|

시장보고서

상품코드

1823727

전기버스 시장 예측(-2032년) : 버스 전체 길이별, 배터리 유형별, 배터리 용량별, 출력별, 항속거리별, 승차 정원별, 용도별, 소비자별, 차량총중량별, 추진력별, 컴포넌트별, 자율주행 레벨별, 지역별Electric Bus Market by Propulsion, Battery, Length, Battery Capacity, Application, Seating Capacity, Range, Power Output, Autonomy Level, Component, Consumer and Region - Global Forecast to 2032 |

||||||

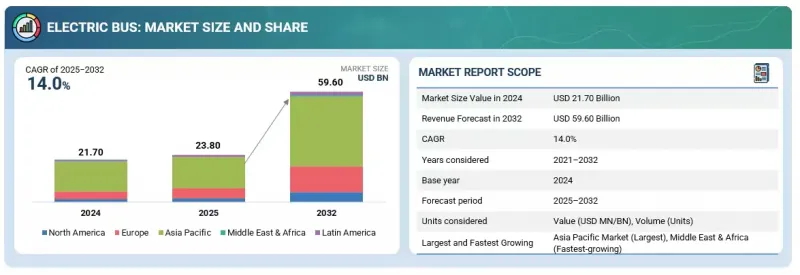

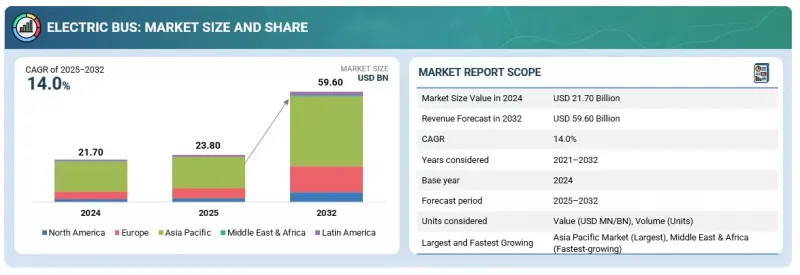

전기버스 시장 규모는 2025년 238억 달러에서 2032년에는 596억 달러로 성장하며, CAGR은 14.0%에 달할 것으로 예측됩니다.

세계 전기버스 시장은 정부의 지원과 기술 발전에 힘입어 지속적으로 성장하고 있습니다. 배터리의 에너지 밀도와 충전 속도의 향상으로 항속거리 불안 등의 우려가 해소되어 전기버스가 디젤 차량과 동등한 운행 성능을 발휘할 수 있게 됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2032년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2032년 |

| 대상 유닛 | 수량(대) 및 금액(100만 달러/10억 달러) |

| 부문 | 버스 전체 길이별, 배터리 유형별, 배터리 용량별, 출력별, 항속거리별, 승차 정원별, 용도별, 소비자별, 차량총중량별, 추진력별, 컴포넌트별, 자율주행 레벨별, 지역별 |

| 대상 지역 | 아시아태평양, 북미, 유럽, 라틴아메리카, 중동 및 아프리카 |

고급 배터리 관리 시스템을 개발하고 LFP 배터리 화학을 채택하여 안전성, 수명, 효율성을 향상시킵니다. 또한 총소유비용(TCO)은 차량 수명주기 동안 연료비와 유지보수 비용이 낮기 때문에 전기버스 수요를 촉진하는 중요한 요소 중 하나입니다.

전기버스는 대규모 보조금과 의무화를 통해 도시 및 도시 간 노선에 광범위하게 배치할 수 있는 대규모 보조금과 의무화를 통해 주로 대중교통 차량을 통해 정부 부문에서 중요한 용도를 가질 준비가 되어 있습니다. 국가 및 도시 수준의 정부는 보조금, 구속력 있는 규제, 차량 교체 의무화 등을 통해 지방 교통 당국이 전기버스를 조달하도록 적극적으로 장려하고 있습니다. 예를 들어 중국 정부는 심천에서 전기버스 차량에 보조금을 지급하고 있으며, 그 결과 심천 버스 그룹(Shenzhen Bus Group)과 같은 지방 자치 단체에서 16,000대 이상의 공공 전기버스를 운행하고 있습니다. 인도에서는 FAME-II 제도가 주정부 교통 사업에 전기버스 1대당 ₹2-4만 달러의 보조금을 제공하고 있으며, 뭄바이의 BEST와 같은 지자체에 7,120대의 공공 전기버스를 조달하고 2027년까지 전국적으로 5만 대의 전기버스 보급을 목표로 하고 있습니다. 미국 연방 교통부는 초당적 인프라 법에 따라 17억 달러를 배정하고, 오리건 주 공립학교 전기버스 보유량의 70%를 차지하는 비버튼 교육구의 28대의 전기버스에서 볼 수 있듯이, 1,300대 이상의 무공해 대중교통 버스에 자금을 지원하고 있습니다. 유럽에서는 EU의 클린버스 보급 구상이 함부르크의 호흐반(Hochbahn)과 같은 유틸리티를 위해 2024년 7,779대의 전기버스 등록을 추진하고 있으며, 2030년까지 100% 전기화 목표를 달성하기 위해 무공해 차량에 대한 보조금을 지급하고 있습니다.

이와는 대조적으로 기업 셔틀버스나 택배와 같은 민간 부문에 대한 적용은 틈새 시장임에는 변함이 없지만, 동등한 정부 지원이 없으면 초기 비용이 많이 들기 때문에 지연되고 있습니다. 네덜란드에서는 비상장 회사가 정부와의 계약에 따라 공공버스를 운행하고 있습니다. 규모나 자금 면에서 정부 주도의 노력이 유리하며, 민간 도입은 공항 셔틀과 같은 특수한 용도에 국한되어 있습니다.

연료전지 전기버스(FCEV)는 배터리 전기버스(BEV)의 대항마로, 특히 장거리 노선이나 충전 인프라가 부족한 지역에서 주목받고 있습니다. 전기버스 전문지에 따르면 유럽에서 수소전기버스 등록대수는 2023년 207대에서 2024년 378대로 82%나 증가했으나, 제로에미션 버스의 4.6% 정도에 불과합니다.

수소전기버스 관련 주요 공급 계약으로는 이탈리아 볼로냐의 대중교통회사(TPER)가 2023년 하반기 130대의 솔라리스 어비노 12 수소버스를 발주해 2026년부터 납품할 계획인 것 등이 있습니다. 영국에서는 리버풀시가 2023년 20대의 Alexander Dennis Enviro400 FCEV를 도입하고, Wrightbus(영국)가 2024년 쾰른에 Hydroliner FCEV 더블데커 버스를 납품할 예정입니다. 아시아에서는 2019년부터 현대자동차의 일렉시티 수소전기자동차가 시판되고 있으며, 2024년 9월에는 국내 판매량이 1,000대를 돌파할 것으로 예측됩니다. 인도에서는 2025년 초 라다크에서 첫 수소연료전지 버스가 운행되기 시작했으며, 이는 험준한 지형에서 중요한 이정표가 될 것입니다.

BEV와 비교했을 때 연료전지 버스의 장점은 빠른 급유시간과 긴 주행거리로, 도시 간 및 지역 간 서비스에 적합합니다. 하지만 수소전기자동차의 에너지 효율이 낮아 BEV의 85-90%인 반면, 수소전기자동차는 60-70%만 에너지를 변환합니다. 또한 가격도 BEV 버스의 2배에서 3배 정도입니다. 2023년 이탈리아 볼차노에서 실시한 조사에 따르면 FCEB의 운영비용은 배터리 버스의 2배 이상이며, 그 주요 원인은 수소 생산, 유통, 급유 인프라 비용으로 나타났습니다. 이 비용 격차는 수소전기자동차를 선택하는 주체가 민간 사업자가 아닌 정부나 대중교통 기관인 이유를 설명해줍니다.

북미, 특히 미국과 캐나다는 예측 기간 중 전기버스의 가장 중요한 시장 중 하나로 부상했습니다. 미국에서는 전기 스쿨버스 분야가 디젤에서 전기버스로의 전환을 주도하고 있습니다. 그 배경에는 2026년까지 50억 달러의 자금을 지원하여 디젤 스쿨버스를 전기버스로 교체할 수 있도록 지원하는 EPA의 클린 스쿨버스 프로그램이 있습니다. 2024년 하반기까지 EPA는 1,000개 학군에서 약 12,000대의 전기 스쿨버스에 대한 보조금을 지급하고 있으며, 이는 이 지역의 가장 중요한 수요 견인차 역할을 하고 있습니다. 2023년에 17억 달러가 배정되며, 2025년까지 무공해 운송 버스 및 충전 인프라에 대한 자금이 계속 배분될 것으로 예상되는 연방 교통국의 저공해 차량 프로그램(Low-No Program)의 지원을 받아, 운송 기관도 채택을 개선하고 있습니다.

캐나다도 비슷한 길을 걷고 있으며, 제로 배출 교통 기금(ZETF)은 2026년까지 20억 달러를 지원하여 지방 자치 단체가 전기 운송 버스를 조달하고 충전 시설을 건설할 수 있도록 돕고 있습니다. 2024년 현재 캐나다에서는 700대 이상의 전기버스가 판매되고 있으며, 2025년에는 더 늘어날 것으로 예측됩니다. 이러한 연방정부와 주정부 차원의 인센티브 덕분에 미국과 캐나다는 북미에서 전기버스 도입의 선두주자로 자리매김하고 있습니다. 전체 전기버스 판매량에서 중국과 유럽이 여전히 우위를 점하고 있지만, 북미가 스쿨버스의 전기화에 주력하고 있는 것은 이 지역만의 특징입니다.

세계의 전기버스 시장에 대해 조사했으며, 버스 전체 길이별, 배터리 유형별, 배터리 용량별, 출력별, 항속거리별, 승차 정원별, 용도별, 소비자별, 차량총중량별, 추진력별, 컴포넌트별, 자율주행 레벨별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

제6장 업계 동향

- AI/생성형 AI가 전기버스 시장에 미치는 영향

- 무역 분석

- 에코시스템 분석

- 공급망 분석

- 총소유 비용 : 디젤 버스 vs.전기버스

- 가격 분석

- 특허 분석

- 규제 상황

- 사례 연구 분석

- 고객 비즈니스에 영향을 미치는 동향과 혼란

- 부품 표 분석

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 주요 이해관계자와 구입 기준

- 공급업체 분석

- 투자와 자금조달 시나리오

제7장 OEM 분석

제8장 기술 분석

- 기술 분석

- 주요 기술

- 인접 기술

- 보완적 기술

제9장 전기버스 시장(버스 전체 길이별)

- 서론

- 9M 미만

- 9-14M

- 14M 이상

- 주요 업계 인사이트

제10장 전기버스 시장(배터리 유형별)

- 서론

- NMC 배터리

- LFP 배터리

- NCA 배터리

- 기타

- 주요 업계 인사이트

제11장 전기버스 시장(배터리 용량별)

- 서론

- 400KWH 미만

- 400KWH 이상

- 주요 업계 인사이트

제12장 전기버스 시장(출력별)

- 서론

- 250kW 미만

- 250kW 이상

- 주요 인사이트

제13장 전기버스 시장(항속거리별)

- 서론

- 300마일 미만

- 300마일 이상

- 주요 인사이트

제14장 전기버스 시장(승차 정원별)

- 서론

- 40석 미만

- 40-70석

- 70석 이상

- 주요 업계 인사이트

제15장 전기버스 시장(용도별)

- 서론

- 시내 버스/노선버스

- 코치

- 스쿨버스

- 기타

- 주요 업계 인사이트

제16장 전기버스 시장(소비자별)

- 서론

- 프라이빗

- 정부

- 주요 업계 인사이트

제17장 전기버스 시장(차량총중량(GVW)별)

- 서론

- 10톤 미만

- 10-20톤

- 20톤 이상

- 주요 업계 인사이트

제18장 전기버스 시장(추진력별)

- 서론

- 배터리 전기버스

- 연료전지 전기버스

- 주요 업계 인사이트

제19장 전기버스 시장(컴포넌트별)

- 서론

- 모터

- 배터리

- 연료전지 스택

- 배터리 관리 시스템

- 배터리 냉각 시스템

- DC-DC 컨버터

- 인버터

- AC/DC 충전기

- EV 커넥터

- 주요 업계 인사이트

제20장 전기버스 시장(자율주행 레벨별)

- 서론

- 반자율형

- 자율형

- 주요 업계 인사이트

제21장 전기버스 시장(지역별)

- 서론

- 아시아태평양

- 거시경제 전망

- 중국

- 일본

- 인도

- 한국

- 싱가포르

- 인도네시아

- 호주

- 유럽

- 거시경제 전망

- 프랑스

- 독일

- 스페인

- 이탈리아

- 노르웨이

- 스웨덴

- 덴마크

- 네덜란드

- 벨기에

- 영국

- 핀란드

- 폴란드

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 라틴아메리카

- 거시경제 전망

- 아르헨티나

- 브라질

- 칠레

- 멕시코

- 콜롬비아

- 중동 및 아프리카

- 거시경제 전망

- 남아프리카공화국

- 아랍에미리트

- 카타르

제22장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 전기버스 시장 점유율 분석(2024년)

- 매출 분석

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 기업 평가

- 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제23장 기업 개요

- 주요 참여 기업

- BYD COMPANY LTD.

- YUTONG BUS CO., LTD.

- ZHEJIANG GEELY HOLDING GROUP

- DAIMLER TRUCK AG

- NFI GROUP

- AB VOLVO

- CAF(SOLARIS BUS & COACH SP. Z O.O.)

- ZHONGTONG BUS HOLDING CO., LTD.

- CRRC CORPORATION LIMITED

- VDL GROEP

- EBUSCO

- XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.

- 기타 기업

- BLUE BIRD CORPORATION

- GILLIG LLC.

- THE LION ELECTRIC COMPANY

- TATA MOTORS LIMITED.

- ASHOK LEYLAND

- SUNDA NEW ENERGY TECHNOLOGY CO., LTD.

- GREE ALTAIRNANO NEW ENERGY INC.

- XIAMEN GOLDEN DRAGON BUS CO. LTD.

- JBM GROUP

- SCANIA AB

- IRIZAR GROUP

- IVECO S.P.A

- BLUEBUS

- BOZANKAYA

- CAETANOBUS

- CHARIOT MOTORS

- HEULIEZ BUS

- OTOKAR OTOMOTIV VE SAVUNMA SANAYI A.S.

- TEMSA

- URSUS S.A.

- VAN HOOL

- KARSAN

- MELLOR

- HINO MOTORS, LTD.

- ANHUI ANKAI AUTOMOBILE CO., LTD.

- OLECTRA GREENTECH LIMITED

제24장 시장에서 제안

제25장 부록

KSA 25.10.02The electric bus market is projected to grow from USD 23.80 billion in 2025 to USD 59.60 billion by 2032, at a CAGR of 14.0%. The global electric bus market is experiencing consistent growth, driven by government support and significant technological advancements. Improvements in battery energy density and charging speeds address concerns like range anxiety and allow electric buses to match the operational performance of diesel fleets.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2032 |

| Base Year | 2024 |

| Forecast Period | 2025-2032 |

| Units Considered | Volume (Units) and Value (USD Million/Billion) |

| Segments | The Electric Bus Market By Propulsion, By Battery Type, By Consumer Type, By Length of Bus, By Seating Capacity, Level of Autonomy, Range, By Application, By GVW |

| Regions covered | Asia Pacific, North America, Europe, Latin America, the Middle East & Africa |

Developing advanced battery management systems and adopting LFP battery chemistry enhances safety, longevity, and efficiency. Additionally, the total cost of ownership (TCO) is one of the critical factors driving the demand for electric buses as they have lower fuel and maintenance costs over the vehicle's lifecycle.

"The government sector is estimated to generate the largest demand for electric buses in 2025."

Electric buses are poised to have significant applications in the government sector, primarily through public transit fleets, due to large-scale subsidies and mandates that enable widespread deployment for urban and intercity routes. National and city-level governments actively push local transport authorities to procure electric buses through subsidies, binding regulations, and fleet replacement mandates. For instance, China's government has subsidized electric bus fleets in Shenzhen, resulting in over 16,000 public e-buses operated by municipal companies like Shenzhen Bus Group. In India, the FAME-II scheme provides ₹20-40 lakh subsidies per e-bus for state transport undertakings, leading to 7,120 public e-buses procured for municipal fleets like BEST in Mumbai, targeting 50,000 e-buses nationwide by 2027. The US Federal Transit Administration's USD 1.7 billion allocation under the Bipartisan Infrastructure Law has funded over 1,300 zero-emission public transit buses, as seen in Beaverton School District's 28 e-school buses, covering 70% of Oregon's public-school electric bus fleet. In Europe, the EU's Clean Bus Deployment Initiative has driven 7,779 e-bus registrations in 2024 for public operators like Hochbahn in Hamburg, with subsidies for zero-emission fleets achieving 100% electrification targets by 2030.

In contrast, private sector applications, such as corporate shuttles or delivery fleets, remain niche but lag due to higher upfront costs without equivalent government support. Private companies in the Netherlands operate public buses under government contracts; the scale and funding favor government-led initiatives, with private adoption limited to specialized uses like airport shuttles, where e-buses save USD 125,000 in maintenance over diesel counterparts but require custom infrastructure.

"The fuel cell electric bus market is projected to witness a positive growth rate during the forecast period."

Fuel-cell electric buses (FCEVs) are gaining attention as a counterpart to battery electric buses (BEVs), especially for longer routes and regions with limited charging infrastructure. According to an electric bus magazine, in Europe, registrations of FCEV buses increased from 207 in 2023 to 378 in 2024, an 82% jump, yet they still represent only about 4.6% of zero-emission buses.

Major supply contracts related to FCEV buses include the public transport company (TPER) in Bologna, Italy, placing an order for 130 Solaris Urbino 12 hydrogen buses in late 2023, with deliveries planned from 2026. In the UK, Liverpool city introduced 20 Alexander Dennis Enviro400FCEVs in 2023, while Wrightbus (UK) delivered its Hydroliner FCEV double-decker buses to Cologne in 2024. In Asia, Hyundai's Elec City FCEV has been commercially available since 2019 and has surpassed 1,000-unit sales in South Korea by September 2024. In India, the first hydrogen fuel-cell bus entered service in Ladakh in early 2025, marking an important milestone in challenging terrain.

The benefits of fuel cell buses compared to BEVs lie in their fast-refueling times and extended driving range, which make them better suited for intercity and regional services. However, FCEVs are less energy efficient, converting only 60 to 70% of energy compared to 85 to 90% for BEVs. These buses are also twice to three times as expensive as BEV buses. A 2023 study in Bolzano, Italy, found that the running costs of FCEBs were more than twice those of battery buses, primarily due to hydrogen production, distribution, and fueling infrastructure costs. This cost gap explains why only governments and public transport agencies opt for FCEVs rather than private operators.

"North America is projected to be one of the major electric bus markets."

North America, particularly the US and Canada, is emerging as one of the most important markets for electric buses during the forecast period. In the US, the electric school bus segment is leading the transition from diesel to electric buses. This is backed by the EPA's Clean School Bus Program, which is providing USD 5 billion in funding till 2026 to support the replacement of diesel school buses with electric alternatives. By late 2024, the EPA had awarded grants for nearly 12,000 electric school buses across 1,000 school districts, making it the region's most significant single driver of demand. Transit agencies are also improving adoption, supported by the Federal Transit Administration's Low-No Emission Vehicle Program (Low-No Program), which allocated USD 1.7 billion in 2023 and is expected to continue distributing funds through 2025 for zero-emission transit buses and charging infrastructure.

Canada is following a similar path, with the Zero Emission Transit Fund (ZETF) providing USD 2 billion in support till 2026 to help municipalities procure electric transit buses and build charging facilities. As of 2024, more than 700 electric buses have been sold in Canada, which is expected to increase further in 2025. These federal and state-level incentives are positioning the US and Canada as leaders in e-bus adoption in North America. While China and Europe still dominate in overall sales of electric buses, North America's focus on electrifying both school buses is a unique regional characteristic.

The break-up of the profile of primary participants in the electric bus market is as follows:

- By Company Type: Electric Bus OEM - 90%, Tier 1 - 10%

- By Designation: C Level - 60%, Director-level - 30%, Others - 10%

- By Region: North America- 10%, Europe - 40%, Asia Pacific - 50%

Prominent companies include BYD Company Ltd. (China), Yutong Co., Ltd. (China), Xiamen King Long (China), CRRC Corporation Limited (China), and Zhejiang Geely Holding Group (China), which are the leading manufacturers of electric buses in the global market.

Research Coverage:

The study segments the electric bus market and forecasts the market size based on propulsion (BEVs, FCEVs), range (up to 300 miles, above 300 miles), the length of the bus (less than 9 m, 9-14 m, more than 14m), consumer (private, government), application (transit buses, coaches, school buses, and others), battery capacity (up to 400 kWh, Above 400 kWh), component (motors, batteries, fuel cell stacks, battery management systems, battery cooling systems, DC-DC converters, inverters, AC/DC chargers, EV connectors), the level of autonomy (semi-autonomous, autonomous), power output (up to 250 kW, above 250 kW), seating capacity (up to 40 seats, 40-70 seats, above 70 seats), by GVW (Up to 10 tonnes, 10 to 20 tonnes and above 20 tonnes), and region (Asia Pacific, North America, Middle East & Africa [MEA], Europe, and Latin America). This report covers the competitive analysis of upcoming startups/SMEs in the electric bus market ecosystem.

Reasons to buy this report:

The report will help the market leaders/new entrants with information on the closest approximations of the revenue numbers for the overall electric bus market and the subsegments. The report includes a comprehensive market share analysis, supply chain analysis, extensive lists and insights into component manufacturers, chapter segmentation based on materials, a thorough supply chain analysis, and a competitive landscape. The report also helps stakeholders understand the market pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following points:

- Analysis of key drivers (rising GHG emissions, government incentives and policies, overall targets to reduce fleet-level emissions and increasing demand for emission-free vehicles), restraints (CNG and biofuel buses slowing the adoption of electric buses, safety concerns in EV batteries and high development cost), opportunities (development of advanced battery technologies, transition towards hydrogen fuel cell electric mobility), and challenges (high cost of developing charging infrastructure) influencing the growth of the electric bus market

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and product & service launches in the electric bus market

- Market Development: Comprehensive information about lucrative markets (the report analyzes the electric bus market across varied regions)

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the electric bus market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players in the electric bus market, such as BYD Company Ltd. (China), Yutong Co., Ltd. (China), Xiamen King Long (China), CRRC Corporation Limited (China), and Zhejiang Geely Holding Group (China)

The report also helps stakeholders understand the pulse of the electric bus market by providing them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION AND REGIONAL SNAPSHOT

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.4 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key secondary sources

- 2.1.1.2 Key data from secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary participants

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 FACTOR ANALYSIS

- 2.5 RESEARCH ASSUMPTIONS AND RISK ASSESSMENT

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ELECTRIC BUS MARKET

- 4.2 ELECTRIC BUS MARKET, BY PROPULSION

- 4.3 ELECTRIC BUS MARKET, BY RANGE

- 4.4 ELECTRIC BUS MARKET, BY COMPONENT

- 4.5 ELECTRIC BUS MARKET, BY CONSUMER

- 4.6 ELECTRIC BUS MARKET, BY BATTERY CAPACITY

- 4.7 ELECTRIC BUS MARKET, BY BATTERY TYPE

- 4.8 ELECTRIC BUS MARKET, BY APPLICATION

- 4.9 ELECTRIC BUS MARKET, BY POWER OUTPUT

- 4.10 ELECTRIC BUS MARKET, BY LENGTH

- 4.11 ELECTRIC BUS MARKET, BY SEATING CAPACITY

- 4.12 ELECTRIC BUS MARKET, BY GVW

- 4.13 ELECTRIC BUS MARKET, BY REGION

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Rising GHG emissions

- 5.2.1.1.1 Government incentives and policies

- 5.2.1.1.2 Target to reduce fleet-level emissions

- 5.2.1.2 Increasing demand for emission-free vehicles and decline in battery prices

- 5.2.1.1 Rising GHG emissions

- 5.2.2 RESTRAINTS

- 5.2.2.1 CNG and biofuel buses slowing adoption of electric buses

- 5.2.2.2 Safety concerns in EV batteries and high development costs

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Development of advanced battery technologies

- 5.2.3.2 Transition toward hydrogen fuel cell electric mobility

- 5.2.3.3 Emergence of charging services for electric buses

- 5.2.4 CHALLENGES

- 5.2.4.1 High cost of developing charging infrastructure

- 5.2.1 DRIVERS

6 INDUSTRY TRENDS

- 6.1 IMPACT OF AI/GEN AI ON ELECTRIC BUS MARKET

- 6.2 TRADE ANALYSIS

- 6.2.1 IMPORT SCENARIO

- 6.2.2 EXPORT SCENARIO

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 SUPPLY CHAIN ANALYSIS

- 6.5 TOTAL COST OF OWNERSHIP: DIESEL BUSES VS. ELECTRIC BUSES

- 6.5.1 COST COMPARISON: ELECTRIC BUSES VS. ICE BUSES

- 6.6 PRICING ANALYSIS

- 6.6.1 BY APPLICATION

- 6.6.2 BY PROPULSION

- 6.6.3 BY REGION

- 6.7 PATENT ANALYSIS

- 6.7.1 INTRODUCTION

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 NORTH AMERICA

- 6.8.2 EUROPE

- 6.8.3 ASIA PACIFIC

- 6.8.4 LATIN AMERICA

- 6.8.5 MIDDLE EAST & AFRICA

- 6.8.6 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS, BY REGION

- 6.9 CASE STUDY ANALYSIS

- 6.9.1 COMPLETE TRANSITION TO ELECTRIC BUSES IN SHENZHEN, CHINA

- 6.9.2 ZENOBE HELPED STAGECOACH INCORPORATE CHARGING INFRASTRUCTURE AND INSTALL CUSTOM MANAGEMENT SOFTWARE SYSTEM

- 6.9.3 A COMPREHENSIVE ANALYSIS TO EVALUATE FINANCIAL FEASIBILITY OF DEPLOYING ELECTRIC BUS FLEETS THAT REDUCE EMISSIONS

- 6.9.4 ELECTRIC BUS DEPLOYMENT WITH INFRASTRUCTURAL CHANGES

- 6.9.5 HSL WAS AWARDED OPERATIONS BASED ON OPEN TENDERS UNDER CHARGING-AS-A-SERVICE (CAAS) BUSINESS MODEL

- 6.9.6 AI-POWERED SOFTWARE IMPLEMENTED TO HELP FLEET OPERATORS CHARGE ELECTRIC BUSES

- 6.9.7 HIGHLAND ELECTRIC FLEETS, IN PARTNERSHIP WITH NATIONAL GRID, PROVIDED ELECTRIC SCHOOL BUSES AND COORDINATED ITS PARTICIPATION IN V2G PROGRAM FOR SCHOOL BUSES

- 6.9.8 VERMONT ELECTRIC SCHOOL AND TRANSIT BUS PILOT PROGRAM IMPLEMENTED TO FACILITATE COST-EFFECTIVE ELECTRIFICATION

- 6.9.9 FLEET TEST & EVALUATION TEAM AT NREL SUPPORTED AVTA BY CONDUCTING ASSESSMENTS OF MEDIUM- AND HEAVY-DUTY VEHICLES, ELECTRIC BUSES, AND TROLLEYS

- 6.9.10 EVENERGI DEVELOPED FRAMEWORK TO DETERMINE OPTIMAL COMBINATION OF DEPOT LAYOUTS, CHARGER SPEEDS, AND CHARGER TYPES

- 6.10 TRENDS AND DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.11 BILL OF MATERIALS ANALYSIS

- 6.12 KEY CONFERENCES AND EVENTS, 2025-2026

- 6.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 6.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 6.13.2 BUYING CRITERIA

- 6.14 SUPPLIER ANALYSIS

- 6.14.1 MAJOR ELECTRIC BUS BATTERY CELL MANUFACTURERS

- 6.14.2 KEY ELECTRIC BUS AXLE MANUFACTURERS

- 6.14.3 KEY ELECTRIC BUS HVAC SYSTEM MANUFACTURERS

- 6.14.4 MAJOR ELECTRIC BUS MOTOR MANUFACTURERS

- 6.15 INVESTMENT AND FUNDING SCENARIO

7 OEM ANALYSIS

- 7.1 INTRODUCTION

- 7.2 ELECTRIC AND ICE BUS MODELS: LENGTH VS. NUMBER OF SEATS

- 7.3 ELECTRIC BUS MODELS: LENGTH VS. NUMBER OF SEATS

- 7.4 BATTERY CAPACITY VS. DRIVE RANGE VS. PAX

- 7.5 ELECTRIC BUS SALES BY OEMS, 2021-2025

- 7.6 ELECTRIC BUS DRIVE MOTOR SUPPLIERS, BY OEM AND REGION

- 7.7 ELECTRIC BUS BATTERY CELL SUPPLIERS, BY OEM AND REGION

- 7.8 ELECTRIC BUS, OEM-WISE INSTALLED BATTERY CAPACITIES, 2021-2025 (IN MWH)

8 TECHNOLOGY ANALYSIS

- 8.1 TECHNOLOGY ANALYSIS

- 8.1.1 FUTURE TECHNOLOGY OVERVIEW

- 8.1.2 TECHNOLOGY ROADMAP

- 8.2 KEY TECHNOLOGIES

- 8.2.1 AUTONOMOUS BUSES

- 8.3 ADJACENT TECHNOLOGIES

- 8.3.1 CHARGING AS A SERVICE

- 8.3.2 BATTERY AS A SERVICE

- 8.3.3 PACKAGED FUEL CELL SYSTEM MODULE

- 8.3.4 METHANE FUEL CELLS

- 8.4 COMPLEMENTARY TECHNOLOGIES

- 8.4.1 UPCOMING BATTERY TECHNOLOGIES

- 8.4.1.1 NMC4

- 8.4.1.2 Solid-state battery technology

- 8.4.1.3 Sodium-ion battery technology

- 8.4.2 INNOVATIVE CHARGING SOLUTIONS

- 8.4.2.1 Off-board top-down pantograph charging system

- 8.4.2.2 On-board bottom-up pantograph charging system

- 8.4.2.3 Ground-based static/dynamic charging system

- 8.4.1 UPCOMING BATTERY TECHNOLOGIES

9 ELECTRIC BUS MARKET, BY LENGTH OF BUS

- 9.1 INTRODUCTION

- 9.2 LESS THAN 9 M

- 9.2.1 EASY MANEUVERING ON COMPACT ROADS

- 9.3 9-14 M

- 9.3.1 SUITABLE FOR FULL-DAY OPERATIONS

- 9.4 MORE THAN 14 M

- 9.4.1 GROWING NUMBER OF ARTICULATED ELECTRIC BUSES TO DRIVE MARKET

- 9.5 KEY INDUSTRY INSIGHTS

10 ELECTRIC BUS MARKET, BY BATTERY TYPE

- 10.1 INTRODUCTION

- 10.2 NMC BATTERIES

- 10.2.1 INCREASED PREFERENCE FOR HIGH ENERGY DENSITY

- 10.3 LFP BATTERIES

- 10.3.1 DEMAND FOR LOW-COST AND GOOD THERMAL STABILITY

- 10.4 NCA BATTERIES

- 10.4.1 BENEFITS ASSOCIATED WITH HIGH ENERGY DENSITY AND LONG-LIFE CYCLE

- 10.5 OTHER BATTERIES

- 10.6 KEY INDUSTRY INSIGHTS

11 ELECTRIC BUS MARKET, BY BATTERY CAPACITY

- 11.1 INTRODUCTION

- 11.2 UP TO 400 KWH

- 11.2.1 DEPLOYMENT IN INTRACITY TRANSPORT TO PROPEL GROWTH

- 11.3 ABOVE 400 KWH

- 11.3.1 USED FOR LONG-DISTANCE COMMUTE

- 11.4 KEY INDUSTRY INSIGHTS

12 ELECTRIC BUS MARKET, BY POWER OUTPUT

- 12.1 INTRODUCTION

- 12.2 UP TO 250 KW

- 12.2.1 WIDELY USED IN PUBLIC TRANSPORT BUSES

- 12.3 ABOVE 250 KW

- 12.3.1 DEMAND FOR HIGH-PERFORMANCE ELECTRIC BUSES TO DRIVE MARKET

- 12.4 KEY PRIMARY INSIGHTS

13 ELECTRIC BUS MARKET, BY RANGE

- 13.1 INTRODUCTION

- 13.2 UP TO 300 MILES

- 13.2.1 SUITABLE FOR URBAN AND SUBURBAN ROUTES WITH FREQUENT STOPS AND SHORTER DISTANCES BETWEEN CHARGING POINTS

- 13.3 ABOVE 300 MILES

- 13.3.1 INCREASING DEMAND FOR INTERCITY ELECTRIC BUSES TO DRIVE MARKET

- 13.4 KEY PRIMARY INSIGHTS

14 ELECTRIC BUS MARKET, BY SEATING CAPACITY

- 14.1 INTRODUCTION

- 14.2 UP TO 40 SEATS

- 14.2.1 NEED FOR ELECTRIC BUSES FOR SHORT-DISTANCE SHUTTLES TO DRIVE DEMAND

- 14.3 40-70 SEATS

- 14.3.1 SUITABLE FOR DENSELY POPULATED AREAS

- 14.4 ABOVE 70 SEATS

- 14.4.1 NEED FOR HIGHER PASSENGER-CARRYING CAPABILITIES TO DRIVE DEMAND

- 14.5 KEY INDUSTRY INSIGHTS

15 ELECTRIC BUS MARKET, BY APPLICATION

- 15.1 INTRODUCTION

- 15.2 CITY/TRANSIT BUS

- 15.2.1 NEED TO IMPROVE AIR QUALITY IN CITIES TO DRIVE DEMAND

- 15.3 COACHES

- 15.3.1 INCREASING DEMAND FOR SUSTAINABLE LONG-DISTANCE TRAVEL TO DRIVE GROWTH

- 15.4 SCHOOL BUSES

- 15.4.1 GROWING DEMAND IN NORTH AMERICA TO DRIVE ELECTRIC SCHOOL BUS MARKET

- 15.5 OTHER APPLICATIONS

- 15.6 KEY INDUSTRY INSIGHTS

16 ELECTRIC BUS MARKET, BY CONSUMER

- 16.1 INTRODUCTION

- 16.2 PRIVATE

- 16.2.1 GOVERNMENT SUBSIDIES TO PROMOTE ADOPTION OF ELECTRIC BUSES

- 16.3 GOVERNMENT

- 16.3.1 USE OF ELECTRIC BUSES FOR PUBLIC TRANSPORTATION

- 16.4 KEY INDUSTRY INSIGHTS

17 ELECTRIC BUS MARKET, BY GROSS VEHICLE WEIGHT (GVW)

- 17.1 INTRODUCTION

- 17.2 UP TO 10 TONNES

- 17.2.1 NEED FOR ELECTRIC BUSES FOR SHORT-DISTANCE SHUTTLES TO DRIVE GROWTH

- 17.3 10-20 TONNES

- 17.3.1 ASIA PACIFIC TO LEAD MARKET IN THIS SEGMENT

- 17.4 ABOVE 20 TONNES

- 17.4.1 ENGINEERED FOR BIGGER AND TEDIOUS OPERATIONS

- 17.5 KEY INDUSTRY INSIGHTS

18 ELECTRIC BUS MARKET, BY PROPULSION

- 18.1 INTRODUCTION

- 18.2 BATTERY ELECTRIC BUSES

- 18.2.1 FALLING BATTERY PRICES AND GOVERNMENT INCENTIVES TO ELECTRIFY PUBLIC BUS FLEETS

- 18.3 FUEL CELL ELECTRIC BUSES

- 18.3.1 SUSTAINABLE PRODUCTION OF HYDROGEN TO DRIVE GROWTH

- 18.4 KEY INDUSTRY INSIGHTS

19 ELECTRIC BUS MARKET, BY COMPONENT

- 19.1 INTRODUCTION

- 19.2 MOTORS

- 19.2.1 HIGHER EFFICIENCY THAN TRADITIONAL COMBUSTION ENGINES TO DRIVE GROWTH

- 19.3 BATTERIES

- 19.3.1 DECREASING PRICE OF LITHIUM-ION BATTERIES TO DRIVE GROWTH

- 19.4 FUEL CELL STACKS

- 19.4.1 INCREASING DEMAND FOR HYDROGEN FUEL CELL ELECTRIC BUSES TO DRIVE GROWTH

- 19.5 BATTERY MANAGEMENT SYSTEMS

- 19.5.1 NEED FOR EFFICIENT BATTERY OPTIMIZATION IN ELECTRIC BUSES TO DRIVE GROWTH

- 19.6 BATTERY COOLING SYSTEMS

- 19.6.1 GROWING FOCUS ON INCREASING BATTERY LIFE AND IMPROVING THERMAL MANAGEMENT TO DRIVE GROWTH

- 19.7 DC-DC CONVERTERS

- 19.7.1 KEY SAFETY SYSTEMS IN ELECTRIC BUSES

- 19.8 INVERTERS

- 19.8.1 GROWING DEMAND FOR ELECTRIC BUSES WITH HIGHER RANGE TO DRIVE GROWTH

- 19.9 AC/DC CHARGERS

- 19.9.1 CRITICAL TO OVERALL OPERATION AND EFFICIENCY OF ELECTRIC BUSES

- 19.10 EV CONNECTORS

- 19.10.1 INCREASING INVESTMENTS IN SUSTAINABLE URBAN TRANSPORTATION INITIATIVES TO DRIVE GROWTH

- 19.11 KEY INDUSTRY INSIGHTS

20 ELECTRIC BUS MARKET, BY LEVEL OF AUTONOMY

- 20.1 INTRODUCTION

- 20.2 SEMI-AUTONOMOUS

- 20.3 AUTONOMOUS

- 20.4 KEY INDUSTRY INSIGHTS

21 ELECTRIC BUS MARKET, BY REGION

- 21.1 INTRODUCTION

- 21.2 ASIA PACIFIC

- 21.2.1 MACROECONOMIC OUTLOOK

- 21.2.2 CHINA

- 21.2.2.1 Widespread adoption of electric buses in public transport and presence of leading OEMs to boost growth

- 21.2.3 JAPAN

- 21.2.3.1 Focus on developing advanced electric buses to drive market

- 21.2.4 INDIA

- 21.2.4.1 Government support for electrification of public transport to propel demand

- 21.2.5 SOUTH KOREA

- 21.2.5.1 Focus on electrification of public transport fleets to boost growth

- 21.2.6 SINGAPORE

- 21.2.6.1 Growing emphasis on promoting green public transport by 2040 to boost growth

- 21.2.7 INDONESIA

- 21.2.7.1 Government's commitment to improving air quality to spur demand

- 21.2.8 AUSTRALIA

- 21.2.8.1 Increasing awareness regarding climate change to drive growth

- 21.3 EUROPE

- 21.3.1 MACROECONOMIC OUTLOOK

- 21.3.2 FRANCE

- 21.3.2.1 Aim for all-electric public transport fleet by 2025 to promote use of electric buses

- 21.3.3 GERMANY

- 21.3.3.1 Increased government incentives and investments for infrastructure development to boost market

- 21.3.4 SPAIN

- 21.3.4.1 Government's focus on replacing existing public transport fleet with electric buses to boost growth

- 21.3.5 ITALY

- 21.3.5.1 Rising concerns about emissions to encourage government to adopt electrification of public transport system

- 21.3.6 NORWAY

- 21.3.6.1 Rising government support and schemes for electric buses to increase demand

- 21.3.7 SWEDEN

- 21.3.7.1 Presence of market-leading OEMs to support growth of electric bus market

- 21.3.8 DENMARK

- 21.3.8.1 Favorable government regulations to support growth of electric bus market

- 21.3.9 NETHERLANDS

- 21.3.9.1 Increased orders and deliveries of electric buses to boost demand

- 21.3.10 BELGIUM

- 21.3.10.1 Investments for electrification of public transport to drive growth

- 21.3.11 UK

- 21.3.11.1 Stringent regulations for emission-free buses to boost adoption of electric buses

- 21.3.12 FINLAND

- 21.3.12.1 Continuous need for reducing carbon emissions to drive growth

- 21.3.13 POLAND

- 21.3.13.1 Push toward sustainable public transportation to spur demand for electric buses

- 21.4 NORTH AMERICA

- 21.4.1 MACROECONOMIC OUTLOOK

- 21.4.2 US

- 21.4.2.1 Government programs to promote zero-emission vehicles to boost growth

- 21.4.3 CANADA

- 21.4.3.1 Government subsidies and presence of key players to boost adoption of electric school buses

- 21.5 LATIN AMERICA

- 21.5.1 MACROECONOMIC OUTLOOK

- 21.5.2 ARGENTINA

- 21.5.2.1 Demand for electrification of bus fleets to boost demand for advanced electric buses

- 21.5.3 BRAZIL

- 21.5.3.1 Growing environmental concerns to lead to demand for electric buses

- 21.5.4 CHILE

- 21.5.4.1 Government's focus on promoting emission-free public transport to encourage use of electric buses

- 21.5.5 MEXICO

- 21.5.5.1 Rapid strategies undertaken by government to indicate growth of electric bus market

- 21.5.6 COLOMBIA

- 21.5.6.1 Increasing government initiatives for electric bus purchases to drive market

- 21.6 MIDDLE EAST & AFRICA

- 21.6.1 MACROECONOMIC OUTLOOK

- 21.6.2 SOUTH AFRICA

- 21.6.2.1 Investments by leading OEMs in advanced technologies in automotive sector to drive market

- 21.6.3 UAE

- 21.6.3.1 Growing electrification trend in cities to boost demand for electric buses

- 21.6.4 QATAR

- 21.6.4.1 Net-zero aims to push incorporation of electric buses

22 COMPETITIVE LANDSCAPE

- 22.1 OVERVIEW

- 22.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 22.3 ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.1 ASIA: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.2 EUROPE: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.3.3 NORTH AMERICA: ELECTRIC BUS MARKET SHARE ANALYSIS, 2024

- 22.4 REVENUE ANALYSIS

- 22.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 22.5.1 STARS

- 22.5.2 EMERGING LEADERS

- 22.5.3 PERVASIVE PLAYERS

- 22.5.4 PARTICIPANTS

- 22.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 22.5.5.1 Consumer footprint

- 22.5.5.2 Region footprint

- 22.5.5.3 Application footprint

- 22.5.5.4 Propulsion footprint

- 22.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 22.6.1 PROGRESSIVE COMPANIES

- 22.6.2 RESPONSIVE COMPANIES

- 22.6.3 DYNAMIC COMPANIES

- 22.6.4 STARTING BLOCKS

- 22.6.5 COMPETITIVE BENCHMARKING

- 22.6.5.1 List of key startups/SMEs

- 22.6.5.2 Competitive benchmarking of key startups/SMEs

- 22.7 COMPANY VALUATION

- 22.8 FINANCIAL METRICS

- 22.9 BRAND/PRODUCT COMPARISON

- 22.10 COMPETITIVE SCENARIO

- 22.10.1 PRODUCT LAUNCHES, DEVELOPMENTS, AND ENHANCEMENTS, SEPTEMBER 2022-JULY 2025

- 22.10.2 DEALS, AUGUST 2022-MARCH 2025

- 22.10.3 EXPANSIONS, JUNE 2021-JULY 2025

- 22.10.4 OTHERS, OCTOBER 2022-JULY 2025

23 COMPANY PROFILES

- 23.1 KEY PLAYERS

- 23.1.1 BYD COMPANY LTD.

- 23.1.1.1 Business overview

- 23.1.1.2 Products/Solutions offered

- 23.1.1.3 Recent developments

- 23.1.1.3.1 Product launches

- 23.1.1.3.2 Deals

- 23.1.1.3.3 Expansions

- 23.1.1.3.4 Others

- 23.1.1.4 MnM view

- 23.1.1.4.1 Right to win

- 23.1.1.4.2 Strategic choices

- 23.1.1.4.3 Weaknesses & competitive threats

- 23.1.2 YUTONG BUS CO., LTD.

- 23.1.2.1 Business overview

- 23.1.2.2 Products/Solutions offered

- 23.1.2.3 Recent developments

- 23.1.2.3.1 Product launches/enhancements

- 23.1.2.3.2 Deals

- 23.1.2.3.3 Expansions

- 23.1.2.3.4 Others

- 23.1.2.4 MnM view

- 23.1.2.4.1 Right to win

- 23.1.2.4.2 Strategic choices

- 23.1.2.4.3 Weaknesses & competitive threats

- 23.1.3 ZHEJIANG GEELY HOLDING GROUP

- 23.1.3.1 Business overview

- 23.1.3.2 Products/Solutions offered

- 23.1.3.3 Recent developments

- 23.1.3.3.1 Product launches

- 23.1.3.3.2 Deals

- 23.1.3.3.3 Others

- 23.1.3.4 MnM view

- 23.1.3.4.1 Right to win

- 23.1.3.4.2 Strategic choices

- 23.1.3.4.3 Weaknesses & competitive threats

- 23.1.4 DAIMLER TRUCK AG

- 23.1.4.1 Business overview

- 23.1.4.2 Products/Solutions offered

- 23.1.4.3 Recent developments

- 23.1.4.3.1 Product launches

- 23.1.4.3.2 Deals

- 23.1.4.3.3 Expansions

- 23.1.4.3.4 Others

- 23.1.4.4 MnM view

- 23.1.4.4.1 Right to win

- 23.1.4.4.2 Strategic choices

- 23.1.4.4.3 Weaknesses & competitive threats

- 23.1.5 NFI GROUP

- 23.1.5.1 Business overview

- 23.1.5.2 Products/Solutions offered

- 23.1.5.3 Recent developments

- 23.1.5.3.1 Product launches/developments/enhancements

- 23.1.5.3.2 Deals

- 23.1.5.3.3 Others

- 23.1.5.4 MnM view

- 23.1.5.4.1 Right to win

- 23.1.5.4.2 Strategic choices

- 23.1.5.4.3 Weaknesses & competitive threats

- 23.1.6 AB VOLVO

- 23.1.6.1 Business overview

- 23.1.6.2 Products/Solutions offered

- 23.1.6.3 Recent developments

- 23.1.6.3.1 Product launches

- 23.1.6.3.2 Deals

- 23.1.6.3.3 Others

- 23.1.7 CAF (SOLARIS BUS & COACH SP. Z O.O.)

- 23.1.7.1 Business overview

- 23.1.7.2 Products/Solutions offered

- 23.1.7.3 Recent developments

- 23.1.7.3.1 Product launches

- 23.1.7.3.2 Others

- 23.1.8 ZHONGTONG BUS HOLDING CO., LTD.

- 23.1.8.1 Business overview

- 23.1.8.2 Products/Solutions offered

- 23.1.8.3 Recent developments

- 23.1.8.3.1 Deals

- 23.1.9 CRRC CORPORATION LIMITED

- 23.1.9.1 Business overview

- 23.1.9.2 Products/Solutions offered

- 23.1.9.3 Recent developments

- 23.1.9.3.1 Product launches

- 23.1.9.3.2 Deals

- 23.1.9.3.3 Expansions

- 23.1.9.3.4 Others

- 23.1.10 VDL GROEP

- 23.1.10.1 Business overview

- 23.1.10.2 Products/Solutions offered

- 23.1.10.3 Recent developments

- 23.1.10.3.1 Product launches

- 23.1.10.3.2 Deals

- 23.1.10.3.3 Expansions

- 23.1.10.3.4 Others

- 23.1.11 EBUSCO

- 23.1.11.1 Business overview

- 23.1.11.2 Products/Solutions offered

- 23.1.11.3 Recent developments

- 23.1.11.3.1 Product enhancements

- 23.1.11.3.2 Deals

- 23.1.11.3.3 Others

- 23.1.12 XIAMEN KING LONG INTERNATIONAL TRADING CO., LTD.

- 23.1.12.1 Business overview

- 23.1.12.2 Products/Solutions offered

- 23.1.12.3 Recent developments

- 23.1.12.3.1 Product launches

- 23.1.12.3.2 Others

- 23.1.1 BYD COMPANY LTD.

- 23.2 OTHER PLAYERS

- 23.2.1 BLUE BIRD CORPORATION

- 23.2.2 GILLIG LLC.

- 23.2.3 THE LION ELECTRIC COMPANY

- 23.2.4 TATA MOTORS LIMITED.

- 23.2.5 ASHOK LEYLAND

- 23.2.6 SUNDA NEW ENERGY TECHNOLOGY CO., LTD.

- 23.2.7 GREE ALTAIRNANO NEW ENERGY INC.

- 23.2.8 XIAMEN GOLDEN DRAGON BUS CO. LTD.

- 23.2.9 JBM GROUP

- 23.2.10 SCANIA AB

- 23.2.11 IRIZAR GROUP

- 23.2.12 IVECO S.P.A

- 23.2.13 BLUEBUS

- 23.2.14 BOZANKAYA

- 23.2.15 CAETANOBUS

- 23.2.16 CHARIOT MOTORS

- 23.2.17 HEULIEZ BUS

- 23.2.18 OTOKAR OTOMOTIV VE SAVUNMA SANAYI A.S.

- 23.2.19 TEMSA

- 23.2.20 URSUS S.A.

- 23.2.21 VAN HOOL

- 23.2.22 KARSAN

- 23.2.23 MELLOR

- 23.2.24 HINO MOTORS, LTD.

- 23.2.25 ANHUI ANKAI AUTOMOBILE CO., LTD.

- 23.2.26 OLECTRA GREENTECH LIMITED

24 RECOMMENDATIONS BY MARKETSANDMARKETS

- 24.1 ASIA PACIFIC TO BE MAJOR ELECTRIC BUS MARKET

- 24.2 BATTERY ELECTRIC BUSES TO BE KEY FOCUS AREA FOR MANUFACTURERS

- 24.3 CONCLUSION

25 APPENDIX

- 25.1 KEY INDUSTRY INSIGHTS

- 25.2 DISCUSSION GUIDE

- 25.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 25.4 CUSTOMIZATION OPTIONS

- 25.5 RELATED REPORTS

- 25.6 AUTHOR DETAILS