|

시장보고서

상품코드

1819100

일회용 의료기기 시장 예측(-2030년) : 디바이스, 디바이스 클래스, 소재, 용도별Disposable Medical Device Market by Device, Device Class, Material, and Application - Global Forecast to 2030 |

||||||

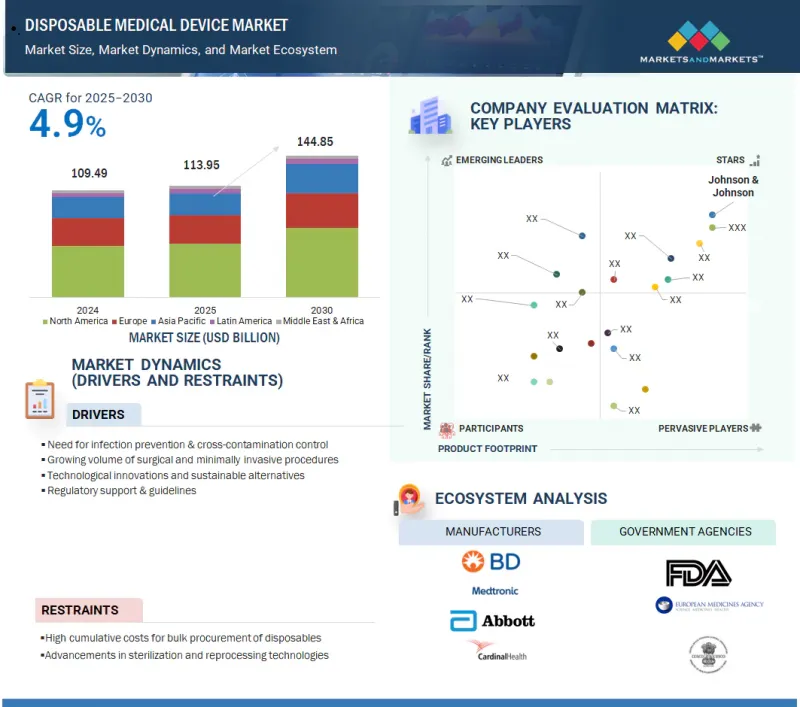

세계의 일회용 의료기기 시장 규모는 2025년 1,139억 5,000만 달러에서 예측 기간 중 CAGR 4.9%로 추이하며, 2030년에는 1,448억 5,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 디바이스 유형, 디바이스 클래스, 소재, 용도, 최종사용자, 지역 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 라틴아메리카, 중동 및 아프리카 |

병원내 감염(HAI)에 대한 우려 증가, 수술 건수 증가, 비용 효율적인 일회용 솔루션의 필요성이 이 시장의 성장을 촉진하고 있습니다. 또한 고령 인구 증가, 만성질환의 유병률 증가, 재택치료에 대한 강한 수요가 이러한 추세를 촉진하고 있습니다. 감염 관리에 대한 규제 강화, 재료 및 제조 기술의 발전도 세계 시장 확대를 가속화하고 있습니다.

"장치 유형별로는 약물전달 장치 부문이 예측 기간 중 가장 높은 CAGR로 성장할 것으로 예측됩니다."

약물전달 장치 부문은 큰 폭의 성장세를 보이고 있으며, 당뇨병, 암, 자가면역질환과 같은 만성질환의 유병률 증가로 인해 장기적인 치료 관리를 위한 일회용 주사기, 바늘, 수액세트에 대한 수요가 크게 증가하고 있습니다. 또한 특히 팬데믹 이후 전 세계에서 백신 접종 프로그램이 확대됨에 따라 오염 위험을 줄이고 환자의 안전을 강화하기 위해 일회용 약물전달 시스템의 도입이 가속화되었습니다. 재택의료와 자가주사 보급도 성장을 지원하고 있습니다. 또한 편의성과 컴플라이언스를 향상시키는 프리필드 시린지, 오토인젝터와 같은 기술 혁신도 한몫을 하고 있습니다. 또한 감염 예방에 대한 규제 강화와 일회용 제품의 비용 효율성도 이 부문의 급속한 확장을 더욱 촉진하고 있습니다.

"플라스틱 기반 부문은 예측 기간 중 가장 높은 CAGR로 성장할 것으로 예측됩니다."

이는 플라스틱 소재가 제공하는 비용 효율성, 경량성, 높은 범용성, 대량 생산의 용이성에 기인합니다. 폴리에틸렌, 폴리프로필렌, PVC 등의 플라스틱은 주사기, 카테터, 수술기구 등 다양한 일회용 기기의 제조에 널리 사용되고 있습니다. 또한 생체 적합성 및 재활용 가능한 플라스틱의 발전은 지속가능성 추세를 지원하고 이 부문의 성장을 더욱 촉진하고 있습니다.

"지역별로는 아시아태평양이 예측 기간 중 가장 높은 CAGR로 성장할 것으로 예측됩니다."

아시아태평양의 성장은 급속한 도시화와 중산층 확대에 따른 의료 서비스 접근성 향상에 힘입어 저렴하고 효율적인 의료 솔루션에 대한 수요를 증가시키고 있습니다. 인도, 중국, 동남아시아 정부는 의료 인프라에 많은 투자를 하고 있으며, 보험제도도 확대되고 있으며, 병원 및 진료소에서 일회용 의료기기의 사용이 증가하고 있습니다. 또한 만성질환의 부담 증가, 감염 예방에 대한 인식 증가, 고령화 진행으로 인해 일회용 의료제품의 필요성이 더욱 높아지고 있습니다. 강력한 의료기기 제조거점과 비용 효율적인 생산 능력으로 이 지역은 국내 소비와 세계 공급의 거점 역할을 하고 있습니다.

세계의 일회용 의료기기 시장을 조사했으며, 시장 개요, 시장 성장에 대한 각종 영향요인의 분석, 기술·특허의 동향, 법규제 환경, 사례 연구, 시장 규모 추이·예측, 각종 구분·지역/주요 국가별 상세 분석, 경쟁 구도, 주요 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 업계 동향

- 기술 분석

- Porter's Five Forces 분석

- 규제 상황

- 가격 분석

- 밸류체인 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 특허 분석

- 공급망 분석

- 에코시스템 분석

- 무역 분석

- 주요 이해관계자와 구입 기준

- 일회용 의료기기 인접 시장

- 일회용 의료기기 시장에서의 미충족 요구/최종사용자 기대

- 일회용 의료기기 시장에서 생성형 AI의 영향

- 투자와 자금조달 시나리오

- 2025년 미국 관세의 영향

제6장 일회용 의료기기 시장 : 기기 유형별

- 약물전달 디바이스

- 주사기

- 바늘

- 정맥 카테터

- 수액 세트

- 프리필드 플래시 시린지

- 일회용 네뷸라이저 키트

- 비강 스프레이 디바이스

- 흡입기

- 외과용 및 시술용 기구

- 스테이플러

- 겸자와 메스

- 흡인 튜브

- 큐렛

- 트로카와 캐뉼라

- 전기 소작 펜슬

- 지혈 클립

- 그라스퍼

- 카테터와 튜브

- 요도 카테터

- 중심 정맥 카테터

- 경비 위관

- 영양 튜브

- 기관내 튜브

- 개인보호장비(PPE)

- 장갑

- 페이스마스크

- 가운과 캡

- 진단 및 검사 기기

- 측방유동 어세이

- 혈당 측정 스트립

- 면봉

- 검체 용기

- 일회용 체온계

- 심전도 전극

- 호흡기 및 마취기

- 산소 마스크

- 비강 캐뉼라

- 가온 가습 교환기

- 마취 회로

- 일회용 후두경 블레이드

- 비뇨기과 및 부인과용 기기

- 일회용 질경

- 일회용 자궁경 카테터

- 요도 확장기

- 안과·이비인후과용 기기

- 안과 수술용 블레이드

- 이비인후과용 흡인용 칩

- 일회용 이경 스페큘라

- 기타

제7장 일회용 의료기기 시장 : 기기 클래스별

- 클래스 I

- 클래스 II

- 클래스 III

제8장 일회용 의료기기 시장 : 재질별

- 플라스틱 기반

- 금속 기반

- 고무 기반

- 기타

제9장 일회용 의료기기 시장 : 최종사용자별

- 병원

- 공립 병원

- 사립 병원

- 외래 수술 센터

- 홈케어

- 기타

제10장 일회용 의료기기 시장 : 용도별

- 일반 외과

- 호흡기

- 비뇨기과

- 부인과

- 창상관리

- 진단과 모니터링

- 심장혈관

- 감염 관리

- ICU/응급

- 기타

제11장 일회용 의료기기 시장 : 지역별

- 북미

- 미국

- 캐나다

- 아시아태평양

- 일본

- 중국

- 인도

- 호주

- 한국

- 기타

- 유럽

- 독일

- 영국

- 프랑스

- 스페인

- 이탈리아

- 기타

- 라틴아메리카

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- GCC 국가

- 기타

제12장 경쟁 구도

- 개요

- 주요 기업의 매출 점유율 분석

- 시장 점유율 분석

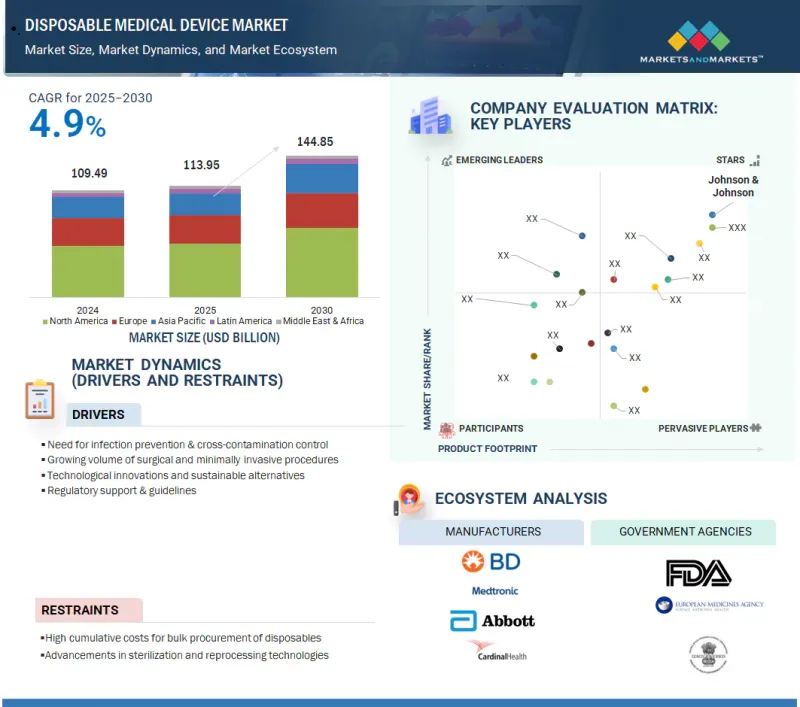

- 기업 평가 매트릭스 : 주요 기업

- 스타트업/중소기업용 기업 평가 매트릭스

- 기업 평가와 재무 지표

- 브랜드/제품 비교 분석

- 주요 기업의 R&D평가

- 경쟁 시나리오

제13장 기업 개요

- 주요 기업

- JOHNSON & JOHNSON

- BD

- CARDINAL HEALTH

- MEDTRONIC

- ABBOTT

- SOLVENTUM

- BOSTON SCIENTIFIC CORPORATION

- BAXTER

- TERUMO CORPORATION

- NIPRO CORPORATION

- TELEFLEX INCORPORATED

- STRYKER

- FRESENIUS KABI AG

- MEDLINE INDUSTRIES, INC.

- MERIT MEDICAL SYSTEMS.

- B. BRAUN SE

- ALCON INC.

- 기타 기업

- ICU MEDICAL, INC.

- STERIS

- INTEGRA LIFESCIENCES CORPORATION

- COLOPLAST CORP.

- PAUL HARTMANN AG

- OWENS & MINOR.

- KIRWAN SURGICAL PRODUCTS, LLC

- ASPEN SURGICAL PRODUCTS, INC.

제14장 부록

KSA 25.10.01The global disposable medical device market is projected to reach 144.85 billion in 2030, growing from USD 113.95 billion in 2025, at a CAGR of 4.9% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Device Type, Class of Device, Material, Application, End User, and Region |

| Regions covered | Asia Pacific, North America, Europe, Latin America, and the Middle East & Africa |

The growth of the market is driven by rising concerns over hospital-acquired infections (HAIs), increasing surgical procedures, and the need for cost-effective, single-use solutions. Additionally, the growing elderly population, rising prevalence of chronic diseases, and strong demand for home healthcare support this trend. Regulatory emphasis on infection control, materials, and manufacturing technology advancements fuels global market expansion.

"By device type, the drug delivery devices segment is projected to grow at the highest CAGR during the forecast period."

The drug delivery devices segment is experiencing significant growth driven by the increasing prevalence of chronic diseases, such as diabetes, cancer, and autoimmune disorders, which are significantly boosting the demand for disposable syringes, needles, and infusion sets for long-term therapy management. Additionally, the global rise in vaccination programs, especially post-pandemic, has accelerated the adoption of single-use drug delivery systems to reduce the risk of contamination and enhance patient safety. The growing preference for home-based care and self-administration of injectable drugs also supports this growth, alongside technological advancements, such as prefilled syringes and auto-injectors that offer greater convenience and compliance. Moreover, regulatory push for infection prevention and disposables' cost-effectiveness further reinforces this segment's rapid expansion.

"The plastic-based segment is projected to grow at the highest CAGR during the forecast period."

The plastic-based segment is projected to witness the fastest growth during the forecast period. The growth is due to the cost-effectiveness, lightweight nature, high versatility, and ease of mass production offered by plastic-based materials. Plastics like polyethylene, polypropylene, and PVC are widely used for manufacturing a broad range of disposable devices, such as syringes, catheters, and surgical instruments. Additionally, advancements in biocompatible and recyclable plastics support sustainability trends, further fueling growth in this segment.

"By class of device, the class II segment is projected to grow at the highest CAGR during the forecast period."

The growth of the class II segment is driven by the widespread use of class II medical devices in essential medical procedures, especially in infection prevention and chronic disease management. These devices, such as surgical gloves, catheters, infusion sets, and diagnostic tools, balance safety and regulatory requirements, which makes them faster to market compared to class III devices. Additionally, the rising number of hospital admissions, outpatient procedures, and home healthcare setups has significantly boosted the demand for these moderately regulated devices. Moreover, post-pandemic infection control protocols and the global push for safe, single-use medical solutions continue accelerating the adoption of class II disposable devices.

"By end user, the homecare setting segment is projected to grow at the highest CAGR during the forecast period."

The projected growth of the home care setting during the forecast period is due to the increasing preference for home-based treatment, especially among the elderly and patients with chronic illnesses. Additionally, the rising cost of hospital care has further encouraged a shift toward more affordable home care solutions. Technological advancements have led to the development of compact, user-friendly, and safe disposable devices, such as insulin pens, wound dressings, and portable diagnostic tools. Moreover, greater awareness of people regarding health management and improved patient education empower individuals to manage their conditions independently at home, further fueling this segment's growth.

"Asia Pacific is projected to grow at the highest CAGR during the forecast period."

The growth of the disposable medical devices market in Asia Pacific is driven by rapid urbanization and an expanding middle-class population with increased access to healthcare services, boosting the demand for affordable and efficient medical solutions. Governments in India, China, and Southeast Asia are investing heavily in healthcare infrastructure and expanding insurance coverage, which, in turn, supports higher usage of disposable devices in hospitals and clinics. Additionally, the growing burden of chronic diseases, rising awareness of infection prevention, and an aging population are amplifying the need for single-use medical products. A strong medical manufacturing base and cost-effective production capabilities make the region a hub for domestic consumption and global supply of disposable medical devices.

A breakdown of the primary participants (supply-side) is provided below:

- By Company Type: Tier 1 - 45%, Tier 2 - 20%, and Tier 3 - 35%

- By Designation: C-level Executives - 35%, Directors - 25%, and Others - 40%

- By Region: North America - 40%, Europe - 25%, Asia Pacific - 20%, Latin America - 10%, Middle East & Africa - 5%

The prominent players in the disposable medical device market include Johnson & Johnson (US), Baxter. (US), BD (US), Cardinal Health, Inc. (US), Abbott (US), Medtronic (Ireland), Solventum (US), Boston Scientific Corporation (US), Stryker Corporation (US), Teleflex Incorporated (US), B Braun SE. (US), Terumo Corporation (Japan), Nipro Corporation (Japan), Merit Medical Systems. (US), Alcon Inc. [Switzerland], Medline Industries, Inc. (US), Fresenius SE & Co. KGaA (Germany), ICU Medical, Inc. (US), STERIS. (US), Integra LifeSciences Holdings Corporation (US), Coloplast (Denmark), Kirwan Surgical Products, LLC (US), Owens & Minor, Inc. (US), Aspen Surgical Products, Inc. (US), and Paul Hartmann AG (Germany).

Research Coverage:

The report analyzes the disposable medical device market. It aims to estimate its size and future growth potential based on device type, device class, material, application, end user, and region. It covers a competitive analysis of key players and studies their company profiles, product/service offerings, recent developments, and key market strategies.

Reasons to Buy the Report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall disposable medical device market and its subsegments. It will help stakeholders understand the competitive landscape, gain more insights, and position their businesses better to plan suitable go-to-market strategies. The report will also help stakeholders understand the market pulse and provide information on key market drivers, restraints, challenges, and opportunities.

This report provides insights into the following pointers:

- Market Dynamics: Analysis of key drivers (Need for Infection Prevention & Cross-contamination Control, Growing Volume of Surgical and Minimally Invasive Procedures, Technological Innovations and Sustainable Alternatives, Regulatory Support and Guidelines), restraints (High Cumulative Costs for Bulk Procurement of Disposables, Advancements in Sterilization and Reprocessing Technologies), opportunities (Innovation in Sustainable Materials, Expansion in Emerging Markets & Underserved Regions), and challenges (Environmental Concerns and Regulatory Scrutiny on Medical Waste)

- Market Penetration: Extensive information on product portfolios offered by the major players in the global disposable medical device market

- Product Enhancement/Innovation: Comprehensive details about product launches and anticipated trends in the global disposable medical device market

- Market Development: Thorough knowledge and analysis of profitable markets by device type, class of device, material, application, end user, and region

- Market Diversification: Comprehensive information about newly launched consumable products, expanding markets, current advancements, and investments in the global disposable medical device market

- Competitive Assessment: Thorough evaluation of the market share, growth plans, product and service offerings, and capacities of the major competitors in the global disposable medical device market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH APPROACH

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primary interviews

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.3 GROWTH FORECAST

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 KEY INDUSTRY INSIGHTS

- 2.6 RESEARCH LIMITATIONS

- 2.6.1 METHODOLOGY-RELATED LIMITATIONS

- 2.7 RISK ASSESSMENT

- 2.8 RESEARCH ASSUMPTIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 DISPOSABLE MEDICAL DEVICE MARKET OVERVIEW

- 4.2 ASIA PACIFIC DISPOSABLE MEDICAL DEVICE MARKET, BY APPLICATION AND COUNTRY

- 4.3 DISPOSABLE MEDICAL DEVICE MARKET: DEVELOPED VS. EMERGING ECONOMIES

- 4.4 DISPOSABLE MEDICAL DEVICE MARKET, BY COUNTRY

- 4.5 DISPOSABLE MEDICAL DEVICE MARKET: REGIONAL MIX

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Infection prevention & cross-contamination control

- 5.2.1.2 Growing surgical volumes and minimally invasive procedures

- 5.2.1.3 Technological innovations and sustainable alternatives

- 5.2.1.4 Regulatory support and guidelines

- 5.2.2 RESTRAINTS

- 5.2.2.1 High cumulative costs for large-volume users

- 5.2.2.2 Advancements in sterilization methods and reprocessing technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovation in sustainable materials

- 5.2.3.2 Expansion in emerging markets and underserved regions

- 5.2.4 CHALLENGES

- 5.2.4.1 Environmental concerns and regulatory scrutiny of medical waste

- 5.2.1 DRIVERS

- 5.3 INDUSTRY TRENDS

- 5.3.1 ADVANCEMENTS IN MATERIAL SCIENCE AND SUSTAINABLE DESIGN

- 5.3.2 GROWING INTEREST OF PRIVATE EQUITY FIRMS IN DISPOSABLE MEDICAL DEVICE MARKET

- 5.3.3 OUTSOURCING OF DISPOSABLE MEDICAL DEVICE SERVICES

- 5.4 TECHNOLOGY ANALYSIS

- 5.4.1 KEY TECHNOLOGIES

- 5.4.1.1 Biodegradable/Biopolymer materials

- 5.4.1.2 IoMT-enabled smart disposables

- 5.4.2 ADJACENT TECHNOLOGIES

- 5.4.2.1 3D printing (additive manufacturing)

- 5.4.2.2 Wearable sensors

- 5.4.3 COMPLEMENTARY TECHNOLOGIES

- 5.4.3.1 Sterilization technologies

- 5.4.1 KEY TECHNOLOGIES

- 5.5 PORTER'S FIVE FORCES ANALYSIS

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.5.1.1 Barriers to entry

- 5.5.1.2 Brand loyalty and trust

- 5.5.1.3 Demand for compact, cost-effective, and non-invasive devices

- 5.5.1.4 Poor financing environment

- 5.5.2 THREAT OF SUBSTITUTES

- 5.5.2.1 Sustainability & environmental concerns

- 5.5.2.2 Growth of reusable and hybrid devices

- 5.5.2.3 Availability of alternatives

- 5.5.3 BARGAINING POWER OF SUPPLIERS

- 5.5.3.1 Raw material dependency and volume demand

- 5.5.3.2 Role of contract manufacturing organizations (CMOs)

- 5.5.3.3 Regulatory & compliance constraints

- 5.5.3.4 Innovation vs. commoditization

- 5.5.4 BARGAINING POWER OF BUYERS

- 5.5.4.1 Price sensitivity and bulk procurement

- 5.5.4.2 Regulatory and quality expectations

- 5.5.4.3 Low switching cost

- 5.5.4.4 Growth of centralized procurement models

- 5.5.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.5.5.1 Standardized product offerings

- 5.5.5.2 Overlapping target customers

- 5.5.5.3 Cost efficiency and scale as differentiators

- 5.5.5.4 Low exit barriers

- 5.5.1 THREAT OF NEW ENTRANTS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY FRAMEWORK

- 5.6.1.1 North America

- 5.6.1.1.1 US

- 5.6.1.1.2 Canada

- 5.6.1.2 Europe

- 5.6.1.3 Asia Pacific

- 5.6.1.3.1 Japan

- 5.6.1.3.2 China

- 5.6.1.3.3 India

- 5.6.1.1 North America

- 5.6.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.1 REGULATORY FRAMEWORK

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE RANGE FOR DISPOSABLE MEDICAL DEVICES, BY DEVICE AND KEY PLAYERS, 2022-2024

- 5.7.2 AVERAGE SELLING PRICE RANGE, BY REGION, 2022-2024

- 5.8 VALUE CHAIN ANALYSIS

- 5.9 KEY CONFERENCES AND EVENTS IN 2025-2026

- 5.10 PATENT ANALYSIS

- 5.10.1 INSIGHTS ON PATENT PUBLICATION TRENDS, TOP APPLICANTS, AND JURISDICTIONS FOR DISPOSABLE MEDICAL DEVICE MARKET

- 5.10.2 LIST OF MAJOR PATENTS, JANUARY 2022-JUNE 2025

- 5.11 SUPPLY CHAIN ANALYSIS

- 5.12 ECOSYSTEM ANALYSIS

- 5.13 TRADE ANALYSIS

- 5.13.1 IMPORT DATA FOR HS CODE 9018, 2020-2024

- 5.13.2 EXPORT DATA FOR HS CODE 9018, 2020-2024

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 ADJACENT MARKETS FOR DISPOSABLE MEDICAL DEVICES

- 5.16 UNMET NEEDS/END USER EXPECTATIONS IN DISPOSABLE MEDICAL DEVICE MARKET

- 5.17 IMPACT OF GEN AI IN DISPOSABLE MEDICAL DEVICE MARKET

- 5.18 INVESTMENT AND FUNDING SCENARIO

- 5.19 IMPACT OF 2025 US TARIFFS

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.4.1 US

- 5.19.4.2 Europe

- 5.19.4.3 Asia Pacific

- 5.19.5 IMPACT ON END-USE INDUSTRIES

- 5.19.5.1 Hospitals and clinics

- 5.19.5.2 Ambulatory surgical centers

- 5.19.5.3 Home care settings

6 DISPOSABLE MEDICAL DEVICE MARKET, BY DEVICE TYPE

- 6.1 INTRODUCTION

- 6.2 DRUG DELIVERY DEVICES

- 6.2.1 SYRINGES

- 6.2.1.1 Growing demand for safe injection practices, mass immunization programs, and rising chronic conditions to drive market

- 6.2.2 NEEDLES

- 6.2.2.1 Increasing focus on injection safety, rising chronic disease burden, and hospital-acquired infection control to drive market

- 6.2.3 IV CATHETERS

- 6.2.3.1 Increased procedural volume, safety mandates, and infection prevention to drive market

- 6.2.4 INFUSION SETS

- 6.2.4.1 Growth in chronic disease management, inpatient therapies, and home care fuels infusion to drive demand

- 6.2.5 PREFILLED FLUSH SYRINGES

- 6.2.5.1 Focus on infection prevention, workflow efficiency, and catheter maintenance to propel adoption of disposable prefilled flush syringes

- 6.2.6 DISPOSABLE NEBULIZER KITS

- 6.2.6.1 Rising respiratory disease burden, infection control mandates, and outpatient therapy to fuel demand for disposable nebulizer kits

- 6.2.7 NASAL SPRAY DEVICES

- 6.2.7.1 Convenience, dose accuracy, and expanding intranasal drug delivery applications to fuel demand for disposable nasal spray devices

- 6.2.8 INHALERS

- 6.2.8.1 Rise in respiratory disease prevalence and demand for infection-free, portable treatment to drive growth

- 6.2.1 SYRINGES

- 6.3 SURGICAL & PROCEDURAL INSTRUMENTS

- 6.3.1 STAPLERS

- 6.3.1.1 Rising adoption in minimally invasive and outpatient surgeries to drive market

- 6.3.2 FORCEPS & SCALPELS

- 6.3.2.1 Enhanced infection control and growing demand in emergency settings to fuel growth

- 6.3.3 SUCTION TUBES

- 6.3.3.1 Rising focus on infection control and operative efficiency to drive demand for disposable suction tubes

- 6.3.4 CURETTES

- 6.3.4.1 Growing preference for single-use instruments in OB/GYN, ENT, and dermatological procedures to drive market

- 6.3.5 TROCARS & CANNULAS

- 6.3.5.1 Increasing laparoscopic procedures and infection control mandates to fuel demand for disposable trocars & cannulas

- 6.3.6 ELECTROCAUTERY PENCILS

- 6.3.6.1 Rise in surgical volume and stricter infection control standards to bolster demand for disposable electrocautery pencils

- 6.3.7 HEMOSTATIC CLIPS

- 6.3.7.1 Increasing use of disposable hemostatic clips in minimally invasive procedures to prevent bleeding

- 6.3.8 GRASPERS

- 6.3.8.1 Growing demand for cost-effective and infection-safe instruments in laparoscopic and general surgeries to drive market

- 6.3.1 STAPLERS

- 6.4 CATHETERS & TUBES

- 6.4.1 URINARY CATHETERS

- 6.4.1.1 Increasing urinary incontinence cases and focus on infection control to drive demand

- 6.4.2 GLOBAL VOLUME ANALYSIS OF URINARY CATHETERS, 2023-2030 (THOUSAND UNITS)

- 6.4.3 CENTRAL VENOUS CATHETERS

- 6.4.3.1 Increasing adoption in critical care & infection-control driven protocols to fuel market

- 6.4.4 GLOBAL VOLUME ANALYSIS OF CENTRAL VENOUS CATHETERS, 2023-2030 (THOUSAND UNITS)

- 6.4.5 NASOGASTRIC TUBES

- 6.4.5.1 Clinical versatility, infection control protocols, and demand from critical care units to drive market

- 6.4.6 FEEDING TUBES

- 6.4.6.1 Rising geriatric population, chronic conditions, and shift toward home nutrition support to fuel market

- 6.4.7 ENDOTRACHEAL TUBES

- 6.4.7.1 Rising critical care procedures and infection prevention measures to drive demand

- 6.4.1 URINARY CATHETERS

- 6.5 PERSONAL PROTECTIVE EQUIPMENT (PPE)

- 6.5.1 GLOVES

- 6.5.1.1 Rising infection control measures, surgical volumes, and hygiene protocols to drive market expansion

- 6.5.2 FACE MASKS

- 6.5.2.1 Rising emphasis on infection control, airborne disease prevention, and occupational safety to fuel market growth

- 6.5.3 GOWNS & CAPS

- 6.5.3.1 Stringent infection control guidelines and pandemic-driven protocols to boost adoption of single-use protective apparel

- 6.5.1 GLOVES

- 6.6 DIAGNOSTIC & TESTING DEVICES

- 6.6.1 LATERAL FLOW ASSAYS

- 6.6.1.1 Rise in point-of-care diagnostics and infectious disease surveillance to drive market expansion

- 6.6.2 GLOBAL VOLUME ANALYSIS OF LATERAL FLOW ASSAYS, 2023-2030 (THOUSAND UNITS)

- 6.6.3 BLOOD GLUCOSE STRIPS

- 6.6.3.1 Rising diabetes burden and shift toward home-based monitoring to drive demand

- 6.6.4 GLOBAL VOLUME ANALYSIS OF BLOOD GLUCOSE STRIPS, 2023-2030 (THOUSAND UNITS)

- 6.6.5 SWABS

- 6.6.5.1 Rising demand from diagnostic testing, infection surveillance, and point-of-care settings to drive growth

- 6.6.6 SPECIMEN CONTAINERS

- 6.6.6.1 Rising emphasis on diagnostic accuracy, infection control, and regulatory compliance to drive growth

- 6.6.7 DISPOSABLE THERMOMETERS

- 6.6.7.1 Infection prevention, cost-effectiveness, and point-of-care efficiency to drive growth

- 6.6.8 ECG ELECTRODES

- 6.6.8.1 Rising cardiac monitoring needs & infection prevention measures to drive demand

- 6.6.1 LATERAL FLOW ASSAYS

- 6.7 RESPIRATORY & ANESTHESIA DEVICES

- 6.7.1 OXYGEN MASKS

- 6.7.1.1 Rising incidence of respiratory disorders & emergency care utilization to boost market

- 6.7.2 NASAL CANNULAS

- 6.7.2.1 Growing respiratory patient pool and home oxygen therapy to drive demand

- 6.7.3 HEAT MOISTURE EXCHANGERS

- 6.7.3.1 Critical role in airway management and ICU ventilation to drive market

- 6.7.4 ANESTHESIA CIRCUITS

- 6.7.4.1 Rising focus on cross-contamination prevention and or efficiency to drive market

- 6.7.5 DISPOSABLE LARYNGOSCOPE BLADES

- 6.7.5.1 Rising focus on cross-contamination control & emergency preparedness to drive demand

- 6.7.1 OXYGEN MASKS

- 6.8 UROLOGY & GYNECOLOGY DEVICES

- 6.8.1 DISPOSABLE VAGINAL SPECULUMS

- 6.8.1.1 Rising gynecological screening, infection control, and patient-centric care to drive market

- 6.8.2 SINGLE-USE HYSTEROSCOPY CATHETERS

- 6.8.2.1 Rising preference for minimally invasive gynecological procedures & infection control to propel demand

- 6.8.3 URETHRAL DILATORS

- 6.8.3.1 Rising preference for minimally invasive gynecological procedures & infection control to propel demand

- 6.8.1 DISPOSABLE VAGINAL SPECULUMS

- 6.9 OPHTHALMIC & ENT DEVICES

- 6.9.1 OPHTHALMIC SURGICAL BLADES

- 6.9.1.1 Precision in microsurgery and focus on sterility drive market

- 6.9.2 ENT SUCTION TIPS

- 6.9.2.1 Rising surgical volumes, infection control protocols, and pediatric ENT procedures to propel market

- 6.9.3 DISPOSABLE OTOSCOPE SPECULA

- 6.9.3.1 Rising infection prevention measures and pediatric applications to drive market

- 6.9.1 OPHTHALMIC SURGICAL BLADES

- 6.10 OTHER DEVICES

7 DISPOSABLE MEDICAL DEVICE MARKET, BY DEVICE CLASS

- 7.1 INTRODUCTION

- 7.2 CLASS I

- 7.2.1 POSSESS MINIMUM POTENTIAL TO HARM USERS

- 7.3 CLASS II

- 7.3.1 REQUIRE REGULATORY CONTROLS TO ENSURE SAFETY AND EFFICACY

- 7.4 CLASS III

- 7.4.1 ESSENTIAL IN PREVENTING HEALTH IMPAIRMENT OR POTENTIAL UNREASONABLE RISK OF ILLNESS OR INJURY

8 DISPOSABLE MEDICAL DEVICE MARKET, BY MATERIAL

- 8.1 INTRODUCTION

- 8.2 PLASTIC BASED

- 8.2.1 SHIFT TOWARD PLASTICS FOR AFFORDABILITY, DESIGN FLEXIBILITY, AND INFECTION CONTROL TO DRIVE DEMAND

- 8.3 METAL BASED

- 8.3.1 DEMAND FOR PRECISION, STRENGTH, AND SINGLE-USE COMPLIANCE TO DRIVE GROWTH

- 8.4 RUBBER BASED

- 8.4.1 WIDESPREAD USE IN SEALING, DAMPING, AND BIOCOMPATIBLE APPLICATIONS TO DRIVE DEMAND

- 8.5 OTHER MATERIALS

9 DISPOSABLE MEDICAL DEVICE MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 PUBLIC HOSPITALS

- 9.2.2 PRIVATE HOSPITALS

- 9.3 AMBULATORY SURGICAL CENTERS

- 9.3.1 GROWING PREFERENCE FOR DISPOSABLE MEDICAL DEVICES IN AMBULATORY SETTINGS DRIVEN BY INFECTION CONTROL, OPERATIONAL EFFICIENCY, AND REGULATORY COMPLIANCE

- 9.4 HOMECARE SETTING

- 9.4.1 RISING DEMAND FOR SELF-ADMINISTERED AND REMOTE CARE TO FUEL GROWTH

- 9.5 OTHER END USERS

10 DISPOSABLE MEDICAL DEVICE MARKET, BY APPLICATION

- 10.1 INTRODUCTION

- 10.2 GENERAL SURGERY

- 10.2.1 INCREASING USE OF DISPOSABLE INSTRUMENTS IN OPERATING ROOMS TO REDUCE INFECTIONS AND IMPROVE EFFICIENCY

- 10.3 RESPIRATORY

- 10.3.1 INCREASING RESPIRATORY DISEASE BURDEN, INFECTION CONTROL MEASURES, AND AT-HOME VENTILATION TO FUEL DEMAND

- 10.4 UROLOGY

- 10.4.1 RISING GERIATRIC POPULATION, INFECTION PREVENTION PROTOCOLS, AND AT-HOME CARE MODELS TO DRIVE DEMAND

- 10.5 GYNECOLOGY

- 10.5.1 GROWING EMPHASIS ON INFECTION CONTROL, AMBULATORY CARE, AND TECHNOLOGICAL SIMPLICITY TO DRIVE DEMAND

- 10.6 WOUND CARE

- 10.6.1 RISING SURGICAL PROCEDURES AND DIABETIC ULCERS TO DRIVE DEMAND

- 10.7 DIAGNOSTIC & MONITORING

- 10.7.1 RISING DEMAND FOR CHRONIC DISEASE MANAGEMENT AND HOME-BASED MONITORING TO DRIVE MARKET

- 10.8 CARDIOVASCULAR

- 10.8.1 RISING CARDIOVASCULAR DISEASE BURDEN AND TECHNOLOGICAL INNOVATIONS TO DRIVE DEMAND

- 10.9 INFECTION CONTROL

- 10.9.1 EMPHASIS ON HAIS PREVENTION, REGULATORY PRESSURE, AND PANDEMIC PREPAREDNESS TO DRIVE GROWTH

- 10.10 ICU/EMERGENCY

- 10.10.1 RISING ACUTE CARE DEMAND & INFECTION PREVENTION PROTOCOLS TO ACCELERATE DISPOSABLE DEVICE USE IN CRITICAL SETTINGS

- 10.11 OTHER APPLICATIONS

11 DISPOSABLE MEDICAL DEVICE MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.1.1 GLOBAL VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK

- 11.2.2 NORTH AMERICA: VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.2.3 US

- 11.2.3.1 Growth fueled by regulatory push, rising chronic diseases, and infection control mandates

- 11.2.4 CANADA

- 11.2.4.1 Stringent infection control regulations and chronic disease burden to propel growth

- 11.3 ASIA PACIFIC

- 11.3.1 MACROECONOMIC OUTLOOK

- 11.3.2 ASIA PACIFIC: VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.3.3 JAPAN

- 11.3.3.1 Aging population, infection control norms, and technological innovation to fuel growth

- 11.3.4 CHINA

- 11.3.4.1 Aging population, regulatory push, and local manufacturing to fuel growth

- 11.3.5 INDIA

- 11.3.5.1 Rising focus on infection control, government schemes, and domestic manufacturing to drive growth

- 11.3.6 AUSTRALIA

- 11.3.6.1 Growing emphasis on infection control, aging population, and local manufacturing push to drive growth

- 11.3.7 SOUTH KOREA

- 11.3.7.1 Regulatory streamlining, digital healthcare infrastructure, and local production to drive growth

- 11.3.8 REST OF ASIA PACIFIC

- 11.4 EUROPE

- 11.4.1 MACROECONOMIC OUTLOOK

- 11.4.2 EUROPE: VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.4.3 GERMANY

- 11.4.3.1 Strong regulatory standards, aging population, and digital health integration to drive adoption

- 11.4.4 UK

- 11.4.4.1 Stringent infection control regulations, NHS procurement, and sustainability initiatives to drive growth

- 11.4.5 FRANCE

- 11.4.5.1 Regulatory alignment, rising infection control standards, and shift toward ambulatory care to drive market

- 11.4.6 SPAIN

- 11.4.6.1 Rising hospital admissions, infection control regulations, and public-private healthcare investment to fuel growth

- 11.4.7 ITALY

- 11.4.7.1 Aging population, healthcare reforms, and infection prevention measures to accelerate market growth

- 11.4.8 REST OF EUROPE

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK

- 11.5.2 LATIN AMERICA: VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.5.3 BRAZIL

- 11.5.3.1 Public health expansion, domestic manufacturing push, and infection control measures to drive growth

- 11.5.4 MEXICO

- 11.5.4.1 Regulatory reform, healthcare expansion, and public health investments to drive market growth

- 11.5.5 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 MACROECONOMIC OUTLOOK

- 11.6.2 MIDDLE EAST & AFRICA: VOLUME ANALYSIS OF CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES, 2023-2030 (THOUSAND UNITS)

- 11.6.3 GCC COUNTRIES

- 11.6.3.1 Kingdom of Saudi Arabia (KSA)

- 11.6.3.1.1 Healthcare system transformation and regulatory focus to drive demand for disposable medical device types

- 11.6.3.2 UAE

- 11.6.3.2.1 Growing ICU procedures, chronic disease therapy needs, and infection control mandates to drive disposable CVC adoption

- 11.6.3.3 Rest of GCC Countries

- 11.6.3.1 Kingdom of Saudi Arabia (KSA)

- 11.6.4 REST OF MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.1.1 KEY STRATEGIES ADOPTED BY PLAYERS IN DISPOSABLE MEDICAL DEVICE MARKET

- 12.2 REVENUE SHARE ANALYSIS OF TOP MARKET PLAYERS

- 12.3 MARKET SHARE ANALYSIS

- 12.3.1 DISPOSABLE MEDICAL DEVICE MARKET SHARE, BY KEY PLAYERS, 2024 (GLOBAL)

- 12.3.2 DISPOSABLE MEDICAL DEVICE MARKET SHARE, BY KEY PLAYERS, 2024 (US)

- 12.4 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.4.1 STARS

- 12.4.2 EMERGING LEADERS

- 12.4.3 PERVASIVE PLAYERS

- 12.4.4 PARTICIPANTS

- 12.4.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.4.5.1 Company footprint

- 12.4.5.2 Regional footprint

- 12.4.5.3 Device type footprint

- 12.4.5.4 Material footprint

- 12.4.5.5 Device class footprint

- 12.4.5.6 Application footprint

- 12.5 COMPANY EVALUATION MATRIX, STARTUPS/ SMES, 2024

- 12.5.1 PROGRESSIVE COMPANIES

- 12.5.2 RESPONSIVE COMPANIES

- 12.5.3 DYNAMIC COMPANIES

- 12.5.4 STARTING BLOCKS

- 12.5.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.5.5.1 List of key startups/SMEs

- 12.5.5.2 Competitive benchmarking of key startups/SMEs

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6.1 FINANCIAL METRICS

- 12.6.2 COMPANY VALUATION

- 12.7 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 12.8 R&D ASSESSMENT OF KEY PLAYERS

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 OTHER DEVELOPMENTS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 JOHNSON & JOHNSON

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product approvals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 BD

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches

- 13.1.2.3.2 Deals

- 13.1.2.3.3 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 CARDINAL HEALTH

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Deals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 MEDTRONIC

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses and competitive threats

- 13.1.5 ABBOTT

- 13.1.5.1 Business overview

- 13.1.5.2 Products offered

- 13.1.5.3 Recent developments

- 13.1.5.3.1 Deals

- 13.1.5.4 MnM view

- 13.1.5.4.1 Right to win

- 13.1.5.4.2 Strategic choices

- 13.1.5.4.3 Weaknesses and competitive threats

- 13.1.6 SOLVENTUM

- 13.1.6.1 Business overview

- 13.1.6.2 Products offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.6.3.2 Other developments

- 13.1.7 BOSTON SCIENTIFIC CORPORATION

- 13.1.7.1 Business overview

- 13.1.7.2 Products offered

- 13.1.7.3 Recent developments

- 13.1.7.3.1 Product approvals

- 13.1.8 BAXTER

- 13.1.8.1 Business overview

- 13.1.8.2 Products offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Product approvals

- 13.1.8.3.2 Other developments

- 13.1.9 TERUMO CORPORATION

- 13.1.9.1 Business overview

- 13.1.9.2 Products offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Product launches

- 13.1.9.3.2 Expansions

- 13.1.10 NIPRO CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Expansions

- 13.1.11 TELEFLEX INCORPORATED

- 13.1.11.1 Business overview

- 13.1.11.2 Products offered

- 13.1.11.3 Recent developments

- 13.1.11.3.1 Product launches

- 13.1.11.3.2 Deals

- 13.1.12 STRYKER

- 13.1.12.1 Business overview

- 13.1.12.2 Products offered

- 13.1.12.3 Recent developments

- 13.1.12.3.1 Product approvals

- 13.1.13 FRESENIUS KABI AG

- 13.1.13.1 Business overview

- 13.1.13.2 Products offered

- 13.1.13.3 Recent developments

- 13.1.13.3.1 Product approvals

- 13.1.13.3.2 Deals

- 13.1.13.3.3 Other developments

- 13.1.14 MEDLINE INDUSTRIES, INC.

- 13.1.14.1 Business overview

- 13.1.14.2 Products offered

- 13.1.14.3 Recent developments

- 13.1.14.3.1 Deals

- 13.1.15 MERIT MEDICAL SYSTEMS.

- 13.1.15.1 Business overview

- 13.1.15.2 Products offered

- 13.1.15.3 Recent developments

- 13.1.15.3.1 Deals

- 13.1.16 B. BRAUN SE

- 13.1.16.1 Business overview

- 13.1.16.2 Products offered

- 13.1.16.3 Recent developments

- 13.1.16.3.1 Product launches and approvals

- 13.1.16.3.2 Deals

- 13.1.16.3.3 Other developments

- 13.1.17 ALCON INC.

- 13.1.17.1 Business overview

- 13.1.17.2 Products offered

- 13.1.17.3 Recent developments

- 13.1.17.3.1 Deals

- 13.1.1 JOHNSON & JOHNSON

- 13.2 OTHER PLAYERS

- 13.2.1 ICU MEDICAL, INC.

- 13.2.2 STERIS

- 13.2.3 INTEGRA LIFESCIENCES CORPORATION

- 13.2.4 COLOPLAST CORP.

- 13.2.5 PAUL HARTMANN AG

- 13.2.6 OWENS & MINOR.

- 13.2.7 KIRWAN SURGICAL PRODUCTS, LLC

- 13.2.8 ASPEN SURGICAL PRODUCTS, INC.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 CUSTOMIZATION OPTIONS

- 14.2.1 DEVICE TYPE ANALYSIS

- 14.2.2 GEOGRAPHIC ANALYSIS

- 14.2.3 COMPANY INFORMATION

- 14.2.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 14.2.5 COUNTRY-LEVEL VOLUME ANALYSIS BY CATHETERS & TUBES AND DIAGNOSTIC & TESTING DEVICES

- 14.2.6 BY DEVICE TYPE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 14.2.7 ANY CONSULT/CUSTOM REQUIREMENTS AS PER CLIENT REQUESTS

- 14.3 RELATED REPORTS

- 14.4 AUTHOR DETAILS