|

시장보고서

상품코드

1823733

크라프트지 시장 예측(-2030년) : 등급별, 포장 형태별, 최종 용도 산업별, 지역별Kraft Paper Market by Grade (Unbleached Kraft, Bleached Kraft, Unbleached Sack), Packaging Form (Industrial Bags, Wraps), End-use Industry (Food & Beverage, Building & Construction), & Region - Global Forecast to 2030 |

||||||

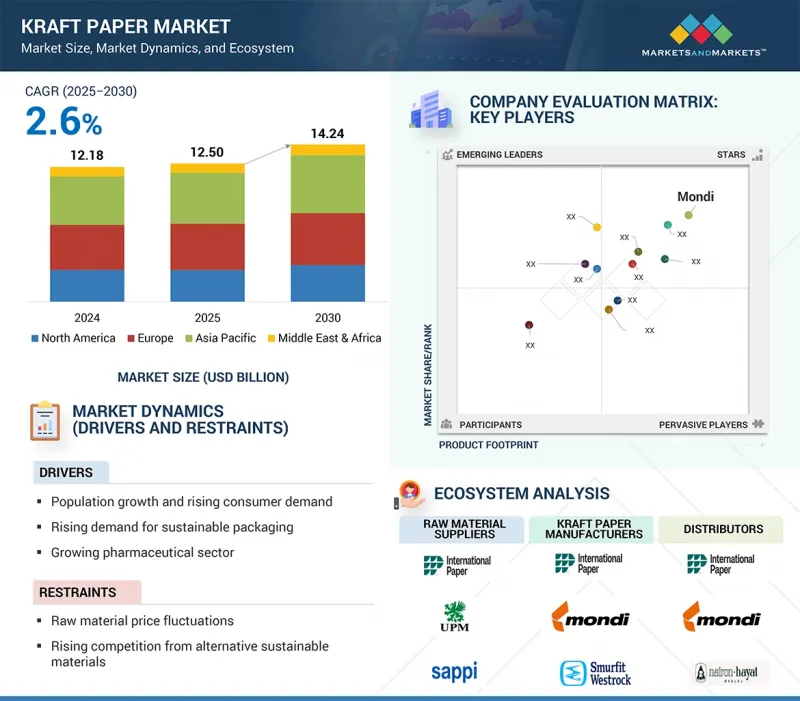

세계의 크라프트지 시장 규모는 예측 기간 중 2.6%의 CAGR로 확대하며, 2025년 125억 달러에서 2030년에는 142억 4,000만 달러에 달할 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 검토 단위 | 금액(100만 달러), 킬로톤 |

| 부문 | 등급별, 포장 형태별, 최종 용도 산업별, 지역별 |

| 대상 지역 | 북미, 아시아태평양, 유럽, 중동 및 아프리카, 남미 |

이러한 성장의 원동력은 지속가능한 포장재로의 전 세계적인 전환, 환경에 대한 인식 증가, 플라스틱 사용에 대한 규제가 강화되고 있기 때문입니다. 크라프트지는 지속가능성과 비용 효율성으로 인해 식품 및 음료, E-Commerce, 소매, 산업 제품 등 다양한 산업 분야에서 널리 사용되고 있습니다.

미표백 크라프트 분야는 크라프트지 시장에서 가장 빠른 성장이 예상됩니다. 이러한 성장은 튼튼하고 경제적이며 환경 친화적인 특성으로 인한 것입니다. 무표백 크라프트지는 화학약품을 추가로 처리하지 않아 자연 그대로의 갈색을 유지할 수 있으며, 환경보호에 관심이 많은 소비자와 기업에게도 매력적입니다. 강도와 높은 인장 강도가 필수적인 산업용 가방, 식료품 가방, 보호 포장의 제조에 일반적으로 사용됩니다.

파우치/봉지 부문은 예측 기간 중 크라프트지 시장에서 가장 빠르게 성장하는 포장 형태가 될 것으로 예측됩니다. 이러한 성장은 다용도성, 편리성, 지속가능성에 기인합니다. 파우치/소포는 가볍고, 작고, 보관이 용이하고, 비용 효율적이기 때문에 식품/음료, 퍼스널케어 제품, 의약품 포장용으로 인기를 끌고 있습니다. 또한 특히 도시 지역에서는 테이크아웃이나 1회분씩 포장하는 수요가 증가하고 있는 것도 사용량 증가에 더욱 기여하고 있습니다.

안전하고 지속가능하며 경제적인 포장에 대한 수요가 증가함에 따라 식품 및 음료 분야는 예측 기간 중 크라프트 종이 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 소비자의 선호도가 식품의 안전과 신선도 유지에 도움이 되는 포장 식품과 조리된 식품으로 이동함에 따라 크라프트 종이봉투, 랩, 파우치에 대한 수요가 증가하고 있습니다. 퀵서비스 레스토랑, 카페, 테이크아웃도 크라프트 종이 포장을 채택하고 있습니다. 또한 E-Commerce를 통한 식료품 배달 및 온라인 식품 배달 서비스의 부상도 큰 요인으로 작용하고 있으며, 크라프트 종이는 다양한 식품에 유연하고 내구성이 뛰어난 포장 솔루션을 제공합니다.

아시아태평양은 산업 기반 개발, E-Commerce의 급속한 확장, 지속가능한 포장 솔루션에 대한 소비자의 인식이 높아짐에 따라 예측 기간 중 크라프트지 시장에서 가장 빠른 성장을 기록할 것으로 예측됩니다. 신흥 국가, 특히 중국, 인도, 동남아시아 국가에서는 소매업과 온라인 쇼핑이 증가함에 따라 내구성이 뛰어나고 친환경적인 포장재에 대한 수요가 증가하고 있습니다. 또한 패스트푸드점의 인기와 테이크아웃 상품에 대한 수요 증가와 함께 식품 및 음료 산업도 확대되고 있습니다. 그 결과, 크라프트 종이봉투, 파우치, 포장 제품에 대한 수요는 지속적으로 증가하고 있습니다.

세계의 크라프트지 시장에 대해 조사했으며, 등급별, 포장 형태별, 최종 용도 산업별, 지역별 동향 및 시장에 참여하는 기업의 개요 등을 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 개요

제4장 주요 인사이트

제5장 시장 개요

- 서론

- 시장 역학

- 고객 비즈니스에 영향을 미치는 동향/혼란

- 에코시스템 분석

- 밸류체인 분석

- 규제 상황

- 가격 분석

- 무역 분석

- 기술 분석

- 특허 분석

- 사례 연구 분석

- Porter's Five Forces 분석

- 주요 이해관계자와 구입 기준

- 2025-2026년의 주요 컨퍼런스와 이벤트

- 투자와 자금조달 시나리오

- AI가 크라프트지 시장에 미치는 영향

- 거시경제 분석

- 2025년 미국 관세가 크라프트지 시장에 미치는 영향

제6장 크라프트지 시장(등급별)

- 서론

- 미표백 크라프트지

- 표백 크라프트지

- 미표백 자루(SACK)

- 표백 자루

제7장 크라프트지 시장(포장 형태별)

- 서론

- 랩

- 파우치

- 봉투

- 식료품 백

- 산업용 백

제8장 크라프트지 시장(최종 용도 산업별)

- 서론

- 식품 및 음료

- 의약품

- 건축·건설

- 퍼스널케어·화장품

- 기타

제9장 크라프트지 시장(지역별)

- 서론

- 아시아태평양

- 중국

- 인도

- 일본

- 한국

- 태국

- 인도네시아

- 기타

- 유럽

- 독일

- 프랑스

- 이탈리아

- 스페인

- 스웨덴

- 튀르키예

- 핀란드

- 기타

- 북미

- 미국

- 캐나다

- 멕시코

- 중동 및 아프리카

- GCC 국가

- 남아프리카공화국

- 기타

- 남미

- 브라질

- 아르헨티나

- 칠레

- 기타

제10장 경쟁 구도

- 개요

- 주요 참여 기업의 전략/강점

- 매출 분석

- 시장 점유율 분석

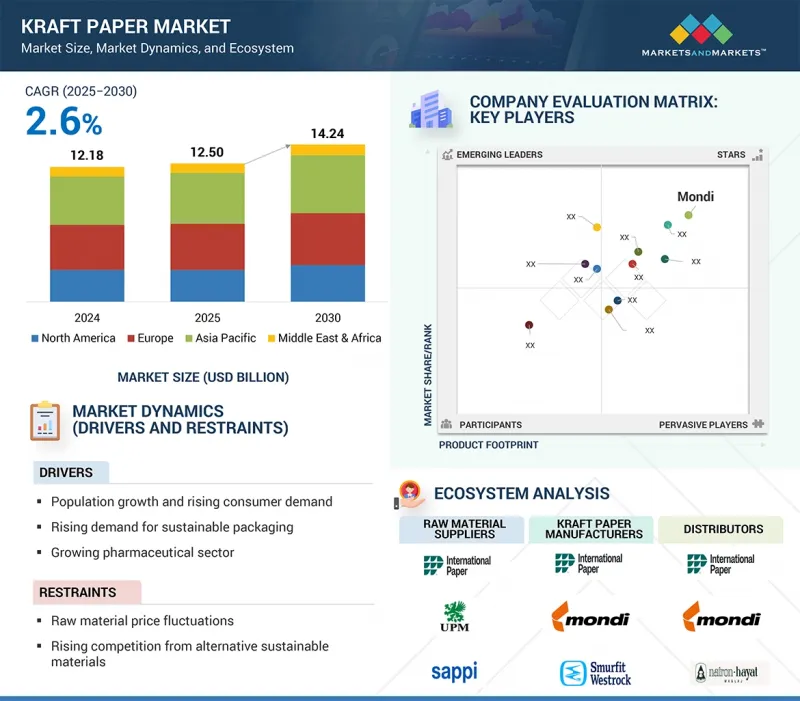

- 기업 평가

- 브랜드/제품 비교

- 기업 평가 매트릭스 : 주요 참여 기업, 2024년

- 기업 평가 매트릭스 : 스타트업/중소기업, 2024년

- 경쟁 시나리오

제11장 기업 개요

- 주요 참여 기업

- MONDI

- INTERNATIONAL PAPER

- SMURFIT WESTROCK

- STORA ENSO

- CANFOR

- NORDIC PAPER HOLDING AB

- BILLERUD

- SEGEZHA GROUP

- OJI HOLDINGS CORPORATION

- APP GROUP

- 기타 기업

- HEINZEL GROUP

- CMPC

- NIPPON PAPER INDUSTRIES CO., LTD

- GASCOGNE GROUP

- KLABIN S.A.

- TOKUSHU TOKAI PAPER CO., LTD.

- NATRON-HAYAT D.O.O. MAGLAJ

- CANADIAN KRAFT PAPER LTD.

- HORIZON PULP & PAPER LTD.

- GUANGZHOU BMPAPER CO., LTD.

- GENUS PAPER

- SHREE VARUDI PAPER MILL LIMITED

- PACKMAN PACKAGING PRIVATE LIMITED.

- CTI PAPER USA

- THANAKORN PAPER INDUSTRY CO., LTD.

제12장 인접 시장과 관련 시장

제13장 부록

KSA 25.10.02The global kraft paper market is projected to reach USD 14.24 billion by 2030 from USD 12.50 billion in 2025, at a CAGR of 2.6% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million), Volume (Kiloton) |

| Segments | Grade, Packaging Form, End-use Industry, and Region |

| Regions covered | North America, Asia Pacific, Europe, the Middle East & Africa, and South America |

This growth is driven by a global shift toward sustainable packaging materials, increased environmental awareness, and rising regulations against plastic use. The sustainability and cost-effectiveness of kraft paper have made it a popular choice in various industries, including food & beverages, e-commerce, retail, and industrial goods.

By grade, unbleached kraft is projected to register the fastest growth during the forecast period

The unbleached kraft segment is expected to experience the fastest growth in the kraft paper market. This growth is due to its strong, economical, and environmentally friendly properties. Unbleached kraft paper is also more appealing to environmentally conscious consumers and companies because it is not processed with additional chemicals, allowing it to retain its natural brown color. It is commonly used for producing industrial bags, grocery bags, and protective wrapping, where strength and high tensile strength are essential.

By packaging form, the pouches/sachets segment is projected to register the fastest growth during the forecast period

The pouches/sachets segment is expected to be the fastest-growing packaging form in the kraft paper market over the forecast period. This growth is attributed to their versatility, convenience, and sustainability. Pouches/sachets are gaining popularity for packaging food, beverages, personal care products, and pharmaceuticals because they are lightweight, compact, easy to store, and cost-effective. Additionally, the rising demand for on-the-go and single-serve packaging, particularly in urban areas, has further contributed to their increased usage.

By end-use industry, the food & beverage segment is projected to register the highest CAGR during the forecast period

The food & beverage segment is projected to register the highest CAGR in the kraft paper market over the forecast period due to the rising demand for safe, sustainable, and economical packaging. There is an increasing demand for kraft paper bags, wraps, and pouches as consumer preferences shift toward packaged and ready-to-eat foods that help maintain food security and freshness. Quick-service restaurants, cafes, and takeaways are also adopting kraft paper packaging. Additionally, the rise of e-commerce grocery delivery and online food delivery services is a significant factor, as kraft paper offers a flexible and durable packaging solution for various food items.

By region, the Asia Pacific is projected to register the highest CAGR during the forecast period

The Asia Pacific region is projected to register the fastest growth in the kraft paper market during the forecast period, driven by the development of industrial bases, the rapid expansion of e-commerce, and increasing consumer awareness of sustainable packaging solutions. Emerging economies, particularly China, India, and Southeast Asian countries, are witnessing a rise in retail and online shopping, which in turn boosts the demand for durable and eco-friendly packaging materials. Additionally, the food and beverage industry is expanding, along with the popularity of fast-food restaurants and the growing demand for takeout products. As a result, the need for kraft paper bags, pouches, and wrapping products continues to increase.

Profile break-up of primary participants for the report:

- By Company Type: Tier 1: 25%, Tier 2: 42%, and Tier 3: 33%

- By Designation: C Level: 20%, Director Level: 30%, and Others: 50%

- By Region: North America: 20%, Europe: 10%, Asia Pacific: 40%, Middle East & Africa: 20%, and South America: 10%.

Companies Covered:

Mondi (UK), International Paper (US), Smurfit Westrock (Ireland), Stora Enso (Finland), Billerud (Sweden), Segezha Group (Russia), Oji Holdings Corporation (Japan), and APP Group (Indonesia) are some of the key players in the kraft paper market.

Research Coverage

The market study covers the kraft paper market across various segments. It aims to estimate the market size and the growth potential of this market across different segments based on grade, packaging form, end-use industry, and region. The study also includes an in-depth competitive analysis of key players in the market, their company profiles, key observations related to their products and business offerings, recent developments undertaken by them, and key growth strategies adopted by them to improve their position in the kraft paper market.

Key Benefits of Buying the Report

The report is expected to help the market leaders/new entrants in this market share the closest approximations of the revenue numbers of the overall kraft paper market and its segments and subsegments. This report is projected to help stakeholders understand the competitive landscape of the market, gain insights to improve the position of their businesses, and plan suitable go-to-market strategies. The report also aims to help stakeholders understand the pulse of the market and provide them with information on the key market drivers, restraints, challenges, and opportunities.

The report provides insights into the following pointers:

- Analysis of key drivers (rising demand for sustainable packaging), restraints (raw material price fluctuations), opportunities (premium and luxury packaging trends), and challenges (intense competition and price pressure) influencing the growth of the kraft paper market.

- Product Development/Innovation: Detailed insights on upcoming technologies, research & development activities, and new product & service launches in the kraft paper market

- Market Development: Comprehensive information about profitable markets - the report analyses the kraft paper market across varied regions

Market Diversification: Exhaustive information about new products & services, untapped geographies, recent developments, and investments in the kraft paper market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players like Mondi (UK), International Paper (US), Stora Enso (Finland), Billerud (Sweden), and APP Group (Indonesia) in the kraft paper market. The report also helps stakeholders understand the pulse of the kraft paper market and provides them with information on key market drivers, restraints, challenges, and opportunities.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 RESEARCH LIMITATIONS

- 1.6 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key primary participants

- 2.1.2.2 Key data from primary sources

- 2.1.2.3 Breakdown of interviews with experts

- 2.1.2.4 Key industry insights

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 TOP-DOWN APPROACH

- 2.2.2 BOTTOM-UP APPROACH

- 2.3 BASE NUMBER CALCULATION

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.4 GROWTH FORECAST

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 FACTOR ANALYSIS

- 2.8 RESEARCH LIMITATIONS

- 2.9 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN KRAFT PAPER MARKET

- 4.2 KRAFT PAPER MARKET, BY GRADE

- 4.3 KRAFT PAPER MARKET, BY PACKAGING FORM

- 4.4 KRAFT PAPER MARKET, BY END-USE INDUSTRY

- 4.5 ASIA PACIFIC KRAFT PAPER MARKET, BY END-USE INDUSTRY AND COUNTRY

- 4.6 KRAFT PAPER MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Population growth and rising consumer demand

- 5.2.1.2 Rising demand for sustainable packaging

- 5.2.1.3 Growing pharmaceutical sector

- 5.2.1.4 Exponential rise of global e-commerce

- 5.2.2 RESTRAINTS

- 5.2.2.1 Fluctuations in raw material prices

- 5.2.2.2 Rising competition from alternative sustainable materials

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Expansion of personal care and cosmetics packaging

- 5.2.3.2 Premium and luxury packaging trends

- 5.2.3.3 Growing demand in emerging markets

- 5.2.3.4 Government regulations on plastic bans

- 5.2.4 CHALLENGES

- 5.2.4.1 Intense competition and price pressure

- 5.2.4.2 High capital investment for advanced machinery

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 ECOSYSTEM ANALYSIS

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 REGULATORY LANDSCAPE

- 5.6.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.6.2 KEY REGULATIONS AND STANDARDS

- 5.7 PRICING ANALYSIS

- 5.7.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY GRADE, 2024

- 5.7.2 AVERAGE SELLING PRICE TREND, BY REGION, 2021-2024

- 5.8 TRADE ANALYSIS

- 5.8.1 EXPORT SCENARIO (HS CODE 4840)

- 5.8.2 IMPORT SCENARIO (HS CODE 4840)

- 5.9 TECHNOLOGY ANALYSIS

- 5.9.1 KEY TECHNOLOGIES

- 5.9.1.1 Bleaching process

- 5.9.1.2 Advanced coating and barrier coating

- 5.9.2 COMPLEMENTARY TECHNOLOGIES

- 5.9.2.1 Digital and flexographic printing technologies

- 5.9.3 ADJACENT TECHNOLOGIES

- 5.9.3.1 Anti-counterfeit and track-and-trace solutions

- 5.9.1 KEY TECHNOLOGIES

- 5.10 PATENT ANALYSIS

- 5.10.1 INTRODUCTION

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 RANPAK PROVIDES NEOPHARM WITH ECO-FRIENDLY PROTECTIVE PACKAGING

- 5.11.2 PERFORMANCE ASSESSMENT OF COMPOSITE MATERIAL BASED ON KRAFT PAPER AND RESIN FORMULATED WITH EXPANDED POLYSTYRENE WASTE

- 5.12 PORTER'S FIVE FORCES ANALYSIS

- 5.12.1 THREAT OF NEW ENTRANTS

- 5.12.2 THREAT OF SUBSTITUTES

- 5.12.3 BARGAINING POWER OF SUPPLIERS

- 5.12.4 BARGAINING POWER OF BUYERS

- 5.12.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.13 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.13.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.13.2 BUYING CRITERIA

- 5.14 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.15 INVESTMENT AND FUNDING SCENARIO

- 5.16 IMPACT OF AI ON KRAFT PAPER MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 IMPACT OF AI ON KRAFT PAPER MARKET

- 5.17 MACROECONOMIC ANALYSIS

- 5.17.1 INTRODUCTION

- 5.17.2 GDP TRENDS AND FORECASTS

- 5.18 IMPACT OF 2025 US TARIFF ON KRAFT PAPER MARKET

- 5.18.1 INTRODUCTION

- 5.18.2 KEY TARIFF RATES

- 5.18.3 PRICE IMPACT ANALYSIS

- 5.18.4 IMPACT ON COUNTRY/REGION

- 5.18.4.1 US

- 5.18.4.2 Asia Pacific

- 5.18.4.3 Europe

- 5.18.5 IMPACT ON END-USE INDUSTRIES

6 KRAFT PAPER MARKET, BY GRADE

- 6.1 INTRODUCTION

- 6.2 UNBLEACHED KRAFT

- 6.2.1 VERSATILITY, STRENGTH, AND SUSTAINABILITY TO DRIVE DEMAND

- 6.3 BLEACHED KRAFT

- 6.3.1 PREMIUM APPEARANCE AND PRINTABILITY TO PROPEL DEMAND

- 6.4 UNBLEACHED SACK

- 6.4.1 RISING INDUSTRIAL AND AGRICULTURAL DEMAND TO DRIVE MARKET

- 6.5 BLEACHED SACK

- 6.5.1 RISING DEMAND FOR BRANDED AND CONSUMER-FACING PACKAGING TO FUEL MARKET GROWTH

7 KRAFT PAPER MARKET, BY PACKAGING FORM

- 7.1 INTRODUCTION

- 7.2 WRAPS

- 7.2.1 INCREASED USE OF KRAFT PAPER WRAPS IN FOOD AND HEALTHCARE INDUSTRIES TO DRIVE MARKET

- 7.3 POUCHES

- 7.3.1 RISING DEMAND FOR VERSATILE, ECO-FRIENDLY, AND COST-EFFECTIVE POUCHES TO PROPEL MARKET

- 7.4 ENVELOPES

- 7.4.1 GROWING COURIER, PARCEL, AND INSTITUTIONAL USE TO BOOST MARKET

- 7.5 GROCERY BAGS

- 7.5.1 GOVERNMENT-LED REGULATIONS RELATED TO SINGLE-USE PLASTIC BAGS AND SUSTAINABILITY CONCERNS TO PROPEL MARKET

- 7.6 INDUSTRIAL BAGS

- 7.6.1 GROWING DEMAND FOR HIGH-STRENGTH KRAFT PAPER-BASED INDUSTRIAL BAGS IN AGRICULTURE, CHEMICAL, AND CONSTRUCTION INDUSTRIES TO DRIVE MARKET

8 KRAFT PAPER MARKET, BY END-USE INDUSTRY

- 8.1 INTRODUCTION

- 8.2 FOOD & BEVERAGE

- 8.2.1 RISING DEMAND FOR PACKAGED FOOD PRODUCTS TO DRIVE MARKET

- 8.3 PHARMACEUTICAL

- 8.3.1 INCREASING GLOBAL HEALTHCARE TRADE TO PROPEL MARKET

- 8.4 BUILDING & CONSTRUCTION

- 8.4.1 RISING CEMENT PRODUCTION AND INFRASTRUCTURE GROWTH TO DRIVE MARKET

- 8.5 PERSONAL CARE & COSMETIC

- 8.5.1 GROWING DIRECT SELLING AND ECO-FRIENDLY PACKAGING NEEDS TO PROPEL MARKET

- 8.6 OTHER END-USE INDUSTRIES

9 KRAFT PAPER MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 ASIA PACIFIC

- 9.2.1 CHINA

- 9.2.1.1 Rising consumer goods retail sales to drive market

- 9.2.2 INDIA

- 9.2.2.1 Infrastructure and real estate growth to drive market

- 9.2.3 JAPAN

- 9.2.3.1 Growth of beauty and personal care industry to drive market

- 9.2.4 SOUTH KOREA

- 9.2.4.1 Rapid growth of K-Beauty exports to drive market

- 9.2.5 THAILAND

- 9.2.5.1 Rising foodservice sector and takeaway culture to drive market

- 9.2.6 INDONESIA

- 9.2.6.1 Expansion of modern retail and convenience stores to drive market

- 9.2.7 REST OF ASIA PACIFIC

- 9.2.1 CHINA

- 9.3 EUROPE

- 9.3.1 GERMANY

- 9.3.1.1 Aging population and rising health consciousness to drive market

- 9.3.2 FRANCE

- 9.3.2.1 Pharma trade demand to drive market

- 9.3.3 ITALY

- 9.3.3.1 Growth in foodservice and tourism to drive market

- 9.3.4 SPAIN

- 9.3.4.1 Expanding agribusiness and food sector to drive market

- 9.3.5 SWEDEN

- 9.3.5.1 Strong healthcare trade to drive market

- 9.3.6 TURKEY

- 9.3.6.1 Expansion of modern retail and convenience stores to drive market

- 9.3.7 FINLAND

- 9.3.7.1 Expansion of modern retail and convenience stores to drive market

- 9.3.8 REST OF EUROPE

- 9.3.1 GERMANY

- 9.4 NORTH AMERICA

- 9.4.1 US

- 9.4.1.1 Booming foodservice and retail sector to propel market

- 9.4.2 CANADA

- 9.4.2.1 Plastic ban regulations to drive market

- 9.4.3 MEXICO

- 9.4.3.1 Expansion of modern retail chains to drive market

- 9.4.1 US

- 9.5 MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.5.1.1 Saudi Arabia

- 9.5.1.1.1 Expanding food retail and packaged goods demand to drive market

- 9.5.1.2 UAE

- 9.5.1.2.1 Government regulations on single-use plastics to drive market

- 9.5.1.3 Rest of GCC countries

- 9.5.1.1 Saudi Arabia

- 9.5.2 SOUTH AFRICA

- 9.5.2.1 Expansion of food retail sector to drive market

- 9.5.3 REST OF MIDDLE EAST & AFRICA

- 9.5.1 GCC COUNTRIES

- 9.6 SOUTH AMERICA

- 9.6.1 BRAZIL

- 9.6.2 ARGENTINA

- 9.6.3 CHILE

- 9.6.4 REST OF SOUTH AMERICA

10 COMPETITIVE LANDSCAPE

- 10.1 OVERVIEW

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS

- 10.4 MARKET SHARE ANALYSIS

- 10.5 COMPANY VALUATION

- 10.5.1 FINANCIAL METRICS

- 10.6 BRAND/PRODUCT COMPARISON

- 10.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.7.1 STARS

- 10.7.2 EMERGING LEADERS

- 10.7.3 PERVASIVE PLAYERS

- 10.7.4 PARTICIPANTS

- 10.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.7.5.1 Company footprint

- 10.7.5.2 Region footprint

- 10.7.5.3 Grade footprint

- 10.7.5.4 Packaging form footprint

- 10.7.5.5 End-use industry footprint

- 10.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.8.1 PROGRESSIVE COMPANIES

- 10.8.2 RESPONSIVE COMPANIES

- 10.8.3 DYNAMIC COMPANIES

- 10.8.4 STARTING BLOCKS

- 10.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.8.6 DETAILED LIST OF KEY STARTUPS/SMES

- 10.8.7 COMPETITIVE BENCHMARKING OF KEY STARTUPS/SMES

- 10.9 COMPETITIVE SCENARIO

- 10.9.1 PRODUCT LAUNCHES

- 10.9.2 DEALS

- 10.9.3 EXPANSIONS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 MONDI

- 11.1.1.1 Business overview

- 11.1.1.2 Products/Solutions/Services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Deals

- 11.1.1.3.2 Expansions

- 11.1.1.3.3 Others

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/Right to win

- 11.1.1.4.2 Strategic choices

- 11.1.1.4.3 Weaknesses/Competitive threats

- 11.1.2 INTERNATIONAL PAPER

- 11.1.2.1 Business overview

- 11.1.2.2 Products/Solutions/Services offered

- 11.1.2.3 Recent developments

- 11.1.2.3.1 Deals

- 11.1.2.3.2 Expansions

- 11.1.2.4 MnM view

- 11.1.2.4.1 Key strengths/Right to win

- 11.1.2.4.2 Strategic choices

- 11.1.2.4.3 Weaknesses/Competitive threats

- 11.1.3 SMURFIT WESTROCK

- 11.1.3.1 Business overview

- 11.1.3.2 Products/Solutions/Services offered

- 11.1.3.3 MnM view

- 11.1.3.3.1 Key strengths/Right to win

- 11.1.3.3.2 Strategic choices

- 11.1.3.3.3 Weaknesses/Competitive threats

- 11.1.4 STORA ENSO

- 11.1.4.1 Business overview

- 11.1.4.2 Products/Solutions/Services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/Right to win

- 11.1.4.3.2 Strategic choices

- 11.1.4.3.3 Weaknesses/Competitive threats

- 11.1.5 CANFOR

- 11.1.5.1 Business overview

- 11.1.5.2 Products/Solutions/Services offered

- 11.1.5.3 MnM view

- 11.1.5.3.1 Key strengths/Right to win

- 11.1.5.3.2 Strategic choices

- 11.1.5.3.3 Weaknesses/Competitive threats

- 11.1.6 NORDIC PAPER HOLDING AB

- 11.1.6.1 Business overview

- 11.1.6.2 Products/Solutions/Services offered

- 11.1.6.3 MnM view

- 11.1.7 BILLERUD

- 11.1.7.1 Business overview

- 11.1.7.2 Products/Solutions/Services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.7.3.2 Deals

- 11.1.7.4 MnM view

- 11.1.8 SEGEZHA GROUP

- 11.1.8.1 Business overview

- 11.1.8.2 Products/Solutions/Services offered

- 11.1.8.3 MnM view

- 11.1.9 OJI HOLDINGS CORPORATION

- 11.1.9.1 Business overview

- 11.1.9.2 Products/Solutions/Services offered

- 11.1.9.3 MnM view

- 11.1.10 APP GROUP

- 11.1.10.1 Business overview

- 11.1.10.2 Products/Solutions/Services offered

- 11.1.10.3 MnM view

- 11.1.1 MONDI

- 11.2 OTHER PLAYERS

- 11.2.1 HEINZEL GROUP

- 11.2.2 CMPC

- 11.2.3 NIPPON PAPER INDUSTRIES CO., LTD

- 11.2.4 GASCOGNE GROUP

- 11.2.5 KLABIN S.A.

- 11.2.6 TOKUSHU TOKAI PAPER CO., LTD.

- 11.2.7 NATRON-HAYAT D.O.O. MAGLAJ

- 11.2.8 CANADIAN KRAFT PAPER LTD.

- 11.2.9 HORIZON PULP & PAPER LTD.

- 11.2.10 GUANGZHOU BMPAPER CO., LTD.

- 11.2.11 GENUS PAPER

- 11.2.12 SHREE VARUDI PAPER MILL LIMITED

- 11.2.13 PACKMAN PACKAGING PRIVATE LIMITED.

- 11.2.14 CTI PAPER USA

- 11.2.15 THANAKORN PAPER INDUSTRY CO., LTD.

12 ADJACENT AND RELATED MARKET

- 12.1 INTRODUCTION

- 12.2 LIMITATIONS

- 12.2.1 PAPER BAGS MARKET

- 12.2.1.1 Market definition

- 12.2.1.2 Paper bags market, by product type

- 12.2.1.3 Paper bags market, by thickness

- 12.2.1.4 Paper bags market, by material

- 12.2.1.5 Paper bags market, by end use

- 12.2.1.6 Paper bags market, by region

- 12.2.1 PAPER BAGS MARKET

13 APPENDIX

- 13.1 DISCUSSION GUIDE

- 13.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 13.3 CUSTOMIZATION OPTIONS

- 13.4 RELATED REPORTS

- 13.5 AUTHOR DETAILS