|

시장보고서

상품코드

1823730

체외진단(IVD) 품질관리 시장 예측(-2030년) : 제품 및 서비스, 기술별, 제조업체별, 최종사용자별In Vitro Diagnostics (IVD) Quality Control Market by Product & Service (QC (Plasma, Serum, Blood), Solutions), Technology (Immunoassay, MDx, Microbiology, Hematology), Manufacturer (Third-party, OEM), End User (Hospitals, Labs) - Global Forecast to 2030 |

||||||

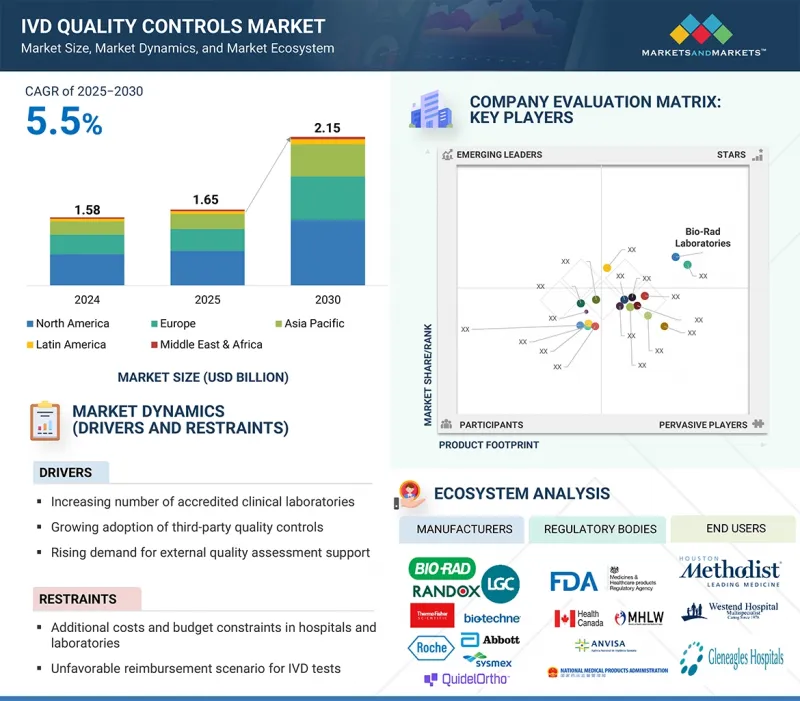

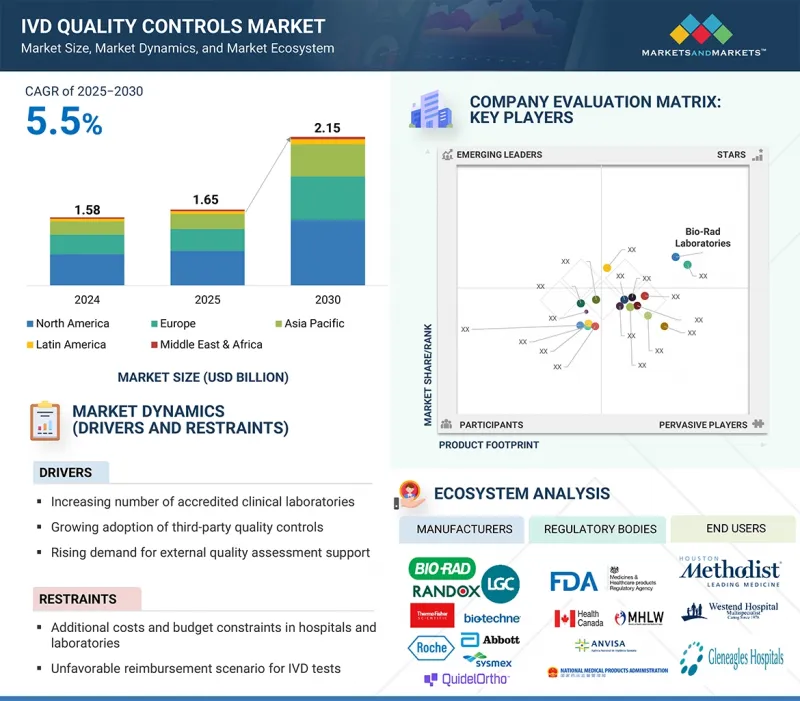

세계의 IVD 품질관리 시장 규모는 2025년에 추정 16억 5,000만 달러로, 2030년까지 21억 5,000만 달러에 달할 것으로 예측되며, 예측 기간에 CAGR로 5.5%의 성장이 전망됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2023-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 달러 |

| 부문 | 제품·서비스, 기술, 제조업체 유형, 최종사용자 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 라틴아메리카, 중동 및 아프리카 |

IVD 품질관리는 임상 실험실 및 의료시설 전체에서 진단 검사 결과의 정확성, 신뢰성 및 일관성을 보장하는 데 중요한 역할을 합니다. 타사 품질관리의 채택 확대는 IVD 품질관리 시장의 주요 촉진요인 중 하나입니다. 특정 기기 관리와 달리 타사 솔루션은 유연성이 높고, 여러 플랫폼과 호환되며, 보존 기간이 깁니다.

이를 통해 공정한 성능 평가와 일관된 분석물의 안정성을 제공하고, 실험실에서 재현성 있고 신뢰할 수 있는 결과를 유지할 수 있도록 도와줍니다. 규제 및 인증에 대한 요구사항이 증가함에 따라 검사실은 워크플로우 효율성을 최적화하고 규정 준수를 보장하기 위해 타사 관리를 선호하고 있습니다. 다중 항목 관리의 사용이 증가함에 따라 여러 분석의 동시 모니터링이 가능하고 운영 비용을 절감할 수 있으므로 수요가 더욱 증가하고 있습니다. 특히 병원과 임상검사실은 대량의 검사와 다양한 진단 적용을 지원하기 위해 이러한 솔루션을 채택하고 있습니다. 이러한 제3자 품질관리로의 전환은 세계 IVD 품질관리 시장의 혁신, 채택 및 지속적인 성장을 지속적으로 촉진할 것입니다.

"제품 및 서비스별로는 품질관리 제품 부문이 2024년 IVD 품질관리 시장을 주도했습니다. "

2024년,품질관리 제품이 가장 큰 점유율을 차지했습니다. 이는 진단 검사 횟수 증가와 정확하고 신뢰할 수 있는 재현성 있는 결과에 대한 니즈에 기인합니다. 규제 및 인증 요건은 검사실이 규정 준수를 유지하고 환자의 안전을 보장하는 것을 목표로 하므로 품질관리 제품의 채택을 더욱 촉진하고 있습니다. 품질관리 제품은 여러 분석 및 플랫폼에서 일관된 성능 모니터링을 통해 오류를 줄이고 워크플로우의 효율성을 높일 수 있도록 지원합니다. 타사 관리 및 다중 항목 관리의 사용이 증가함에 따라 이 부문이 더욱 강화되어 운영 비용을 최적화하면서 동시에 여러 분석물을 동시에 검사할 수 있게 되었습니다. 전반적으로 QC 제품은 여전히 실험실 품질관리의 중추이며, IVD 품질관리 시장을 독점하는 부문입니다.

"제조업체 유형별로는 타사 관리 부문이 예측 기간 중 가장 높은 성장률을 나타낼 것으로 예측됩니다. "

예측 기간 중 타사 관리 부문이 가장 빠르게 성장할 것으로 예측됩니다. 이들은 여러 플랫폼에 호환되고, 보존 기간이 길고, 성능 평가에 대한 편견이 없기 때문에 검사실에서 점점 더 선호되고 있습니다. 타사 관리는 또한 다항목 검사 및 표준화된 QC 절차를 지원하여 실험실이 워크플로우 효율성을 개선하고 반복 가능한 결과를 보장할 수 있도록 도와줍니다. 특정 기기 용도에서 OEM 관리의 중요성은 변함없지만, 다용도하고 비용 효율적이며 신뢰할 수 있는 솔루션에 대한 수요가 증가함에 따라 전 세계에서 타사 관리의 급속한 채택이 계속 증가하고 있습니다.

"아시아태평양이 예측 기간 중 가장 빠르게 성장하는 시장이 될 것으로 예측됩니다. "

의료 인프라의 급속한 발전과 첨단 진단 기술에 대한 투자 증가로 아시아태평양은 예측 기간 중 IVD 품질관리 시장에서 가장 빠르게 성장하는 지역이 될 것으로 예측됩니다. 이 지역에는 임상실험실, 병원, 진단센터의 수가 증가하고 있으며, 신뢰할 수 있고 정확한 품질관리 제품에 대한 수요가 증가하고 있습니다. 질병 조기 발견의 중요성에 대한 인식이 높아지면서 규제 당국의 검사실 표준을 개선하려는 노력과 함께 시장 성장을 더욱 촉진하고 있습니다. 또한 환자 수 증가와 만성질환 및 감염성 질환의 확산으로 인해 정확성과 재현성을 보장하는 품질관리 솔루션에 대한 수요가 증가하고 있습니다.

세계의 체외진단(IVD) 품질관리 시장에 대해 조사분석했으며, 주요 촉진요인과 억제요인, 경쟁 구도, 향후 동향 등의 정보를 제공하고 있습니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 중요 인사이트

- IVD 품질관리 시장의 개요

- IVD 품질관리 시장 : 제품·서비스별(2025년·2030년)

- IVD 품질관리 시장 : 기술별(2025년·2030년)

- IVD 품질관리 시장 : 제조업체 유형별(2025년·2030년)

- IVD 품질관리 시장 : 최종사용자별(2025년·2030년)

- IVD 품질관리 시장 : 지역적 성장 기회

제5장 시장 개요

- 서론

- 시장 역학

- 촉진요인

- 억제요인

- 기회

- 과제

- 가격결정 분석

- IVD 품질관리 제품의 평균 판매 가격 동향(2023-2025년)

- IVD 품질관리 제품의 평균 판매 가격 동향 : 주요 기업별(2023-2025년)

- IVD 품질관리 제품의 평균 판매 가격 동향 : 지역별(2023-2025년)

- 특허 분석

- 밸류체인 분석

- 공급망 분석

- 무역 분석

- 수입 데이터(HS 코드 3822)

- 수출 데이터(HS 코드 3822)

- 에코시스템 분석

- Porter's Five Forces 분석

- 규제 분석

- 규제 구조

- 규제기관, 정부기관, 기타 조직

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 주요 컨퍼런스와 이벤트(2025-2026년)

- 고객 비즈니스에 영향을 미치는 동향/파괴적 변화

- 주요 이해관계자와 구입 기준

- 투자와 자금조달 시나리오

- 사례 연구 분석

- IVD 품질관리 시장에 대한 AI/생성형 AI의 영향

- 서론

- AI 시장의 장래성

- AI 사용 사례

- AI 실장 : 주요 기업별, 사용 사례별

- IVD 품질관리 시장에서 AI의 미래

- IVD 품질관리 시장에 대한 2025년 미국 관세의 영향

- 서론

- 주요 관세율

- 가격의 영향 분석

- 국가/지역에 대한 영향

- 최종 용도 산업에 대한 영향

제6장 IVD 품질관리 시장 : 제품·서비스별

- 서론

- 품질관리 제품

- 데이터 관리 솔루션

- 품질 보증 서비스

제7장 IVD 품질관리 시장 : 기술별

- 서론

- 면역분석법

- 임상화학

- 분자진단

- 미생물학

- 혈액학

- 응고·지혈

- 기타 기술

제8장 IVD 품질관리 시장 : 제조업체 유형별

- 서론

- 서드파티 관리

- OEM 관리

제9장 IVD 품질관리 시장 : 최종사용자별

- 서론

- 병원

- 임상 검사실

- 학술연구기관

- 기타 최종사용자

제10장 IVD 품질관리 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 유럽

- 유럽의 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 스페인

- 러시아

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 중국

- 일본

- 인도

- 호주

- 한국

- 기타 아시아태평양

- 라틴아메리카

- 라틴아메리카의 거시경제 전망

- 브라질

- 멕시코

- 기타 라틴아메리카

- 중동 및 아프리카

- 중동 및 아프리카의 거시경제 전망

- 사우디아라비아

- 아랍에미리트

- 기타 중동 및 아프리카

제11장 경쟁 구도

- 서론

- 주요 참여 기업의 전략/강점

- 매출 분석(2022-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 기업의 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- BIO-RAD LABORATORIES, INC.

- THERMO FISHER SCIENTIFIC, INC.

- ABBOTT

- LGC LIMITED

- F. HOFFMANN-LA ROCHE LTD.

- RANDOX LABORATORIES LTD.

- SIEMENS HEALTHINEERS AG

- QUIDELORTHO CORPORATION

- DANAHER CORPORATION

- SYSMEX CORPORATION

- BIO-TECHNE CORPORATION

- MICROBIX BIOSYSTEMS INC.

- GRIFOLS, S.A.

- MICROBIOLOGICS, INC.

- ZEPTOMETRIX

- FORTRESS DIAGNOSTICS

- 기타 기업

- HELENA LABORATORIES CORPORATION

- STRECK, INC.

- MAINE MOLECULAR QUALITY CONTROLS, INC.

- SUN DIAGNOSTICS, LLC

- SERO AS

- CONEBIOPRODUCTS

- ALPHA-TEC

- EUROTROL B.V.

- BIOREX DIAGNOSTICS

제13장 부록

KSA 25.10.02The IVD quality controls market is valued at an estimated USD 1.65 billion in 2025 and is projected to reach USD 2.15 billion by 2030, at a CAGR of 5.5% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2023-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD) |

| Segments | Product & Service, Technology, Manufacturer Type, End User |

| Regions covered | North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa |

IVD quality controls play a critical role in ensuring the accuracy, reliability, and consistency of diagnostic test results across clinical laboratories and healthcare facilities. The growing adoption of third-party quality controls is one of the major drivers of the IVD quality controls market. Unlike instrument-specific controls, third-party solutions offer greater flexibility, compatibility across multiple platforms, and longer shelf life.

They provide unbiased performance assessment and consistent analyte stability, helping laboratories maintain reproducible and reliable results. With increasing regulatory and accreditation requirements, laboratories are favoring third-party controls to ensure compliance while optimizing workflow efficiency. The rising use of multianalyte controls further enhances demand, allowing simultaneous monitoring of multiple assays and reducing operational costs. Hospitals and clinical laboratories, in particular, are adopting these solutions to support high-volume testing and diverse diagnostic applications. This shift toward third-party quality controls continues to drive innovation, adoption, and sustained growth in the global IVD quality controls market.

"By product & service, the quality control products segment dominated the IVD quality controls market in 2024."

By product & service, the IVD quality controls market is segmented into quality control products, data management solutions, and quality assurance services. In 2024, quality control products held the largest share, driven by the increasing number of diagnostic tests and the need for accurate, reliable, and reproducible results. Regulatory and accreditation requirements further support their adoption, as laboratories aim to maintain compliance and ensure patient safety. Quality control products enable consistent performance monitoring across multiple assays and platforms, helping reduce errors and improve workflow efficiency. The rising use of third-party and multianalyte controls has further strengthened this segment, allowing simultaneous testing of multiple analytes while optimizing operational costs. Overall, QC products remain the backbone of laboratory quality management, making them the dominant segment within the IVD quality controls market.

"By manufacturer type, the third-party controls segment is projected to achieve the highest growth during the forecast period."

By manufacturer type, the IVD quality controls market is segmented into third-party controls and original equipment manufacturer (OEM) controls. Third-party controls are projected to be the fastest-growing segment during the forecast period. Their compatibility across multiple platforms, longer shelf life, and unbiased performance assessment make them increasingly preferred by laboratories. Third-party controls also support multianalyte testing and standardized QC procedures, helping laboratories improve workflow efficiency and ensure reproducible results. While OEM controls remain important for instrument-specific applications, the growing demand for versatile, cost-effective, and reliable solutions continues to drive the rapid adoption of third-party controls globally.

"The Asia Pacific is projected to be the fastest-growing regional market during the forecast period."

The market for IVD quality controls is categorized into North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. The Asia Pacific is anticipated to be the fastest-growing region in the IVD quality controls market during the forecast period, driven by the rapid development of healthcare infrastructure and increasing investment in advanced diagnostic technologies. The region is witnessing a growing number of clinical laboratories, hospitals, and diagnostic centers, which is boosting the demand for reliable and accurate quality control products. Rising awareness about the importance of early disease detection, coupled with regulatory initiatives to improve laboratory standards, is further supporting market growth. Additionally, the expanding patient population and the rising prevalence of chronic and infectious diseases are creating strong demand for quality control solutions to ensure accuracy and reproducibility.

Breakdown of the profiles of primary participants in the IVD quality controls market:

- By Company Type: Tier 1 (40%), Tier 2 (30%), and Tier 3 (30%)

- By Designation: C-level Executives (27%), Director-level Executives (18%), and Others (55%)

- By Region: North America (51%), Europe (21%), Asia Pacific (18%), Latin America (6%), and the Middle East & Africa (4%)

The key players in the IVD quality controls market are Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific Inc. (US), Abbott (US), LGC Limited (UK), F. Hoffmann-La Roche Ltd. (Switzerland), Randox Laboratories Ltd. (UK), Siemens Healthineers AG (Germany), QuidelOrtho Corporation (US), Danaher Corporation (US), Sysmex Corporation (Japan), Bio-Techne Corporation (US), Microbix Biosystems Inc. (Canada), Microbiologics, Inc. (US), ZeptoMetrix (US), Fortress Diagnostics (UK), Helena Laboratories Corporation (US), Streck, Inc. (US), SERO AS (Norway), Maine Molecular Quality Controls, Inc. (US), Sun Diagnostics, LLC (US), Alpha-Tec (US), Grifols, S.A. (Spain), ConeBioproducts (US), Eurotrol B.V. (Netherlands), and Biorex Diagnostics (UK).

Research Coverage:

This research report categorizes the IVD quality controls market by product & service (quality control products, data management solutions, and quality assurance services), technology (immunoassays, clinical chemistry, molecular diagnostics, microbiology, hematology, coagulation & hemostasis, and other technologies), manufacturer type [third-party controls ([independent controls, instrument-specific controls), original equipment manufacturer controls], end user (hospitals, clinical laboratories, academic & research institutes, and other end users), and region (North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa).

The scope of the report covers detailed information regarding the major factors, such as drivers, restraints, opportunities, and challenges influencing the growth of the IVD quality controls market. A detailed analysis of the key industry players has been done to provide insights into their business overview, solutions, key strategies, acquisitions, and agreements. A competitive analysis of upcoming startups in the IVD quality controls market ecosystem is covered in this report.

Reasons to Buy this Report:

The report will help market leaders/new entrants in this market with information on the closest approximations of the revenue numbers for the overall IVD quality controls market and the subsegments. It will also help stakeholders understand the competitive landscape and gain more insights to better position their businesses and plan suitable go-to-market strategies. The report also helps stakeholders understand the pulse of the market and provides them with information on key market drivers, restraints, opportunities, and challenges.

The report provides insights into the following pointers:

- Analysis of key drivers (increasing number of accredited clinical laboratories, growing adoption of third-party quality controls, rising demand for external quality assessment support, rising geriatric population and subsequent growth in prevalence of chronic

and infectious diseases, and increasing adoption of PoC instruments in developed regions), opportunities (rising demand for multianalyte controls and increasing growth opportunities in emerging economies), restraints (additional costs and budget constraints in hospitals and laboratories and unfavorable reimbursement scenario for IVD tests), and challenges (stringent product approval process and lack of regulations for clinical laboratory accreditation in several emerging countries) influencing the growth of the IVD quality controls market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product launches in the IVD quality controls market

- Market Development: Comprehensive information about lucrative markets across varied regions

- Market Diversification: Exhaustive information about products, untapped geographies, recent developments, and investments in the IVD quality controls market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and product offerings of leading players like Bio-Rad Laboratories, Inc. (US), Thermo Fisher Scientific Inc. (US), Abbott (US), LGC Limited (UK), and F. Hoffmann-La Roche Ltd. (Switzerland)

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED & REGIONAL SCOPE

- 1.4 INCLUSIONS & EXCLUSIONS

- 1.4.1 YEARS CONSIDERED

- 1.5 CURRENCY CONSIDERED

- 1.6 KEY STAKEHOLDERS

- 1.7 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 Key secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Primary sources

- 2.2.2.2 Key data from primary sources

- 2.2.2.3 Key industry insights

- 2.2.2.4 Breakdown of primary interviews

- 2.2.1 SECONDARY DATA

- 2.3 MARKET SIZE ESTIMATION

- 2.3.1 BOTTOM-UP APPROACH

- 2.3.1.1 Approach 1: Company revenue estimation approach

- 2.3.1.2 Approach 2: Presentations of companies and primary interviews

- 2.3.1.3 Growth forecast

- 2.3.1.4 CAGR projections

- 2.3.2 TOP-DOWN APPROACH

- 2.3.1 BOTTOM-UP APPROACH

- 2.4 MARKET BREAKDOWN & DATA TRIANGULATION

- 2.5 MARKET SHARE ASSESSMENT

- 2.6 RESEARCH ASSUMPTIONS

- 2.6.1 PARAMETRIC ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

- 2.8 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 IVD QUALITY CONTROLS MARKET OVERVIEW

- 4.2 IVD QUALITY CONTROLS MARKET, BY PRODUCT & SERVICE, 2025 VS. 2030

- 4.3 IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY, 2025 VS. 2030

- 4.4 IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE, 2025 VS. 2030

- 4.5 IVD QUALITY CONTROLS MARKET, BY END USER, 2025 VS. 2030

- 4.6 IVD QUALITY CONTROLS MARKET: GEOGRAPHIC GROWTH OPPORTUNITIES

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing number of accredited clinical laboratories

- 5.2.1.2 Growing adoption of third-party quality controls

- 5.2.1.3 Rising demand for external quality assessment support

- 5.2.1.4 Rising geriatric population and subsequent growth in prevalence of chronic and infectious diseases

- 5.2.1.5 Increasing adoption of POC instruments in developed regions

- 5.2.2 RESTRAINTS

- 5.2.2.1 Additional costs and budget constraints in hospitals and laboratories

- 5.2.2.2 Unfavorable reimbursement scenario for IVD tests

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Rising demand for multianalyte controls

- 5.2.3.2 Increasing growth opportunities in emerging economies

- 5.2.4 CHALLENGES

- 5.2.4.1 Stringent product approval process

- 5.2.4.2 Lack of regulations for clinical laboratory accreditation in several emerging countries

- 5.2.1 DRIVERS

- 5.3 PRICING ANALYSIS

- 5.3.1 AVERAGE SELLING PRICE TREND OF IVD QUALITY CONTROL PRODUCTS, 2023-2025

- 5.3.2 AVERAGE SELLING PRICE TREND OF IVD QUALITY CONTROLS, BY KEY PLAYER, 2023-2025

- 5.3.3 AVERAGE SELLING PRICE TREND OF IVD QUALITY CONTROL PRODUCTS, BY REGION, 2023-2025

- 5.4 PATENT ANALYSIS

- 5.4.1 LIST OF MAJOR PATENTS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 SUPPLY CHAIN ANALYSIS

- 5.7 TRADE ANALYSIS

- 5.7.1 IMPORT DATA (HS CODE 3822)

- 5.7.2 EXPORT DATA (HS CODE 3822)

- 5.8 ECOSYSTEM ANALYSIS

- 5.8.1 IVD QUALITY CONTROLS MARKET: ROLE OF COMPANIES IN ECOSYSTEM

- 5.9 PORTER'S FIVE FORCES ANALYSIS

- 5.9.1 THREAT OF NEW ENTRANTS

- 5.9.2 THREAT OF SUBSTITUTES

- 5.9.3 BARGAINING POWER OF BUYERS

- 5.9.4 BARGAINING POWER OF SUPPLIERS

- 5.9.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.10 REGULATORY ANALYSIS

- 5.10.1 REGULATORY FRAMEWORK

- 5.10.1.1 North America

- 5.10.1.1.1 US

- 5.10.1.1.2 Canada

- 5.10.1.2 Europe

- 5.10.1.2.1 Germany

- 5.10.1.2.2 UK

- 5.10.1.2.3 France

- 5.10.1.2.4 Italy

- 5.10.1.3 Asia Pacific

- 5.10.1.3.1 China

- 5.10.1.3.2 Japan

- 5.10.1.3.3 India

- 5.10.1.4 Latin America

- 5.10.1.4.1 Brazil

- 5.10.1.4.2 Mexico

- 5.10.1.5 Middle East

- 5.10.1.6 Africa

- 5.10.1.1 North America

- 5.10.2 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.10.1 REGULATORY FRAMEWORK

- 5.11 TECHNOLOGY ANALYSIS

- 5.11.1 KEY TECHNOLOGIES

- 5.11.1.1 Immunoassays

- 5.11.2 COMPLEMENTARY TECHNOLOGIES

- 5.11.2.1 Molecular diagnostics

- 5.11.3 ADJACENT TECHNOLOGIES

- 5.11.3.1 Clinical chemistry

- 5.11.1 KEY TECHNOLOGIES

- 5.12 KEY CONFERENCES & EVENTS, 2025-2026

- 5.13 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.14 KEY STAKEHOLDERS & BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 INVESTMENT & FUNDING SCENARIO

- 5.16 CASE STUDY ANALYSIS

- 5.16.1 CASE STUDY 1: QUALITY CONTROL DATA MANAGEMENT WITH UNITY REAL-TIME IN MOLECULAR VIROLOGY

- 5.16.2 CASE STUDY 2: ENHANCING RELIABILITY OF INFLUENZA DIAGNOSTICS WITH EXTERNAL QUALITY CONTROLS

- 5.17 IMPACT OF AI/GENERATIVE AI ON IVD QUALITY CONTROLS MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 MARKET POTENTIAL OF AI

- 5.17.3 AI USE CASES

- 5.17.4 IMPLEMENTATION OF AI, BY KEY COMPANY AND USE CASE

- 5.17.5 FUTURE OF AI IN IVD QUALITY CONTROLS MARKET

- 5.18 IMPACT OF 2025 US TARIFFS ON IVD QUALITY CONTROLS MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 North America

- 5.18.4.2 Europe

- 5.18.4.3 Asia Pacific

- 5.18.5 IMPACT ON END-USE INDUSTRIES

- 5.18.5.1 Hospitals

- 5.18.5.2 Clinical laboratories

- 5.18.5.3 Academic & research institutes

6 IVD QUALITY CONTROLS MARKET, BY PRODUCT & SERVICE

- 6.1 INTRODUCTION

- 6.2 QUALITY CONTROL PRODUCTS

- 6.2.1 SERUM/PLASMA-BASED CONTROLS

- 6.2.1.1 Greater stability and accuracy of diagnostic test results to increase demand for serum/plasma-based controls

- 6.2.2 WHOLE BLOOD-BASED CONTROLS

- 6.2.2.1 Rising need to ensure high-quality clinical test results to drive market

- 6.2.3 URINE-BASED CONTROLS

- 6.2.3.1 Growing incidence of kidney diseases to drive demand for urine-based controls

- 6.2.4 OTHER CONTROLS

- 6.2.1 SERUM/PLASMA-BASED CONTROLS

- 6.3 DATA MANAGEMENT SOLUTIONS

- 6.3.1 RISING FOCUS ON IMPROVING ANALYTICAL PERFORMANCE OF CLINICAL LABORATORIES TO SUPPORT MARKET GROWTH

- 6.4 QUALITY ASSURANCE SERVICES

- 6.4.1 GROWING NEED FOR PERFORMANCE ASSESSMENT OF CLINICAL LABORATORIES TO INCREASE DEMAND FOR QUALITY ASSURANCE SERVICES

7 IVD QUALITY CONTROLS MARKET, BY TECHNOLOGY

- 7.1 INTRODUCTION

- 7.2 IMMUNOASSAYS

- 7.2.1 FOCUS ON MONITORING PRECISION OF IMMUNOASSAY TESTS TO DRIVE ADOPTION OF IMMUNOASSAY CONTROLS

- 7.3 CLINICAL CHEMISTRY

- 7.3.1 RISING INCIDENCE OF LIFESTYLE DISEASES TO PROVIDE OPPORTUNITIES FOR MARKET GROWTH

- 7.4 MOLECULAR DIAGNOSTICS

- 7.4.1 GROWING INCIDENCE OF INFECTIOUS DISEASES TO DRIVE DEMAND FOR MOLECULAR DIAGNOSTIC CONTROLS

- 7.5 MICROBIOLOGY

- 7.5.1 INCREASING ADOPTION OF AUTOMATED CLINICAL MICROBIOLOGY TESTING INSTRUMENTS TO SUPPORT MARKET GROWTH

- 7.6 HEMATOLOGY

- 7.6.1 NEED FOR ACCURACY IN HEMATOLOGICAL TEST RESULTS TO DRIVE RELIANCE ON HEMATOLOGY QUALITY CONTROLS

- 7.7 COAGULATION & HEMOSTASIS

- 7.7.1 GROWING NUMBER OF CARDIOVASCULAR SURGERIES TO DRIVE DEMAND FOR COAGULATION & HEMOSTASIS TESTING

- 7.8 OTHER TECHNOLOGIES

8 IVD QUALITY CONTROLS MARKET, BY MANUFACTURER TYPE

- 8.1 INTRODUCTION

- 8.2 THIRD-PARTY CONTROLS

- 8.2.1 INDEPENDENT CONTROLS

- 8.2.1.1 Unbiased and independent performance assessment for analytical processes to drive adoption

- 8.2.2 INSTRUMENT-SPECIFIC CONTROLS

- 8.2.2.1 Dependence on instrument-specific compatibility to restrict demand

- 8.2.1 INDEPENDENT CONTROLS

- 8.3 ORIGINAL EQUIPMENT MANUFACTURER CONTROLS

- 8.3.1 OEM CONTROLS TO WITNESS LOWER ADOPTION AS THEY ARE LESS SENSITIVE TO QC-RELATED ISSUES

9 IVD QUALITY CONTROLS MARKET, BY END USER

- 9.1 INTRODUCTION

- 9.2 HOSPITALS

- 9.2.1 LARGE VOLUME OF IVD PROCEDURES PERFORMED TO DRIVE MARKET

- 9.3 CLINICAL LABORATORIES

- 9.3.1 GROWING NUMBER OF ACCREDITED LABORATORIES TO DRIVE MARKET

- 9.4 ACADEMIC & RESEARCH INSTITUTES

- 9.4.1 RISING FOCUS ON ACCURATE RESEARCH RESULTS TO SUPPORT MARKET GROWTH

- 9.5 OTHER END USERS

10 IVD QUALITY CONTROLS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 10.2.2 US

- 10.2.2.1 High healthcare expenditure to propel market growth

- 10.2.3 CANADA

- 10.2.3.1 Government initiatives and research funding to support market growth

- 10.3 EUROPE

- 10.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 10.3.2 GERMANY

- 10.3.2.1 Rising volume of high-quality tests performed to support market growth

- 10.3.3 UK

- 10.3.3.1 Growing number of diagnostic centers to drive market

- 10.3.4 FRANCE

- 10.3.4.1 Increasing prevalence of infectious diseases and growing demand for early diagnosis to drive market

- 10.3.5 ITALY

- 10.3.5.1 Growing disease prevalence to drive demand for better and more accurate disease diagnosis

- 10.3.6 SPAIN

- 10.3.6.1 Rising incidence of chronic diseases to support market growth

- 10.3.7 RUSSIA

- 10.3.7.1 Increasing access to quality healthcare and growing incidence of lifestyle and infectious diseases to drive market

- 10.3.8 REST OF EUROPE

- 10.4 ASIA PACIFIC

- 10.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 10.4.2 CHINA

- 10.4.2.1 Growing access to modern healthcare and government support to boost market growth

- 10.4.3 JAPAN

- 10.4.3.1 Well-developed healthcare system and demand for improvements in quality of IVD test results to drive market

- 10.4.4 INDIA

- 10.4.4.1 Rising need to secure NABL accreditations to drive demand for quality controls

- 10.4.5 AUSTRALIA

- 10.4.5.1 Initiatives to enhance access to healthcare and improve infrastructure to propel market growth

- 10.4.6 SOUTH KOREA

- 10.4.6.1 Rising healthcare expenditure and growing number of hospitals to drive market

- 10.4.7 REST OF ASIA PACIFIC

- 10.5 LATIN AMERICA

- 10.5.1 MACROECONOMIC OUTLOOK FOR LATIN AMERICA

- 10.5.2 BRAZIL

- 10.5.2.1 Brazil to dominate Latin American IVD quality controls market

- 10.5.3 MEXICO

- 10.5.3.1 Increasing number of accredited clinical laboratories to support market growth

- 10.5.4 REST OF LATIN AMERICA

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 MACROECONOMIC OUTLOOK FOR MIDDLE EAST & AFRICA

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Rising government healthcare expenditure to boost market

- 10.6.3 UAE

- 10.6.3.1 Improvements in healthcare infrastructure to support growth

- 10.6.4 REST OF MIDDLE EAST & AFRICA

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.2.1 OVERVIEW OF STRATEGIES DEPLOYED BY PLAYERS IN IVD QUALITY CONTROLS MARKET

- 11.3 REVENUE ANALYSIS, 2022-2024

- 11.4 MARKET SHARE ANALYSIS, 2024

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Product & service footprint

- 11.5.5.4 Technology footprint

- 11.5.5.5 Manufacturer type footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key emerging players/startups, by product & service and manufacturer type

- 11.6.5.3 Competitive benchmarking of key startups/SMEs, by region

- 11.7 COMPANY VALUATION & FINANCIAL METRICS

- 11.7.1 FINANCIAL METRICS

- 11.7.2 COMPANY VALUATION

- 11.8 BRAND/PRODUCT COMPARISON

- 11.8.1 BRAND/PRODUCT COMPARATIVE ANALYSIS

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT & SERVICE LAUNCHES AND APPROVALS

- 11.9.2 DEALS

- 11.9.3 EXPANSIONS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 BIO-RAD LABORATORIES, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products & services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product & service launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses & competitive threats

- 12.1.2 THERMO FISHER SCIENTIFIC, INC.

- 12.1.2.1 Business overview

- 12.1.2.2 Products & services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Deals

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses & competitive threats

- 12.1.3 ABBOTT

- 12.1.3.1 Business overview

- 12.1.3.2 Products & services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses & competitive threats

- 12.1.4 LGC LIMITED

- 12.1.4.1 Business overview

- 12.1.4.2 Products & services offered

- 12.1.4.3 Recent developments

- 12.1.4.3.1 Deals

- 12.1.4.4 MnM view

- 12.1.4.4.1 Key strengths

- 12.1.4.4.2 Strategic choices

- 12.1.4.4.3 Weaknesses & competitive threats

- 12.1.5 F. HOFFMANN-LA ROCHE LTD.

- 12.1.5.1 Business overview

- 12.1.5.2 Products & services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses & competitive threats

- 12.1.6 RANDOX LABORATORIES LTD.

- 12.1.6.1 Business overview

- 12.1.6.2 Products & services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Product & service launches

- 12.1.6.3.2 Deals

- 12.1.7 SIEMENS HEALTHINEERS AG

- 12.1.7.1 Business overview

- 12.1.7.2 Products & services offered

- 12.1.8 QUIDELORTHO CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products & services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Deals

- 12.1.8.3.2 Expansions

- 12.1.9 DANAHER CORPORATION

- 12.1.9.1 Business overview

- 12.1.9.2 Products & services offered

- 12.1.10 SYSMEX CORPORATION

- 12.1.10.1 Business overview

- 12.1.10.2 Products & services offered

- 12.1.10.3 Recent developments

- 12.1.10.3.1 Product & service launches

- 12.1.10.3.2 Deals

- 12.1.10.3.3 Expansions

- 12.1.11 BIO-TECHNE CORPORATION

- 12.1.11.1 Business overview

- 12.1.11.2 Products & services offered

- 12.1.11.3 Recent developments

- 12.1.11.3.1 Product & service launches

- 12.1.11.3.2 Deals

- 12.1.11.3.3 Expansions

- 12.1.12 MICROBIX BIOSYSTEMS INC.

- 12.1.12.1 Business overview

- 12.1.12.2 Products & services offered

- 12.1.12.3 Recent developments

- 12.1.12.3.1 Product & service launches

- 12.1.12.3.2 Deals

- 12.1.13 GRIFOLS, S.A.

- 12.1.13.1 Business overview

- 12.1.13.2 Products & services offered

- 12.1.14 MICROBIOLOGICS, INC.

- 12.1.14.1 Business overview

- 12.1.14.2 Products & services offered

- 12.1.14.3 Recent developments

- 12.1.14.3.1 Deals

- 12.1.15 ZEPTOMETRIX

- 12.1.15.1 Business overview

- 12.1.15.2 Products & services offered

- 12.1.15.3 Recent developments

- 12.1.15.3.1 Product & service launches & approvals

- 12.1.16 FORTRESS DIAGNOSTICS

- 12.1.16.1 Business overview

- 12.1.16.2 Products & services offered

- 12.1.1 BIO-RAD LABORATORIES, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 HELENA LABORATORIES CORPORATION

- 12.2.2 STRECK, INC.

- 12.2.3 MAINE MOLECULAR QUALITY CONTROLS, INC.

- 12.2.4 SUN DIAGNOSTICS, LLC

- 12.2.5 SERO AS

- 12.2.6 CONEBIOPRODUCTS

- 12.2.7 ALPHA-TEC

- 12.2.8 EUROTROL B.V.

- 12.2.9 BIOREX DIAGNOSTICS

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS