|

시장보고서

상품코드

1819093

위성 페이로드 시장 : 페이로드 유형별, 구성요소별, 조작 기술별, 주파수대별, 위성 질량별, 지구 궤도별, 최종사용자별, 지역별 - 예측(-2030년)Satellite Payload Market by Payload Type [Communication (Laser/Optical, RF), Navigation (PNT, GNSS, Tracking, Augmentation), EO (Laser/Optical Cameras, Radar, Hyper & Multispectral Imaging)], Technology, Frequency, Satellite - Global Forecast to 2030 |

||||||

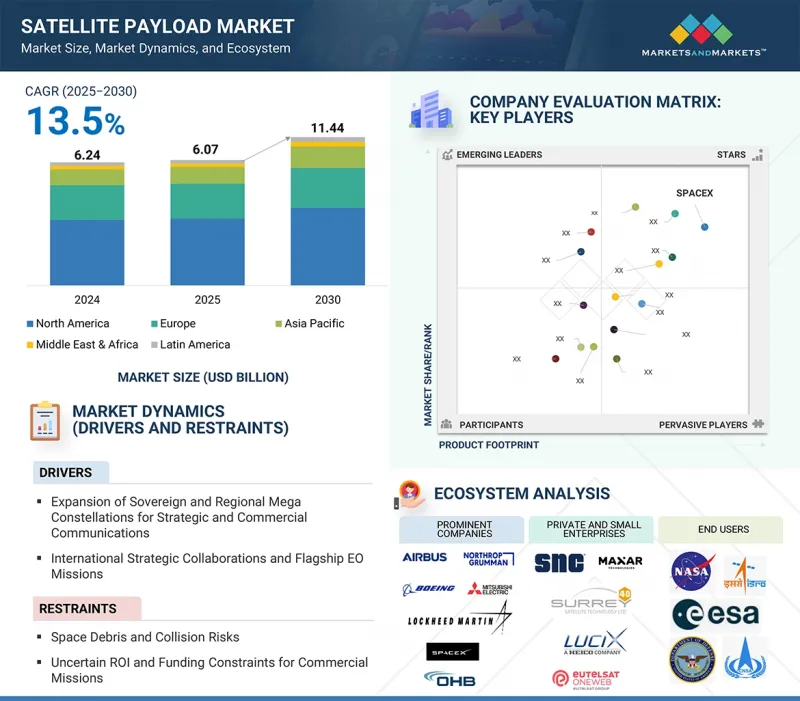

위성 페이로드 시장 규모는 2025년에 60억 7,000만 달러로 추정되며, 예측 기간 동안 CAGR 13.5%로 전망되고, 2030년에는 114억 4,000만 달러에 달할 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 페이로드 유형별, 구성요소별, 조작 기술별, 주파수대별, 위성 질량별, 지구 궤도별, 최종사용자별, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

기술 발전과 시장 환경의 변화는 위성 페이로드 시장의 주요 촉진요인입니다.

구성요소별로 보면 위성 간 링크(ISL) 부문은 예측 기간 동안 위성 페이로드 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. 위성 간 링크는 세계 실시간 데이터 전송을 가능하게 하고, 위성 별자리 통신 방식을 변경하여 지상 인프라에 대한 의존도를 줄입니다.

최종사용자별로는 정부 및 군사 부문이 예측 기간 동안 위성 페이로드 시장에서 가장 높은 CAGR을 기록할 것으로 예상됩니다. 이러한 성장의 주요 요인은 각국의 군사비 증가, 지정학적 긴장 고조, 안보상의 필요성 등이 있습니다. 지정학적 갈등의 재연과 우주 군사화의 진전은 정부 및 군의 페이로드 수요를 이끄는 주요 원동력이 되고 있습니다.

중동 및 아프리카는 국가 안보와 자원 관리의 우선순위 변화로 인해 가장 빠르게 성장하는 시장이 될 것으로 예상됩니다. 국가 안보의 회복력과 자원 관리 솔루션의 복합적인 추진력이 MEA의 폭발적인 성장의 주요 요인입니다. 사우디아라비아, 나이지리아 등 최근 진출한 국가들이 세계 우주 강국들과 협력하여 선진 시스템을 공동 개발하는 한편, 이집트, 남아프리카공화국, 아랍에미리트연합은 페이로드에 대한 투자를 늘리고 있습니다. 이 지역의 불안정성과 국경과 중요한 자원을 보호해야 하는 절박한 필요성이 이러한 급격한 성장의 원인입니다.

세계의 위성 페이로드 시장에 대해 조사했으며, 탑재체 종류별, 구성요소별, 운용 기술별, 주파수 대역별, 위성 질량별, 지구 궤도별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 무역 데이터

- 운영 데이터

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 생태계 분석

- 밸류체인 분석

- 가격 분석

- 사례 연구 분석

- 특허 분석

- 2025-2026년의 주요 회의와 이벤트

- 규제 상황

- 주요 이해관계자와 구입 기준

- 기술 분석

- 투자와 자금 조달 시나리오

- 테크놀러지 로드맵

- AI의 영향

- 총소유비용

- 거시경제 전망

- 메가트렌드의 영향

- 기술 동향

- 부품표 분석

- 비즈니스 모델

제6장 위성 페이로드 시장(페이로드 유형별)

- 소개

- 통신 페이로드

- 내비게이션 페이로드

- 지구 관측(원격탐사) 페이로드

- 기타

제7장 위성 페이로드 시장(구성요소별)

- 소개

- 안테나

- 위성간 링크

- 프로세서/마이크로컨트롤러

- 센서

- 온보드 컴퓨터

- 필드 프로그래머블 게이트 어레이

- 원자시계

- 트랜스폰더

- 증폭기

- 수신기

- 기타

제8장 위성 페이로드 시장(조작 기술별)

- 소개

- 소프트웨어 정의

- 기존

제9장 위성 페이로드 시장(주파수대별)

- 소개

- 무선 주파수

- 레이저/광학

제10장 위성 페이로드 시장(위성 질량별)

- 소개

- 큐브 새틀라이트

- 소형 위성

- 중형 위성

- 대형 위성

제11장 위성 페이로드 시장(지구 궤도별)

- 소개

- LEO

- MEO

- GEO

- BGEO

제12장 위성 페이로드 시장(최종사용자별)

- 소개

- 상업

- 정부와 군대

- 이중 사용

제13장 위성 페이로드 시장(지역별)

- 소개

- 북미

- PESTLE 분석

- 미국

- 캐나다

- 유럽

- PESTLE 분석

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타

- 아시아태평양

- PESTLE 분석

- 중국

- 인도

- 일본

- 한국

- 호주

- 기타

- 라틴아메리카

- PESTLE 분석

- 멕시코

- 브라질

- 아르헨티나

- 중동 및 아프리카

- PESTLE 분석

- GCC

- 이스라엘

- 튀르키예

제14장 경쟁 구도

- 소개

- 기업 평가와 재무 지표

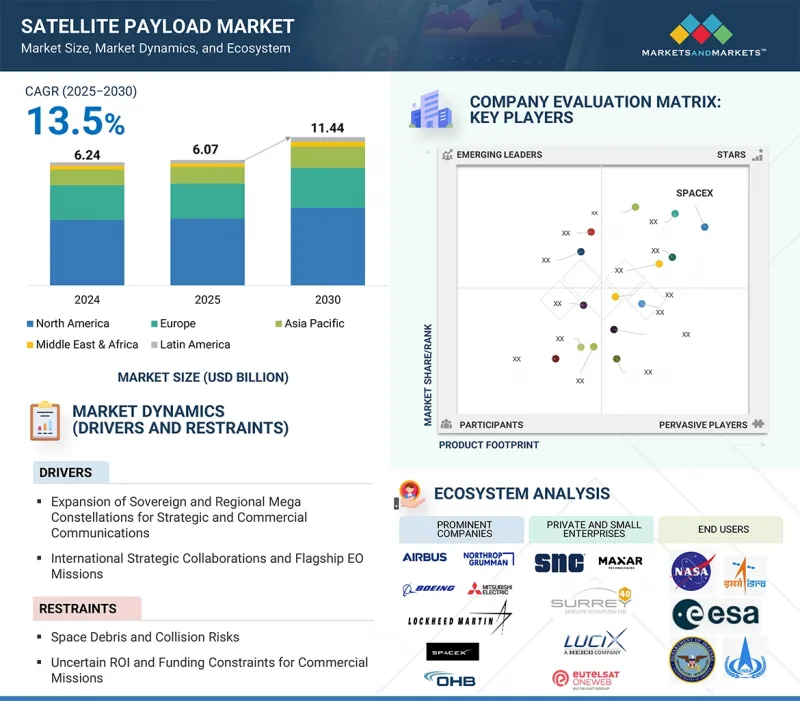

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

제15장 기업 개요

- 주요 진출 기업

- SPACEX

- AIRBUS

- LOCKHEED MARTIN CORPORATION

- L3HARRIS TECHNOLOGIES, INC.

- NORTHROP GRUMMAN

- RTX

- BOEING

- MITSUBISHI ELECTRIC CORPORATION

- HONEYWELL INTERNATIONAL INC.

- MAXAR TECHNOLOGIES

- VIASAT, INC.

- THALES ALENIA SPACE

- GENERAL DYNAMICS MISSION SYSTEMS, INC.

- GOMSPACE

- ST ENGINEERING

- AAC CLYDE SPACE

- LUCIX CORPORATION

- SURREY SATELLITE TECHNOLOGIES LTD

- MDA SPACE

- ONEWEB.NET

- KUIPER SYSTEMS LLC

- PLANET LABS PBC.

- SIERRA NEVADA COMPANY LLC

- OHB SE

- TESAT-SPACECOM GMBH & CO. KG

- MYNARIC AG

- 주요 기업(인도)

- BHARAT ELECTRONICS LIMITED

- ANANTH TECHNOLOGIES LTD.

- DATA PATTERNS(INDIA) LTD.

- TATA ADVANCED SYSTEMS LIMITED

- DHRUVA SPACE PRIVATE LIMITED

- PIXXEL

제16장 부록

KSM 25.09.29The satellite payload market is estimated at USD 6.07 billion in 2025 and is projected to reach USD 11.44 billion by 2030 at a CAGR of 13.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Payload Type, Component, Operation Technology, Frequency Band, Satellite Mass, Orbit, End User |

| Regions covered | North America, Europe, APAC, RoW |

Technological advancements and changing market conditions are the key drivers of the satellite payload market.

"The inter-satellite link segment is projected to register the highest CAGR in the satellite payload market by component."

Based on component, the inter-satellite link (ISL) segment is projected to register the highest CAGR in the satellite payload market during the forecast period. Inter-satellite links enable real-time data transfer globally and lessen dependency on ground infrastructure by altering the way satellite constellations communicate.

"The government & military end user segment is projected to register the highest CAGR during the forecast period."

Based on end user, the government & military segment is projected to register the highest CAGR in the satellite payload market during the forecast period. The growth is mainly attributed to some of the factors, such as the rising military expenditure across different nations and rising geopolitical tensions & security imperatives. Rekindled geopolitical rivalries and the increasing militarization of space are the primary drivers of government and military demand for payloads.

"The Middle East & Africa is projected to be the fastest-growing market during the forecast period."

The Middle East & Africa is projected to be the fastest-growing market due to its changing national security and resource management priorities. The combined drive for national security resilience and resource management solutions is the main factor behind MEA's explosive growth. While more recent entrants like Saudi Arabia and Nigeria are collaborating with global space powers to jointly develop advanced systems, Egypt, South Africa, and the United Arab Emirates are increasing their payload investments. Instability in the region and the pressing need to protect borders and vital resources are the causes of this surge.

The break-up of the profile of primary participants in the satellite payload market:

- By Company Type: Tier 1 - 35%, Tier 2 - 45%, and Tier 3 - 20%

- By Designation: Directors- 25%, Managers - 35%, Others - 40%

- By Region: North America - 30%, Europe - 20%, Asia Pacific - 40%, Rest of the World-20%

SpaceX (US), Airbus (Netherlands), Lockheed Martin Corporation (US), Northrop Grumman Corporation (US), and L3Harris Technologies Inc (US) are the key players with well-equipped and strong distribution networks across North America, Europe, the Asia Pacific, the Middle East & Africa, and Latin America.

Research Coverage:

The study covers the satellite payload market across various segments and subsegments. It aims to estimate the size and growth potential of this market across different segments based on payload type, component, operation technology, frequency band, satellite mass, orbit, end user, and region. This study also includes an in-depth competitive analysis of the key players in the market, along with their company profiles, key observations related to their solutions and business offerings, recent developments undertaken by them, and key market strategies adopted by them.

This report segments the satellite payload market across five key regions: North America, Europe, the Asia Pacific, the Middle East & Africa, Latin America, and their respective key countries. The report's scope includes in-depth information on significant factors, such as drivers, restraints, challenges, and opportunities that influence the growth of the satellite payload market.

A comprehensive analysis of major industry players has been conducted to provide insights into their business profiles, solutions, and services. This analysis also covers key aspects like agreements, collaborations, product launches, contracts, expansions, acquisitions, and partnerships associated with the satellite payload market.

Reasons to buy this report:

This report serves as a valuable resource for market leaders and newcomers in the satellite payload market, offering data that closely approximates revenue figures for both the overall market and its subsegments. It equips stakeholders with a comprehensive understanding of the competitive landscape, facilitating informed decisions to enhance their market positioning and formulate effective go-to-market strategies. The report imparts valuable insights into the market dynamics, offering information on crucial factors such as drivers, restraints, challenges, and opportunities, enabling stakeholders to gauge the market's pulse.

The report provides insights into the following pointers:

- Analysis of key drivers and factors, such as expansion of sovereign and regional mega constellations for strategic and commercial communications; international strategic collaborations & flagship EO missions; growing focus on disaster risk reduction; and rising demand from military electronic warfare & signal intelligence requirements

- Market Penetration: Comprehensive information on satellite payload solutions offered by the top players in the market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the satellite payload market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the satellite payload market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the satellite payload market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the satellite payload market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.3 BREAKDOWN OF PRIMARY INTERVIEWS

- 2.1.1 SECONDARY DATA

- 2.2 FACTOR ANALYSIS

- 2.2.1 INTRODUCTION

- 2.2.2 DEMAND-SIDE INDICATORS

- 2.2.3 SUPPLY-SIDE INDICATORS

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Market size estimation methodology (demand side)

- 2.3.1.2 Satellite payload market size illustration

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN SATELLITE PAYLOAD MARKET

- 4.2 SATELLITE PAYLOAD MARKET, BY ORBIT

- 4.3 SATELLITE PAYLOAD MARKET, BY END USER

- 4.4 SATELLITE PAYLOAD MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Expansion of sovereign and regional megaconstellations for strategic and commercial communications

- 5.2.1.2 International strategic collaborations and Flagship Earth Observation missions

- 5.2.1.3 Growing focus on disaster risk reduction

- 5.2.1.4 Rising demand from military electronic warfare & signal intelligence requirements

- 5.2.2 RESTRAINTS

- 5.2.2.1 Space debris and collision risks

- 5.2.2.2 Uncertain ROI and funding constraints for commercial missions

- 5.2.2.3 Risks from design errors, quality control lapses, and technical complexities

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Integration of onboard AI into satellite payloads

- 5.2.3.2 Private LEO constellations

- 5.2.4 CHALLENGES

- 5.2.4.1 Supply chain issues and manufacturing bottlenecks

- 5.2.4.2 Cyber and data security risks

- 5.2.1 DRIVERS

- 5.3 TRADE DATA

- 5.3.1 IMPORT SCENARIO (HS CODE 880260)

- 5.3.2 EXPORT SCENARIO (HS CODE 880260)

- 5.4 OPERATIONAL DATA

- 5.5 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 PROMINENT COMPANIES

- 5.6.2 PRIVATE AND SMALL ENTERPRISES

- 5.6.3 END USERS

- 5.7 VALUE CHAIN ANALYSIS

- 5.7.1 RESEARCH & DEVELOPMENT

- 5.7.2 RAW MATERIAL

- 5.7.3 COMPONENT/PRODUCT MANUFACTURING

- 5.7.4 SUBSYSTEM ASSEMBLY AND FUNCTIONAL TESTING

- 5.7.5 ASSEMBLERS & INTEGRATORS

- 5.8 PRICING ANALYSIS

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY SATELLITE MASS

- 5.8.1.1 Indicative pricing analysis, by satellite mass

- 5.8.1.2 Average selling price range for communication payloads, by vendor

- 5.8.1.3 Average selling price range for navigation payloads, by vendor

- 5.8.1.4 Average selling price range for Earth observation payloads, by vendor

- 5.8.1 INDICATIVE PRICING ANALYSIS, BY SATELLITE MASS

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 HYPERSPECTRAL CUBESAT CONSTELLATION

- 5.9.2 PHI-SAT-1 WITH ONBOARD AI CLOUD FILTERING

- 5.9.3 INTUITION-1 HYPERSPECTRAL CUBESAT WITH ONBOARD PROCESSING

- 5.10 PATENT ANALYSIS

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 TARIFF DATA

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.3 KEY REGULATIONS

- 5.12.3.1 North America

- 5.12.3.2 Europe

- 5.12.3.3 Asia Pacific

- 5.12.3.4 Middle East

- 5.12.3.5 Latin America

- 5.12.3.6 Africa

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 TECHNOLOGY ANALYSIS

- 5.14.1 KEY TECHNOLOGIES

- 5.14.1.1 Regenerative payloads

- 5.14.1.2 Software-defined payloads (SDP)

- 5.14.1.3 Active and passive RF components

- 5.14.2 COMPLEMENTARY TECHNOLOGIES

- 5.14.2.1 High-frequency band technology (Ku/Ka)

- 5.14.2.2 Quantum cryptography

- 5.14.3 ADJACENT TECHNOLOGIES

- 5.14.3.1 Satellite constellation network management systems

- 5.14.1 KEY TECHNOLOGIES

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 TECHNOLOGY ROADMAP

- 5.17 IMPACT OF AI

- 5.18 TOTAL COST OF OWNERSHIP

- 5.18.1 MISSION OPERATIONS (40% OVER 10-YEAR LIFECYCLE)

- 5.18.2 PAYLOAD DEVELOPMENT & MANUFACTURING (20%)

- 5.18.3 SPACECRAFT DEVELOPMENT & MANUFACTURING (15%)

- 5.18.4 LAUNCH & DEPLOYMENT (15%)

- 5.18.5 GROUND SYSTEMS & INFRASTRUCTURE (5%)

- 5.18.6 INSURANCE & RISK MANAGEMENT (3%)

- 5.18.7 END-OF-LIFE & DISPOSAL (2%)

- 5.18.8 CONCLUSION

- 5.19 MACROECONOMIC OUTLOOK

- 5.19.1 INTRODUCTION

- 5.19.2 NORTH AMERICA

- 5.19.3 EUROPE

- 5.19.4 ASIA PACIFIC

- 5.19.5 MIDDLE EAST

- 5.19.6 LATIN AMERICA

- 5.19.7 AFRICA

- 5.20 IMPACT OF MEGATRENDS

- 5.20.1 EDGE AI FOR ONBOARD DATA PROCESSING AND AUTONOMOUS PAYLOAD OPERATIONS

- 5.20.2 GENERATIVE AI-BASED PAYLOAD SIMULATION AND SYNTHETIC SENSOR TRAINING

- 5.20.3 ADDITIVE MANUFACTURING FOR LIGHTWEIGHT, INTEGRATED PAYLOAD STRUCTURES

- 5.20.4 QUANTUM-ENABLED PAYLOADS FOR SPACE-BASED QKD AND PRECISION TIMING

- 5.20.5 OPTICAL INTER-SATELLITE LINKS FOR REAL-TIME PAYLOAD NETWORKING

- 5.21 TECHNOLOGY TRENDS

- 5.21.1 SENSOR MINIATURIZATION

- 5.21.2 MODULAR PAYLOAD ARCHITECTURES

- 5.21.3 PHASED ARRAY ANTENNAS

- 5.21.4 SOFTWARE-DEFINED RADIOS (SDR)

- 5.21.5 CROSSLINK-ENABLED PAYLOADS

- 5.21.6 IN-ORBIT RECONFIGURABLE SENSORS

- 5.22 BILL OF MATERIALS ANALYSIS

- 5.23 BUSINESS MODELS

- 5.23.1 DIRECT SALES MODEL

- 5.23.1.1 Key features

- 5.23.1.2 Advantages

- 5.23.1.3 Challenges

- 5.23.2 SUBSCRIPTION [SATELLITE-AS-A-SERVICE (SAAS)] MODEL

- 5.23.2.1 Key features

- 5.23.2.2 Advantages

- 5.23.2.3 Challenges

- 5.23.3 HOSTED PAYLOAD MODEL

- 5.23.3.1 Key features

- 5.23.3.2 Advantages

- 5.23.3.3 Challenges

- 5.23.4 SYSTEM INTEGRATION & CUSTOMIZATION MODEL

- 5.23.4.1 Key features

- 5.23.4.2 Advantages

- 5.23.4.3 Challenges

- 5.23.5 CONCLUSION

- 5.23.1 DIRECT SALES MODEL

6 SATELLITE PAYLOAD MARKET, BY PAYLOAD TYPE

- 6.1 INTRODUCTION

- 6.2 COMMUNICATION PAYLOAD

- 6.2.1 EXPANDING FLEXIBLE COMMUNICATION ARCHITECTURES FOR MISSION-TAILORED CONNECTIVITY

- 6.2.2 LASER/OPTICAL PAYLOAD

- 6.2.3 RF PAYLOAD

- 6.3 NAVIGATION PAYLOAD

- 6.3.1 ENABLING PRECISION POSITIONING AND GLOBAL NAVIGATION CAPABILITIES

- 6.3.2 PNT PAYLOAD

- 6.3.3 GNSS PAYLOAD

- 6.3.4 TRACKING, RANGING, & MONITORING PAYLOAD

- 6.3.5 AUGMENTATION PAYLOAD

- 6.4 EARTH OBSERVATION (REMOTE SENSING) PAYLOAD

- 6.4.1 EVOLVING PAYLOAD DESIGNS FOR MULTI-DOMAIN INTELLIGENCE AND RESOURCE MONITORING

- 6.4.2 LASER/OPTICAL CAMERA SYSTEM

- 6.4.3 RADAR SYSTEM

- 6.4.4 HYPERSPECTRAL & MULTISPECTRAL IMAGING SYSTEM

- 6.4.5 IR & THERMAL SENSOR/IMAGER

- 6.5 OTHER PAYLOADS

7 SATELLITE PAYLOAD MARKET, BY COMPONENT

- 7.1 INTRODUCTION

- 7.2 ANTENNA

- 7.2.1 ALLOWING PRECISION SIGNAL TRANSMISSION AND RECEPTION FOR PAYLOAD EFFICIENCY

- 7.3 INTER-SATELLITE LINK

- 7.3.1 DRIVING AUTONOMOUS PAYLOAD NETWORKING IN NEXT-GENERATION CONSTELLATIONS

- 7.4 PROCESSOR/MICROCONTROLLER

- 7.4.1 FACILITATING EDGE INTELLIGENCE IN SATELLITE PAYLOADS

- 7.5 SENSOR

- 7.5.1 POWERING HIGH-FIDELITY DATA CAPTURE ACROSS DIVERSE PAYLOAD MISSIONS

- 7.6 ONBOARD COMPUTER

- 7.6.1 ENABLING AUTONOMOUS PAYLOAD CONTROL AND IN-ORBIT PROCESSING

- 7.7 FIELD PROGRAMMABLE GATE ARRAY

- 7.7.1 ENABLING CUSTOMIZATION AND PARALLEL PROCESSING IN PAYLOAD SYSTEMS

- 7.8 ATOMIC CLOCK

- 7.8.1 ELEVATING TIME-CRITICAL PAYLOADS FOR NAVIGATION AND SYNCHRONIZATION

- 7.9 TRANSPONDER

- 7.9.1 SUPPORTING CORE UPLINK-DOWNLINK RELAY ACROSS BROADCAST AND SECURE MISSIONS

- 7.10 AMPLIFIER

- 7.10.1 ENHANCING PAYLOAD SIGNAL STRENGTH FOR EXTENDED REACH AND HIGHER THROUGHPUT

- 7.11 RECEIVER

- 7.11.1 ALLOWING MULTI-BAND SIGNAL ACQUISITION AND ONBOARD PREPROCESSING FOR ADVANCED PAYLOADS

- 7.12 OTHER COMPONENTS

8 SATELLITE PAYLOAD MARKET, BY OPERATION TECHNOLOGY

- 8.1 INTRODUCTION

- 8.2 SOFTWARE-DEFINED

- 8.2.1 IN-ORBIT RECONFIGURABILITY AND MULTI-MISSION FLEXIBILITY PROPELLING GROWTH

- 8.3 TRADITIONAL

- 8.3.1 LONG-TERM STABILITY AND MISSION-SPECIFIC RELIABILITY FUELING ADOPTION

9 SATELLITE PAYLOAD MARKET, BY FREQUENCY BAND

- 9.1 INTRODUCTION

- 9.2 RF

- 9.2.1 ENHANCING PAYLOAD EFFICIENCY THROUGH OPTIMIZED SPECTRUM UTILIZATION

- 9.2.2 L-BAND

- 9.2.3 S-BAND

- 9.2.4 C-BAND

- 9.2.5 X-BAND

- 9.2.6 KU-BAND

- 9.2.7 K-BAND

- 9.2.8 KA-BAND

- 9.2.9 V-BAND

- 9.2.10 W-BAND

- 9.2.11 HF/UHF-BAND

- 9.3 LASER/OPTICAL

- 9.3.1 DRIVING HIGH-CAPACITY DATA LINKS THROUGH ADVANCED LIGHT-BASED COMMUNICATION

10 SATELLITE PAYLOAD MARKET, BY SATELLITE MASS

- 10.1 INTRODUCTION

- 10.2 CUBE SATELLITE

- 10.2.1 DRIVING HIGH-PERFORMANCE MINIATURIZED PAYLOAD INTEGRATION FOR SCALABLE SPACE DEPLOYMENTS

- 10.3 SMALL SATELLITE

- 10.3.1 ADVANCING SCALABLE PAYLOAD PLATFORMS FOR COST-EFFECTIVE AND HIGH-CAPACITY ORBITAL MISSIONS

- 10.3.2 NANO SATELLITE

- 10.3.3 MICRO SATELLITE

- 10.3.4 MINI SATELLITE

- 10.4 MEDIUM SATELLITE

- 10.4.1 EXPANDING HIGH-CAPACITY PAYLOAD PLATFORMS FOR MULTI-ORBIT AND LONG-DURATION MISSIONS

- 10.5 LARGE SATELLITE

- 10.5.1 MAXIMIZING PAYLOAD POWER AND COMPLEXITY FOR STRATEGIC AND SCIENTIFIC FLAGSHIP MISSIONS

11 SATELLITE PAYLOAD MARKET, BY EARTH ORBIT

- 11.1 INTRODUCTION

- 11.2 LEO

- 11.2.1 MAXIMIZING LOW-LATENCY AND HIGH-REVISIT PAYLOAD CAPABILITIES

- 11.3 MEO

- 11.3.1 STRENGTHENING PRECISION NAVIGATION AND TIMING PAYLOAD OPERATIONS

- 11.4 GEO

- 11.4.1 ENHANCING CONTINUOUS HIGH-POWER PAYLOAD COVERAGE

- 11.5 BGEO

- 11.5.1 EXPANDING AUTONOMOUS AND RESILIENT PAYLOAD OPERATIONS

12 SATELLITE PAYLOAD MARKET, BY END USER

- 12.1 INTRODUCTION

- 12.2 COMMERCIAL

- 12.2.1 EXPANDING CONNECTIVITY, DATA SERVICES, AND SPACE-ENABLED BUSINESS MODELS

- 12.2.2 SATELLITE OPERATOR/OWNER

- 12.2.3 MEDIA & ENTERTAINMENT COMPANY

- 12.2.4 ENERGY SERVICE PROVIDER

- 12.2.5 SCIENTIFIC R&D ORGANIZATION

- 12.2.6 OTHER COMMERCIAL INDUSTRIES

- 12.3 GOVERNMENT & MILITARY

- 12.3.1 STRENGTHENING SOVEREIGN CAPABILITIES AND STRATEGIC SECURITY THROUGH ADVANCED PAYLOAD DEPLOYMENTS

- 12.3.2 DEFENSE & INTELLIGENCE AGENCY

- 12.3.3 NATIONAL SPACE AGENCY

- 12.3.4 SEARCH & RESCUE ENTITY

- 12.3.5 ACADEMIC & RESEARCH INSTITUTION

- 12.3.6 NATIONAL MAPPING & TOPOGRAPHIC AGENCY

- 12.4 DUAL USE

- 12.4.1 MAXIMIZING PAYLOAD UTILITY ACROSS CIVIL AND DEFENSE DOMAINS

13 SATELLITE PAYLOAD MARKET, BY REGION

- 13.1 INTRODUCTION

- 13.2 NORTH AMERICA

- 13.2.1 PESTLE ANALYSIS

- 13.2.2 US

- 13.2.2.1 Defense modernization, commercial space expansion, and sustained federal funding to drive market

- 13.2.3 CANADA

- 13.2.3.1 Targeted SAR investment, lunar robotics, and commercial orbital safety capabilities to fuel demand

- 13.3 EUROPE

- 13.3.1 PESTLE ANALYSIS

- 13.3.2 GERMANY

- 13.3.2.1 Popularity of defense-led ISR programs, EO research investment, and support from launcher ecosystem to drive market

- 13.3.3 FRANCE

- 13.3.3.1 Encrypted defense communication, sovereign SSA deployment, and NewSpace launcher funding to drive market

- 13.3.4 UK

- 13.3.4.1 Indigenous ISR rollout, adaptive beam-hopping payloads, and launcher ecosystem development to drive market

- 13.3.5 ITALY

- 13.3.5.1 Radar imaging specialization, smallsat platform manufacturing, and national satcom autonomy efforts to drive market

- 13.3.6 REST OF EUROPE

- 13.4 ASIA PACIFIC

- 13.4.1 PESTLE ANALYSIS

- 13.4.2 CHINA

- 13.4.2.1 Focus on mass-scale constellation rollout, reusable heavy-lift launch systems, and AI-enabled payload processing to fuel market

- 13.4.3 INDIA

- 13.4.3.1 Commercial payload acceleration, multi-mission EO platform development, and sovereign orbital servicing validation to drive market

- 13.4.4 JAPAN

- 13.4.4.1 Focus on defense-grade ISR enhancements, optical imaging constellation growth, and interplanetary science payload integration to fuel demand

- 13.4.5 SOUTH KOREA

- 13.4.5.1 Sovereign ISR buildup, dual-use optical payloads, and private launch integration to drive market

- 13.4.6 AUSTRALIA

- 13.4.6.1 Defense-driven payload demand, sovereign EO expansion, and dual-use launch initiatives to fuel demand

- 13.4.7 REST OF ASIA PACIFIC

- 13.5 LATIN AMERICA

- 13.5.1 PESTLE ANALYSIS

- 13.5.2 MEXICO

- 13.5.2.1 Renewed EO satellite planning and regional collaboration frameworks to fuel market

- 13.5.3 BRAZIL

- 13.5.3.1 Domestic manufacturing momentum and bilateral payload collaboration to drive market

- 13.5.4 ARGENTINA

- 13.5.4.1 Progress in Earth observation asset deployment to drive market

- 13.6 MIDDLE EAST & AFRICA

- 13.6.1 PESTLE ANALYSIS

- 13.6.2 GCC

- 13.6.2.1 Saudi Arabia

- 13.6.2.1.1 State-backed EO expansion and strategic technology transfer agreements to drive market

- 13.6.2.2 UAE

- 13.6.2.2.1 Dual-track investment in EO and interplanetary payload programs to drive market

- 13.6.2.1 Saudi Arabia

- 13.6.3 ISRAEL

- 13.6.3.1 Use of defense-grade imaging payloads and autonomous SmallSat platforms to drive demand

- 13.6.4 TURKEY

- 13.6.4.1 Indigenous satellite payload achievement with Turksat-6A to drive market

14 COMPETITIVE LANDSCAPE

- 14.1 INTRODUCTION

- 14.1.1 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2024

- 14.1.2 REVENUE ANALYSIS, 2021-2024

- 14.1.3 MARKET SHARE ANALYSIS, 2024

- 14.1.4 BRAND/PRODUCT COMPARISON

- 14.2 COMPANY VALUATION AND FINANCIAL METRICS

- 14.3 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 14.3.1 STARS

- 14.3.2 EMERGING LEADERS

- 14.3.3 PERVASIVE PLAYERS

- 14.3.4 PARTICIPANTS

- 14.3.5 COMPANY FOOTPRINT

- 14.3.5.1 Company footprint

- 14.3.5.2 Region footprint

- 14.3.5.3 Payload Type footprint

- 14.3.5.4 End user footprint

- 14.3.5.5 Orbit footprint

- 14.3.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 14.3.7 PROGRESSIVE COMPANIES

- 14.3.8 RESPONSIVE COMPANIES

- 14.3.9 DYNAMIC COMPANIES

- 14.3.10 STARTING BLOCKS

- 14.3.11 COMPETITIVE BENCHMARKING

- 14.3.11.1 List of startups/SMES

- 14.3.11.2 Competitive benchmarking of startups/SMES

- 14.3.12 COMPETITIVE SCENARIO

- 14.3.12.1 Product launches/developments

- 14.3.12.2 Deals

- 14.3.12.3 Others

15 COMPANY PROFILES

- 15.1 KEY PLAYERS

- 15.1.1 SPACEX

- 15.1.1.1 Business overview

- 15.1.1.2 Products offered

- 15.1.1.3 Recent developments

- 15.1.1.3.1 Product launches

- 15.1.1.3.2 Deals

- 15.1.1.3.3 Others

- 15.1.1.4 MnM view

- 15.1.1.4.1 Right to win

- 15.1.1.4.2 Strategic choices

- 15.1.1.4.3 Weaknesses and competitive threats

- 15.1.2 AIRBUS

- 15.1.2.1 Business overview

- 15.1.2.2 Products offered

- 15.1.2.3 Recent developments

- 15.1.2.3.1 Product launches/developments

- 15.1.2.3.2 Deals

- 15.1.2.3.3 Others

- 15.1.2.4 MnM view

- 15.1.2.4.1 Right to win

- 15.1.2.4.2 Strategic choices

- 15.1.2.4.3 Weaknesses and competitive threats

- 15.1.3 LOCKHEED MARTIN CORPORATION

- 15.1.3.1 Business overview

- 15.1.3.2 Products offered

- 15.1.3.3 Recent developments

- 15.1.3.3.1 Product launches

- 15.1.3.3.2 Deals

- 15.1.3.3.3 Others

- 15.1.3.4 MnM view

- 15.1.3.4.1 Right to win

- 15.1.3.4.2 Strategic choices

- 15.1.3.4.3 Weaknesses and competitive threats

- 15.1.4 L3HARRIS TECHNOLOGIES, INC.

- 15.1.4.1 Business overview

- 15.1.4.2 Products offered

- 15.1.4.3 Recent developments

- 15.1.4.3.1 Product launches/developments

- 15.1.4.3.2 Deals

- 15.1.4.3.3 Others

- 15.1.4.4 MnM view

- 15.1.4.4.1 Right to win

- 15.1.4.4.2 Strategic choices

- 15.1.4.4.3 Weaknesses and competitive threats

- 15.1.5 NORTHROP GRUMMAN

- 15.1.5.1 Business overview

- 15.1.5.2 Products offered

- 15.1.5.3 Recent developments

- 15.1.5.3.1 Product developments

- 15.1.5.3.2 Deals

- 15.1.5.3.3 Others

- 15.1.5.4 MnM view

- 15.1.5.4.1 Right to win

- 15.1.5.4.2 Strategic choices

- 15.1.5.4.3 Weaknesses and competitive threats

- 15.1.6 RTX

- 15.1.6.1 Business overview

- 15.1.6.2 Products offered

- 15.1.6.3 Recent developments

- 15.1.6.3.1 Product launches

- 15.1.6.3.2 Deals

- 15.1.6.3.3 Others

- 15.1.7 BOEING

- 15.1.7.1 Business overview

- 15.1.7.2 Products offered

- 15.1.7.3 Recent developments

- 15.1.7.3.1 Product launches

- 15.1.7.3.2 Deals

- 15.1.7.3.3 Others

- 15.1.8 MITSUBISHI ELECTRIC CORPORATION

- 15.1.8.1 Business overview

- 15.1.8.2 Products offered

- 15.1.8.3 Recent developments

- 15.1.8.3.1 Product launches

- 15.1.8.3.2 Deals

- 15.1.8.3.3 Others

- 15.1.9 HONEYWELL INTERNATIONAL INC.

- 15.1.9.1 Business overview

- 15.1.9.2 Products offered

- 15.1.9.3 Recent developments

- 15.1.9.3.1 Deals

- 15.1.9.3.2 Others

- 15.1.10 MAXAR TECHNOLOGIES

- 15.1.10.1 Business overview

- 15.1.10.2 Products offered

- 15.1.10.3 Recent developments

- 15.1.10.3.1 Product launches

- 15.1.10.3.2 Deals

- 15.1.10.3.3 Others

- 15.1.11 VIASAT, INC.

- 15.1.11.1 Business overview

- 15.1.11.2 Products offered

- 15.1.11.3 Recent developments

- 15.1.11.3.1 Product launches

- 15.1.11.3.2 Deals

- 15.1.11.3.3 Others

- 15.1.12 THALES ALENIA SPACE

- 15.1.12.1 Business overview

- 15.1.12.2 Products offered

- 15.1.12.3 Recent developments

- 15.1.12.3.1 Product launches

- 15.1.12.3.2 Deals

- 15.1.12.3.3 Others

- 15.1.13 GENERAL DYNAMICS MISSION SYSTEMS, INC.

- 15.1.13.1 Business overview

- 15.1.13.2 Products offered

- 15.1.13.3 Recent developments

- 15.1.13.3.1 Product launches

- 15.1.13.3.2 Deals

- 15.1.13.3.3 Others

- 15.1.14 GOMSPACE

- 15.1.14.1 Business overview

- 15.1.14.2 Products offered

- 15.1.14.3 Recent developments

- 15.1.14.3.1 Product launches

- 15.1.14.3.2 Deals

- 15.1.14.3.3 Others

- 15.1.15 ST ENGINEERING

- 15.1.15.1 Business overview

- 15.1.15.2 Products offered

- 15.1.15.3 Recent developments

- 15.1.15.3.1 Product launches

- 15.1.15.3.2 Deals

- 15.1.15.3.3 Others

- 15.1.16 AAC CLYDE SPACE

- 15.1.16.1 Business overview

- 15.1.16.2 Products offered

- 15.1.16.3 Recent developments

- 15.1.16.3.1 Product launches

- 15.1.16.3.2 Deals

- 15.1.16.3.3 Others

- 15.1.17 LUCIX CORPORATION

- 15.1.17.1 Business overview

- 15.1.17.2 Products offered

- 15.1.17.3 Recent developments

- 15.1.17.3.1 Deals

- 15.1.17.3.2 Others

- 15.1.18 SURREY SATELLITE TECHNOLOGIES LTD

- 15.1.18.1 Business overview

- 15.1.18.2 Products offered

- 15.1.18.3 Recent developments

- 15.1.18.3.1 Product launches/developments

- 15.1.18.3.2 Deals

- 15.1.18.3.3 Others

- 15.1.19 MDA SPACE

- 15.1.19.1 Business overview

- 15.1.19.2 Products offered

- 15.1.19.3 Recent developments

- 15.1.19.3.1 Product launches

- 15.1.19.3.2 Deals

- 15.1.19.3.3 Others

- 15.1.20 ONEWEB.NET

- 15.1.20.1 Business overview

- 15.1.20.2 Products offered

- 15.1.20.3 Recent developments

- 15.1.20.3.1 Product launches

- 15.1.20.3.2 Deals

- 15.1.20.3.3 Others

- 15.1.21 KUIPER SYSTEMS LLC

- 15.1.21.1 Business overview

- 15.1.21.2 Products offered

- 15.1.21.3 Recent developments

- 15.1.21.3.1 Product launches

- 15.1.21.3.2 Deals

- 15.1.21.3.3 Others

- 15.1.22 PLANET LABS PBC.

- 15.1.22.1 Business overview

- 15.1.22.2 Products offered

- 15.1.22.3 Recent developments

- 15.1.22.3.1 Product launches

- 15.1.22.3.2 Deals

- 15.1.22.3.3 Others

- 15.1.23 SIERRA NEVADA COMPANY LLC

- 15.1.23.1 Business overview

- 15.1.23.2 Products offered

- 15.1.23.3 Recent developments

- 15.1.23.3.1 Deals

- 15.1.23.3.2 Others

- 15.1.24 OHB SE

- 15.1.24.1 Business overview

- 15.1.24.2 Products offered

- 15.1.24.3 Recent developments

- 15.1.24.3.1 Product launches

- 15.1.24.3.2 Deals

- 15.1.24.3.3 Others

- 15.1.25 TESAT-SPACECOM GMBH & CO. KG

- 15.1.25.1 Business overview

- 15.1.25.2 Products offered

- 15.1.25.3 Recent developments

- 15.1.25.3.1 Product launches

- 15.1.25.3.2 Deals

- 15.1.25.3.3 Others

- 15.1.26 MYNARIC AG

- 15.1.26.1 Business overview

- 15.1.26.2 Products offered

- 15.1.26.3 Recent developments

- 15.1.26.3.1 Deals

- 15.1.26.3.2 Others

- 15.1.1 SPACEX

- 15.2 KEY PLAYERS (INDIA)

- 15.2.1 BHARAT ELECTRONICS LIMITED

- 15.2.1.1 Business overview

- 15.2.1.2 Products offered

- 15.2.1.3 Recent developments

- 15.2.1.3.1 Product launches

- 15.2.1.3.2 Deals

- 15.2.2 ANANTH TECHNOLOGIES LTD.

- 15.2.2.1 Business overview

- 15.2.2.2 Products offered

- 15.2.2.3 Recent developments

- 15.2.2.3.1 Deals

- 15.2.3 DATA PATTERNS (INDIA) LTD.

- 15.2.3.1 Business overview

- 15.2.3.2 Products offered

- 15.2.3.3 Recent developments

- 15.2.3.3.1 Deals

- 15.2.3.3.2 Others

- 15.2.4 TATA ADVANCED SYSTEMS LIMITED

- 15.2.4.1 Business overview

- 15.2.4.2 Products offered

- 15.2.4.3 Recent developments

- 15.2.4.3.1 Product launches

- 15.2.4.3.2 Deals

- 15.2.4.3.3 Others

- 15.2.5 DHRUVA SPACE PRIVATE LIMITED

- 15.2.5.1 Business overview

- 15.2.5.2 Products offered

- 15.2.5.2.1 Deals

- 15.2.5.2.2 Others

- 15.2.6 PIXXEL

- 15.2.6.1 Business overview

- 15.2.6.2 Products offered

- 15.2.6.3 Recent developments

- 15.2.6.3.1 Product launches

- 15.2.6.3.2 Deals

- 15.2.6.3.3 Others

- 15.2.1 BHARAT ELECTRONICS LIMITED

16 APPENDIX

- 16.1 DISCUSSION GUIDE

- 16.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 16.3 CUSTOMIZATION OPTIONS

- 16.4 RELATED REPORTS

- 16.5 AUTHOR DETAILS