|

시장보고서

상품코드

1823728

디지털 지도 시장 예측(-2030년) : 솔루션별, 사용 사례별Digital Map Market by Solution, Use Case - Global Forecast to 2030 |

||||||

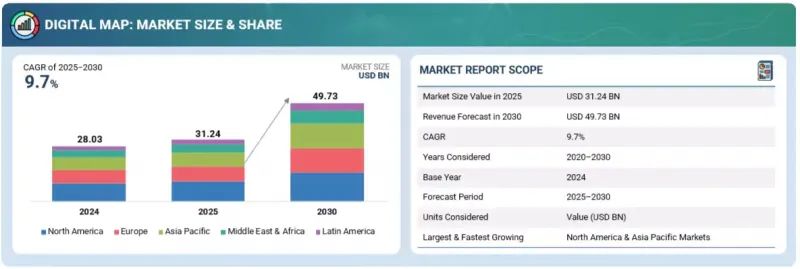

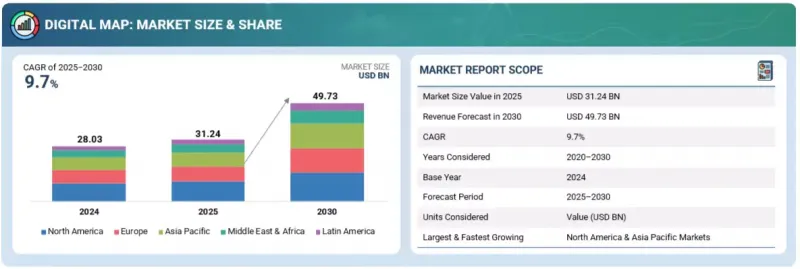

세계의 디지털 지도 시장 규모는 2025년 추정 312억 4,000만 달러에서 2030년까지 497억 3,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 9.7%의 성장이 전망됩니다.

소매업체와 마케팅 담당자들이 매장 입지 선정, 고객 타겟팅, 물류 개선에 위치 정보 분석을 점점 더 많이 활용하고 있으므로 시장이 확대되고 있습니다. 동시에 정부와 기업은 계획과 유지보수를 지원하는 통신, 전력, 수도망 등 인프라의 고급 매핑을 요구하고 있습니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2020-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러 |

| 부문 | 제공, 지도제작 장소, 지도제작 유형, 기능 사용 사례, 업계, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 중동 및 아프리카, 라틴아메리카 |

그러나 자율주행차나 물류와 같이 급성장하는 분야에서의 성공은 자동차 제조업체나 운송업체와의 파트너십에 크게 의존하는 경우가 많기 때문에 의존성 리스크가 벤더의 중요한 제약 요인으로 작용하고 있습니다.

"모빌리티와 인프라 혁신을 선도하는 아웃도어 매핑"

내비게이션, 물류, 모빌리티 서비스 대부분이 야외 공간 데이터에 크게 의존하고 있으므로 야외 매핑 위치 부문이 2025년 디지털 지도 시장에서 큰 비중을 차지할 것으로 추정됩니다. 야외 지도는 도로 내비게이션, 대중교통 계획, 라스트마일 배송 등 다양한 용도의 중추적인 역할을 하고 있으며, E-Commerce 및 라이드헤일링 플랫폼의 확장과 함께 빠르게 성장하고 있습니다. 고정밀 야외지도에 대한 수요는 자율주행차와 드론의 등장으로 인해 더욱 증가하고 있으며, 이들 차량은 실제 환경에서 안전하게 운행하기 위해 고화질로 지속적으로 업데이트되는 야외지도를 필요로 합니다. 정부와 지자체는 스마트 시티 구상을 지원하기 위해 도로, 공공시설, 공공공간의 디지털화를 추진하고 있으며, 야외 지도의 채택을 장려하고 있습니다. 또한 농업, 임업, 광업, 에너지 등의 분야에서는 지역적 공간 데이터가 광활한 지역의 모니터링과 자원 관리에 활용되고 있으며, 야외 지도는 중요한 역할을 하고 있습니다. GPS를 지원하는 스마트폰과 커넥티드 기기의 사용으로 야외 지도는 일상적인 소비자의 내비게이션과 위치 정보 서비스에 필수적인 요소로 자리 잡았습니다. 위성 이미지, 항공 측량, 센서 통합의 지속적인 개선으로 야외 지도의 정확도와 사용 편의성이 더욱 향상되고 있습니다.

"위성 이미지와 원격 감지 기술의 발전은 2D 매핑 유형 부문을 촉진할 것입니다. "

2D 매핑 유형 부문은 소비자 및 기업용 용도 모두에서 널리 사용되므로 2025년 디지털 지도 시장에서 가장 큰 점유율을 차지할 것으로 예측됩니다. 2D 지도는 대부분의 내비게이션 시스템, 모바일 애플리케이션, 온라인 플랫폼의 기반이 되고 있으며, 가장 친숙하고 이용하기 쉬운 지도 형식입니다. 스마트폰, GPS 장치, 웹 기반 용도에서 널리 사용되며, 경로 안내, 위치 검색, 지역 개요 등의 정보를 제공합니다. 물류, 소매, 여행 등의 산업에서 2D 지도는 3D 지도에 비해 단순하고 처리 요구 사항이 낮기 때문에 자산 추적, 배송 경로 최적화, 고객 참여 계획 수립을 위해 계속 선택되고 있습니다. 정부 및 공공 기관도 토지 기록, 인프라 계획, 도시 관리 등의 업무에서 2D 지도에 크게 의존하고 있으며, 대규모 채택에 있으며, 2D 지도의 역할은 더욱 확고해졌습니다. 위성영상과 원격탐사 기술의 발전으로 2D 지도의 정확도와 상세도가 크게 향상되어 실시간 용도에 대한 신뢰도가 높아지고 있습니다. 또한 클라우드 플랫폼 및 API와의 통합을 통해 기업은 2D 지도를 디지털 서비스에 쉽게 통합할 수 있습니다. 친숙함, 비용 효율성, 광범위한 호환성의 조합으로 인해 2D 지도는 2025년까지 시장 점유율에서 우위를 유지할 것으로 예측됩니다.

"아시아태평양은 혁신과 신기술에 힘입어 급성장, 북미는 시장 규모에서 선두를 달리고 있습니다. "

아시아태평양은 급속한 도시화, 대규모 인프라 개발, 정부 지원 스마트 시티 계획으로 인해 2025-2030년 가장 빠르게 성장하는 디지털 지도 시장이 될 것으로 예측됩니다. 중국, 인도, 일본, 한국 등의 국가들은 지형공간기술, 위성영상, 5G 대응 위치정보 서비스에 많은 투자를 하고 있습니다. E-Commerce, 라이드헤일링 플랫폼, 배송 물류의 부상으로 실시간, 고화질 매핑 솔루션에 대한 수요가 더욱 가속화되고 있습니다.

세계의 디지털 지도 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- 디지털 지도 시장의 기업에 매력적인 기회

- 디지털 지도 시장 : 지도제작 유형

- 북미의 디지털 지도 시장 : 기능 사용 사례별, 업계별

- 디지털 지도 시장 : 지역별

제5장 시장 개요와 산업 동향

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 디지털 지도 시장에 대한 생성형 AI의 영향

- 자동 맵 컨텐츠 생성

- 동적 경로 최적화

- 3D 도시, 지형 모델링

- 맞춤형 위치정보 서비스

- 실시간 교통 예측

- 테마에 따른 맵 및 커스텀 맵 작성

- 디지털 지도의 진화

- 공급망 분석

- 에코시스템 분석

- GIS 플랫폼/GIS 시스템 프로바이더

- 지리공간 인텔리전스 툴 프로바이더

- 위치 정보 애널리틱스 솔루션 프로바이더

- 실내 지도제작·측위 툴 프로바이더

- 내비게이션·라우팅 플랫폼 프로바이더

- 지도제작 데이터·컨텐츠 플랫폼 프로바이더

- 기타 솔루션 프로바이더

- 2025년 미국 관세의 영향 - 디지털 지도 시장

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

- 투자와 자금조달 시나리오

- 사례 연구 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 규제

- 특허 분석

- 조사 방법

- 특허 출원 건수 : 서류 유형별

- 혁신과 특허 출원

- 가격결정 분석

- 평균 판매 가격 : 주요 기업별(2025년)

- 평균 판매 가격 : 기능 사용 사례별(2025년)

- 주요 컨퍼런스와 이벤트(2025-2026년)

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 물류용 인텔리전스 지도제작 : 예측 ETA·라이브 라우팅

- 예측 ETA에 의한 물류의 최적화

- 동적 플릿 관리를 목적으로 한 라이브 라우팅의 유효화

- 지리공간 인사이트에 의한 전략적 의사결정의 추진

- 소프트웨어 정의 차량용 통합 AI 지도제작 프레임워크

- 소프트웨어 정의 차량(SDV) 기능의 혁명

- 경쟁 차별화와 확장성의 강화

- AI에 의한 퍼스널라이제이션과 시장 확대의 추진

제6장 디지털 지도 시장 : 제공별

- 서론

- 유형

- 배포 방식

- 규모

제7장 디지털 지도 시장 : 지도제작 유형별

- 서론

- 2D

- 3D

- 4D

제8장 디지털 지도 시장 : 지도제작 장소별

- 서론

- 실내

- 야외

제9장 디지털 지도 시장 : 기능 사용 사례별

- 서론

- 내비게이션 지도

- 테마에 따른 지도

- 위성 지도

- 교통 지도

제10장 디지털 지도 시장 : 업계별

- 서론

- 정부·방위

- 부동산·건설

- 운송·물류

- 자동차

- 통신

- 소매·소비재

- 여행·관광

- 제조

- BFSI

- 에너지·유틸리티

- 농업·임업

- 기타 업계

제11장 디지털 지도 시장 : 지역별

- 서론

- 북미

- 북미의 디지털 지도 시장 촉진요인

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 디지털 지도 시장 촉진요인

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 디지털 지도 시장 촉진요인

- 아시아태평양의 거시경제 전망

- 중국

- 인도

- 일본

- 한국

- 싱가포르

- 기타 아시아태평양

- 중동 및 아프리카

- 중동 및 아프리카의 디지털 지도 시장 촉진요인

- 중동 및 아프리카의 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 카타르

- 남아프리카공화국

- 기타 중동 및 아프리카

- 라틴아메리카

- 라틴아메리카의 디지털 지도 시장 촉진요인

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

제12장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점(2022-2025년)

- 매출 분석(2020-2024년)

- 시장 점유율 분석(2024년)

- 제품의 비교

- 기업의 평가와 재무 지표

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제13장 기업 개요

- 서론

- 주요 기업

- APPLE

- TOMTOM

- BENTLEY SYSTEMS

- PLANET LABS

- HEXAGON

- GENESYS

- ESRI

- HERE TECHNOLOGIES

- NEARMAP

- INRIX

- LIGHTBOX

- SERVICENOW

- INPIXON

- MICROSOFT

- MAXAR TECHNOLOGIES

- CARTO

- TELEDYNE TECHNOLOGIES

- MAPBOX

- BLUE MARBLE GEOGRAPHICS

- MAPPLS

- SUPERMAP

- 기타 기업

- EMAPA

- MAPTIVE

- GIS CLOUD

- DABEEO

- CALIPER

- GEOVERRA

- PRIVATEER

- DIGIMAP

- MAPQUEST

- INDOORATLAS

- MAPSTED

- MAPIDEA

- GEOCENTO

- GEOSPIN

- JAWG MAPS

- BARIKOI

- EASYMAPMAKER

- BATCHGEO

- ESPATIAL

- MAPLINE

- SCRIBBLE MAPS

제14장 인접 시장과 관련 시장

- 서론

- 지리공간 영상 애널리틱스 시장 - 세계 예측(-2030년)

- 시장의 정의

- 시장의 개요

- 지리공간 애널리틱스 시장 - 세계 예측(-2029년)

- 시장의 정의

- 시장의 개요

제15장 부록

KSA 25.10.02The digital map market is anticipated to witness a compound annual growth rate (CAGR) of 9.7% over the forecast period, reaching USD 49.73 billion by 2030 from an estimated USD 31.24 billion in 2025. The digital map market is growing as retailers and marketers increasingly use location analytics to choose store sites, target customers, and improve logistics. At the same time, governments and enterprises are demanding advanced mapping of infrastructure such as telecom, power, and water networks to support planning and maintenance.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2020-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | USD (Million) |

| Segments | Offering, Mapping Location, Mapping Type, Functional Use Case, Industry Vertical, and Region |

| Regions covered | North America, Europe, Asia Pacific, Middle East & Africa, and Latin America |

However, a key restraint for vendors is that success in fast-growing areas like autonomous vehicles and logistics often depends heavily on partnerships with automotive and transport players, creating dependency risks.

"Outdoor mapping leading mobility and infrastructure innovation"

The outdoor mapping location segment is estimated to hold the major share of the digital map market in 2025, as most navigation, logistics, and mobility services rely heavily on outdoor spatial data. Outdoor maps are the backbone of applications such as road navigation, public transportation planning, and last-mile delivery, all of which are growing rapidly with the expansion of e-commerce and ride-hailing platforms. The demand for accurate outdoor mapping is also being fueled by the rise of autonomous vehicles and drones, which require high-definition, constantly updated outdoor maps to operate safely in real-world conditions. Governments and municipalities are increasingly digitizing roads, utilities, and public spaces to support smart city initiatives, boosting the adoption of outdoor mapping. Additionally, outdoor maps play a critical role in sectors like agriculture, forestry, mining, and energy, where geospatial data is used for monitoring and resource management across vast areas. The use of GPS-enabled smartphones and connected devices has made outdoor mapping indispensable for everyday consumer navigation and location-based services. Continuous improvements in satellite imaging, aerial surveys, and sensor integration are further enhancing the accuracy and usability of outdoor maps

"Advances in satellite imaging and remote sensing fuel 2D mapping type segment"

The 2D mapping type segment is estimated to hold the largest share of the digital map market in 2025 because of its widespread use across both consumer and enterprise applications. Two-dimensional maps form the foundation of most navigation systems, mobile applications, and online platforms, making them the most familiar and accessible mapping format. They are widely used in smartphones, GPS devices, and web-based applications to provide route guidance, location searches, and area overviews. In industries such as logistics, retail, and travel, 2D maps continue to be the preferred choice for tracking assets, optimizing delivery routes, and planning customer engagement due to their simplicity and lower processing requirements compared to 3D maps. Governments and public agencies also rely heavily on 2D maps for tasks like land records, infrastructure planning, and urban management, further cementing their role in large-scale adoption. Advances in satellite imaging and remote sensing have significantly improved the accuracy and detail of 2D maps, making them more reliable for real-time applications. In addition, integration with cloud platforms and APIs allows businesses to easily embed 2D maps into their digital services at scale. The combination of familiarity, cost efficiency, and broad compatibility ensures that 2D mapping will maintain its dominance in market share by 2025.

"Asia Pacific to witness rapid market growth fueled by innovation and emerging technologies, while North America leads in market size"

Asia Pacific is expected to be the fastest-growing market for digital maps during 2025-2030, driven by rapid urbanization, large-scale infrastructure development, and government-backed smart city initiatives. Countries such as China, India, Japan, and South Korea are making significant investments in geospatial technologies, satellite imaging, and 5G-enabled location services. The rise of e-commerce, ride-hailing platforms, and delivery logistics across the region further accelerates demand for real-time and high-definition mapping solutions. In parallel, the region is also witnessing strong adoption of drones, robotics, and autonomous vehicle trials, all of which require advanced digital mapping. On the other hand, North America is estimated to hold the largest market share in 2025 due to its early adoption of mapping technologies, mature ecosystem of digital map vendors, and high usage across sectors such as automotive, defense, logistics, and utilities. The region benefits from widespread penetration of connected devices, early rollout of autonomous mobility solutions, and continuous advancements in GPS and sensor integration. Strong collaboration between technology providers, transport players, and enterprises ensures that digital maps are deeply embedded in everyday business operations. This makes North America the leading region in terms of current market size, while Asia Pacific emerges as the fastest-growing region during the forecast period.

Breakdown of Primaries

In-depth interviews were conducted with chief executive officers (CEOs), innovation and technology directors, system integrators, and executives from various key organizations operating in the digital map market.

- By Company: Tier I - 55%, Tier II - 25%, and Tier III - 20%

- By Designation: Directors - 50%, Managers - 30%, and others - 20%

- By Region: North America - 40%, Europe - 35%, Asia Pacific - 20%, RoW (Middle East & Africa, and Latin America - 5%

The report includes the study of key players offering digital map solutions and services. It profiles major vendors in the digital map market. The major players in the digital map market include Google (US), Esri (US), Apple (US), TomTom (Netherlands), Here Technologies (Netherlands), Maxar Technologies (US), Lightbox (US), Nearmap (Australia), Carto (US), ServiceNow (US), Mappls (India), Microsoft (US), Inrix (US), Inpixon (US), Maptive (US), Mapbox (US), GIS Cloud (UK), Teledyne Technologies (US), Blue Marble Geographies (US), Planet Labs (US), Hexagon (Sweden), Emapa (Poland), Dabeeo (South Korea), Caliper Corporation (US), GeoVerra (Canada), Privateer (US), Digimap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), Barikoi (Bangladesh), EasyMapMaker (US), BatchGeo (US), Espatial (Ireland), Mapline (US), Scribble Maps (US), SuperMap (China), Bentley Systems (US), and Genesys (India).

Research Coverage

This research report covers the digital map market, which has been segmented based on Offering, Mapping Location, Mapping Type, Functional Use case, and Industry vertical. The offering segment consists of offering type (Solutions and Services), deployment mode (Cloud and On-premises), and Scale (Small-scale Map and Large-scale Map). The mapping location segment consists Indoor and Outdoor. The mapping type segment includes 2D, 3D, and 4D, and the functional use case segment consists of Navigation Maps, Thematic Maps, Satellite Maps, and Traffic Maps. The industry vertical segment consists of Government & Defense, Real Estate & Construction, Transportation & Logistics, Automotive, Telecommunications, Retail & Consumer Goods, Travel & Tourism, Manufacturing, BFSI, Energy & Utilities, Agriculture & Forestry, and Other Industry Verticals (IT & ITes, Healthcare & Life Sciences, and Education). The regional analysis of the digital map market covers North America, Europe, Asia Pacific, the Middle East & Africa (MEA), and Latin America.

Key Benefits of Buying the Report

The report would provide the market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall digital map market and its subsegments. It would help stakeholders understand the competitive landscape and gain more insights to position their business and plan suitable go-to-market strategies. It also helps stakeholders understand the market's pulse and provides information on key market drivers, restraints, challenges, and opportunities.

The report provides insights on the following pointers:

Analysis of key drivers (Advancing 3D terrain and city modeling software, scaling location-based personalization engines, AI-driven integration of live geospatial mapping, and predictive traffic management solutions gaining momentum), restraints (Interoperability gaps in GIS and mapping platforms and latency challenges in real-time traffic monitoring), opportunities (Emerging style marketplaces and white-label map studios, verified store-level geotargeting and attribution, and unlocking spatial commerce and 4D consumer journeys), and challenges (High dependency on external data sources and intensive processing needs for real-time 3D and AR navigation).

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the digital map market.

- Market Development: Comprehensive information about lucrative markets - the report analyses the digital map market across varied regions.

- Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the digital map market.

- Competitive Assessment: In-depth assessment of market shares, growth strategies and offerings of leading players like Google (US), Esri (US), Apple (US), TomTom (Netherlands), Here Technologies (Netherlands), Maxar Technologies (US), Lightbox (US), Nearmap (Australia), Carto (US), ServiceNow (US), Mappls (India), Microsoft (US), Inrix (US), Inpixon (US), Maptive (US), Mapbox (US), GIS Cloud (UK), Teledyne Technologies (US), Blue Marble Geographies (US), Planet Labs (US), Hexagon (Sweden), Emapa (Poland), Dabeeo (South Korea), Caliper Corporation (US), Geoverra (Canada), Privateer (US), Digimap (US), MapQuest (US), IndoorAtlas (Finland), Mapsted (canada), Mapidea (Portugal), Geocento (UK), Geospin (Germany), Jawg Maps (France), Barikoi (Bangladesh), EasyMapMaker (US), BatchGeo (US), Espatial (Ireland), Mapline (US), Scribble Maps (US), SuperMap (China), Bentley Systems (US), and Genesys (India), among others, in the digital map market. The report also helps stakeholders understand the pulse of the digital map market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.3 STUDY SCOPE

- 1.3.1 MARKET SEGMENTATION

- 1.3.2 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 STAKEHOLDERS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 List of primary participants

- 2.1.2.2 Breakdown of primaries

- 2.1.2.3 Key industry insights

- 2.2 MARKET BREAKUP AND DATA TRIANGULATION

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 TOP-DOWN APPROACH

- 2.3.2 BOTTOM-UP APPROACH

- 2.4 MARKET FORECAST

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN DIGITAL MAP MARKET

- 4.2 DIGITAL MAP MARKET: MAPPING TYPE

- 4.3 NORTH AMERICA: DIGITAL MAP MARKET, BY FUNCTIONAL USE CASE AND INDUSTRY VERTICAL

- 4.4 DIGITAL MAP MARKET: BY REGION

5 MARKET OVERVIEW AND INDUSTRY TRENDS

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Advancing 3D terrain and city modeling software

- 5.2.1.2 Scaling location-based personalization engines

- 5.2.1.3 Rise of AI-powered real-time geospatial mapping for dynamic decision-making

- 5.2.1.4 Growing adoption of predictive traffic management solutions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Interoperability gaps in GIS and mapping platforms

- 5.2.2.2 Latency issues in real-time traffic monitoring

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emerging style marketplaces and white-label map studios

- 5.2.3.2 Verified store-level geotargeting and attribution

- 5.2.3.3 Unlocking spatial commerce and 4D consumer journeys

- 5.2.4 CHALLENGES

- 5.2.4.1 High dependency on external data sources

- 5.2.4.2 Intensive processing needs for real-time 3D and AR navigation

- 5.2.1 DRIVERS

- 5.3 IMPACT OF GENERATIVE AI ON DIGITAL MAP MARKET

- 5.3.1 AUTOMATED MAP CONTENT GENERATION

- 5.3.2 DYNAMIC ROUTE OPTIMIZATION

- 5.3.3 3D CITY AND TERRAIN MODELING

- 5.3.4 PERSONALIZED LOCATION-BASED SERVICES

- 5.3.5 REAL-TIME TRAFFIC PREDICTION

- 5.3.6 THEMATIC AND CUSTOM MAPS CREATION

- 5.4 EVOLUTION OF DIGITAL MAP

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.6.1 GIS PLATFORM/GIS SYSTEM PROVIDERS

- 5.6.2 GEOSPATIAL INTELLIGENCE TOOL PROVIDERS

- 5.6.3 LOCATION ANALYTICS SOLUTION PROVIDERS

- 5.6.4 INDOOR MAPPING AND POSITIONING TOOL PROVIDERS

- 5.6.5 NAVIGATION AND ROUTING PLATFORM PROVIDERS

- 5.6.6 MAPPING DATA AND CONTENT PLATFORM PROVIDERS

- 5.6.7 OTHER SOLUTION PROVIDERS

- 5.7 IMPACT OF 2025 US TARIFF - DIGITAL MAP MARKET

- 5.7.1 INTRODUCTION

- 5.7.2 KEY TARIFF RATES

- 5.7.3 PRICE IMPACT ANALYSIS

- 5.7.3.1 Strategic shifts and emerging trends

- 5.7.4 IMPACT ON COUNTRY/REGION

- 5.7.4.1 US

- 5.7.4.2 Asia Pacific

- 5.7.4.3 Europe

- 5.7.5 IMPACT ON END-USE INDUSTRIES

- 5.7.5.1 BFSI

- 5.7.5.2 Government & defense

- 5.7.5.3 Transportation & logistics

- 5.7.5.4 Manufacturing

- 5.7.5.5 Real estate & construction

- 5.7.5.6 Automotive

- 5.7.5.7 Telecommunications

- 5.7.5.8 Retail & consumer goods

- 5.7.5.9 Travel & tourism

- 5.7.5.10 Energy & utilities

- 5.7.5.11 Agriculture & forestry

- 5.8 INVESTMENT AND FUNDING SCENARIO

- 5.9 CASE STUDY ANALYSIS

- 5.9.1 AETHER AND NEARMAP DELIVER AI-POWERED LOCATION INTELLIGENCE FOR CONTRACTORS

- 5.9.2 TOLL BROTHERS ENHANCES LAND ACQUISITION WITH LIGHTBOX GIS MAPPING

- 5.9.3 TETON COUNTY BOOSTS 911 ACCURACY WITH ESRI GEOCODING COLLABORATION

- 5.9.4 PLANET LABS AND SHRIMPL MODERNIZE AQUACULTURE WITH SATELLITE DATA AND AI

- 5.9.5 RAPIDO BUILDS TRUST AND EFFICIENCY WITH GOOGLE MAPS PLATFORM

- 5.10 TECHNOLOGY ANALYSIS

- 5.10.1 KEY TECHNOLOGIES

- 5.10.1.1 Global navigation satellite systems (GNSS)

- 5.10.1.2 Aerial and satellite imagery

- 5.10.1.3 LiDAR (airborne and terrestrial)

- 5.10.1.4 Photogrammetry/structure-from-motion (SFM)

- 5.10.1.5 HD and 3D mapping engines

- 5.10.1.6 Simultaneous localization and mapping (SLAM)

- 5.10.1.7 GIS

- 5.10.1.8 Geocoding/reverse geocoding

- 5.10.2 COMPLEMENTARY TECHNOLOGIES

- 5.10.2.1 Cloud computing

- 5.10.2.2 Artificial intelligence (AI)

- 5.10.2.3 Edge computing

- 5.10.2.4 Computer vision

- 5.10.2.5 5G and connectivity

- 5.10.2.6 Indoor positioning technologies (BLE, UWB, Wi-Fi RTT, magnetic)

- 5.10.3 ADJACENT TECHNOLOGIES

- 5.10.3.1 Augmented reality (AR) and virtual reality (VR)

- 5.10.3.2 Autonomous vehicles and ADAS

- 5.10.3.3 Digital twins and urban simulation

- 5.10.3.4 Internet of Things (IoT)

- 5.10.1 KEY TECHNOLOGIES

- 5.11 REGULATORY LANDSCAPE

- 5.11.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.11.2 REGULATIONS

- 5.11.2.1 North America

- 5.11.2.1.1 US Geospatial Data Act (2018)

- 5.11.2.1.2 US National Map Policy (USGS)

- 5.11.2.1.3 Canada's Geospatial Data Policy (GeoBase Initiative)

- 5.11.2.1.4 Artificial Intelligence and Data Act (AIDA) (Canada)

- 5.11.2.1.5 US FCC Location Accuracy Requirements

- 5.11.2.2 Europe

- 5.11.2.2.1 European Union (EU) - Artificial Intelligence Act (AIA)

- 5.11.2.2.2 General Data Protection Regulation (Europe)

- 5.11.2.2.3 EU INSPIRE Directive (2007)

- 5.11.2.2.4 UK Ordnance Survey Public Data Release Policy

- 5.11.2.2.5 Germany's Federal Spatial Data Infrastructure (GDI-DE)

- 5.11.2.3 Asia Pacific

- 5.11.2.3.1 Interim Administrative Measures for Generative Artificial Intelligence Services (China)

- 5.11.2.3.2 National AI Strategy (Singapore)

- 5.11.2.3.3 India - Geospatial Data Policy 2021

- 5.11.2.3.4 China - Surveying and Mapping Law

- 5.11.2.3.5 Japan - Basic Act on the Advancement of Utilizing Geospatial Information (2007)

- 5.11.2.3.6 Australia - Location Information Privacy Guidelines

- 5.11.2.4 Middle East & Africa

- 5.11.2.4.1 National Strategy for Artificial Intelligence (UAE)

- 5.11.2.4.2 National Artificial Intelligence Strategy (Qatar)

- 5.11.2.4.3 United Arab Emirates - National Geospatial Data Infrastructure (NGDI) Policy

- 5.11.2.4.4 Saudi Arabia - General Authority for Survey and Geospatial Information (GASGI) Regulations

- 5.11.2.4.5 South Africa - Spatial Data Infrastructure Act (2003)

- 5.11.2.4.6 Qatar - National Geospatial Center Directives

- 5.11.2.5 Latin America

- 5.11.2.5.1 Santiago Declaration (Chile)

- 5.11.2.5.2 Brazilian Artificial Intelligence Strategy (EBIA)

- 5.11.2.1 North America

- 5.12 PATENT ANALYSIS

- 5.12.1 METHODOLOGY

- 5.12.2 PATENTS FILED, BY DOCUMENT TYPE

- 5.12.3 INNOVATION AND PATENT APPLICATIONS

- 5.13 PRICING ANALYSIS

- 5.13.1 AVERAGE SELLING PRICE OF OFFERINGS, BY KEY PLAYER, 2025

- 5.13.2 AVERAGE SELLING PRICE, BY FUNCTIONAL USE CASE, 2025

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 PORTER'S FIVE FORCES ANALYSIS

- 5.15.1 THREAT OF NEW ENTRANTS

- 5.15.2 THREAT OF SUBSTITUTES

- 5.15.3 BARGAINING POWER OF SUPPLIERS

- 5.15.4 BARGAINING POWER OF BUYERS

- 5.15.5 INTENSITY OF COMPETITION RIVALRY

- 5.16 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.16.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.16.2 BUYING CRITERIA

- 5.17 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.18 INTELLIGENCE MAPPING FOR LOGISTICS: PREDICTIVE ETAS & LIVE ROUTING

- 5.18.1 OPTIMIZING LOGISTICS WITH PREDICTIVE ESTIMATED TIME OF ARRIVAL (ETA)

- 5.18.2 ENABLING LIVE ROUTING FOR DYNAMIC FLEET MANAGEMENT

- 5.18.3 DRIVING STRATEGIC DECISION-MAKING WITH GEOSPATIAL INSIGHTS

- 5.19 UNIFIED AI MAPPING FRAMEWORKS FOR SOFTWARE-DEFINED VEHICLES

- 5.19.1 REVOLUTIONIZING SOFTWARE-DEFINED VEHICLE (SDV) FUNCTIONALITY

- 5.19.2 ENHANCING COMPETITIVE DIFFERENTIATION AND SCALABILITY

- 5.19.3 DRIVING AI-POWERED PERSONALIZATION AND MARKET EXPANSION

6 DIGITAL MAP MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.1.1 DRIVERS: DIGITAL MAP MARKET, BY OFFERING

- 6.2 TYPE

- 6.2.1 SOLUTIONS

- 6.2.1.1 GIS platforms/GIS systems

- 6.2.1.1.1 Expanding role of GIS platforms in enterprise decision-making

- 6.2.1.2 Location analytics solutions

- 6.2.1.2.1 Driving business insights with location analytics solutions

- 6.2.1.3 Geospatial intelligence tools

- 6.2.1.3.1 Enhancing decision-making with geospatial intelligence tools

- 6.2.1.4 Mapping data and content platforms

- 6.2.1.4.1 Rising demand for mapping data and content platforms

- 6.2.1.5 Navigation and routing platforms

- 6.2.1.5.1 Strengthening mobility through navigation and routing platforms

- 6.2.1.6 Indoor mapping and positioning tools

- 6.2.1.6.1 Transforming indoor experiences with mapping and positioning tools

- 6.2.1.7 Other solutions

- 6.2.1.1 GIS platforms/GIS systems

- 6.2.2 SERVICES

- 6.2.2.1 Professional services

- 6.2.2.1.1 Bridging technology and business outcomes through professional services

- 6.2.2.1.2 Consulting & advisory

- 6.2.2.1.3 Deployment & integration

- 6.2.2.1.4 Data collection & surveying

- 6.2.2.1.5 Map updating & maintenance

- 6.2.2.1.6 Support & training

- 6.2.2.2 Managed services

- 6.2.2.2.1 Driving efficiency through managed services

- 6.2.2.1 Professional services

- 6.2.1 SOLUTIONS

- 6.3 DEPLOYMENT MODE

- 6.3.1 CLOUD

- 6.3.1.1 Fueling flexible and scalable mapping adoption through cloud deployment

- 6.3.2 ON-PREMISES

- 6.3.2.1 Ensuring security and data control with on-premises deployment

- 6.3.1 CLOUD

- 6.4 SCALE

- 6.4.1 SMALL-SCALE MAPS

- 6.4.1.1 Small-scale maps supporting detailed visualization needs

- 6.4.2 LARGE-SCALE MAPS

- 6.4.2.1 Large-scale maps driving precision and operational efficiency

- 6.4.1 SMALL-SCALE MAPS

7 DIGITAL MAP MARKET, BY MAPPING TYPE

- 7.1 INTRODUCTION

- 7.1.1 DRIVERS: DIGITAL MAP MARKET, BY MAPPING TYPE

- 7.2 2D

- 7.2.1 DRIVING RELIABLE NAVIGATION AND ROUTE OPTIMIZATION

- 7.3 3D

- 7.3.1 POWERING SMART CITIES AND IMMERSIVE EXPERIENCES

- 7.4 4D

- 7.4.1 ENABLING PREDICTIVE INSIGHTS AND REAL-TIME SIMULATIONS

8 DIGITAL MAP MARKET, BY MAPPING LOCATION

- 8.1 INTRODUCTION

- 8.1.1 DRIVERS: DIGITAL MAP MARKET, BY MAPPING LOCATION

- 8.2 INDOOR

- 8.2.1 INDOOR MAPPING TO GAIN TRACTION AS IT ACHIEVES OPERATIONAL EFFICIENCY AND CUSTOMER SATISFACTION

- 8.2.2 INDOOR NAVIGATION & WAYFINDING

- 8.2.3 INDOOR POSITIONING SYSTEMS (IPS)

- 8.2.4 INDOOR ASSET & RESOURCE TRACKING

- 8.2.5 INDOOR FACILITY MAPPING

- 8.2.6 INDOOR SAFETY & EMERGENCY MAPPING

- 8.3 OUTDOOR

- 8.3.1 OUTDOOR MAPPING EMPOWERS APPLICATIONS ACROSS LAND MANAGEMENT AND INFRASTRUCTURE DEVELOPMENT

- 8.3.2 TOPOGRAPHIC MAPPING

- 8.3.3 THEMATIC MAPPING

- 8.3.4 NAVIGATIONAL MAPPING

- 8.3.5 CADASTRAL & PARCEL MAPPING

- 8.3.6 SATELLITE & AERIAL MAPPING

- 8.3.7 UTILITY & INFRASTRUCTURE MAPPING

9 DIGITAL MAP MARKET, BY FUNCTIONAL USE CASE

- 9.1 INTRODUCTION

- 9.1.1 DRIVERS: DIGITAL MAP MARKET, BY FUNCTIONAL USE CASE

- 9.2 NAVIGATION MAPS

- 9.2.1 TURN-BY-TURN NAVIGATION MAPS

- 9.2.1.1 Supporting real-time traffic and road updates

- 9.2.2 PEDESTRIAN NAVIGATION MAPS

- 9.2.2.1 Enhancing walkability and smart city mobility

- 9.2.3 PUBLIC TRANSPORT MAPS

- 9.2.3.1 Improving commuter experience and route planning

- 9.2.1 TURN-BY-TURN NAVIGATION MAPS

- 9.3 THEMATIC MAPS

- 9.3.1 DEMOGRAPHIC MAPS

- 9.3.1.1 Enhancing location-based marketing strategies

- 9.3.2 ENVIRONMENTAL MAPS

- 9.3.2.1 Driving disaster preparedness and response planning

- 9.3.3 ECONOMIC MAPS

- 9.3.3.1 Driving infrastructure investments and growth planning

- 9.3.4 HEALTH MAPS

- 9.3.4.1 Enabling emergency response and epidemic preparedness

- 9.3.1 DEMOGRAPHIC MAPS

- 9.4 SATELLITE MAPS

- 9.4.1 AERIAL IMAGERY

- 9.4.1.1 Driving precision agriculture and land monitoring

- 9.4.2 REMOTE SENSING IMAGERY

- 9.4.2.1 Enabling resource exploration and management

- 9.4.3 MULTISPECTRAL IMAGERY

- 9.4.3.1 Driving crop monitoring and agricultural productivity

- 9.4.4 RADAR IMAGERY

- 9.4.4.1 Supporting all-weather defense and security operations

- 9.4.1 AERIAL IMAGERY

- 9.5 TRAFFIC MAPS

- 9.5.1 CONGESTION HEAT MAPS

- 9.5.1.1 Enabling infrastructure and road planning decisions

- 9.5.2 INCIDENT MAPS

- 9.5.2.1 Supporting emergency response and public safety

- 9.5.3 PREDICTIVE TRAFFIC MAPS

- 9.5.3.1 Driving proactive commuter route decisions

- 9.5.4 ALTERNATIVE ROUTE MAPS

- 9.5.4.1 Supporting faster and reliable travel choices

- 9.5.1 CONGESTION HEAT MAPS

10 DIGITAL MAP MARKET, BY INDUSTRY VERTICAL

- 10.1 INTRODUCTION

- 10.1.1 DRIVERS: DIGITAL MAP MARKET, BY INDUSTRY VERTICAL

- 10.2 GOVERNMENT & DEFENSE

- 10.2.1 DIGITAL MAPS STRENGTHENING NATIONAL SECURITY AND EMERGENCY RESPONSE

- 10.3 REAL ESTATE & CONSTRUCTION

- 10.3.1 DIGITAL MAPS POWERING SMART INFRASTRUCTURE AND URBAN DEVELOPMENT

- 10.4 TRANSPORTATION & LOGISTICS

- 10.4.1 DIGITAL MAPS DRIVING ROUTE OPTIMIZATION AND SUPPLY CHAIN EFFICIENCY

- 10.5 AUTOMOTIVE

- 10.5.1 DIGITAL MAPS ENABLING AUTONOMOUS DRIVING AND CONNECTED MOBILITY

- 10.6 TELECOMMUNICATIONS

- 10.6.1 DIGITAL MAPS SUPPORTING NETWORK PLANNING AND 5G ROLLOUT

- 10.7 RETAIL & CONSUMER GOODS

- 10.7.1 DIGITAL MAPS ENHANCING CUSTOMER TARGETING AND STORE OPTIMIZATION

- 10.8 TRAVEL & TOURISM

- 10.8.1 DIGITAL MAPS DELIVERING IMMERSIVE TRAVEL AND SEAMLESS NAVIGATION

- 10.9 MANUFACTURING

- 10.9.1 DIGITAL MAPS OPTIMIZING PLANT OPERATIONS AND INDUSTRIAL SUPPLY CHAINS

- 10.10 BFSI

- 10.10.1 DIGITAL MAPS SUPPORTING RISK ASSESSMENT AND BRANCH EXPANSION

- 10.11 ENERGY & UTILITIES

- 10.11.1 DIGITAL MAPS ENABLING GRID MONITORING AND RESOURCE MANAGEMENT

- 10.12 AGRICULTURE & FORESTRY

- 10.12.1 DIGITAL MAPS DRIVING PRECISION FARMING AND SUSTAINABLE LAND USE

- 10.13 OTHER INDUSTRY VERTICALS

11 DIGITAL MAP MARKET, BY REGION

- 11.1 INTRODUCTION

- 11.2 NORTH AMERICA

- 11.2.1 NORTH AMERICA: DIGITAL MAP MARKET DRIVERS

- 11.2.2 NORTH AMERICA: MACROECONOMIC OUTLOOK

- 11.2.3 US

- 11.2.3.1 Strong technology ecosystem and early adoption of advanced solutions to drive market

- 11.2.4 CANADA

- 11.2.4.1 Government support and smart city investments to fuel digital map adoption

- 11.3 EUROPE

- 11.3.1 EUROPE: DIGITAL MAP MARKET DRIVERS

- 11.3.2 EUROPE: MACROECONOMIC OUTLOOK

- 11.3.3 UK

- 11.3.3.1 Smart mobility and infrastructure modernization to boost mapping demand

- 11.3.4 GERMANY

- 11.3.4.1 Automotive innovation and Industry 4.0 integration to accelerate demand

- 11.3.5 FRANCE

- 11.3.5.1 Urban mobility solutions and sustainability goals to drive market

- 11.3.6 ITALY

- 11.3.6.1 Tourism digitization and infrastructure upgrades to drive market

- 11.3.7 REST OF EUROPE

- 11.4 ASIA PACIFIC

- 11.4.1 ASIA PACIFIC: DIGITAL MAP MARKET DRIVERS

- 11.4.2 ASIA PACIFIC: MACROECONOMIC OUTLOOK

- 11.4.3 CHINA

- 11.4.3.1 Rapid urbanization and AI-powered mapping innovations to fuel market

- 11.4.4 INDIA

- 11.4.4.1 Government initiatives and digital transformation programs to accelerate adoption

- 11.4.5 JAPAN

- 11.4.5.1 Developments in automation and high-tech transport systems to boost demand

- 11.4.6 SOUTH KOREA

- 11.4.6.1 5G deployment and smart infrastructure projects to support market growth

- 11.4.7 SINGAPORE

- 11.4.7.1 Smart nation vision and digital-first policies to drive market

- 11.4.8 REST OF ASIA PACIFIC

- 11.5 MIDDLE EAST & AFRICA

- 11.5.1 MIDDLE EAST & AFRICA: DIGITAL MAP MARKET DRIVERS

- 11.5.2 MIDDLE EAST & AFRICA: MACROECONOMIC OUTLOOK

- 11.5.3 SAUDI ARABIA

- 11.5.3.1 Vision 2030 initiatives and digital economy growth to fuel demand

- 11.5.4 UAE

- 11.5.4.1 Smart city mega-projects and advanced infrastructure to increase demand

- 11.5.5 QATAR

- 11.5.5.1 World-class infrastructure and event-driven development to boost adoption

- 11.5.6 SOUTH AFRICA

- 11.5.6.1 Smart urban planning and transport modernization to drive market

- 11.5.7 REST OF MIDDLE EAST & AFRICA

- 11.6 LATIN AMERICA

- 11.6.1 LATIN AMERICA: DIGITAL MAP MARKET DRIVERS

- 11.6.2 LATIN AMERICA: MACROECONOMIC OUTLOOK

- 11.6.3 BRAZIL

- 11.6.3.1 Large-scale urban mobility and smart city programs to accelerate adoption

- 11.6.4 MEXICO

- 11.6.4.1 Logistics optimization and cross-border trade digitization TO support MARKET GROWTH

- 11.6.5 REST OF LATIN AMERICA

12 COMPETITIVE LANDSCAPE

- 12.1 OVERVIEW

- 12.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2022-2025

- 12.3 REVENUE ANALYSIS, 2020-2024

- 12.4 MARKET SHARE ANALYSIS, 2024

- 12.5 PRODUCT COMPARISON

- 12.5.1 PRODUCT COMPARATIVE ANALYSIS, BY OFFERING

- 12.6 COMPANY VALUATION AND FINANCIAL METRICS

- 12.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 12.7.1 STARS

- 12.7.2 EMERGING LEADERS

- 12.7.3 PERVASIVE PLAYERS

- 12.7.4 PARTICIPANTS

- 12.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 12.7.5.1 Company footprint

- 12.7.5.2 Regional footprint

- 12.7.5.3 Offering footprint

- 12.7.5.4 Functional use case footprint

- 12.7.5.5 Industry vertical footprint

- 12.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 12.8.1 PROGRESSIVE COMPANIES

- 12.8.2 RESPONSIVE COMPANIES

- 12.8.3 DYNAMIC COMPANIES

- 12.8.4 STARTING BLOCKS

- 12.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 12.8.5.1 Detailed list of key startups/SMEs

- 12.8.5.2 Competitive benchmarking of key startups/SMEs

- 12.9 COMPETITIVE SCENARIO

- 12.9.1 PRODUCT LAUNCHES AND ENHANCEMENTS

- 12.9.2 DEALS

13 COMPANY PROFILES

- 13.1 INTRODUCTION

- 13.2 KEY PLAYERS

- 13.2.1 GOOGLE

- 13.2.1.1 Business overview

- 13.2.1.2 Products/Solutions/Services offered

- 13.2.1.3 Recent developments

- 13.2.1.3.1 Product launches and enhancements

- 13.2.1.3.2 Deals

- 13.2.1.4 MnM view

- 13.2.1.4.1 Right to win

- 13.2.1.4.2 Strategic choices

- 13.2.1.4.3 Weaknesses and competitive threats

- 13.2.2 APPLE

- 13.2.2.1 Business overview

- 13.2.2.2 Products/Solutions/Services offered

- 13.2.2.3 Recent developments

- 13.2.2.3.1 Product launches and enhancements

- 13.2.2.3.2 Deals

- 13.2.2.4 MnM view

- 13.2.2.4.1 Right to win

- 13.2.2.4.2 Strategic choices

- 13.2.2.4.3 Weaknesses and competitive threats

- 13.2.3 TOMTOM

- 13.2.3.1 Business overview

- 13.2.3.2 Products/Solutions/Services offered

- 13.2.3.3 Recent developments

- 13.2.3.3.1 Deals

- 13.2.3.3.2 Other developments

- 13.2.3.4 MnM view

- 13.2.3.4.1 Right to win

- 13.2.3.4.2 Strategic choices

- 13.2.3.4.3 Weaknesses and competitive threats

- 13.2.4 BENTLEY SYSTEMS

- 13.2.4.1 Business overview

- 13.2.4.2 Products/Solutions/Services offered

- 13.2.4.3 Recent developments

- 13.2.4.3.1 Product launches and enhancements

- 13.2.4.3.2 Deals

- 13.2.4.4 MnM view

- 13.2.4.4.1 Right to win

- 13.2.4.4.2 Strategic choices

- 13.2.4.4.3 Weaknesses and competitive threats

- 13.2.5 PLANET LABS

- 13.2.5.1 Business overview

- 13.2.5.2 Products/Solutions/Services offered

- 13.2.5.3 Recent developments

- 13.2.5.3.1 Product launches and enhancements

- 13.2.5.3.2 Deals

- 13.2.5.3.3 Other developments

- 13.2.5.4 MnM view

- 13.2.5.4.1 Right to win

- 13.2.5.4.2 Strategic choices

- 13.2.5.4.3 Weaknesses and competitive threats

- 13.2.6 HEXAGON

- 13.2.6.1 Business overview

- 13.2.6.2 Products/Solutions/Services offered

- 13.2.6.3 Recent developments

- 13.2.6.3.1 Product launches and enhancements

- 13.2.6.3.2 Deals

- 13.2.7 GENESYS

- 13.2.7.1 Business overview

- 13.2.7.2 Products/Solutions/Services offered

- 13.2.7.3 Recent developments

- 13.2.7.3.1 Deals

- 13.2.8 ESRI

- 13.2.8.1 Business overview

- 13.2.8.2 Products/Solutions/Services offered

- 13.2.8.3 Recent developments

- 13.2.8.3.1 Product launches and enhancements

- 13.2.8.3.2 Deals

- 13.2.9 HERE TECHNOLOGIES

- 13.2.9.1 Business overview

- 13.2.9.2 Products/Solutions/Services offered

- 13.2.9.3 Recent developments

- 13.2.9.3.1 Product launches and enhancements

- 13.2.9.3.2 Deals

- 13.2.10 NEARMAP

- 13.2.10.1 Business overview

- 13.2.10.2 Products/Solutions/Services offered

- 13.2.10.3 Recent developments

- 13.2.10.3.1 Product launches and enhancements

- 13.2.10.3.2 Deals

- 13.2.11 INRIX

- 13.2.11.1 Business overview

- 13.2.11.2 Products/Solutions/Services offered

- 13.2.11.3 Recent developments

- 13.2.11.3.1 Product launches and enhancements

- 13.2.11.3.2 Deals

- 13.2.12 LIGHTBOX

- 13.2.12.1 Business overview

- 13.2.12.2 Products/Solutions/Services offered

- 13.2.12.3 Recent developments

- 13.2.12.3.1 Product launches and enhancements

- 13.2.12.3.2 deals

- 13.2.13 SERVICENOW

- 13.2.13.1 Business overview

- 13.2.13.2 Products/Solutions/Services offered

- 13.2.13.3 Recent developments

- 13.2.13.3.1 Deals

- 13.2.14 INPIXON

- 13.2.14.1 Business overview

- 13.2.14.2 Products/Solutions/Services offered

- 13.2.14.3 Recent developments

- 13.2.14.3.1 Deals

- 13.2.15 MICROSOFT

- 13.2.15.1 Business overview

- 13.2.15.2 Products/Solutions/Services offered

- 13.2.15.3 Recent developments

- 13.2.15.3.1 Deals

- 13.2.16 MAXAR TECHNOLOGIES

- 13.2.16.1 Business overview

- 13.2.16.2 Products/Solutions/Services offered

- 13.2.16.3 Recent developments

- 13.2.16.3.1 Product launches and enhancements

- 13.2.16.4 Recent developments

- 13.2.16.4.1 Deals

- 13.2.17 CARTO

- 13.2.18 TELEDYNE TECHNOLOGIES

- 13.2.19 MAPBOX

- 13.2.20 BLUE MARBLE GEOGRAPHICS

- 13.2.21 MAPPLS

- 13.2.22 SUPERMAP

- 13.2.1 GOOGLE

- 13.3 OTHER PLAYERS

- 13.3.1 EMAPA

- 13.3.2 MAPTIVE

- 13.3.3 GIS CLOUD

- 13.3.4 DABEEO

- 13.3.5 CALIPER

- 13.3.6 GEOVERRA

- 13.3.7 PRIVATEER

- 13.3.8 DIGIMAP

- 13.3.9 MAPQUEST

- 13.3.10 INDOORATLAS

- 13.3.11 MAPSTED

- 13.3.12 MAPIDEA

- 13.3.13 GEOCENTO

- 13.3.14 GEOSPIN

- 13.3.15 JAWG MAPS

- 13.3.16 BARIKOI

- 13.3.17 EASYMAPMAKER

- 13.3.18 BATCHGEO

- 13.3.19 ESPATIAL

- 13.3.20 MAPLINE

- 13.3.21 SCRIBBLE MAPS

14 ADJACENT AND RELATED MARKETS

- 14.1 INTRODUCTION

- 14.2 GEOSPATIAL IMAGERY ANALYTICS MARKET - GLOBAL FORECAST TO 2030

- 14.2.1 MARKET DEFINITION

- 14.2.2 MARKET OVERVIEW

- 14.2.2.1 Geospatial imagery analytics market, by application

- 14.2.2.2 Geospatial imagery analytics market, by data modality

- 14.2.2.3 Geospatial imagery analytics market, by data source

- 14.2.2.4 Geospatial imagery analytics market, by offering

- 14.2.2.5 Geospatial imagery analytics market, by vertical

- 14.2.2.6 Geospatial imagery analytics market, by region

- 14.3 GEOSPATIAL ANALYTICS MARKET - GLOBAL FORECAST TO 2029

- 14.3.1 MARKET DEFINITION

- 14.3.2 MARKET OVERVIEW

- 14.3.2.1 Geospatial analytics market, by offering

- 14.3.2.2 Geospatial analytics) market, by technology

- 14.3.2.3 Geospatial analytics market, by data type

- 14.3.2.4 Geospatial analytics market, by vertical

- 14.3.2.5 Geospatial analytics market, by region

15 APPENDIX

- 15.1 DISCUSSION GUIDE

- 15.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.3 CUSTOMIZATION OPTIONS

- 15.4 RELATED REPORTS

- 15.5 AUTHOR DETAILS