|

시장보고서

상품코드

1822293

센서 패치 시장 : 기술별, 웨어러블 유형별, 제품 유형별, 용도별, 최종 이용 산업별, 지역별 - 예측(-2030년)Sensor Patch Market by Wearable Type (Bodywear, Neckwear, Footwear, Wristwear), Product Type (Temperature, Blood Glucose, Blood Pressure, Heart Rate, ECG, Blood Oxygen, and Others), Application, End-use Industry and Region - Global Forecast to 2030 |

||||||

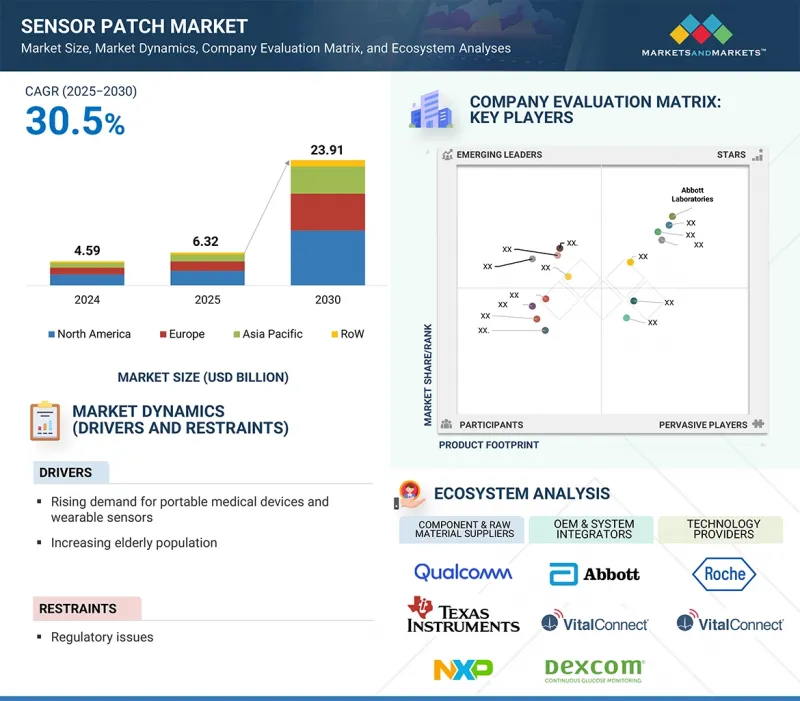

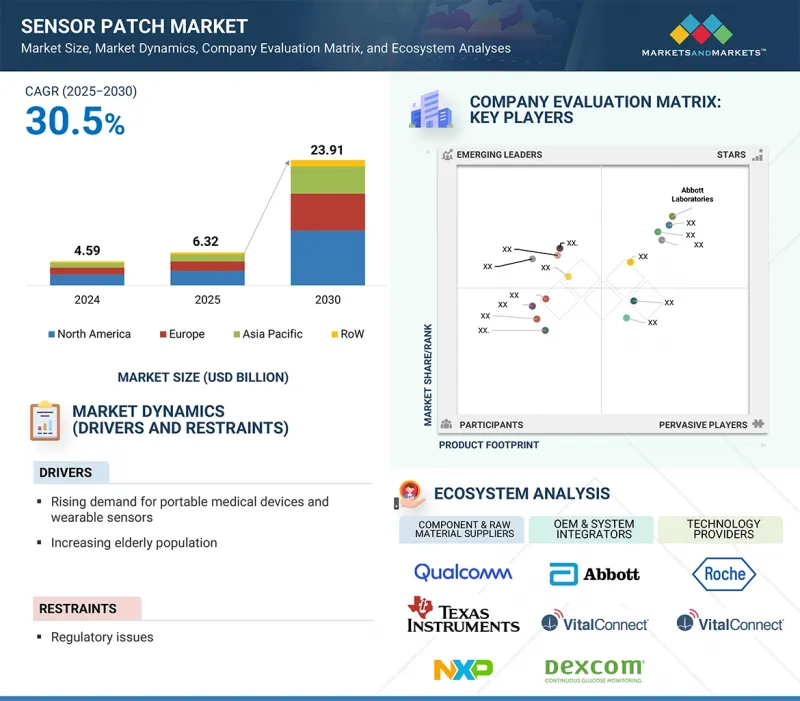

세계의 센서 패치 시장 규모는 30.5%의 연평균 복합 성장률(CAGR)로 확대되어 2025년 63억 2,000만 달러에서 2030년에는 239억 1,000만 달러로 성장할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(10억 달러) |

| 부문별 | 기술별, 웨어러블 유형별, 제품 유형별, 용도별, 최종 이용 산업별, 지역별 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

시장 성장은 당뇨병 환자의 포도당 수치를 모니터링하기 위한 센서 패치 사용 증가, 노인 인구 증가, 무선 모바일 헬스케어 시스템 채택 증가에 기인합니다. 또한, 원격 의료 증가 추세는 시장 성장을 가속하고 있습니다. 웨어러블 센서 패치는 환자의 활력 징후, 미숙아, 어린이, 운동선수, 피트니스 애호가, 의료 및 보건 서비스에서 멀리 떨어진 원격지의 개인을 지속적으로 모니터링할 수 있는 기회가 증가하고 있습니다.

혈당 센서 패치는 혈액이나 땀 속의 포도당 농도를 측정합니다. 이 패치는 당뇨병 환자, 주자, 자전거 타는 사람, 운동선수, 운동선수, 운동선수가 혈당 수치를 기록할 수 있도록 설계되었습니다. 인슐린을 사용하는 당뇨병 환자는 다음 인슐린 투여의 필요성을 판단하기 위해 혈중 포도당 농도를 모니터링합니다. 혈당 센서 패치는 혈당 및 콜레스테롤 검사, 약물 남용, 감염, 임신 검사에 적용되고 있습니다. 혈당 모니터 및 혈당 센서의 주요 제조업체로는 Medtronic(미국)과 Abbott Laboratories(미국), DexCom, Inc.

바디웨어에는 암웨어, 가슴 패치, 센서가 부착된 콘택트렌즈 등이 포함됩니다. 암웨어 패치는 혈압, 체온, 심박수 측정 및 모니터링 등 다양한 헬스케어 용도로 사용됩니다. 이 장치들은 블루투스를 통해 iOS 또는 안드로이드 휴대폰에 연결할 수 있습니다. 가슴 스트랩은 달리기 중 심박수를 모니터링하기 위해 가슴에 착용합니다. 운동선수나 피트니스에 관심이 많은 사람들이 이 기기를 사용하고 있습니다. 또한 땀에 포함된 나트륨 농도를 측정하여 피부에서 직접 땀의 양을 측정할 수 있는 센서도 있습니다. 스마트 콘택트렌즈는 무선 칩으로 구성되어 있으며, 당뇨병 환자들이 사용하고 있습니다. 이 렌즈는 눈물의 포도당 수치를 모니터링하는 데 사용됩니다. 구글(Google Inc., 미국)과 노바티스(Novartis AG, 스위스)는 혈당을 모니터링하고 시력을 교정하는 스마트 콘택트렌즈 제조를 위해 협력하고 있습니다.

중국의 방대한 인구 기반과 현대적 의료 시스템 및 그에 상응하는 상환 시설 개발에 초점을 맞춘 정부 이니셔티브가 시행되고 있는 것이 중국 센서 패치 시장의 성장을 가속하는 주요 요인입니다. 중국의 센서 패치 시장을 촉진하는 다른 요인으로는 급속한 경제 성장, 고령화 인구 증가, 더 나은 의료 서비스 구축을 위한 정부의 이니셔티브 등이 있습니다. 중국 내 다국적기업(MNC) 수출업체와 생산업체들은 대부분 안정적인 국내 유통 및 서비스 인프라를 확보하기 위해 인수 및 제휴 등의 전략을 채택하고 있습니다. 인구 고령화에 따라 심장질환을 포함한 각종 질환의 유병률이 크게 증가할 것으로 예측됩니다.

세계의 센서 패치(Sensor Patch) 시장에 대해 조사했으며, 기술별/웨어러블 유형별/제품 유형별/용도별/최종 이용 산업별/지역별 동향, 시장 진출기업 프로파일 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 밸류체인 분석

- 생태계 분석

- 고객의 비즈니스에 영향을 미치는 동향/혼란

- 가격 분석

- 기술 분석

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 생성형 AI/AI가 센서 패치 시장에 미치는 영향

- 특허 분석

- 무역 분석

- 주요 이해관계자와 구입 기준

- Porter의 Five Forces 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 규제 상황과 기준

- 2025년 미국 관세가 센서 패치 시장에 미치는 영향

제6장 센서 패치 시장(기술별)

- 서론

- 전류 측정

- 전도 비율 측정

- 전위차계

제7장 센서 패치 시장(웨어러블 유형별)

- 서론

- 리스트웨어

- 풋웨어

- 넥웨어

- 바디웨어

제8장 센서 패치 시장(제품 유형별)

- 서론

- 체온 센서 패치

- 혈당 센서 패치

- 혈압 및 혈류 센서 패치

- 심박 센서 패치

- ECG 센서 패치

- 혈중 산소 센서 패치

- 기타

제9장 센서 패치 시장(용도별)

- 서론

- 모니터링

- 진단

- 치료

제10장 센서 패치 시장(최종 이용 산업별)

- 서론

- 헬스케어

- 피트니스 및 스포츠

제11장 센서 패치 시장(지역별)

- 서론

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 독일

- 프랑스

- 영국

- 이탈리아

- 기타

- 아시아태평양

- 중국

- 일본

- 한국

- 인도

- 기타

- 기타 지역

- 남미

- 중동

- 아프리카

제12장 경쟁 구도

- 개요

- 주요 시장 진출기업이 채택한 전략(2021년 1월-2025년 8월)

- 시장 점유율 분석, 2024년

- 매출 분석, 2022년-2024년

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 시장 진출기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오와 동향

제13장 기업 개요

- 주요 시장 진출기업

- ABBOTT LABORATORIES

- MEDTRONIC

- DEXCOM, INC.

- IRHYTHM INC.

- TEXAS INSTRUMENTS INCORPORATED

- MASIMO

- GENTAG, INC.

- KONINKLIJKE PHILIPS N.V.

- SENSEONICS, INC.

- BOSTON SCIENTIFIC CORPORATION

- 기타 기업

- LIFESIGNALS

- VITALCONNECT

- BIOLINQ INCORPORATED

- NANOSONIC, INC.

- G TECH MEDICAL

- SMARTCARDIA INC.

- VIVALNK, INC.

- EPICORE BIOSYSTEMS, INC.

- VPATCH CARDIO PTY LTD

- WEAROPTIMO

- MAKANISCIENCE.NET

- LIEF THERAPEUTICS

- COVESTRO AG

- BIOINTELLISENSE, INC.

- THERANICA BIO-ELECTRONICS LTD.

제14장 부록

LSH 25.09.30The global sensor patch market is projected to grow from 6.32 billion in 2025 to USD 23.91 billion by 2030, at a CAGR of 30.5%.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Technology, Product Type, Wearable Type, Application, End-use Industry, and Region |

| Regions covered | North America, Europe, APAC, RoW |

The growth in the market is attributed to the increasing use of sensor patches to monitor glucose levels in individuals with diabetes, the increasing elderly population, and the rising adoption of wireless mobile healthcare systems. Additionally, the growing trend of telehealth is boosting market growth. Wearable sensor patches find increasing opportunities for continuously monitoring patients' vital signs, premature infants, children, athletes, or fitness buffs, and individuals in remote areas far from medical and health services.

"Blood glucose sensor patch segment to account for significant market share in 2030"

Blood glucose sensor patches measure glucose concentration in blood or sweat. These patches are designed for diabetic patients, runners, cyclists, athletes, and players to keep track of their blood glucose levels. Diabetic patients who use insulin monitor their glucose levels in their blood to determine the requirement for the next insulin dose. Blood glucose sensor patches find applications in blood glucose and cholesterol testing, as well as for testing drug abuse, infectious diseases, and pregnancy. Some major manufacturers of blood glucose monitors and blood glucose sensors include Medtronic (US) and Abbott Laboratories. (US), and DexCom, Inc. (US).

"Bodywear segment to capture largest share of sensor patch market throughout forecast period"

Bodywear includes armwear, chest patches, and sensor-based contact lenses. Armwear patches are used for various healthcare applications, such as measuring and monitoring blood pressure, body temperature, and heart rate. These devices can be connected to iOS or Android phones via Bluetooth. Chest straps are worn on the chest to monitor the heart rate while running. Athletes and fitness-conscious people use these devices. Also, some sensors can measure the sodium level in sweat and determine the sweat rate directly from the skin. Smart contact lenses consist of a wireless chip, which diabetes patients use. These lenses are used to monitor the glucose level in tears. Google Inc. (US) and Novartis AG (Switzerland) are working to manufacture smart contact lenses that monitor blood sugar levels and correct vision.

"China to hold largest share of Asia Pacific sensor patch market in 2030"

The presence of a vast population base in China and the implementation of government initiatives focusing on developing a modern healthcare system and corresponding reimbursement facilities are the major factors promoting the growth of the sensor patch market in the country. Other factors driving the sensor patch market in China include fast economic growth, a growing aging population, and government efforts to create better healthcare services. Many multinational corporations (MNCs) exporters and producers in China have adopted strategies such as acquisitions or partnerships that help in reliable domestic distribution and service infrastructure. With the aging population, there would be a considerable increase in the incidence rates of various disorders, including heart diseases.

Extensive primary interviews were conducted with key industry experts in the sensor patch market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakup of primary participants for the report is shown below: The study contains insights from various industry experts, from component suppliers to tier 1

companies and OEMs. The breakup of the primaries is as follows:

- By Company Type: Tier 1 - 40%, Tier 2 - 35%, and Tier 3 - 25%

- By Designation: C-level Executives - 45%, Directors - 35%, and Others - 20%

- By Region: North America - 30%, Europe - 22%, Asia Pacific - 40%, and RoW - 8%

Note: Three tiers of companies are defined based on their total revenue as of 2024; tier 1: revenue more than or equal to USD 500 million, tier 2: revenue between USD 100 million and USD 500 million, and tier 3: revenue less than or equal to USD 100 million. Other designations include sales and marketing executives, researchers, and members of various sensor patch organizations.

Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), and Boston Scientific Corporation (US) are some key players in the sensor patch market.

The study includes an in-depth competitive analysis of these key players in the sensor patch market, with their company profiles, recent developments, and key market strategies.

Study Coverage:

This research report categorizes the sensor patch market based on wearable type (bodywear, neckwear, footwear, wristwear), product type (temperature, blood glucose, blood pressure, heart rate, ECG, blood oxygen, and other product types (stress monitoring patches, sweat monitoring sensor patches, and position and motion sensor patches), technology (amperometric, potentiometric, conductometric) application (monitoring, diagnostics, medical therapeutics), end-use industry (healthcare, fitness & sports), and region (North America, Europe, Asia Pacific, and RoW). The report describes the major drivers, restraints, challenges, and opportunities pertaining to the sensor patch market and forecasts the same till 2030. The report also consists of leadership mapping and analysis of all companies in the sensor patch ecosystem.

Key Benefits of Buying the Report

The report will help the market leaders/new entrants in this market by providing information on the closest approximations of the revenue numbers for the overall sensor patch market and the subsegments. This report will help stakeholders understand the competitive landscape and gain more insights to position their businesses better and plan suitable go-to-market strategies. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of market dynamics: The report includes drivers (rising demand for portable medical devices and wearable sensors, increasing elderly population, and surging use of sensor patches to monitor glucose levels in individuals with diabetes) restraints (regulatory issues), opportunities (growing adoption of telehealth and high-growth opportunities in the wearable device market), and challenges (issues related to data security due to connected medical devices and design complexities and thermal considerations) influencing the growth of the sensor patch market.

- Product Development/Innovation: The report detailed insights into upcoming technologies, research and development activities, and the latest product and service launches in the sensor patch market.

- Market Development: The report provides comprehensive information about lucrative markets and analyzes the sensor patch market across varied regions.

- Market Diversification: It includes exhaustive information about new products and services, untapped geographies, recent developments, and investments in the sensor patch market.

- Competitive Assessment: Details regarding In-depth assessment of market shares, growth strategies of players, and service offerings of leading players, such as Abbott Laboratories (US), Medtronic PLC (Ireland), DexCom, Inc. (US), iRhythm Technologies, Inc. (US), Texas Instruments Incorporated (US), Masimo (US), GENTAG, Inc. (US), Koninklijke Philips N.V. (Netherlands), Senseonics, Inc. (US), Boston Scientific Corporation (US) are included in the sensor patch market report.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 LIMITATIONS

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 List of major secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary interview participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to derive market size using top-down approach (supply side)

- 2.3 MARKET BREAKDOWN AND DATA TRIANGULATION

- 2.4 RESEARCH ASSUMPTIONS

- 2.5 RESEARCH LIMITATIONS

- 2.6 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES IN SENSOR PATCH MARKET

- 4.2 SENSOR PATCH MARKET FOR HEALTHCARE APPLICATIONS

- 4.3 SENSOR PATCH MARKET IN NORTH AMERICA, BY COUNTRY AND BY PRODUCT

- 4.4 SENSOR PATCH MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising demand for portable medical devices and wearable sensors

- 5.2.1.2 Increasing elderly population

- 5.2.1.3 Increasing use of sensor patches to monitor glucose levels in individuals with diabetes

- 5.2.2 RESTRAINTS

- 5.2.2.1 Regulatory issues

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Growing adoption of telehealth

- 5.2.3.2 High-growth opportunities in wearable device market

- 5.2.4 CHALLENGES

- 5.2.4.1 Issues related to data security due to connected medical devices

- 5.2.4.2 Design complexities and thermal considerations

- 5.2.1 DRIVERS

- 5.3 VALUE CHAIN ANALYSIS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.6 PRICING ANALYSIS

- 5.6.1 AVERAGE SELLING PRICE TREND OF SENSOR PATCHES, BY APPLICATION (USD)

- 5.6.2 AVERAGE SELLING PRICE OF MONITORING & DIAGNOSTICS SENSOR PATCH OFFERED BY THREE KEY PLAYERS (USD)

- 5.6.3 INDICATIVE SELLING PRICE TREND OF SENSOR PATCHES, BY REGION, 2021-2024

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Multiplexed sensor patches

- 5.7.1.2 AI-integrated sensor patch platforms

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Cloud-based data analytics platforms

- 5.7.2.2 Nanotechnology in sensing

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Drug delivery systems

- 5.7.1 KEY TECHNOLOGIES

- 5.8 CASE STUDY ANALYSIS

- 5.8.1 COVESTRO COLLABORATES WITH MEDTECH COMPANIES TO DEVELOP SENSOR-BASED WEARABLE PATCHES TO MONITOR VITAL SIGNS

- 5.8.2 MEDHERANT COLLABORATES WITH BAYER TO LEVERAGE TEPI PATCH TECHNOLOGY FOR IMPROVED DRUG DELIVERY

- 5.8.3 DEXCOM PARTNERS WITH QUALCOMM TO ENABLE SEAMLESS DATA TRANSMISSION FROM PATIENTS' HOMES

- 5.9 INVESTMENT AND FUNDING SCENARIO

- 5.10 IMPACT OF GEN AI/AI ON SENSOR PATCH MARKET

- 5.11 PATENT ANALYSIS

- 5.12 TRADE ANALYSIS

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.16 REGULATORY LANDSCAPE AND STANDARDS

- 5.16.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.16.2 STANDARDS

- 5.17 2025 US TARIFF IMPACT ON SENSOR PATCH MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRY/REGION

- 5.17.4.1 US

- 5.17.5 EUROPE

- 5.17.6 ASIA PACIFIC

- 5.17.7 IMPACT ON APPLICATION

- 5.17.7.1 Healthcare

- 5.17.7.2 Fitness & sports

6 SENSOR PATCH MARKET, BY TECHNOLOGY

- 6.1 INTRODUCTION

- 6.2 AMPEROMETRIC

- 6.2.1 AMPEROMETRIC TECHNIQUE-BASED SENSOR PATCH SOLUTIONS: COST-EFFECTIVE AND EASY TO MASS-PRODUCE

- 6.3 CONDUCTOMETRIC

- 6.3.1 CONDUCTOMETRIC TECHNIQUE-BASED SOLUTIONS: SUITABLE FOR BLOOD GLUCOSE MONITORING DEVICES

- 6.4 POTENTIOMETRIC

- 6.4.1 POTENTIOMETRIC-BASED SENSOR PATCHES: MAINLY USED TO MONITOR TOTAL ION CONTENT IN PERSPIRATION

7 SENSOR PATCH MARKET, BY WEARABLE TYPE

- 7.1 INTRODUCTION

- 7.2 WRISTWEAR

- 7.2.1 HIGH DEMAND FOR MEDICAL AND FITNESS PURPOSES - KEY DRIVERS

- 7.3 FOOTWEAR

- 7.3.1 USE IN TRACKING POSITION FOR FITNESS AND MEDICAL PURPOSES TO BOOST MARKET

- 7.4 NECKWEAR

- 7.4.1 USE IN DIAGNOSIS AND TREATMENT OF APHASIA TO BOOST MARKET

- 7.5 BODYWEAR

- 7.5.1 CAN BE USED FOR VARIOUS HEALTHCARE AND FITNESS APPLICATIONS TO BOOST MARKET

8 SENSOR PATCH MARKET, BY PRODUCT TYPE

- 8.1 INTRODUCTION

- 8.2 TEMPERATURE SENSOR PATCHES

- 8.2.1 ADOPTION FOR PATIENT MONITORING AND DIAGNOSTICS PROPELS MARKET GROWTH

- 8.3 BLOOD GLUCOSE SENSOR PATCHES

- 8.3.1 NEED FOR SELF-MONITORING OF GLUCOSE LEVELS TO FUEL DEMAND

- 8.4 BLOOD PRESSURE/FLOW SENSOR PATCHES

- 8.4.1 INCREASING NEED FOR BLOOD PRESSURE MONITORING IN HOSPITALS TO BOOST MARKET

- 8.5 HEART RATE SENSOR PATCHES

- 8.5.1 GROWING INCIDENCES OF HEART-RELATED DISEASES PROPEL DEMAND

- 8.6 ECG SENSOR PATCHES

- 8.6.1 INCREASING DEMAND FOR ECG SENSOR PATCHES FOR QUICK DIAGNOSIS TO BOOST MARKET GROWTH

- 8.7 BLOOD OXYGEN SENSOR PATCHES

- 8.7.1 BLOOD OXYGEN SENSORS FOR ANESTHESIA MONITORING APPLICATION TO WITNESS STEADY GROWTH

- 8.8 OTHERS

- 8.8.1 NEED TO MONITOR STRESS AND ANXIETY SYMPTOMS OF PATIENTS TO BOOST MARKET

9 SENSOR PATCH MARKET, BY APPLICATION

- 9.1 INTRODUCTION

- 9.2 MONITORING

- 9.2.1 RISING ADOPTION OF PORTABLE PATIENT MONITORING DEVICES TO PROPEL MARKET GROWTH

- 9.3 DIAGNOSTICS

- 9.3.1 INCREASING DEMAND FOR IMPROVED DIAGNOSIS TO LEAD TO GROWTH OF MARKET

- 9.4 MEDICAL THERAPEUTICS

- 9.4.1 USE FOR INSULIN DELIVERY TO BOOST MARKET

10 SENSOR PATCH MARKET, BY END-USE INDUSTRY

- 10.1 INTRODUCTION

- 10.2 HEALTHCARE

- 10.2.1 HOSPITALS & CLINICS

- 10.2.1.1 Large patient volume and high demand from hospitals to propel adoption

- 10.2.2 HOME CARE

- 10.2.2.1 Growing geriatric population and increasing number of diabetic patients to drive adoption in home care settings

- 10.2.3 DIAGNOSTIC LABORATORIES

- 10.2.3.1 Growing volume of clinic data and rising need to modernize imaging workflows to drive segment

- 10.2.1 HOSPITALS & CLINICS

- 10.3 FITNESS & SPORTS

- 10.3.1 GROWING AWARENESS OF HEALTH AND FITNESS BOOSTS DEMAND FOR SENSOR PATCHES

11 SENSOR PATCH MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 US

- 11.2.1.1 Presence of key players that offer sensor patch-based PoC applications to boost market growth

- 11.2.2 CANADA

- 11.2.2.1 Increasing government support likely to escalate growth of market

- 11.2.3 MEXICO

- 11.2.3.1 Use to detect cardiovascular disorders propels market growth

- 11.2.1 US

- 11.3 EUROPE

- 11.3.1 GERMANY

- 11.3.1.1 Monitoring of chronic diseases to accelerate sensor patch market growth

- 11.3.2 FRANCE

- 11.3.2.1 Technological advancements in healthcare systems to drive growth

- 11.3.3 UK

- 11.3.3.1 Rising cardiac diseases and aging population to drive market growth

- 11.3.4 ITALY

- 11.3.4.1 Growing private sector to result in increasing demand for sensor patch

- 11.3.5 REST OF EUROPE

- 11.3.1 GERMANY

- 11.4 ASIA PACIFIC

- 11.4.1 CHINA

- 11.4.1.1 Government initiatives for better healthcare products and services likely to propel market growth

- 11.4.2 JAPAN

- 11.4.2.1 Improved standard of living, rise in health awareness, and surge in aging population - key market drivers

- 11.4.3 SOUTH KOREA

- 11.4.3.1 Improving health infrastructure drives market

- 11.4.4 INDIA

- 11.4.4.1 Growing population accelerates demand for sensor patches for healthcare services

- 11.4.5 REST OF ASIA PACIFIC

- 11.4.1 CHINA

- 11.5 ROW

- 11.5.1 SOUTH AMERICA

- 11.5.1.1 Emerging economies present significant opportunities for market growth

- 11.5.2 MIDDLE EAST

- 11.5.2.1 Significant government and financial support for adoption of POC testing kits to drive market

- 11.5.2.2 GCC

- 11.5.2.2.1 Saudi Arabia

- 11.5.2.2.2 UAE

- 11.5.2.2.3 Rest of GCC

- 11.5.2.3 Rest of Middle East

- 11.5.3 AFRICA

- 11.5.3.1 Increasing penetration in medical devices to boost market

- 11.5.1 SOUTH AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 STRATEGIES ADOPTED BY KEY PLAYERS, JANUARY 2021-AUGUST 2025

- 12.3 MARKET SHARE ANALYSIS, 2024

- 12.4 REVENUE ANALYSIS, 2022-2024

- 12.5 COMPANY VALUATION AND FINANCIAL METRICS

- 12.6 BRAND COMPARISON

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Region footprint

- 12.7.5.3 Product footprint

- 12.7.5.4 Type footprint

- 12.7.5.5 End-use industry footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING

- 12.8.5.1 Sensor patch market: Detailed list of startups/SMEs

- 12.8.5.2 Sensor patch market: Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO AND TRENDS

- 12.9.1 PRODUCT LAUNCHES

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 KEY PLAYERS

- 13.1.1 ABBOTT LABORATORIES

- 13.1.1.1 Business overview

- 13.1.1.2 Products/Solutions/Services offered

- 13.1.1.3 Recent developments

- 13.1.1.3.1 Deals

- 13.1.1.4 MnM view

- 13.1.1.4.1 Right to win

- 13.1.1.4.2 Strategic choices

- 13.1.1.4.3 Weaknesses & competitive threats

- 13.1.2 MEDTRONIC

- 13.1.2.1 Business overview

- 13.1.2.2 Products/Services/Solutions offered

- 13.1.2.3 Recent developments

- 13.1.2.3.1 Deals

- 13.1.2.4 MnM view

- 13.1.2.4.1 Right to win

- 13.1.2.4.2 Strategic choices

- 13.1.2.4.3 Weaknesses & competitive threats

- 13.1.3 DEXCOM, INC.

- 13.1.3.1 Business overview

- 13.1.3.2 Products/Solutions/Services offered

- 13.1.3.3 Recent developments

- 13.1.3.3.1 Product launches

- 13.1.3.4 MnM view

- 13.1.3.4.1 Right to win

- 13.1.3.4.2 Strategic choices

- 13.1.3.4.3 Weaknesses & competitive threats

- 13.1.4 IRHYTHM INC.

- 13.1.4.1 Business overview

- 13.1.4.2 Products/Solutions/Services offered

- 13.1.4.3 Recent developments

- 13.1.4.3.1 Product launches

- 13.1.4.3.2 Deals

- 13.1.4.4 MnM view

- 13.1.4.4.1 Right to win

- 13.1.4.4.2 Strategic choices

- 13.1.4.4.3 Weaknesses & competitive threats

- 13.1.5 TEXAS INSTRUMENTS INCORPORATED

- 13.1.5.1 Business overview

- 13.1.5.2 Products/Solutions/Services offered

- 13.1.5.3 MnM view

- 13.1.5.3.1 Right to win

- 13.1.5.3.2 Strategic choices

- 13.1.5.3.3 Weaknesses & competitive threats

- 13.1.6 MASIMO

- 13.1.6.1 Business overview

- 13.1.6.2 Products/Solutions/Services offered

- 13.1.6.3 Recent developments

- 13.1.6.3.1 Deals

- 13.1.7 GENTAG, INC.

- 13.1.7.1 Business overview

- 13.1.7.2 Products/Solutions/Services offered

- 13.1.8 KONINKLIJKE PHILIPS N.V.

- 13.1.8.1 Business overview

- 13.1.8.2 Products/Solutions/Services offered

- 13.1.8.3 Recent developments

- 13.1.8.3.1 Deals

- 13.1.9 SENSEONICS, INC.

- 13.1.9.1 Business overview

- 13.1.9.2 Products/Solutions/Services offered

- 13.1.9.3 Recent developments

- 13.1.9.3.1 Deals

- 13.1.10 BOSTON SCIENTIFIC CORPORATION

- 13.1.10.1 Business overview

- 13.1.10.2 Products/Solutions/Services offered

- 13.1.10.3 Recent developments

- 13.1.10.3.1 Deals

- 13.1.1 ABBOTT LABORATORIES

- 13.2 OTHER PLAYERS

- 13.2.1 LIFESIGNALS

- 13.2.2 VITALCONNECT

- 13.2.3 BIOLINQ INCORPORATED

- 13.2.4 NANOSONIC, INC.

- 13.2.5 G TECH MEDICAL

- 13.2.6 SMARTCARDIA INC.

- 13.2.7 VIVALNK, INC.

- 13.2.8 EPICORE BIOSYSTEMS, INC.

- 13.2.9 VPATCH CARDIO PTY LTD

- 13.2.10 WEAROPTIMO

- 13.2.11 MAKANISCIENCE.NET

- 13.2.12 LIEF THERAPEUTICS

- 13.2.13 COVESTRO AG

- 13.2.14 BIOINTELLISENSE, INC.

- 13.2.15 THERANICA BIO-ELECTRONICS LTD.

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS