|

시장보고서

상품코드

1816001

임상시험수탁기관(CRO) 서비스 시장 예측(-2030년) : 유형별, 치료 영역별, 모달리티별, 최종사용자별, 지역별Contract Research Organization Services Market by Type, Therapeutic Area (Cancer, Infectious, Neurology, Vaccines), Modality - Global Forecast to 2030 |

||||||

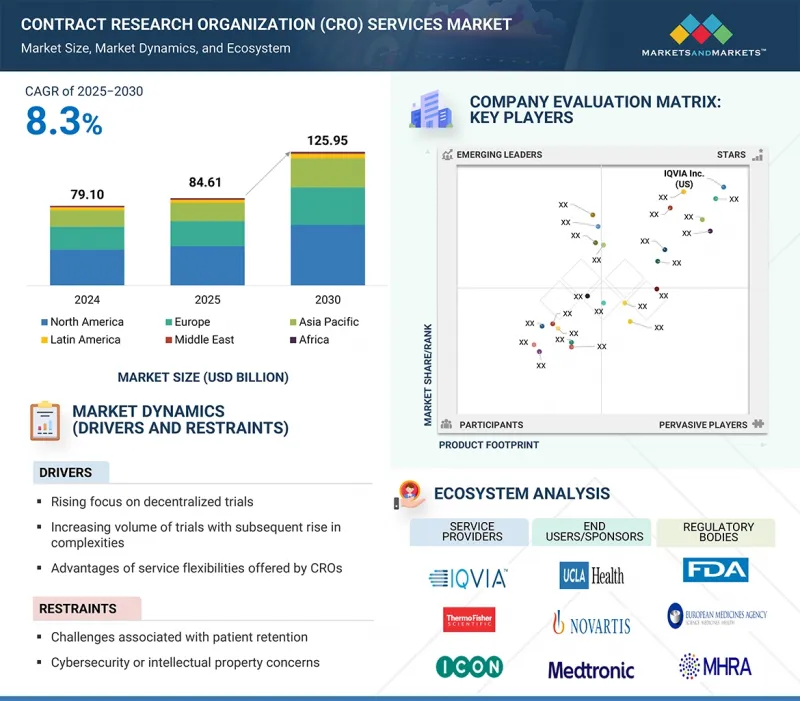

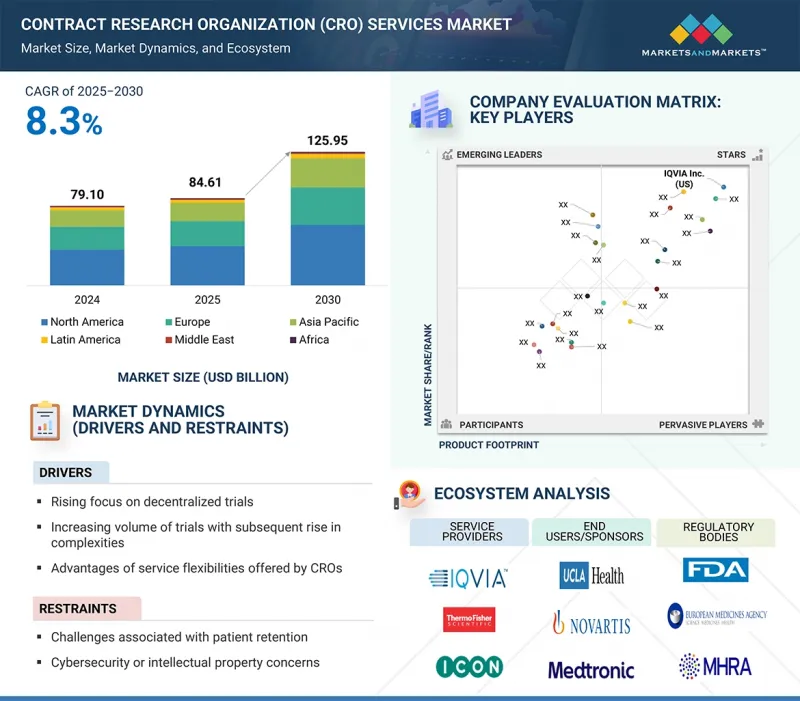

임상시험수탁기관(CRO) 서비스 시장 규모는 예측 기간 중 8.3%의 CAGR로 확대하며, 2025년 846억 1,000만 달러에서 2030년에는 1,259억 5,000만 달러에 달할 것으로 예측됩니다.

시장 성장의 주요 요인으로는 세포 및 유전자 치료제 파이프라인의 확대, 정밀의료에 대한 관심 증가 등을 꼽을 수 있습니다. 이러한 요인들로 인해 복잡한 디자인, 유전체 스크리닝, 맞춤형 물류, 자체적으로 활용하기 어려운 장기 추적관찰의 필수 기능 등에 대응할 수 있는 CRO 파트너에 대한 스폰서들의 관심이 높아질 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2024-2030 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 유형별, 치료 영역별, 모달리티별, 최종사용자별, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

정밀 프로그램은 환자 코호트를 세분화하고 등록 기간을 단축하므로 통합된 CRO-실험실 네트워크와 세계 사이트 커버리지는 타임라인과 데이터 품질에 결정적인 영향을 미칩니다. 규제 당국과 지불자가 강력한 실시간 증거를 요구하는 가운데, 스폰서들은 개발 리스크를 줄이기 위해 고급 실험실, 데이터 사이언스 및 RWE 기능을 갖춘 임상 업무를 제공하는 CRO에 대한 의존도를 높이고 있습니다.

서비스 유형별로는 2024년 CRO 서비스 시장에서 개발 초기 단계 서비스 부문이 가장 큰 비중을 차지할 것으로 예측됩니다.

서비스 유형별로 CRO 서비스 시장은 임상연구 서비스, 초기 단계 개발 서비스, 실험실 서비스, 컨설팅 서비스, 데이터 관리 서비스로 구분됩니다. 2024년에는 초기 개발 서비스 분야가 시장에서 가장 큰 점유율을 차지할 것입니다. 현재 파이프라인은 신규 생물제제, CGT, 표적치료제 개발에 중점을 두고 있으며, 이러한 개발에는 전문적인 독성학, DMPK, 바이오 분석, 안전성 약리학이 필요합니다.

최종사용자별로는 제약 및 바이오 제약 기업이 2024년 CRO 서비스 시장에서 가장 큰 점유율을 차지했습니다.

최종사용자별로 보면 CRO 서비스 시장은 제약 및 바이오제약 기업, 의료기기 기업, 학술기관으로 구분됩니다. 2024년에는 제약 및 바이오 제약 기업이 CRO 서비스 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 이 최종사용자 부문이 큰 비중을 차지하는 이유는 제약회사 및 바이오테크놀러지 기업의 의약품 파이프라인 제품 수가 많기 때문인 것으로 추정됩니다. 또한 CRO는 속도, 규모, 유연한 비용 기반을 제공하여 최종사용자를 끌어들이고 있습니다.

지역별로는 북미가 2024년 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다.

2024년에는 북미가 세계 CRO 서비스 시장에서 가장 큰 점유율을 차지했습니다. 이는 아웃소싱된 R&D 서비스에 대한 큰 수요를 촉진하는 기존 제약 및 생명공학 산업의 존재에 기인합니다. 또한 이 지역에는 대규모 임상시험을 수행하기 위한 이상적인 인프라를 제공하는 임상 시설, 병원, 전문 시설의 방대한 네트워크가 존재합니다. 또한 미국내 디지털 헬스 솔루션과 분산형 임상시험 모델의 급속한 도입은 이 지역에서 CRO의 점유율을 높이는 데 크게 기여하고 있으며, 스폰서들이 환자 모집과 유지를 개선할 수 있는 혁신적인 방법을 찾고 있으며, CRO에 대한 수요를 더욱 증가시키고 있습니다.

세계의 임상시험수탁기관(CRO) 서비스 시장에 대해 조사했으며, 유형별, 치료 영역별, 모달리티별, 최종사용자별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

제6장 업계 동향

- 시장 동향

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 에코시스템 분석

- 투자/자금조달 활동

- 기술 분석

- 주요 컨퍼런스와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고객 상황

- AI/생성형 AI가 CRO 서비스 시장에 미치는 영향

- 2025년 트럼프 관세가 CRO 서비스 시장에 미치는 영향

제7장 CRO 서비스 시장(유형별)

- 서론

- 임상 연구 서비스

- 초기 단계 개발 서비스

- 실험실 서비스

- 컨설팅 서비스

- 데이터 관리 서비스

제8장 CRO 서비스 시장(치료 영역별)

- 서론

- 종양

- 감염증

- 심혈관계 질환

- 신경질환

- 백신

- 대사질환/내분비

- 면역 질환

- 정신과

- 호흡기질환

- 피부과

- 안과

- 소화기 질환

- 비뇨생식기와 여성 건강

- 혈액과

- 기타

제9장 CRO 서비스 시장(모달리티별)

- 서론

- 소분자

- 생물학

- 의료기기

- 바이오시밀러

제10장 CRO 서비스 시장(최종사용자별)

- 서론

- 제약회사 및 바이오의약품 회사

- 의료기기 기업

- 학술기관

제11장 CRO 서비스 시장(지역별)

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- 호주

- 한국

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동

- 중동의 거시경제 전망

- GCC 국가

- 아프리카

- 성장을 촉진하는 급성장중 제약 업계

- 아프리카의 거시경제 전망

제12장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 매출 분석, 2020-2024년

- 시장 점유율 분석, 2024년

- 기업 평가와 재무 지표

- 브랜드/서비스 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 참여 기업

- IQVIA INC.

- ICON PLC

- THERMO FISHER SCIENTIFIC INC.

- LABCORP

- FORTREA, INC.

- SYNEOS HEALTH

- WUXI APPTEC

- CHARLES RIVER LABORATORIES

- PAREXEL INTERNATIONAL CORPORATION

- PHARMARON

- MEDPACE

- SGS SOCIETE GENERALE DE SURVEILLANCE SA

- FRONTAGE LABS

- EUROFINS SCIENTIFIC

- TIGERMED

- PSI

- BIOAGILE THERAPEUTICS PRIVATE LIMITED

- FIRMA CLINICAL RESEARCH

- ACCULAB LIFE SCIENCES

- NOVOTECH

- LINICAL

- ADVANCED CLINICAL

- 기타 기업

- ALLUCENT

- EMVENIO

- GUIRES INC.

- WORLDWIDE CLINICAL TRIALS

- CTI CLINICAL TRIAL & CONSULTING

제14장 부록

KSA 25.09.25The Contract Research Organization (CRO) services market is expected to reach USD 125.95 billion in 2030 from USD 84.61 billion in 2025, at a CAGR of 8.3% during the forecast period. The key factors contributing to market growth include the expanding pipeline of cell & gene therapies and the growing focus on precision medicine. These factors are expected to fuel sponsors towards CRO partners that can handle complex designs, genomic screening, customizable logistics, and mandatory long-term follow-up capabilities that are challenging to utilize in-house.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Service Type, Modality, and End User |

| Regions covered | North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa |

Precision programs fragment patient cohorts and shorten enrollment windows, making integrated CRO-lab networks and global site coverage decisive for timelines and data quality. As regulators and payers demand robust, real-time evidence, sponsors increasingly depend on CROs that offer clinical operations with advanced lab, data science, and RWE capabilities to de-risk development.

By service type, the early phase development services segment accounted for the largest share of the CRO services market in 2024.

Based on service type, the CRO services market is segmented into clinical research services, early phase development services, laboratory services, consulting services, and data management services. In 2024, the early phase development services segment accounted for the largest share of the market. The current pipeline is focused on developing novel biologics, CGT, and targeted modalities that require specialized toxicology, DMPK, bioanalysis, and safety pharmacology, which several sponsors prefer to outsource to reach the IND (investigational new drug) stage faster.

By end user, the pharmaceutical & biopharmaceutical companies accounted for the largest share in the CRO services market in 2024.

Based on end user, the CRO services market is segmented into pharmaceutical & biopharmaceutical companies, medical device companies, and academic institutes. In 2024, the pharmaceutical & biopharmaceutical companies segment accounted for the largest share of the CRO services market. The large share of this end-user segment can be attributed to the large number of drug pipeline products of pharma and biotech companies. Moreover, CROs deliver speed, scale, and flexible cost bases, attracting end users.

By region, North America accounted for the largest share of the market in 2024.

In 2024, North America held the largest share of the global CRO services market, driven by the presence of well-established pharmaceutical and biotechnology industries, which drive significant demand for outsourced research and development services. Additionally, a vast network of clinical sites, hospitals, and specialized facilities, providing an ideal infrastructure for conducting large-scale clinical trials, is present in the region. Additionally, the rapid adoption of digital health solutions and decentralized trial models in the US, a significant contributor to the substantial share of the region, is further boosting CRO demand, as sponsors seek innovative ways to improve patient recruitment and retention.

The primary interviews conducted for this report can be categorized as follows:

- By Respondent: Supply-side- 70% and Demand-side 30%

- By Designation: Managers - 45%, CXOs & Directors - 30%, and Executives - 25%

- By Region: North America - 40%, Europe -25%, Asia Pacific -25%, Latin America -5%, and the Middle East & Africa- 5%

List of Companies Profiled in the Report:

- IQVIA Inc. (US)

- ICON plc (Ireland)

- Thermo Fisher Scientific Inc. (US)

- Laboratory Corporation of America Holdings (LabCorp) (US)

- Fortrea, Inc. (US)

- Syneos Health (US)

- WuXi AppTec (China)

- Charles River Laboratories (US)

- Parexel International Corporation (US)

- Pharmaron (China)

- Medpace (US)

- SGS SA (Switzerland), Frontage Labs (US)

- Eurofins Scientific (Luxembourg)

- BioAgile (India)

- Firma Clinical Research (US)

- Acculab Life Sciences (US)

- Novotech (Australia)

- KCR S.A. (US)

- Linical (Japan)

- Advanced Clinical (US)

- Allucent (US)

- Clinical Trial Service (Netherlands)

- Guires Inc. (Pepgra Healthcare Pvt. Ltd.) (UK)

- Worldwide Clinical Trials (US)

- CTI Clinical Trial And Consulting (US)

Research Coverage

This research report categorizes the CRO services market by service type (clinical research services, early phase development services, laboratory services, consulting services, and data management services), modality (small molecules, biologics, biosimilars, medical devices), end user (pharmaceutical & biopharmaceutical companies, medical device companies, and academic institutes), and regional scope (North America, Europe, the Asia Pacific, Latin America, the Middle East, and Africa). The report covers detailed information regarding the leading factors, such as drivers, restraints, challenges, and opportunities, influencing the growth of the CRO services market. A thorough analysis of the key industry players has provided insights into their business overview, services, key strategies, collaborations, partnerships, and agreements. New launches, collaborations, partnerships, and acquisitions are the recent developments associated with the CRO services market.

Key Benefits of Buying the Report

The report will help market leaders/new entrants by providing the closest approximations of the revenue numbers for the overall CRO services market and its subsegments. It will also help stakeholders better understand the competitive landscape and gain more insights to position their business better and make suitable go-to-market strategies. This report will enable stakeholders to understand the market's pulse and provide them with information on the key market drivers, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (Increasing focus on decentralized trials, rising complexity and volume of trials, service flexibility offered by CROs), opportunities (regulatory focus on patient pool diversity), and challenges (challenges of patient retention and cybersecurity/intellectual property concerns) influencing the growth of the market.

- Service Development/Innovation: Detailed insights on newly launched services of the CRO services market

- Market Development: Comprehensive information about lucrative markets - the report analyzes the market across varied regions.

- Market Diversification: Exhaustive information about new services, untapped geographies, recent developments, and investments in the CRO services market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of key players, including IQVIA Inc. (US), ICON Plc (Ireland), Medpace (US), Laboratory Corporation of America Holdings (LabCorp) (US), Thermo Fisher Scientific Inc. (US), and Fortrea, Inc. (US). A detailed analysis of the key industry players has been conducted to provide insights into their key strategies, service launches, acquisitions, partnerships, agreements, collaborations, expansions, other recent developments, investment and funding activities, brand/service comparative analysis, and vendor valuation and financial metrics of the CRO services market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key sources of secondary data

- 2.1.1.2 Key objectives of secondary research

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Breakdown of primaries

- 2.1.2.2 Key objectives of primary research

- 2.1.1 SECONDARY DATA

- 2.2 MARKET ESTIMATION METHODOLOGY

- 2.2.1 COMPANY REVENUE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 MNM REPOSITORY ANALYSIS AND PRIMARY RESEARCH

- 2.2.3 DEMAND AND SUPPLY-SIDE ANALYSIS

- 2.2.4 SEGMENTAL MARKET ASSESSMENT (TOP-DOWN APPROACH)

- 2.3 GROWTH RATE PROJECTIONS

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

- 3.1 KEY INSIGHTS AND MARKET HIGHLIGHTS

- 3.2 STRATEGIC IMPERATIVES FOR STAKEHOLDERS IN CRO SERVICES MARKET

- 3.3 DISRUPTIVE TRENDS SHAPING CRO SERVICES MARKET

- 3.4 HIGH GROWTH SEGMENTS AND EMERGING FRONTIERS

4 PREMIUM INSIGHTS

- 4.1 GLOBAL CRO SERVICES MARKET SNAPSHOT

- 4.2 NORTH AMERICA: CRO SERVICES MARKET, BY MODALITY AND COUNTRY, 2024

- 4.3 CRO SERVICES MARKET, BY TYPE, 2024

- 4.4 CRO SERVICES MARKET, BY END USER, 2024

- 4.5 CRO SERVICES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

- 4.6 UNMET NEEDS AND WHITE SPACES

- 4.7 STRATEGIC ANALYSIS OF GROWTH OPPORTUNITIES

- 4.8 EMERGING BUSINESS MODELS AND ECOSYSTEM SHIFT

- 4.9 INTERCONNECTED MARKETS AND CROSS-SECTOR OPPORTUNITIES

- 4.10 SUSTAINABILITY IMPACT AND REGULATORY POLICY INITIATIVES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising clinical trial volume and escalating protocol complexity

- 5.2.1.2 Growing focus on decentralized/patient-centric trials

- 5.2.1.3 Increasing preference for service flexibility

- 5.2.1.4 Technological integration

- 5.2.1.5 Growing R&D budgets and expanding late-stage pipelines

- 5.2.2 OPPORTUNITIES

- 5.2.2.1 Shift toward regulatory compliance

- 5.2.2.2 Growing adoption of risk-based monitoring

- 5.2.2.3 Favorable reimbursement scenario

- 5.2.3 CHALLENGES

- 5.2.3.1 Patient retention

- 5.2.3.2 Cybersecurity and intellectual property challenges

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 MARKET TRENDS

- 6.1.1 HEALTH ECONOMICS & OUTCOMES RESEARCH AND REAL-WORLD EVIDENCE

- 6.1.2 IN-SILICO TRIALS

- 6.1.3 SPECIALIZED ANALYTICS FOR EMERGING MODALITIES

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 PRICING ANALYSIS

- 6.3.1 INDICATIVE PRICING ANALYSIS, BY SERVICE TYPE

- 6.3.2 INDICATIVE PRICING ANALYSIS, BY PHASE

- 6.3.3 INDICATIVE PRICING ANALYSIS, BY REGION

- 6.4 VALUE CHAIN ANALYSIS

- 6.5 ECOSYSTEM ANALYSIS

- 6.6 INVESTMENT/FUNDING ACTIVITY

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Clinical trial management system

- 6.7.1.2 Randomization and trial supply management

- 6.7.1.3 Electronic Data Capture (EDC) system

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Model-informed drug development

- 6.7.2.2 Data management and informatics technologies

- 6.7.3 ADJACENT TECHNOLOGIES

- 6.7.3.1 Clinical trial simulation tools

- 6.7.1 KEY TECHNOLOGIES

- 6.8 KEY CONFERENCES AND EVENTS

- 6.9 REGULATORY LANDSCAPE

- 6.9.1 REGULATORY FRAMEWORK

- 6.9.1.1 North America

- 6.9.1.2 Europe

- 6.9.1.3 Asia Pacific

- 6.9.1.4 Rest of the World

- 6.9.2 REGULATORY ANALYSIS

- 6.9.3 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.9.4 REGULATORY SCENARIO FOR DRUG APPROVALS AND CGMP PROCEDURES

- 6.9.1 REGULATORY FRAMEWORK

- 6.10 PORTER'S FIVE FORCES ANALYSIS

- 6.10.1 BARGAINING POWER OF SUPPLIERS

- 6.10.2 BARGAINING POWER OF BUYERS

- 6.10.3 THREAT OF NEW ENTRANTS

- 6.10.4 THREAT OF SUBSTITUTES

- 6.10.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.11 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.11.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.11.2 BUYING CRITERIA

- 6.12 CUSTOMER LANDSCAPE

- 6.12.1 BUDGET ALLOCATION TREND

- 6.12.2 ADOPTION BARRIER AND INTERNAL FRICTION

- 6.13 IMPACT OF AI/GEN AI ON CRO SERVICES MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 MARKET POTENTIAL ACROSS DRUG DEVELOPMENT STAGES

- 6.13.3 AI USE CASES

- 6.13.4 KEY COMPANIES IMPLEMENTING AI

- 6.13.5 FUTURE OF GENERATIVE AI IN DRUG DEVELOPMENT ECOSYSTEM

- 6.14 IMPACT OF 2025 TRUMP TARIFF ON CRO SERVICES MARKET

- 6.14.1 INTRODUCTION

- 6.14.2 KEY TARIFF RATES

- 6.14.3 PRICE IMPACT ANALYSIS

- 6.14.4 IMPACT ON COUNTRY/REGION

- 6.14.4.1 North America (US)

- 6.14.4.2 Europe

- 6.14.4.3 Asia Pacific

- 6.14.5 IMPACT ON END-USE INDUSTRIES

- 6.14.5.1 Pharmaceutical & biotech companies

- 6.14.5.2 Medical device companies

- 6.14.5.3 Academic institutes

7 CRO SERVICES MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 CLINICAL RESEARCH SERVICES

- 7.2.1 PHASE III

- 7.2.1.1 Large-scale testing ability to assess efficacy and safety of drugs to aid growth

- 7.2.2 PHASE II

- 7.2.2.1 Growing number of pipeline products in Phase II studies to drive market

- 7.2.3 PHASE I

- 7.2.3.1 Robust pipeline of pharmaceutical and biopharmaceutical products to support growth

- 7.2.4 PHASE IV

- 7.2.4.1 Stringent global regulations for drug safety monitoring to spur growth

- 7.2.1 PHASE III

- 7.3 EARLY PHASE DEVELOPMENT SERVICES

- 7.3.1 CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES

- 7.3.1.1 Growing need to meet regulatory norms for drugs to fuel market

- 7.3.2 PRECLINICAL SERVICES

- 7.3.2.1 Pharmacokinetics/Pharmacodynamics

- 7.3.2.1.1 Rise in outsourcing services by pharmaceutical and biopharmaceutical companies to promote growth

- 7.3.2.2 Toxicology testing

- 7.3.2.2.1 Need to prevent late-stage failures to contribute to growth

- 7.3.2.3 Other preclinical services

- 7.3.2.1 Pharmacokinetics/Pharmacodynamics

- 7.3.3 DISCOVERY STUDIES

- 7.3.3.1 Increasing reliance on CRO services for target identification and validation to expedite growth

- 7.3.1 CHEMISTRY, MANUFACTURING, AND CONTROL SERVICES

- 7.4 LABORATORY SERVICES

- 7.4.1 ANALYTICAL TESTING

- 7.4.1.1 Physical characterization

- 7.4.1.1.1 Ability to minimize product failure in late-phase development to favor growth

- 7.4.1.2 Raw material testing

- 7.4.1.2.1 Need to maintain quality of finished product to facilitate growth

- 7.4.1.3 Batch-release testing

- 7.4.1.3.1 Need to maintain batch-to-batch consistency of pharmaceutical dosage forms to advance growth

- 7.4.1.4 Stability testing

- 7.4.1.4.1 Ability to establish drug compatibility and formulation development to aid growth

- 7.4.1.5 Other analytical testing services

- 7.4.1.1 Physical characterization

- 7.4.2 BIOANALYTICAL TESTING

- 7.4.2.1 Increasing outsourcing of R&D activities to accelerate growth

- 7.4.1 ANALYTICAL TESTING

- 7.5 CONSULTING SERVICES

- 7.5.1 GROWING ADOPTION OF CONSULTING SERVICES FOR FASTER REGULATORY APPROVALS TO BOOST MARKET

- 7.6 DATA MANAGEMENT SERVICES

- 7.6.1 NEED TO TRACK PROGRESS OF EARLY DRUG DEVELOPMENT TO AUGMENT GROWTH

8 CRO SERVICES MARKET, BY THERAPEUTIC AREA

- 8.1 INTRODUCTION

- 8.2 ONCOLOGY

- 8.2.1 BREAST CANCER

- 8.2.1.1 Increasing cases and high spending on treating breast cancer to support growth

- 8.2.2 LUNG CANCER

- 8.2.2.1 Increasing focus on developing drugs against lung cancer to foster growth

- 8.2.3 COLORECTAL CANCER

- 8.2.3.1 Increasing drug discovery and development efforts against colorectal cancer to aid growth

- 8.2.4 PROSTATE CANCER

- 8.2.4.1 Growing clinical pipeline to propel market

- 8.2.5 OTHER CANCERS

- 8.2.1 BREAST CANCER

- 8.3 INFECTIOUS DISEASES

- 8.3.1 INCREASING INCIDENCE OF CHRONIC INFECTIONS TO SUPPORT GROWTH

- 8.4 CARDIOVASCULAR SYSTEM DISORDERS

- 8.4.1 HIGH MORTALITY RATES DUE TO CARDIOVASCULAR DISEASES TO FUEL MARKET

- 8.5 NEUROLOGY

- 8.5.1 GROWING INVESTMENTS IN NEUROLOGICAL DISORDER RESEARCH TO DRIVE MARKET

- 8.6 VACCINES

- 8.6.1 INCREASING FOCUS ON VACCINE DEVELOPMENT TO SPUR GROWTH

- 8.7 METABOLIC DISORDERS/ENDOCRINOLOGY

- 8.7.1 INCREASING GLOBAL DIABETES AND OBESITY POPULATION TO PROMOTE GROWTH

- 8.8 IMMUNOLOGICAL DISORDERS

- 8.8.1 GROWING CLINICAL RESEARCH FOR IMMUNOLOGICAL DISORDERS TO BOOST MARKET

- 8.9 PSYCHIATRY

- 8.9.1 RISING CASES OF PSYCHIATRIC DISORDERS AND DEPRESSION TO SUSTAIN GROWTH

- 8.10 RESPIRATORY DISORDERS

- 8.10.1 RISING INCIDENCE OF CHRONIC RESPIRATORY DISEASE TO FOSTER GROWTH

- 8.11 DERMATOLOGY

- 8.11.1 GROWING FOCUS ON DRUG DEVELOPMENT AGAINST VARIOUS SKIN CONDITIONS TO DRIVE MARKET

- 8.12 OPHTHALMOLOGY

- 8.12.1 GROWTH IN OPHTHALMOLOGY PIPELINE DRUGS TO SUPPORT MARKET

- 8.13 GASTROINTESTINAL DISEASES

- 8.13.1 RAPID LIFESTYLE AND DIETARY CHANGES TO AMPLIFY GROWTH

- 8.14 GENITOURINARY & WOMEN'S HEALTH

- 8.14.1 RISING AWARENESS ABOUT EARLY DISEASE DIAGNOSIS AND TREATMENT TO BOLSTER GROWTH

- 8.15 HEMATOLOGY

- 8.15.1 INCREASING DRUG APPROVALS FOR DRUGS AGAINST NON-MALIGNANT HEMATOLOGICAL CONDITIONS TO SUPPORT GROWTH

- 8.16 OTHER THERAPEUTIC AREAS

9 CRO SERVICES MARKET, BY MODALITY

- 9.1 INTRODUCTION

- 9.2 SMALL MOLECULES

- 9.2.1 ONGOING SURGE IN PHARMACEUTICAL R&D INVESTMENTS TO SUPPORT GROWTH

- 9.3 BIOLOGICS

- 9.3.1 MONOCLONAL ANTIBODY

- 9.3.1.1 Surging demand for targeted therapies across oncology, autoimmune disorders, and infectious diseases to drive market

- 9.3.2 CELL & GENE THERAPY

- 9.3.2.1 Robust drug pipeline and R&D initiatives to drive market

- 9.3.3 OTHER BIOLOGICS

- 9.3.1 MONOCLONAL ANTIBODY

- 9.4 MEDICAL DEVICES

- 9.4.1 RAPID INNOVATIONS IN DIAGNOSTICS, IMPLANTABLE, AND DIGITAL HEALTH TECHNOLOGIES TO FOSTER GROWTH

- 9.5 BIOSIMILARS

- 9.5.1 MONOCLONAL ANTIBODY BIOSIMILARS

- 9.5.1.1 Rising demand for affordable therapeutic options to support growth

- 9.5.2 INSULIN

- 9.5.2.1 Increasing patent expirations to contribute to growth

- 9.5.3 COLONY STIMULATING FACTOR

- 9.5.3.1 Increasing use of colony stimulating factor during post-chemotherapy to aid growth

- 9.5.4 ERYTHROPOEITIN

- 9.5.4.1 Essential role of erythropoietin in treating anemia to stimulate growth

- 9.5.5 OTHER BIOSIMILARS

- 9.5.1 MONOCLONAL ANTIBODY BIOSIMILARS

10 CRO SERVICES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 PHARMACEUTICAL AND BIOPHARMACEUTICAL COMPANIES

- 10.2.1 INCREASING OUTSOURCING AND PARTNERSHIPS TO ACCELERATE GROWTH

- 10.3 MEDICAL DEVICE COMPANIES

- 10.3.1 INCREASING RECOGNITION OF CRO PROVIDERS TO AUGMENT GROWTH

- 10.4 ACADEMIC INSTITUTES

- 10.4.1 CONSISTENT COLLABORATIONS BETWEEN CROS AND ACADEMIA TO INTENSIFY GROWTH

11 CRO SERVICES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Increasing incidence of oncology indications to accelerate growth

- 11.2.3 CANADA

- 11.2.3.1 Favorable government initiatives and high investments to support growth

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Presence of strong pharmaceutical and biotechnology R&D infrastructure to spur growth

- 11.3.3 UK

- 11.3.3.1 Rising R&D expenditure in pharmaceutical industry to expedite growth

- 11.3.4 FRANCE

- 11.3.4.1 Increasing technological advancements and faster drug discovery and development initiatives to aid growth

- 11.3.5 ITALY

- 11.3.5.1 Short timeline for drug approvals to encourage growth

- 11.3.6 SPAIN

- 11.3.6.1 Growing investment in pharmaceutical industry to boost market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 CHINA

- 11.4.2.1 Continued efforts on improving level of drug safety and supply to spur growth

- 11.4.3 INDIA

- 11.4.3.1 Large pool of patients and presence of highly skilled medical professionals to augment growth

- 11.4.4 JAPAN

- 11.4.4.1 Growing drug development activity to propel market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Growing focus on funding opportunities to boost market

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Emerging clinical research hub to sustain growth

- 11.4.7 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Growing focus on enhancing pharmaceutical research and production to fuel market

- 11.5.3 MEXICO

- 11.5.3.1 Increasing investments in pharma R&D to promote growth

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST

- 11.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST

- 11.6.2 GCC COUNTRIES

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.6.2.1.1 Expanding clinical trials ecosystem to contribute to growth

- 11.6.2.2 United Arab Emirates (UAE)

- 11.6.2.2.1 Growing clinical trials activity to drive market

- 11.6.2.2.2 Rest of GCC Countries

- 11.6.2.3 Rest of Middle East

- 11.6.2.1 Kingdom of Saudi Arabia (KSA)

- 11.7 AFRICA

- 11.7.1 BOOMING PHARMACEUTICAL INDUSTRY TO FACILITATE GROWTH

- 11.7.2 MACROECONOMIC OUTLOOK FOR AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN CRO SERVICES MARKET

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND/SERVICE COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Type footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 SERVICE/SOLUTION LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 IQVIA INC.

- 13.1.1.1 Business overview

- 13.1.1.2 Services/Solutions offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Service/Solution launches and approvals

- 13.1.1.3.2 Deals

- 13.1.1.3.3 Other developments

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ICON PLC

- 13.1.2.1 Business overview

- 13.1.2.2 Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Service/Solution launches and approvals

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 THERMO FISHER SCIENTIFIC INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Services/Solutions offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Service/Solution launches and approvals

- 13.1.3.3.2 Deals

- 13.1.3.3.3 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 LABCORP

- 13.1.4.1 Business overview

- 13.1.4.2 Services/Solutions offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Service/Solution launches and approvals

- 13.1.4.3.2 Deals

- 13.1.4.3.3 Expansions

- 13.1.4.3.4 Other developments

- 13.1.4.4 MnM view

- 13.1.4.4.1 Key strengths

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 FORTREA, INC.

- 13.1.5.1 Company overview

- 13.1.5.2 Services/Solutions offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Service/Solution launches and approvals

- 13.1.5.3.2 Deals

- 13.1.5.3.3 Expansions

- 13.1.5.3.4 Other developments

- 13.1.5.4 MnM view

- 13.1.5.4.1 Key strengths

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SYNEOS HEALTH

- 13.1.6.1 Business overview

- 13.1.6.2 Services/Solutions offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Service/Solution launches and approvals

- 13.1.6.3.2 Deals

- 13.1.7 WUXI APPTEC

- 13.1.7.1 Business overview

- 13.1.7.2 Services/Solutions offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Service/Solution launches and approvals

- 13.1.7.3.2 Deals

- 13.1.7.3.3 Expansions

- 13.1.8 CHARLES RIVER LABORATORIES

- 13.1.8.1 Business overview

- 13.1.8.2 Services/Solutions offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.8.3.2 Expansions

- 13.1.9 PAREXEL INTERNATIONAL CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Services/Solutions offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Service/Solution launches and approvals

- 13.1.9.3.2 Deals

- 13.1.9.3.3 Expansions

- 13.1.10 PHARMARON

- 13.1.10.1 Business overview

- 13.1.10.2 Services/Solutions offered

- 13.1.11 MEDPACE

- 13.1.11.1 Business overview

- 13.1.11.2 Services/Solutions offered

- 13.1.12 SGS SOCIETE GENERALE DE SURVEILLANCE SA

- 13.1.12.1 Business overview

- 13.1.12.2 Services/Solutions offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Deals

- 13.1.13 FRONTAGE LABS

- 13.1.13.1 Business overview

- 13.1.13.2 Services/Solutions offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Deals

- 13.1.13.3.2 Expansions

- 13.1.13.3.3 Other developments

- 13.1.14 EUROFINS SCIENTIFIC

- 13.1.14.1 Business overview

- 13.1.14.2 Services/Solutions offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 TIGERMED

- 13.1.15.1 Business overview

- 13.1.15.2 Services/Solutions offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Service/Solution launches and approvals

- 13.1.15.3.2 Deals

- 13.1.16 PSI

- 13.1.16.1 Business overview

- 13.1.16.2 Services/Solutions offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Service/Solution launches and approvals

- 13.1.16.3.2 Deals

- 13.1.16.3.3 Expansions

- 13.1.17 BIOAGILE THERAPEUTICS PRIVATE LIMITED

- 13.1.17.1 Business overview

- 13.1.17.2 Services/Solutions offered

- 13.1.18 FIRMA CLINICAL RESEARCH

- 13.1.18.1 Business overview

- 13.1.18.2 Services/Solutions offered

- 13.1.19 ACCULAB LIFE SCIENCES

- 13.1.19.1 Business overview

- 13.1.19.2 Services/Solutions offered

- 13.1.20 NOVOTECH

- 13.1.20.1 Business overview

- 13.1.20.2 Services/Solutions offered

- 13.1.20.3 Recent developments

- 13.1.20.3.1 Deals

- 13.1.21 LINICAL

- 13.1.21.1 Business overview

- 13.1.21.2 Services/Solutions offered

- 13.1.21.3 Recent developments

- 13.1.21.3.1 Deals

- 13.1.21.3.2 Expansions

- 13.1.22 ADVANCED CLINICAL

- 13.1.22.1 Business overview

- 13.1.22.2 Services/Solutions offered

- 13.1.22.3 Recent developments

- 13.1.22.3.1 Deals

- 13.1.22.3.2 Expansions

- 13.1.1 IQVIA INC.

- 13.2 OTHER PLAYERS

- 13.2.1 ALLUCENT

- 13.2.2 EMVENIO

- 13.2.3 GUIRES INC.

- 13.2.4 WORLDWIDE CLINICAL TRIALS

- 13.2.5 CTI CLINICAL TRIAL & CONSULTING

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS