|

시장보고서

상품코드

1826565

테라헤르츠 기술 시장 : 유형, 용도, 발생기, 검출기별, 지역별 - 예측(-2030년)Terahertz Technology Market by Type, Application, Sources and Detectors & Region - Global Forecast to 2030 |

||||||

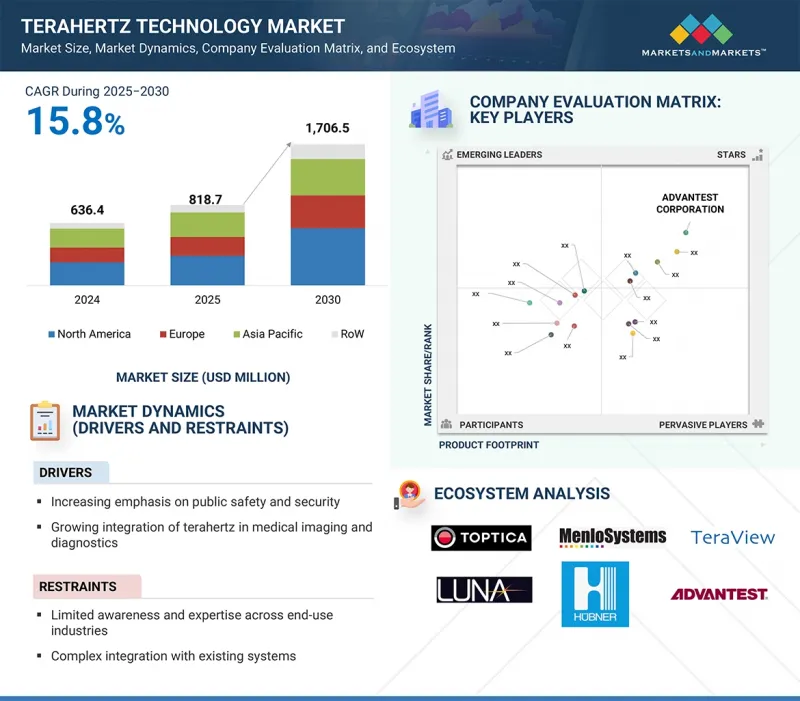

세계의 테라헤르츠 기술 시장 규모는 2025년 8억 1,870만 달러에서 2030년까지 17억 650만 달러에 이르고, CAGR 15.8%의 성장이 전망됩니다.

의료 분야에서 테라헤르츠 이미징과 테라헤르츠 분광학이 비분리 고해상도 진단, 코팅의 무결성 검사, 의약품 품질 관리 등에 활용되는 것이 성장의 주요 요인입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 100만 달러 |

| 부문 | 유형, 용도, 발생기, 검출기, 지역 |

| 대상 지역 | 북미, 유럽, 아시아태평양, 기타 지역 |

동시에 군사 및 국토 안보에 대한 투자 증가는 폭발물 및 숨겨진 위협을 감지하기 위한 비침습적 검사에 사용되는 테라헤르츠 시스템에 대한 수요를 촉진하고 있습니다. 테라헤르츠 주파수는 위성통신, 전술통신, 실내외 통신에 사용되는 초고속의 안전한 무선 데이터 전송을 지원하기 위함입니다. 또한, 테라헤르츠 솔루션은 분자 분석을 위한 실험실 연구와 손상 없이 구조물의 무결성을 평가하는 산업용 비파괴 검사(NDT)에도 활용되고 있습니다. 이러한 다양한 응용 분야로 인해 테라헤르츠 기술은 의료, 국방, 통신, 산업 등 다양한 분야에서 중요한 원동력으로 자리매김하고 있으며, 전 세계적으로 강력한 시장 확대를 유지하고 있습니다.

의료용은 2024년 시장 점유율 2위를 차지했습니다.

2024년 테라헤르츠 기술 시장에서 두 번째로 큰 비중을 차지할 것으로 예상되는 의료 분야는 비침습적 진단 및 의약품 품질 관리의 역할 확대에 힘입은 것으로 보입니다. 테라헤르츠 시스템은 고해상도의 비이온화 이미징이 가능하고 기존 방식보다 안전하여 질병의 조기 발견, 조직성상 진단, 치과 이미징 등의 용도로 활용이 확대되고 있습니다. 또한, 제약 회사는 테라헤르츠 분광법을 사용하여 코팅 두께, 결정화도, 불순물 수준을 분석하여 제품의 품질과 규정 준수를 보장합니다. 병원, 연구기관, 생명과학 기업들도 정밀의료를 촉진하고 치료 결과를 개선하기 위해 이러한 시스템을 통합하고 있습니다. 보다 안전한 진단 기술에 대한 수요 증가와 의약품 개발에서 신뢰할 수 있는 품질 보증의 필요성은 의료 분야를 가장 유망한 최종 사용 분야 중 하나로 자리매김하고 있습니다. 특히 이미징 및 포인트 오브 케어 용도의 기술 혁신이 가속화됨에 따라 이 부문은 세계 테라헤르츠 기술 시장에 대한 기여도를 지속적으로 확대하고 있습니다.

테라헤르츠 이미징 부문은 예측 기간 동안 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다.

테라헤르츠 이미징 부문은 의료, 보안, 산업 분야에서의 활용 확대에 힘입어 예측 기간 동안 테라헤르츠 기술 시장에서 두 번째로 높은 CAGR을 나타낼 것으로 예측됩니다. 의료 분야에서 테라헤르츠 이미징은 비침습적 진단의 견인차 역할을 하고 있으며, 유해한 방사선을 사용하지 않고도 조직의 상세한 시각화를 가능하게 합니다. 마찬가지로, 군사 및 국토 안보 분야에서는 은폐된 무기 및 폭발물을 감지하는 데 있어 기존의 스캐닝 방법을 대체할 수 있는 안전하고 효과적인 방법을 제공하기 위해 개발이 진행되고 있습니다. 이 기술은 산업용 비파괴 검사(NDT)에도 적용되어 재료나 부품을 손상시키지 않고 정확하게 검사할 수 있습니다. 고해상도 실시간 이미징에 대한 관심이 높아지고 소형 휴대용 시스템의 발전으로 인해 상업 및 연구 분야 모두에서 채택이 확대되고 있습니다. 산업계가 안전, 품질 보증, 첨단 진단 솔루션의 우선순위를 계속 높여가고 있는 가운데, 테라헤르츠 이미징은 향후 몇 년 동안 시장 성장에 매우 중요한 역할을 할 것으로 보입니다.

캐나다가 예측 기간 동안 북미 테라헤르츠 기술 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다.

캐나다는 의학 연구, 국방 현대화, 첨단 통신 기술에 대한 투자 증가로 인해 예측 기간 동안 북미 테라헤르츠 기술 시장에서 가장 높은 CAGR을 나타낼 것으로 예측됩니다. 캐나다의 대학 및 연구기관들은 테라헤르츠의 바이오메디컬 이미징 및 의약품 검사에 대한 적용을 적극적으로 모색하고 있으며, 분광 시스템 및 이미징 시스템에 대한 강력한 수요를 창출하고 있습니다. 동시에, 국토 안보 및 방어 능력을 강화하려는 정부의 이니셔티브는 위협 식별을 위한 테라헤르츠 기반 스크리닝 및 감지 시스템의 채택을 촉진하고 있습니다. 또한, 6G 연구를 포함한 차세대 무선통신 인프라 개발에 캐나다의 참여가 확대되고 있으며, 초고속 데이터 전송을 위한 테라헤르츠 주파수에 대한 관심이 가속화되고 있습니다. 강력한 연구 활동, 의료 혁신, 정부 지원 프로그램을 통해 캐나다는 북미에서 테라헤르츠 기술의 주요 성장 시장으로 부상하고 있습니다.

세계의 테라헤르츠 기술 시장에 대해 조사 분석했으며, 주요 촉진요인과 저해요인, 경쟁 구도, 향후 동향 등의 정보를 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 중요 지견

- 테라헤르츠 기술 시장의 매력적인 성장 기회

- 테라헤르츠 기술 시장 : 유형별

- 테라헤르츠 기술 시장 : 용도별

- 테라헤르츠 기술 시장 : 지역별

- 테라헤르츠 기술 시장 : 국가별

제5장 시장 개요

- 서론

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- 고객의 비즈니스에 영향을 미치는 동향/파괴

- 가격 결정 분석

- 평균 판매 가격 동향 : 지역별

- 주요 기업의 평균 판매 가격 동향 : 유형별

- 공급망 분석

- 생태계 분석

- 기술 분석

- 주요 기술

- 보완 기술

- 인접 기술

- 특허 분석

- 무역 분석

- 수출 시나리오

- 수입 시나리오

- 주요 컨퍼런스 및 이벤트

- 사례 연구 분석

- 규제 상황

- 규제기관, 정부기관, 기타 조직

- 주요 규제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 테라헤르츠 기술 시장 AI의 영향

- 2025년 미국 관세의 영향 - 테라헤르츠 기술 시장

- 서론

- 주요 관세율

- 가격에 대한 영향 분석

- 국가/지역에 대한 영향

- 용도에 대한 영향

제6장 테라헤르츠 기술 시장 : 유형별

- 서론

- 테라헤르츠 이미징

- 테라헤르츠 분광

- 테라헤르츠 통신 시스템

제7장 테라헤르츠 기술 시장 : 용도별

- 서론

- 실험실에서의 연구

- 의료

- 군 및 국토안보

- 산업용 비파괴 검사(NDT)

- 위성통신

- 전술/군용 통신

- 야외/실내 무선통신

제8장 테라헤르츠 기술 : 발생기, 검출기별

- 서론

- 테라헤르츠 발생기

- 양자 캐스케이드 레이저(QCL)

- 주파수 배율기

- 그로바

- 광전도 안테나(PCA)

- STAR(Stimulated Terahertz Amplified Radiation)

- 검출기

- Schottky barrier diode

- 고전자 이동도 트랜지스터(HEMT)

- 나노와이어

- 초전 검출기

- GOLAY CELL

- 볼러미터 및 SHAB(Superconducting Hotspot Air-bridge Bolometer)

제9장 테라헤르츠 기술 시장 : 지역별

- 서론

- 북미

- 북미의 거시경제 전망

- 미국

- 캐나다

- 멕시코

- 유럽

- 유럽의 거시경제 전망

- 영국

- 독일

- 프랑스

- 이탈리아

- 스페인

- 기타 유럽

- 아시아태평양

- 아시아태평양의 거시경제 전망

- 일본

- 중국

- 인도

- 한국

- 기타 아시아태평양

- 기타 지역

- 기타 지역 거시경제 전망

- 중동 및 아프리카

- 남미

제10장 경쟁 구도

- 서론

- 주요 시장 진출기업의 전략/강점

- 매출 분석(2021년-2024년)

- 시장 점유율 분석(2024년)

- 기업 평가 매트릭스 : 주요 기업(2024년)

- 기업 평가 매트릭스 : 스타트업/중소기업(2024년)

- 경쟁 시나리오

제11장 기업 개요

- 주요 기업

- ADVANTEST CORPORATION

- LUNA INNOVATIONS

- TERAVIEW LIMITED

- TOPTICA PHOTONICS AG

- HUBNER GMBH & CO. KG

- MENLO SYSTEMS

- TERASENSE GROUP INC.

- GENTEC ELECTRO-OPTICS

- QMC INSTRUMENTS LTD.

- TERAVIL LTD

- 기타 기업

- VIRGINIA DIODES, INC.

- MICROTECH INSTRUMENTS

- SWISSTO12

- DEL MAR PHOTONICS, INC.

- INSIGHT PRODUCT COMPANY

- BATOP GMBH

- LYTID SAS

- TYDEX

- QUANTUM DESIGN INC.

- RAYSECUR, INC.

- LONGWAVE PHOTONICS LLC

- BRIDGE12 TECHNOLOGIES, INC.

- ACAL BFI

- THORLABS, INC.

- SCIENCETECH INC.

제12장 부록

LSH 25.10.10The Terahertz Technology market is expected to grow from USD 818.7 million in 2025 to USD 1,706.5 million by 2030, at a CAGR of 15.8%. Growth is primarily fueled by the expanding adoption of terahertz imaging and spectroscopy in the medical and healthcare sector, where it enables non-ionizing, high-resolution diagnostics, coating integrity checks, and pharmaceutical quality control.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) |

| Segments | By Type, Application, Sources and Detectors, Region |

| Regions covered | North America, Europe, APAC, RoW |

At the same time, increasing investments in military and homeland security are driving demand for terahertz systems used in non-invasive screening to detect explosives and concealed threats. Another major growth catalyst is the advancement of next-generation communication technologies, as terahertz frequencies support ultra-fast, secure wireless data transfer for satellite, tactical, and indoor/outdoor communications. In addition, terahertz solutions are being adopted in laboratory research for molecular analysis and in industrial non-destructive testing (NDT) to evaluate structural integrity without causing damage. Together, these diverse application areas position terahertz technology as a critical enabler across healthcare, defense, communications, and industrial domains, sustaining strong market expansion worldwide.

The medical & healthcare applications accounted for the second-largest market share in 2024.

The medical & healthcare application represents the second largest share of the terahertz technology market in 2024, supported by its growing role in non-invasive diagnostics and pharmaceutical quality control. Terahertz systems are increasingly utilized for applications such as early disease detection, tissue characterization, and dental imaging, owing to their ability to deliver high-resolution, non-ionizing imaging that is safer than conventional methods. In addition, pharmaceutical companies are adopting terahertz spectroscopy to analyze coating thickness, crystallinity, and impurity levels, ensuring product quality and regulatory compliance. Hospitals, research institutions, and life sciences companies are also integrating these systems to advance precision medicine and improve treatment outcomes. The rising demand for safer diagnostic technologies, coupled with the need for reliable quality assurance in drug development, has positioned medical and healthcare as one of the most promising end-use sectors. As innovation accelerates, particularly in imaging and point-of-care applications, this segment continues to expand its contribution to the global terahertz technology market.

The terahertz imaging segment is projected to register the second-highest CAGR during the forecast period.

The terahertz imaging segment is projected to register the second-highest CAGR in the terahertz technology market during the forecast period, driven by its expanding use across healthcare, security, and industrial applications. In the medical and healthcare sector, terahertz imaging is gaining traction for non-invasive diagnostics, enabling detailed visualization of tissues without harmful radiation. Similarly, in military and homeland security, it is increasingly deployed to detect concealed weapons and explosives, offering a safer and more effective alternative to conventional scanning methods. The technology is also being adopted in industrial non-destructive testing (NDT), where it ensures precise inspection of materials and components without causing damage. The growing emphasis on high-resolution, real-time imaging, combined with advancements in compact and portable systems, is fueling wider adoption across both commercial and research domains. As industries continue to prioritize safety, quality assurance, and advanced diagnostic solutions, terahertz imaging is set to play a pivotal role in shaping market growth over the coming years.

Canada is estimated to register the highest CAGR in the North American terahertz technology market during the forecast period.

Canada is anticipated to record the highest CAGR in the North American terahertz technology market over the forecast period, driven by increasing investments in medical research, defense modernization, and advanced communication technologies. Canadian universities and research institutes are actively exploring terahertz applications in biomedical imaging and pharmaceutical testing, creating strong demand for spectroscopy and imaging systems. At the same time, government initiatives to enhance homeland security and defense capabilities are fostering the adoption of terahertz-based screening and detection systems for threat identification. Furthermore, the growing participation of Canada in developing next-generation wireless communication infrastructure, including 6G research, is accelerating interest in terahertz frequencies for ultra-fast data transfer. The strong research activity, rising healthcare innovation, and supportive government programs position Canada as a leading growth market for terahertz technology in North America.

Breakdown of Primaries

A variety of executives from key organizations operating in the terahertz technology market were interviewed in-depth, including CEOs, marketing directors, and innovation and technology directors.

- By Company Type: Tier 1-35%, Tier 2- 40%, and Tier 3-25%

- By Designation: C-level Executives-30%, Directors-40%, and Others-30%

- By Region: North America-40%, Europe -32%, Asia Pacific -23%, and Rest of the World-5%

The terahertz technology market is dominated by globally established players such as ADVANTEST CORPORATION (Japan), HUBNER GmbH & Co. KG (Germany), TOPTICA Photonics AG (Germany), Gentec Electro-Optics (Canada), Luna Innovations (US), Menlo Systems (Germany), TeraView Limited (UK), Terasense Group Inc. (US), QMC Instruments Ltd. (UK), and Quantum Design Inc. (US). The study includes an in-depth competitive analysis of these key players in the terahertz technology market, as well as their company profiles, recent developments, and key market strategies.

Study Coverage

The report segments the terahertz technology market and forecasts its size by type, application, and region. It also discusses the market's drivers, restraints, opportunities, and challenges. It gives a detailed view of the market across four main regions: North America, Europe, Asia Pacific, and Rest of the World. The report includes a supply chain analysis, along with the key players and their competitive analysis of the terahertz technology ecosystem.

Key Benefits of Buying the Report

- Analysis of key drivers (increasing emphasis on public safety and security, growing integration of terahertz in medical imaging and diagnostics), restraints (limited awareness and expertise across end-use industries, and complex integration with existing systems), opportunities (increasing focus on 6G and ultra-high-speed communications, booming automotive sector for advanced driver assistance systems, and growing investment in quantum and ultrafast optics research), and challenges (technical barriers to generating and detecting stable terahertz signals) influencing the growth of the terahertz technology market

- Products/Solution/Service Development/Innovation: Detailed insights into upcoming technologies, research and development activities, and new product/solution/service launches in the terahertz technology market

- Market Development: Comprehensive information about lucrative markets-the report analyses the terahertz technology market across varied regions.

- Market Diversification: Exhaustive information about new products/solutions/services, untapped geographies, recent developments, and investments in the terahertz technology market

- Competitive Assessment: In-depth assessment of market shares, growth strategies, and service offerings of leading players such as ADVANTEST CORPORATION (Japan), HUBNER GmbH & Co. KG (Germany), TOPTICA Photonics AG (Germany), Luna Innovations (US), and Thorlabs, Inc. (US), among others.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION AND SCOPE

- 1.2.1 INCLUSIONS AND EXCLUSIONS

- 1.2.2 MARKETS COVERED

- 1.2.3 YEARS CONSIDERED

- 1.3 CURRENCY

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.1.1 Key data from secondary sources

- 2.1.1.2 List of key secondary sources

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Key data from primary sources

- 2.1.2.2 List of primary interview participants

- 2.1.2.3 Breakdown of primaries

- 2.1.2.4 Key industry insights

- 2.1.3 SECONDARY AND PRIMARY RESEARCH

- 2.1.1 SECONDARY DATA

- 2.2 MARKET SIZE ESTIMATION METHODOLOGY

- 2.2.1 BOTTOM-UP APPROACH

- 2.2.1.1 Approach to arrive at market size using bottom-up analysis (demand side)

- 2.2.2 TOP-DOWN APPROACH

- 2.2.2.1 Approach to arrive at market size using top-down analysis (supply side)

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 MARKET SHARE ESTIMATION

- 2.4 DATA TRIANGULATION

- 2.5 RISK ANALYSIS

- 2.6 RESEARCH ASSUMPTIONS

- 2.7 RESEARCH LIMITATIONS

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE GROWTH OPPORTUNITIES IN TERAHERTZ TECHNOLOGY MARKET

- 4.2 TERAHERTZ TECHNOLOGY MARKET, BY TYPE

- 4.3 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION

- 4.4 TERAHERTZ TECHNOLOGY MARKET, BY REGION

- 4.5 TERAHERTZ TECHNOLOGY MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing use in security screening and surveillance applications

- 5.2.1.2 Rise in applications in medical imaging and diagnostics

- 5.2.2 RESTRAINTS

- 5.2.2.1 Limited awareness and expertise across end-user industries

- 5.2.2.2 Complex integration with existing systems

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Role in 6G and ultra-high-speed communications

- 5.2.3.2 Expansion into automotive sector with Advanced Driver Assistance Systems (ADAS)

- 5.2.3.3 Growing investment in quantum and ultrafast optics research

- 5.2.4 CHALLENGES

- 5.2.4.1 Technical barriers to generating and detecting stable terahertz signals

- 5.2.1 DRIVERS

- 5.3 TRENDS/DISRUPTIONS IMPACTING CUSTOMERS' BUSINESSES

- 5.4 PRICING ANALYSIS

- 5.4.1 AVERAGE SELLING PRICE TREND, BY REGION

- 5.4.2 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY TYPE

- 5.5 SUPPLY CHAIN ANALYSIS

- 5.6 ECOSYSTEM ANALYSIS

- 5.7 TECHNOLOGY ANALYSIS

- 5.7.1 KEY TECHNOLOGIES

- 5.7.1.1 Terahertz detectors

- 5.7.1.2 Terahertz imaging systems

- 5.7.1.3 Terahertz spectroscopy

- 5.7.2 COMPLEMENTARY TECHNOLOGIES

- 5.7.2.1 Photonic integration

- 5.7.3 ADJACENT TECHNOLOGIES

- 5.7.3.1 Infrared and optical imaging

- 5.7.3.2 Nanotechnology

- 5.7.1 KEY TECHNOLOGIES

- 5.8 PATENT ANALYSIS

- 5.9 TRADE ANALYSIS

- 5.9.1 EXPORT SCENARIO

- 5.9.2 IMPORT SCENARIO

- 5.10 KEY CONFERENCES AND EVENTS

- 5.11 CASE STUDY ANALYSIS

- 5.11.1 NVIDIA LEVERAGED TERAVIEW TERAHERTZ TECHNOLOGY TO OVERCOME CHIP-LEVEL FAULT ANALYSIS CHALLENGES

- 5.11.2 LUNA INNOVATIONS AND BRIDGESTONE ENHANCED TIRE RELIABILITY WITH TERAHERTZ-BASED MEASUREMENT SOLUTIONS

- 5.11.3 ENHANCED CHIP-LEVEL FAULT ANALYSIS WITH TERAHERTZ TIME-DOMAIN REFLECTOMETRY DRIVING PRECISION AND RELIABILITY

- 5.12 REGULATORY LANDSCAPE

- 5.12.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 5.12.2 KEY REGULATIONS

- 5.13 PORTER'S FIVE FORCES ANALYSIS

- 5.13.1 THREAT OF NEW ENTRANTS

- 5.13.2 THREAT OF SUBSTITUTES

- 5.13.3 BARGAINING POWER OF SUPPLIERS

- 5.13.4 BARGAINING POWER OF BUYERS

- 5.13.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.14 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.14.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.14.2 BUYING CRITERIA

- 5.15 IMPACT OF ARTIFICIAL INTELLIGENCE ON TERAHERTZ TECHNOLOGY MARKET

- 5.15.1 INTRODUCTION

- 5.16 IMPACT OF 2025 US TARIFF - TERAHERTZ TECHNOLOGY MARKET

- 5.16.1 INTRODUCTION

- 5.16.2 KEY TARIFF RATES

- 5.16.3 PRICE IMPACT ANALYSIS

- 5.16.4 IMPACT OF COUNTRY/REGION

- 5.16.4.1 US

- 5.16.4.2 Europe

- 5.16.4.3 Asia Pacific

- 5.16.5 IMPACT ON APPLICATION

6 TERAHERTZ TECHNOLOGY MARKET, BY TYPE

- 6.1 INTRODUCTION

- 6.2 TERAHERTZ IMAGING

- 6.2.1 TRANSFORMING NON-INVASIVE DIAGNOSTICS AND HIGH-PRECISION SECURITY SCREENING USING NEXT-GENERATION TERAHERTZ IMAGING

- 6.2.1.1 Active terahertz imaging systems

- 6.2.1.2 Passive terahertz imaging systems

- 6.2.1 TRANSFORMING NON-INVASIVE DIAGNOSTICS AND HIGH-PRECISION SECURITY SCREENING USING NEXT-GENERATION TERAHERTZ IMAGING

- 6.3 TERAHERTZ SPECTROSCOPY

- 6.3.1 HARNESSING TERAHERTZ SPECTROSCOPY AS STRATEGIC ENABLER FOR NEXT-WAVE BIOMEDICAL AND PHARMA GROWTH

- 6.3.1.1 Terahertz time-domain spectroscopy

- 6.3.1.2 Terahertz frequency-domain spectroscopy

- 6.3.1 HARNESSING TERAHERTZ SPECTROSCOPY AS STRATEGIC ENABLER FOR NEXT-WAVE BIOMEDICAL AND PHARMA GROWTH

- 6.4 TERAHERTZ COMMUNICATION SYSTEMS

- 6.4.1 HARNESSING TERAHERTZ FREQUENCY BANDS TO ENABLE SCALABLE HIGH SPEED WIRELESS COMMUNICATION

- 6.4.1.1 Antennas

- 6.4.1.2 Emitters

- 6.4.1.3 Modulators

- 6.4.1 HARNESSING TERAHERTZ FREQUENCY BANDS TO ENABLE SCALABLE HIGH SPEED WIRELESS COMMUNICATION

7 TERAHERTZ TECHNOLOGY MARKET, BY APPLICATION

- 7.1 INTRODUCTION

- 7.2 LABORATORY RESEARCH

- 7.2.1 ADVANCING SCIENTIFIC FRONTIERS THROUGH TERAHERTZ-ENABLED HIGH-PRECISION LABORATORY RESEARCH SOLUTIONS

- 7.2.1.1 Material characterization

- 7.2.1.2 Biochemistry

- 7.2.1.3 Plasma diagnostics

- 7.2.1 ADVANCING SCIENTIFIC FRONTIERS THROUGH TERAHERTZ-ENABLED HIGH-PRECISION LABORATORY RESEARCH SOLUTIONS

- 7.3 MEDICAL & HEALTHCARE

- 7.3.1 LEVERAGING TERAHERTZ IMAGING FOR NON-IONIZING, HIGH-PRECISION DIAGNOSTICS IN NEXT-GEN HEALTHCARE

- 7.3.1.1 Oncology

- 7.3.1.2 Dentistry

- 7.3.1.3 Dermatology

- 7.3.1.4 Tomography

- 7.3.1 LEVERAGING TERAHERTZ IMAGING FOR NON-IONIZING, HIGH-PRECISION DIAGNOSTICS IN NEXT-GEN HEALTHCARE

- 7.4 MILITARY & HOMELAND SECURITY

- 7.4.1 ADVANCING DEFENSE AND SECURITY CAPABILITIES THROUGH TERAHERTZ-DRIVEN THREAT DETECTION AND HIGH-SPEED COMMUNICATIONS

- 7.4.1.1 Passenger screening

- 7.4.1.2 Landmine and improvised explosive device detection

- 7.4.1 ADVANCING DEFENSE AND SECURITY CAPABILITIES THROUGH TERAHERTZ-DRIVEN THREAT DETECTION AND HIGH-SPEED COMMUNICATIONS

- 7.5 INDUSTRIAL NON-DESTRUCTIVE TESTING (NDT)

- 7.5.1 UNLOCKING STRATEGIC VALUE THROUGH TERAHERTZ-DRIVEN, HIGH-PRECISION NON-DESTRUCTIVE TESTING SOLUTIONS

- 7.5.1.1 Aerospace

- 7.5.1.2 Semiconductor and electronics

- 7.5.1.3 Pharmaceuticals

- 7.5.1 UNLOCKING STRATEGIC VALUE THROUGH TERAHERTZ-DRIVEN, HIGH-PRECISION NON-DESTRUCTIVE TESTING SOLUTIONS

- 7.6 SATELLITE COMMUNICATIONS

- 7.6.1 LEVERAGING INTER-SATELLITE COMMUNICATIONS TO ENHANCE BANDWIDTH, SECURITY, AND ORBITAL ASSET MONITORING

- 7.7 TACTICAL/MILITARY COMMUNICATIONS

- 7.7.1 TRANSFORMING TACTICAL CONNECTIVITY THROUGH TERAHERTZ-ENABLED ULTRA-SECURE, HIGH-BANDWIDTH BATTLEFIELD COMMUNICATIONS

- 7.8 OUTDOOR/INDOOR WIRELESS COMMUNICATIONS

- 7.8.1 UNLOCKING ULTRA-HIGH DATA THROUGHPUT VIA SHORT-RANGE, LOW-TERAHERTZ WIRELESS NETWORK INNOVATION

8 TERAHERTZ TECHNOLOGY: SOURCES AND DETECTORS

- 8.1 INTRODUCTION

- 8.2 THZ SOURCES

- 8.2.1 QUANTUM-CASCADE LASER (QCL)

- 8.2.2 FREQUENCY MULTIPLIER

- 8.2.3 GLOBAR

- 8.2.4 PHOTOCONDUCTIVE ANTENNA (PCA)

- 8.2.5 STIMULATED TERAHERTZ AMPLIFIED RADIATION (STAR)

- 8.3 DETECTORS

- 8.3.1 SCHOTTKY DIODE

- 8.3.2 HIGH ELECTRON MOBILITY TRANSISTOR (HEMT)

- 8.3.3 NANOWIRE

- 8.3.4 PYROELECTRIC DETECTOR

- 8.3.5 GOLAY CELL

- 8.3.6 BOLOMETER AND SUPERCONDUCTIVE HOT-SPOT AIR-BRIDGE BOLOMETER (SHAB)

9 TERAHERTZ TECHNOLOGY MARKET, BY REGION

- 9.1 INTRODUCTION

- 9.2 NORTH AMERICA

- 9.2.1 MACROECONOMIC OUTLOOK FOR NORTH AMERICA

- 9.2.2 US

- 9.2.2.1 Academic leadership and stratospheric mission validations to accelerate commercialization of terahertz systems

- 9.2.3 CANADA

- 9.2.3.1 Healthcare innovation and cancer diagnostics drive adoption of non-ionizing terahertz imaging solutions

- 9.2.4 MEXICO

- 9.2.4.1 Telecom reforms and national research infrastructure to strengthen Mexico's terahertz technology capabilities

- 9.3 EUROPE

- 9.3.1 MACROECONOMIC OUTLOOK FOR EUROPE

- 9.3.2 UK

- 9.3.2.1 Research excellence and breakthroughs to drive commercialization of terahertz applications in UK

- 9.3.3 GERMANY

- 9.3.3.1 Germany to fuel market leadership through breakthroughs in terahertz imaging and 6G-enabled systems

- 9.3.4 FRANCE

- 9.3.4.1 France to strengthen terahertz ecosystem through strategic investments in security, telecom, and industrial modernization

- 9.3.5 ITALY

- 9.3.5.1 Italy to strengthen global terahertz positioning through quantum devices and industrial integration

- 9.3.6 SPAIN

- 9.3.6.1 Spain to position terahertz as strategic enabler for industrial and healthcare innovation

- 9.3.7 REST OF EUROPE

- 9.4 ASIA PACIFIC

- 9.4.1 MACROECONOMIC OUTLOOK FOR ASIA PACIFIC

- 9.4.2 JAPAN

- 9.4.2.1 Innovations in terahertz devices and 6G demonstrations to drive Japan's market growth across telecom and connectivity sectors

- 9.4.3 CHINA

- 9.4.3.1 Economic expansion and semiconductor autonomy to support China's terahertz technology market growth

- 9.4.4 INDIA

- 9.4.4.1 India to accelerate terahertz adoption through health, wellness, and defense-focused technological innovations

- 9.4.5 SOUTH KOREA

- 9.4.5.1 South Korea to expand terahertz commercialization through 6G innovation and cross-industry adoption

- 9.4.6 REST OF ASIA PACIFIC

- 9.5 REST OF THE WORLD (ROW)

- 9.5.1 MACROECONOMIC OUTLOOK FOR ROW

- 9.5.2 MIDDLE EAST & AFRICA

- 9.5.2.1 Unlocking strategic value of terahertz in next-gen connectivity and cultural asset preservation to support market growth

- 9.5.3 SOUTH AMERICA

- 9.5.3.1 Advancing terahertz innovation to drive South America's science and industry landscape

10 COMPETITIVE LANDSCAPE

- 10.1 INTRODUCTION

- 10.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 10.3 REVENUE ANALYSIS, 2021-2024

- 10.4 MARKET SHARE ANALYSIS, 2024

- 10.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 10.5.1 STARS

- 10.5.2 EMERGING LEADERS

- 10.5.3 PERVASIVE PLAYERS

- 10.5.4 PARTICIPANTS

- 10.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 10.5.5.1 Company footprint

- 10.5.5.2 Regional footprint

- 10.5.5.3 Application footprint

- 10.5.5.4 Type footprint

- 10.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 10.6.1 PROGRESSIVE COMPANIES

- 10.6.2 RESPONSIVE COMPANIES

- 10.6.3 DYNAMIC COMPANIES

- 10.6.4 STARTING BLOCKS

- 10.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 10.6.5.1 Detailed list of key startups/SMEs

- 10.6.5.2 Competitive benchmarking of key startups/SMEs

- 10.7 COMPETITIVE SCENARIO

- 10.7.1 PRODUCT LAUNCHES

- 10.7.2 DEALS

- 10.7.3 EXPANSIONS

- 10.7.4 OTHER DEVELOPMENTS

11 COMPANY PROFILES

- 11.1 KEY PLAYERS

- 11.1.1 ADVANTEST CORPORATION

- 11.1.1.1 Business overview

- 11.1.1.2 Products/solutions/services offered

- 11.1.1.3 Recent developments

- 11.1.1.3.1 Product launches

- 11.1.1.3.2 Deals

- 11.1.1.3.3 Other developments

- 11.1.1.4 MnM view

- 11.1.1.4.1 Key strengths/right to win

- 11.1.1.4.2 Strategic choices made

- 11.1.1.4.3 Weaknesses and competitive threats

- 11.1.2 LUNA INNOVATIONS

- 11.1.2.1 Business overview

- 11.1.2.2 Products/solutions/services offered

- 11.1.2.2.1 Expansions

- 11.1.2.2.2 Other developments

- 11.1.2.3 MnM view

- 11.1.2.3.1 Key strengths/right to win

- 11.1.2.3.2 Strategic choices made

- 11.1.2.3.3 Weaknesses and competitive threats

- 11.1.3 TERAVIEW LIMITED

- 11.1.3.1 Business overview

- 11.1.3.2 Products/solutions/services offered

- 11.1.3.3 Recent developments

- 11.1.3.3.1 Product launches

- 11.1.3.3.2 Deals

- 11.1.3.4 MnM view

- 11.1.3.4.1 Key strengths/right to win

- 11.1.3.4.2 Strategic choices

- 11.1.3.4.3 Weaknesses and competitive threats

- 11.1.4 TOPTICA PHOTONICS AG

- 11.1.4.1 Business overview

- 11.1.4.2 Products/solutions/services offered

- 11.1.4.3 MnM view

- 11.1.4.3.1 Key strengths/right to win

- 11.1.4.3.2 Strategic choices made

- 11.1.4.3.3 Weaknesses and competitive threats

- 11.1.5 HUBNER GMBH & CO. KG

- 11.1.5.1 Business overview

- 11.1.5.2 Products/solutions/services offered

- 11.1.5.3 Recent developments

- 11.1.5.3.1 Product launches

- 11.1.5.3.2 Deals

- 11.1.5.4 MnM view

- 11.1.5.4.1 Key strengths/right to win

- 11.1.5.4.2 Strategic choices

- 11.1.5.4.3 Weaknesses and competitive threats

- 11.1.6 MENLO SYSTEMS

- 11.1.6.1 Business overview

- 11.1.6.2 Products/solutions/services offered

- 11.1.6.3 Recent developments

- 11.1.6.3.1 Product launches

- 11.1.6.3.2 Expansions

- 11.1.7 TERASENSE GROUP INC.

- 11.1.7.1 Business overview

- 11.1.7.2 Products/solutions/services offered

- 11.1.7.3 Recent developments

- 11.1.7.3.1 Product launches

- 11.1.8 GENTEC ELECTRO-OPTICS

- 11.1.8.1 Business overview

- 11.1.8.2 Products/solutions/services offered

- 11.1.9 QMC INSTRUMENTS LTD.

- 11.1.9.1 Business overview

- 11.1.9.2 Products/solutions/services offered

- 11.1.10 TERAVIL LTD

- 11.1.10.1 Business overview

- 11.1.10.2 Products/solutions/services offered

- 11.1.1 ADVANTEST CORPORATION

- 11.2 OTHER PLAYERS

- 11.2.1 VIRGINIA DIODES, INC.

- 11.2.2 MICROTECH INSTRUMENTS

- 11.2.3 SWISSTO12

- 11.2.4 DEL MAR PHOTONICS, INC.

- 11.2.5 INSIGHT PRODUCT COMPANY

- 11.2.6 BATOP GMBH

- 11.2.7 LYTID SAS

- 11.2.8 TYDEX

- 11.2.9 QUANTUM DESIGN INC.

- 11.2.10 RAYSECUR, INC.

- 11.2.11 LONGWAVE PHOTONICS LLC

- 11.2.12 BRIDGE12 TECHNOLOGIES, INC.

- 11.2.13 ACAL BFI

- 11.2.14 THORLABS, INC.

- 11.2.15 SCIENCETECH INC.

12 APPENDIX

- 12.1 DISCUSSION GUIDE

- 12.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 12.3 CUSTOMIZATION OPTIONS

- 12.4 RELATED REPORTS

- 12.5 AUTHOR DETAILS