|

시장보고서

상품코드

1826566

장갑 재료 시장(-2030년) : 유형(금속 및 합금, 복합재료, 세라믹), 용도(차량 장갑, 항공우주 장갑, 차체 장갑), 최종사용자 산업, 지역별Armor Materials Market by Type (Metals & Alloys, Composites, Ceramics), Application (Vehicle Armor, Aerospace Armor, Body Armor), End-use Industry and Region - Global Forecast to 2030 |

||||||

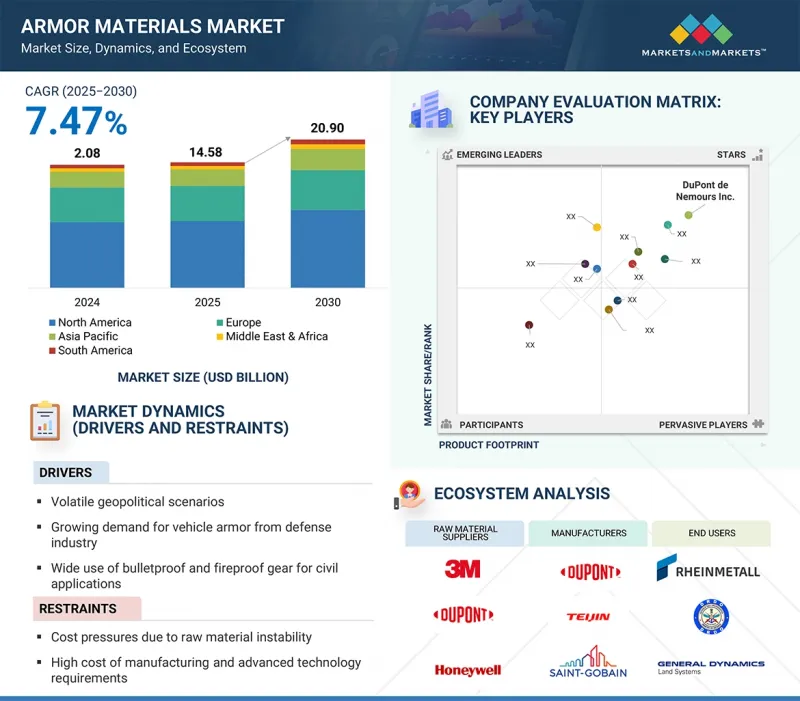

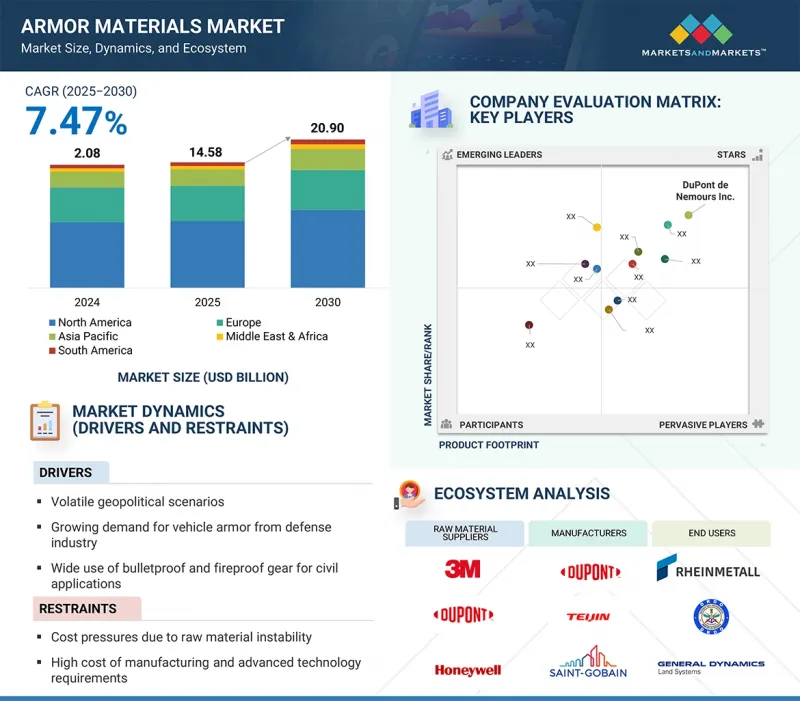

장갑 재료 시장 규모는 2025년 145억 8,000만 달러에서 2030년에는 209억 달러에 이르고, 예측 기간 중 연평균 복합 성장률(CAGR)은 7.47%를 나타낼 전망입니다.

| 조사 범위 | |

|---|---|

| 조사 대상 연도 | 2021-2030년 |

| 기준 연도 | 2024년 |

| 예측 기간 | 2025-2030년 |

| 단위 | 금액(달러), 평방미터 |

| 부문 | 유형, 접착제 유형, 배킹, 기술, 최종사용자 산업, 지역 |

| 대상 지역 | 중국, 아시아태평양, 북미, 중동 및 아프리카, 남미 |

"방산분야의 경량-고성능 보호재 수요 증가가 시장 성장을 견인할 것"

군사적 위협은 점점 더 고도화, 비대칭화되고 있으며, 기동성을 해치지 않으면서도 인원과 차량을 보호할 수 있는 장갑이 필요합니다. 이러한 유형의 갑옷은 일반적으로 전투 차량, 방탄복, 항공기, 함정 등에 사용됩니다. 고속 총알을 막고, 폭발의 영향을 줄이고, 전체 플랫폼 무게를 줄이는 데 중요한 역할을 합니다. 극한의 환경에서도 내구성이 요구되는 상황을 견딜 수 있도록 설계되었으며, 가혹한 조건을 견디면서 복잡한 형상으로 성형할 수 있어 매우 유용합니다. 군의 현대화와 병사의 생존성 향상에 대한 관심이 높아지면서 고성능 장갑 소재에 대한 수요가 증가하고 있습니다. 이러한 소재는 더 가볍고 기동성이 높은 플랫폼, 후방 지원 부담 감소, 임무 수행 능력 향상을 가능하게 합니다. 혁신이 방위 산업을 계속 형성함에 따라 첨단 장갑 재료는 설계 유연성, 작전 우위, 지속 가능한 성능을 보장하는 데 점점 더 중요한 역할을 하게 될 것입니다.

"유형별로는 복합재료 부문이 2024년 두 번째로 큰 부문이 될 것"

경량화는 기동성, 연비 효율성, 작전 행동 범위에 매우 중요하며, 경량 군용 플랫폼에 대한 수요가 이러한 성장의 주요 원동력입니다. 복합재료는 강철 갑옷보다 가볍고 탄도 성능도 우수합니다. 차량의 스파 라이너, 추가 장갑 패널, 헬멧, 항공기 및 선박의 구조 부품 등에 사용됩니다. 이러한 재료는 종종 금속이나 세라믹과 결합하여 하이브리드 시스템으로 사용되기도 하지만, 중요한 장점은 복합재료가 플랫폼의 기동성을 방해하지 않으면서도 신속하고 모듈식으로 장갑을 강화할 수 있다는 점입니다.

"최종 사용자 산업별로는 항공우주 부문이 2024년에 두 번째 점유율을 차지할 것으로 예측됩니다."

고가의 항공기와 승무원을 지상 화력 및 기타 탄도 위협으로부터 보호하는 것은 필수적입니다. 항공우주 플랫폼은 무게 제한이 엄격하기 때문에 복합재료, 첨단 세라믹, 특수 섬유와 같은 경량화 소재가 필요합니다. 헬리콥터, 수송기, 대지 공격기는 임무의 성공과 생존을 위해 조종석, 엔진, 승무원 구역을 보호해야 합니다. 항공우주 장갑은 투명 캐노피, 중요 시스템 주변의 복합 패널, 승무원을 보호하는 세라믹 플레이트 등의 형태로 도입되어 비행 성능의 저하 없이 생명을 보호합니다. 이 특성은 항공기의 생존성을 향상시키고, 상업적으로도 중요하며, 전 세계 공군의 최우선 순위가 되고 있습니다.

"지역별로는 남미가 예측 기간 동안 시장에서 세 번째로 빠르게 성장하는 지역이 될 것입니다."

남미 지역의 확대는 진행 중인 군사 현대화와 각국의 안보 우려 증가로 인해 추진되고 있습니다. 국제 조직범죄 대응, 국경 보안, 노후화된 군용 차량 교체 등 정부의 이니셔티브으로 인해 장갑재에 대한 수요가 증가하고 있습니다. 법 집행 기관과 군는 장갑 민간 차량, 경전투 차량, 순찰선을 채택하는 사례가 늘고 있습니다. 갑옷에 사용되는 재료는 위험한 환경에서 활동하는 인원을 보호하기 위해 필수적입니다. 지역 안보 요구 사항이 확립됨에 따라 비용 효율적이고 신뢰할 수 있는 장갑 솔루션에 대한 수요가 증가하고 있습니다. 역내 치안 및 방위 분야 또한 남미 지역의 장갑재 시장 성장의 주요 원동력이 될 것입니다.

세계의 장갑재 시장을 조사했으며, 시장 개요, 시장 성장에 영향을 미치는 각종 영향요인 분석, 기술 및 특허 동향, 법 및 규제 환경, 사례 분석, 시장 규모 추이 및 예측, 각종 부문별/지역별/주요 국가별 상세 분석, 경쟁 구도, 주요 기업 개요 등의 정보를 정리하여 전해드립니다.

목차

제1장 서론

제2장 조사 방법

제3장 주요 요약

제4장 프리미엄 인사이트

제5장 시장 개요

- 시장 역학

- 성장 촉진요인

- 성장 억제요인

- 기회

- 과제

- Porter의 Five Forces 분석

- 주요 이해관계자와 구입 기준

- 거시경제 지표

제6장 업계 동향

- 공급망 분석

- 고객 사업에 영향을 미치는 동향/혼란

- 생태계 분석

- 가격 분석

- 무역 분석

- 기술 분석

- 사례 연구 분석

- 규제 상황

- 주요 컨퍼런스 및 이벤트

- 투자 및 자금조달 시나리오

- 특허 분석

- AI/생성형 AI가 장갑 재료 시장에 미치는 영향

- 2025년 미국 관세의 영향 - 장갑 재료 시장

제7장 장갑 재료 시장 : 재료별

- 금속 및 합금

- 고밀도강

- 알루미늄

- 티타늄

- 세라믹

- 산화알루미늄

- 탄화규소

- 탄화붕소

- 복합재료

- 패브릭

- 매트릭스 재료

- 프리프레그

- 하이브리드 복합재료

- 3D 복합재료

- 파라아라미드 섬유

- 초고분자량 폴리에틸렌

- 유리섬유

- 기타

제8장 장갑 재료 시장 : 용도별

- 차량 장갑

- 항공우주 장갑

- 바디 아머

- 민간 장갑

- 해양 장갑

제9장 장갑 재료 시장 : 최종사용자 산업별

- 방위

- 국토안보 및 법집행

- 민간 및 상업

제10장 장갑 재료 시장 : 지역별

- 북미

- 미국

- 캐나다

- 멕시코

- 유럽

- 러시아

- 프랑스

- 영국

- 독일

- 이탈리아

- 폴란드

- 아시아태평양

- 중국

- 인도

- 한국

- 일본

- 호주

- 인도네시아

- 필리핀

- 남미

- 브라질

- 아르헨티나

- 중동 및 아프리카

- 이스라엘

- 사우디아라비아

- 아랍에미리트(UAE)

- 알제리

제11장 경쟁 구도

- 주요 시장 진출기업의 전략/강점

- 시장 점유율 분석

- 매출 분석

- 기업 평가 매트릭스 : 주요 기업

- 기업 평가 매트릭스 : 스타트업/중소기업

- 기업 평가와 재무 지표

- 브랜드/제품 비교

- 경쟁 시나리오

제12장 기업 개요

- 주요 기업

- DUPONT DE NEMOURS, INC.

- TEIJIN LIMITED

- 3M COMPANY

- SAINT-GOBAIN S.A.

- HONEYWELL INTERNATIONAL INC.

- AVIENT CORPORATION

- ATI, INC.

- ALCOA CORPORATION

- SSAB AB

- TATA STEEL LIMITED

- CERAMTEC TOPCO GMBH

- MORGAN ADVANCED MATERIALS

- TENCATE ADVANCED ARMOR

- 기타 기업

- PPG INDUSTRIES

- COORSTEK, INC.

- CERCO CORPORATION

- AGY HOLDING CORP.

- SAFARILAND, LLC

- LEECO STEEL

- ARMORWORKS ENTERPRISES LLC

- WACO COMPOSITES LTD.

- AT&F ADVANCED METALS LLC

- PROTECTIVE STRUCTURES, LTD.

- CPS TECHNOLOGIES, CORP.

- JPS COMPOSITES MATERIALS

- SCHUNK CARBON TECHNOLOGY

- SURMET CORPORATION

제13장 인접 시장과 관련 시장

제14장 부록

LSH 25.10.10Armor materials market is projected to be valued at USD 14.58 billion in 2025 and reach USD 20.90 billion by 2030, at a CAGR of 7.47% during the forecast period.

| Scope of the Report | |

|---|---|

| Years Considered for the Study | 2021-2030 |

| Base Year | 2024 |

| Forecast Period | 2025-2030 |

| Units Considered | Value (USD Million) and Volume (Million Square Meter) |

| Segments | Type, Adhesive Type, Backing, Technology, End-use Industry, and Region |

| Regions covered | China, Asia Pacific, Europe, North America, Middle East & Africa, and South America |

"Increasing Demand for Lightweight, High-Performance Protection to Drive Market Growth in Defense Sector"

Military threats are becoming more sophisticated and asymmetric, creating a need for armor that protects both personnel and vehicles without compromising on mobility. These types of armor are commonly used in combat vehicles, body armor, aircraft, and naval vessels. They play vital roles in stopping high-velocity projectiles, reducing blast effects, and cutting down overall platform weight. Designed to withstand extreme environments where durability is essential, they are invaluable because they can endure harsh conditions and be molded into complex shapes. The increasing focus on military modernization and boosting soldiers' survivability is driving demand for high-performance armor materials. These materials enable lighter, more agile platforms, lower logistical loads, and enhance mission effectiveness. As innovation continues to shape the defense industry, advanced armor materials will become even more important for design flexibility, operational superiority, and sustained performance.

"Composites segment was second-largest segment of global armor materials market in 2024"

The composites segment was the second-largest type in the global armor materials market by value in 2024. This growth is mainly driven by the demand for lightweight military platforms, where reducing weight is crucial for mobility, fuel efficiency, and operational range. Composite materials are lighter than steel armor and perform well ballistically. They are used in vehicle spall liners, add-on armor panels, helmets, and structural components for aircraft and naval vessels. Although these materials are often combined with metals and ceramics in hybrid systems, a key benefit is that composites do not impede a platform's mobility and enable quick, modular up-armoring.

"Aerospace armor segment accounted for second-largest share of armor materials market in 2024"

In 2024, the aerospace armor segment held the second-largest share of the armor materials market. Protecting high-value aircraft and crew members from ground fire and other ballistic threats is essential. Due to strict weight limitations, aerospace platforms require lightweight materials, such as composites, advanced ceramics, and specialty fibers. Helicopters, transport aircraft, and ground-attack jets need this protection to safeguard the cockpit, engines, and crew compartments for mission success and survival. Aerospace armor saves lives without compromising flying performance, whether it is transparent canopies, composite panels around critical systems, or ceramic plates shielding the crew. This feature enhances the aircraft's survivability and is therefore both commercially significant and a top priority for air forces worldwide.

"South America to be third-fastest growing region in armor materials market during forecast period"

The expansion of South America is driven by ongoing military modernization and increasing security concerns across countries. Demand for armor materials is rising due to government initiatives to combat transnational organized crime, secure borders, and upgrade aging military vehicle fleets. Law enforcement and military forces are increasingly adopting armored civilian vehicles, light combat vehicles, and patrol boats. The materials used in armor provide essential protection for personnel operating in such dangerous environments. As regional security requirements become more established, there is a growing need for cost-effective and reliable armor solutions. The internal security and defense sector will also be a key driver of growth in the region's armor materials market.

- By Company Type: Tier 1 - 33%, Tier 2 - 25%, and Tier 3 - 42%

- By Designation: Directors - 36%, Managers - 19%, and Others - 45%

- By Region: North America - 25%, Europe - 17%, Asia Pacific - 42%, South America - 8%, Middle East & Africa - 8%

The key players profiled in the report include DuPont de Nemours, Inc. (US), Teijin Limited (Japan), Honeywell International Inc. (US), 3M Company (US), Saint-Gobain S.A. (France), ATI, Inc. (US), Avient Corporation (US), Alcoa Corporation (US), SSAB AB (Sweden), and Morgan Advanced Materials (UK).

Research Coverage

This report segments the armor materials market by type, application, and region and offers estimates of market value (USD Million) across different regions. It includes a detailed analysis of major industry players, highlighting their business overviews, services, and main strategies related to the armor materials market.

Reasons to Buy Report

This research report focuses on multiple levels of analysis - industry trends, market share of top players, and company profiles, which together provide a comprehensive view of the competitive landscape, emerging and high-growth segments of the armor materials market; high-growth regions; and market drivers, restraints, and opportunities.

The report provides insights into the following points:

- Market Penetration: Comprehensive information on armor materials offered by top players in the global market

- Analysis of key drivers: (Increasing geopolitical tensions and rising defense budgets, growing demand for lightweight protection, and military modernization programs), restraints (High cost of advanced armor materials), opportunities (Development of next-generation materials and smart armor systems), and challenges (Stringent testing and certification requirements) influencing the growth of the armor materials market.

- Product Development/Innovation: Detailed insights into upcoming technologies, research & development activities, and new product & service launches in the armor materials market

- Market Development: Comprehensive information about lucrative emerging markets - the report analyzes the markets for armor materials across regions.

- Market Diversification: Exhaustive information about new products, untapped regions, and recent developments in the global armor materials market

- Competitive Assessment: In-depth assessment of market shares, strategies, products, and manufacturing capabilities of leading players in the armor materials market.

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 STUDY OBJECTIVES

- 1.2 MARKET DEFINITION

- 1.3 STUDY SCOPE

- 1.3.1 MARKETS COVERED AND REGIONAL SCOPE

- 1.3.2 INCLUSIONS AND EXCLUSIONS

- 1.3.3 YEARS CONSIDERED

- 1.3.4 CURRENCY CONSIDERED

- 1.3.5 UNIT CONSIDERED

- 1.4 STAKEHOLDERS

- 1.5 SUMMARY OF CHANGES

2 RESEARCH METHODOLOGY

- 2.1 RESEARCH DATA

- 2.1.1 SECONDARY DATA

- 2.1.2 PRIMARY DATA

- 2.1.2.1 Primary interviews - demand and supply sides

- 2.1.2.2 Key industry insights

- 2.1.2.3 Breakdown of primaries

- 2.2 MARKET SIZE ESTIMATION

- 2.2.1 BOTTOM-UP APPROACH

- 2.3 DATA TRIANGULATION

- 2.4 GROWTH FORECAST

- 2.4.1 SUPPLY SIDE

- 2.4.2 DEMAND SIDE

- 2.5 RESEARCH ASSUMPTIONS

- 2.6 RESEARCH LIMITATIONS

- 2.7 RISK ASSESSMENT

3 EXECUTIVE SUMMARY

4 PREMIUM INSIGHTS

- 4.1 ATTRACTIVE OPPORTUNITIES FOR PLAYERS IN ARMOR MATERIALS MARKET

- 4.2 ARMOR MATERIALS MARKET, BY REGION

- 4.3 NORTH AMERICAN ARMOR MATERIALS MARKET, BY APPLICATION AND COUNTRY

- 4.4 REGIONAL ANALYSIS: ARMOR MATERIALS MARKET, BY APPLICATION

- 4.5 ARMOR MATERIALS MARKET, BY COUNTRY

5 MARKET OVERVIEW

- 5.1 INTRODUCTION

- 5.2 MARKET DYNAMICS

- 5.2.1 DRIVERS

- 5.2.1.1 Increasing security concerns in developing countries

- 5.2.1.2 Growing demand for homeland security

- 5.2.1.3 Development of lethal ammunition and weapons

- 5.2.2 RESTRAINTS

- 5.2.2.1 Government-led regulations regarding production capacity and supply chain

- 5.2.2.2 Inability to provide complete protection

- 5.2.3 OPPORTUNITIES

- 5.2.3.1 Military modernization programs

- 5.2.3.2 Need for lightweight armor

- 5.2.3.3 Changing battlefield scenario

- 5.2.4 CHALLENGES

- 5.2.4.1 Development of explosive reactive armor systems

- 5.2.4.2 High cost of lightweight armor materials

- 5.2.1 DRIVERS

- 5.3 PORTER'S FIVE FORCES ANALYSIS

- 5.3.1 THREAT OF SUBSTITUTES

- 5.3.2 THREAT OF NEW ENTRANTS

- 5.3.3 BARGAINING POWER OF SUPPLIERS

- 5.3.4 BARGAINING POWER OF BUYERS

- 5.3.5 INTENSITY OF COMPETITIVE RIVALRY

- 5.4 KEY STAKEHOLDERS AND BUYING CRITERIA

- 5.4.1 KEY STAKEHOLDERS IN BUYING PROCESS

- 5.4.2 BUYING CRITERIA

- 5.5 MACROECONOMIC INDICATORS

- 5.5.1 GDP TRENDS AND FORECAST

6 INDUSTRY TRENDS

- 6.1 SUPPLY CHAIN ANALYSIS

- 6.2 TRENDS/DISRUPTIONS IMPACTING CUSTOMER BUSINESS

- 6.3 ECOSYSTEM ANALYSIS

- 6.4 PRICING ANALYSIS

- 6.4.1 AVERAGE SELLING PRICE TREND OF KEY PLAYERS, BY MATERIAL TYPE, 2024

- 6.4.2 AVERAGE SELLING PRICE TREND, BY REGION, 2022-2030

- 6.5 TRADE ANALYSIS

- 6.5.1 IMPORT SCENARIO (HS CODE 5909)

- 6.5.2 EXPORT SCENARIO (HS CODE 5909)

- 6.6 TECHNOLOGY ANALYSIS

- 6.6.1 KEY TECHNOLOGIES

- 6.6.1.1 Shear-thickening fluids

- 6.6.1.2 Ceramic matrix composites

- 6.6.1.3 Reactive armor systems

- 6.6.2 COMPLEMENTARY TECHNOLOGIES

- 6.6.2.1 Shear wave dispersion layers

- 6.6.2.2 Energy-redirecting auxetic structures

- 6.6.1 KEY TECHNOLOGIES

- 6.7 CASE STUDY ANALYSIS

- 6.7.1 BAE SYSTEMS-GRAPHENE-ENHANCED COMPOSITE ARMOR

- 6.7.2 RHEINMETALL-CERAMIC ARMOR INTEGRATION FOR MILITARY VEHICLES

- 6.7.3 TATA ADVANCED SYSTEMS-ARAMID AND STFS FOR LAW ENFORCEMENT

- 6.8 REGULATORY LANDSCAPE

- 6.8.1 REGULATORY BODIES, GOVERNMENT AGENCIES, AND OTHER ORGANIZATIONS

- 6.8.2 REGULATIONS

- 6.8.2.1 NIJ 0101.07 (Ballistic Resistance of Body Armor)

- 6.8.2.2 STANAG 2920 (Ballistic and Fragmentation Protection)

- 6.8.2.3 REACH Regulation (EC 1907/2006)

- 6.8.2.4 BA 9000 (Body Armor Quality Management System)

- 6.9 KEY CONFERENCES AND EVENTS, 2025-2027

- 6.10 INVESTMENT AND FUNDING SCENARIO

- 6.11 PATENT ANALYSIS

- 6.11.1 APPROACH

- 6.11.2 PATENT TYPE

- 6.11.3 TOP APPLICANTS

- 6.11.4 JURISDICTION ANALYSIS

- 6.12 IMPACT OF AI/GEN AI ON ARMOR MATERIALS MARKET

- 6.13 IMPACT OF 2025 US TARIFF - ARMOR MATERIALS MARKET

- 6.13.1 INTRODUCTION

- 6.13.2 KEY TARIFF RATES

- 6.13.3 PRICE IMPACT ANALYSIS

- 6.13.4 IMPACT ON KEY COUNTRIES/REGIONS

- 6.13.4.1 US

- 6.13.4.2 Europe

- 6.13.4.3 Asia Pacific

- 6.13.5 IMPACT ON END-USE INDUSTRIES

7 ARMOR MATERIALS MARKET, BY MATERIAL TYPE

- 7.1 INTRODUCTION

- 7.2 METALS & ALLOYS

- 7.2.1 HIGH ROBUSTNESS, STRENGTH, AND TOUGHNESS TO DRIVE DEMAND

- 7.2.2 HIGH-DENSITY STEEL

- 7.2.3 ALUMINUM

- 7.2.4 TITANIUM

- 7.3 CERAMICS

- 7.3.1 HIGH BALLISTIC RESISTANCE, LOW WEIGHT, AND DURABILITY TO FUEL DEMAND

- 7.3.2 ALUMINUM OXIDE

- 7.3.3 SILICON CARBIDE

- 7.3.4 BORON CARBIDE

- 7.4 COMPOSITES

- 7.4.1 HIGH MECHANICAL STRENGTH AND STIFFNESS TO PROPEL DEMAND

- 7.4.2 FIBERS

- 7.4.3 FABRICS

- 7.4.4 MATRIX MATERIALS

- 7.4.5 PREPREGS

- 7.4.6 HYBRID COMPOSITES

- 7.4.7 3D COMPOSITES

- 7.5 PARA-ARAMID FIBER

- 7.5.1 ULTRA-HIGH STRENGTH AND LOW DENSITY TO FUEL DEMAND

- 7.6 ULTRA-HIGH-MOLECULAR-WEIGHT POLYETHYLENE

- 7.6.1 SHOCK ABSORPTION PROPERTIES TO DRIVE DEMAND

- 7.7 FIBERGLASS

- 7.7.1 FAVORABLE PROPERTIES FOR BALLISTIC APPLICATIONS TO ACCELERATE DEMAND

- 7.8 OTHER MATERIAL TYPES

8 ARMOR MATERIALS MARKET, BY APPLICATION

- 8.1 INTRODUCTION

- 8.2 VEHICLE ARMOR

- 8.2.1 RISING CROSS-BORDER CONFLICTS TO DRIVE DEMAND

- 8.3 AEROSPACE ARMOR

- 8.3.1 HIGH INVESTMENTS BY AIR FORCE DEPARTMENTS IN INNOVATION TO DRIVE DEMAND

- 8.4 BODY ARMOR

- 8.4.1 RISING NEED FOR PROTECTION SYSTEMS BY LAW ENFORCEMENT AGENCIES TO DRIVE MARKET

- 8.5 CIVIL ARMOR

- 8.5.1 INCREASING SAFETY CONCERNS OF CIVILIANS TO CONTRIBUTE TO MARKET GROWTH

- 8.6 MARINE ARMOR

- 8.6.1 EXPANSION OF NAVY FLEET IN DEVELOPING COUNTRIES TO DRIVE MARKET

9 ARMOR MATERIALS MARKET, BY END-USE INDUSTRY

- 9.1 INTRODUCTION

- 9.2 DEFENSE

- 9.2.1 INNOVATIONS IN MILITARY PROTECTION SYSTEMS TO DRIVE DEMAND

- 9.3 HOMELAND SECURITY & LAW ENFORCEMENT

- 9.3.1 RISING THREATS OF TERRORISM, ORGANIZED CRIME, AND ACTIVE SHOOTER INCIDENTS TO FUEL DEMAND

- 9.4 CIVIL AND COMMERCIAL

- 9.4.1 GROWING CONCERNS ABOUT CIVILIAN SAFETY TO PROPEL DEMAND

10 ARMOR MATERIALS MARKET, BY REGION

- 10.1 INTRODUCTION

- 10.2 NORTH AMERICA

- 10.2.1 US

- 10.2.1.1 High military spending and constant research for upgrading army and military equipment to drive market

- 10.2.2 CANADA

- 10.2.2.1 Military modernization programs to drive demand

- 10.2.3 MEXICO

- 10.2.3.1 Rising investments from major foreign investors to fuel market growth

- 10.2.1 US

- 10.3 EUROPE

- 10.3.1 RUSSIA

- 10.3.1.1 Increasing investments in military modernization programs to propel market

- 10.3.2 FRANCE

- 10.3.2.1 Efforts to modernize old fleet of armored vehicles to drive market

- 10.3.3 UK

- 10.3.3.1 Increasing investments in homeland security to boost market growth

- 10.3.4 GERMANY

- 10.3.4.1 Rising procurement of defense equipment and vehicles to contribute to market growth

- 10.3.5 ITALY

- 10.3.5.1 Rising production of military and army aircraft to drive demand

- 10.3.6 POLAND

- 10.3.6.1 Growing spending on procurement of new military equipment to propel market

- 10.3.1 RUSSIA

- 10.4 ASIA PACIFIC

- 10.4.1 CHINA

- 10.4.1.1 High R&D spending on new and advanced armored vehicles to contribute to market growth

- 10.4.2 INDIA

- 10.4.2.1 Increasing defense budget to fuel demand

- 10.4.3 SOUTH KOREA

- 10.4.3.1 Rising conflict with North Korea to fuel market growth

- 10.4.4 JAPAN

- 10.4.4.1 High-end indigenous military technologies to increase demand

- 10.4.5 AUSTRALIA

- 10.4.5.1 Continuous government-led investments in armed and home security force developments to fuel market growth

- 10.4.6 INDONESIA

- 10.4.6.1 Growing need for advanced naval fleet to propel market

- 10.4.7 PHILIPPINES

- 10.4.7.1 Future planning to increase military spending to contribute to market growth

- 10.4.1 CHINA

- 10.5 SOUTH AMERICA

- 10.5.1 BRAZIL

- 10.5.1.1 Gang wars and other incidents to fuel demand

- 10.5.2 ARGENTINA

- 10.5.2.1 Increasing procurement of armored vehicles to drive market

- 10.5.1 BRAZIL

- 10.6 MIDDLE EAST & AFRICA

- 10.6.1 ISRAEL

- 10.6.1.1 Investments in R&D of modern weaponry and armor systems to drive market

- 10.6.2 SAUDI ARABIA

- 10.6.2.1 Constant R&D on advanced military technologies to fuel market growth

- 10.6.3 UAE

- 10.6.3.1 Significant investments in armored vehicle capabilities to influence market growth

- 10.6.4 ALGERIA

- 10.6.4.1 Increasing defense and security budget to strengthen military forces to contribute to market growth

- 10.6.1 ISRAEL

11 COMPETITIVE LANDSCAPE

- 11.1 INTRODUCTION

- 11.2 KEY PLAYER STRATEGIES/RIGHT TO WIN

- 11.3 MARKET SHARE ANALYSIS

- 11.4 REVENUE ANALYSIS

- 11.5 COMPANY EVALUATION MATRIX: KEY PLAYERS, 2024

- 11.5.1 STARS

- 11.5.2 EMERGING LEADERS

- 11.5.3 PERVASIVE PLAYERS

- 11.5.4 PARTICIPANTS

- 11.5.5 COMPANY FOOTPRINT: KEY PLAYERS, 2024

- 11.5.5.1 Company footprint

- 11.5.5.2 Region footprint

- 11.5.5.3 Material type footprint

- 11.5.5.4 Application footprint

- 11.6 COMPANY EVALUATION MATRIX: STARTUPS/SMES, 2024

- 11.6.1 PROGRESSIVE COMPANIES

- 11.6.2 RESPONSIVE COMPANIES

- 11.6.3 DYNAMIC COMPANIES

- 11.6.4 STARTING BLOCKS

- 11.6.5 COMPETITIVE BENCHMARKING: STARTUPS/SMES, 2024

- 11.6.5.1 Detailed list of key startups/SMEs

- 11.6.5.2 Competitive benchmarking of key startups/SMEs

- 11.7 COMPANY VALUATION AND FINANCIAL METRICS

- 11.8 BRAND/PRODUCT COMPARISON

- 11.9 COMPETITIVE SCENARIO

- 11.9.1 PRODUCT LAUNCHES

- 11.9.2 DEALS

- 11.9.3 OTHERS

12 COMPANY PROFILES

- 12.1 KEY PLAYERS

- 12.1.1 DUPONT DE NEMOURS, INC.

- 12.1.1.1 Business overview

- 12.1.1.2 Products/Solutions/Services offered

- 12.1.1.3 Recent developments

- 12.1.1.3.1 Product launches

- 12.1.1.3.2 Deals

- 12.1.1.4 MnM view

- 12.1.1.4.1 Key strengths/Right to win

- 12.1.1.4.2 Strategic choices

- 12.1.1.4.3 Weaknesses/Competitive threats

- 12.1.2 TEIJIN LIMITED

- 12.1.2.1 Business overview

- 12.1.2.2 Products/Solutions/Services offered

- 12.1.2.3 Recent developments

- 12.1.2.3.1 Product launches

- 12.1.2.3.2 Expansions

- 12.1.2.3.3 Others

- 12.1.2.4 MnM view

- 12.1.2.4.1 Key strengths/Right to win

- 12.1.2.4.2 Strategic choices

- 12.1.2.4.3 Weaknesses/Competitive threats

- 12.1.3 3M COMPANY

- 12.1.3.1 Business overview

- 12.1.3.2 Products/Solutions/Services offered

- 12.1.3.3 MnM view

- 12.1.3.3.1 Key strengths/Right to win

- 12.1.3.3.2 Strategic choices

- 12.1.3.3.3 Weaknesses/Competitive threats

- 12.1.4 SAINT-GOBAIN S.A.

- 12.1.4.1 Business overview

- 12.1.4.2 Products/Solutions/Services offered

- 12.1.4.3 MnM view

- 12.1.4.3.1 Key strengths/Right to win

- 12.1.4.3.2 Strategic choices made

- 12.1.4.3.3 Weaknesses/Competitive threats

- 12.1.5 HONEYWELL INTERNATIONAL INC.

- 12.1.5.1 Business overview

- 12.1.5.2 Products/Solutions/Services offered

- 12.1.5.3 Recent developments

- 12.1.5.3.1 Product launches

- 12.1.5.3.2 Deals

- 12.1.5.4 MnM view

- 12.1.5.4.1 Key strengths/Right to win

- 12.1.5.4.2 Strategic choices

- 12.1.5.4.3 Weaknesses/Competitive threats

- 12.1.6 AVIENT CORPORATION

- 12.1.6.1 Business overview

- 12.1.6.2 Products/Solutions/Services offered

- 12.1.6.3 Recent developments

- 12.1.6.3.1 Deals

- 12.1.6.4 MnM view

- 12.1.6.4.1 Key strengths/Right to win

- 12.1.6.4.2 Strategic choices

- 12.1.6.4.3 Weaknesses/Competitive threats

- 12.1.7 ATI, INC.

- 12.1.7.1 Business overview

- 12.1.7.2 Products/Solutions/Services offered

- 12.1.7.3 Recent developments

- 12.1.7.3.1 Deals

- 12.1.7.4 MnM view

- 12.1.7.4.1 Key strengths/Right to win

- 12.1.7.4.2 Strategic choices made

- 12.1.7.4.3 Weaknesses/Competitive threats

- 12.1.8 ALCOA CORPORATION

- 12.1.8.1 Business overview

- 12.1.8.2 Products/Solutions/Services offered

- 12.1.8.3 Recent developments

- 12.1.8.3.1 Others

- 12.1.8.4 MnM view

- 12.1.8.4.1 Key strengths/Right to win

- 12.1.8.4.2 Strategic choices

- 12.1.8.4.3 Weaknesses/Competitive threats

- 12.1.9 SSAB AB

- 12.1.9.1 Business overview

- 12.1.9.2 Products/Solutions/Services offered

- 12.1.9.3 MnM view

- 12.1.9.3.1 Key strengths/Right to win

- 12.1.9.3.2 Strategic choices

- 12.1.9.3.3 Weaknesses/Competitive threats

- 12.1.10 TATA STEEL LIMITED

- 12.1.10.1 Business overview

- 12.1.10.2 Products/Solutions/Services offered

- 12.1.10.3 MnM view

- 12.1.10.3.1 Key strengths/Right to win

- 12.1.10.3.2 Strategic choices

- 12.1.10.3.3 Weaknesses/Competitive threats

- 12.1.11 CERAMTEC TOPCO GMBH

- 12.1.11.1 Business overview

- 12.1.11.2 Products/Solutions/Services offered

- 12.1.12 MORGAN ADVANCED MATERIALS

- 12.1.12.1 Business overview

- 12.1.12.2 Products/Solutions/Services offered

- 12.1.13 TENCATE ADVANCED ARMOR

- 12.1.13.1 Business overview

- 12.1.13.2 Products/Solutions/Services offered

- 12.1.1 DUPONT DE NEMOURS, INC.

- 12.2 OTHER PLAYERS

- 12.2.1 PPG INDUSTRIES

- 12.2.2 COORSTEK, INC.

- 12.2.3 CERCO CORPORATION

- 12.2.4 AGY HOLDING CORP.

- 12.2.5 SAFARILAND, LLC

- 12.2.6 LEECO STEEL

- 12.2.7 ARMORWORKS ENTERPRISES LLC

- 12.2.8 WACO COMPOSITES LTD.

- 12.2.9 AT&F ADVANCED METALS LLC

- 12.2.10 PROTECTIVE STRUCTURES, LTD.

- 12.2.11 CPS TECHNOLOGIES, CORP.

- 12.2.12 JPS COMPOSITES MATERIALS

- 12.2.13 SCHUNK CARBON TECHNOLOGY

- 12.2.14 SURMET CORPORATION

13 ADJACENT AND RELATED MARKET

- 13.1 INTRODUCTION

- 13.2 LIMITATIONS

- 13.3 ARMORED VEHICLES MARKET

- 13.3.1 MARKET DEFINITION

- 13.3.2 MARKET OVERVIEW

- 13.3.3 ARMORED VEHICLES MARKET, BY REGION

- 13.3.3.1 North America

- 13.3.3.2 Europe

- 13.3.3.3 Asia Pacific

- 13.3.3.4 Middle East

- 13.3.3.5 RoW

14 APPENDIX

- 14.1 DISCUSSION GUIDE

- 14.2 KNOWLEDGESTORE: MARKETSANDMARKETS' SUBSCRIPTION PORTAL

- 14.3 CUSTOMIZATION OPTIONS

- 14.4 RELATED REPORTS

- 14.5 AUTHOR DETAILS