|

시장보고서

상품코드

1819092

라틴아메리카의 주입 펌프 시장 : 제품별, 용도별, 최종사용자별 - 예측(-2030년)Latin America Infusion Pump Market by Product (Accessories & Consumables, Devices (Volumetric, Insulin, Syringe, Ambulatory, PCA)), Application (Chemotherapy, Diabetes, Analgesia, Pediatrics, Hematology), End User (Hospitals) - Global Forecast to 2030 |

||||||

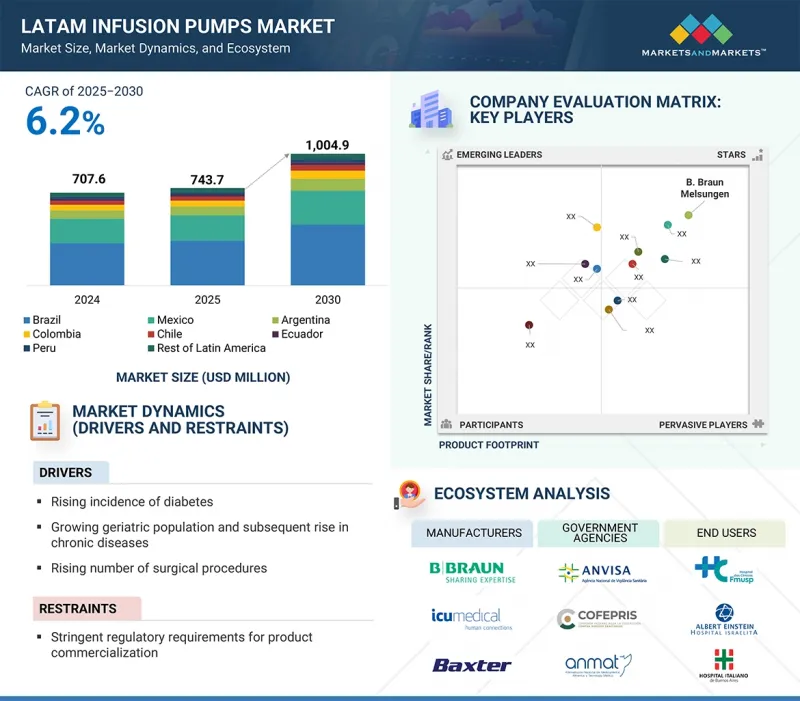

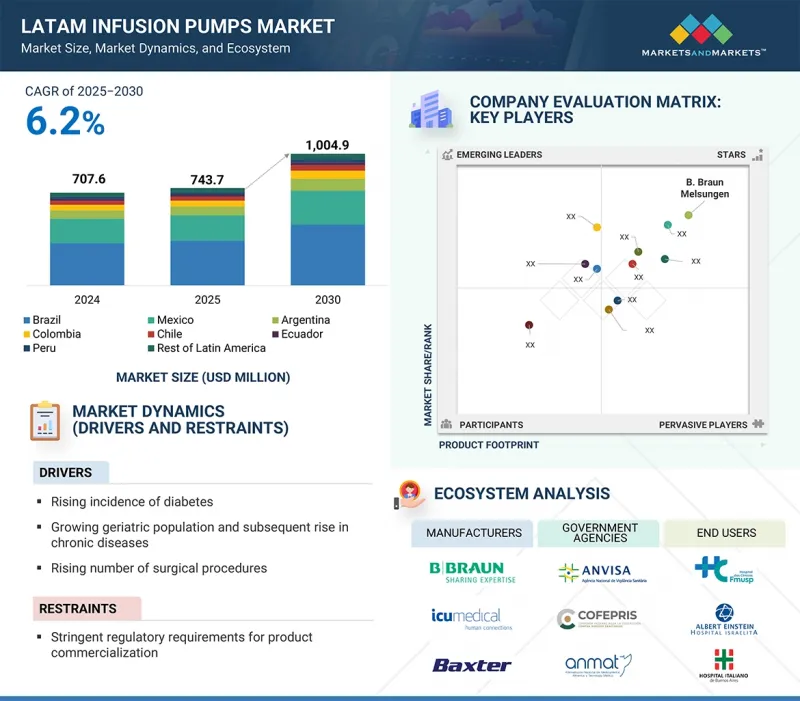

라틴아메리카의 주입 펌프 시장 규모는 2025년 7억 4,000만 달러에서 2030년까지 10억 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 6.2%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 10억 달러 |

| 부문 | 제품, 용도, 최종사용자 |

| 대상 지역 | 브라질, 멕시코, 아르헨티나, 콜롬비아, 칠레, 에콰도르, 페루, 기타 라틴아메리카 |

라틴아메리카의 주입 펌프 시장은 만성질환 증가, 인구통계학적 변화, 의료시설 확충 등의 요인에 힘입어 꾸준히 성장하고 있습니다. 이 지역에서는 당뇨병, 암, 심혈관질환 등의 질병이 흔하게 발생하고 있으며, 많은 경우 정확하고 지속적인 약물전달이 요구됩니다. 주입 펌프는 특히 장기 치료가 필요한 환자에게 의사가 정확한 치료를 제공하는 데 도움을 주고 있습니다. 또한, 노인 인구의 증가도 이러한 수요에 기여하고 있습니다. 노인들은 보통 약물을 자주, 그리고 조절하면서 투여해야 하기 때문입니다. 이와 더불어, 종양 치료 및 응급 처치에 대한 수요가 증가함에 따라 주입 펌프는 라틴아메리카 전역의 병원과 클리닉에 필수적인 장비가 되었습니다.

제품별로는 액세서리 및 소모품 부문이 2024년 가장 큰 시장 점유율을 차지했습니다.

액세서리 및 소모품 부문은 주입 펌프의 가동률 증가와 수액 세트, 카테터, 튜브와 같은 소모품에 대한 정기적인 수요 증가에 힘입어 성장세를 보이고 있습니다. 장기 치료 및 입원의 증가도 정기적인 교체 및 유지보수 부품에 대한 수요를 증가시키고 있습니다.

제품(장치)별로는 용적식 주입 펌프 부문이 2024년 가장 큰 시장 점유율을 차지했습니다.

라틴아메리카 시장에서의 체적식 주입 펌프 부문의 성장은 정확한 수액 투여가 필요한 만성질환의 유병률 증가와 지역 내 의료 인프라의 확대에 기인합니다. 또한, 안전 기능이 강화된 스마트 펌프를 포함한 첨단 수액 기술의 채택과 의료비 증가가 이 부문의 확대에 기여하고 있습니다.

용도별로는 당뇨병 부문이 2024년 가장 큰 시장 점유율을 차지했습니다.

당뇨병 유병률의 증가와 정확하고 지속적인 인슐린 투여를 위한 인슐린 펌프의 채택이 증가함에 따라 당뇨병 부문이 가장 큰 시장 점유율을 차지했습니다. 선진화된 당뇨병 관리에 대한 인식이 높아지면서 의료 지원 노력이 수요를 더욱 가속화하고 있습니다.

2024년 브라질은 거대한 환자 인구와 만성질환의 높은 유병률로 인해 주요 병원 시스템에서 종양, 당뇨병, 응급처치 및 수액 요법에 대한 수요를 촉진하여 가장 큰 시장 점유율을 차지했습니다. 병원 인프라와 IT의 발전에 힘입어 스마트 펌프와 이동식 펌프의 사용이 증가하고 있으며, 채택과 교체 속도가 빨라지고 있습니다. 또한, 정부와 민간의 의료 투자와 브라질의 보조 의료 시스템 확대로 인해 조달 능력이 강화되고, 전사적 수액 플랫폼과 서비스 계약을 촉진하는 표준화 활동이 지원되고 있습니다.

라틴아메리카의 주입 펌프 시장에 대해 조사 분석했으며, 주요 촉진요인과 억제요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 라틴아메리카의 주입 펌프 시장 개요

- 라틴아메리카의 주입 펌프 시장 : 제품별, 국가별(2024년)

- 라틴아메리카의 주입 펌프 시장 : 지역 구성

- 라틴아메리카의 주입 펌프 시장 : 지리적 성장 기회

제5장 시장 개요

- 시장 역학

- 시장 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- Porter's Five Forces 분석

- 규제 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 특허 분석

- 주입 펌프 특허 공보 동향

- 인사이트 : 관할구역과 주요 신청자 분석

- 무역 분석

- HS 코드 901890 수출 데이터

- HS 코드 901890 수입 데이터

- 상환 분석

- 가격 책정 분석

- 디바이스 평균판매가격 동향 : 주요 기업별(2022-2024년)

- 주입 펌프 평균판매가격 동향 : 지역별(2022-2024년)

- 주요 회의와 이벤트(2025-2026년)

- 주요 이해관계자와 구입 기준

- 라틴아메리카의 주입 펌프 시장에 대한 AI/생성형 AI의 영향

- 소개

- 라틴아메리카의 주입 펌프 생태계의 시장 전망

- 주입 펌프에 AI를 도입하고 있는 주요 기업

- 라틴아메리카의 주입 펌프 생태계에서 생성형 AI의 미래

- 생태계 분석

- 밸류체인 분석

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 투자와 자금 조달 시나리오

- 중남미의 주입 펌프 시장에 대한 트럼프 관세의 영향

- 소개

- 주요 관세율

- 가격의 영향 분석

- 라틴아메리카의 지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 라틴아메리카의 주입 펌프 시장 : 제품별

- 소개

- 액세서리·소모품

- 전용 액세서리·소모품

- 비전용 액세서리·소모품

- 디바이스

- 디바이스 시장 : 제품별

- 디바이스 시장 : 기술별

- 디바이스 시장 : 유형별

제7장 라틴아메리카의 주입 펌프 시장 : 용도별

- 소개

- 화학요법/종양

- 당뇨병 관리

- 소화기내과

- 진통/통증 관리

- 소아과/신생아과

- 혈액

- 기타 용도

제8장 라틴아메리카의 주입 펌프 시장 : 최종사용자별

- 소개

- 병원

- 재택 케어 환경

- 외래 케어 환경

- 학술연구기관

- 암센터

- 기타 최종사용자

제9장 라틴아메리카의 주입 펌프 시장 : 국가별

- 라틴아메리카

- 라틴아메리카의 주입 펌프 디바이스 시장 : 제품별(2023-2030년)

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 아르헨티나

- 콜롬비아

- 칠레

- 에콰도르

- 페루

- 기타 라틴아메리카

제10장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점(2022-2025년)

- 매출 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 주요 기업 연구개발비

- 기업 평가와 재무 지표

- 브랜드/제품의 비교 분석

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- BECTON, DICKINSON AND COMPANY(BD)

- B. BRAUN MELSUNGEN AG

- BAXTER INTERNATIONAL INC.

- FRESENIUS KABI

- MEDTRONIC

- TERUMO CORPORATION

- ICU MEDICAL, INC.

- AVANOS MEDICAL, INC.

- NIPRO CORPORATION

- JMS CO., LTD.

- CARDINAL HEALTH, INC.

- ROCHE DIAGNOSTICS

- ABBOTT LABORATORIES

- DANAHER CORPORATION

- YPSOMED AG

- 기타 기업

- TANDEM DIABETES CARE, INC.

- HARVARD BIOSCIENCE INC.

- SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- INTUVIE HOLDINGS LLC

- ANGIPLAST PVT. LTD.

- IRADIMED CORPORATION

- NEW ERA INSTRUMENTS

- EPIC MEDICAL

- SHENZHEN MEDRENA BIOTECH CO., LTD.

- CODAN COMPANIES

제12장 부록

KSM 25.09.29The Latin America infusion pumps market is projected to reach USD 1.00 billion by 2030 from USD 0.74 billion in 2025, at a CAGR of 6.2% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | By Product, Application, and End User |

| Regions covered | Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru, and the rest of Latin America |

The infusion pumps market in Latin America is growing steadily, supported by factors such as rising chronic diseases, changing demographics, and better healthcare facilities. Conditions like diabetes, cancer, and cardiovascular disorders are becoming more common in the region and often require precise and continuous delivery of medicines. Infusion pumps help doctors provide accurate treatment, especially for patients who need long-term care. The growing elderly population also adds to this demand, as older people usually need frequent and controlled drug administration. Along with this, the increasing need for oncology and critical care therapies makes infusion pumps essential for hospitals and clinics across Latin America.

By product, the accessories & consumables segment accounted for the largest share of the market in 2024.

By product, the Latin America infusion pumps market has been segmented into accessories & consumables and devices. The accessories & consumables segment accounted for the largest share of the infusion pumps market in 2024. The accessories & consumables segment is driven by the growing installed base of infusion pumps and the recurring need for disposables like IV sets, catheters, and tubing. The rise in long-term therapies and hospital admissions also increases demand for regular replacement and maintenance components.

By product (devices), the volumetric infusion pumps segment accounted for the largest market share in 2024.

Based on devices, the Latin America infusion pumps market is segmented into volumetric infusion pumps, insulin pumps, enteral infusion pumps, ambulatory infusion pumps, syringe infusion pumps, patient-controlled analgesia (PCA) pumps, and implantable infusion pumps. The volumetric infusion pumps segment accounted for the largest infusion pump devices market share in 2024. The growth of the volumetric infusion pumps segment in the LATAM market is driven by the rising prevalence of chronic diseases necessitating precise fluid administration and the expansion of healthcare infrastructure across the region. Additionally, adopting advanced infusion technologies, including smart pumps with enhanced safety features, and increased healthcare spending contribute to the segment's expansion.

By application, the diabetes segment accounted for the largest share of the market in 2024.

Based on application, the Latin America infusion pumps market is segmented into chemotherapy/oncology, diabetes management, gastroenterology, analgesia/pain management, pediatrics/neonatology, hematology, and other applications (includes infectious diseases, autoimmune diseases, and diseases of the heart, kidney, lung, and liver). The diabetes segment accounted for the largest market share owing to the rising prevalence of diabetes and the increasing adoption of insulin pumps for precise, continuous insulin delivery. Growing awareness of advanced diabetes management and supportive healthcare initiatives further accelerates demand.

By country, Brazil accounted for the largest share of the market in 2024.

The Latin America infusion pump market is divided by country, including Brazil, Mexico, Argentina, Colombia, Chile, Ecuador, Peru, and the Rest of Latin America. In 2024, Brazil accounted for the largest market share, driven by its large patient population and high prevalence of chronic diseases, fueling the demand for infusion therapies in oncology, diabetes, and critical care across leading hospital systems. The growing use of smart and ambulatory pumps, aided by advancements in hospital infrastructure and IT, accelerates adoption and replacement rates. Additionally, government and private healthcare investments and Brazil's expansive supplementary health plans are enhancing procurement capacity and supporting standardization efforts that promote enterprise-wide infusion platforms and service agreements.

A breakdown of the primary participants (supply-side) for the Latin America infusion pumps market referred to in this report is provided below:

- By Company Type: Tier 1-45%, Tier 2-20%, and Tier 3-35%

- By Designation: C-level-35%, Director Level-25%, and Others-40%

- By Region: Brazil-40%, Mexico-25%, Argentina-20%, Colombia- 10%, and the Rest of Latin America- 5%.

The key players in the Latin America infusion pumps market include are Becton, Dickinson and Company (US), B. Braun Melsungen AG (Germany), Baxter International Inc. (US), Fresenius Kabi (Germany), Medtronic plc (Ireland), ICU Medical, Inc. (US), Terumo Corporation (Japan), Nipro Corporation (Japan), Avanos Medical, Inc. (US), JMS Co., Ltd. (Japan), Cardinal Health, Inc. (US), Roche Diagnostics (Switzerland), Abbott Laboratories (US), Danaher Corporation (US), Ypsomed Holding AG (Switzerland), and Tandem Diabetes Care, Inc. (US), Harvard Bioscience, Inc. (US), Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China), and Intuvie Holding LLC (US), among others.

Research Coverage:

The report analyzes the Latin America infusion pumps market and estimates the market size and future growth potential based on various segments such as devices & consumables, cancer type, procedure, end user, and region. The report also includes a competitive analysis of the key players in this market along with their company profiles, service offerings, recent developments, and key market strategies.

Reasons to Buy the Report

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall Latin America infusion pumps market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Analysis of key drivers (rising incidence of diabetes, growing geriatric population and subsequent rise in chronic diseases, rising number of surgical procedures, and the increasing adoption of enteral feeding pumps due to surge in pre-term births), restraints (stringent regulatory requirements for product commercialization, increasing adoption of refurbished & rented infusion pumps), opportunities (high growth potential in emerging economies and the increasing adoption of specialty infusion systems), challenges (increasing incidence of medication errors and inadequate wireless connectivity across several hospitals)

- Market Penetration: Comprehensive information on product portfolios offered by the top players in the Latin America infusion pumps market. The report analyzes this market by product, application, and end user.

- Product Enhancement/Innovation: Detailed insights on upcoming trends and product launches in the Latin America infusion pumps market

- Market Development: Comprehensive information on the lucrative emerging markets by product, application, and end user.

- Market Diversification: Exhaustive information about new products or product enhancements, growing geographies, recent developments, and investments in the Latin America infusion pumps market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, product offerings, competitive leadership mapping, and capabilities of leading players in the Latin America infusion pumps market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS & EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.2.4 CURRENCY CONSIDERED

- 1.3 MARKET STAKEHOLDERS

- 1.4 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 GROWTH FORECAST

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 KEY INDUSTRY INSIGHTS

- 2.6 LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 STUDY ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LATAM INFUSION PUMPS MARKET OVERVIEW

- 4.2 LATAM INFUSION PUMPS MARKET, BY PRODUCT & COUNTRY, 2024 (USD MILLION)

- 4.3 LATAM INFUSION PUMPS MARKET: REGIONAL MIX

- 4.4 LATAM INFUSION PUMPS MARKET: GEOGRAPHICAL GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 MARKET DYNAMICS

- 5.1.1 MARKET DRIVERS

- 5.1.1.1 Rising incidence of diabetes

- 5.1.1.2 Growing geriatric population and subsequent rise in chronic diseases

- 5.1.1.3 Rising number of surgical procedures

- 5.1.1.4 Increasing adoption of enteral feeding pumps due to surge in pre-term births

- 5.1.2 RESTRAINTS

- 5.1.2.1 Stringent regulatory requirements for product commercialization

- 5.1.2.2 Increasing adoption of refurbished & rented infusion pumps

- 5.1.3 OPPORTUNITIES

- 5.1.3.1 High growth potential in emerging economies

- 5.1.3.2 Increasing adoption of specialty infusion systems

- 5.1.4 CHALLENGES

- 5.1.4.1 Increasing incidence of medication errors and inadequate wireless connectivity across several hospitals

- 5.1.1 MARKET DRIVERS

- 5.2 TECHNOLOGY ANALYSIS

- 5.2.1 KEY TECHNOLOGIES

- 5.2.1.1 Flow generation

- 5.2.1.2 Smart infusion systems

- 5.2.1.3 Closed-loop infusion control systems

- 5.2.2 COMPLEMENTARY TECHNOLOGIES

- 5.2.2.1 Dose-error reduction systems

- 5.2.2.2 Wireless connectivity

- 5.2.2.3 AI-powered decision support systems

- 5.2.3 ADJACENT TECHNOLOGIES

- 5.2.3.1 Embedded software

- 5.2.3.2 Sensing technology

- 5.2.1 KEY TECHNOLOGIES

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF NEW ENTRANTS

- 5.3.2 THREAT OF SUBSTITUTES

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 REGULATORY ANALYSIS

- 5.4.1 REGULATORY LANDSCAPE

- 5.4.1.1 Brazil

- 5.4.1.2 Mexico

- 5.4.1.3 Argentina

- 5.4.1.4 Colombia

- 5.4.1.5 Chile

- 5.4.1.6 Ecuador

- 5.4.1.7 Peru

- 5.4.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.4.1 REGULATORY LANDSCAPE

- 5.5 PATENT ANALYSIS

- 5.5.1 PATENT PUBLICATION TRENDS FOR INFUSION PUMPS

- 5.5.2 INSIGHTS: JURISDICTION & TOP APPLICANT ANALYSIS

- 5.6 TRADE ANALYSIS

- 5.6.1 EXPORT DATA FOR HS CODE 901890

- 5.6.2 IMPORT DATA FOR HS CODE 901890

- 5.7 REIMBURSEMENT ANALYSIS

- 5.8 PRICING ANALYSIS

- 5.8.1 AVERAGE SELLING PRICE TREND FOR DEVICES, BY KEY PLAYER, 2022-2024

- 5.8.2 AVERAGE SELLING PRICE TREND OF INFUSION PUMPS, BY REGION, 2022-2024

- 5.9 KEY CONFERENCES & EVENTS, 2025-2026

- 5.10 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.10.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.10.2 BUYING CRITERIA

