|

시장보고서

상품코드

1819094

재료 시험 시장 예측(-2030년) : 유형(만능 시험기, 유압 서보 시험기, 경도 시험기), 재료(금속, 플라스틱, 고무 및 엘라스토머), 최종사용자(자동차, 건설), 지역별Material Testing Market by Type (Universal Testing Machine, Servohydraulic Testing Machine, Hardness Testing Equipment), Material (Metal, Plastic, Rubber & Elastomer), End User (Automotive, Construction), & Region - Global Forecast to 2030 |

||||||

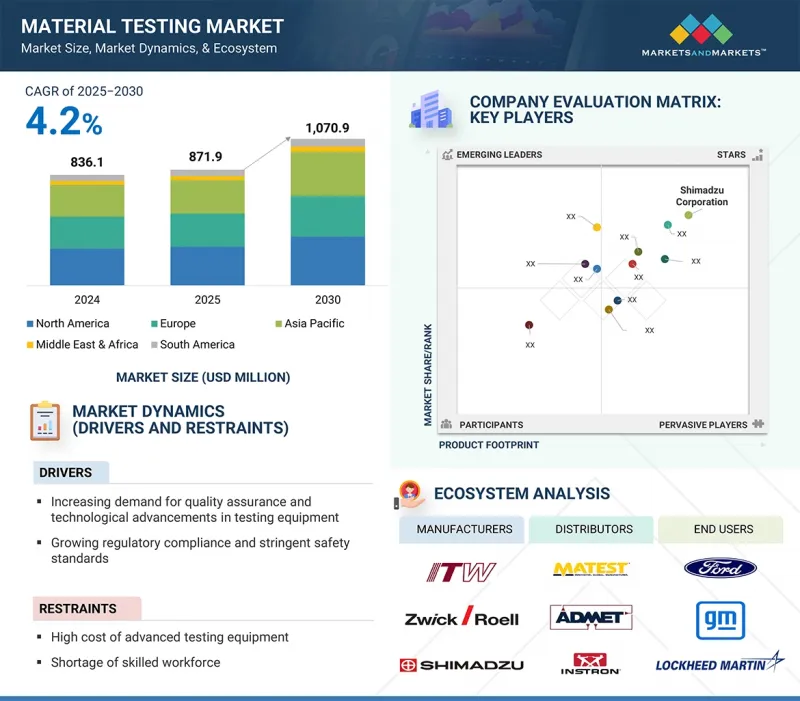

재료 시험 시장 규모는 2025년 8억 7,190만 달러에서 CAGR 4.2%로 추이하며, 2030년에는 10억 7,090만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2022-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 유형, 소재, 최종사용자 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 중동 및 아프리카, 남미 |

재료 시험 시장은 자동차, 항공우주, 건설 등의 산업에서 품질 보증에 대한 수요가 증가함에 따라 성장하고 있습니다. 이러한 수요는 안전 및 성능에 대한 규제 강화, AI, 자동화, 디지털화 등 기술 발전으로 지원되고 있습니다. 이러한 기술은 정확성, 효율성, 처리 시간을 향상시킵니다. 그 결과, 제조업체는 제품의 신뢰성을 높이고, 결함을 줄이며, 시장 출시 시간을 단축할 수 있으며, 재료 시험 분야의 지속적인 성장에 기여하고 있습니다.

"최종사용자별로는 교육기관이 예측 기간 중 가장 큰 점유율을 차지할 것으로 예측됩니다."

이는 주로 정부 및 기업의 연구개발 활동이 활발해졌기 때문입니다. 학교는 차세대 엔지니어와 과학자를 교육하기 전에 신소재를 실험하고 충분히 이해하기 위해 혁신적인 테스트 장비를 도입해야 합니다. 특히 고급 시험 솔루션에 대한 지속적인 혁신과 교재 업데이트는 전체 시장의 가치에 큰 영향을 미치고 있습니다.

"유형별로는 경도 시험기가 예측 기간 중 두 번째로 빠르게 성장하는 유형으로"

경도 시험기는 금속, 플라스틱, 고무 제조에서 정확한 품질 평가에 대한 수요가 증가함에 따라 재료 시험 장비 시장에서 두 번째로 빠르게 성장하는 유형입니다. 특히 대량 생산을 수반하는 산업 제조 공정에서는 그 중요성이 더욱 커지고 있습니다. 자동화 및 AI를 탑재한 시험기는 시험의 정확도와 처리 능력을 향상시켜 자동차 및 항공우주와 같이 일관된 성능이 요구되는 산업에 필수적인 요소로 자리 잡고 있습니다. 동시에 경량화 및 첨단 소재에 대한 관심이 높아지면서 특수 경도 시험에 대한 수요도 물류 측면의 요구사항으로 인해 지속적으로 증가하고 있습니다. 또한 국제 품질 기준과 규제가 제조업체와 산업 생산자에게 미치는 영향도 경도 시험기 분야의 성장을 가속하고 있습니다.

"지역별로는 아시아태평양이 가장 큰 점유율을 차지하며 가장 빠르게 성장하고 있는 지역으로 꼽혔습니다."

이러한 성장은 중국, 인도, 일본과 같은 국가들의 급속한 산업화, 인프라 확장, 제조거점 확대에 의해 촉진되고 있습니다. 또한 정부의 투자 증가, 첨단 시험 기술 도입 확대, 품질 기준 상향 조정 등의 요인도 시장 성장에 기여하고 있습니다. 신흥 경제국의 거대한 소비자 기반은 이 지역의 재료 시험 서비스에 대한 수요를 더욱 증가시키고 있습니다.

세계의 재료 시험 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

제6장 업계 동향

- 밸류체인 분석

- 에코시스템 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 무역 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 테크놀러지 분석

- 거시경제 지표

- 가격 분석

- 규제 상황

- AI/생성형 AI의 영향

- 주요 컨퍼런스와 이벤트

- 사례 연구 분석

- 투자와 자금조달 시나리오

- 특허 분석

- 2025년 미국 관세의 영향 - 개요

제7장 재료 시험 시장 : 유형별

- 만능 시험기

- 서보 유압 시험기

- 경도 시험 장비

- 충격시험 장비

- 기타

제8장 재료 시험 시장 : 재료별

- 금속

- 플라스틱

- 고무와 엘라스토머

- 세라믹 & 복합재

- 기타

제9장 재료 시험 시장 : 최종사용자별

- 자동차

- 건설

- 교육 기관

- 항공우주·방위

- 의료기기

- 전력

- 기타

제10장 재료 시험 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 아시아태평양

- 중국

- 일본

- 인도

- 한국

- 인도네시아

- 태국

- 베트남

- 필리핀

- 기타

- 유럽

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 튀르키예

- 기타

- 남미

- 브라질

- 아르헨티나

- 기타

제11장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- ILLINOIS TOOL WORKS INC.

- ZWICKROELL

- AMETEK

- SHIMADZU CORPORATION

- MITUTOYO CORPORATION

- TINIUS OLSEN

- QATM

- ERICHSEN GMBH & CO. KG

- HEGEWALD & PESCHKE

- NOVA MEASUREMENTS LLC

- 기타 기업

- ADMET, INC.

- HUMBOLDT MFG. CO.

- STRUERS

- FOUNDRAX ENGINEERING PRODUCTS LTD.

- TORONTECH INC.

- HUNG TA INSTRUMENT CO., LTD.

- SHANGHAI JIUBIN INSTRUMENT CO., LTD.

- DEVCO S.R.L

- TA INSTRUMENTS

- QUALITEST

- APPLIED TEST SYSTEMS

- JINAN LIANGONG TESTING TECHNOLOGY CO., LTD.

- MATEST

- ELE INTERNATIONAL

- INTERNATIONAL EQUIPMENTS

제13장 부록

KSA 25.10.01The material testing market is projected to reach USD 1,070.9 million by 2030 from USD 871.9 million in 2025, at a CAGR of 4.2%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2022-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | Type, Material, and End-User |

| Regions covered | Asia Pacific, North America, Europe, the Middle East & Africa, and South America |

The material testing market is growing due to an increasing demand for quality assurance in industries such as automotive, aerospace, and construction. This demand is driven by stricter safety and performance regulations, as well as technological advancements in areas like AI, automation, and digitalization. These technologies enhance accuracy, efficiency, and turnaround times. As a result, manufacturers can improve product reliability, reduce defects, and accelerate time-to-market, contributing to sustained growth in the material testing sector.

"Based on end-user, educational institutions account for the largest share in the material testing market during the forecast period."

Educational institutions are expected to hold the largest share of the material testing market during the forecast period. This is largely due to significant government and business-based research and development efforts. Schools need to acquire innovative testing equipment to experiment with and fully understand new materials before they teach the next generation of engineers and scientists. The continuous evolution of innovations and updates to course materials, particularly in advanced testing solutions, greatly influences the overall value of the market.

"Hardness testing equipment is the second-fastest-growing type in the material testing market during the forecast period."

Hardness testing equipment is the second-fastest-growing type in the material testing equipment market because of the growing demand for accurate quality assessment in metals, plastics, and rubber manufacturing, especially given the high-volume industrial manufacturing process. The automated and AI-enhanced testers have improved testing precision and a more significant throughput, allowing this type of testing equipment to be critical in industries that require consistent performance materials, such as automotive and aerospace. At the same time, as the materials testing equipment industry has continued to place more emphasis on lightweight and advanced materials, specialist hardness testing has continued to grow due to logistical requirements. In addition, the influence of global quality standards and regulations on the manufacturers and industrial producers continues to fuel growth in the hardness testing equipment sector.

"Based on region, Asia Pacific accounts for the largest share and is the fastest-growing region in the material testing market, in terms of value."

The Asia Pacific region accounts for the largest share of the material testing market and is also the fastest-growing market. This growth is driven by rapid industrialization, infrastructure expansion, and a growing manufacturing base in countries such as China, India, and Japan. Additional factors contributing to market growth include increased government investments, a rising adoption of advanced testing technologies, and higher quality standards. The demand for material testing services in this region is further heightened by a large consumer base supported by developing economies.

In the process of determining and verifying the market size for several segments and subsegments identified through secondary research, extensive primary interviews were conducted. A breakdown of the profiles of the primary interviewees is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 30%, and Tier 3 - 30%

- By Designation: Directors - 35%, Managers - 25%, and Others - 40%

- By Region: North America - 22%, Europe - 22%, Asia Pacific - 45%, and RoW - 11%

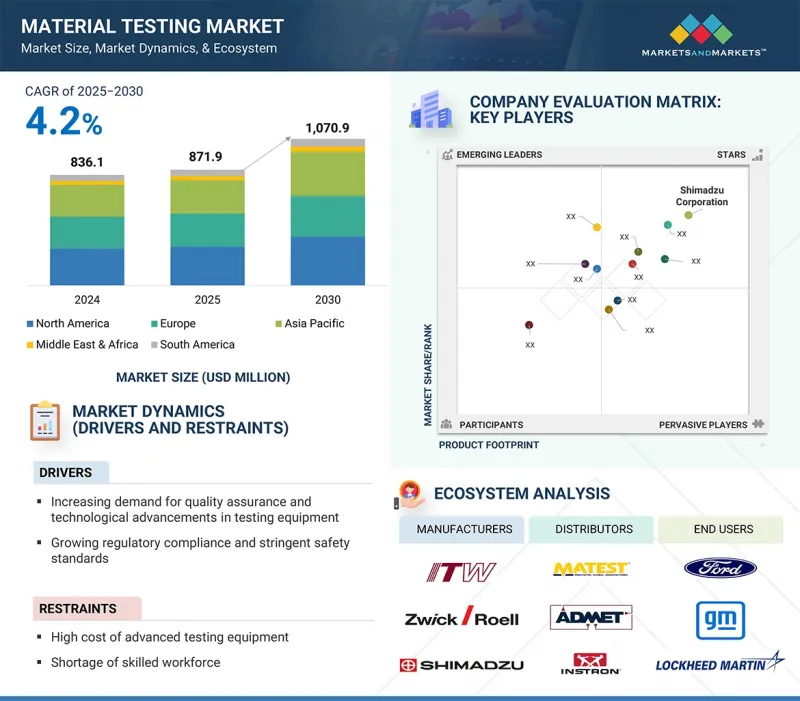

The key players in this market are Illinois Tool Works Inc. (US), ZwickRoell (Germany), Shimadzu Corporation (Japan), Tinius Olsen (US), Ametek (US), Mitutoyo Corporation (Japan), QATM (Germany), ERICHSEN GmbH & Co. KG (Germany), Hegewald & Peschke (Germany), and Nova Measurements LLC (US).

Research Coverage

This report segments the material testing market based on type, material, end user, and region, and provides estimations for the overall market value across various regions. It has also conducted a detailed analysis of key industry players to provide insights into their business overviews, products and services, key strategies, new product launches, expansions, and mergers and acquisitions associated with the material testing market.

Key Benefits of Buying This Report

This research report focuses on various levels of analysis, including industry analysis (industry trends), market ranking analysis of top players, and company profiles. Together, these provide an overall view of the competitive landscape, emerging and high-growth segments of the material testing market, high-growth regions, and market drivers, restraints, opportunities, and challenges.

The report provides insights on the following pointers:

- Analysis of key drivers (increasing demand for quality assurance and regulatory compliance across industries and rapid technological advancements in testing equipment), restraints (high cost of advanced material testing equipment and associated maintenance and a shortage of skilled professionals capable of operating sophisticated testing systems), opportunities (expanding use of advanced materials such as nanomaterials, biomaterials, and composites that require specialized testing solutions), and challenges (high capital investment and operational costs associated with advanced testing equipment).

- Market Penetration: Comprehensive information on the material testing market offered by top players in the global material testing market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the material testing market.

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the material testing market across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global material testing market.

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the material testing market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS OF STUDY

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants - demand and supply sides

- 2.1.2.3 Key industry insights

- 2.1.2.4 Breakdown of interviews with experts

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.3 FORECAST NUMBER CALCULATION

- 2.4 DATA TRIANGULATION

- 2.5 FACTOR ANALYSIS

- 2.6 ASSUMPTIONS

- 2.7 LIMITATIONS & RISKS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN MATERIAL TESTING MARKET

- 4.2 MATERIAL TESTING MARKET, BY TYPE

- 4.3 MATERIAL TESTING MARKET, BY MATERIAL

- 4.4 MATERIAL TESTING MARKET, BY END USER

- 4.5 MATERIAL TESTING MARKET, BY KEY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Growth in infrastructure and construction

- 5.2.1.2 Technological advancements in testing equipment

- 5.2.1.3 Stringent regulatory standards and quality assurance

- 5.2.2 RESTRAINTS

- 5.2.2.1 High initial costs and maintenance

- 5.2.2.2 Complexity of testing advanced materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Adoption of Industry 4.0 technologies

- 5.2.3.2 Rise of additive manufacturing

- 5.2.4 CHALLENGES

- 5.2.4.1 High costs of advanced equipment

- 5.2.4.2 Economic and supply chain disruptions

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 VALUE CHAIN ANALYSIS

- 6.1.1 RAW MATERIAL SUPPLIERS

- 6.1.2 MANUFACTURERS

- 6.1.3 DISTRIBUTORS

- 6.1.4 END USERS

- 6.2 ECOSYSTEM ANALYSIS

- 6.3 PORTER'S FIVE FORCES ANALYSIS

- 6.3.1 THREAT OF NEW ENTRANTS

- 6.3.2 THREAT OF SUBSTITUTES

- 6.3.3 BARGAINING POWER OF SUPPLIERS

- 6.3.4 BARGAINING POWER OF BUYERS

- 6.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 6.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.4.2 QUALITY

- 6.4.3 SERVICE

- 6.4.4 BUYING CRITERIA

- 6.5 TRADE ANALYSIS

- 6.5.1 EXPORT SCENARIO (HS CODE 9024)

- 6.5.2 IMPORT SCENARIO (HS CODE 9024)

- 6.6 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.7 TECHNOLOGY ANALYSIS

- 6.7.1 KEY TECHNOLOGIES

- 6.7.1.1 Proportional-integral-derivative controllers

- 6.7.1.2 Hydraulic actuators

- 6.7.2 COMPLEMENTARY TECHNOLOGIES

- 6.7.2.1 Finite element analysis software

- 6.7.2.2 Digital image correlation

- 6.7.1 KEY TECHNOLOGIES

- 6.8 MACROECONOMIC INDICATORS

- 6.8.1 GDP TRENDS AND FORECASTS

- 6.9 PRICING ANALYSIS

- 6.9.1 AVERAGE SELLING PRICE, BY REGION

- 6.9.2 AVERAGE SELLING PRICE OF END USERS, BY KEY PLAYER

- 6.10 REGULATORY LANDSCAPE

- 6.10.1 NORTH AMERICA

- 6.10.2 ASIA PACIFIC

- 6.10.3 EUROPE

- 6.10.4 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.11 IMPACT OF AI/GEN AI

- 6.12 KEY CONFERENCES AND EVENTS

- 6.13 CASE STUDY ANALYSIS

- 6.13.1 GRINM GROUP DOUBLES HIGH-TEMPERATURE TENSILE TESTING EFFICIENCY USING ZWICKROELL'S EXTENSOMETRY SOLUTION

- 6.13.2 SPC WERKSTOFFLABOR ENHANCES EFFICIENCY AND RELIABILITY IN METALS TESTING WITH ZWICKROELL'S AUTOMATED HARDNESS TESTING SOLUTIONS

- 6.13.3 LEIBNIZ UNIVERSITY HANOVER ADVANCES PLANT-SOIL INTERACTION RESEARCH USING ZWICKROELL'S ALLROUNDLINE TESTING SYSTEM TO SIMULATE ROOT GROWTH

- 6.14 INVESTMENT AND FUNDING SCENARIO

- 6.15 PATENT ANALYSIS

- 6.15.1 INTRODUCTION

- 6.15.2 LEGAL STATUS OF PATENTS

- 6.15.3 JURISDICTION ANALYSIS

- 6.16 IMPACT OF 2025 US TARIFF - OVERVIEW

- 6.16.1 INTRODUCTION

- 6.16.2 KEY TARIFF RATES

- 6.16.3 PRICE IMPACT ANALYSIS

- 6.16.4 IMPACT ON COUNTRY/REGION

- 6.16.4.1 US

- 6.16.4.2 Europe

- 6.16.4.3 Asia Pacific

- 6.16.5 IMPACT ON END-USE INDUSTRIES

7 MATERIAL TESTING MARKET, BY TYPE

- 7.1 INTRODUCTION

- 7.2 UNIVERSAL TESTING MACHINES

- 7.2.1 COST-EFFECTIVENESS AND ABILITY TO PERFORM MULTIPLE TESTS ON SINGLE PLATFORM TO DRIVE ADOPTION

- 7.3 SERVOHYDRAULIC TESTING MACHINES

- 7.3.1 ABILITY TO HANDLE LARGE LOAD CAPACITIES TO SUPPORT ADOPTION

- 7.4 HARDNESS TESTING EQUIPMENT

- 7.4.1 VITAL ROLE IN QUALITY CONTROL AND MATERIAL CHARACTERIZATION TO DRIVE MARKET

- 7.5 IMPACT TESTING EQUIPMENT

- 7.5.1 RISING DEMAND TO EVALUATE TOUGHNESS, FRACTURE RESISTANCE, AND IMPACT STRENGTH IN END-USE INDUSTRIES TO FUEL MARKET GROWTH

- 7.6 OTHER TYPES

8 MATERIAL TESTING MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 METAL

- 8.2.1 WIDESPREAD USE ACROSS INDUSTRIES TO DRIVE ADOPTION

- 8.3 PLASTIC

- 8.3.1 INCREASING DEMAND FOR LIGHTWEIGHT, COST-EFFECTIVE, AND VERSATILE MATERIALS TO DRIVE MARKET

- 8.4 RUBBER & ELASTOMER

- 8.4.1 GROWING DEMAND FOR HIGH-PERFORMANCE ELASTOMERS IN ELECTRIC VEHICLES AND AEROSPACE COMPONENTS TO PROPEL MARKET

- 8.5 CERAMIC & COMPOSITE

- 8.5.1 UNIQUE COMBINATION OF STRENGTH, DURABILITY, AND LIGHTWEIGHT PROPERTIES TO PROPEL ADOPTION

- 8.6 OTHER MATERIALS

9 MATERIAL TESTING MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 AUTOMOTIVE INDUSTRY

- 9.2.1 COMPLIANCE WITH STRINGENT EMISSION STANDARDS TO DRIVE MARKET

- 9.3 CONSTRUCTION INDUSTRY

- 9.3.1 INCREASING NUMBER OF LARGE-SCALE INFRASTRUCTURE PROJECTS TO PROPEL MARKET

- 9.4 EDUCATIONAL INSTITUTIONS

- 9.4.1 VITAL ROLE IN ADVANCING RESEARCH AND LEARNING TO SUPPORT MARKET GROWTH

- 9.5 AEROSPACE & DEFENSE INDUSTRY

- 9.5.1 GROWING FOCUS ON LIGHTWEIGHT MATERIALS TO ENHANCE FUEL EFFICIENCY TO PROPEL MARKET

- 9.6 MEDICAL DEVICE INDUSTRY

- 9.6.1 RISE OF PERSONALIZED MEDICINE AND 3D-PRINTED IMPLANTS TO DRIVE MARKET

- 9.7 POWER INDUSTRY

- 9.7.1 GROWING SHIFT TOWARD RENEWABLE ENERGY AND SMART GRIDS TO SUPPORT MARKET GROWTH

- 9.8 OTHER END USERS

10 MATERIAL TESTING MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 Innovation and regulatory rigor in high-tech industries to fuel market growth

- 10.2.2 CANADA

- 10.2.2.1 Surge in sustainability and zero-emission technology advancements to fuel market

- 10.2.3 MEXICO

- 10.2.3.1 Nearshoring and industrial localization in global supply chains to drive market

- 10.2.1 US

- 10.3 ASIA PACIFIC

- 10.3.1 CHINA

- 10.3.1.1 Rapid technological adoption to fuel market

- 10.3.2 JAPAN

- 10.3.2.1 Precision engineering and high-quality standards to drive market

- 10.3.3 INDIA

- 10.3.3.1 Rise of domestic startups in electric vehicles and space technology to fuel demand

- 10.3.4 SOUTH KOREA

- 10.3.4.1 Technological innovation and export-driven economy to boost market

- 10.3.5 INDONESIA

- 10.3.5.1 Resource-rich economy and rapid urbanization to support market growth

- 10.3.6 THAILAND

- 10.3.6.1 Government initiatives promoting industrial growth to propel market

- 10.3.7 VIETNAM

- 10.3.7.1 Low-cost manufacturing and rapid industrialization to fuel market

- 10.3.8 PHILIPPINES

- 10.3.8.1 Emerging maritime industries to drive market

- 10.3.9 REST OF ASIA PACIFIC

- 10.3.1 CHINA

- 10.4 EUROPE

- 10.4.1 GERMANY

- 10.4.1.1 Global leadership in precision manufacturing to drive market

- 10.4.2 UK

- 10.4.2.1 Advanced research and financial sector integration to propel market

- 10.4.3 FRANCE

- 10.4.3.1 Aerospace innovation and luxury goods excellence to accelerate adoption

- 10.4.4 ITALY

- 10.4.4.1 Presence of design-driven industries and cultural heritage preservation to drive market

- 10.4.5 SPAIN

- 10.4.5.1 Renewable energy and tourism-driven infrastructure to boost market growth

- 10.4.6 REST OF EUROPE

- 10.4.1 GERMANY

- 10.5 MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.5.1.1 Saudi Arabia

- 10.5.1.1.1 Vision 2030 and mega-infrastructure projects to propel market

- 10.5.1.2 Rest of GCC countries

- 10.5.1.1 Saudi Arabia

- 10.5.2 SOUTH AFRICA

- 10.5.2.1 Mining excellence and infrastructure modernization to propel market

- 10.5.3 TURKEY

- 10.5.3.1 Cultural emphasis on industrial self-sufficiency to support market growth

- 10.5.4 REST OF MIDDLE EAST & AFRICA

- 10.5.1 GCC COUNTRIES

- 10.6 SOUTH AMERICA

- 10.6.1 BRAZIL

- 10.6.1.1 Resource exploitation and bioeconomy growth to fuel market growth

- 10.6.2 ARGENTINA

- 10.6.2.1 Agricultural innovation and industrial self-sufficiency to boost market growth

- 10.6.3 REST OF SOUTH AMERICA

- 10.6.1 BRAZIL

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 REVENUE ANALYSIS

- 11.4 MARKET SHARE ANALYSIS

- 11.5 COMPANY VALUATION AND FINANCIAL METRICS

- 11.6 BRAND/PRODUCT COMPARISON ANALYSIS

- 11.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.7.1 STARS

- 11.7.2 EMERGING LEADERS

- 11.7.3 PERVASIVE PLAYERS

- 11.7.4 PARTICIPANTS

- 11.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.7.5.1 Company footprint

- 11.7.5.2 Region footprint

- 11.7.5.3 Type footprint

- 11.7.5.4 Material footprint

- 11.7.5.5 End-user footprint

- 11.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.8.1 PROGRESSIVE COMPANIES

- 11.8.2 RESPONSIVE COMPANIES

- 11.8.3 DYNAMIC COMPANIES

- 11.8.4 STARTING BLOCKS

- 11.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.8.5.1 Detailed list of key startups/SMEs

- 11.8.5.2 Competitive benchmarking of key startups/SMEs

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 EXPANSIONS

- 11.9.3 DEALS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 ILLINOIS TOOL WORKS INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 ZWICKROELL

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 AMETEK

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 Recent developments

- 12.1.3.3.1 Expansions

- 12.1.3.4 MnM view

- 12.1.3.4.1 Key strengths

- 12.1.3.4.2 Strategic choices

- 12.1.3.4.3 Weaknesses and competitive threats

- 12.1.4 SHIMADZU CORPORATION

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Product launches

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses and competitive threats

- 12.1.5 MITUTOYO CORPORATION

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 MnM view

- 12.1.5.3.1 Key strengths

- 12.1.5.3.2 Strategic choices

- 12.1.5.3.3 Weaknesses and competitive threats

- 12.1.6 TINIUS OLSEN

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 MnM view

- 12.1.6.3.1 Key strengths

- 12.1.6.3.2 Strategic choices

- 12.1.6.3.3 Weaknesses and competitive threats

- 12.1.7 QATM

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 MnM view

- 12.1.7.3.1 Key strengths

- 12.1.7.3.2 Strategic choices

- 12.1.7.3.3 Weaknesses and competitive threats

- 12.1.8 ERICHSEN GMBH & CO. KG

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 MnM view

- 12.1.8.3.1 Key strengths

- 12.1.8.3.2 Strategic choices

- 12.1.8.3.3 Weaknesses and competitive threats

- 12.1.9 HEGEWALD & PESCHKE

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Key strengths

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses and competitive threats

- 12.1.10 NOVA MEASUREMENTS LLC

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Deals

- 12.1.10.4 MnM view

- 12.1.10.4.1 Key strengths

- 12.1.10.4.2 Strategic choices

- 12.1.10.4.3 Weaknesses and competitive threats

- 12.1.1 ILLINOIS TOOL WORKS INC.

- 12.2 OTHER PLAYERS

- 12.2.1 ADMET, INC.

- 12.2.2 HUMBOLDT MFG. CO.

- 12.2.3 STRUERS

- 12.2.4 FOUNDRAX ENGINEERING PRODUCTS LTD.

- 12.2.5 TORONTECH INC.

- 12.2.6 HUNG TA INSTRUMENT CO., LTD.

- 12.2.7 SHANGHAI JIUBIN INSTRUMENT CO., LTD.

- 12.2.8 DEVCO S.R.L

- 12.2.9 TA INSTRUMENTS

- 12.2.10 QUALITEST

- 12.2.11 APPLIED TEST SYSTEMS

- 12.2.12 JINAN LIANGONG TESTING TECHNOLOGY CO., LTD.

- 12.2.13 MATEST

- 12.2.14 ELE INTERNATIONAL

- 12.2.15 INTERNATIONAL EQUIPMENTS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 RELATED REPORTS

- 13.4 AUTHOR DETAILS