|

시장보고서

상품코드

1819101

폴리 카테터 시장 : 삽입별, 프렌치 사이즈별, 팁별, 풍선 사이즈별, 루멘수별, 재료별, 코팅 유형별, 성별, 최종사용자별, 지역별 - 예측(-2030년)Foley Catheters Market by Insertion (Suprapubic), French Size (16Fr), Tip (Coude), Balloon Size (5 mL), Lumen Number (2-way), Material (Silicone), Coating Type (Hydrophilic), Gender (Male), End User (Hospitals & ASCs) & Region - Global Forecast to 2030 |

||||||

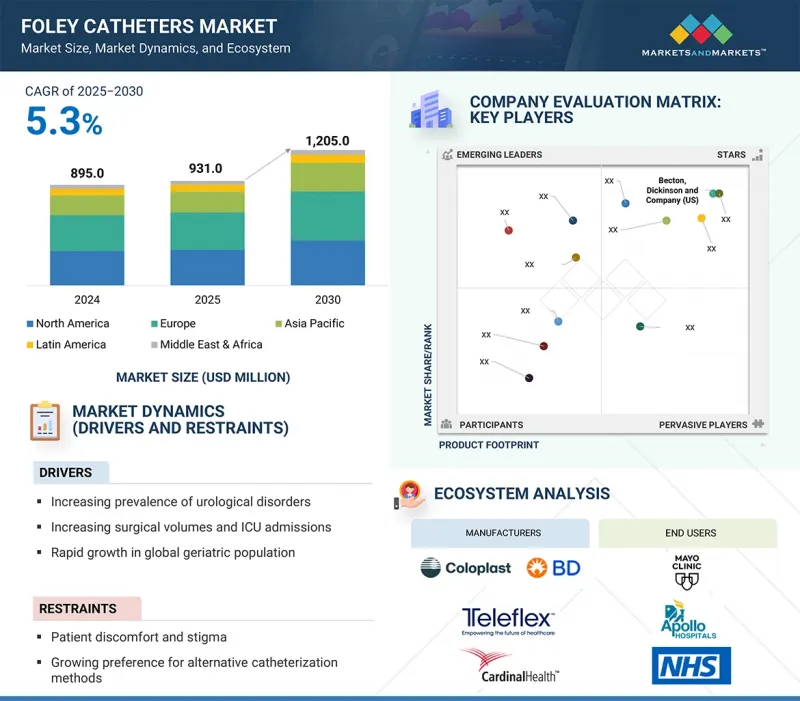

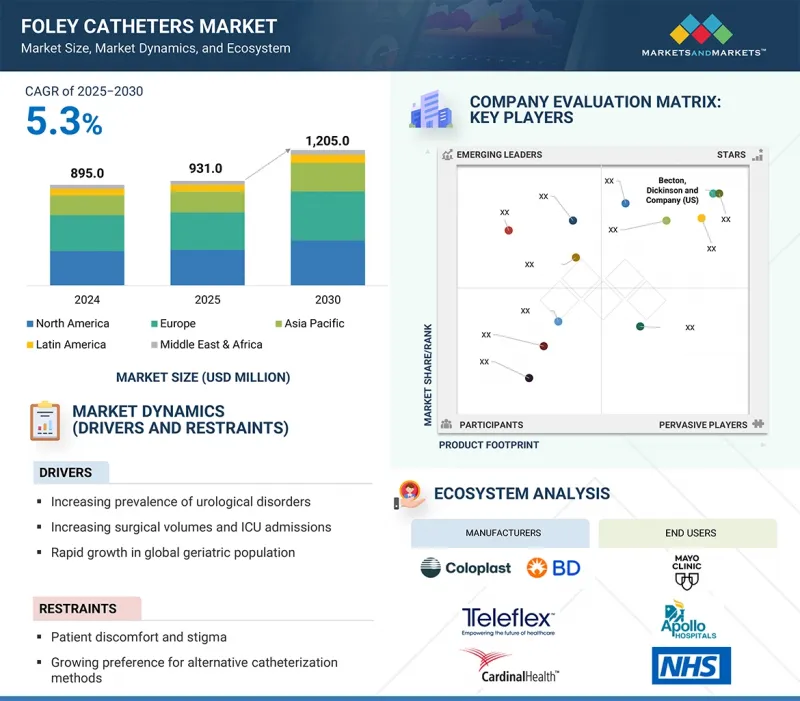

세계의 폴리 카테터 시장 규모는 2025년 9억 3,100만 달러에서 2030년까지 12억 500만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 5.3%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 삽입 유형, 프렌치 사이즈, 칩 유형, 풍선 유형, 루멘수, 재료, 코팅 유형, 성, 최종사용자 |

| 대상 지역 | 아시아태평양, 유럽, 북미, 중동 및 아프리카, 라틴아메리카 |

폴리 카테터 시장은 비뇨기 질환, 요실금, 전립선 관련 질환의 유병률 증가, 특히 노년층의 비뇨기 질환의 증가에 의해 주도되고 있습니다. 또한 비뇨기과, 산부인과, 일반외과 등 전문 분야의 수술 건수 증가가 수술 전후 관리에서 폴리 카테터의 사용 확대에 기여하고 있습니다.

신흥 경제권에서 의료 인프라의 성장은 첨단 치료 옵션에 대한 접근성 향상과 함께 환자 접근성을 확대하고 수요를 촉진하고 있습니다. 또한, 항균 코팅 및 감염 방지 설계와 같은 제품 혁신은 병원내 감염의 위험을 줄이고 이러한 카테터의 채택을 더욱 매력적으로 만듭니다.

이러한 긍정적인 추세에도 불구하고, 환자의 불편함과 편견, 대체 카테터 치료법에 대한 선호도 증가는 시장 성장을 저해할 수 있습니다.

풍선 유형별로는 5mL 풍선이 예측 기간 동안 가장 높은 CAGR을 기록할 것으로 예상됩니다.

5mL 풍선 부문이 예측 기간 동안 가장 높은 CAGR을 기록할 것입니다. 이는 편안하고 방광에 대한 자극이 적어 단기간의 카테터 삽입이나 수술 후 관리용으로 사용되기 때문입니다. 소아 및 여성 환자들에게 어필할 수 있다는 점이 수요를 더욱 증가시키고 있습니다. 이러한 추세를 활용하기 위해 시장 진입 기업은 고품질의 감염에 강한 5mL 카테터 개발에 집중하고, 특정 환자의 요구를 타겟팅하면서 병원 내 유통을 강화해야 합니다.

재료별로는 라텍스 폴리 카테터가 예측 기간 동안 가장 큰 시장 점유율을 차지할 것입니다.

라텍스 폴리 카테터 부문은 접근성, 유연성, 높은 비용 효율성으로 인해 시장 점유율을 주도하고 있으며, 전 세계 병원과 클리닉에서 널리 사용되고 있습니다. 라텍스 알레르기가 우려되는 반면, 실리콘에 비해 사용이 편리하고 가격도 저렴하기 때문에 수요가 여전히 높습니다. 제조업체는 고급 코팅과 저자극성 옵션을 통해 안전성을 향상시키면서 가격을 중시하는 시장에서의 유통을 개선함으로써 수요가 높은 이 부문에서 주도권을 유지할 수 있습니다.

유럽이 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다.

유럽은 선진화된 의료 인프라, 높은 의료비 지출, 비뇨기과 질환에 취약한 노인 인구로 인해 예측 기간 동안 가장 큰 시장 점유율을 차지할 것으로 예상됩니다. 독일, 프랑스, 영국 등 주요 국가들은 강력한 수술 건수와 확립된 상환제도로 수요를 촉진하고 있습니다. 이 지역은 감염 통제에 중점을 두고 있기 때문에 코팅된 항균 폴리 카테터의 사용이 증가하고 있습니다. 시장 진입 기업들은 지속가능한 성장을 위해 첨단 기술을 도입하고 의료 서비스 제공자와의 협력을 강화함으로써 유럽의 혁신 주도 환경을 활용할 수 있습니다.

세계의 폴리 카테터 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 상황, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 중요한 인사이트

- 폴리 카테터 시장 개요

- 유럽의 폴리 카테터 시장 : 최종사용자별, 국가별(2024년)

- 폴리 카테터 시장의 지리적 성장 기회

- 폴리 카테터 시장 : 지리적 구성

- 폴리 카테터 시장 : 신흥국 vs. 선진국

제5장 시장 개요

- 소개

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 가격 책정 분석

- 제품 평균판매가격 동향 : 주요 기업별(2022-2024년)

- 평균판매가격 동향 : 지역별(2022-2024년)

- 평균판매가격 동향 : 칩 유형별(2022-2024년)

- 평균판매가격 동향 : 코팅 유형별(2022-2024년)

- 밸류체인 분석

- 연구개발

- 원재료 공급업체

- 제조

- 유통

- 마케팅·세일즈

- 애프터서비스

- 공급망 분석

- 저명 기업

- 중소기업

- 최종사용자

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- Porter's Five Forces 분석

- 규제 분석

- 규제기관, 정부기관, 기타 조직

- 규제 상황

- 특허 분석

- 무역 분석

- HS 코드 901839 수입 데이터

- HS 코드 901839 수출 데이터

- 주요 회의와 이벤트(2025-2026년)

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향/디스럽션

- 주요 이해관계자와 구입 기준

- 투자와 자금 조달 시나리오

- 폴리 카테터 시장에 대한 AI/생성형 AI의 영향

- 소개

- 폴리 카테터 시장에서 AI의 가능성

- AI 이용 사례

- AI를 도입하고 있는 주요 기업

- 폴리 카테터 시장에서 생성형 AI의 미래

- 폴리 카테터 시장에 대한 2025년 미국 관세의 영향

- 소개

- 주요 관세율

- 가격에 대한 관세의 영향

- 지역에 대한 영향

- 최종 이용 산업에 대한 영향

제6장 폴리 카테터 시장 : 삽입 유형별

- 소개

- 요도 카테터

- 치골상 카테터

제7장 폴리 카테터 시장 : 프렌치 사이즈별

- 소개

- 12FR 이하

- 14FR

- 16FR

- 18FR

- 20FR 이상

제8장 폴리 카테터 시장 : 팁 유형별

- 소개

- 스트레이트 팁 카테터

- 쿠드 팁 카테터

- 기타 팁 카테터

제9장 폴리 카테터 시장 : 풍선 사이즈별

- 소개

- 5mL 풍선

- 10mL 풍선

- 기타 풍선 사이즈

제10장 폴리 카테터 시장 : 루멘수별

- 소개

- 2웨이

- 3웨이·4웨이

제11장 폴리 카테터 시장 : 재료별

- 소개

- 라텍스 폴리 카테터

- 실리콘 폴리 카테터

- 하이브리드 폴리 카테터

제12장 폴리 카테터 시장 : 코팅 유형별

- 소개

- 항균 코팅 폴리 카테터

- 친수성/윤활 코팅 폴리 카테터

- 비코팅 폴리 카테터

제13장 폴리 카테터 시장 : 성별

- 소개

- 남성

- 여성

제14장 폴리 카테터 시장 : 최종사용자별

- 소개

- 병원·ASC

- 장기간병 시설

- 기타 최종사용자

제15장 폴리 카테터 시장 : 지역별

- 소개

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

제16장 경쟁 구도

- 개요

- 주요 진출 기업의 전략/강점

- 매출 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 중소기업·스타트업 기업(2024년)

- 기업 평가와 재무 지표

- 브랜드/제품의 비교

- 경쟁 시나리오

제17장 기업 개요

- 주요 기업

- COLOPLAST A/S

- BECTON, DICKINSON AND COMPANY

- TELEFLEX INCORPORATED

- CARDINAL HEALTH, INC.

- B. BRAUN SE

- MEDLINE INDUSTRIES, LP

- MEDTRONIC PLC

- STERIMED GROUP

- AMSINO INTERNATIONAL, INC.

- BACTIGUARD AB

- MCKESSON CORPORATION

- 기타 기업

- ADVACARE PHARMA

- ANGIPLAST PRIVATE LIMITED

- OPTIMUM MEDICAL LIMITED

- SUZHOU SUNMED CO., LTD.

- WELL LEAD MEDICAL CO., LTD.

- POLYMED

- HEMC(HOSPITAL EQUIPMENT MANUFACTURING COMPANY)

- HANGZHOU FORMED MEDICAL DEVICES CO., LTD.

- RWD LIFE SCIENCE CO., LTD.

- PENNINE HEALTHCARE

- GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- GPC MEDICAL LTD.

- ADVIN HEALTH CARE

- RIBBEL INTERNATIONAL LTD.

- HANDAN FCH MEDICAL TECHNOLOGY CO., LTD.

제18장 부록

KSM 25.09.29The global Foley catheters market is projected to reach USD 1,205.0 million by 2030 from USD 931.0 million in 2025, at a CAGR of 5.3% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million) |

| Segments | Insertion Type, French Size, Tip Type, Balloon Type, Lumen Number, Material, Coating Type, Gender, and End User |

| Regions covered | Asia Pacific, Europe, North America, Middle East & Africa, and Latin America |

The market for Foley catheters is primarily driven by the rising prevalence of urological disorders, urinary incontinence, and prostate-related conditions, particularly among the aging population. Additionally, increasing surgical volumes in specialties such as urology, gynecology, and general surgery are contributing to the greater use of Foley catheters in perioperative care.

The growth of healthcare infrastructure in emerging economies, along with improved access to advanced treatment options, is expanding patient reach and driving demand. Furthermore, product innovations-such as antimicrobial coatings and infection-resistant designs-are mitigating the risks of hospital-acquired infections, making the adoption of these catheters more appealing.

Despite these positive trends, patient discomfort, stigma, and a growing preference for alternative catheterization methods may restrain market growth.

By balloon type, the 5 mL balloons segment is expected to register the highest CAGR during the forecast period.

Based on balloon size, the Foley catheters market is divided into 5 mL balloons, 10 mL balloons, and other balloon sizes. The 5 mL balloons segment registered the highest CAGR during the forecast period, driven by its use in short-term catheterization and postoperative care due to its comfort and minimal bladder irritation. Its appeal to pediatric and female patients further boosts demand. To capitalize on this trend, market players should focus on developing high-quality, infection-resistant 5 mL catheters and strengthening distribution in hospitals while targeting specific patient needs.

By material, the latex Foley catheters segment holds the largest market share during the forecast period.

By material, the Foley catheters market is divided into latex, silicone, and hybrid Foley catheters. The latex Foley catheters segment leads in market share due to their availability, flexibility, and cost-effectiveness, making them popular in hospitals and clinics globally. Despite concerns about latex allergies, demand remains high because of their ease of use and affordability compared to silicone. Manufacturers can enhance safety with advanced coatings and hypoallergenic options while improving distribution in price-sensitive markets to maintain leadership in this high-demand segment.

Europe is expected to hold the largest market share during the forecast period.

The global Foley catheters market is divided into five regions: North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. Europe is expected to hold the largest market share during the forecast period due to its advanced healthcare infrastructure, high spending, and an aging population susceptible to urological disorders. Key countries like Germany, France, and the UK drive demand with strong surgical volumes and established reimbursement systems. The region's focus on infection control has increased the use of coated and antimicrobial Foley catheters. Market players can capitalize on Europe's innovation-driven environment by introducing advanced technologies and enhancing collaborations with healthcare providers for sustained growth.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 (28%), Tier 2 (39%), and Tier 3 (33%)

- By Designation: C-level Executives (26%), Director-level Executives (32%), and Others (42%)

- By Region: North America (24%), Europe (40%), Asia Pacific (33%), Latin America (2%), and the Middle East & Africa (1%)

Note 1: Companies are classified into tiers based on their total revenue. As of 2024, Tier 1 = >USD 10.0 billion, Tier 2 = USD 1.0 billion to USD 10.0 billion, and Tier 3 = <USD 1.0 billion.

Note 2: C-level executives include CEOs, CFOs, COOs, and VPs.

Note 3: Others include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The players operating in the Foley catheters market include Coloplast A/S (Denmark), B. Braun SE (Germany), Becton, Dickinson and Company (US), Cardinal Health, Inc. (US), Teleflex Incorporated (US), Medtronic Plc (Ireland), Sterimed Group (India), Medline Industries, LP (US), Amsino International, Inc. (US), Bactiguard AB (US), McKesson Corporation (US), AdvaCare Pharma (US), Angiplast Private Limited (India), Ribbel International Limited (India), Optimum Medical Limited (UK), Suzhou Sunmed Co., Ltd. (China), Well Lead Medical Co., Ltd. (China), Polymed (India), HEMC (Hospital Equipment Manufacturing Company) (India), GPC Medical Ltd. (India), Hangzhou Formed Medical Devices Co., Ltd. (China), RWD Life Science Co., Ltd. (China), Advin Health Care (India), Pennine Healthcare (UK), Guangdong Baihe Medical Technology Co., Ltd. (China), and Handan FCH Medical Technology Co., Ltd. (China).

Research Coverage

This report analyzes the Foley catheters market by examining several key factors, including insertion type, French size, tip type, balloon type, number of lumens, material, coating type, gender, end user, and region. It also investigates the elements that influence market growth, such as drivers, restraints, opportunities, and challenges, while offering insights into the competitive landscape among leading market players. Furthermore, the report evaluates micromarkets by assessing their individual growth trends and forecasting the revenue of market segments across five major regions, including their respective countries.

Reasons to Buy the Report

The report will help both established companies and new or smaller firms understand the current market trends, allowing them to increase their market share. Companies that purchase the report can implement one or more of the following strategies to enhance their market presence.

This report provides insights into the following pointers:

- Analysis of key drivers (increasing prevalence of urological disorders, increasing surgical volumes and ICU admissions, rapid growth in global geriatric population, and shift toward post-acute and home-based care), restraints (patient discomfort and stigma and growing preference for alternative catheterization methods), opportunities (innovation in catheter design and material composition, development of smart Foley catheters, and increasing healthcare infrastructure in emerging markets), and challenges (high risk of catheter-associated urinary tract infections (CAUTIs) and improper insertion or maintenance of Foley catheters)

- Market Penetration: Complete knowledge of the spectrum of products presented by the major companies in the Foley catheters market

- Product Development/Innovation: Comprehensive understanding of the forthcoming trends, research and development initiatives, and product launches & approvals within the Foley catheters market

- Market Development: Complete knowledge about profitable developing regions

- Market Diversification: Exhaustive knowledge of new goods, expanding geographies, and current changes in the Foley catheters industry helps to diversify the market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Coloplast A/S (Denmark), Becton, Dickinson and Company (US), Teleflex Incorporated (US), Cardinal Health, Inc. (US), and B. Braun SE (Germany)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 MARKET SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.3.2 INCLUSIONS & EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.4 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY RESEARCH

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Key industry insights

- 2.1.1 SECONDARY RESEARCH

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach 1: Company revenue estimation approach

- 2.2.1.2 Approach 2: Presentations of companies and primary interviews

- 2.2.1.3 Growth forecast

- 2.2.2 TOP-DOWN APPROACH

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.4 MARKET SHARE ESTIMATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 PARAMETRIC ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 FOLEY CATHETERS MARKET OVERVIEW

- 4.2 EUROPE: FOLEY CATHETERS MARKET, BY END USER AND COUNTRY (2024)

- 4.3 GEOGRAPHICAL GROWTH OPPORTUNITIES IN FOLEY CATHETERS MARKET

- 4.4 FOLEY CATHETERS MARKET: GEOGRAPHICAL MIX

- 4.5 FOLEY CATHETERS MARKET: EMERGING VS. DEVELOPED ECONOMIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of urological disorders

- 5.2.1.2 Increasing surgical volumes and ICU admissions

- 5.2.1.3 Rapid growth in global geriatric population

- 5.2.1.4 Shift toward post-acute and home-based care

- 5.2.2 RESTRAINTS

- 5.2.2.1 Patient discomfort and stigma

- 5.2.2.2 Growing preference for alternative catheterization methods

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Innovation in catheter design and material composition

- 5.2.3.2 Development of smart Foley catheters

- 5.2.3.3 Increasing healthcare infrastructure in emerging markets

- 5.2.4 CHALLENGES

- 5.2.4.1 High risk of catheter-associated urinary tract infections (CAUTIs)

- 5.2.4.2 Improper insertion or maintenance of Foley catheters

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF PRODUCTS, BY KEY PLAYERS, 2022-2024

- 5.3.2 AVERAGE SELLING PRICE TREND, BY REGION 2022-2024

- 5.3.3 AVERAGE SELLING PRICE TREND, BY TIP TYPE, 2022-2024

- 5.3.4 AVERAGE SELLING PRICE TREND, BY COATING TYPE, 2022-2024

- 5.4 VALUE CHAIN ANALYSIS

- 5.4.1 RESEARCH & DEVELOPMENT

- 5.4.2 RAW MATERIAL SUPPLIERS

- 5.4.3 MANUFACTURING

- 5.4.4 DISTRIBUTION

- 5.4.5 MARKETING & SALES

- 5.4.6 POST-SALES SERVICES

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.5.1 PROMINENT COMPANIES

- 5.5.2 SMALL & MEDIUM-SIZED ENTERPRISES

- 5.5.3 END USERS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Antimicrobial coating technologies

- 5.7.1.2 Hydrophilic technology

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Smart catheters

- 5.7.2.2 Catheter securement devices

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PORTER'S FIVE FORCES ANALYSIS

- 5.8.1 THREAT OF NEW ENTRANTS

- 5.8.2 THREAT OF SUBSTITUTES

- 5.8.3 BARGAINING POWER OF SUPPLIERS

- 5.8.4 BARGAINING POWER OF BUYERS

- 5.8.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.9 REGULATORY ANALYSIS

- 5.9.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.9.2 REGULATORY LANDSCAPE

- 5.9.2.1 North America

- 5.9.2.1.1 US

- 5.9.2.1.2 Canada

- 5.9.2.2 Europe

- 5.9.2.2.1 Germany

- 5.9.2.2.2 UK

- 5.9.2.2.3 France

- 5.9.2.2.4 Italy

- 5.9.2.2.5 Spain

- 5.9.2.3 Asia Pacific

- 5.9.2.3.1 China

- 5.9.2.3.2 Japan

- 5.9.2.3.3 India

- 5.9.2.4 Latin America

- 5.9.2.4.1 Brazil

- 5.9.2.4.2 Mexico

- 5.9.2.5 Middle East

- 5.9.2.6 Africa

- 5.9.2.1 North America

- 5.10 PATENT ANALYSIS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA FOR HS CODE 901839

- 5.11.2 EXPORT DATA FOR HS CODE 901839

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 CASE STUDY ANALYSIS

- 5.13.1 CASE STUDY 1: APPROPRIATE USE OF INDWELLING URINARY CATHETERS REDUCES RISK OF CAUTI

- 5.13.2 CASE STUDY 2: DECREASE IN FOLEY CATHETER UTILIZATION RATES IMPROVES PATIENT CARE IN AN INTENSIVE CORONARY CARE UNIT

- 5.14 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.15 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 INVESTMENT & FUNDING SCENARIO

- 5.17 IMPACT OF AI/GENERATIVE AI ON FOLEY CATHETERS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 POTENTIAL OF AI IN FOLEY CATHETERS MARKET

- 5.17.3 AI USE CASES

- 5.17.4 KEY COMPANIES IMPLEMENTING AI

- 5.17.5 FUTURE OF GENERATIVE AI IN FOLEY CATHETERS MARKET

- 5.18 IMPACT OF 2025 US TARIFFS ON FOLEY CATHETERS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 IMPACT OF TARIFFS ON PRICING

- 5.18.4 IMPACT ON REGIONS

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 END-USER INDUSTRY IMPACT

6 FOLEY CATHETERS MARKET, BY INSERTION TYPE

- 6.1 INTRODUCTION

- 6.2 URETHRAL CATHETERS

- 6.2.1 GROWING BURDEN OF UROLOGIC CANCERS TO DRIVE MARKET GROWTH

- 6.3 SUPRAPUBIC CATHETERS

- 6.3.1 REDUCED INCIDENCE OF CATHETER-ASSOCIATED URINARY TRACT INFECTIONS (CAUTIS) TO DRIVE DEMAND

7 FOLEY CATHETERS MARKET, BY FRENCH SIZE

- 7.1 INTRODUCTION

- 7.2 12FR AND BELOW

- 7.2.1 INCREASING FOCUS ON PEDIATRIC UROLOGY AND NEONATAL INTENSIVE CARE TO DRIVE MARKET GROWTH

- 7.3 14FR

- 7.3.1 INCREASING BURDEN OF CHRONIC DISEASES TO SUPPORT MARKET GROWTH

- 7.4 16FR

- 7.4.1 GROWING GERIATRIC POPULATION AND INCREASING INCIDENCE OF CHRONIC CONDITIONS TO BOOST MARKET

- 7.5 18FR

- 7.5.1 GROWING PREVALENCE OF URINARY INCONTINENCE TO BOOST MARKET

- 7.6 20FR AND ABOVE

- 7.6.1 RISING INCIDENCE OF GENITOURINARY MALIGNANCIES TO DRIVE MARKET GROWTH

8 FOLEY CATHETERS MARKET, BY TIP TYPE

- 8.1 INTRODUCTION

- 8.2 STRAIGHT-TIPPED CATHETERS

- 8.2.1 INCREASING INCIDENCE OF POSTOPERATIVE URINARY RETENTION TO PROPEL DEMAND

- 8.3 COUDE-TIPPED CATHETERS

- 8.3.1 GROWING PREVALENCE OF BENIGN PROSTATIC HYPERPLASIA (BHP) TO SUPPORT MARKET GROWTH

- 8.4 OTHER-TIPPED CATHETERS

9 FOLEY CATHETERS MARKET, BY BALLOON SIZE

- 9.1 INTRODUCTION

- 9.2 5 ML BALLOONS

- 9.2.1 PROVISION OF SECURE BLADDER ANCHORAGE TO DRIVE DEMAND

- 9.3 10 ML BALLOONS

- 9.3.1 AGING POPULATION TO FUEL DEMAND FOR 10 ML BALLOONS

- 9.4 OTHER BALLOON SIZES

10 FOLEY CATHETERS MARKET, BY LUMEN NUMBER

- 10.1 INTRODUCTION

- 10.2 2-WAY

- 10.2.1 INCREASING INCIDENCE OF NEUROGENIC BLADDER DISORDERS TO DRIVE DEMAND FOR 2-WAY CATHETERS

- 10.3 3-WAY & 4-WAY

- 10.3.1 INCREASING INCIDENCE OF BLADDER CANCER TO DRIVE GROWTH

11 FOLEY CATHETERS MARKET, BY MATERIAL

- 11.1 INTRODUCTION

- 11.2 LATEX FOLEY CATHETERS

- 11.2.1 COST-EFFECTIVENESS OF LATEX TO PROPEL DEMAND

- 11.3 SILICONE FOLEY CATHETERS

- 11.3.1 REDUCED RISK OF ALLERGIC REACTIONS ASSOCIATED WITH SILICONE CATHETERS TO SUPPORT MARKET GROWTH

- 11.4 HYBRID FOLEY CATHETERS

- 11.4.1 ADVANCEMENTS IN COATING TECHNOLOGIES TO DRIVE ADOPTION

12 FOLEY CATHETERS MARKET, BY COATING TYPE

- 12.1 INTRODUCTION

- 12.2 ANTIMICROBIAL-COATED FOLEY CATHETERS

- 12.2.1 HIGH INCIDENCE OF CATHETER-ASSOCIATED URINARY TRACT INFECTIONS TO DRIVE DEMAND

- 12.3 HYDROPHILIC OR LUBRICATION-COATED FOLEY CATHETERS

- 12.3.1 INCREASING FOCUS ON PATIENT SAFETY AND COMFORT TO SUPPORT MARKET GROWTH

- 12.4 UNCOATED FOLEY CATHETERS

- 12.4.1 INCREASING DEMAND DUE TO AFFORDABILITY AND ACCESSIBILITY TO DRIVE MARKET GROWTH

13 FOLEY CATHETERS MARKET, BY GENDER

- 13.1 INTRODUCTION

- 13.2 MALES

- 13.2.1 INCREASING INCIDENCE OF KIDNEY, PROSTATE, AND BLADDER CANCERS AMONG MEN TO BOOST MARKET GROWTH

- 13.3 FEMALES

- 13.3.1 INCREASING PREVALENCE OF URINARY INCONTINENCE TO DRIVE MARKET GROWTH

14 FOLEY CATHETERS MARKET, BY END USER

- 14.1 INTRODUCTION

- 14.2 HOSPITALS & ASCS

- 14.2.1 HIGH VOLUME OF SURGICAL PROCEDURES TO DRIVE DEMAND

- 14.3 LONG-TERM CARE FACILITIES

- 14.3.1 EXPANSION OF LONG-TERM CARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 14.4 OTHER END USERS

15 FOLEY CATHETERS MARKET, BY REGION

- 15.1 INTRODUCTION

- 15.2 EUROPE

- 15.2.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 15.2.2 GERMANY

- 15.2.2.1 Growing incidence of urinary incontinence to propel demand

- 15.2.3 UK

- 15.2.3.1 Well-established healthcare infrastructure to accelerate demand

- 15.2.4 FRANCE

- 15.2.4.1 Large target population to support market growth

- 15.2.5 ITALY

- 15.2.5.1 Increasing prevalence of urological conditions to drive the demand

- 15.2.6 SPAIN

- 15.2.6.1 Rising prevalence of chronic disorders to drive market growth

- 15.2.7 REST OF EUROPE

- 15.3 NORTH AMERICA

- 15.3.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 15.3.2 US

- 15.3.2.1 Rising prevalence of conditions such as benign prostatic hyperplasia (BPH) to drive demand

- 15.3.3 CANADA

- 15.3.3.1 Substantial investment in healthcare infrastructure to drive demand

- 15.4 ASIA PACIFIC

- 15.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 15.4.2 CHINA

- 15.4.2.1 Rapidly increasing elderly population to boost demand

- 15.4.3 JAPAN

- 15.4.3.1 Presence of established healthcare system and favorable reimbursements to drive market

- 15.4.4 INDIA

- 15.4.4.1 Rising incidence of cancers to drive demand

- 15.4.5 REST OF ASIA PACIFIC

- 15.5 LATIN AMERICA

- 15.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 15.5.2 BRAZIL

- 15.5.2.1 Rising prevalence of cancer to drive demand

- 15.5.3 MEXICO

- 15.5.3.1 Rising geriatric population to drive demand

- 15.5.4 REST OF LATIN AMERICA

- 15.6 MIDDLE EAST & AFRICA

- 15.6.1 IMPROVEMENTS IN HEALTHCARE INFRASTRUCTURE TO SUPPORT MARKET GROWTH

- 15.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

16 COMPETITIVE LANDSCAPE

- 16.1 OVERVIEW

- 16.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 16.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN FOLEY CATHETERS MARKET

- 16.3 REVENUE ANALYSIS, 2022-2024

- 16.4 MARKET SHARE ANALYSIS, 2024

- 16.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 16.5.1 STARS

- 16.5.2 EMERGING LEADERS

- 16.5.3 PERVASIVE PLAYERS

- 16.5.4 PARTICIPANTS

- 16.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 16.5.5.1 Company footprint

- 16.5.5.2 Region footprint

- 16.5.5.3 Insertion type footprint

- 16.5.5.4 Coating type footprint

- 16.5.5.5 End-user footprint

- 16.6 COMPANY EVALUATION MATRIX: SMES/STARTUPS, 2024

- 16.6.1 PROGRESSIVE COMPANIES

- 16.6.2 RESPONSIVE COMPANIES

- 16.6.3 DYNAMIC COMPANIES

- 16.6.4 STARTING BLOCKS

- 16.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 16.6.5.1 Detailed list of key startups/SMEs

- 16.6.5.2 Competitive benchmarking of key emerging players/startups

- 16.7 COMPANY VALUATION & FINANCIAL METRICS

- 16.8 BRAND/PRODUCT COMPARISON

- 16.9 COMPETITIVE SCENARIO

- 16.9.1 PRODUCT LAUNCHES & APPROVALS

- 16.9.2 DEALS

- 16.9.3 EXPANSIONS

17 COMPANY PROFILES

- 17.1 KEY PLAYERS

- 17.1.1 COLOPLAST A/S

- 17.1.1.1 Business overview

- 17.1.1.2 Products offered

- 17.1.1.3 Recent developments

- 17.1.1.3.1 Expansions

- 17.1.1.4 MnM view

- 17.1.1.4.1 Key strengths

- 17.1.1.4.2 Strategic choices

- 17.1.1.4.3 Weaknesses & competitive threats

- 17.1.2 BECTON, DICKINSON AND COMPANY

- 17.1.2.1 Business overview

- 17.1.2.2 Products offered

- 17.1.2.3 Recent developments

- 17.1.2.3.1 Deals

- 17.1.2.4 MnM view

- 17.1.2.4.1 Key strengths

- 17.1.2.4.2 Strategic choices

- 17.1.2.4.3 Weaknesses & competitive threats

- 17.1.3 TELEFLEX INCORPORATED

- 17.1.3.1 Business overview

- 17.1.3.2 Products offered

- 17.1.3.3 MnM view

- 17.1.3.3.1 Key strengths

- 17.1.3.3.2 Strategic choices

- 17.1.3.3.3 Weaknesses & competitive threats

- 17.1.4 CARDINAL HEALTH, INC.

- 17.1.4.1 Business overview

- 17.1.4.2 Products offered

- 17.1.4.3 Recent developments

- 17.1.4.3.1 Expansions

- 17.1.4.4 MnM view

- 17.1.4.4.1 Key strengths

- 17.1.4.4.2 Strategic choices

- 17.1.4.4.3 Weaknesses & competitive threats

- 17.1.5 B. BRAUN SE

- 17.1.5.1 Business overview

- 17.1.5.2 Products offered

- 17.1.5.3 MnM view

- 17.1.5.3.1 Key strengths

- 17.1.5.3.2 Strategic choices

- 17.1.5.3.3 Weaknesses & competitive threats

- 17.1.6 MEDLINE INDUSTRIES, LP

- 17.1.6.1 Business overview

- 17.1.6.2 Products offered

- 17.1.6.3 Recent developments

- 17.1.6.3.1 Deals

- 17.1.6.3.2 Expansions

- 17.1.7 MEDTRONIC PLC

- 17.1.7.1 Business overview

- 17.1.7.2 Products offered

- 17.1.8 STERIMED GROUP

- 17.1.8.1 Business overview

- 17.1.8.2 Products offered

- 17.1.9 AMSINO INTERNATIONAL, INC.

- 17.1.9.1 Business overview

- 17.1.9.2 Products offered

- 17.1.9.3 Recent developments

- 17.1.9.3.1 Product launches

- 17.1.9.3.2 Expansions

- 17.1.10 BACTIGUARD AB

- 17.1.10.1 Business overview

- 17.1.10.2 Products offered

- 17.1.10.3 Recent developments

- 17.1.10.3.1 Product approvals

- 17.1.11 MCKESSON CORPORATION

- 17.1.11.1 Business overview

- 17.1.11.2 Products offered

- 17.1.1 COLOPLAST A/S

- 17.2 OTHER PLAYERS

- 17.2.1 ADVACARE PHARMA

- 17.2.2 ANGIPLAST PRIVATE LIMITED

- 17.2.3 OPTIMUM MEDICAL LIMITED

- 17.2.4 SUZHOU SUNMED CO., LTD.

- 17.2.5 WELL LEAD MEDICAL CO., LTD.

- 17.2.6 POLYMED

- 17.2.7 HEMC (HOSPITAL EQUIPMENT MANUFACTURING COMPANY)

- 17.2.8 HANGZHOU FORMED MEDICAL DEVICES CO., LTD.

- 17.2.9 RWD LIFE SCIENCE CO., LTD.

- 17.2.10 PENNINE HEALTHCARE

- 17.2.11 GUANGDONG BAIHE MEDICAL TECHNOLOGY CO., LTD.

- 17.2.12 GPC MEDICAL LTD.

- 17.2.13 ADVIN HEALTH CARE

- 17.2.14 RIBBEL INTERNATIONAL LTD.

- 17.2.15 HANDAN FCH MEDICAL TECHNOLOGY CO., LTD.

18 APPENDIX

- 18.1 DISCUSSION GUIDE

- 18.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 18.3 CUSTOMIZATION OPTIONS

- 18.4 RELATED REPORTS

- 18.5 AUTHOR DETAILS