- 5.11 IMPACT OF AI/GENERATIVE AI ON LATAM INFUSION PUMPS MARKET

- 5.11.1 INTRODUCTION

- 5.11.2 MARKET POTENTIAL IN LATAM INFUSION PUMPS ECOSYSTEM

- 5.11.3 KEY COMPANIES IMPLEMENTING AI IN INFUSION PUMPS

- 5.11.4 FUTURE OF GENERATIVE AI IN LATAM INFUSION PUMPS ECOSYSTEM

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 VALUE CHAIN ANALYSIS

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 TRUMP TARIFF IMPACT ON LATAM INFUSION PUMPS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT ON LATAM REGION

- 5.16.5 IMPACT ON END-USE INDUSTRIES

6 LATIN AMERICA INFUSION PUMPS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 ACCESSORIES & CONSUMABLES

- 6.2.1 DEDICATED ACCESSORIES & CONSUMABLES

- 6.2.1.1 Volumetric infusion pump dedicated disposables

- 6.2.1.1.1 High adoption across hospitals & clinical settings to fuel uptake

- 6.2.1.2 Insulin infusion pump dedicated disposables

- 6.2.1.2.1 Rising number of insulin-dependent diabetic patients to support market growth

- 6.2.1.3 Enteral infusion pump dedicated disposables

- 6.2.1.3.1 Precision & consistency in results to fuel uptake

- 6.2.1.4 Syringe infusion pump dedicated disposables

- 6.2.1.4.1 High demand in developed countries to aid market

- 6.2.1.5 Ambulatory infusion pump dedicated disposables

- 6.2.1.5.1 Growth in home healthcare market to boost demand

- 6.2.1.6 PCA pump dedicated disposables

- 6.2.1.6.1 Increasing demand for critical pain management to boost market

- 6.2.1.7 Implantable infusion pump dedicated disposables

- 6.2.1.7.1 High compatibility with pumps to fuel uptake

- 6.2.1.1 Volumetric infusion pump dedicated disposables

- 6.2.2 NON-DEDICATED ACCESSORIES & CONSUMABLES

- 6.2.2.1 Infusion catheters

- 6.2.2.1.1 Potential for recurrent use to drive demand

- 6.2.2.2 IV administration sets

- 6.2.2.2.1 Rising demand for use in various systems to propel market

- 6.2.2.3 Needleless connectors

- 6.2.2.3.1 Reduction in bloodstream infection risks to boost demand

- 6.2.2.4 Cannulas

- 6.2.2.4.1 Ability to ease patient discomfort to boost demand

- 6.2.2.5 Tubing & extension sets

- 6.2.2.5.1 Need for continuous & efficient connections to fuel uptake

- 6.2.2.6 Valves

- 6.2.2.6.1 Improvement in quality of infusion to drive market

- 6.2.2.7 Other non-dedicated accessories & consumables

- 6.2.2.1 Infusion catheters

- 6.2.1 DEDICATED ACCESSORIES & CONSUMABLES

- 6.3 DEVICES

- 6.3.1 DEVICES MARKET, BY PRODUCT

- 6.3.1.1 Volumetric infusion pumps

- 6.3.1.1.1 Technological improvements to boost market

- 6.3.1.2 Insulin pumps

- 6.3.1.2.1 High demand from diabetics to propel market

- 6.3.1.3 Ambulatory infusion pumps

- 6.3.1.3.1 Rising cancer prevalence and increasing patient awareness to fuel market

- 6.3.1.4 Syringe infusion pumps

- 6.3.1.4.1 Cost-effectiveness and portability to boost demand

- 6.3.1.5 Enteral infusion pumps

- 6.3.1.5.1 Technological advancements to bolster market

- 6.3.1.6 PCA pumps

- 6.3.1.6.1 Growth in pain management to fuel uptake

- 6.3.1.7 Implantable infusion pumps

- 6.3.1.7.1 Growing use of long-term delivery of opioid medication to boost market

- 6.3.1.1 Volumetric infusion pumps

- 6.3.2 DEVICES MARKET, BY TECHNOLOGY

- 6.3.2.1 Traditional infusion pumps

- 6.3.2.1.1 Growing use in long-term care settings to drive demand

- 6.3.2.2 Specialty infusion pumps

- 6.3.2.2.1 Rising adoption in home care settings to drive market

- 6.3.2.1 Traditional infusion pumps

- 6.3.3 DEVICES MARKET, BY TYPE

- 6.3.3.1 Stationary infusion pumps

- 6.3.3.1.1 High adoption in hospitals to drive market

- 6.3.3.2 Portable infusion pumps

- 6.3.3.2.1 Technological advancements to support market growth

- 6.3.3.1 Stationary infusion pumps

- 6.3.1 DEVICES MARKET, BY PRODUCT

7 LATIN AMERICA INFUSION PUMPS MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 CHEMOTHERAPY/ONCOLOGY

- 7.2.1 GROWING INCIDENCE OF CANCER TO DRIVE MARKET

- 7.3 DIABETES MANAGEMENT

- 7.3.1 RISING DEMAND FOR EFFECTIVE DIABETES TREATMENT TO BOOST MARKET

- 7.4 GASTROENTEROLOGY

- 7.4.1 GROWING UPTAKE IN GASTROINTESTINAL DISEASE TREATMENT TO FUEL MARKET

- 7.5 ANALGESIA/PAIN MANAGEMENT

- 7.5.1 RISING NUMBER OF SURGICAL PROCEDURES TO AID MARKET

- 7.6 PEDIATRICS/NEONATOLOGY

- 7.6.1 INCREASING INCIDENCE OF PEDIATRIC DIABETES TO SUPPORT MARKET GROWTH

- 7.7 HEMATOLOGY

- 7.7.1 INCREASING PREVALENCE OF BLOOD DISORDERS TO BOOST DEMAND

- 7.8 OTHER APPLICATIONS

8 LATIN AMERICA INFUSION PUMPS MARKET, BY END USER

- 8.1 INTRODUCTION

- 8.2 HOSPITALS

- 8.2.1 RISING INCIDENCE OF CHRONIC DISEASES AND GROWING FOCUS ON INFUSION THERAPY TO DRIVE MARKET

- 8.3 HOME CARE SETTINGS

- 8.3.1 RISING TECHNOLOGICAL ADVANCEMENTS IN PORTABLE & USER-FRIENDLY DEVICES TO PROPEL MARKET

- 8.4 AMBULATORY CARE SETTINGS

- 8.4.1 RISING NUMBER OF SURGICAL PROCEDURES TO BOOST MARKET

- 8.5 ACADEMIC & RESEARCH INSTITUTES

- 8.5.1 INCREASING MEDICAL RESEARCH ACTIVITIES TO SUPPORT MARKET GROWTH

- 8.6 ONCOLOGY CENTERS

- 8.6.1 GROWING FOCUS ON THERAPEUTICS TO FUEL UPTAKE

- 8.7 OTHER END USERS

9 LATIN AMERICA INFUSION PUMPS MARKET, BY COUNTRY

- 9.1 LATIN AMERICA

- 9.1.1 LATAM INFUSION PUMP DEVICES MARKET, BY PRODUCT, 2023-2030 (THOUSAND UNITS)

- 9.1.2 MACROECONOMIC OUTLOOK FOR LATAM COUNTRIES

- 9.1.3 BRAZIL

- 9.1.3.1 Increasing number of chronic conditions to drive market

- 9.1.4 MEXICO

- 9.1.4.1 Favorable government initiatives for commercialization of medical devices to boost market

- 9.1.5 ARGENTINA

- 9.1.5.1 Rapid aging population and subsequent rise in chronic diseases to boost market

- 9.1.6 COLOMBIA

- 9.1.6.1 Integration of technological advancements in hospitals & infusion therapy settings to propel market

- 9.1.7 CHILE

- 9.1.7.1 Growing focus on local infusion-therapy product manufacturers to fuel uptake

- 9.1.8 ECUADOR

- 9.1.8.1 Digital health initiatives to support market growth

- 9.1.9 PERU

- 9.1.9.1 Increasing focus on oncology therapeutics to boost market

- 9.1.10 REST OF LATIN AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 10.3 REVENUE ANALYSIS, 2022-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Country footprint

- 10.5.5.3 Product footprint

- 10.5.5.4 Application footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.6 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.6.6.1 Competitive benchmarking of key startups/SMEs

- 10.7 R&D EXPENDITURE OF KEY PLAYERS

- 10.8 COMPANY VALUATION AND FINANCIAL METRICS

- 10.8.1 COMPANY VALUATION

- 10.8.2 FINANCIAL METRICS

- 10.9 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 10.10 COMPETITIVE SCENARIO

- 10.10.1 PRODUCT LAUNCHES & APPROVALS

- 10.10.2 DEALS

- 10.10.3 EXPANSIONS

- 10.10.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 BECTON, DICKINSON AND COMPANY (BD)

- 11.1.1.1 Business overview

- 11.1.1.2 Products offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches & approvals

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Expansions

- 11.1.1.3.4 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses & competitive threats

- 11.1.2 B. BRAUN MELSUNGEN AG

- 11.1.2.1 Business overview

- 11.1.2.2 Products offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Product launches & approvals

- 11.1.2.3.2 Deals

- 11.1.2.3.3 Other developments

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses & competitive threats

- 11.1.3 BAXTER INTERNATIONAL INC.

- 11.1.3.1 Business overview

- 11.1.3.2 Products offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product approvals

- 11.1.3.3.2 Deals

- 11.1.3.3.3 Other developments

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses & competitive threats

- 11.1.4 FRESENIUS KABI

- 11.1.4.1 Business overview

- 11.1.4.2 Products offered

- 11.1.4.3 Recent developments

- 11.1.4.3.1 Product approvals

- 11.1.4.3.2 Deals

- 11.1.4.3.3 Other developments

- 11.1.4.4 MnM view

- 11.1.4.4.1 Key strengths

- 11.1.4.4.2 Strategic choices

- 11.1.4.4.3 Weaknesses & competitive threats

- 11.1.5 MEDTRONIC

- 11.1.5.1 Business overview

- 11.1.5.2 Products offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches & approvals

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses & competitive threats

- 11.1.6 TERUMO CORPORATION

- 11.1.6.1 Business overview

- 11.1.6.2 Products offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Deals

- 11.1.6.3.3 Expansions

- 11.1.7 ICU MEDICAL, INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product approvals

- 11.1.7.3.2 Deals

- 11.1.7.3.3 Other developments

- 11.1.8 AVANOS MEDICAL, INC.

- 11.1.8.1 Business overview

- 11.1.8.2 Products offered

- 11.1.9 NIPRO CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products offered

- 11.1.9.3 Recent developments

- 11.1.9.3.1 Expansions

- 11.1.10 JMS CO., LTD.

- 11.1.10.1 Business overview

- 11.1.10.2 Products offered

- 11.1.11 CARDINAL HEALTH, INC.

- 11.1.11.1 Business overview

- 11.1.11.2 Products offered

- 11.1.12 ROCHE DIAGNOSTICS

- 11.1.12.1 Business overview

- 11.1.12.2 Products offered

- 11.1.12.3 Recent developments

- 11.1.12.3.1 Expansions

- 11.1.13 ABBOTT LABORATORIES

- 11.1.13.1 Business overview

- 11.1.13.2 Products offered

- 11.1.14 DANAHER CORPORATION

- 11.1.14.1 Business overview

- 11.1.14.2 Products offered

- 11.1.15 YPSOMED AG

- 11.1.15.1 Business overview

- 11.1.15.2 Products offered

- 11.1.1 BECTON, DICKINSON AND COMPANY (BD)

- 11.2 OTHER PLAYERS

- 11.2.1 TANDEM DIABETES CARE, INC.

- 11.2.2 HARVARD BIOSCIENCE INC.

- 11.2.3 SHENZHEN MINDRAY BIO-MEDICAL ELECTRONICS CO., LTD.

- 11.2.4 INTUVIE HOLDINGS LLC

- 11.2.5 ANGIPLAST PVT. LTD.

- 11.2.6 IRADIMED CORPORATION

- 11.2.7 NEW ERA INSTRUMENTS

- 11.2.8 EPIC MEDICAL

- 11.2.9 SHENZHEN MEDRENA BIOTECH CO., LTD.

- 11.2.10 CODAN COMPANIES

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.3.1 PRODUCT ANALYSIS

- 12.3.2 GEOGRAPHIC ANALYSIS

- 12.3.3 COMPANY INFORMATION

- 12.3.4 MARKET SHARE ANALYSIS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS