|

시장보고서

상품코드

1822291

측방유동 어세이(LFA) 컴포넌트 시장 : 제품별, 기술별, 용도별, 최종사용자별, 지역별 - 예측(-2030년)Lateral Flow Assay Components Market by Type (Membrane, Pad), Application (Clinical Testing (Infectious, Cardiac Marker Test, Fertility, Pregnancy, Cholesterol Testing), Veterinary, Food Safety), Technique, End User & Region - Global Forecast to 2030 |

||||||

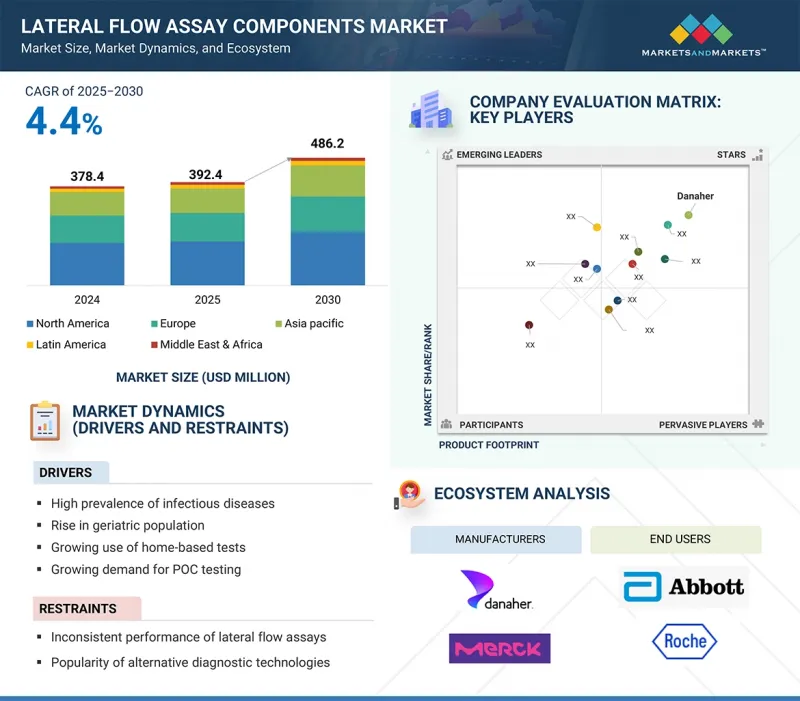

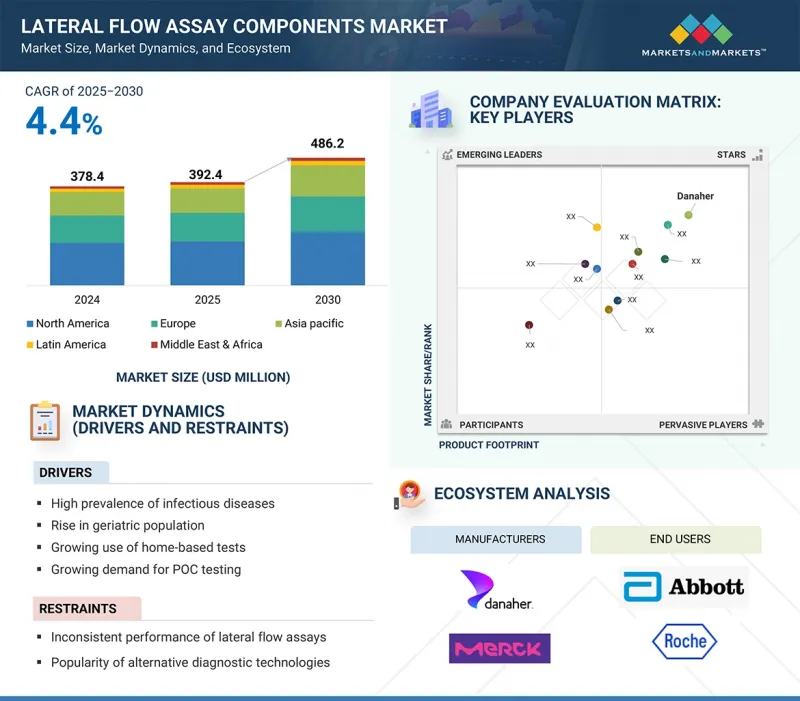

세계의 측방유동 어세이(LFA) 컴포넌트 시장 규모는 2025년 3억 9,240만 달러에서 2030년에는 4억 8,620만 달러에 이를 것으로 예측되며, 예측 기간 중 연평균 복합 성장률(CAGR)은 4.4%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2024-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문 | 제품별, 기술별, 용도별, 최종사용자별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카, GCC 국가 |

최근, 측방유동 어세이(LFA) 컴포넌트 시장은 감염병 유행 증가, 현장 검사 수요 증가, 재택 진단의 채택 확대 등을 배경으로 큰 활기를 띠고 있습니다. 멤브레인, 패드 및 관련 재료의 지속적인 개발로 검사 정확도가 향상되고 납기가 단축되어 임상, 수의학, 식품안전, 의약품 개발 현장에서 사용이 확대되고 있습니다. 기존 기업뿐만 아니라 소재 설계 및 생산방식의 혁신을 주도하는 소규모 및 전문 제조업체도 증가하고 있으며, 최종 사용자의 다양한 니즈와 요구에 부응하는 독자적인 솔루션을 제공합니다.

측방유동 어세이(LFA) 컴포넌트 시장은 샌드위치 분석, 경쟁 분석, 멀티플렉스 검출 분석으로 나뉩니다. 이 중 샌드위치 분석은 민감도, 특이도가 높고 세균성 병원체, 바이러스 항원, 주요 바이오마커와 같은 대형 분석물 검출에 적합하여 2024년 가장 큰 시장 점유율을 차지했습니다. 이 방법은 피분석물을 특이성이 높은 두 개의 항체로 '끼워 넣는' 방식으로 피분석물 농도와 직접적으로 상관관계가 있는 신호가 생성되어 신뢰도 높은 정량 결과를 얻을 수 있습니다. 샌드위치 분석의 우수성은 임신 검사(hCG), 감염 검사(HIV, B형 간염, 헬리코박터 파일로리균), 심장 마커 검출(트로포닌, CK-MB, 미오글로빈) 등 가장 일반적인 진단 검사에 사용됨으로써 그 우수성을 더욱 입증하고 있습니다. 분석물의 농도에 관계없이 일관되게 강력한 제어 라인 신호를 생성하는 능력은 임상 진단 및 재택 진단에 필수적인 검사의 신뢰성을 향상시킵니다. 의료 서비스 제공업체들이 점점 더 많은 POC(Point-of-Care) 솔루션을 채택함에 따라 샌드위치 분석 형식에 맞는 멤브레인, 접합 패드, 나노입자에 대한 수요는 계속 증가하고 있습니다. 대조적으로, 경쟁 분석은 단일 항원 결정기를 가진 작은 분자에 적합하며, 약물 남용 검사 및 특정 식품 안전 응용 분야와 같은 분야에서 여전히 중요합니다. 한편, 멀티플렉스 검출 분석은 여러 타겟을 동시에 분석할 수 있다는 점에서 인기를 끌고 있습니다. 그럼에도 불구하고, 샌드위치 분석의 광범위한 임상 적용과 확립된 진단 정확도는 주로 세계 시장의 성분 소비를 주도하고 있습니다.

최종 사용자별 측방유동 어세이(LFA) 컴포넌트 시장은 의료기기 제조 기업과 의료기기 수탁 제조 기업으로 나뉩니다. 이 중 의료기기 제조 기업은 광범위한 진단 장비의 설계, 엔지니어링 및 제조에서 광범위한 역할을 수행하기 때문에 2024년 시장을 선도하며 주요 점유율을 차지할 것으로 예측됩니다. Abbott(미국), Hoffmann-La Roche(스위스), Danaher Corporation(미국), Siemens Healthineers(독일), Bio-Rad Laboratories(미국), Thermo Fisher Scientific(미국), PerkinElmer(미국), Hologic(미국), Merck KGaA(독일) 등이 멤브레인, 패드, 접합체, 하우징 재료의 주요 소비자입니다. 전염병의 확산, 노인 인구 증가, 재택 및 현장 진단의 확산은 LFA 구성요소를 진단 제품 포트폴리오에 통합하는 것을 촉진하고 있습니다. 이 때문에 의료기기 제조업체가 부품 시장의 주요 수요 촉진요인으로 작용하고 있습니다. 한편, 의료기기 수탁제조업체는 꾸준히 성장하고 있는 분야입니다. OEM이 비용 절감, 빠른 확장성, 전문 지식 활용을 위해 생산을 아웃소싱하는 가운데, 위탁 생산 업체는 멤브레인, 패드 및 기타 소모품의 중요한 구매자가 되고 있습니다. 이러한 추세는 특히 아시아태평양에서 두드러지게 나타나고 있으며, 유리한 인건비와 제조 생태계의 지원으로 세계 기업들이 현지 생산자와의 제휴를 추진하여 이 분야의 부품 수요를 더욱 촉진하고 있습니다.

세계 측방유동 어세이(LFA) 컴포넌트 시장은 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카의 5개 부문으로 분류됩니다. 아시아태평양은 급속한 헬스케어 확대, 강력한 경제 성장, 국내외 기업들의 투자 증가로 인해 예측 기간 동안 측방유동 어세이(LFA) 컴포넌트 시장에서 가장 높은 CAGR을 달성할 것으로 예측됩니다. 이 성장의 주요 요인으로는 중국, 인도, 일본, 한국, 대만, 호주, 싱가포르 등 고성장 국가를 들 수 있습니다. 의료비 지출 증가, 인구 고령화, 평균 수명 연장, 현장 검사 및 재택 검사에 대한 수요 증가 등의 요인으로 인해 멤브레인, 접합 패드, 금 나노입자 및 기타 LFA 구성 요소에 대한 수요가 증가하고 있습니다. 중국과 인도는 의료 인프라의 확대, 소득 증가, 정부의 진단약에 대한 집중으로 인해 여전히 가장 영향력 있는 시장입니다. 인도의 2023-24년 의료 예산 증가는 이러한 노력을 뒷받침하고 있습니다. 한편, 베트남, 인도네시아, 필리핀 등 동남아시아 국가들은 강력한 GDP 성장, 제조 능력 향상, 해외 투자로 인해 새로운 성장 중심지로 부상하고 있습니다. 이러한 성장 동력에도 불구하고, 니어 페이슨트 검사의 장점에 대한 낮은 인지도, 불충분한 보상 제도, 농촌 및 원격지에서의 인프라 격차 등은 완전한 보급을 가로막는 장벽으로 작용하고 있습니다. (인도), J. Mitra, Inc.(인도), J. Mitra & Co.(인도), Nupore Filtration(중국), Equinox(중국)와 같은 경쟁력 있는 현지 제조업체의 존재는 다국적 공급업체와 함께 이 지역의 LFA 부품 생태계를 강화하여 가장 빠르게 성장하는 지역 시장으로서의 지위를 유지하고 있습니다.

세계의 측방유동 어세이(LFA) 컴포넌트 시장에 대해 조사했으며, 제품별/기술별/용도별/최종사용자별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 공급망 분석

- 생태계 분석

- 투자 및 자금조달 시나리오

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- AI가 측방유동 어세이(LFA) 컴포넌트 시장에 미치는 영향

- 2025년 미국 관세의 영향

제6장 측방유동 어세이(LFA) 컴포넌트 시장(제품별)

- 서론

- 멤브레인

- 패드

- 기타

제7장 측방유동 어세이(LFA) 컴포넌트 시장(기술별)

- 서론

- 샌드위치 어세이

- 경쟁 어세이

- 멀티플렉스 감지 어세이

제8장 측방유동 어세이(LFA) 컴포넌트 시장(용도별)

- 서론

- 임상시험

- 동물 의료 진단

- 식품 안전 및 환경 시험

- 의약품 개발 및 품질 시험

제9장 측방유동 어세이(LFA) 컴포넌트 시장(최종사용자별)

- 서론

- 의료기기 제조 회사

- 의료기기 수탁 제조 회사

제10장 측방유동 어세이(LFA) 컴포넌트 시장(지역별)

- 서론

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 유럽

- 거시경제 전망

- 독일

- 프랑스

- 영국

- 이탈리아

- 스페인

- 기타

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 기타

- 라틴아메리카

- 거시경제 전망

- 브라질

- 멕시코

- 기타

- 중동 및 아프리카

- 성장을 가속하기 위해서 헬스케어 예산을 확대한다

- 거시경제 전망

제11장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점, 2024년

- 매출 분석, 2022년-2024년

- 시장 점유율 분석, 2024년

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 개요

- 주요 시장 진출기업

- DANAHER CORPORATION

- SARTORIUS AG

- AHLSTROM

- MERCK KGAA

- ADVANCED MICRODEVICES PVT. LTD.

- DCN DIAGNOSTICS

- FORTIS LIFE SCIENCES, LLC.

- COBETTER

- AXIVA SICHEM PVT. LTD.

- NUPORE FILTRATION SYSTEMS

- 기타 기업

- BALLYA

- EQUINOX

- CYTODIAGNOSTICS INC

- POREX

- KENOSHA

- ANTITECK LIFE SCIENCES LIMITED

- MINIPORE MICRO PRODUCTS

- PRAHAS HEALTHCARE

- NANOHYBRIDS

- PROGNOSIS BIOTECH S.A.

- LATERAL DX

- BANGS LABORATORIES

- BBI SOLUTIONS

- SONA NANOTECH

- ZHEJIANG TAILIN BIOENGINEERING CO., LTD.

제13장 부록

LSH 25.09.30The global lateral flow assay (LFA) components market is projected to reach USD 486.2 million by 2030 from USD 392.4 million in 2025, at a CAGR of 4.4% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2024-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD billion) |

| Segments | Product, Application, Technique, Sample Type, and End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, the Middle East & Africa, and GCC Countries |

In recent years, the lateral flow assay components market has gained significant momentum, driven by the increasing prevalence of infectious diseases, rising demand for point-of-care testing, and greater adoption of home-based diagnostics. Ongoing improvements in membranes, pads, and related materials have improved test accuracy and reduced turnaround times, expanding their use in clinical, veterinary, food safety, and drug development settings. Along with established companies, a growing number of small and specialized manufacturers are leading innovation in material design and production methods, offering unique solutions that meet diverse end-user needs and requirements.

"The sandwich assays segment of the lateral flow assay components market, by technique, is expected to hold the largest position during the forecast period."

The lateral flow assay components market is divided into sandwich assays, competitive assays, and multiplex detection assays. Among these, sandwich assays held the largest market share in 2024, due to their higher sensitivity, specificity, and suitability for detecting larger analytes like bacterial pathogens, viral antigens, and key biomarkers. In this method, the analyte is "sandwiched" between two highly specific antibodies, creating a signal that directly correlates with analyte concentration, ensuring reliable and quantitative results. The dominance of sandwich assays is further supported by their use in some of the most common diagnostic tests, including pregnancy testing (hCG), infectious disease testing (HIV, hepatitis B, H. pylori), and cardiac marker detection (troponin, CK-MB, myoglobin). Their ability to consistently produce strong control line signals, regardless of analyte levels, improves test reliability-a vital aspect for clinical and home-based diagnostics. As healthcare providers increasingly adopt point-of-care solutions, the demand for membranes, conjugate pads, and nanoparticles tailored to sandwich assay formats continues to grow. In contrast, competitive assays-more suitable for small molecules with a single antigenic determinant-remain important in areas like drug-of-abuse testing and certain food safety applications. Meanwhile, multiplex detection assays are gaining popularity for their capacity to analyze multiple targets simultaneously. Nevertheless, it is the extensive clinical applications and established diagnostic accuracy of sandwich assays that primarily drive the consumption of components worldwide market.

"The medical device manufacturing companies accounted for the largest market share in the lateral flow assay components market, by end user."

The lateral flow assay components market, by end user, is divided into medical device manufacturing companies and medical device contract manufacturing companies. Among these, medical device manufacturing companies led the market in 2024, holding the largest share because of their extensive role in designing, engineering, and producing a wide range of diagnostic devices. These companies, including Abbott (US), Hoffmann-La Roche (Switzerland), Danaher Corporation (US), Siemens Healthineers (Germany), Bio-Rad Laboratories (US), Thermo Fisher Scientific (US), PerkinElmer (US), Hologic (US), and Merck KGaA (Germany), are the main consumers of membranes, pads, conjugates, and housing materials. The increasing prevalence of infectious diseases, the growing elderly population, and the rising adoption of home-based and point-of-care diagnostics have driven the integration of LFA components into diagnostic product portfolios. This has made medical device manufacturers the primary demand drivers in the component market. Meanwhile, medical device contract manufacturing companies form a steadily growing segment. As OEMs outsource production for cost savings, faster scalability, and access to specialized expertise, contract manufacturers are becoming important buyers of membranes, pads, and other consumables. This trend is especially strong in Asia-Pacific, where favorable labor costs and supportive manufacturing ecosystems encourage global companies to partner with local producers, further boosting demand for components from this segment.

"The Asia Pacific is the fastest-growing region of the lateral flow assay components market by region."

The global lateral flow assay components market is segmented into five segments, namely, North America, Europe, the Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific region is expected to achieve the highest CAGR in the lateral flow assay components market during the forecast period, driven by rapid healthcare expansion, strong economic growth, and increasing investments from both domestic and international players. Key contributors to this growth include high-growth countries such as China, India, Japan, South Korea, Taiwan, Australia, and Singapore. Factors like rising healthcare expenditure, an aging population, longer life expectancy, and the increasing demand for point-of-care and home-based testing are boosting demand for membranes, conjugate pads, gold nanoparticles, and other LFA components. China and India remain the most influential markets due to their expanding healthcare infrastructure, rising incomes, and government focus on diagnostics. India's increased health budget for FY 2023-24 underscores this commitment. Meanwhile, Southeast Asian economies like Vietnam, Indonesia, and the Philippines are emerging as new growth centers, driven by strong GDP growth, increased manufacturing capacity, and foreign investment. Despite these growth drivers, challenges such as limited awareness of near-patient testing benefits, inadequate reimbursement structures, and infrastructural gaps in rural and remote areas pose barriers to full adoption. Nevertheless, the presence of competitive local manufacturers such as Advanced Microdevices Ltd. (India), J. Mitra & Co. (India), Nupore Filtration (China), and Equinox (China), alongside multinational suppliers, is strengthening the region's LFA component ecosystem and maintaining its position as the fastest-growing regional market.

A breakdown of the primary participants referred to for this report is provided below:

- By Company Type: Tier 1: 38%, Tier 2: 29%, and Tier 3: 33%

- By Designation: C Level: 27%, Director Level: 18%, and Others: 55%

- By Region: North America: 50%, Europe: 20%, Asia Pacific: 20%, Latin America: 7%, and Middle East & Africa: 3%

Note 1: Companies are classified into tiers based on their total revenue. As of 2023, Tier 1 = >USD 10.00 billion, Tier 2 = USD 1.00 billion to USD 10.00 billion, and Tier 3 = <USD 1.00 billion.

Note 2: C-level primaries include CEOs, CFOs, COOs, and VPs.

Note 3: Other designations include sales managers, marketing managers, business development managers, product managers, distributors, and suppliers.

The major players operating in the lateral flow assay components market are Danaher Corporation (US), Sartorius AG (Germany), Merck KGaA (Germany), Ahlstrom (Finland), Advanced Microdevices Pvt. Ltd. (India), DCN Diagnostics (US), Fortis Life Sciences, LLC. (US), Cobetter (China), Axiva Sichem Pvt. Ltd. (India), and Nupore Filtration Systems (India).

Research Coverage

This report examines the lateral flow assay components market based on product, application, technique, end user, and region. It also evaluates factors such as drivers, restraints, opportunities, and challenges impacting market growth, and provides details about the competitive landscape of market leaders. Additionally, the report analyzes micro-markets concerning their individual growth trends. It forecasts the revenue of market segments across five major regions and their respective countries regions).

Reasons to Buy the Report

The report will help both established firms and smaller entrants assess the market, which can assist them in gaining a larger market share. Companies purchasing the report can utilize one or a combination of the strategies listed below to strengthen their market position presence.

This report provides insights into the following pointers:

- Analysis of: key drivers (High prevalence of infectious diseases driving market demand, Rise in geriatric population boosting demand, Growing use of home-based tests driving component consumption, Growing demand for POC testing), restraints (Inconsistent performance of LFAs impacting component demand, Alternative diagnostic technologies limiting adoption), opportunities (Expanding Applications Driving Demand for LFA Components, Rising Demand for LFA Components in the Food & Beverage Sector), challenges (Limited Reimbursements Restricting LFA Component Market, Need for Specialized Storage and Shipping for LFA Membranes)

- Market Penetration: Comprehensive information on the product portfolios offered by the top players in the lateral flow assay components market

- Product Development/Innovation: Detailed insights on the upcoming trends, R&D activities, and product launches in the lateral flow assay components market

- Market Development: Comprehensive information on lucrative emerging regions.

- Market Diversification: Exhaustive information about new products, growing geographies, and recent developments in the lateral flow assay components market

- Competitive Assessment: In-depth assessment of market segments, growth strategies, revenue analysis, and products of the leading market players

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SCOPE

- 1.4 INCLUSIONS AND EXCLUSIONS

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key industry insights

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Based on cost of goods sold & component share

- 2.3.1.3 Approach 3: Primary interviews

- 2.3.1.4 Growth forecast

- 2.3.1.5 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.5 RESEARCH ASSUMPTIONS

- 2.5.1 STUDY-RELATED ASSUMPTIONS

- 2.5.2 PARAMETRIC ASSUMPTIONS

- 2.5.3 GROWTH RATE ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 LATERAL FLOW ASSAY (LFA) COMPONENTS MARKET OVERVIEW

- 4.2 ASIA PACIFIC: LATERAL FLOW ASSAY COMPONENTS MARKET, BY PRODUCT AND COUNTRY

- 4.3 LATERAL FLOW ASSAY COMPONENTS MARKET, BY KEY COUNTRY

- 4.4 LATERAL FLOW ASSAY COMPONENTS MARKET, REGIONAL MIX, 2025 VS. 2030

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 High prevalence of infectious diseases

- 5.2.1.2 Rise in geriatric population

- 5.2.1.3 Growing use of home-based tests driving consumption of components

- 5.2.1.4 Growing demand for POC testing

- 5.2.2 RESTRAINTS

- 5.2.2.1 Inconsistent performance of LFAs impacting demand for components

- 5.2.2.2 Alternative diagnostic technologies

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expanding applications driving demand for LFA components

- 5.2.3.2 Rising demand for LFA components in food & beverage industry

- 5.2.4 CHALLENGES

- 5.2.4.1 Limited reimbursements

- 5.2.4.2 Need for specialized storage and shipping for LFA components

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND OF LATERAL FLOW ASSAY COMPONENTS, BY KEY PLAYERS, 2023-2025

- 5.4.2 AVERAGE SELLING PRICE TREND OF LATERAL FLOW ASSAY COMPONENTS, BY REGION, 2023-2025

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 ECOSYSTEM ANALYSIS

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Membrane technology

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Lyophilization

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Enzyme-linked immunosorbent assays

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 LIST OF MAJOR PATENTS

- 5.11 TRADE ANALYSIS

- 5.11.1 IMPORT DATA (HS CODE 382200)

- 5.11.2 EXPORT DATA (HS CODE 382200)

- 5.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY ANALYSIS

- 5.13.1.1 North America

- 5.13.1.2 Europe

- 5.13.1.3 Asia Pacific

- 5.13.1.3.1 India

- 5.13.1.3.2 China

- 5.13.1.3.3 Japan

- 5.13.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2.1 North America

- 5.13.2.2 Europe

- 5.13.2.3 Asia Pacific

- 5.13.2.4 Latin America

- 5.13.2.5 Rest of the World

- 5.13.1 REGULATORY ANALYSIS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 THREAT OF NEW ENTRANTS

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF AI ON LATERAL FLOW ASSAY COMPONENTS MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 POTENTIAL OF AI IN LATERAL FLOW ASSAY COMPONENTS MARKET

- 5.16.3 AI USE CASES

- 5.16.4 FUTURE OF AI IN LATERAL FLOW ASSAY COMPONENTS MARKET

- 5.17 IMPACT OF 2025 US TARIFFS

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 KEY IMPACTS ON REGIONS

- 5.17.4.1 North America

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON END-USE INDUSTRIES

- 5.17.5.1 Medical device manufacturing companies

6 LATERAL FLOW ASSAY COMPONENTS MARKET, BY PRODUCT

- 6.1 INTRODUCTION

- 6.2 MEMBRANES

- 6.2.1 NITROCELLULOSE MEMBRANES

- 6.2.1.1 High protein-binding affinity to drive growth

- 6.2.2 OTHER MEMBRANES

- 6.2.1 NITROCELLULOSE MEMBRANES

- 6.3 PADS

- 6.3.1 SAMPLE PADS

- 6.3.1.1 Role of sample pads in ensuring even and controlled sample distribution to drive growth

- 6.3.2 CONJUGATE PADS

- 6.3.2.1 Conjugate pads as key performance controllers in lateral flow immunoassays to drive growth

- 6.3.3 ABSORBENT PADS

- 6.3.3.1 Absorbent pads as critical backflow preventers in l ateral flow immunoassays to drive growth

- 6.3.1 SAMPLE PADS

- 6.4 OTHERS

7 LATERAL FLOW ASSAY COMPONENTS MARKET, BY TECHNIQUE

- 7.1 INTRODUCTION

- 7.2 SANDWICH ASSAYS

- 7.2.1 SUPERIOR SENSITIVITY AND SPECIFICITY TO DRIVE DEMAND

- 7.3 COMPETITIVE ASSAYS

- 7.3.1 LOWER SENSITIVITY OF COMPETITIVE ASSAYS COMPARED TO SANDWICH FORMATS TO LIMIT GROWTH

- 7.4 MULTIPLEX DETECTION ASSAYS

- 7.4.1 ADOPTION OF MULTI-ANALYTE ASSAYS TO DRIVE GROWTH

8 LATERAL FLOW ASSAY COMPONENTS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 CLINICAL TESTING

- 8.2.1 INFECTIOUS DISEASE TESTING

- 8.2.1.1 Rising demand in emerging markets to drive growth

- 8.2.2 CARDIAC MARKER TESTING

- 8.2.2.1 Cardiovascular disease prevalence to drive demand

- 8.2.3 PREGNANCY & FERTILITY TESTING

- 8.2.3.1 Lifestyle changes and rising infertility rates to fuel demand

- 8.2.4 CHOLESTEROL TESTING/LIPID PROFILING

- 8.2.4.1 Growing prevalence of obesity and cardiovascular diseases to drive demand

- 8.2.5 DRUG-OF-ABUSE TESTING

- 8.2.5.1 Technological advancements and workplace testing initiatives to fuel growth

- 8.2.6 OTHER CLINICAL TESTING APPLICATIONS

- 8.2.1 INFECTIOUS DISEASE TESTING

- 8.3 VETERINARY DIAGNOSTICS

- 8.3.1 INFECTIOUS DISEASE OUTBREAKS IN LARGE LIVESTOCK ANIMALS TO DRIVE DEMAND

- 8.4 FOOD SAFETY & ENVIRONMENTAL TESTING

- 8.4.1 HIGH SENSITIVITY AND EASE OF USE TO FUEL DEMAND FOR LATERAL FLOW ASSAYS IN FOOD SAFETY

- 8.5 DRUG DEVELOPMENT & QUALITY TESTING

- 8.5.1 RISING EMPHASIS ON PRODUCT SAFETY AND QUALITY ASSURANCE TO DRIVE GROWTH

9 LATERAL FLOW ASSAY COMPONENTS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 MEDICAL DEVICE MANUFACTURING COMPANIES

- 9.2.1 RISING POINT-OF-CARE TESTING TO BOOST ADOPTION

- 9.3 MEDICAL DEVICE CONTRACT MANUFACTURING COMPANIES

- 9.3.1 GROWING FOCUS ON FAST AND EARLY DIAGNOSIS TO DRIVE GROWTH

10 LATERAL FLOW ASSAY COMPONENTS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK

- 10.2.2 US

- 10.2.2.1 Expanding patient base and healthcare needs to drive demand

- 10.2.3 CANADA

- 10.2.3.1 Research funding and policy support to drive demand

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK

- 10.3.2 GERMANY

- 10.3.2.1 Rising point-of-care testing to drive growth

- 10.3.3 FRANCE

- 10.3.3.1 Aging population and healthcare policies shaping demand for LFA components

- 10.3.4 UK

- 10.3.4.1 Rising burden of chronic conditions to drive demand

- 10.3.5 ITALY

- 10.3.5.1 Decentralization of healthcare services to support demand

- 10.3.6 SPAIN

- 10.3.6.1 Aging demographics and strong healthcare system to fuel demand

- 10.3.7 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK

- 10.4.2 CHINA

- 10.4.2.1 Modernized healthcare system to drive market

- 10.4.3 JAPAN

- 10.4.3.1 Aging population and advanced healthcare system to fuel demand

- 10.4.4 INDIA

- 10.4.4.1 Growing base of local manufacturers to drive market

- 10.4.5 AUSTRALIA

- 10.4.5.1 Rising infectious disease burden and healthcare spending to drive market

- 10.4.6 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK

- 10.5.2 BRAZIL

- 10.5.2.1 Growing healthcare investments and aging population to drive market

- 10.5.3 MEXICO

- 10.5.3.1 Expanding healthcare access and rising chronic disease burden to drive demand

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 EXPANDING HEALTHCARE BUDGETS TO DRIVE GROWTH

- 10.6.2 MACROECONOMIC OUTLOOK

11 COMPETITIVE LANDSCAPE

- 11.1 OVERVIEW

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2024

- 11.2.1 OVERVIEW OF STRATEGIES ADOPTED BY PLAYERS IN LATERAL FLOW ASSAY COMPONENTS MARKET

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product footprint

- 11.5.5.4 Application footprint

- 11.5.5.5 Technique footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 List of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.7.1 COMPANY VALUATION

- 11.7.2 FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 EXPANSIONS

- 11.9.2 OTHER DEVELOPMENTS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DANAHER CORPORATION

- 12.1.1.1 Business overview

- 12.1.1.2 Products offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Expansions

- 12.1.1.3.2 Others

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses and competitive threats

- 12.1.2 SARTORIUS AG

- 12.1.2.1 Business overview

- 12.1.2.2 Products offered

- 12.1.2.3 MnM view

- 12.1.2.3.1 Key strengths

- 12.1.2.3.2 Strategic choices

- 12.1.2.3.3 Weaknesses and competitive threats

- 12.1.3 AHLSTROM

- 12.1.3.1 Business overview

- 12.1.3.2 Products offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses and competitive threats

- 12.1.4 MERCK KGAA

- 12.1.4.1 Business overview

- 12.1.4.2 Products offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Expansions

- 12.1.5 ADVANCED MICRODEVICES PVT. LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products offered

- 12.1.6 DCN DIAGNOSTICS

- 12.1.6.1 Business overview

- 12.1.6.2 Products offered

- 12.1.7 FORTIS LIFE SCIENCES, LLC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products offered

- 12.1.8 COBETTER

- 12.1.8.1 Business overview

- 12.1.8.2 Products offered

- 12.1.9 AXIVA SICHEM PVT. LTD.

- 12.1.9.1 Business overview

- 12.1.9.2 Products offered

- 12.1.10 NUPORE FILTRATION SYSTEMS

- 12.1.10.1 Business overview

- 12.1.10.2 Products offered

- 12.1.1 DANAHER CORPORATION

- 12.2 OTHER PLAYERS

- 12.2.1 BALLYA

- 12.2.2 EQUINOX

- 12.2.3 CYTODIAGNOSTICS INC

- 12.2.4 POREX

- 12.2.5 KENOSHA

- 12.2.6 ANTITECK LIFE SCIENCES LIMITED

- 12.2.7 MINIPORE MICRO PRODUCTS

- 12.2.8 PRAHAS HEALTHCARE

- 12.2.9 NANOHYBRIDS

- 12.2.10 PROGNOSIS BIOTECH S.A.

- 12.2.11 LATERAL DX

- 12.2.12 BANGS LABORATORIES

- 12.2.13 BBI SOLUTIONS

- 12.2.14 SONA NANOTECH

- 12.2.15 ZHEJIANG TAILIN BIOENGINEERING CO., LTD.

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS