|

시장보고서

상품코드

1812632

아크릴 수지 시장 : 화학별, 특성별, 용해성별, 용도별, 최종 이용 산업별, 지역별 - 예측(-2030년)Acrylic Resins Market by Chemistry, Property, Solvency, Application, End-use Industry (Building & Construction, Industrial, Paper & Paperboard, Consumer Goods, Electrical & Electronics, and Packaging), and Region - Global Forecast to 2030 |

||||||

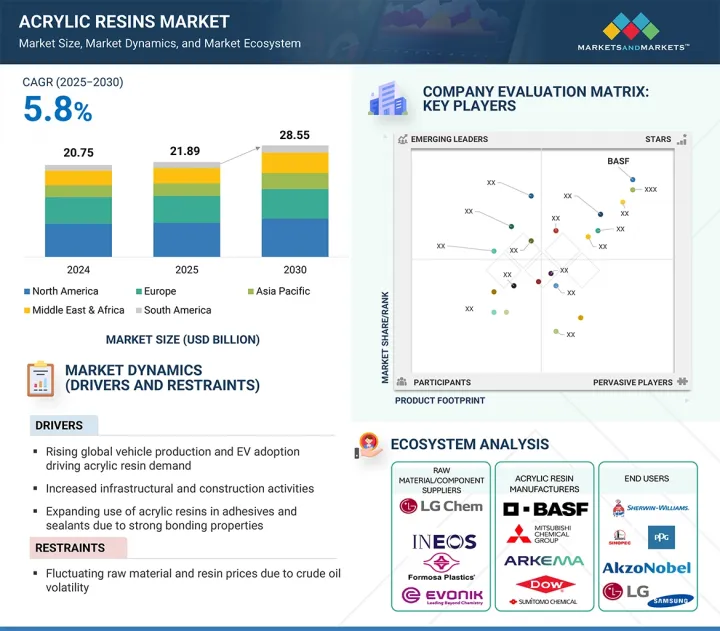

아크릴 수지 시장 규모는 2025년 218억 9,000만 달러에서 2030년에는 285억 5,000만 달러에 달할 것으로 예측되며, 예측 기간 동안 CAGR 5.8%가 될 것으로 보입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2022-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러)/킬로톤 |

| 부문 | 화학별, 특성별, 용해성별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

아크릴 수지 시장은 건설, 자동차, 전자 등 다양한 분야에서 내구성, 지속가능성, 고성능 소재에 대한 수요가 증가함에 따라 견고한 성장 기회를 목격하고 있습니다. 아크릴 수지는 내구성을 향상시키고, 매력적인 색상과 광택을 제공하며, 우수한 내후성 및 자외선 차단제 역할을 하고, 다른 화학제품에 대한 내성이 본질적으로 우수하기 때문에 코팅제 및 접착제에 유용합니다.

새로운 문제가 시장에 도입됨에 따라 미국 환경보호청(EPA)과 유럽화학제품청(ECHA) 등 규제기관은 수지 시스템 내에서 허용되는 휘발성 유기화합물(VOC)과 유해물질의 양을 제한하고 있습니다. 이 문제를 해결하기 위해 아크릴 수지 제조업체들은 지속가능하고 VOC가 적은 수성 아크릴계 수지를 개발하여 도입하고 있습니다. VOC에 대한 집중적인 규제를 통해 그린 케미스트리는 더욱 빠르게 발전하고 있으며, 보다 친환경적인 제품들이 개발되고 있습니다. 또한, 업계의 수요는 자가복구 시스템, 항균 아크릴 페인트 등 혁신적인 스마트 배합 기술에 대한 수요를 지속적으로 증가시킬 것으로 보입니다. 산업계가 환경 규정 준수와 내구성 및 성능에 계속 초점을 맞추고(그리고 더 엄격한 규제로 인해 법적 의무가 부과됨에 따라) 아크릴과 아크릴은 미래의 매트릭스의 구성요소가 될 것으로 예상됩니다.

2024년 아크릴 수지 시장은 주거, 상업, 인프라 프로젝트에 사용되는 내구성, 내후성 코팅제, 접착제, 실링제의 증가로 인해 건축 및 건설 분야가 주도했습니다. 전 세계적으로 건설 활동이 활발해지고 있으며, 아크릴 수지는 자외선(태양광)에 대한 안정성, 색상 유지력, 유연성, 내마모성, 내구성 등 장기적인 성능이 필요한 외장 도료 및 보호 도료에 필수적인 종합적인 생태학적 측면에서 장점을 가지고 있습니다. 특히 신흥 경제국에서는 전 세계적인 도시화와 인프라 투자 증가 추세가 지속되고 있어, 아크릴계 소재를 건축에 계속 사용할 수 있는 큰 기회를 창출하고 있습니다. 환경 규제가 강화되면서 건축, 건설 전 분야에서 저 VOC, 수성 아크릴 수지를 선호하는 가운데, 아크릴 수지를 기반으로 한 제품의 채용이 증가하고 있습니다.

수계 아크릴은 규제 당국과 환경보호론자들의 생물다양성 보호 강화, 용제계 제품에 대한 규제 강화로 인해 2024년 아크릴 수지 시장에서 가장 큰 비중을 차지했습니다. 수성 아크릴은 솔벤트계 아크릴보다 VOC 배출량이 적고, 접착력, 내구성 등의 성능을 유지하면서 환경과 건강을 고려한 제품입니다. 수성 아크릴은 지속가능성과 환경 규제에 대한 안전한 적합성이 매우 중요한 건축용 도료, 실링재, 접착제에 널리 사용되고 있습니다. 지속가능하고 친환경적인 제품으로의 제조업체와 최종사용자의 시스템 전환은 수성 아크릴 수지 배합의 전 세계적인 인기 상승에 기여하고 있습니다.

2024년, 북미는 아크릴 수지 시장에서 가장 큰 점유율을 차지했습니다. 자동차, 건설, 전자제품 제조 등 산업 분야가 비교적 성숙되어 있습니다. 북미는 EPA의 저 VOC 요건 등 가장 엄격한 환경 규제를 가지고 있으며, 첨단 수계 및 기타 환경 친화적인 아크릴 수지 배합의 사용을 가속화하려는 움직임이 있습니다. 또한, 신축 및 애프터마켓에서 고성능 코팅제, 접착제, 실링제에 대한 수요가 증가하면서 시장 성장을 견인하고 있습니다. 또한, 최대 규모의 화학업체들의 존재와 연구개발에 대한 투자로 북미는 세계 최대 아크릴 수지 시장으로서의 입지를 확고히 하고 있습니다.

대상 기업 : BASF(독일), Dow(미국), Mitsubishi Chemical Group Corporation(일본), Sumitomo Chemical(일본), Arkema(프랑스), DIC CORPORATION(일본), Covestro AG(독일), Mitsui Chemicals, Inc. ), Mitsui Chemicals, Inc.(일본), Trinseo(미국), Asahi Kasei Corporation(일본)을 대상으로 하고 있습니다.

본 조사에서는 아크릴 수지 시장의 주요 기업들에 대해 기업 프로파일, 최근 동향, 주요 시장 전략 등 상세한 경쟁 분석을 실시하였습니다.

조사 대상

아크릴 수지 시장을 화학(메타크릴레이트, 아크릴레이트, 하이브리드), 용해도(용매 기반, 수성), 특성(열경화성, 열가소성), 용도(페인트 및 코팅, 접착제/실란트, DIY 코팅, 엘라스토머), 최종사용 산업(건축/건설, 산업, 종이/판지, 소비재, 전기/전자, 포장), 지역(아시아태평양, 북미, 유럽, 남미, 중동 및 아프리카)을 기준으로 분류하고 있습니다. 본 보고서의 조사 범위는 아크릴 수지 시장의 성장에 영향을 미치는 촉진요인, 시장 억제요인, 과제 및 기회에 대한 상세한 정보를 망라하고 있습니다. 주요 업계 플레이어를 자세히 분석하고 사업 개요, 제공 제품, 아크릴 수지 시장과 관련된 파트너십, 제휴, 합병, 인수, 인수, 제품 출시, 사업 확장과 같은 주요 전략에 대한 인사이트를 제공합니다. 이 보고서는 아크릴 수지 시장 생태계에서 향후 신흥 기업의 경쟁 분석을 다루고 있습니다.

보고서를 구매해야 하는 이유

이 보고서는 시장 리더/신규 진입자에게 전체 아크릴 수지 시장 및 하위 부문의 수익 수에 대한 가장 가까운 근사치에 대한 정보를 제공합니다. 이 보고서는 이해관계자들이 경쟁 상황을 이해하고, 자신의 비즈니스를 더 잘 포지셔닝하기 위해 고민하고, 적절한 시장 진입 전략을 계획하는 데 도움이 될 것입니다. 이 보고서는 이해관계자들이 시장의 흐름을 이해하고 주요 시장 촉진요인, 억제요인, 과제 및 기회에 대한 정보를 제공하는 데 도움이 될 것입니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

제6장 업계 동향

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 생태계 분석

- 밸류체인 분석

- 규제 상황

- 무역 분석

- 가격 분석

- 기술 분석

- 특허 분석

- 사례 연구 분석

- 2025-2026년의 주요 회의와 이벤트

- 투자와 자금 조달 시나리오

- 생성형 AI/AI가 아크릴 수지 시장에 미치는 영향

- 거시경제 분석

- 2025년 미국 관세가 아크릴 수지 시장에 미치는 영향

제7장 아크릴 수지 시장(화학별)

- 소개

- 메타크릴레이트

- 아크릴산염

- 하이브리드

제8장 아크릴 수지 시장(특성별)

- 소개

- 열경화성

- 열가소성 수지

제9장 아크릴 수지 시장(용해성별)

- 소개

- 용제형

- 수성

- 기타

제10장 아크릴 수지 시장(용도별)

- 소개

- 페인트와 코팅

- 접착제와 실란트

- DIY 코팅

- 엘라스토머

- 기타

제11장 아크릴 수지 시장(최종 이용 산업별)

- 소개

- 건축·건설

- 산업

- 종이·판지

- 소비재

- 전기·전자공학

- 포장

- 기타

제12장 아크릴 수지 시장(지역별)

- 소개

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제13장 경쟁 구도

- 개요

- 주요 진출 기업의 전략

- 시장 점유율 분석, 2024년

- 매출 분석, 2020-2024년

- 기업 평가와 재무 지표

- 제품/브랜드 비교

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제14장 기업 개요

- 주요 진출 기업

- BASF

- DOW

- MITSUBISHI CHEMICAL GROUP CORPORATION

- SUMITOMO CHEMICAL CO., LTD.

- ARKEMA

- DIC CORPORATION

- COVESTRO AG

- MITSUI CHEMICALS, INC.

- TRINSEO

- ASAHI KASEI CORPORATION

- 기타 기업

- SYNTHOMER PLC

- LUBRIZOL

- NIPPON SHOKUBAI CO., LTD.

- RESONAC HOLDINGS CORPORATION

- ROHM GMBH

- YIP'S CHEMICAL HOLDINGS LIMITED

- CHANSIEH ENTERPRISES CO., LTD

- JOTUN

- GEO

- FUJIKURA KASEI CO., LTD.

- ETERNAL MATERIALS CO., LTD.

- ALLNEX GMBH

- KAMSONS

- AEKYUNG

- BERGER PAINTS INDIA

제15장 부록

KSM 25.09.25The acrylic resins market is expected to reach USD 28.55 billion by 2030 from USD 21.89 billion in 2025, at a CAGR of 5.8% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) / Volume (Kilotons) |

| Segments | Chemistry, Property, Solvency, Application, End-use industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

The acrylic resins market is witnessing solid growth opportunities, partly fueled by an increasing demand for durable, sustainable, and high-performance materials in a variety of sectors, including construction, automotive, and electronics. Acrylic resins are beneficial for coatings and adhesives because they increase durability, yield attractive color and glossy finish, act as excellent weathering and UV radiation resistant barriers, and have inherently excellent resistance to other chemicals.

As new issues are introduced to the market, regulatory bodies such as the U.S. Environmental Protection Agency (EPA) and the European Chemicals Agency (ECHA) are now restricting the amounts of volatile organic compounds (VOCs) and hazardous materials allowed within resin systems. To address this issue, the manufacturers of acrylic resins are developing and introducing sustainable, low-VOC, and waterborne acrylic-style resins. In concentrating on and regulating VOCs, this focus has certainly allowed green chemistry to advance more rapidly and more environmentally sensitive products to be developed. In addition, industry demand will continually elevate innovative smart formulation technologies, such as self-healing systems, antimicrobial acrylic coatings, etc. As industries continue to focus (and be legally obligated with stricter regulations) on environmental compliance and durability and performance, it is thought that acrylates and acrylics will be a component of the matrix of the future.

"The building & construction segment accounted for the largest share of the acrylic resins market in 2024."

In 2024, the acrylic resins market was led by the building and construction sector, driven by a rise in durable, weather-resistant coatings, adhesives, and sealants used in residential, commercial, and infrastructure projects. There is growing construction activity worldwide, and acrylic resins offer an overall ecological benefit in terms of stability against UV radiation (sunlight), color retention, flexibility, wear resistance, and durability-all of which are crucial for exterior paints and protective coatings when long-term performance is needed. The ongoing trend of global urbanization and increased infrastructure investment, especially in developing economies, has created significant opportunities for the continued application of acrylic-based materials in construction. Where stricter environmental regulations favor low-VOC and waterborne acrylics across all segments of building and construction, product adoption based on acrylic resin is higher.

"Water-based acrylic resins dominated the market by solvency type in 2024."

Waterborne acrylics held the largest portion of the acrylic resins market in 2024, with increased biodiversity protections from regulators and environmentalists and increasing restrictions on solvent-based products. Waterborne acrylics possess lower VOC emissions than solvent-based acrylics and have better environmental and health profiles, while maintaining performance properties, including adhesion and durability. They are used extensively in architectural coatings, sealants, and adhesives, where sustainability and safe compliance with environmental regulations are very important. Manufacturers' and end users' systemic transition to sustainable, environmentally friendly products has contributed to the increased popularity of water-based acrylic resin formulations worldwide.

"North America dominated the regional market for acrylic resins market in 2024."

In 2024, North America accounted for the largest share of the acrylic resins market. The industrial sector is relatively mature, including automotive, construction, and electronics manufacturing. North America has some of the strictest environmental regulations, including low-VOC requirements from the EPA, which lends a mindset to accelerate the use of advanced waterborne and otherwise environmentally friendly acrylic resin formulations. In addition, robust demand for high-performance coatings, adhesives, and sealants in new construction and aftermarket refinishing drives market growth. Additionally, the presence of the largest chemical manufacturers and commitment to investment in research & development help solidify North America's position as the largest acrylic resins market in the world.

By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

By Designation: C-level Executives: 20%, Directors: 30%, and Other Designations: 50%

By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, South America: 10%, and Middle East & Africa 20%

Notes: Other designations include sales, marketing, and product managers.

Tier 1: >USD 1 Billion; Tier 2: USD 500 million-1 Billion; and Tier 3: <USD 500 million

Companies Covered: BASF (Germany), Dow (US), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Arkema (France), DIC CORPORATION (Japan), Covestro AG (Germany), Mitsui Chemicals, Inc. (Japan), Trinseo (US), and Asahi Kasei Corporation (Japan) are covered in the report.

The study includes an in-depth competitive analysis of these key players in the acrylic resins market, with their company profiles, recent developments, and key market strategies.

Research Coverage

This research report categorizes the acrylic resins market based on Chemistry (Methacrylates, Acrylates, and Hybrid), Solvency (Solvent based and Water based), Property (thermosetting and thermoplastics), application ( Paints & Coatings, Adhesives & Sealants, DIY Coatings, and Elastomers ), end-use industry (Building & Construction, Industrial, Paper & Paperboard, Consumer Goods, Electrical & Electronics, Packaging), and Region (Asia Pacific, North America, Europe, South America, and Middle East & Africa). The report's scope covers detailed information regarding the drivers, restraints, challenges, and opportunities influencing the growth of the acrylic resins market. A detailed analysis of the key industry players has been done to provide insights into their business overview, products offered, and key strategies, such as partnerships, collaborations, mergers, acquisitions, product launches, and expansions, associated with the acrylic resins market. This report covers a competitive analysis of upcoming startups in the acrylic resins market ecosystem.

Reasons to Buy the Report

The report will offer the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall acrylic resins market and the subsegments. This report will help stakeholders understand the competitive landscape, gain more insights into positioning their businesses better, and plan suitable go-to-market strategies. The report will help stakeholders understand the pulse of the market and provide them with information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Assessing the major drivers (increased global vehicle production and electric vehicle adoption boost acrylic resin demand, rising infrastructure and construction activities, and growing demand for acrylic resins in adhesives and sealants given superior bonding performance), restraints (volatile raw material and resin prices due to crude oil price fluctuations, environmental concerns regarding low biodegradability of acrylic resins coming into play with disposal), opportunities (rapid growth of photopolymer and 3D-printing resin uses and growing market for bio-based and sustainable resin alternatives), and challenges (stringent environmental regulations and related compliance costs).

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the acrylic resins market.

- Market Development: Comprehensive information about profitable markets - the report analyzes the acrylic resins market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the acrylic resins market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as BASF (Germany), Dow (US), Mitsubishi Chemical Group Corporation (Japan), Sumitomo Chemical Co., Ltd. (Japan), Arkema (France), DIC CORPORATION (Japan), Covestro AG (Germany), Mitsui Chemicals, Inc. (Japan), Trinseo (US), and Asahi Kasei Corporation (Japan), among others

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNITS CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 GROWTH RATE ASSUMPTIONS/FORECAST

- 2.5.1 SUPPLY SIDE

- 2.5.2 DEMAND SIDE

- 2.6 RISK ASSESSMENT

- 2.7 LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ACRYLIC RESINS MARKET

- 4.2 ASIA PACIFIC: ACRYLIC RESINS MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.3 ACRYLIC RESINS MARKET, BY CHEMISTRY

- 4.4 ACRYLIC RESINS MARKET, BY SOLVENCY

- 4.5 ACRYLIC RESINS MARKET, BY PROPERTY

- 4.6 ACRYLIC RESINS MARKET, BY APPLICATION

- 4.7 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY

- 4.8 ACRYLIC RESINS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising global vehicle production and adoption of EVs

- 5.2.1.2 Increasing infrastructural and construction activities

- 5.2.1.3 Expanding use in adhesives and sealants due to strong bonding properties

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuating prices of raw materials and resins

- 5.2.2.2 Environmental concerns over limited biodegradability of acrylic resins

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rapid expansion of photopolymer and 3D-printing resin applications

- 5.2.3.2 Expanding market for bio-based and sustainable resin alternatives

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent environmental regulations and compliance burdens

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 PORTER'S FIVE FORCES ANALYSIS

- 6.1.1 BARGAINING POWER OF SUPPLIERS

- 6.1.2 BARGAINING POWER OF BUYERS

- 6.1.3 INTENSITY OF COMPETITIVE RIVALRY

- 6.1.4 THREAT OF NEW ENTRANTS

- 6.1.5 THREAT OF SUBSTITUTES

- 6.2 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.2.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.2.2 BUYING CRITERIA

- 6.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.4 ECOSYSTEM ANALYSIS

- 6.5 VALUE CHAIN ANALYSIS

- 6.6 REGULATORY LANDSCAPE

- 6.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.6.2 REGULATIONS

- 6.6.2.1 IS 14765 (2000) - Specification for Acrylic Resin for Surface Coatings

- 6.6.2.2 ASTM D5095 - Standard Specification for Acrylic Emulsion for Textured Coatings

- 6.6.2.3 UN GHS - Globally Harmonized System of Classification and Labeling of Chemicals

- 6.6.2.4 OSHA Hazard Communication Standard (29 CFR 1910.1200)

- 6.6.2.5 REACH Regulation (EC) No. 1907/2006 - Registration, Evaluation, Authorization and Restriction of Chemicals

- 6.7 TRADE ANALYSIS

- 6.7.1 IMPORT SCENARIO (HS CODE 3906)

- 6.7.2 EXPORT SCENARIO (HS CODE 3906)

- 6.8 PRICING ANALYSIS

- 6.8.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY END-USE INDUSTRY, 2024

- 6.8.2 AVERAGE SELLING PRICE TREND, BY REGION, 2024-2030

- 6.9 TECHNOLOGY ANALYSIS

- 6.9.1 KEY TECHNOLOGIES

- 6.9.1.1 Solution polymerization technology

- 6.9.1.2 Emulsion polymerization technology

- 6.9.2 COMPLEMENTARY TECHNOLOGIES

- 6.9.2.1 UV-curable acrylic systems

- 6.9.2.2 Controlled Radical Polymerization (CRP)

- 6.9.3 ADJACENT TECHNOLOGIES

- 6.9.3.1 Bio-based acrylic resin technology

- 6.9.3.2 Nanocomposite and hybrid acrylic materials

- 6.9.1 KEY TECHNOLOGIES

- 6.10 PATENT ANALYSIS

- 6.10.1 METHODOLOGY

- 6.10.2 DOCUMENT TYPES

- 6.10.3 INSIGHTS

- 6.10.4 LEGAL STATUS OF PATENTS

- 6.10.5 JURISDICTION ANALYSIS

- 6.11 CASE STUDY ANALYSIS

- 6.11.1 DURABLE ROAD MARKING SYSTEM USING METHYL METHACRYLATE (MMA)-BASED ACRYLIC RESIN

- 6.11.2 UV-CURABLE ACRYLIC RESIN COATINGS FOR AUTOMOTIVE INTERIORS

- 6.11.3 ACRYLIC RESIN-BASED PROTECTIVE COATING FOR OFFSHORE WIND TURBINE BLADES

- 6.11.4 ACRYLIC RESIN FLOOR COATING IN FOOD PROCESSING FACILITY

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 INVESTMENT AND FUNDING SCENARIO

- 6.14 IMPACT OF GEN AI/AI ON ACRYLIC RESINS MARKET

- 6.14.1 AI IN ACRYLIC RESIN MANUFACTURING AND PROCESS OPTIMIZATION

- 6.14.2 AI-DRIVEN QUALITY CONTROL AND COMPUTER VISION

- 6.14.3 GEN AI FOR FORMULATION DESIGN AND R&D ACCELERATION

- 6.15 MACROECONOMIC ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 GDP TRENDS AND FORECASTS

- 6.16 IMPACT OF 2025 US TARIFF ON ACRYLIC RESINS MARKET

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 China/South Korea/Taiwan

- 6.16.4.3 Europe

- 6.16.4.4 Mexico and Canada

- 6.16.5 IMPACT ON END-USE INDUSTRIES

- 6.16.5.1 Building & construction

- 6.16.5.2 Industrial (coatings, adhesives, industrial films)

- 6.16.5.3 Paper & paperboard

7 ACRYLIC RESINS MARKET, BY CHEMISTRY

- 7.1 INTRODUCTION

- 7.2 METHACRYLATES

- 7.2.1 HARDNESS, DURABILITY, AND SUSTAINABILITY TO DRIVE MARKET GROWTH

- 7.3 ACRYLATES

- 7.3.1 EASY AVAILABILITY, VERSATILITY, AND GREEN CHEMISTRY APPROACHES TO BOOST DEMAND

- 7.4 HYBRID

- 7.4.1 INCREASED ADOPTION IN HIGH-PERFORMANCE COATING APPLICATIONS TO ACCELERATE MARKET DEMAND

8 ACRYLIC RESINS MARKET, BY PROPERTY

- 8.1 INTRODUCTION

- 8.2 THERMOSETTING

- 8.2.1 HIGH STRENGTH, CHEMICAL RESISTANCE, AND LONG TERM STABILITY TO DRIVE MARKET

- 8.3 THERMOPLASTICS

- 8.3.1 EXCELLENT CLARITY, IMPACT RESISTANCE, AND PROCESSABILITY TO SUPPORT GROWTH

9 ACRYLIC RESINS MARKET, BY SOLVENCY

- 9.1 INTRODUCTION

- 9.2 SOLVENT-BASED

- 9.2.1 HIGH DURABILITY AND PREMIUM APPEARANCE TO DRIVE NICHE DEMAND

- 9.3 WATER-BASED

- 9.3.1 ENVIRONMENTAL COMPLIANCE AND SAFETY ADVANTAGES TO BOOST RAPID ADOPTION

- 9.4 OTHER SOLVENCIES

10 ACRYLIC RESINS MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 PAINTS & COATINGS

- 10.2.1 WIDE SUBSTRATE COMPATIBILITY AND SUPERIOR PERFORMANCE TO DRIVE MARKET DEMAND

- 10.3 ADHESIVES & SEALANTS

- 10.3.1 HIGH-GROWTH APPLICATIONS ACROSS INDUSTRIES TO BOOST CONSUMPTION

- 10.4 DIY COATINGS

- 10.4.1 ENHANCED WEATHERING, OXIDATION RESISTANCE, AND EXCELLENT COLOR AND GLOSS RETENTION TO FUEL MARKET

- 10.5 ELASTOMERS

- 10.5.1 ADVANCEMENTS IN COMPONENT DESIGN TO PROPEL DEMAND

- 10.6 OTHER APPLICATIONS

11 ACRYLIC RESINS MARKET, BY END-USE INDUSTRY

- 11.1 INTRODUCTION

- 11.2 BUILDING & CONSTRUCTION

- 11.2.1 DEMAND FOR INTERNAL JOINTS, FIXTURES, FILLINGS, AND CRACK REPAIR TO BOOST MARKET

- 11.3 INDUSTRIAL

- 11.3.1 VERSATILITY AND DURABILITY IN AUTOMOTIVE, MACHINERY, FURNITURE, AND MANUFACTURING SECTORS TO DRIVE MARKET

- 11.4 PAPER & PAPERBOARD

- 11.4.1 STRENGTH, HARDNESS, SURFACE TEXTURE, PRINTABILITY, AND BARRIER RESISTANCE TO BOOST MARKET

- 11.5 CONSUMER GOODS

- 11.5.1 HIGH FINISHING AND BONDING PROPERTIES TO SUSTAIN DEMAND

- 11.6 ELECTRICAL & ELECTRONICS

- 11.6.1 FAST CURING AND HIGH ADHESION TO DRIVE MARKET GROWTH

- 11.7 PACKAGING

- 11.7.1 SUPERIOR GLOSS, PRINTABILITY, AND BARRIER PERFORMANCE TO FUEL ADOPTION

- 11.8 OTHER END-USE INDUSTRIES

12 ACRYLIC RESINS MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 US

- 12.2.1.1 Robust industrial base, strong consumer demand, and stringent regulations to drive market

- 12.2.2 CANADA

- 12.2.2.1 Diversified industrial base and strong focus on sustainable manufacturing to support market growth

- 12.2.3 MEXICO

- 12.2.3.1 Demand for development of water infrastructure, sanitation, and expanding industrial base to boost market

- 12.2.1 US

- 12.3 EUROPE

- 12.3.1 GERMANY

- 12.3.1.1 Sustainability, innovation, and industrial growth to propel demand

- 12.3.2 FRANCE

- 12.3.2.1 Expanding pharmaceutical, chemical, and specialty manufacturing sectors to propel demand

- 12.3.3 UK

- 12.3.3.1 Advanced chemical, construction, and manufacturing sectors to drive demand

- 12.3.4 ITALY

- 12.3.4.1 Strong industrial base and design-driven consumer goods sector to fuel market growth

- 12.3.5 SPAIN

- 12.3.5.1 Focus on sustainable manufacturing and industrial innovation to support demand

- 12.3.6 REST OF EUROPE

- 12.3.1 GERMANY

- 12.4 ASIA PACIFIC

- 12.4.1 CHINA

- 12.4.1.1 Robust construction, home furnishing, electronics, and automotive sectors to boost market

- 12.4.2 JAPAN

- 12.4.2.1 Rising demand for high-performance materials across architectural coatings, electronics, automotive, and packaging sectors to drive demand

- 12.4.3 INDIA

- 12.4.3.1 Increasing domestic demand, export potential, and policy support to boost growth

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Durability, weather resistance, and functionality in electronics, automotive, construction, and shipbuilding to drive market

- 12.4.5 REST OF ASIA PACIFIC

- 12.4.1 CHINA

- 12.5 MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.5.1.1 Saudi Arabia

- 12.5.1.1.1 Government initiatives to catalyze market development

- 12.5.1.2 UAE

- 12.5.1.2.1 Focus on construction, real estate, transportation, and logistics sectors to support growth

- 12.5.1.3 Rest of GCC countries

- 12.5.1.1 Saudi Arabia

- 12.5.2 SOUTH AFRICA

- 12.5.2.1 Water treatment and agrochemical challenges to propel demand

- 12.5.3 REST OF MIDDLE EAST & AFRICA

- 12.5.1 GCC COUNTRIES

- 12.6 SOUTH AMERICA

- 12.6.1 BRAZIL

- 12.6.1.1 Industrial diversification and sustainability goals to drive growth

- 12.6.2 ARGENTINA

- 12.6.2.1 Industrial recovery and expanding construction, packaging, and automotive production to drive market

- 12.6.3 REST OF SOUTH AMERICA

- 12.6.1 BRAZIL

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2020-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 PRODUCT/BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Chemistry footprint

- 13.7.5.4 Solvency footprint

- 13.7.5.5 Application footprint

- 13.7.5.6 End-use industry footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

- 13.9.3 EXPANSIONS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 BASF

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Deals

- 14.1.1.3.2 Expansions

- 14.1.1.4 MnM view

- 14.1.1.4.1 Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses and competitive threats

- 14.1.2 DOW

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 Recent developments

- 14.1.2.3.1 Product launches

- 14.1.2.4 MnM view

- 14.1.2.4.1 Right to win

- 14.1.2.4.2 Strategic choices

- 14.1.2.4.3 Weaknesses and competitive threats

- 14.1.3 MITSUBISHI CHEMICAL GROUP CORPORATION

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 Recent developments

- 14.1.3.3.1 Product launches

- 14.1.3.4 MnM view

- 14.1.3.4.1 Right to win

- 14.1.3.4.2 Strategic choices

- 14.1.3.4.3 Weaknesses and competitive threats

- 14.1.4 SUMITOMO CHEMICAL CO., LTD.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 Recent developments

- 14.1.4.3.1 Product launches

- 14.1.4.3.2 Expansions

- 14.1.4.4 MnM view

- 14.1.4.4.1 Right to win

- 14.1.4.4.2 Strategic choices

- 14.1.4.4.3 Weaknesses and competitive threats

- 14.1.5 ARKEMA

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 Recent developments

- 14.1.5.3.1 Product launches

- 14.1.5.3.2 Deals

- 14.1.5.4 MnM view

- 14.1.5.4.1 Right to win

- 14.1.5.4.2 Strategic choices

- 14.1.5.4.3 Weaknesses and competitive threats

- 14.1.6 DIC CORPORATION

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Deals

- 14.1.6.4 MnM view

- 14.1.6.4.1 Right to win

- 14.1.6.4.2 Strategic choices

- 14.1.6.4.3 Weaknesses and competitive threats

- 14.1.7 COVESTRO AG

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Product launches

- 14.1.7.4 MnM view

- 14.1.7.4.1 Right to win

- 14.1.7.4.2 Strategic choices

- 14.1.7.4.3 Weaknesses and competitive threats

- 14.1.8 MITSUI CHEMICALS, INC.

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Solutions/Services offered

- 14.1.8.3 Recent developments

- 14.1.8.3.1 Expansions

- 14.1.8.4 MnM view

- 14.1.8.4.1 Right to win

- 14.1.8.4.2 Strategic choices

- 14.1.8.4.3 Weaknesses and competitive threats

- 14.1.9 TRINSEO

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.9.3 Recent developments

- 14.1.9.3.1 Deals

- 14.1.9.3.2 Expansions

- 14.1.9.4 MnM view

- 14.1.9.4.1 Right to win

- 14.1.9.4.2 Strategic choices

- 14.1.9.4.3 Weaknesses and competitive threats

- 14.1.10 ASAHI KASEI CORPORATION

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.10.3 MnM view

- 14.1.10.3.1 Right to win

- 14.1.10.3.2 Strategic choices

- 14.1.10.3.3 Weaknesses and competitive threats

- 14.1.1 BASF

- 14.2 OTHER PLAYERS

- 14.2.1 SYNTHOMER PLC

- 14.2.2 LUBRIZOL

- 14.2.3 NIPPON SHOKUBAI CO., LTD.

- 14.2.4 RESONAC HOLDINGS CORPORATION

- 14.2.5 ROHM GMBH

- 14.2.6 YIP'S CHEMICAL HOLDINGS LIMITED

- 14.2.7 CHANSIEH ENTERPRISES CO., LTD

- 14.2.8 JOTUN

- 14.2.9 GEO

- 14.2.10 FUJIKURA KASEI CO., LTD.

- 14.2.11 ETERNAL MATERIALS CO., LTD.

- 14.2.12 ALLNEX GMBH

- 14.2.13 KAMSONS

- 14.2.14 AEKYUNG

- 14.2.15 BERGER PAINTS INDIA

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS