|

시장보고서

상품코드

1812623

유체 관리 시스템 시장 : 제품별, 용도별, 최종사용자별, 지역별 - 예측(-2030년)Fluid Management Systems Market by Product Type (Systems, Disposables & Accessories), Application, End User, Key Stakeholder, Buying Criteria & Unmet Needs - Global Forecast to 2030 |

||||||

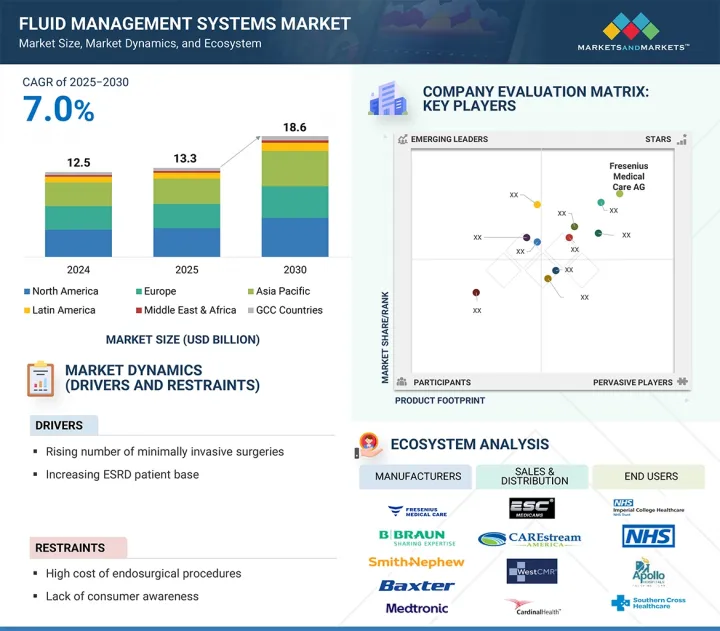

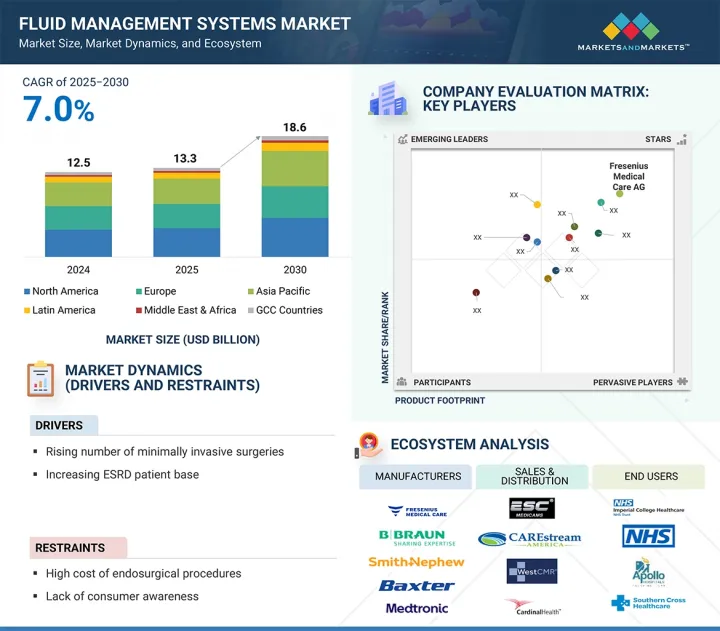

유체 관리 시스템 시장 규모는 예측 기간 동안 7.0%의 CAGR로 확대되어 2025년 132억 6,000만 달러에서 2030년에는 186억 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

유체 관리 시스템(FMS) 시장은 외과 수술의 증가, 최소침습 기술에 대한 수요 증가, 만성 신장 및 비뇨기 질환의 발생률 증가 등 여러 요인에 의해 주도되고 있습니다. 자동 흡입 및 관류 시스템과 같은 기술 발전은 효율성과 안전성을 향상시켜 의료 시설에서 폭넓게 채택되고 있습니다.

그러나 높은 시술 비용과 신흥 지역에서의 낮은 인지도는 성장의 걸림돌로 작용할 수 있습니다. 아시아태평양에는 확장의 큰 기회가 있으며, 일회용 시스템 및 통합 시스템의 혁신적인 개발로 접근성과 경제성을 향상시킬 수 있습니다.

유형별로는 일체형 시스템이 예측 기간 동안 가장 높은 성장률을 보일 것으로 예상됩니다. 이는 수술 절차의 간소화, 셋업 시간 단축, 업무 효율성이 향상될 수 있기 때문입니다. 또한, 최소침습 수술의 확대와 컴팩트한 올인원 솔루션에 대한 선호는 전 세계적으로 시장 확대를 더욱 촉진하고 있습니다.

최종사용자별로는 병원이 예측 기간 동안 유체 관리 시스템 시장에서 가장 높은 성장률을 기록할 것으로 예상됩니다. 이러한 성장의 원동력은 수술 건수의 증가, 의료 인프라의 발전, 최소침습적 시술의 채택 증가에 기인합니다. 그 결과, 병원은 첨단 체액 관리 기술의 주요 최종사용자로 자리매김하고 있습니다.

아시아태평양은 예측 기간 동안 유체 관리 시스템(FMS) 시장에서 가장 높은 성장률을 기록할 것으로 예상됩니다. 이러한 급증의 주요 요인은 의료 인프라의 급속한 확장, 병원 현대화를 위한 정부 투자 증가, 만성 신장 및 비뇨기 질환 증가 등입니다. 또한 최소침습 수술의 보급과 인도, 중국, 태국 등에서의 의료관광 증가도 이러한 시스템 수요에 기여하고 있습니다. 또한, 규제 개혁에 대한 지원과 첨단 수술 기술에 대한 인식이 높아지면서 이 지역의 시장 확대가 더욱 가속화되고 있습니다.

세계의 유체 관리 시스템 시장에 대해 조사했으며, 제품별, 용도별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자와 자금 조달 시나리오

- 기술 분석

- 업계 동향

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 사례 연구 분석

- 규제 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- AI/생성형 AI가 유체 관리 시스템 시장에 미치는 영향

- 인접 시장 분석

- 트럼프 관세가 유체 관리 시스템 시장에 미치는 영향

제6장 유체 관리 시스템 시장(제품별)

- 소개

- 시스템

- 일회용·액세서리

제7장 유체 관리 시스템 시장(용도별)

- 소개

- 비뇨기과·신장과

- 소화기내과

- 일반외과

- 정형외과

- 부인과

- 심혈관외과

- 신경외과

- 이비인후과

- 기타

제8장 유체 관리 시스템 시장(최종사용자별)

- 소개

- 병원

- 투석 센터

- 외래 수술 센터

- 기타

제9장 유체 관리 시스템 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 호주

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 유체 관리 시스템 채용을 촉진하기 위한 확립된 안전기준

- 중동 및 아프리카의 거시경제 전망

- GCC 국가

- 성장을 촉진하기 위해 공적 및 민간 헬스케어 제공자 전체에서 정식적 조달 프로그램이 증가하고 있습니다.

- GCC 국가의 거시경제 전망

제10장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제11장 기업 개요

- 주요 진출 기업

- FRESENIUS MEDICAL CARE AG

- CARDINAL HEALTH

- BAXTER INTERNATIONAL INC.

- OLYMPUS CORPORATION

- B. BRAUN SE

- STRYKER

- MEDTRONIC

- JOHNSON & JOHNSON

- SMITH & NEPHEW PLC

- NIPRO CORPORATION

- CONMED CORPORATION

- ECOLAB INC.

- HOLOGIC, INC.

- ZIMMER BIOMET HOLDINGS, INC.

- ICU MEDICAL, INC.

- 기타 기업

- KARL STORZ GMBH & CO. KG

- ACTEON MEDICAL

- MEDLINE INDUSTRIES, LP

- DEROYAL INDUSTRIES, INC.

- MOLNLYCKE HEALTH CARE AB

- TIANJIN ZHICHAO MEDICAL TECHNOLOGY CO., LTD.

- HUNAN HONYMED CO., LTD.

- SCIVITA MEDICAL

- HANGZHOU VALUED MEDTECH CO., LTD.

- SERENNO MEDICAL

제12장 부록

KSM 25.09.25The fluid management systems market is projected to reach USD 18.60 billion by 2030 from USD 13.26 billion in 2025, at a CAGR of 7.0% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product Type, Application, End User, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

The fluid management systems (FMS) market is driven by several factors, including the increasing number of surgical procedures, a rising demand for minimally invasive techniques, and the growing incidence of chronic kidney and urological disorders. Technological advancements, such as automated suction and irrigation systems, enhance efficiency and safety, leading to wider adoption in healthcare facilities.

However, challenges such as high procedural costs and limited awareness in emerging regions can hinder growth. There are significant opportunities for expansion in the Asia Pacific region and for innovative developments in disposable and integrated systems that can improve accessibility and affordability.

The integrated systems segment is expected to register the highest CAGR during the forecast period.

By type, integrated systems are projected to experience the highest growth rate during the forecast period. This can be attributed to their ability to streamline surgical procedures, reduce setup time, and enhance operational efficiency. Additionally, their growing adoption in minimally invasive surgeries and the preference for compact, all-in-one solutions are further driving market expansion on a global scale.

The hospitals segment is expected to register the highest CAGR during the forecast period.

By end user, hospitals are expected to experience the highest growth rate in the fluid management systems market during the forecast period. This growth is driven by an increase in surgical volumes, advancements in healthcare infrastructure, and a rising adoption of minimally invasive procedures. As a result, hospitals are positioned as the primary end users of advanced fluid management technologies.

The Asia Pacific is expected to register the highest CAGR during the forecast period.

The Asia Pacific region is expected to experience the highest growth rate in the fluid management systems (FMS) market during the forecast period. This surge is primarily driven by the rapid expansion of healthcare infrastructure, increased government investments in modernizing hospitals, and a rise in chronic kidney and urological diseases. The growing adoption of minimally invasive surgeries and the increase in medical tourism in countries such as India, China, and Thailand also contribute to the demand for these systems. Additionally, supportive regulatory reforms and heightened awareness of advanced surgical technologies further enhance market expansion in this region.

A breakdown of the primary participants (supply side) for the fluid management systems market referred to in this report is provided below:

- By Company Type: Tier 1 (45%), Tier 2 (30%), and Tier 3 (25%)

- By Designation: C-level Executives (42%), Director-level Executives (29%), and Others (29%)

- By Region: North America (29%), Europe (24%), Asia Pacific (29%), Latin America (10%), the Middle East & Africa (5%), and GCC Countries (3%)

Prominent players in the fluid management systems market are Fresenius Medical Care AG (Germany), Smith & Nephew Plc (UK), B. Braun SE (Germany), Stryker (US), Ecolab (US), CONMED Corporation (US), Cardinal Health (US), Olympus Corporation (Japan), ICU Medical (US), Zimmer Biomet Holdings, Inc. (US), Medtronic (Ireland), Hologic, Inc. (US), Johnson & Johnson (US), Baxter (Vantive) (US), and Nipro (Japan), among others.

Research Coverage

The report assesses the fluid management systems market, estimating its size and growth potential based on various segments, including products, applications, end users, and regions. Additionally, the report features a competitive analysis of the major players in this market, which includes company profiles, product offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will provide valuable data on revenue estimates for the overall fluid management systems market and its subsegments, benefiting both market leaders and new entrants. It will help stakeholders grasp the competitive landscape and gain insights for better positioning their businesses and developing effective go-to-market strategies. Additionally, the report offers an understanding of market trends, highlighting key drivers, obstacles, and opportunities within the industry.

This report provides insights into the following points:

- Analysis of key drivers (rising number of minimally invasive surgeries, increasing ESRD patient base, technological advancements in fluid management systems, government funds and grants for endosurgical procedures, and rising number of hospitals and investments in endoscopy and laparoscopy facilities), restraints (high cost of endosurgical procedures and lack of consumer awareness), opportunities (untapped potential in emerging markets and single-use disposable devices and accessories), and challenges (dearth of surgeons worldwide)

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global fluid management systems market

- Market Development: Thorough knowledge and analysis of the profitable rising markets by product, application, end user, and region

- Market Diversification: Comprehensive information about newly launched products and services, expanding markets, current advancements, and investments in the global fluid management systems market

- Competitive Assessment: Thorough evaluation of the market shares, growth plans, offerings, and capacities of the major competitors in the global fluid management systems market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.2.4 CURRENCY CONSIDERED

- 1.3 MARKET STAKEHOLDERS

- 1.4 LIMITATIONS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 STUDY ASSUMPTIONS

- 2.6 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 FLUID MANAGEMENT SYSTEMS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: FLUID MANAGEMENT SYSTEMS MARKET, BY PRODUCT & COUNTRY (2024)

- 4.3 FLUID MANAGEMENT SYSTEMS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.4 FLUID MANAGEMENT SYSTEMS MARKET, REGIONAL MIX, 2023-2030

- 4.5 FLUID MANAGEMENT SYSTEMS MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising number of minimally invasive surgeries

- 5.2.1.2 Increasing prevalence of ESRD

- 5.2.1.3 Technological advancements in fluid management systems

- 5.2.1.4 Government funds & grants for endosurgical procedures

- 5.2.1.5 Rising establishment of endoscopy & laparoscopy facilities in hospitals

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cost of endosurgical procedures

- 5.2.2.2 Lack of consumer & patient awareness

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 High growth potential of emerging economies

- 5.2.3.2 Single-use disposable devices & accessories

- 5.2.4 CHALLENGES

- 5.2.4.1 Shortage of surgeons

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE OF KEY PLAYERS, BY PRODUCT, 2024 (USD)

- 5.4.2 AVERAGE SELLING PRICE TREND OF INTEGRATED FLUID MANAGEMENT SYSTEMS, BY REGION, 2022-2024 (USD)

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT & FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Irrigation/Distension pumps & disposable cassettes

- 5.9.1.2 Closed fluid waste capture & automated transfer

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 OR/Endoscopy integration, traceability, and connectivity

- 5.9.2.2 Procedure-specific sterile kits & modular disposables

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Hemodynamic monitoring & decision support

- 5.9.3.2 Renal support & critical-care circuits (CRRT/Dialysis/ECMO)

- 5.9.1 KEY TECHNOLOGIES

- 5.10 INDUSTRY TRENDS

- 5.10.1 GRADUAL SHIFT TO CLOSED-LOOP & HANDS-FREE WASTE SYSTEMS

- 5.10.2 DIGITIZATION, TRACEABILITY, AND CONNECTIVITY

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.12.1 IMPORT DATA (HS CODE 901890)

- 5.12.2 EXPORT DATA (HS CODE 901890)

- 5.13 KEY CONFERENCES & EVENTS, 2025-2026

- 5.14 CASE STUDY ANALYSIS

- 5.14.1 CASE STUDY 1: CLOSED FLUID WASTE MANAGEMENT SYSTEM (STRYKER'S NEPTUNE)-SAFER & FASTER OPERATING ROOM TURNOVERS

- 5.14.2 CASE STUDY 2: FLUID WARMING SYSTEMS-REDUCING PERIOPERATIVE HYPOTHERMIA

- 5.14.3 CASE STUDY 3: HEIDELBERG ENGINEERING-NHS UK OCT DEPLOYMENT

- 5.15 REGULATORY ANALYSIS

- 5.15.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.15.2 REGULATORY FRAMEWORK

- 5.15.2.1 North America

- 5.15.2.1.1 US

- 5.15.2.1.2 Canada

- 5.15.2.2 Europe

- 5.15.2.2.1 Germany

- 5.15.2.2.2 France

- 5.15.2.2.3 UK

- 5.15.2.3 Asia Pacific

- 5.15.2.3.1 India

- 5.15.2.3.2 China

- 5.15.2.3.3 Japan

- 5.15.2.4 Latin America

- 5.15.2.4.1 Brazil

- 5.15.2.4.2 Mexico

- 5.15.2.5 Middle East & Africa

- 5.15.2.5.1 Middle East

- 5.15.2.5.2 Africa

- 5.15.2.1 North America

- 5.16 PORTER'S FIVE FORCES ANALYSIS

- 5.16.1 BARGAINING POWER OF SUPPLIERS

- 5.16.2 BARGAINING POWER OF BUYERS

- 5.16.3 THREAT OF NEW ENTRANTS

- 5.16.4 THREAT OF SUBSTITUTES

- 5.16.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.17 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.17.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.17.2 BUYING CRITERIA

- 5.18 IMPACT OF AI/GENERATIVE AI ON FLUID MANAGEMENT SYSTEMS MARKET

- 5.18.1 AI-USE CASES

- 5.18.2 KEY COMPANIES IMPLEMENTING AI

- 5.18.3 FUTURE OF AI/GEN AI

- 5.19 ADJACENT MARKET ANALYSIS

- 5.20 TRUMP TARIFF IMPACT ON FLUID MANAGEMENT SYSTEMS MARKET

- 5.20.1 KEY TARIFF RATES

- 5.20.2 PRICE IMPACT ANALYSIS

- 5.20.3 KEY IMPACT ON COUNTRY/REGION

- 5.20.3.1 US

- 5.20.3.2 Europe

- 5.20.3.3 Asia Pacific

- 5.20.4 IMPACT ON END-USER INDUSTRIES

6 FLUID MANAGEMENT SYSTEMS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 SYSTEMS

- 6.2.1 STANDALONE SYSTEMS

- 6.2.1.1 Dialyzers

- 6.2.1.1.1 Rising CKD and ESRD cases globally to fuel consistent demand for dialyzers in fluid management systems

- 6.2.1.2 Insufflators

- 6.2.1.2.1 Growing adoption of minimally invasive surgeries to drive demand for insufflators

- 6.2.1.3 Suction/Evacuation & irrigation systems

- 6.2.1.3.1 Critical role of these systems in ensuring surgical precision to boost demand

- 6.2.1.4 Fluid waste management systems

- 6.2.1.4.1 Reduced risk of cross-contamination and exposure to biohazardous waste to drive adoption

- 6.2.1.5 Other standalone systems

- 6.2.1.1 Dialyzers

- 6.2.2 INTEGRATED SYSTEMS

- 6.2.2.1 Growing need for accurate and efficient fluid management to support market growth

- 6.2.1 STANDALONE SYSTEMS

- 6.3 DISPOSABLES & ACCESSORIES

- 6.3.1 CATHETERS

- 6.3.1.1 Recurring demand for single-use catheters to support sustained revenue growth in market

- 6.3.2 BLOODLINES

- 6.3.2.1 Advancements in bloodline design and safety to fuel segment growth

- 6.3.3 TUBING SETS

- 6.3.3.1 Increasing patient safety awareness to accelerate demand for sterile tubing sets in hospitals and clinics

- 6.3.4 PRESSURE MONITORING LINES

- 6.3.4.1 Technological advancements in monitoring devices to enhance utility of pressure monitoring lines in critical care

- 6.3.5 PRESSURE TRANSDUCERS

- 6.3.5.1 Increasing patient safety awareness to accelerate demand in hospitals and clinics

- 6.3.6 VALVES, CONNECTORS, AND FITTINGS

- 6.3.6.1 Increased focus on infection prevention to boost market

- 6.3.7 SUCTION CANISTERS

- 6.3.7.1 Disposable suction canisters to gain traction due to stricter infection control and contamination prevention protocols

- 6.3.8 CANNULAS

- 6.3.8.1 Expanding chronic disease treatments to boost cannula utilization in fluid management applications

- 6.3.9 OTHER DISPOSABLES & ACCESSORIES

- 6.3.1 CATHETERS

7 FLUID MANAGEMENT SYSTEMS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 UROLOGY & NEPHROLOGY

- 7.2.1 INCREASING PREVALENCE OF CKD AND ESRD TO DRIVE MARKET GROWTH

- 7.3 GASTROENTEROLOGY

- 7.3.1 EXPANDING ENDOSCOPY CENTERS IN BOTH DEVELOPED AND EMERGING ECONOMIES TO SUPPORT GROWTH

- 7.4 GENERAL SURGERY

- 7.4.1 TECHNOLOGICAL INNOVATIONS IN SURGICAL EQUIPMENT TO FUEL ADOPTION

- 7.5 ORTHOPEDICS

- 7.5.1 GROWING NUMBER OF SPECIALIZED ORTHOPEDIC CENTERS TO FUEL GROWTH

- 7.6 GYNECOLOGY

- 7.6.1 STRONG DEMAND FOR RELIABLE FLUID REGULATION TECHNOLOGIES TO SUPPORT MARKET GROWTH

- 7.7 CARDIOVASCULAR SURGERY

- 7.7.1 ABILITY OF FLUID MANAGEMENT SYSTEMS TO ENSURE STABLE HEMODYNAMICS AND MINIMIZE BLOOD LOSS TO DRIVE GROWTH

- 7.8 NEUROSURGERY

- 7.8.1 ADVANCEMENTS IN NEURO-ENDOSCOPY AND IMAGE-GUIDED SURGERIES TO PROPEL MARKET GROWTH

- 7.9 ENT

- 7.9.1 INCREASING PREVALENCE OF ENT DISORDERS TO SUPPORT GROWTH

- 7.10 OTHER APPLICATIONS

8 FLUID MANAGEMENT SYSTEMS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 ADVANCED INFRASTRUCTURE, SPECIALIZED OPERATING ROOMS, AND HIGHLY SKILLED MEDICAL PROFESSIONALS TO BOOST MARKET

- 8.3 DIALYSIS CENTERS

- 8.3.1 INCREASING NUMBER OF PATIENTS REQUIRING LONG-TERM DIALYSIS CARE TO EXPAND MARKET

- 8.4 AMBULATORY SURGICAL CENTERS

- 8.4.1 RISING PREFERENCE FOR OUTPATIENT SURGERIES TO BOOST GROWTH

- 8.5 OTHER END USERS

9 FLUID MANAGEMENT SYSTEMS MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Growing ASC migration and OSHA compliance to accelerate adoption of fluid management systems

- 9.2.3 CANADA

- 9.2.3.1 Growing biosafety requirements to boost adoption of standardized, closed-loop fluid handling consumables nationwide

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 GERMANY

- 9.3.2.1 Multi-year public tenders and regional procurement structures to drive uniform adoption of closed-loop fluid handling systems

- 9.3.3 FRANCE

- 9.3.3.1 High procedure throughput, rapid ambulatory adoption, and codified biosafety rules to support market growth

- 9.3.4 UK

- 9.3.4.1 High NHS funding and sustained diagnostic capacity build-out to boost growth

- 9.3.5 ITALY

- 9.3.5.1 Large hospital network and steadily aging population to contribute to market growth

- 9.3.6 SPAIN

- 9.3.6.1 High hospital throughput and codified exposure-control expectations to propel market

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Aging demographics and high exam/surgery capacity to boost market

- 9.4.3 CHINA

- 9.4.3.1 Large care volumes, dense hospital infrastructure, and broad insurance coverage to support growth

- 9.4.4 INDIA

- 9.4.4.1 High prevalence of diabetes and increasing awareness about eye health to fuel market

- 9.4.5 SOUTH KOREA

- 9.4.5.1 Universal coverage and high endoscopy throughput to drive market growth

- 9.4.6 AUSTRALIA

- 9.4.6.1 High caseloads and mixed public-private hospital base to propel growth

- 9.4.7 REST OF ASIA PACIFIC

- 9.5 LATIN AMERICA

- 9.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 9.5.2 BRAZIL

- 9.5.2.1 Large inpatient volumes and critical care capacity to aid growth

- 9.5.3 MEXICO

- 9.5.3.1 Expanding insured base in Mexico to boost adoption

- 9.5.4 REST OF LATIN AMERICA

- 9.6 MIDDLE EAST & AFRICA

- 9.6.1 ESTABLISHED SAFETY STANDARDS TO DRIVE ADOPTION OF FLUID MANAGEMENT SYSTEMS

- 9.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 9.7 GCC COUNTRIES

- 9.7.1 GROWING NUMBER OF FORMAL PROCUREMENT PROGRAMS ACROSS PUBLIC AND PRIVATE HEALTHCARE PROVIDERS TO FUEL GROWTH

- 9.7.2 MACROECONOMIC OUTLOOK FOR GCC COUNTRIES

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN FLUID MANAGEMENT SYSTEMS MARKET

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Region footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.5.5.5 End-user footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of startups/SMEs

- 10.7 COMPANY VALUATION AND FINANCIAL METRICS

- 10.7.1 FINANCIAL METRICS

- 10.7.2 COMPANY VALUATION

- 10.8 BRAND/PRODUCT COMPARISON

- 10.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT ENHANCEMENTS

- 10.9.2 DEALS

11 COMPANY PROFILE

- 11.1 KEY PLAYERS

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product enhancements

- 11.1.1.3.2 Deals

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 CARDINAL HEALTH

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 BAXTER INTERNATIONAL INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses & competitive threats

- 11.1.4 OLYMPUS CORPORATION

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses & competitive threats

- 11.1.5 B. BRAUN SE

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Other developments

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 STRYKER

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.7 MEDTRONIC

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Other developments

- 11.1.8 JOHNSON & JOHNSON

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 SMITH & NEPHEW PLC

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.10 NIPRO CORPORATION

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.10.3 Recent developments

- 11.1.10.3.1 Deals

- 11.1.11 CONMED CORPORATION

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ECOLAB INC.

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.13 HOLOGIC, INC.

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 ZIMMER BIOMET HOLDINGS, INC.

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 ICU MEDICAL, INC.

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 FRESENIUS MEDICAL CARE AG

- 11.2 OTHER PLAYERS

- 11.2.1 KARL STORZ GMBH & CO. KG

- 11.2.2 ACTEON MEDICAL

- 11.2.3 MEDLINE INDUSTRIES, LP

- 11.2.4 DEROYAL INDUSTRIES, INC.

- 11.2.5 MOLNLYCKE HEALTH CARE AB

- 11.2.6 TIANJIN ZHICHAO MEDICAL TECHNOLOGY CO., LTD.

- 11.2.7 HUNAN HONYMED CO., LTD.

- 11.2.8 SCIVITA MEDICAL

- 11.2.9 HANGZHOU VALUED MEDTECH CO., LTD.

- 11.2.10 SERENNO MEDICAL

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS