|

시장보고서

상품코드

1819102

동물용 단클론항체 시장 : 동물 유형별, 제품별, 투여 경로별, 치료 분야별, 최종사용자별, 지역별 - 예측(-2030년)Veterinary Monoclonal Antibodies Market by Animal Type (Canine, Feline, Swine), Product (Cytopoint, Librela, Solensia), Therapy Area (Dermatology, Infectious, Osteoarthritis, Pain, Oncology, Others), Route of Administration - Global Forecast to 2030 |

||||||

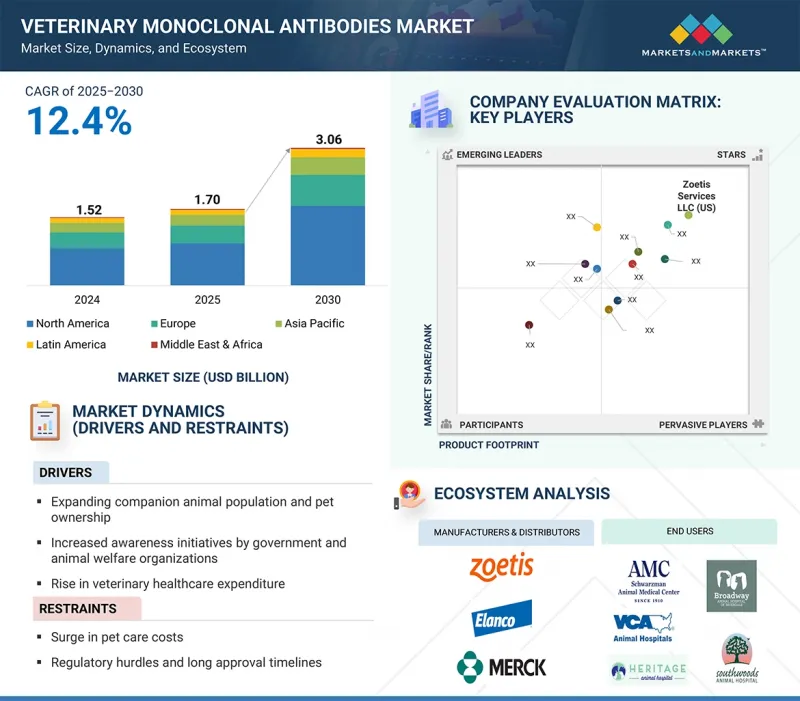

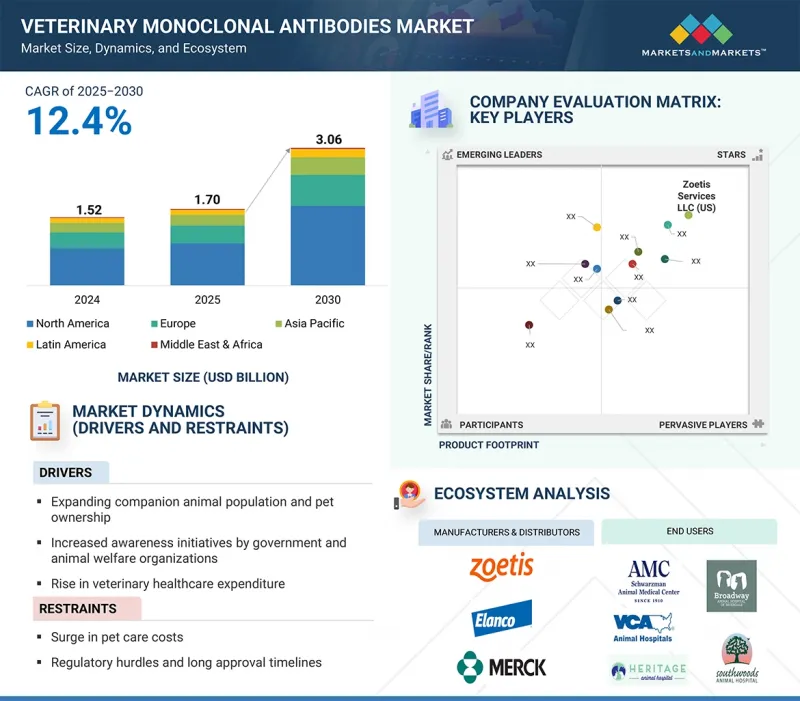

세계의 동물용 단클론항체 시장 규모는 2025년 17억 달러에서 2030년에는 30억 6,000만 달러에 달하고, CAGR은 12.4%로 성장할 것으로 예측됩니다.

이 시장은 반려동물 인구의 증가와 반려동물 양육률의 상승에 힘입어 괄목할 만한 성장세를 보이고 있습니다. 만성질환에 대한 관심이 높아지면서 수의학적 치료에 대한 수요가 더욱 증가하고 있습니다. 정부 및 동물보호단체는 동물보호 캠페인을 적극적으로 추진하고 있으며, 반려동물과 가축의 피부질환을 조기에 진단하고 치료할 수 있도록 장려하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2023-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러/10억 달러) |

| 부문 | 동물 유형별, 제품별, 투여 경로별, 치료 분야별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

하지만 반려동물 의료비 상승으로 인해 치료 도입이 제한되는 등의 문제에 직면해 있습니다. 또한, 규제 지침이 엄격하고 의약품 승인에 시간이 오래 걸리기 때문에 시장 성장을 더욱 억제하고 있습니다. 이러한 장애물에도 불구하고, 피부과와 골관절염 이외의 치료 적응증 확대는 새로운 시장 기회를 지속적으로 창출하고 있습니다.

반려견 사육률 증가와 동물 건강 관리에 대한 지출 증가로 인해 개 부문이 2024년 가장 큰 시장 점유율을 차지했습니다. 개는 알레르기, 곰팡이 감염, 외부 기생충 감염 등 피부 질환에 걸리기 쉬워 잦은 피부과 치료가 필요합니다. 반려동물의 인간화 추세와 고급 수의학에 대한 수요가 시장 성장을 더욱 뒷받침하고 있습니다. 또한, 생물학적 제제 및 표적 단클론항체 치료를 포함한 피부과 치료의 발전은 반려견의 치료 결과를 개선하고 이 부문에서 시장에서의 우위를 확고히 하고 있습니다.

피하 투여 부문은 투여가 용이하고 반려동물의 순응도가 높기 때문에 예측 기간 동안 가장 빠른 속도로 성장할 것으로 예상됩니다. 외용제보다 전신요법을 권장하는 수의사가 증가하고, 감염증을 타겟으로 한 새로운 단클론항체 개발이 진행되면서 수요가 증가하고 있습니다. 또한, 감염성 질환을 타겟으로 한 단클론항체의 기술 혁신은 동물용 단클론항체 시장의 성장을 더욱 촉진하고 있습니다.

사이트포인트 분야는 개 아토피 피부염 치료를 위한 최초이자 유일한 FDA 및 EMA 승인 단클론항체 치료제로서 2024년 가장 큰 시장 점유율을 차지했습니다. 또한, 반려견 아토피 피부염의 높은 유병률, 입증된 효과, 안전성 프로파일, 수의사 채용률 증가로 인해 사이트포인트에 대한 수요가 증가하고 있습니다. 고급 수의학 치료에 대한 보호자들의 투자 의지가 높아지면서 시장 성장에 더욱 박차를 가하고 있습니다.

개 아토피 피부염과 같은 만성질환의 유병률 증가로 인해 피부과 분야가 2024년 가장 큰 시장 점유율을 차지했습니다. 또한, 미국 조에티스(Zoetis)의 사이토포인트(Cytopoint)와 같은 첨단 치료 옵션에 대한 인식이 높아지면서 반려견의 알레르기성 피부염 및 아토피성 피부염 치료에 있어 장기적인 완화와 최소한의 부작용으로 큰 지지를 받고 있습니다. 반려동물의 건강관리에 대한 지출 의지가 이 시장의 성장을 더욱 촉진하고 있습니다.

동물병원/전문센터는 동물병원 방문 증가와 반려동물 건강관리 전문 서비스 이용 가능성에 힘입어 가장 빠른 성장이 예상됩니다. 이들 시설에서는 다양한 증상에 대한 고급 진단, 처방약, 수술 등 종합적인 치료 옵션을 제공하고 있습니다. 또한, 피부과 치료에 반려동물 보험이 적용되면서 보호자들이 수의사에게 진료를 받으면서 이 분야의 수요를 증가시키고 있습니다.

북미는 잘 구축된 동물 건강 관리 인프라와 높은 반려동물 사육률에 힘입어 2024년 가장 큰 시장 점유율을 차지했습니다. 이 지역에는 혁신적인 단클론항체 치료제의 연구개발에 투자하는 주요 시장 진입 기업들이 많이 진출해 있습니다. 반려동물의 건강에 대한 인식이 높아지고 동물 의료에 대한 지출이 증가하는 것도 시장 성장의 원동력이 되고 있습니다. 고급 펫케어 제품에 대한 수요 증가도 세계 동물용 단클론항체 시장에서 북미의 우위를 더욱 강화시키고 있습니다.

세계의 동물용 단클론항체 시장에 대해 조사했으며, 동물 종류별, 제품별, 투여 경로별, 치료 분야별, 최종사용자별, 지역별 동향, 시장 진입 기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 소개

제2장 조사 방법

제3장 주요 요약

제4장 주요 인사이트

제5장 시장 개요

- 소개

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 공급망 분석

- 생태계 분석

- 투자와 자금 조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년의 주요 회의와 이벤트

- 규제 상황

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 미충족 수요/최종사용자 기대

- 상환 분석

- 파이프라인 분석

- 동물용 단클론항체 시장의 AI/GEN AI의 영향

- 2025년 미국 관세의 영향

제6장 동물용 단클론항체 시장(동물 유형별)

- 소개

- 개과

- 고양이과

- 기타

제7장 동물용 단클론항체 시장(제품별)

- 소개

- 로키베트엠에이비(사이토포인트)

- 베딘베트엠에이비(리브레라)

- 프루네베타브(솔렌시아)

- 개 파보바이러스 단클론항체(CPMA)

- 길베트엠에이비

- 기타

제8장 동물용 단클론항체 시장(투여 경로별)

- 소개

- 피하 투여

- 정맥내 투여

- 경구 투여

제9장 동물용 단클론항체 시장(치료 분야별)

- 소개

- 피부과

- 통증 관리

- 감염증

- 종양

- 기타

제10장 동물용 단클론항체 시장(최종사용자별)

- 소개

- 동물 병원/전문 센터

- 수의 클리닉

- 수의학 연구·학술기관

- 기타

제11장 동물용 단클론항체 시장(지역별)

- 소개

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 네덜란드

- 기타

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 호주

- 한국

- 뉴질랜드

- 기타

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 반려동물이나 식용 동물 증가가 시장을 견인

- 중동 및 아프리카의 거시경제 전망

제12장 경쟁 구도

- 소개

- 주요 진출 기업의 전략/강점

- 매출 점유율 분석, 2022-2024년

- 시장 점유율 분석, 2024년

- 브랜드/제품 비교

- 기업 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 진출 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제13장 기업 개요

- 주요 진출 기업

- ZOETIS SERVICES LLC

- ELANCO

- MERCK & CO., INC.

- ANIMAB

- 기타 기업

- VAXXINOVA INTERNATIONAL B.V.

- CEVA LOGISTICS

- MABGENESIS INC.

- DECHRA

- BIOGENESIS BAGO

- BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- VIRBAC

- BIOVETA, A.S.

- NIPPON ZENYAKU KOGYO CO., LTD.

제14장 부록

KSM 25.09.29The global veterinary monoclonal antibodies market is projected to reach USD 3.06 billion by 2030, from USD 1.70 billion in 2025, with a CAGR of 12.4%. The market is experiencing significant growth, driven by the expanding companion animal population and rising pet ownership. Growing concerns about chronic diseases have further boosted the demand for veterinary treatments. Government and animal welfare organizations actively promote awareness campaigns, encouraging early diagnosis and treatment of dermatological conditions in both pets and farm animals.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD million/billion) |

| Segments | Animal Type, Product, Therapy Area, Route of Administration, End user |

| Regions covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

However, the market faces challenges such as rising pet care costs, which can limit treatment adoption. Furthermore, strict regulatory guidelines and lengthy approval times for drugs further restrain market growth. Despite these hurdles, expanding therapeutic indications beyond dermatology and osteoarthritis continues to create new market opportunities.

"By animal type, the canine segment held the highest share in 2024."

The canine segment held the largest market share in 2024, driven by rising pet dog ownership and increasing spending on animal healthcare. Dogs are highly prone to skin conditions such as allergies, fungal infections, and ectoparasitic infestations, which require frequent dermatological treatments. The growing trend of pet humanization and the demand for premium veterinary care further support market growth. Additionally, advancements in dermatological treatments, including biologics and targeted monoclonal antibody therapies, improve treatment outcomes for dogs, solidifying the segment's dominance in the market.

"By route of administration, the subcutaneous segment is projected to record the highest CAGR between 2025 and 2030."

The subcutaneous segment is expected to grow at the fastest rate during the forecast period due to its ease of administration and better pet owner compliance. Rising veterinary recommendations for systemic treatments over topical solutions and the ongoing development of new monoclonal antibodies targeting infectious diseases are increasing demand. Moreover, innovations in monoclonal antibodies targeting infectious diseases further support the segment's growth in the veterinary monoclonal antibodies market.

"By product, cytopoint was the leading segment in 2024."

The cytopoint segment held the largest market share in 2024, driven by its status as the first and only FDA- and EMA-approved monoclonal antibody therapy for treating canine atopic dermatitis. Additionally, the high prevalence of atopic dermatitis in dogs has increased demand for cytopoint due to its proven efficacy, safety profile, and rising adoption by veterinarians. The growing willingness of pet owners to invest in advanced veterinary treatments has further fueled market growth.

"By therapy type, dermatology surpassed other segments in 2024."

The dermatology segment held the largest market share in 2024 due to the rising prevalence of chronic diseases such as atopic dermatitis in dogs. Additionally, growing awareness of advanced treatment options like Cytopoint by Zoetis (US) has gained significant traction due to its long-lasting relief and minimal side effects in treating allergic and atopic dermatitis in dogs. The willingness to spend on pet healthcare has further driven this market growth.

"By end user, veterinary hospitals/specialty centers are expected to exhibit the fastest growth during the forecast period."

Veterinary hospitals/specialty centers are expected to grow at the fastest rate, fueled by the rise in veterinary visits and the availability of specialized pet healthcare services. These facilities offer comprehensive treatment options, including advanced diagnostics, prescription medications, and surgical procedures for various conditions. Additionally, pet insurance coverage for dermatological treatments encourages pet owners to seek veterinary care, boosting demand in this segment.

"North America accounted for the largest share in 2024."

North America held the largest market share in 2024, supported by a well-established veterinary healthcare infrastructure and high pet ownership rates. The region has a strong presence of leading market players investing in R&D for innovative monoclonal antibody therapies. Rising awareness about pet health, along with increasing spending on veterinary care, also drives market growth. The growing demand for premium pet care products further contributes to North America's dominance in the global veterinary monoclonal antibodies market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1 - 75%, Tier 2 - 15%, and Tier 3 - 10%

- By Designation: C-level - 30%, D-level - 23%, and Other Designations - 47%

- By Region: North America - 35%, Europe - 20%, Asia Pacific - 25%, Latin America - 13%, and Middle East & Africa - 7%

The major players operating in the veterinary monoclonal antibodies market are Zoetis Services LLC (US), Elanco (US), and Merck & Co., Inc. (US).

Research Coverage

This report examines the veterinary monoclonal antibodies market based on animal type, product, therapy area, route of administration, end user, and region. It also considers factors such as drivers and restraints that influence market growth. The report highlights opportunities and challenges within the market and offers details about the competitive landscape for market leaders. Additionally, it analyzes micro markets concerning their individual growth trends and forecasts the revenue of market segments across five main regions and their respective countries.

Reasons to Buy this Report

The report can assist both established firms and new or smaller companies in understanding the market dynamics, which can help them increase their market share. Companies purchasing the report may employ one or a combination of the five strategies listed below.

This report provides insights into the following points:

- Analysis of key drivers (increased prevalence of chronic diseases in animals, innovation in monoclonal antibodies targeting infectious diseases, rise in companion animal population and pet ownership, growth in veterinary healthcare expenditure), restraints (regulatory hurdles and long approval timelines, high cost of development and treatment), opportunities (expanding therapeutic indications beyond dermatology and osteoarthritis, novel administration routes for monoclonal antibodies, rising strategic developments among market players in development of veterinary monoclonal antibodies), and challenges (emerging safety concerns and adverse events reporting, and limited species-specific knowledge) influencing the growth of veterinary monoclonal antibodies market

- Product Development/Innovation: Detailed insights on upcoming technologies, R&D activities, and product launches in the veterinary monoclonal antibodies market

- Market Development: Comprehensive information about lucrative emerging markets. The report analyzes the markets for various types of monoclonal antibody treatments across regions.

- Market Diversification: Exhaustive information about products, untapped regions, recent developments, and investments in the veterinary monoclonal antibodies market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, distribution networks, and manufacturing capabilities of the leading players in the veterinary monoclonal antibodies market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary sources

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 REVENUE SHARE ANALYSIS (BOTTOM-UP APPROACH)

- 2.2.2 EPIDEMIOLOGY-BASED APPROACH

- 2.2.3 COMPANY INVESTOR PRESENTATIONS AND PRIMARY INTERVIEWS

- 2.2.4 TOP-DOWN APPROACH

- 2.2.5 BOTTOM-UP APPROACH

- 2.2.6 PRIMARY INTERVIEWS

- 2.3 GROWTH RATE PROJECTION

- 2.4 DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 VETERINARY MONOCLONAL ANTIBODIES MARKET OVERVIEW

- 4.2 NORTH AMERICA: VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE AND COUNTRY

- 4.3 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE, 2025 VS. 2030

- 4.4 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT, 2025 VS. 2030 (USD MILLION)

- 4.5 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION, 2025 VS. 2030 (USD MILLION)

- 4.6 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA, 2025 VS. 2030 (USD MILLION)

- 4.7 VETERINARY MONOCLONAL ANTIBODIES MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing prevalence of chronic diseases in animals

- 5.2.1.2 Innovations in monoclonal antibodies targeting infectious diseases

- 5.2.1.3 Rise in companion animal population and pet ownership

- 5.2.1.4 Growth in veterinary healthcare expenditure

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory hurdles and long approval timelines

- 5.2.2.2 High cost of development and treatment

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding therapeutic indications beyond dermatology and osteoarthritis

- 5.2.3.2 Novel administration routes for monoclonal antibodies

- 5.2.3.3 Evolving landscape of strategic collaborations and acquisitions

- 5.2.4 CHALLENGES

- 5.2.4.1 Emerging safety concerns and adverse event reporting

- 5.2.4.2 Limited species-specific knowledge

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 INDICATIVE SELLING PRICE, BY KEY PLAYER

- 5.4.2 INDICATIVE SELLING PRICE, BY REGION

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 INVESTMENT AND FUNDING SCENARIO

- 5.8 TECHNOLOGY ANALYSIS

- 5.8.1 KEY TECHNOLOGIES

- 5.8.1.1 Hybridoma technology

- 5.8.1.2 Recombinant antibody production

- 5.8.2 COMPLEMENTARY TECHNOLOGIES

- 5.8.2.1 Long-acting injectables

- 5.8.3 ADJACENT TECHNOLOGIES

- 5.8.3.1 RNA-based therapies

- 5.8.1 KEY TECHNOLOGIES

- 5.9 PATENT ANALYSIS

- 5.9.1 PATENT PUBLICATION TREND

- 5.9.2 JURISDICTION AND TOP APPLICANT ANALYSIS

- 5.10 TRADE ANALYSIS

- 5.10.1 IMPORT DATA

- 5.10.2 EXPORT DATA

- 5.11 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY FRAMEWORK

- 5.12.1.1 North America

- 5.12.1.2 Europe

- 5.12.1.3 Asia Pacific

- 5.12.1.4 Latin America

- 5.12.1.5 Middle East & Africa

- 5.12.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.1 REGULATORY FRAMEWORK

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 BARGAINING POWER OF SUPPLIERS

- 5.13.2 BARGAINING POWER OF BUYERS

- 5.13.3 THREAT OF NEW ENTRANTS

- 5.13.4 THREAT OF SUBSTITUTES

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 KEY BUYING CRITERIA

- 5.15 UNMET NEEDS/END-USER EXPECTATIONS

- 5.16 REIMBURSEMENT ANALYSIS

- 5.17 PIPELINE ANALYSIS

- 5.18 IMPACT OF AI/GEN AI IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 MARKET POTENTIAL OF AI IN VETERINARY MONOCLONAL ANTIBODIES

- 5.18.3 AI USE CASES

- 5.18.4 KEY COMPANIES IMPLEMENTING AI

- 5.19 IMPACT OF 2025 US TARIFF

- 5.19.1 INTRODUCTION

- 5.19.2 KEY TARIFF RATES

- 5.19.3 PRICE IMPACT ANALYSIS

- 5.19.4 IMPACT ON COUNTRY/REGION

- 5.19.5 IMPACT ON END-USE INDUSTRIES

6 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ANIMAL TYPE

- 6.1 INTRODUCTION

- 6.2 CANINES

- 6.2.1 INCREASING PREVALENCE OF OSTEOARTHRITIS AND CANINE ATOPIC DERMATITIS TO BOLSTER GROWTH

- 6.3 FELINES

- 6.3.1 GROWING RECOGNITION OF OSTEOARTHRITIS IN CATS AND SUCCESSFUL LAUNCH OF SOLENSIA TO FUEL MARKET

- 6.4 OTHER ANIMALS

7 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY PRODUCT

- 7.1 INTRODUCTION

- 7.2 LOKIVETMAB (CYTOPOINT)

- 7.2.1 INCREASING PREVALENCE OF ATOPIC DERMATITIS IN DOGS TO PROMOTE GROWTH

- 7.3 BEDINVETMAB (LIBRELA)

- 7.3.1 NEED FOR BETTER PAIN MANAGEMENT SOLUTIONS TO EXPEDITE GROWTH

- 7.4 FRUNEVETMAB (SOLENSIA)

- 7.4.1 ABILITY TO IMPROVE MOBILITY AND COMFORT IN AGING CATS TO AID GROWTH

- 7.5 CANINE PARVOVIRUS MONOCLONAL ANTIBODY (CPMA)

- 7.5.1 INCREASING ADOPTION OF CPMA BY VETERINARY CLINICS, SHELTERS, AND PET OWNERS TO SPUR MARKET

- 7.6 GILVETMAB

- 7.6.1 GROWING TREND TOWARD PERSONALIZED, TARGETED TREATMENTS TO FUEL MARKET

- 7.7 OTHER PRODUCTS

8 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY ROUTE OF ADMINISTRATION

- 8.1 INTRODUCTION

- 8.2 SUBCUTANEOUS ROUTE OF ADMINISTRATION

- 8.2.1 EASE OF ADMINISTRATION AND LOWER RISK OF TISSUE DAMAGE TO FACILITATE GROWTH

- 8.3 INTRAVENOUS ROUTE OF ADMINISTRATION

- 8.3.1 GROWING USE OF IV IN EMERGENCY CASES AND ONCOLOGY TO BOOST MARKET

- 8.4 ORAL ROUTE OF ADMINISTRATION

- 8.4.1 RISING INNOVATIONS IN LIVESTOCK APPLICATIONS TO ENCOURAGE GROWTH

9 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY THERAPY AREA

- 9.1 INTRODUCTION

- 9.2 DERMATOLOGY

- 9.2.1 FAVORABLE SAFETY PROFILE AND IMPROVED EFFICACY TO FOSTER GROWTH

- 9.3 PAIN MANAGEMENT

- 9.3.1 RISING NEED FOR ALTERNATIVE DRUG DELIVERY TO AUGMENT GROWTH

- 9.4 INFECTIOUS DISEASES

- 9.4.1 GROWING FOCUS ON REDUCED HOSPITALIZATION TO DRIVE MARKET

- 9.5 ONCOLOGY

- 9.5.1 INCREASING ADVANCEMENTS IN MONOCLONAL ANTIBODY THERAPIES TO ACCELERATE GROWTH

- 9.6 OTHER THERAPY AREAS

10 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY END USER

- 10.1 INTRODUCTION

- 10.2 VETERINARY HOSPITALS/SPECIALTY CENTERS

- 10.2.1 RISE IN NUMBER OF VETERINARY SPECIALISTS TO SPEED UP GROWTH

- 10.3 VETERINARY CLINICS

- 10.3.1 GROWING PET OWNERSHIP AND PET CARE SPENDING TO FUEL MARKET

- 10.4 VETERINARY RESEARCH & ACADEMIC INSTITUTES

- 10.4.1 INCREASING COLLABORATIVE RESEARCH EFFORTS TO EXPEDITE GROWTH

- 10.5 OTHER END USERS

11 VETERINARY MONOCLONAL ANTIBODIES MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 11.2.2 US

- 11.2.2.1 Strong R&D and early commercial adoption of monoclonal antibodies to drive market

- 11.2.3 CANADA

- 11.2.3.1 Growing pet adoption to drive market

- 11.3 EUROPE

- 11.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 11.3.2 GERMANY

- 11.3.2.1 Established veterinary infrastructure and high rate of pet ownership to aid growth

- 11.3.3 FRANCE

- 11.3.3.1 Growing companion animal population to drive market

- 11.3.4 UK

- 11.3.4.1 Increasing pet ownership to drive the market

- 11.3.5 ITALY

- 11.3.5.1 Strong demand for advanced therapies for companion animals and livestock to augment growth

- 11.3.6 SPAIN

- 11.3.6.1 Ongoing research in veterinary biologics to spur growth

- 11.3.7 NETHERLANDS

- 11.3.7.1 Emerging pet care sector to contribute to growth

- 11.3.8 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 11.4.2 JAPAN

- 11.4.2.1 Increasing awareness about pet health and well-established pet insurance system to drive market

- 11.4.3 CHINA

- 11.4.3.1 Expanding pet market to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Growing pet adoption and veterinary shortage to drive market

- 11.4.5 AUSTRALIA

- 11.4.5.1 Increased spending on veterinary care to support growth

- 11.4.6 SOUTH KOREA

- 11.4.6.1 Increasing awareness and adoption of preventive healthcare measures to drive market

- 11.4.7 NEW ZEALAND

- 11.4.7.1 Rising awareness of skin disorders to expedite growth

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 LATIN AMERICA

- 11.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 11.5.2 BRAZIL

- 11.5.2.1 Expanding large-scale livestock operations to boost market

- 11.5.3 MEXICO

- 11.5.3.1 Increasing demand for targeted biologics in livestock and pets to drive market

- 11.5.4 REST OF LATIN AMERICA

- 11.6 MIDDLE EAST & AFRICA

- 11.6.1 GROWING NUMBER OF COMPANION AND FOOD-PRODUCING ANIMALS TO PROPEL MARKET

- 11.6.2 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

12 COMPETITIVE LANDSCAPE

- 12.1 INTRODUCTION

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 12.2.1 OVERVIEW OF STRATEGIES ADOPTED BY KEY PLAYERS IN VETERINARY MONOCLONAL ANTIBODIES MARKET

- 12.3 REVENUE SHARE ANALYSIS, 2022-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 BRAND/PRODUCT COMPARISON

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6.1 COMPANY VALUATION

- 12.6.2 FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Animal type footprint

- 12.7.5.4 Route of administration footprint

- 12.7.5.5 Therapy area footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND APPROVALS

- 12.9.2 DEALS

- 12.9.3 EXPANSIONS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ZOETIS SERVICES LLC

- 13.1.1.1 Business overview

- 13.1.1.2 Products offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Product launches and approvals

- 13.1.1.3.2 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Key strengths

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses and competitive threats

- 13.1.2 ELANCO

- 13.1.2.1 Business overview

- 13.1.2.2 Products offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Product launches and approvals

- 13.1.2.3.2 Expansions

- 13.1.2.4 MnM view

- 13.1.2.4.1 Key strengths

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses and competitive threats

- 13.1.3 MERCK & CO., INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches and approvals

- 13.1.3.3.2 Expansions

- 13.1.3.4 MnM view

- 13.1.3.4.1 Key strengths

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses and competitive threats

- 13.1.4 ANIMAB

- 13.1.4.1 Business overview

- 13.1.4.2 Products offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Deals

- 13.1.1 ZOETIS SERVICES LLC

- 13.2 OTHER PLAYERS

- 13.2.1 VAXXINOVA INTERNATIONAL B.V.

- 13.2.2 CEVA LOGISTICS

- 13.2.3 MABGENESIS INC.

- 13.2.4 DECHRA

- 13.2.5 BIOGENESIS BAGO

- 13.2.6 BOEHRINGER INGELHEIM INTERNATIONAL GMBH

- 13.2.7 VIRBAC

- 13.2.8 BIOVETA, A.S.

- 13.2.9 NIPPON ZENYAKU KOGYO CO., LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.3.1 PRODUCT ANALYSIS

- 14.3.2 COMPANY INFORMATION

- 14.3.3 GEOGRAPHIC ANALYSIS

- 14.3.4 REGIONAL/COUNTRY-LEVEL MARKET SHARE ANALYSIS

- 14.3.5 COUNTRY-LEVEL VOLUME ANALYSIS

- 14.3.6 BY PRODUCT TYPE MARKET SHARE ANALYSIS (TOP 5 PLAYERS)

- 14.3.7 ANY CONSULTS/CUSTOM REQUIREMENTS AS PER CLIENT REQUEST

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS