역(북미, 유럽, 라틴아메리카, 아시아태평양, 중동, 아프리카, GCC 국가)으로 구분됩니다. 이 중 일본, 인도, 중국 등을 포함한 아시아태평양은 큰 성장 기회를 가져올 것으로 예상되며 예측 기간 동안 가장 높은 CAGR을 나타낼 것으로 예측됩니다.

아시아태평양의 성장에는 의료비 증가, 저렴하고 사용하기 쉬운 관리에 대한 수요 증가, 노인 인구 증가 등 여러 요인이 기여하고 있습니다. 또한 이 지역 정부는 지원 정책, 자금 지원 이니셔티브 및 인프라 개발을 통해 재택 헬스케어를 적극적으로 추진하고 있습니다. 이러한 노력은 기존 의료시설의 부담을 줄이고 의료 액세스를 개선하는 것을 목적으로 하고 있으며, 아시아태평양에서의 재택 헬스케어 시장 확대에 박차를 가하고 있습니다.

본 보고서에서는 세계의 재택 헬스케어 시장에 대해 조사했으며, 제품별, 서비스별, 적응증별, 지역별 동향, 시장 진출기업 프로파일 등을 정리했습니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객사업에 영향을 주는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 주요 컨퍼런스 및 행사(2025-2026년)

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구매 기준

- 재택 헬스케어 시장에 있어서의 AI의 영향

- 재택 헬스케어 시장의 인접 시장

- 미국 관세 규제가 재택 헬스케어 시장에 미치는 영향

제6장 재택 헬스케어 시장(제품별)

- 서론

- 치료 제품

- 검사, 선별 및 모니터링 제품

- 이동 보조 제품

제7장 재택 헬스케어 시장(서비스별)

- 서론

- 전문 간호 서비스

- 재활 치료 서비스

- 호스피스 및 완화 의료 서비스

- 비전문 간병 서비스

- 호흡 치료 서비스

- 주입 요법 서비스

- 임신 관리 서비스

제8장 재택 헬스케어 시장(적응증별)

- 서론

- 암

- 호흡기 질환

- 이동 장애

- 임신

- 심혈관 질환 및 고혈압

- 상처 관리

- 당뇨병

- 청각 장애

- 기타

제9장 재택 헬스케어 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시 경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시 경제 전망

- 일본

- 중국

- 인도

- 기타

- 라틴아메리카

- 헬스케어의 고조가 성장을 뒷받침

- 라틴아메리카의 거시 경제 전망

- 중동 및 아프리카

- 헬스케어 인프라에 대한 투자 확대가 시장을 견인

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 디지털 전환과 관민 연계의 확대가 시장을 활성화

- GCC 국가의 거시 경제 전망

제10장 경쟁 구도

- 개요

- 주요 진입기업의 전략/강점

- 수익 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업평가와 재무지표

- 브랜드/제품 비교

- 기업평가 매트릭스 : 주요 진입기업(2024년)

- 기업평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 프로파일

- 주요 진출기업

- FRESENIUS MEDICAL CARE AG

- ABBOTT

- LINDE PLC

- F. HOFFMANN-LA ROCHE LTD

- RESMED

- KONINKLIJKE PHILIPS NV

- GE HEALTHCARE

- A&D HOLON HOLDINGS COMPANY, LIMITED

- CONVATEC GROUP PLC

- AMEDISYS

- OMRON HEALTHCARE CO., LTD.

- 기타 기업

- INVACARE CORPORATION

- BAYADA HOME HEALTH CARE

- DRIVE DEVILBISS HEALTHCARE

- SUNRISE MEDICAL

- ROMA MEDICAL

- CAREMAX REHABILITATION EQUIPMENT CO., LTD.

- VITALOGRAPH

- ADVITA PFLEGEDIENST GMBH

- THE RENAFAN GROUP

- CONTEC MEDICAL SYSTEMS CO., LTD.

- B. BRAUN SE

- BAXTER

- MEDLINE INDUSTRIES

- ADVIN HEALTH CARE

제12장 부록

KTH 25.09.19The global home healthcare market is projected to reach USD 473.8 billion by 2030 from USD 309.9 billion in 2025, at a CAGR of 8.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Service, Indication, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

The market is expanding due to a rise in lifestyle-related disorders such as high blood pressure, obesity, and cardiac conditions, which are driving greater demand for home healthcare products. Furthermore, ongoing innovation and the introduction of new product lines by leading global companies are contributing to market growth. These companies are offering a wide range of advanced technologies designed specifically for home healthcare.

The therapeutic products segment accounted for the largest share of the home healthcare market in 2024, by product.

The home healthcare market is categorized by type into therapeutic products, testing, screening, and monitoring devices, and mobility care devices. Therapeutic products accounted for the largest share. The strong growth in the therapeutic product segment is largely driven by the increasing number of people living with chronic health conditions such as diabetes, heart disease, and respiratory issues. As these long-term illnesses become more common, there is a growing demand for effective treatment solutions that can be used at home. This rising need for convenient and accessible care is fueling the expansion of the therapeutic product segment within the home healthcare market.

The skilled nursing services segment accounted for the largest market share of the home healthcare market, in 2024, by service.

The home healthcare market is segmented by service into skilled nursing services, rehabilitation therapy services, hospice & palliative care services, unskilled care services, respiratory therapy services, infusion therapy services, and pregnancy care services. Skilled nursing services hold a significant market share, mainly because of the rising number of patients who require professional medical care at home for chronic illnesses, post-surgery recovery, and age-related conditions. These services are provided by licensed nurses and include tasks such as administering medication, wound care, and monitoring vital signs. As the aging population grows and healthcare systems shift toward home-based care, the demand for skilled nursing services continues to rise, making it a key driver of growth in the home healthcare services market.

The Asia Pacific region is projected to witness the highest growth rate in the home healthcare market during the forecast period.

The global home healthcare market is divided into six key regions: North America, Europe, Latin America, Asia Pacific, the Middle East & Africa, and the GCC Countries. Among these, the Asia Pacific region, which includes countries like Japan, India, China, and others, is anticipated to present substantial growth opportunities and is projected to register the highest CAGR during the forecast period.

Several factors contribute to this growth in the Asia Pacific, including rising healthcare expenditures, increasing demand for affordable and accessible care, and a growing elderly population. Moreover, governments in the region are actively promoting home-based healthcare through supportive policies, funding initiatives, and infrastructure development. These efforts are aimed at reducing the burden on traditional healthcare facilities and improving healthcare access, thereby fueling the expansion of the home healthcare market in the Asia Pacific.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1-40%, Tier 2-50%, and Tier 3- 10%

- By Designation: C-level-48%, Director-level-37% and Others-15%

- By Region: North America-46%, Europe-26%, Asia Pacific-17%, Latin America- 7%, Middle East & Africa - 4% and GCC Countries - 1%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the home healthcare market are Fresenius Medical Care AG (Germany), Abbott (US), Linde plc (Ireland), F. Hoffmann-La Roche, Ltd (Switzerland), ResMed (US), Koninklijke Philips N.V. (Netherlands), GE Healthcare (US), A&D HOLON Holdings Company, Limited (Japan), Convatec Group PLC (UK), Amedisys (US), and OMRON Healthcare Co., Ltd. (Japan).

Research Coverage

This report segments the global home healthcare market based on various criteria: product (therapeutic products, testing, screening, and monitoring products, and mobility care products), service (skilled nursing services, rehabilitation therapy services, hospice & palliative care services, unskilled care services, respiratory therapy services, infusion therapy services and pregnancy care services), indication (cancer, respiratory diseases, mobility disorders, cardiovascular diseases & hypertension, pregnancy, wound care, diabetes, hearing disorders and other indications) and region (North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries).

The report provides an in-depth analysis of the key drivers, challenges, opportunities, and restraints influencing market growth. It also offers a detailed evaluation of leading industry players, covering their business profiles, service portfolios, strategic initiatives, acquisitions, product launches & approvals, expansions, and recent developments related to the home healthcare market. Furthermore, the report explores the competitive dynamics of emerging startups within the home healthcare ecosystem.

Reasons to Buy the Report

The report will enable established firms as well as entrants/smaller firms to gauge the pulse of the market, which, in turn, would help them to garner a larger market share. Firms purchasing the report could use one or a combination of the following strategies for strengthening their market presence.

This report provides insights on the following pointers:

- Analysis of key drivers (growing elderly population and rising incidence of chronic diseases, rapid technological advancements, need for cost-effective healthcare delivery, increased preference for personalized care), restraints (changing reimbursement policies, limited insurance coverage, patient safety concerns), opportunities (rising focus on telehealth, growing preference for home-based treatments) and challenges (shortage of home care workers, lack of supporting infrastructure)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the home healthcare market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the home healthcare market

- Market Development: Comprehensive information on lucrative emerging regions

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the home healthcare market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Key data from primary sources

- 2.1.2.4 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Company revenue estimation approach

- 2.2.1.2 Presentations of companies and primary interviews

- 2.2.1.3 Primary interviews

- 2.2.1.4 Growth forecast

- 2.2.1.5 CAGR projections

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.4.1 PARAMETRIC ASSUMPTIONS

- 2.4.2 GROWTH RATE ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 HOME HEALTHCARE MARKET OVERVIEW

- 4.2 GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.3 HOME HEALTHCARE MARKET: GEOGRAPHIC MIX

- 4.4 HOME HEALTHCARE MARKET: DEVELOPED VS. DEVELOPING MARKETS

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growing elderly population and rising incidence of chronic diseases

- 5.2.1.2 Rapid technological advancements

- 5.2.1.3 Need for cost-effective healthcare delivery

- 5.2.1.4 Increased preference for personalized care

- 5.2.2 RESTRAINTS

- 5.2.2.1 Changing reimbursement policies

- 5.2.2.2 Limited insurance coverage

- 5.2.2.3 Patient safety concerns

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising focus on telehealth

- 5.2.3.2 Growing preference for home-based treatments

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of home care workers

- 5.2.4.2 Lack of supporting infrastructure

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY PRODUCT

- 5.4.2 AVERAGE SELLING PRICE TREND, BY KEY PLAYER

- 5.4.3 AVERAGE SELLING PRICE TREND, BY REGION

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Vital sign monitoring devices

- 5.9.1.2 Wearable devices

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Health data platforms

- 5.9.2.2 Medication management system

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Augmented Reality and Virtual Reality (AR/VR)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 901890)

- 5.11.2 EXPORT DATA (HS CODE 901890)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.1.1 North America

- 5.13.1.1.1 US

- 5.13.1.1.2 Canada

- 5.13.1.2 Europe

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 Japan

- 5.13.1.3.2 China

- 5.13.1.3.3 India

- 5.13.1.1 North America

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.1 REGULATORY ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 BARGAINING POWER OF SUPPLIERS

- 5.14.2 BARGAINING POWER OF BUYERS

- 5.14.3 THREAT OF NEW ENTRANTS

- 5.14.4 THREAT OF SUBSTITUTES

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON HOME HEALTHCARE MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 MARKET POTENTIAL OF AI IN HOME HEALTHCARE MARKET

- 5.16.3 AI USE CASES

- 5.16.4 KEY COMPANIES IMPLEMENTING AI

- 5.16.5 FUTURE OF AI IN HOME HEALTHCARE MARKET

- 5.17 ADJACENT MARKETS FOR HOME HEALTHCARE MARKET

- 5.18 IMPACT OF US TARIFF REGULATION ON HOME HEALTHCARE MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 KEY IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Home healthcare providers

6 HOME HEALTHCARE MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 THERAPEUTIC PRODUCTS

- 6.2.1 DIALYSIS EQUIPMENT

- 6.2.1.1 Favorable reimbursement scenario for home dialysis to favor growth

- 6.2.2 WOUND CARE PRODUCTS

- 6.2.2.1 Rising geriatric population and subsequent incidence of chronic diseases to amplify growth

- 6.2.3 IV EQUIPMENT

- 6.2.3.1 Technological advancements in IV therapy to contribute to growth

- 6.2.4 SLEEP APNEA THERAPEUTIC DEVICES

- 6.2.4.1 Increasing patient preference for home-based sleep tests to bolster growth

- 6.2.5 INSULIN DELIVERY DEVICES

- 6.2.5.1 High incidence of diabetes to favor growth

- 6.2.6 OXYGEN DELIVERY SYSTEMS

- 6.2.6.1 Growing trend of using oxygen therapy for respiratory disorders to propel market

- 6.2.7 INHALERS

- 6.2.7.1 High incidence of asthma to stimulate growth

- 6.2.8 NEBULIZERS

- 6.2.8.1 Faster relief and longer symptom control to accelerate growth

- 6.2.9 VENTILATORS

- 6.2.9.1 Growing use of positive airway pressure devices for sleep apnea therapy to drive market

- 6.2.10 OTHER THERAPEUTIC PRODUCTS

- 6.2.1 DIALYSIS EQUIPMENT

- 6.3 TESTING, SCREENING, AND MONITORING PRODUCTS

- 6.3.1 BLOOD GLUCOSE MONITORS

- 6.3.1.1 Increasing preference for self-diagnosis to contribute to growth

- 6.3.2 HEARING AIDS

- 6.3.2.1 High incidence of hearing impairment to augment growth

- 6.3.3 ACTIVITY MONITORS & WRISTBANDS

- 6.3.3.1 Increasing awareness about health and fitness to sustain growth

- 6.3.4 ECG/EKG DEVICES

- 6.3.4.1 High prevalence of cardiovascular diseases to support growth

- 6.3.5 TEMPERATURE MONITORING DEVICES

- 6.3.5.1 Rising use of digital thermometers for quick and accurate results to aid growth

- 6.3.6 HEART RATE MONITORS

- 6.3.6.1 Need for real-time monitoring to advance growth

- 6.3.7 PULSE OXIMETERS

- 6.3.7.1 Rising disease incidence and wide usage of pulse oximetry to promote growth

- 6.3.8 OVULATION & PREGNANCY TEST KITS

- 6.3.8.1 Privacy, convenience, accessibility, and quick results to facilitate growth

- 6.3.9 BLOOD PRESSURE MONITORS

- 6.3.9.1 Growing integration of pressure monitoring devices with digital health platforms to boost market

- 6.3.10 HIV TEST KITS

- 6.3.10.1 Increasing number of HIV-infected individuals globally to favor growth

- 6.3.11 FETAL MONITORING DEVICES

- 6.3.11.1 Increasing reliance on remote-based care to promote growth

- 6.3.12 HOLTER & EVENT MONITORS

- 6.3.12.1 Portability and storage attributes to aid growth

- 6.3.13 DRUG & ALCOHOL TEST KITS

- 6.3.13.1 Rise in drug abuse and alcohol consumption to support growth

- 6.3.14 COAGULATION MONITORING PRODUCTS

- 6.3.14.1 Rising incidence of deep vein thrombosis, pulmonary embolism, and hemophilia to foster growth

- 6.3.15 PEAK FLOW METERS

- 6.3.15.1 High portability and cost-efficiency to increase adoption

- 6.3.16 COLON CANCER TEST KITS

- 6.3.16.1 High incidence of colorectal cancer to drive market

- 6.3.17 EEG DEVICES

- 6.3.17.1 Wide patient population for epilepsy to fuel market

- 6.3.18 HOME SLEEP TESTING DEVICES

- 6.3.18.1 Need for specialized care at home to spur growth

- 6.3.19 CHOLESTEROL TESTING PRODUCTS

- 6.3.19.1 Rising obesity levels and cardiovascular incidence to augment growth

- 6.3.20 HOME HBA1C TEST KITS

- 6.3.20.1 Increasing recommendations for regular testing and favorable clinical outcomes to aid growth

- 6.3.1 BLOOD GLUCOSE MONITORS

- 6.4 MOBILITY CARE PRODUCTS

- 6.4.1 WHEELCHAIRS

- 6.4.1.1 Need for patient mobility with less pain and fatigue to fuel market

- 6.4.2 MOBILITY SCOOTERS

- 6.4.2.1 Increasing demand for mobility-assisted devices to facilitate growth

- 6.4.3 WALKERS & ROLLATORS

- 6.4.3.1 Rising prevalence for gait disorders, osteoarthritis, and other degenerative joint diseases to aid growth

- 6.4.4 CRUTCHES

- 6.4.4.1 Increasing use of crutches during post-operative recovery to boost market

- 6.4.5 CANES

- 6.4.5.1 Low cost, ease of use, and wide availability to contribute to growth

- 6.4.1 WHEELCHAIRS

7 HOME HEALTHCARE MARKET, BY SERVICE

- 7.1 INTRODUCTION

- 7.2 SKILLED NURSING SERVICES

- 7.2.1 NEED FOR SPECIFIC PLAN OF CARE TO PROMOTE GROWTH

- 7.3 REHABILITATION THERAPY SERVICES

- 7.3.1 RISING DEMAND FOR IN-HOME CARE PERSONNEL TO STIMULATE GROWTH

- 7.4 HOSPICE & PALLIATIVE CARE SERVICES

- 7.4.1 INCREASING GERIATRIC POPULATION TO FACILITATE GROWTH

- 7.5 UNSKILLED CARE SERVICES

- 7.5.1 HIGHER AFFORDABILITY THAN HOSPITAL OR NURSING HOME SERVICES TO AID GROWTH

- 7.6 RESPIRATORY THERAPY SERVICES

- 7.6.1 GROWING PREVALENCE OF RESPIRATORY DISORDERS TO DRIVE MARKET

- 7.7 INFUSION THERAPY SERVICES

- 7.7.1 SAFE AND EFFECTIVE ALTERNATIVE TO INPATIENT CARE TO ENCOURAGE GROWTH

- 7.8 PREGNANCY CARE SERVICES

- 7.8.1 NEED FOR BETTER MANAGEMENT OF HIGH-RISK PREGNANCIES AND COMPLICATIONS TO ENSURE GROWTH

8 HOME HEALTHCARE MARKET, BY INDICATION

- 8.1 INTRODUCTION

- 8.2 CANCER

- 8.2.1 INCREASING PREFERENCE FOR AT-HOME TREATMENT TO EXPEDITE GROWTH

- 8.3 RESPIRATORY DISEASES

- 8.3.1 RISING INCIDENCE OF CHRONIC DISEASES TO SUSTAIN GROWTH

- 8.4 MOBILITY DISORDERS

- 8.4.1 GROWING GERIATRIC POPULATION TO BOOST MARKET

- 8.5 PREGNANCY

- 8.5.1 RISING FOCUS ON BETTER CARE AND MONITORING DURING PREGNANCY TO AID GROWTH

- 8.6 CARDIOVASCULAR DISEASES & HYPERTENSION

- 8.6.1 GROWING HEALTH AWARENESS TO DRIVE MARKET

- 8.7 WOUND CARE

- 8.7.1 INCREASING NUMBER OF ROAD ACCIDENTS AND TRAUMA INJURIES TO BOLSTER GROWTH

- 8.8 DIABETES

- 8.8.1 SHIFT IN CONSUMER PREFERENCE FROM TRADITIONAL TO MULTIFUNCTIONAL BLOOD GLUCOSE METERS TO SPUR GROWTH

- 8.9 HEARING DISORDERS

- 8.9.1 WORLDWIDE INCREASE IN HEARING DISABILITIES TO FOSTER GROWTH

- 8.10 OTHER INDICATIONS

9 HOME HEALTHCARE MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Significant demographic change to contribute to growth

- 9.2.3 CANADA

- 9.2.3.1 Growing elderly population to drive market

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Increasing demand for healthcare services to bolster growth

- 9.3.3 UK

- 9.3.3.1 Aging population and rising patient pool to expedite growth

- 9.3.4 FRANCE

- 9.3.4.1 Favorable government support to boost market

- 9.3.5 ITALY

- 9.3.5.1 Universal eligibility for home care to favor growth

- 9.3.6 SPAIN

- 9.3.6.1 Upsurge in elderly population to accelerate growth

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 High life expectancy and growing healthcare innovations to fuel market

- 9.4.3 CHINA

- 9.4.3.1 Increasing cases of diabetes and diabetic foot ulcers to favor growth

- 9.4.4 INDIA

- 9.4.4.1 Rising disposable income and focus on personalized care to spur growth

- 9.4.5 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 RISING HEALTHCARE NEEDS TO AID GROWTH

- 9.5.2 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 GROWING INVESTMENTS IN HEALTHCARE INFRASTRUCTURE TO PROPEL MARKET

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 DIGITAL TRANSFORMATION AND EXPANDING PUBLIC-PRIVATE PARTNERSHIPS TO FUEL MARKET

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY VALUATION AND FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Product & service footprint

- 10.7.5.4 Product footprint

- 10.7.5.5 End-user footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.5.1 Detailed list of key startups/SMEs

- 10.8.5.2 Competitive benchmarking of key startups/SMEs

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES AND APPROVALS

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches and approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 ABBOTT

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches and approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses and competitive threats

- 11.1.3 LINDE PLC

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses and competitive threats

- 11.1.4 F. HOFFMANN-LA ROCHE LTD

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product launches and approvals

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses and competitive threats

- 11.1.5 RESMED

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches and approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 KONINKLIJKE PHILIPS N.V.

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches and approvals

- 11.1.6.3.2 Deals

- 11.1.7 GE HEALTHCARE

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Deals

- 11.1.8 A&D HOLON HOLDINGS COMPANY, LIMITED

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.9 CONVATEC GROUP PLC

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Product launches and approvals

- 11.1.9.4 Recent developments

- 11.1.9.4.1 Expansions

- 11.1.10 AMEDISYS

- 11.1.10.1 Business overview

- 11.1.10.2 Products/solutions/services offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 OMRON HEALTHCARE CO., LTD.

- 11.1.11.1 Business overview

- 11.1.11.2 Products/Solutions/Services offered

- 11.1.11.3 Recent developments

- 11.1.11.3.1 Deals

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.2 OTHER PLAYERS

- 11.2.1 INVACARE CORPORATION

- 11.2.2 BAYADA HOME HEALTH CARE

- 11.2.3 DRIVE DEVILBISS HEALTHCARE

- 11.2.4 SUNRISE MEDICAL

- 11.2.5 ROMA MEDICAL

- 11.2.6 CAREMAX REHABILITATION EQUIPMENT CO., LTD.

- 11.2.7 VITALOGRAPH

- 11.2.8 ADVITA PFLEGEDIENST GMBH

- 11.2.9 THE RENAFAN GROUP

- 11.2.10 CONTEC MEDICAL SYSTEMS CO., LTD.

- 11.2.11 B. BRAUN SE

- 11.2.12 BAXTER

- 11.2.13 MEDLINE INDUSTRIES

- 11.2.14 ADVIN HEALTH CARE

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS