|

시장보고서

상품코드

1826558

크라이오쿨러 시장(-2030년) : 크라이오쿨러타입, 제공 구분, 열교환기, 운전 사이클, 온도 범위, 용도별Cryocooler Market By Cryocooler Type, Offering, Heat Exchanger, Operating Cycle, Tempreature Range, and Application - Global Forecast to 2030 |

||||||

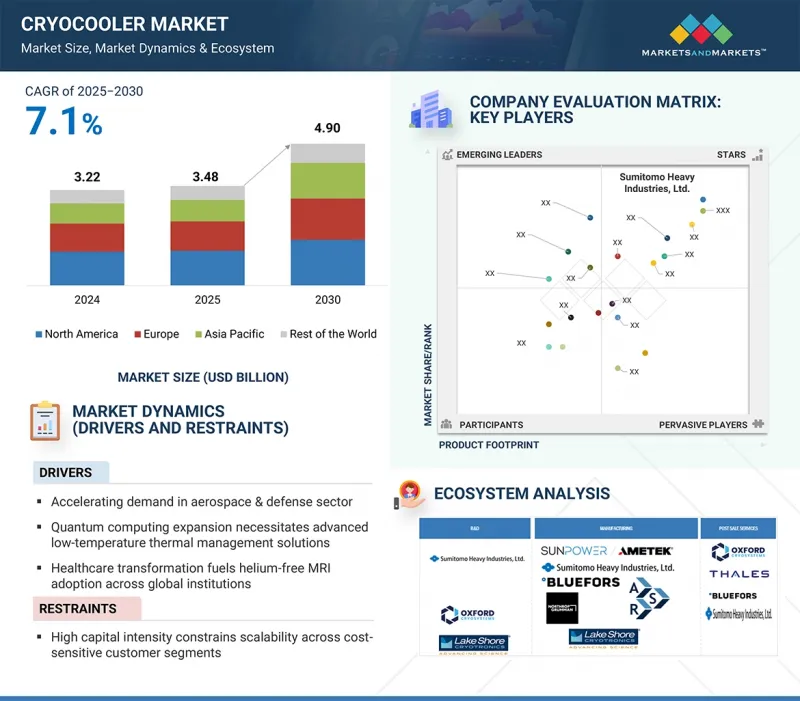

크라이오쿨러 시장 규모는 2025년 34억 8,000만 달러에서 예측 기간중은 CAGR 7.1%로 성장을 지속하여, 2030년에는 49억 달러에 이를 것으로 예측됩니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러) |

| 부문 | 크라이오쿨러 타입, 제공 구분, 열교환기, 운전 사이클, 온도 범위, 용도 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

크라이오쿨러의 성장은 위성 발사, 우주 탐사, 국방 분야에서의 채택 확대, 정부 투자, 냉각 효율의 기술 발전, 양자 컴퓨팅 및 의료 영상 시스템에서의 극저온 수요 증가에 힘입어 성장세를 보이고 있습니다.

"하드웨어 유형별로는 파워 컨디셔닝 유닛 부문이 예측 기간 동안 가장 높은 CAGR로 성장할 것으로 예측됩니다."

이는 섬세한 극저온 시스템에 안정적이고 효율적인 전력 공급을 보장하는 데 중요한 역할을 하기 때문입니다. 이 장치는 전압 변동 조정, 전기적 노이즈 최소화, 전력 장애로부터 섬세한 부품 보호에 기여합니다. 이는 우주 장비, 적외선 센서, 양자 컴퓨팅 장비와 같이 진동에 민감한 용도에 필수적입니다. 국방, 항공우주, 의료영상 분야에서 크라이오쿨러의 활용이 확대됨에 따라 안정적인 연속 전력 공급에 대한 수요가 크라이오쿨러의 채택을 촉진하는 주요 요인으로 작용하고 있습니다. 또한, 첨단 제어 전자장치 및 컴팩트한 시스템 설계와의 통합으로 인해 안정적인 전력 조절 솔루션의 필요성이 증가하고 있으며, 장기적인 운영 안정성과 성능 향상을 보장하는 크라이오쿨러 시스템의 장기적인 운영 안정성을 보장합니다.

"냉동 냉각기 유형별로는 펄스 튜브 냉동 냉각기 부문이 2024년 큰 점유율을 차지할 것으로 예측됩니다."

이는 높은 신뢰성, 긴 수명, 낮은 진동을 실현하고 위성 및 우주 응용 분야에 적합하기 때문입니다. 이러한 시스템은 적외선 센서, 초전도 장치, 우주 망원경 냉각에 점점 더 많이 채택되고 있으며, 진동에 민감한 장비에 안정적인 성능을 제공합니다. 국방 및 항공우주 임무에서 컴팩트하고 유지보수가 필요 없는 크라이오쿨러에 대한 수요가 증가함에 따라 채택이 가속화되고 있습니다. 이러한 솔루션은 기계적 마모 없이 일관된 냉각을 보장합니다. 또한, 첨단 전자장치, 열 관리 시스템, 소형화된 페이로드와의 통합은 차세대 위성 및 감시 프로그램에서의 활용을 촉진하고 있습니다. 이러한 특성으로 인해 안정적이고 효율적이며 내구성이 뛰어난 극저온 성능이 보장되어 중요한 항공우주 및 방위산업 분야에서 펄스 튜브 기술의 채택이 증가하고 있습니다.

"운영 주기별로는 폐쇄형 루프 사이클이 예측 기간 동안 더 높은 CAGR을 나타낼 것으로 예측됩니다."

이러한 성장은 의료용 영상 장비의 채용 확대, 초전도 자석의 효율적인 냉각 수요 증가, 에너지 절약형 극저온 시스템에 대한 관심 증가에 기인합니다. 클로즈드 루프식 크라이오쿨러는 잦은 보충이 필요 없고, 연속적이고 안정적인 냉각 성능을 실현하여 운영 효율을 높이고 다운타임을 줄입니다. 또한, 가변적인 냉각 부하를 처리할 수 있는 능력으로 MRI 장비, 극저온 연구, 새로운 양자 기술 응용에 적합합니다. 자동화 제어 및 첨단 열 관리 솔루션과의 통합은 신뢰성과 확장성을 더욱 높여 시장 성장에 크게 기여하고 있습니다.

세계의 크라이오쿨러(Cryo Cooler) 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객 사업에 영향을 미치는 동향/혼란

- 가격 분석

- 밸류체인 분석

- 생태계 분석

- 기술 분석

- 특허 분석

- 무역 분석

- 2025-2026년 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 투자 및 자금조달 시나리오

- 규제 상황

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 생성형 AI/AI가 냉동기 시장에 미치는 영향

- 2025년 미국 관세가 크라이오쿨러 시장에 미치는 영향

제6장 크라이오쿨러 시장 : 제공 구분별

- 하드웨어

- 압축기

- 콜드 헤드

- 방열 파이프

- 전력 조정 유닛

- 기타

- 서비스

- 기술 지원

- 제품 수리 및 개보수

- 예지보전

- 고객 트레이닝

제7장 크라이오쿨러 시장 : 열교환기 유형별

- 회수 열교환기

- 재생 열교환기

제8장 크라이오쿨러 시장 : 운전 사이클별

- 오픈 루프 사이클

- 클로즈드 루프 사이클

제9장 크라이오쿨러 시장 : 크라이오쿨러타입별

- GIFFORD-MCMAHON CRYOCOOLER

- PULSE TUBE CRYOCOOLERS

- STIRLING CRYOCOOLERS

- JOULE-THOMSON CRYOCOOLERS

- BRAYTON CRYOCOOLERS

제10장 크라이오쿨러 시장 : 온도 범위별

- 1-50K

- 50-150K

- 150K 이상

제11장 크라이오쿨러 시장 : 용도별

- 군

- 미사일 유도용 적외선 센서

- 위성 감시용 적외선 센서

- 의료

- MRI 시스템

- 저장용 산소 액화

- 냉동 수술 및 양성자 치료

- 상업

- 반도체 제조

- 휴대폰 기지국용 고온초전도체

- 비파괴 검사 및 프로세스 모니터링용 IR 센서

- 환경

- 오존홀과 온실 효과에 관한 대기 연구을 위한 적외선 센서

- 오염 모니터링용 적외선 센서

- 에너지

- 열손실 측정용 적외선 센서

- 피크컷용 초전도 자기에너지 저장

- 운송

- 초전도 자석에 의한 선형 모터카

- 플릿 차량용 LNG

- 연구개발

- 핵자기공명

- 전자 상자성 공명

- 공간

- 우주 천문학

- 혹성 과학

- 농업과 생물학

- 생물 세포 및 표본 보관

- 광업 및 금속

- METAL TEMPERING

- SHRINK FITTING

- 기타 용도

제12장 크라이오쿨러 시장 : 지역별

- 북미

- 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 거시경제 전망

- 독일

- 영국

- 프랑스

- 이탈리아

- 네덜란드

- 폴란드

- 북유럽

- 기타

- 아시아태평양

- 거시경제 전망

- 일본

- 중국

- 한국

- 인도

- 호주

- 인도네시아

- 말레이시아

- 태국

- 베트남

- 기타

- 기타 지역

- 거시경제 전망

- 중동

- 아프리카

- 남미

제13장 경쟁 구도

- 개요

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가와 재무 지표

- 브랜드 비교

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 경쟁 시나리오

제14장 기업 개요

- 주요 기업

- SUMITOMO HEAVY INDUSTRIES, LTD.

- THALES

- EDWARDS VACUUM(ATLAS COPCO GROUP)

- AMETEK.INC.

- CHART INDUSTRIES, INC.

- BLUEFORS

- NORTHROP GRUMMAN

- ADVANCED RESEARCH SYSTEMS

- RICOR

- AIR LIQUIDE ADVANCED TECHNOLOGIES

- 기타 기업

- LAKE SHORE CRYOTRONICS

- CREARE

- LIHAN CRYOGENICS CO., LTD.

- TRISTAN TECHNOLOGIES, INC.

- VACREE TECHNOLOGIES CO., LTD.

- HONEYWELL INTERNATIONAL INC.

- BRIGHT INSTRUMENT CO. LTD.

- ABSOLUT SYSTEM

- FABRUM

- CRYOSPECTRA GMBH

- ULVAC CRYOGENICS INC.

- OXFORD CRYOSYSTEMS LTD.

- HYCON LTD.

- RIX INDUSTRIES

- AIM INFRAROT-MODULE GMBH

제15장 부록

LSH 25.10.10The cryocooler market was valued at USD 3.48 billion in 2025 and is projected to reach USD 4.90 billion by 2030, registering a CAGR of 7.1% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Billion) |

| Segments | By Cryocooler Type, Offering, Heat Exchanger, Operating Cycle, Tempreature Range, and Application |

| Regions covered | North America, Europe, APAC, RoW |

The growth of cryocoolers is driven by rising adoption in satellite launches, space exploration, and defense applications, supported by government investments, technological advancements in cooling efficiency, and the growing need for cryogenic temperatures in quantum computing and medical imaging systems.

"Power conditioning unit in hardware type to grow at highest CAGR during forecast period"

By hardware type, the power conditioning unit segment is expected to witness the highest CAGR in the cryocooler market during the forecast period due to its critical role in ensuring stable and efficient power delivery for sensitive cryogenic systems. These units help regulate voltage fluctuations, minimize electrical noise, and protect delicate components from power disturbances, which is essential for vibration-sensitive applications such as space instruments, infrared sensors, and quantum computing devices. As cryocoolers find broader use in defense, aerospace, and medical imaging, the demand for a reliable and continuous power supply is becoming a key driver of adoption. Furthermore, integration with advanced control electronics and compact system designs is driving the requirement for reliable power conditioning solutions, ensuring long-term operational stability and enhanced performance of cryocooler systems.

"Pulse-tube cryocoolers segment accounted for significant share of cryocooler market in 2024"

By cryocooler type, the pulse-tube cryocoolers segment is estimated to account for a significant share of the overall cryocooler market in 2024 due to their ability to deliver high reliability, long operational life, and low vibration, making them suitable for satellite and space applications. These systems are increasingly being adopted for cooling infrared sensors, superconducting devices, and space telescopes, where vibration-sensitive instruments require stable performance. The growing demand for compact and maintenance-free cryocoolers in defense and aerospace missions is accelerating adoption, as these solutions ensure consistent cooling without mechanical wear. Furthermore, integration with advanced electronics, thermal management systems, and miniaturized payloads is driving their use in next-generation satellites and surveillance programs. These features ensure stable, efficient, and durable cryogenic performance, contributing to the increasing preference for pulse-tube technology in critical aerospace and defense applications.

"Closed-loop cycle to register higher CAGR in cryocooler market between 2025 and 2030"

The closed-loop cycle segment is projected to register the highest CAGR in the cryocooler market during the forecast period. This growth is attributed to rising adoption in medical imaging equipment, growing demand for efficient cooling in superconducting magnets, and the increasing focus on energy-efficient cryogenic systems. Closed-loop cryocoolers enable continuous and stable cooling performance without the need for frequent refilling, improving operational efficiency and reducing downtime. Furthermore, their ability to handle variable cooling loads makes them suitable for applications in MRI machines, cryogenic research, and emerging quantum technologies. The integration of closed-loop systems with automated controls and advanced thermal management solutions further enhances reliability and scalability, significantly contributing to market growth.

Extensive primary interviews were conducted with key industry experts in the cryocooler market space to determine and verify the market size for various segments and subsegments gathered through secondary research. The breakdown of primary participants for the report is shown below.

The study contains insights from various industry experts, from component suppliers to Tier 1 companies and OEMs. The break-up of the primaries is as follows:

- By Company Type - Tier 1 - 20%, Tier 2 - 35%, Tier 3 - 45%

- By Designation- C-level Executives - 35%, Directors - 25%, Others - 40%

- By Reion - North America - 45%, Europe -25%, Asia Pacific - 20%, RoW - 10%

The cryocooler market is dominated by a few globally established players, such as Sumitomo Heavy Industries, Ltd. (Japan), Thales (France), AMETEK.Inc. (US), Edwards Vacuum (UK), and Chart Industries, Inc. (US).

The study includes an in-depth competitive analysis of these key players in the cryocooler market, with their company profiles, recent developments, and key market strategies.

Research Coverage:

The report segments the cryocooler market and forecasts its size by application (military, medical, commercial, environmental, energy, transport, research & development, space, agriculture & biology, mining & metal, other applications), offering (hardware, services), heat exchanger type (recuperative heat exchanger, regenerative heat exchanger), temperature range (1k-50k, 50k-150k, above 150k), operating range (open-loop cycle, closed-loop cycle), type (Gifford-McMahon Cryocoolers, Pulse-tube Cryocoolers, Stirling Cryocoolers, Joule Thomson Cryocoolers, Brayton Cryocoolers). It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across the regions (North America, Europe, Asia Pacific, RoW). The report includes a supply chain analysis of the key players and their competitive analysis in the cryocooler ecosystem.

Key Benefits of Buying the Report:

- Analysis of key drivers (Accelerating demand in aerospace and defense catalyzes sustained cryocooler adoption, Quantum computing expansion necessitates advanced low-temperature thermal management solutions, Healthcare transformation fuels helium-free MRI adoption across global institutions), restraint (High capital intensity constrains scalability across cost-sensitive customer segments, Complex maintenance cycles elevate operational expenditure and adoption hesitancy), opportunities (Quantum computing scale-up driving sub-4K pre-cooler demand surges, Rapid commercialization of small satellites generates demand for miniaturized cryocoolers), challenges (Geopolitical risks destabilize specialized component sourcing across critical region, Balancing performance and cost metrics complicates commercial-scale market entry)

- Product Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product launches in the cryocooler market

- Market Development: Comprehensive information about lucrative markets - the report analyses the cryocooler market across varied regions.

- Market Diversification: Exhaustive information about new products, untapped geographies, recent developments, and investments in the cryocooler market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players, such as Sumitomo Heavy Industries, Ltd. (Japan), Thales (France), AMETEK.Inc. (US), Edwards Vacuum (UK), and Chart Industries, Inc. (US), among others, in the cryocooler market

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.4 CURRENCY CONSIDERED

- 1.5 UNIT CONSIDERED

- 1.6 LIMITATIONS

- 1.7 STAKEHOLDERS

- 1.8 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 INTRODUCTION

- 2.2 RESEARCH APPROACH

- 2.2.1 SECONDARY DATA

- 2.2.1.1 List of major secondary sources

- 2.2.1.2 Key data from secondary sources

- 2.2.2 PRIMARY DATA

- 2.2.2.1 Breakdown of primaries

- 2.2.2.2 Key participants in interviews

- 2.2.2.3 Key data from primary sources

- 2.2.2.4 Key industry insights

- 2.2.1 SECONDARY DATA

- 2.3 FACTOR ANALYSIS

- 2.3.1 SUPPLY-SIDE ANALYSIS

- 2.3.2 DEMAND-SIDE ANALYSIS

- 2.4 MARKET SIZE ESTIMATION METHODOLOGY

- 2.4.1 BOTTOM-UP APPROACH

- 2.4.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.4.2 TOP-DOWN APPROACH

- 2.4.2.1 Approach to arrive at market size using top-down approach (supply side)

- 2.4.1 BOTTOM-UP APPROACH

- 2.5 DATA TRIANGULATION

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ANALYSIS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES FOR PLAYERS IN CRYOCOOLER MARKET

- 4.2 CRYOCOOLER MARKET, BY OPERATING CYCLE

- 4.3 CRYOCOOLER MARKET, BY TEMPERATURE RANGE

- 4.4 CRYOCOOLER MARKET, BY HARDWARE TYPE

- 4.5 CRYOCOOLER MARKET IN ASIA PACIFIC, BY COUNTRY

- 4.6 CRYOCOOLER MARKET, BY REGION

- 4.7 CRYOCOOLER MARKET, BY GEOGRAPHY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Accelerating cryocooler demand from aerospace & defense sector

- 5.2.1.2 Surging adoption of quantum computing technology

- 5.2.1.3 Escalating demand for helium-free MRI systems by healthcare providers

- 5.2.2 RESTRAINTS

- 5.2.2.1 Low adoption in cost-sensitive markets due to high upfront costs and extended payback

- 5.2.2.2 Maintenance-driven expenditure and workforce skill gaps

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Emergence of sub-4K pre-coolers tailored for quantum data centers

- 5.2.3.2 Commercialization of small satellites

- 5.2.4 CHALLENGES

- 5.2.4.1 Geopolitical risks impacting specialized component sourcing

- 5.2.4.2 Commercial-scale expansion barriers due to performance-cost trade-offs

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 5.4 PRICING ANALYSIS

- 5.4.1 PRICING RANGE OF CRYOCOOLERS, BY KEY PLAYER, 2024

- 5.4.2 AVERAGE SELLING PRICE TREND OF CRYOCOOLERS, BY REGION, 2021-2024

- 5.5 VALUE CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Pulse tube cryocoolers

- 5.7.1.2 Stirling cryocoolers

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Thermal management & insulation

- 5.7.2.2 Cryogenic sensors & instrumentation

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Thermoelectric coolers (Peltier devices)

- 5.7.3.2 Quantum technologies

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 IMPORT SCENARIO (HS CODE 8418)

- 5.9.2 EXPORT SCENARIO (HS CODE 8418)

- 5.10 KEY CONFERENCES AND EVENTS, 2025-2026

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 SHI'S HIGH-CAPACITY 4 KGM-JT RJT-100 CRYOCOOLER SYSTEM FOR INDUSTRIAL SRF ACCELERATORS

- 5.11.2 CRYOR'S FLEXIBLE AND ADAPTABLE CRYOCOOLER SOLUTION FOR RESEARCH LABORATORIES

- 5.11.3 CREARE'S MECHANICAL CRYOCOOLER FOR NICMOS INFRARED VISION RECOVERY ON HUBBLE SPACE TELESCOPE

- 5.11.4 BLUEFOR' PT450 PULSE TUBE CRYOCOOLER MEETING PERFORMANCE AND ENERGY EFFICIENCY GOALS

- 5.12 INVESTMENT AND FUNDING SCENARIO

- 5.13 REGULATORY LANDSCAPE

- 5.13.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.13.2 KEY REGULATIONS

- 5.14 PORTER'S FIVE FORCES ANALYSIS

- 5.14.1 INTENSITY OF COMPETITIVE RIVALRY

- 5.14.2 THREAT OF SUBSTITUTES

- 5.14.3 BARGAINING POWER OF BUYERS

- 5.14.4 BARGAINING POWER OF SUPPLIERS

- 5.14.5 THREAT OF NEW ENTRANTS

- 5.15 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.15.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.15.2 BUYING CRITERIA

- 5.16 IMPACT OF GEN AI/AI ON CRYOCOOLER MARKET

- 5.17 2025 US TARIFF IMPACT ON CRYOCOOLER MARKET

- 5.17.1 INTRODUCTION

- 5.17.2 KEY TARIFF RATES

- 5.17.3 PRICE IMPACT ANALYSIS

- 5.17.4 IMPACT ON COUNTRIES/REGIONS

- 5.17.4.1 US

- 5.17.4.2 Europe

- 5.17.4.3 Asia Pacific

- 5.17.5 IMPACT ON APPLICATIONS

6 CRYOCOOLER MARKET, BY OFFERING

- 6.1 INTRODUCTION

- 6.2 HARDWARE

- 6.2.1 COMPRESSOR

- 6.2.1.1 Ability to minimize vibration and acoustic interference in sensitive systems to accelerate demand

- 6.2.2 COLD HEAD

- 6.2.2.1 Extended maintenance-free operation to boost demand

- 6.2.3 HEAT DISSIPATION PIPE

- 6.2.3.1 Rising use of additive manufacturing to fabricate complex heat pipe geometries to fuel segmental growth

- 6.2.4 POWER CONDITIONING UNIT

- 6.2.4.1 Ability to withstand radiation and voltage fluctuations to propel market

- 6.2.5 OTHER HARDWARE TYPES

- 6.2.1 COMPRESSOR

- 6.3 SERVICES

- 6.3.1 TECHNICAL SUPPORT

- 6.3.1.1 Need for on-demand expertise to ensure operational continuity to push segmental growth

- 6.3.2 PRODUCT REPAIR & REFURBISHMENT

- 6.3.2.1 Rising focus on extending product lifecycle and maximizing ROI to boost demand

- 6.3.3 PREVENTIVE MAINTENANCE

- 6.3.3.1 Significant focus on reducing downtime and avoiding costly system failures to surge demand

- 6.3.4 CUSTOMER TRAINING

- 6.3.4.1 Requirement to keep customers updated with latest operational practices to spike demand

- 6.3.1 TECHNICAL SUPPORT

7 CRYOCOOLER MARKET, BY HEAT EXCHANGER TYPE

- 7.1 INTRODUCTION

- 7.2 RECUPERATIVE HEAT EXCHANGER

- 7.2.1 INCREASING CRYOGENIC ADOPTION IN SPACE PROGRAMS TO SUPPORT SEGMENTAL GROWTH

- 7.3 REGENERATIVE HEAT EXCHANGER

- 7.3.1 SUPERIOR THERMAL STABILITY AND BETTER UNIFORMITY TO BOOST DEMAND

8 CRYOCOOLER MARKET, BY OPERATING CYCLE

- 8.1 INTRODUCTION

- 8.2 OPEN-LOOP CYCLE

- 8.2.1 EXCELLENCE IN HANDLING HIGH THROUGHPUT AND ADAPTING TO VARYING PROCESS REQUIREMENTS TO SPIKE DEMAND

- 8.3 CLOSED-LOOP CYCLE

- 8.3.1 REDUCED VIBRATION, LOWER MAINTENANCE, AND HIGHER RELIABILITY THAN OPEN-LOOP SYSTEMS TO ACCELERATE ADOPTION

9 CRYOCOOLER MARKET, BY CRYOCOOLER TYPE

- 9.1 INTRODUCTION

- 9.2 GIFFORD-MCMAHON CRYOCOOLERS

- 9.2.1 SUITABILITY FOR APPLICATIONS REQUIRING CONTINUOUS AND STABLE COOLING TO BOOST DEMAND

- 9.3 PULSE TUBE CRYOCOOLERS

- 9.3.1 ABILITY TO DELIVER VIBRATION-FREE, MAINTENANCE-FREE, AND SPACE-COMPATIBLE COOLING SOLUTIONS TO INCREASE DEMAND

- 9.4 STIRLING CRYOCOOLERS

- 9.4.1 RISING USE IN SPACE APPLICATIONS TO DRIVE MARKET

- 9.5 JOULE-THOMSON CRYOCOOLERS

- 9.5.1 WIDESPREAD USE IN GAS LIQUEFACTION, CRYOGENIC RESEARCH, AND MEDICAL IMAGING TO PROPEL MARKET

- 9.6 BRAYTON CRYOCOOLERS

- 9.6.1 INCREASING DEMAND IN AEROSPACE, DEFENSE, AND HIGH-POWER INDUSTRIAL APPLICATIONS TO FOSTER MARKET GROWTH

10 CRYOCOOLER MARKET, BY TEMPERATURE RANGE

- 10.1 INTRODUCTION

- 10.2 1-50 K

- 10.2.1 RISING USE IN ULTRA-LOW-NOISE DETECTION AND QUANTUM COMPUTING APPLICATIONS TO FACILITATE SEGMENTAL GROWTH

- 10.3 >50-150 K

- 10.3.1 ELEVATING DEMAND FOR FIELD-DEPLOYABLE DEFENSE SYSTEMS TO ACCELERATE SEGMENTAL GROWTH

- 10.4 ABOVE 150 K

- 10.4.1 ESCALATING USE IN INDUSTRIAL LIQUEFACTION AND HIGH-TEMPERATURE SUPERCONDUCTING APPLICATIONS TO BOOST SEGMENTAL GROWTH

11 CRYOCOOLER MARKET, BY APPLICATION

- 11.1 INTRODUCTION

- 11.2 MILITARY

- 11.2.1 ESCALATING USE OF UAVS AND DRONES IN BATTLEFIELD SURVEILLANCE TO DRIVE MARKET

- 11.2.2 IR SENSORS FOR MISSILE GUIDANCE

- 11.2.3 IR SENSORS FOR SATELLITE-BASED SURVEILLANCE

- 11.3 MEDICAL

- 11.3.1 PRESSING NEED TO REDUCE DOWNTIME IN CRITICAL HEALTHCARE INFRASTRUCTURE TO CONTRIBUTE TO MARKET GROWTH

- 11.3.2 MRI SYSTEMS

- 11.3.3 LIQUEFACTION OF OXYGEN FOR STORAGE

- 11.3.4 CRYOSURGERY AND PROTON THERAPY

- 11.4 COMMERCIAL

- 11.4.1 EXPANSION OF INDUSTRIAL-SCALE GAS LIQUEFACTION PLANTS TO FACILITATE DEMAND

- 11.4.2 SEMICONDUCTOR FABRICATION

- 11.4.3 HIGH-TEMPERATURE SUPERCONDUCTORS FOR CELL PHONE BASE STATIONS

- 11.4.4 IR SENSORS FOR NDE AND PROCESS MONITORING

- 11.5 ENVIRONMENTAL

- 11.5.1 RISING FOCUS ON TRACKING POLLUTION SOURCES AND IMPROVING URBAN AIR QUALITY TO SUPPORT MARKET GROWTH

- 11.5.2 IR SENSORS FOR ATMOSPHERIC STUDIES ON OZONE HOLE AND GREENHOUSE EFFECT

- 11.5.3 IR SENSORS FOR POLLUTION MONITORING

- 11.6 ENERGY

- 11.6.1 GREATER EMPHASIS ON REDUCING ENERGY LOSSES DURING TRANSMISSION TO FOSTER MARKET GROWTH

- 11.6.2 IR SENSORS FOR THERMAL LOSS MEASUREMENTS

- 11.6.3 SUPERCONDUCTING MAGNETIC ENERGY STORAGE FOR PEAK SHAVING

- 11.7 TRANSPORT

- 11.7.1 ELEVATING DEMAND FOR HYDROGEN-POWERED SHIPS AND SUBMARINES TO CREATE GROWTH OPPORTUNITIES

- 11.7.2 SUPERCONDUCTING MAGNETS IN MAGLEV TRAINS

- 11.7.3 LNG FOR FLEET VEHICLES

- 11.8 RESEARCH & DEVELOPMENT

- 11.8.1 RAPID INNOVATIONS IN SENSORS, NANOTECHNOLOGY, AND SUPERCONDUCTING ELECTRONICS TO PROMOTE MARKET GROWTH

- 11.8.2 NUCLEAR MAGNETIC RESONANCE

- 11.8.3 ELECTRON PARAMAGNETIC RESONANCE

- 11.9 SPACE

- 11.9.1 EARTH OBSERVATION, ASTROPHYSICS, AND DEEP-SPACE EXPLORATION MISSIONS TO SPUR DEMAND

- 11.9.2 SPACE ASTRONOMY

- 11.9.3 PLANETARY SCIENCE

- 11.10 AGRICULTURE & BIOLOGY

- 11.10.1 REQUIREMENT TO PRESERVE SEEDS, GENETIC MATERIALS, AND BIOLOGICAL SAMPLES TO ENCOURAGE ADOPTION

- 11.10.2 STORAGE OF BIOLOGICAL CELLS AND SPECIMENS

- 11.11 MINING & METAL

- 11.11.1 LEVERAGING CRYOCOOLERS TO ENHANCE CORROSION RESISTANCE AND WEAR PERFORMANCE

- 11.11.2 METAL TEMPERING

- 11.11.3 SHRINK FITTING

- 11.12 OTHER APPLICATIONS

12 CRYOCOOLER MARKET, BY REGION

- 12.1 INTRODUCTION

- 12.2 NORTH AMERICA

- 12.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 12.2.2 US

- 12.2.2.1 Well-established military industry and high expenditure on healthcare equipment to drive market

- 12.2.3 CANADA

- 12.2.3.1 Growing medical and healthcare expenditure to spur demand

- 12.2.4 MEXICO

- 12.2.4.1 Emerging industrial applications to drive demand

- 12.3 EUROPE

- 12.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 12.3.2 GERMANY

- 12.3.2.1 Thriving healthcare sector and government support for cryogenic research to foster market growth

- 12.3.3 UK

- 12.3.3.1 Government efforts toward defense system enhancement to fuel market growth

- 12.3.4 FRANCE

- 12.3.4.1 Emphasis on innovation and technological advancement to facilitate market growth

- 12.3.5 ITALY

- 12.3.5.1 Rising use of cryogenic technology in MRI and cancer treatment applications to support market growth

- 12.3.6 NETHERLANDS

- 12.3.6.1 Partnerships between cryogenic technology providers and research institutions to expedite market growth

- 12.3.7 POLAND

- 12.3.7.1 Surging deployment of cooling systems in electronic devices and automotive systems to accelerate market growth

- 12.3.8 NORDICS

- 12.3.8.1 Significant focus on sustainability and cryogenic research synergies to propel market

- 12.3.9 REST OF EUROPE

- 12.4 ASIA PACIFIC

- 12.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 12.4.2 JAPAN

- 12.4.2.1 Surging demand from universities, national laboratories, and research centers to develop innovative products to drive market

- 12.4.3 CHINA

- 12.4.3.1 Adoption of clean energy objectives to promote demand for cooling systems

- 12.4.4 SOUTH KOREA

- 12.4.4.1 Escalating demand for cryopumps from semiconductor manufacturers to fuel market growth

- 12.4.5 INDIA

- 12.4.5.1 Booming healthcare industry to intensify demand

- 12.4.6 AUSTRALIA

- 12.4.6.1 Healthcare, space, and defense verticals to contribute most to market growth

- 12.4.7 INDONESIA

- 12.4.7.1 Introduction of I-NCAP plan to ensure sustainable cooling practices to stimulate demand

- 12.4.8 MALAYSIA

- 12.4.8.1 Rising focus on adopting energy-efficient cooling and modernizing air conditioning standards to spike demand

- 12.4.9 THAILAND

- 12.4.9.1 Heightened demand for high-performance cryogenic systems across industrial and healthcare sectors to propel market

- 12.4.10 VIETNAM

- 12.4.10.1 Expansion of digital infrastructure due to rapid industrialization to create growth opportunities

- 12.4.11 REST OF ASIA PACIFIC

- 12.5 ROW

- 12.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 12.5.2 MIDDLE EAST

- 12.5.2.1 Bahrain

- 12.5.2.1.1 Expanding industrial parks, energy facilities, and manufacturing hubs to support market growth

- 12.5.2.2 Kuwait

- 12.5.2.2.1 Government-supported research programs in energy and materials science to boost adoption

- 12.5.2.3 Oman

- 12.5.2.3.1 Strategic government programs aimed at infrastructure modernization to rise deployment

- 12.5.2.4 Qatar

- 12.5.2.4.1 Capitalize on defense and scientific infrastructure expansion

- 12.5.2.5 Saudi Arabia

- 12.5.2.5.1 Vision 2030 initiative to create opportunities

- 12.5.2.6 UAE

- 12.5.2.6.1 Investment to improve data center capabilities to contribute to market growth

- 12.5.2.7 Rest of Middle East

- 12.5.2.1 Bahrain

- 12.5.3 AFRICA

- 12.5.3.1 South Africa

- 12.5.3.1.1 Healthcare infrastructure modernization efforts to support market growth

- 12.5.3.2 Other African countries

- 12.5.3.1 South Africa

- 12.5.4 SOUTH AMERICA

- 12.5.4.1 Brazil

- 12.5.4.1.1 Push toward renewable energy and industrial automation to spur demand

- 12.5.4.2 Argentina

- 12.5.4.2.1 Growing investments in healthcare, space research, and energy efficiency programs to drive market

- 12.5.4.3 Rest of South America

- 12.5.4.1 Brazil

13 COMPETITIVE LANDSCAPE

- 13.1 OVERVIEW

- 13.2 KEY PLAYER STRATEGIES/RIGHT TO WIN, 2021-2025

- 13.3 MARKET SHARE ANALYSIS, 2024

- 13.4 REVENUE ANALYSIS, 2021-2024

- 13.5 COMPANY VALUATION AND FINANCIAL METRICS

- 13.6 BRAND COMPARISON

- 13.7 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 13.7.1 STARS

- 13.7.2 EMERGING LEADERS

- 13.7.3 PERVASIVE PLAYERS

- 13.7.4 PARTICIPANTS

- 13.7.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 13.7.5.1 Company footprint

- 13.7.5.2 Region footprint

- 13.7.5.3 Cryocooler type footprint

- 13.7.5.4 Temperature range footprint

- 13.7.5.5 Application footprint

- 13.8 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 13.8.1 PROGRESSIVE COMPANIES

- 13.8.2 RESPONSIVE COMPANIES

- 13.8.3 DYNAMIC COMPANIES

- 13.8.4 STARTING BLOCKS

- 13.8.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 13.8.5.1 Detailed list of key startups/SMEs

- 13.8.5.2 Competitive benchmarking of key startups/SMEs

- 13.9 COMPETITIVE SCENARIO

- 13.9.1 PRODUCT LAUNCHES

- 13.9.2 DEALS

14 COMPANY PROFILES

- 14.1 KEY PLAYERS

- 14.1.1 SUMITOMO HEAVY INDUSTRIES, LTD.

- 14.1.1.1 Business overview

- 14.1.1.2 Products/Solutions/Services offered

- 14.1.1.3 Recent developments

- 14.1.1.3.1 Product launches

- 14.1.1.4 MnM view

- 14.1.1.4.1 Key strengths/Right to win

- 14.1.1.4.2 Strategic choices

- 14.1.1.4.3 Weaknesses/Competitive threats

- 14.1.2 THALES

- 14.1.2.1 Business overview

- 14.1.2.2 Products/Solutions/Services offered

- 14.1.2.3 MnM view

- 14.1.2.3.1 Key strengths/Right to win

- 14.1.2.3.2 Strategic choices

- 14.1.2.3.3 Weaknesses/Competitive threats

- 14.1.3 EDWARDS VACUUM (ATLAS COPCO GROUP)

- 14.1.3.1 Business overview

- 14.1.3.2 Products/Solutions/Services offered

- 14.1.3.3 MnM view

- 14.1.3.3.1 Key strengths/Right to win

- 14.1.3.3.2 Strategic choices

- 14.1.3.3.3 Weaknesses/Competitive threats

- 14.1.4 AMETEK.INC.

- 14.1.4.1 Business overview

- 14.1.4.2 Products/Solutions/Services offered

- 14.1.4.3 MnM view

- 14.1.4.3.1 Key strengths/Right to win

- 14.1.4.3.2 Strategic choices

- 14.1.4.3.3 Weaknesses/Competitive threats

- 14.1.5 CHART INDUSTRIES, INC.

- 14.1.5.1 Business overview

- 14.1.5.2 Products/Solutions/Services offered

- 14.1.5.3 MnM view

- 14.1.5.3.1 Key strengths/Right to win

- 14.1.5.3.2 Strategic choices

- 14.1.5.3.3 Weaknesses/Competitive threats

- 14.1.6 BLUEFORS

- 14.1.6.1 Business overview

- 14.1.6.2 Products/Solutions/Services offered

- 14.1.6.3 Recent developments

- 14.1.6.3.1 Product launches

- 14.1.6.3.2 Deals

- 14.1.6.3.3 Expansions

- 14.1.7 NORTHROP GRUMMAN

- 14.1.7.1 Business overview

- 14.1.7.2 Products/Solutions/Services offered

- 14.1.7.3 Recent developments

- 14.1.7.3.1 Deals

- 14.1.8 ADVANCED RESEARCH SYSTEMS

- 14.1.8.1 Business overview

- 14.1.8.2 Products/Services/Solutions offered

- 14.1.9 RICOR

- 14.1.9.1 Business overview

- 14.1.9.2 Products/Solutions/Services offered

- 14.1.10 AIR LIQUIDE ADVANCED TECHNOLOGIES

- 14.1.10.1 Business overview

- 14.1.10.2 Products/Solutions/Services offered

- 14.1.1 SUMITOMO HEAVY INDUSTRIES, LTD.

- 14.2 OTHER PLAYERS

- 14.2.1 LAKE SHORE CRYOTRONICS

- 14.2.2 CREARE

- 14.2.3 LIHAN CRYOGENICS CO., LTD.

- 14.2.4 TRISTAN TECHNOLOGIES, INC.

- 14.2.5 VACREE TECHNOLOGIES CO., LTD.

- 14.2.6 HONEYWELL INTERNATIONAL INC.

- 14.2.7 BRIGHT INSTRUMENT CO. LTD.

- 14.2.8 ABSOLUT SYSTEM

- 14.2.9 FABRUM

- 14.2.10 CRYOSPECTRA GMBH

- 14.2.11 ULVAC CRYOGENICS INC.

- 14.2.12 OXFORD CRYOSYSTEMS LTD.

- 14.2.13 HYCON LTD.

- 14.2.14 RIX INDUSTRIES

- 14.2.15 AIM INFRAROT-MODULE GMBH

15 APPENDIX

- 15.1 INSIGHTS FROM INDUSTRY EXPERTS

- 15.2 DISCUSSION GUIDE

- 15.3 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 15.4 CUSTOMIZATION OPTIONS

- 15.5 RELATED REPORTS

- 15.6 AUTHOR DETAILS